Deep Dive: Solana DApps Revenue - April 2025

Deep Dive: Solana DApps Revenue - April 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - April 2025

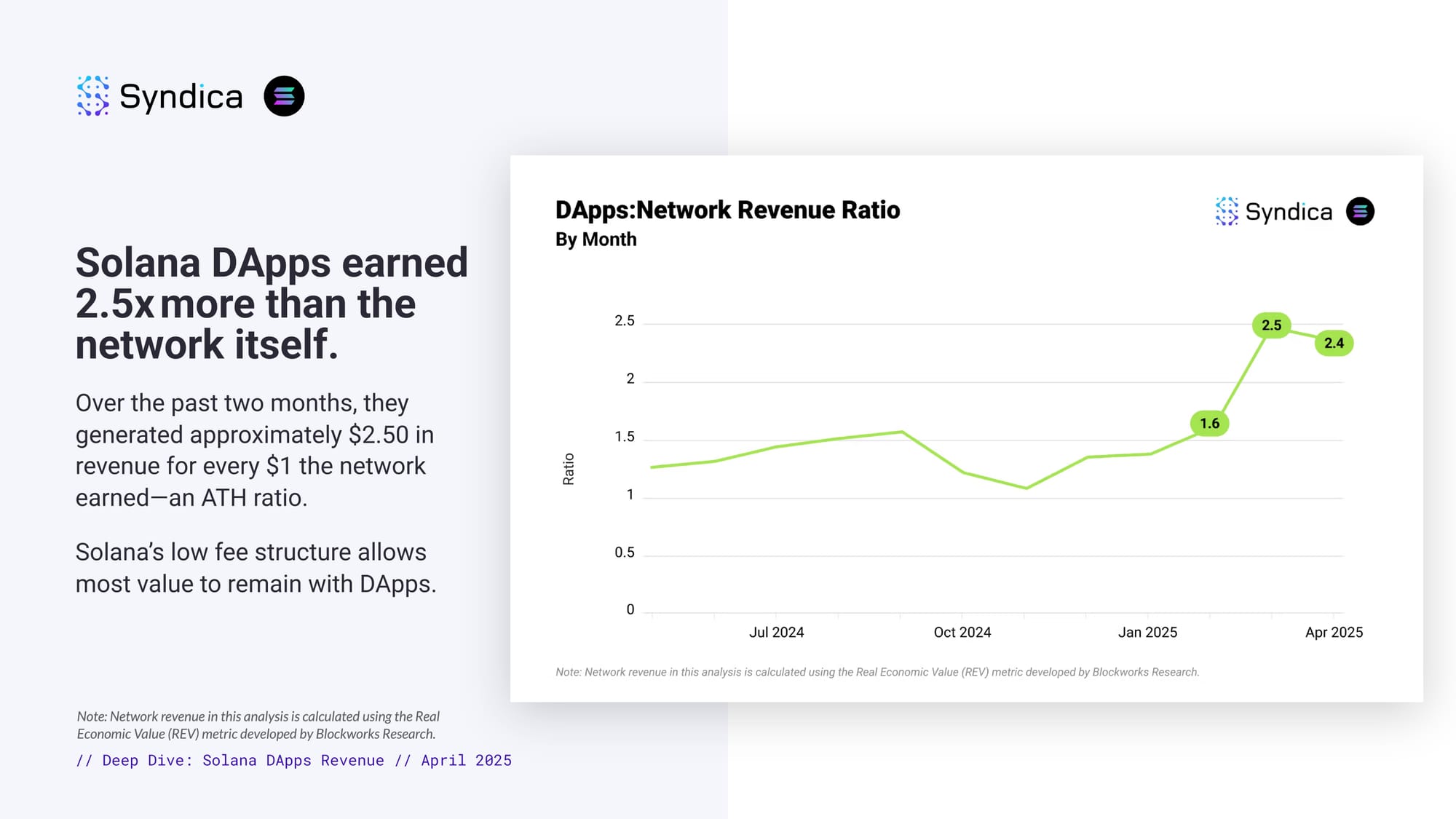

Solana DApps earned 2.5x more than the network itself. Over the past two months, they generated approximately $2.50 in revenue for every $1 the network earned—an ATH ratio. Solana’s low fee structure allows most value to remain with DApps.

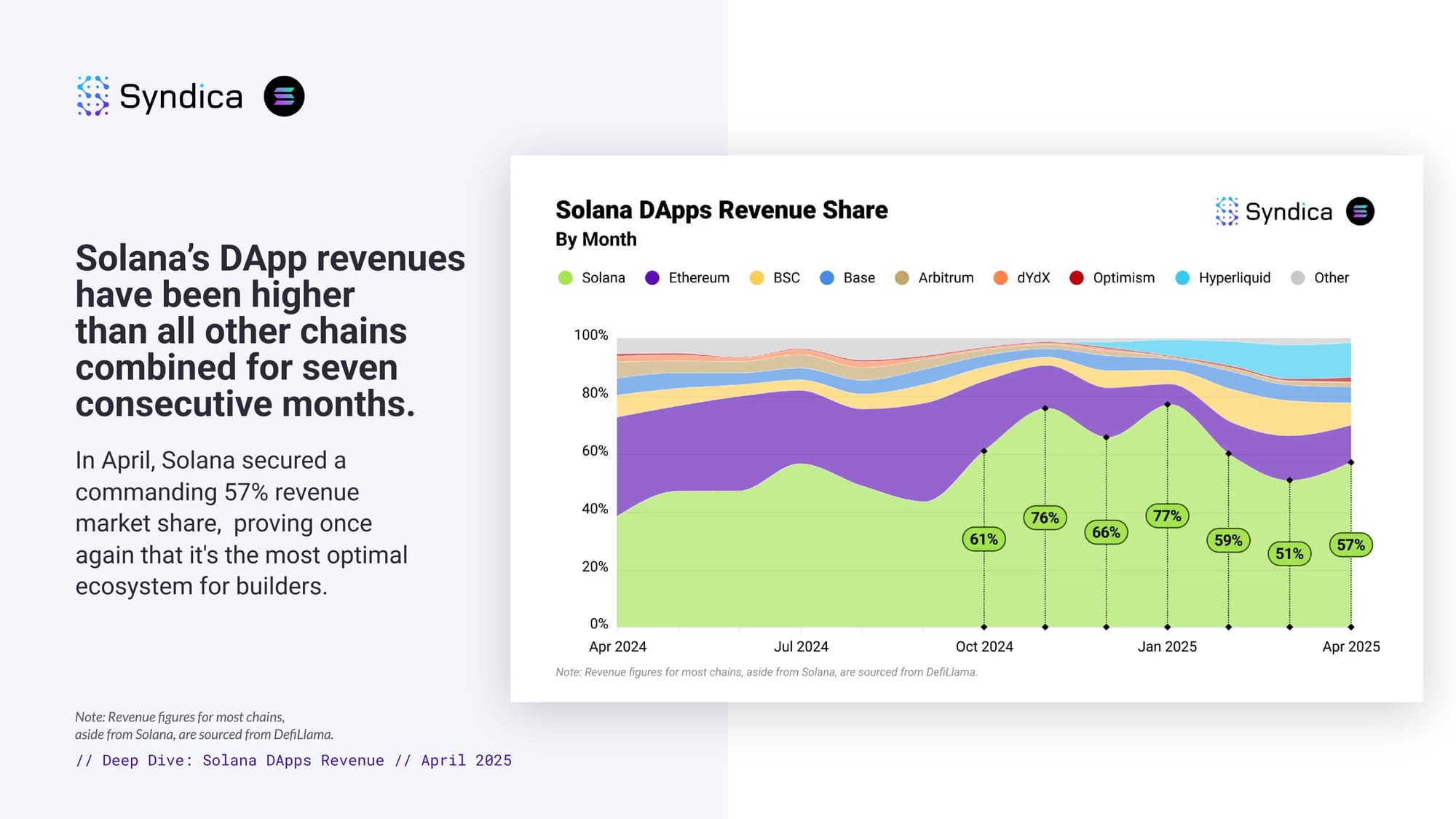

Solana’s DApp revenues have been higher than all other chains combined for seven consecutive months. In April, Solana secured a commanding 57% revenue market share, proving once again that it's the most optimal ecosystem for builders.

