Deep Dive: Solana DApps Revenue - November 2024

Deep Dive: Solana DApps Revenue - November 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - November 2024

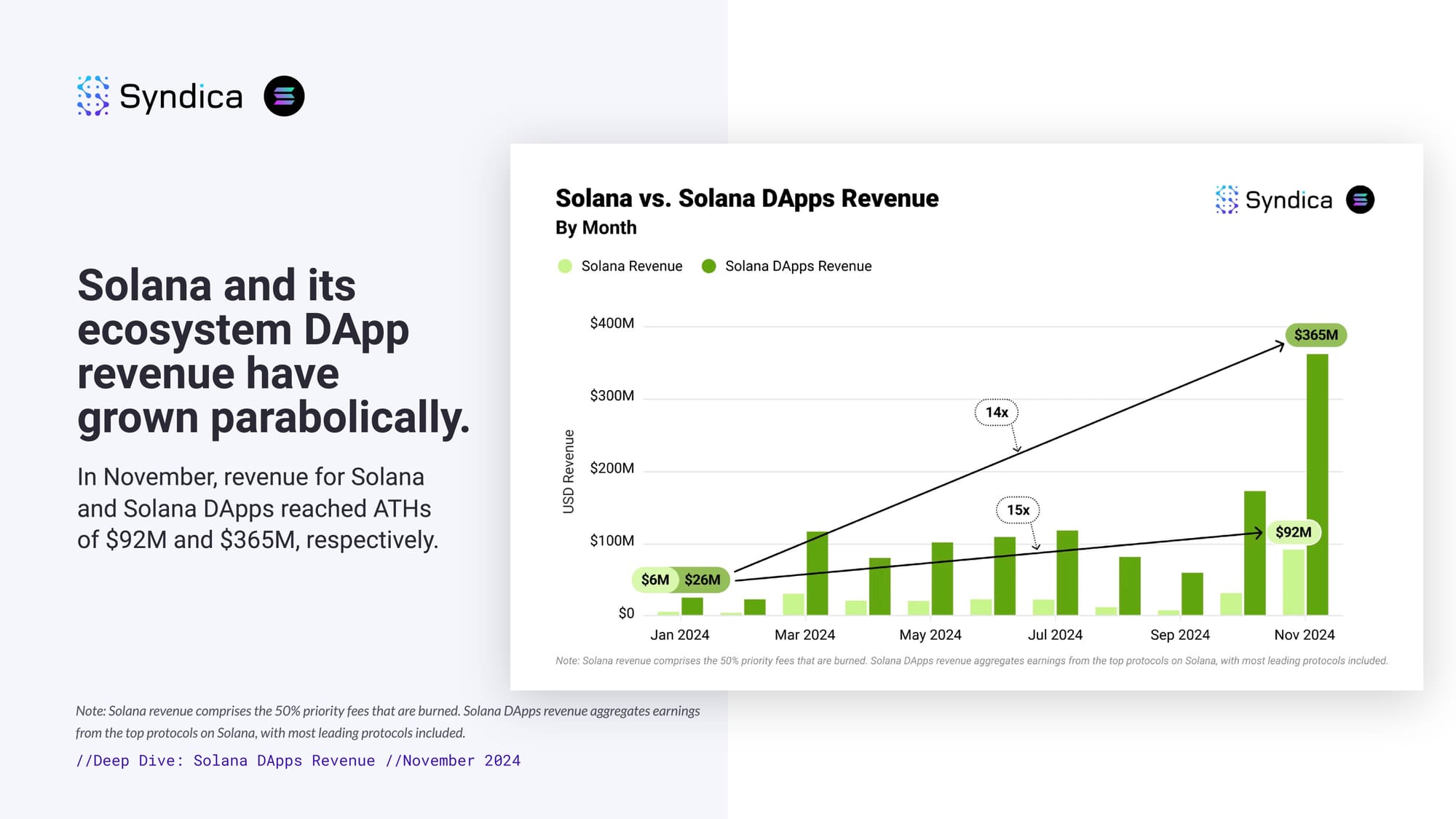

Solana and its ecosystem DApp revenue have grown parabolically. In November, revenue for Solana and Solana DApps reached ATHs of $92M and $365M, respectively.

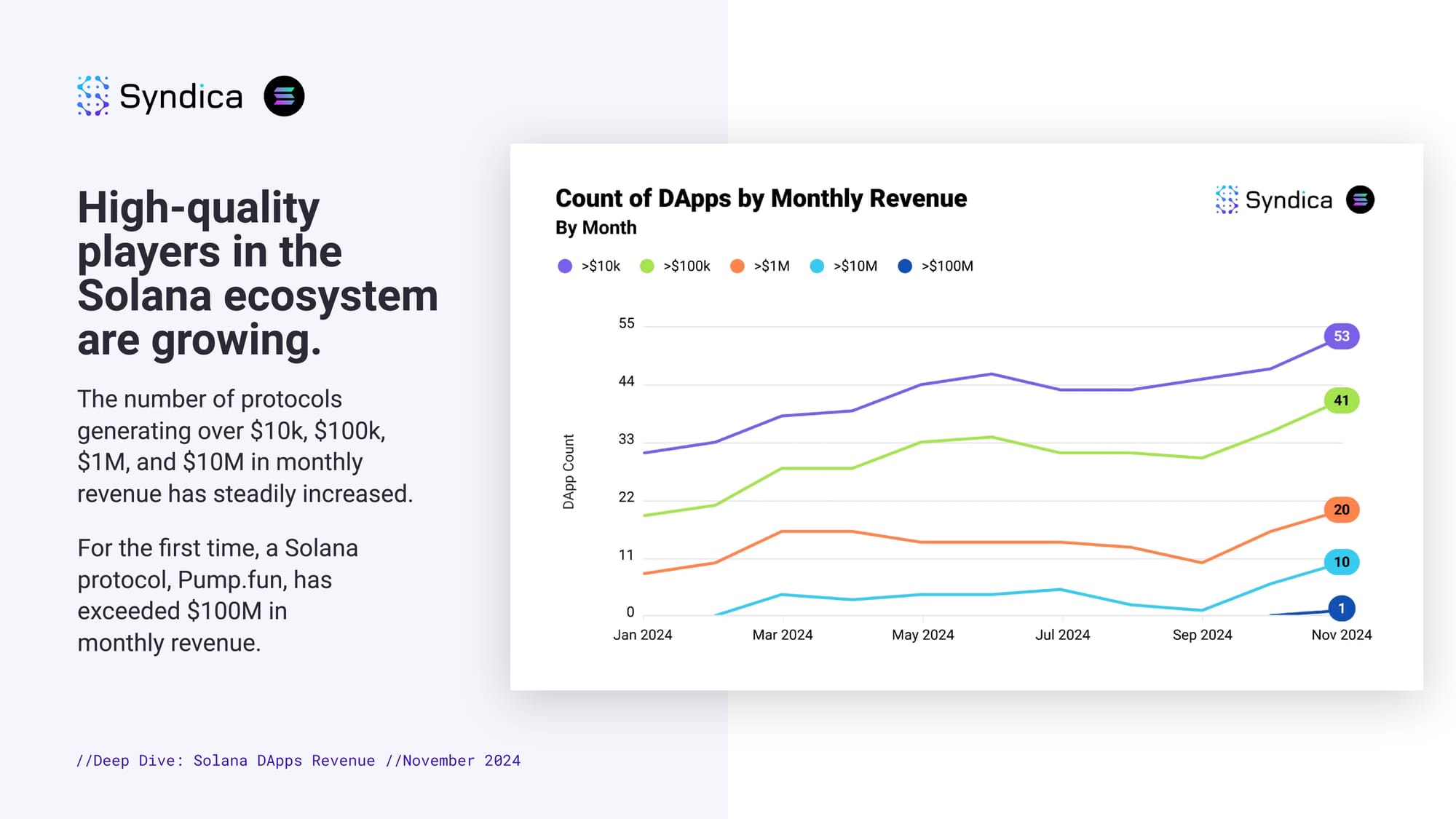

The number of high-quality players in the Solana ecosystem is growing. The number of protocols generating over $10k, $100k, $1M, and $10M in monthly revenue has steadily increased. For the first time, a Solana protocol, Pump.fun, has exceeded $100M in monthly revenue.

