Deep Dive: Solana DeFi - August 2024

Deep Dive: Solana DeFi - August 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - August 2024

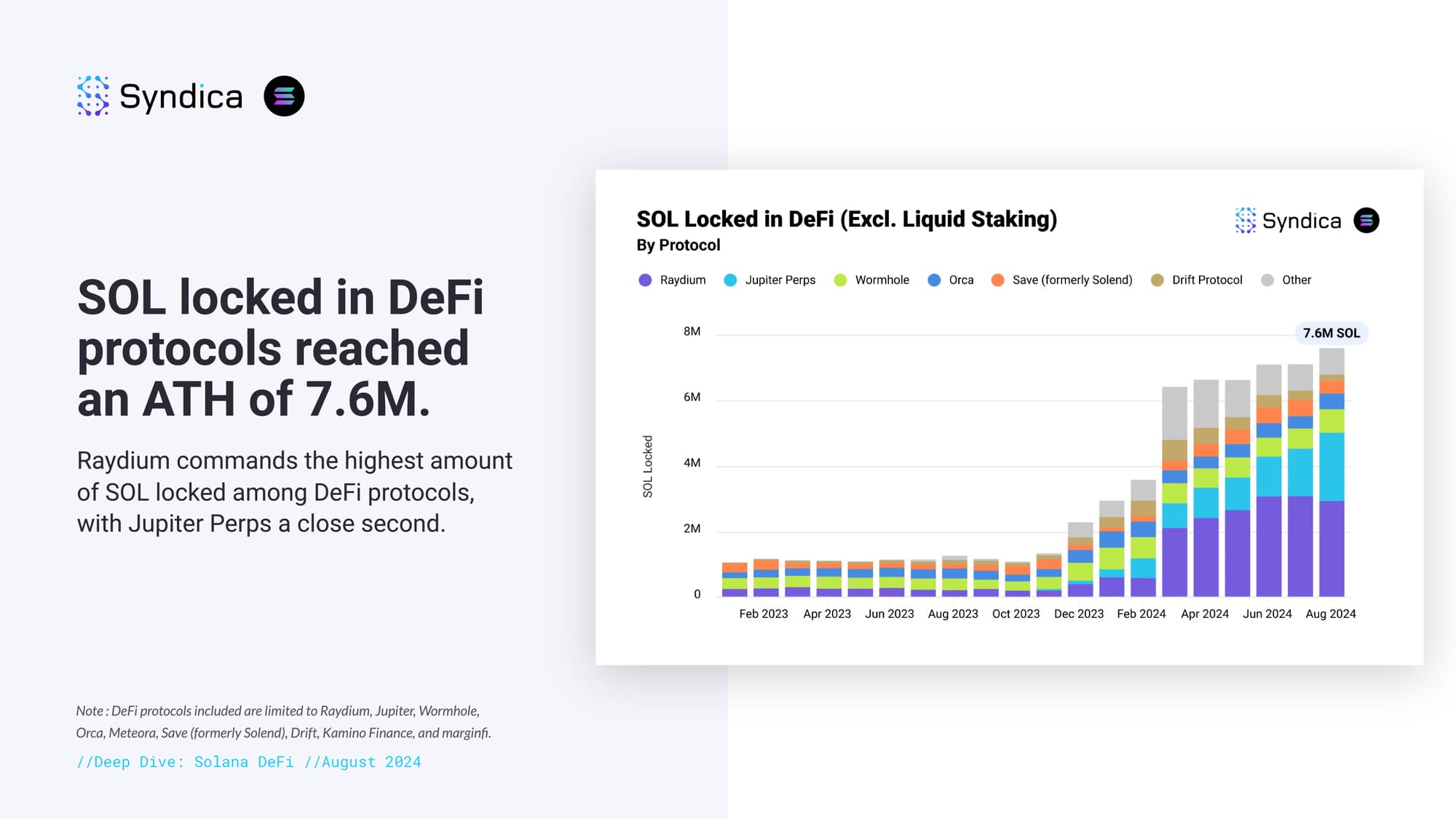

SOL locked in DeFi protocols reached an ATH of 7.6M. Raydium commands the highest amount of SOL locked among DeFi protocols, with Jupiter Perps a close second.

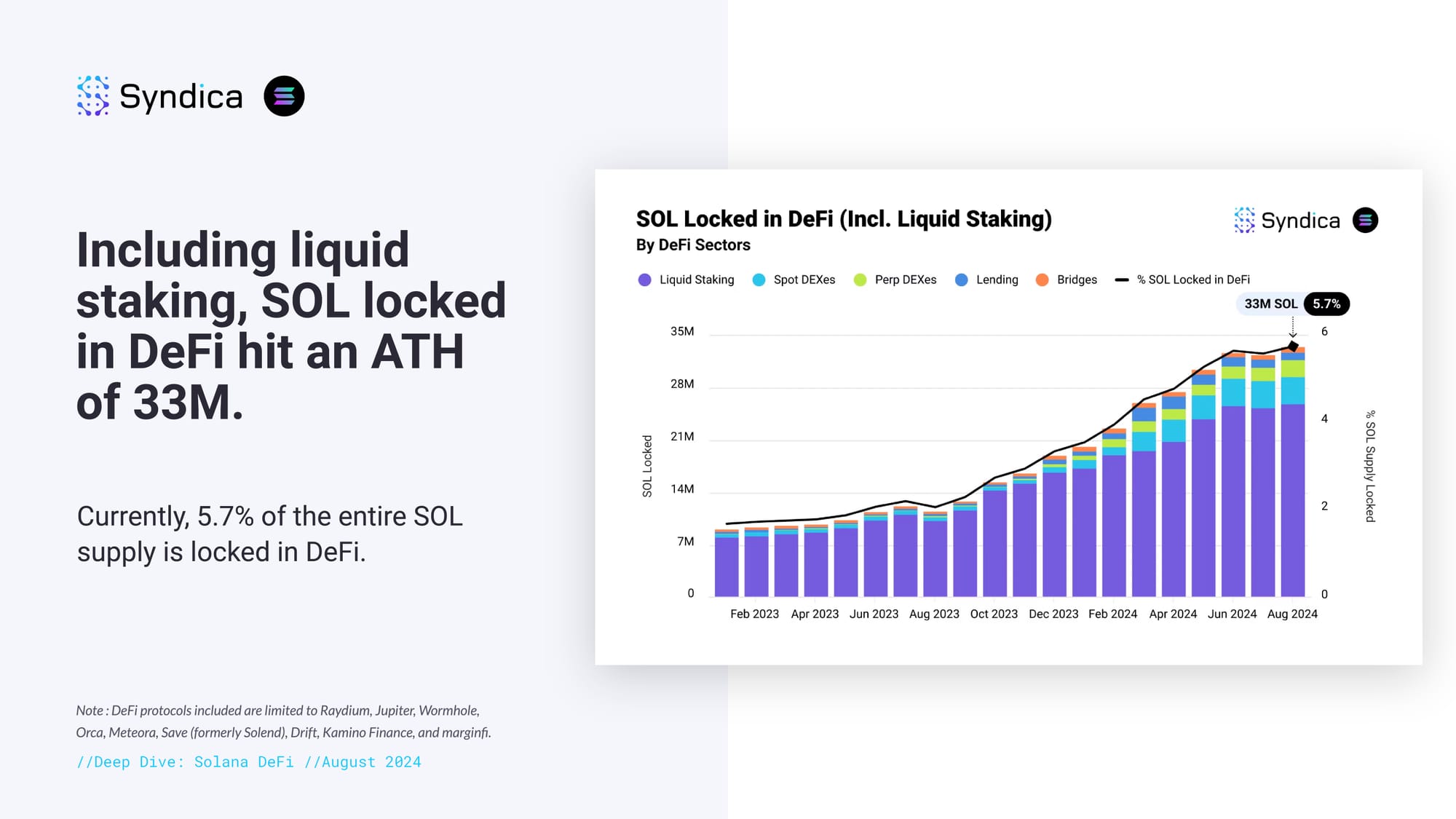

Including liquid staking, SOL locked in DeFi hit an ATH of 33M. Currently, 5.7% of the entire SOL supply is locked in DeFi.

