Deep Dive: Solana DApps Revenue - June 2025

Deep Dive: Solana DApps Revenue - June 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - June 2025

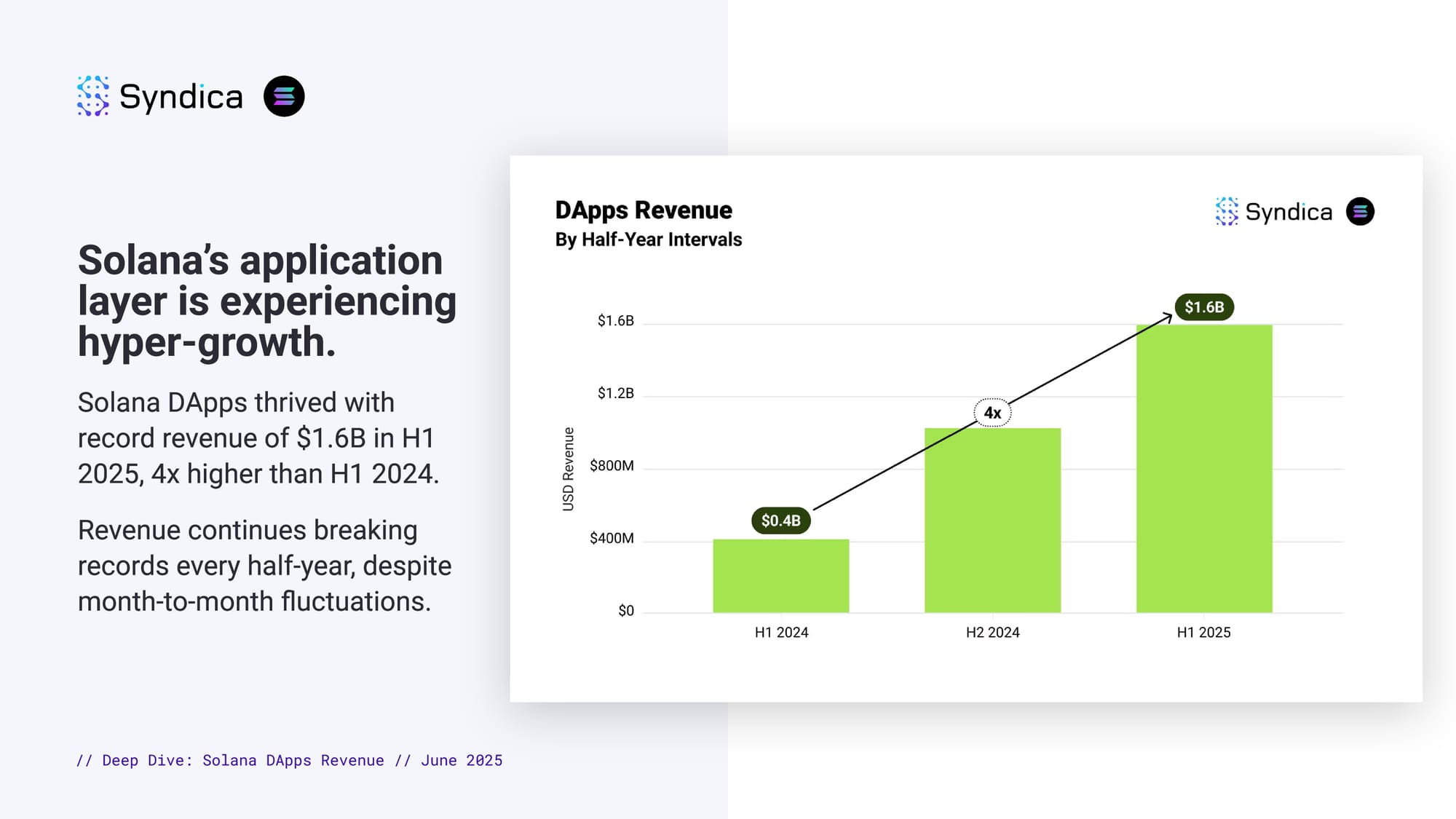

Solana’s application layer is experiencing hyper-growth.

Solana DApps thrived with record revenue of $1.6B in H1 2025, 4x higher than H1 2024. Revenue continues breaking records every half-year, despite month-to-month fluctuations.

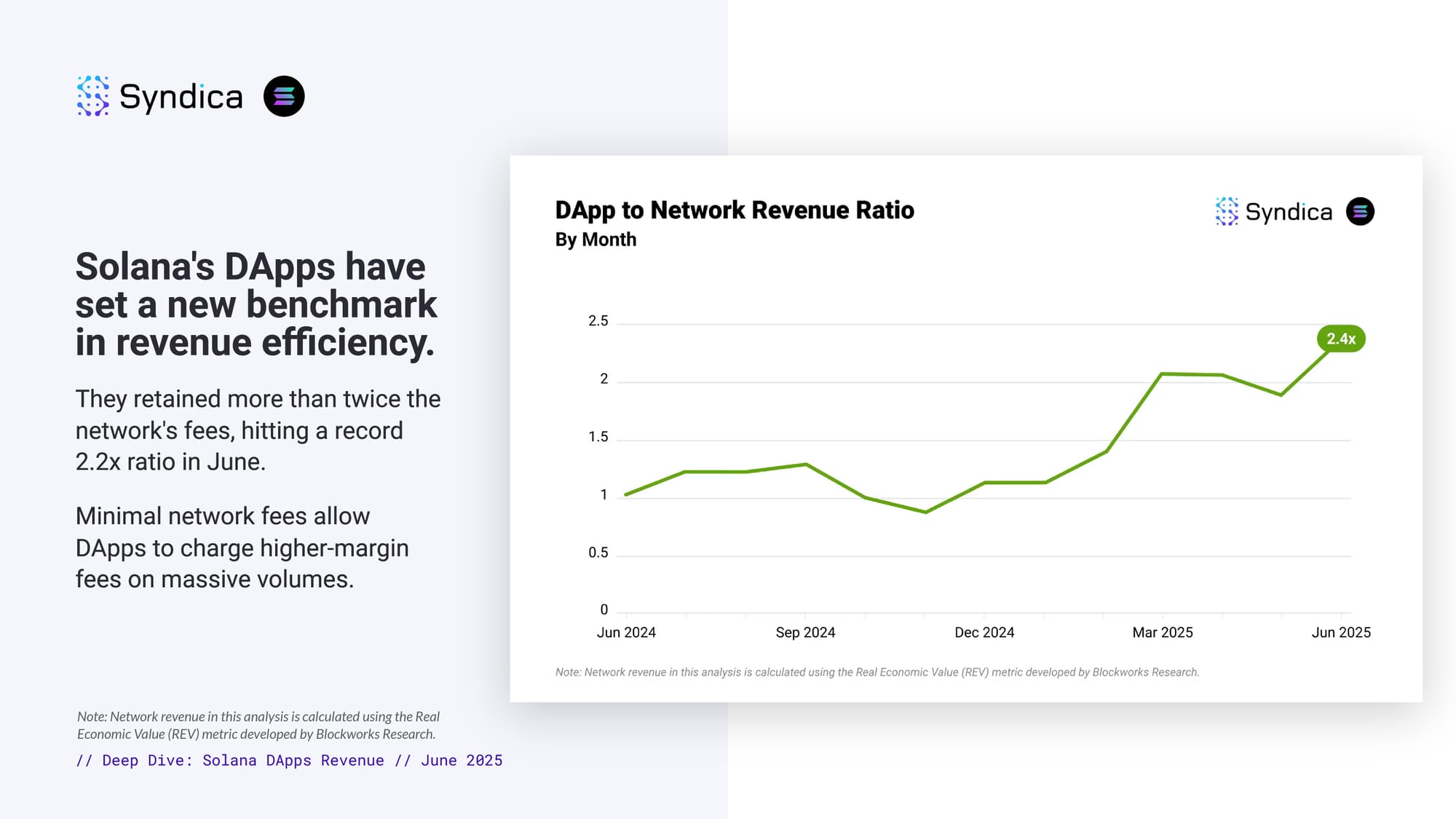

Solana's DApps have set a new benchmark in revenue efficiency.