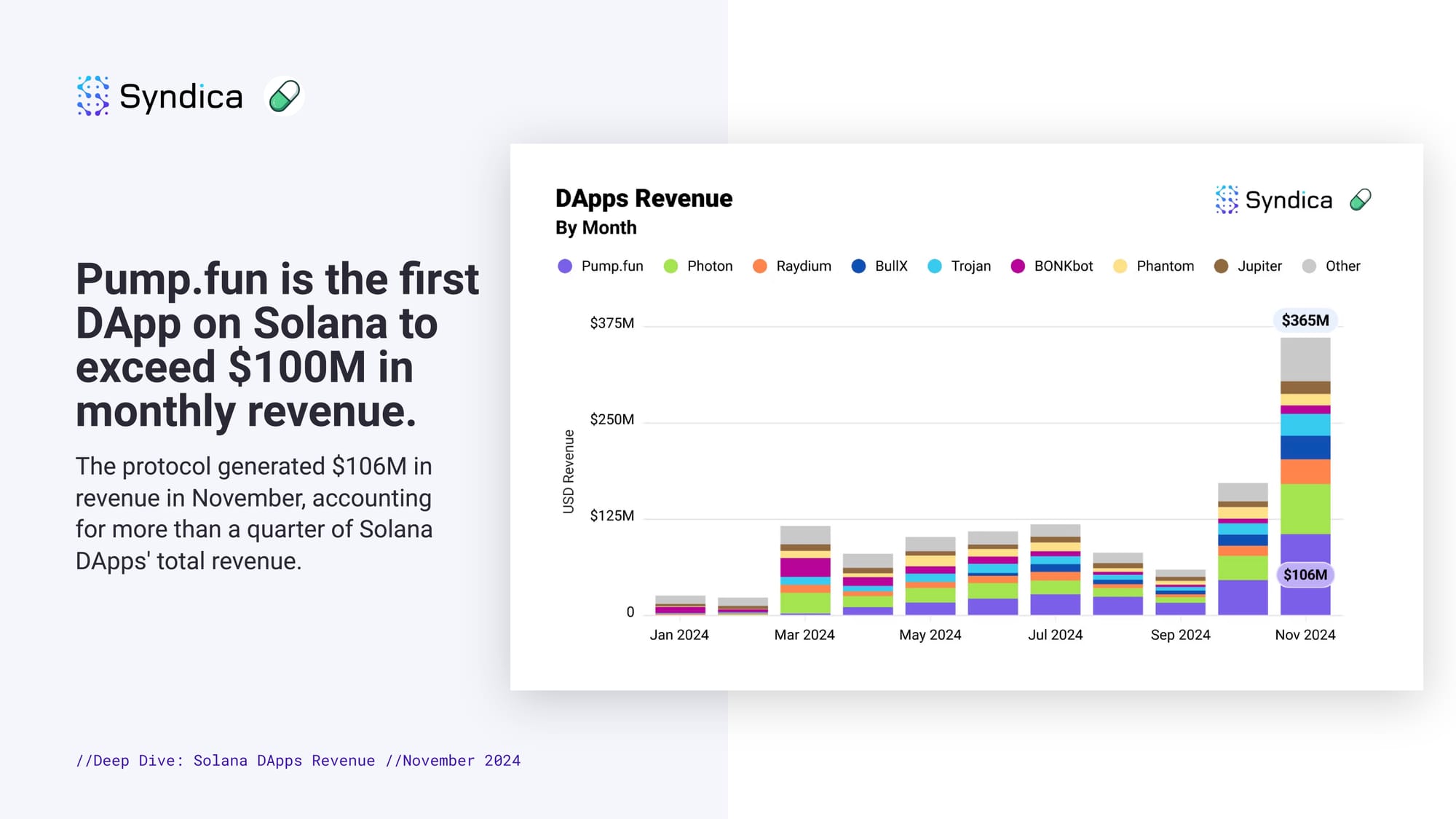

Pump.fun is the first DApp on Solana to exceed $100M in monthly revenue. The protocol generated $106M in revenue in November, accounting for more than a quarter of Solana DApps' total revenue.

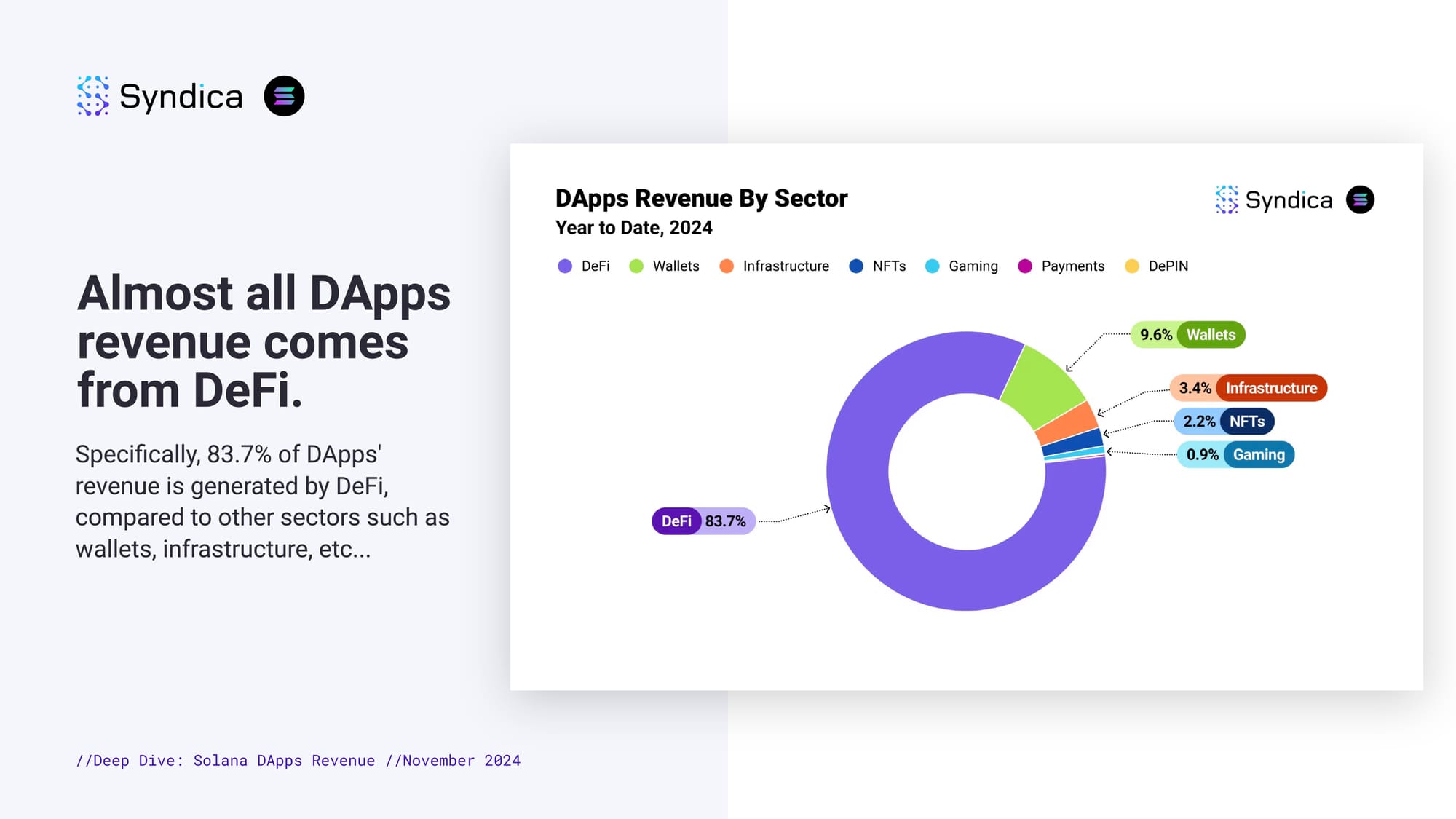

Almost all DApps revenue comes from DeFi. Specifically, 83.7% of DApps' revenue is generated by DeFi, compared to other sectors such as wallets, infrastructure, etc...

