Deep Dive: Solana DApps Revenue - March 2025

Deep Dive: Solana DApps Revenue - March 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - March 2025

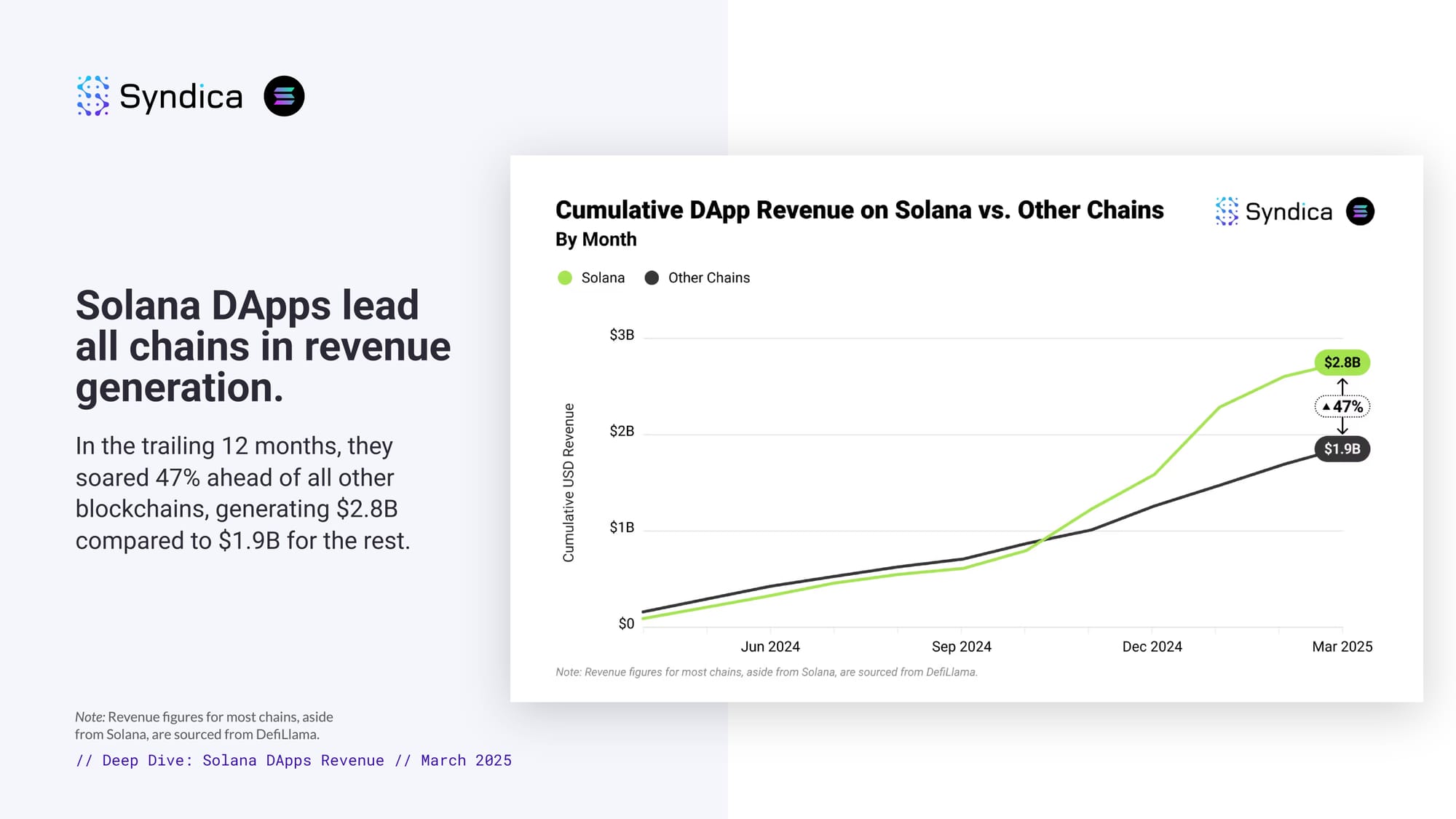

Solana DApps lead all chains in revenue generation. In the trailing 12 months, they soared 47% ahead of all other blockchains, generating $2.8B compared to $1.9B for the rest.

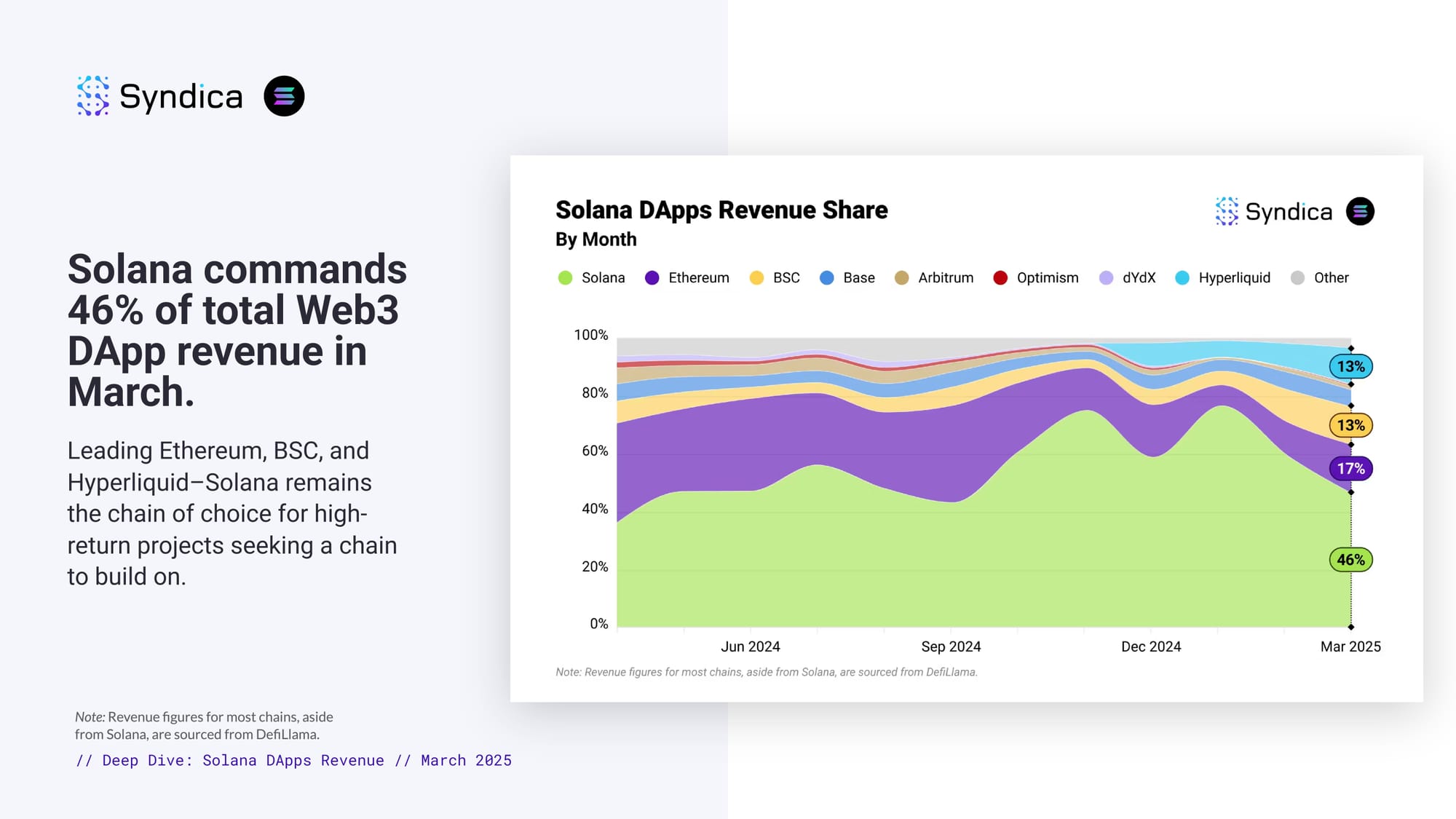

Solana commands 46% of total Web3 DApp revenue in March. Leading Ethereum, BSC, and Hyperliquid–Solana remains the chain of choice for high-return projects seeking a chain to build on.