They retained more than twice the network's fees, hitting a record 2.2x ratio in June. Minimal network fees allow DApps to charge higher-margin fees on massive volumes.

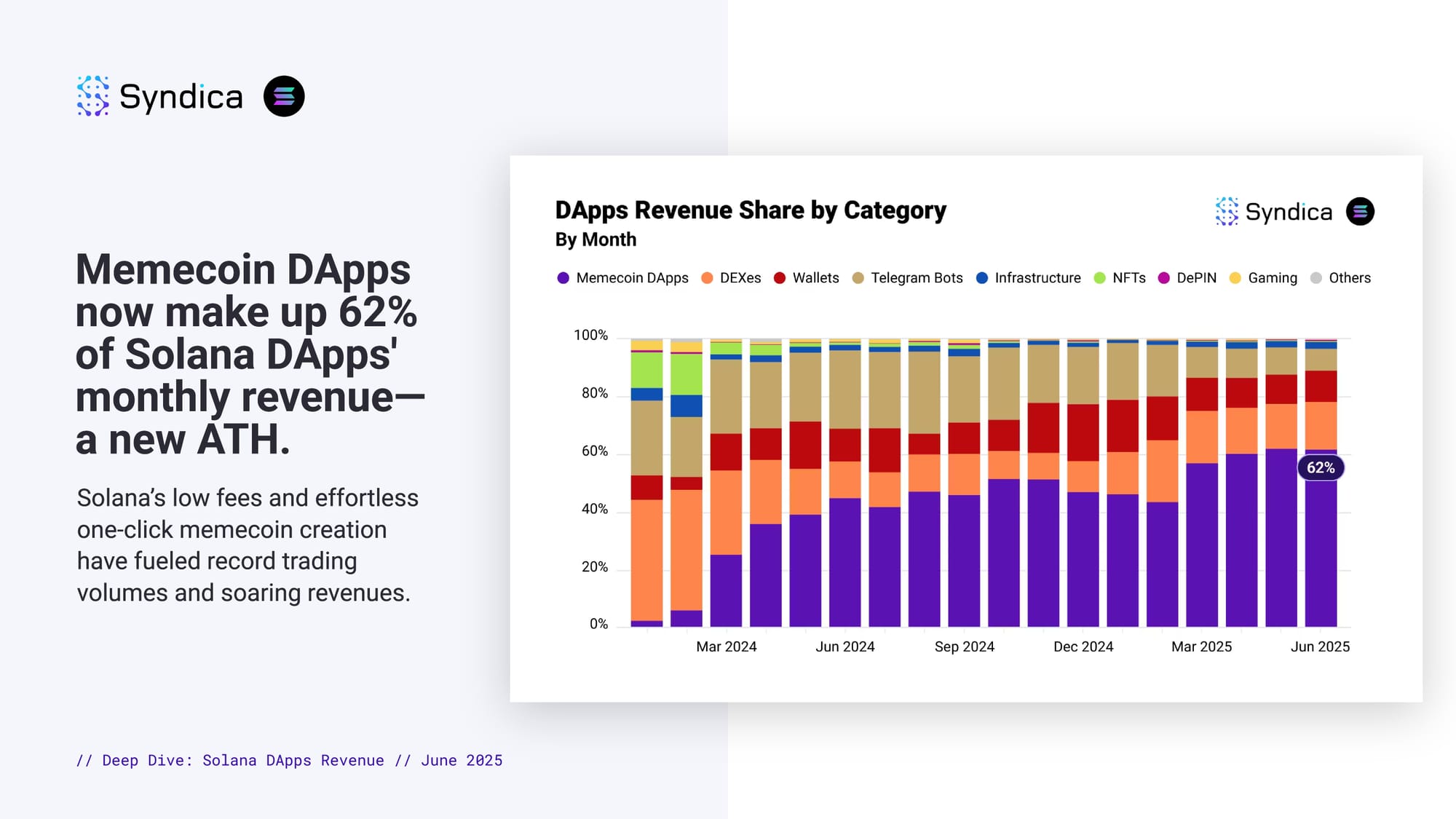

Memecoin DApps now make up 62% of Solana DApps' monthly revenue—a new ATH.

Solana’s low fees and effortless one-click memecoin creation have fueled record trading volumes and soaring revenues.

