Deep Dive: Solana DApps Revenue - August 2025

Deep Dive: Solana DApps Revenue - August 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - August 2025

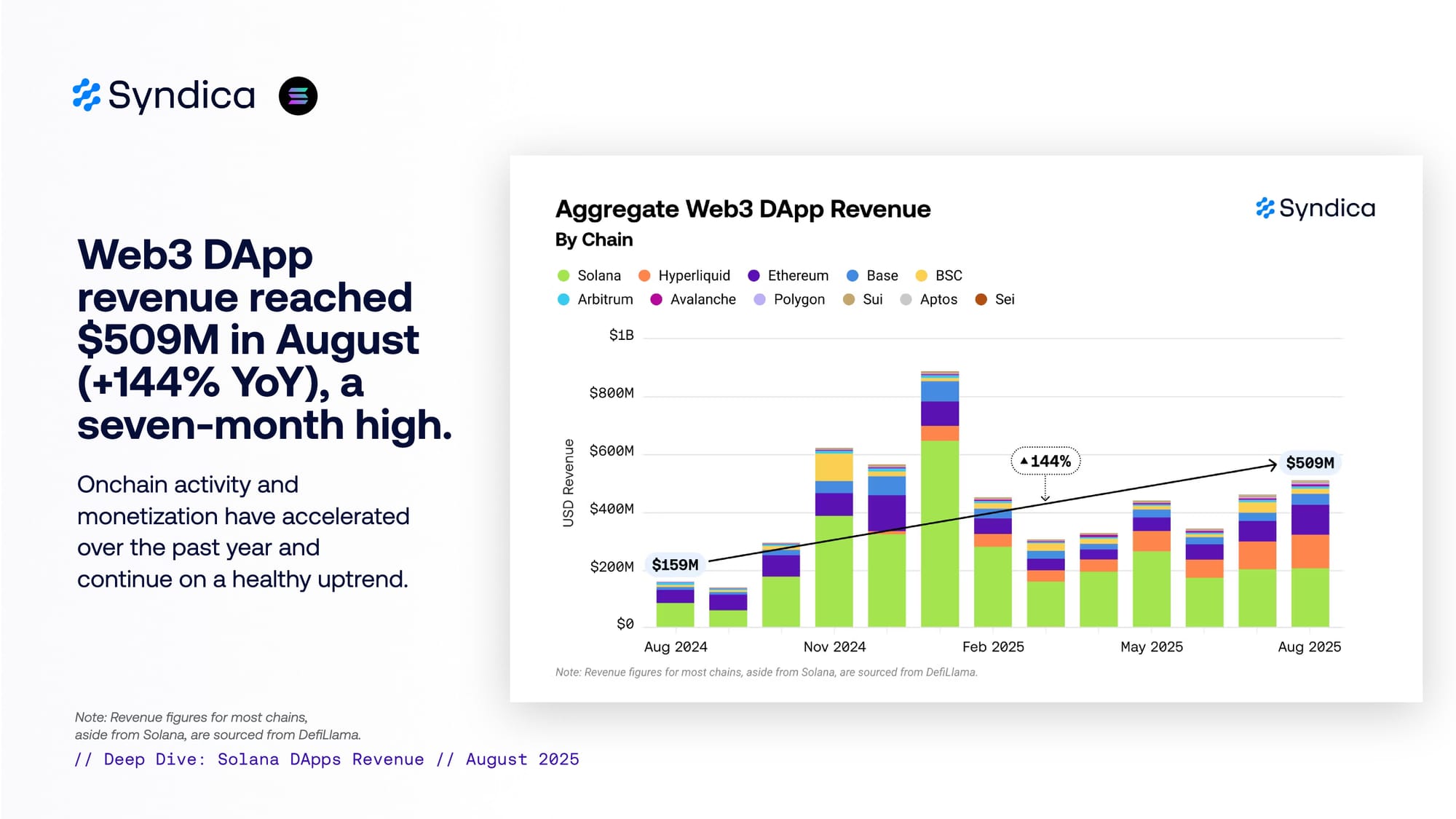

Web3 DApp revenue reached $509M in August (+144% YoY), a seven-month high. Onchain activity and monetization have accelerated over the past year and continue on a healthy uptrend.

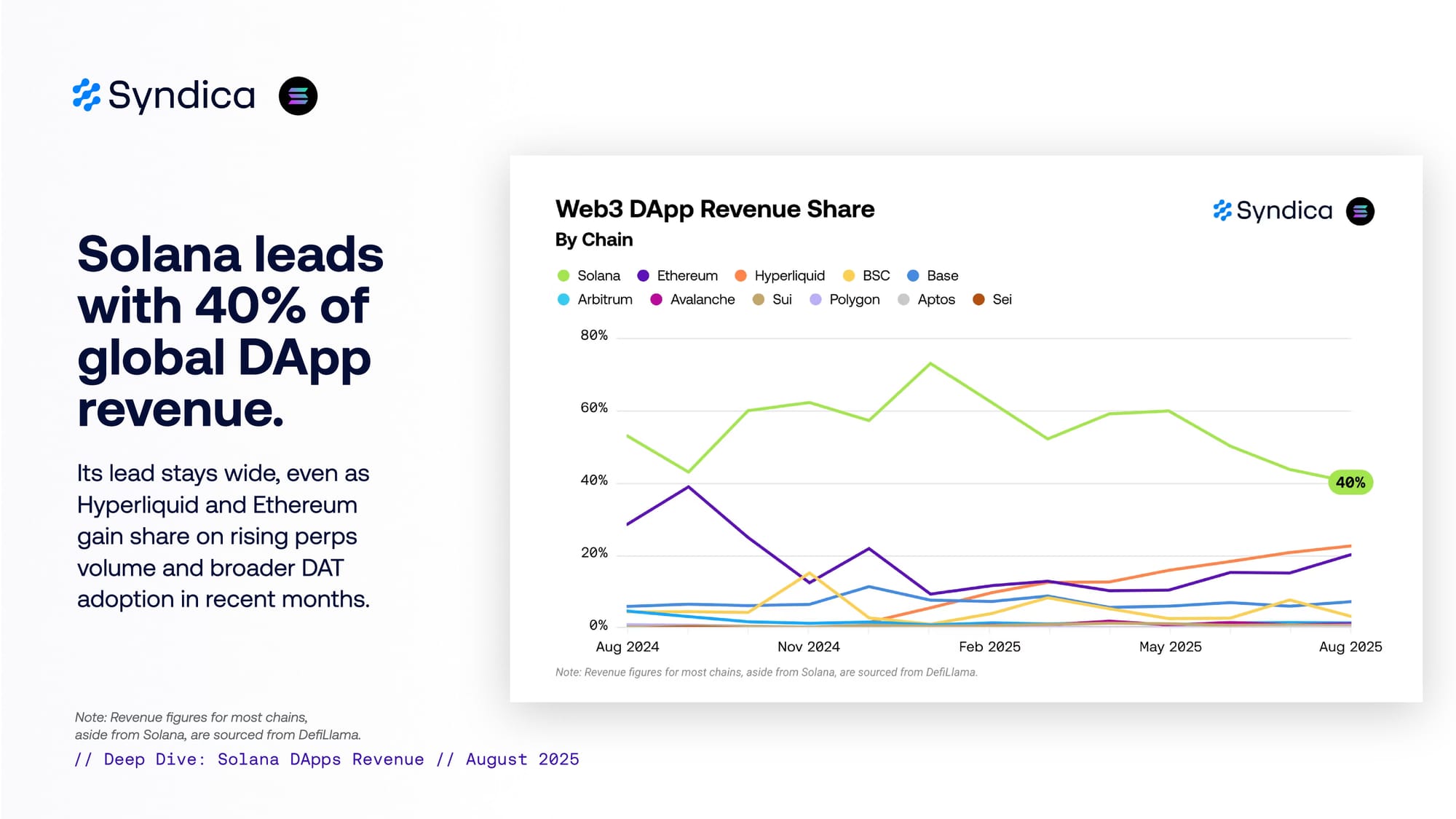

Solana leads with 40% of global DApp revenue. Its lead stays wide, even as Hyperliquid and Ethereum gain share on rising perps volume and broader DAT adoption in recent months.

