Deep Dive: Solana DApps Revenue - January 2025

Deep Dive: Solana DApps Revenue - January 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - January 2025

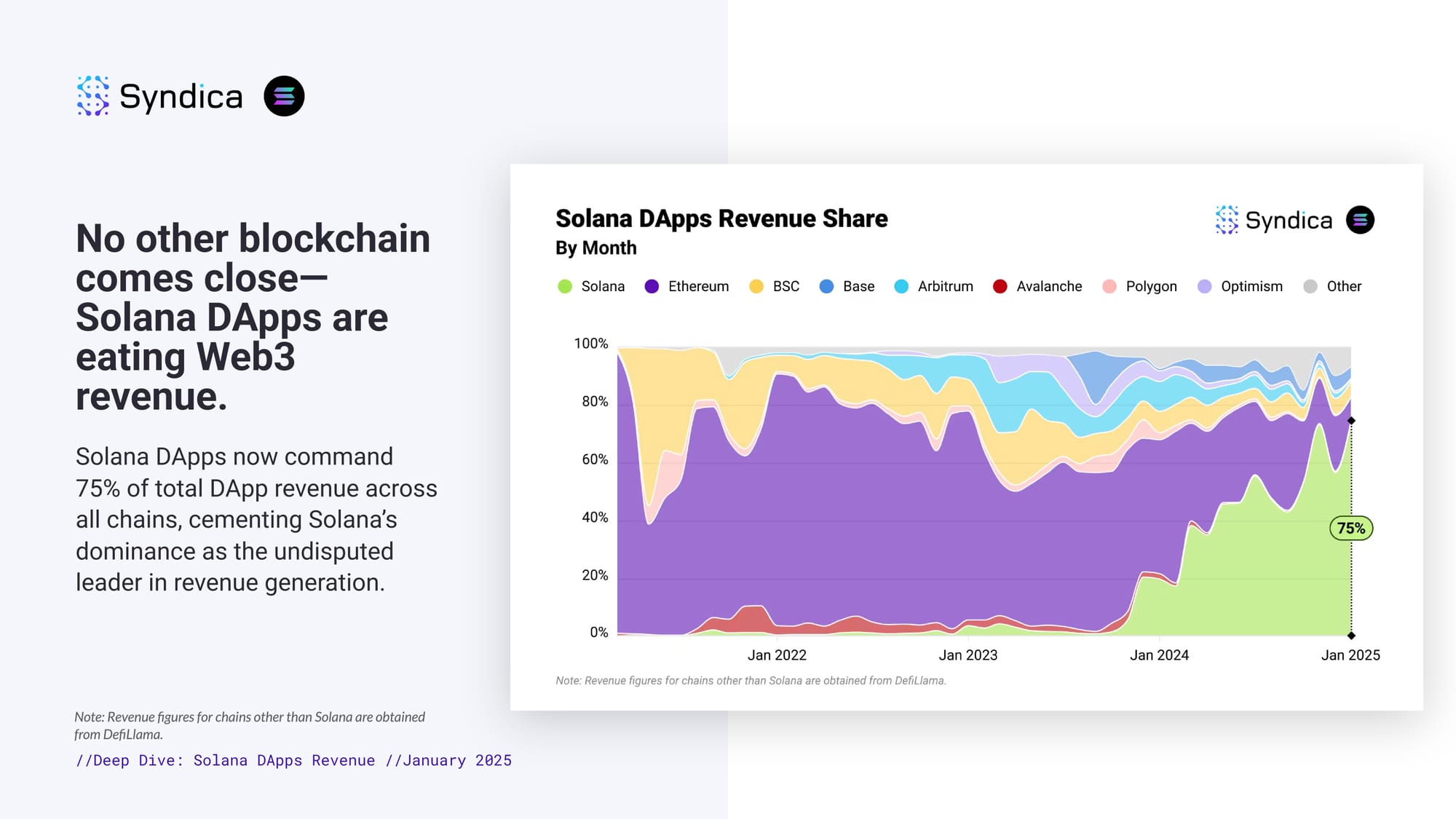

No other blockchain comes close—Solana DApps are eating Web3 revenue. Solana DApps now command 75% of total DApp revenue across all chains, cementing Solana’s dominance as the undisputed leader in revenue generation.

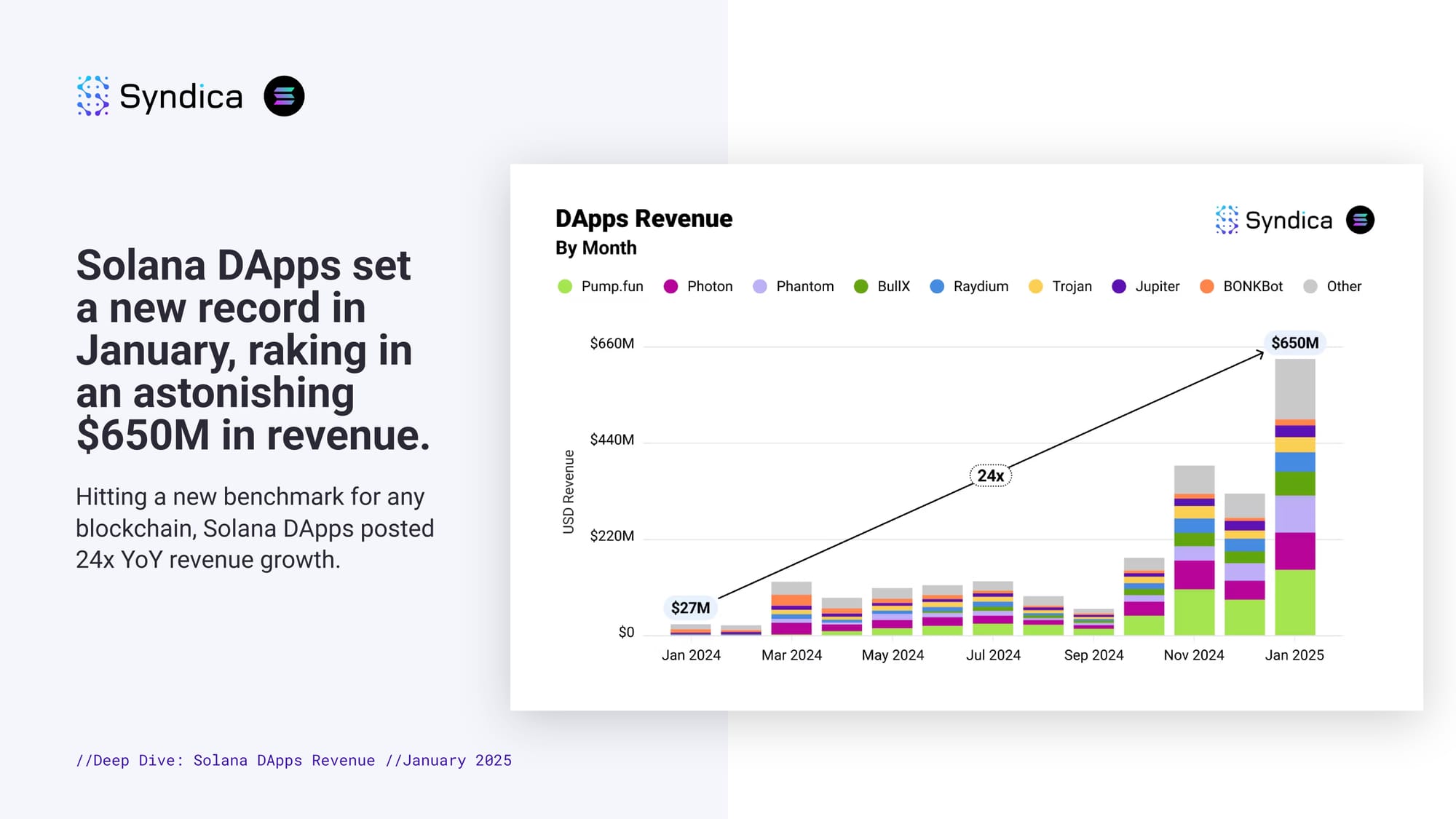

Solana DApps set a new record in January, raking in an astonishing $650M in revenue. Hitting a new benchmark for any blockchain, Solana DApps posted 24x YoY revenue growth.