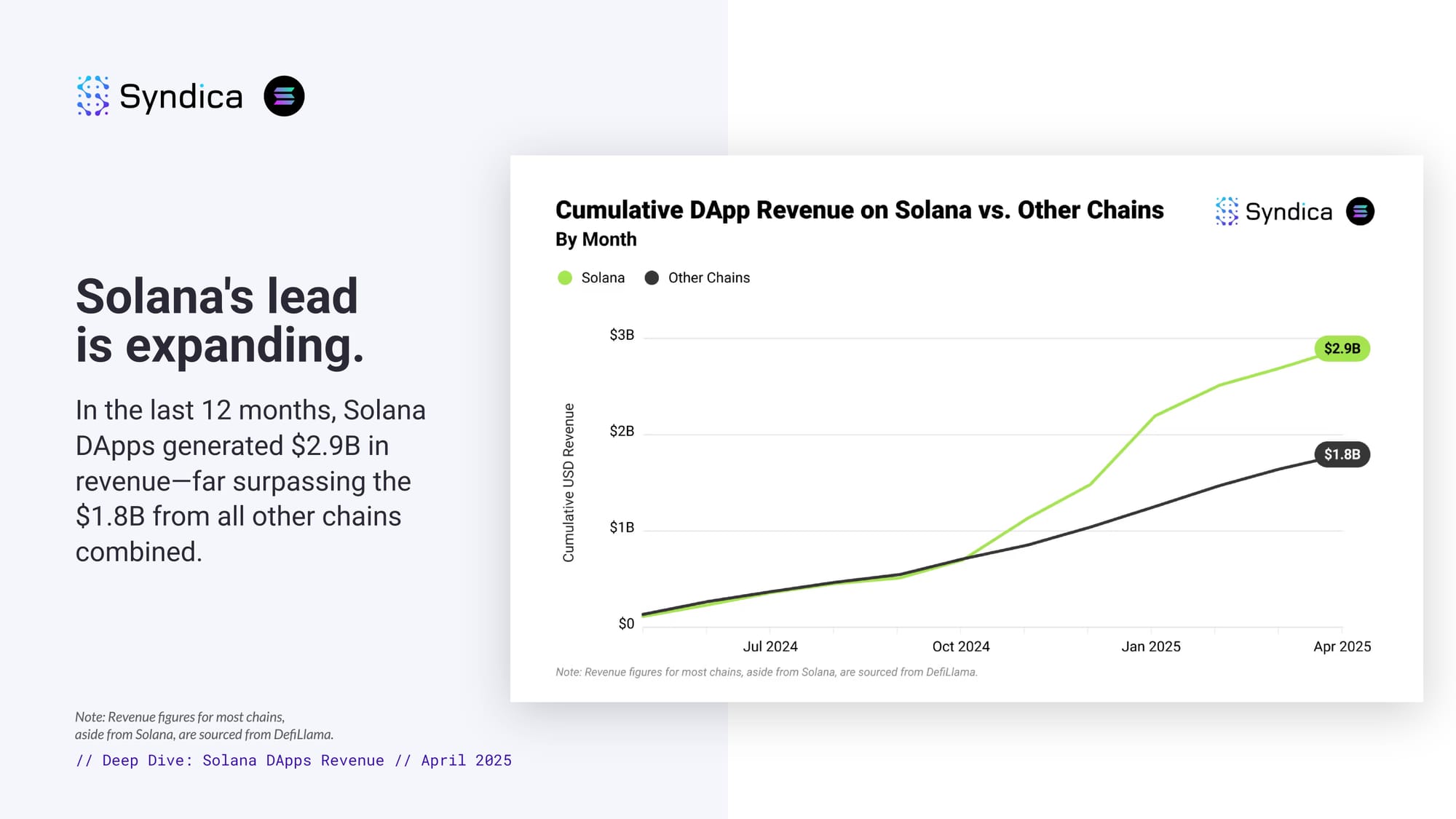

Solana's lead is expanding. In the last 12 months, Solana DApps generated $2.9B in revenue—far surpassing the $1.8B from all other chains combined.

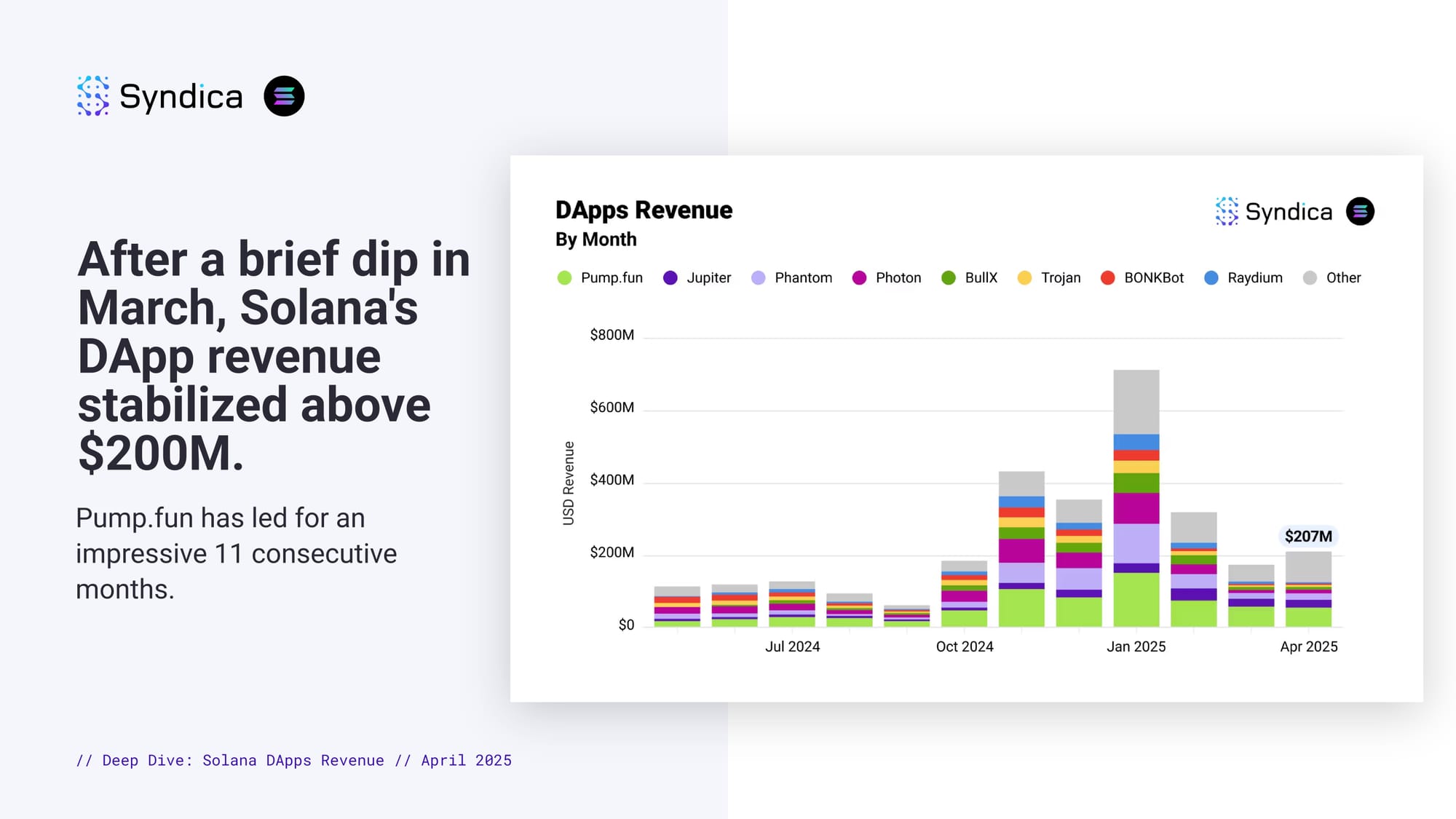

After a brief dip in March, Solana's DApp revenue stabilized above $200M. Pump.fun has led for an impressive 11 consecutive months.