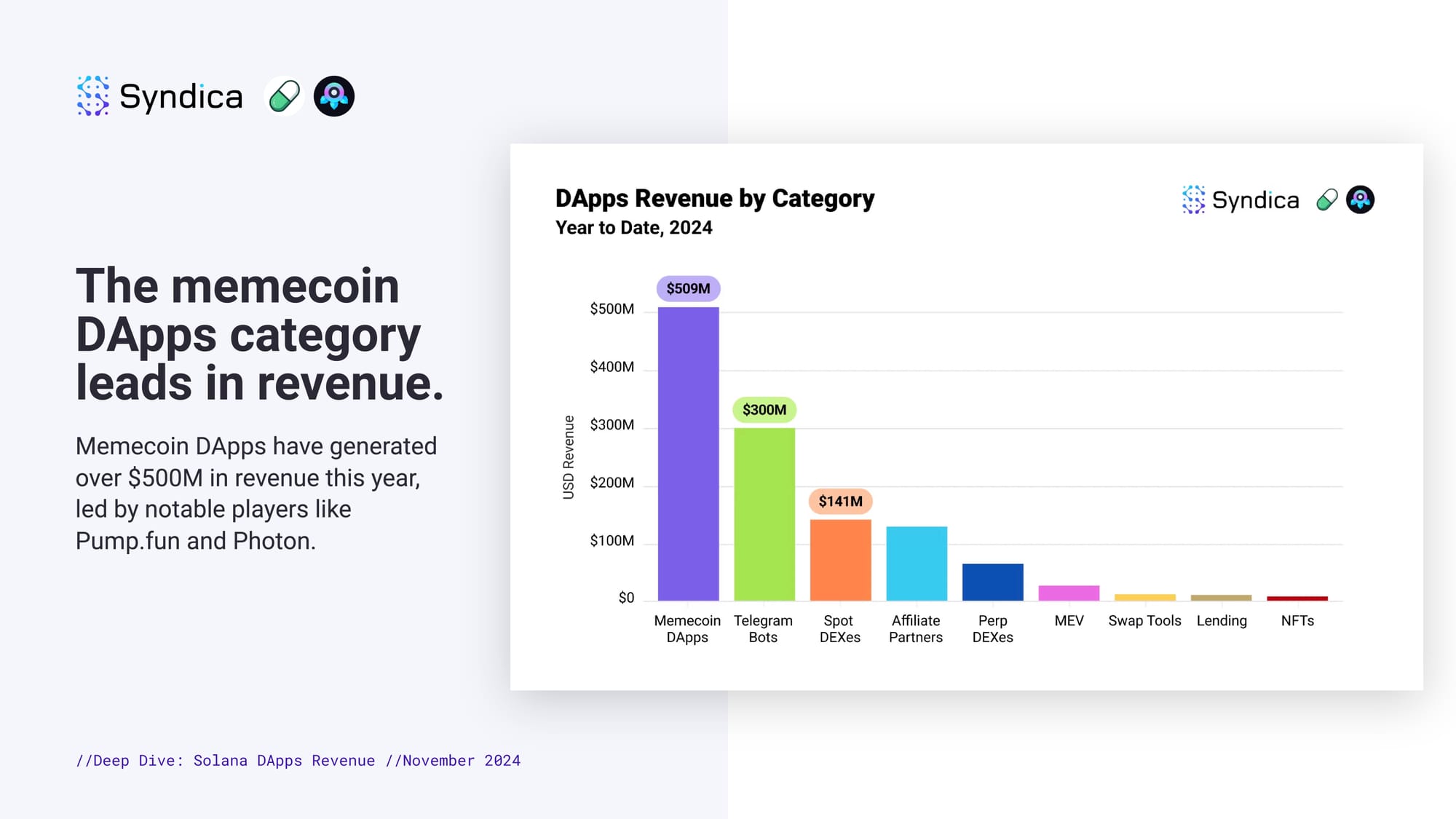

The memecoin DApps category leads in revenue. Memecoin DApps have generated over $500M in revenue this year, led by notable players like Pump.fun and Photon.

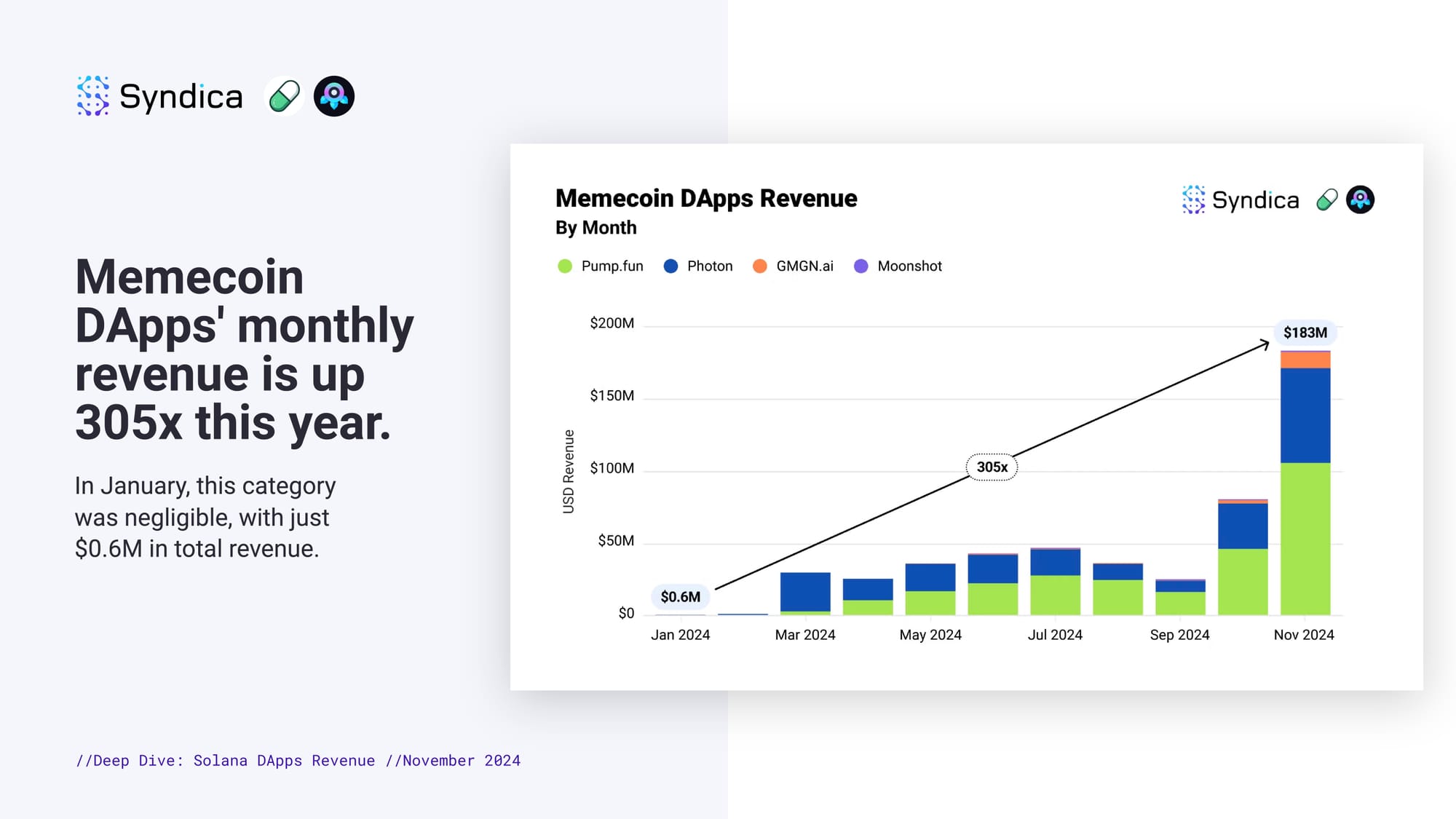

Memecoin DApps' monthly revenue is up 305x this year. In January, this category was negligible, with just $0.6M in total revenue.

