Deep Dive: Solana NFT Market - January 2024

Deep Dive: Solana NFT Market - January 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana NFT Market - January 2024

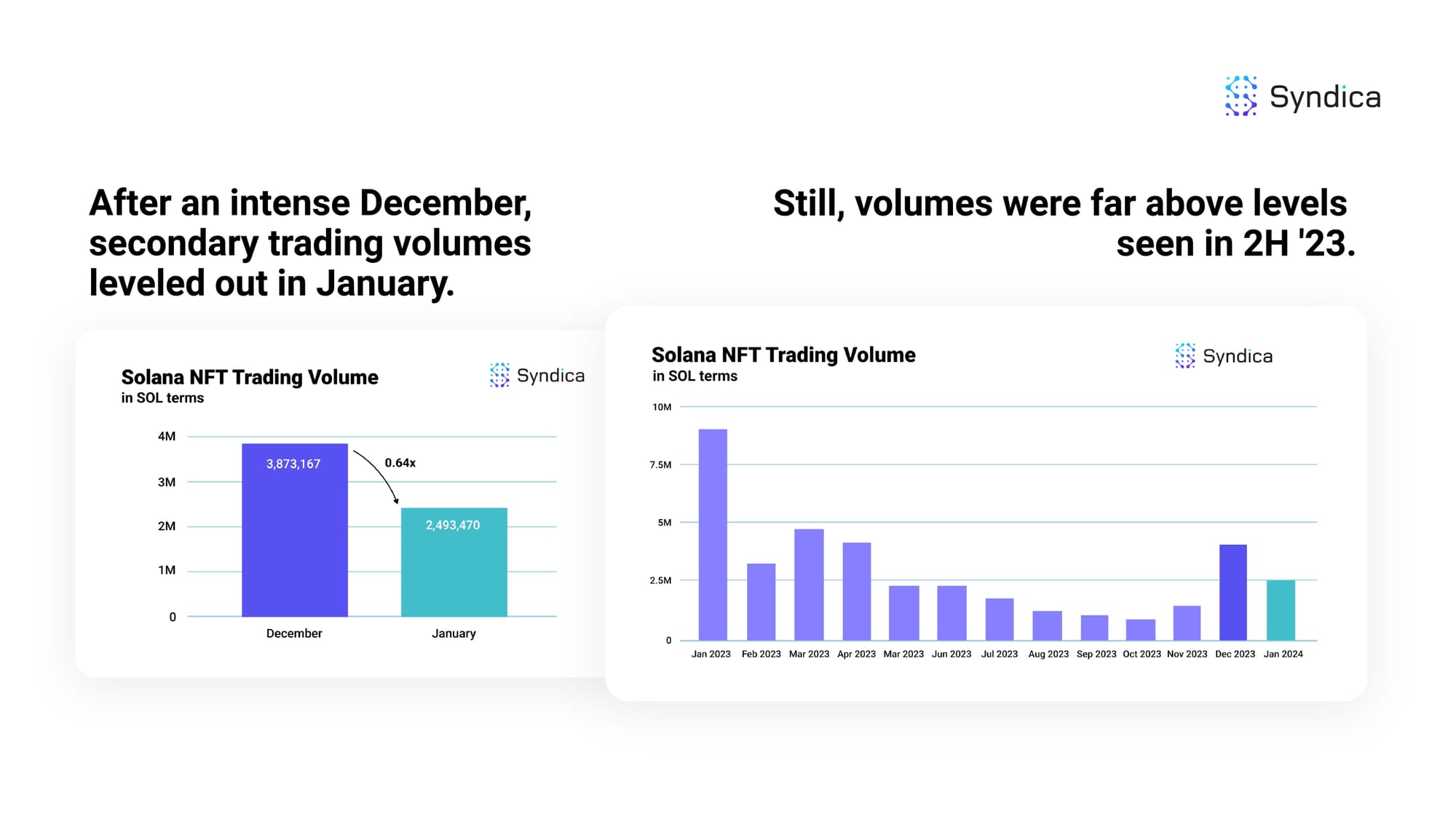

After an intense December, secondary trading volumes leveled out in January. Still, volumes were far above levels seen in 2H '23.

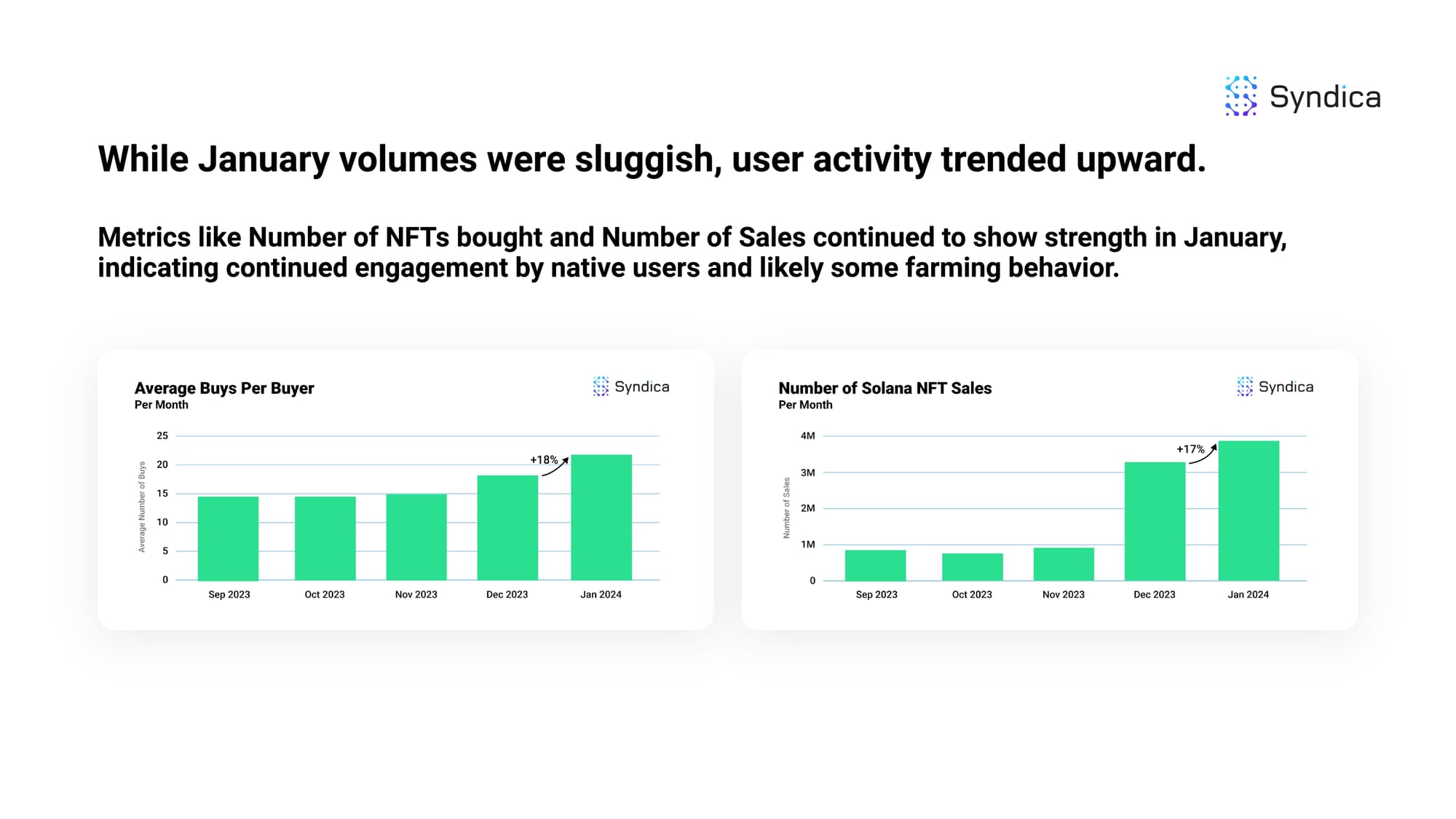

While January volumes were sluggish, user activity trended upward. Metrics like the Number of NFTs bought and the Number of Sales continued to show strength in January, indicating continued engagement by native users and likely some farming behavior.