Part I: Spot and Perp DEXes

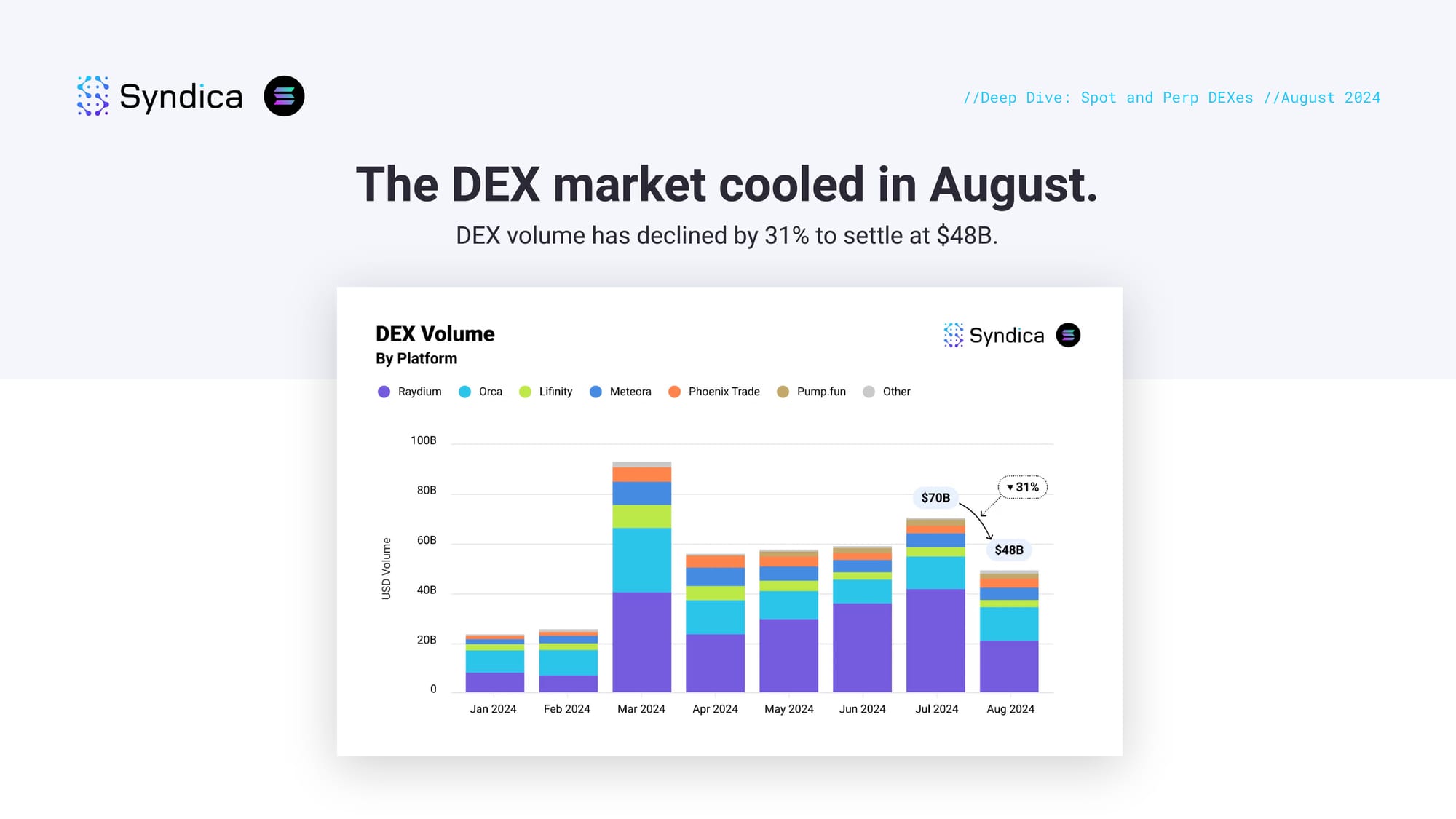

The DEX market cooled in August. DEX volume has declined by 31% to settle at $48B.

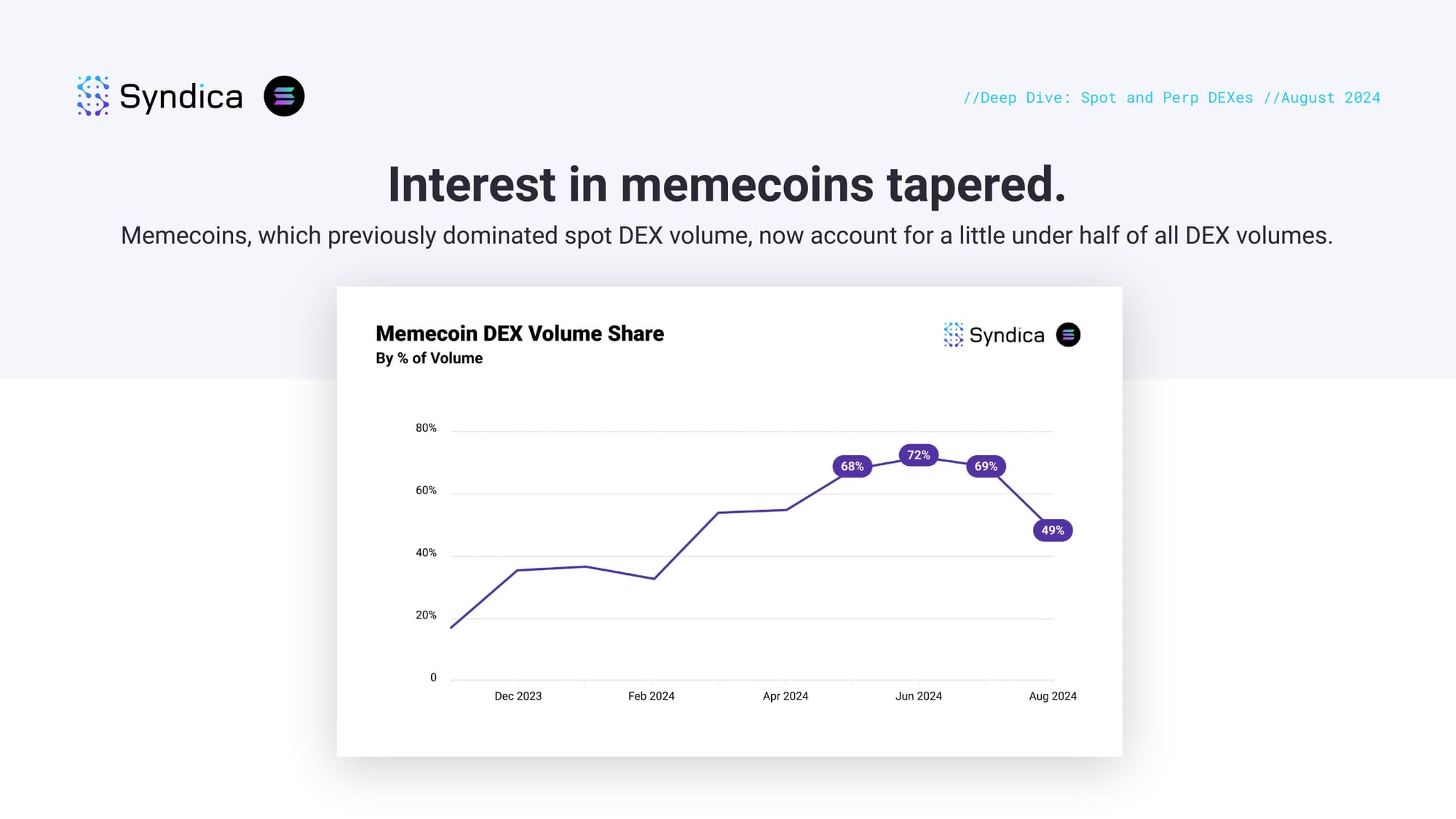

Interest in memecoins tapered. Memecoins, which previously dominated spot DEX volume, now account for a little under half of all DEX volumes.

