Deep Dive: Solana DApps Revenue - October 2025

Deep Dive: Solana DApps Revenue - October 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: DApps Revenue - October 2025

Part I - DApps Revenue Overview

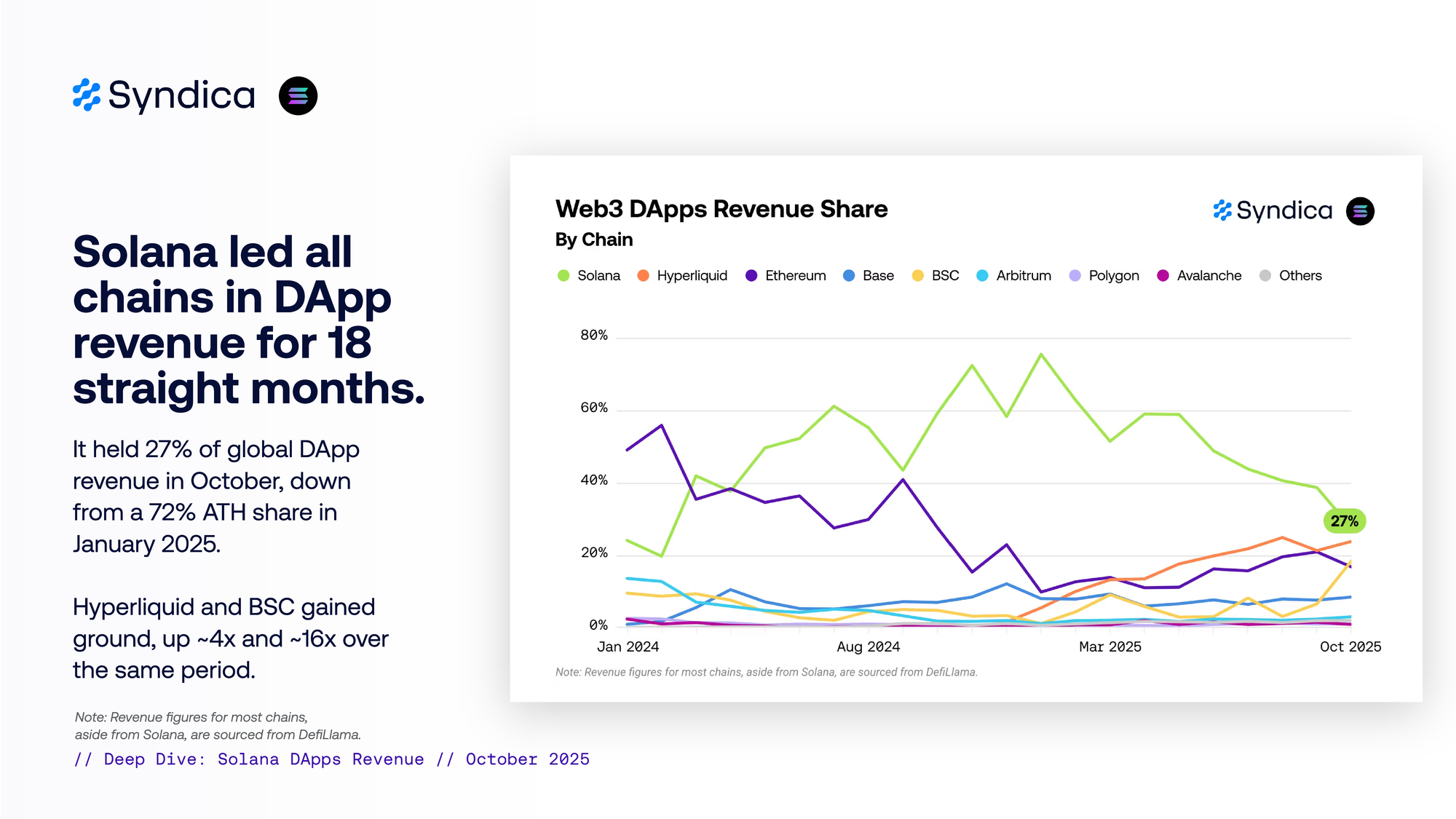

Solana led all chains in DApp revenue for 18 straight months. It held 27% of global DApp revenue in October, down from a 72% ATH share in January 2025. Hyperliquid and BSC gained ground, up ~4x and ~16x over the same period.