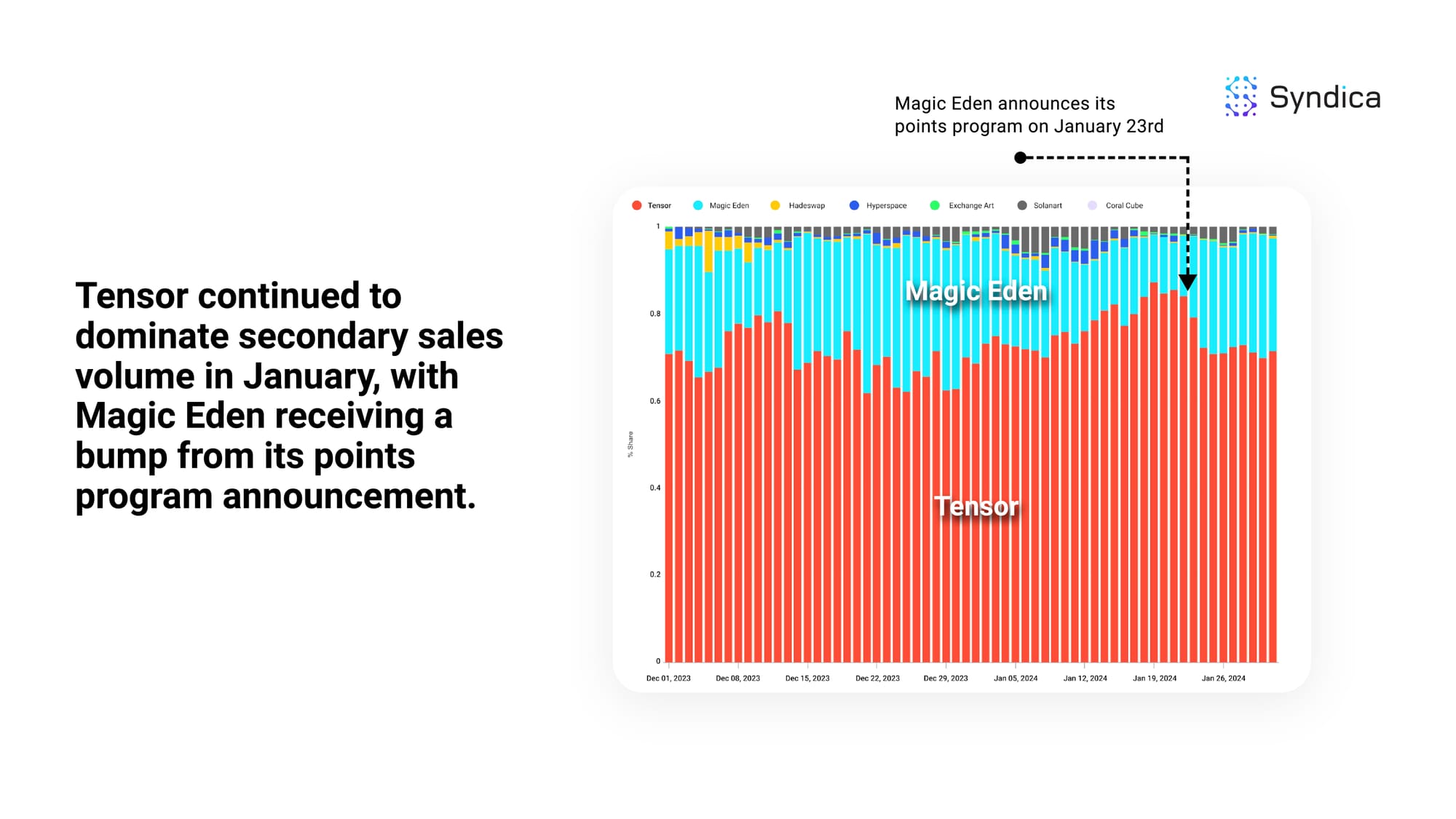

Tensor continued to dominate secondary sales volume in January, with Magic Eden receiving a bump from its points program announcement.

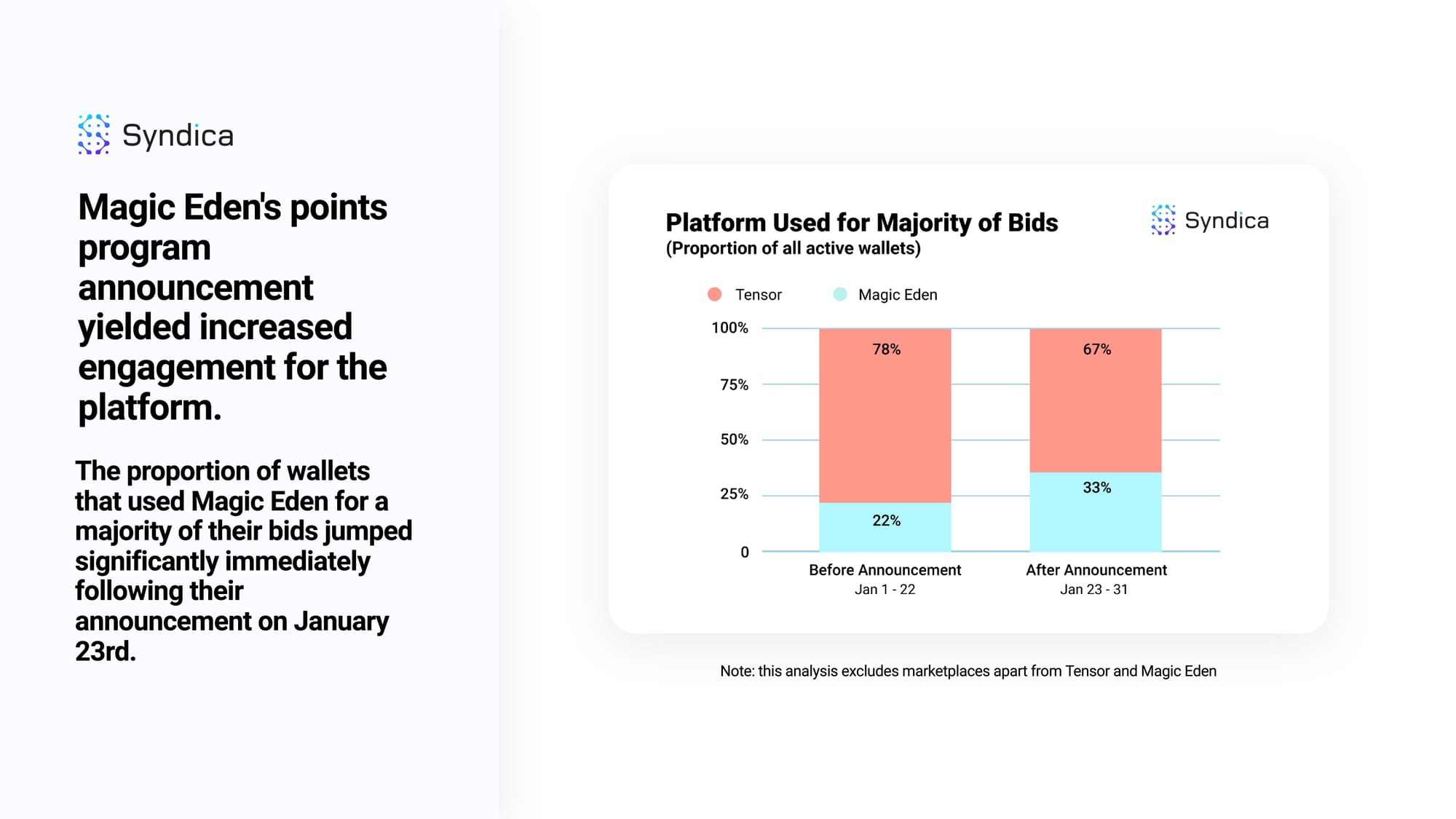

Magic Eden's points program announcement yielded increased engagement for the platform.

The proportion of wallets that used Magic Eden for a majority of their bids jumped significantly immediately following their announcement on January 23rd.

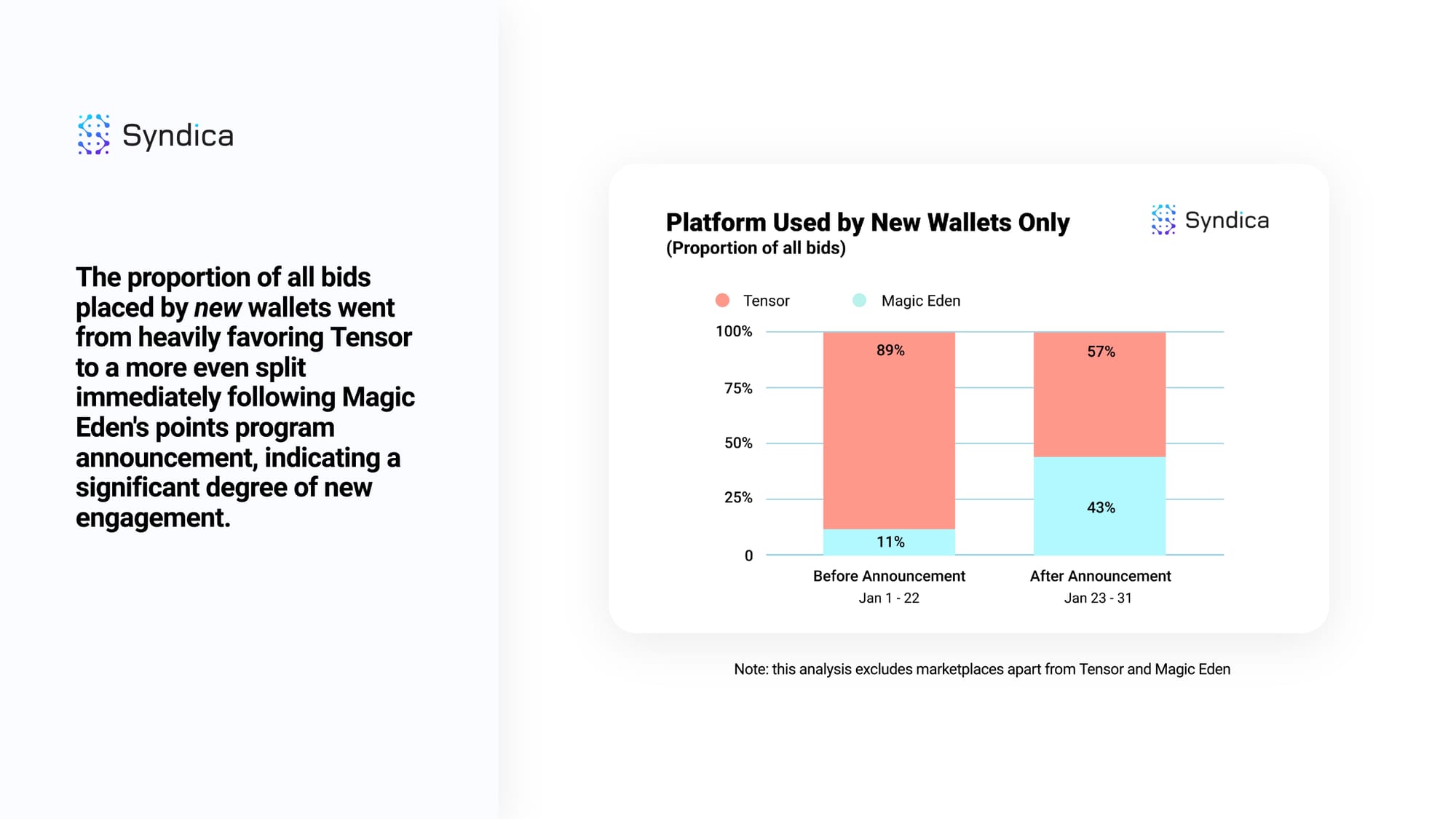

The proportion of all bids placed by new wallets went from heavily favoring Tensor to a more even split immediately following Magic Eden's points program announcement, indicating a significant degree of new engagement.