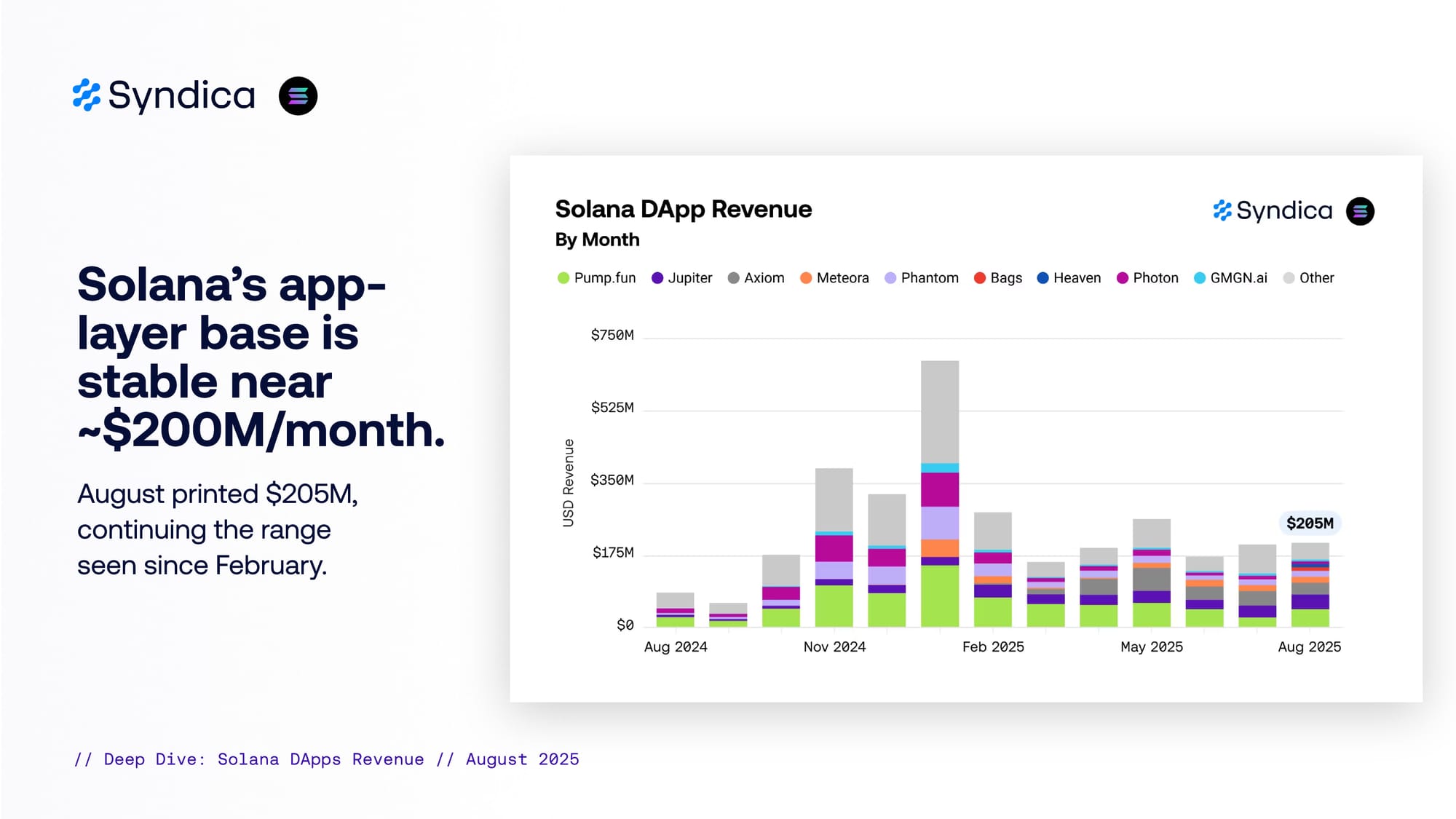

Solana’s app-layer base is stable near ~$200M/month. August printed $205M, continuing the range seen since February.

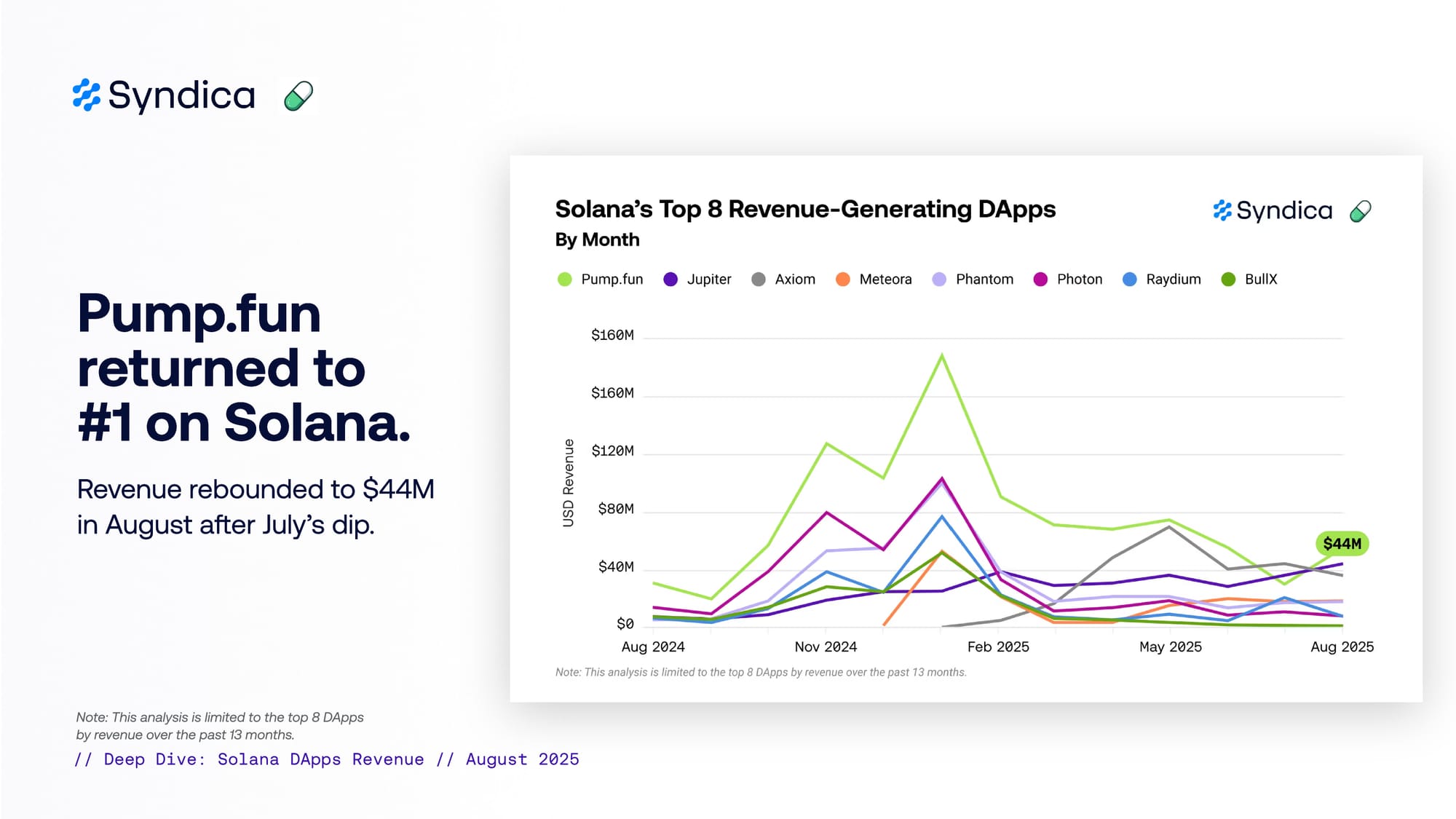

Pump.fun returned to #1 on Solana. Revenue rebounded to $44M in August after July’s dip.