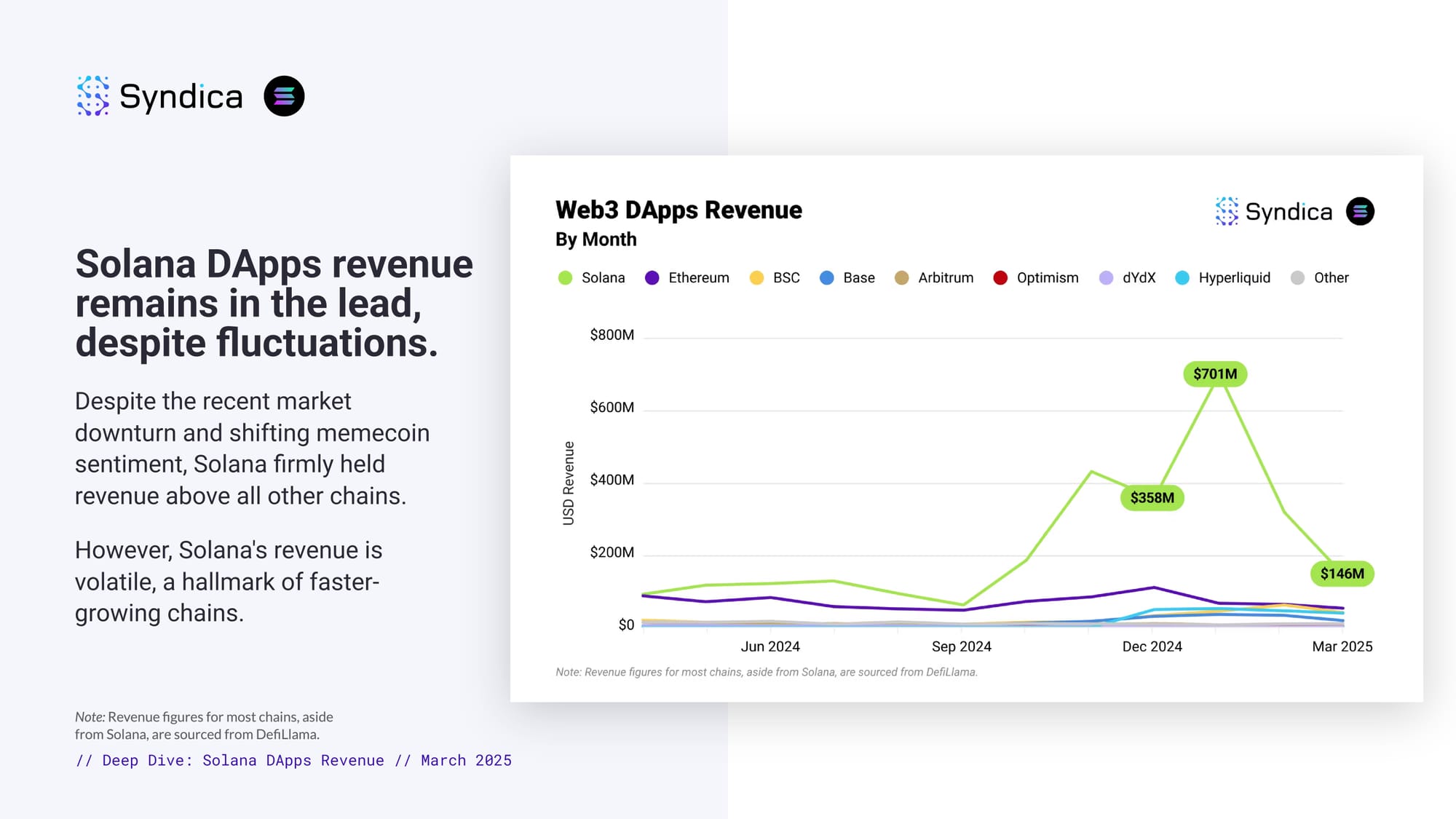

Solana DApps revenue remains in the lead, despite fluctuations. Despite the recent market downturn and shifting memecoin sentiment, Solana firmly held revenue above all other chains. However, Solana's revenue is volatile, a hallmark of faster-growing chains.

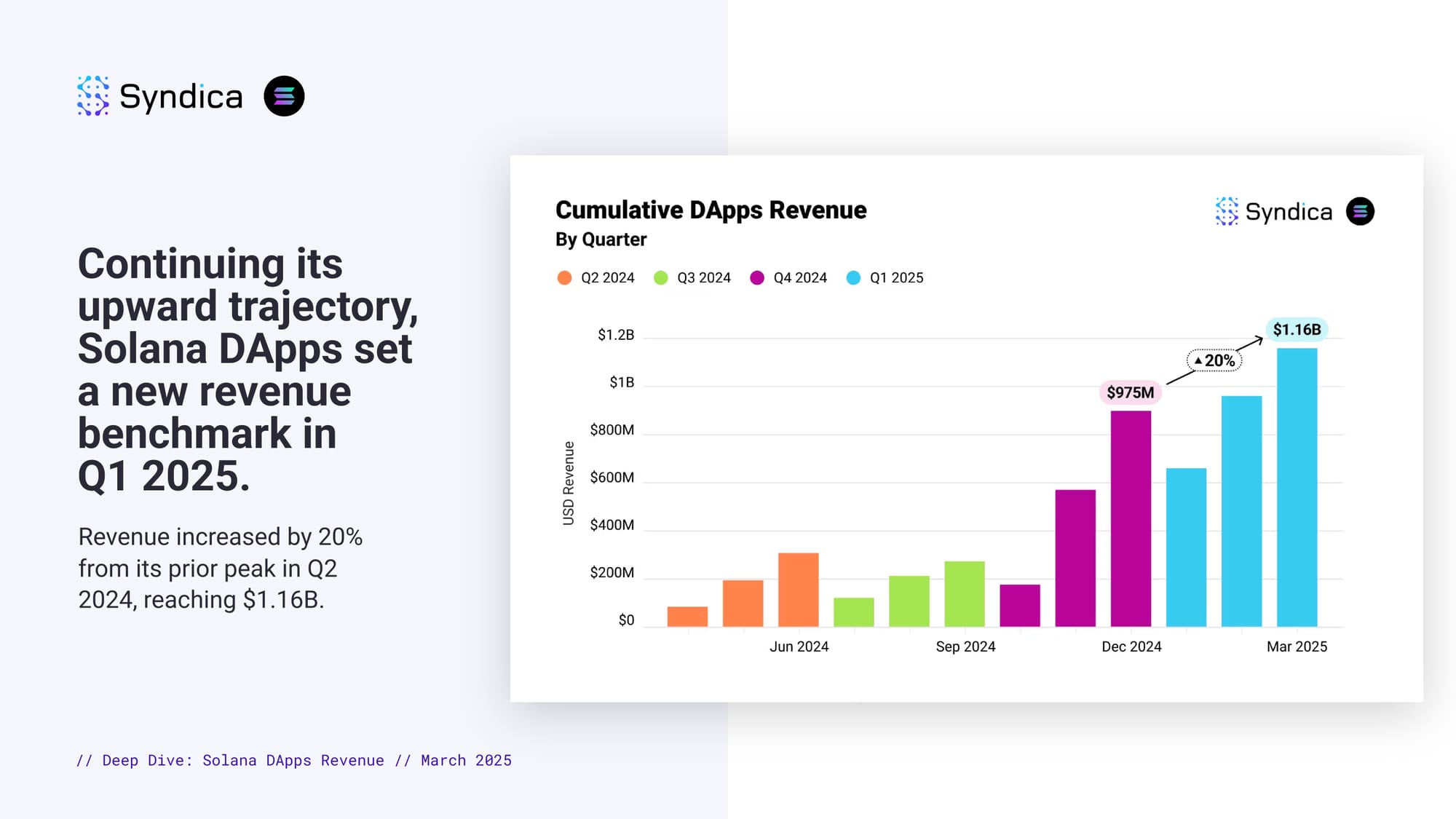

Continuing its upward trajectory, Solana DApps set a new revenue benchmark in Q1 2025. Revenue increased by 20% from its prior peak in Q2 2024, reaching $1.16B.

