Deep Dive: Solana DeFi - December 2024

Deep Dive: Solana DeFi - December 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - December 2024

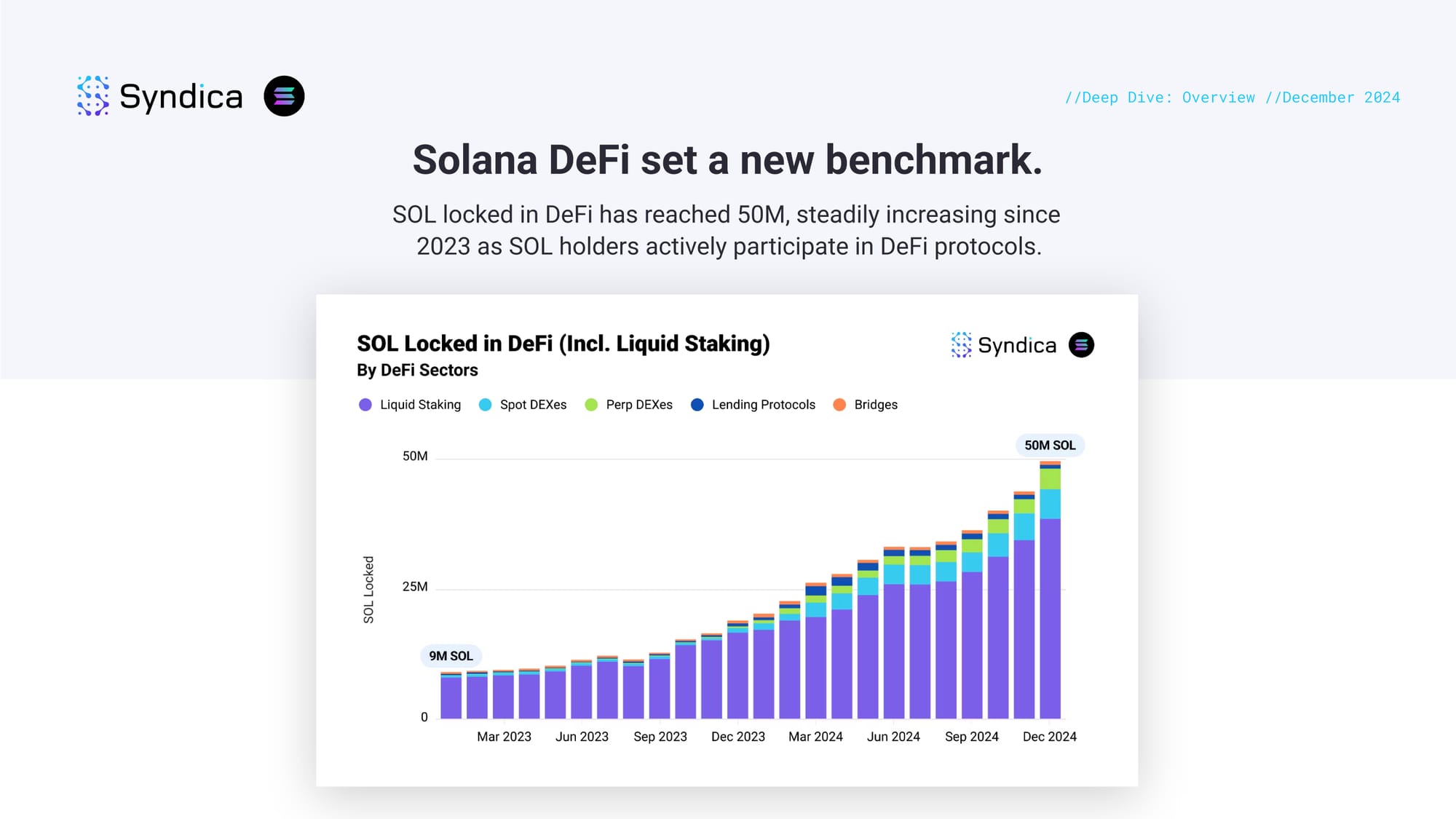

Solana DeFi set a new benchmark. SOL locked in DeFi has reached 50M, steadily increasing since 2023 as SOL holders actively participate in DeFi protocols.