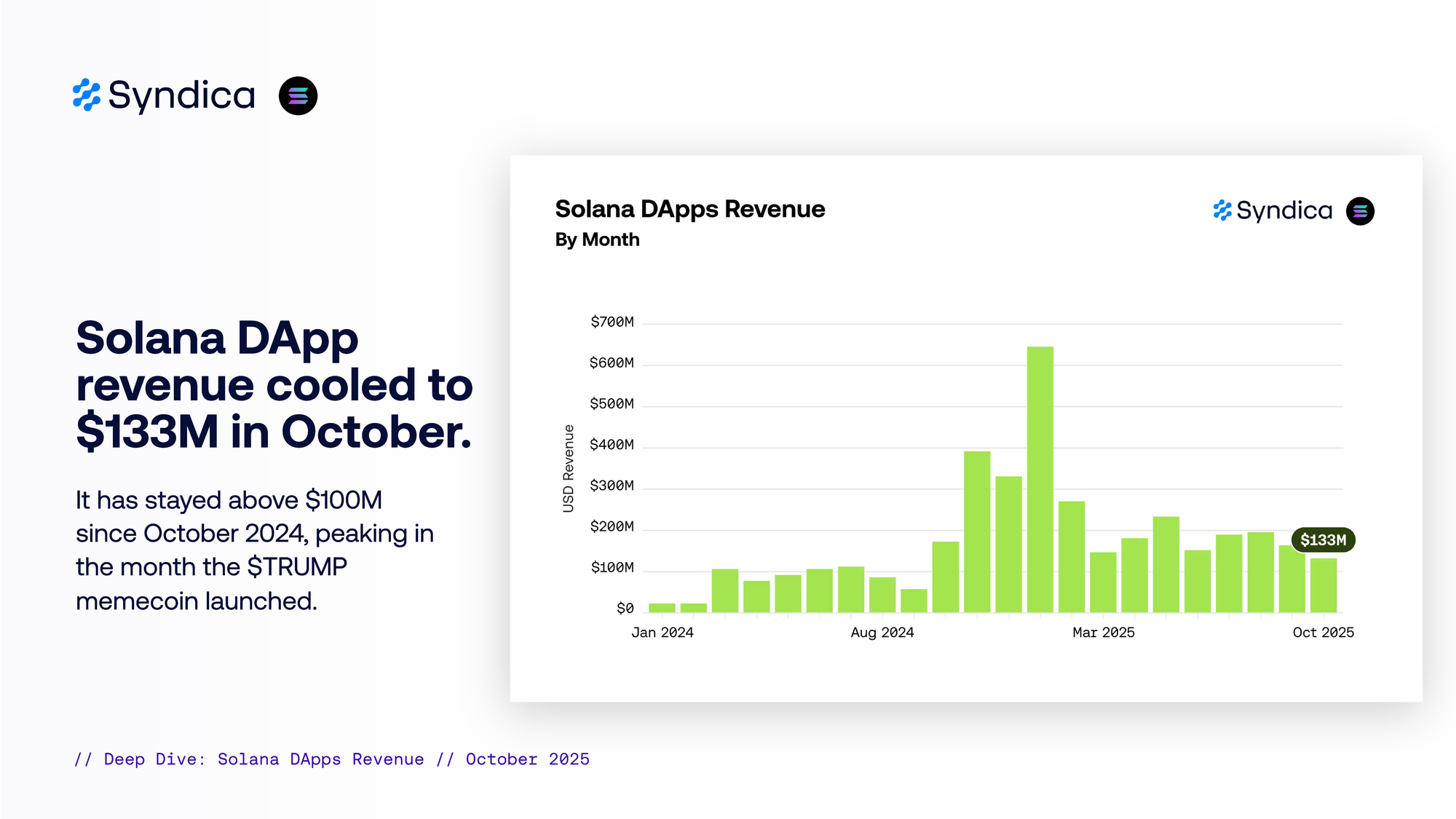

Solana DApp revenue cooled to $133M in October. It has stayed above $100M since October 2024, peaking in the month the $TRUMP memecoin launched.

Part II - Top-Earning DApps

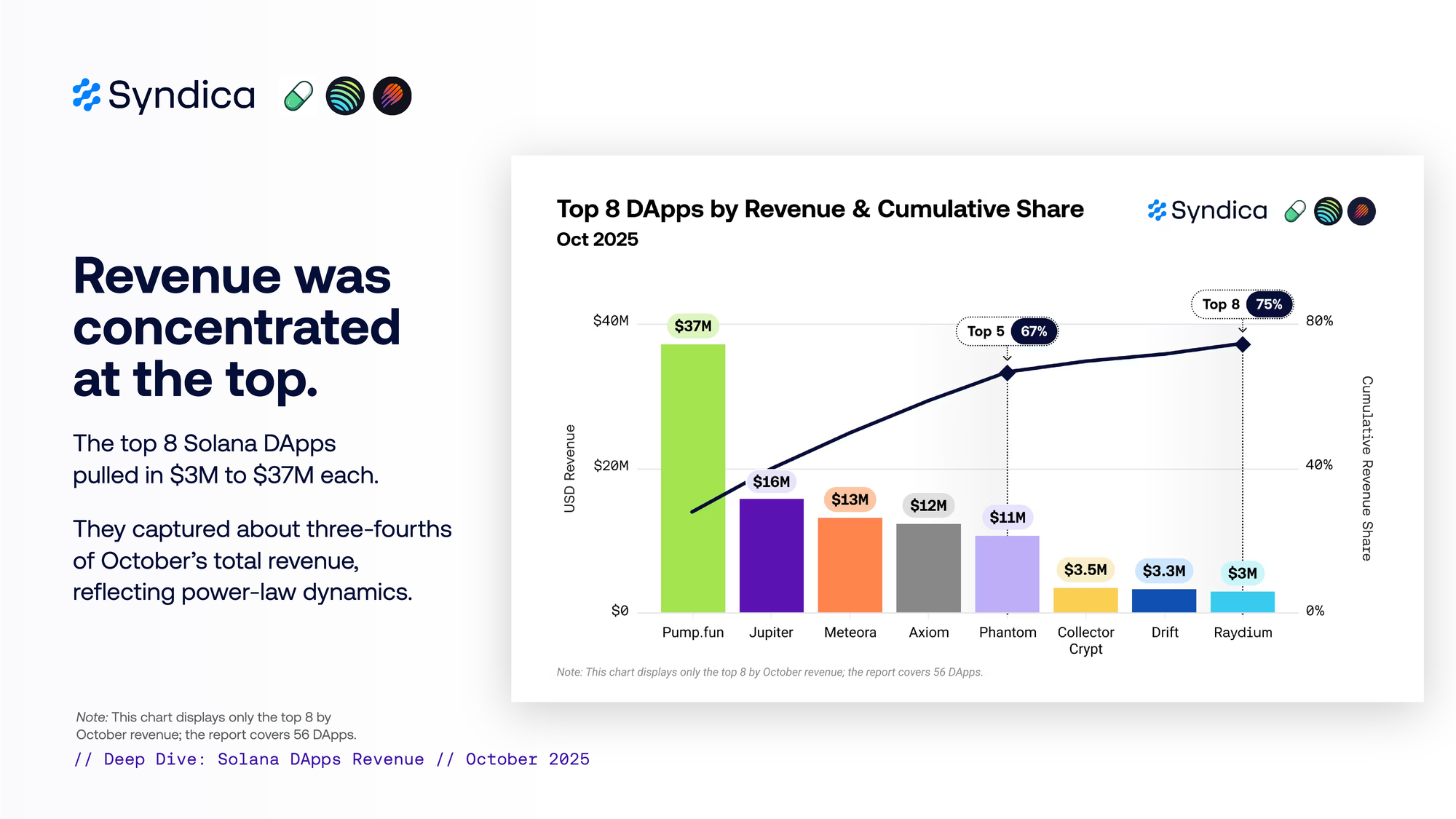

Revenue was concentrated at the top. The top 8 Solana DApps

pulled in $3M to $37M each. They captured about three-fourths of October’s total revenue, reflecting power-law dynamics.