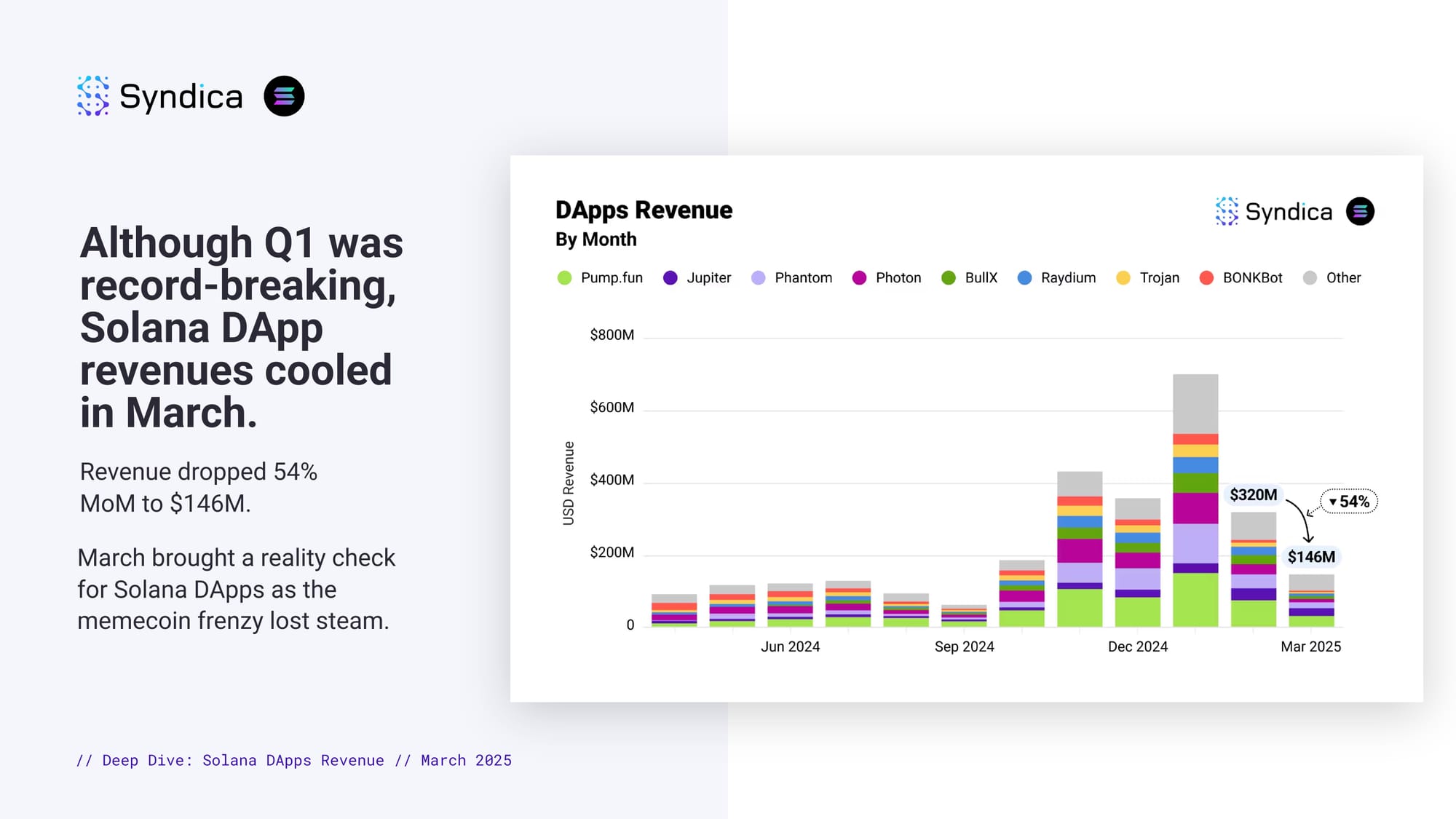

Although Q1 was record-breaking, Solana DApp revenues cooled in March. Revenue dropped 54% MoM to $146M. March brought a reality check for Solana DApps as the memecoin frenzy lost steam.