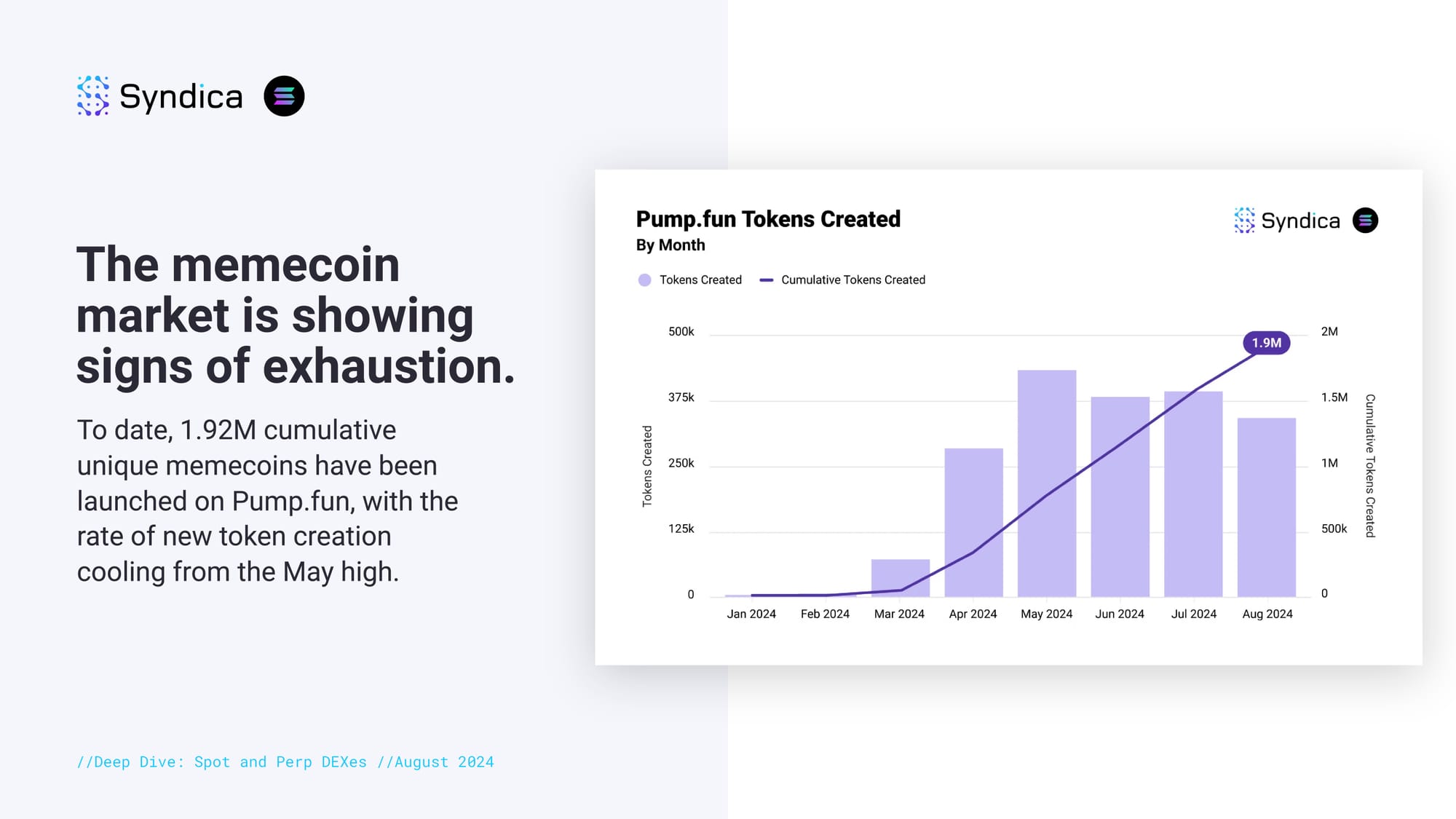

The memecoin market is showing signs of exhaustion. To date, 1.92M cumulative unique memecoins have been launched on Pump.fun, with the rate of new token creation cooling from the May high.

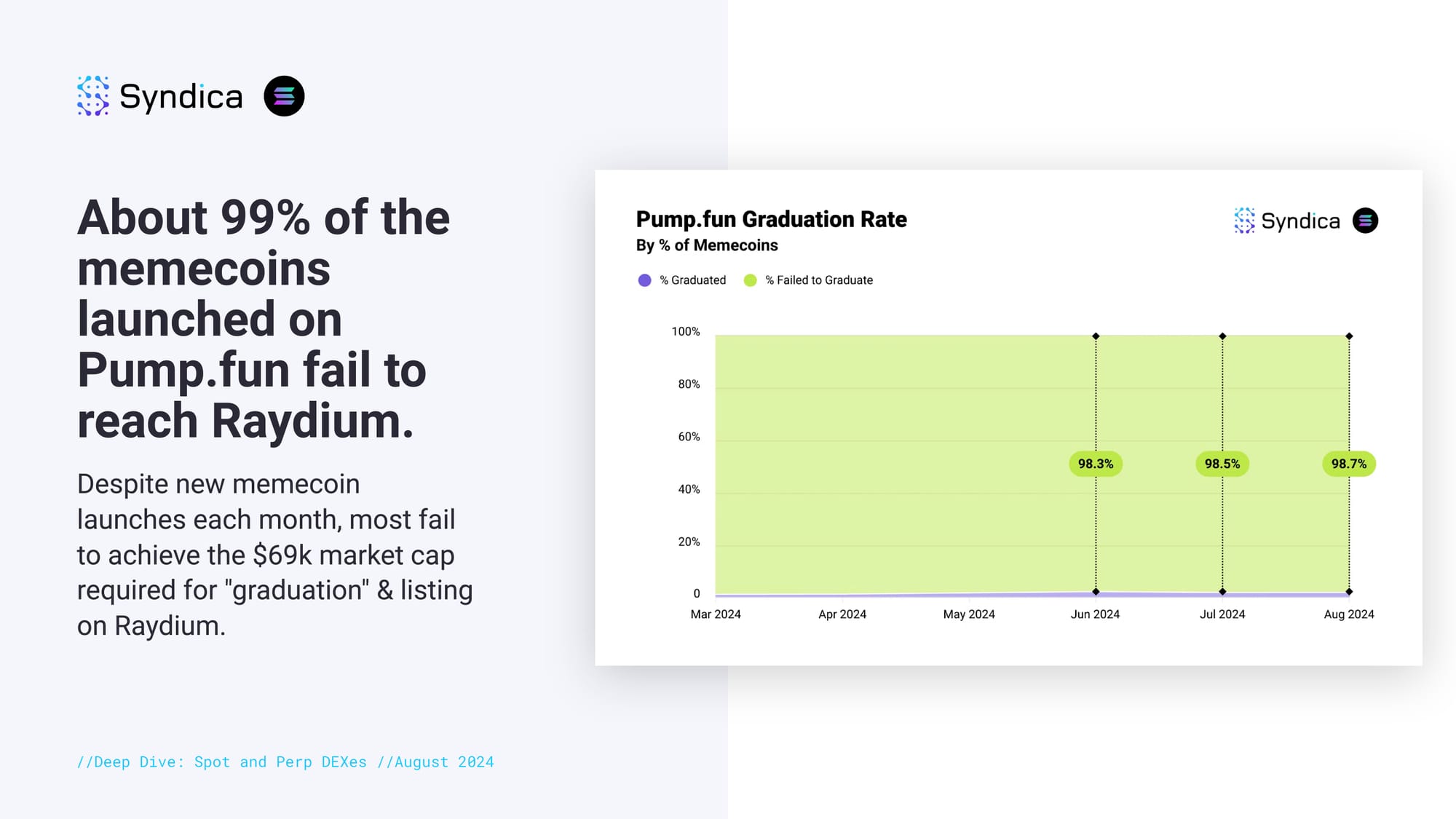

About 99% of the memecoins launched on Pump.fun fail to reach Raydium. Despite new memecoin launches each month, most fail to achieve the $69k market cap required for "graduation" & listing on Raydium.

