Deep Dive: Solana DApps Revenue - July 2025

Deep Dive: Solana DApps Revenue - July 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - July 2025

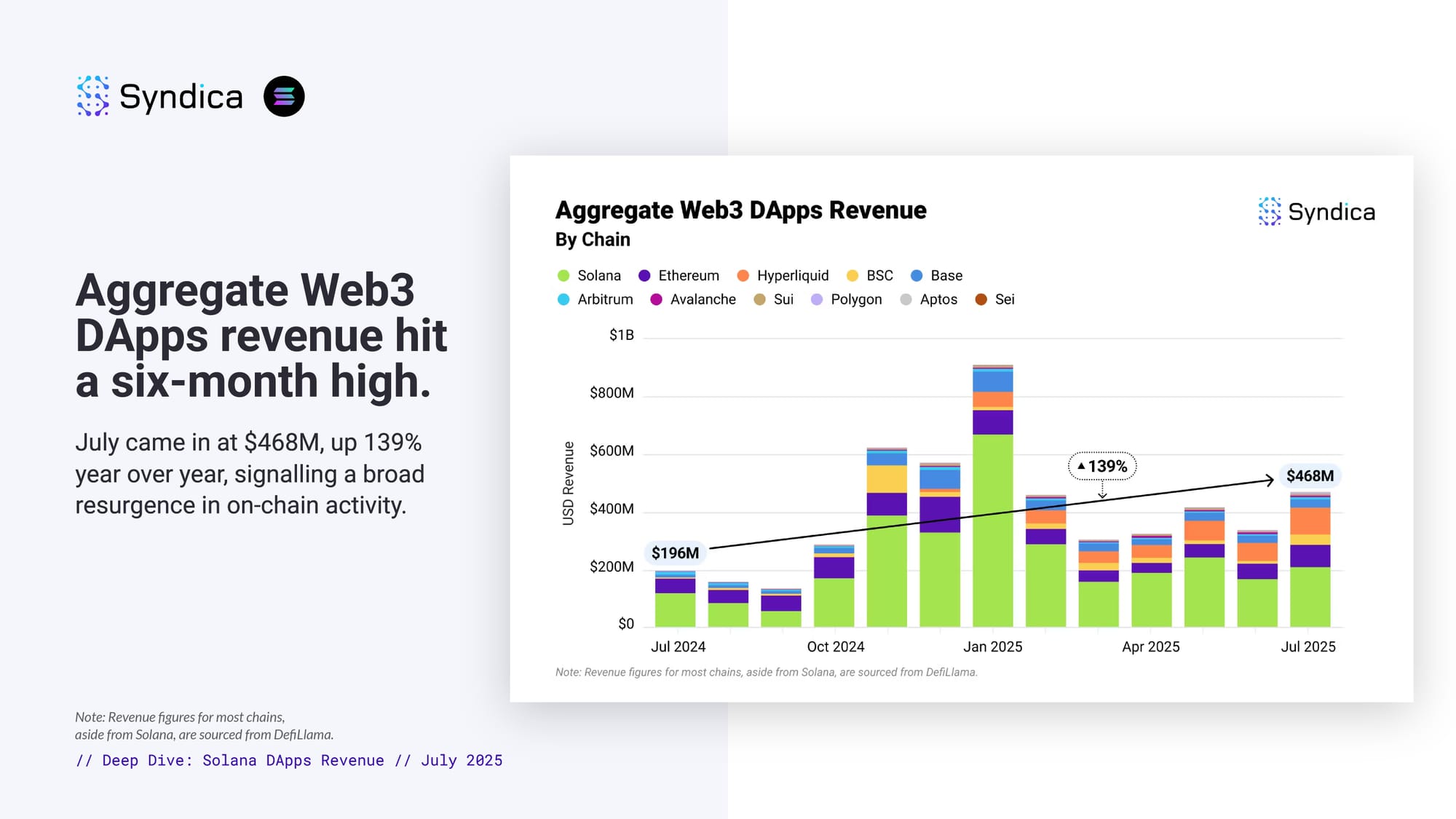

Aggregate Web3 DApps revenue hit a six-month high. July came in at $468M, up 139% year over year, signalling a broad resurgence in on-chain activity.

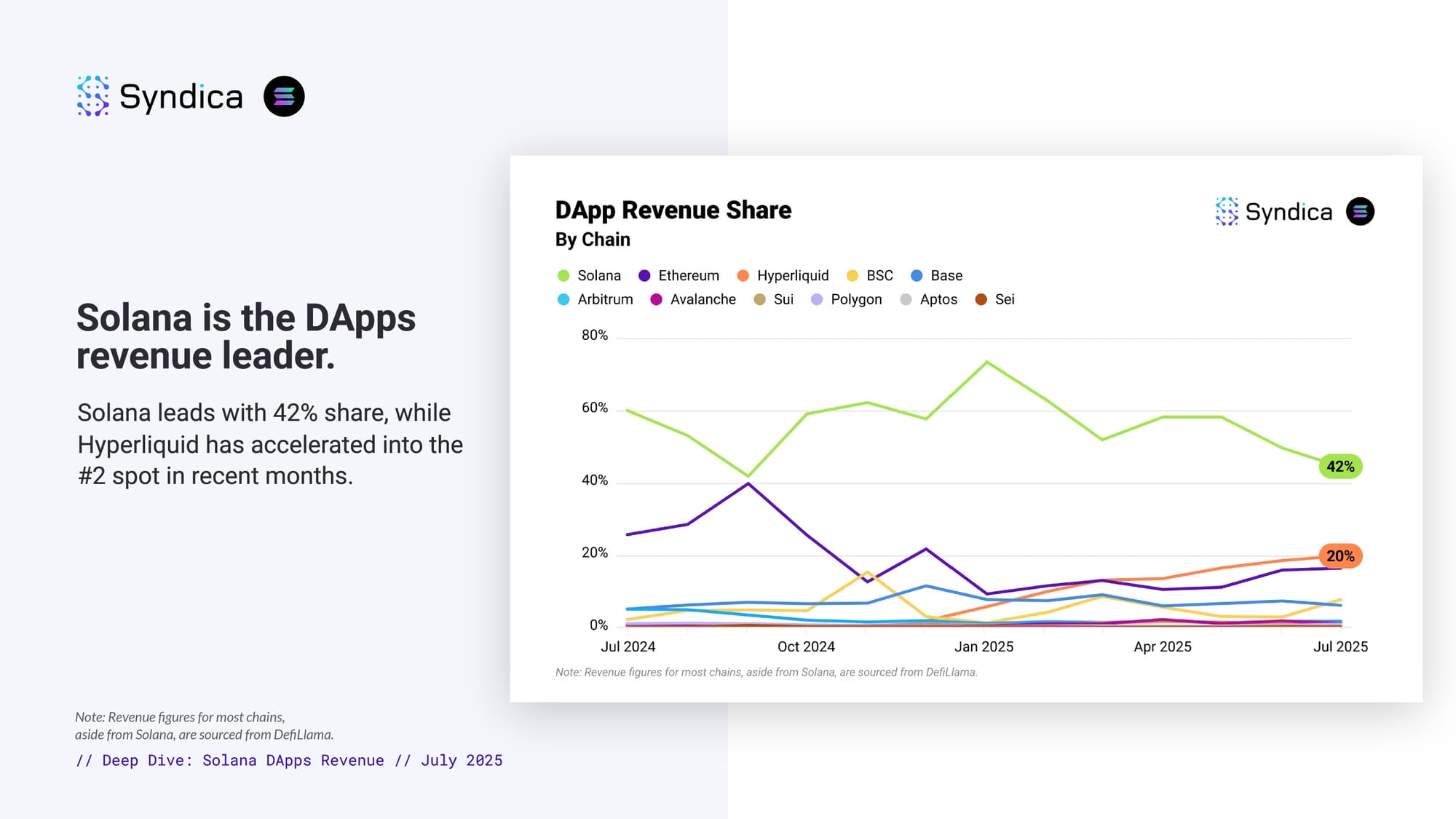

Solana is the DApps revenue leader. Solana leads with 42% share, while Hyperliquid has accelerated into the #2 spot in recent months.