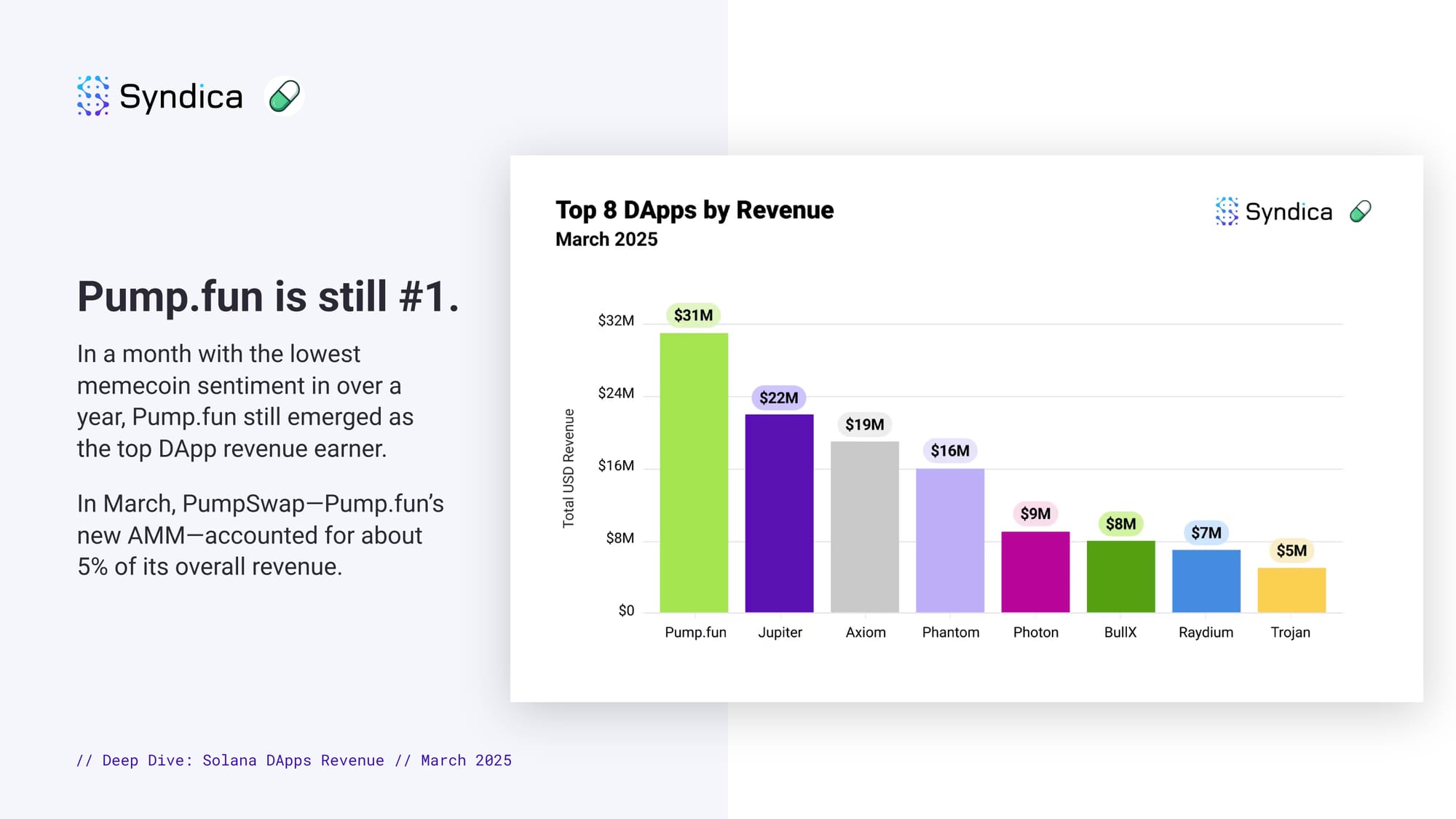

Pump.fun is still #1. In a month with the lowest memecoin sentiment in over a year, Pump.fun still emerged as the top DApp revenue earner. In March, PumpSwap—Pump.fun’s new AMM—accounted for about 5% of its overall revenue.

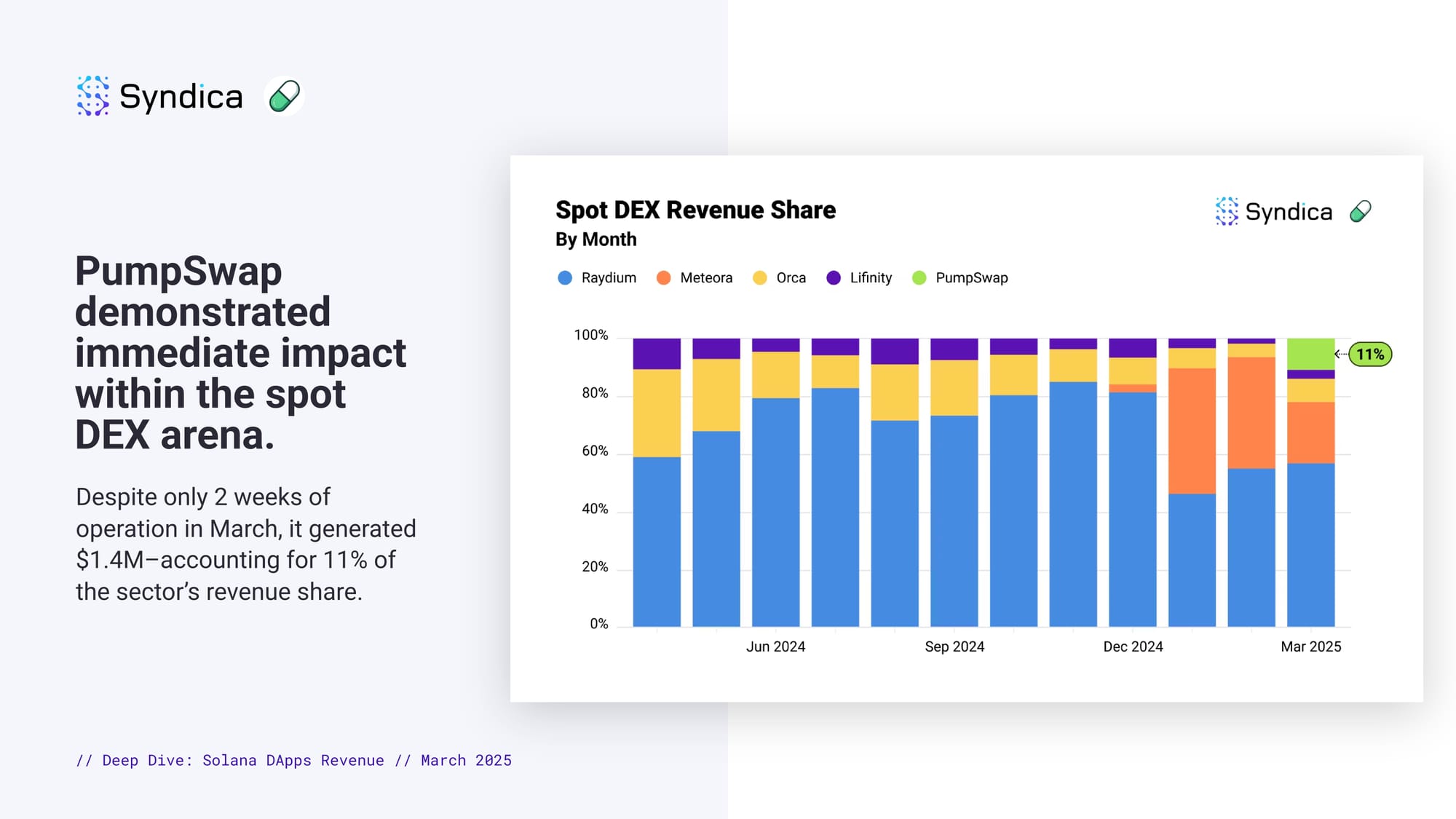

PumpSwap demonstrated immediate impact within the spot DEX arena. Despite only 2 weeks of operation in March, it generated $1.4M–accounting for 11% of the sector’s revenue share.