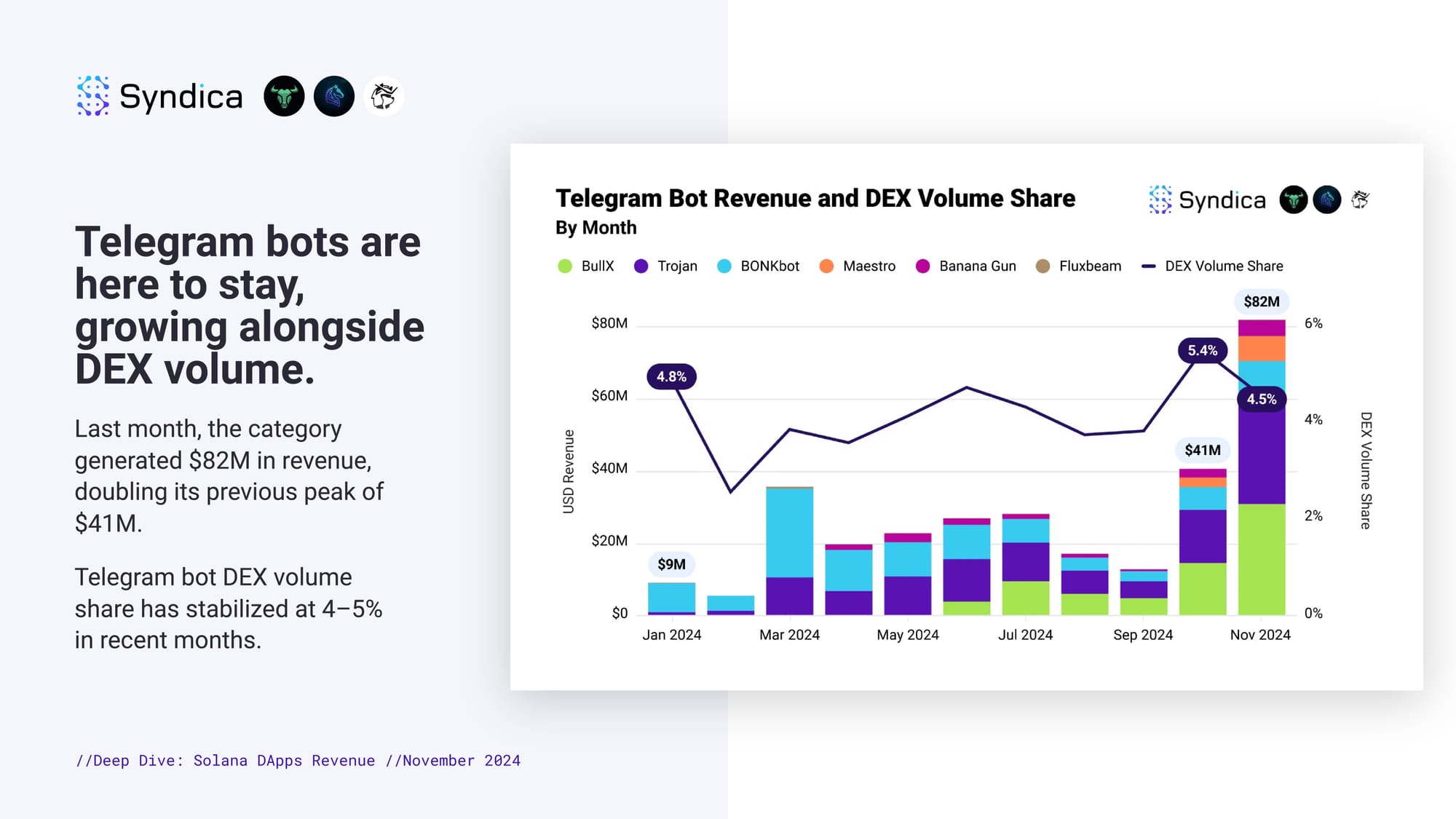

Telegram bots are here to stay, growing alongside DEX volume. Last month, the category generated $82M in revenue, doubling its previous peak of $41M. Telegram bot DEX volume share has stabilized at 4–5% in recent months.

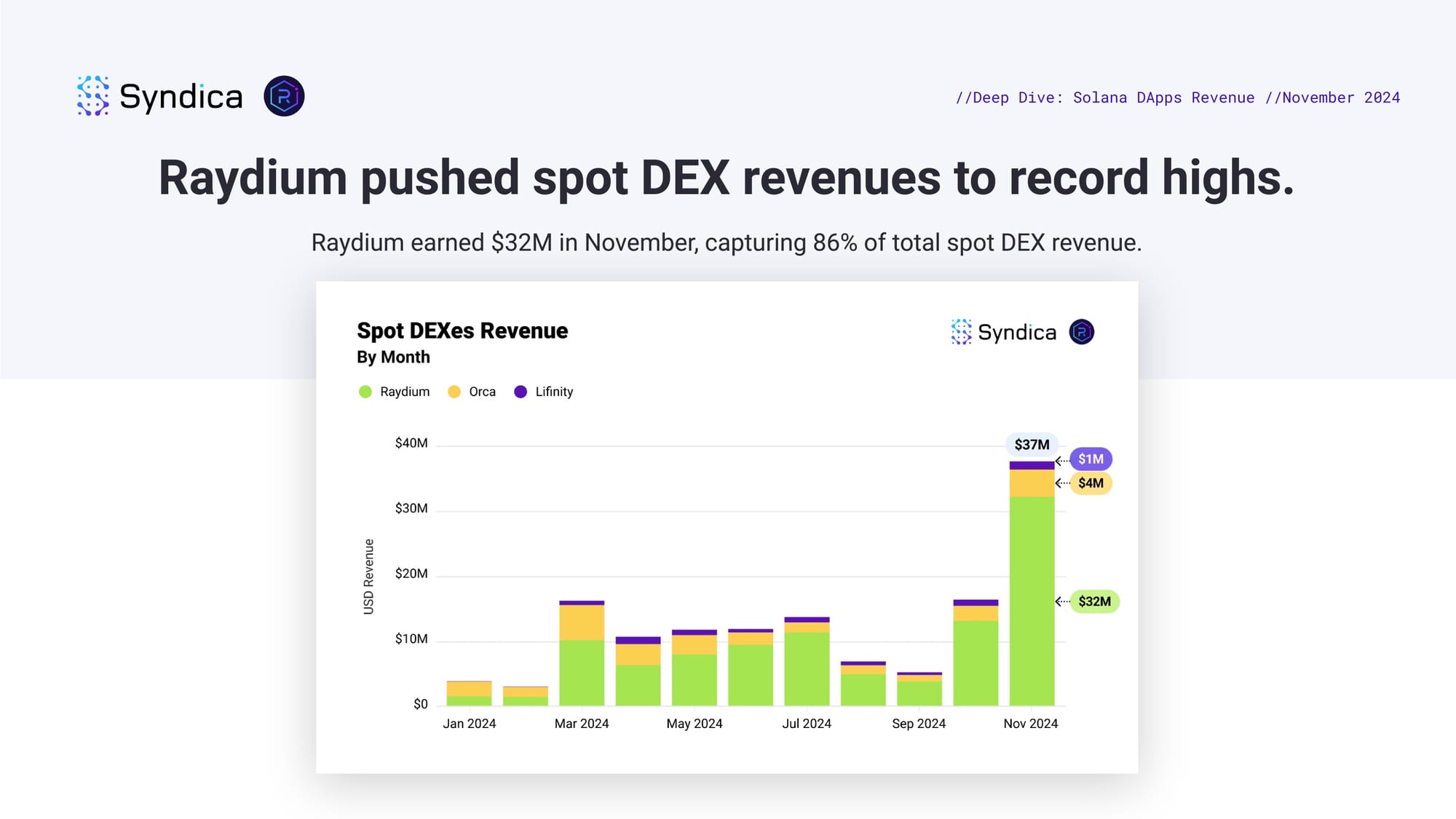

Raydium pushed spot DEX revenues to record highs. Raydium earned $32M in November, capturing 86% of total spot DEX revenue.