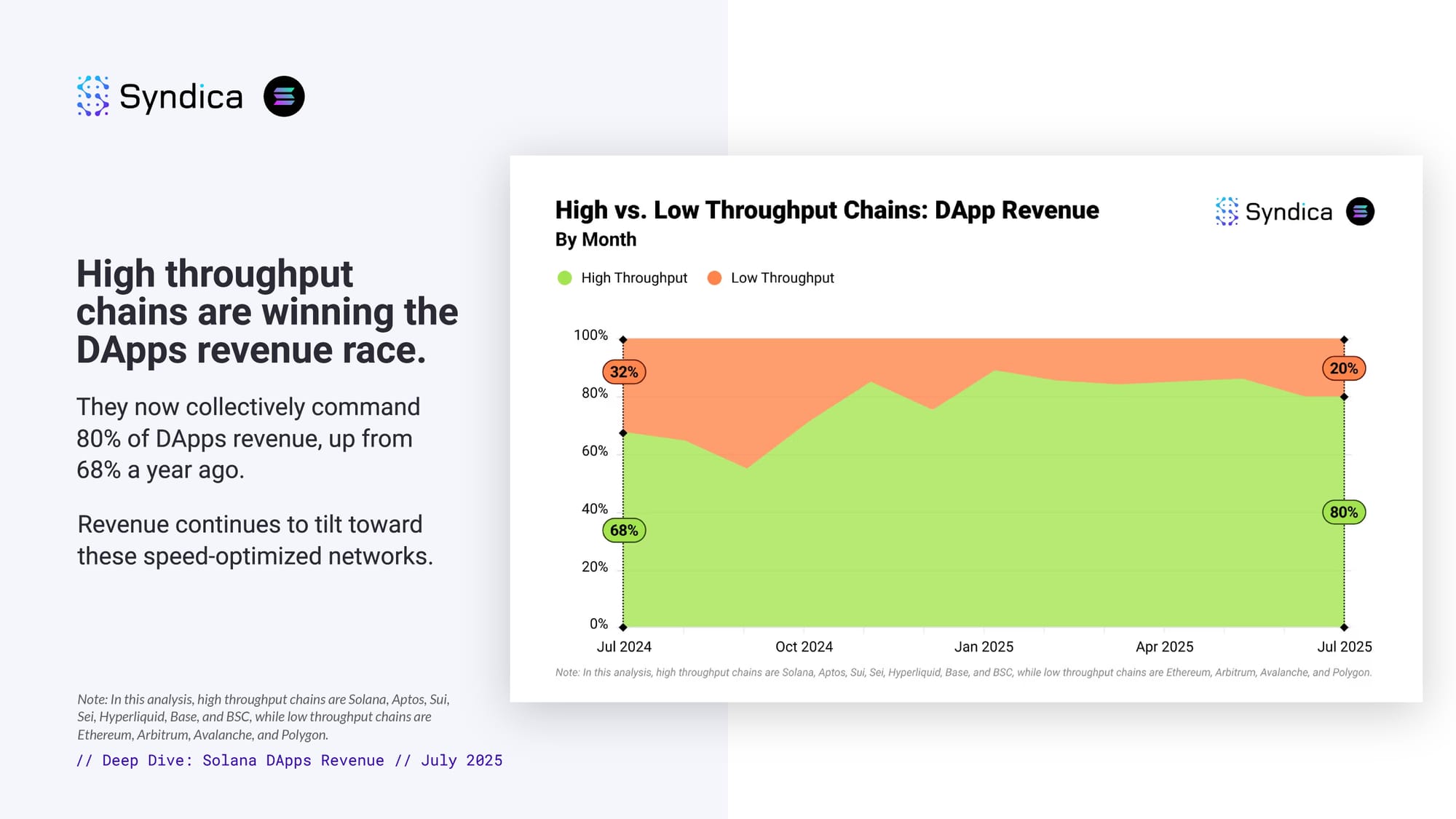

High throughput chains are winning the DApps revenue race. They now collectively command 80% of DApps revenue, up from 68% a year ago. Revenue continues to tilt toward these speed-optimized networks.

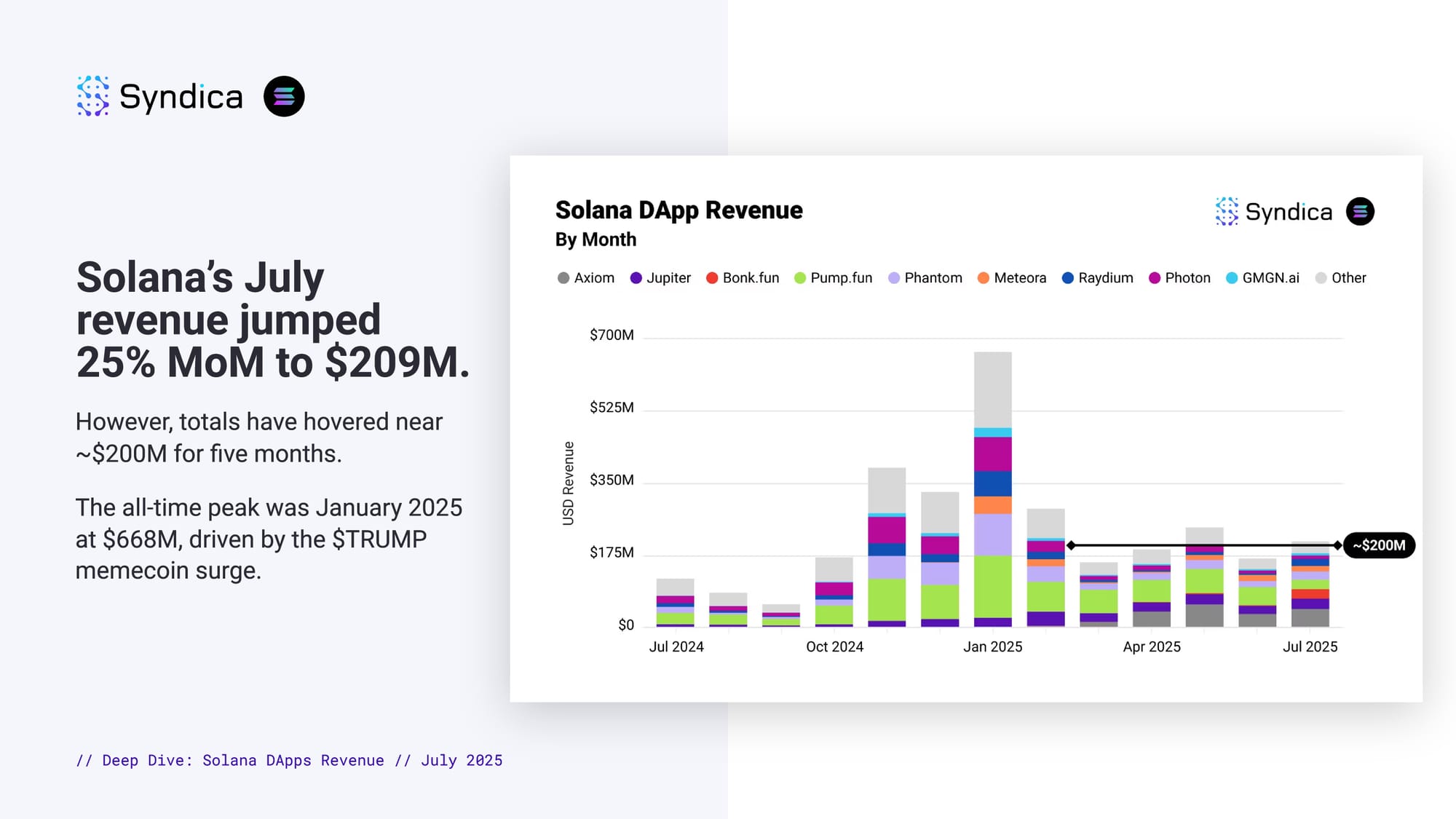

Solana’s July revenue jumped 25% MoM to $209M. However, totals have hovered near ~$200M for five months. The all-time peak was January 2025 at $668M, driven by the $TRUMP memecoin surge.