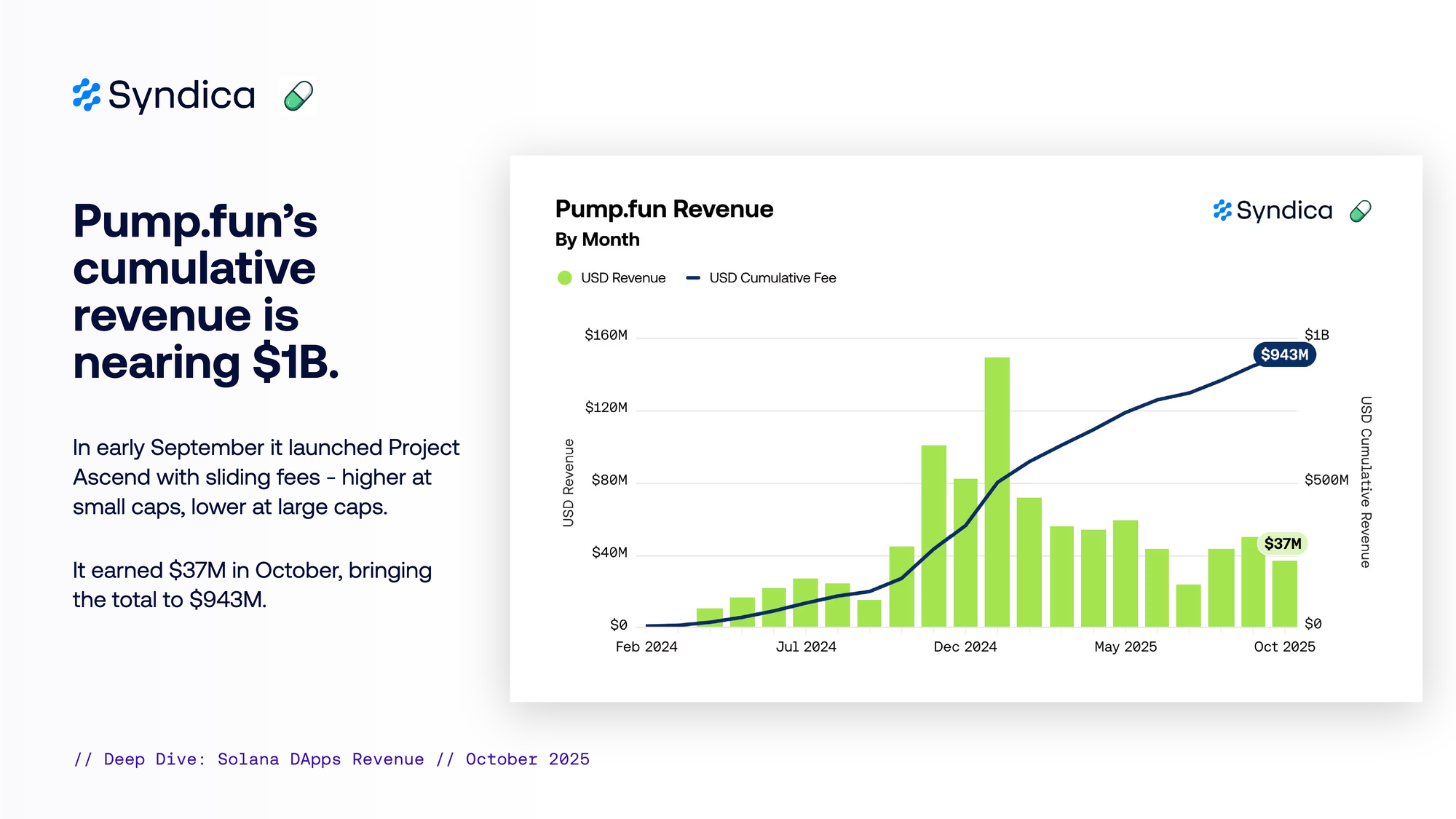

Pump.fun’s cumulative revenue is nearing $1B. In early September it launched Project Ascend with sliding fees - higher at small caps, lower at large caps. It earned $37M in October, bringing the total to $943M.

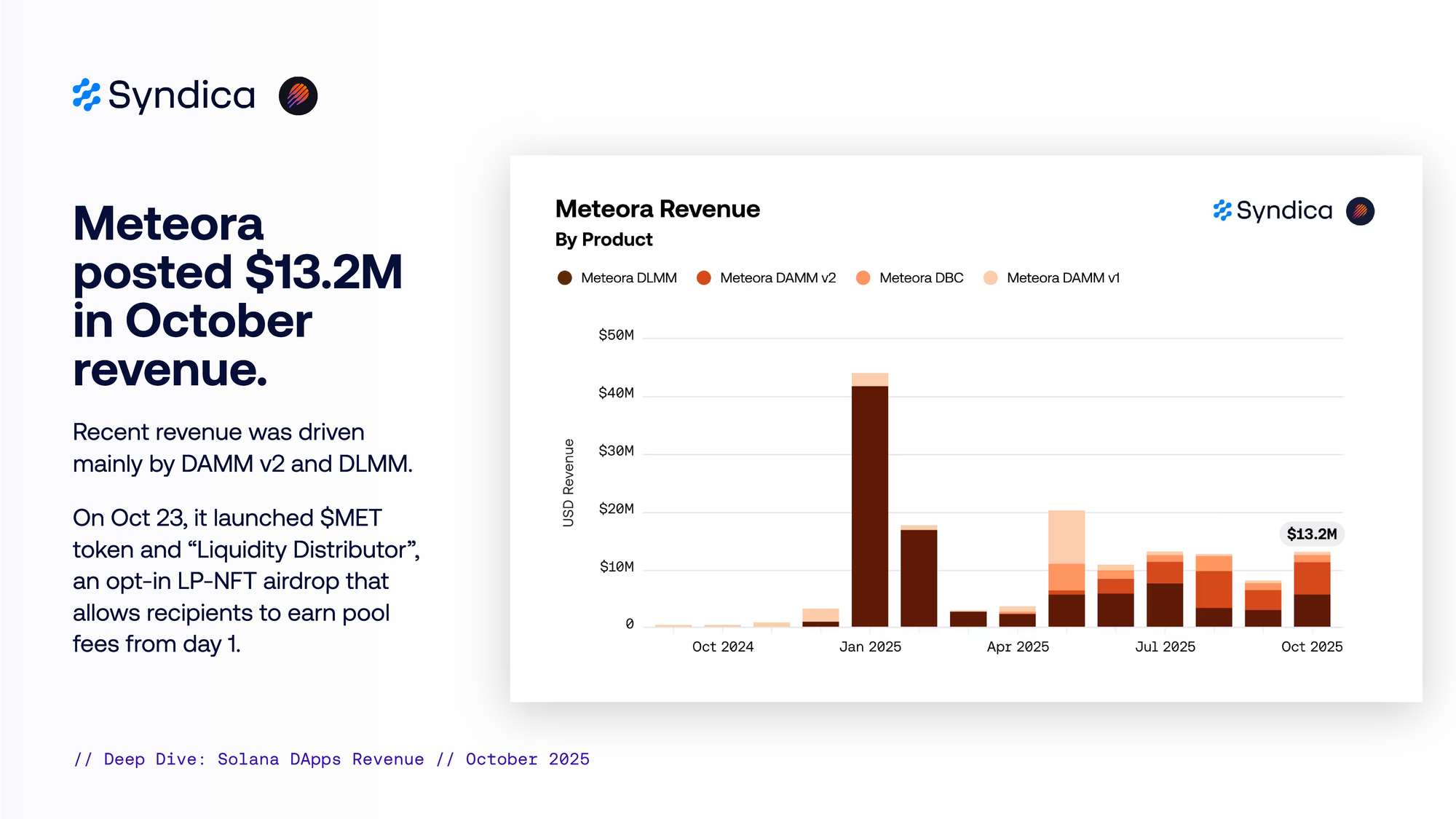

Meteora posted $13.2M in October revenue. Recent revenue was driven mainly by DAMM v2 and DLMM. On Oct 23, it launched $MET token and “Liquidity Distributor”, an opt-in LP-NFT airdrop that allows recipients to earn pool fees from day 1.

