Deep Dive: Solana DApps Revenue - May 2025

Deep Dive: Solana DApps Revenue - May 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - May 2025

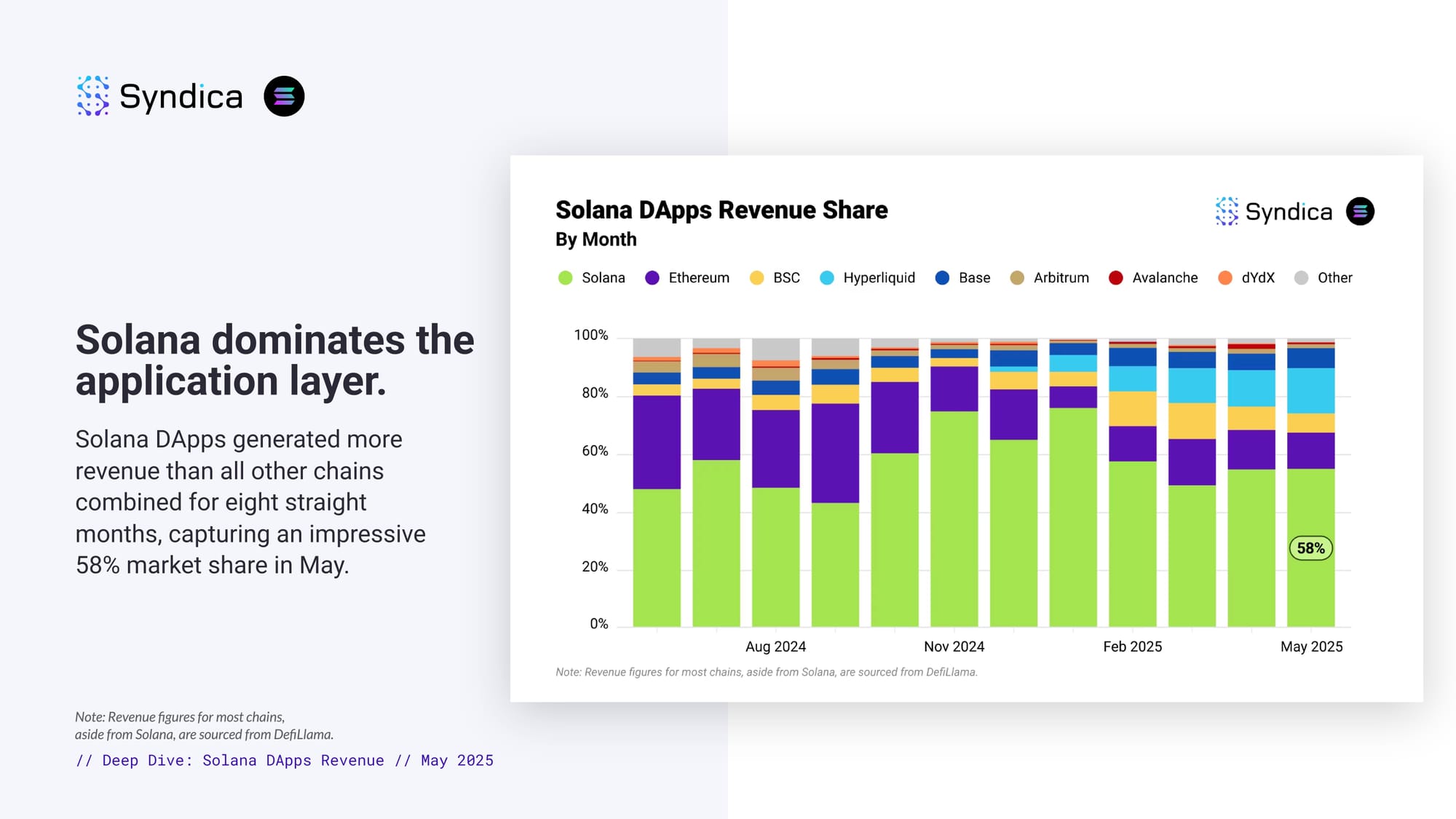

Solana dominates the application layer. Solana DApps generated more revenue than all other chains combined for eight straight months, capturing an impressive 58% market share in May.

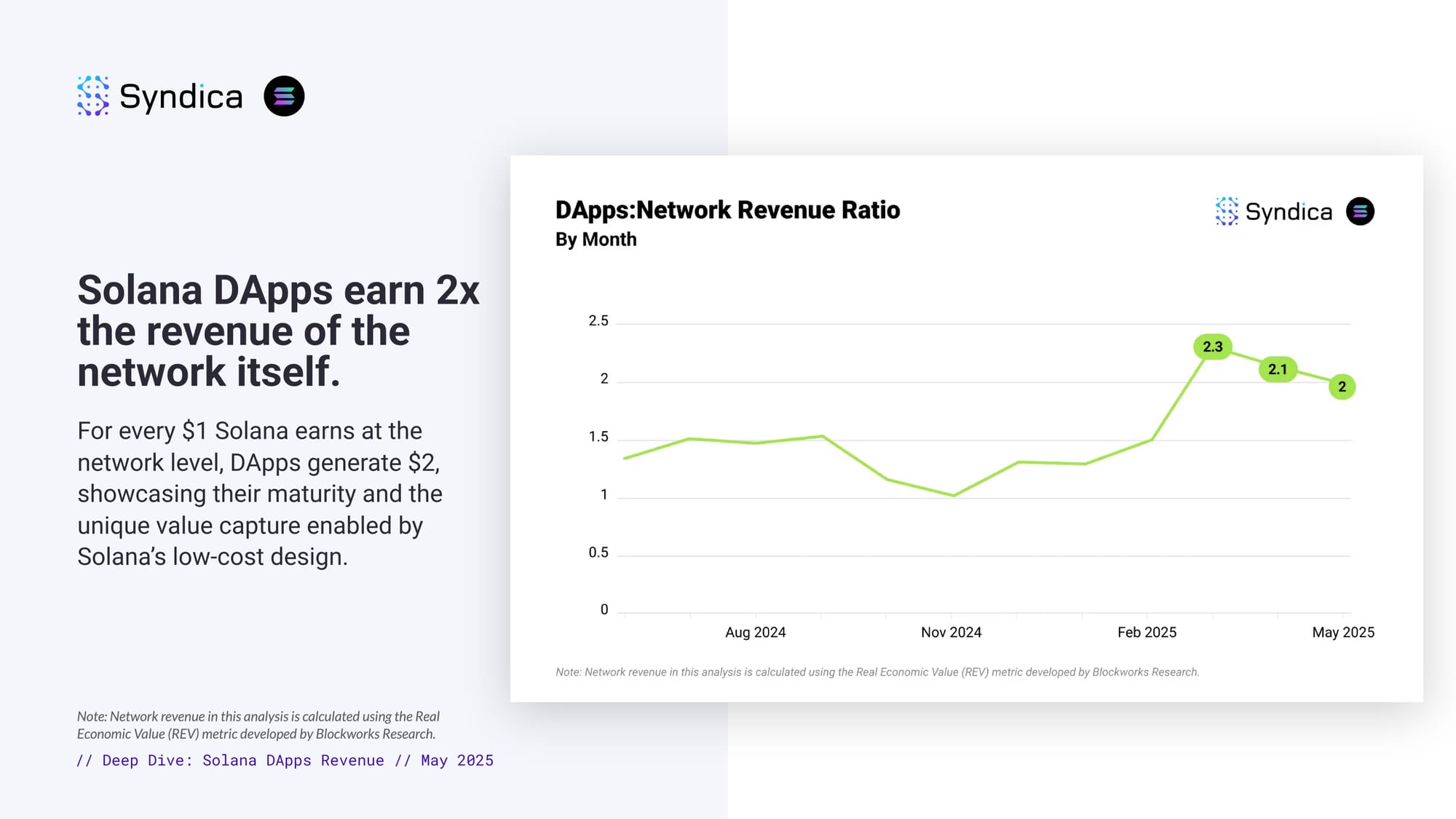

Solana DApps earn 2x the revenue of the network itself. For every $1 Solana earns at the network level, DApps generate $2, showcasing their maturity and the unique value capture enabled by Solana’s low-cost design.

