Deep Dive: Solana DeFi - April 2024

Deep Dive: Solana DeFi - April 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - April 2024

1. DeFi Spot DEXes

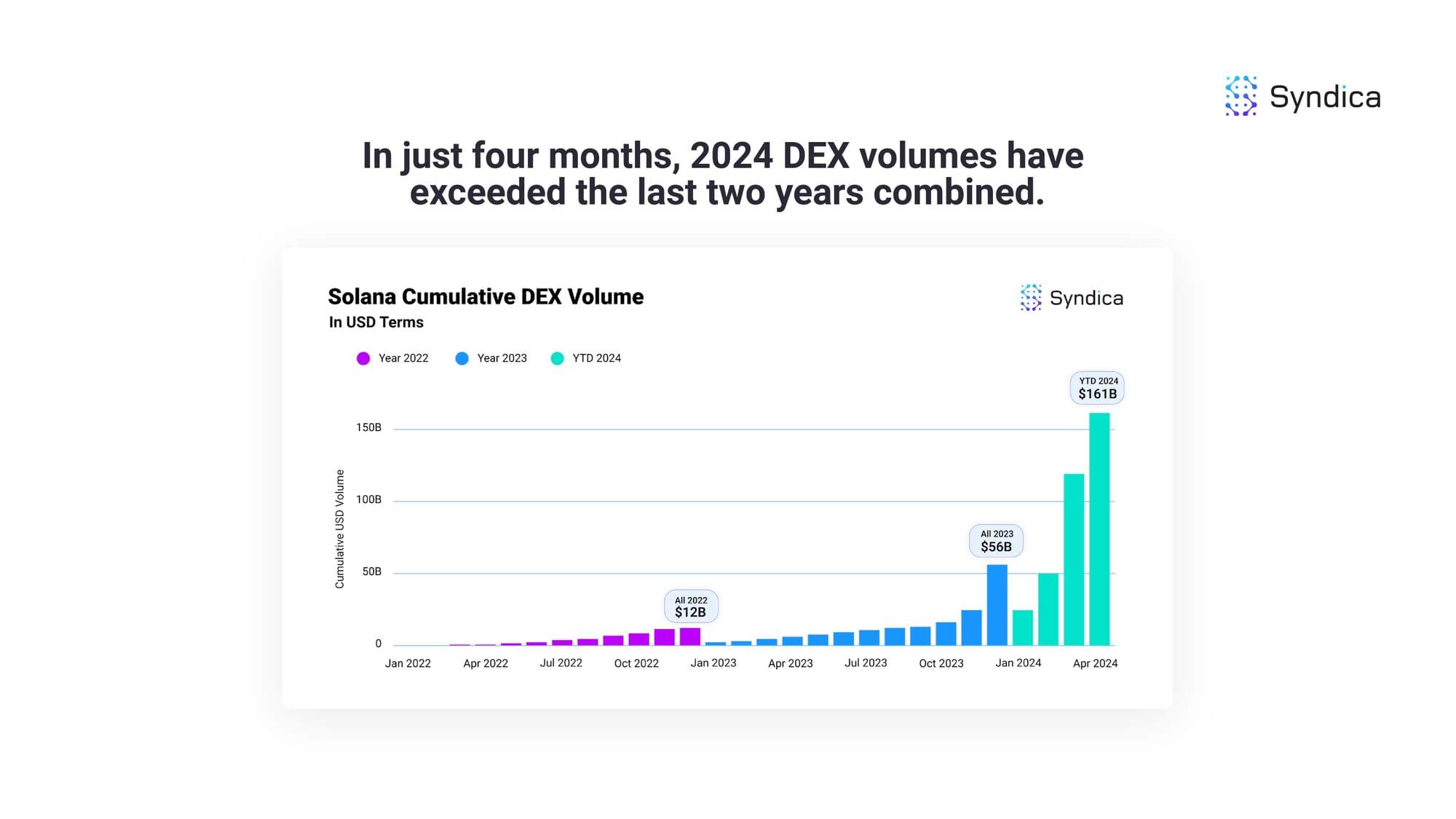

In just four months, 2024 DEX volumes have exceeded the last two years combined.

Solana is eating crypto. Solana's DEX market share has increased ~25x to make up a quarter of crypto-wide DEX volumes.

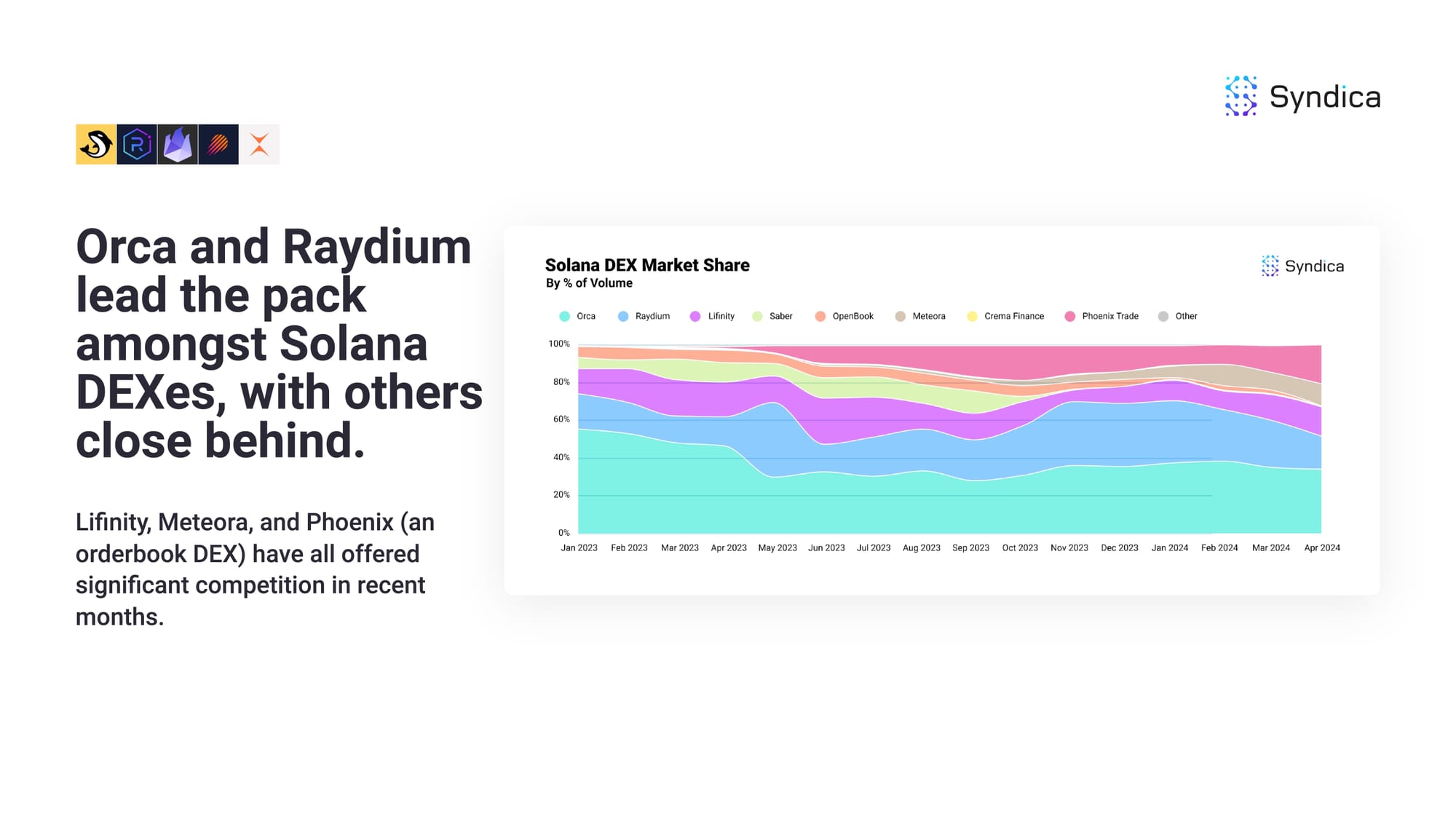

Orca and Raydium lead the pack amongst Solana DEXes, with others close behind. Lifinity, Meteora, and Phoenix (an orderbook DEX) have all offered significant competition in recent months.

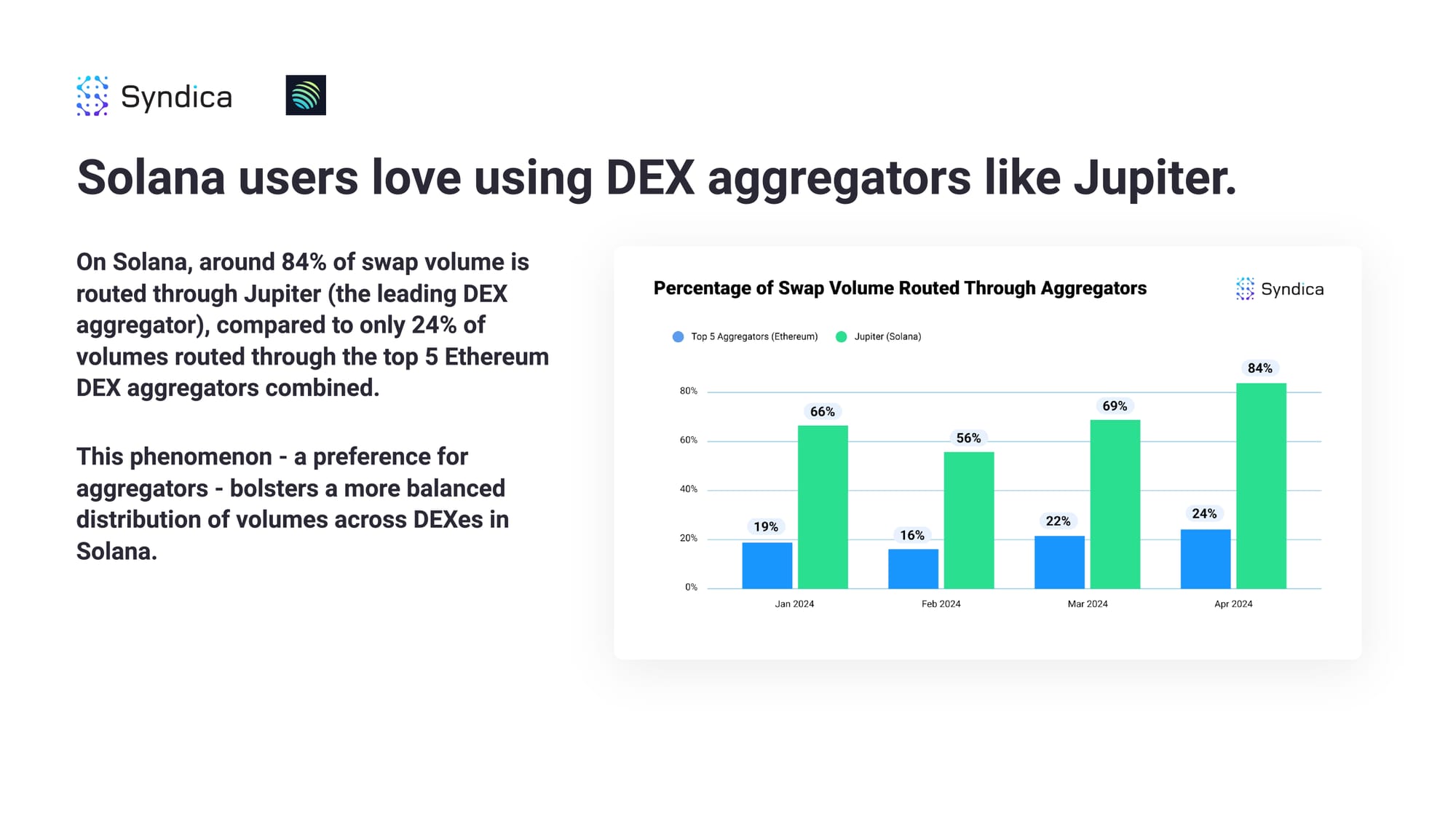

Solana users love using DEX aggregators like Jupiter. On Solana, around 84% of swap volume is routed through Jupiter (the leading DEX aggregator), compared to only 24% of volumes routed through the top 5 Ethereum DEX aggregators combined.