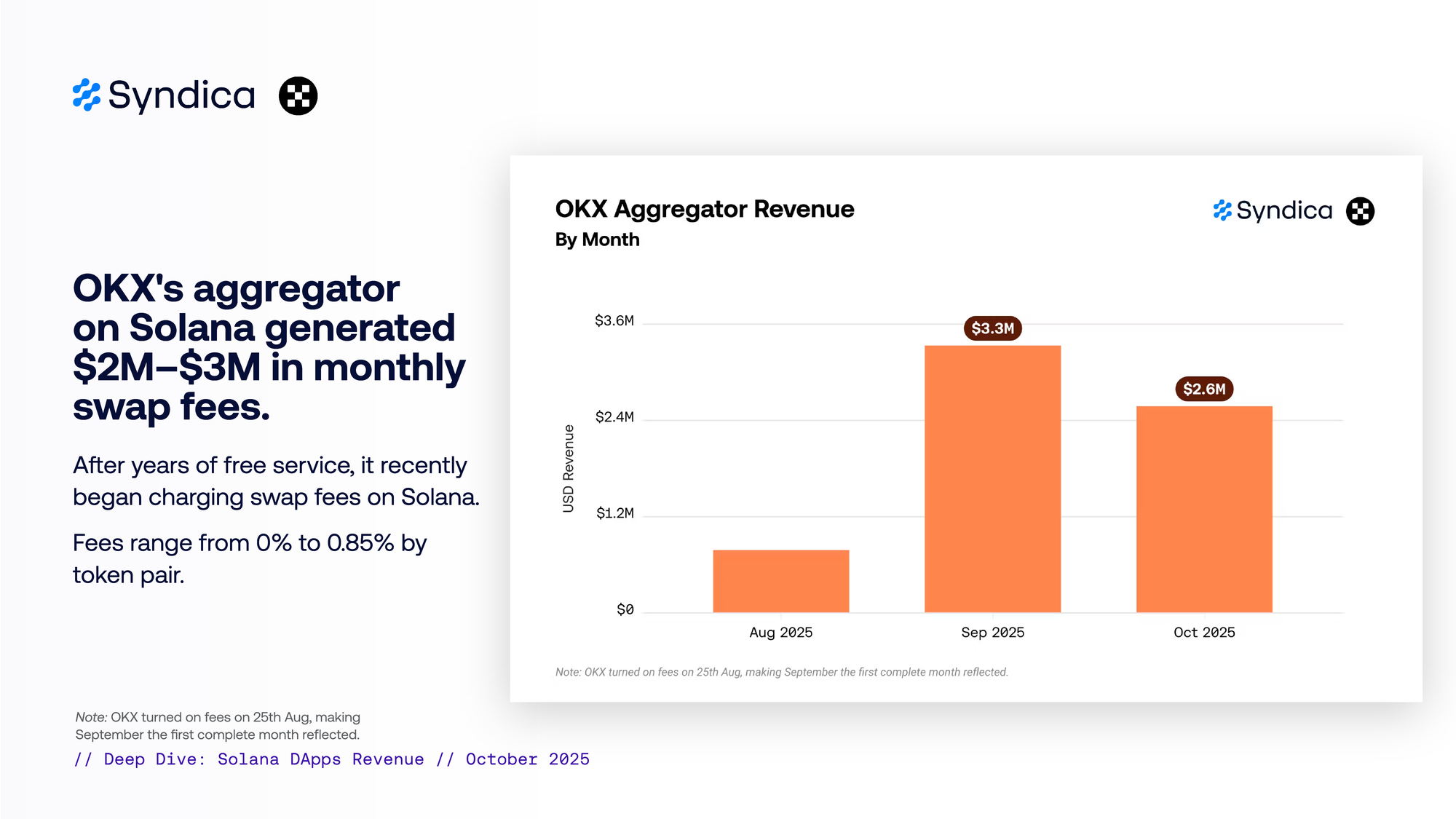

OKX's aggregator on Solana generated $2M–$3M in monthly swap fees. After years of free service, it recently began charging swap fees on Solana. Fees range from 0% to 0.85% by token pair.

Part III - Physical Trading Card Games (TCG)

