Deep Dive: Solana DeFi - April 2025

Deep Dive: Solana DeFi - April 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - April 2025

Part I: DeFi Overview

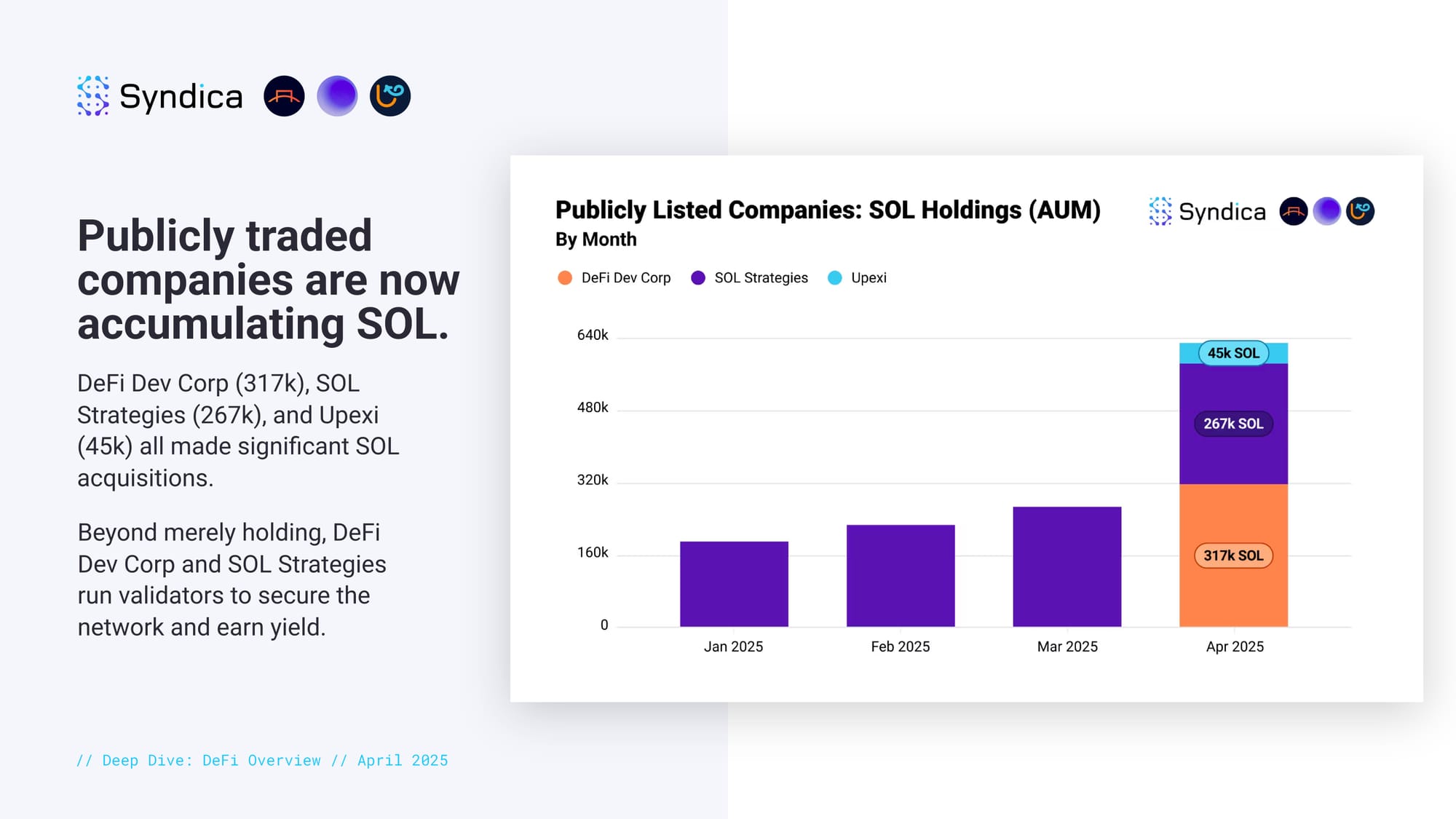

Publicly traded companies are now accumulating SOL. DeFi Dev Corp (317k), SOL Strategies (267k), and Upexi (45k) all made significant SOL acquisitions. Beyond merely holding, DeFi Dev Corp and SOL Strategies run validators to secure the network and earn yield.

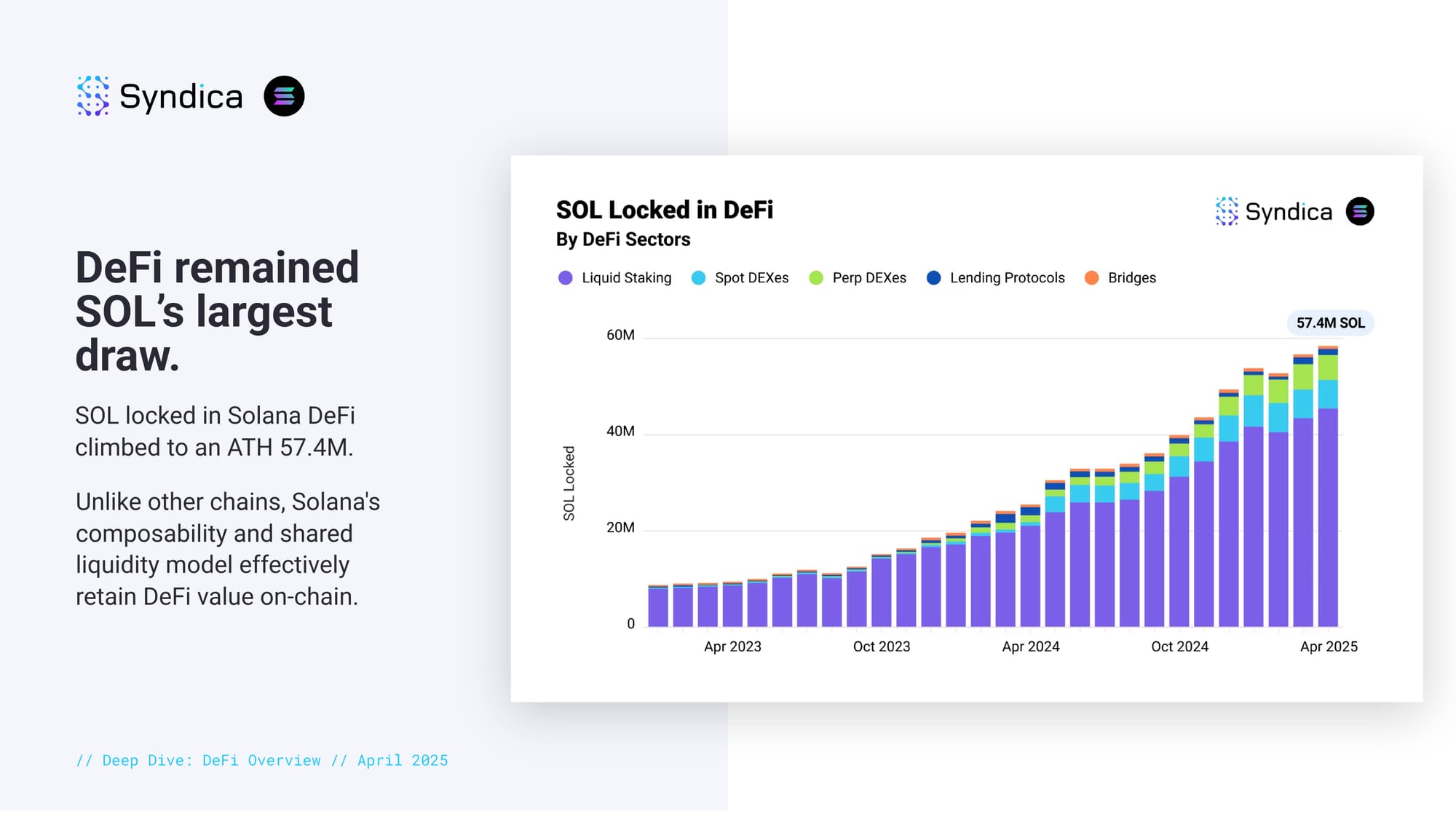

DeFi remained SOL’s largest draw. SOL locked in Solana DeFi climbed to an ATH 57.4M. Unlike other chains, Solana's composability and shared liquidity model effectively retain DeFi value on-chain.