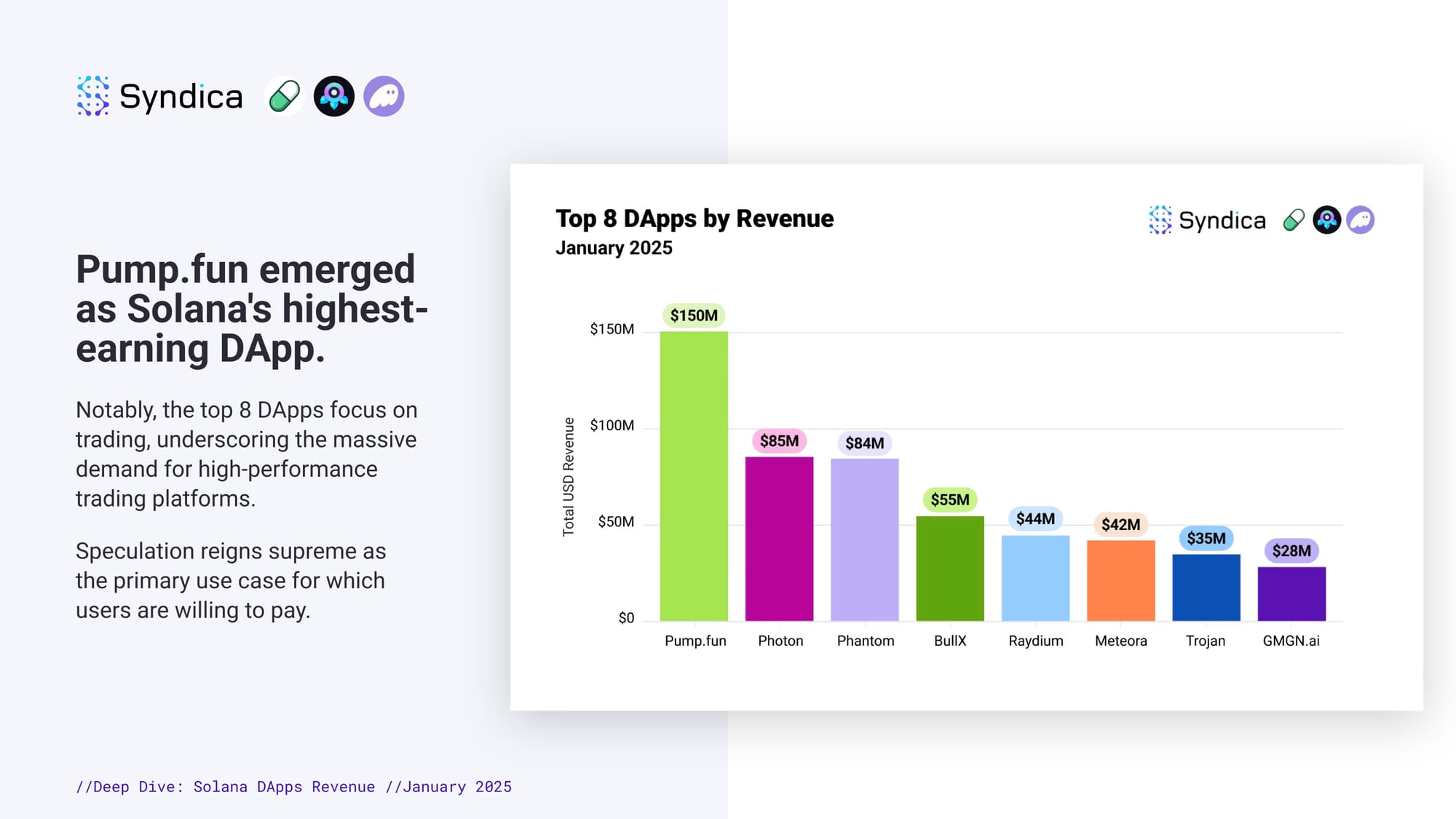

Pump.fun emerged as Solana's highest-earning DApp. Notably, the top 8 DApps focus on trading, underscoring the massive demand for high-performance trading platforms. Speculation reigns supreme as the primary use case for which users are willing to pay.