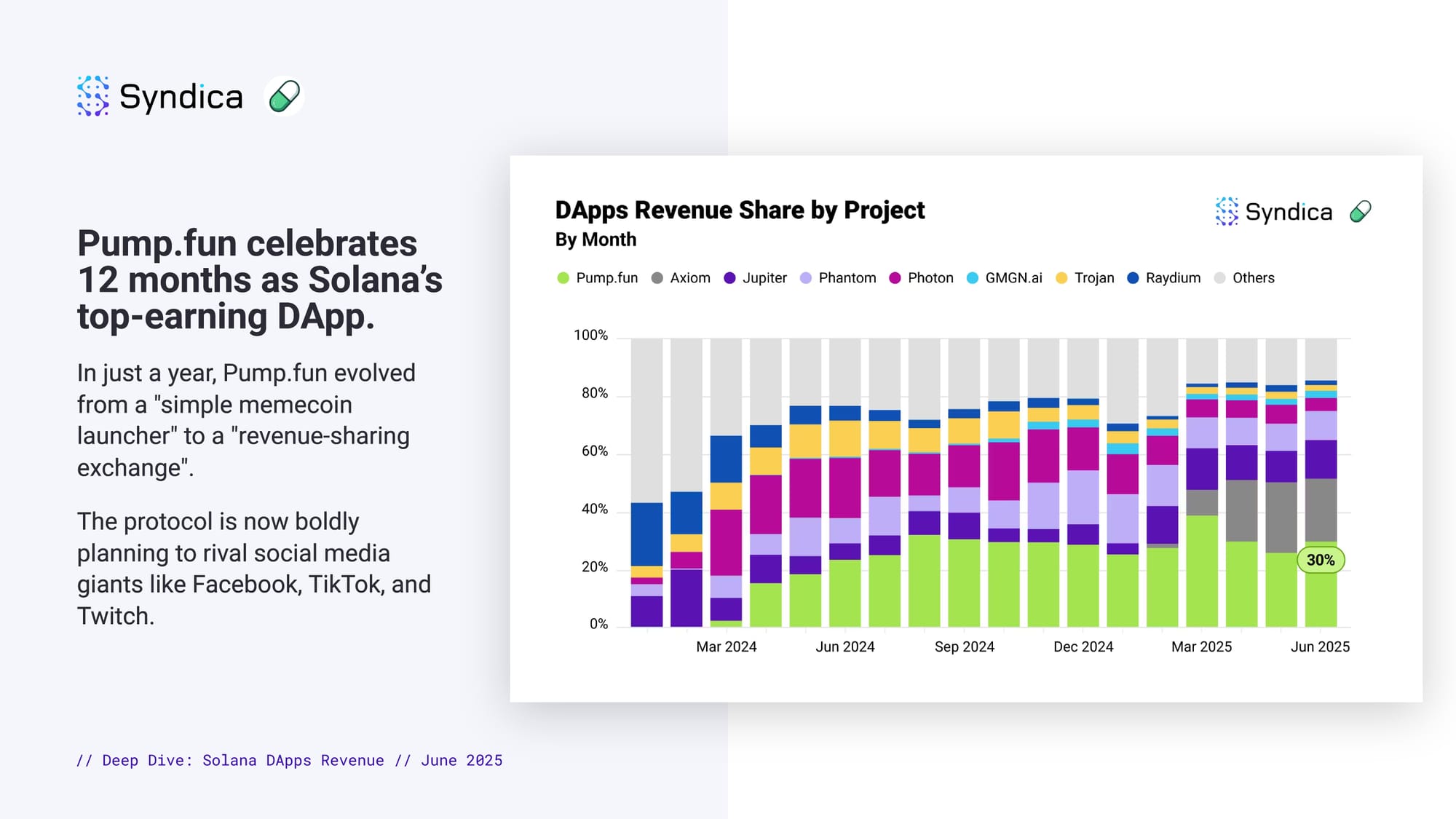

Pump.fun celebrates 12 months as Solana’s top-earning DApp.

In just a year, Pump.fun evolved from a "simple memecoin launcher" to a "revenue-sharing exchange". The protocol is now boldly planning to rival social media giants like Facebook, TikTok, and Twitch.

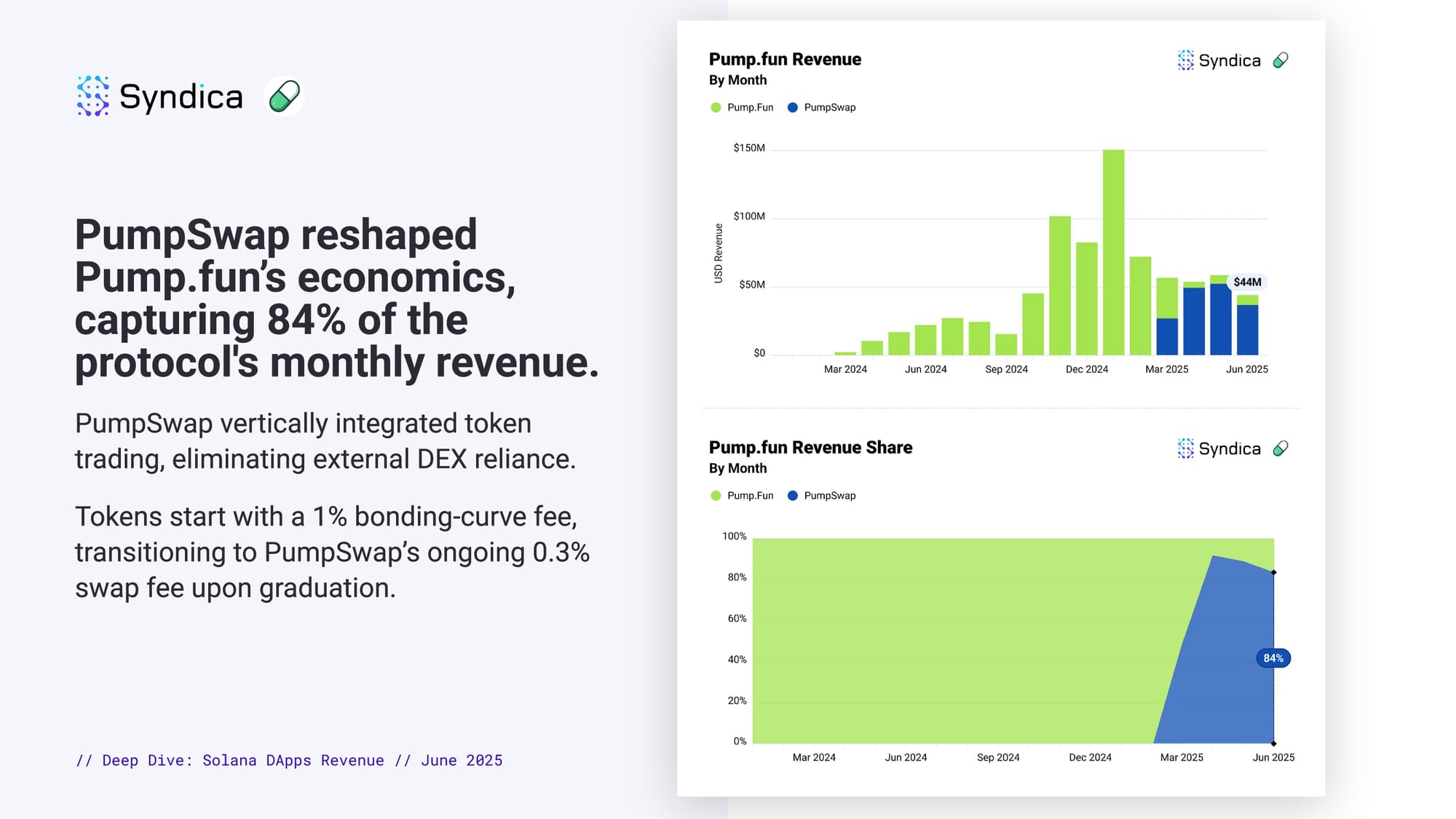

PumpSwap reshaped Pump.fun’s economics, capturing 84% of the protocol's monthly revenue.

PumpSwap vertically integrated token trading, eliminating external DEX reliance. Tokens start with a 1% bonding-curve fee, transitioning to PumpSwap’s ongoing 0.3% swap fee upon graduation.