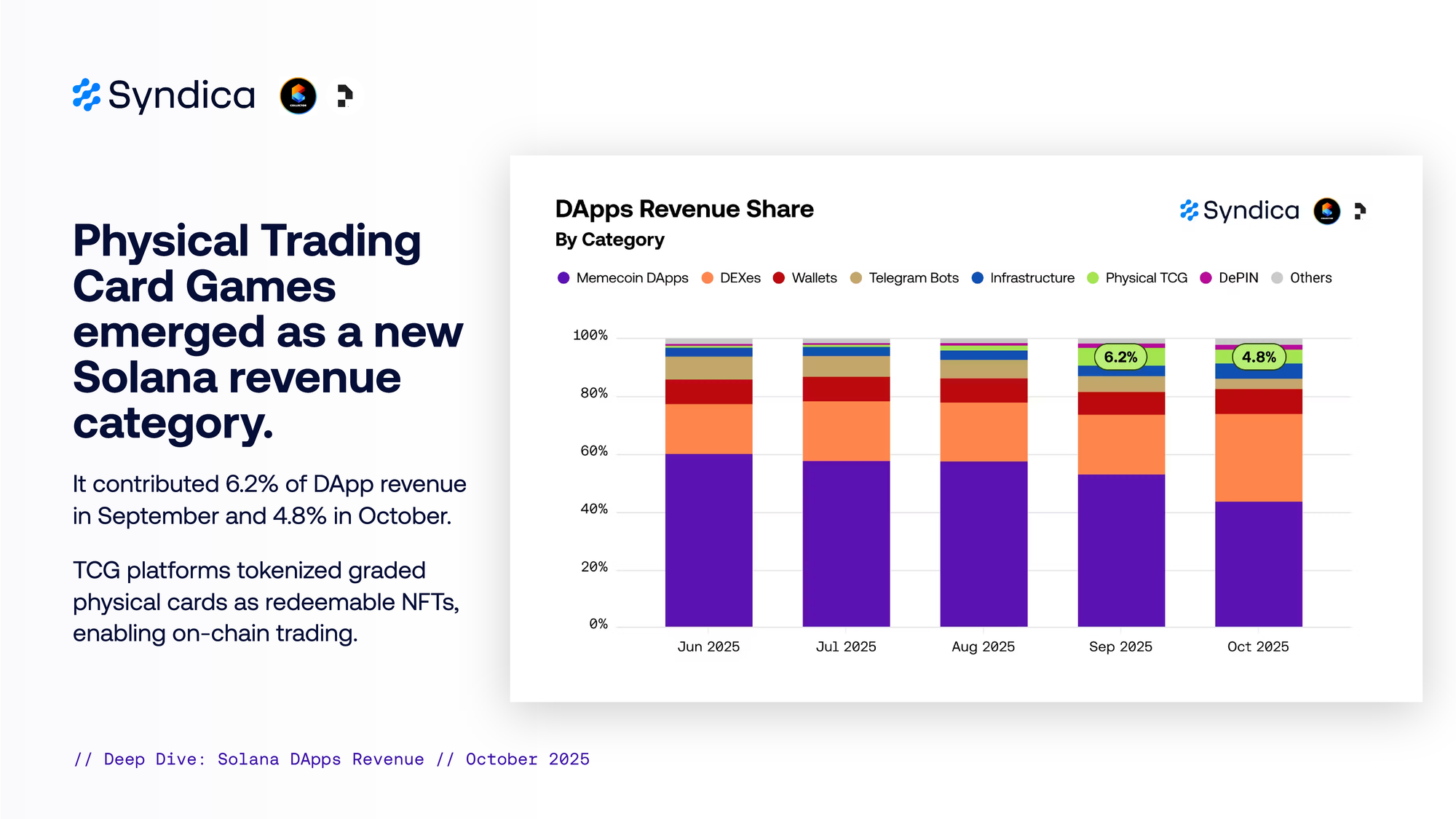

Physical Trading Card Games emerged as a new Solana revenue category. It contributed 6.2% of DApp revenue in September and 4.8% in October. TCG platforms tokenized graded physical cards as redeemable NFTs, enabling on-chain trading.

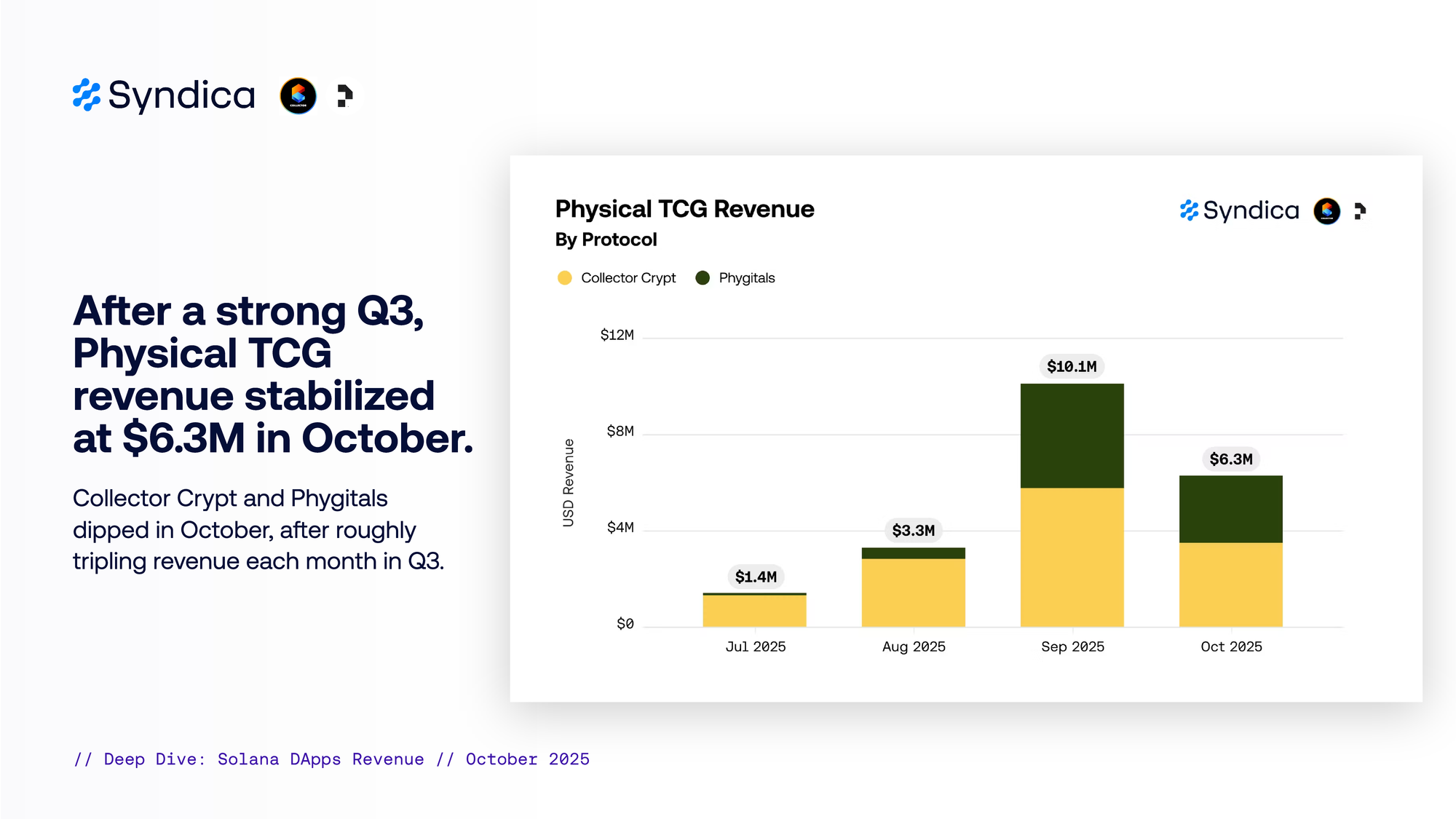

After a strong Q3, Physical TCG revenue stabilized at $6.3M in October. Collector Crypt and Phygitals dipped in October, after roughly tripling revenue each month in Q3.