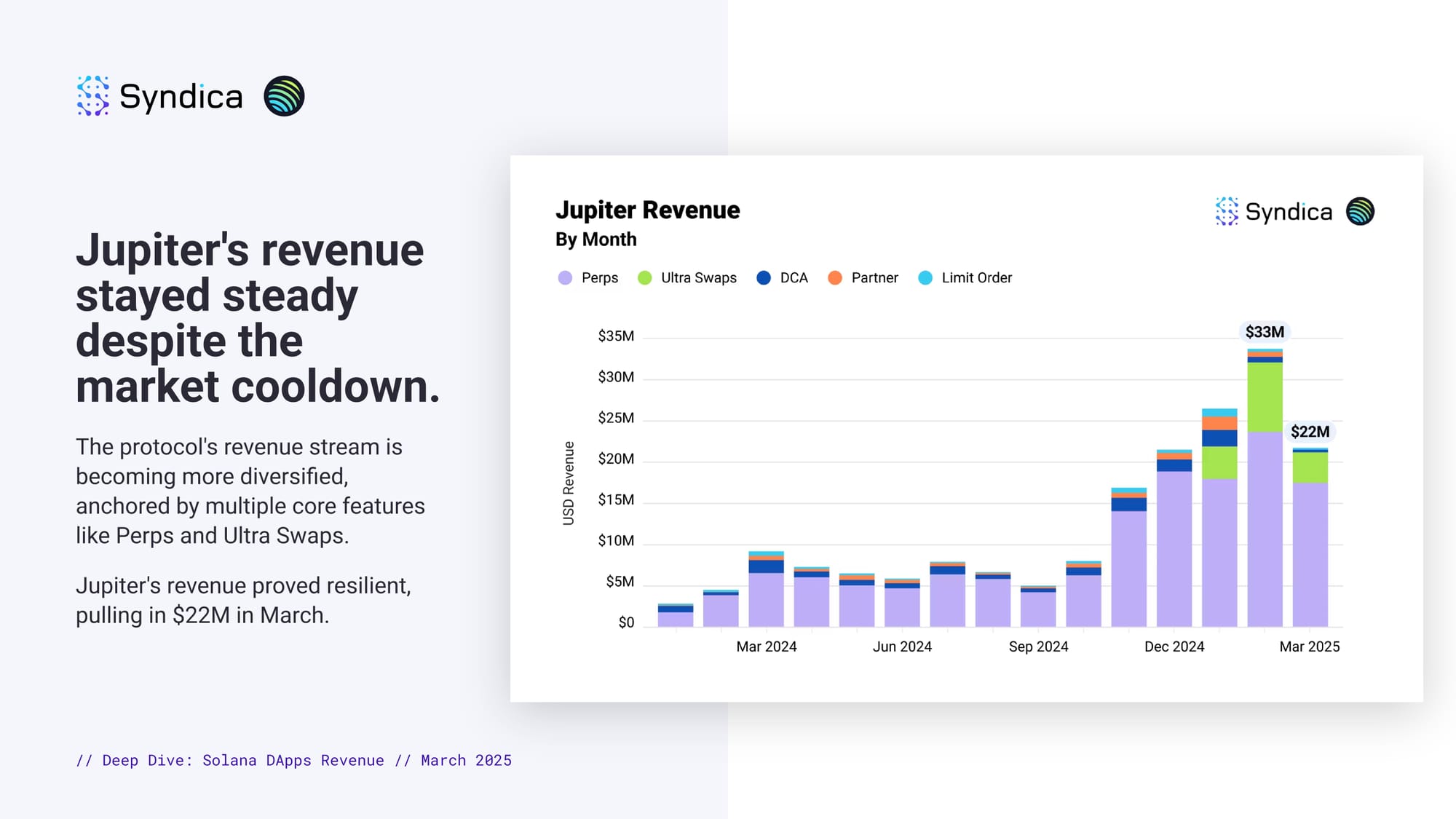

Jupiter's revenue stayed steady despite the market cooldown. The protocol's revenue stream is becoming more diversified, anchored by multiple core features like Perps and Ultra Swaps. Jupiter's revenue proved resilient, pulling in $22M in March.

Jupiter Perps remains the undisputed leader amongst Solana Perp DEXes. The protocol achieved a fresh ATH by dominating the sector with a 93% revenue share, eclipsing Drift and other competitors.

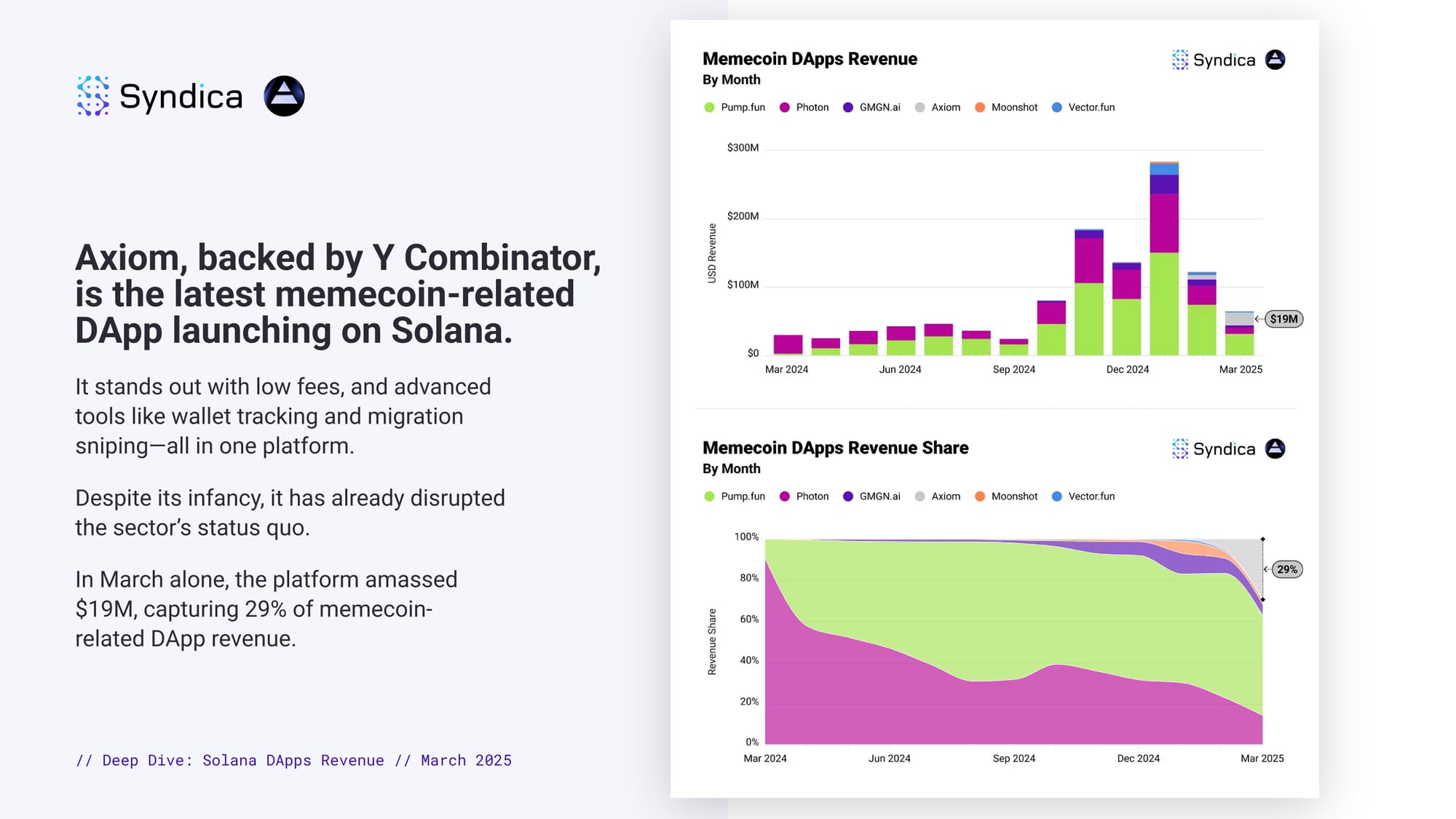

Axiom, backed by Y Combinator, is the latest memecoin-related DApp launching on Solana. It stands out with low fees, and advanced tools like wallet tracking and migration sniping—all in one platform. Despite its infancy, it has already disrupted

the sector’s status quo. In March alone, the platform amassed $19M, capturing 29% of memecoin-related DApp revenue.