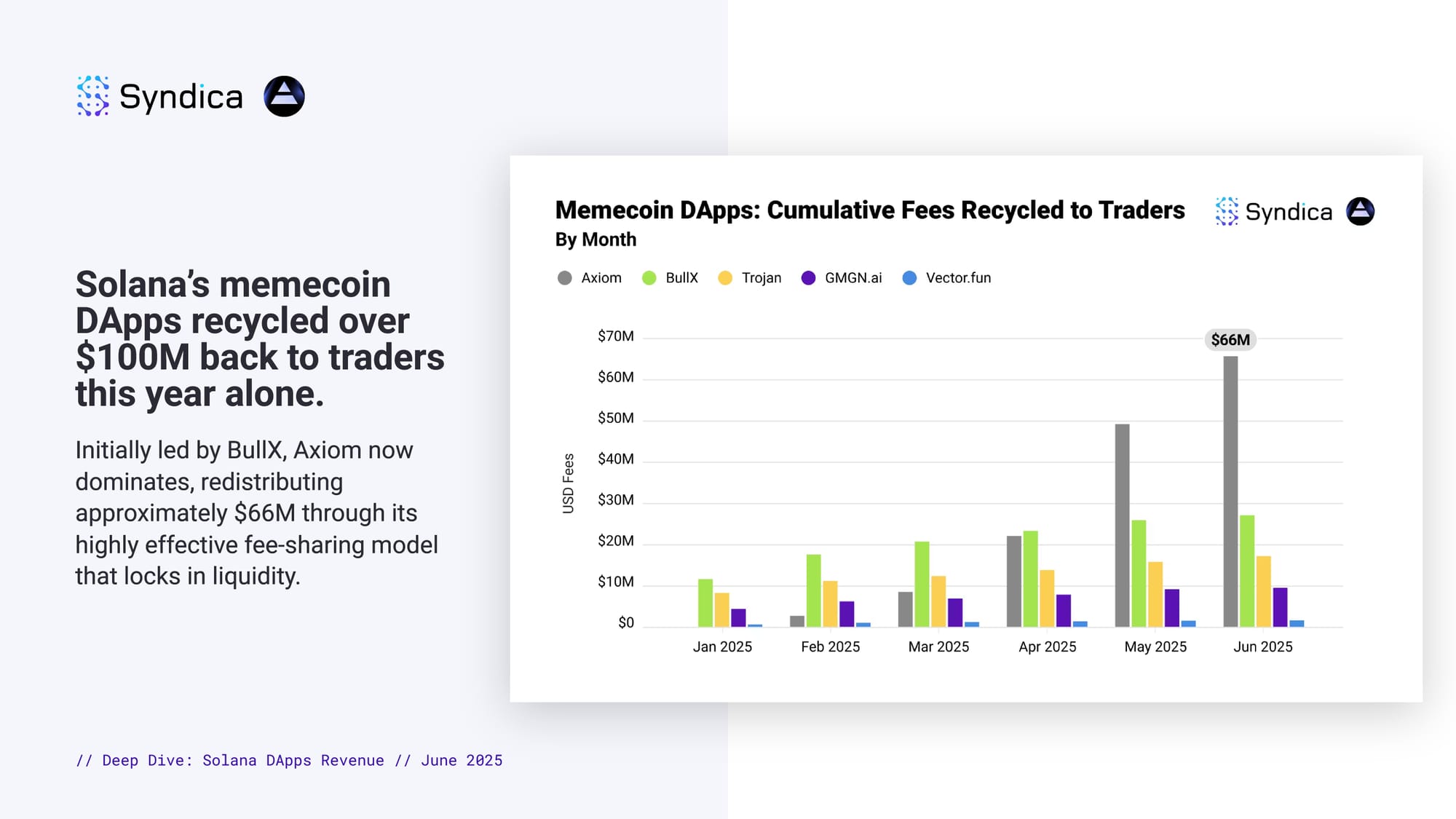

Solana’s memecoin DApps recycled over $100M back to traders this year alone.

Initially led by BullX, Axiom now dominates, redistributing approximately $66M through its highly effective fee-sharing model that locks in liquidity.

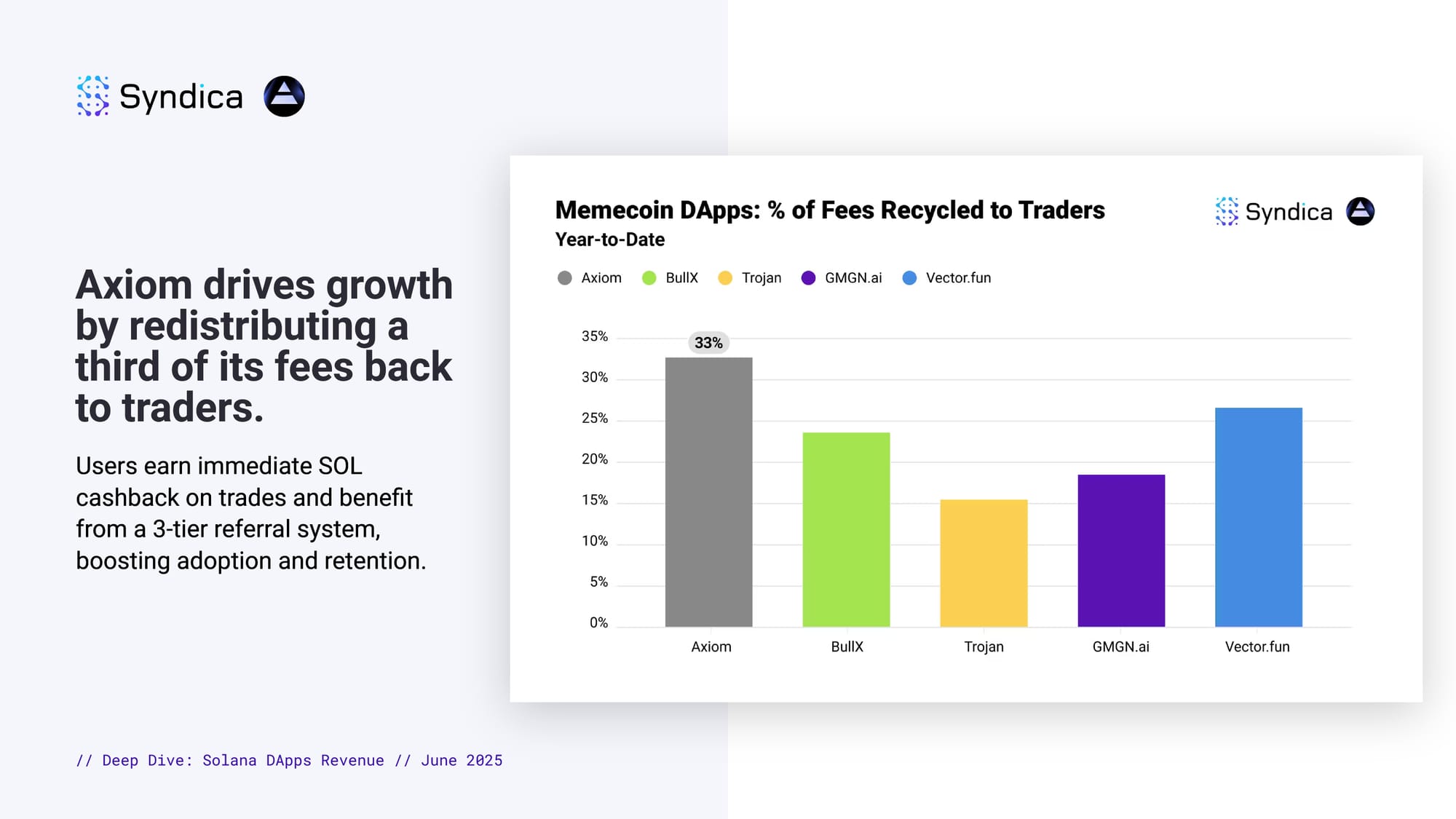

Axiom drives growth by redistributing a third of its fees back to traders.