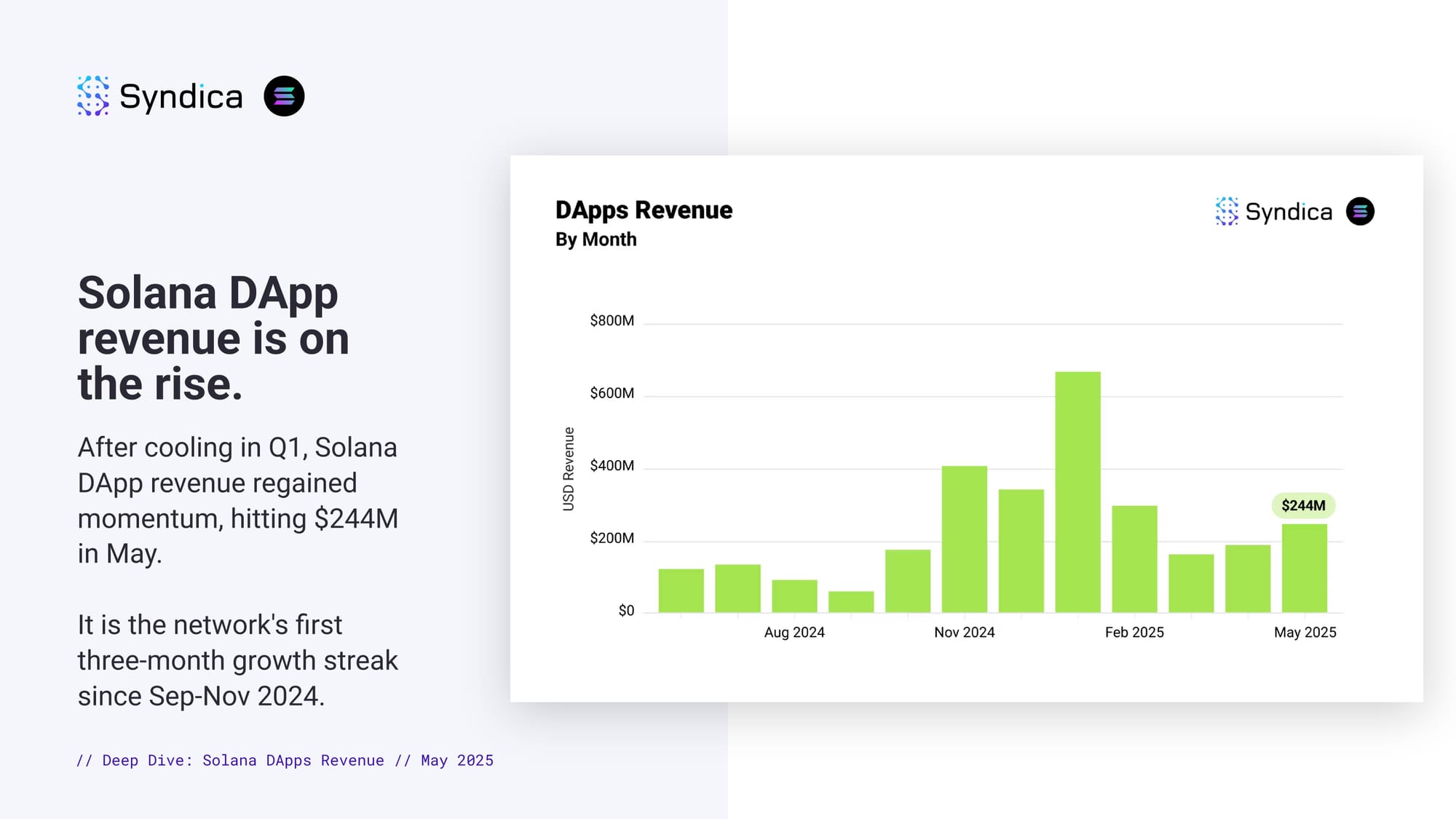

Solana DApp revenue is on the rise. After cooling in Q1, Solana DApp revenue regained momentum, hitting $244M in May. It is the network's first three-month growth streak since Sep-Nov 2024.

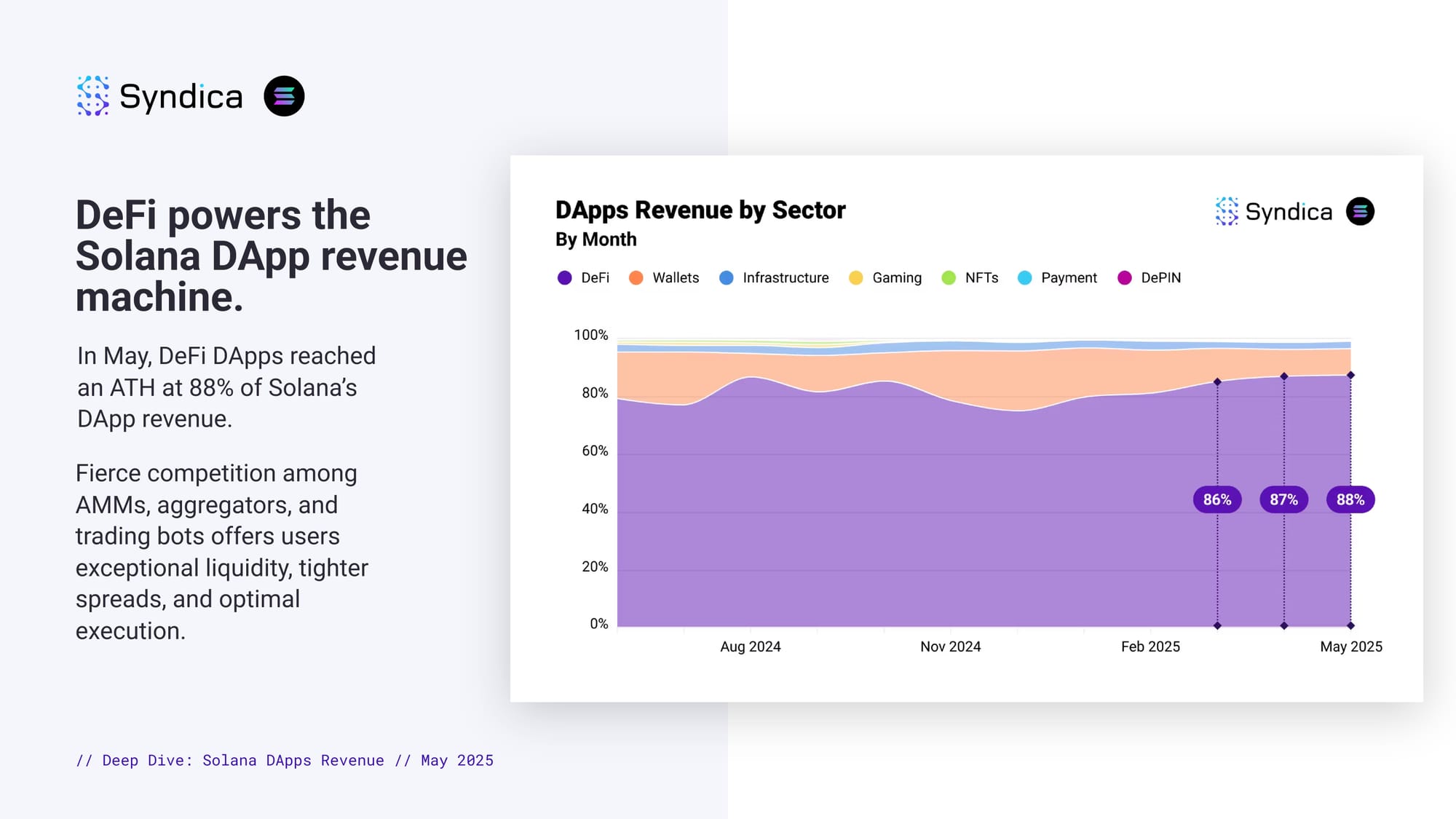

DeFi powers the Solana DApp revenue machine. In May, DeFi DApps reached an ATH at 88% of Solana’s DApp revenue. Fierce competition among AMMs, aggregators, and trading bots offers users exceptional liquidity, tighter spreads, and optimal execution.