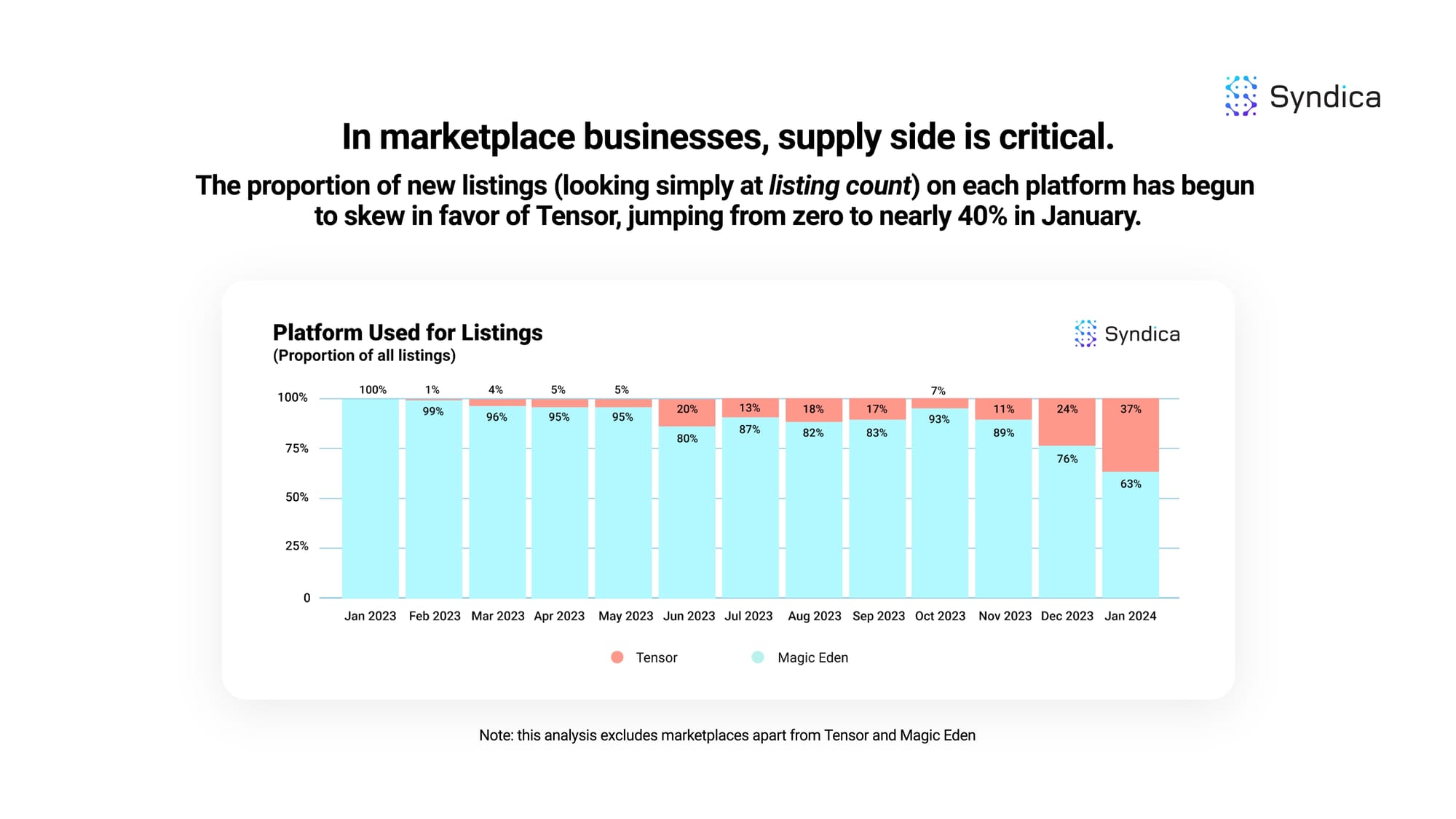

In marketplace businesses, supply side is critical. The proportion of new listings (looking simply at listing count) on each platform has begun to skew in favor of Tensor, jumping from zero to nearly 40% in January.

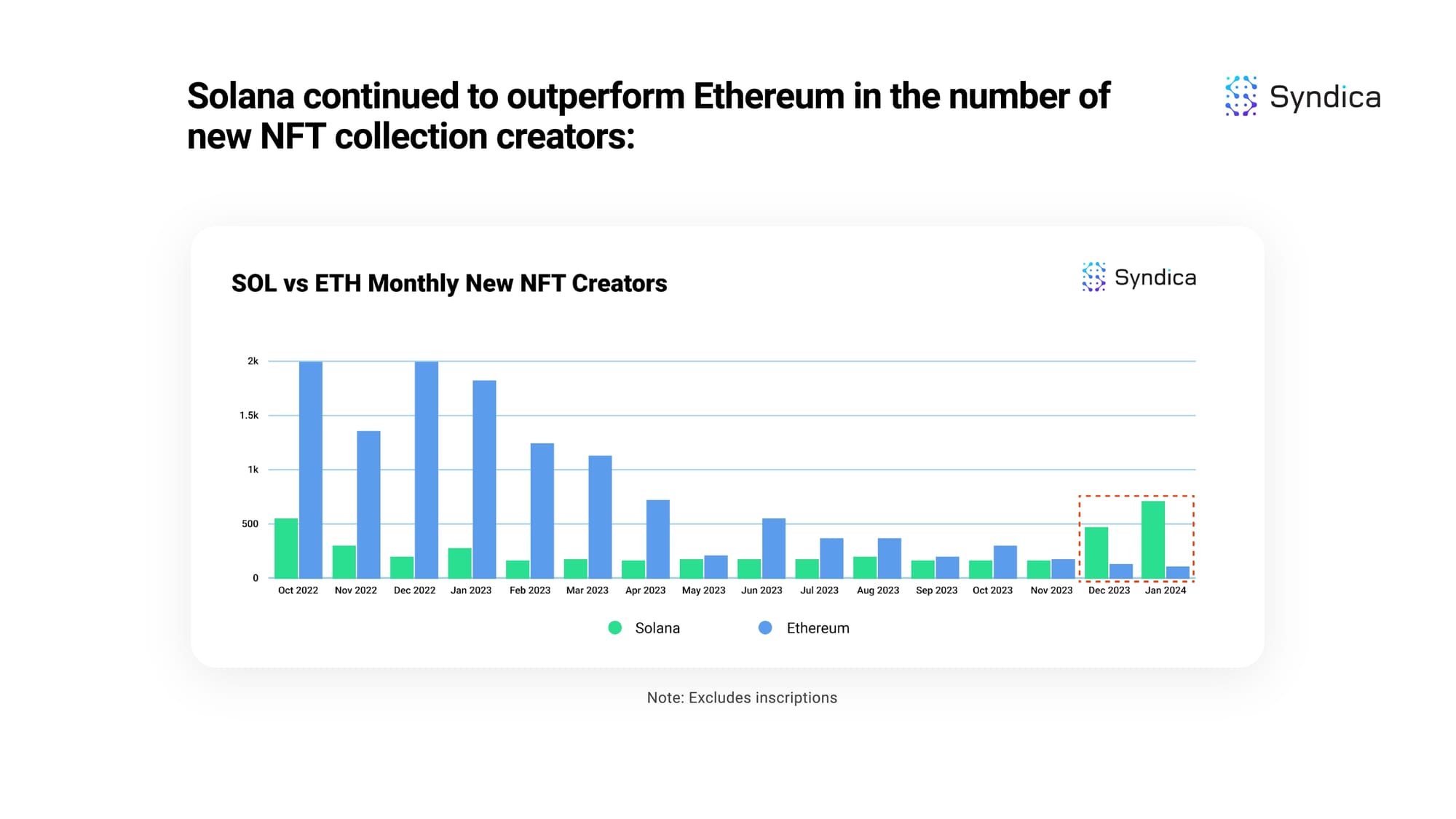

Solana continued to outperform Ethereum in the number of new NFT collection creators.

3 of the top 10 collections by volume were newly launched collections, demonstrating a continuation of December's vibrant NFT market.