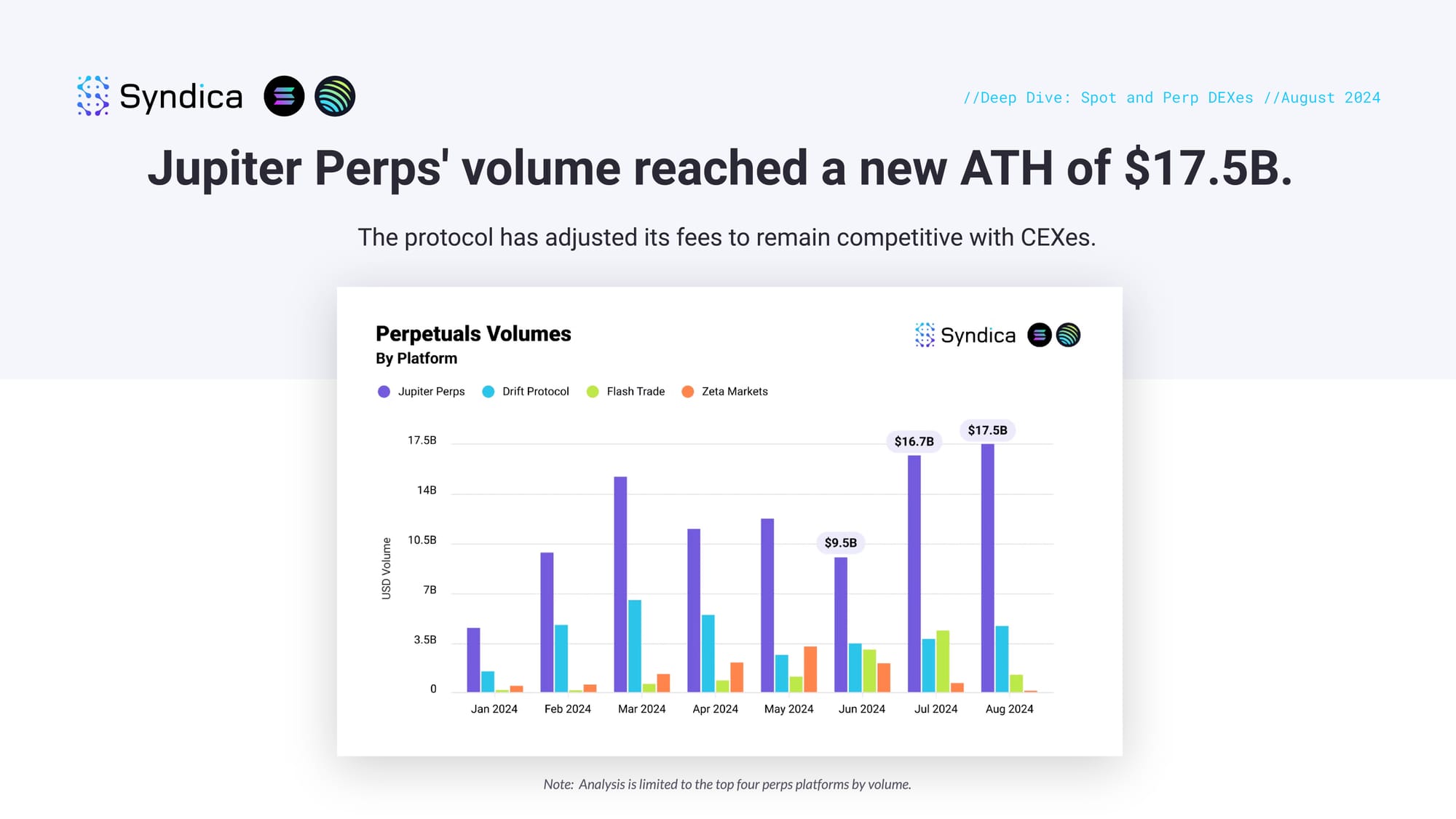

Jupiter Perps' volume reached a new ATH of $17.5B. The protocol has adjusted its fees to remain competitive with CEXes.

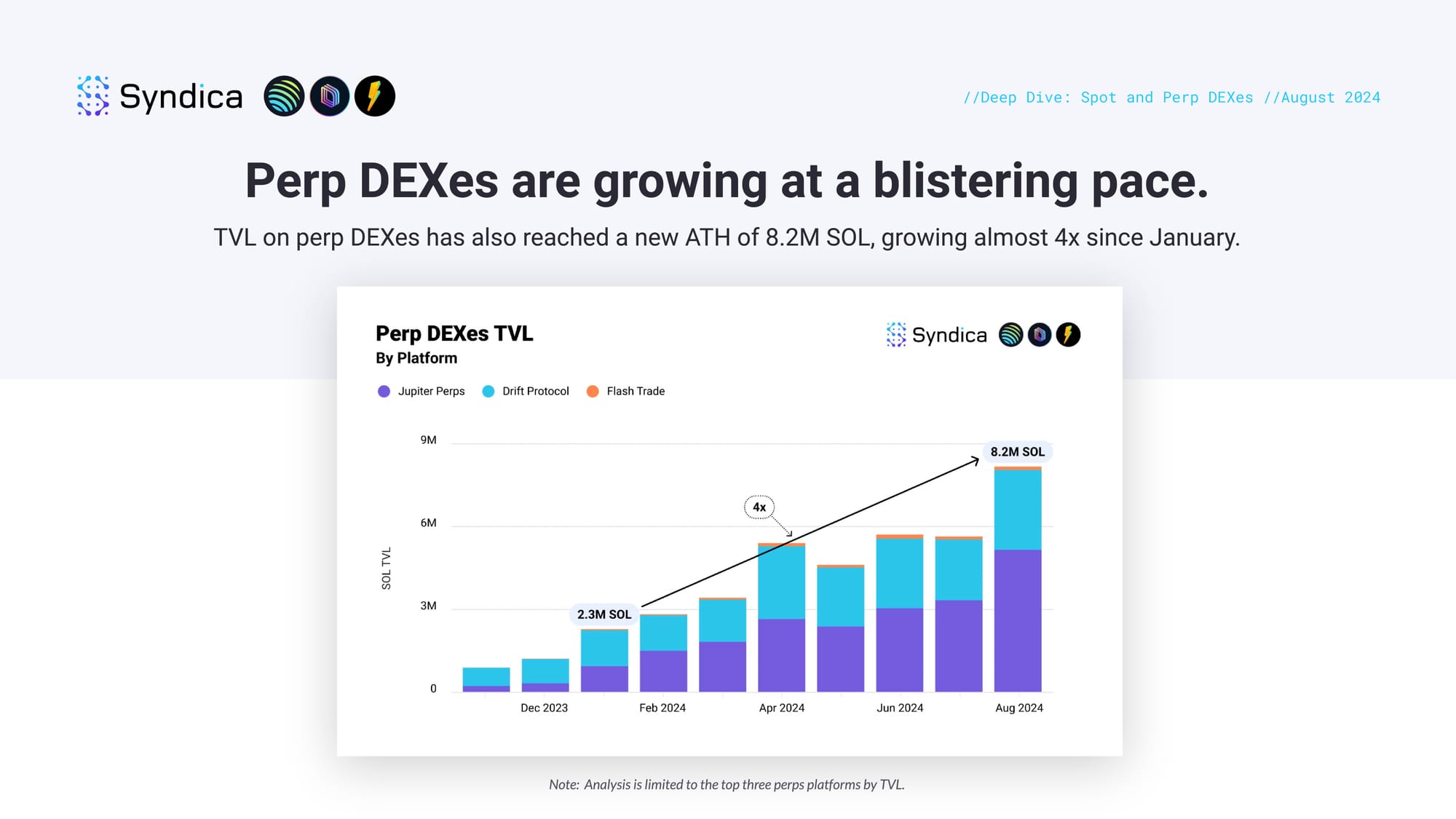

Perp DEXes are growing at a blistering pace. TVL on perp DEXes has also reached a new ATH of 8.2M SOL, growing almost 4x since January.