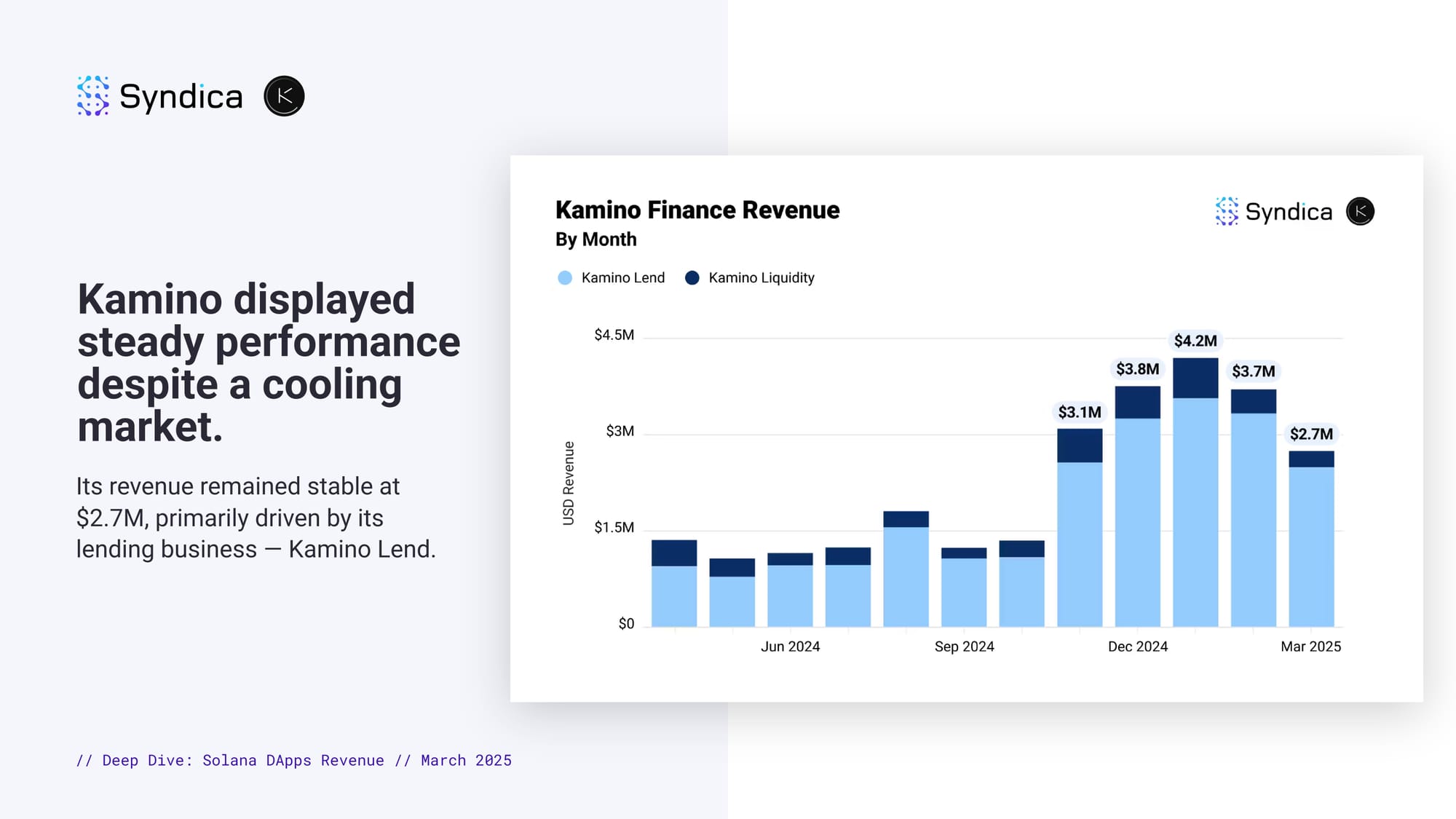

Kamino displayed steady performance despite a cooling market. Its revenue remained stable at $2.7M, primarily driven by its lending business — Kamino Lend.

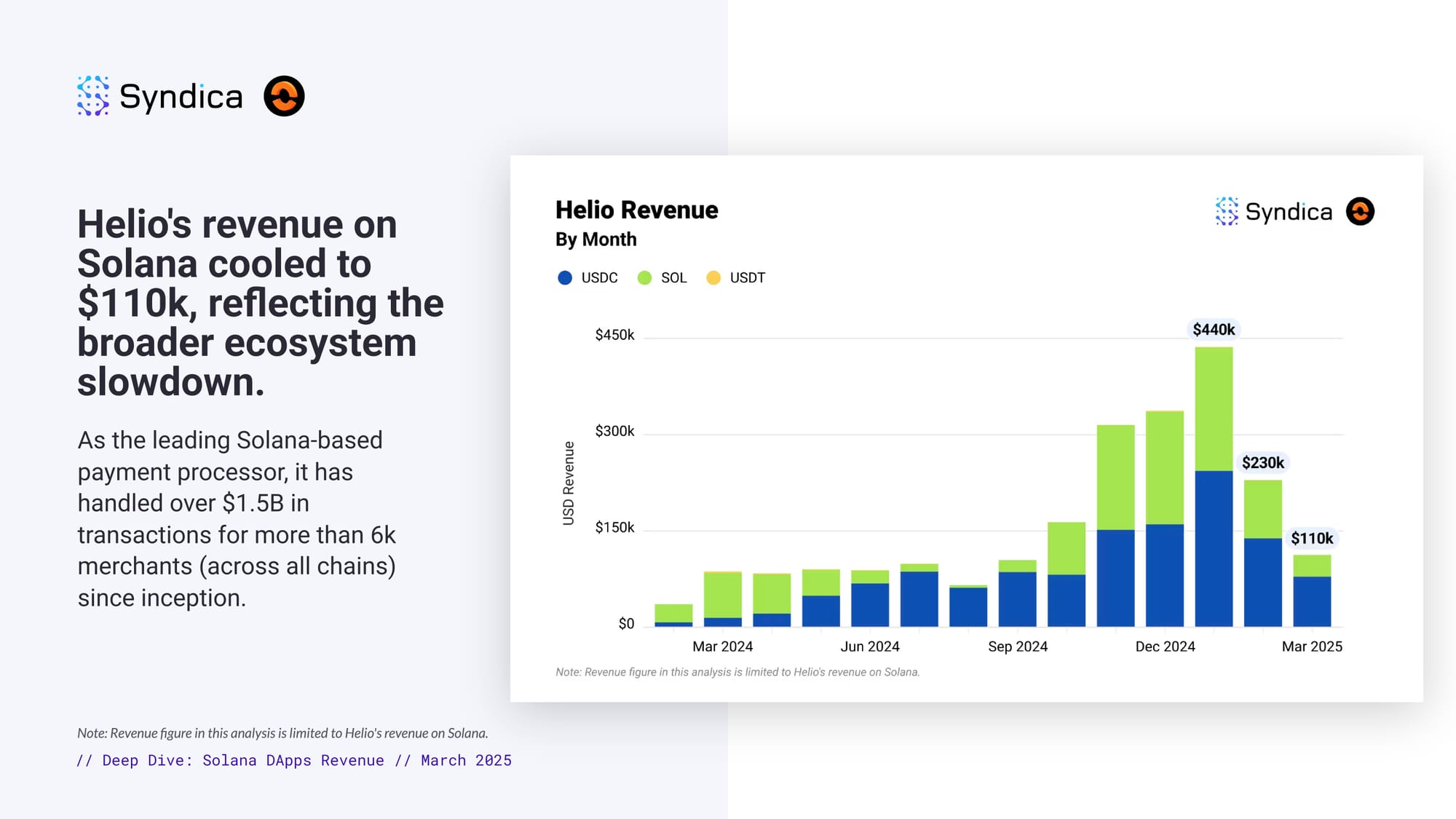

Helio's revenue on Solana cooled to $110k, reflecting the broader ecosystem slowdown. As the leading Solana-based payment processor, it has handled over $1.5B in transactions for more than 6k merchants (across all chains) since inception.