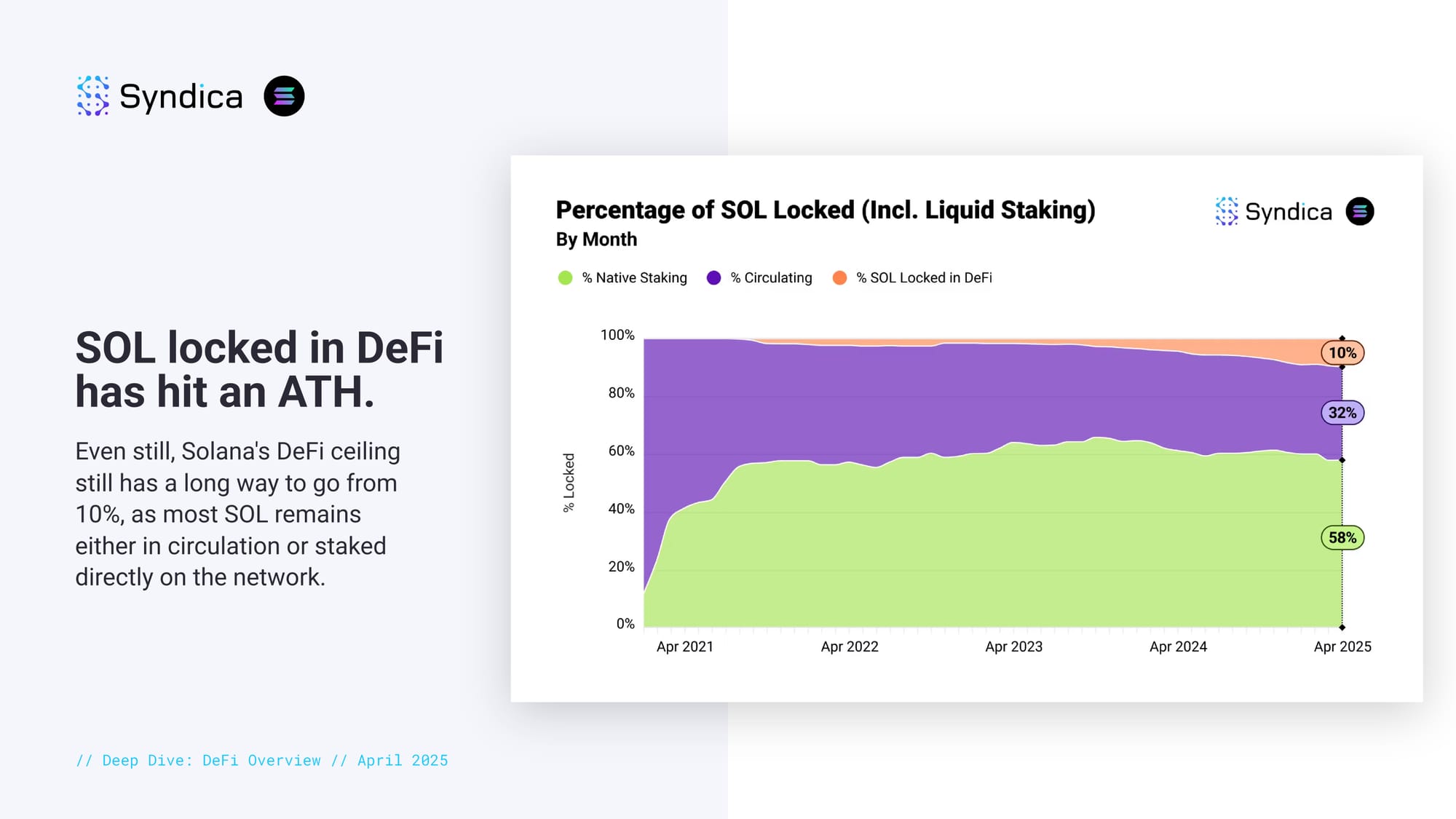

SOL locked in DeFi has hit an ATH. Even still, Solana's DeFi ceiling still has a long way to go from 10%, as most SOL remains either in circulation or staked directly on the network.

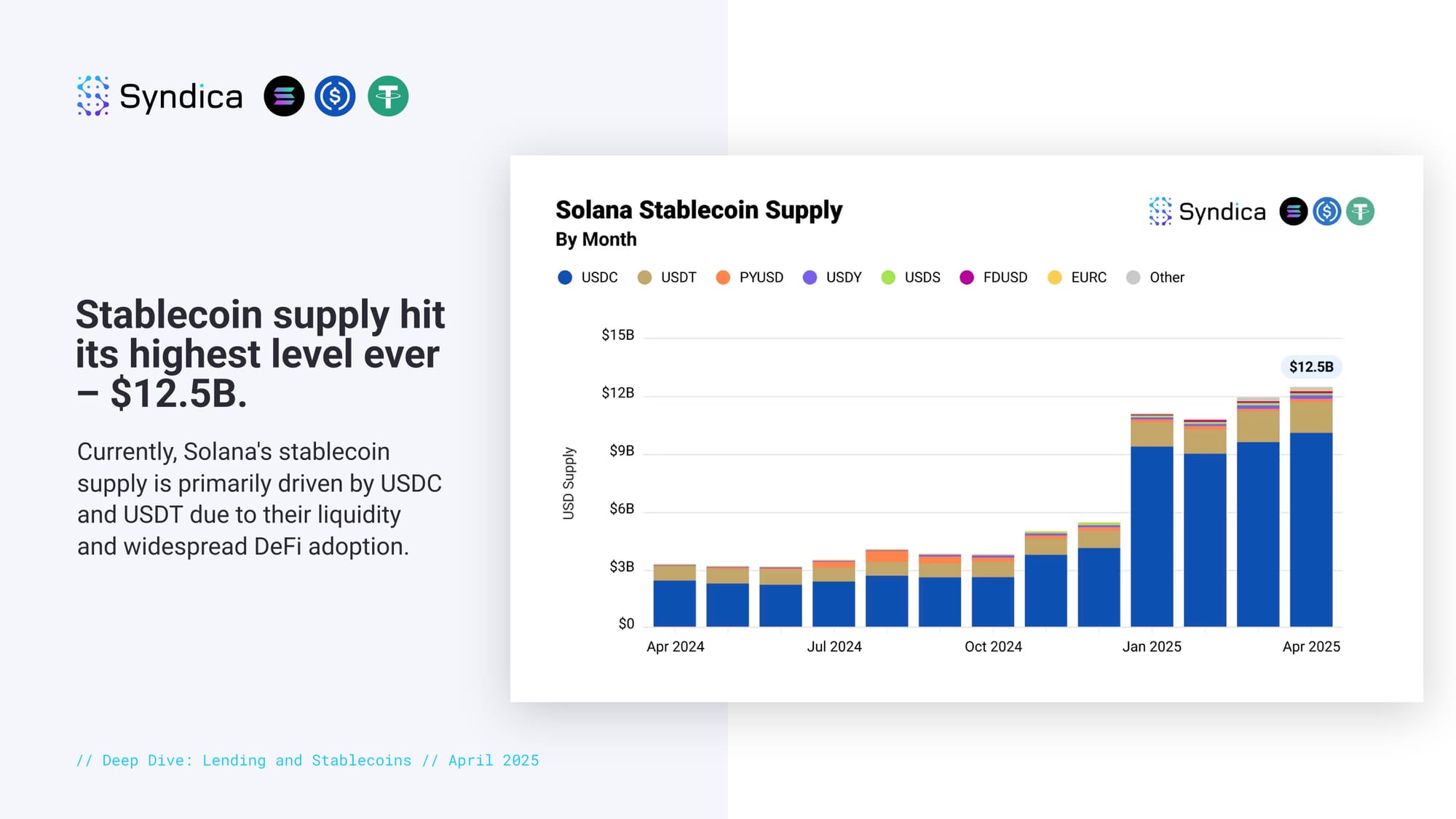

Stablecoin supply hit its highest level ever – $12.5B. Currently, Solana's stablecoin supply is primarily driven by USDC and USDT due to their liquidity and widespread DeFi adoption.