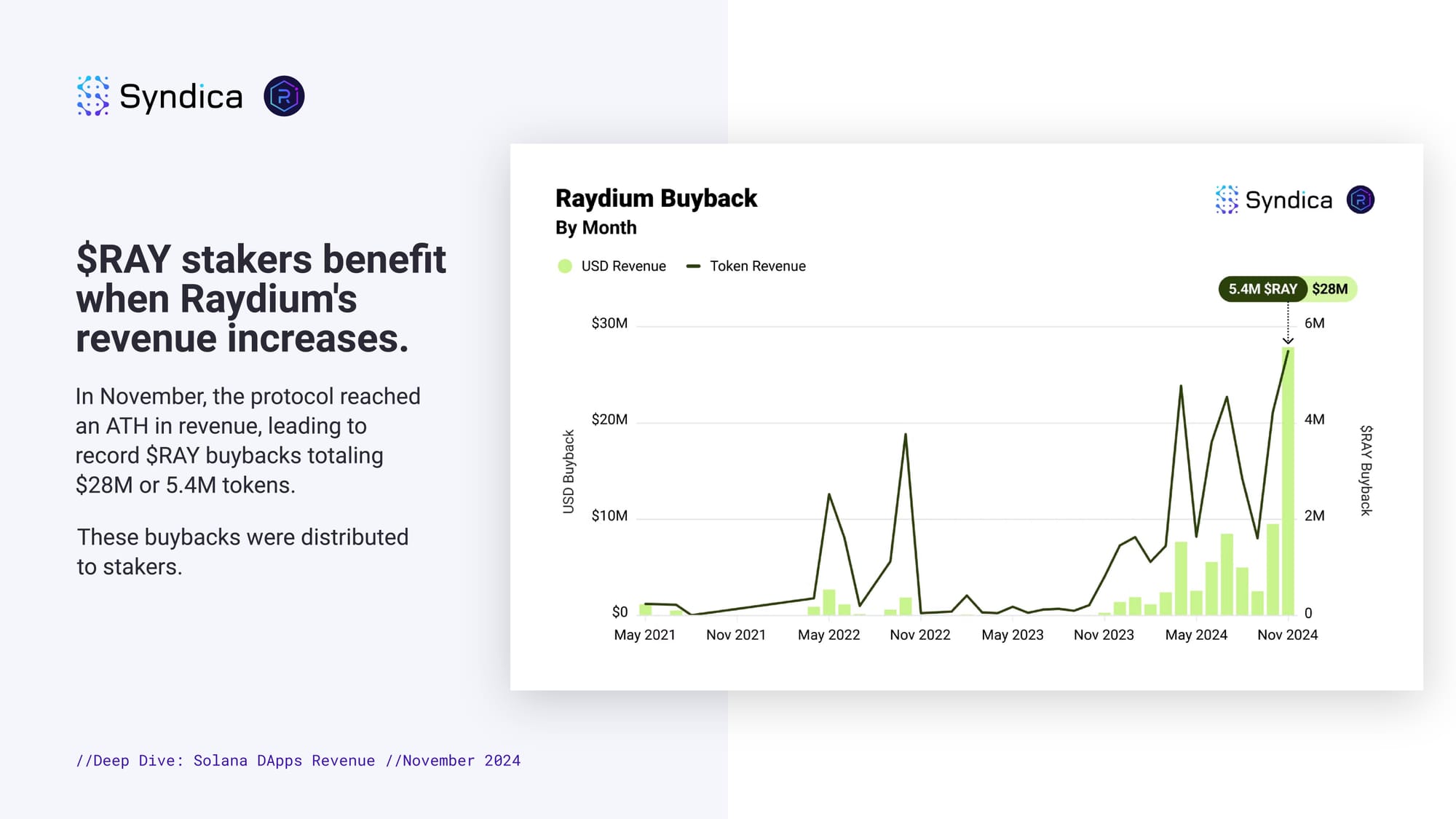

$RAY stakers benefit when Raydium's revenue increases. In November, the protocol reached an ATH in revenue, leading to record $RAY buybacks totaling $28M or 5.4M tokens. These buybacks were distributed to stakers.

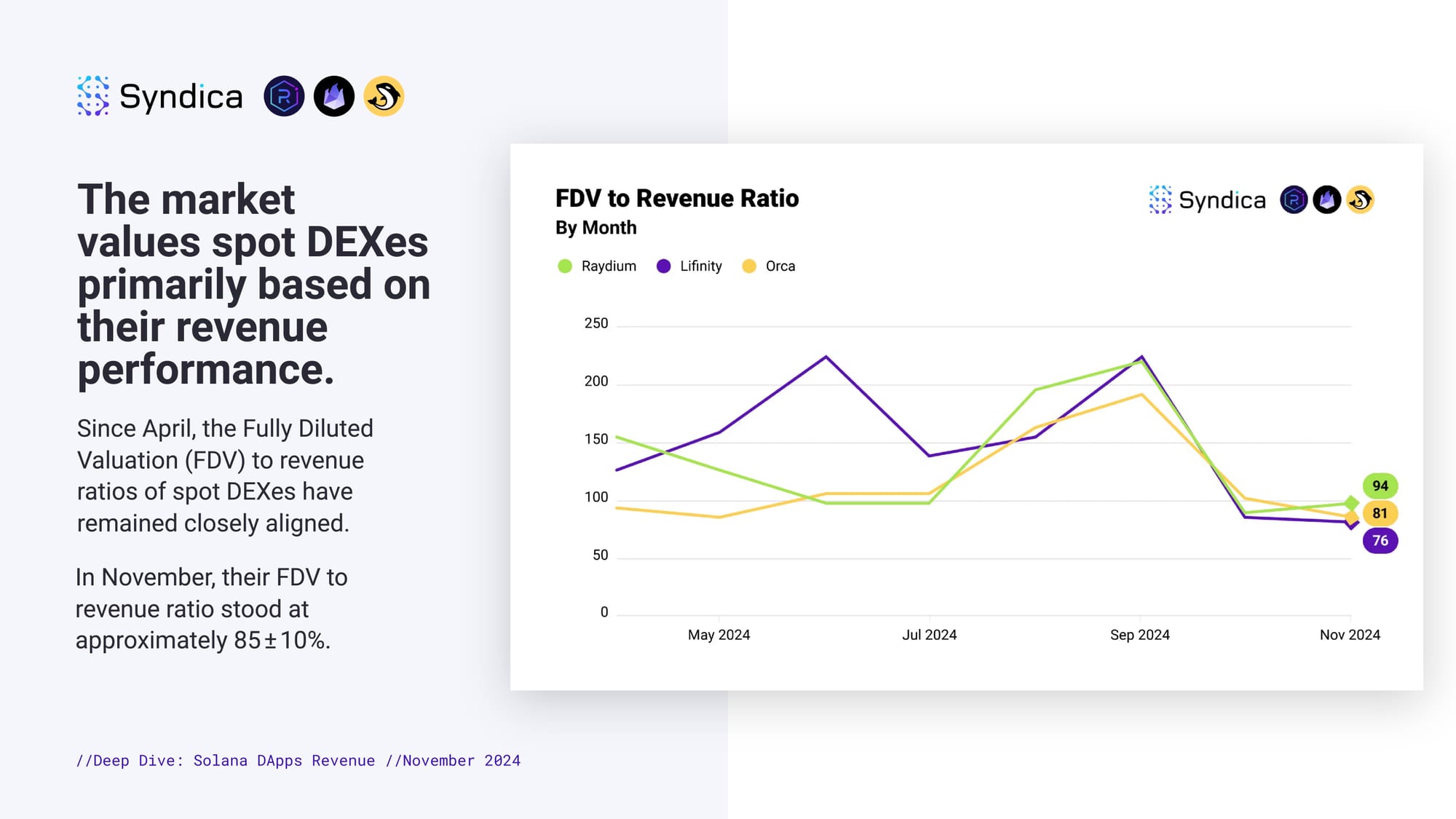

The market values spot DEXes primarily based on their revenue performance. Since April, the Fully Diluted Valuation (FDV) to revenue ratios of spot DEXes have remained closely aligned. In November, their FDV to revenue ratio stood at approximately 85 ± 10%.