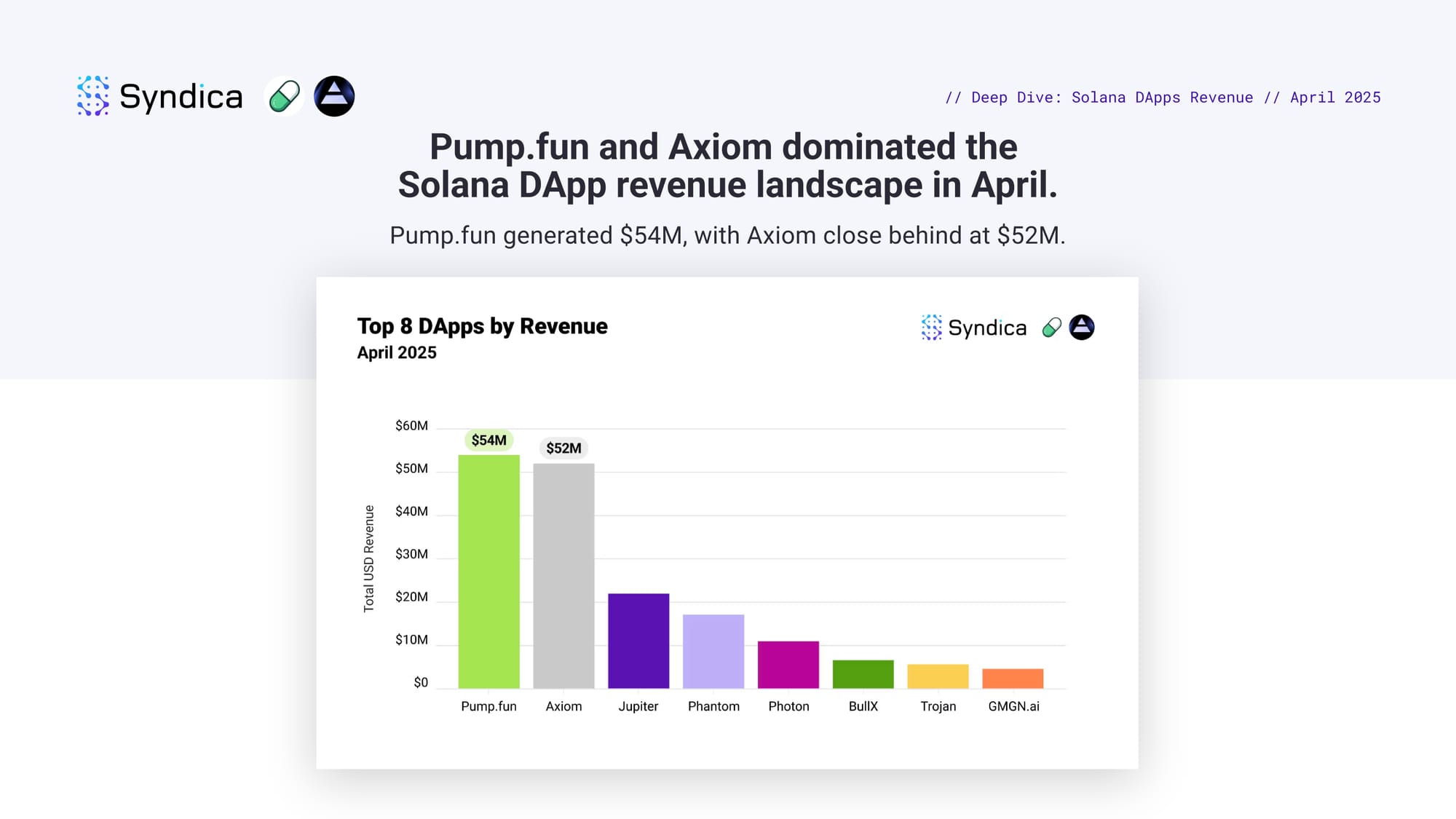

Pump.fun and Axiom dominated the Solana DApp revenue landscape in April. Pump.fun generated $54M, with Axiom close behind at $52M.

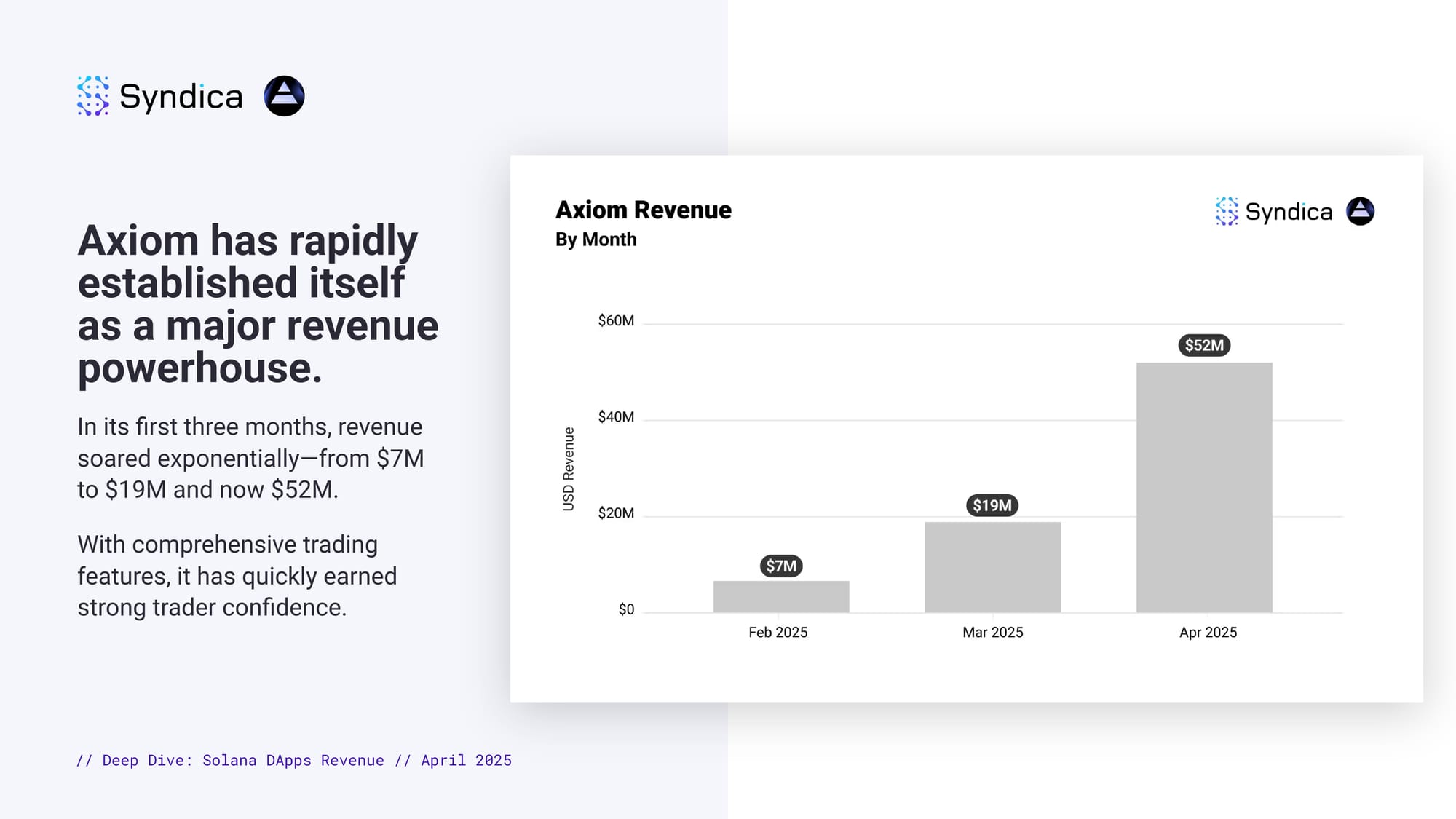

Axiom has rapidly established itself as a major revenue powerhouse. In its first three months, revenue soared exponentially—from $7M to $19M and now $52M. With comprehensive trading features, it has quickly earned strong trader confidence.