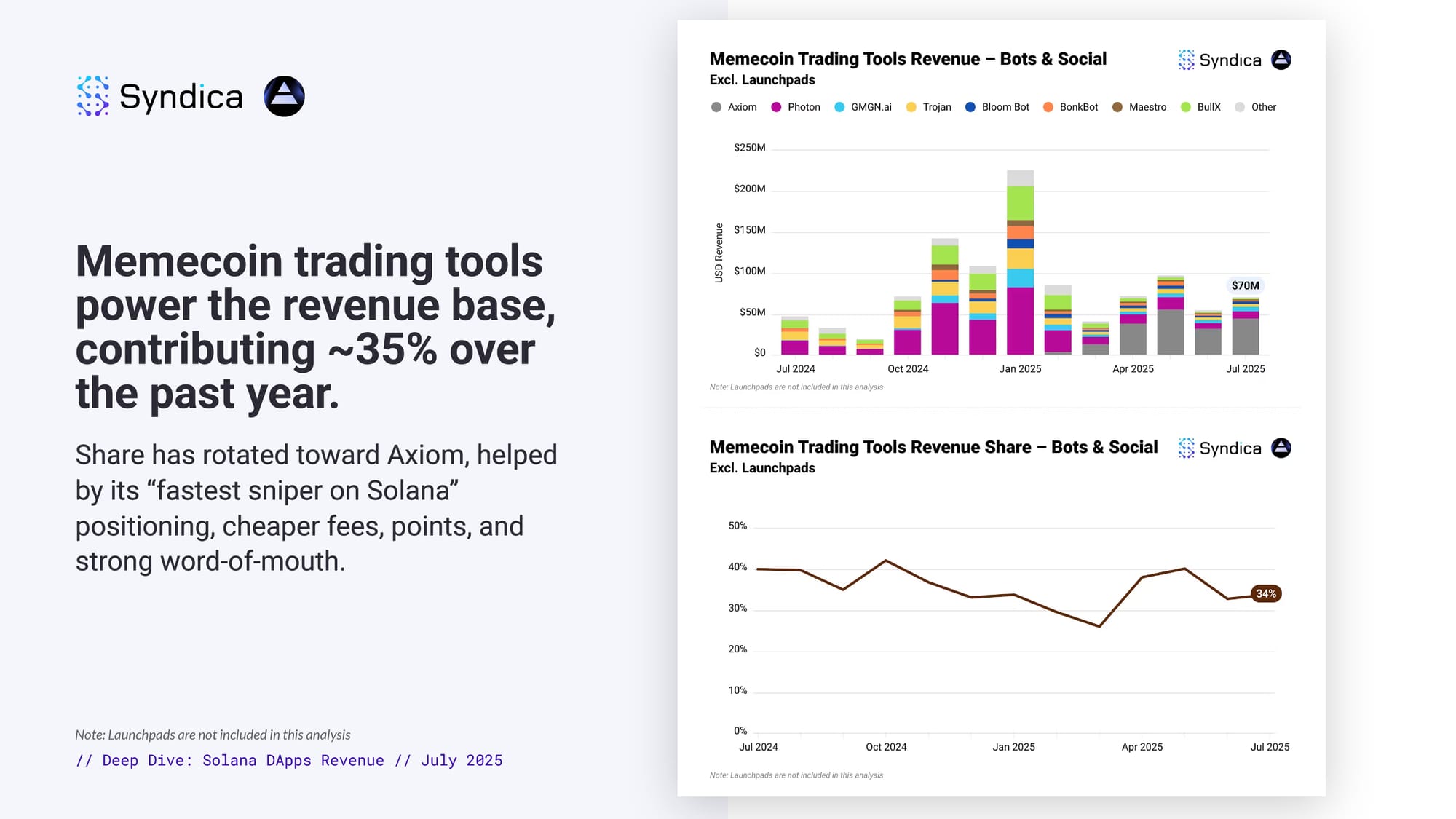

Memecoin trading tools power the revenue base, contributing ~35% over the past year. Share has rotated toward Axiom, helped by its “fastest sniper on Solana” positioning, cheaper fees, points, and strong word-of-mouth.