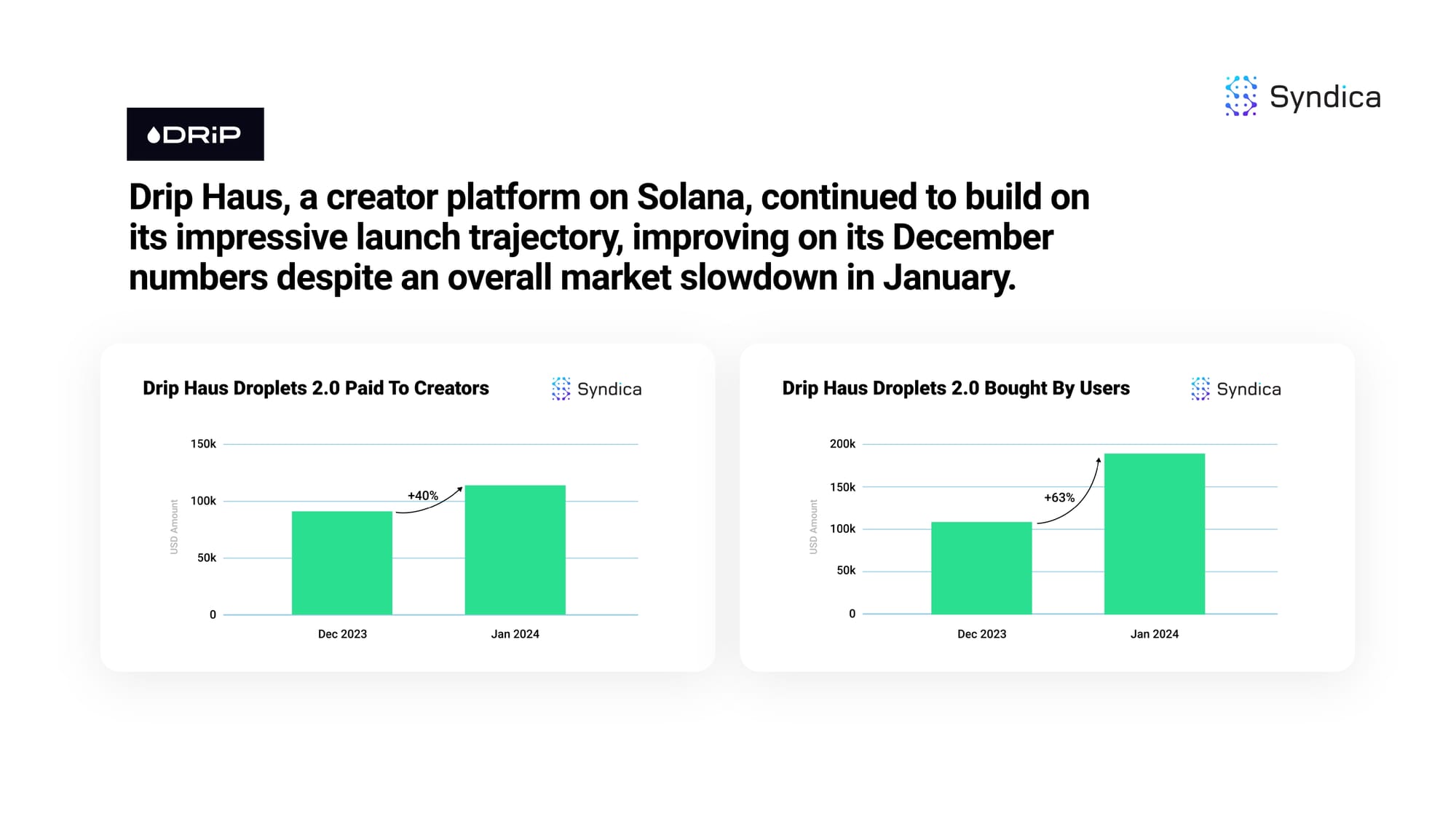

Drip Haus, a creator platform on Solana, continued to build on its impressive launch trajectory, improving on its December numbers despite an overall market slowdown in January.

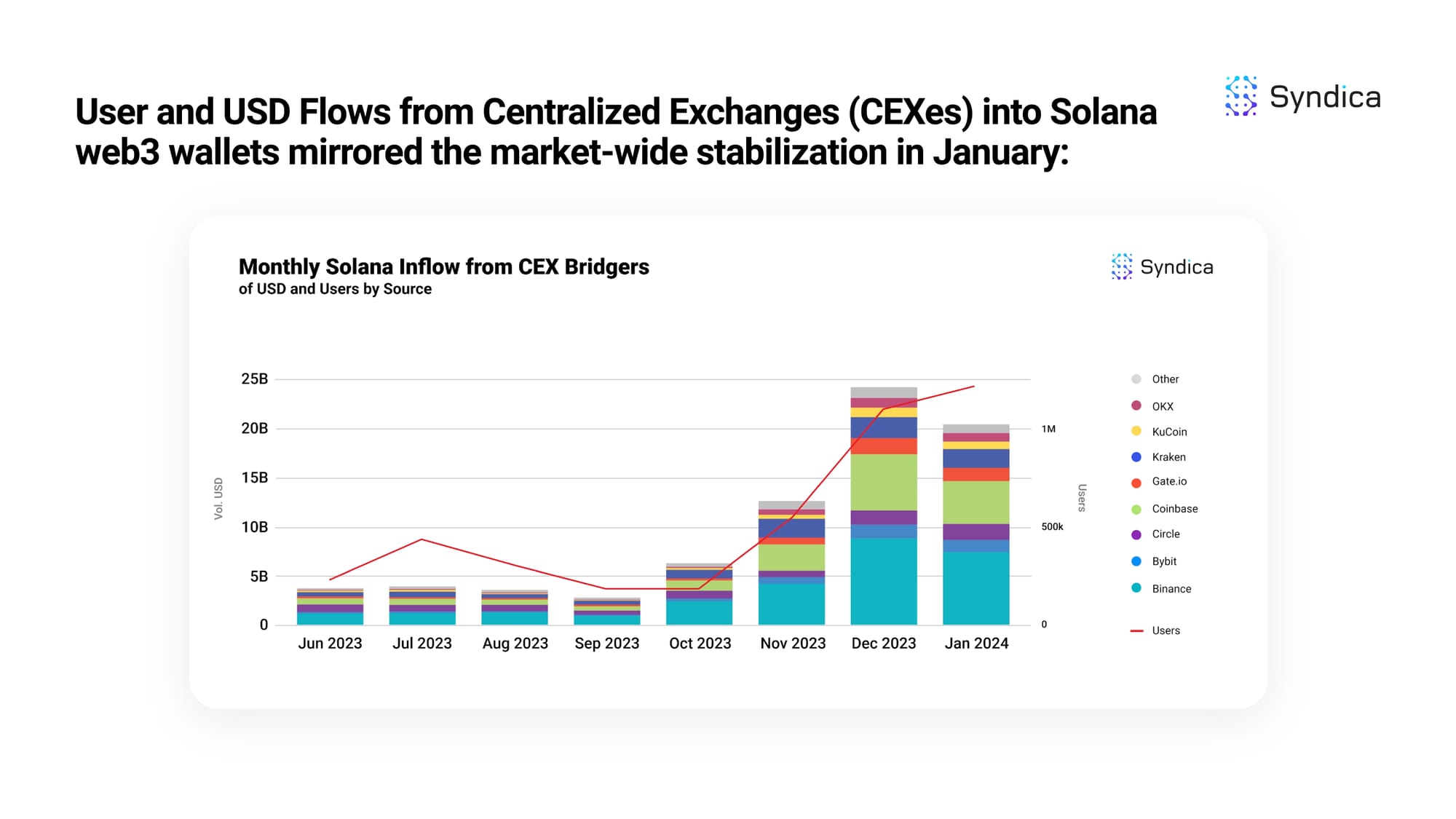

User and USD Flows from Centralized Exchanges (CEXes) into Solana web3 wallets mirrored the market-wide stabilization in January.