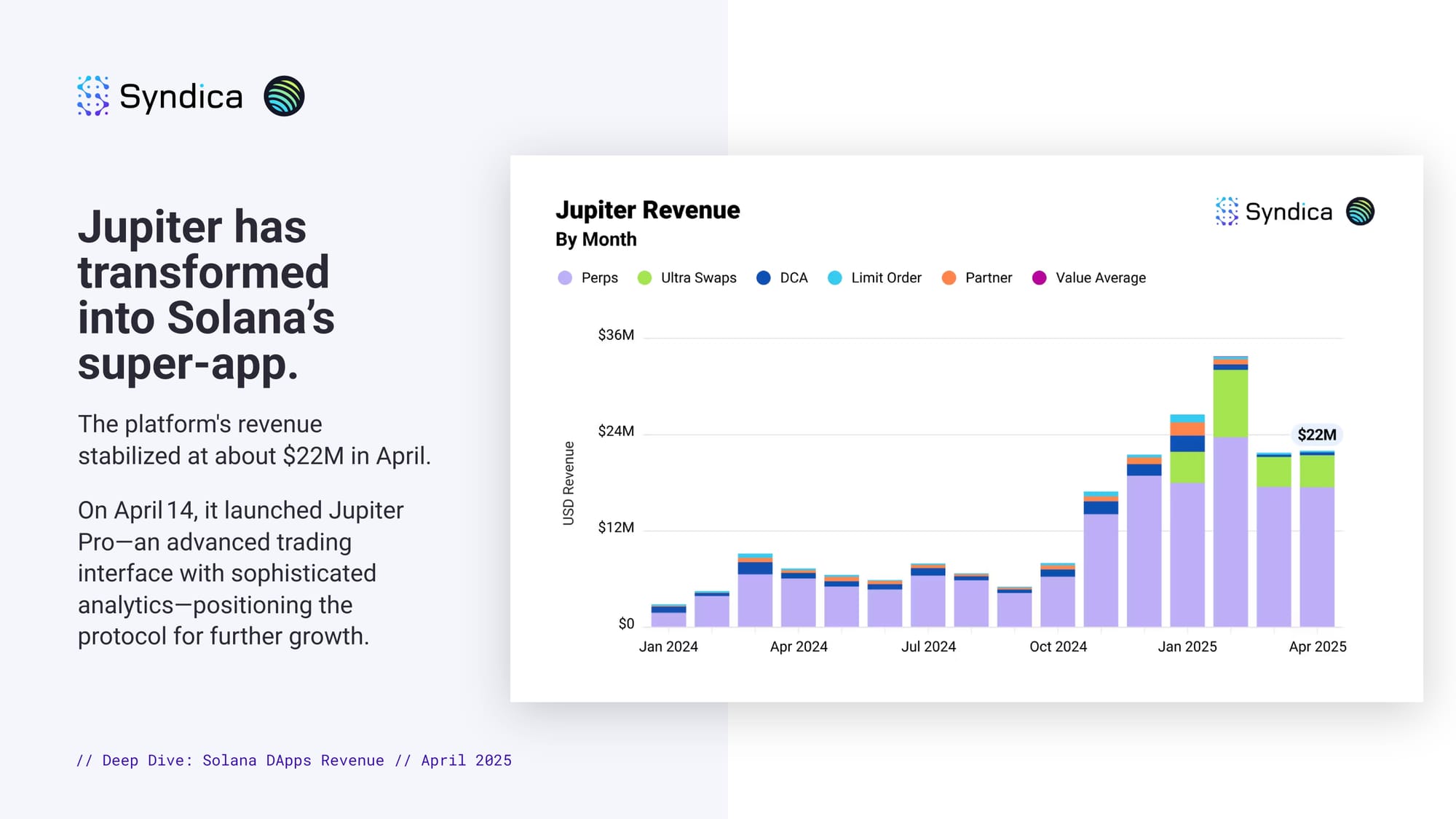

Jupiter has transformed into Solana’s super-app. The platform's revenue stabilized at about $22M in April. On April 14, it launched Jupiter Pro—an advanced trading interface with sophisticated analytics—positioning the protocol for further growth.

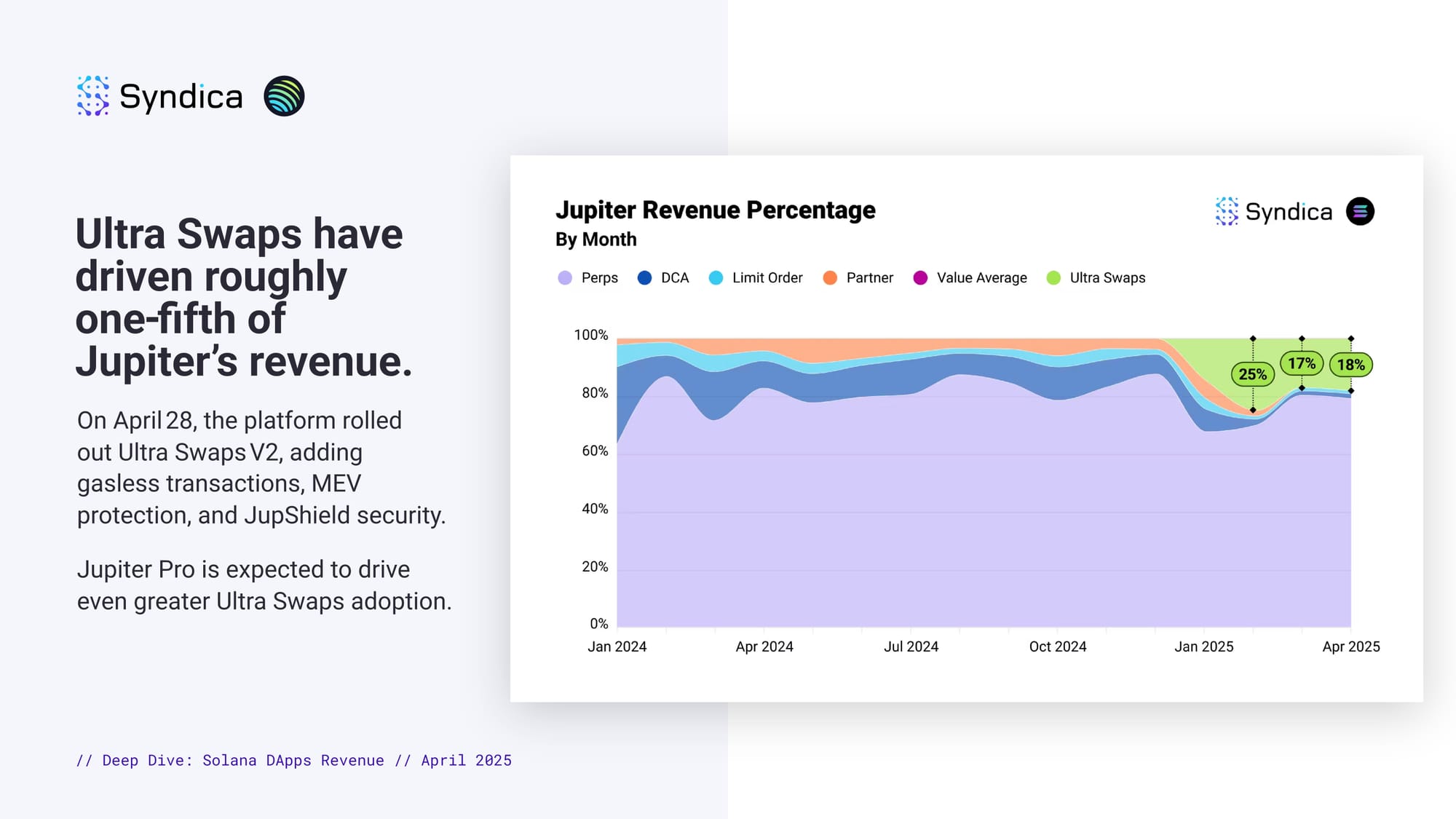

Ultra Swaps have driven roughly one‑fifth of Jupiter’s revenue. On April 28, the platform rolled out Ultra Swaps V2, adding gasless transactions, MEV protection, and JupShield security. Jupiter Pro is expected to drive even greater Ultra Swaps adoption.