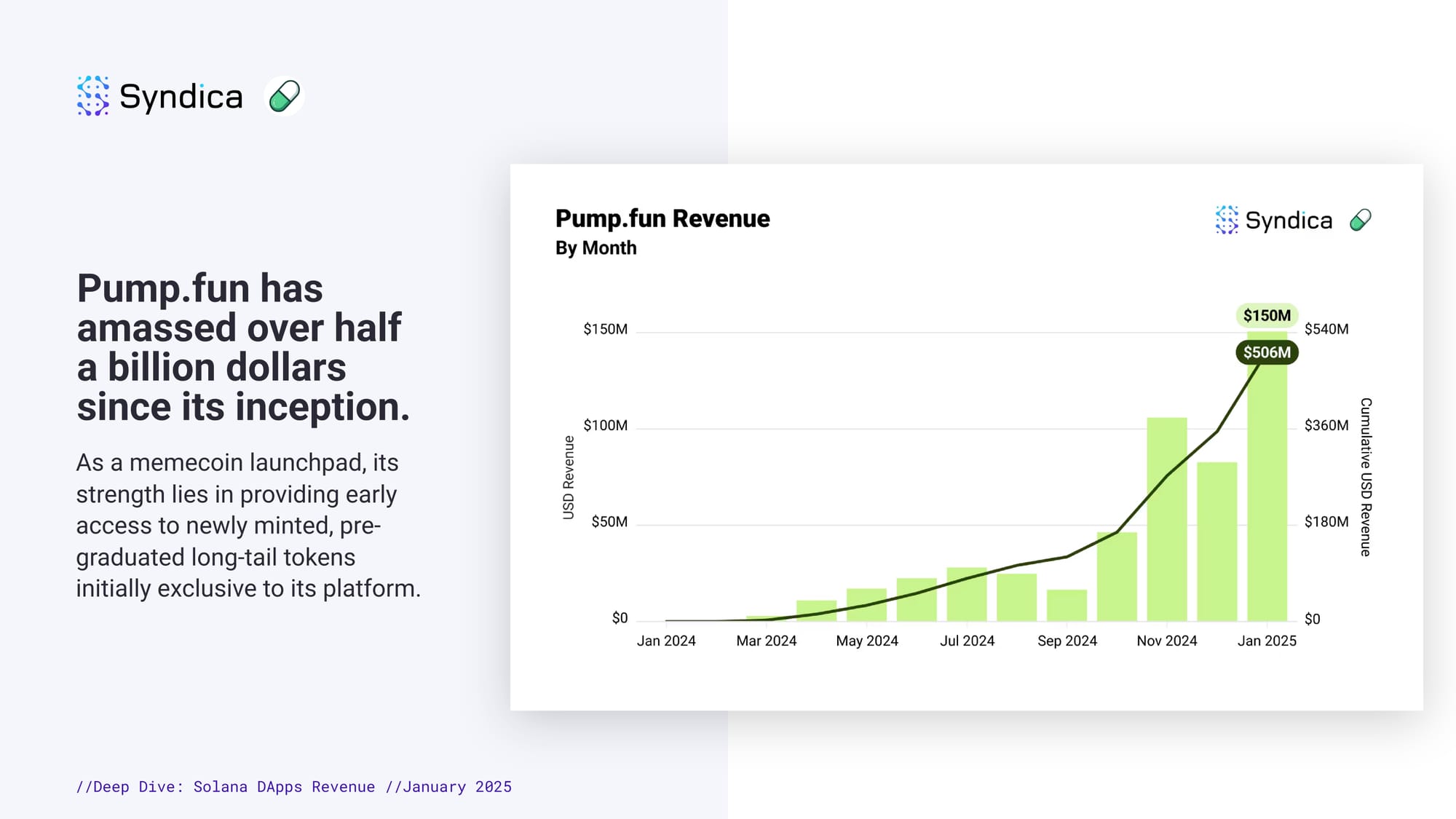

Pump.fun has amassed over half a billion dollars since its inception. As a memecoin launchpad, its strength lies in providing early access to newly minted, pre-graduated long-tail tokens initially exclusive to its platform.

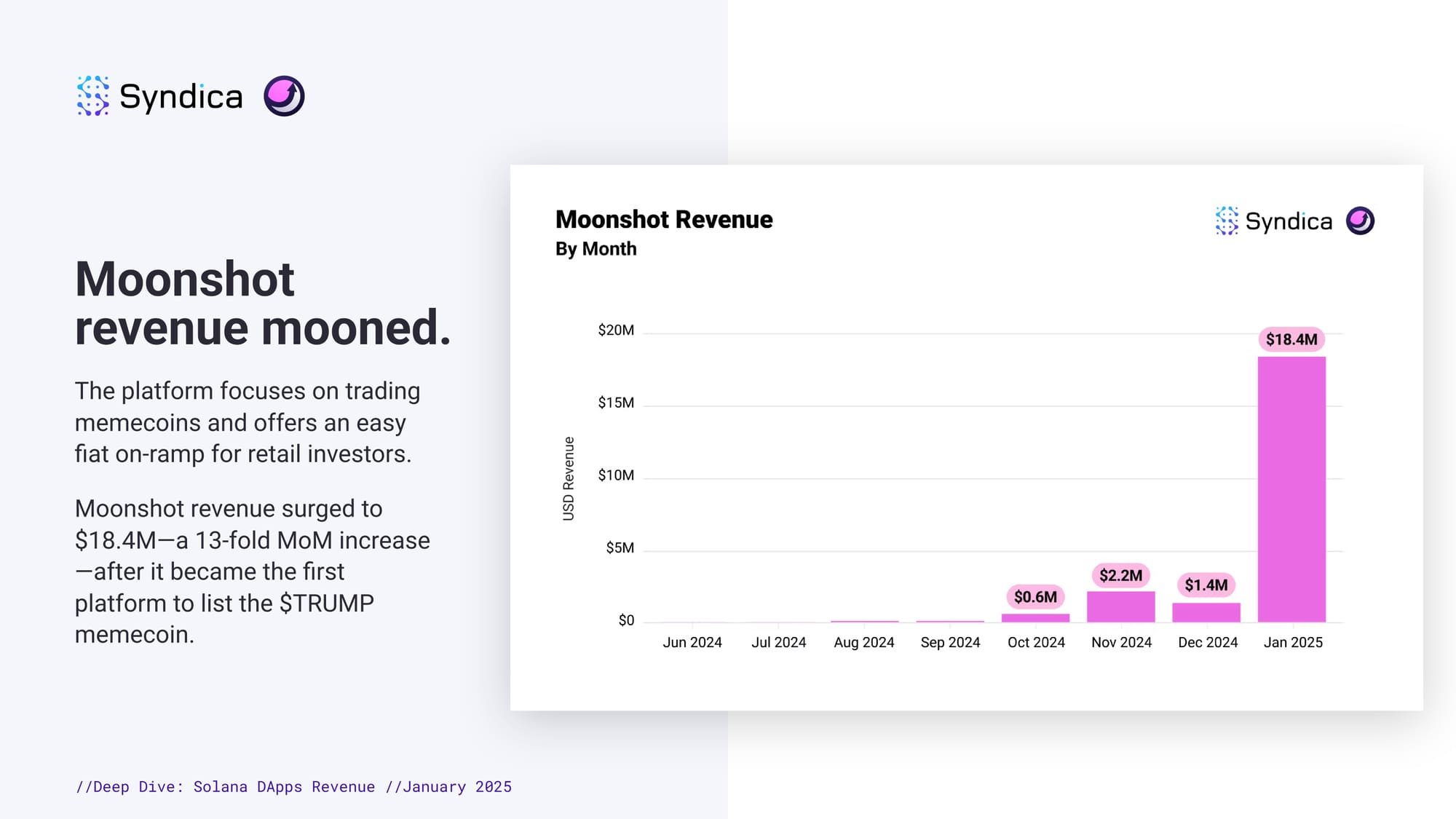

Moonshot revenue mooned. The platform focuses on trading memecoins and offers an easy fiat on-ramp for retail investors. Moonshot revenue surged to $18.4M—a 13-fold MoM increase—after it became the first platform to list the $TRUMP memecoin.