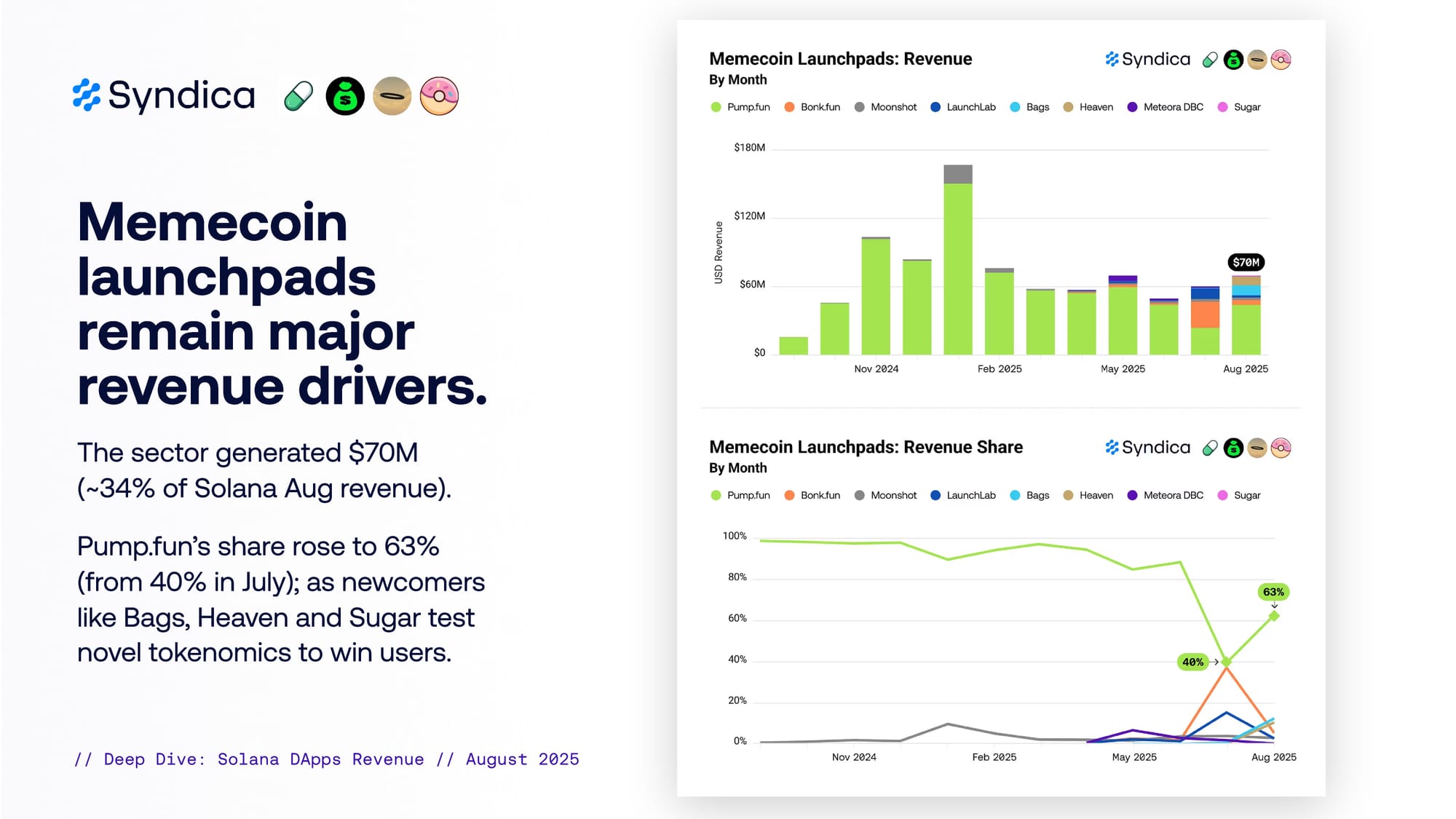

Memecoin launchpads remain major revenue drivers. The sector generated $70M (~34% of Solana Aug revenue). Pump.fun’s share rose to 63% (from 40% in July); as newcomers like Bags, Heaven and Sugar test novel tokenomics to win users.

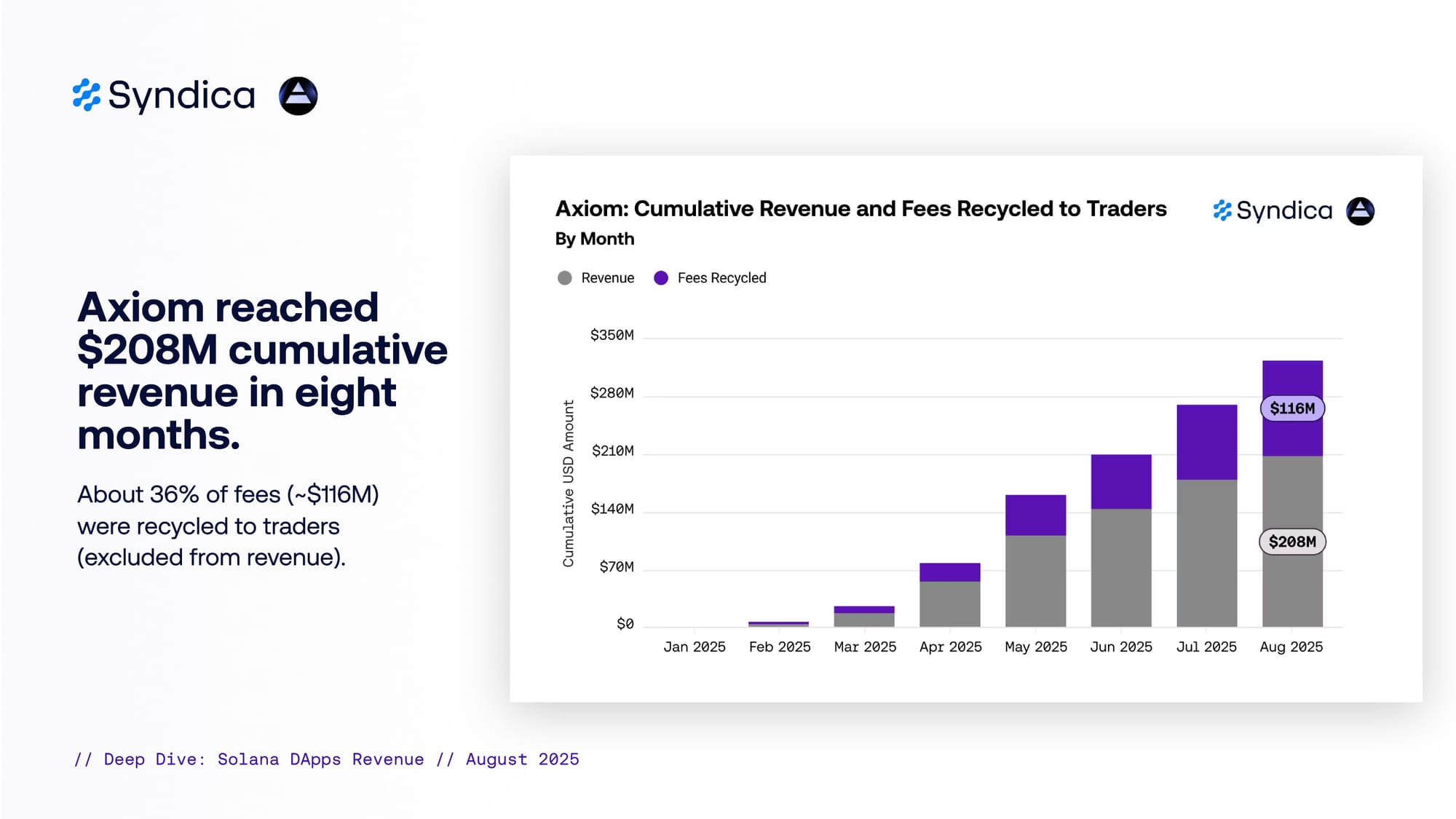

Axiom reached $208M cumulative revenue in eight months. About 36% of fees (~$116M) were recycled to traders (excluded from revenue).