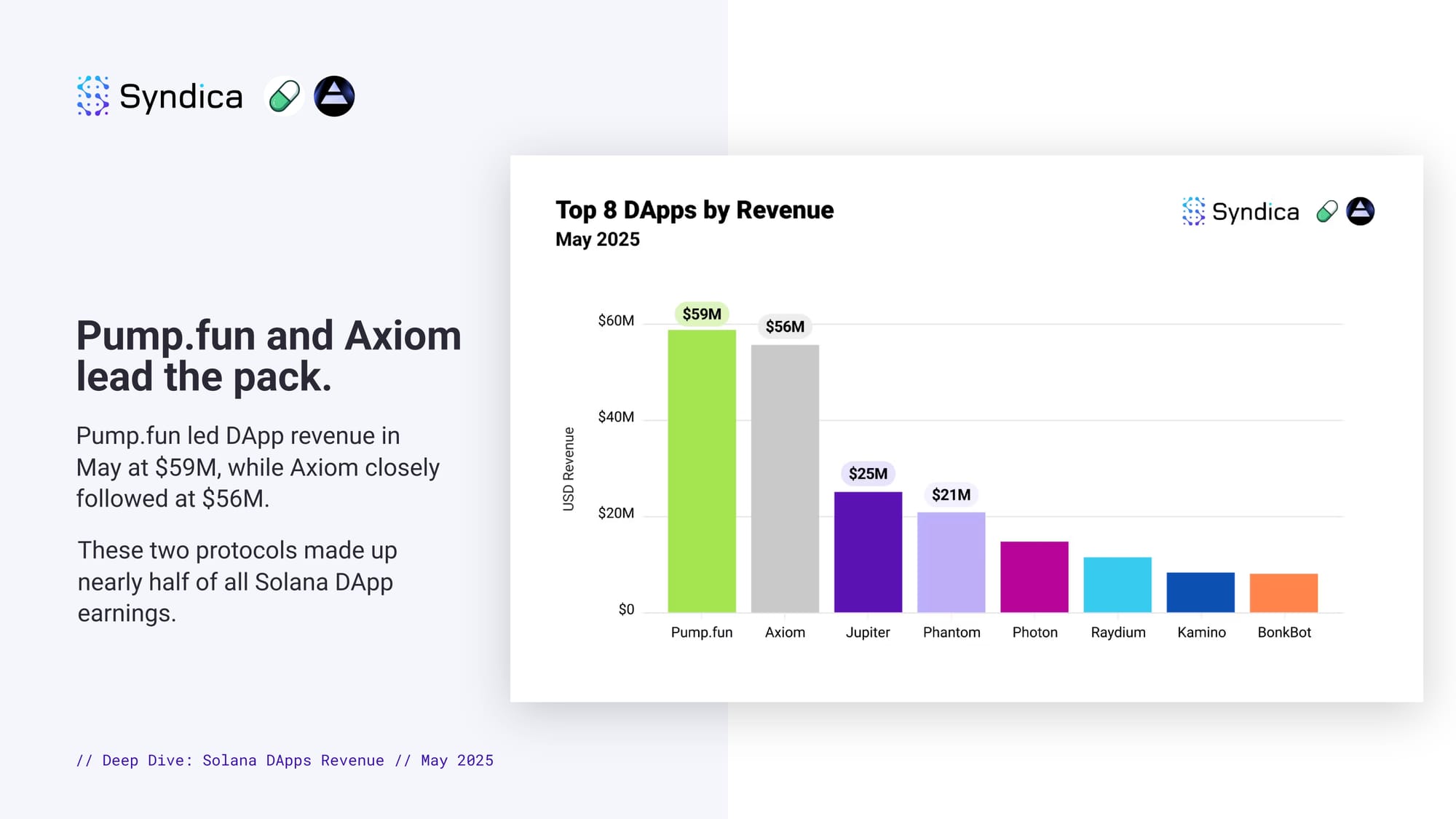

Pump.fun and Axiom lead the pack. Pump.fun led DApp revenue in May at $59M, while Axiom closely followed at $56M. These two protocols made up nearly half of all Solana DApp earnings.

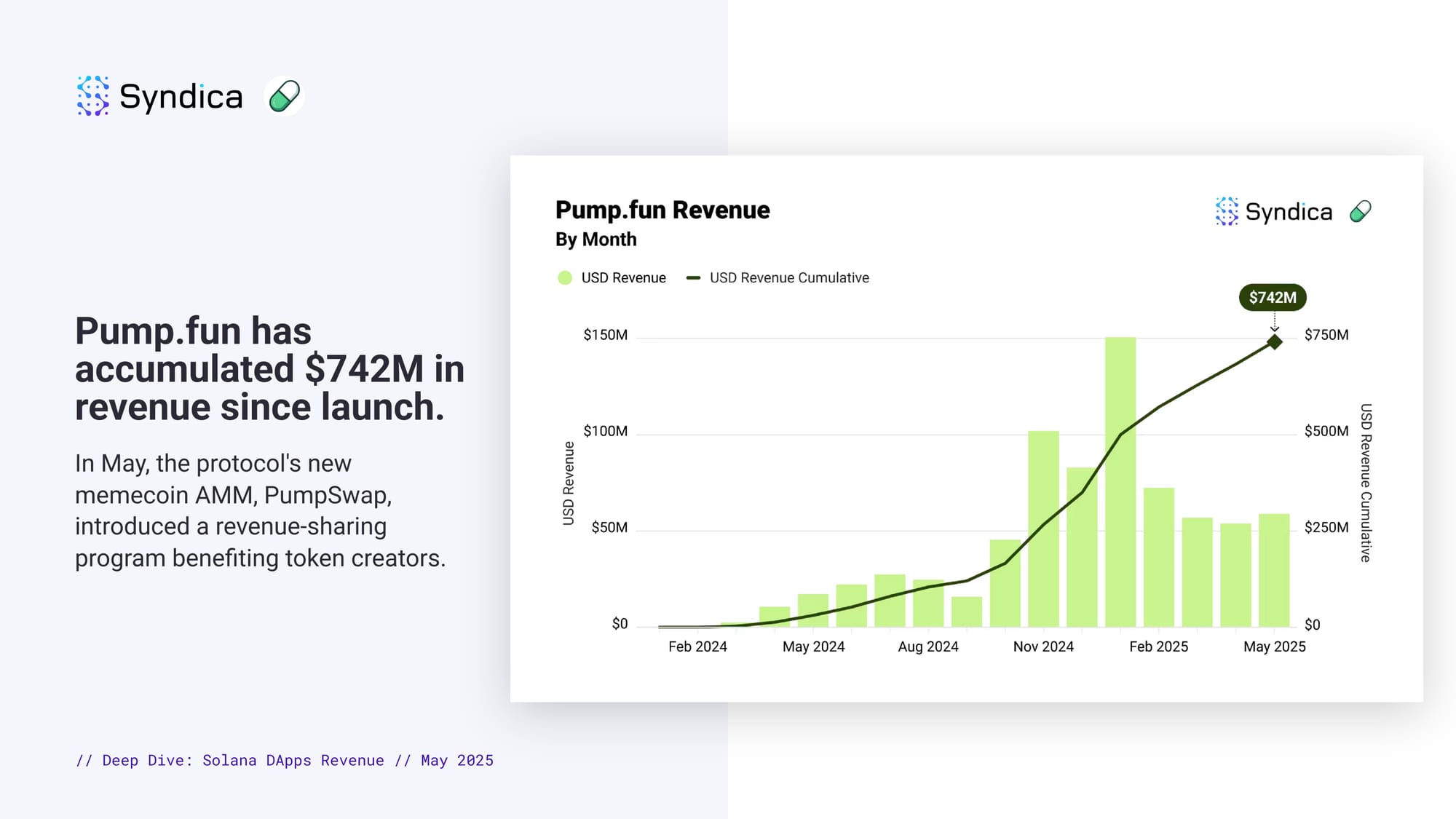

Pump.fun has accumulated $742M in revenue since launch. In May, the protocol's new memecoin AMM, PumpSwap, introduced a revenue-sharing program benefiting token creators.