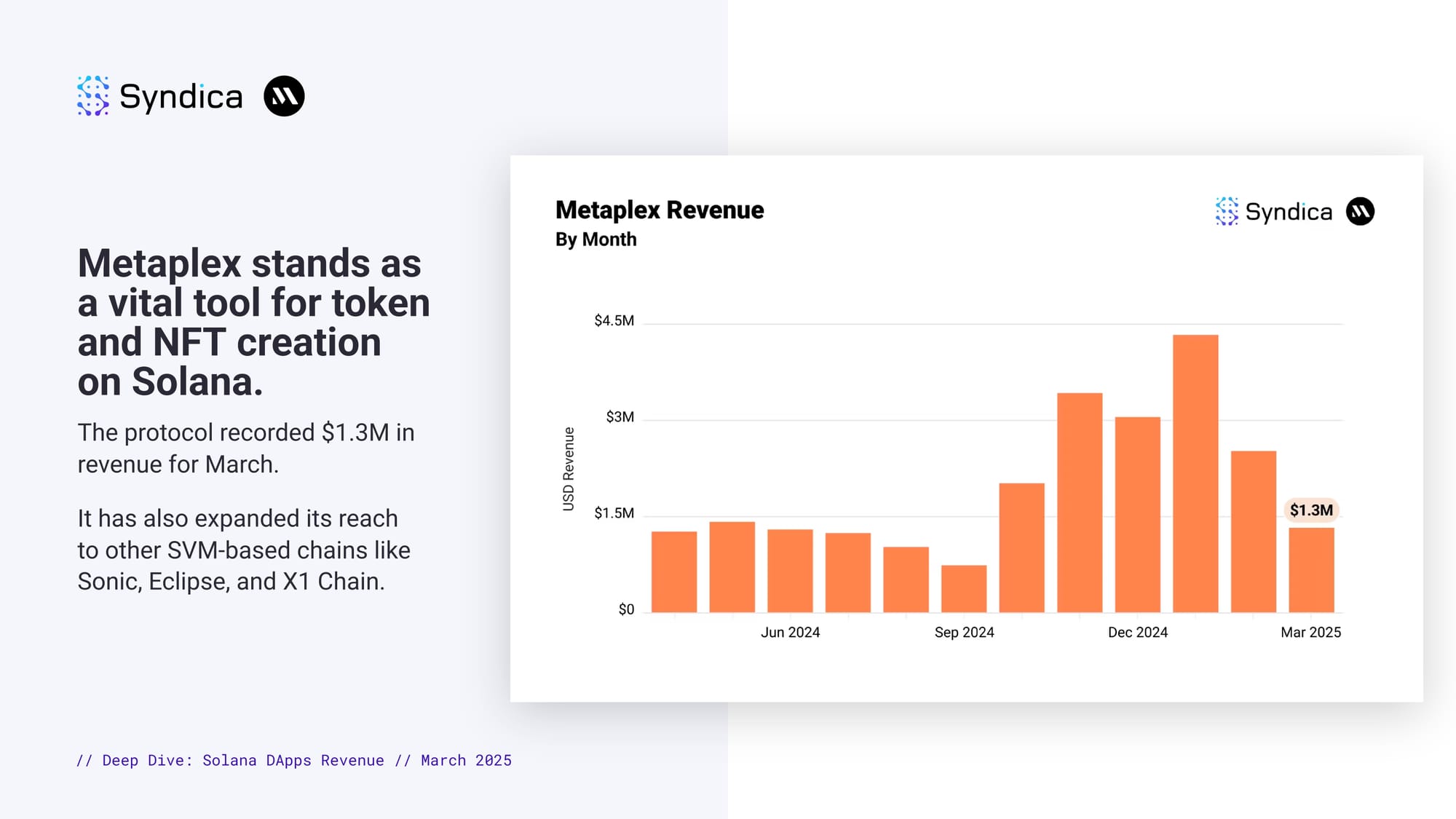

Metaplex stands as a vital tool for token and NFT creation on Solana. The protocol recorded $1.3M in revenue for March. It has also expanded its reach to other SVM-based chains like Sonic, Eclipse, and X1 Chain.

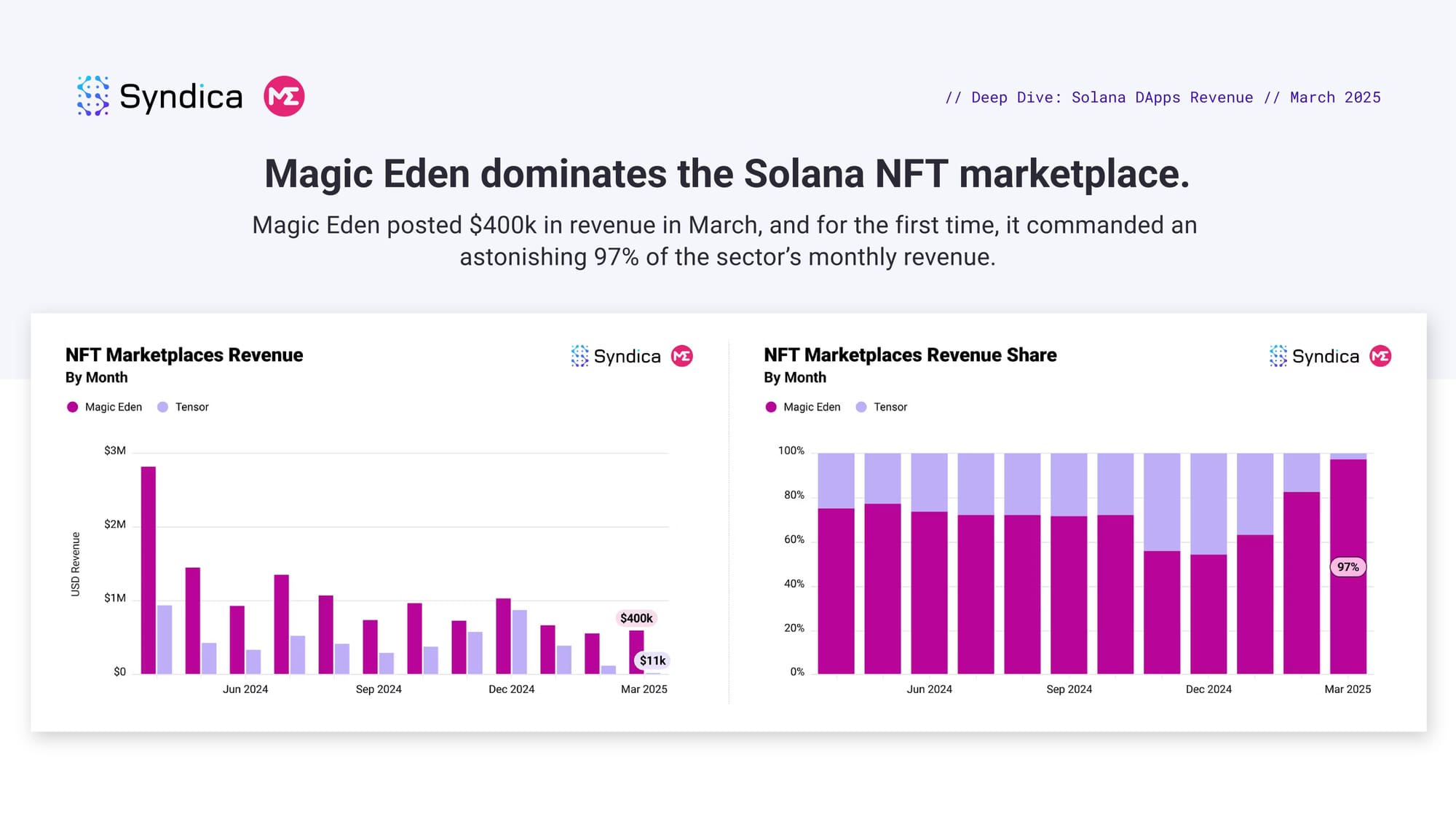

Magic Eden dominates the Solana NFT marketplace. Magic Eden posted $400k in revenue in March, and for the first time, it commanded an astonishing 97% of the sector’s monthly revenue.