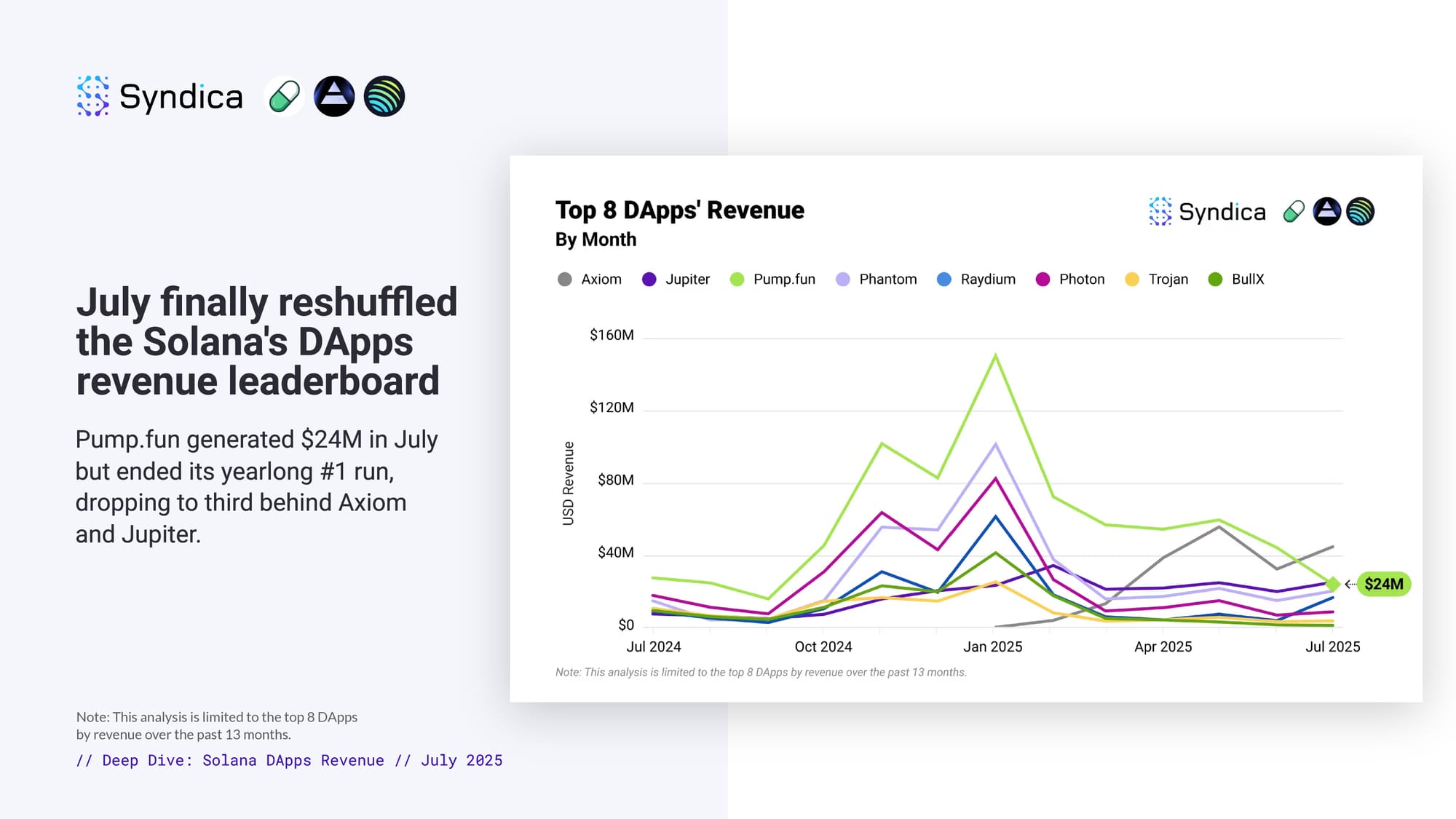

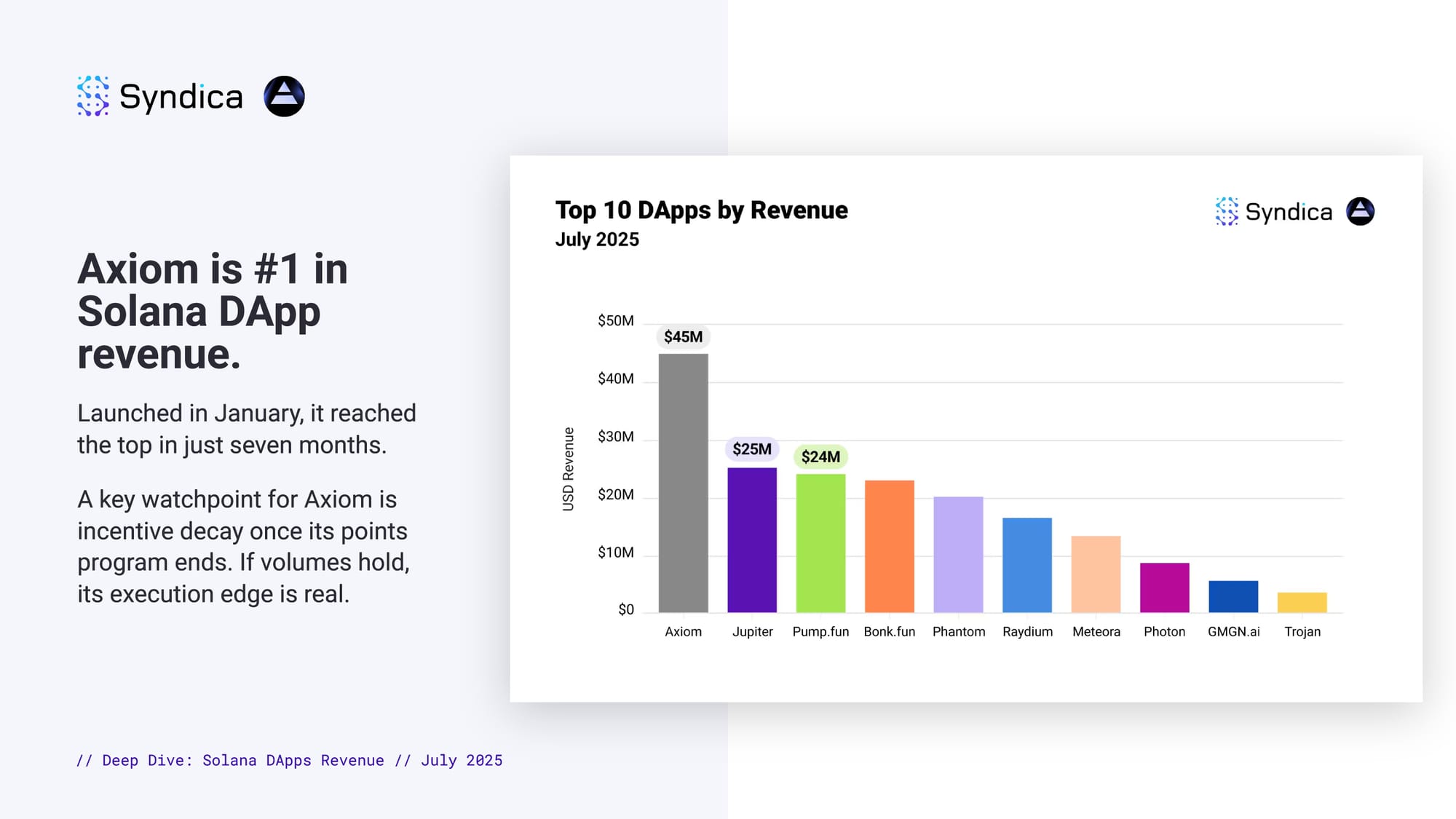

July finally reshuffled the Solana's DApps revenue leaderboard. Pump.fun generated $24M in July but ended its yearlong #1 run, dropping to third behind Axiom and Jupiter.

