Deep Dive: Solana DApps Revenue - February 2025

Deep Dive: Solana DApps Revenue - February 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - February 2025

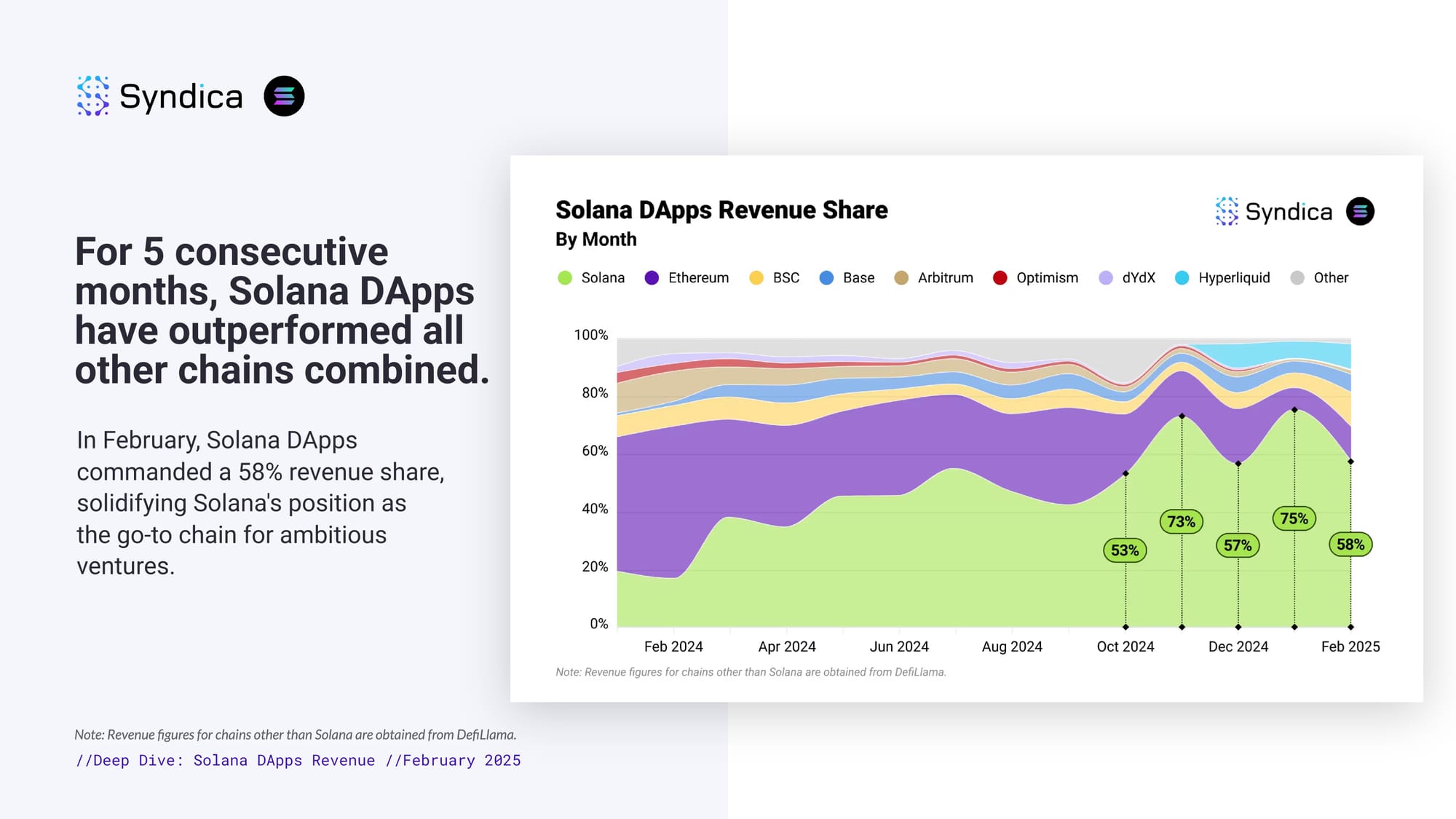

For five consecutive months, Solana DApps have outperformed all other chains combined. In February, Solana DApps commanded a 58% revenue share, solidifying Solana's position as the go-to chain for ambitious ventures.