This phenomenon - a preference for aggregators - bolsters a more balanced distribution of volumes across DEXes in Solana.

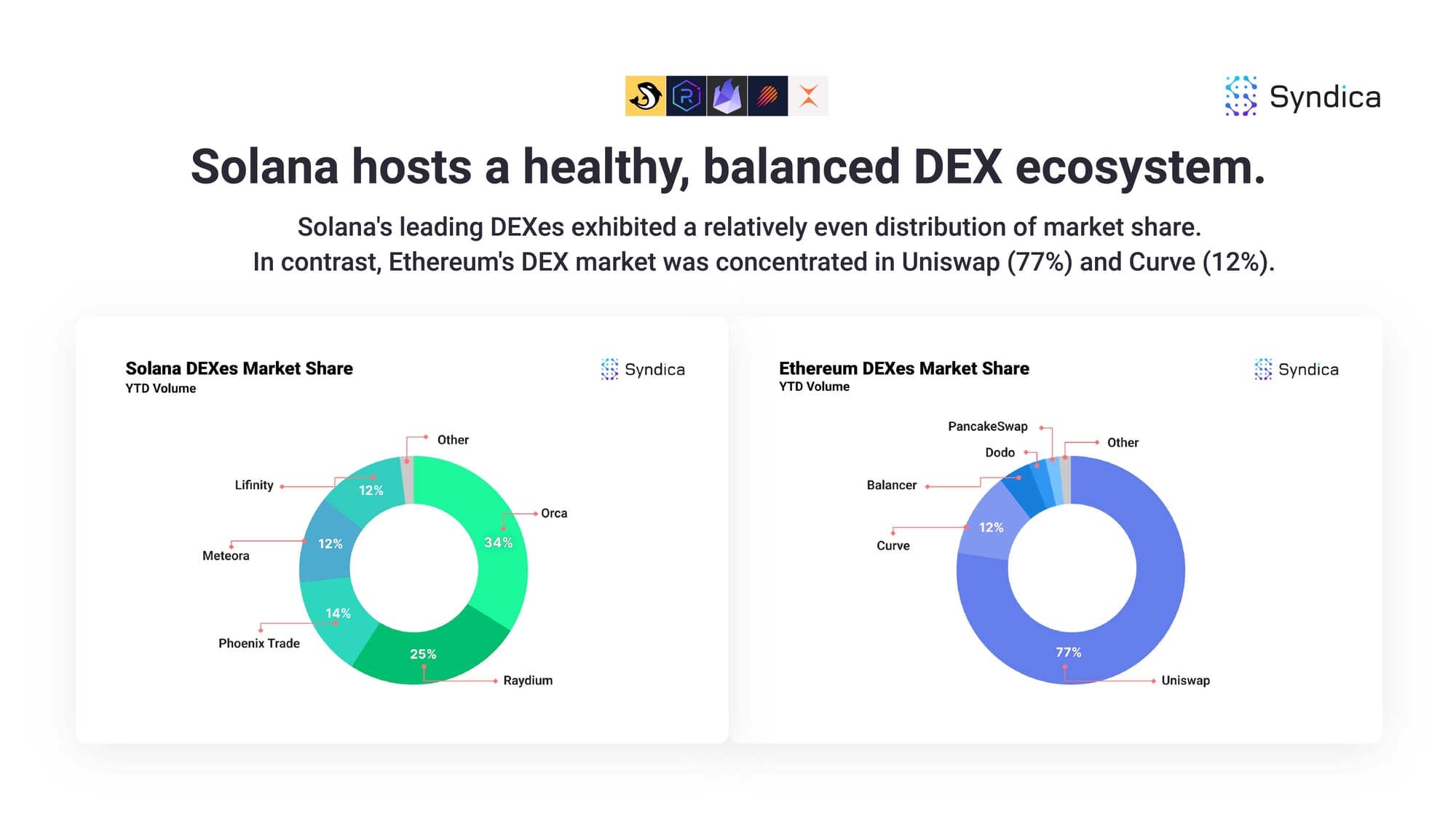

Solana hosts a healthy, balanced DEX ecosystem. Solana's leading DEXes exhibited a relatively even distribution of market share. In contrast, Ethereum's DEX market was concentrated in Uniswap (77%) and Curve (12%).

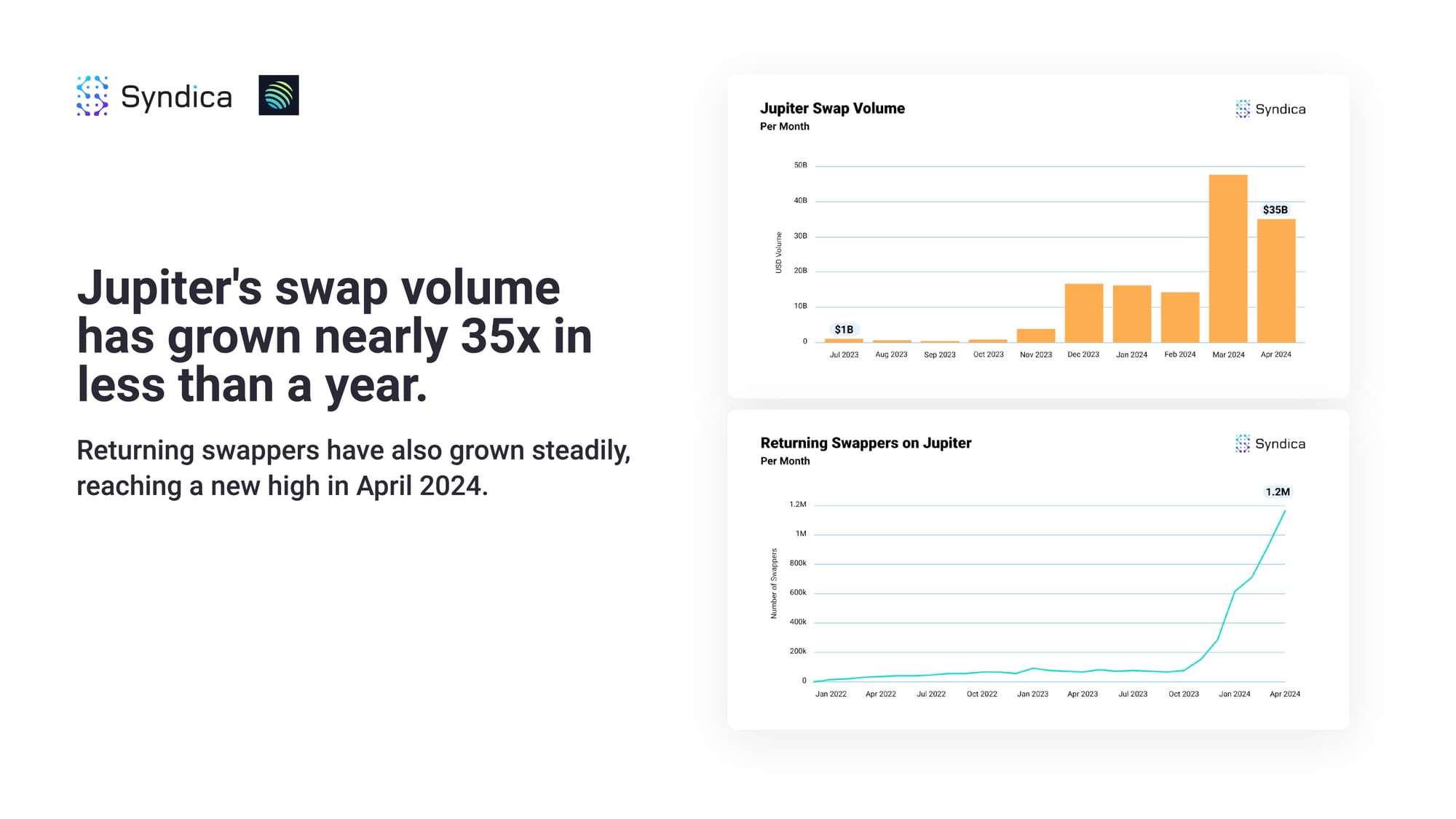

Jupiter's swap volume has grown nearly 35x in less than a year. Returning swappers have also grown steadily, reaching a new high in April 2024.

2. DeFi Perpetuals

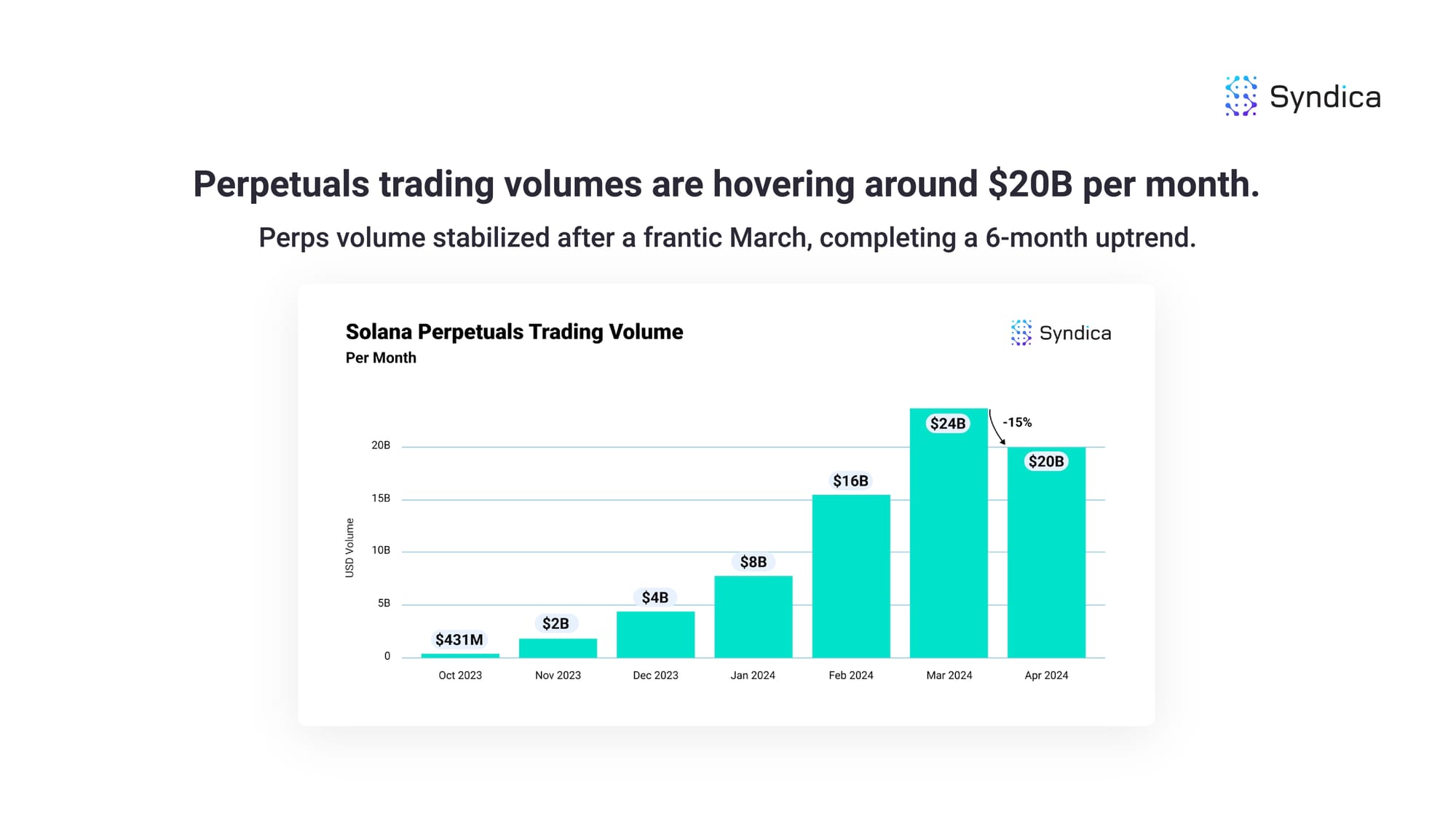

Perpetuals trading volumes are hovering around $20B per month. Perps volume stabilized after a frantic March, completing a 6-month uptrend.