Users earn immediate SOL cashback on trades and benefit from a 3-tier referral system, boosting adoption and retention.

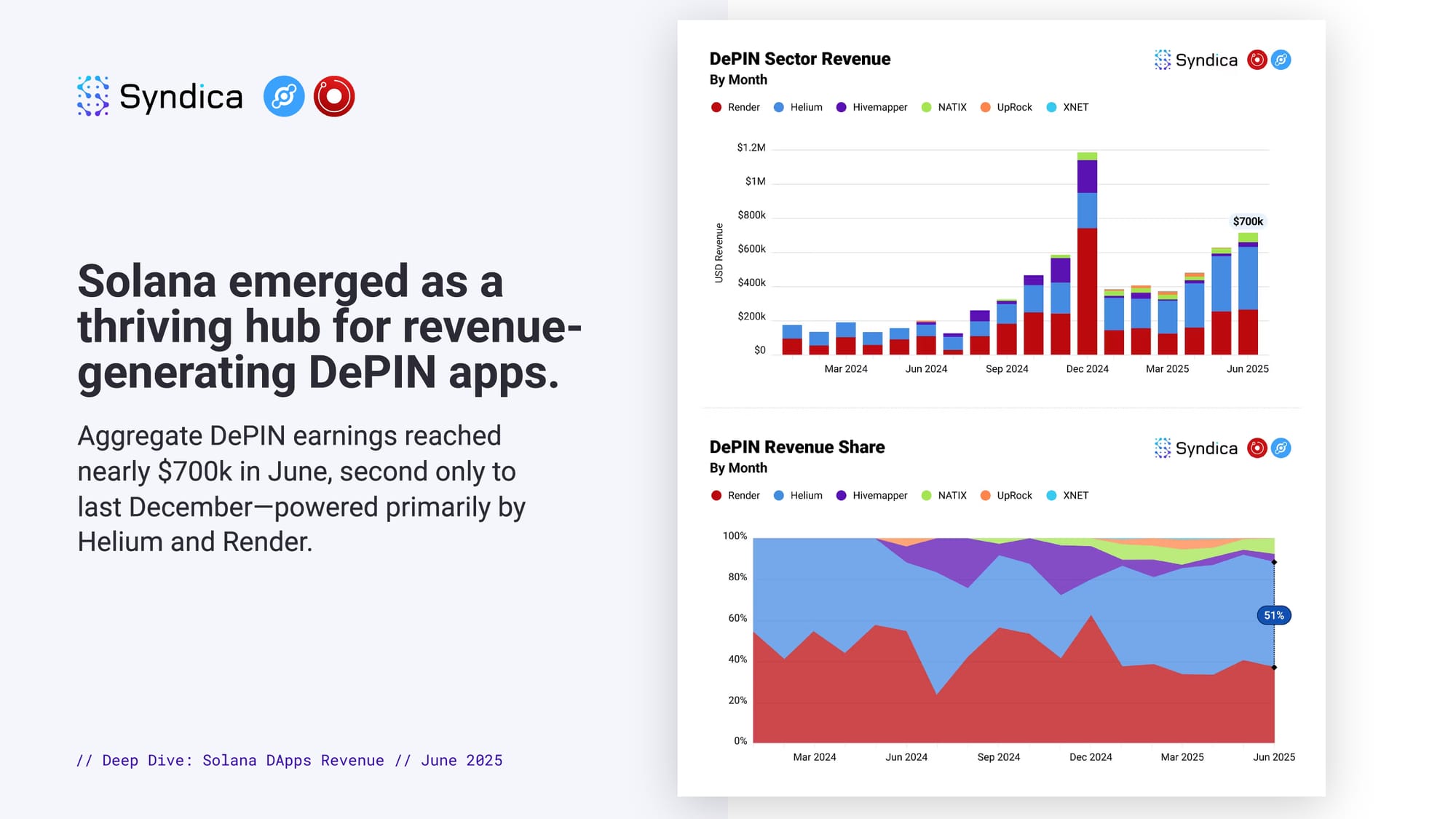

Solana emerged as a thriving hub for revenue-generating DePIN apps.

Aggregate DePIN earnings reached nearly $700k in June, second only to last December—powered primarily by Helium and Render.

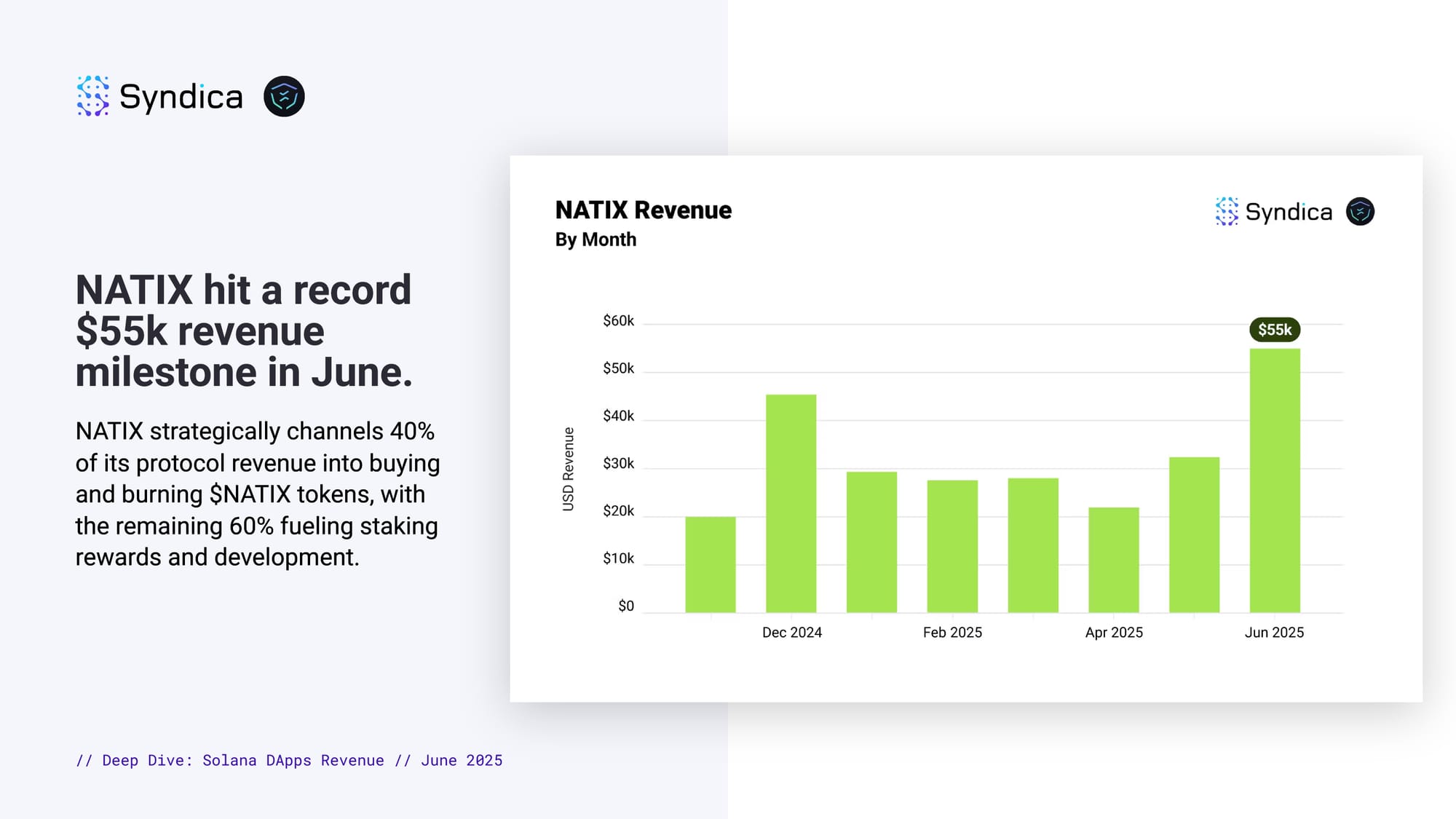

NATIX hit a record $55k revenue milestone in June.