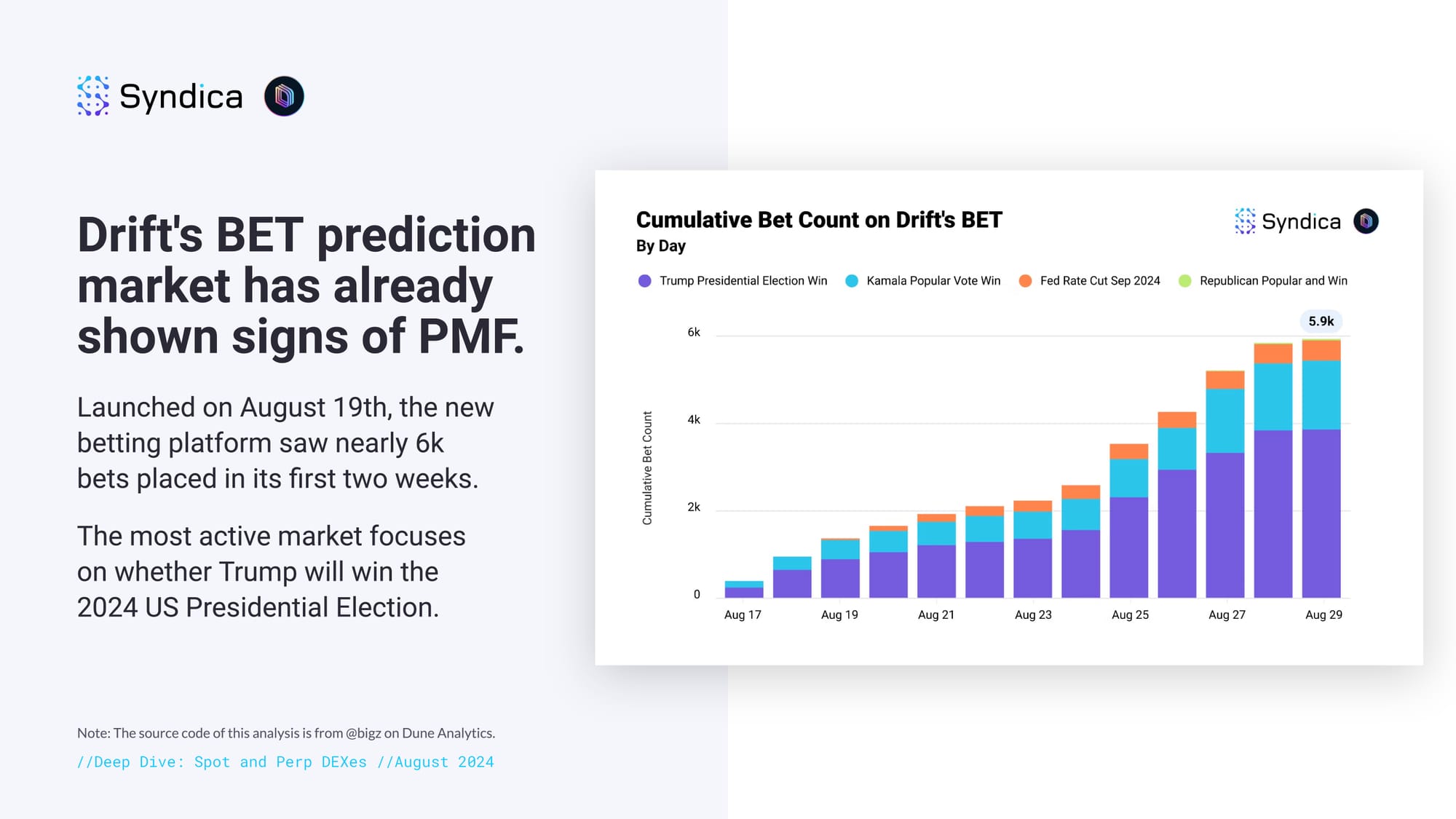

Drift's BET prediction market has already shown signs of PMF. Launched on August 19th, the new betting platform saw nearly 6k bets placed in its first two weeks. The most active market focuses on whether Trump will win the 2024 US Presidential Election.

Part II: Lending and Stablecoins

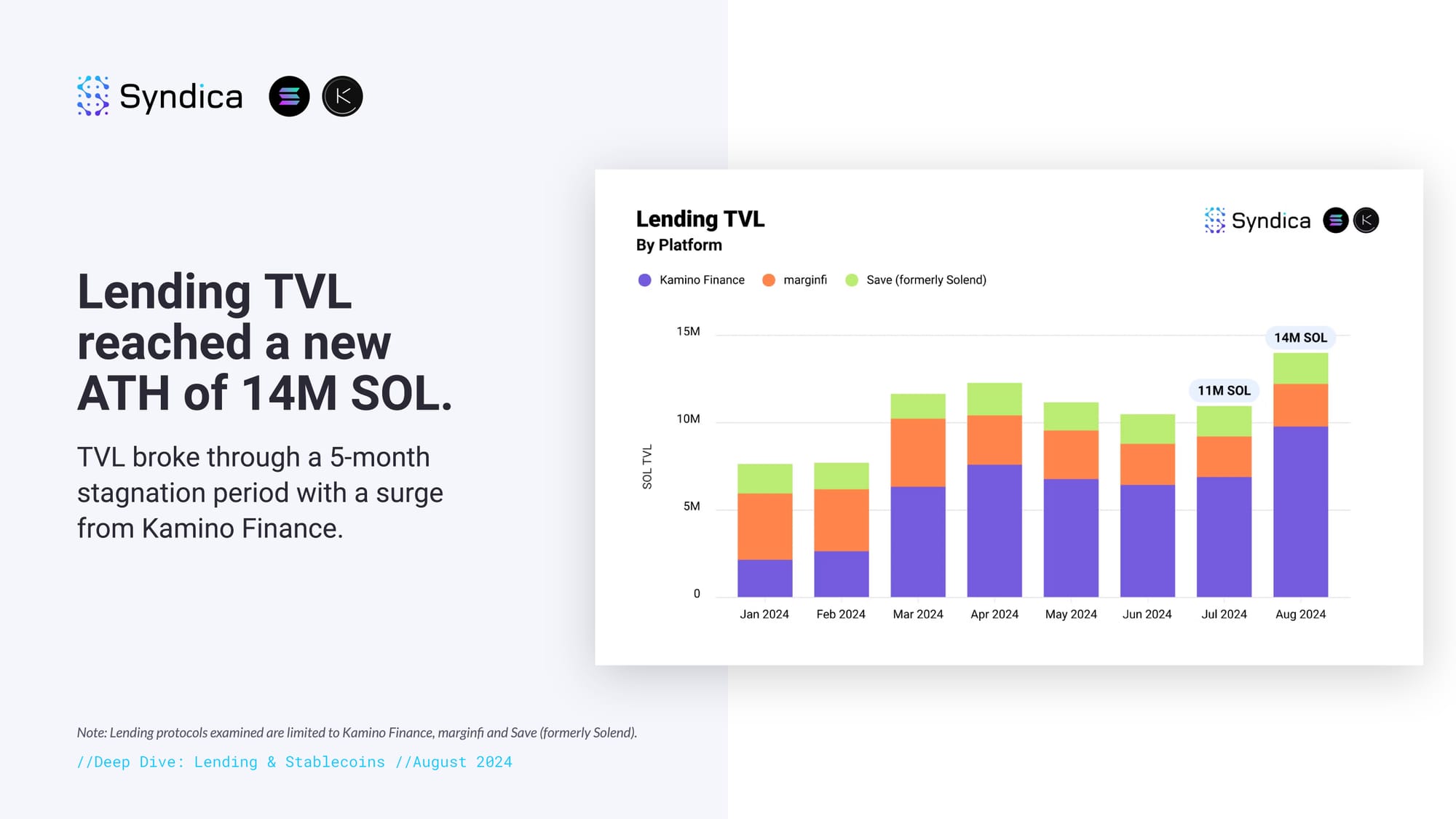

Lending TVL reached a new ATH of 14M SOL. TVL broke through a 5-month stagnation period with a surge from Kamino Finance.

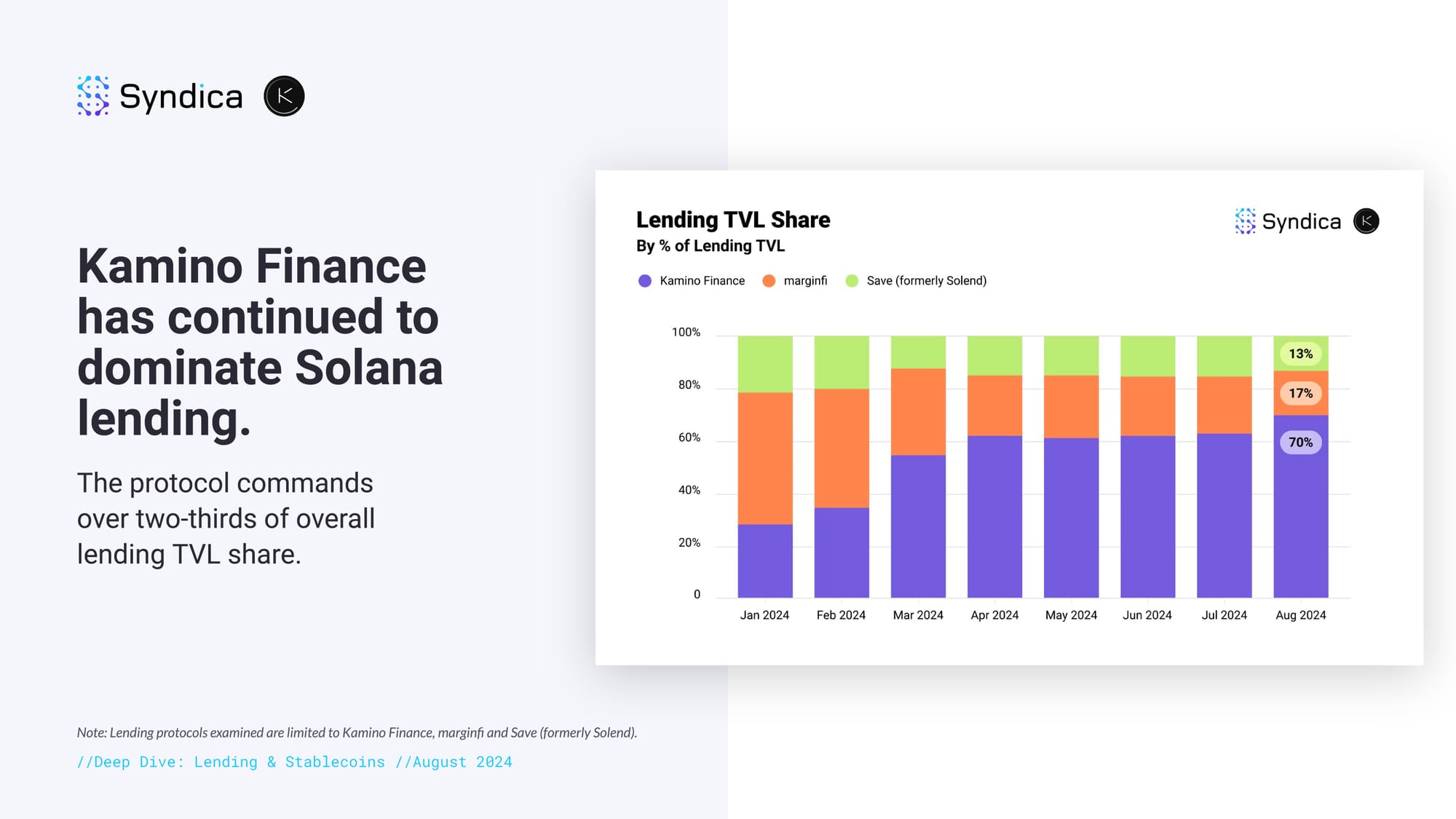

Kamino Finance has continued to dominate Solana lending. The protocol commands over two-thirds of overall lending TVL share.