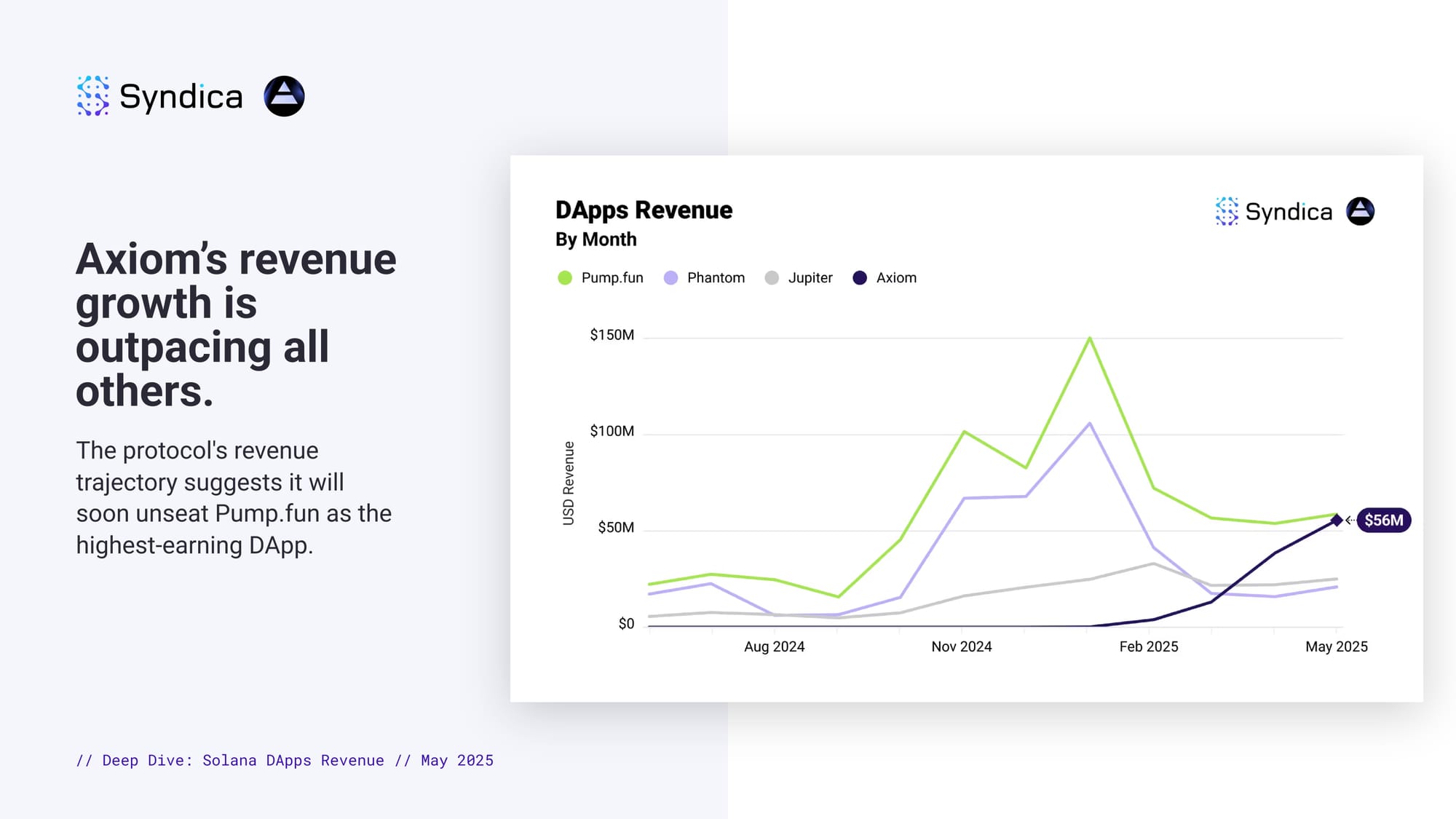

Axiom’s revenue growth is outpacing all others. The protocol's revenue trajectory suggests it will soon unseat Pump.fun as the highest-earning DApp.

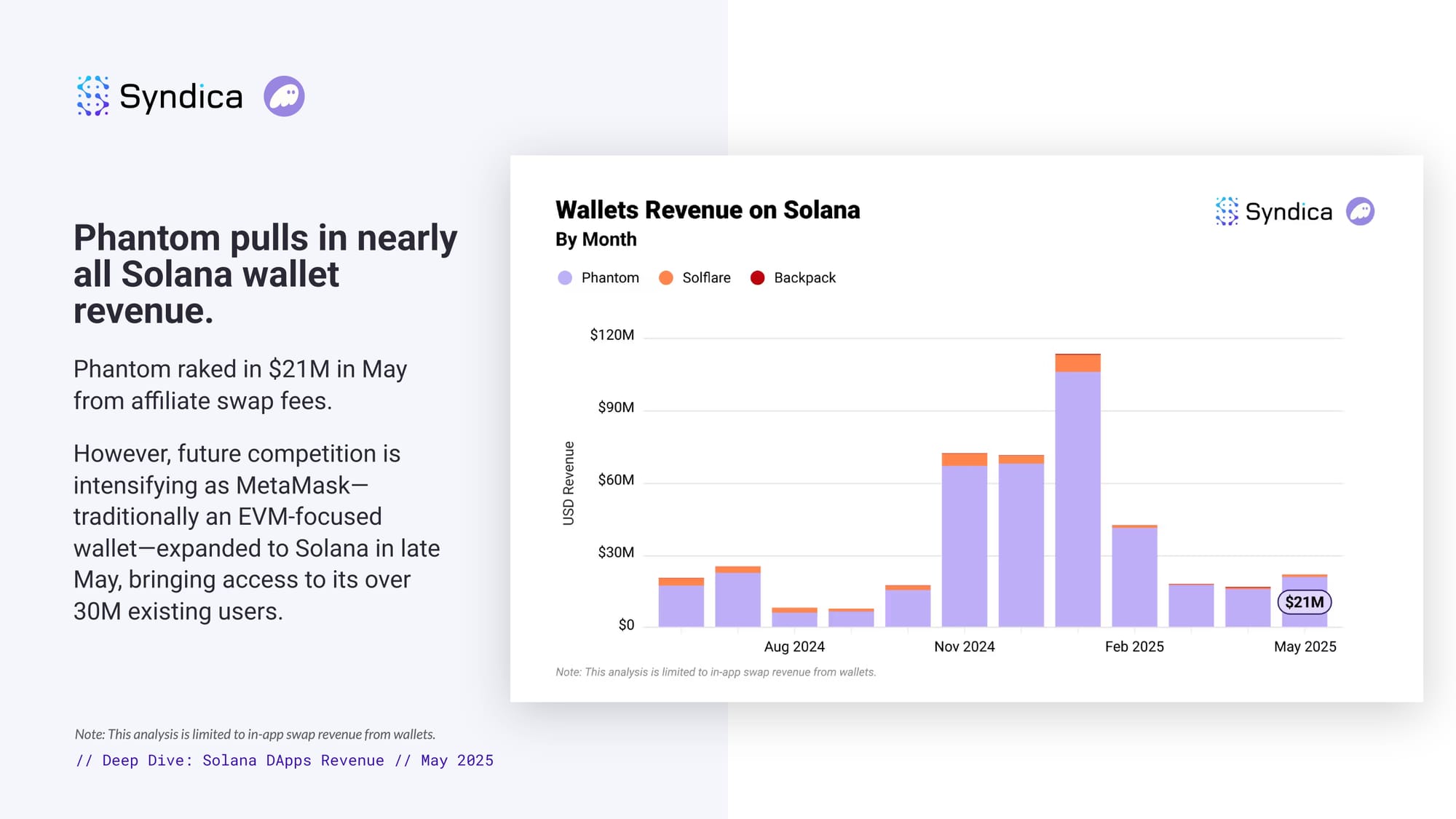

Phantom pulls in nearly all Solana wallet revenue. Phantom raked in $21M in May from affiliate swap fees. However, future competition is intensifying as MetaMask—traditionally an EVM-focused wallet—expanded to Solana in late May, bringing access to its over 30M existing users.