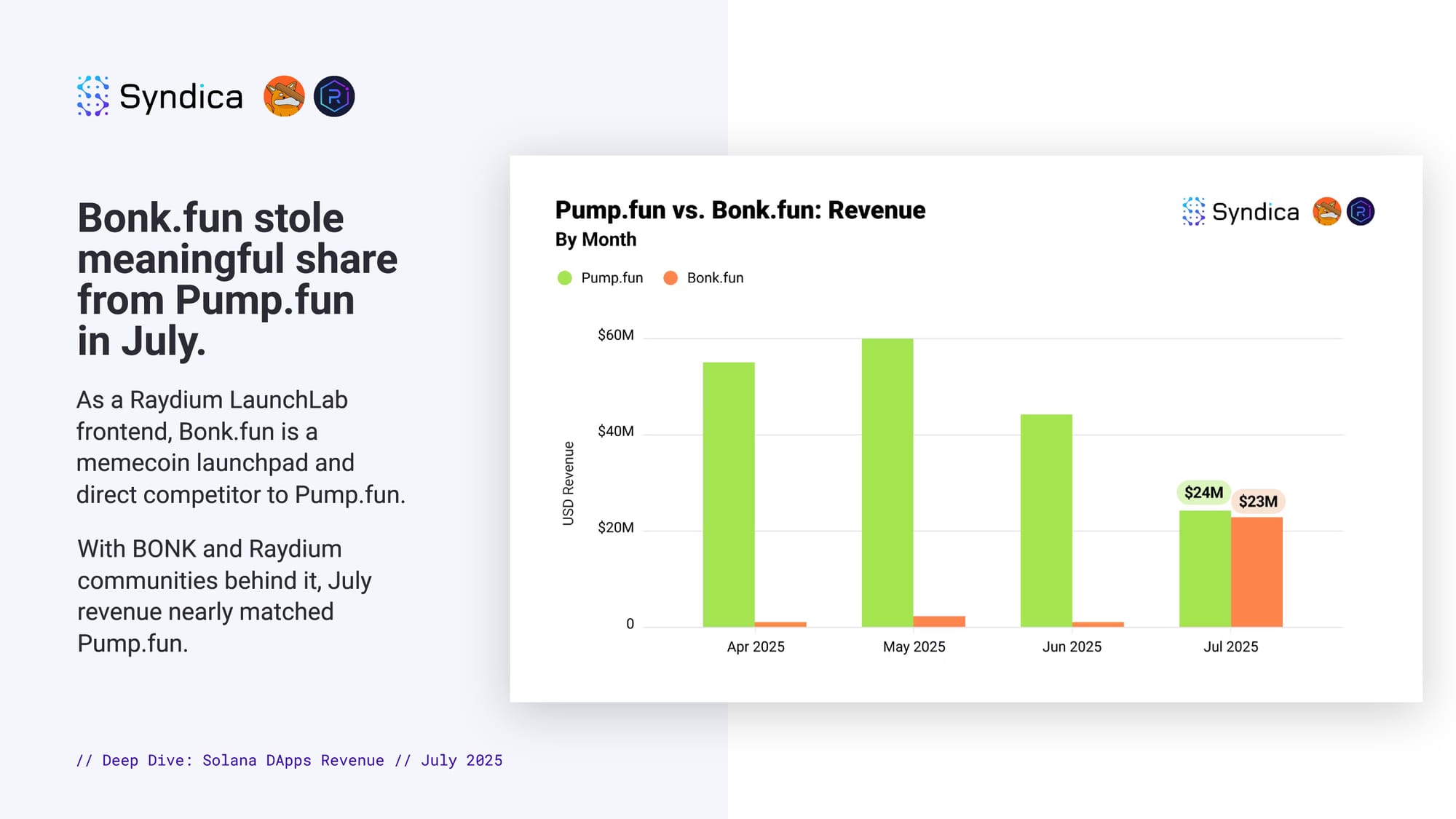

Bonk.fun stole meaningful share from Pump.fun in July. As a Raydium LaunchLab frontend, Bonk.fun is a memecoin launchpad and direct competitor to Pump.fun. With BONK and Raydium communities behind it, July revenue nearly matched Pump.fun.

Axiom is #1 in Solana DApp revenue. Launched in January, it reached the top in just seven months. A key watchpoint for Axiom is incentive decay once its points program ends. If volumes hold, its execution edge is real.

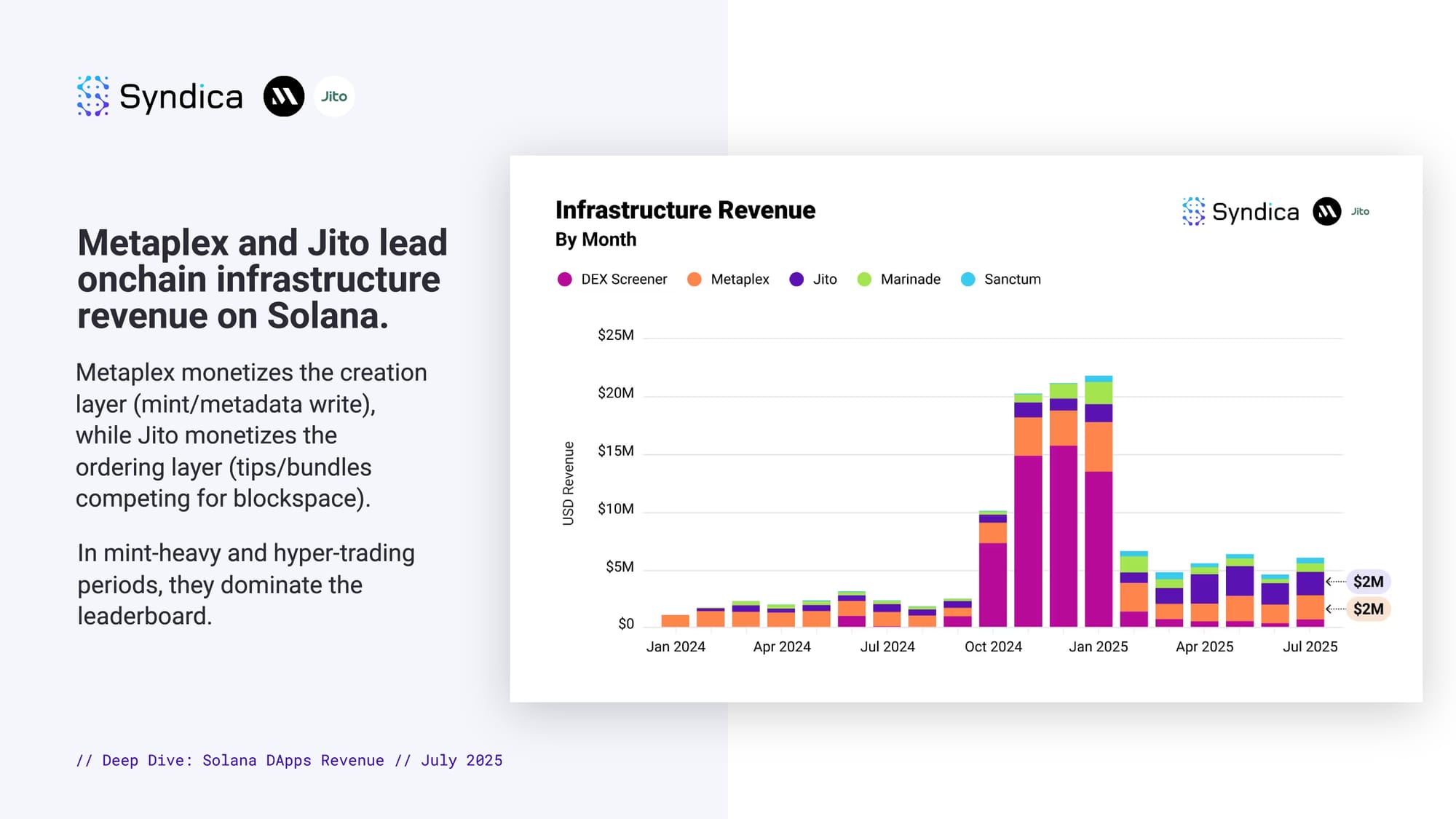

Metaplex and Jito lead onchain infrastructure revenue on Solana. Metaplex monetizes the creation layer (mint/metadata write), while Jito monetizes the ordering layer (tips/bundles competing for blockspace). In mint-heavy and hyper-trading periods, they dominate the leaderboard.

