Deep Dive: Solana DApps Revenue - November 2025

Deep Dive: Solana DApps Revenue - November 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DApps Revenue - November 2025

Part I - DApps Revenue Overview

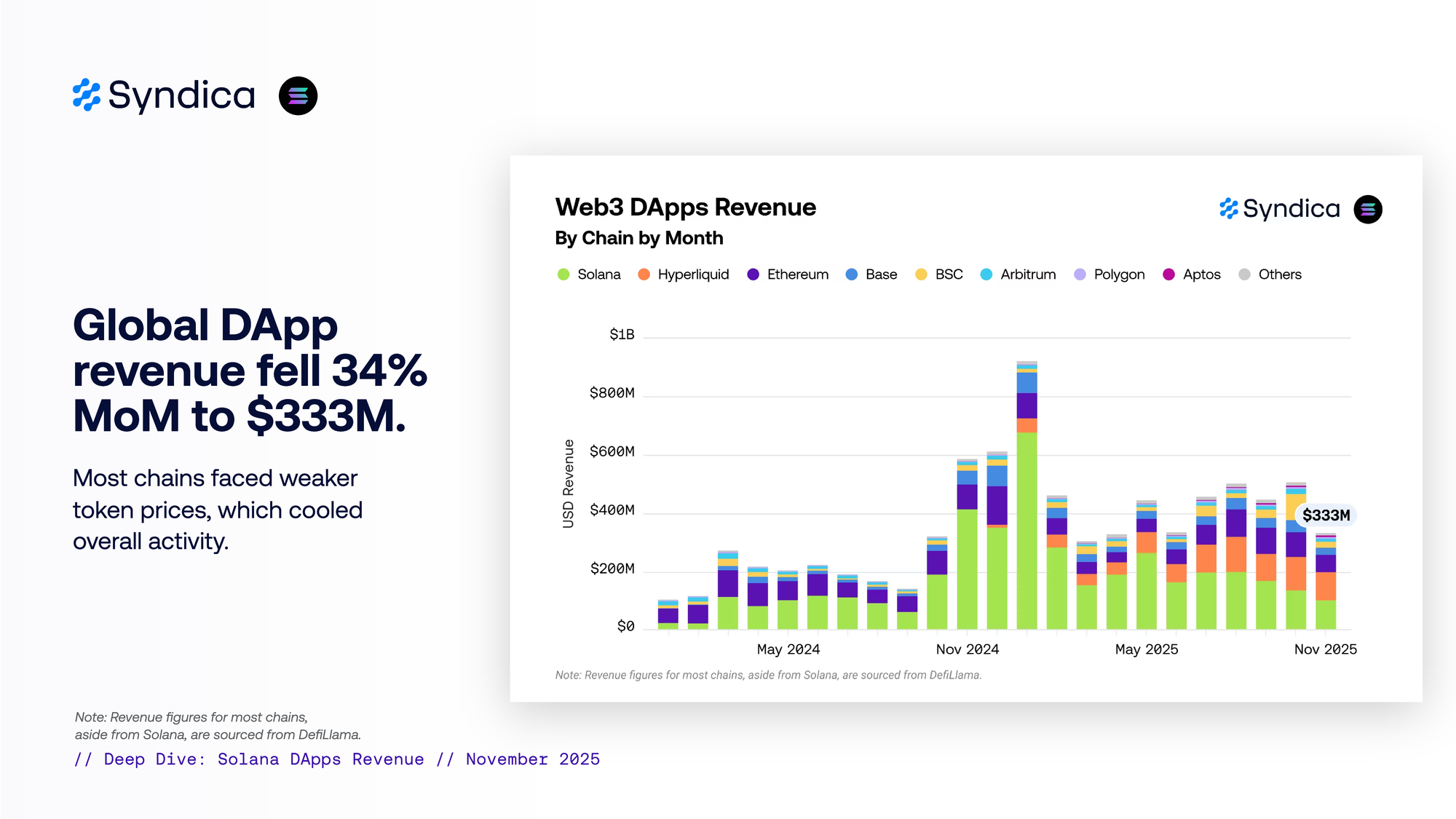

Global DApp revenue fell 34% MoM to $333M. Most chains faced weaker token prices, which cooled overall activity.