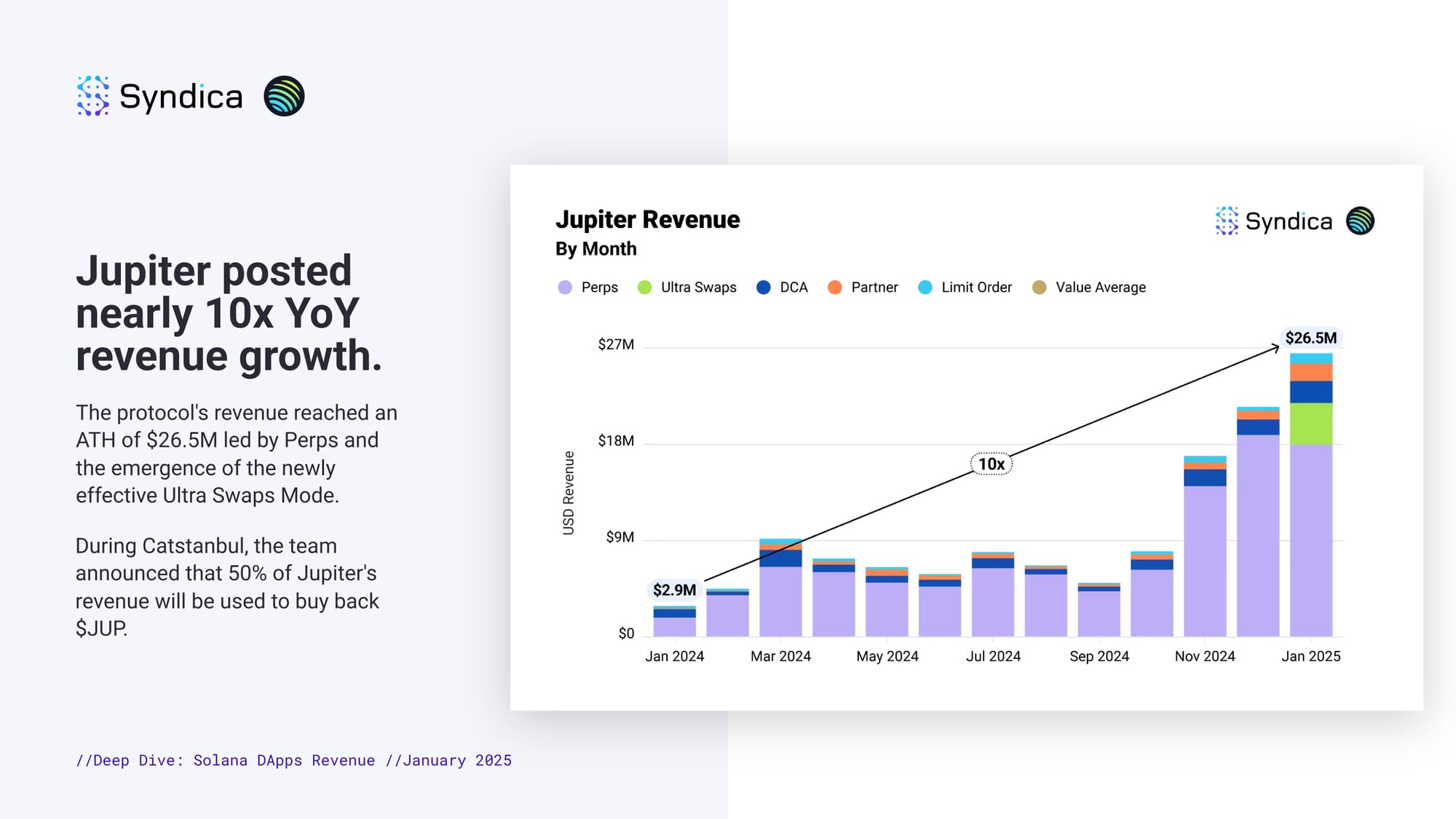

Jupiter posted nearly 10x YoY revenue growth. The protocol's revenue reached an ATH of $26.5M led by Perps and the emergence of the newly effective Ultra Swaps Mode. During Catstanbul, the team announced that 50% of Jupiter's revenue will be used to buy back $JUP.

Jupiter's Spot trading tools achieved record revenue in January. Jupiter Spot offers DCA, Limit Orders, Value Averaging, and Ultra Mode for spot trading on Solana. Despite running for just 7 days, Ultra Swaps generated the highest revenue.

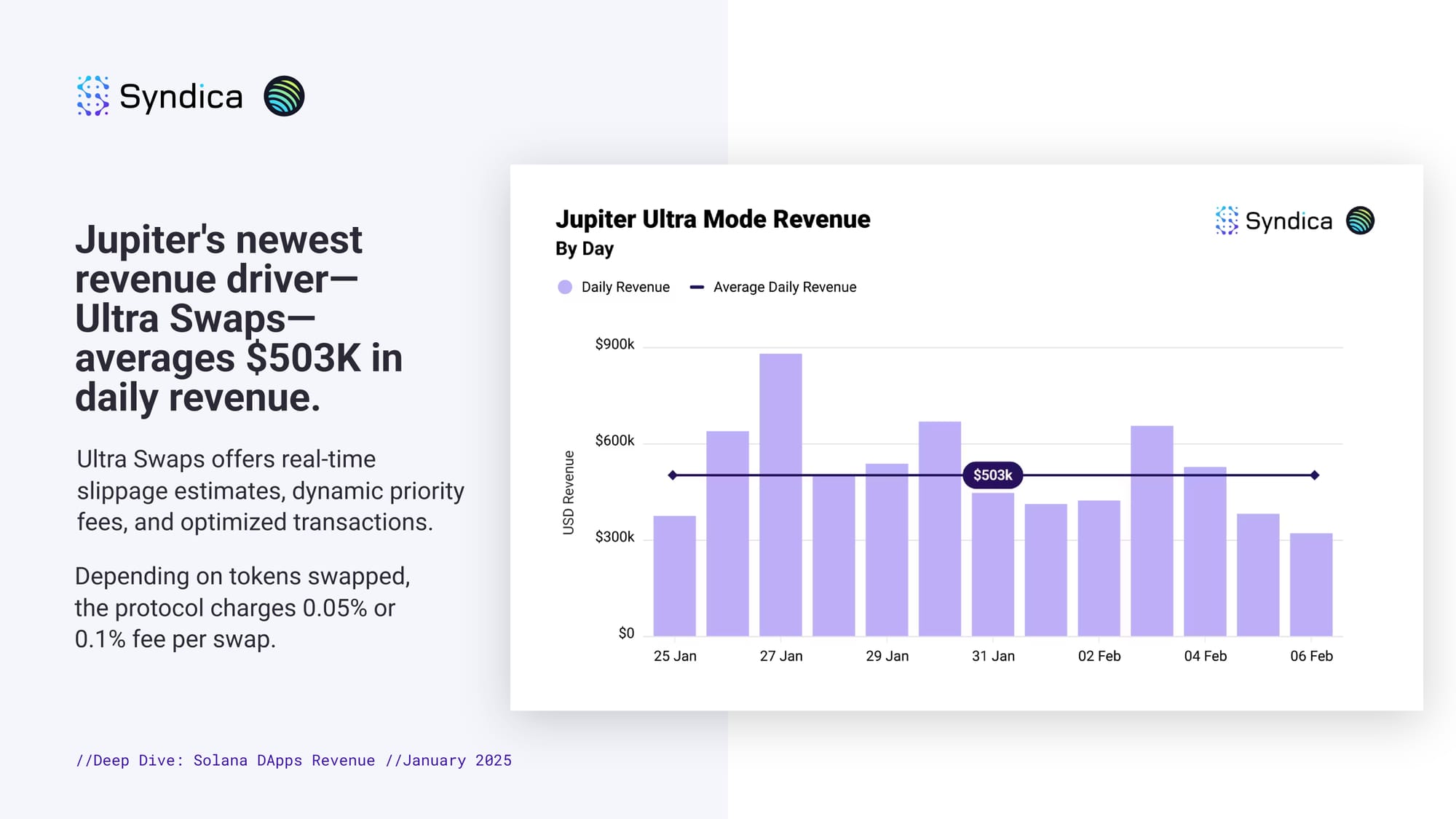

Jupiter's newest revenue driver—Ultra Swaps— averages $503K in daily revenue. Ultra Swaps offers real-time slippage estimates, dynamic priority fees, and optimized transactions. Depending on tokens swapped, the protocol charges 0.05% or 0.1% fee per swap.