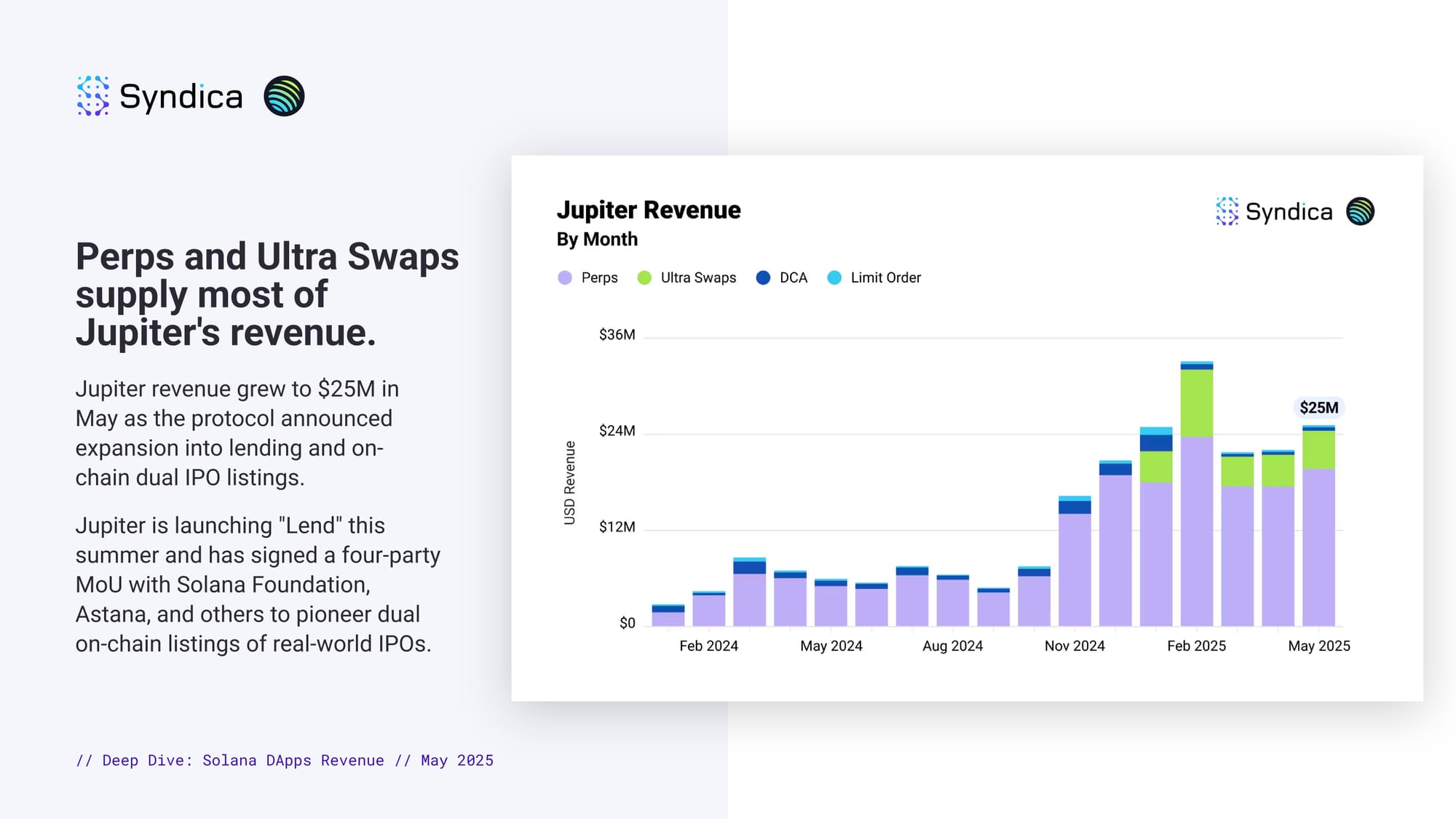

Perps and Ultra Swaps supply most of Jupiter's revenue. Jupiter revenue grew to $25M in May as the protocol announced expansion into lending and on-chain dual IPO listings. Jupiter is launching "Lend" this summer and has signed a four-party MoU with Solana Foundation, Astana, and others to pioneer dual on-chain listings of real-world IPOs.

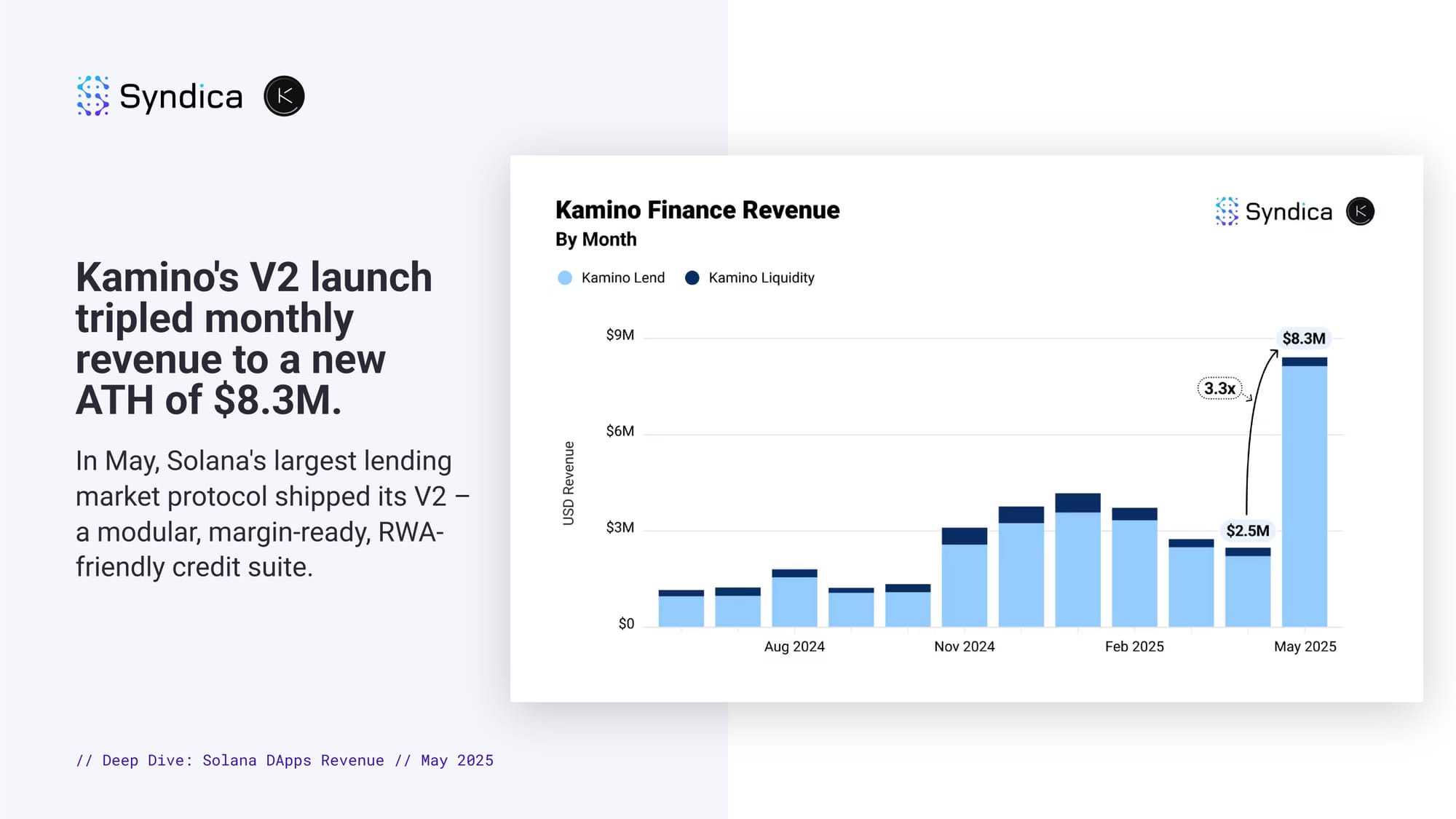

Kamino's V2 launch tripled monthly revenue to a new ATH of $8.3M. In May, Solana's largest lending market protocol shipped its V2 – a modular, margin-ready, RWA-friendly credit suite.