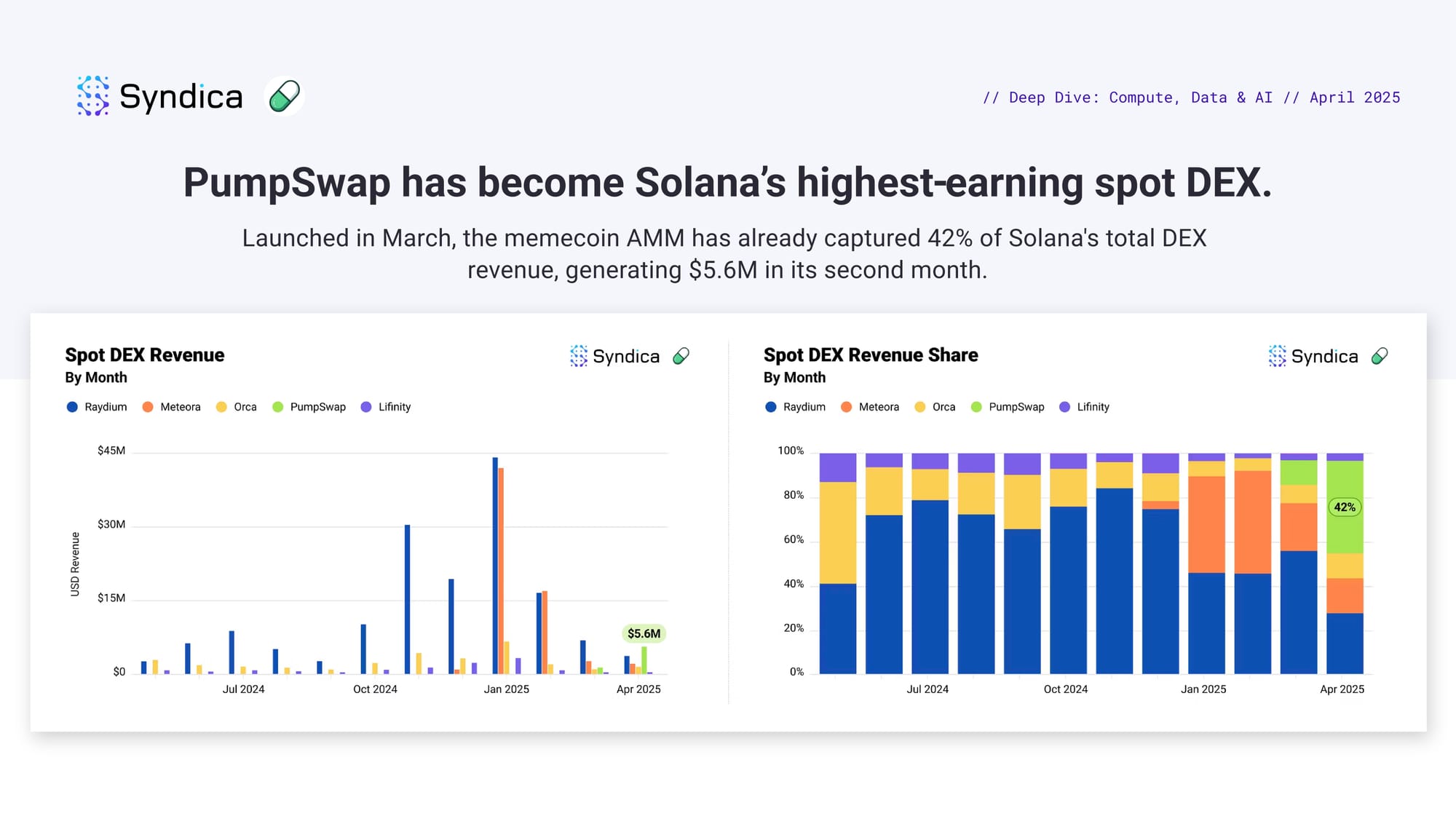

PumpSwap has become Solana’s highest‑earning spot DEX. Launched in March, the memecoin AMM has already captured 42% of Solana's total DEX revenue, generating $5.6M in its second month.

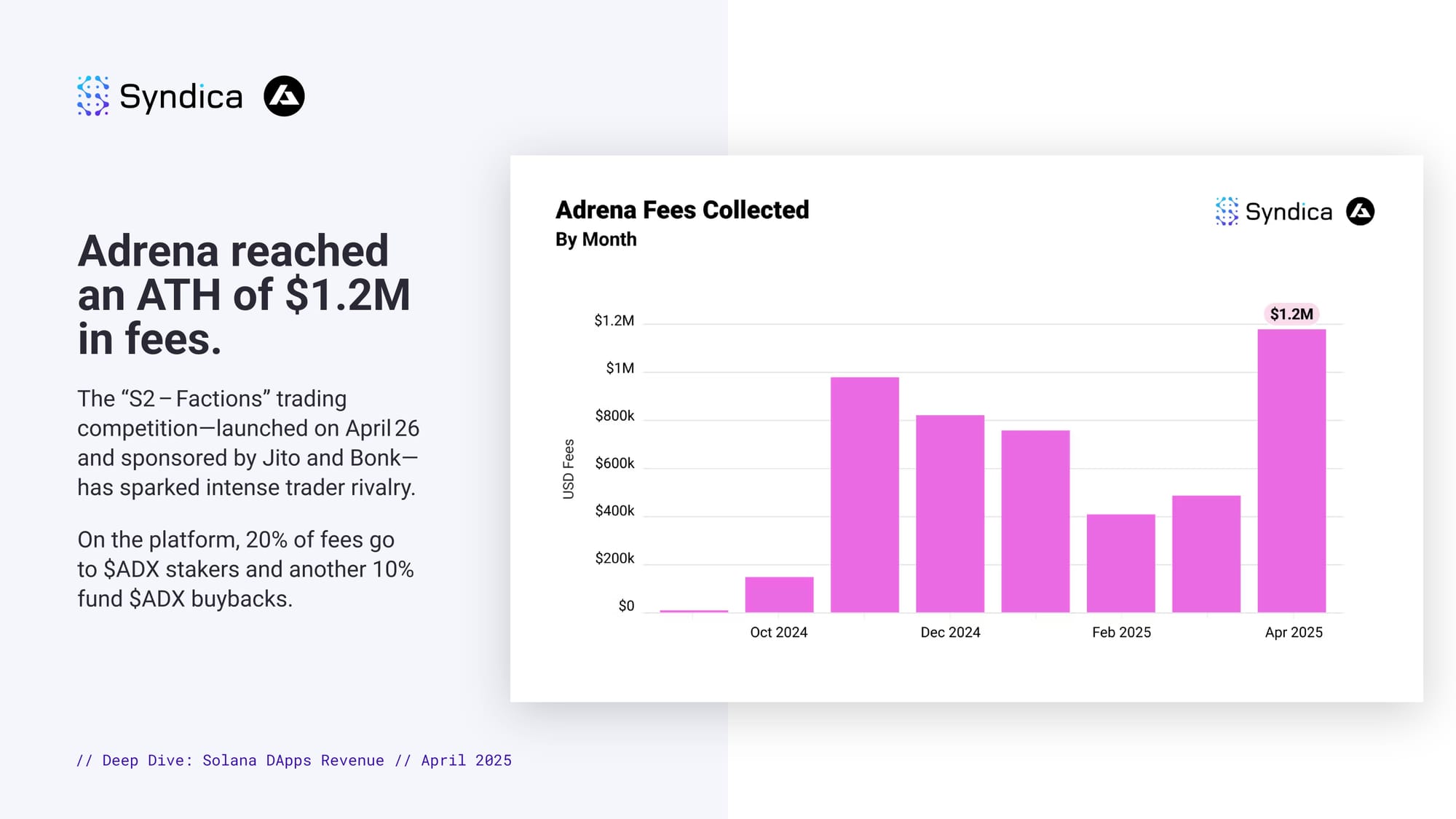

Adrena reached an ATH of $1.2M in fees. The “S2 – Factions” trading competition—launched on April 26 and sponsored by Jito and Bonk—has sparked intense trader rivalry. On the platform, 20% of fees go to $ADX stakers and another 10% fund $ADX buybacks.

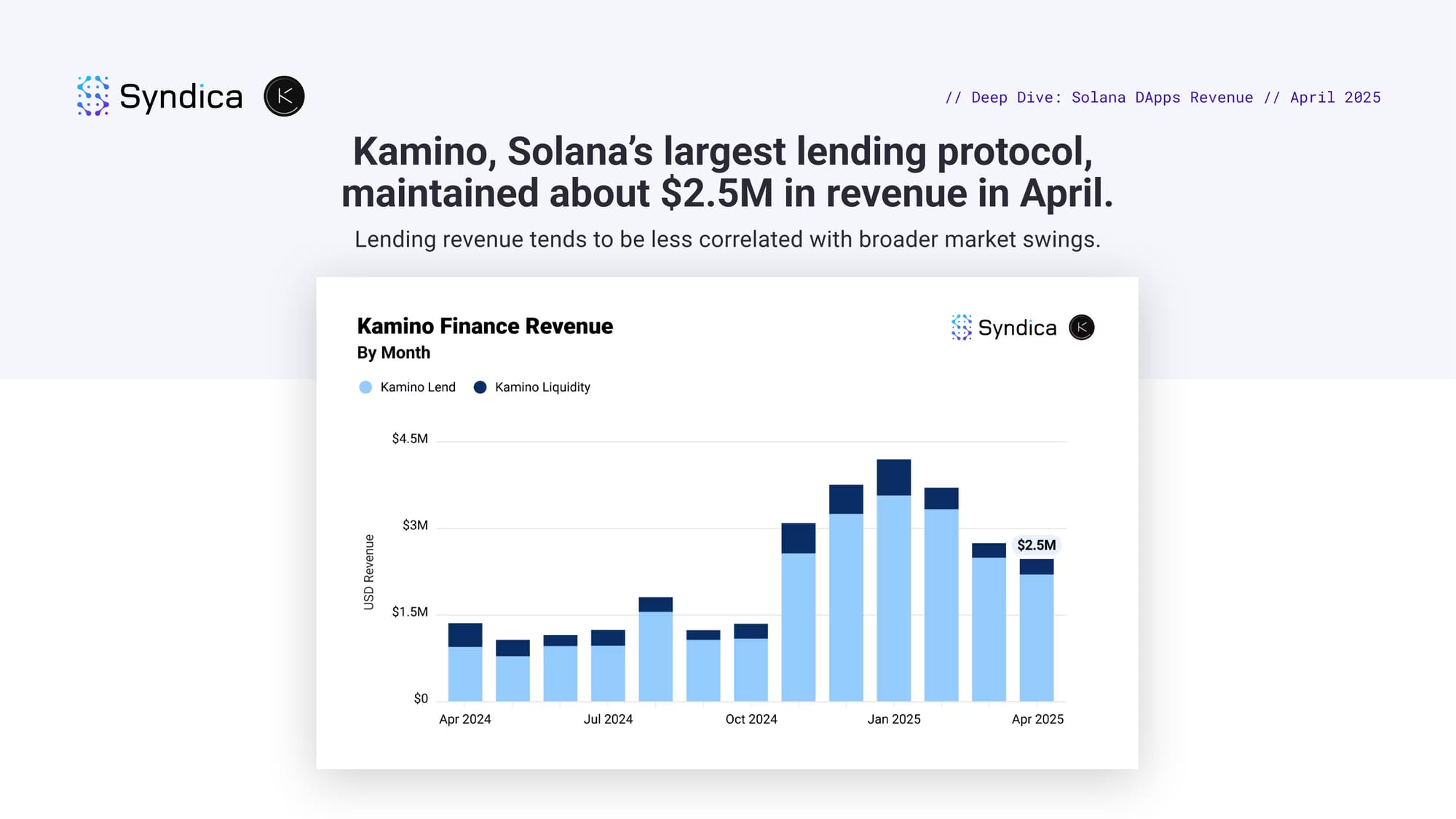

Kamino, Solana’s largest lending protocol, maintained about $2.5M in revenue in April.