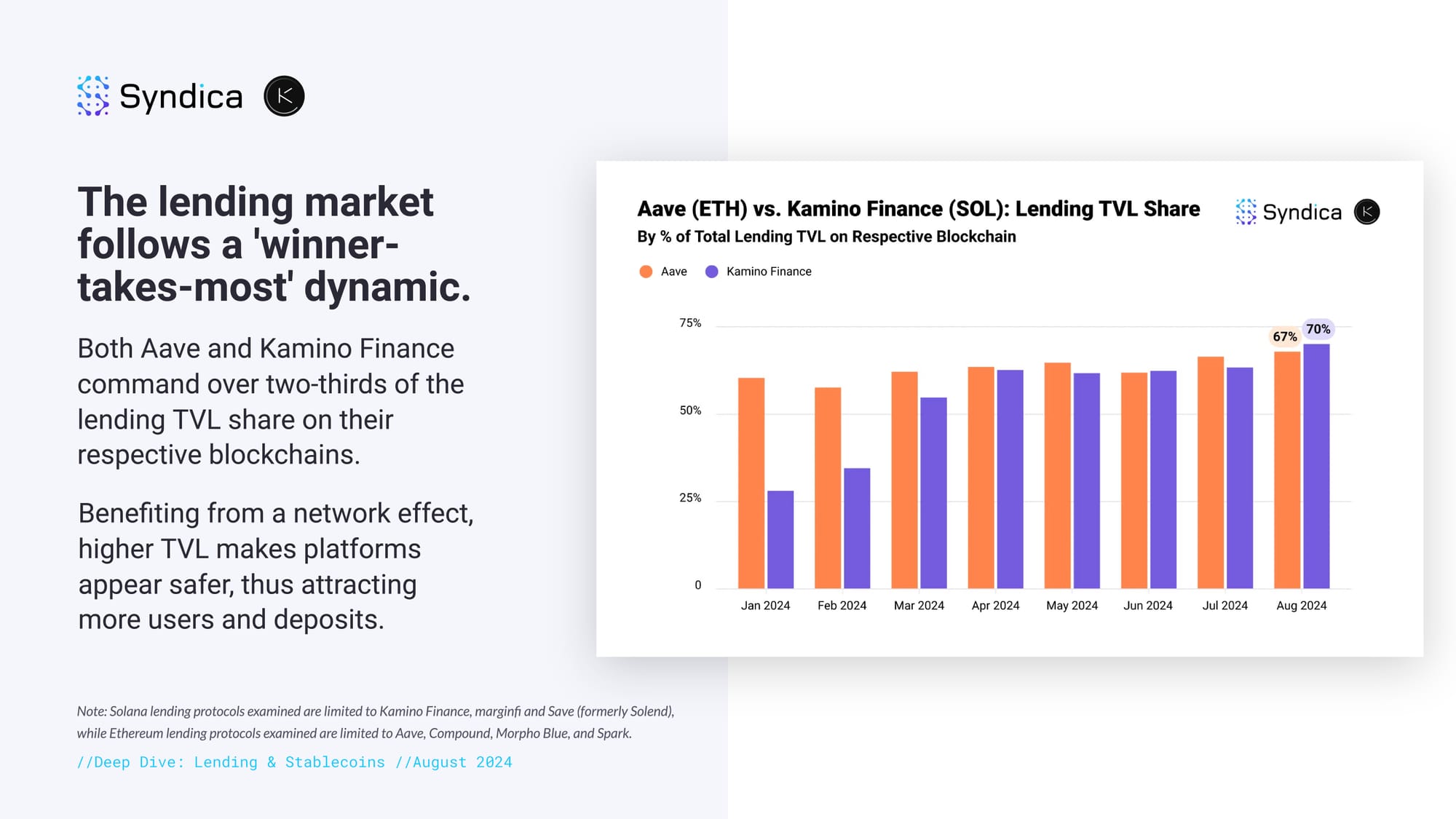

The lending market follows a 'winner-takes-most' dynamic. Both Aave and Kamino Finance command over two-thirds of the lending TVL share on their respective blockchains. Benefiting from a network effect, higher TVL makes platforms appear safer, thus attracting more users and deposits.

Solana stablecoin market cap has returned to pre-FTX levels. Stablecoin adoption has steadily increased throughout 2024, completing a resurgence two years in the making.

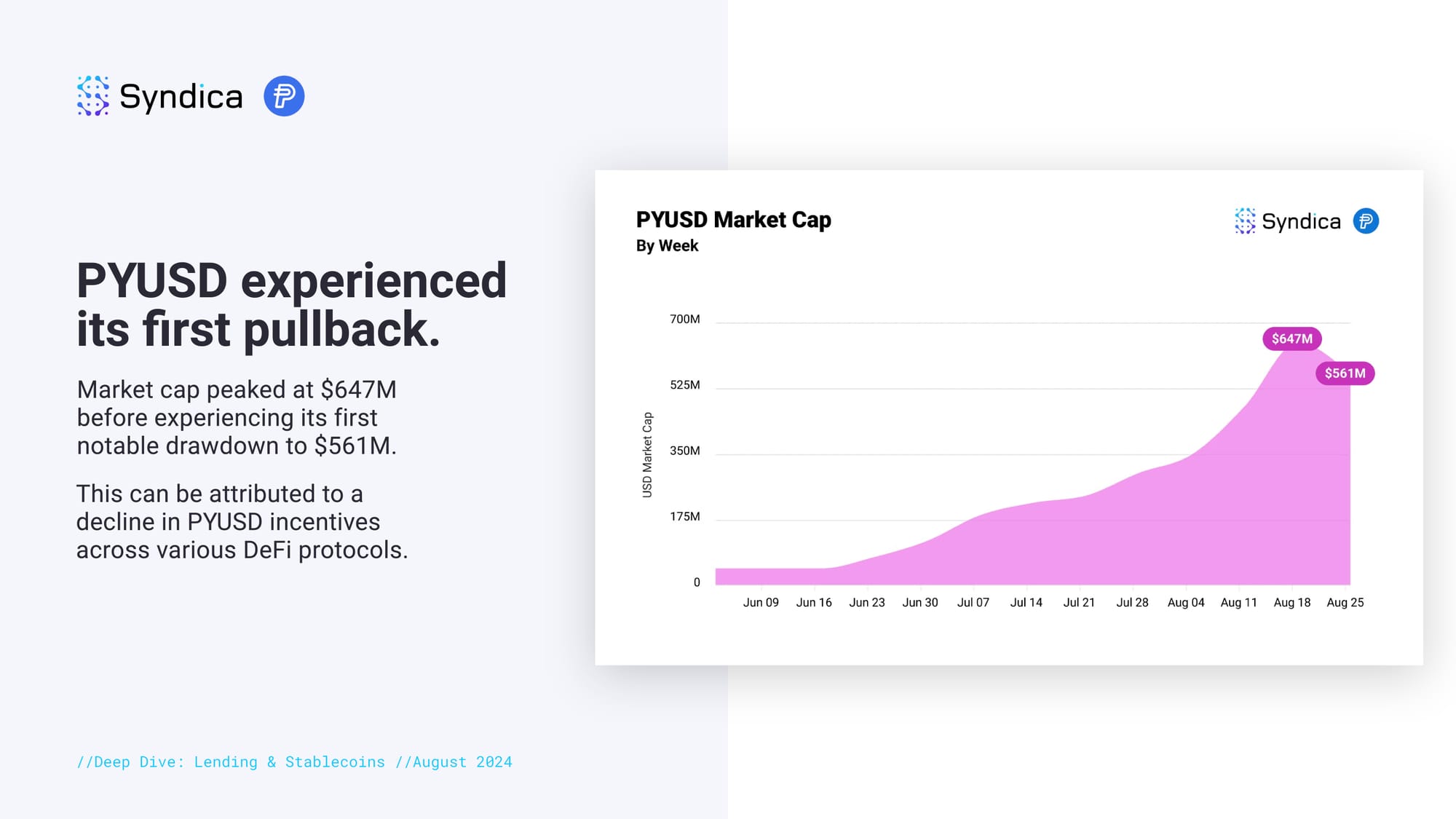

PYUSD experienced its first pullback. Market cap peaked at $647M before experiencing its first notable drawdown to $561M. This can be attributed to a decline in PYUSD incentives across various DeFi protocols.