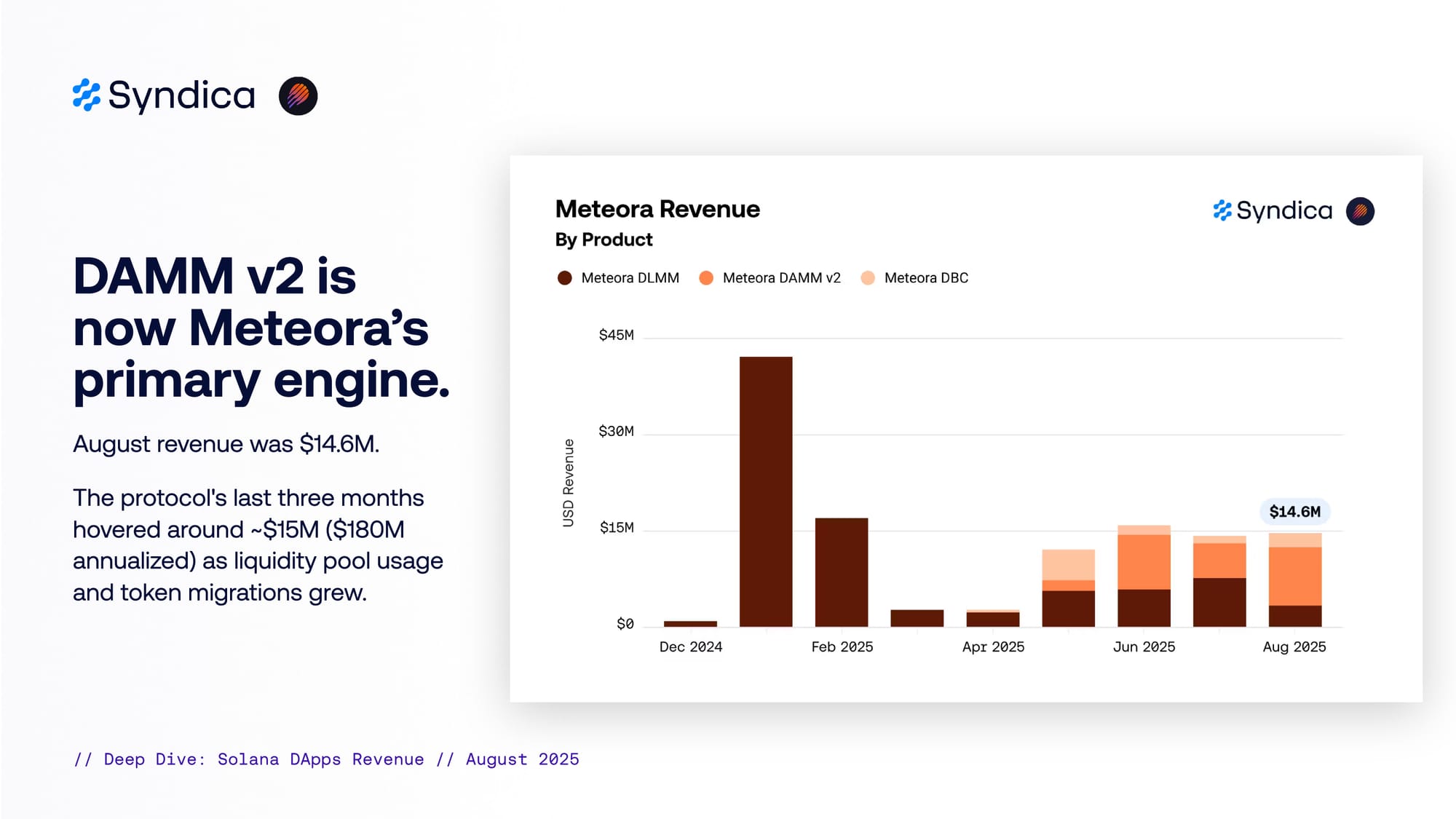

DAMM v2 is now Meteora’s primary engine. August revenue was $14.6M. The protocol's last three months hovered around ~$15M ($180M annualized) as liquidity pool usage and token migrations grew.

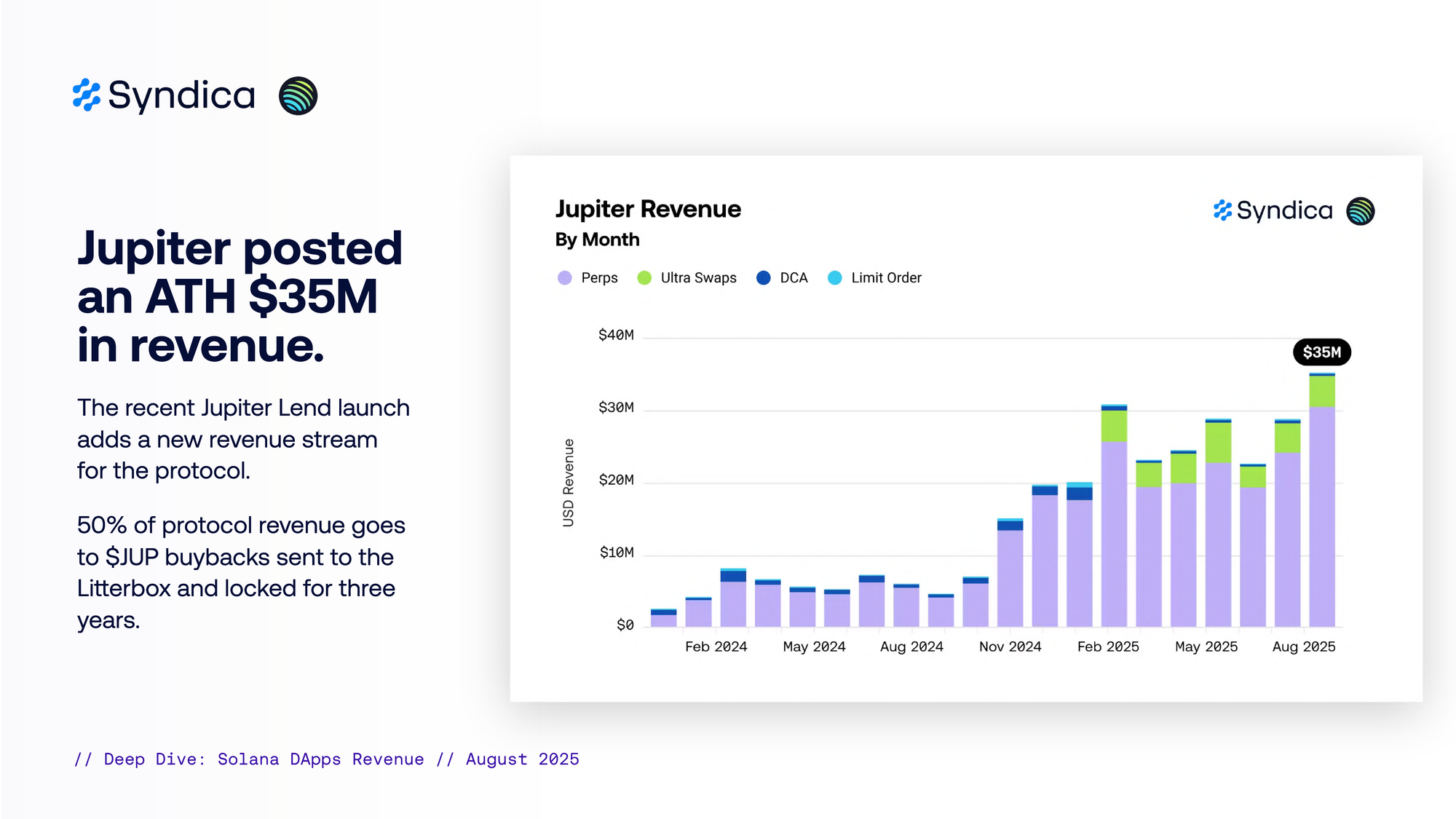

Jupiter posted an ATH $35M in revenue. The recent Jupiter Lend launch adds a new revenue stream for the protocol. 50% of protocol revenue goes to $JUP buybacks sent to the Litterbox and locked for three years.