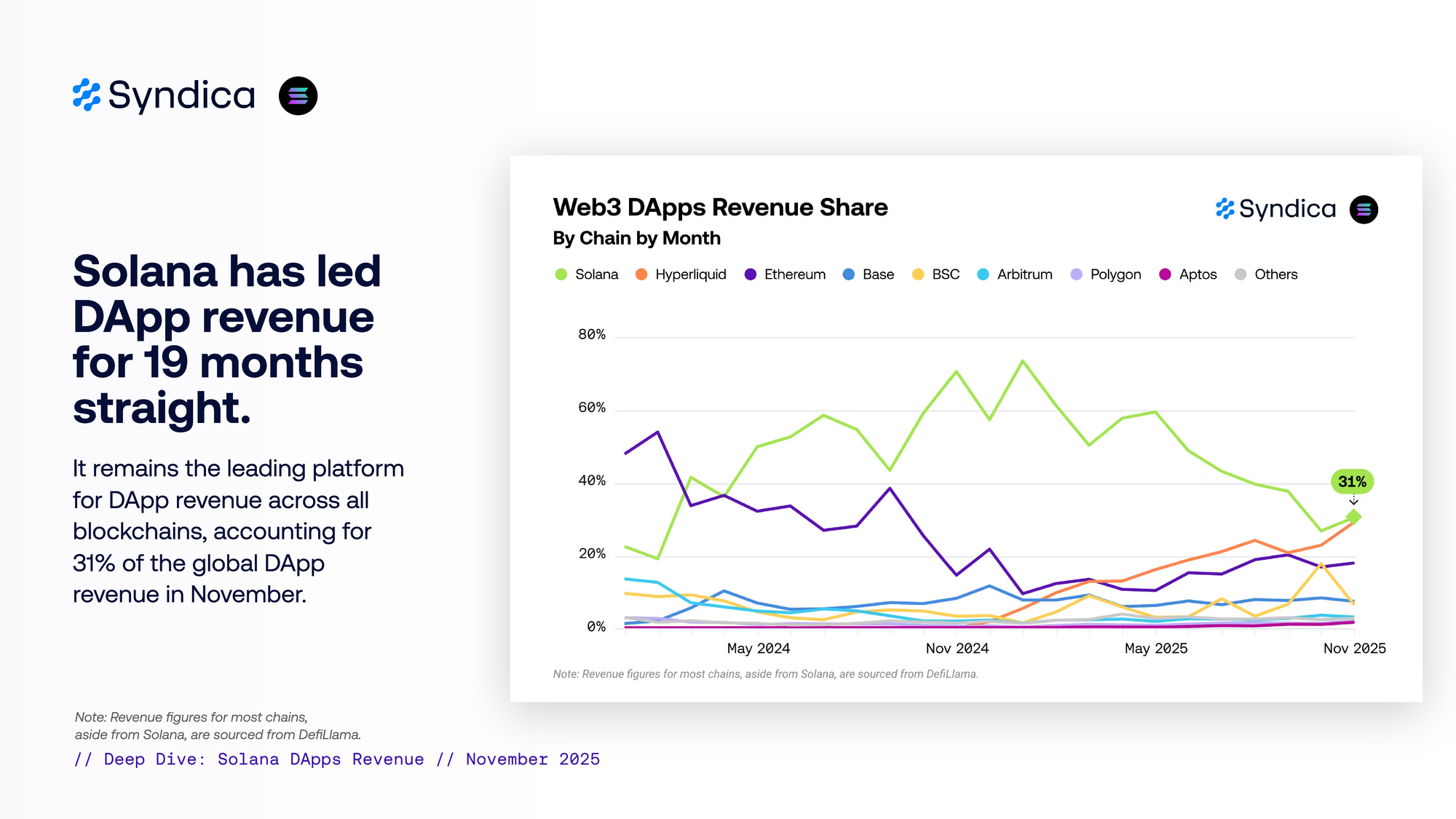

Solana has led DApp revenue for 19 months straight. It remains the leading platform for DApp revenue across all blockchains, accounting for 31% of the global DApp revenue in November.

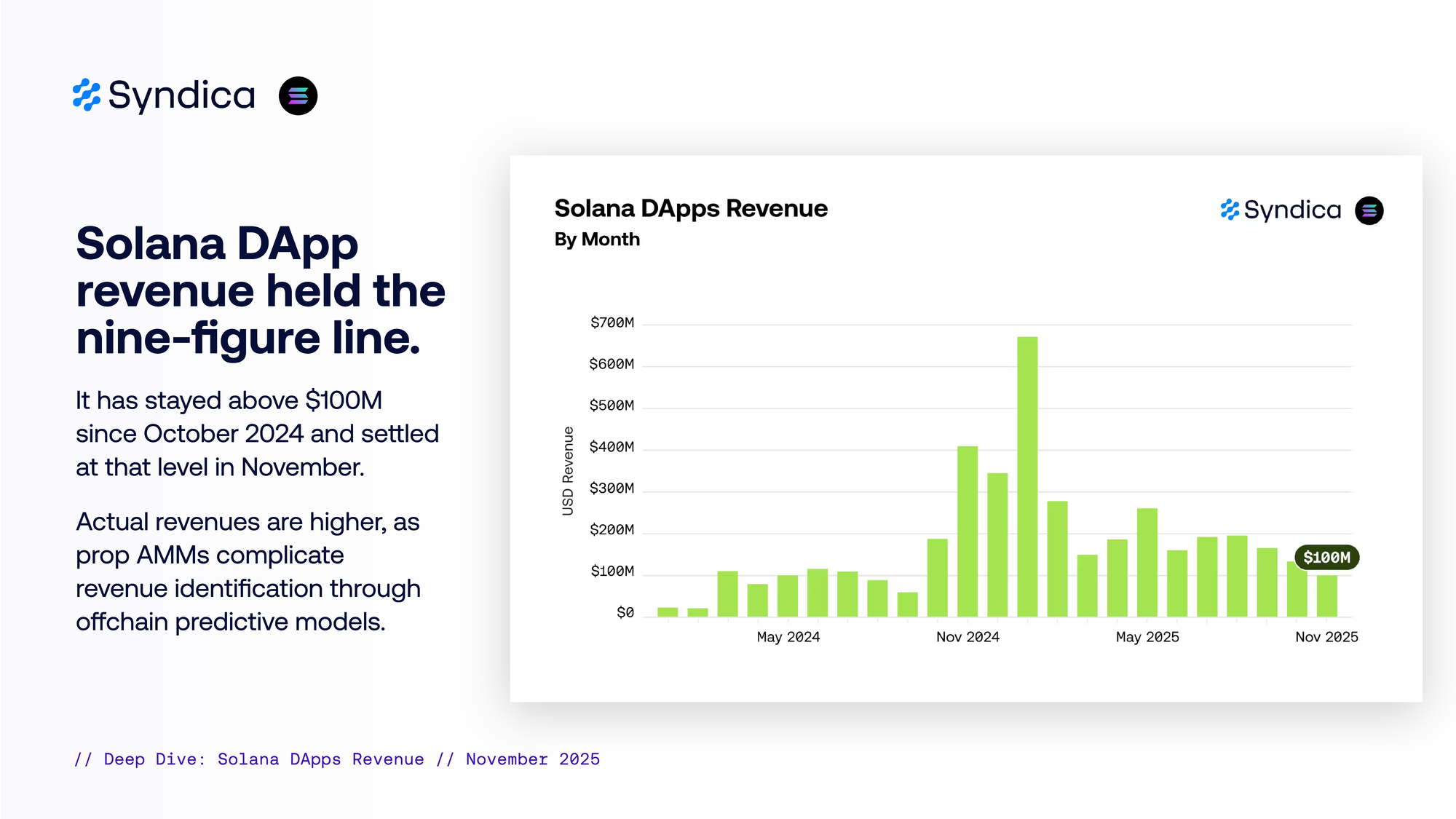

Solana DApp revenue held the nine-figure line. It has stayed above $100M since October 2024 and settled at that level in November. Actual revenues are higher, as prop AMMs complicate revenue identification through offchain predictive models.