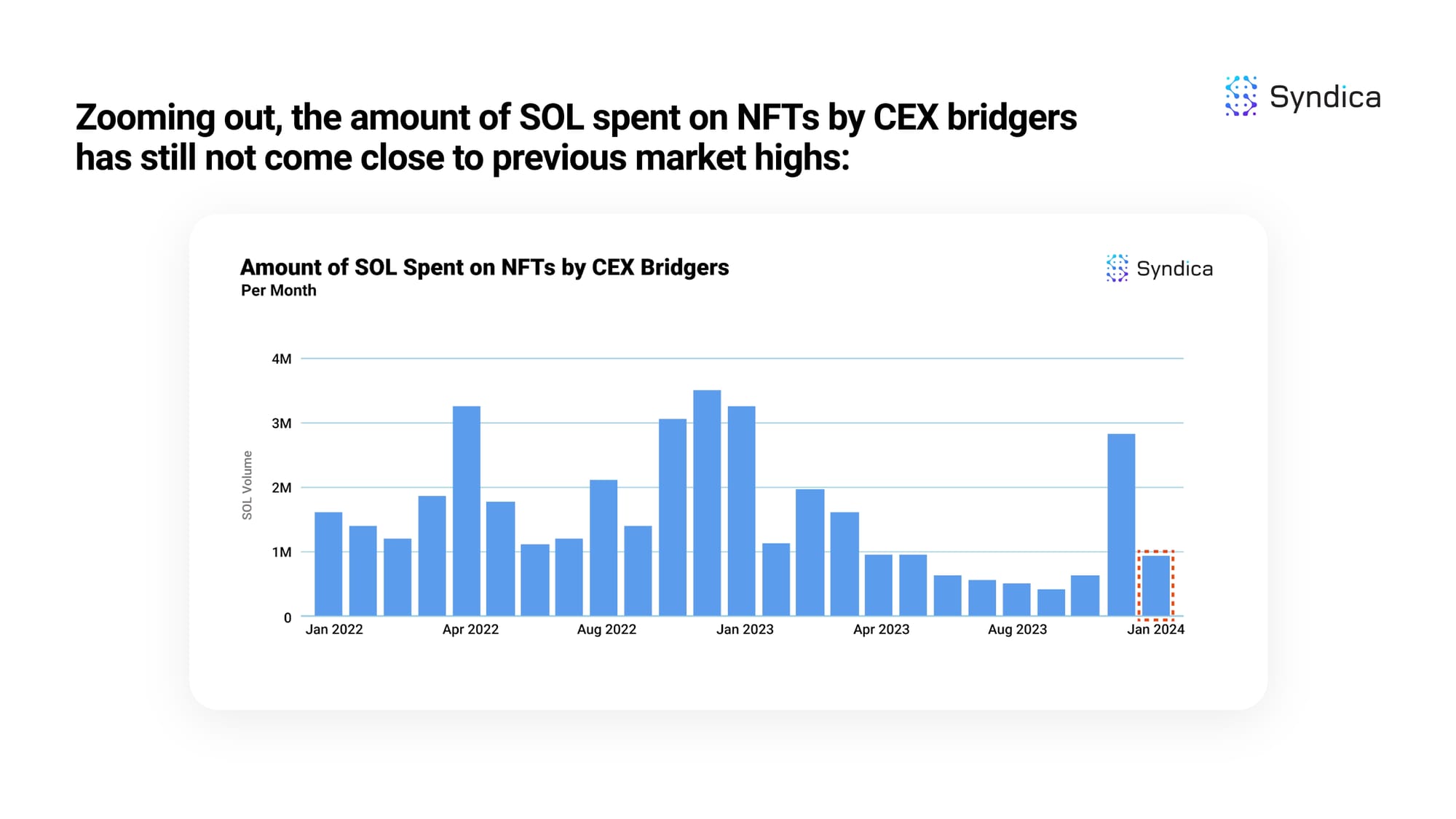

Zooming out, the amount of SOL spent on NFTs by CEX bridgers has still not come close to previous market highs.

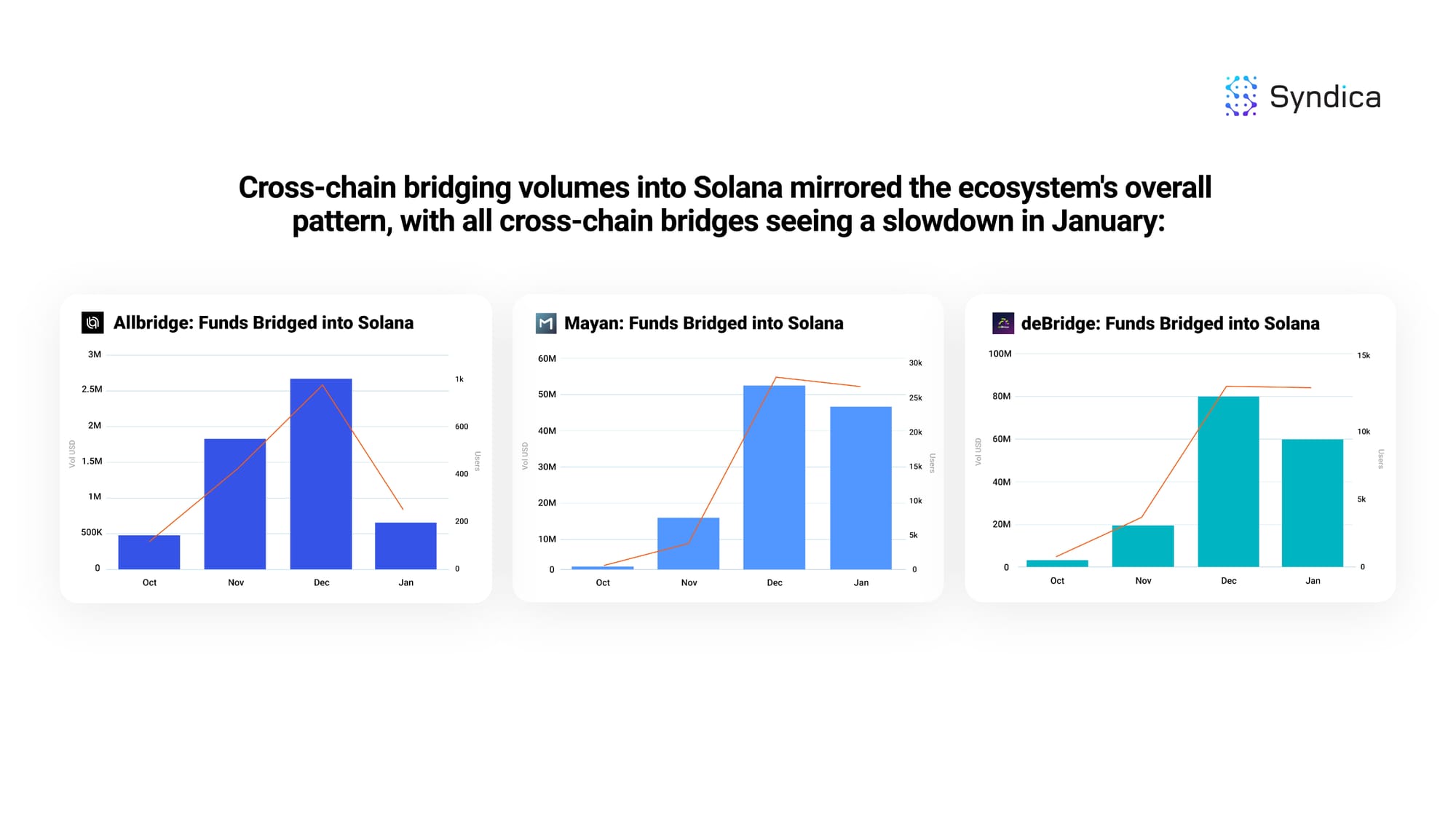

Cross-chain bridging volumes into Solana mirrored the ecosystem's overall pattern, with all cross-chain bridges seeing a slowdown in January.

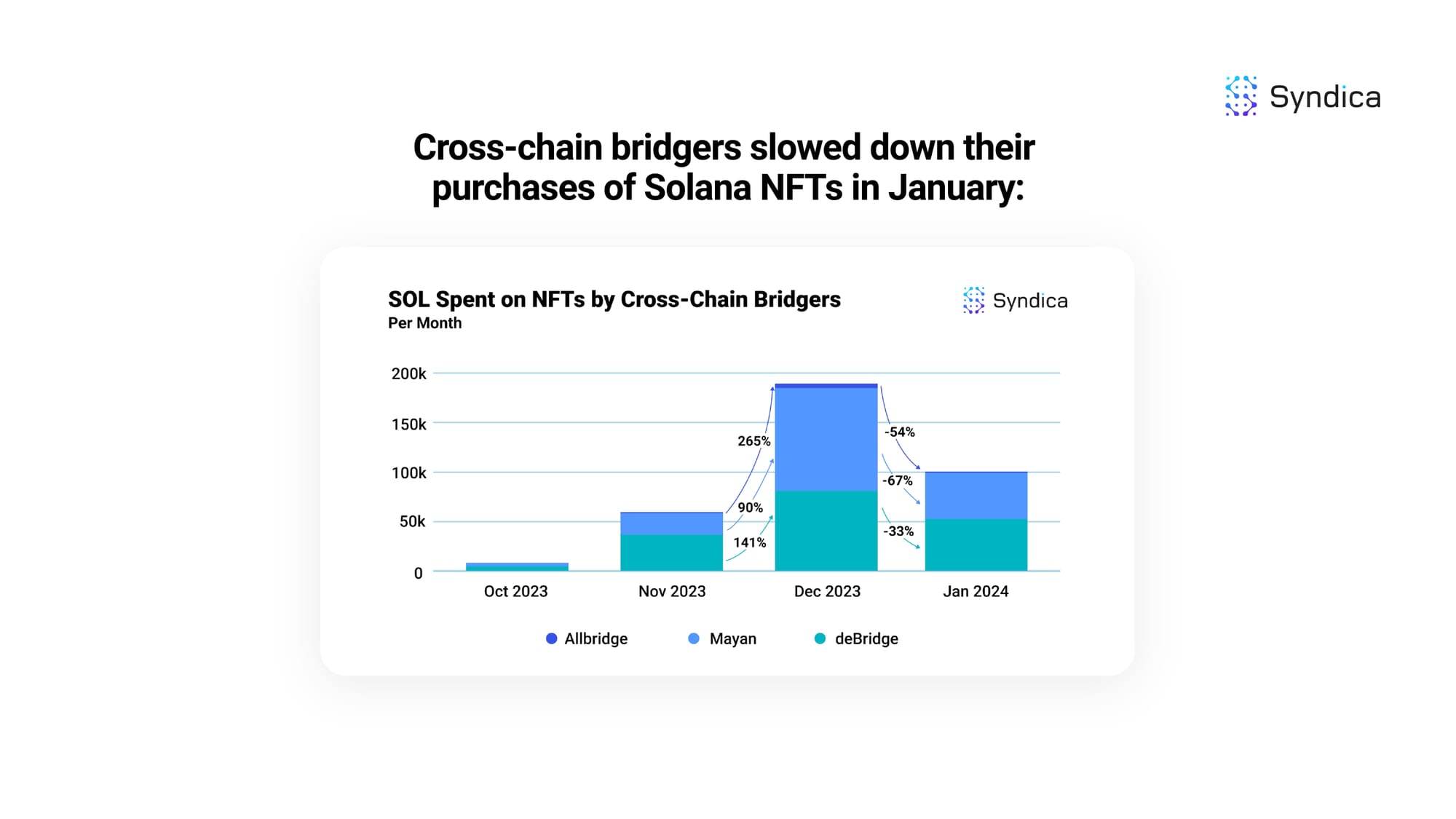

Cross-chain bridgers slowed down their purchases of Solana NFTs in January.