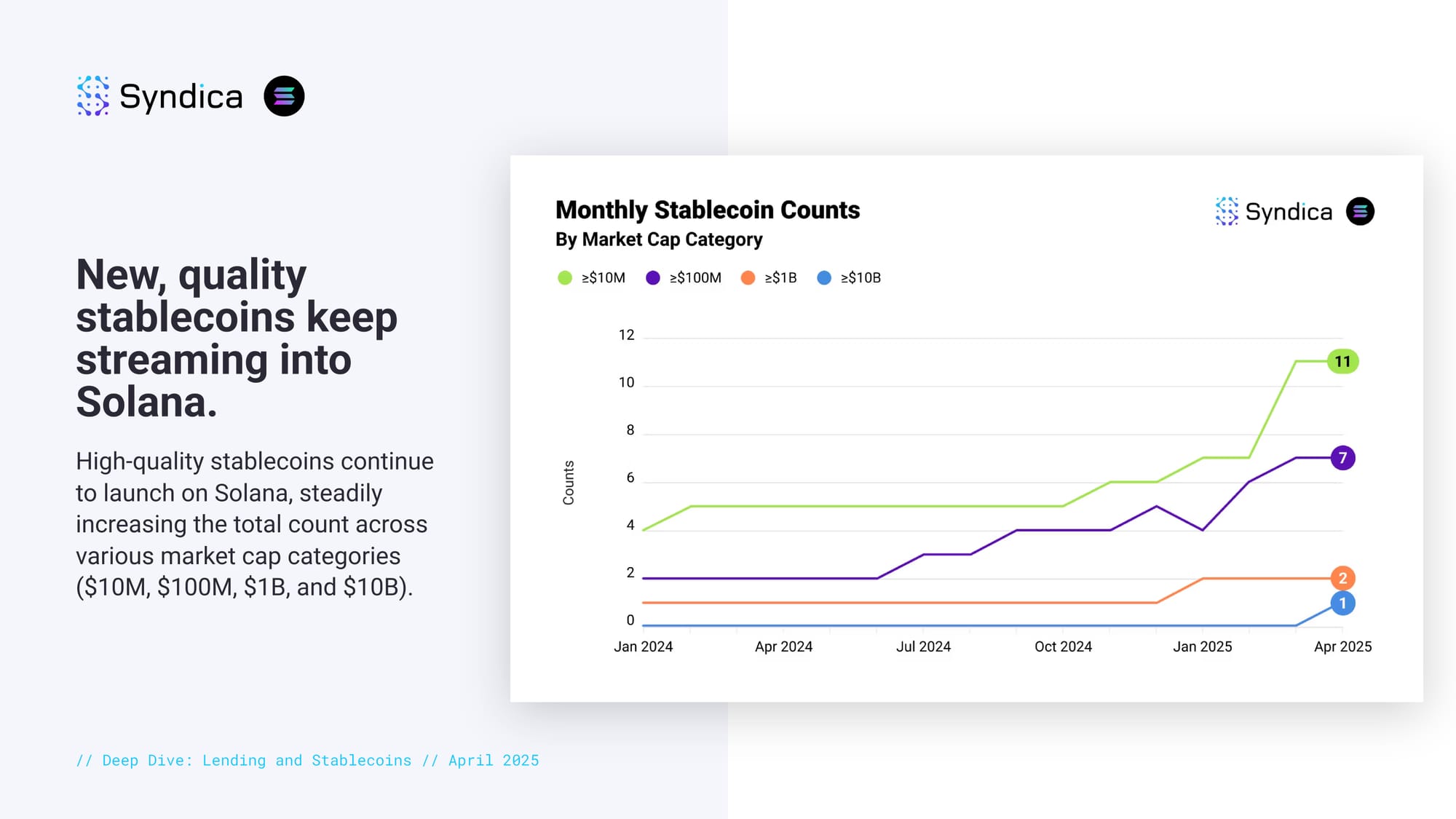

New, quality stablecoins keep streaming into Solana. High-quality stablecoins continue to launch on Solana, steadily increasing the total count across various market cap categories ($10M, $100M, $1B, and $10B).

Part II: DEXes and Aggregators

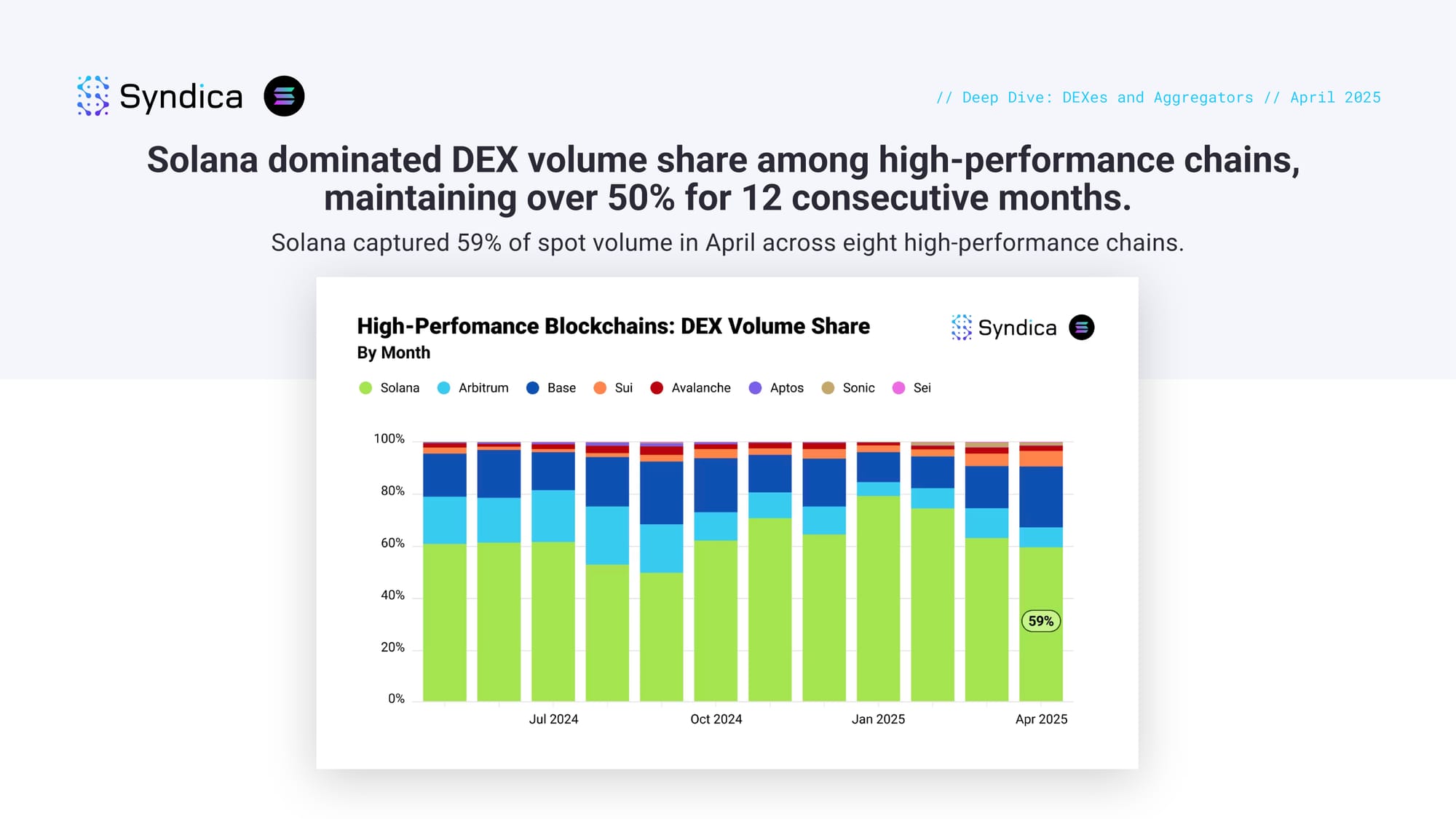

Solana dominated DEX volume share among high-performance chains, maintaining over 50% for 12 consecutive months. Solana captured 59% of spot volume in April across eight high-performance chains.