Part III - Infrastructure Revenue

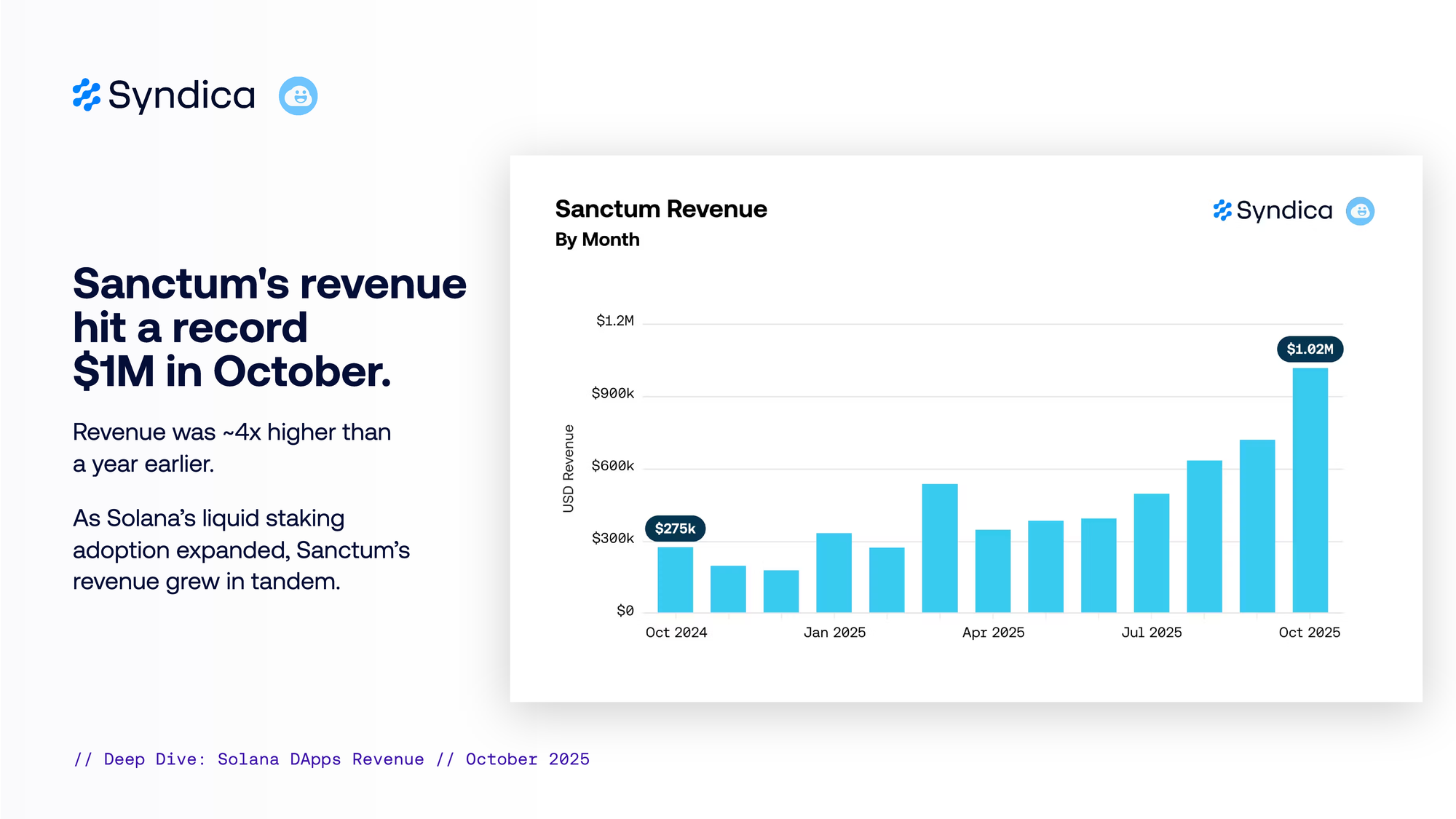

Sanctum's revenue hit a record $1M in October. Revenue was ~4x higher than

a year earlier. As Solana’s liquid staking adoption expanded, Sanctum’s revenue grew in tandem.

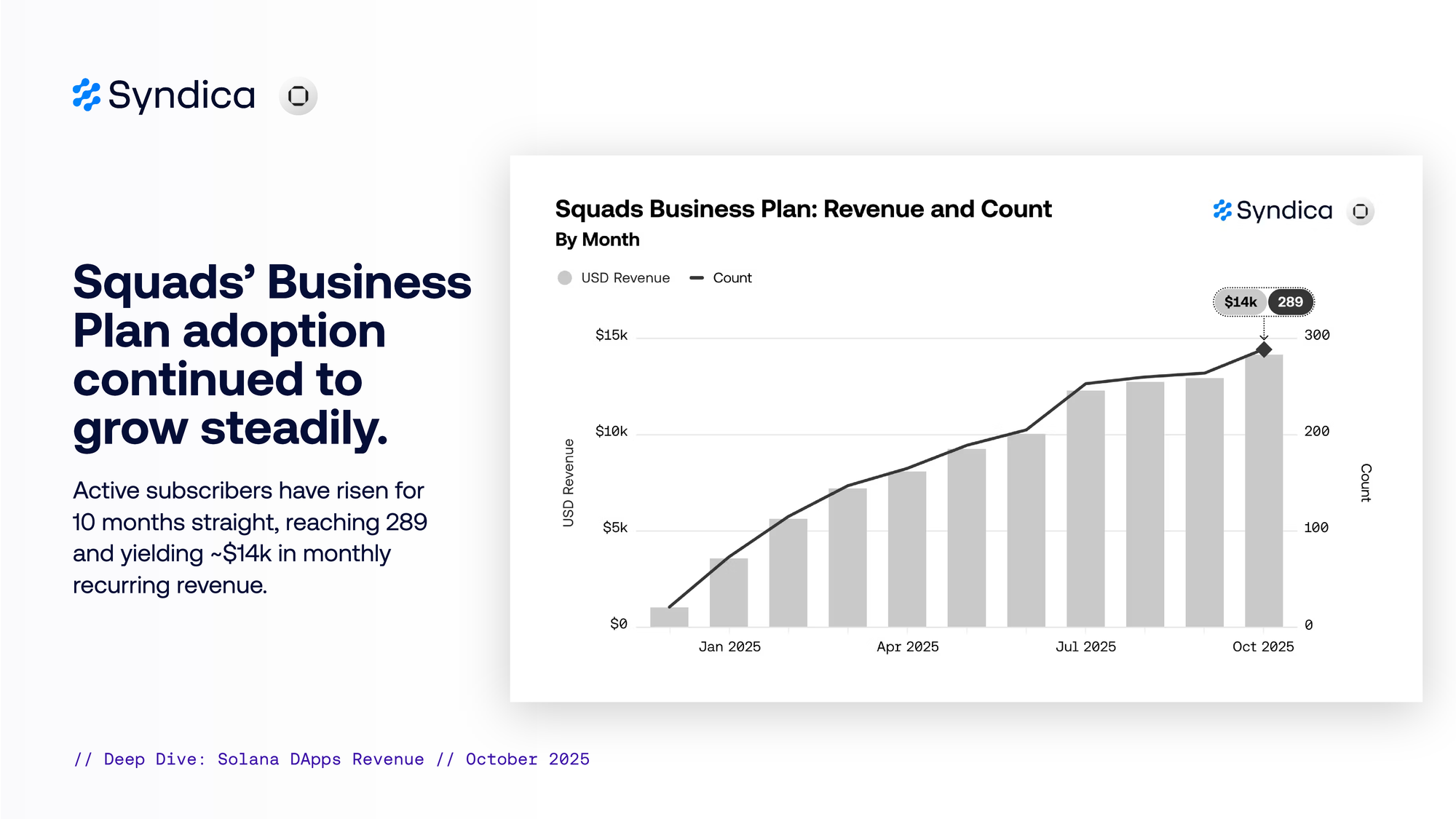

Squads’ Business Plan adoption continued to grow steadily. Active subscribers have risen for 10 months straight, reaching 289 and yielding ~$14k in monthly recurring revenue.