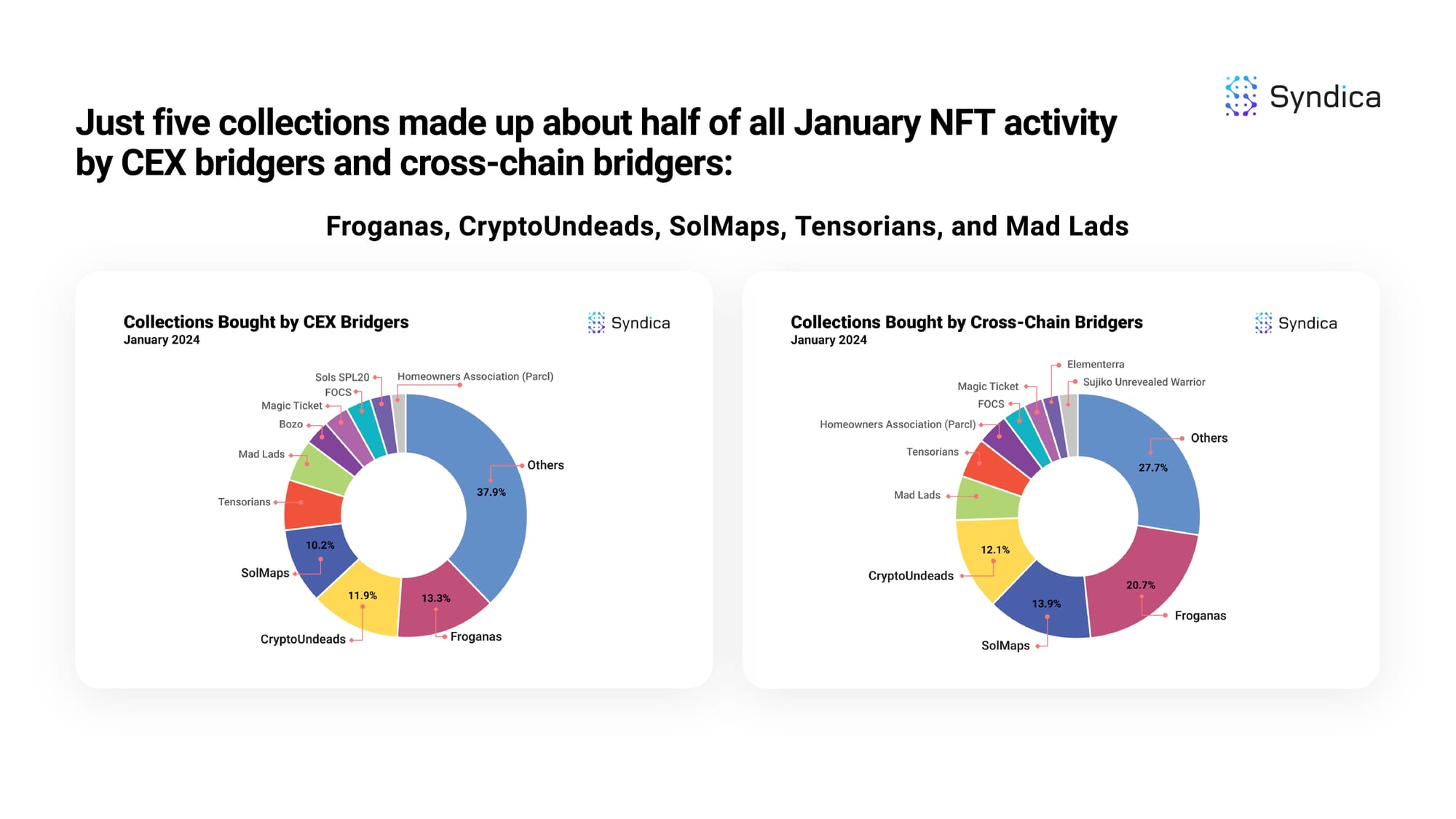

Just five collections made up about half of all January NFT activity by CEX bridgers and cross-chain bridgers: Froganas, CryptoUndeads, SolMaps, Tensorians, and Mad Lads.

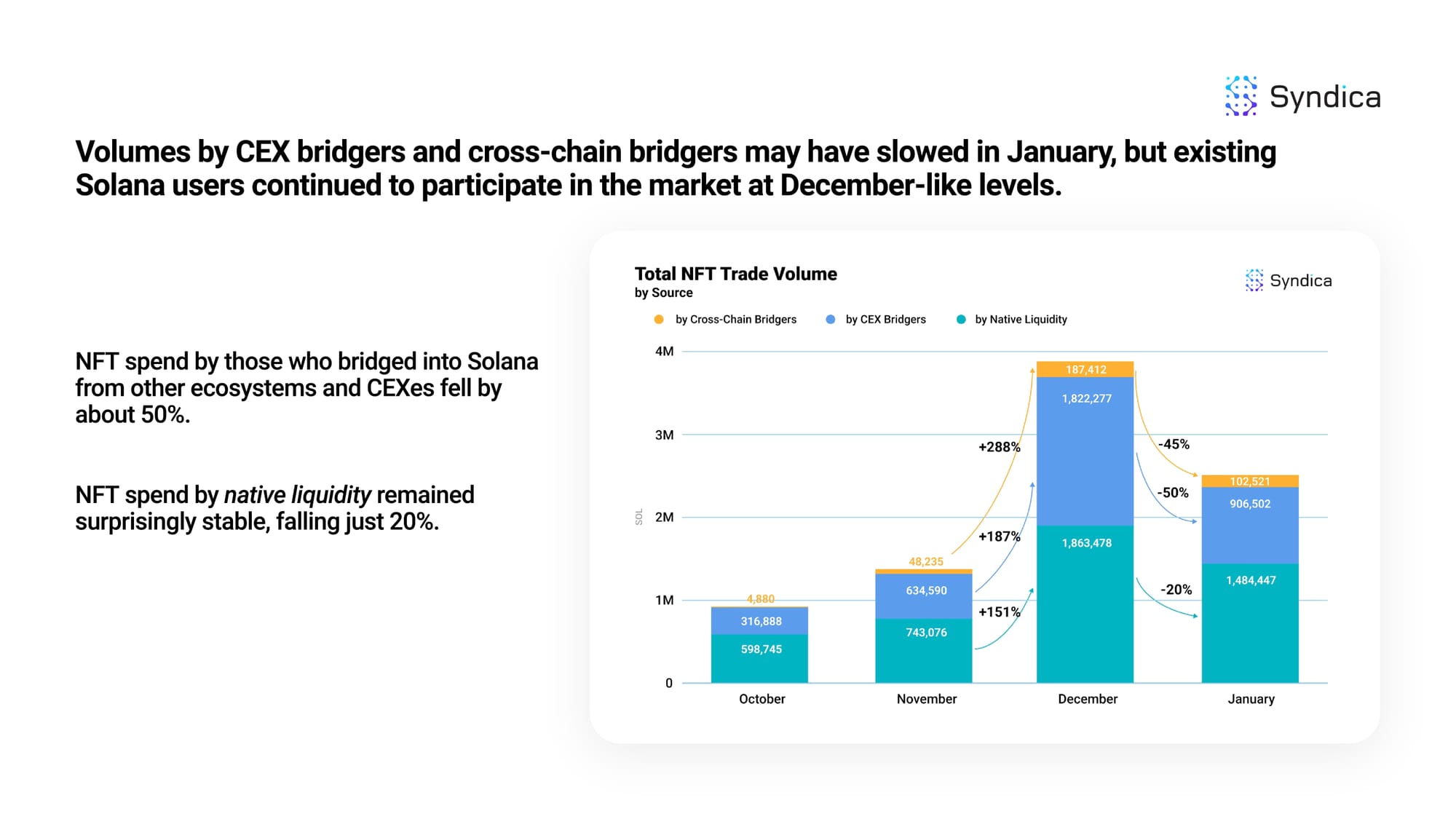

Volumes by CEX bridgers and cross-chain bridgers may have slowed in January, but existing Solana users continued to participate in the market at December-like levels.

NFT spend by those who bridged into Solana from other ecosystems and CEXes fell by about 50%.

NFT spend by native liquidity remained surprisingly stable, falling just 20%.