NATIX strategically channels 40% of its protocol revenue into buying and burning $NATIX tokens, with the remaining 60% fueling staking rewards and development.

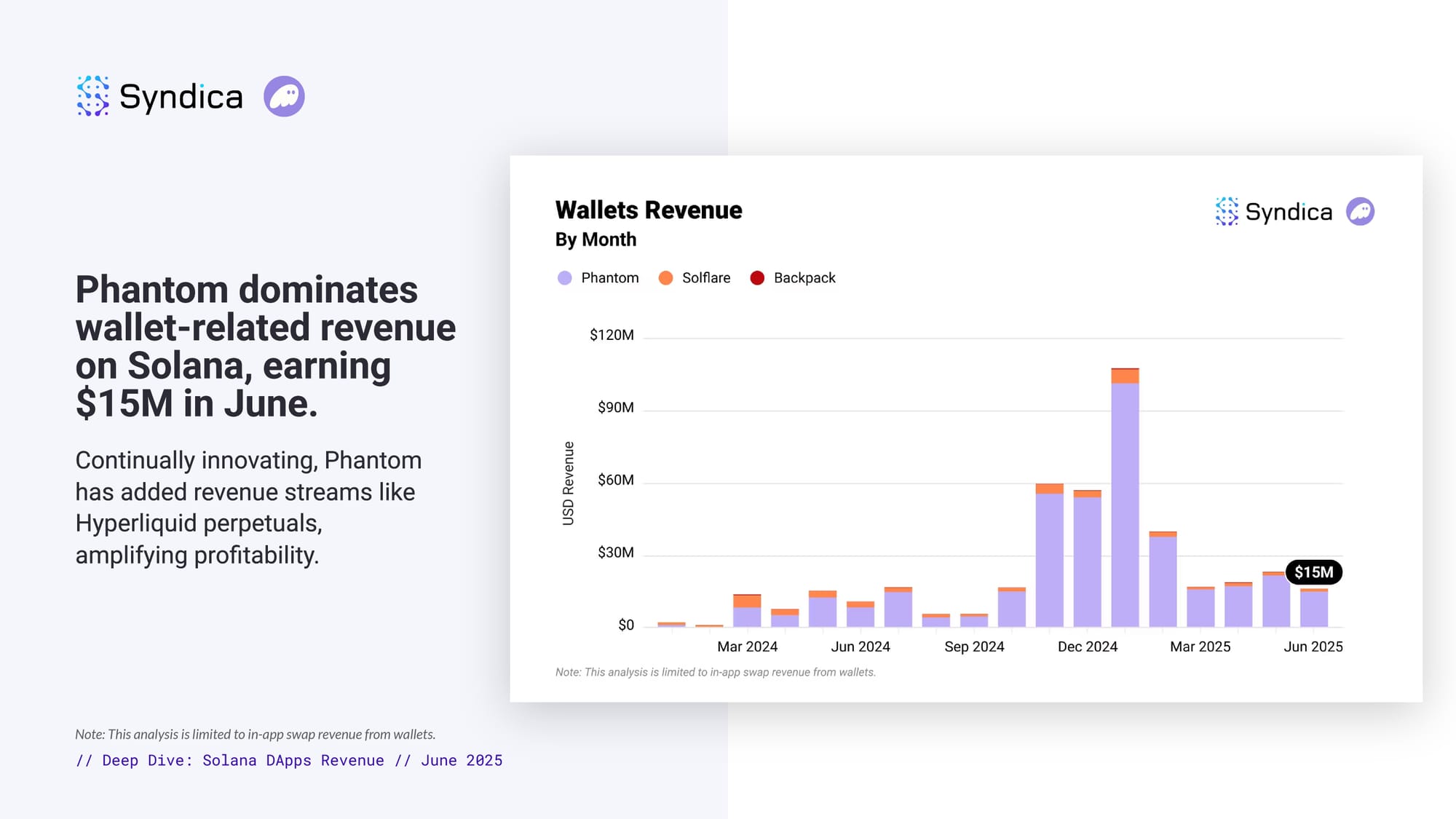

Phantom dominates wallet-related revenue on Solana, earning $15M in June.

Continually innovating, Phantom has added revenue streams like Hyperliquid perpetuals, amplifying profitability.