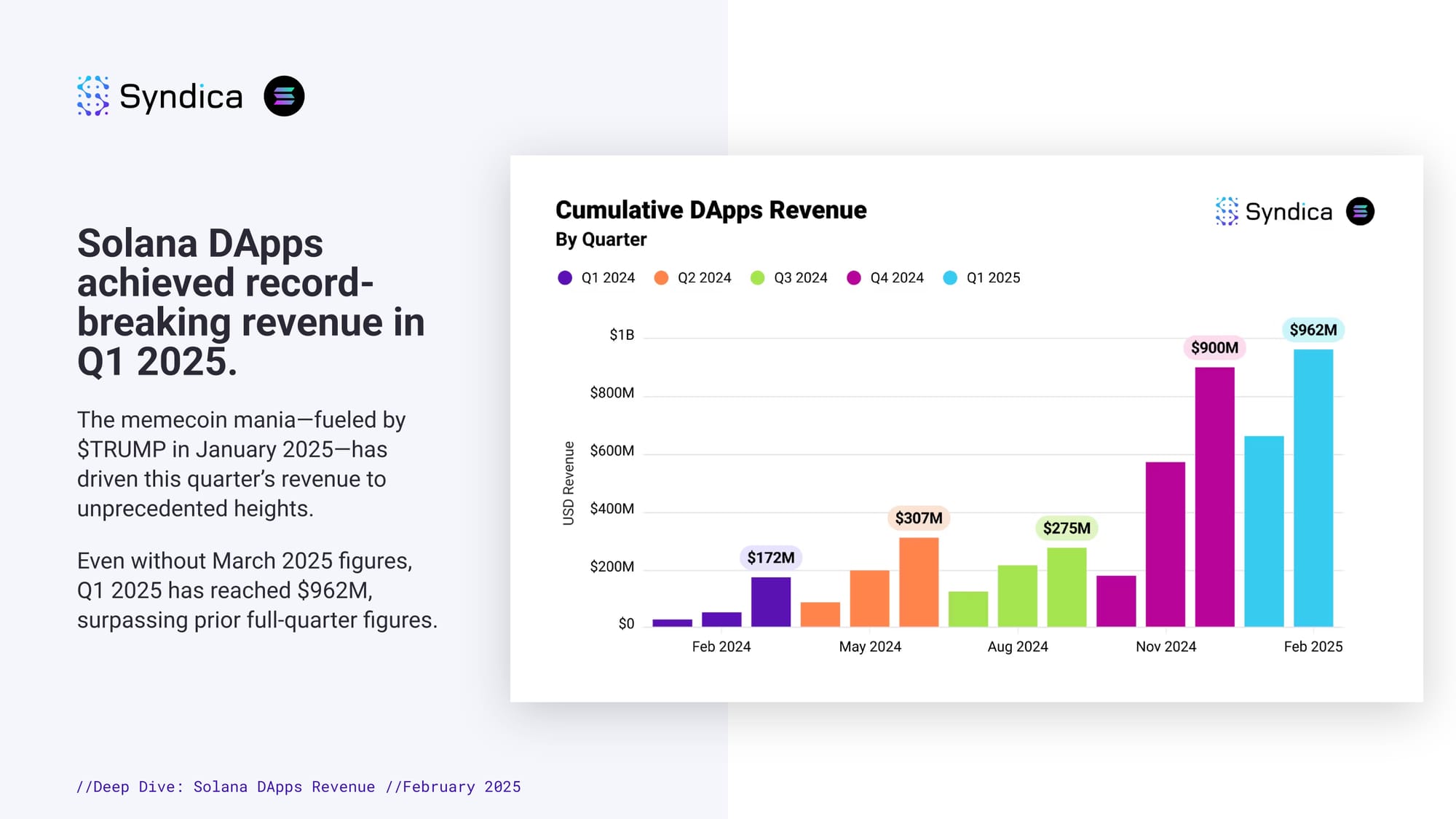

Solana DApps achieved record-breaking revenue in Q1 2025. The memecoin mania—fueled by $TRUMP in January 2025—has driven this quarter’s revenue to unprecedented heights. Even without March 2025 figures, Q1 2025 has reached $962M, surpassing prior full-quarter figures.

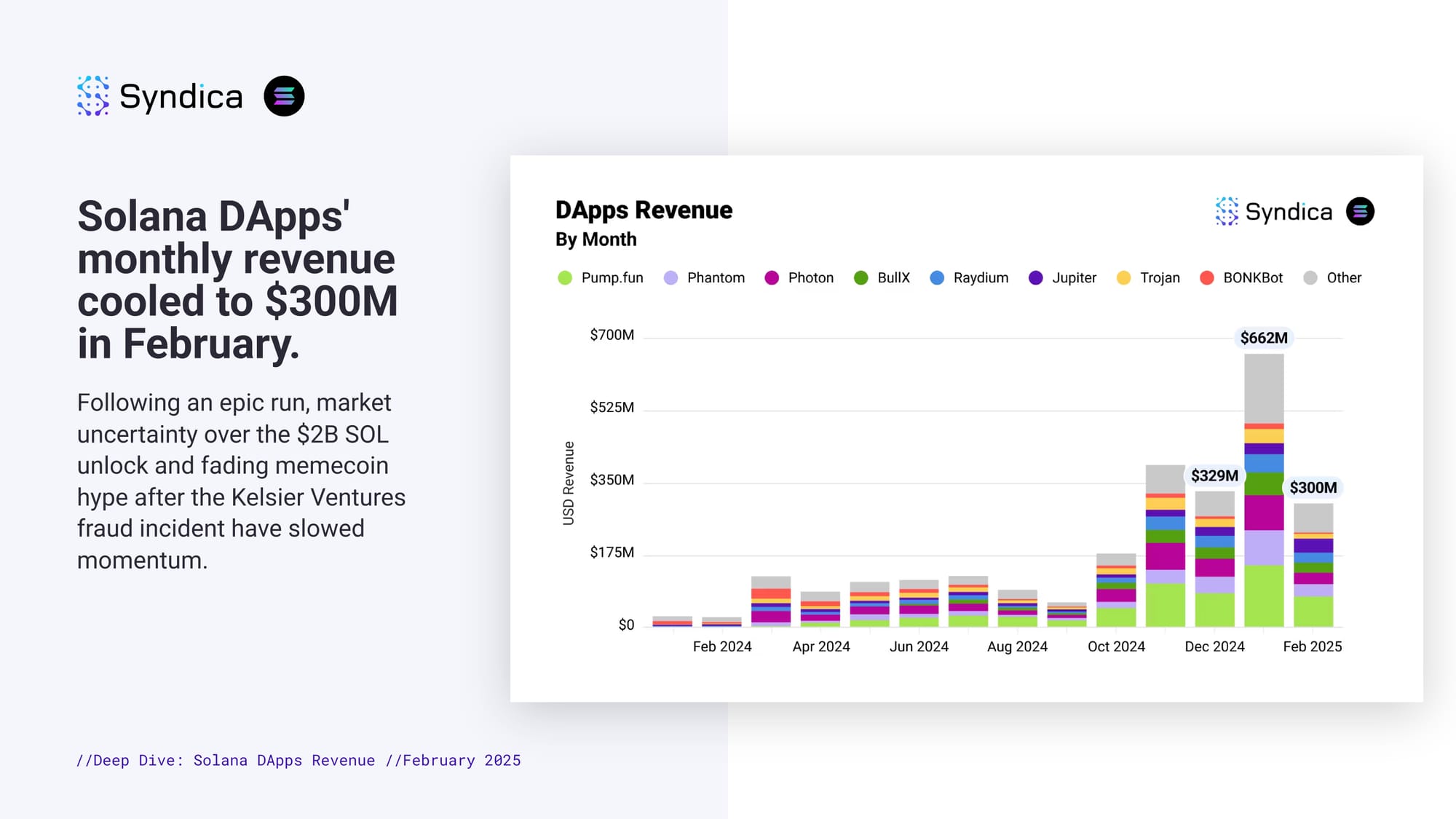

Solana DApps' monthly revenue cooled to $300M in February. Following an epic run, market uncertainty over the $2B SOL unlock and fading memecoin hype after the Kelsier Ventures fraud incident have slowed momentum.