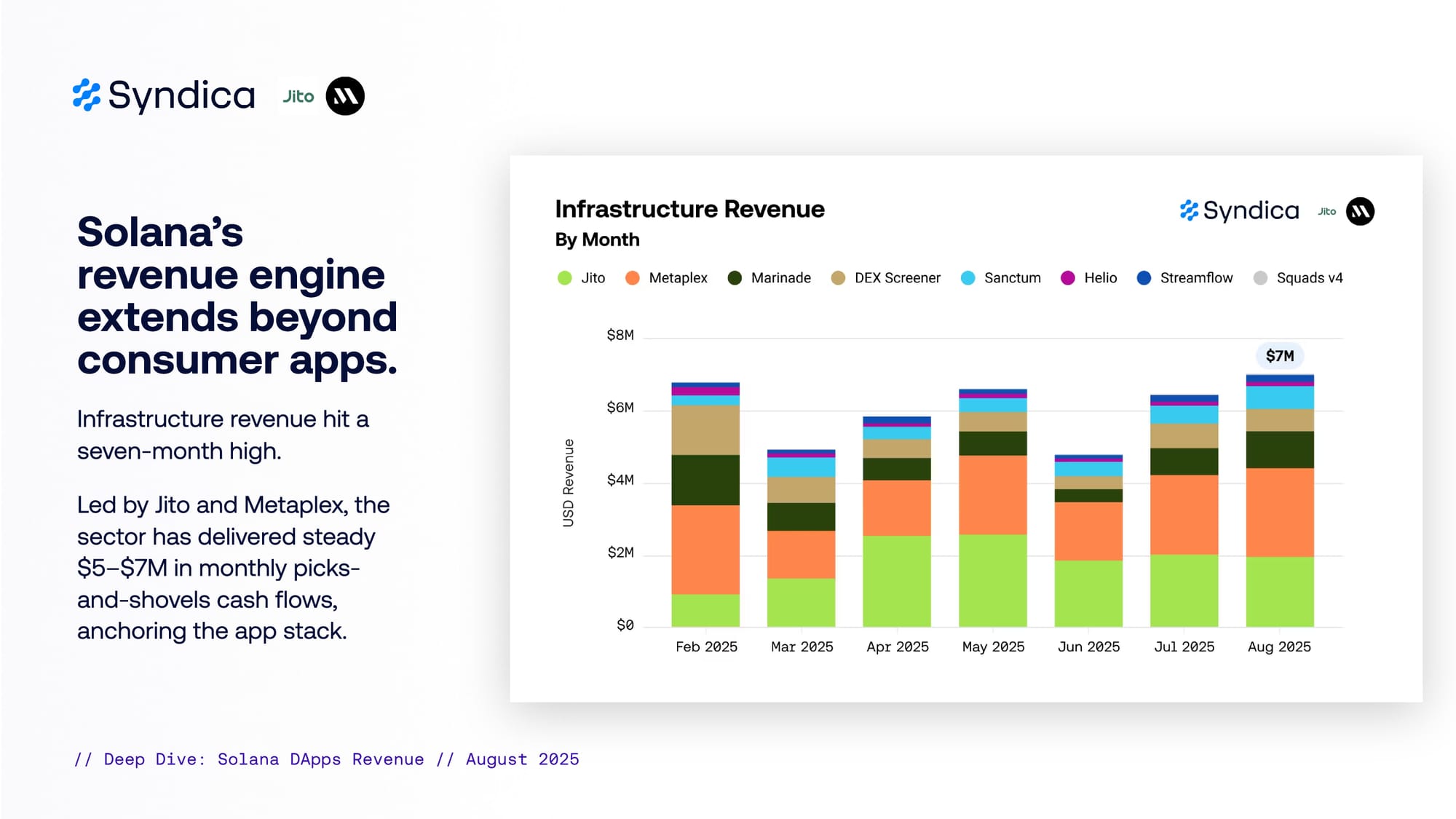

Solana’s revenue engine extends beyond consumer apps. Infrastructure revenue hit a seven-month high. Led by Jito and Metaplex, the sector has delivered steady $5–$7M in monthly picks-and-shovels cash flows, anchoring the app stack.

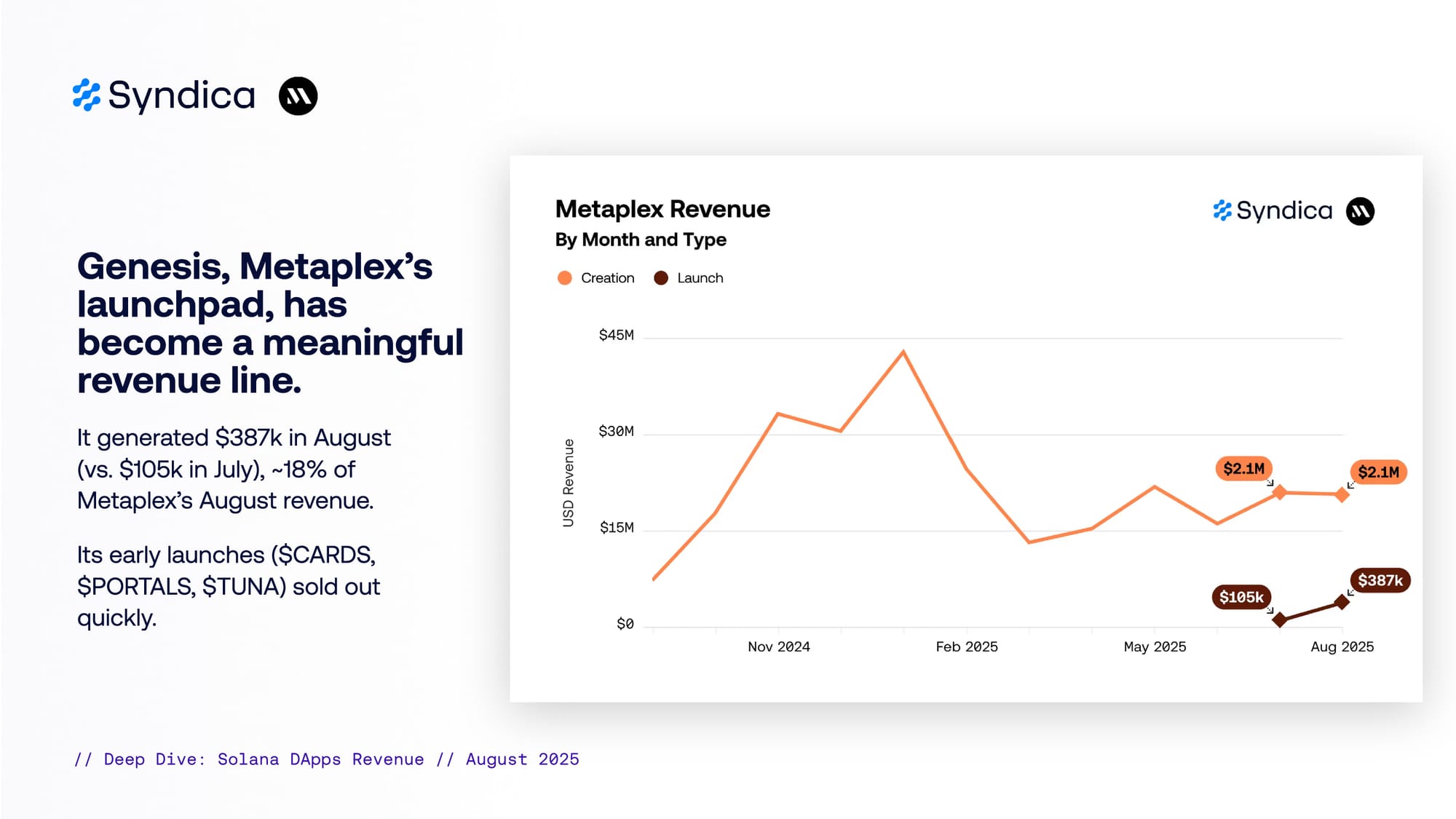

Genesis, Metaplex’s launchpad, has become a meaningful revenue line. It generated $387k in August (vs. $105k in July), ~18% of Metaplex’s August revenue. Its early launches ($CARDS, $PORTALS, $TUNA) sold out quickly.