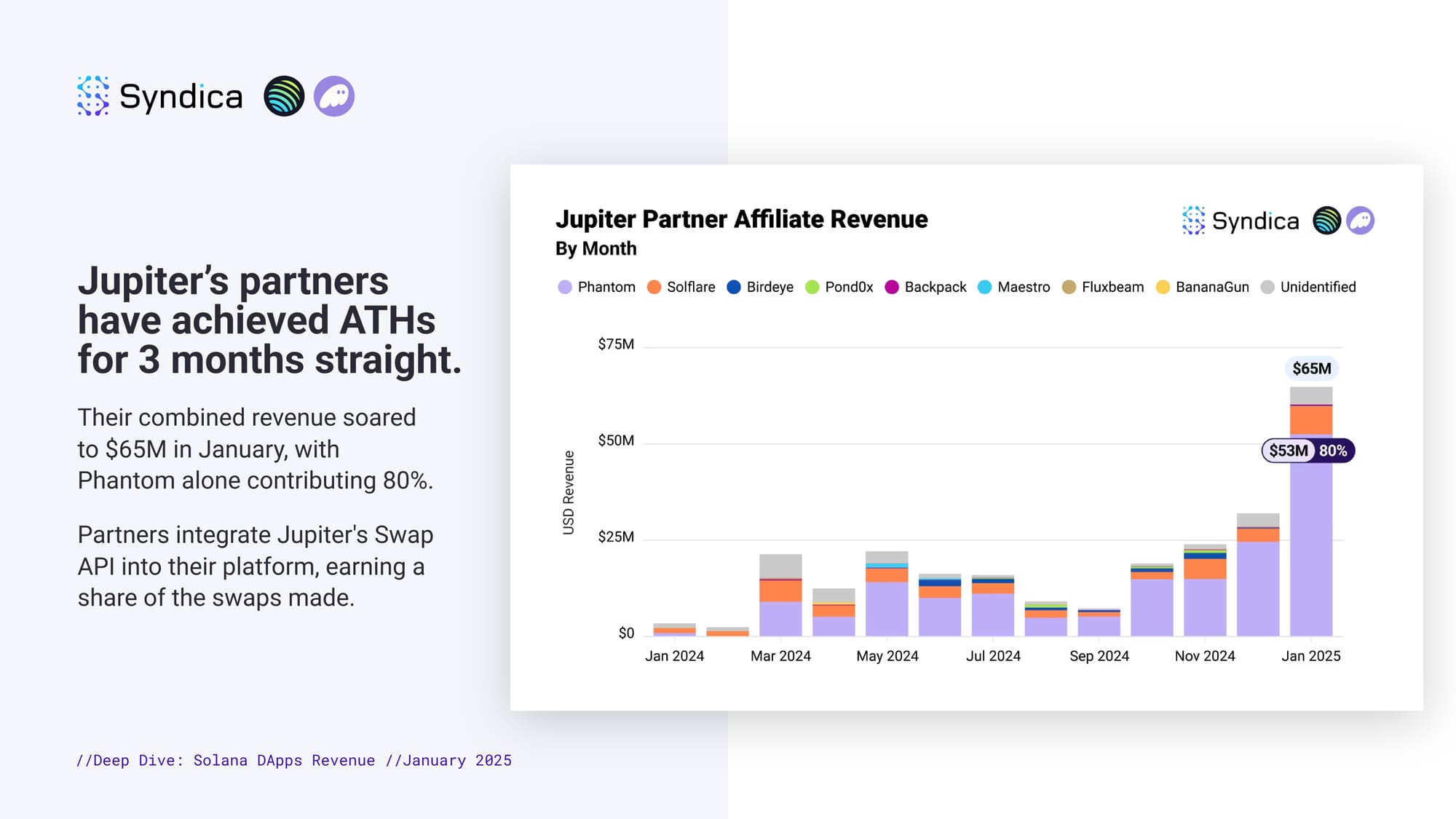

Jupiter’s partners have achieved ATHs for 3 months straight. Their combined revenue soared to $65M in January, with Phantom alone contributing 80%. Partners integrate Jupiter's Swap API into their platform, earning a share of the swaps made.

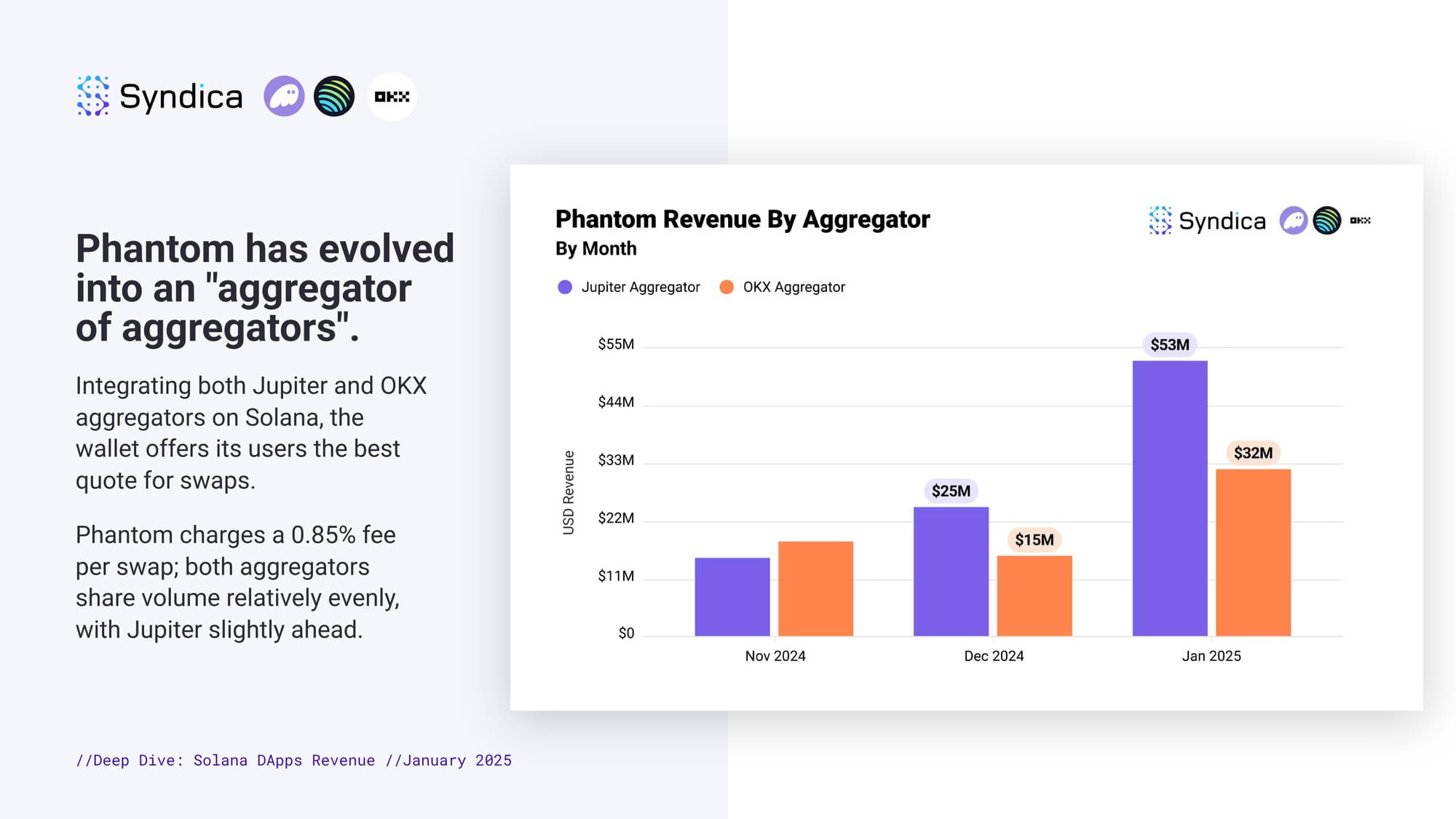

Phantom has evolved into an "aggregator of aggregators". Integrating both Jupiter and OKX aggregators on Solana, the wallet offers its users the best quote for swaps. Phantom charges a 0.85% fee per swap; both aggregators share volume relatively evenly, with Jupiter slightly ahead.