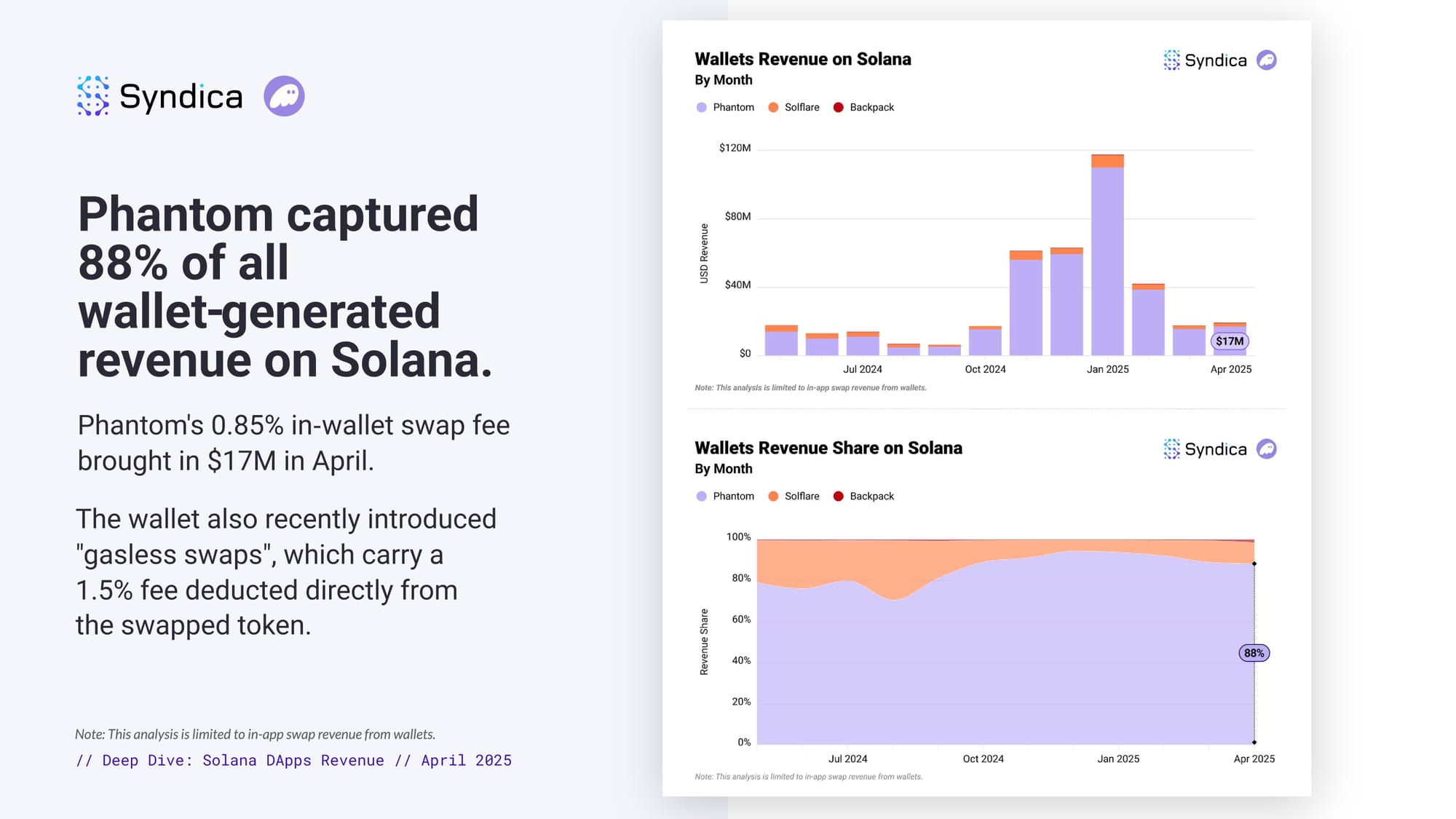

Phantom captured 88% of all wallet‑generated revenue on Solana. Phantom's 0.85% in‑wallet swap fee brought in $17M in April. The wallet also recently introduced "gasless swaps", which carry a 1.5% fee deducted directly from the swapped token.

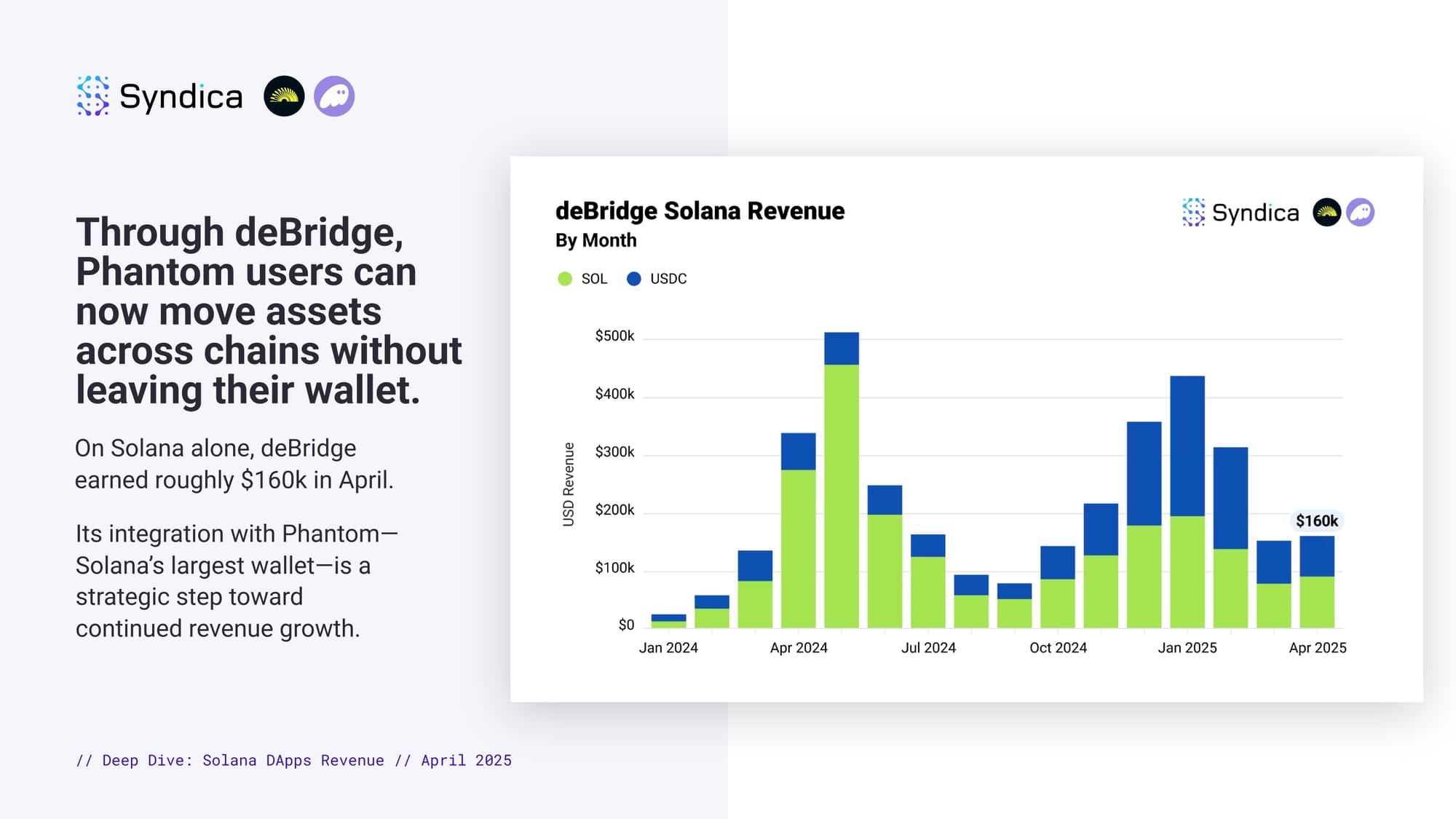

Through deBridge, Phantom users can now move assets across chains without leaving their wallet. On Solana alone, deBridge earned roughly $160k in April. Its integration with Phantom—Solana’s largest wallet—is a strategic step toward continued revenue growth.