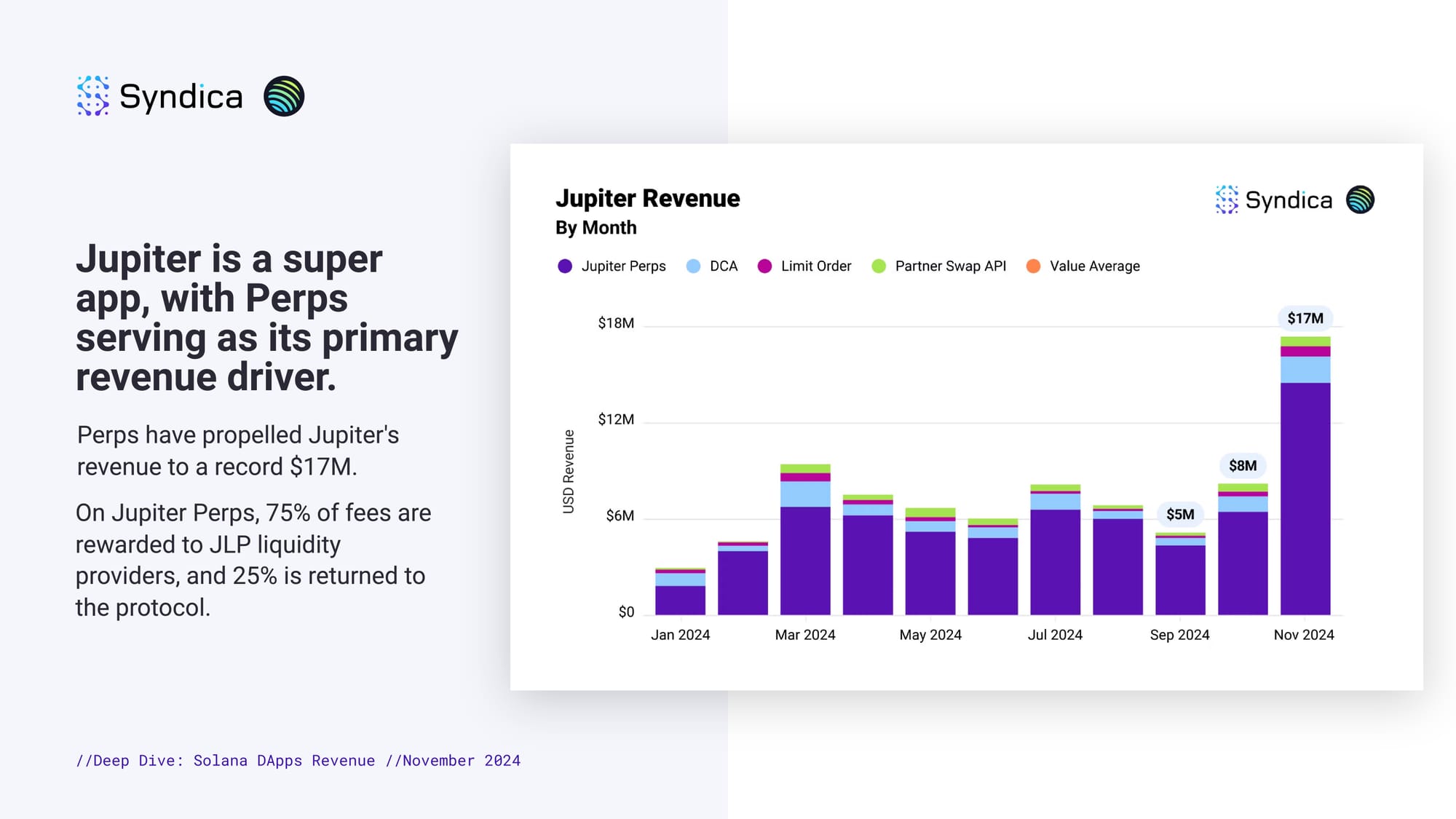

Jupiter is a super app, with Perps serving as its primary revenue driver. Perps have propelled Jupiter's revenue to a record $17M. On Jupiter Perps, 75% of fees are rewarded to JLP liquidity providers, and 25% is returned to the protocol.