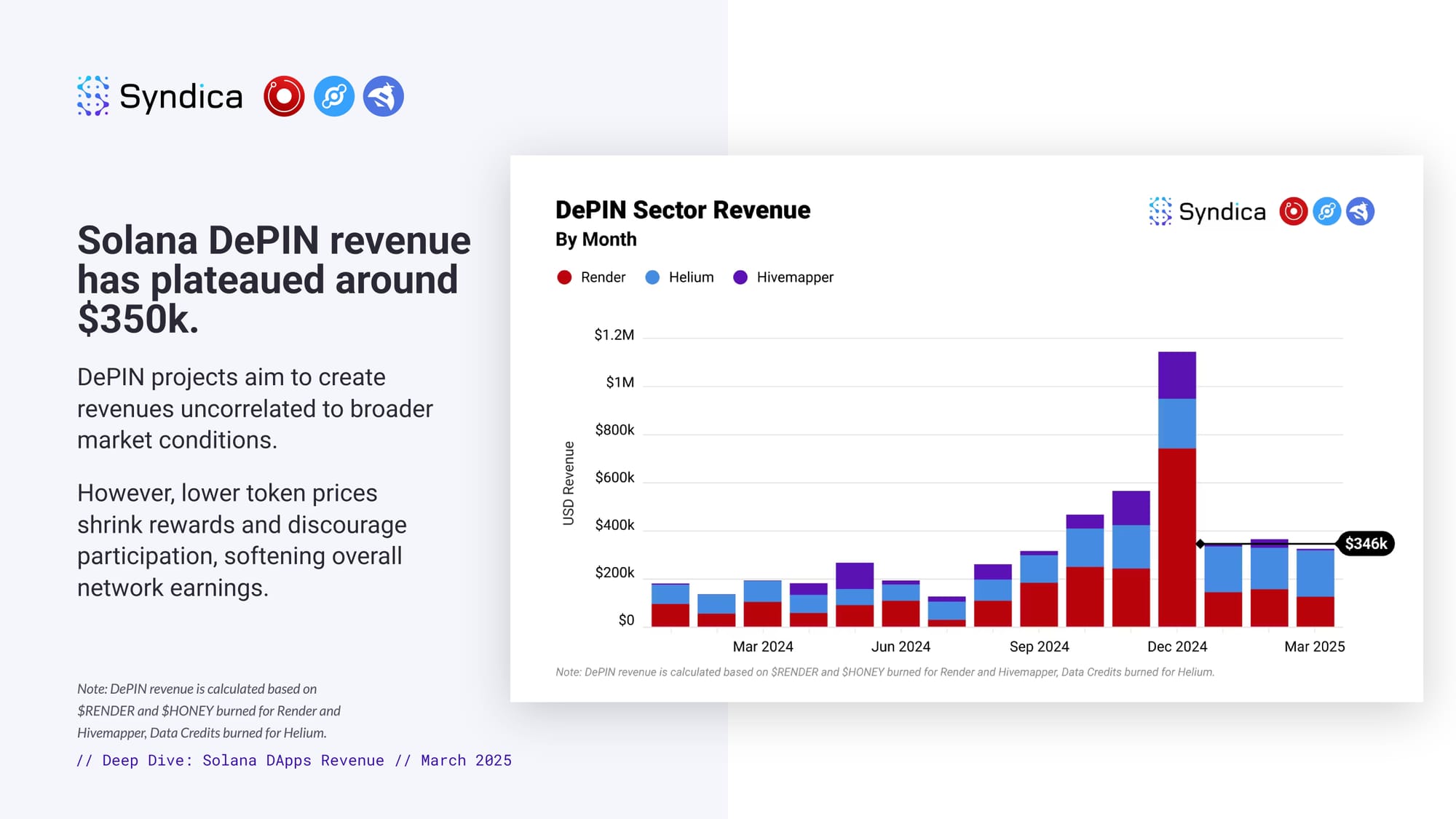

Solana DePIN revenue has plateaued around $350k. DePIN projects aim to create revenues uncorrelated to broader market conditions. However, lower token prices shrink rewards and discourage participation, softening overall network earnings.

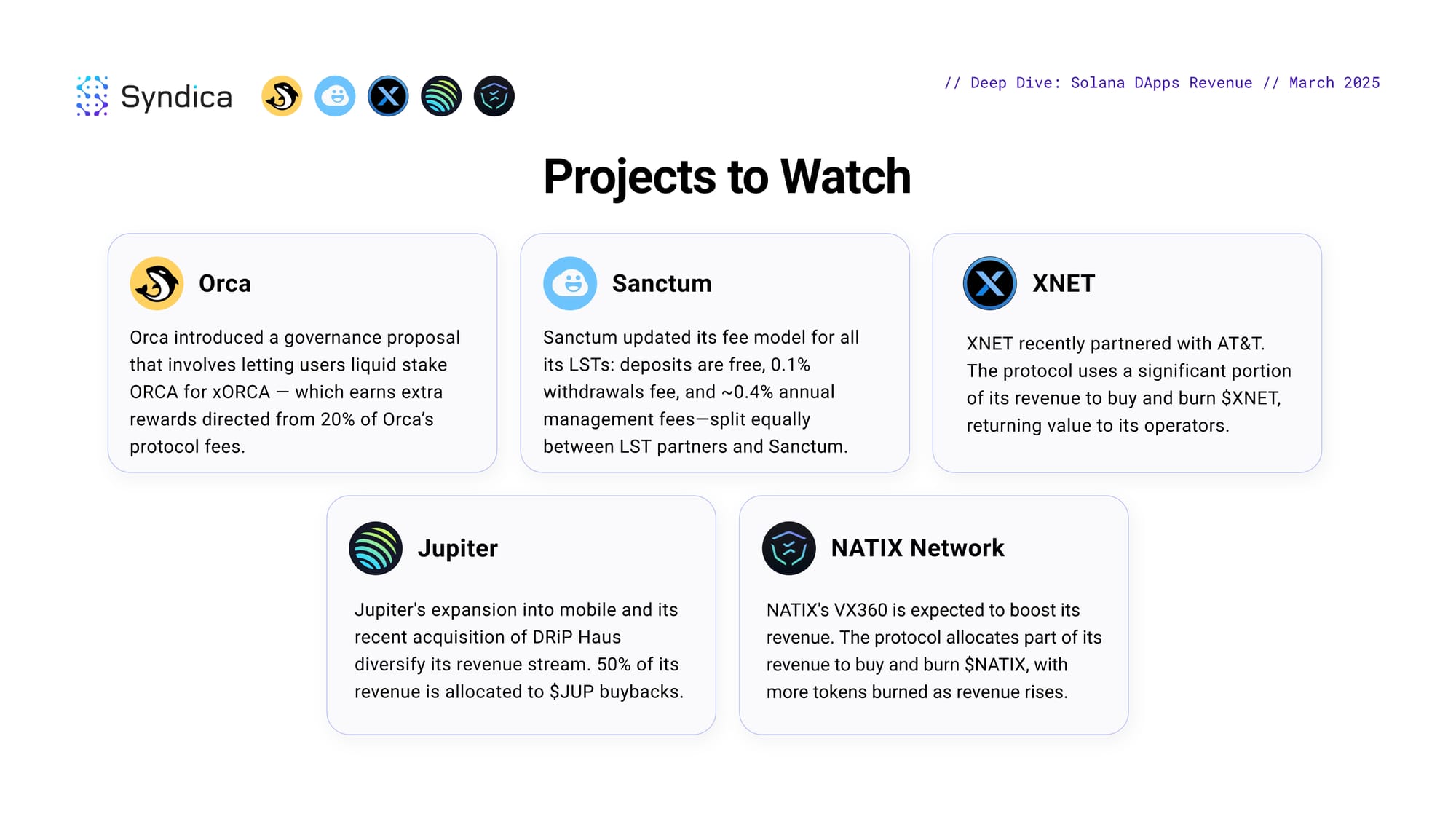

Projects To Watch:

Orca introduced a governance proposal that involves letting users liquid stake ORCA for xORCA — which earns extra rewards directed from 20% of Orca’s protocol fees.

Sanctum updated its fee model for all its LSTs: deposits are free, 0.1% withdrawals fee, and ~0.4% annual management fees—split equally between LST partners and Sanctum.

XNET recently partnered with AT&T. The protocol uses a significant portion of its revenue to buy and burn $XNET, returning value to its operators.

Jupiter's expansion into mobile and its recent acquisition of DRiP Haus diversify its revenue stream. 50% of its revenue is allocated to $JUP buybacks.

NATIX's VX360 is expected to boost its revenue. The protocol allocates part of its revenue to buy and burn $NATIX, with more tokens burned as revenue rises.