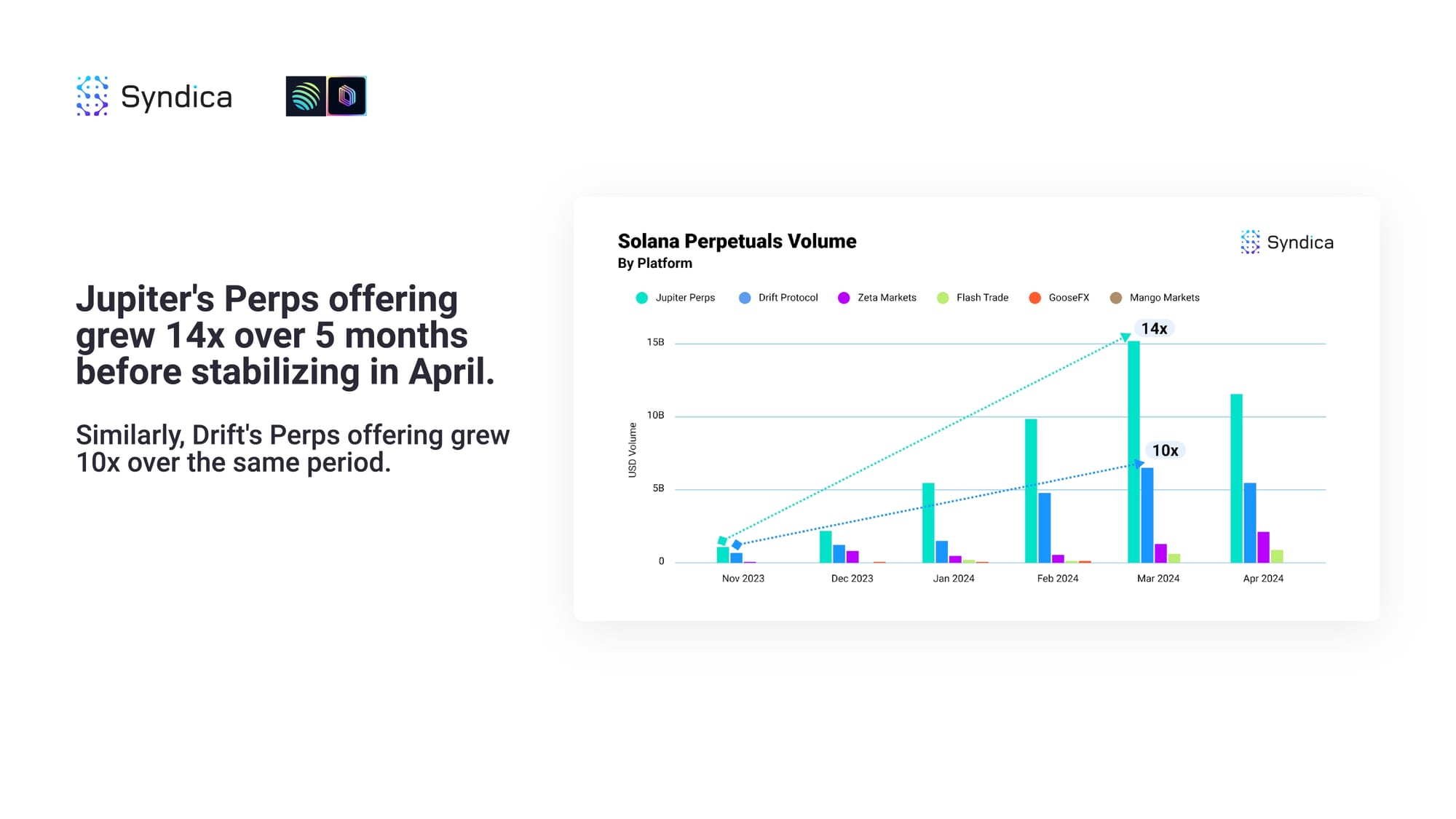

Jupiter's Perps offering grew 14x over 5 months before stabilizing in April. Similarly, Drift's Perps offering grew 10x over the same period.

3. DeFi Lending and Borrowing

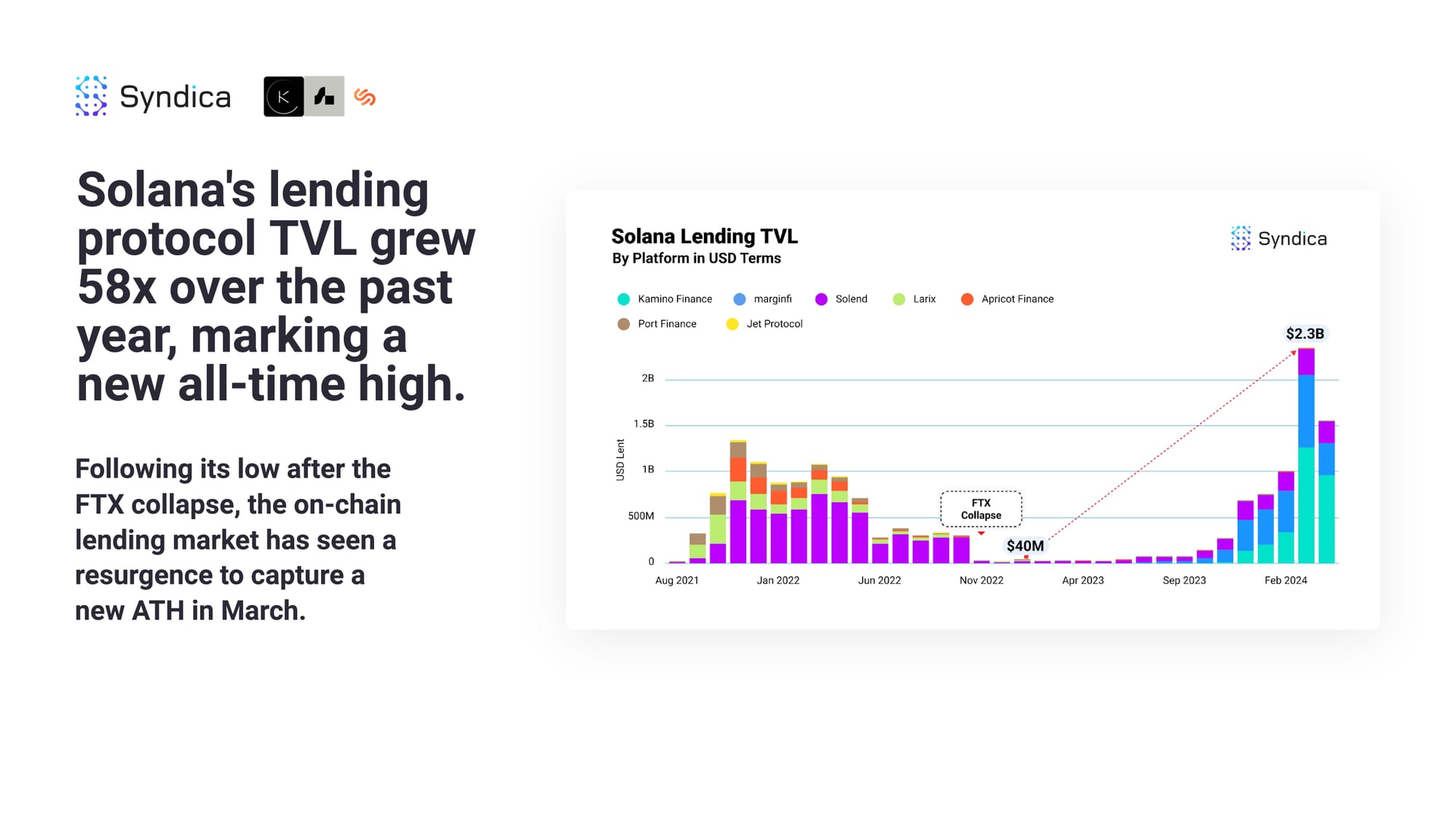

Solana's lending protocol TVL grew 58x over the past year, marking a new all-time high. Following its low after the FTX collapse, the on-chain lending market has seen a resurgence to capture a new ATH in March.

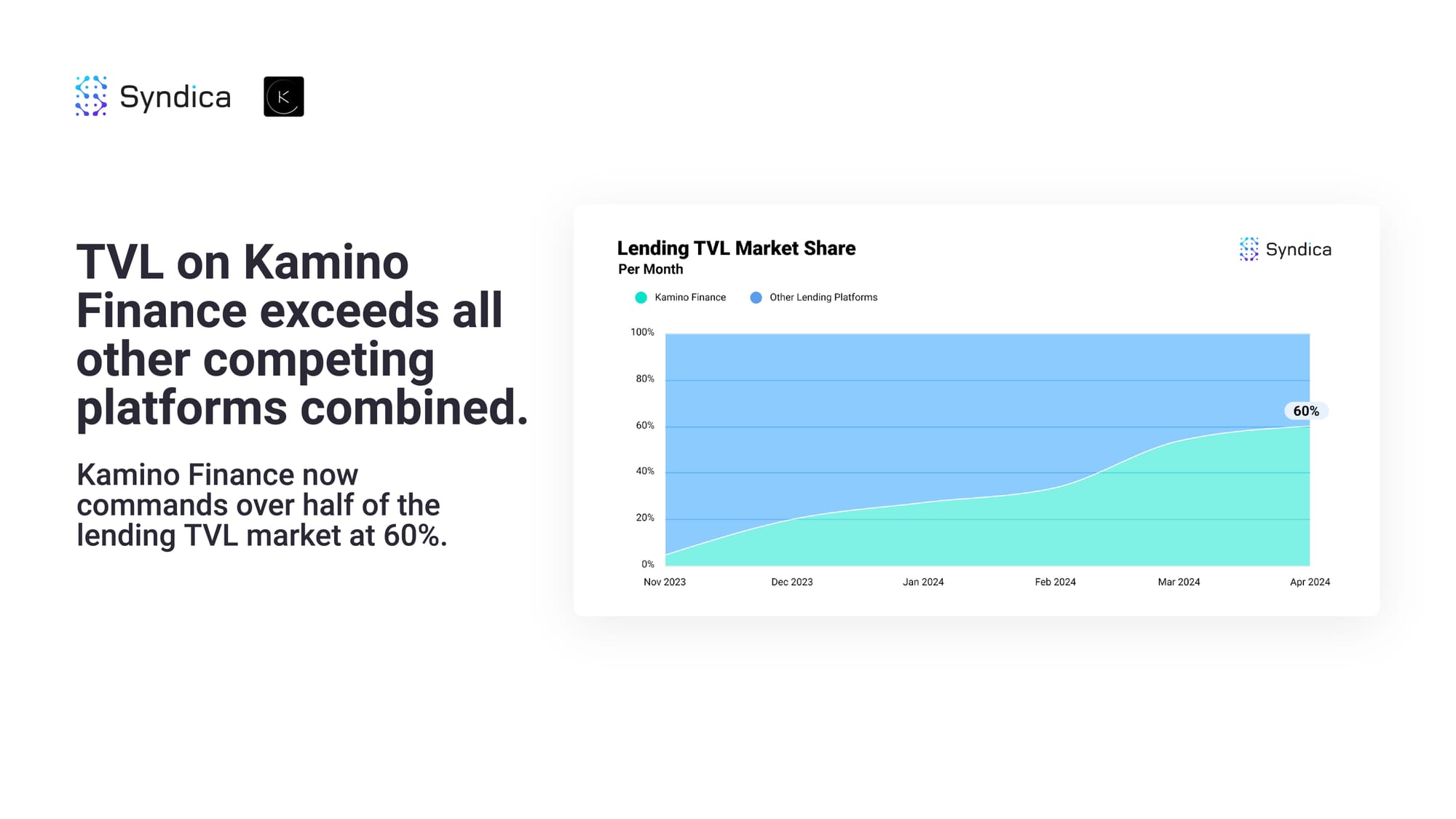

TVL on Kamino Finance exceeds all other competing platforms combined. Kamino Finance now commands over half of the lending TVL market at 60%.