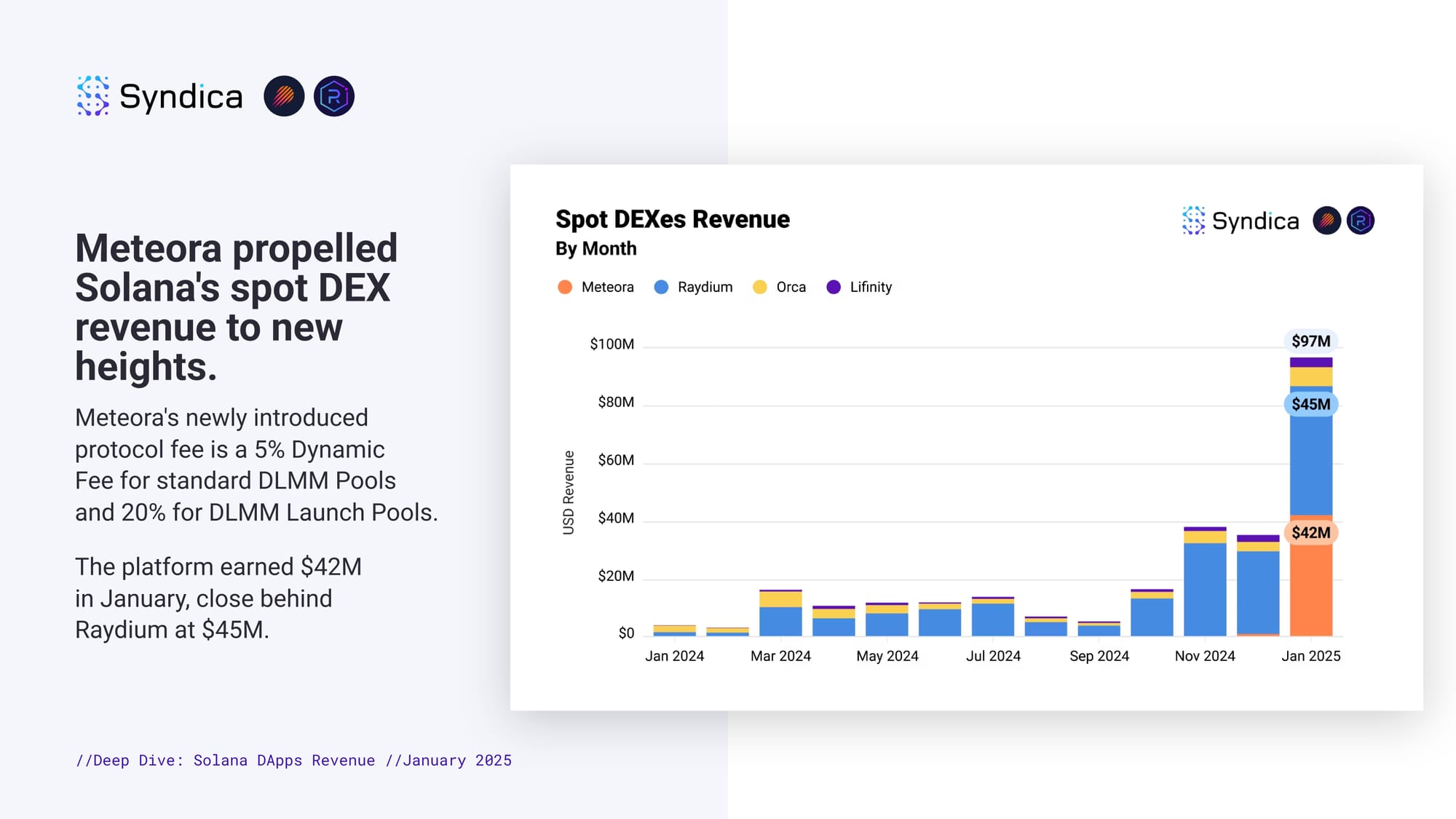

Meteora propelled Solana's spot DEX revenue to new heights. Meteora's newly introduced protocol fee is a 5% Dynamic Fee for standard DLMM Pools and 20% for DLMM Launch Pools. The platform earned $42M in January, close behind Raydium at $45M.