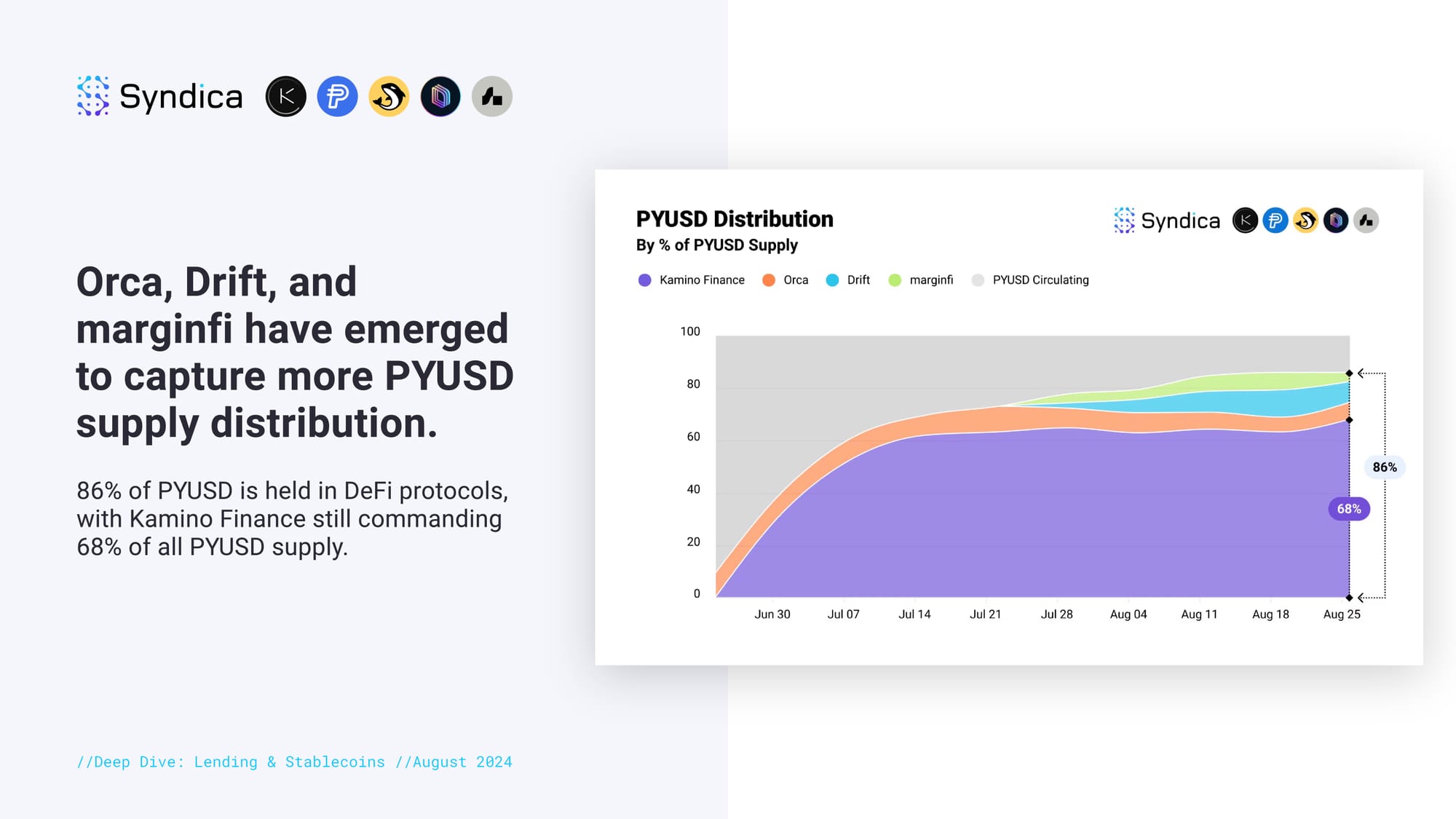

Orca, Drift, and marginfi have emerged to capture more PYUSD supply distribution. 86% of PYUSD is held in DeFi protocols, with Kamino Finance still commanding 68% of all PYUSD supply.

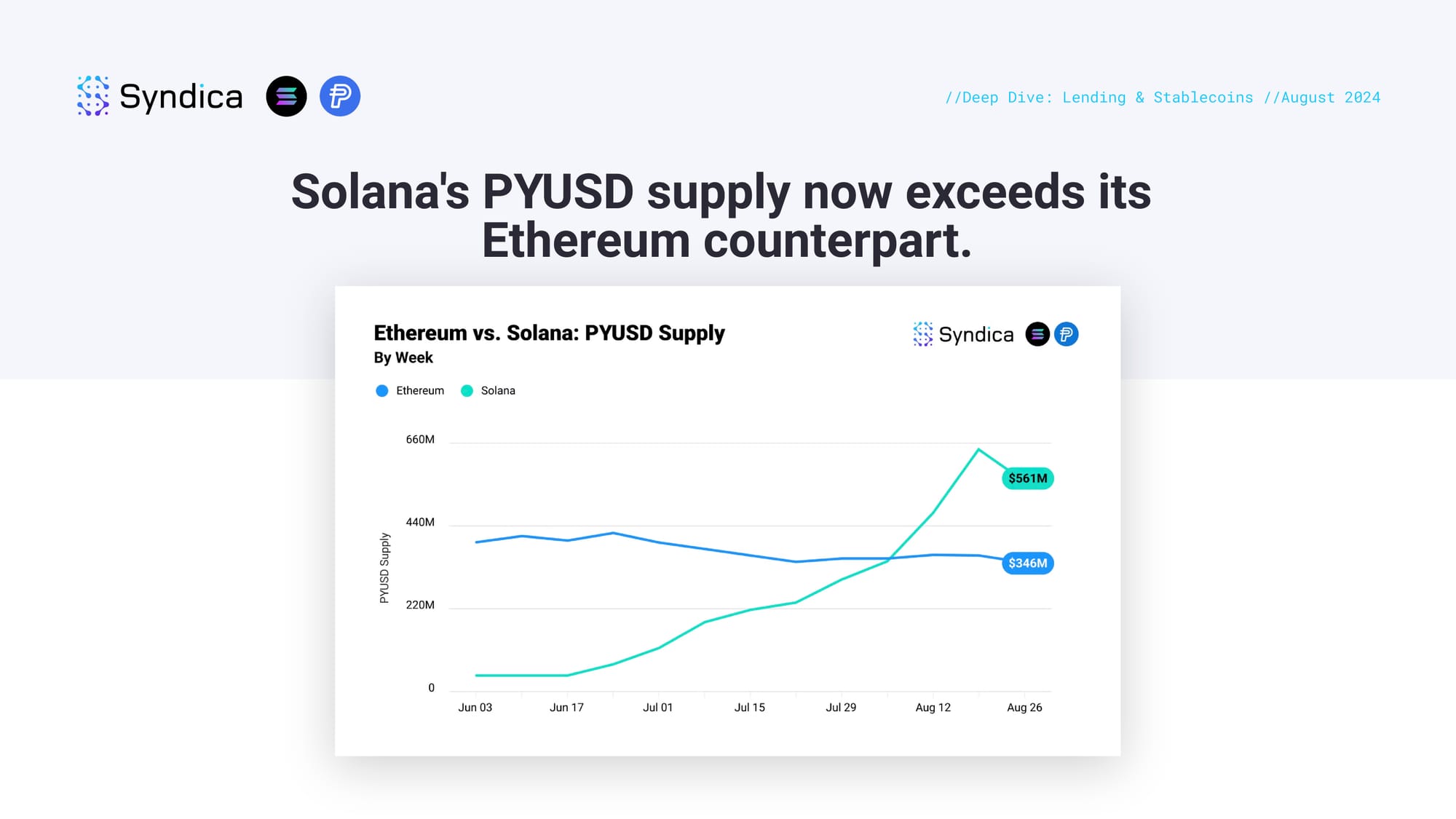

Solana's PYUSD supply now exceeds its Ethereum counterpart.