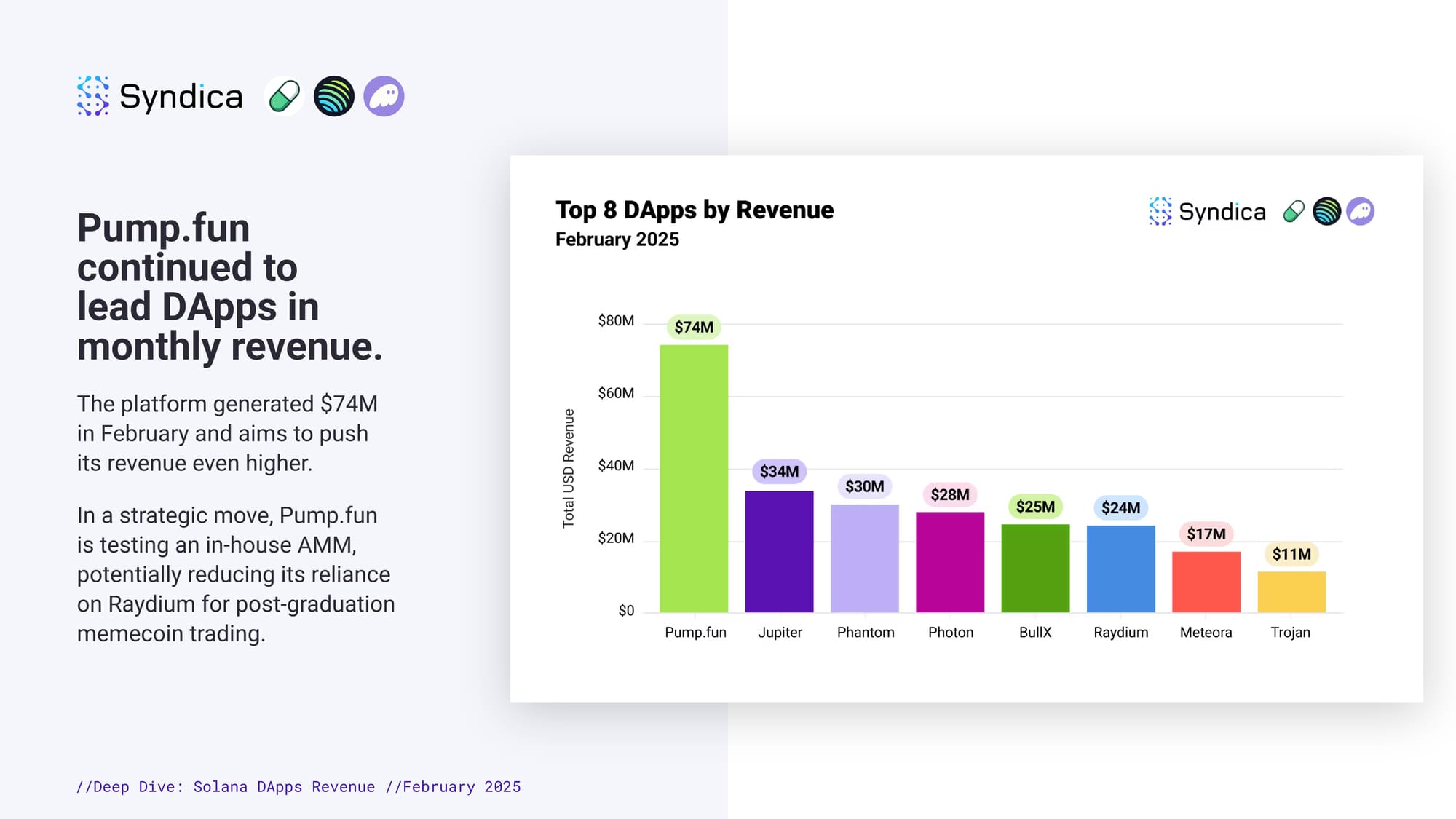

Pump.fun continued to lead DApps in monthly revenue. The platform generated $74M in February and aims to push its revenue even higher. In a strategic move, Pump.fun is testing an in-house AMM, potentially reducing its reliance on Raydium for post-graduation memecoin trading.

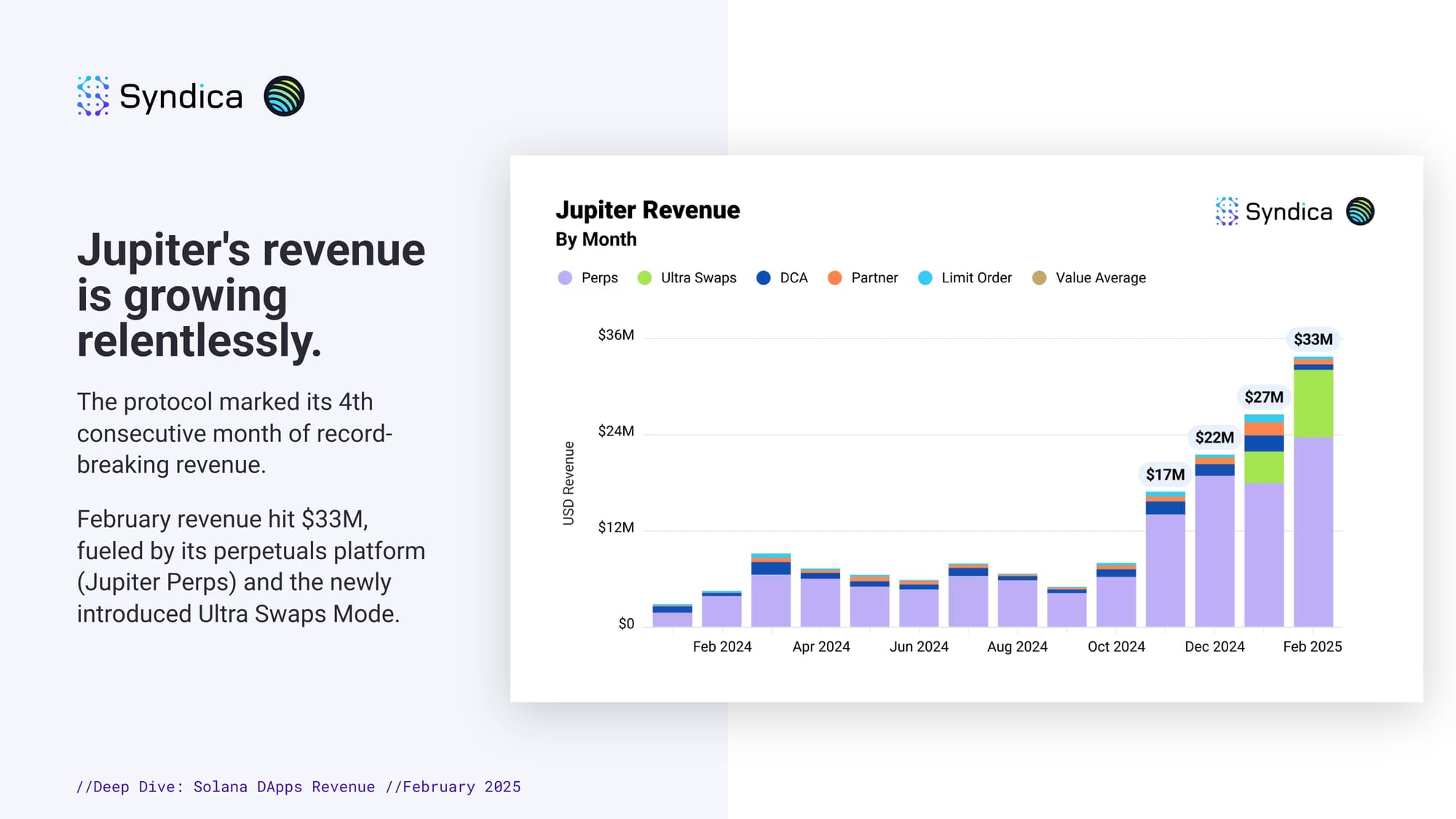

Jupiter's revenue is growing relentlessly. The protocol marked its 4th consecutive month of record-breaking revenue. February revenue hit $33M, fueled by its perpetuals platform (Jupiter Perps) and the newly introduced Ultra Swaps Mode.