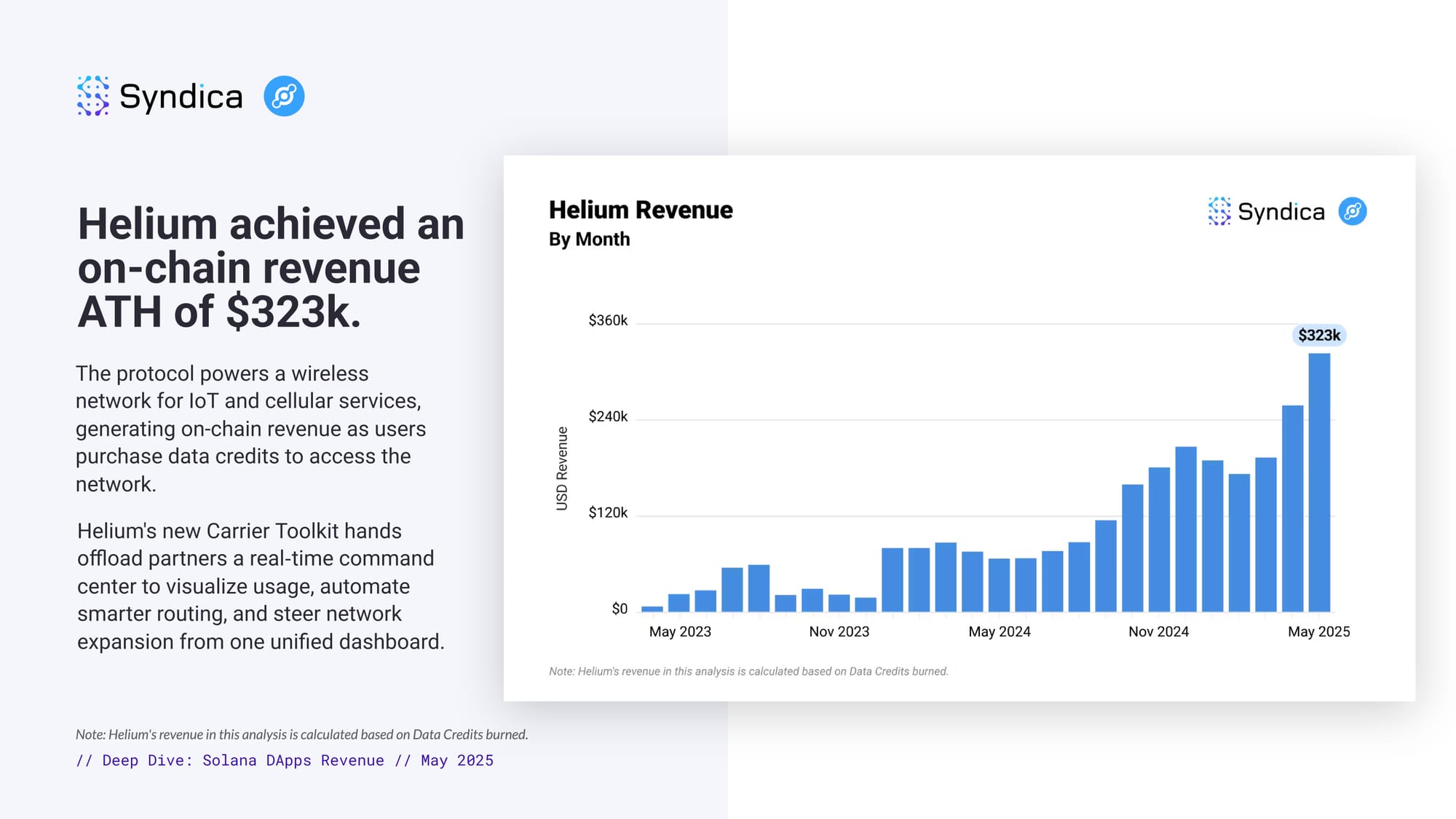

Helium achieved an on-chain revenue ATH of $323k. The protocol powers a wireless network for IoT and cellular services, generating on-chain revenue as users purchase data credits to access the network. Helium's new Carrier Toolkit hands offload partners a real‑time command center to visualize usage, automate smarter routing, and steer network expansion from one unified dashboard.

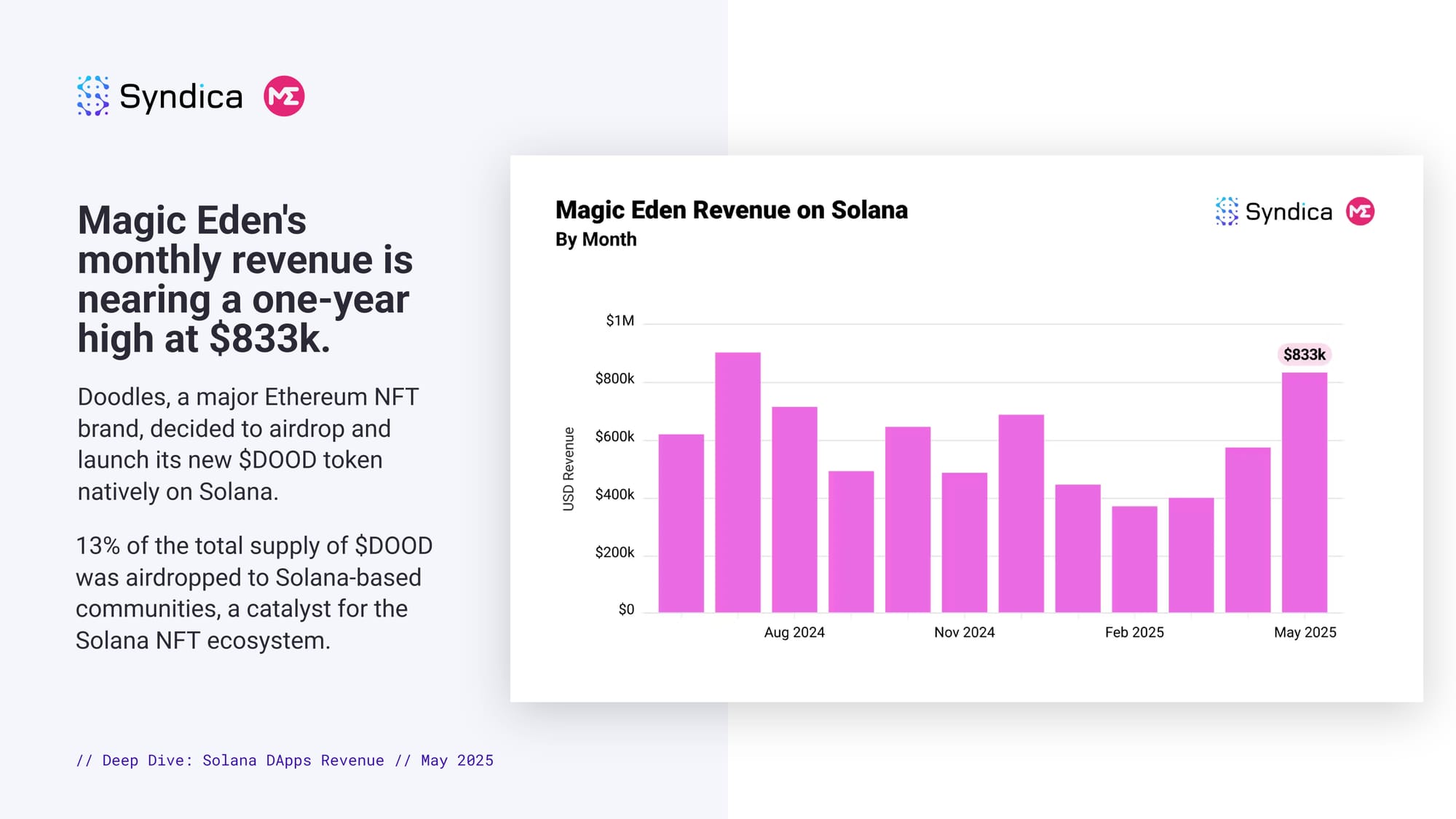

Magic Eden's monthly revenue is nearing a one-year high at $833k. Doodles, a major Ethereum NFT brand, decided to airdrop and launch its new $DOOD token natively on Solana. 13% of the total supply of $DOOD was airdropped to Solana-based communities, a catalyst for the Solana NFT ecosystem.