Our Trends To Watch:

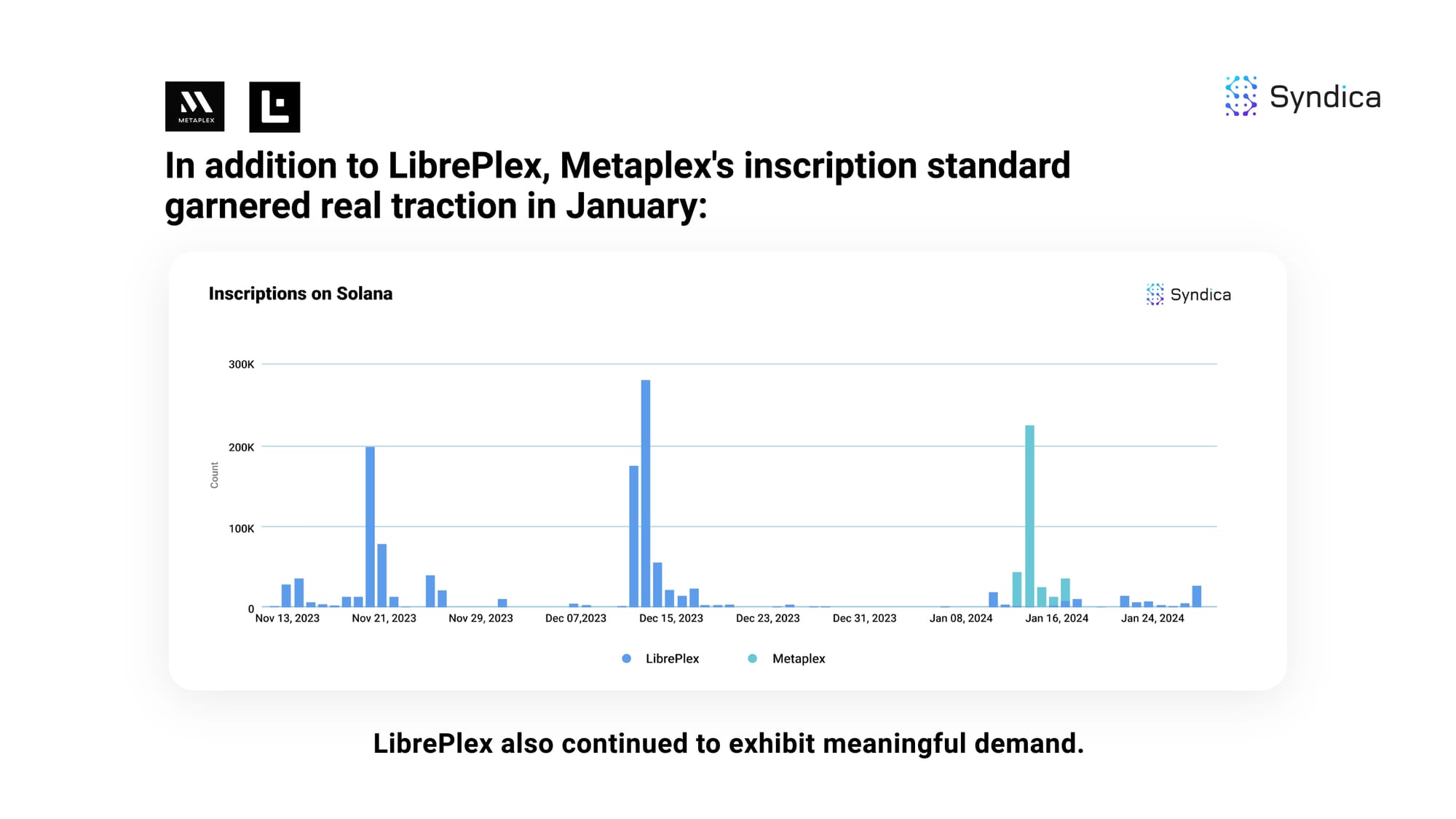

In addition to LibrePlex, Metaplex's inscription standard garnered real traction in January. LibrePlex also continued to exhibit meaningful demand.

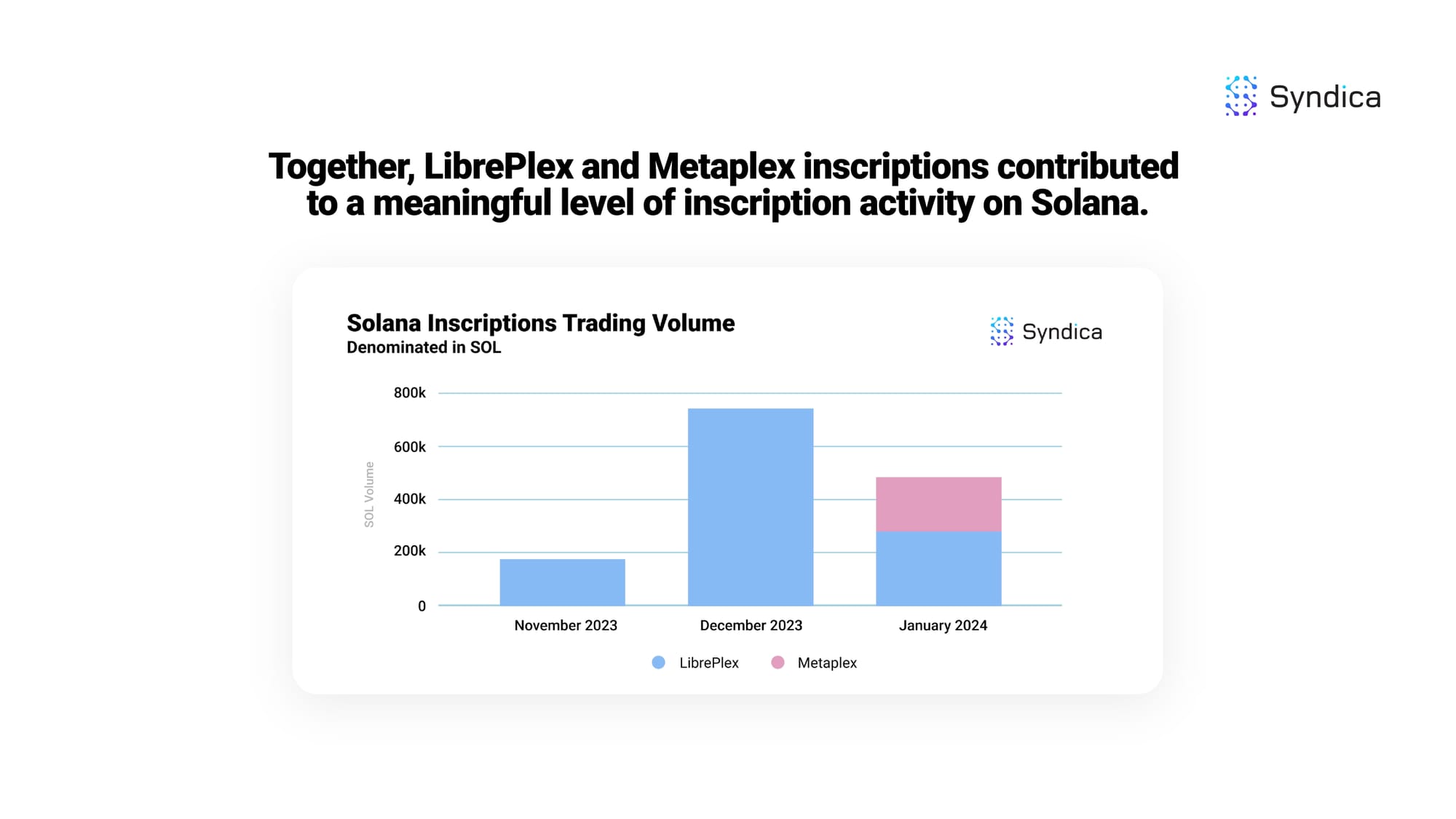

Together, LibrePlex and Metaplex inscriptions contributed to a meaningful level of inscription activity on Solana.