4. DeFi Liquid Staking

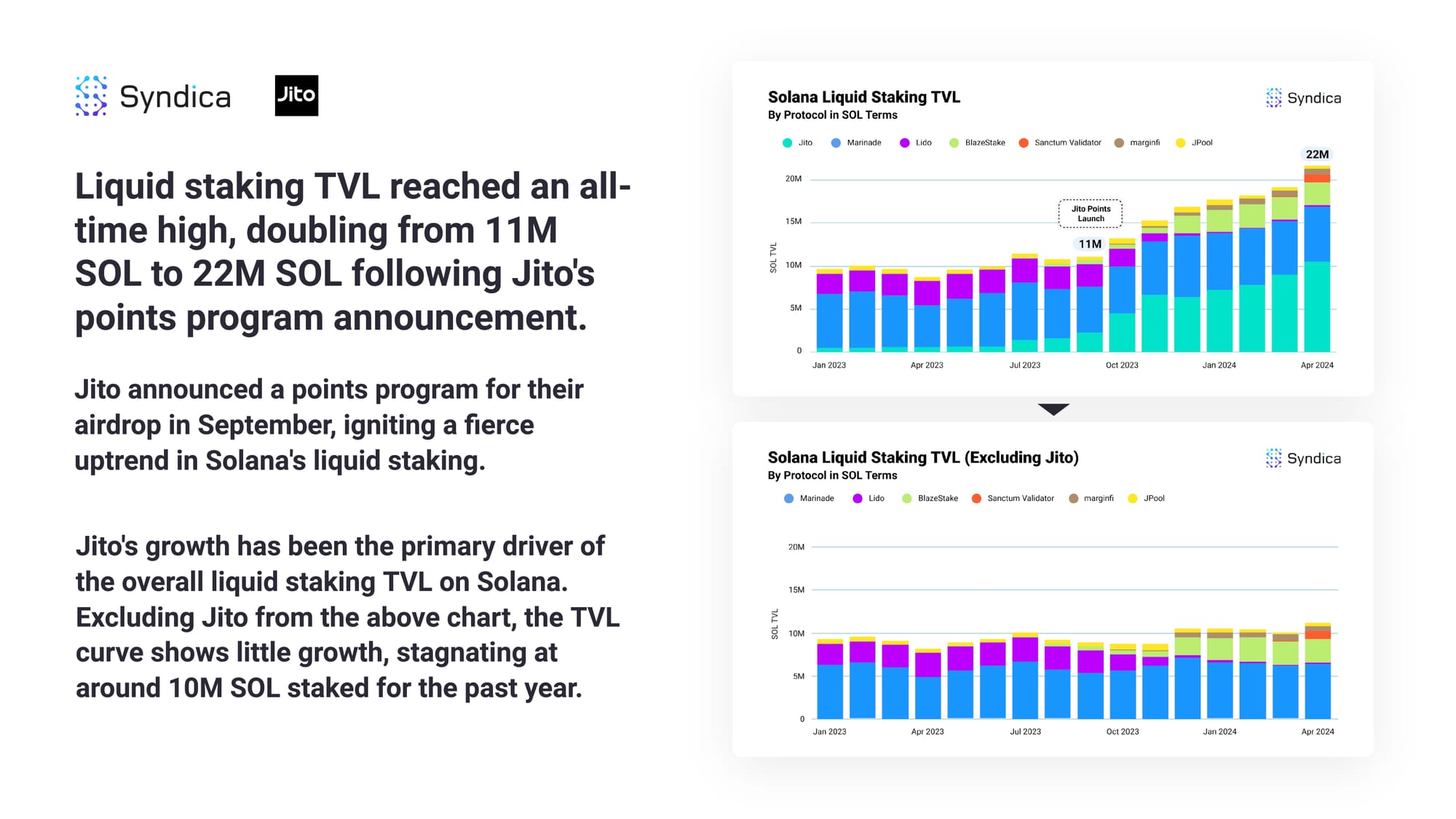

Liquid staking TVL reached an all-time high, doubling from 11M SOL to 22M SOL following Jito's points program announcement. Jito announced a points program for their airdrop in September, igniting a fierce uptrend in Solana's liquid staking.

Jito's growth has been the primary driver of the overall liquid staking TVL on Solana. Excluding Jito from the above chart, the TVL curve shows little growth, stagnating at around 10M SOL staked for the past year.

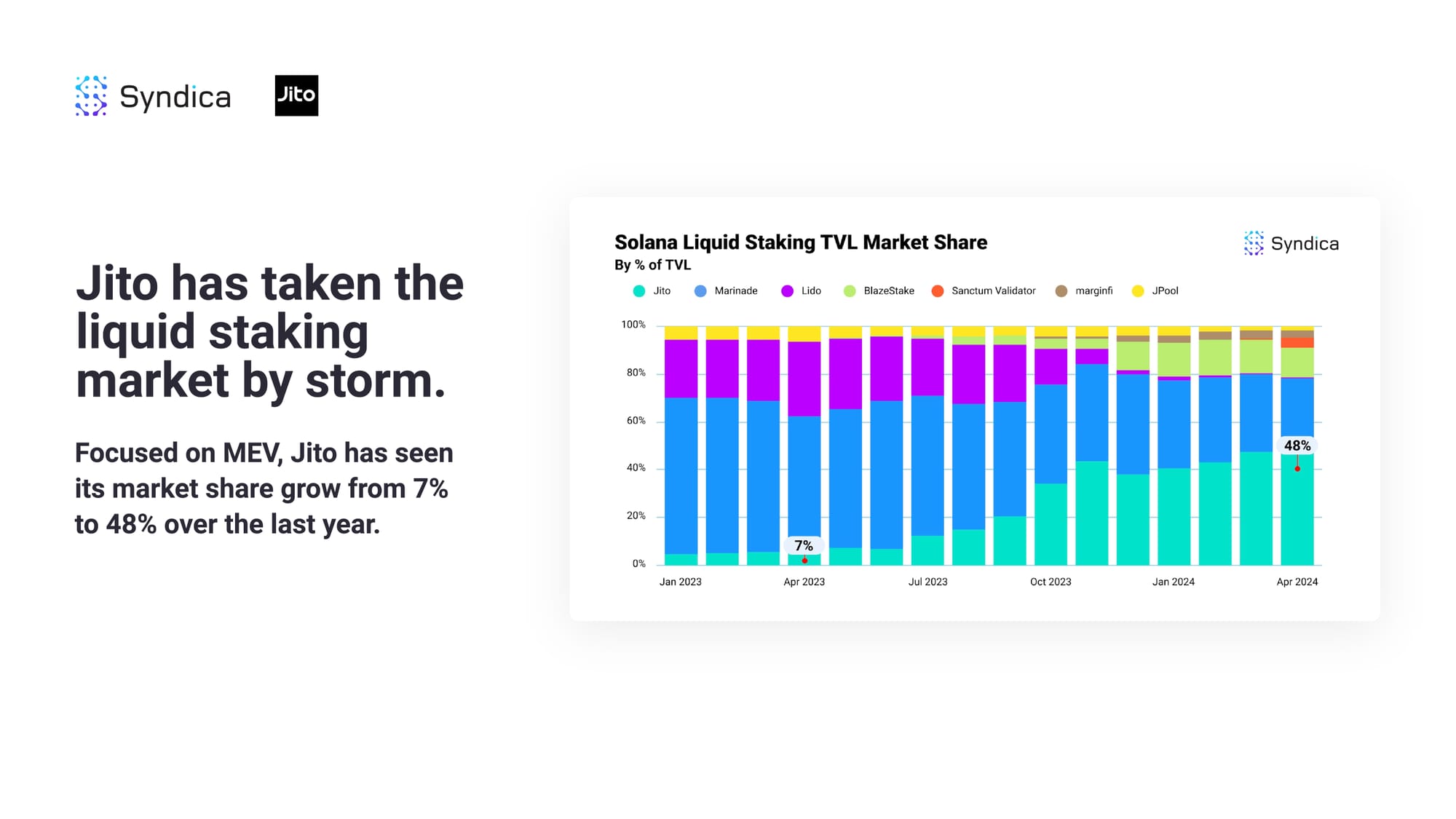

Jito has taken the liquid staking market by storm. Focused on MEV, Jito has seen its market share grow from 7% to 48% over the last year.

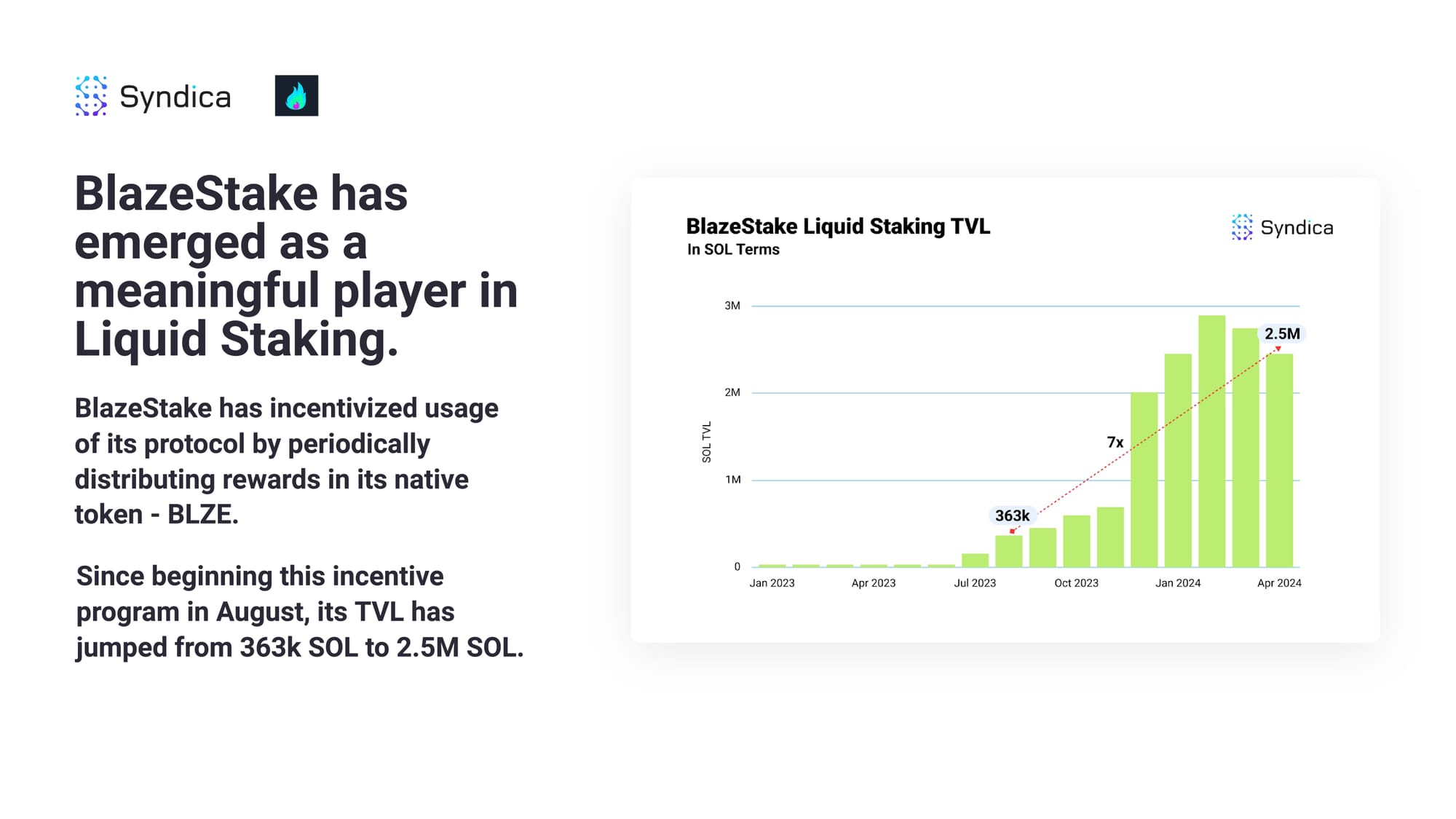

BlazeStake has emerged as a meaningful player in Liquid Staking. BlazeStake has incentivized usage of its protocol by periodically distributing rewards in its native token - BLZE. Since beginning this incentive program in August, its TVL has jumped from 363k SOL to 2.5M SOL.