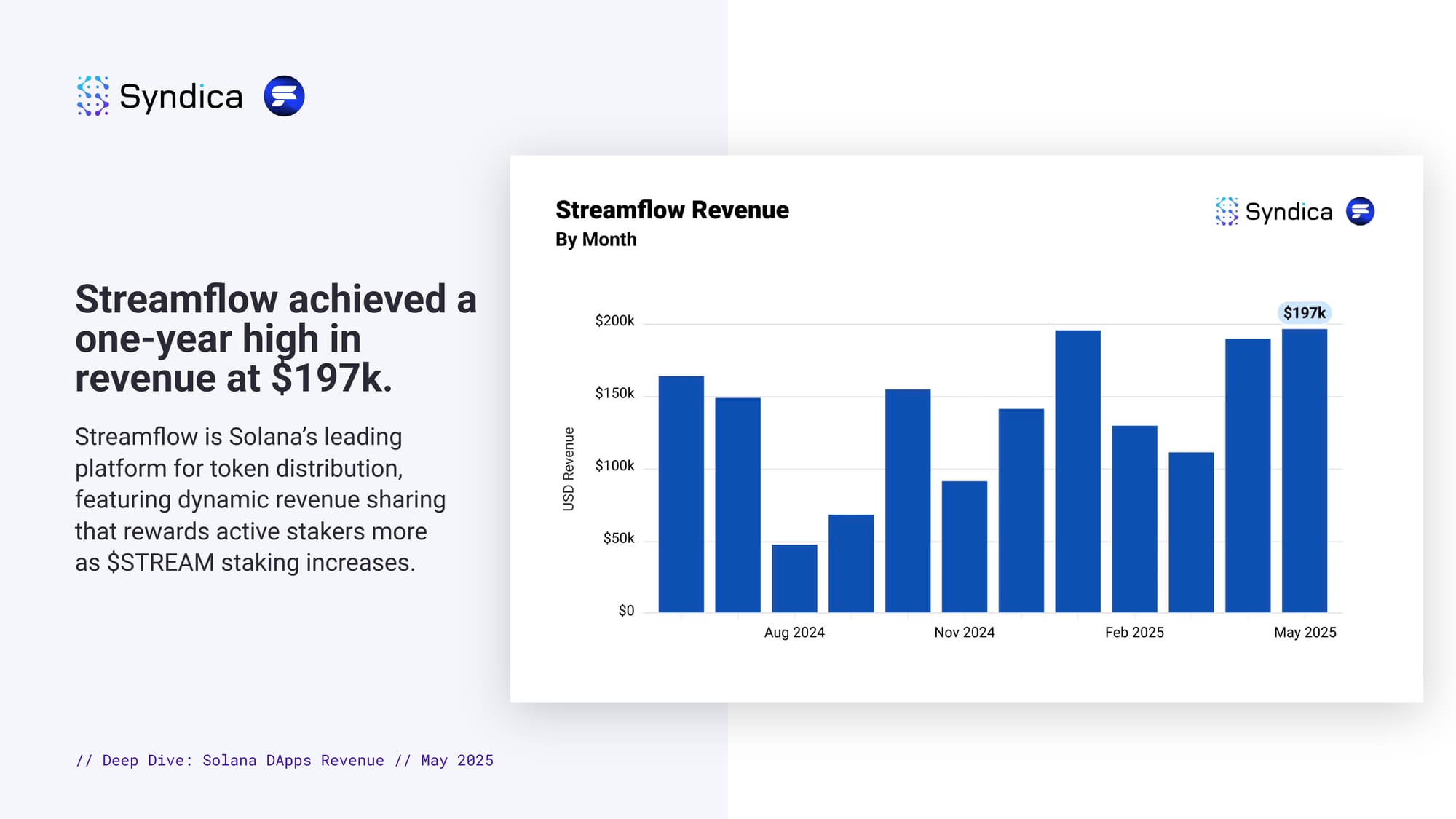

Streamflow achieved a one-year high in revenue at $197k. Streamflow is Solana’s leading platform for token distribution, featuring dynamic revenue sharing that rewards active stakers more as $STREAM staking increases.

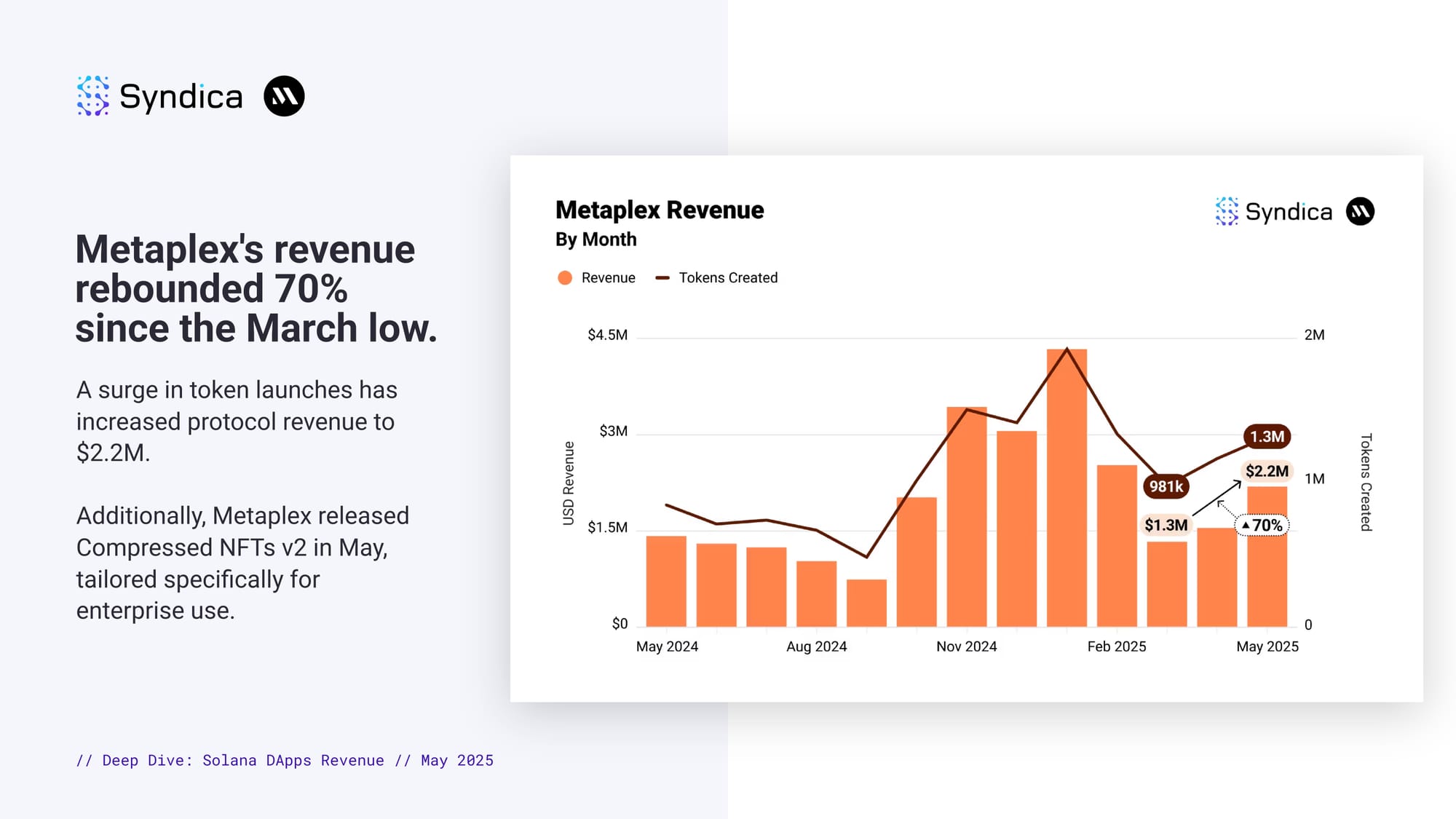

Metaplex's revenue rebounded 70% since the March low. A surge in token launches has increased protocol revenue to $2.2M. Additionally, Metaplex released Compressed NFTs v2 in May, tailored specifically for enterprise use.