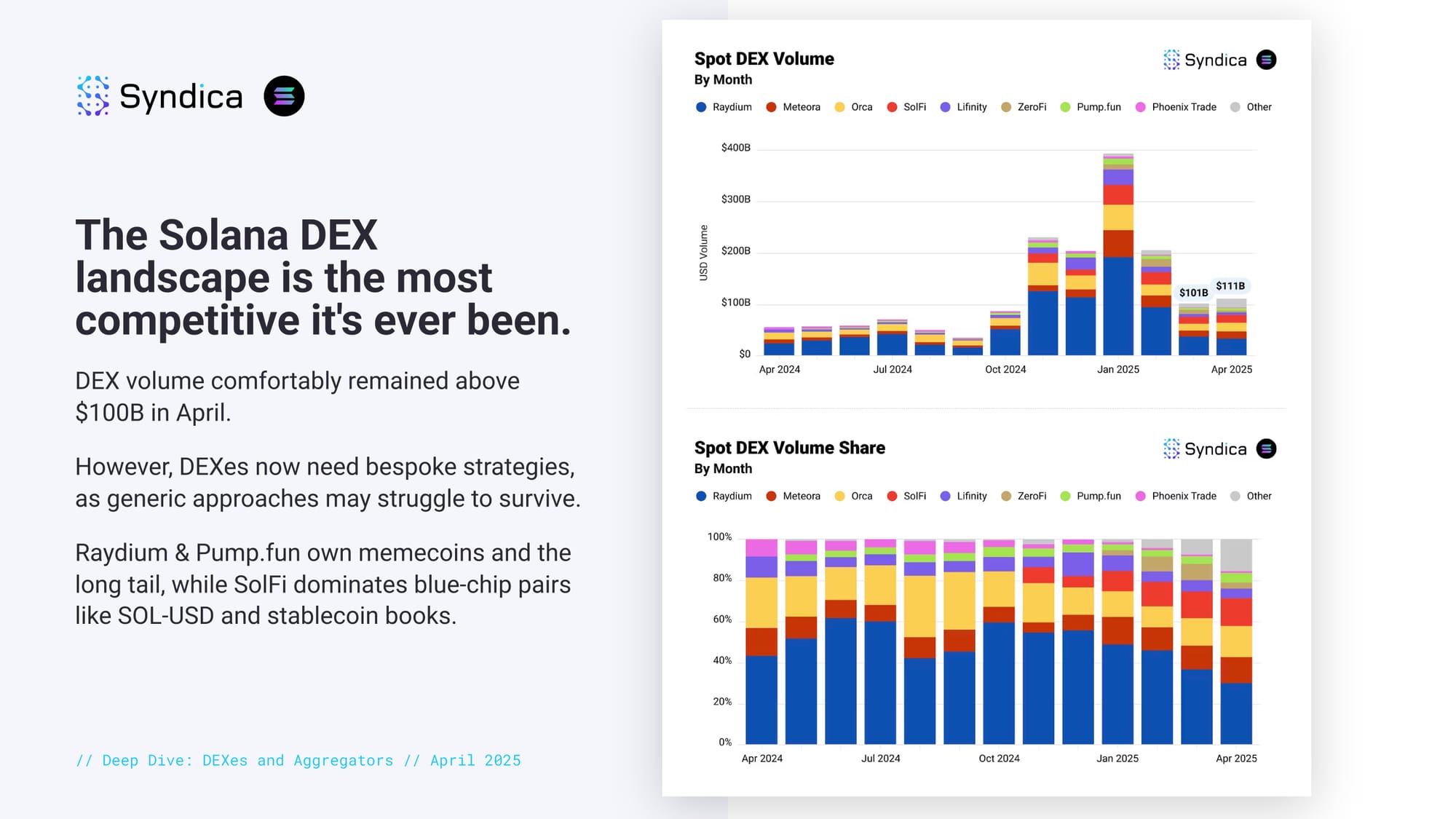

The Solana DEX landscape is the most competitive it's ever been. DEX volume comfortably remained above $100B in April. However, DEXes now need bespoke strategies, as generic approaches may struggle to survive. Raydium & Pump.fun own memecoins and the long tail, while SolFi dominates blue-chip pairs like SOL-USD and stablecoin books.