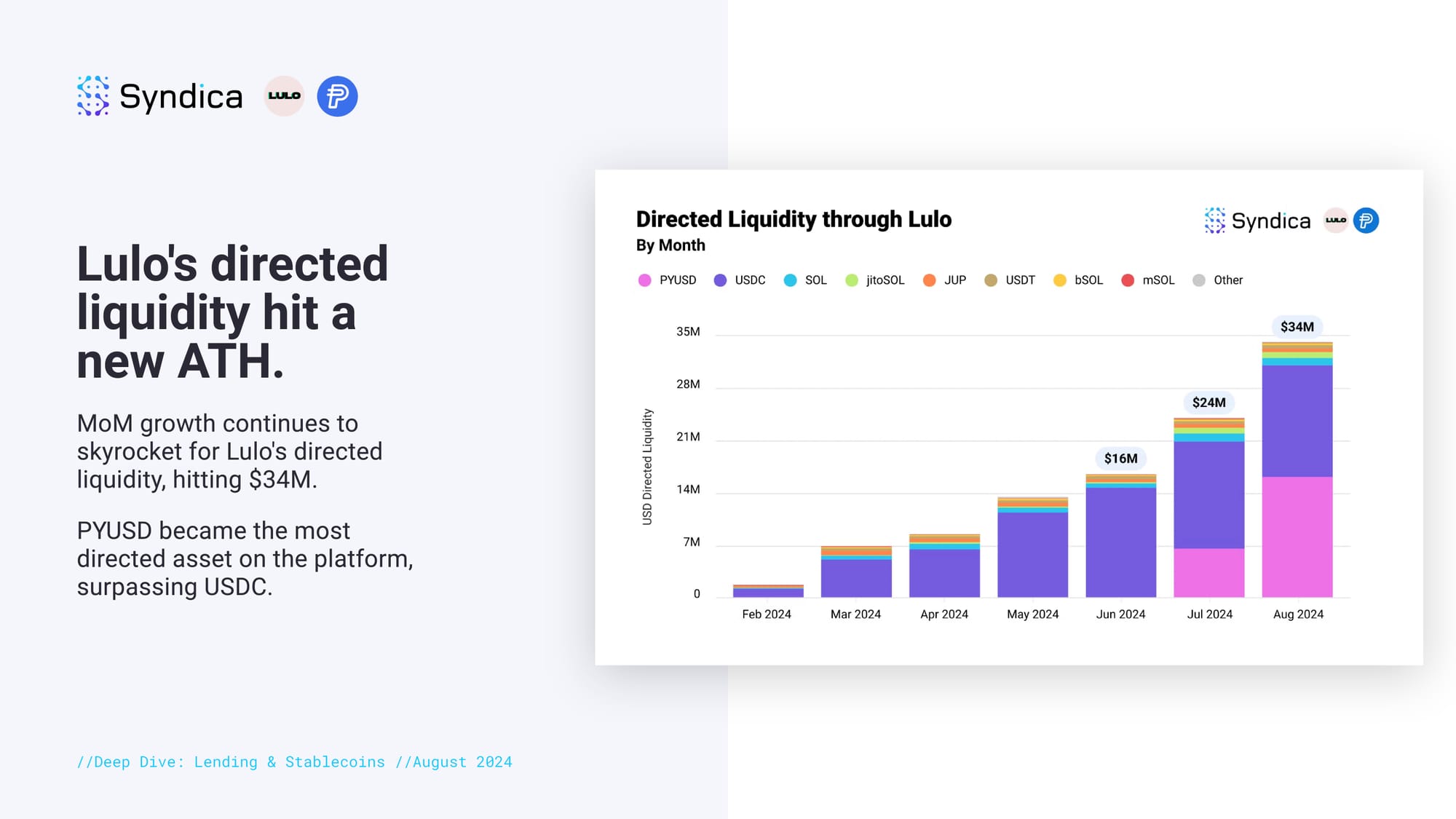

Lulo's directed liquidity hit a new ATH. MoM growth continues to skyrocket for Lulo's directed liquidity, hitting $34M. PYUSD became the most directed asset on the platform, surpassing USDC.

Part III: Liquid Staking

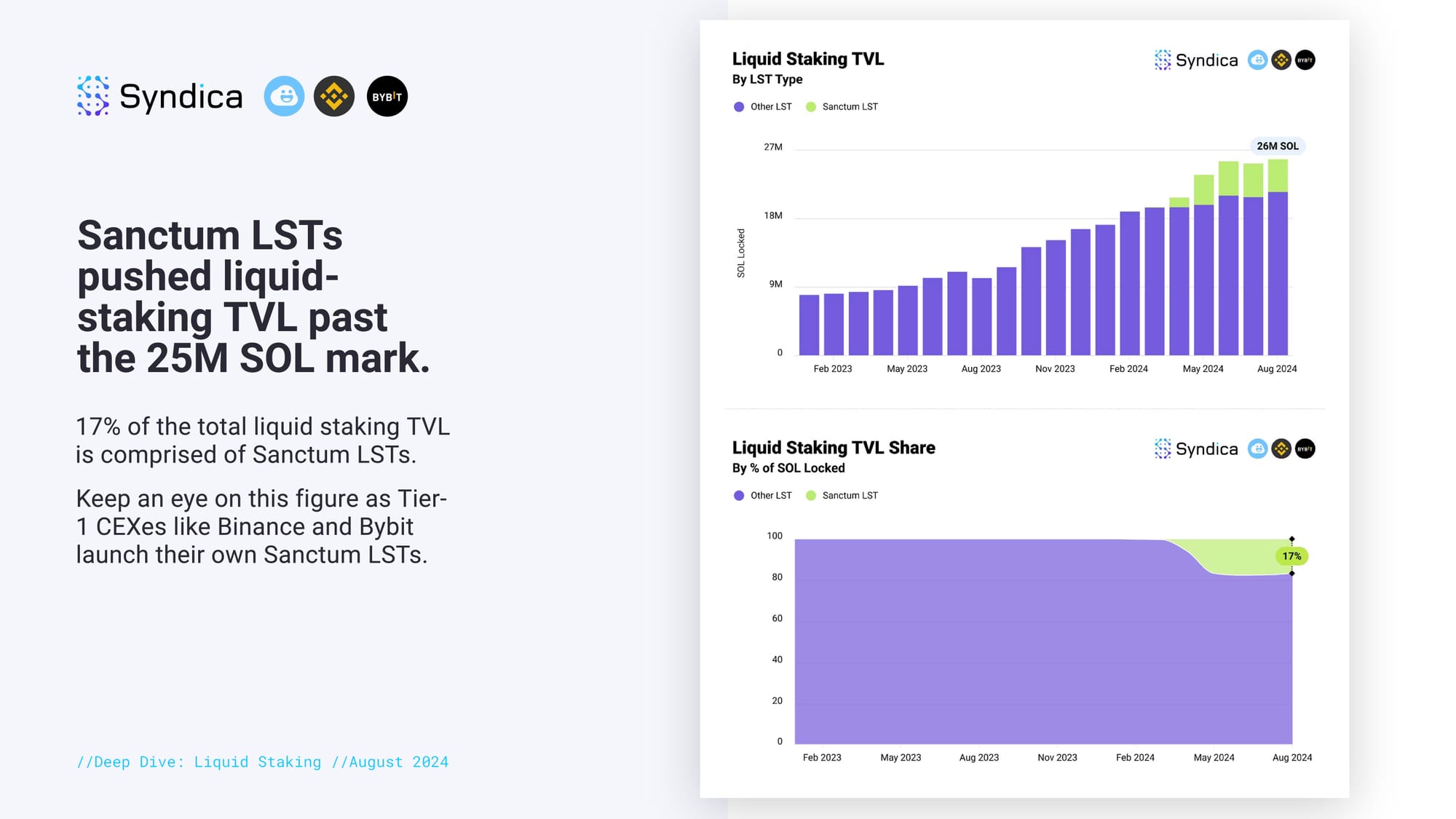

Sanctum LSTs pushed liquid-staking TVL past the 25M SOL mark. 17% of the total liquid staking TVL is comprised of Sanctum LSTs. Keep an eye on this figure as Tier-1 CEXes like Binance and Bybit launch their own Sanctum LSTs.

Part IV: Projects to Watch

Projects to Watch:

Renzo: Ethereum Liquid Restaking Platform Expanding to Solana - Introduces its liquid restaking token, ezSOL, on Solana in partnership with Jito Network

The Vault: First On-Chain Points Program - Introduces "Vault Points" for vSOL stakers, establishing a fully integrated points program on-chain

Pathfinders: First LST-Backed NFT - Redefines NFTs: Each Pathfinder NFT is backed by 2 pathSOL LSTs, allowing minters to recoup their funds at any time and making it unruggable

Carrot: Hold-To-Earn: Simplifies yield earnings for stablecoins by requiring users to hold just one token: CRT