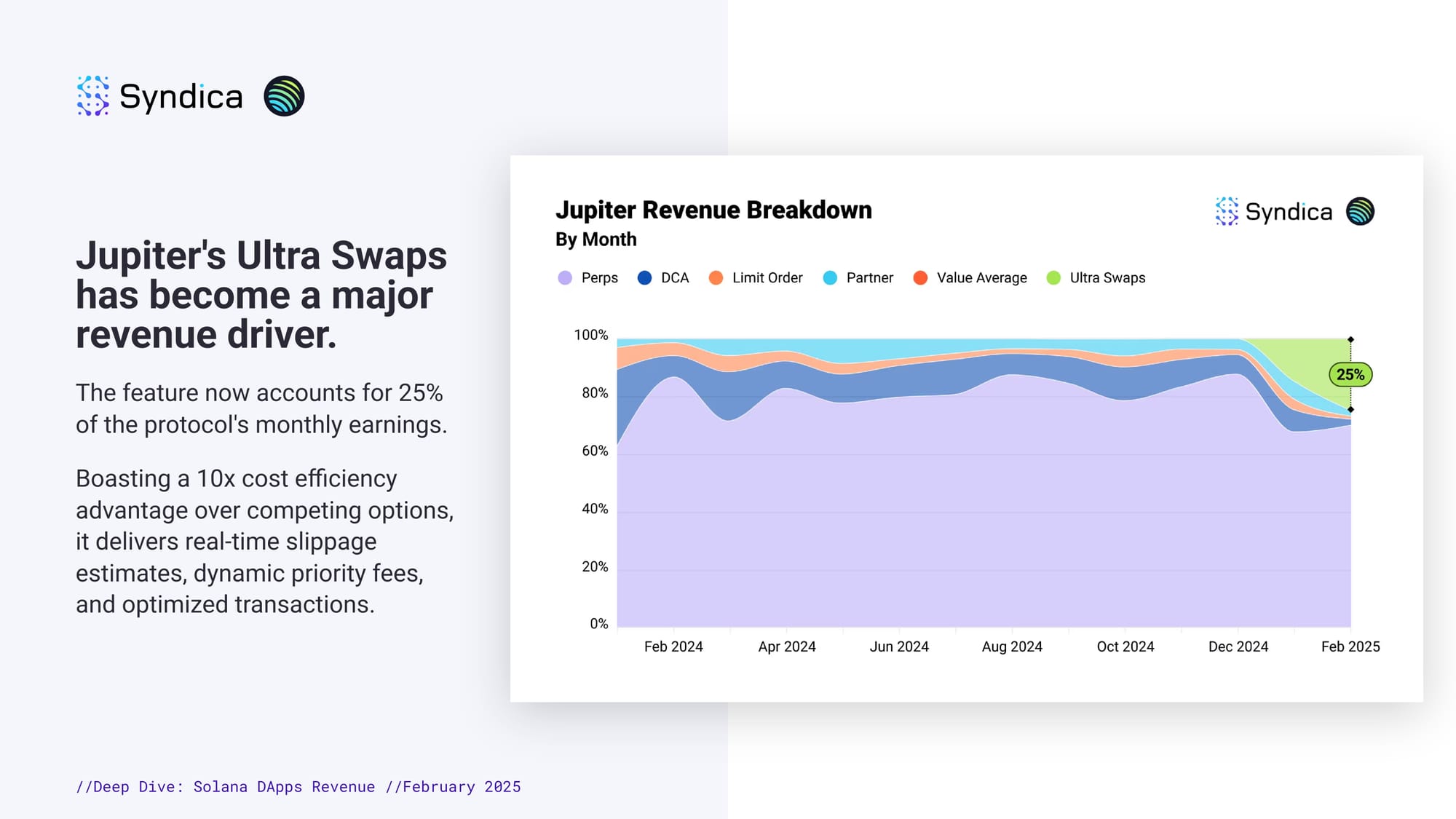

Jupiter's Ultra Swaps has become a major revenue driver. The feature now accounts for 25% of the protocol's monthly earnings. Boasting a 10x cost efficiency advantage over competing options, it delivers real-time slippage estimates, dynamic priority fees, and optimized transactions.

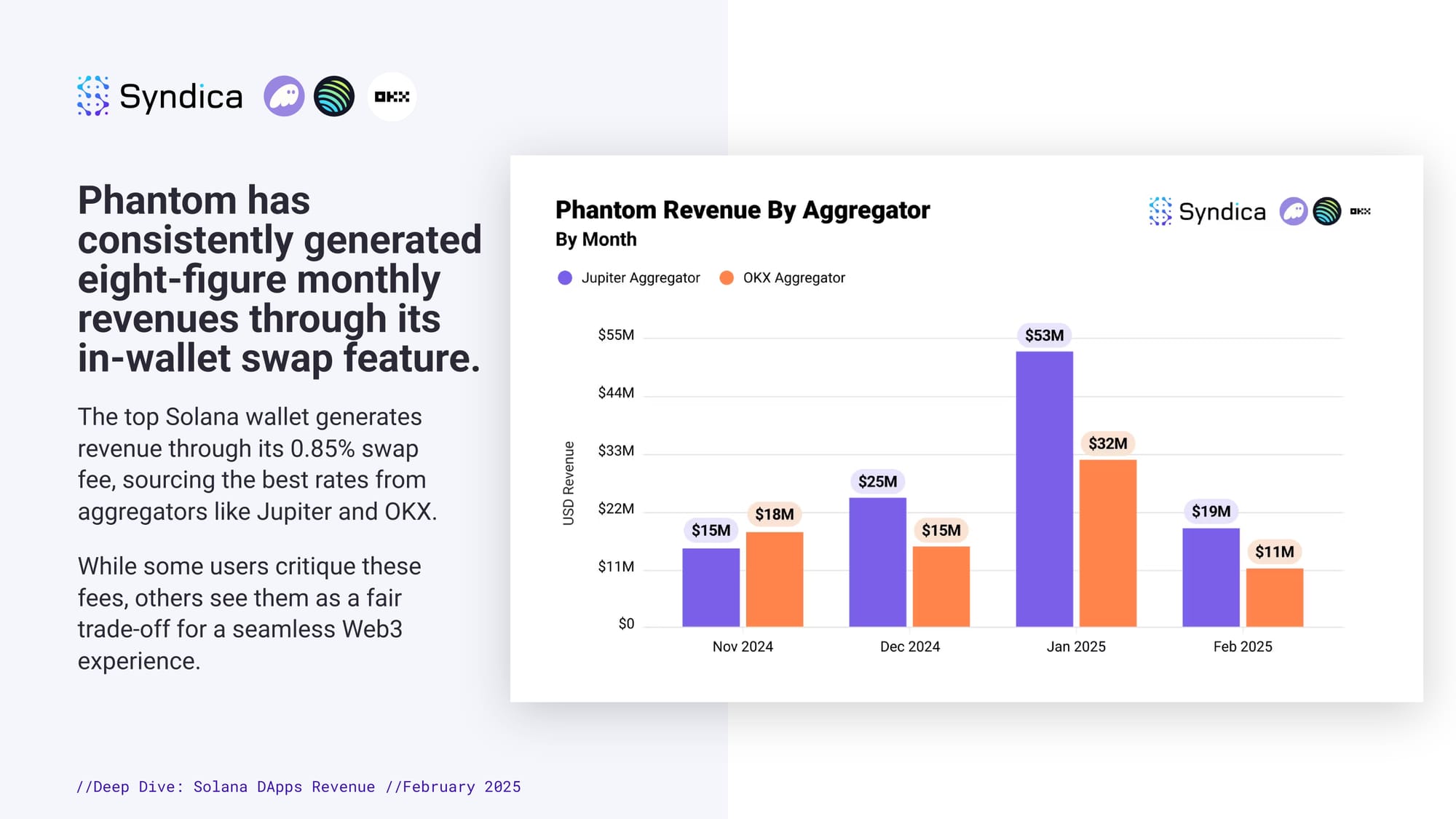

Phantom has consistently generated eight-figure monthly revenues through its in-wallet swap feature. The top Solana wallet generates revenue through its 0.85% swap fee, sourcing the best rates from aggregators like Jupiter and OKX. While some users critique these fees, others see them as a fair trade-off for a seamless Web3 experience.