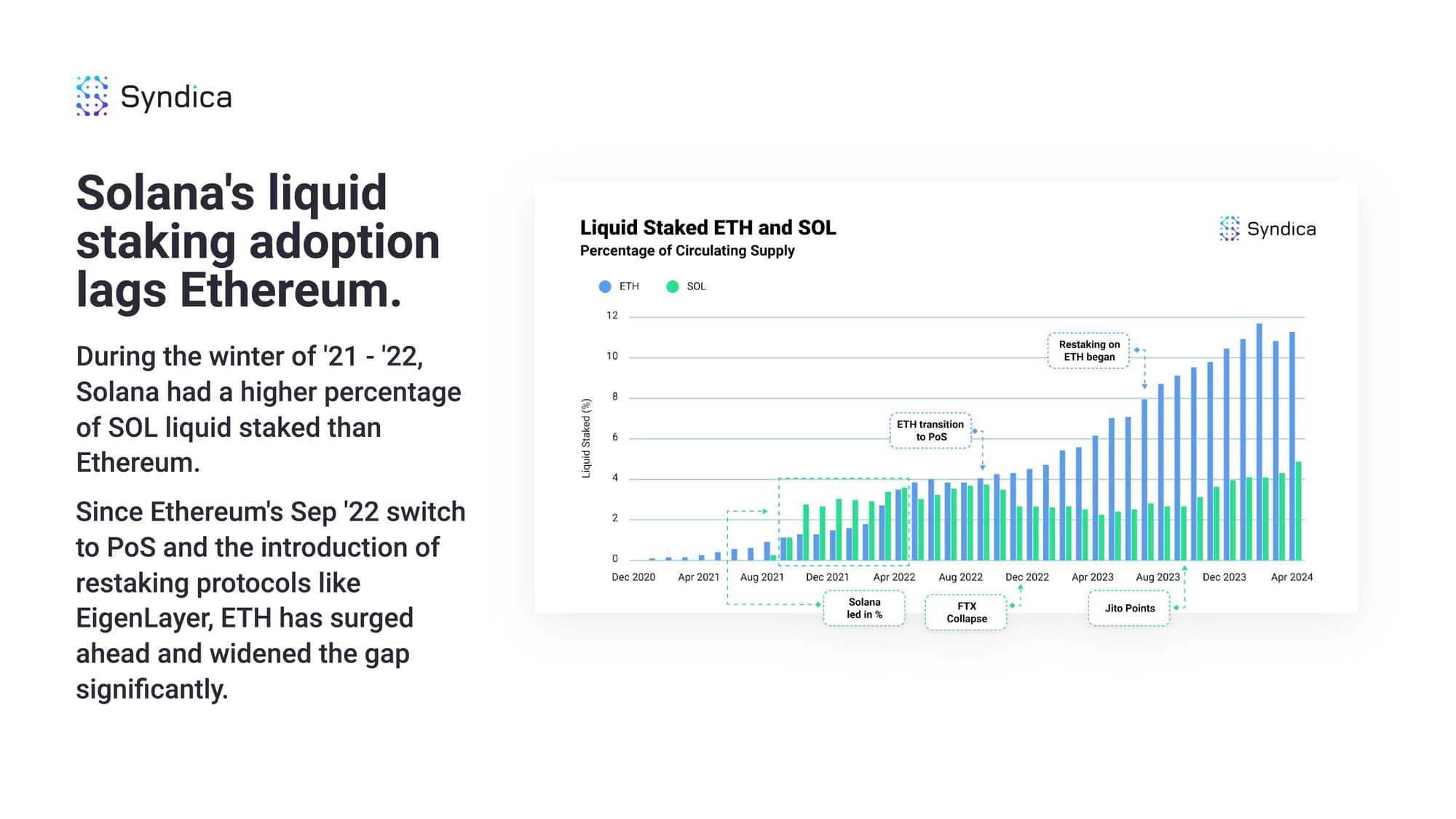

Solana's liquid staking adoption lags Ethereum. During the winter of '21 - '22, Solana had a higher percentage of SOL liquid staked than Ethereum.

Since Ethereum's Sep '22 switch to PoS and the introduction of restaking protocols like EigenLayer, ETH has surged ahead and widened the gap significantly.

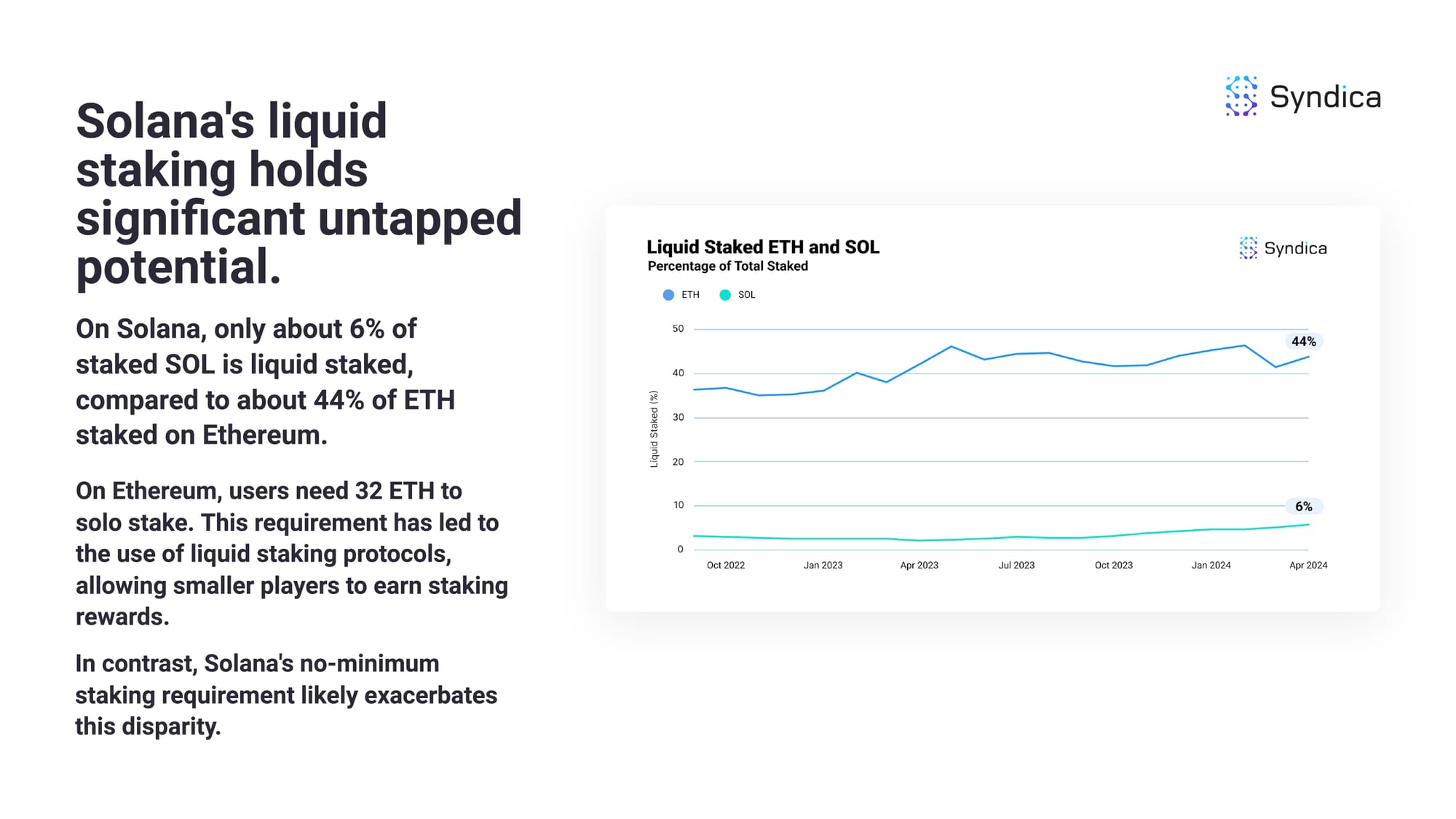

Solana's liquid staking holds significant untapped potential. On Solana, only about 6% of staked SOL is liquid staked, compared to about 44% of ETH staked on Ethereum.

On Ethereum, users need 32 ETH to solo stake. This requirement has led to the use of liquid staking protocols, allowing smaller players to earn staking rewards. In contrast, Solana's no-minimum staking requirement likely exacerbates this disparity.

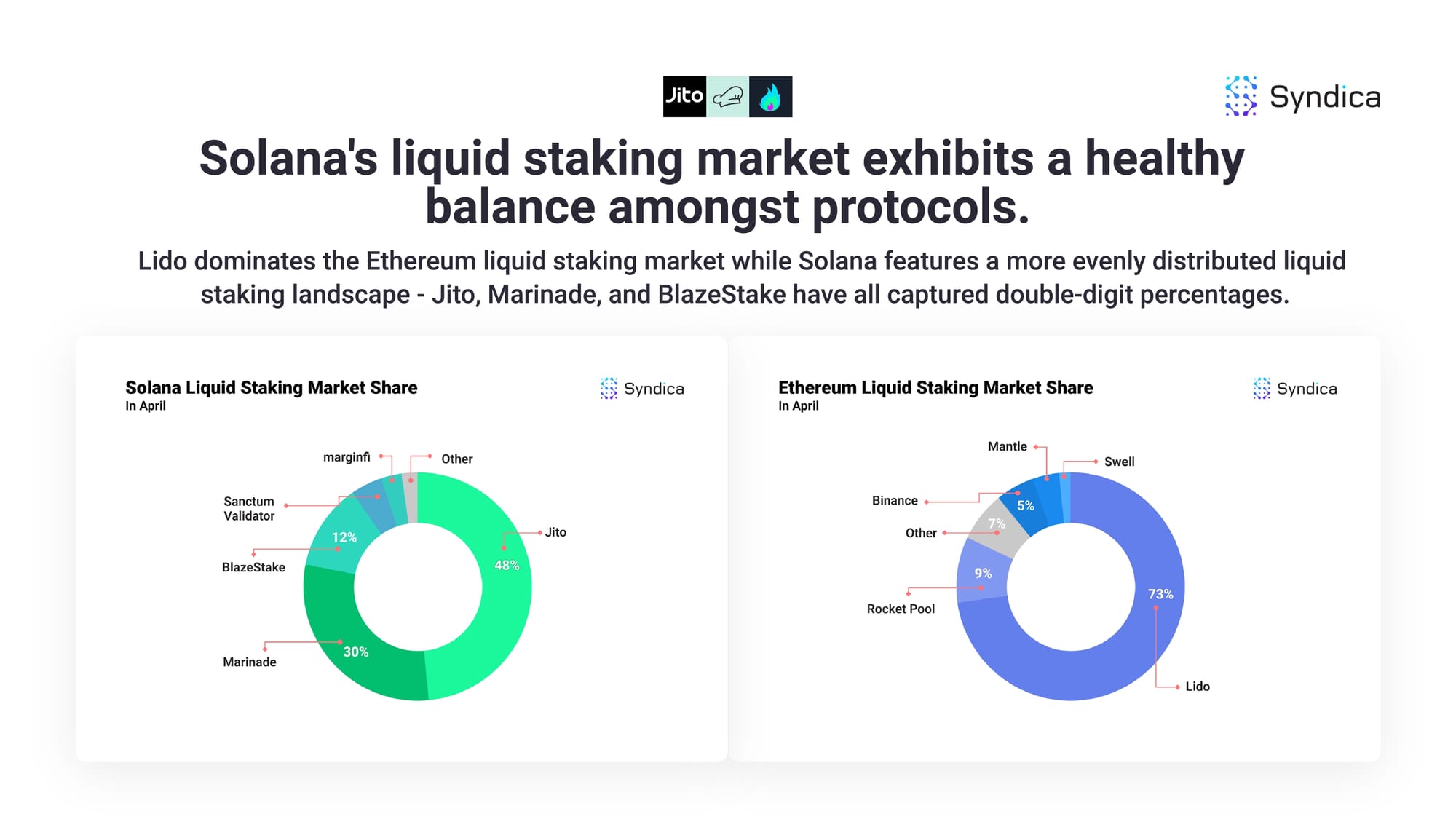

Solana's liquid staking market exhibits a healthy balance amongst protocols. Lido dominates the Ethereum liquid staking market while Solana features a more evenly distributed liquid staking landscape - Jito, Marinade, and BlazeStake have all captured double-digit percentages.