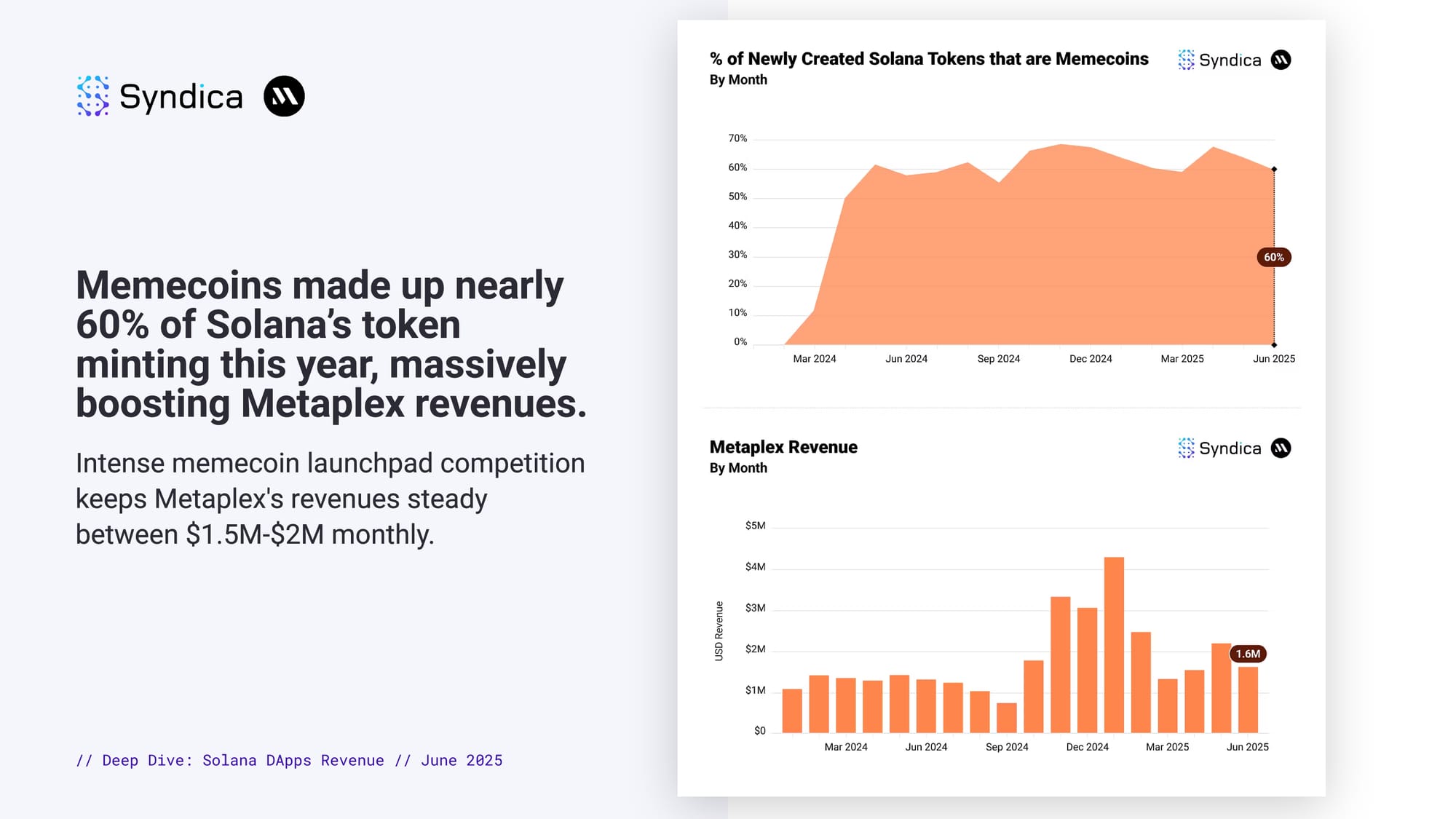

Memecoins made up nearly 60% of Solana’s token minting this year, massively boosting Metaplex revenues.

Intense memecoin launchpad competition keeps Metaplex's revenues steady between $1.5M-$2M monthly.

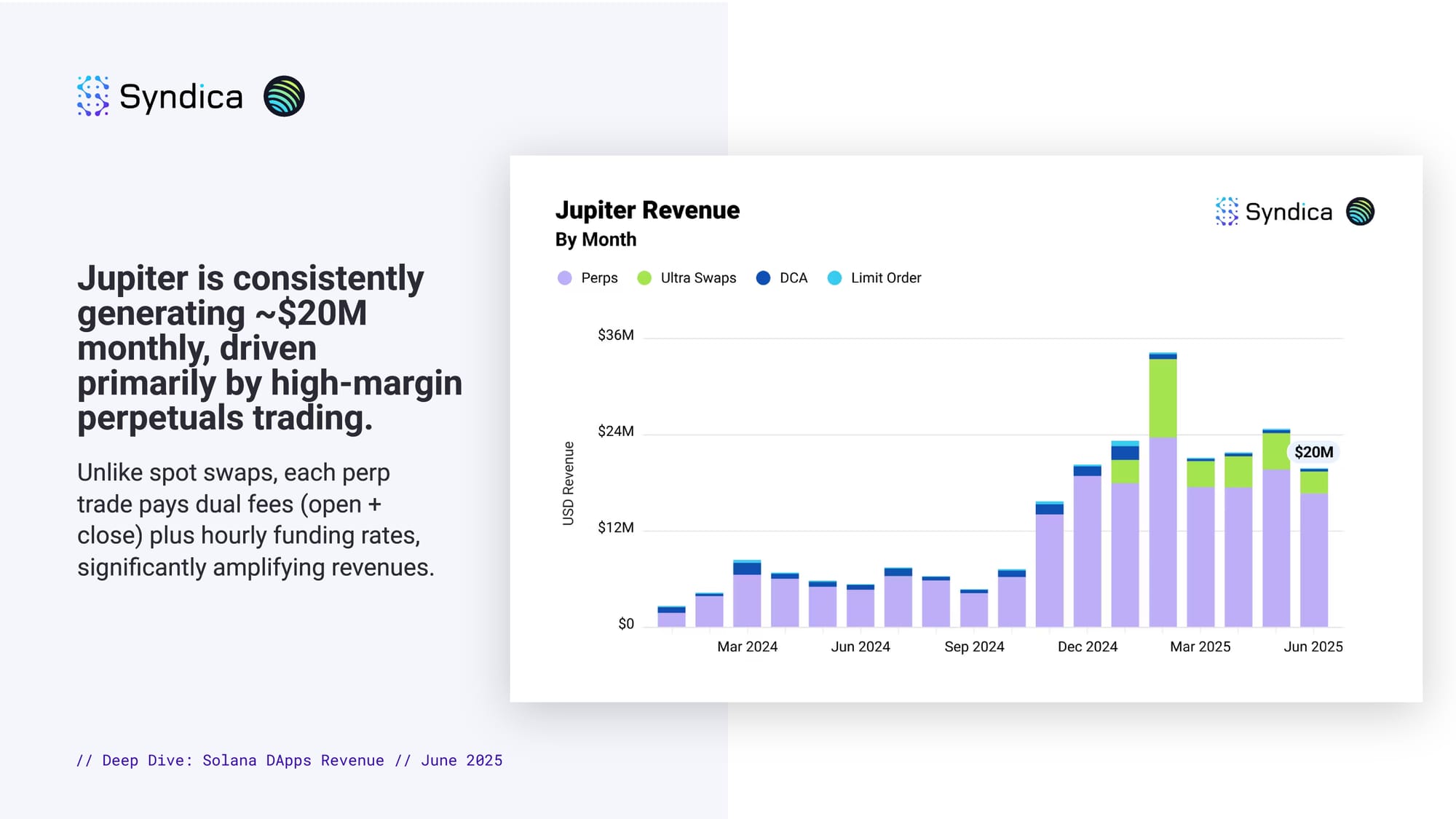

Jupiter is consistently generating ~$20M monthly, driven primarily by high-margin perpetuals trading.

Unlike spot swaps, each perp trade pays dual fees (open + close) plus hourly funding rates, significantly amplifying revenues.