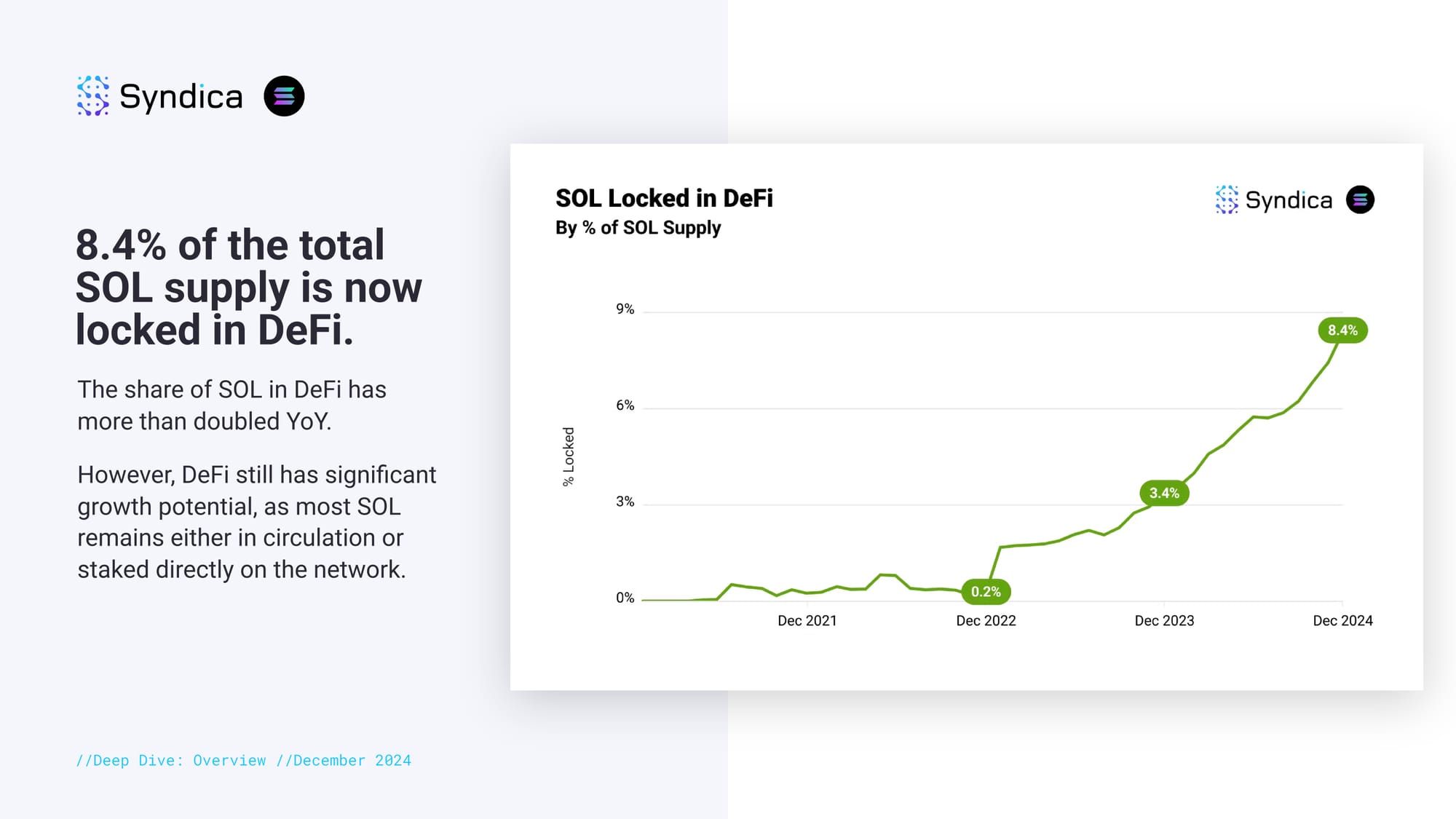

8.4% of the total SOL supply is now locked in DeFi. The share of SOL in DeFi has more than doubled YoY. However, DeFi still has significant growth potential, as most SOL remains either in circulation or staked directly on the network.