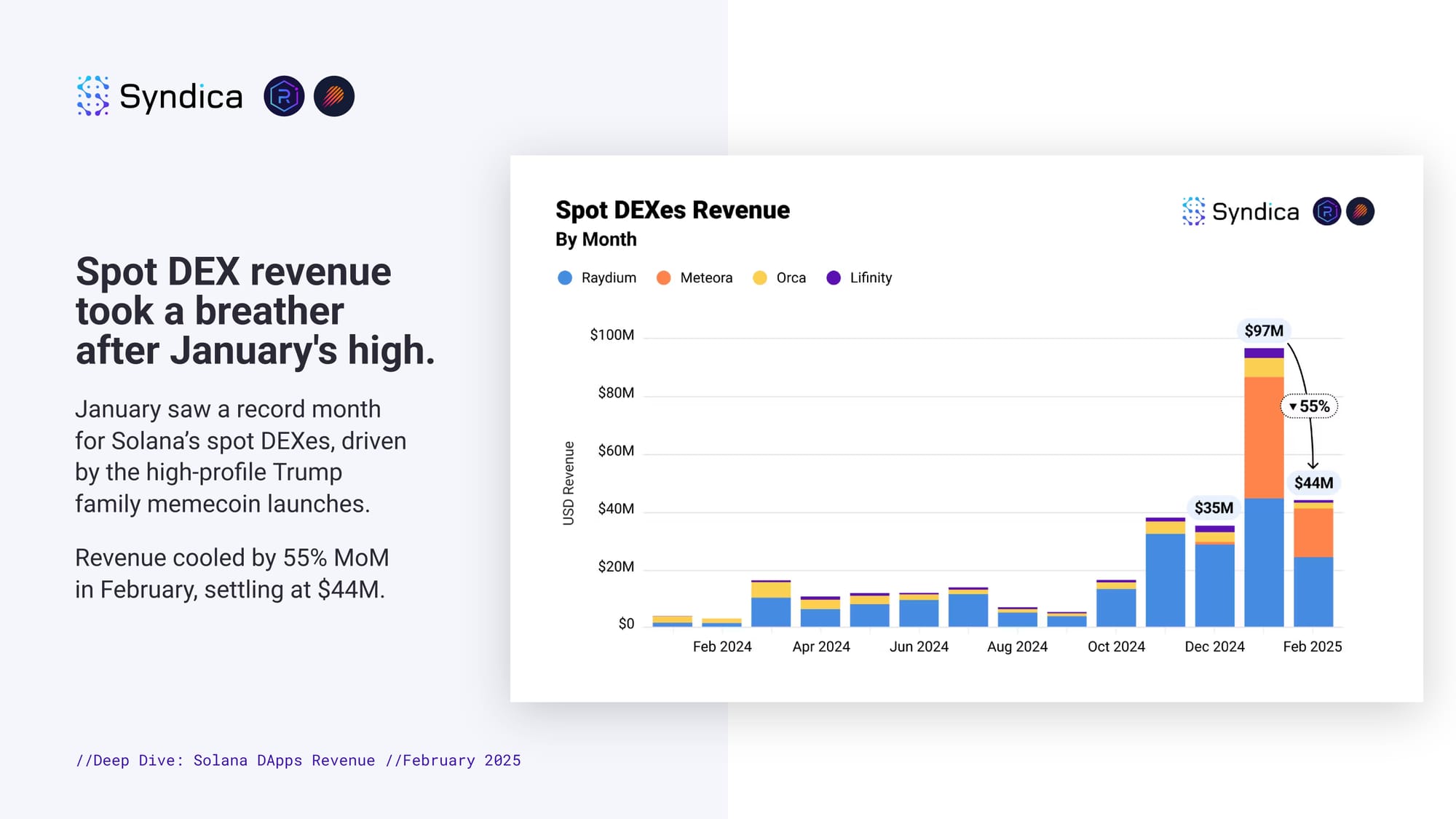

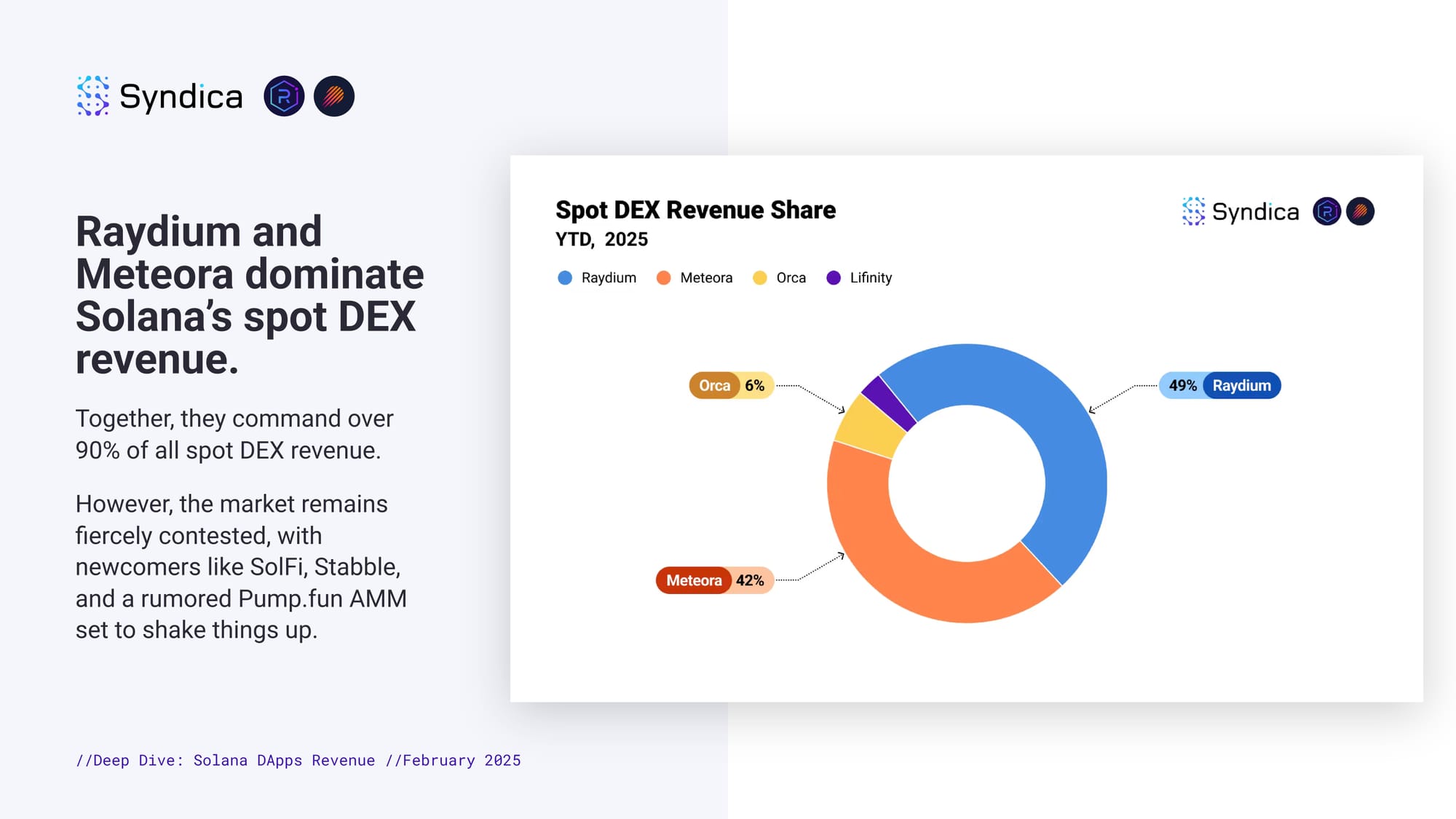

Spot DEX revenue took a breather after January's high. January saw a record month for Solana’s spot DEXes, driven by the high-profile Trump family memecoin launches. Revenue cooled by 55% MoM in February, settling at $44M.