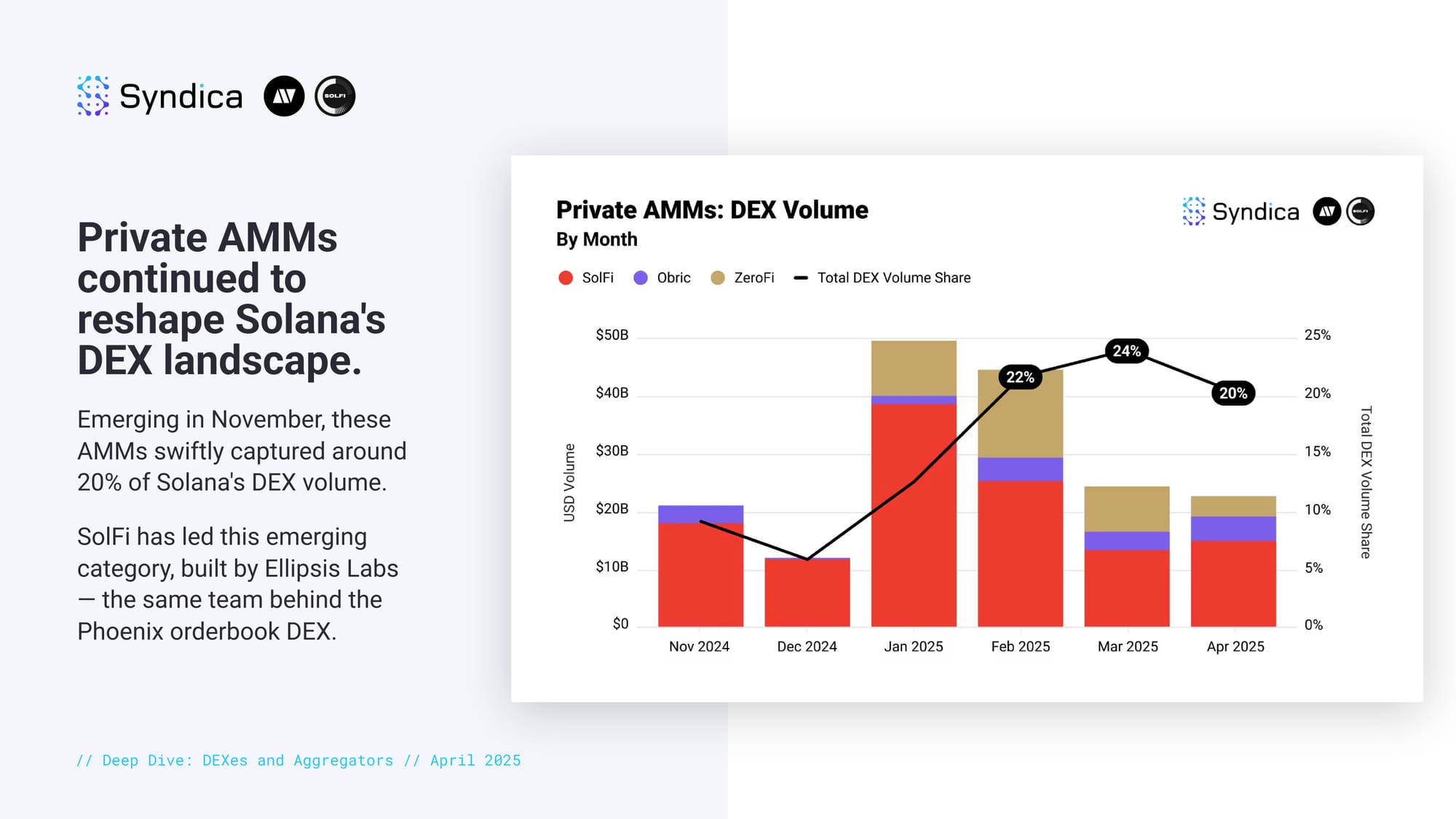

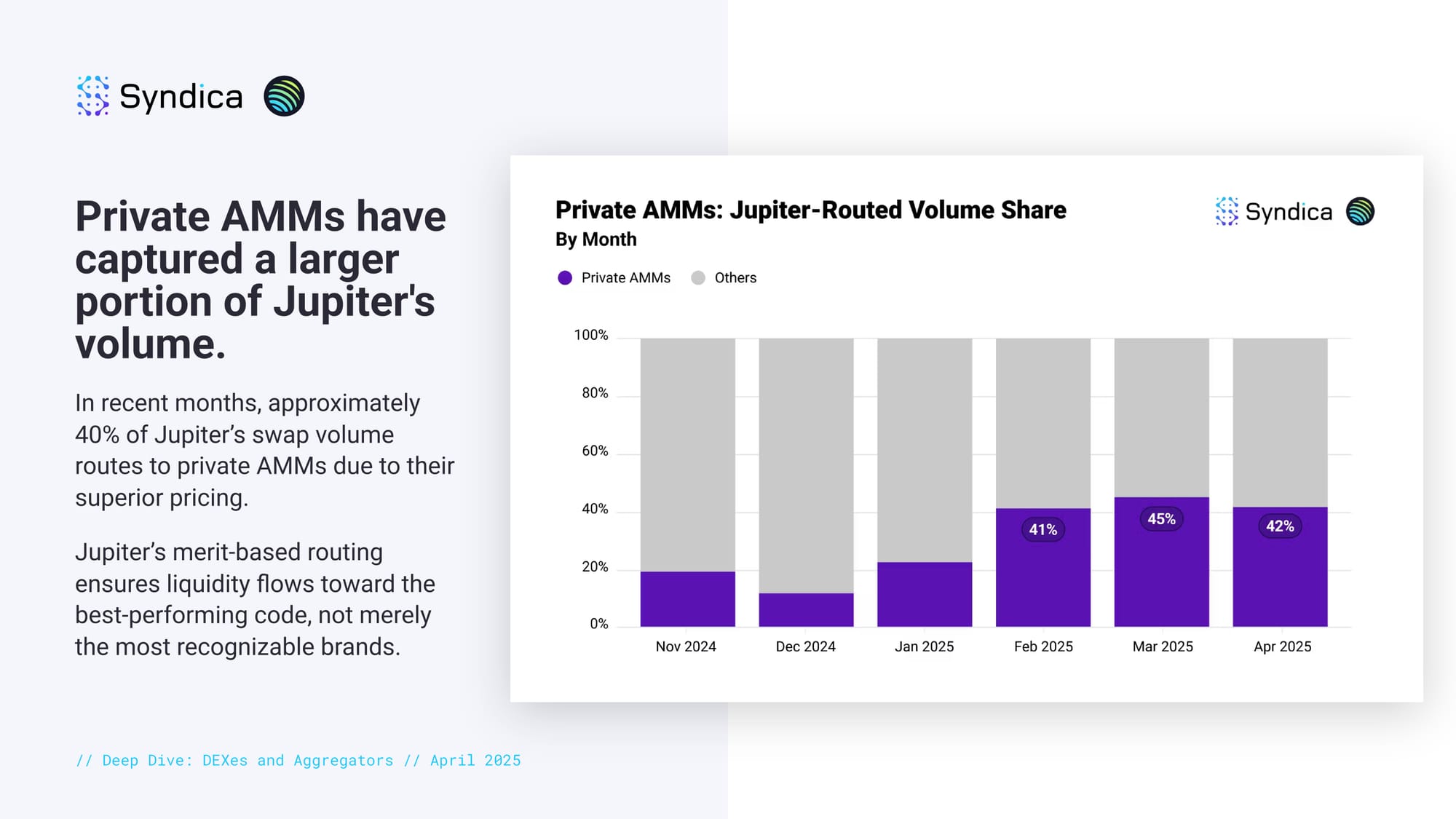

Private AMMs continued to reshape Solana's DEX landscape. Emerging in November, these AMMs swiftly captured around 20% of Solana's DEX volume. SolFi has led this emerging category, built by Ellipsis Labs — the same team behind the Phoenix orderbook DEX.

Private AMMs have captured a larger portion of Jupiter's volume. In recent months, approximately 40% of Jupiter’s swap volume routes to private AMMs due to their superior pricing. Jupiter’s merit-based routing ensures liquidity flows toward the best-performing code, not merely the most recognizable brands.

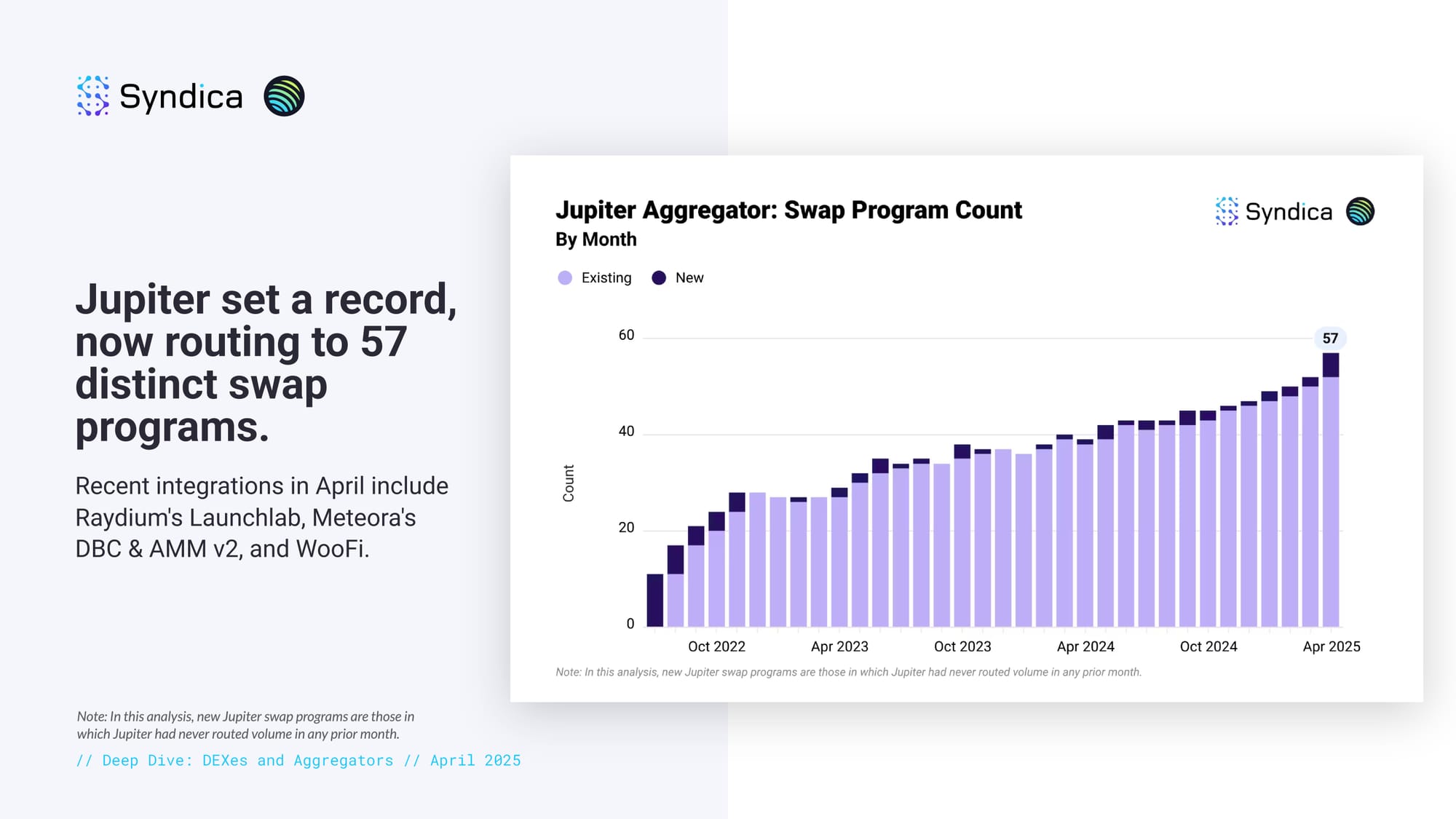

Jupiter set a record, now routing to 57 distinct swap programs. Recent integrations in April include Raydium's Launchlab, Meteora's DBC & AMM v2, and WooFi.

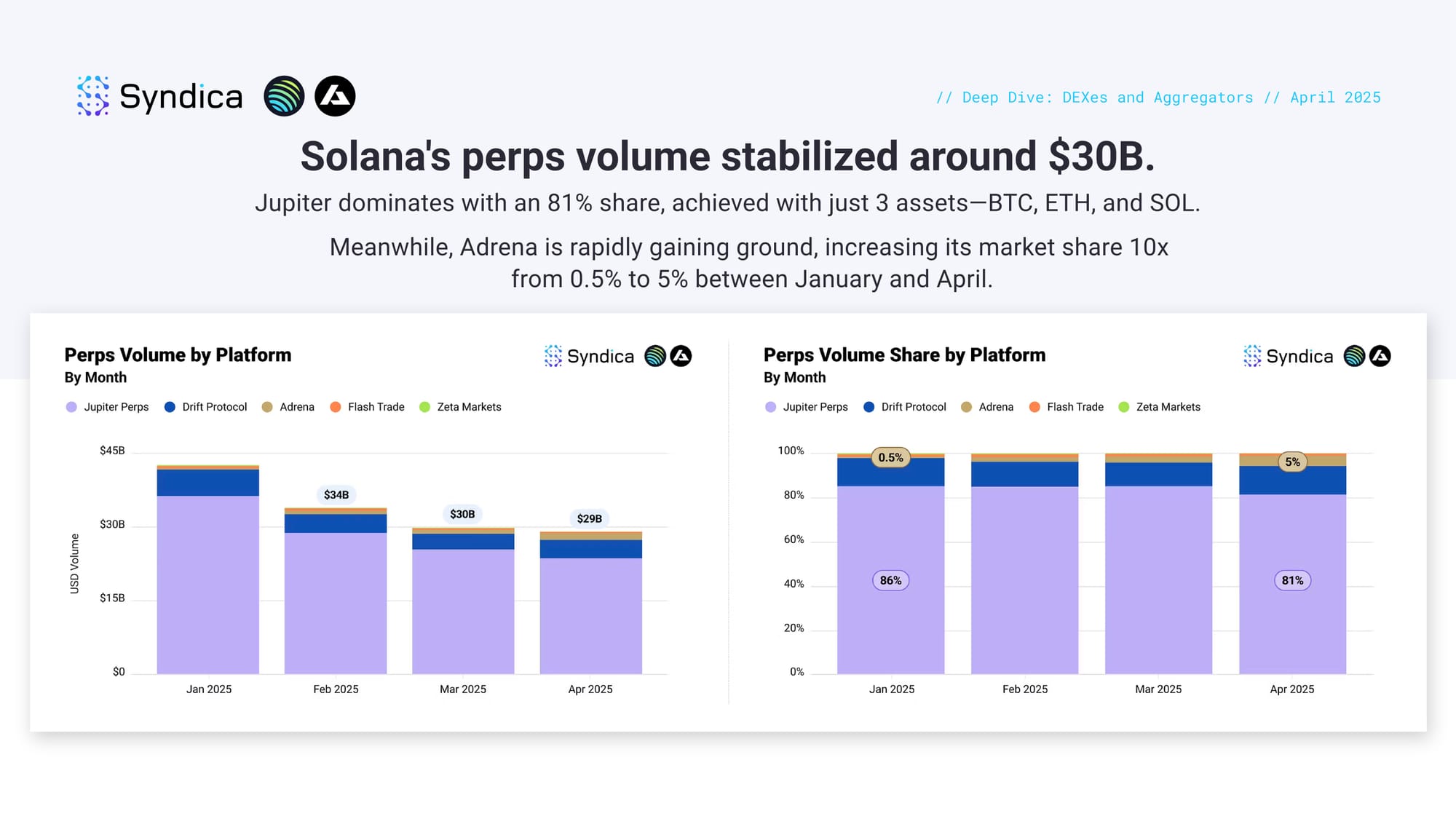

Solana's perps volume stabilized around $30B. Jupiter dominates with an 81% share, achieved with just 3 assets—BTC, ETH, and SOL. Meanwhile, Adrena is rapidly gaining ground, increasing its market share 10x from 0.5% to 5% between January and April.