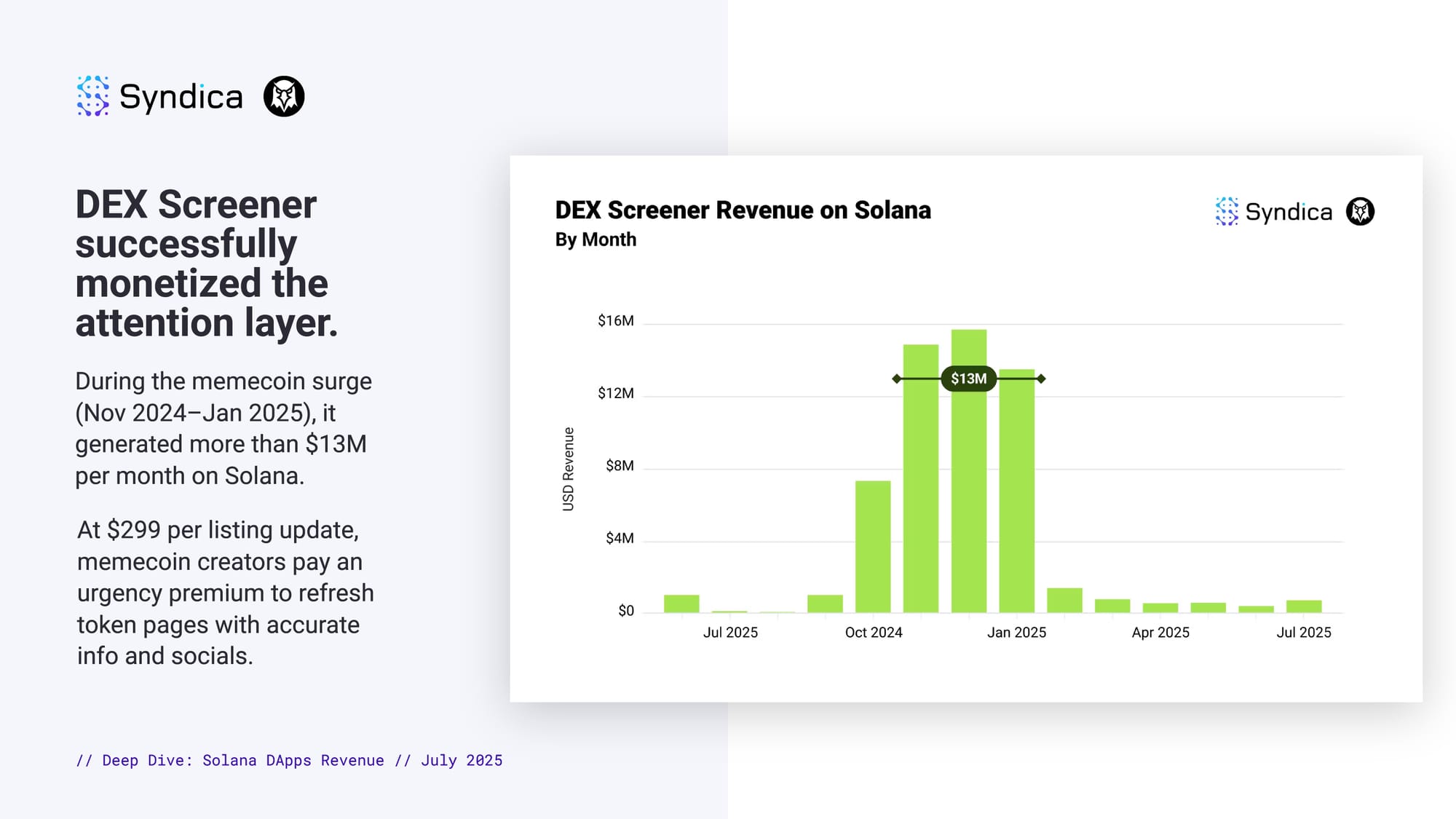

DEX Screener successfully monetized the attention layer. During the memecoin surge (Nov 2024–Jan 2025), it generated more than $13M per month on Solana. At $299 per listing update, memecoin creators pay an urgency premium to refresh token pages with accurate info and socials.

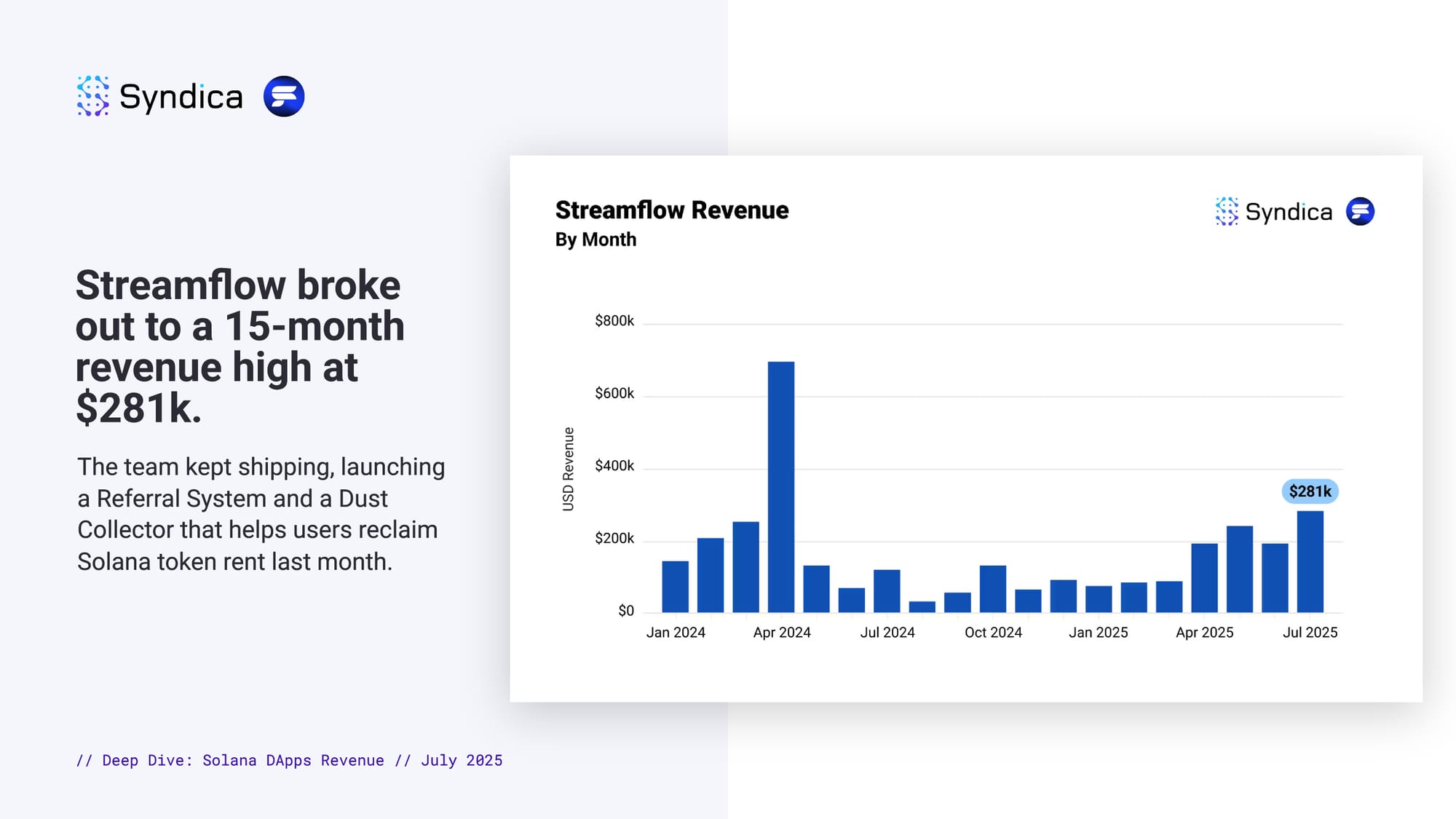

Streamflow broke out to a 15-month revenue high at $281k. The team kept shipping, launching a Referral System and a Dust Collector that helps users reclaim Solana token rent last month.