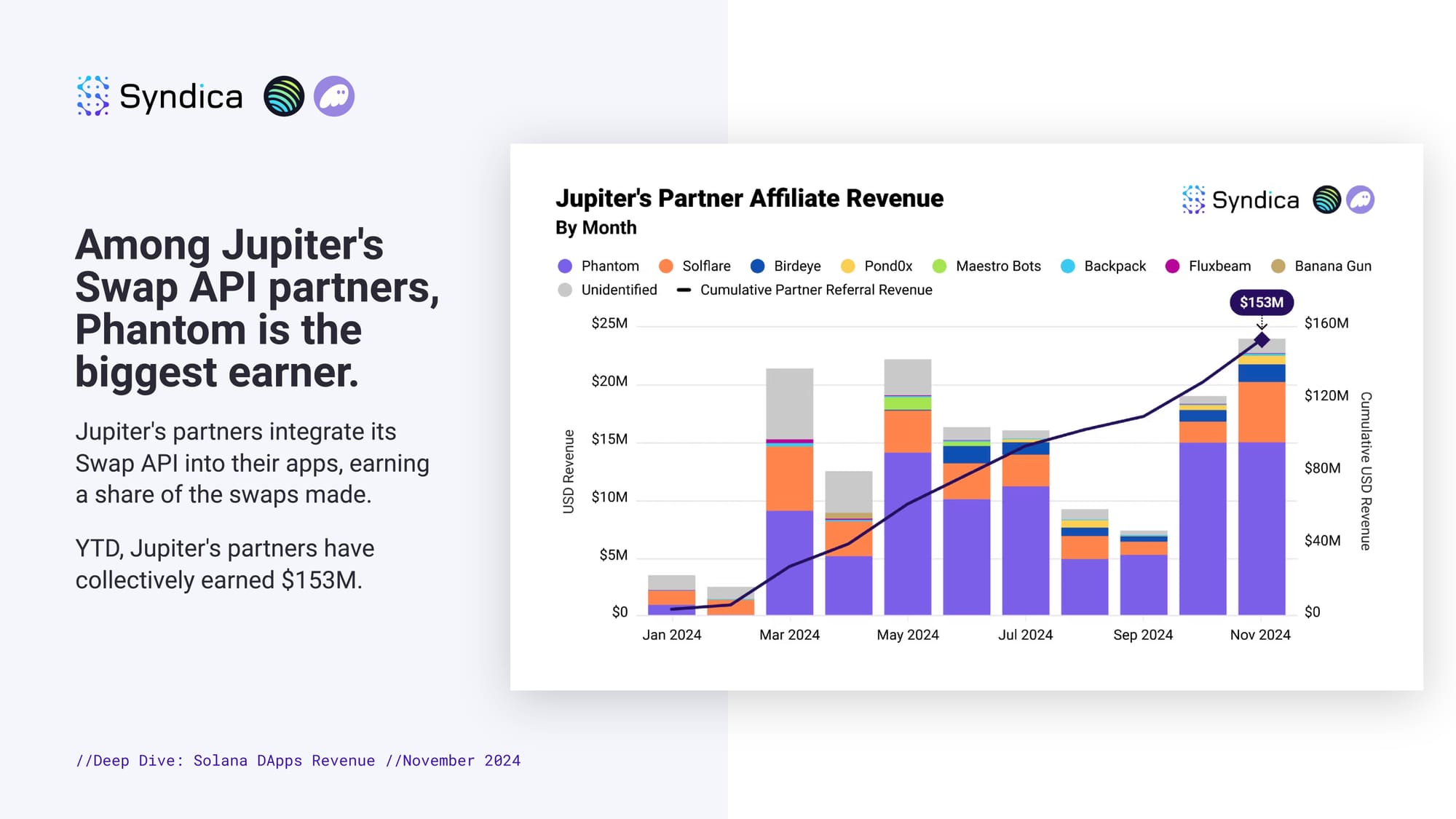

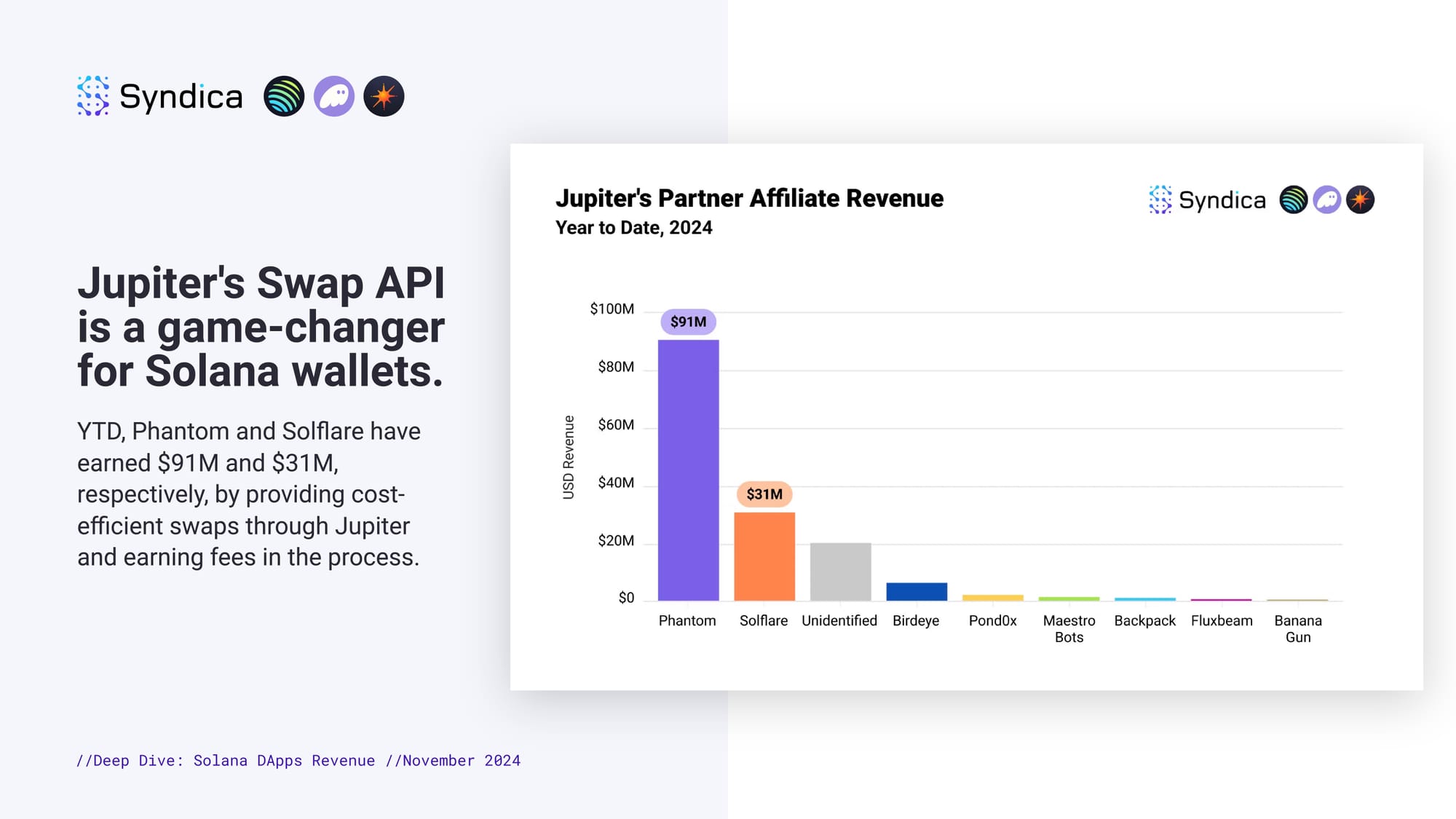

Among Jupiter's Swap API partners, Phantom is the biggest earner. Jupiter's partners integrate its Swap API into their apps, earning a share of the swaps made. YTD, Jupiter's partners have collectively earned $153M.

Jupiter's Swap API is a game-changer for Solana wallets. YTD, Phantom and Solflare have earned $91M and $31M, respectively, by providing cost-efficient swaps through Jupiter and earning fees in the process.

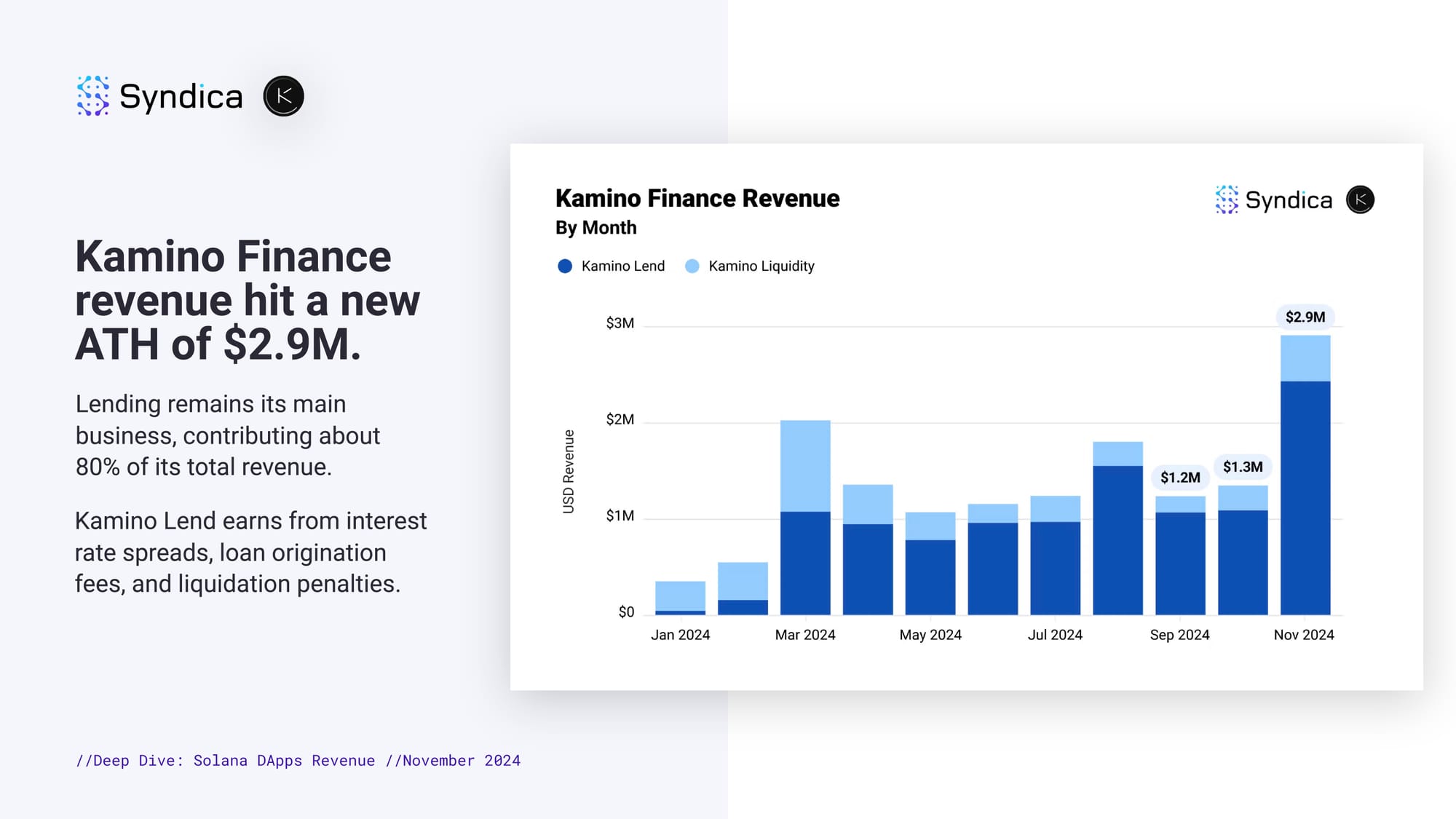

Kamino Finance revenue hit a new ATH of $2.9M. Lending remains its main business, contributing about 80% of its total revenue. Kamino Lend earns from interest rate spreads, loan origination fees, and liquidation penalties.