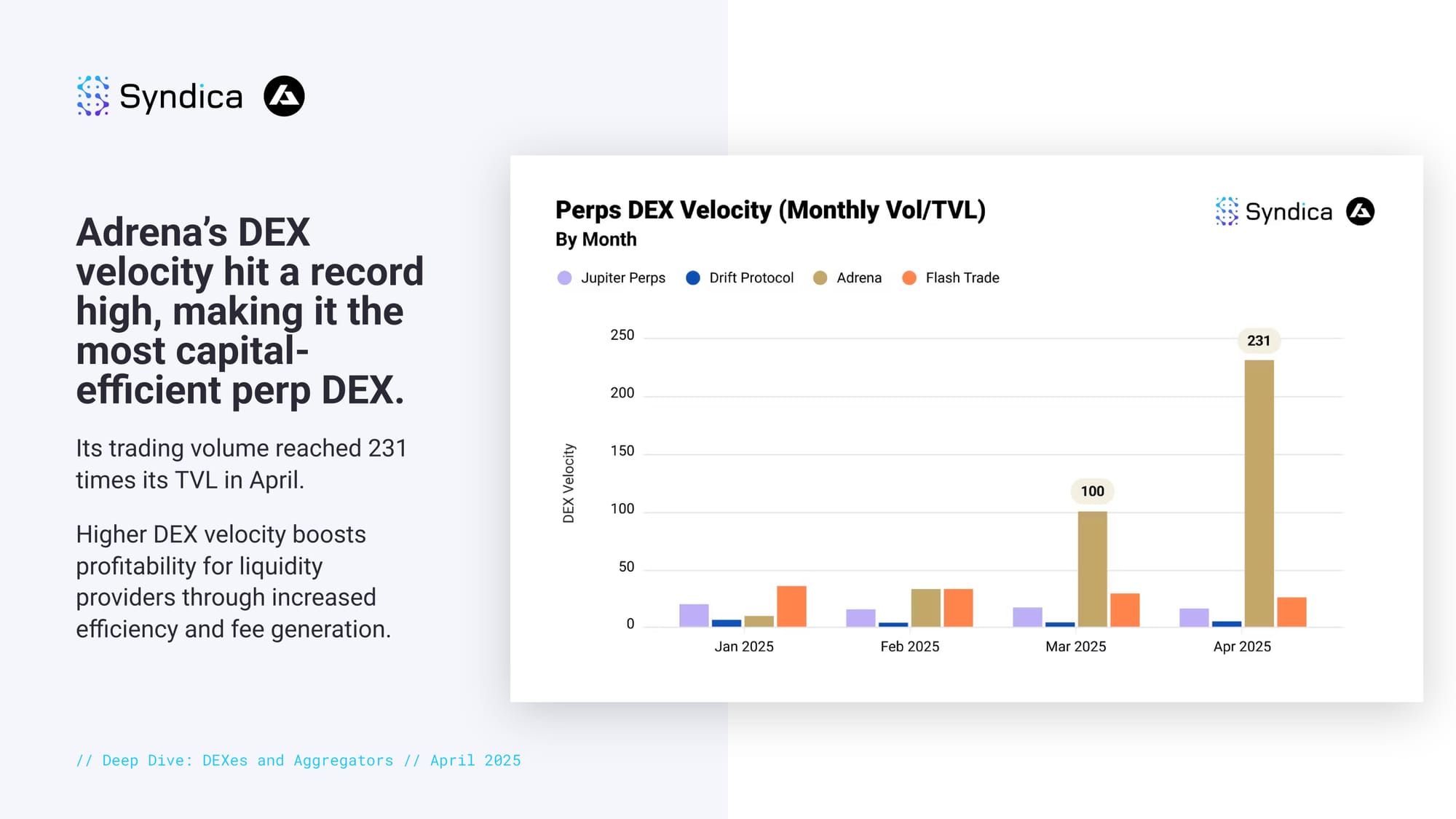

Adrena’s DEX velocity hit a record high, making it the most capital-efficient perp DEX. Its trading volume reached 231 times its TVL in April. Higher DEX velocity boosts profitability for liquidity providers through increased efficiency and fee generation.

Part III: Lending

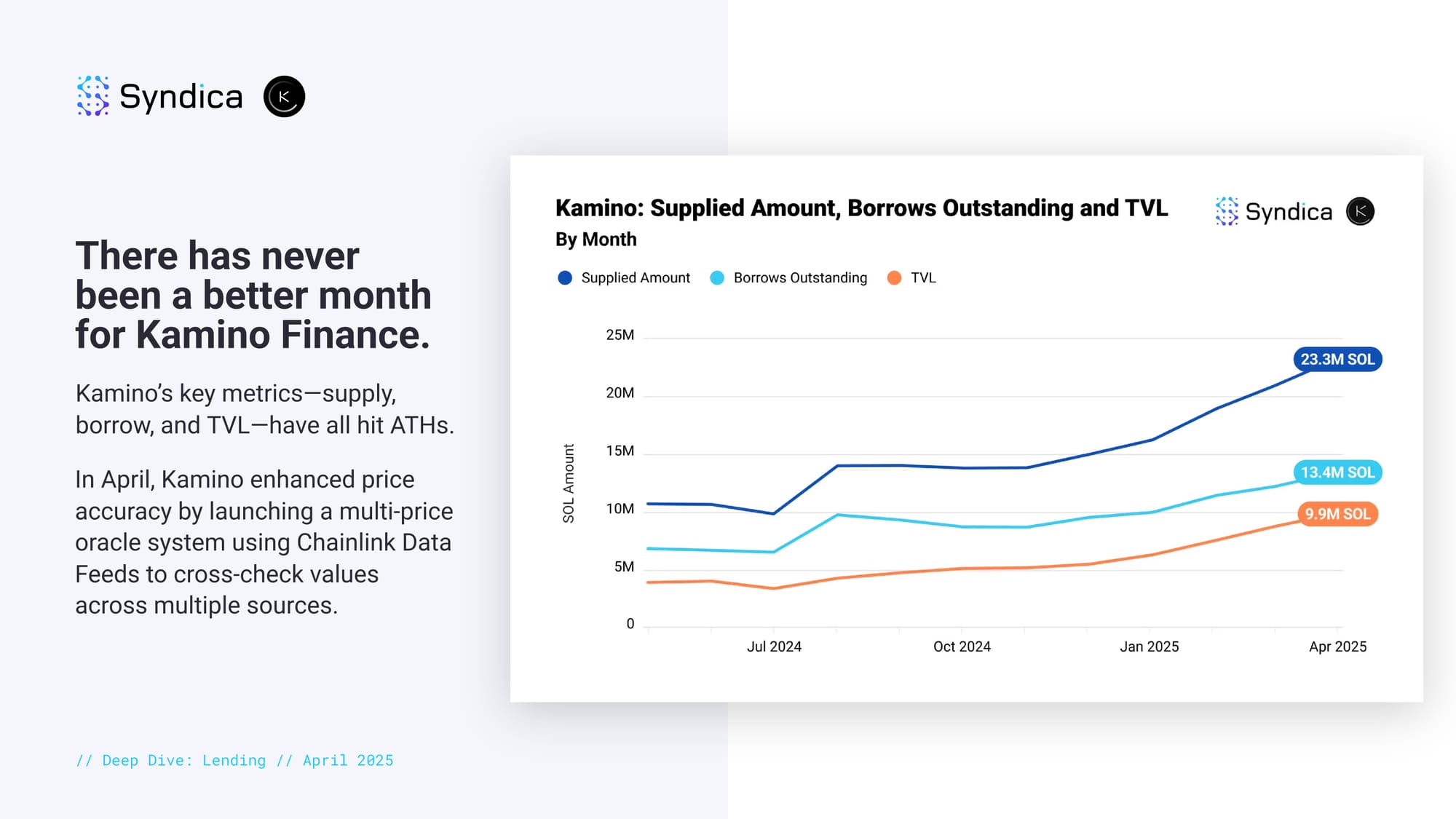

There has never been a better month for Kamino Finance. Kamino’s key metrics—supply, borrow, and TVL—have all hit ATHs. In April, Kamino enhanced price accuracy by launching a multi-price oracle system using Chainlink Data Feeds to cross-check values across multiple sources.