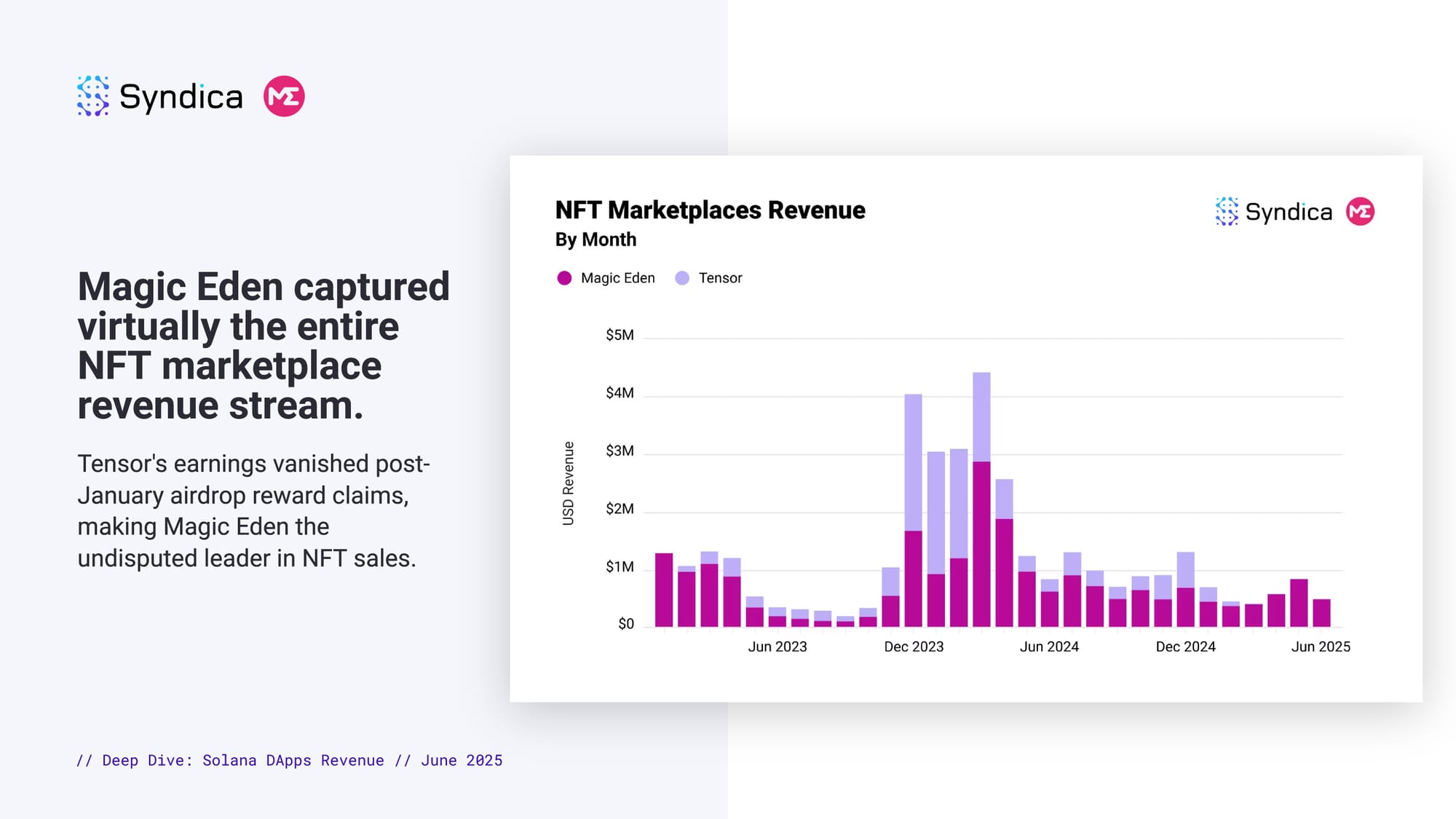

Magic Eden captured virtually the entire NFT marketplace revenue stream.

Tensor's earnings vanished post-January airdrop reward claims, making Magic Eden the undisputed leader in NFT sales.

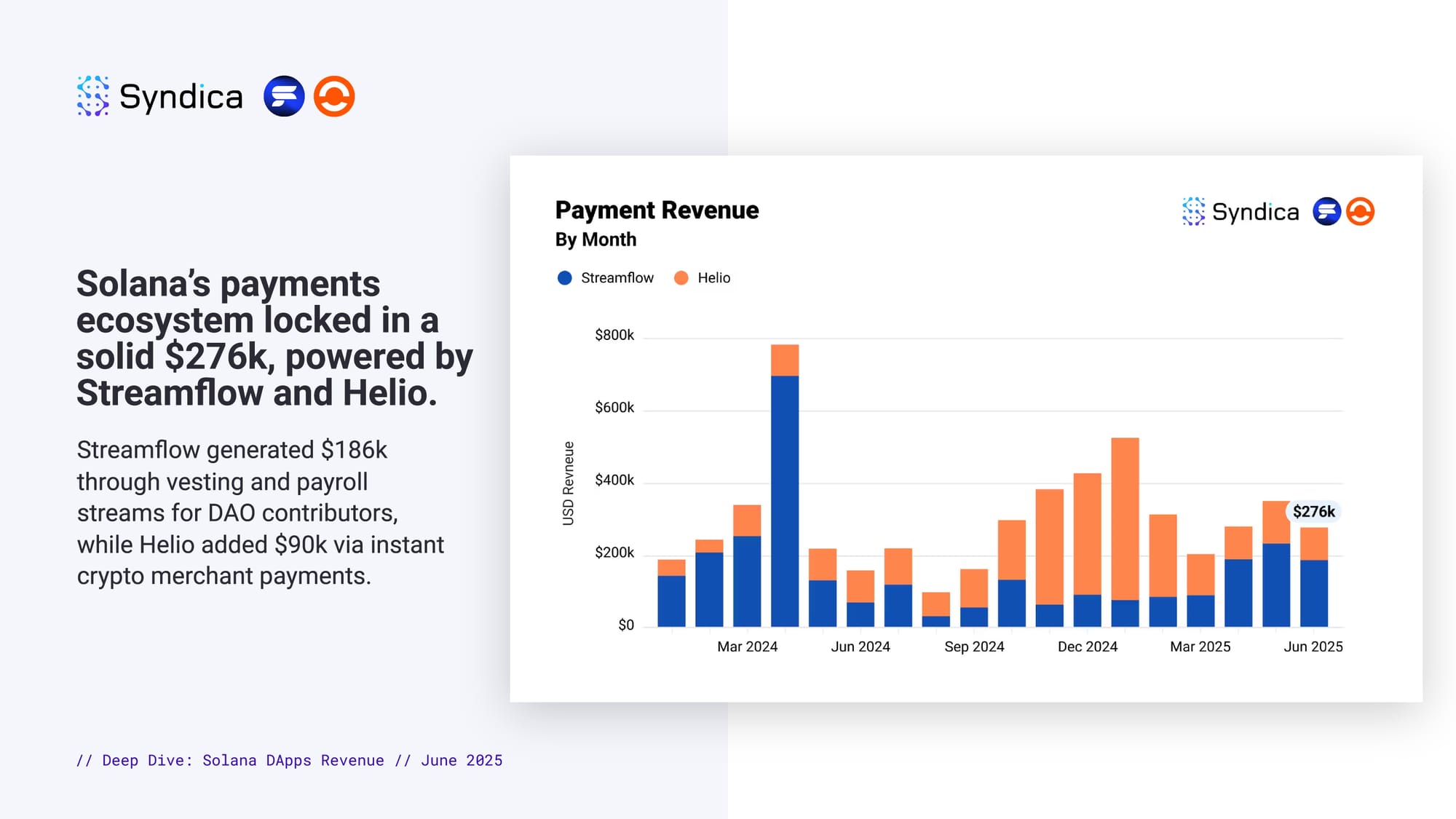

Solana’s payments ecosystem locked in a solid $276k, powered by Streamflow and Helio.

Streamflow generated $186k through vesting and payroll streams for DAO contributors, while Helio added $90k via instant crypto merchant payments.