Part II - Top-Earning DApps

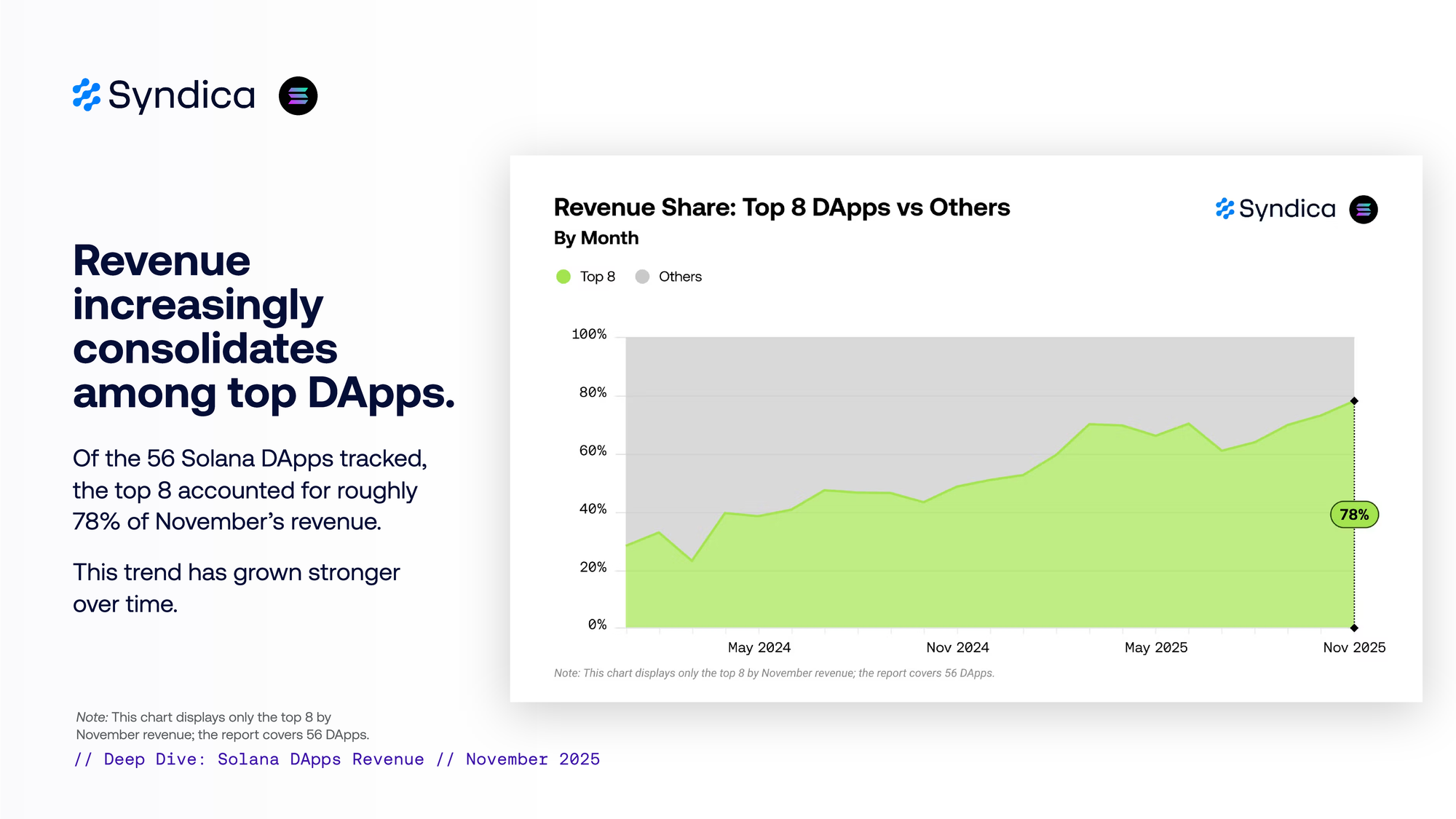

Revenue increasingly consolidates among top DApps. Of the 56 Solana DApps tracked, the top 8 accounted for roughly 78% of November’s revenue. This trend has grown stronger over time.

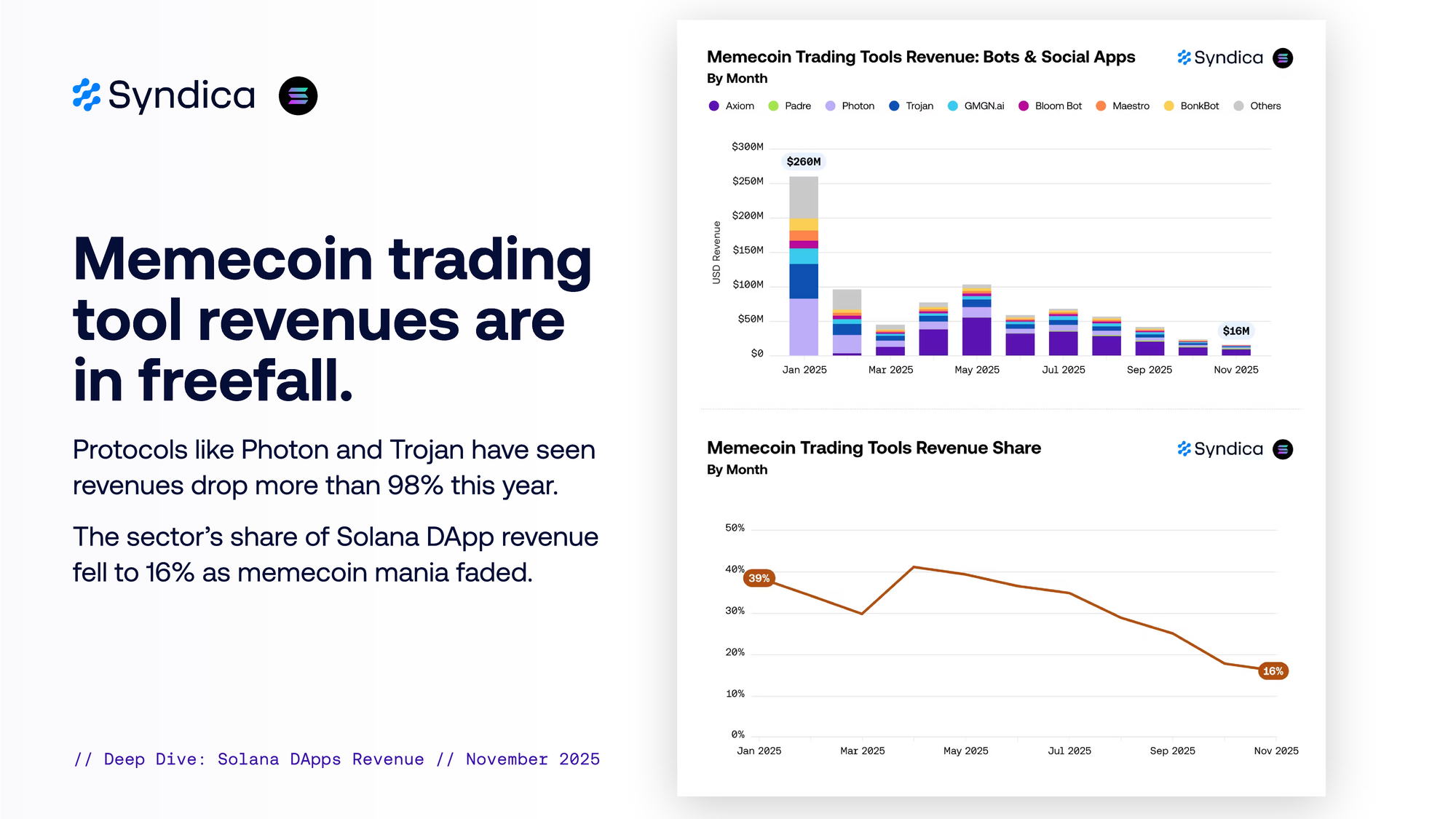

Memecoin trading tool revenues are in freefall. Protocols like Photon and Trojan have seen revenues drop more than 98% this year. The sector’s share of Solana DApp revenue fell to 16% as memecoin mania faded.