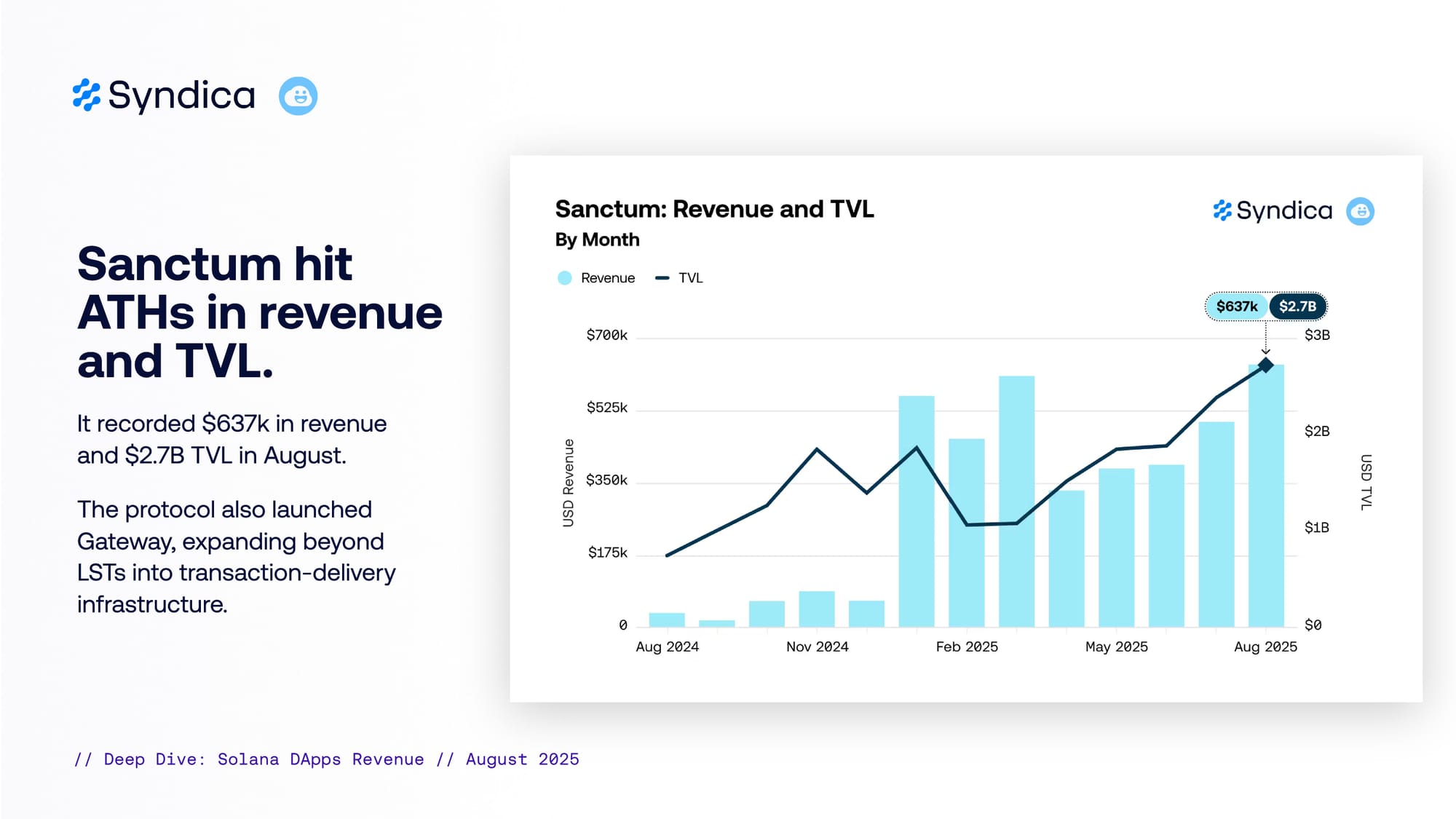

Sanctum hit ATHs in revenue and TVL. It recorded $637k in revenue and $2.7B TVL in August. The protocol also launched Gateway, expanding beyond LSTs into transaction-delivery infrastructure.

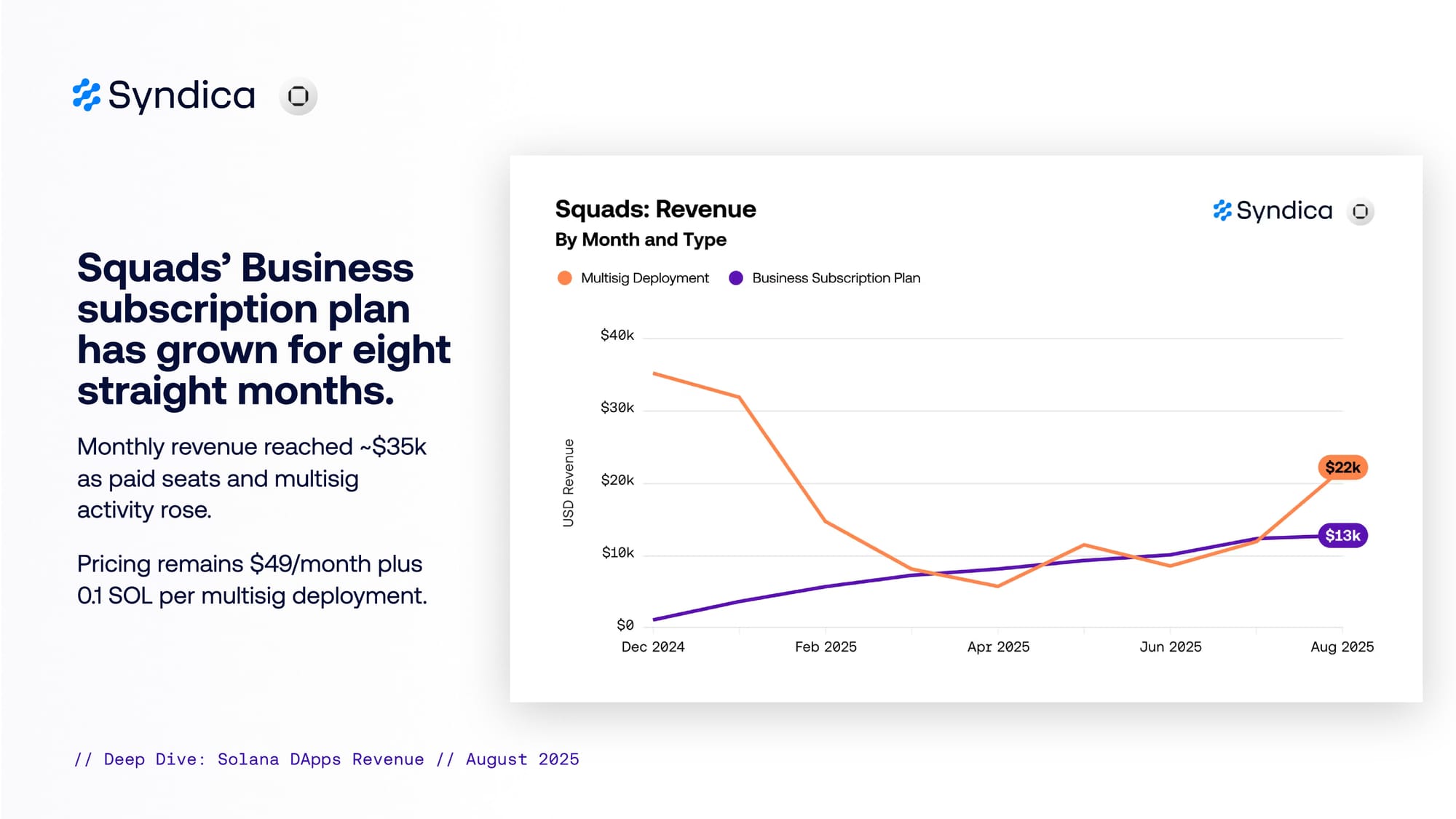

Squads’ Business subscription plan has grown for eight straight months. Monthly revenue reached ~$35k as paid seats and multisig activity rose. Pricing remains $49/month plus 0.1 SOL per multisig deployment.