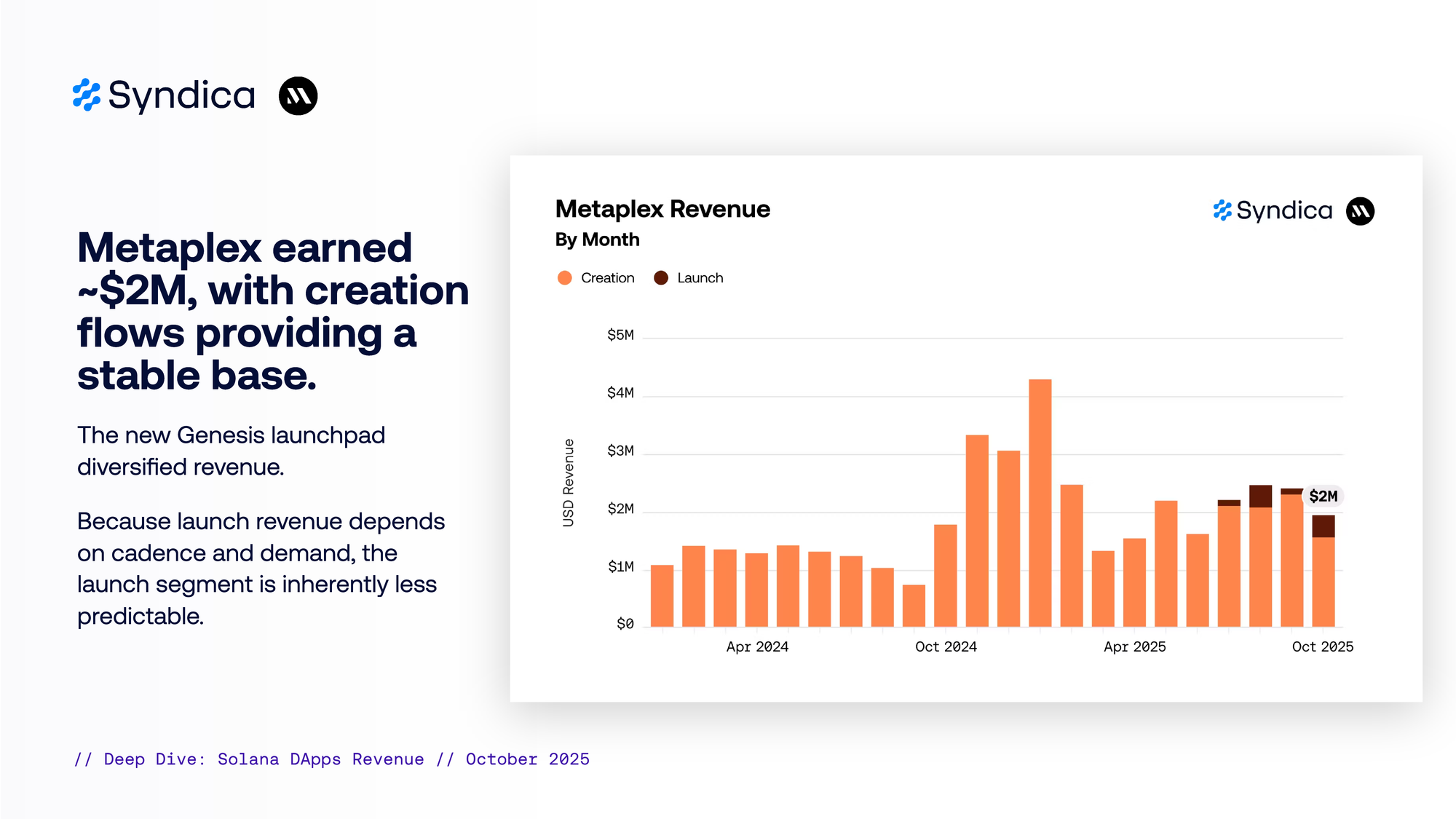

Metaplex earned ~$2M, with creation flows providing a stable base. The new Genesis launchpad diversified revenue. Because launch revenue depends on cadence and demand, the launch segment is inherently less predictable.

Streamflow's revenue reached an 18-month high of ~$287k. The protocol returned a record ~$87k to stakers via Active Staking Rewards (ASR) buybacks. Revenue from locks/vesting, payroll, airdrop streaming, and related services supports sticky and recurring monetization.