Raydium and Meteora dominate Solana’s spot DEX revenue. Together, they command over 90% of all spot DEX revenue. However, the market remains fiercely contested, with newcomers like SolFi, Stabble, and a rumored Pump.fun AMM set to shake things up.

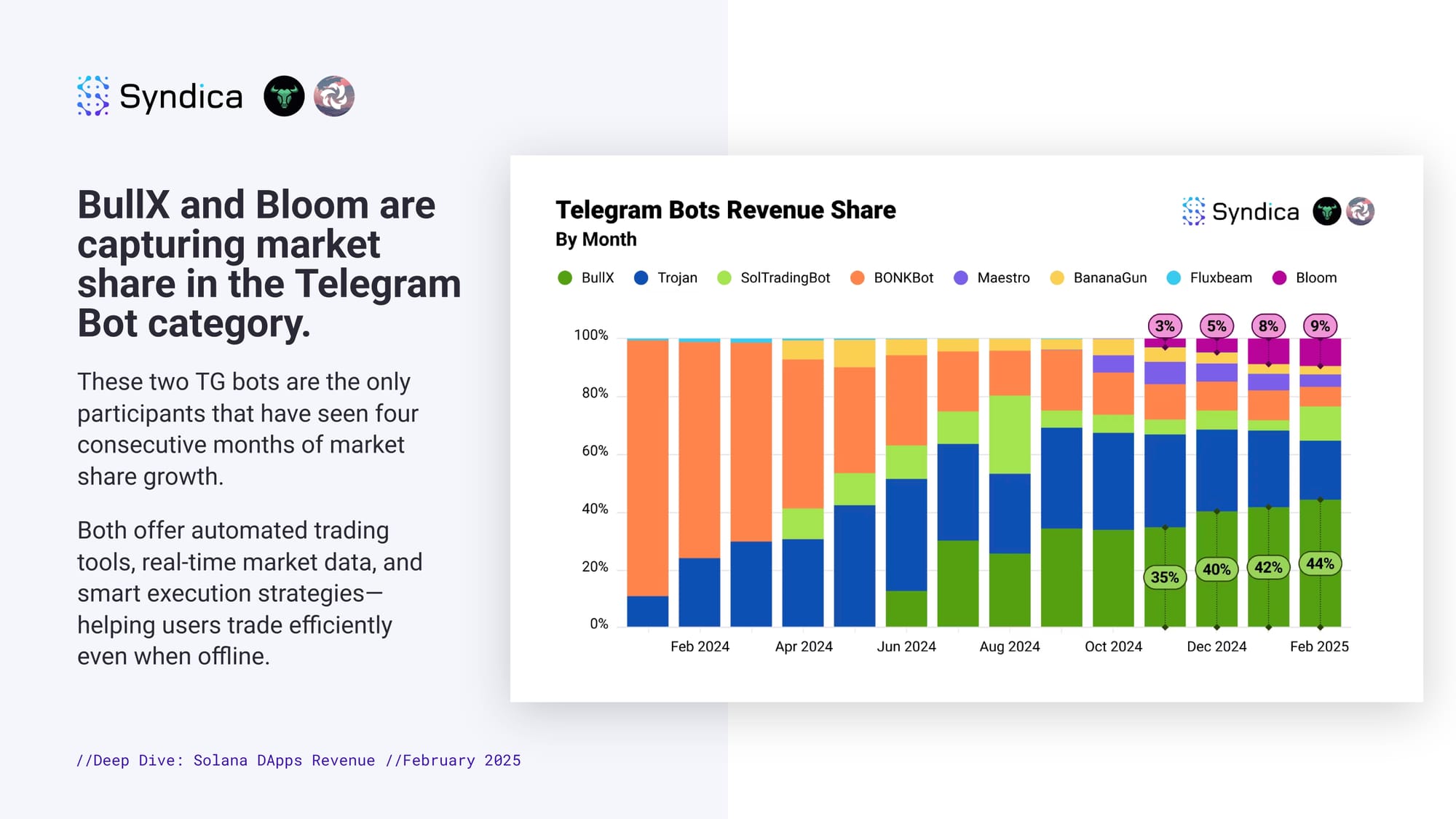

BullX and Bloom are capturing market share in the Telegram Bot category. These two TG bots are the only participants that have seen four consecutive months of market share growth. Both offer automated trading tools, real-time market data, and smart execution strategies—helping users trade efficiently even when offline.