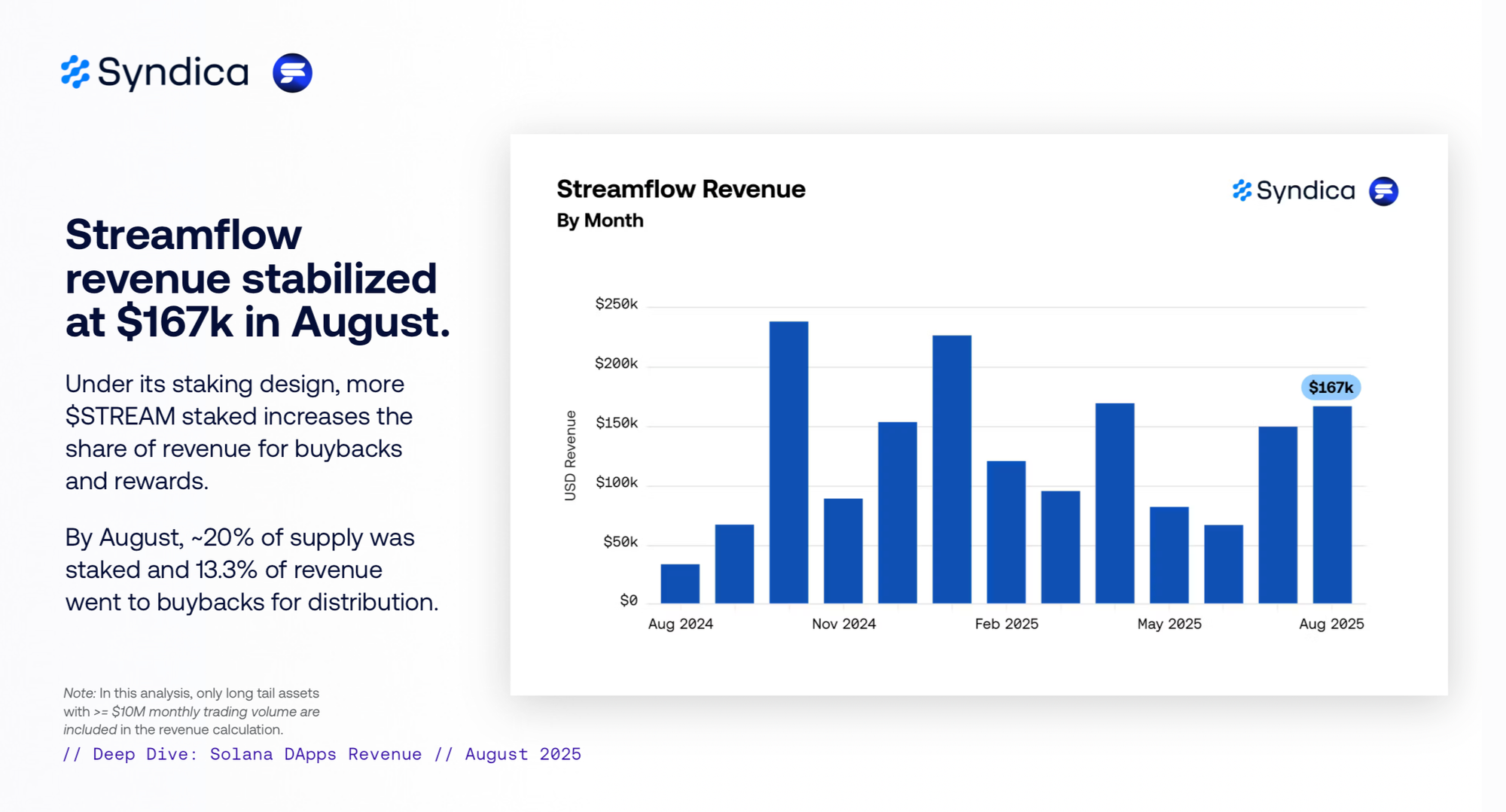

Streamflow revenue stabilized at $167k in August. Under its staking design, more $STREAM staked increases the share of revenue for buybacks and rewards. By August, ~20% of supply was staked and 13.3% of revenue went to buybacks for distribution.

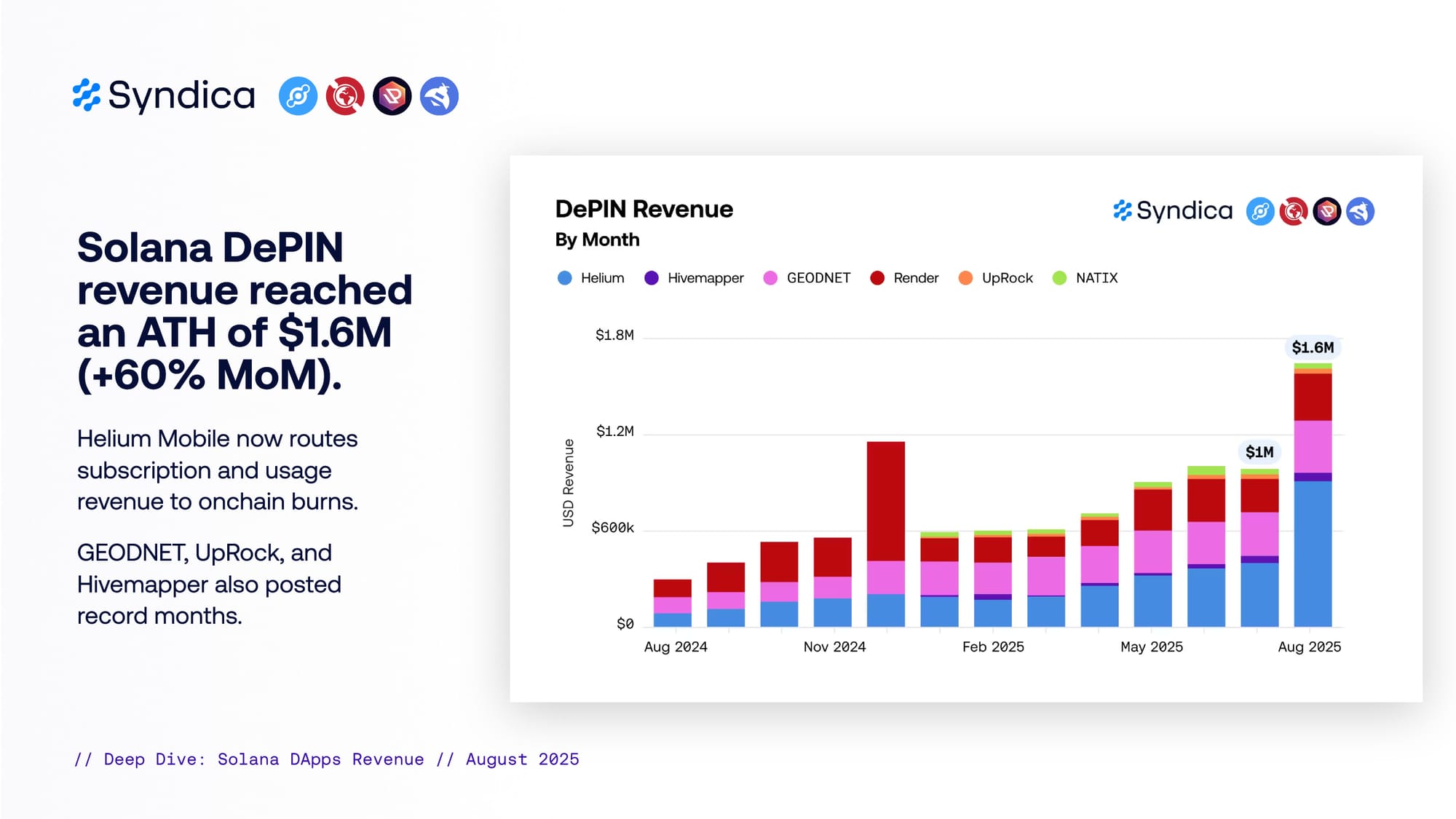

Solana DePIN revenue reached an ATH of $1.6M (+60% MoM). Helium Mobile now routes subscription and usage revenue to onchain burns. GEODNET, UpRock, and Hivemapper also posted record months.