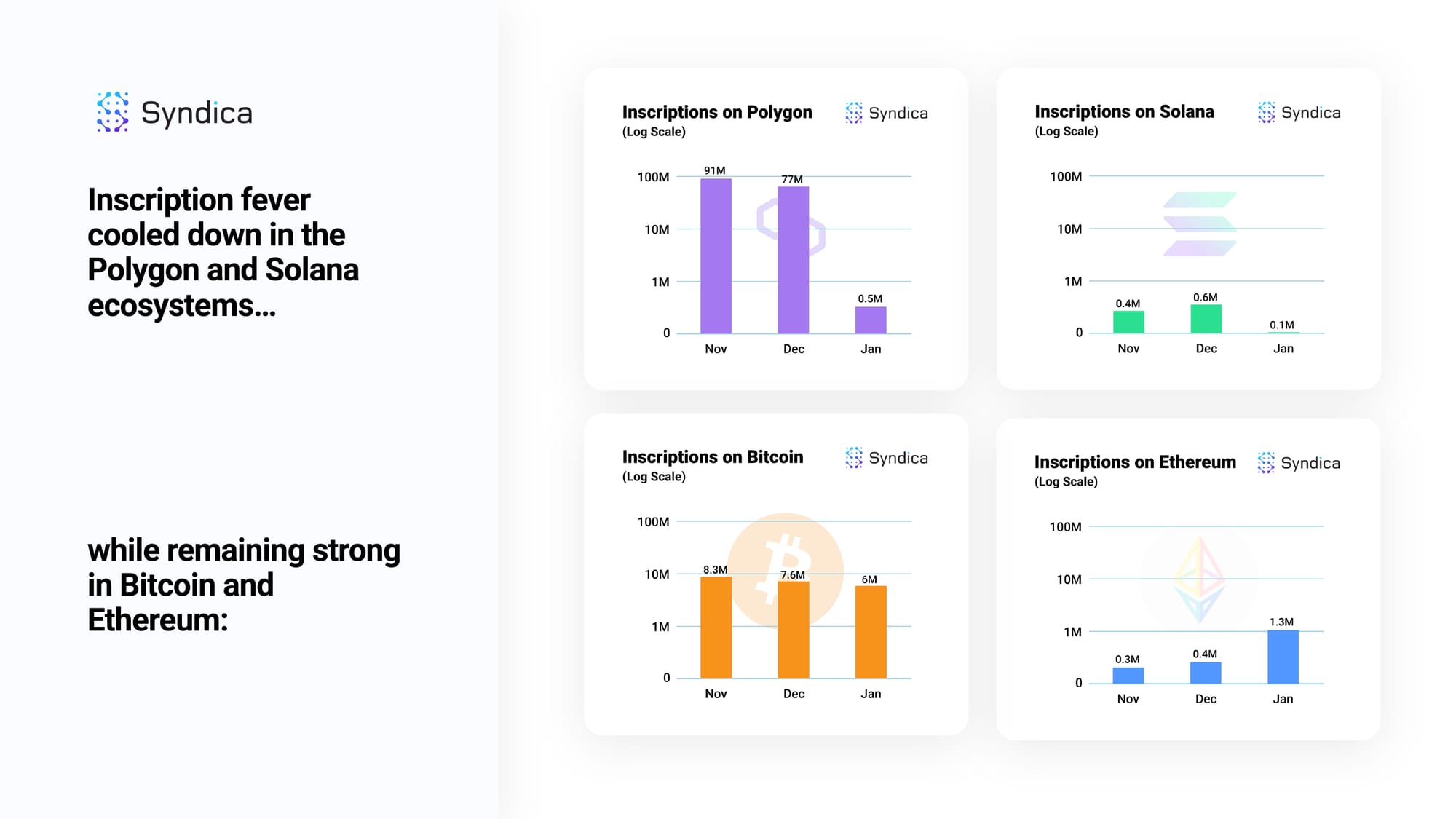

Inscription fever cooled down in the Polygon and Solana ecosystems while remaining strong in Bitcoin and Ethereum.

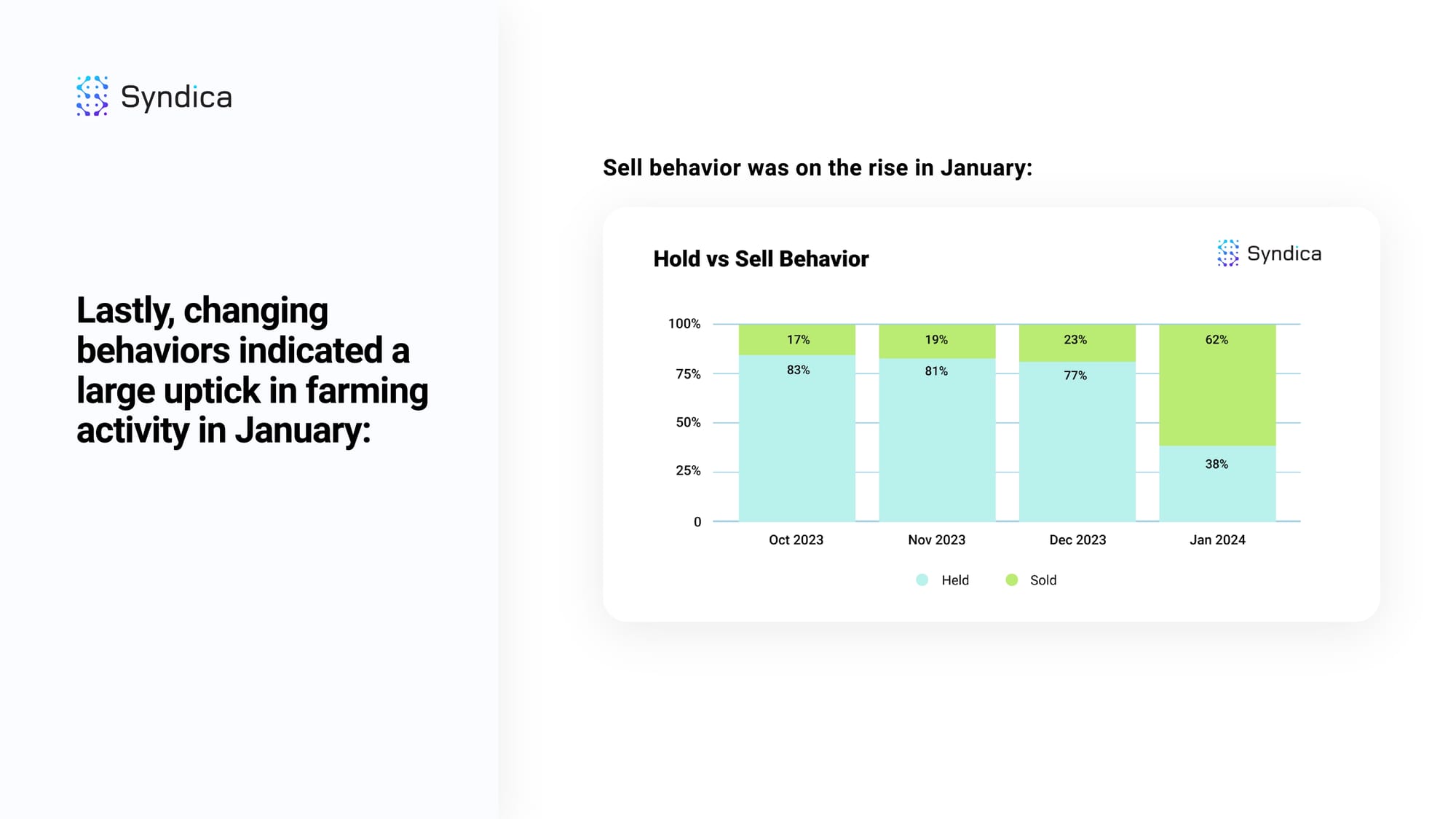

Lastly, changing behaviors indicated a large uptick in farming activity in January.

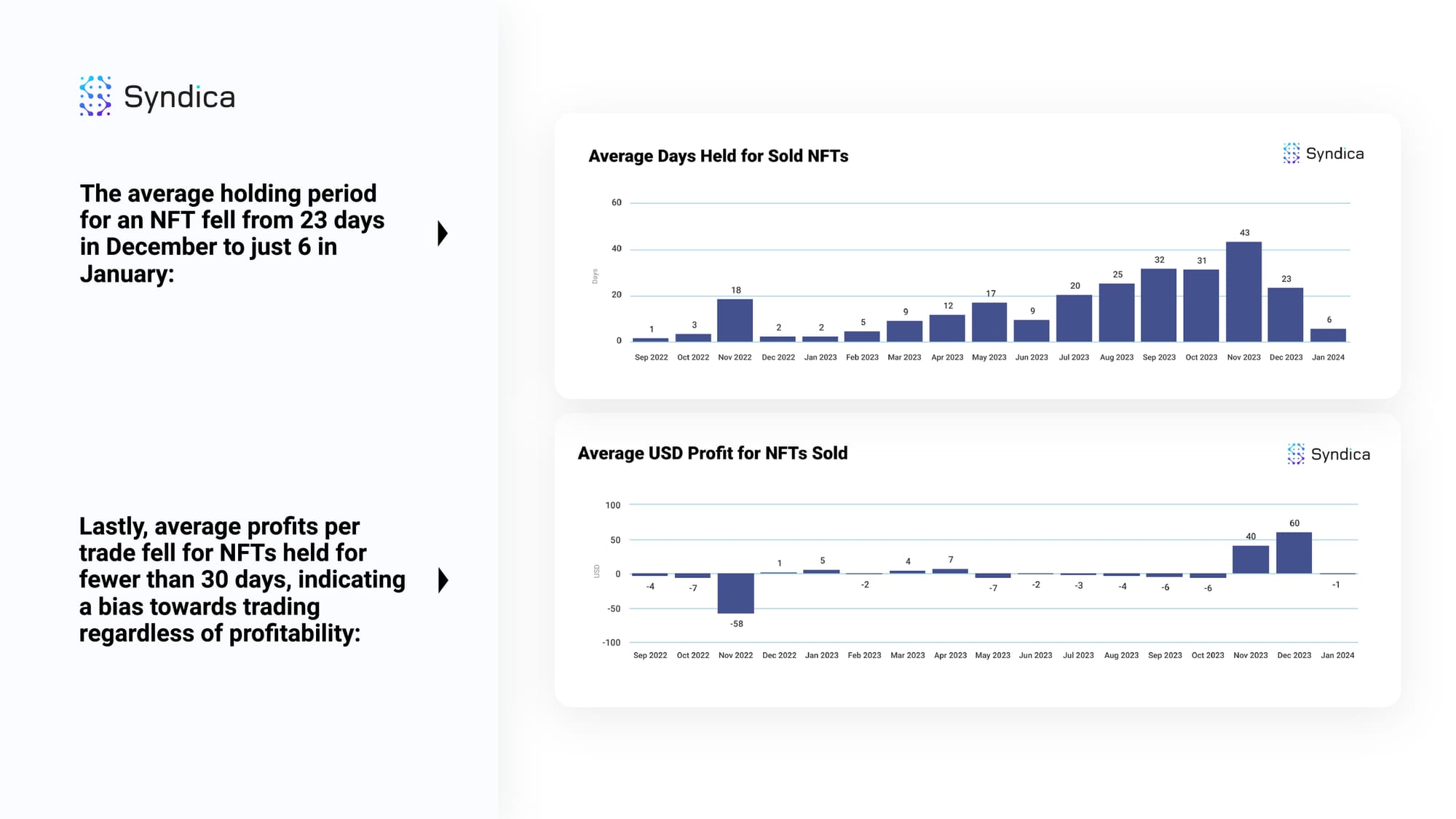

The average holding period for an NFT fell from 23 days in December to just 6 in January. The average profits per trade fell for NFTs held for fewer than 30 days, indicating a bias towards trading regardless of profitability.