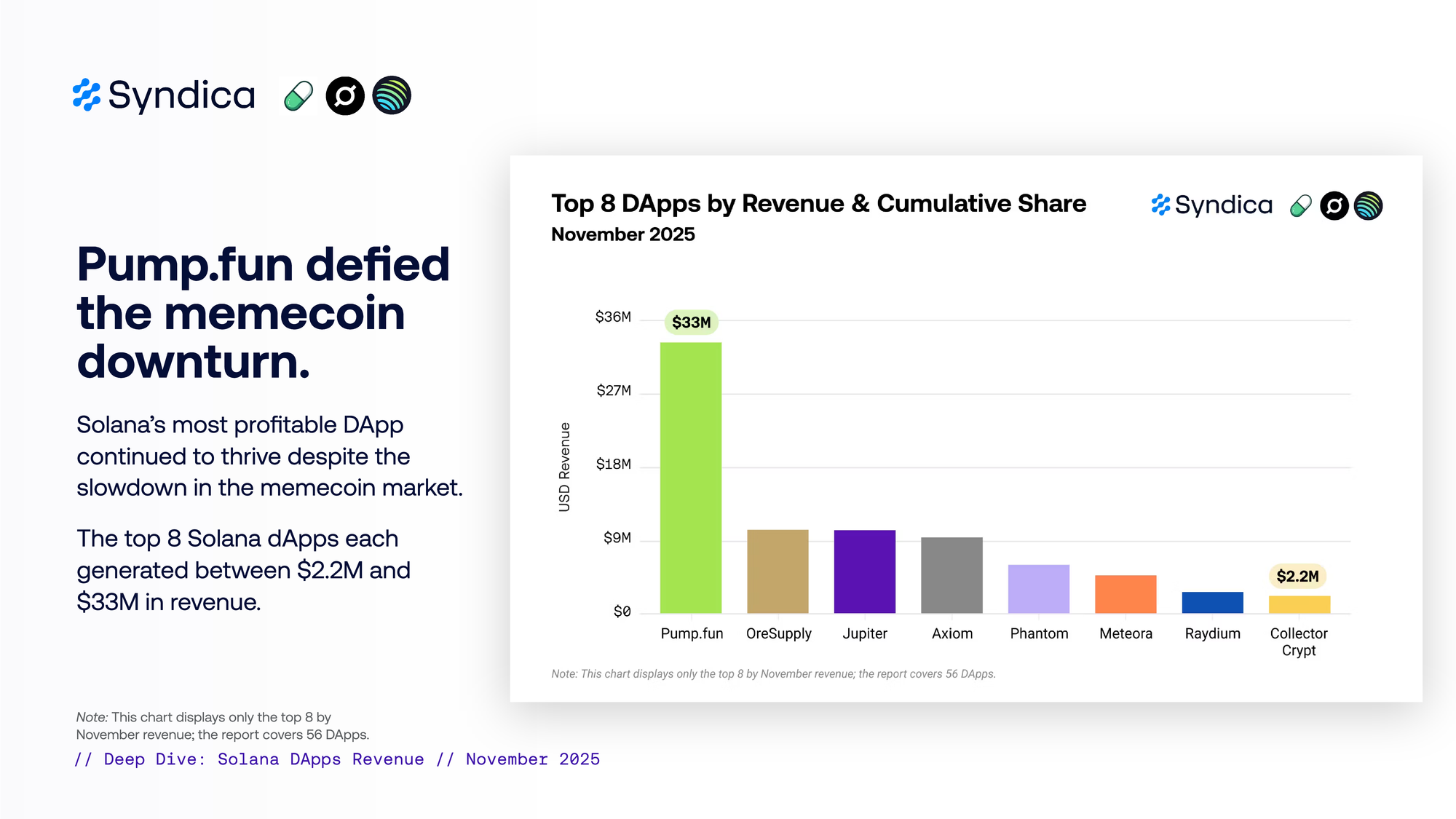

Pump.fun defied the memecoin downturn. Solana’s most profitable DApp continued to thrive despite the slowdown in the memecoin market. The top 8 Solana dApps each generated between $2.2M and $33M in revenue.