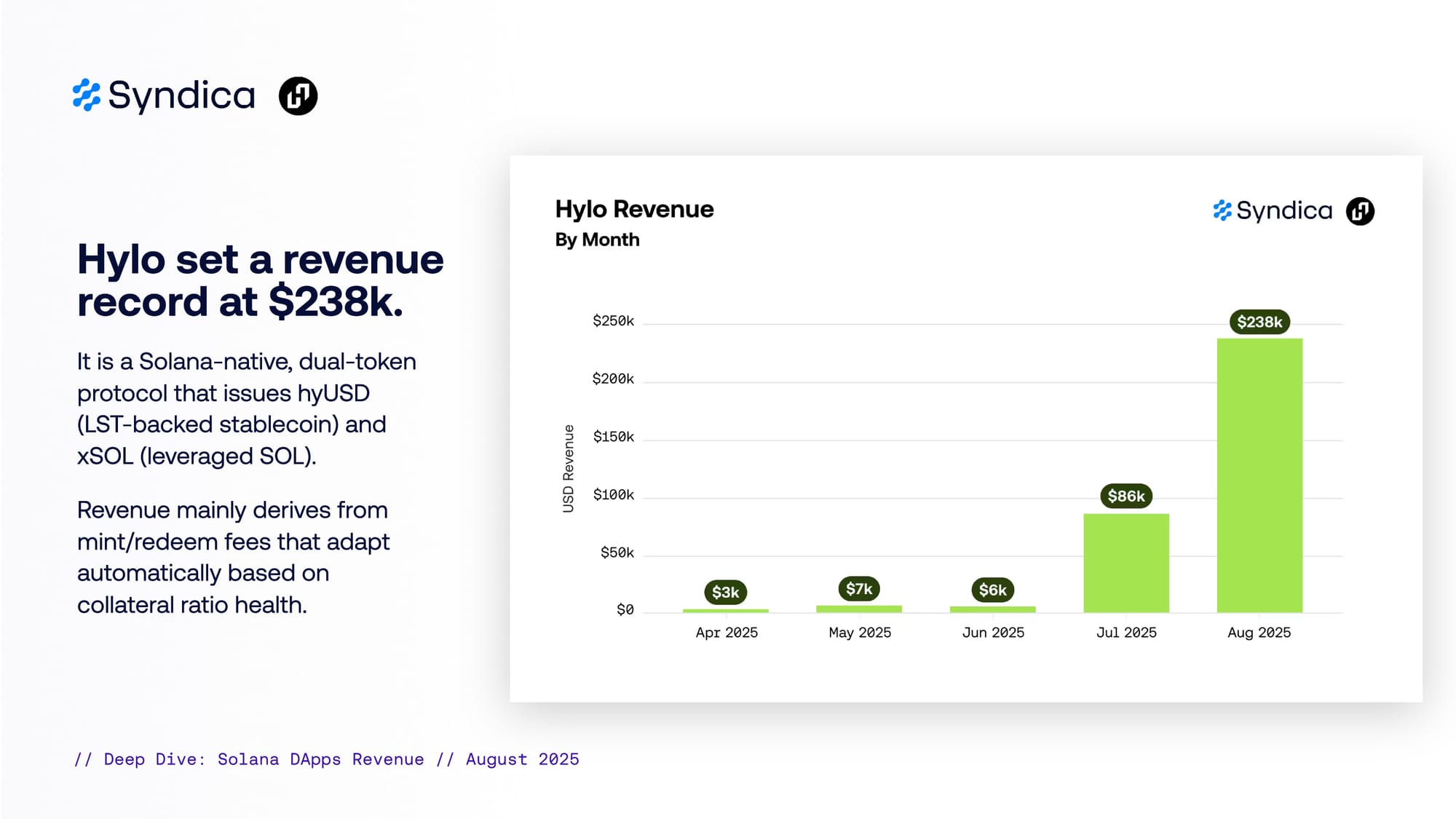

Hylo set a revenue record at $238k. It is a Solana-native, dual-token protocol that issues hyUSD (LST-backed stablecoin) and xSOL (leveraged SOL). Revenue mainly derives from mint/redeem fees that adapt automatically based on collateral ratio health.

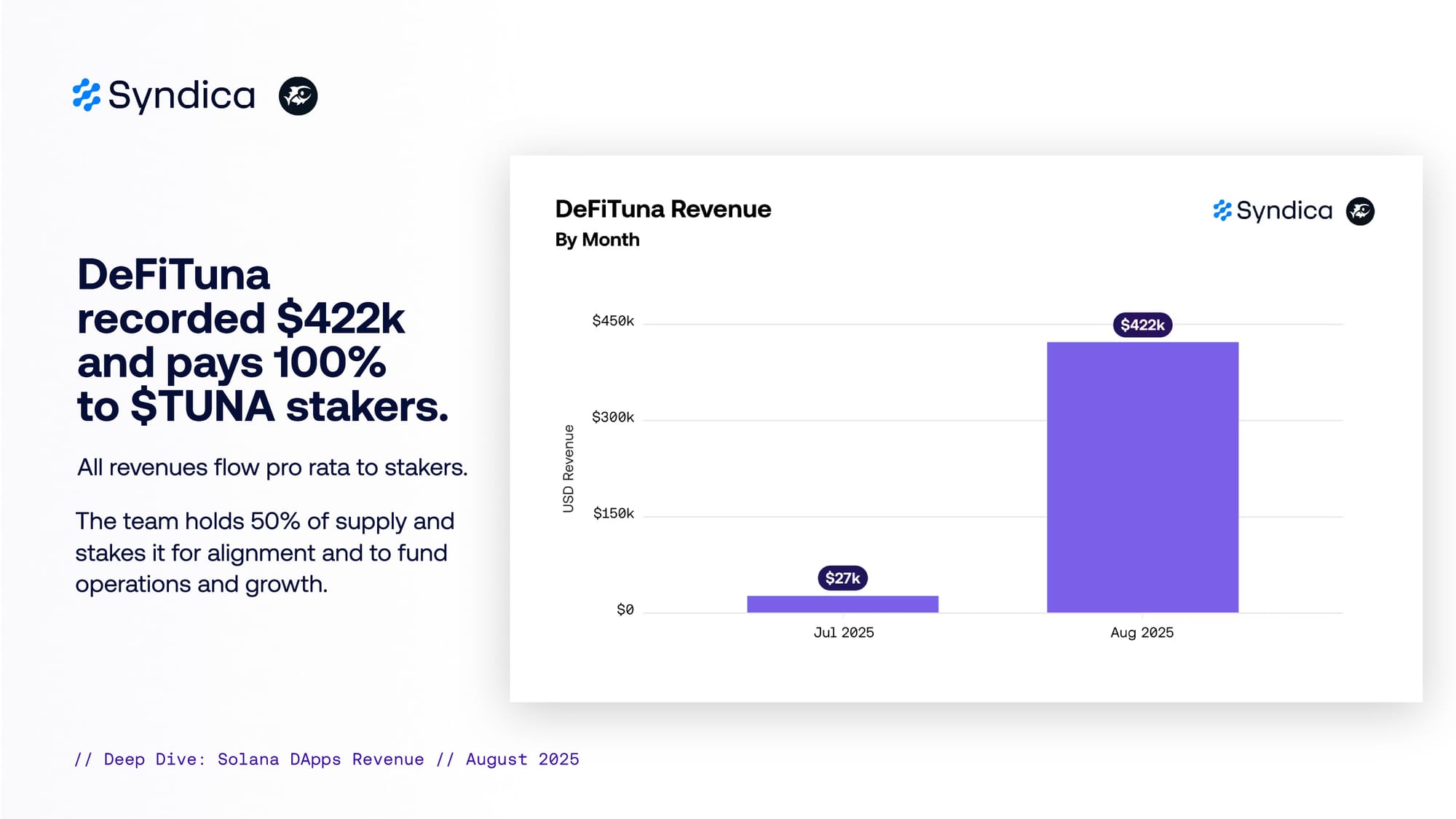

DeFiTuna recorded $422k and pays 100% to $TUNA stakers. All revenues flow pro rata to stakers. The team holds 50% of supply and stakes it for alignment and to fund operations and growth.