5. DeFi Bridges

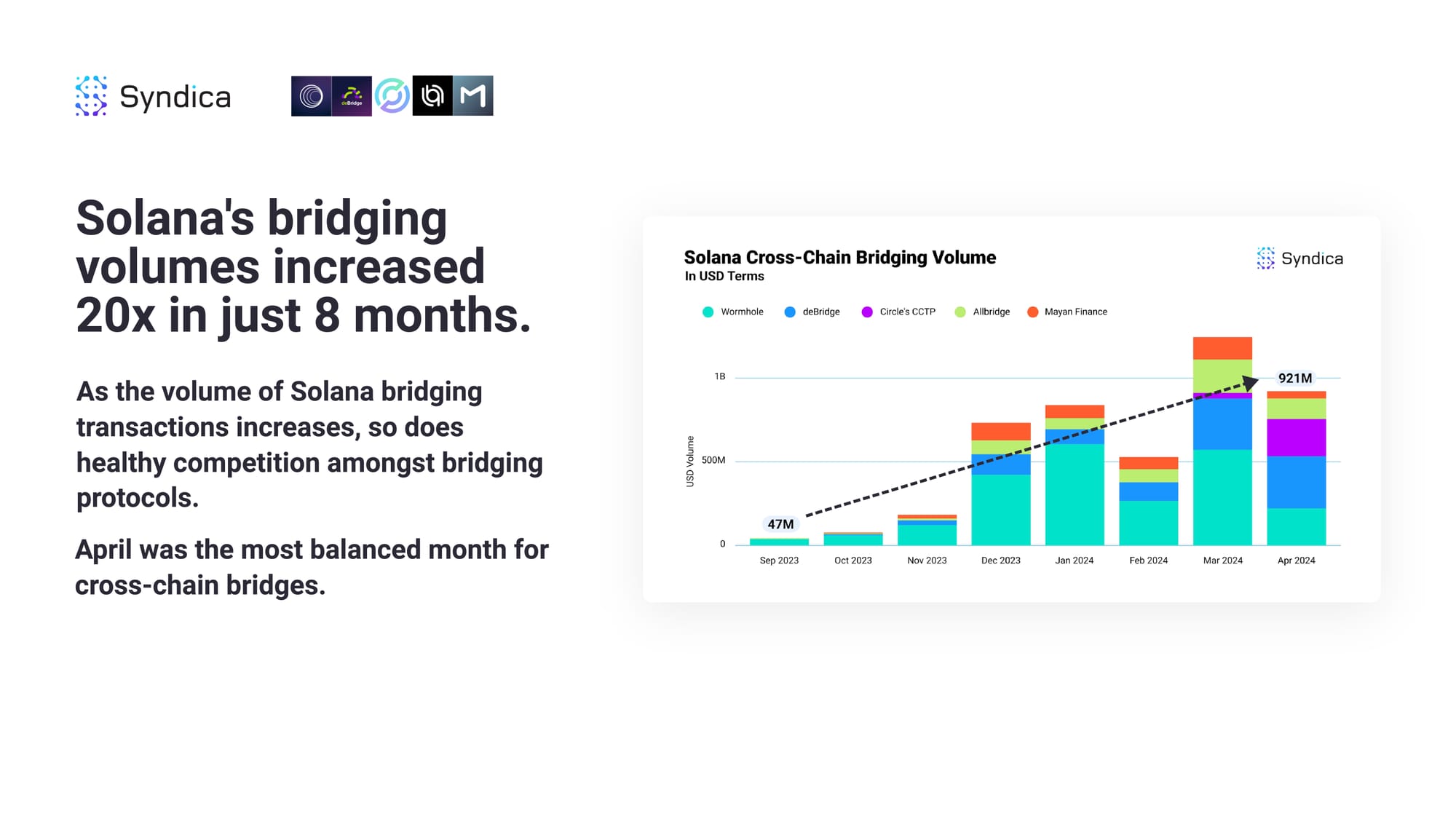

Solana's bridging volumes increased 20x in just 8 months. As the volume of Solana bridging transactions increases, so does healthy competition amongst bridging protocols. April was the most balanced month for cross-chain bridges.

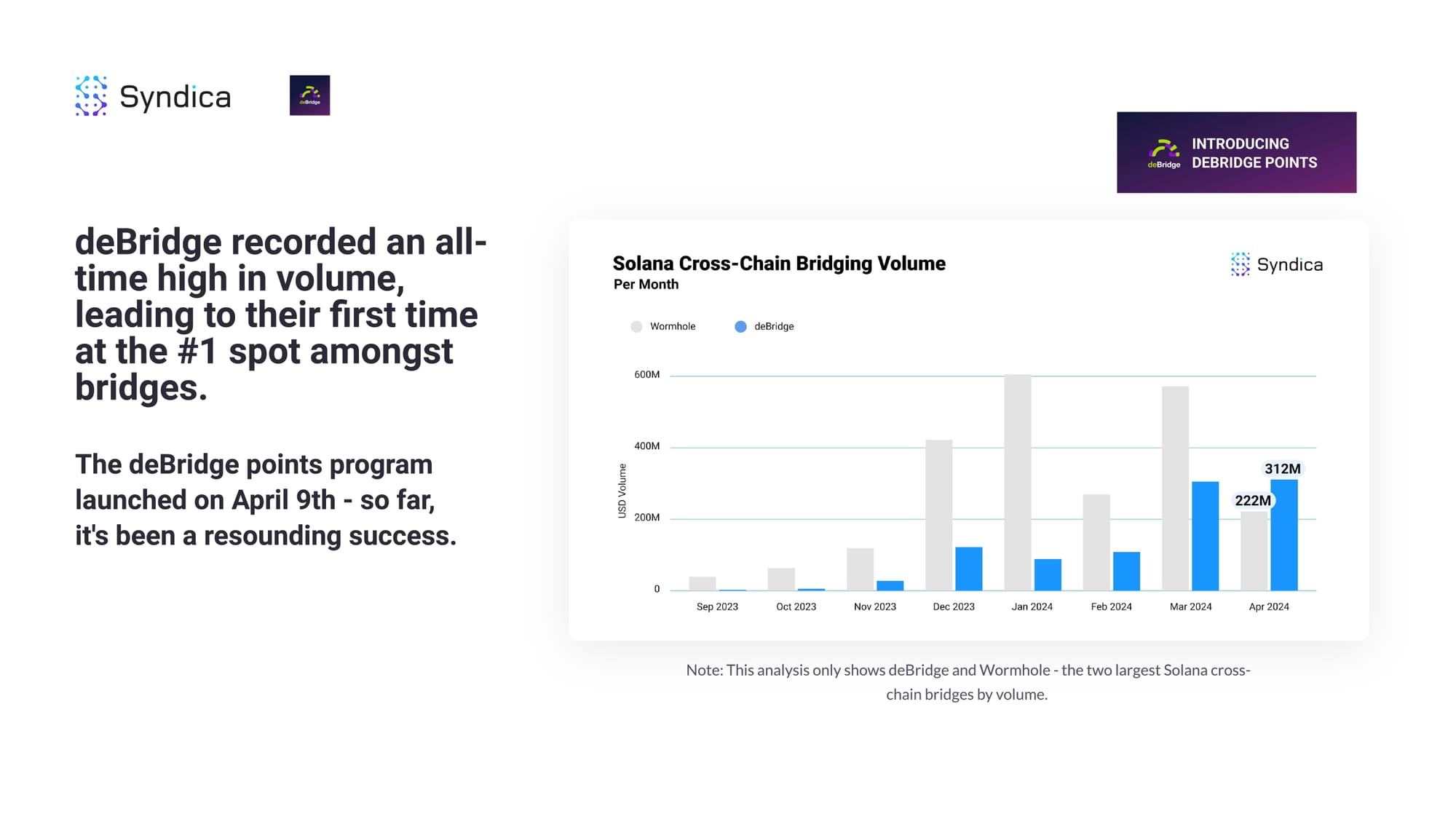

deBridge recorded an all-time high in volume, leading to their first time at the #1 spot amongst bridges. The deBridge points program launched on April 9th - so far, it's been a resounding success.

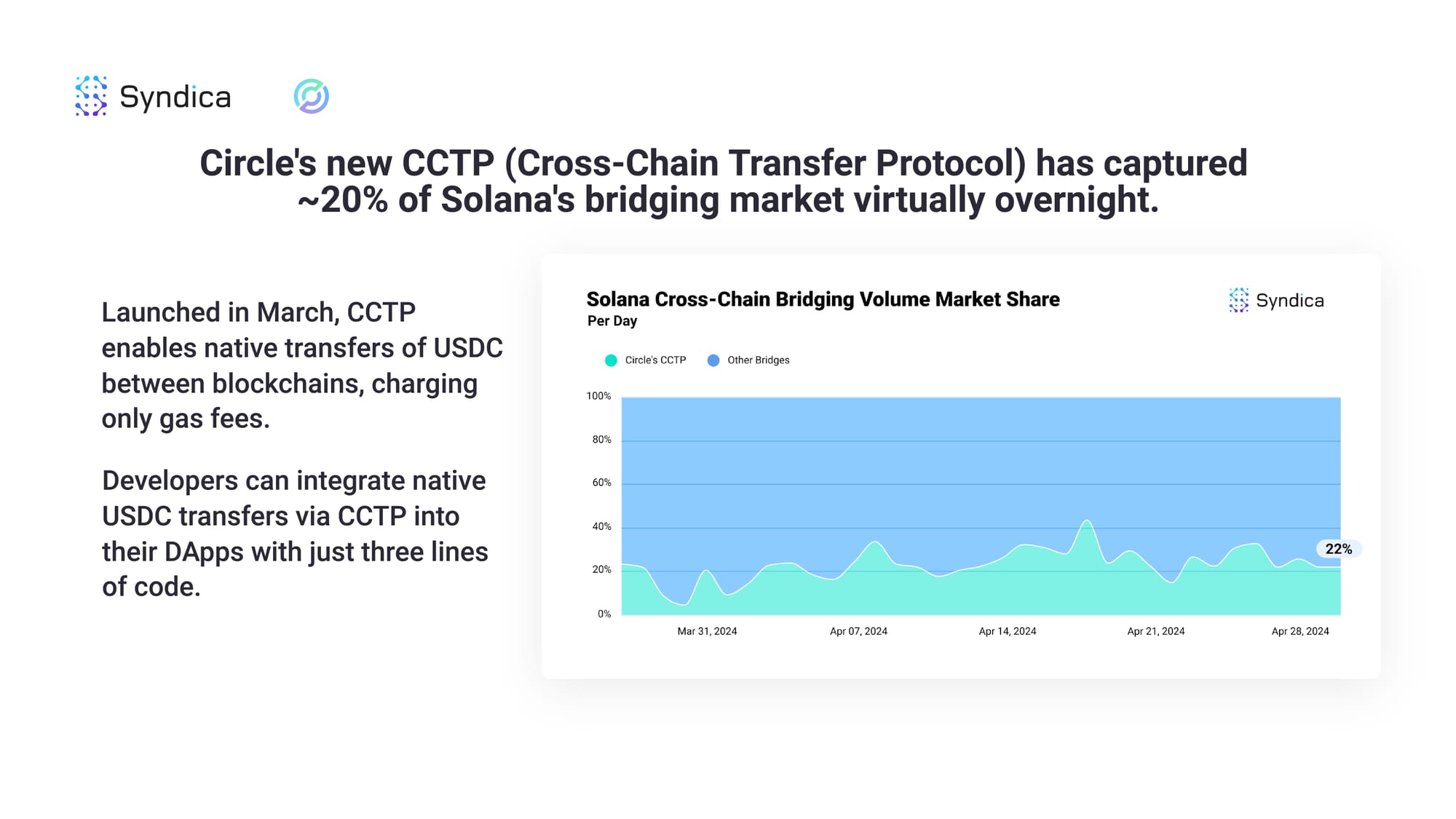

Circle's new CCTP (Cross-Chain Transfer Protocol) has captured ~20% of Solana's bridging market virtually overnight. Launched in March, CCTP enables native transfers of USDC between blockchains, charging only gas fees.