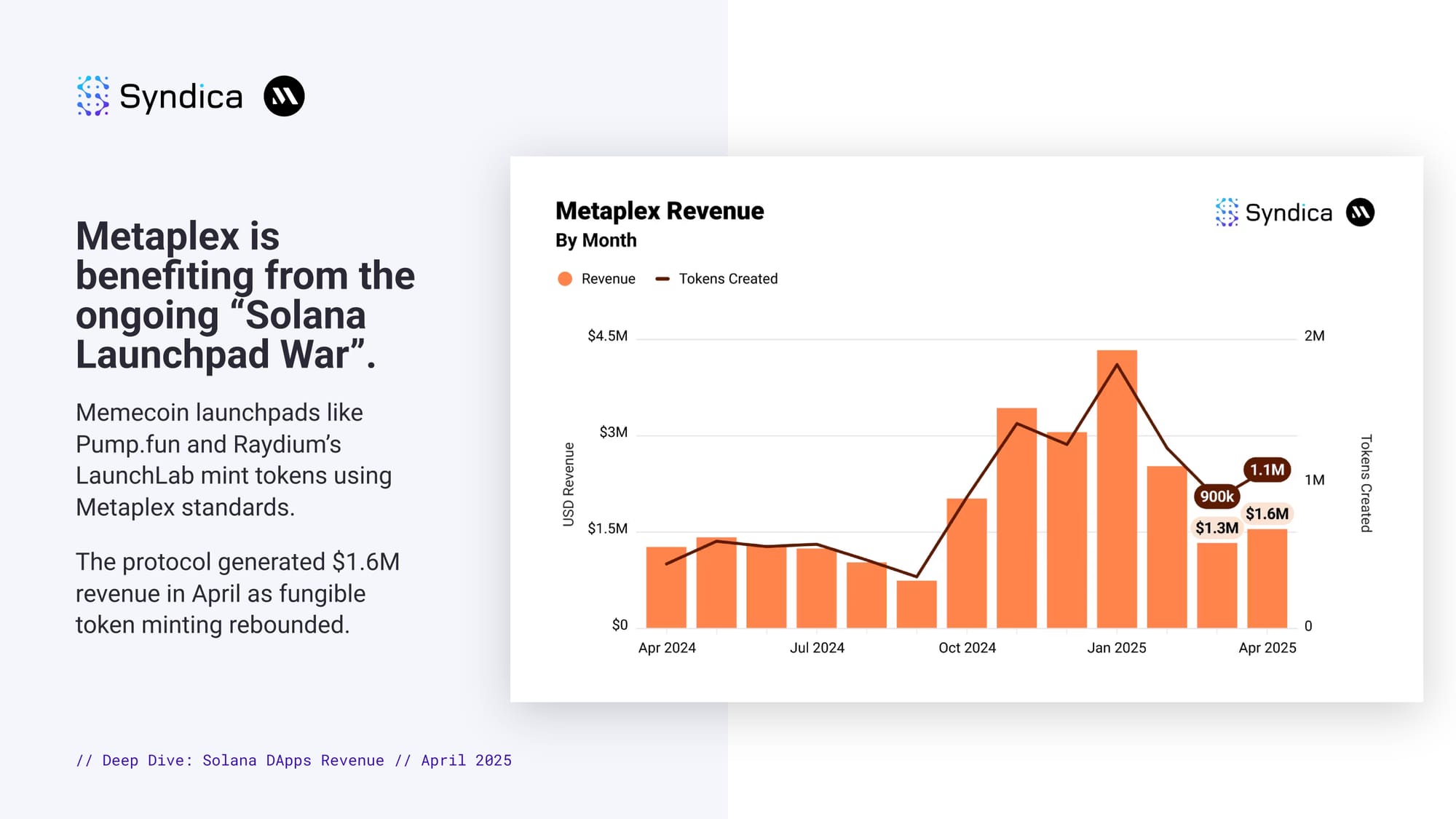

Metaplex is benefiting from the ongoing “Solana Launchpad War”. Memecoin launchpads like Pump.fun and Raydium’s LaunchLab mint tokens using Metaplex standards. The protocol generated $1.6M revenue in April as fungible token minting rebounded.

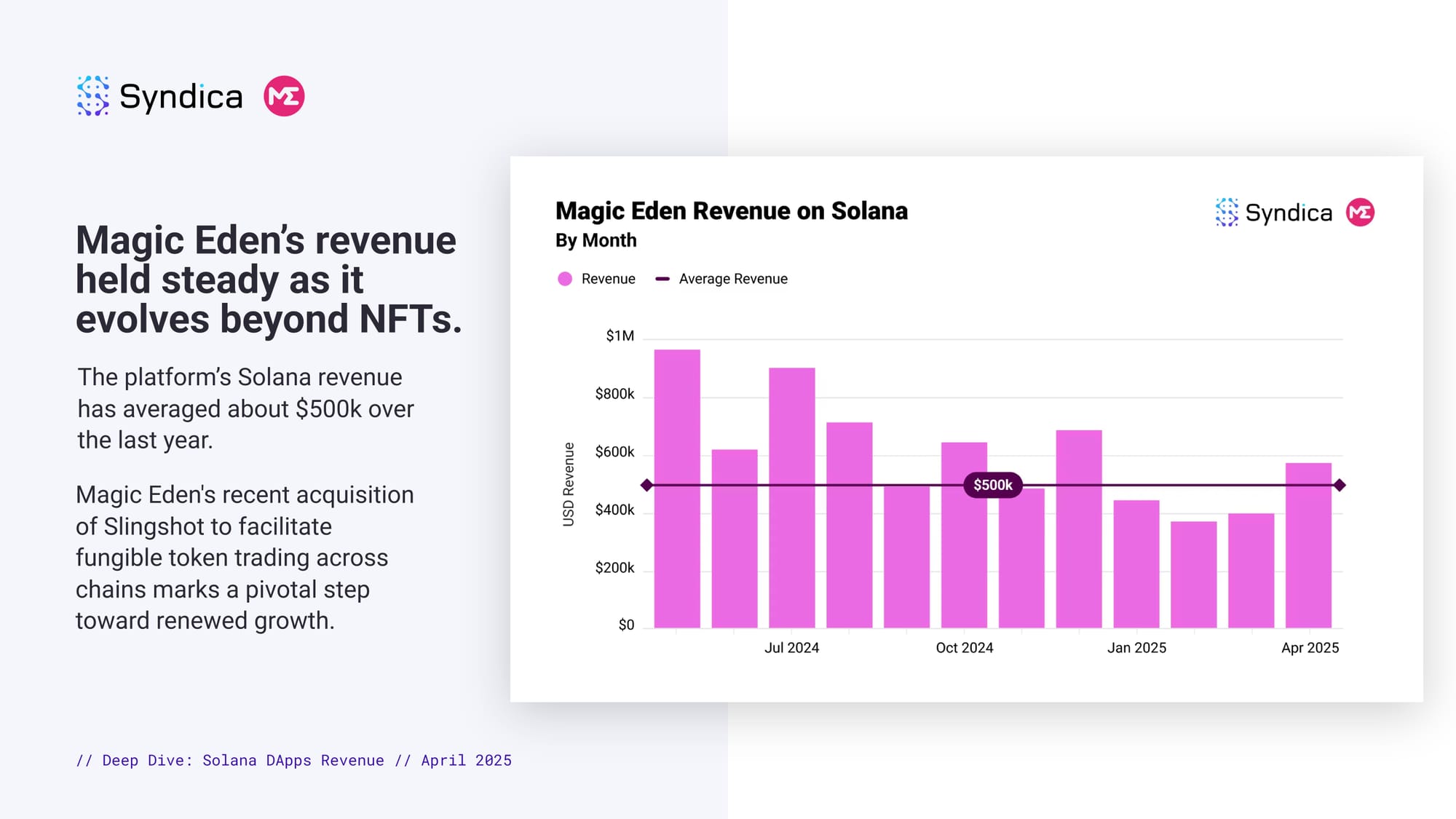

Magic Eden’s revenue held steady as it evolves beyond NFTs. The platform’s Solana revenue has averaged about $500k over the last year. Magic Eden's recent acquisition of Slingshot to facilitate fungible token trading across chains marks a pivotal step toward renewed growth.