Part IV: Liquid Staking

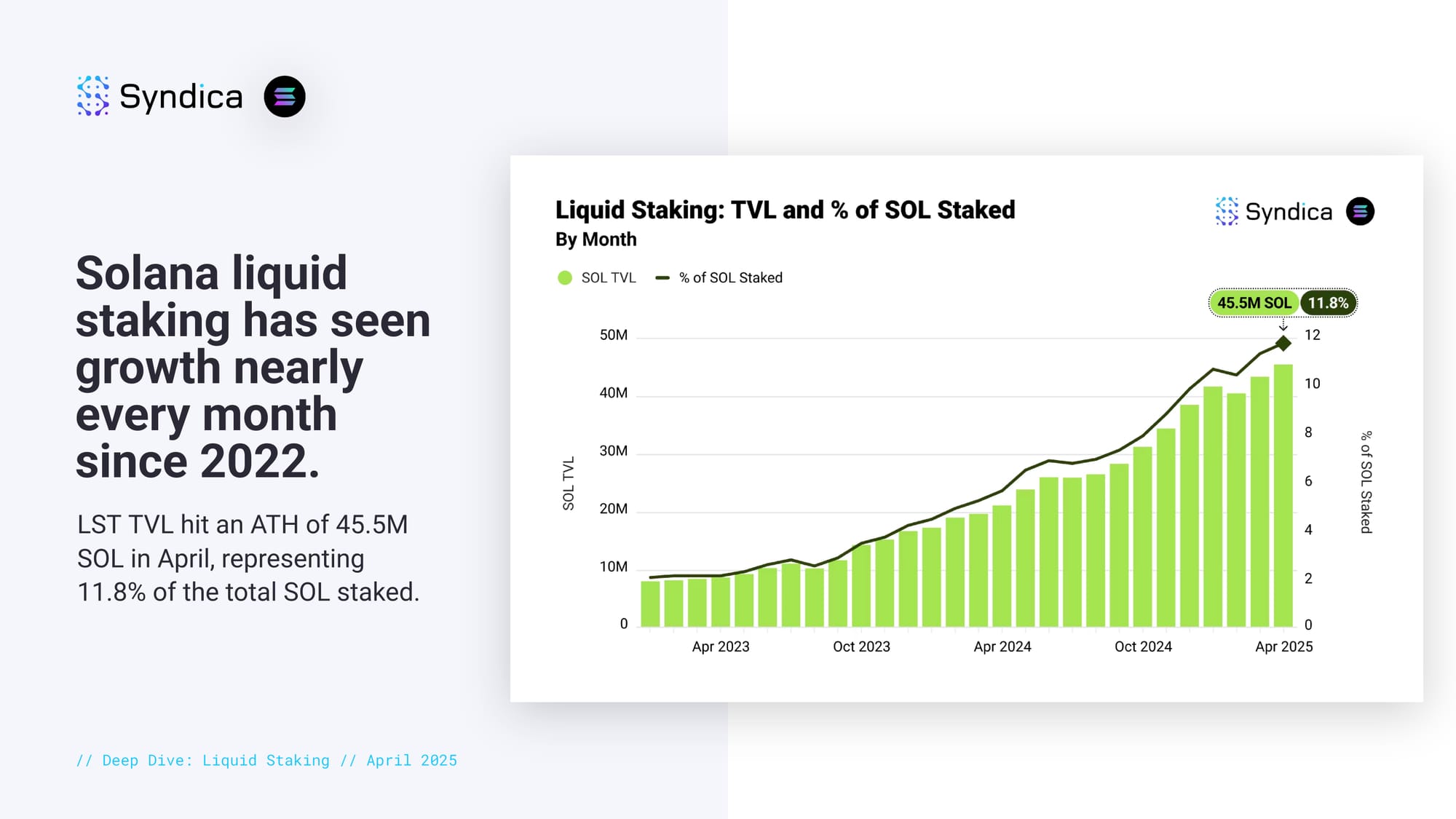

Solana liquid staking has seen growth nearly every month since 2022. LST TVL hit an ATH of 45.5M SOL in April, representing 11.8% of the total SOL staked.

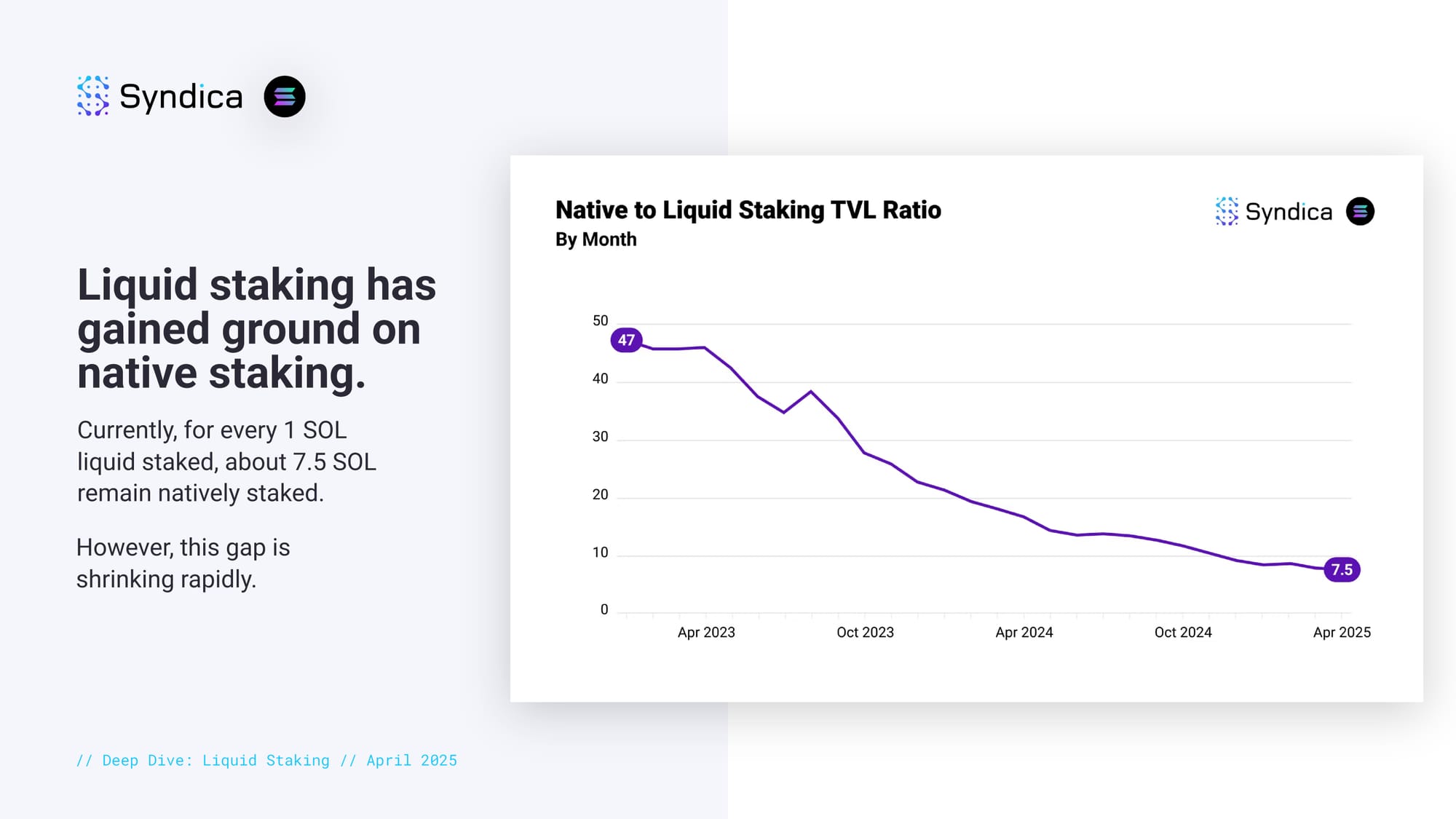

Liquid staking has gained ground on native staking. Currently, for every 1 SOL liquid staked, about 7.5 SOL remain natively staked. However, this gap is shrinking rapidly.