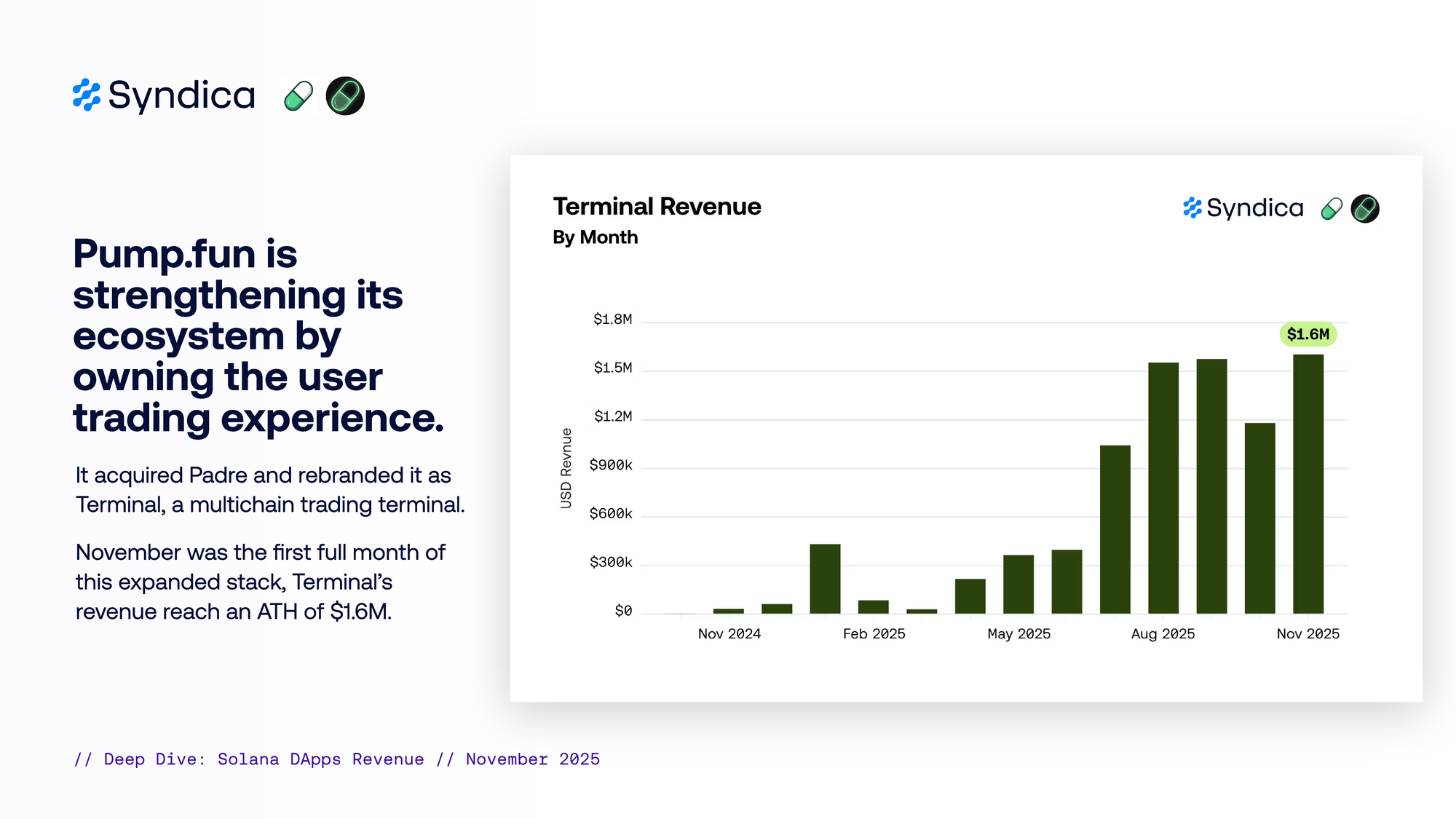

Pump.fun is strengthening its ecosystem by owning the user trading experience. It acquired Padre and rebranded it as Terminal, a multichain trading terminal. November was the first full month of this expanded stack, Terminal’s revenue reach an ATH of $1.6M.

Pump.fun accounted for 90% of the revenue generated from Solana memecoin launches. However, the memecoin launchpad sector reached a new 12-month low, with revenue declining to $36M.

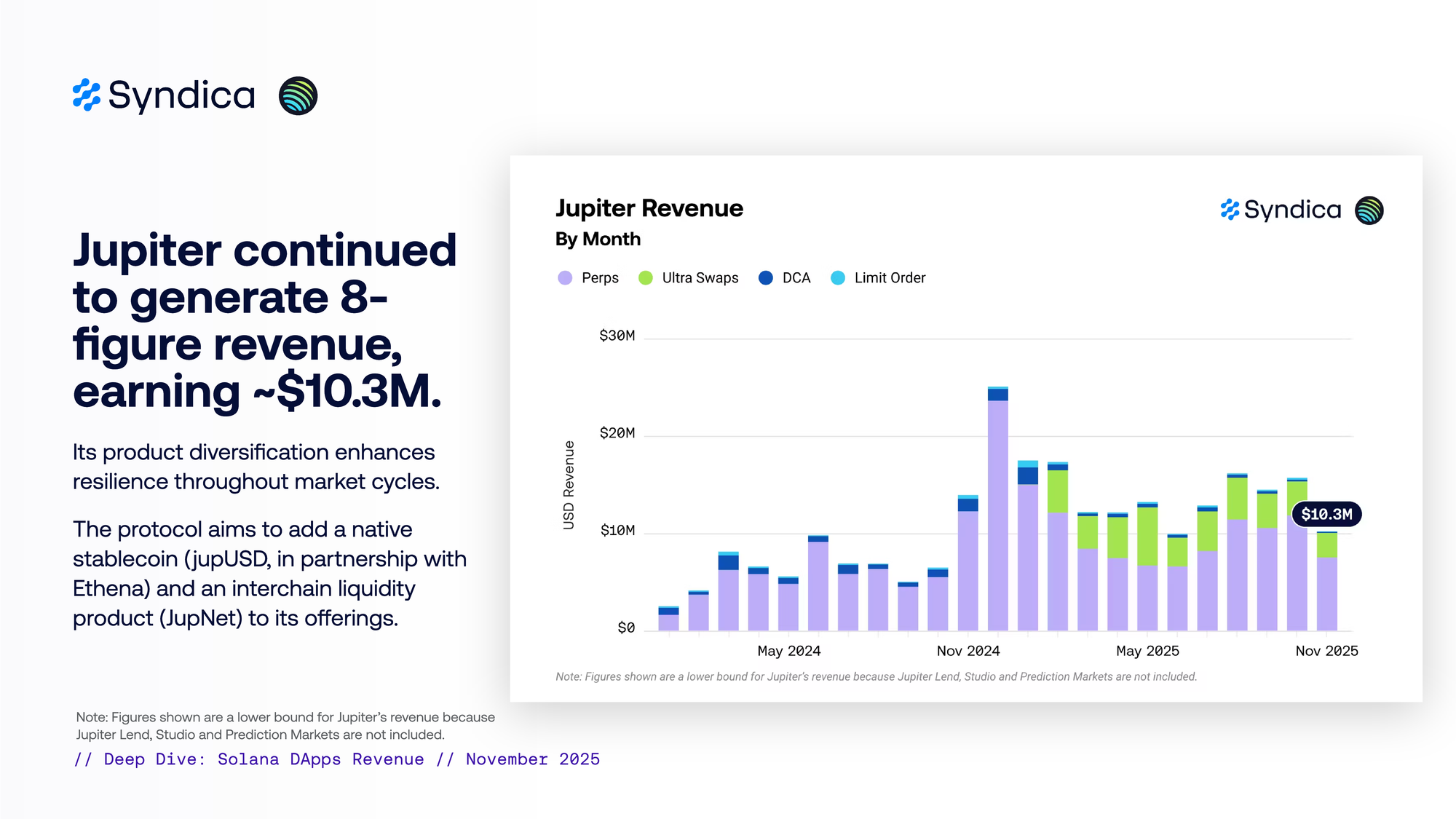

Jupiter continued to generate 8-figure revenue, earning ~$10.3M. Its product diversification enhances resilience throughout market cycles. The protocol aims to add a native stablecoin (jupUSD, in partnership with Ethena) and an interchain liquidity product (JupNet) to its offerings.