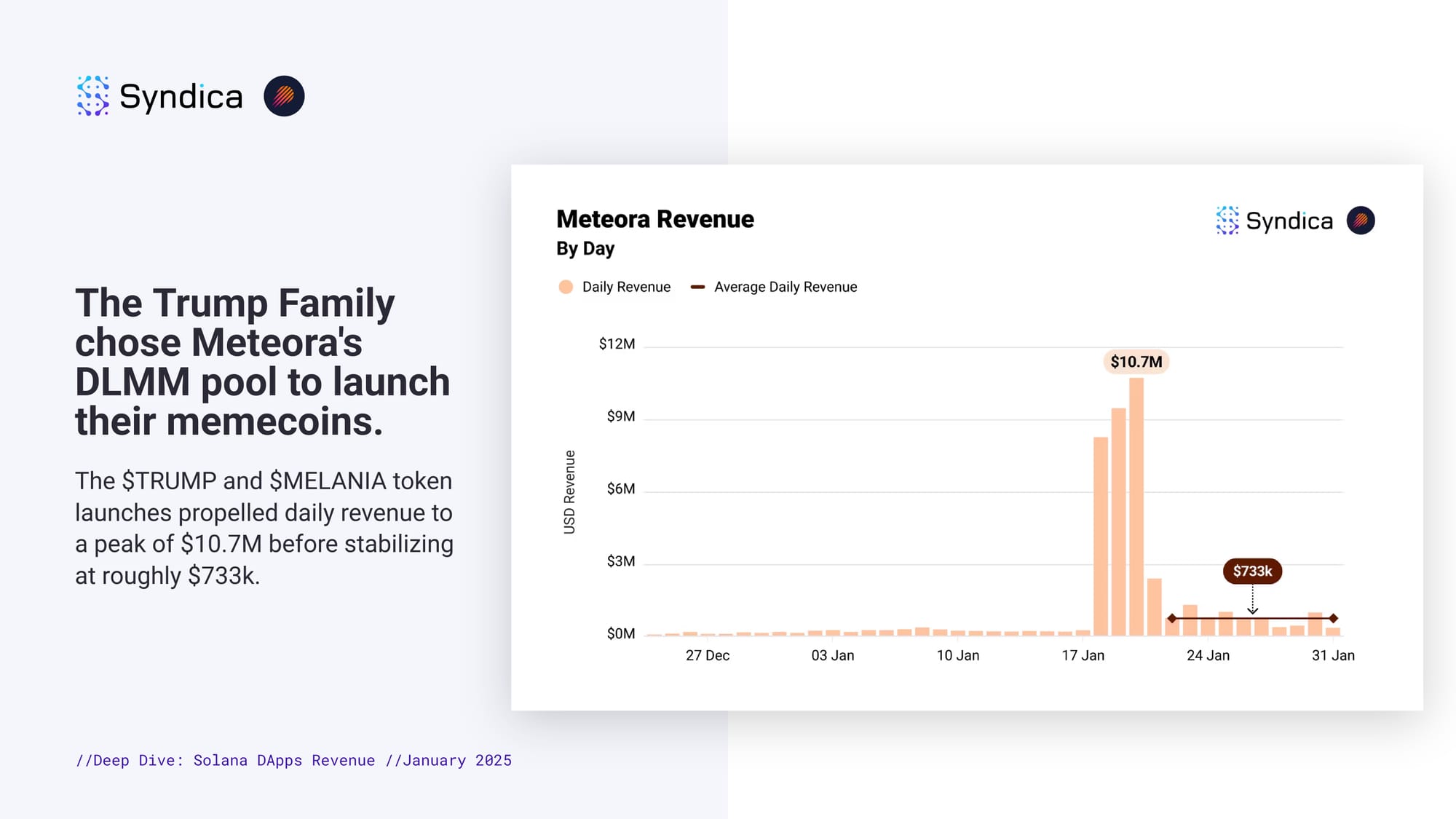

The Trump Family chose Meteora's DLMM pool to launch their memecoins. The $TRUMP and $MELANIA token launches propelled daily revenue to a peak of $10.7M before stabilizing at roughly $733k.

Traders have driven record Telegram Bot revenue. Leading the pack once more, BullX and Trojan drove the Telegram Bot sector to a new high of $120M in revenue. Traders are willing to pay for a streamlined, high-convenience experience.