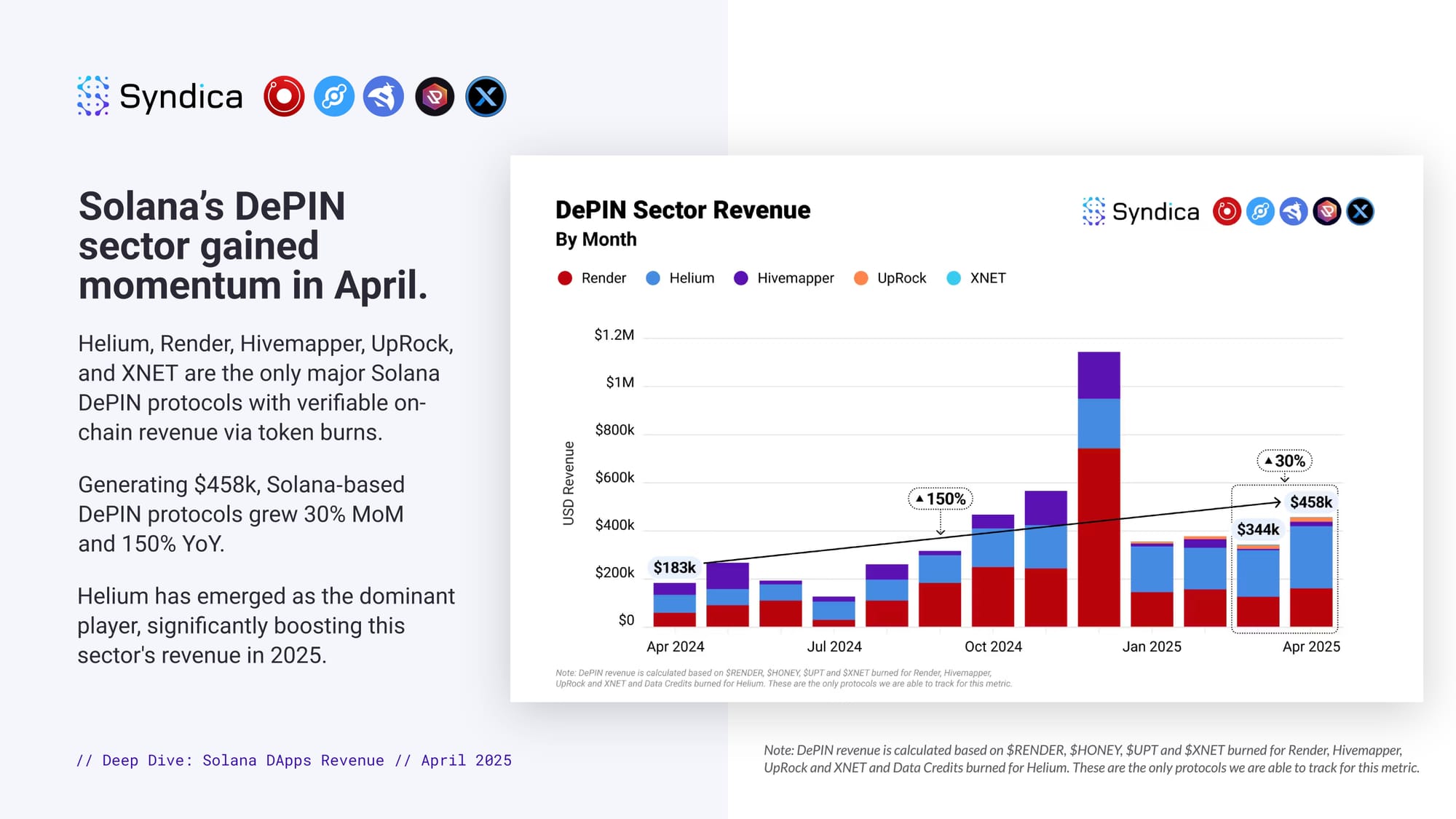

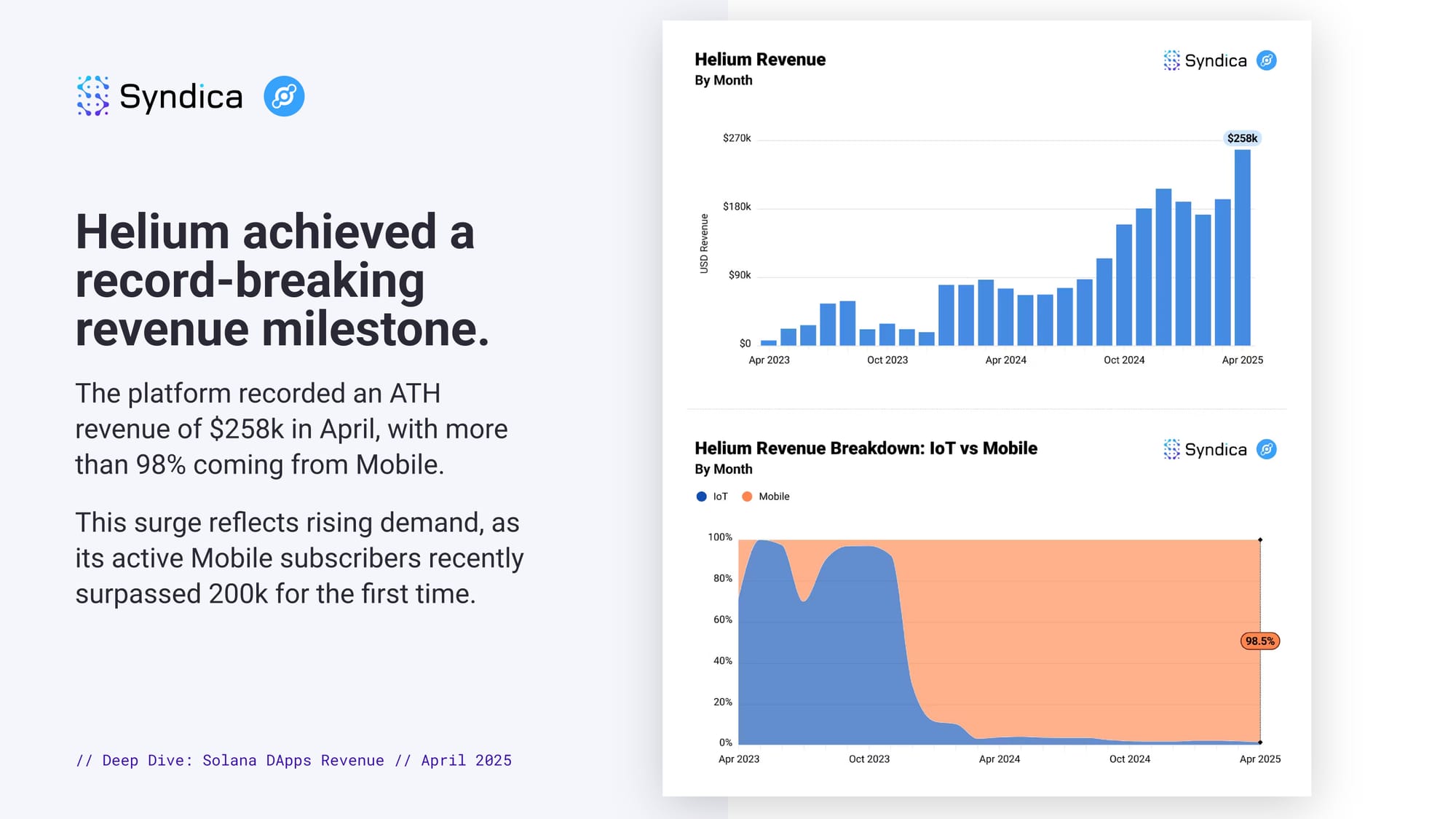

Solana’s DePIN sector gained momentum in April. Helium, Render, Hivemapper, UpRock, and XNET are the only major Solana DePIN protocols with verifiable on-chain revenue via token burns. Generating $458k, Solana‑based DePIN protocols grew 30% MoM and 150% YoY. Helium has emerged as the dominant player, significantly boosting this sector's revenue in 2025.

Helium achieved a record-breaking revenue milestone. The platform recorded an ATH revenue of $258k in April, with more than 98% coming from Mobile. This surge reflects rising demand, as its active Mobile subscribers recently surpassed 200k for the first time.