Developers can integrate native USDC transfers via CCTP into their DApps with just three lines of code.

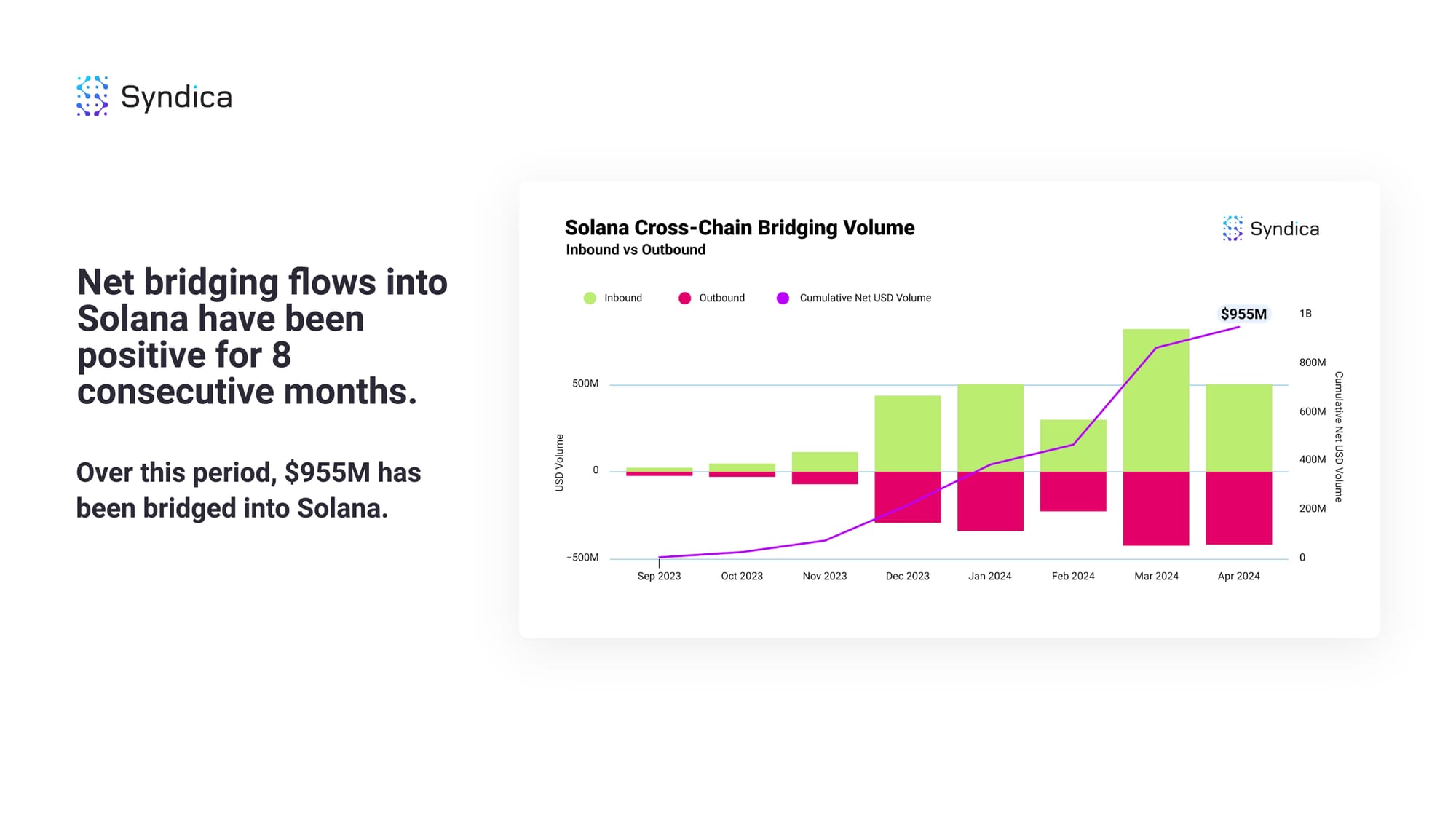

Net bridging flows into Solana have been positive for 8 consecutive months. Over this period, $955M has been bridged into Solana.

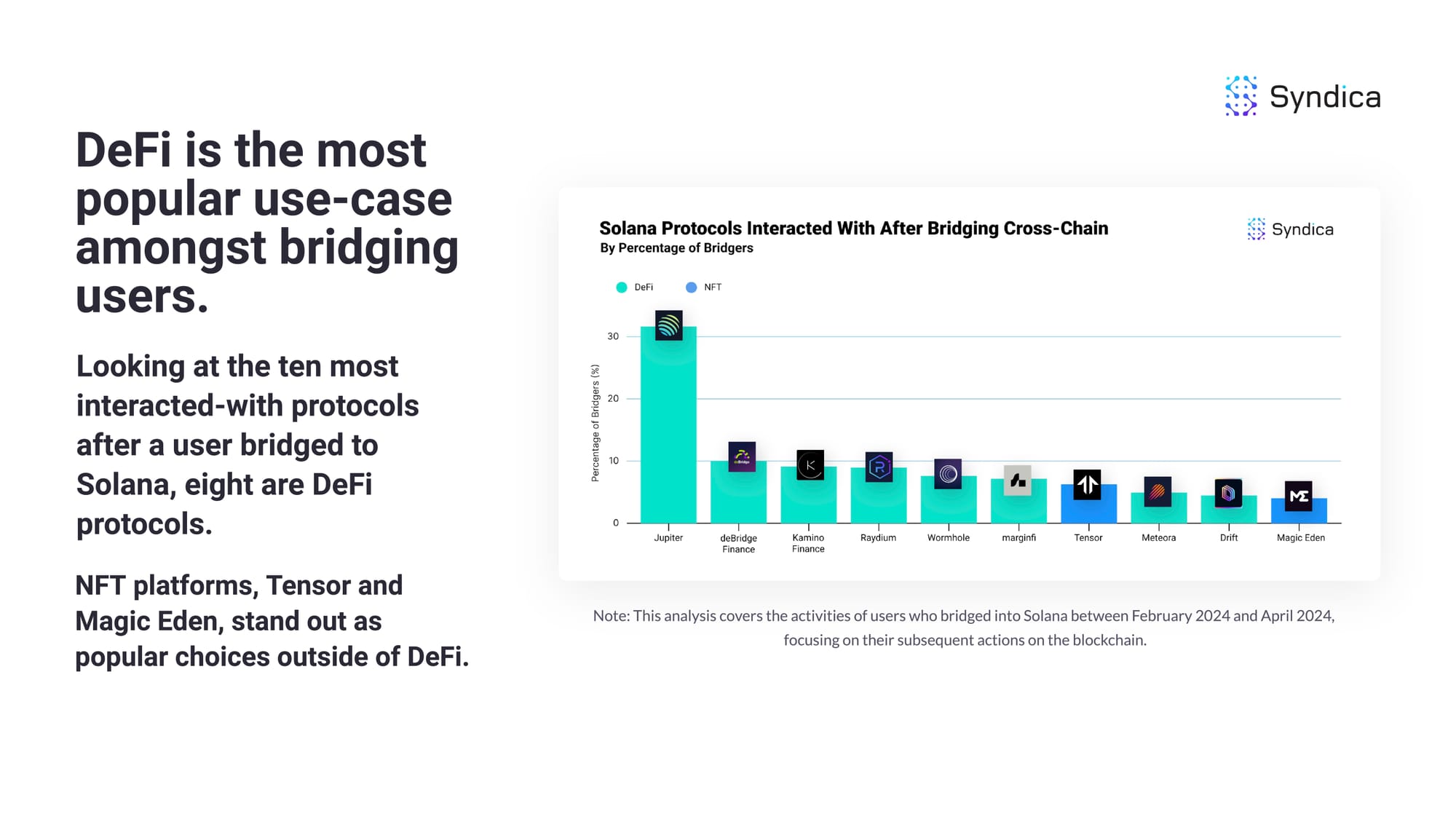

DeFi is the most popular use-case amongst bridging users. Looking at the ten most interacted-with protocols after a user bridged to Solana, eight are DeFi protocols. NFT platforms, Tensor and Magic Eden, stand out as popular choices outside of DeFi.

6. Our Trends to Watch

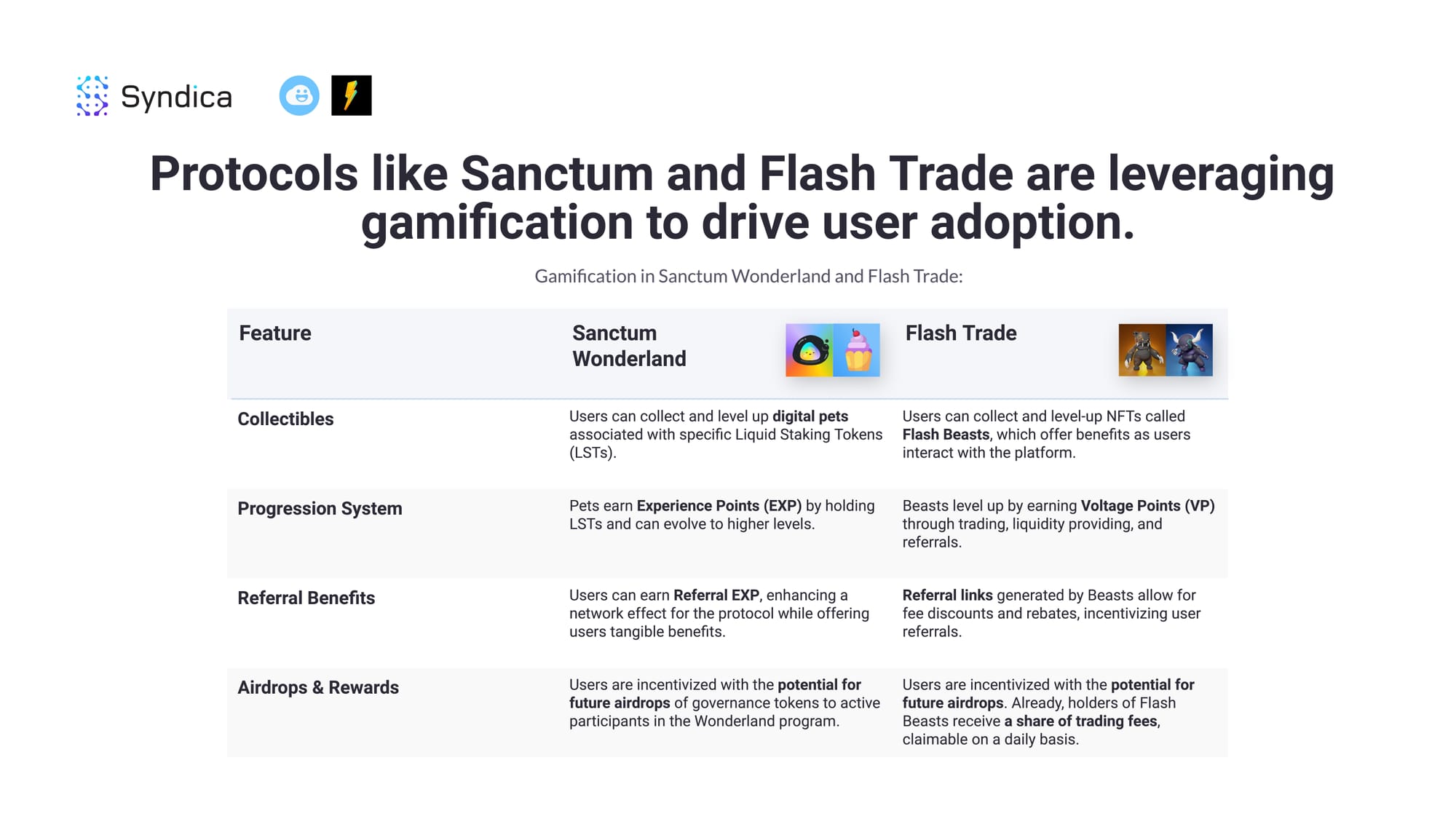

Protocols like Sanctum and Flash Trade are leveraging gamification to drive user adoption.