Part III - Physical Trading Card Games (TCG)

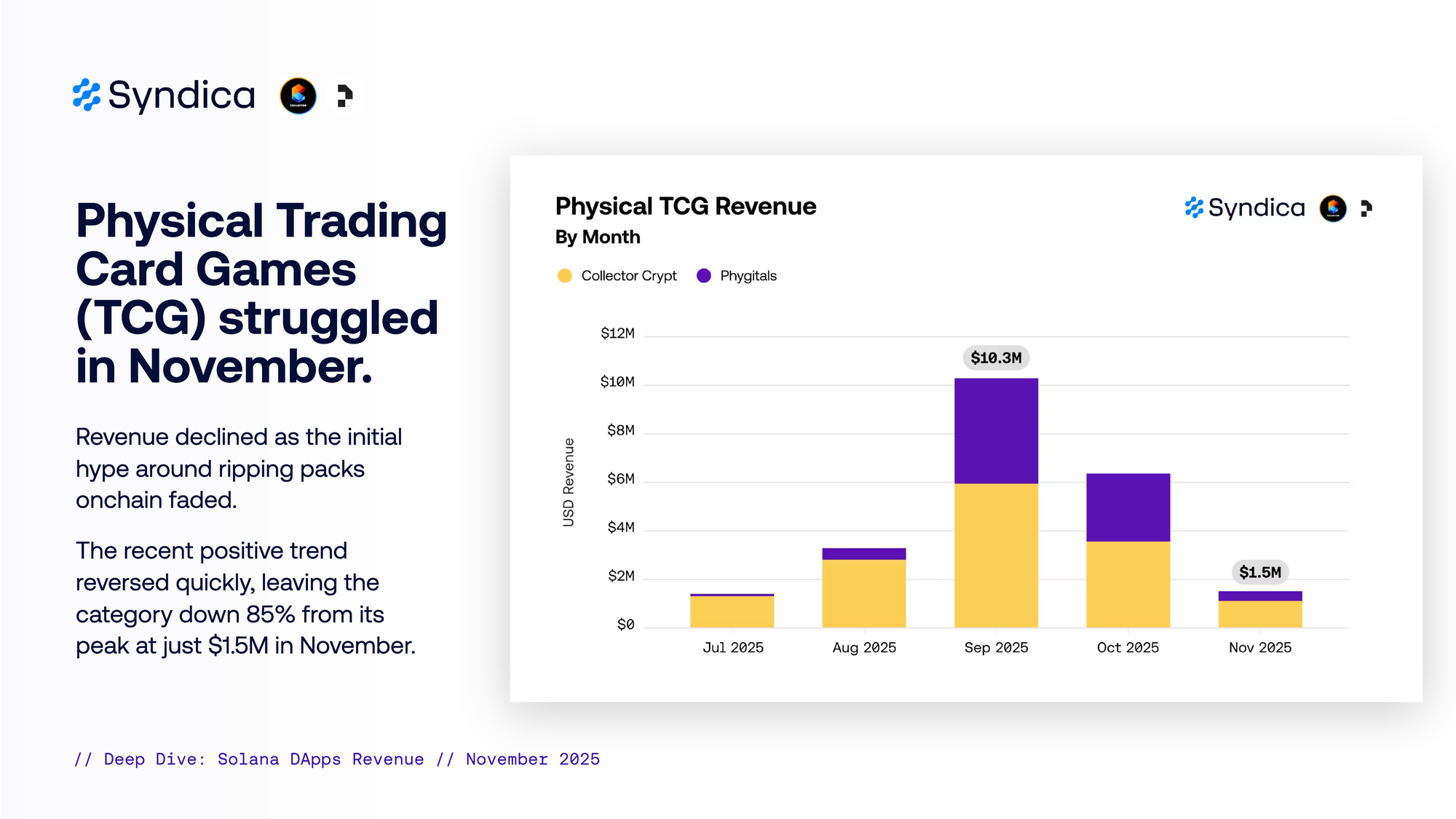

Physical Trading Card Games (TCG) struggled in November. Revenue declined as the initial hype around ripping packs onchain faded. The recent positive trend reversed quickly, leaving the category down 85% from its peak at just $1.5M in November.