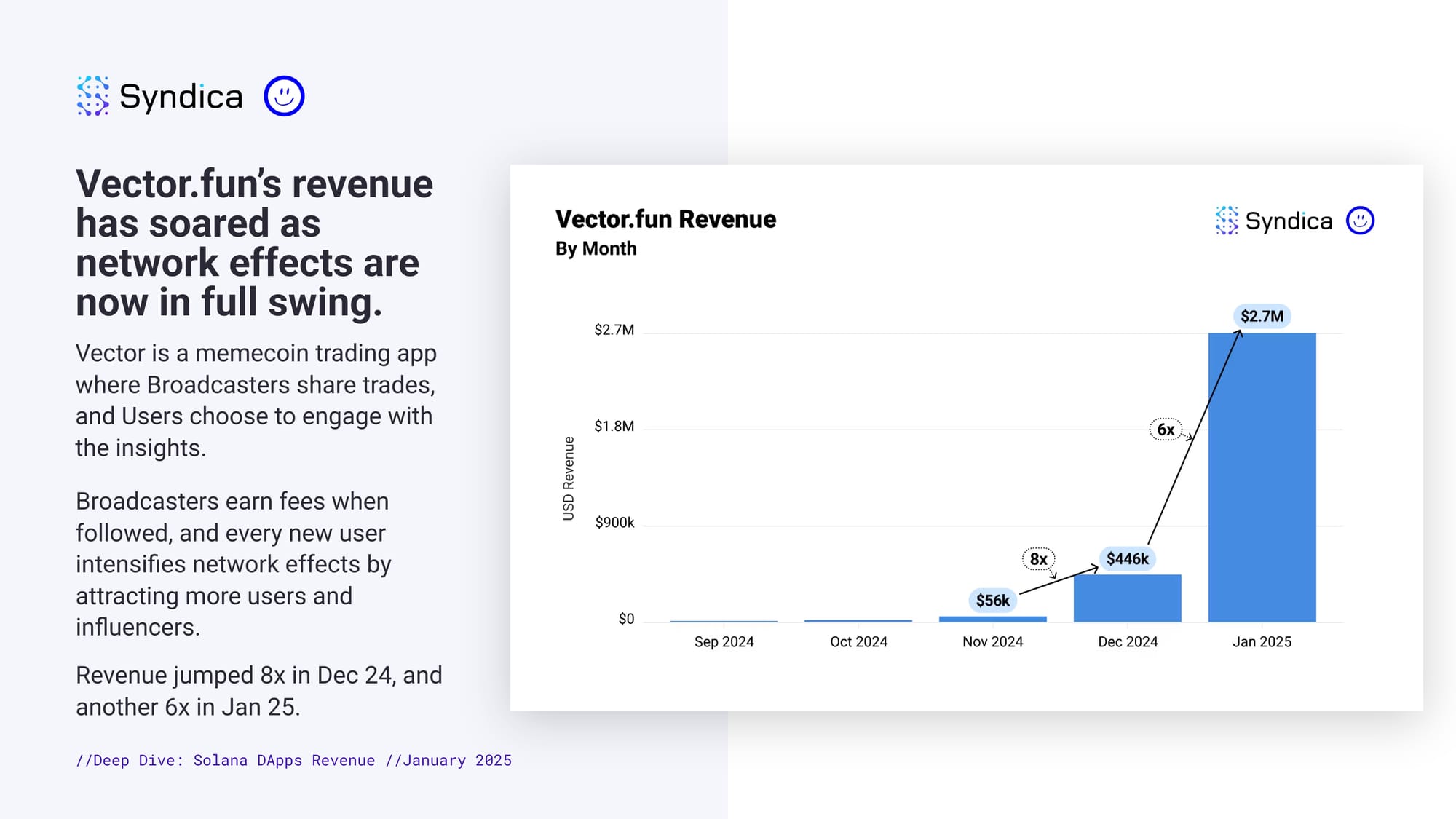

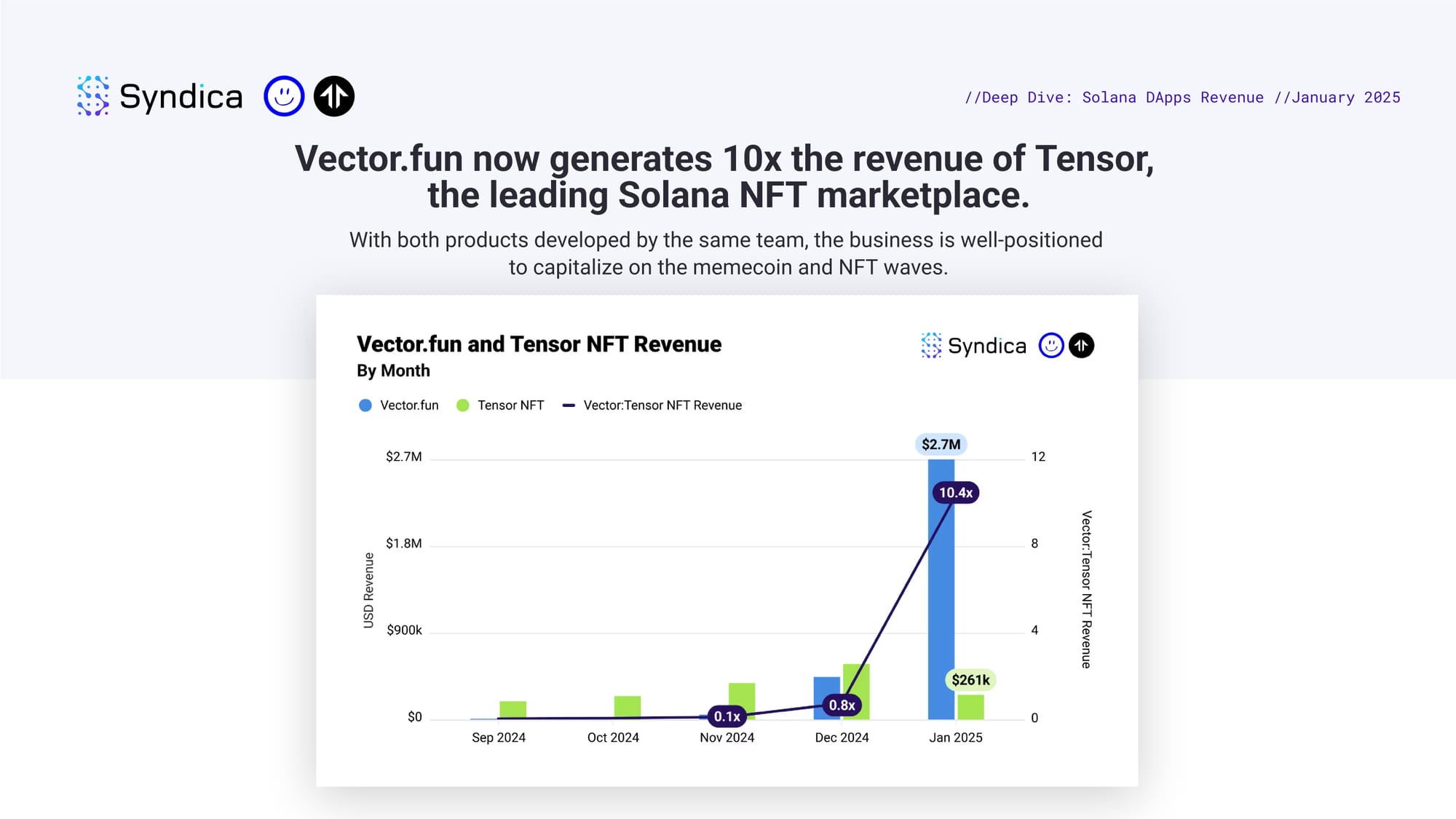

Vector.fun’s revenue has soared as network effects are now in full swing. Vector is a memecoin trading app where Broadcasters share trades, and Users choose to engage with the insights. Broadcasters earn fees when followed, and every new user intensifies network effects by attracting more users and influencers. Revenue jumped 8x in Dec 24, and another 6x in Jan 25.

Vector.fun now generates 10x the revenue of Tensor, the leading Solana NFT marketplace. With both products developed by the same team, the business is well-positioned to capitalize on the memecoin and NFT waves.

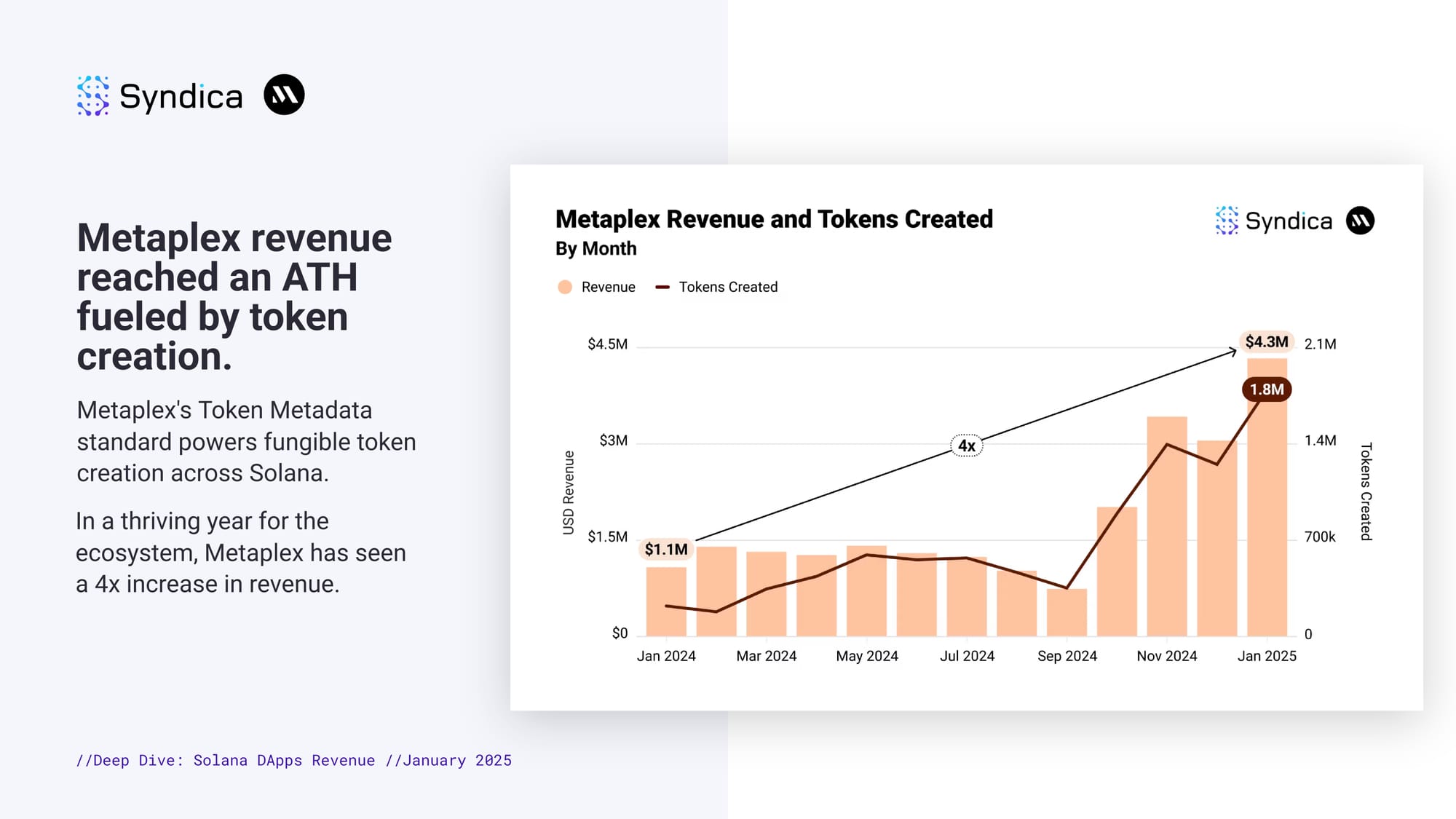

Metaplex revenue reached an ATH fueled by token creation. Metaplex's Token Metadata standard powers fungible token creation across Solana. In a thriving year for the ecosystem, Metaplex has seen a 4x increase in revenue.