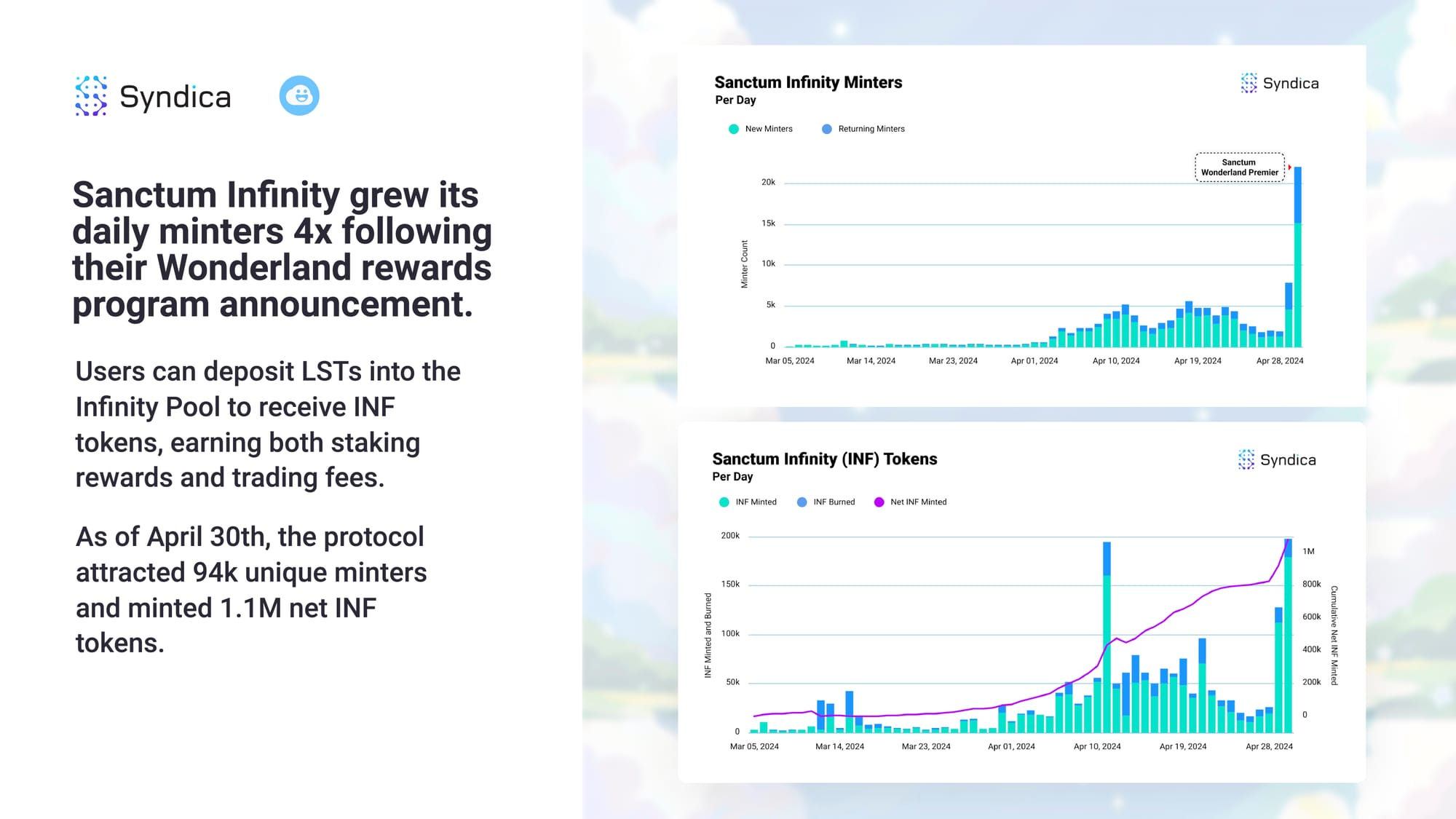

Sanctum Infinity grew its daily minters 4x following their Wonderland rewards program announcement. Users can deposit LSTs into the Infinity Pool to receive INF tokens, earning both staking rewards and trading fees. As of April 30th, the protocol attracted 94k unique minters and minted 1.1M net INF tokens.

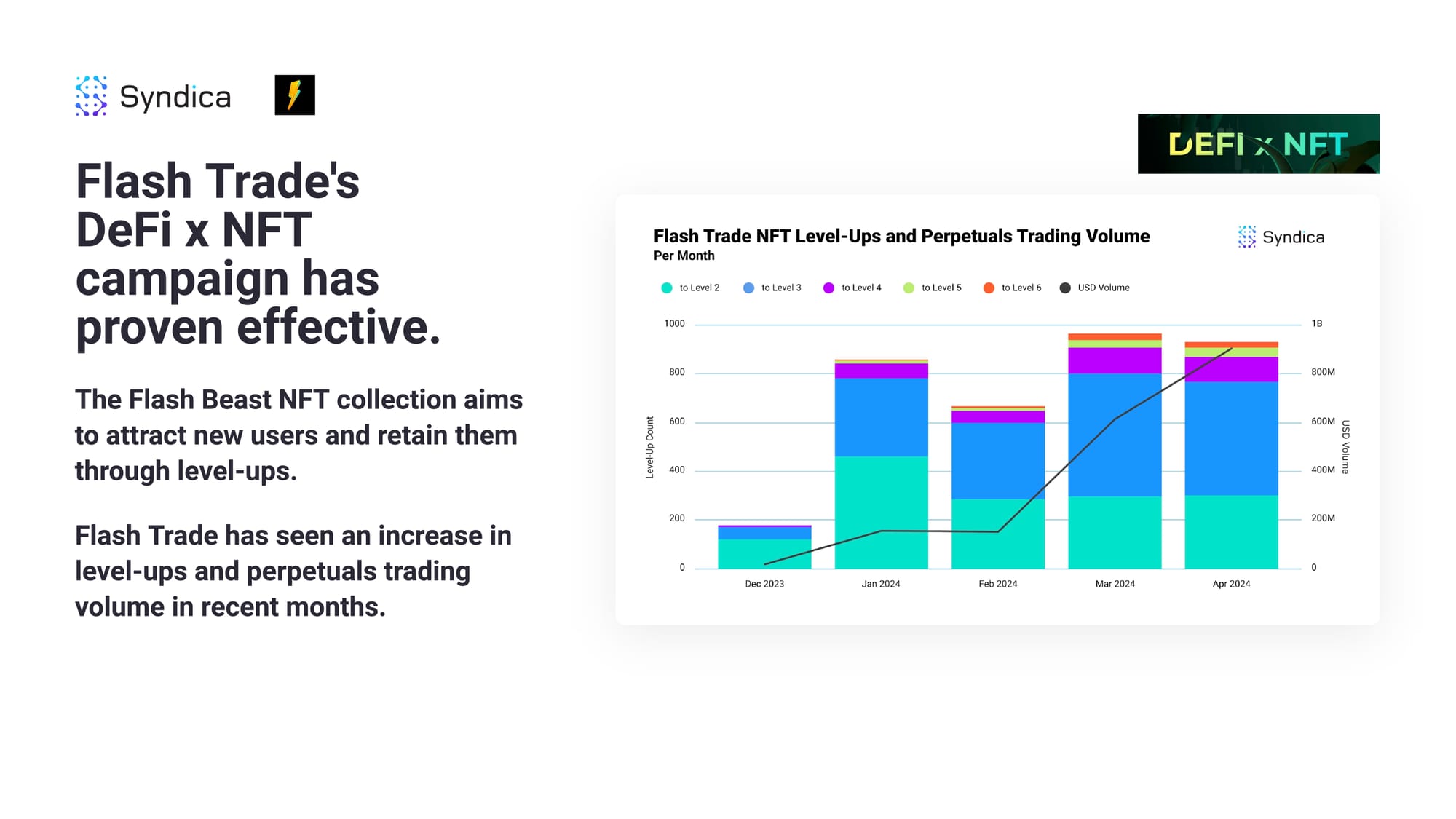

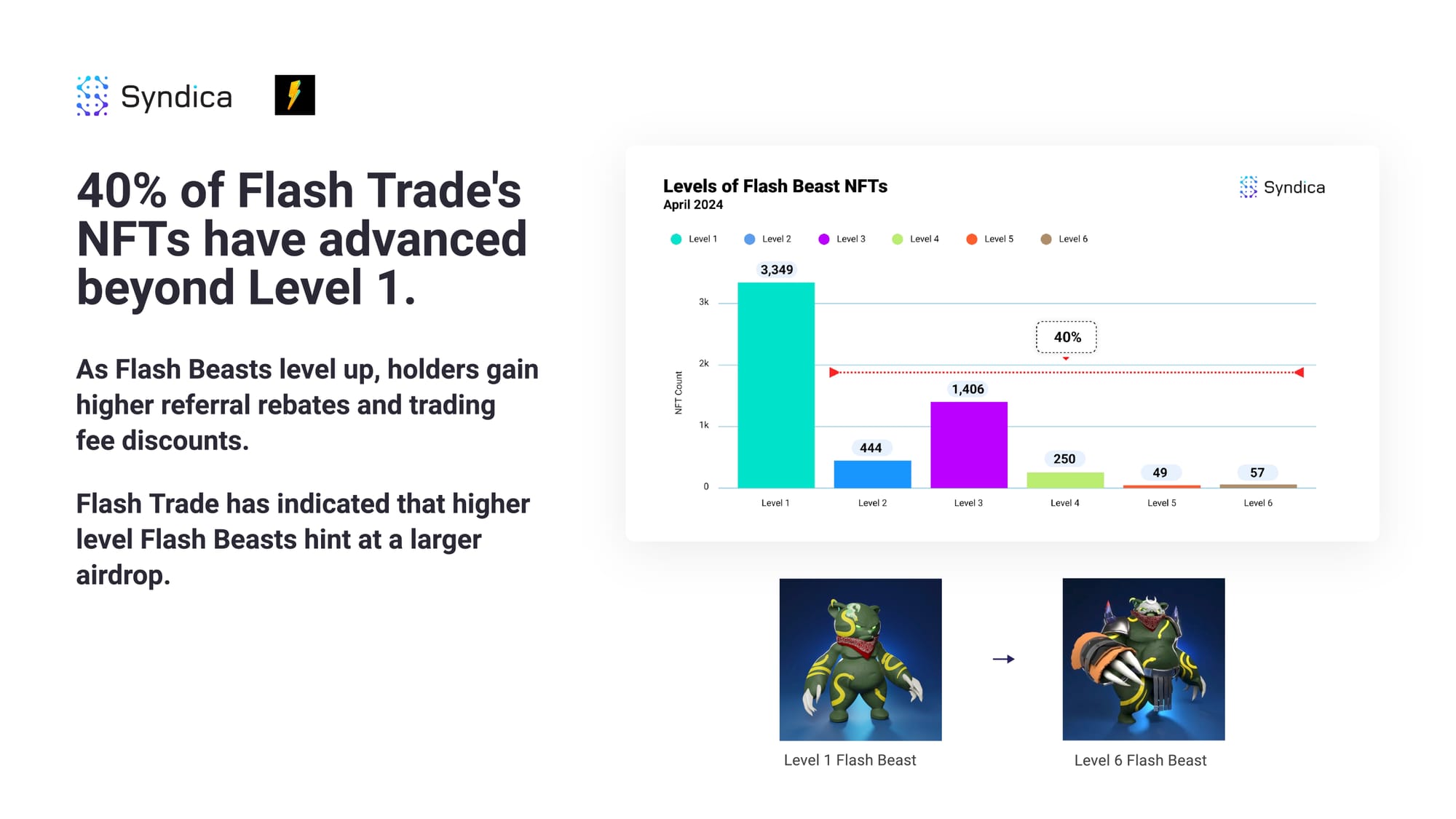

Flash Trade's DeFi x NFT campaign has proven effective. The Flash Beast NFT collection aims to attract new users and retain them through level-ups. Flash Trade has seen an increase in level-ups and perpetuals trading volume in recent months.

40% of Flash Trade's NFTs have advanced beyond Level 1. As Flash Beasts level up, holders gain higher referral rebates and trading fee discounts. Flash Trade has indicated that higher-level Flash Beasts hint at a larger airdrop.