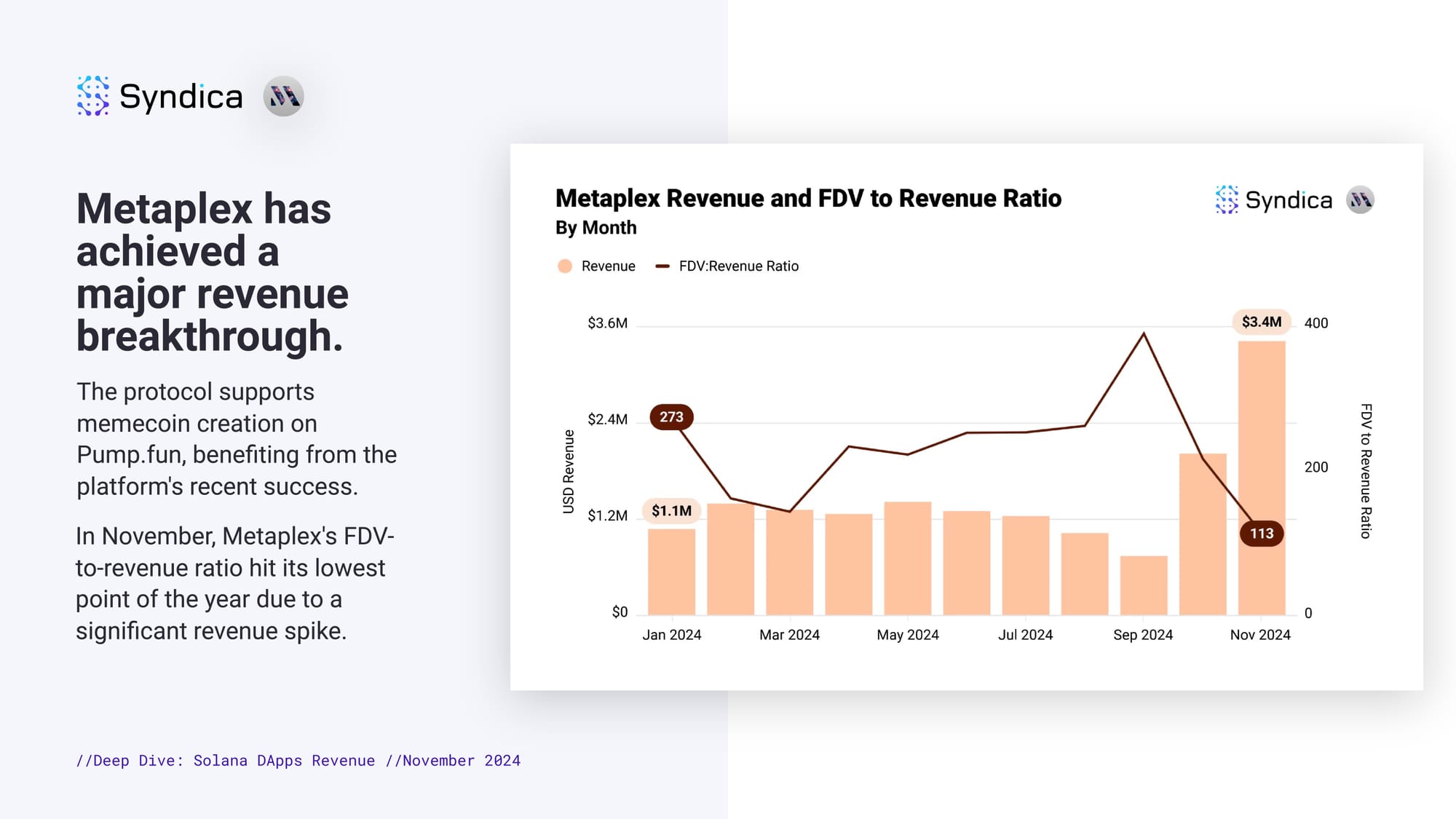

Metaplex has achieved a major revenue breakthrough. The protocol supports memecoin creation on Pump.fun, benefiting from the platform's recent success. In November, Metaplex's FDV-to-revenue ratio hit its lowest point of the year due to a significant revenue spike.

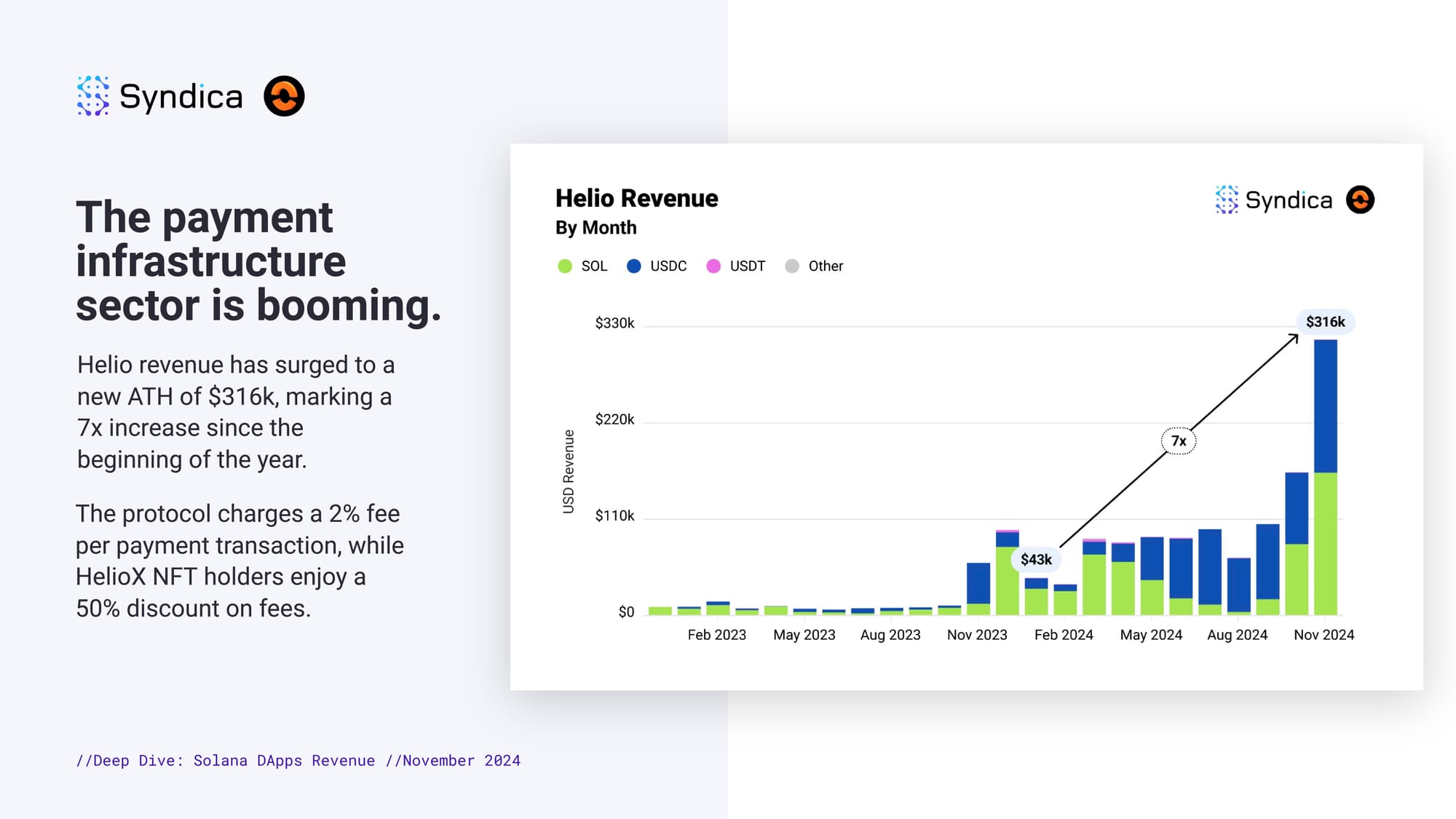

The payment infrastructure sector is booming. Helio revenue has surged to a new ATH of $316k, marking a 7x increase since the beginning of the year. The protocol charges a 2% fee per payment transaction, while HelioX NFT holders enjoy a 50% discount on fees.

The DePIN sector is beginning to show early signs of revenue generation. Protocols such as Render, Nosana, Helium, and Hivemapper have recently seen strong demand for their services, driving notable revenue growth. Render’s decentralized compute network is currently the largest revenue driver in the DePIN sector.