Part IV - Infrastructure Revenue

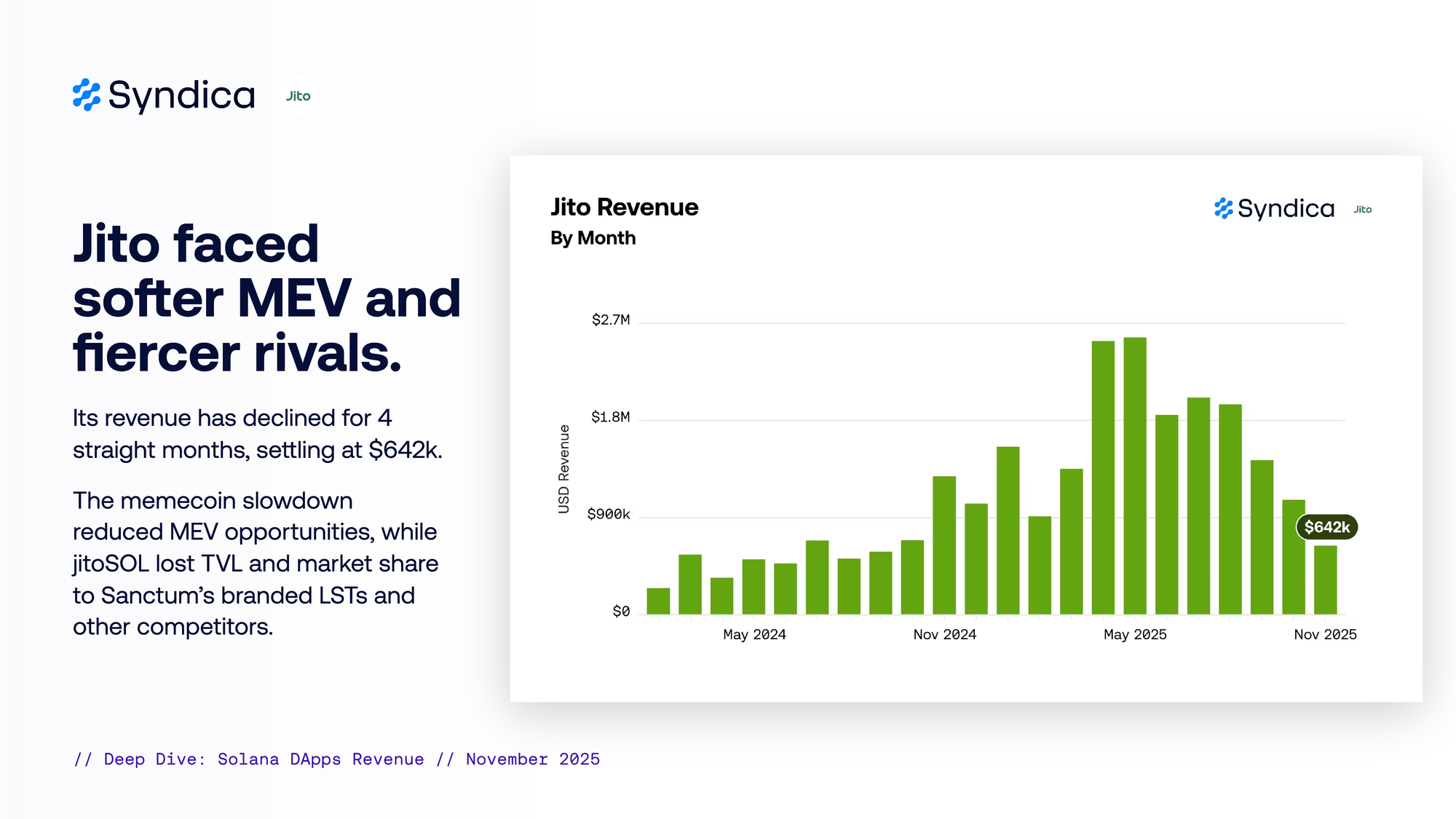

Jito faced softer MEV and fiercer rivals. Its revenue has declined for 4 straight months, settling at $642k. The memecoin slowdown reduced MEV opportunities, while jitoSOL lost TVL and market share to Sanctum’s branded LSTs and other competitors.

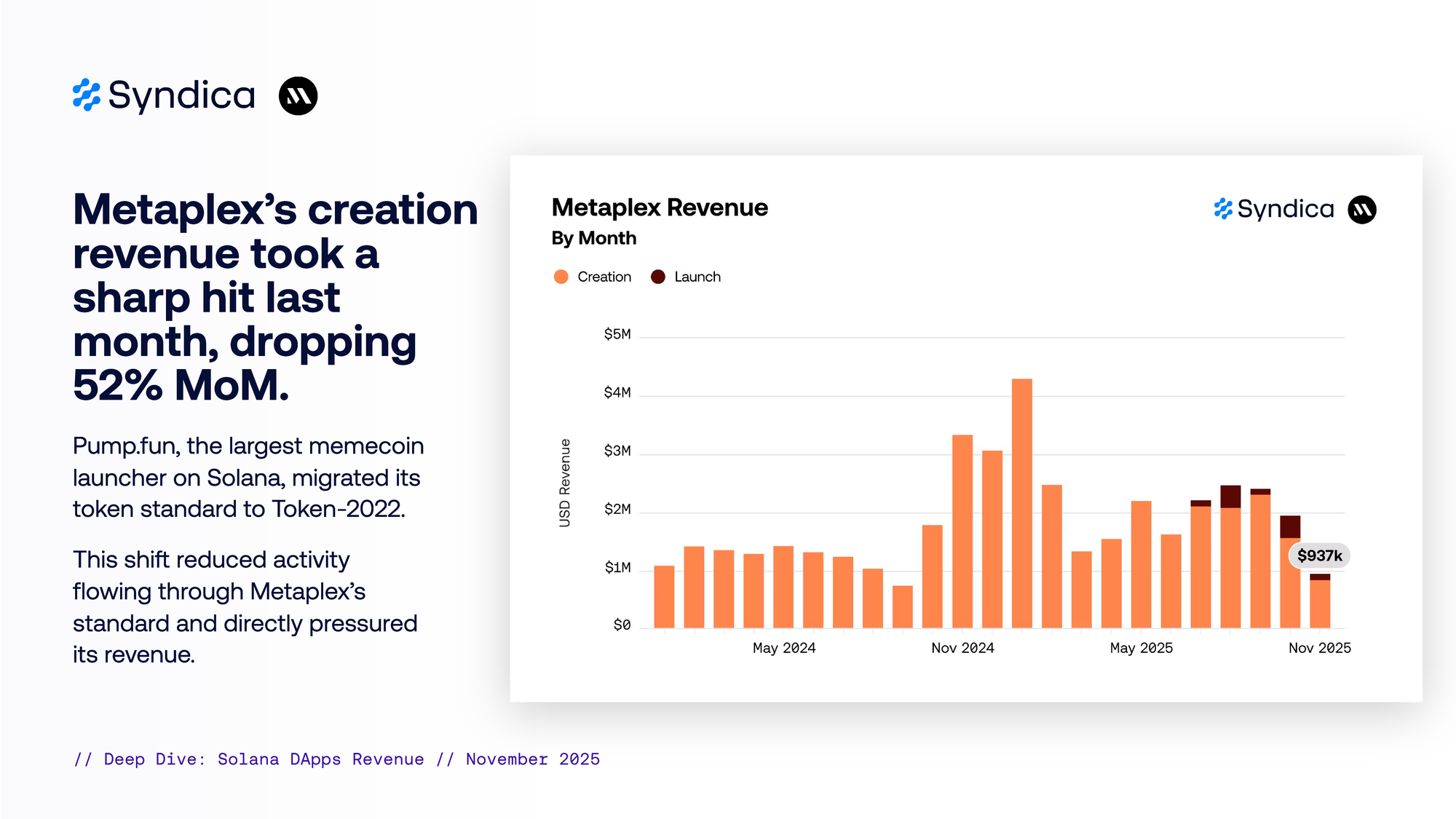

Metaplex’s creation revenue took a sharp hit last month, dropping 52% MoM. Pump.fun, the largest memecoin launcher on Solana, migrated its token standard to Token-2022. This shift reduced activity flowing through Metaplex’s standard and directly pressured its revenue.