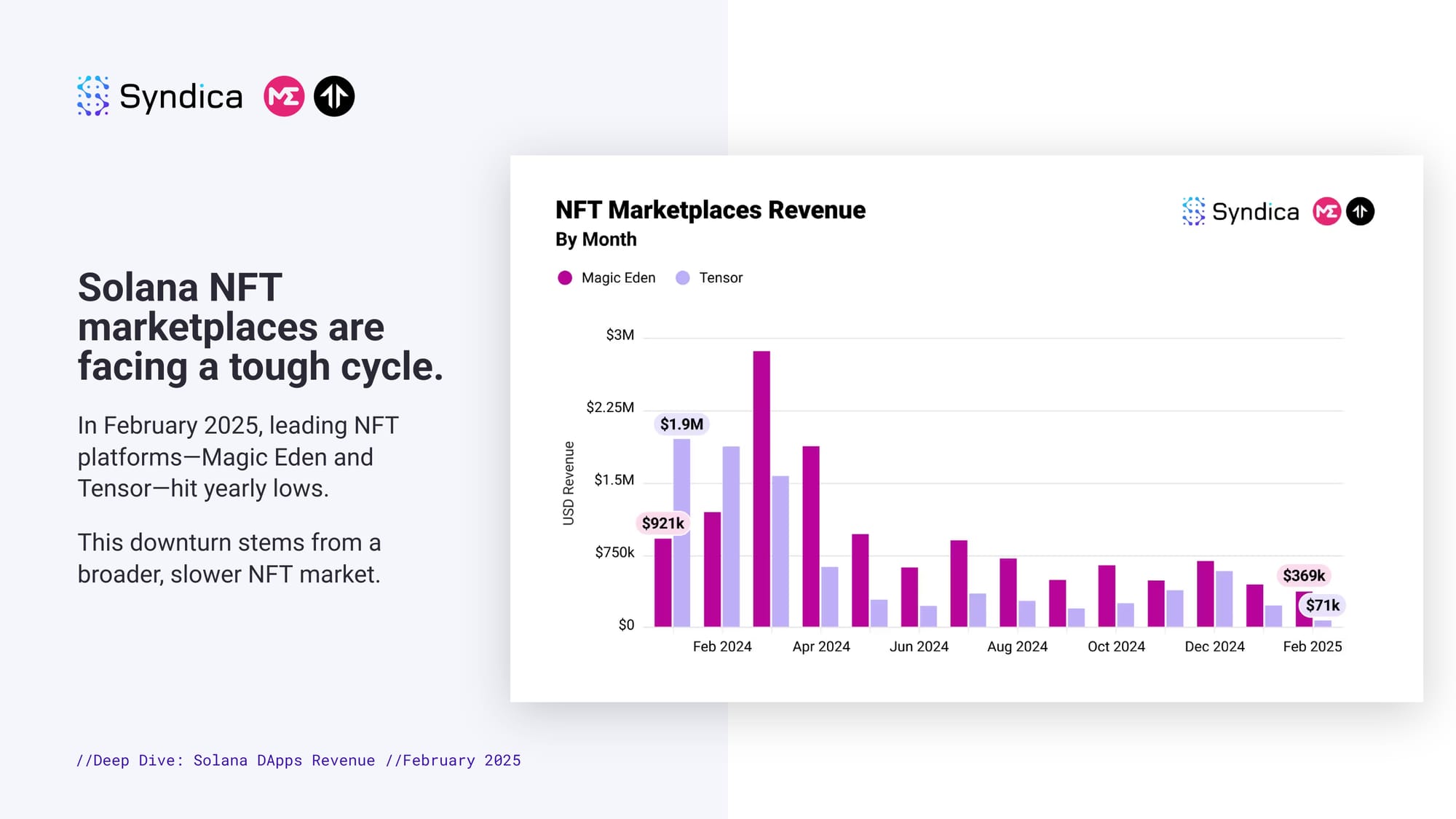

Solana NFT marketplaces are facing a tough cycle. In February 2025, leading NFT platforms—Magic Eden and Tensor—hit yearly lows. This downturn stems from a broader, slower NFT market.

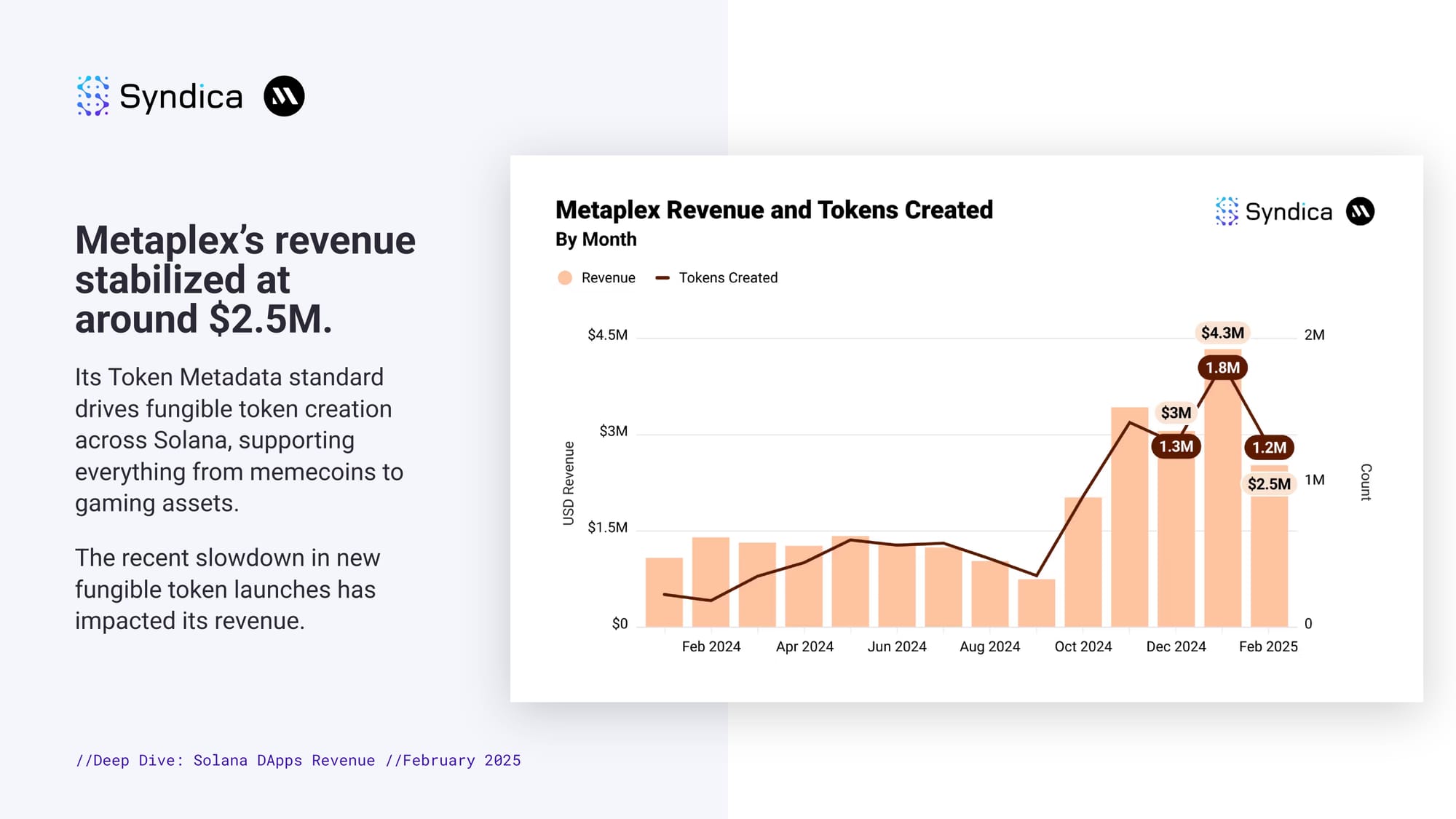

Metaplex’s revenue stabilized at around $2.5M. Its Token Metadata standard drives fungible token creation across Solana, supporting everything from memecoins to gaming assets. The recent slowdown in new fungible token launches has impacted its revenue.