Part I: Spot DEXes

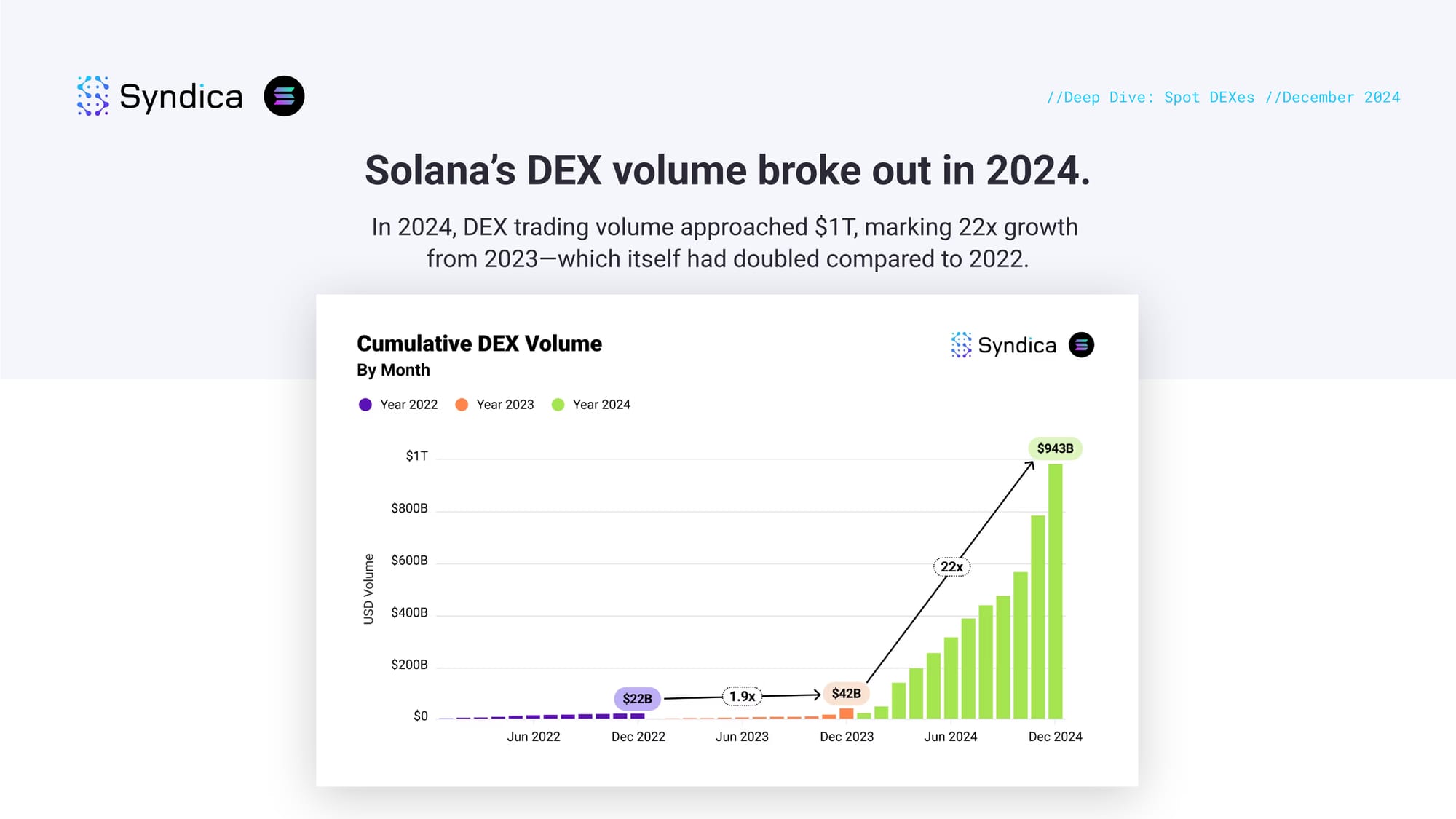

Solana’s DEX volume broke out in 2024. In 2024, DEX trading volume approached $1T, marking 22x growth from 2023—which itself had doubled compared to 2022.