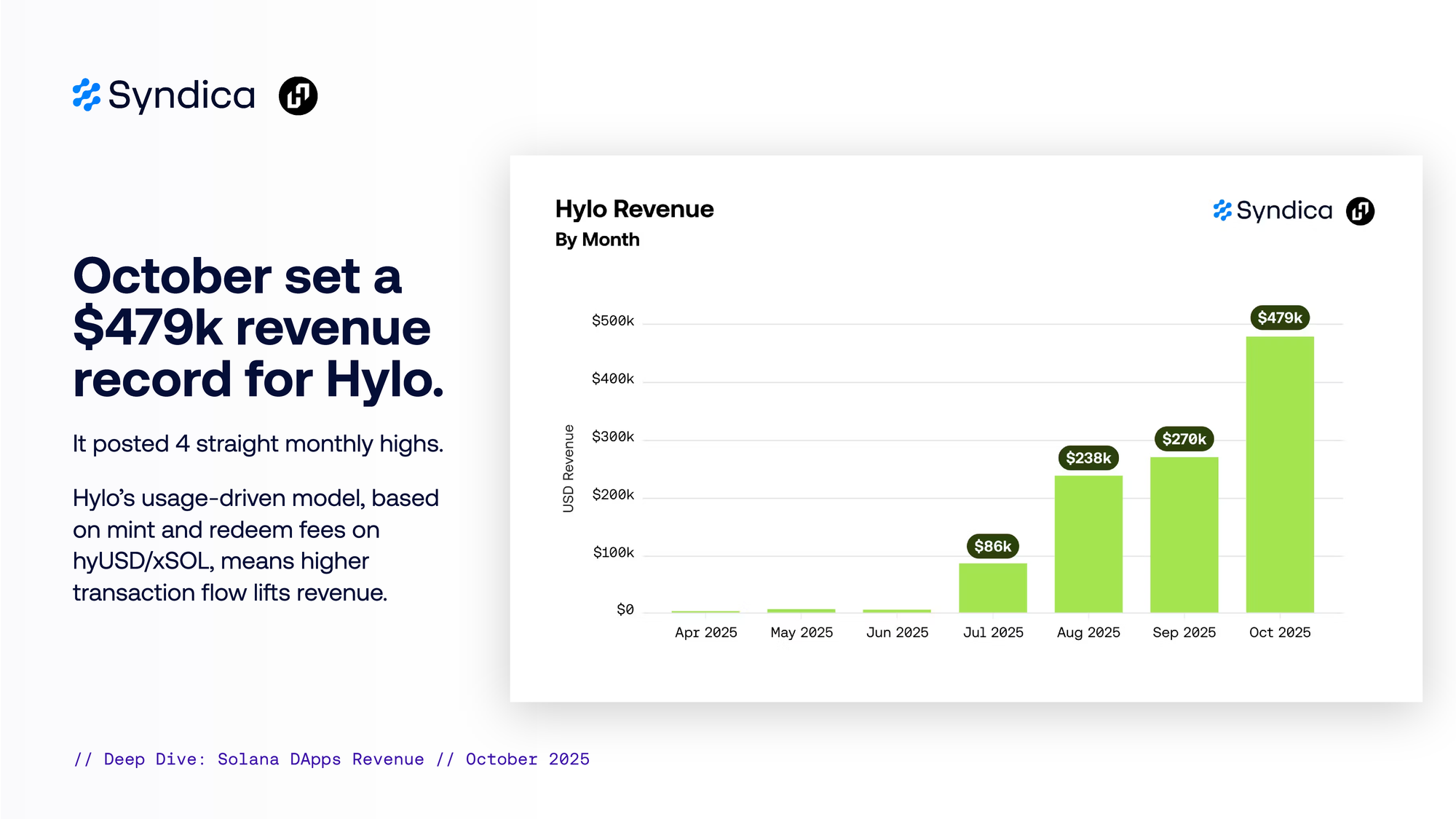

October set a $479k revenue record for Hylo. It posted 4 straight monthly highs. Hylo’s usage-driven model, based on mint and redeem fees on hyUSD/xSOL, means higher transaction flow lifts revenue.

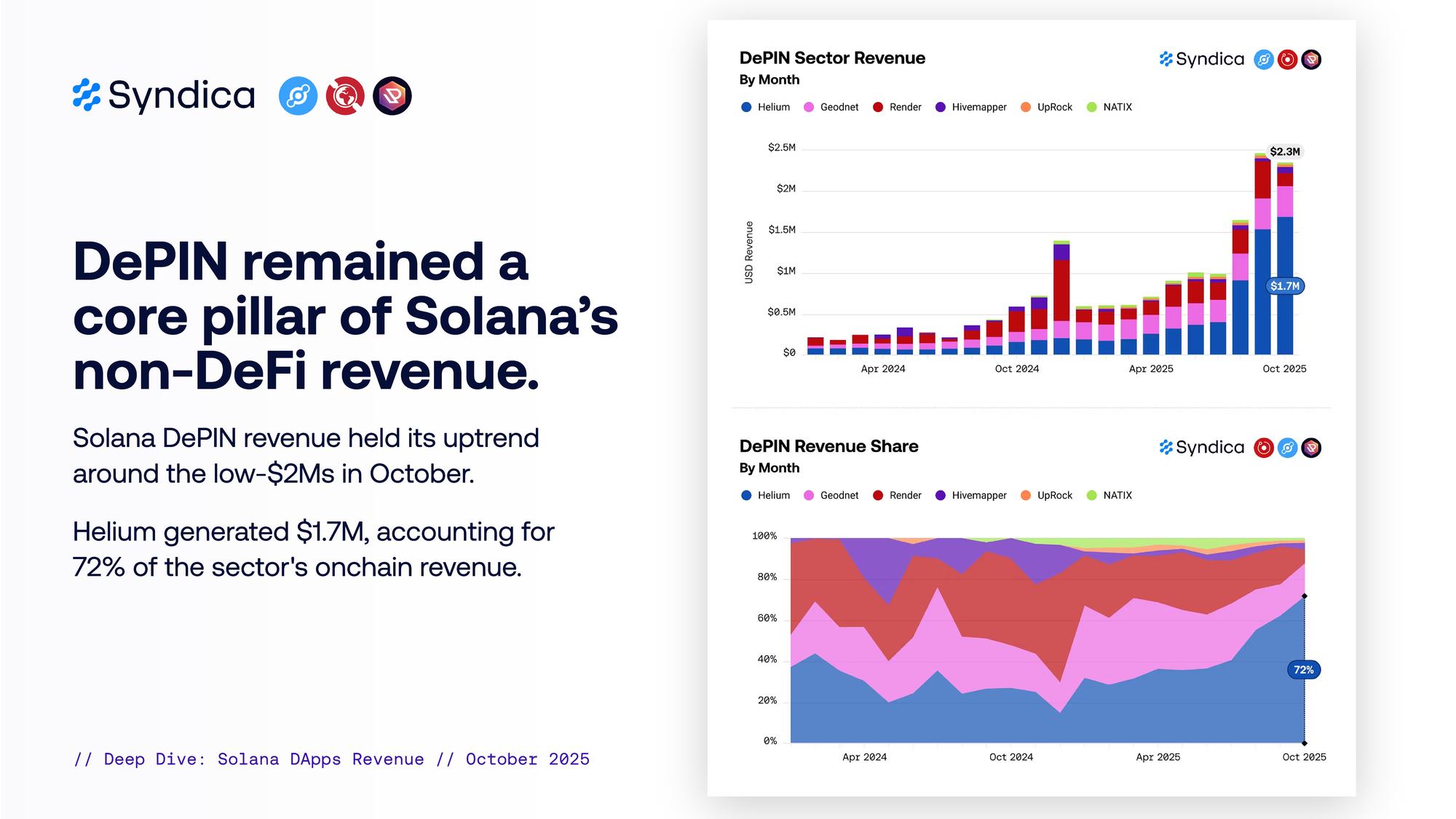

Part IV - DePIN Revenue

DePIN remained a core pillar of Solana’s non-DeFi revenue. Solana DePIN revenue held its uptrend around the low-$2Ms in October. Helium generated $1.7M, accounting for 72% of the sector's onchain revenue.