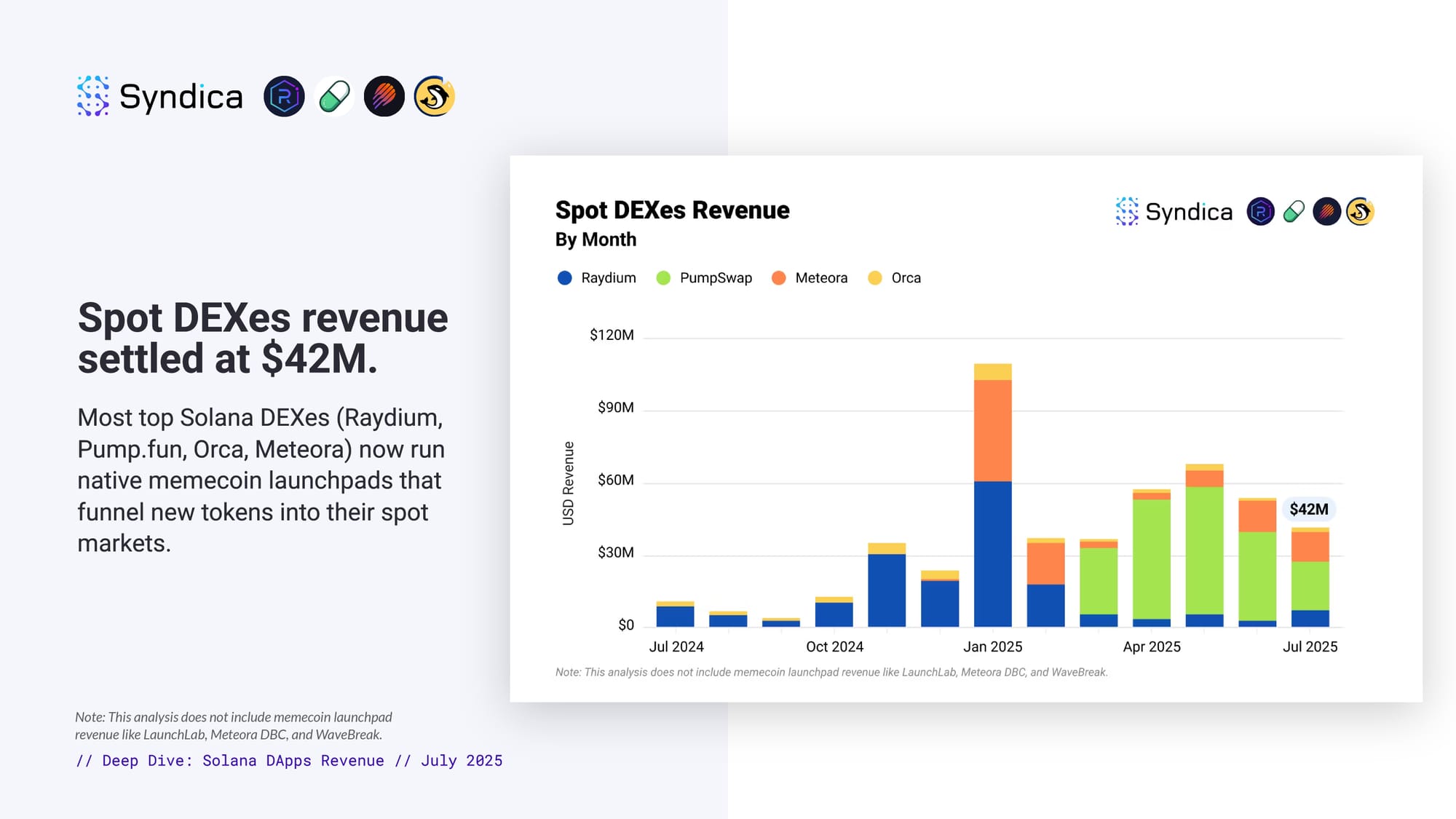

Spot DEXes revenue settled at $42M. Most top Solana DEXes (Raydium, Pump.fun, Orca, Meteora) now run native memecoin launchpads that funnel new tokens into their spot markets.

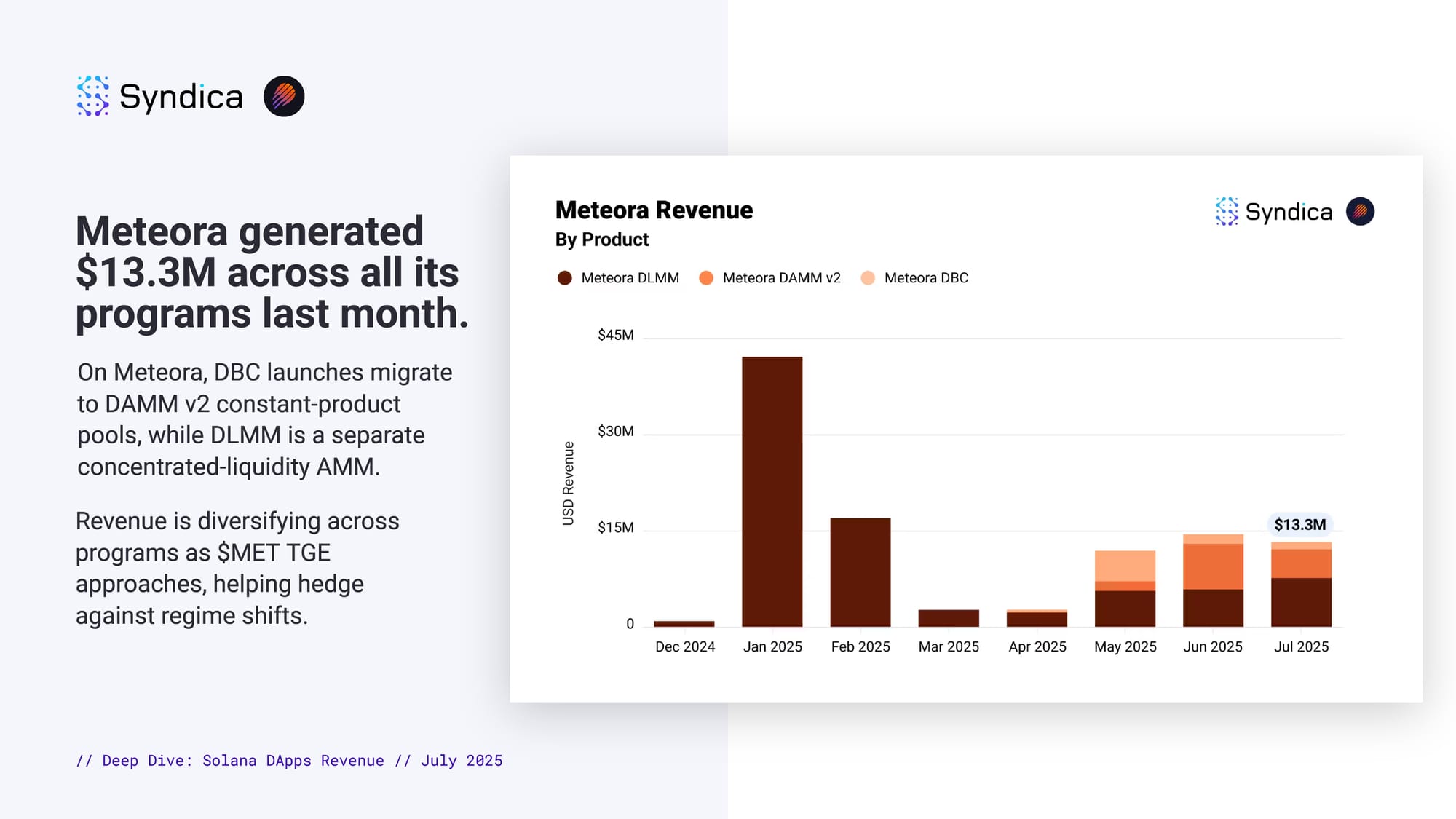

Meteora generated $13.3M across all its programs last month. On Meteora, DBC launches migrate to DAMM v2 constant-product pools, while DLMM is a separate concentrated-liquidity AMM. Revenue is diversifying across programs as $MET TGE approaches, helping hedge against regime shifts.