Part V: Cross-chain Bridges

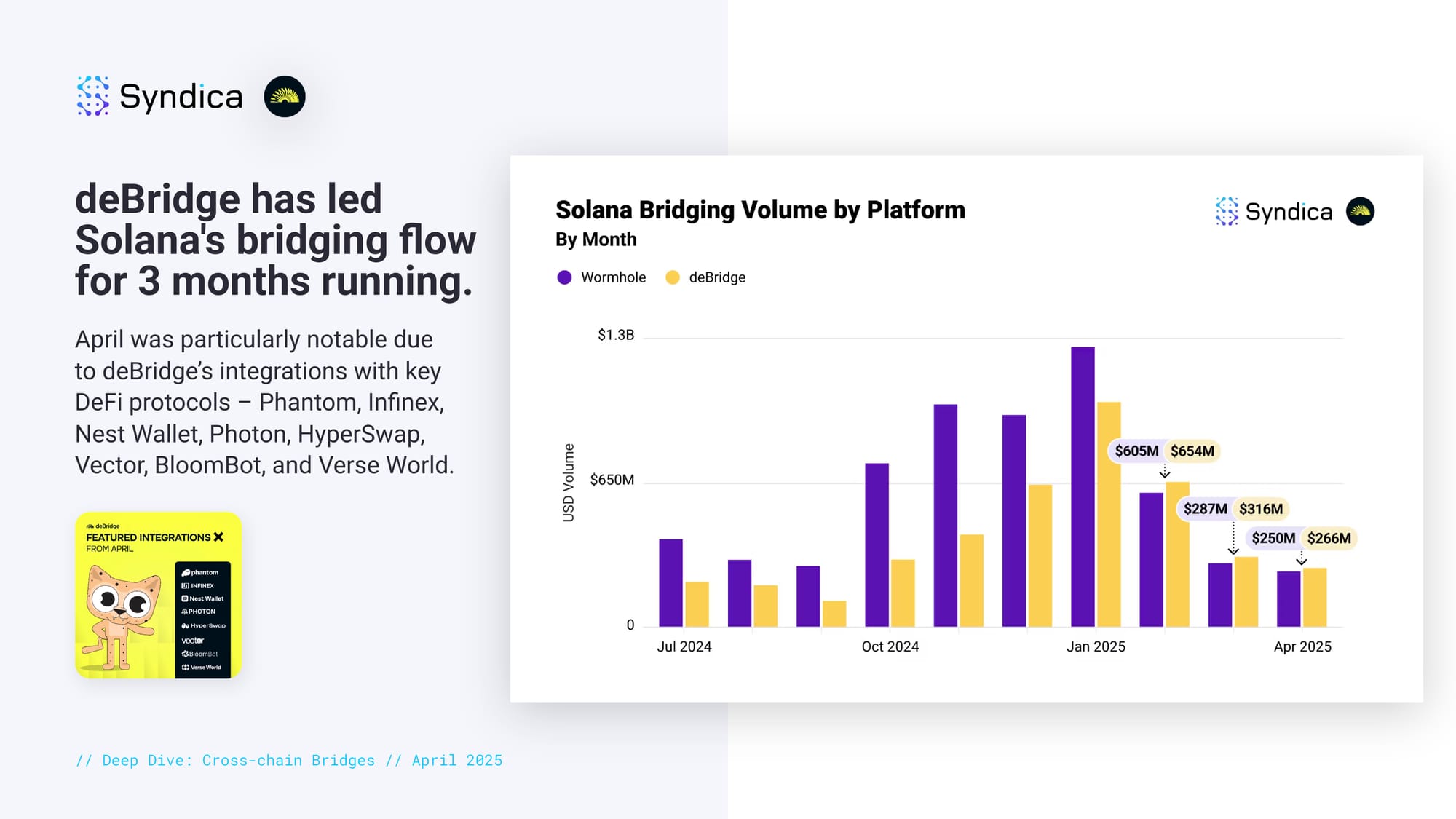

deBridge has led Solana's bridging flow for 3 months running. April was particularly notable due to deBridge’s integrations with key DeFi protocols – Phantom, Infinex, Nest Wallet, Photon, HyperSwap, Vector, BloomBot, and Verse World.

Part VI: Projects to Watch

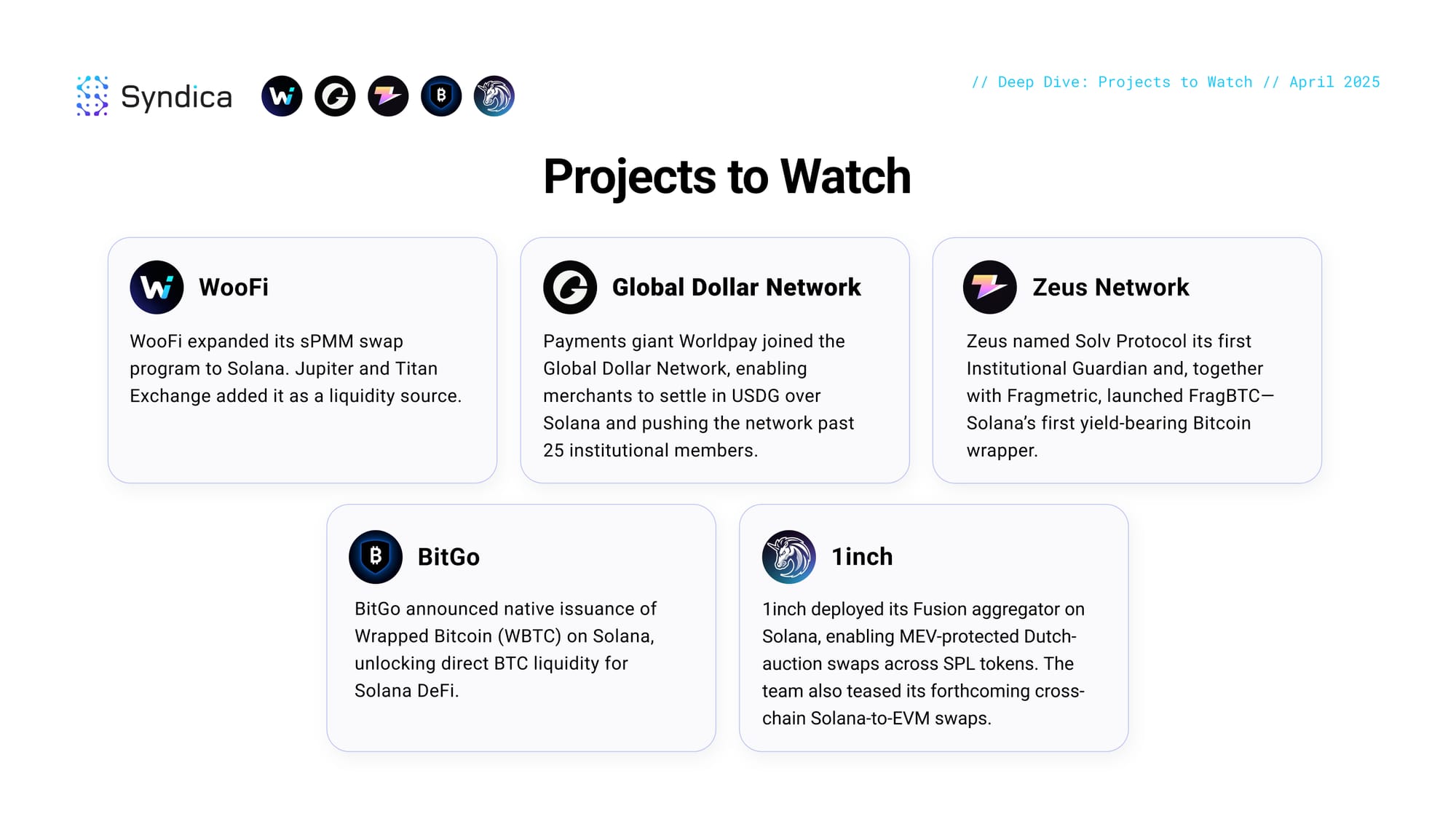

WooFi expanded its sPMM swap program to Solana. Jupiter and Titan Exchange added it as a liquidity source.

Payments giant Worldpay joined the Global Dollar Network, enabling merchants to settle in USDG over Solana and pushing the network past 25 institutional members.

Zeus named Solv Protocol its first Institutional Guardian and, together with Fragmetric, launched FragBTC—Solana’s first yield-bearing Bitcoin wrapper.

BitGo announced native issuance of Wrapped Bitcoin (WBTC) on Solana, unlocking direct BTC liquidity for Solana DeFi.

1inch deployed its Fusion aggregator on Solana, enabling MEV-protected Dutch-auction swaps across SPL tokens. The team also teased its forthcoming cross-chain Solana-to-EVM swaps.