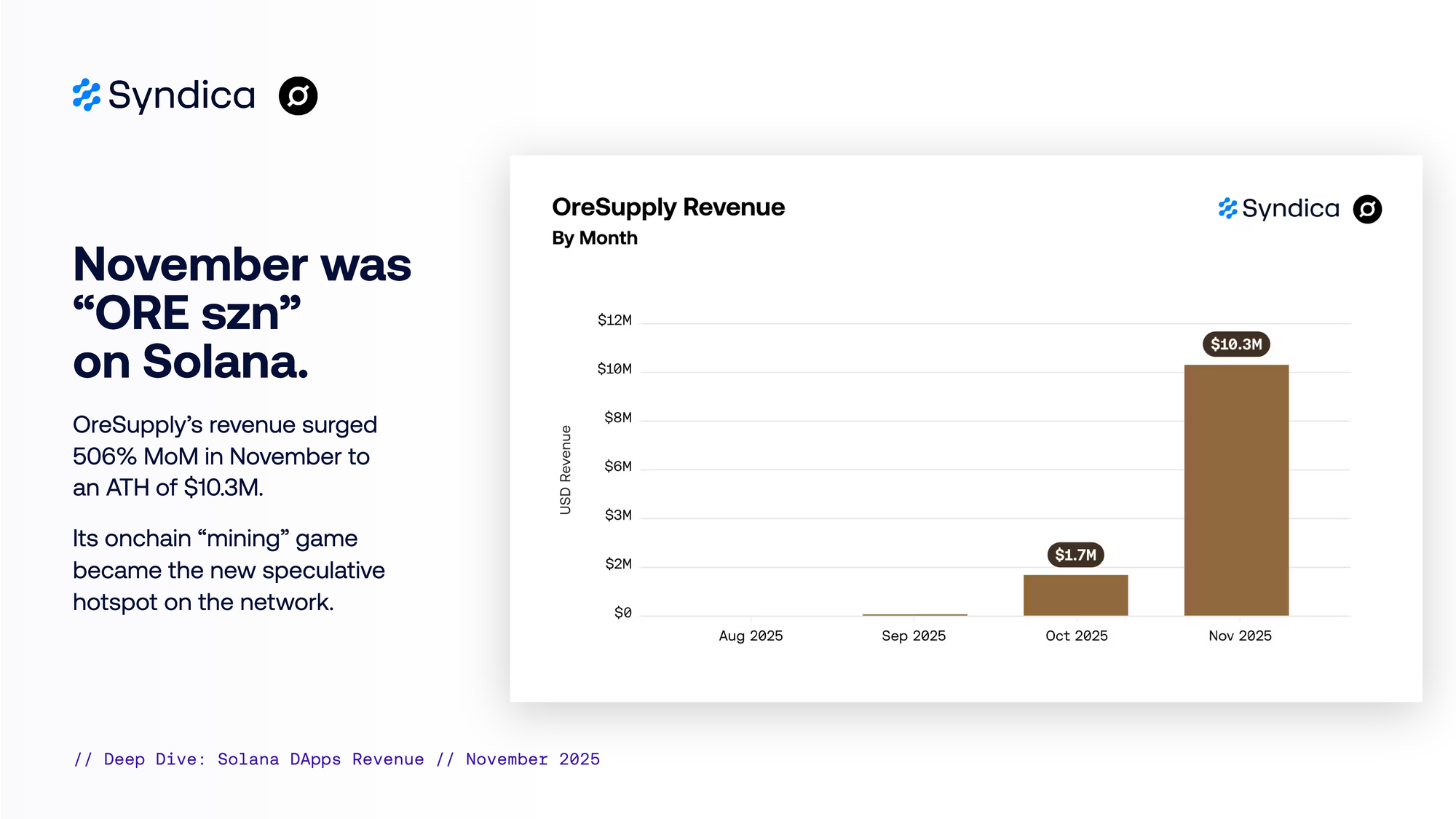

November was “ORE szn” on Solana. OreSupply’s revenue surged 506% MoM in November to an ATH of $10.3M. Its onchain “mining” game became the new speculative hotspot on the network.

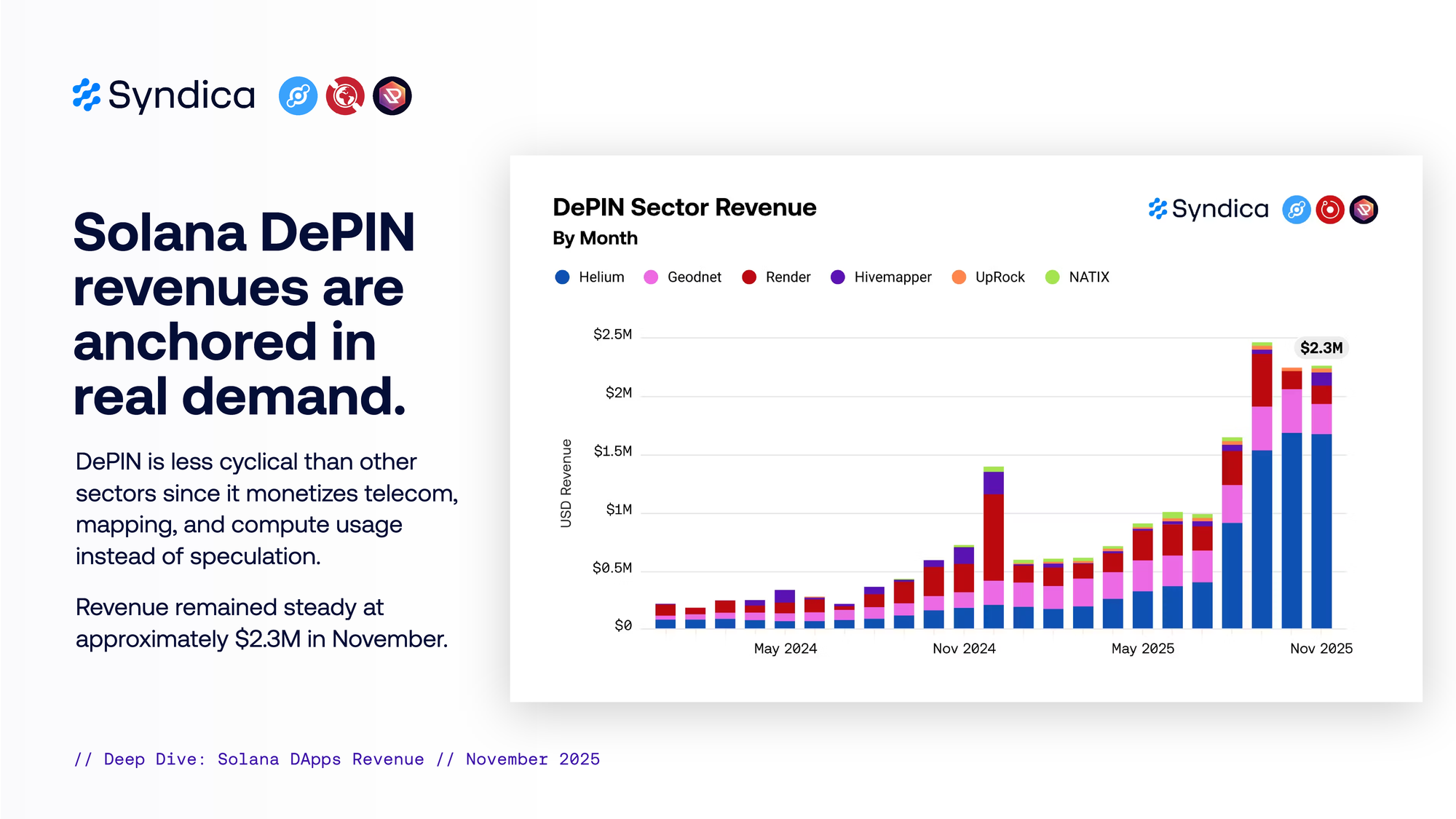

Part V - DePIN Revenue

Solana DePIN revenues are anchored in real demand. DePIN is less cyclical than other sectors since it monetizes telecom, mapping, and compute usage instead of speculation. Revenue remained steady at approximately $2.3M in November.