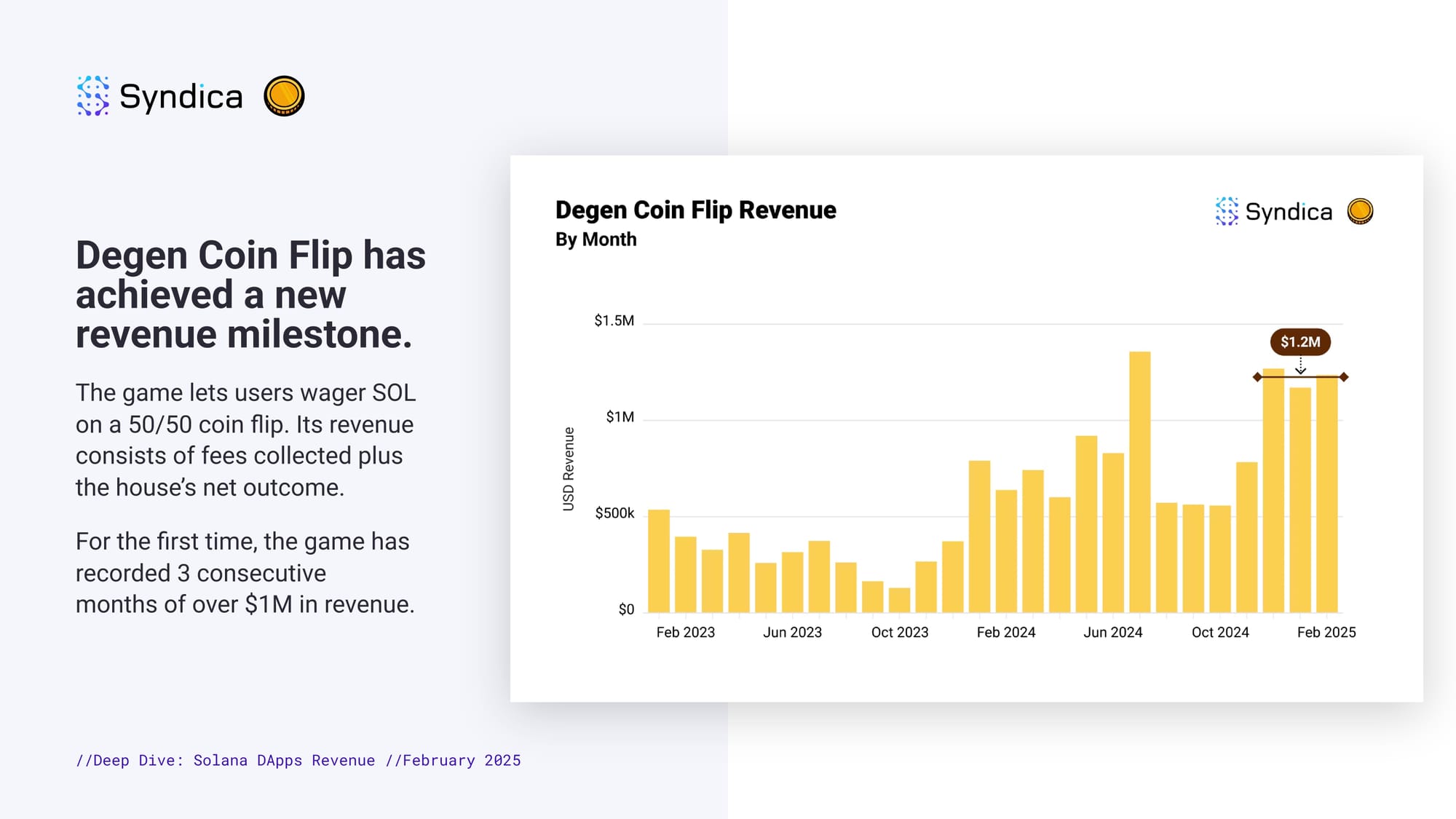

Degen Coin Flip has achieved a new revenue milestone. The game lets users wager SOL on a 50/50 coin flip. Its revenue consists of fees collected plus the house’s net outcome. For the first time, the game has recorded 3 consecutive months of over $1M in revenue.

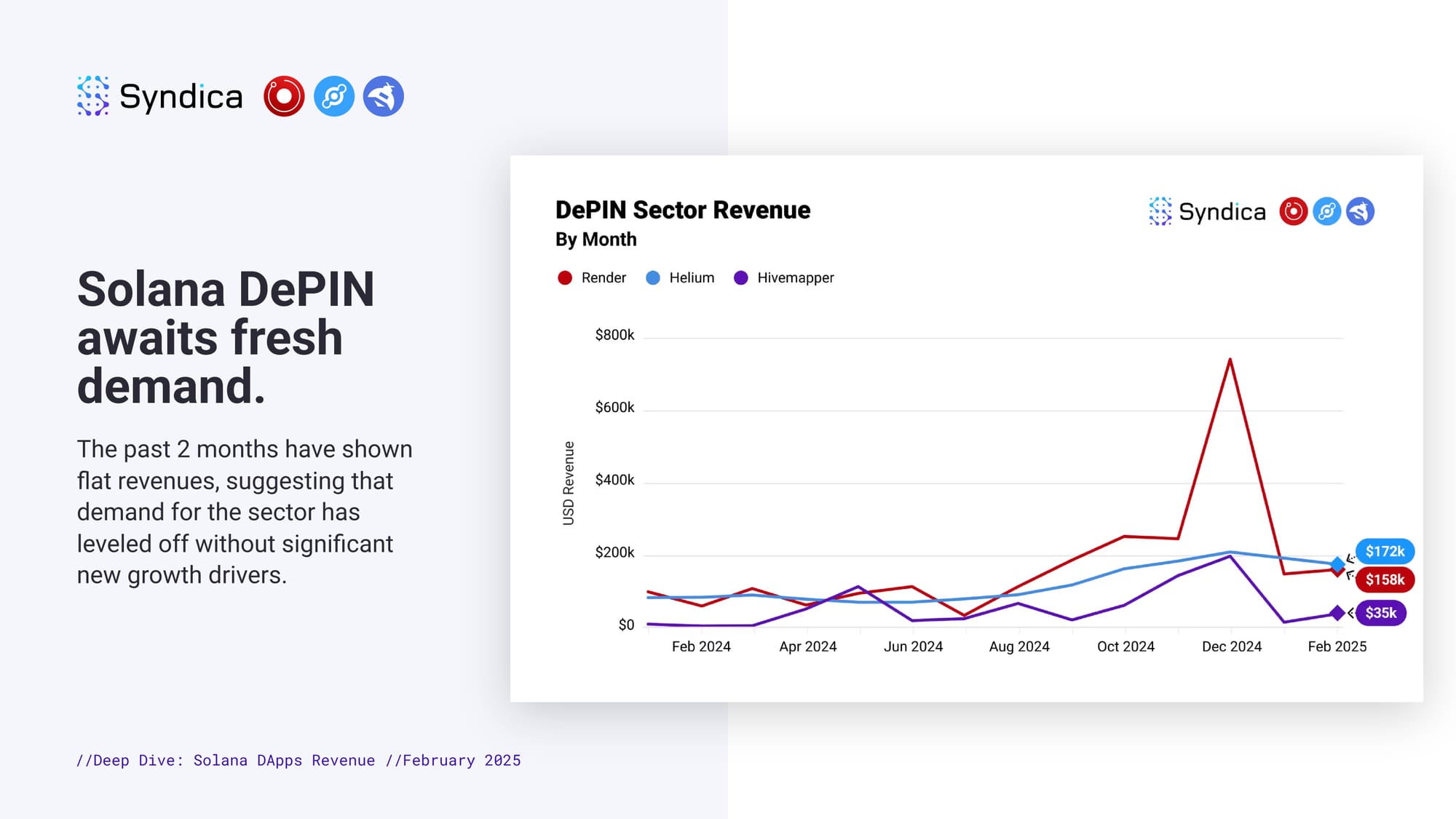

Solana DePIN awaits fresh demand. The past two months have shown flat revenues, suggesting that demand for the sector has leveled off without significant new growth drivers.