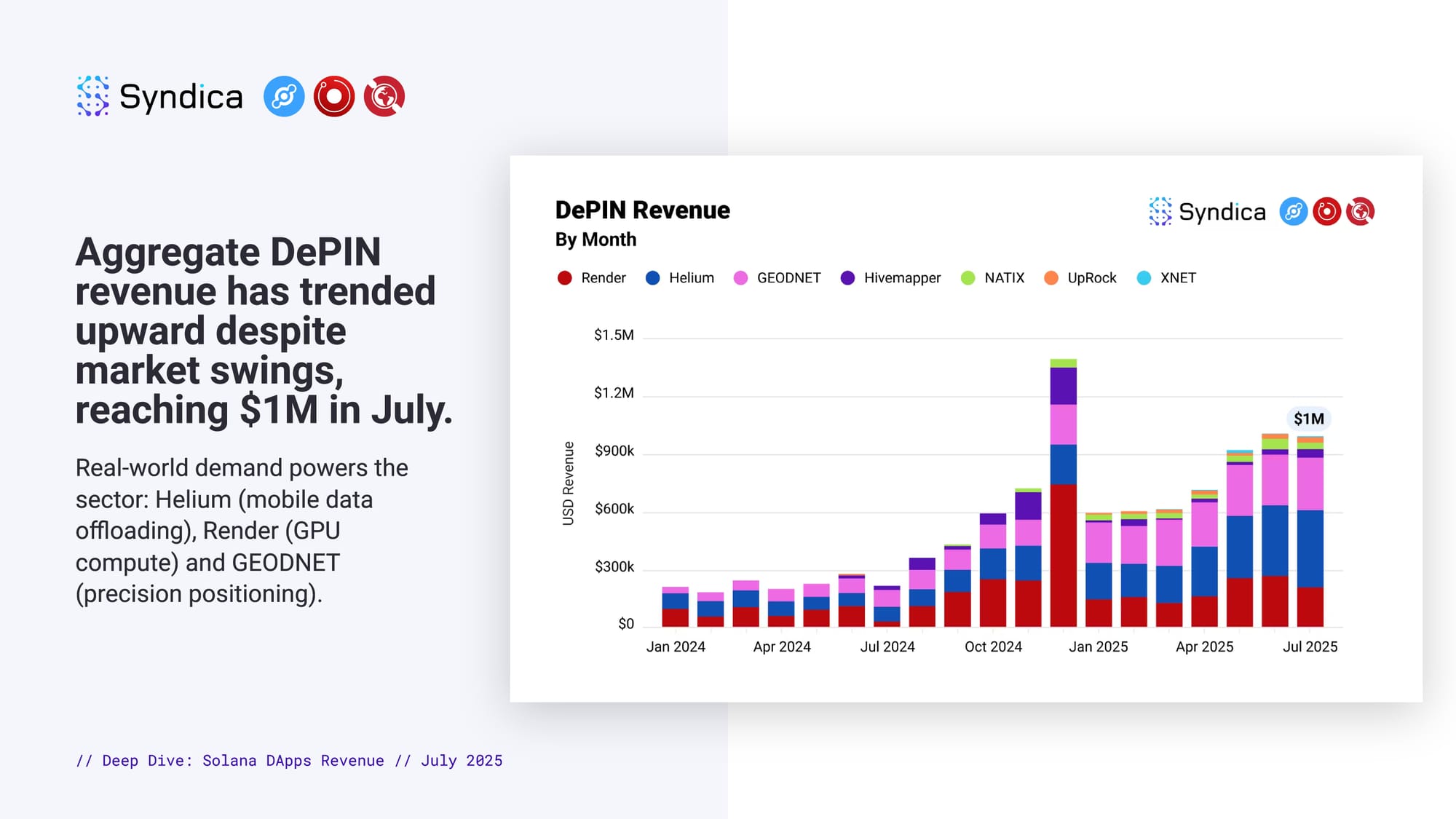

Aggregate DePIN revenue has trended upward despite market swings, reaching $1M in July. Real-world demand powers the sector: Helium (mobile data offloading), Render (GPU compute) and GEODNET (precision positioning).

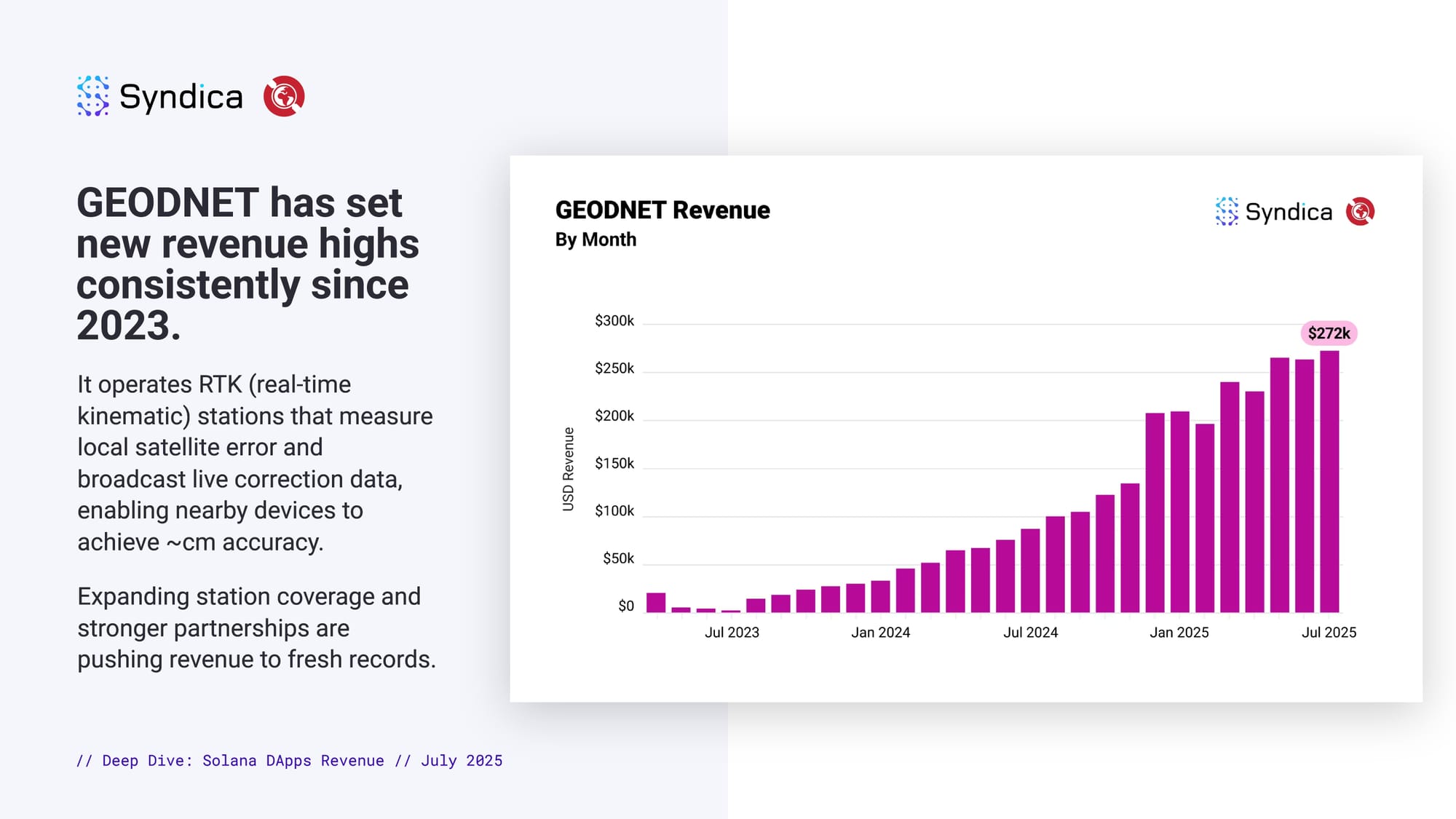

GEODNET has set new revenue highs consistently since 2023. It operates RTK (real-time kinematic) stations that measure local satellite error and broadcast live correction data, enabling nearby devices to achieve ~cm accuracy. Expanding station coverage and stronger partnerships are pushing revenue to fresh records.