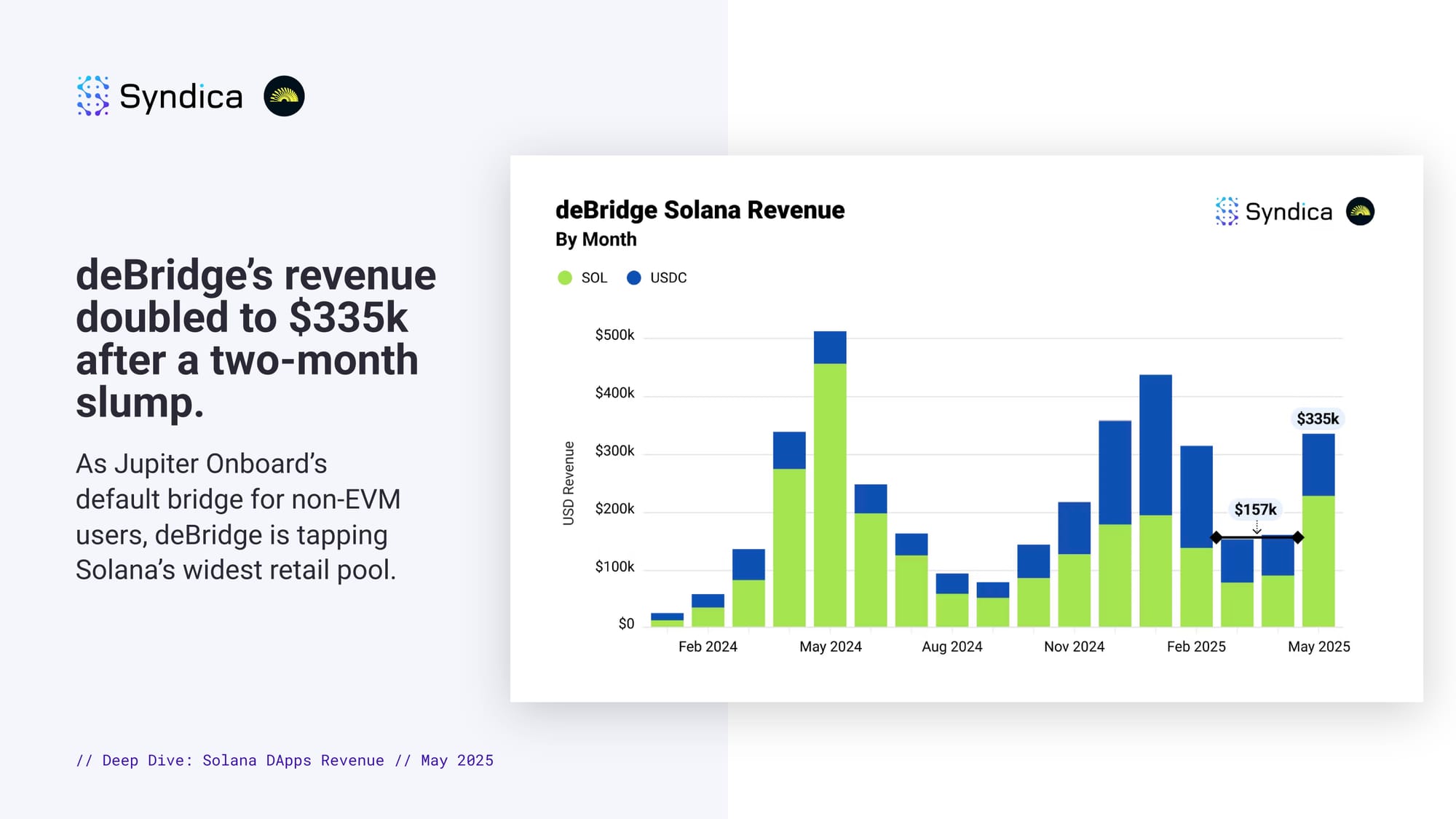

deBridge’s revenue doubled to $335k after a two-month slump. As Jupiter Onboard’s default bridge for non-EVM users, deBridge is tapping Solana’s widest retail pool.

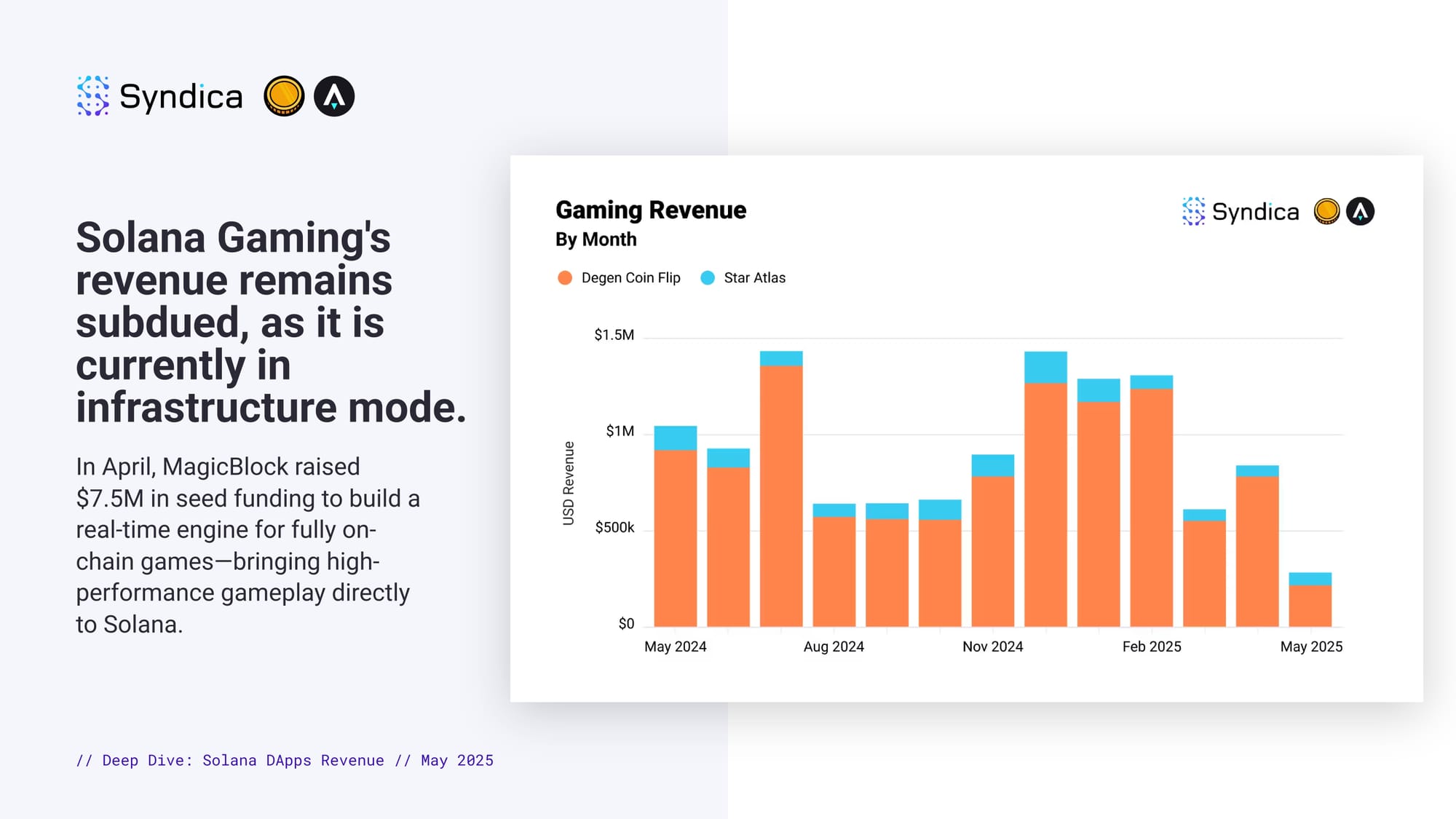

Solana Gaming's revenue remains subdued, as it is currently in infrastructure mode. In April, MagicBlock raised $7.5M in seed funding to build a real-time engine for fully on-chain games—bringing high-performance gameplay directly to Solana.