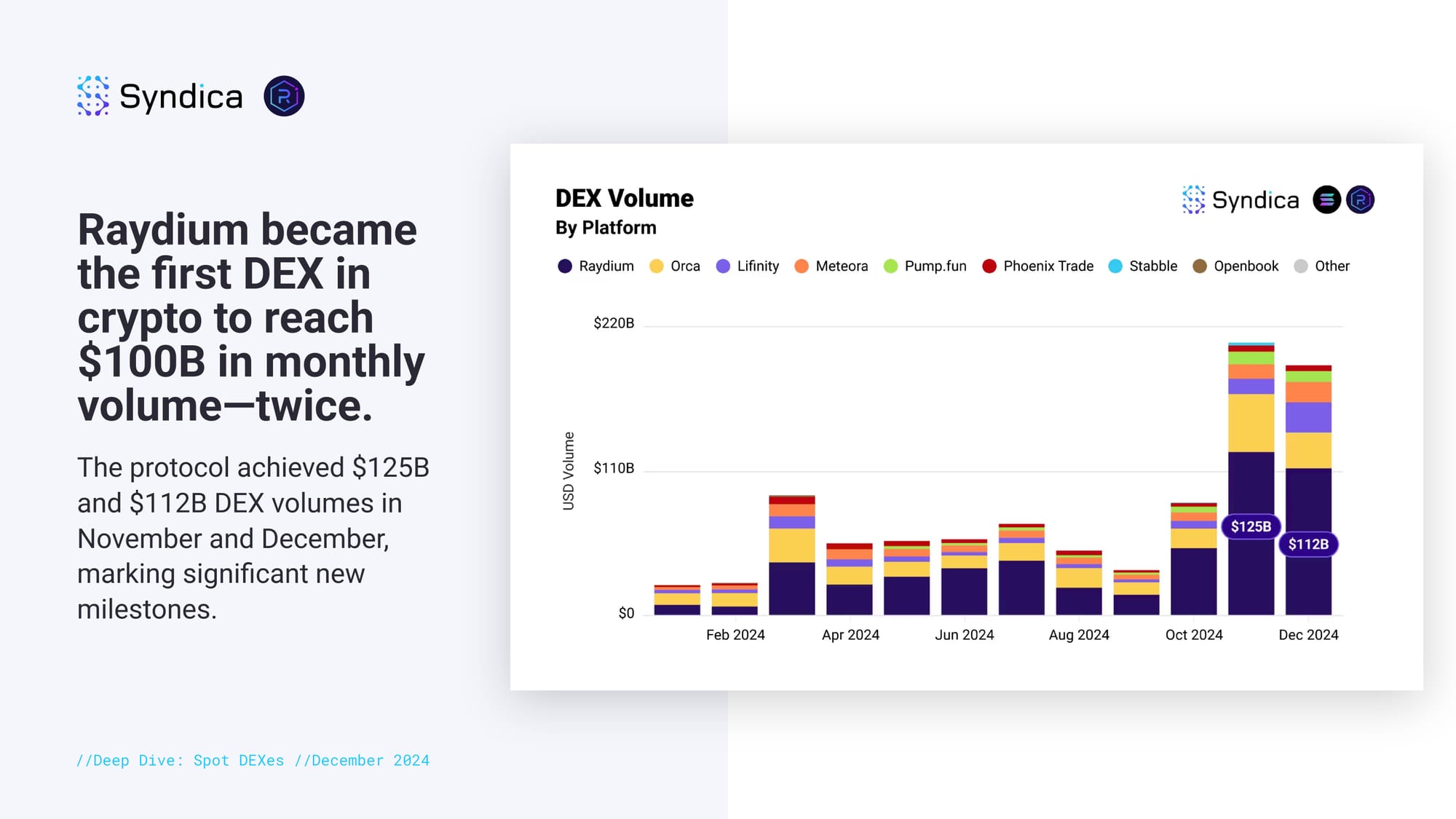

Raydium became the first DEX in crypto to reach $100B in monthly volume—twice. The protocol achieved $125B and $112B DEX volumes in November and December, marking significant new milestones.

Memecoin trading dominance became the norm in 2024. In spot DEXes, memecoins generated swap volumes that exceeded those of all non-memecoins in 9 out of the 12 months in 2024.

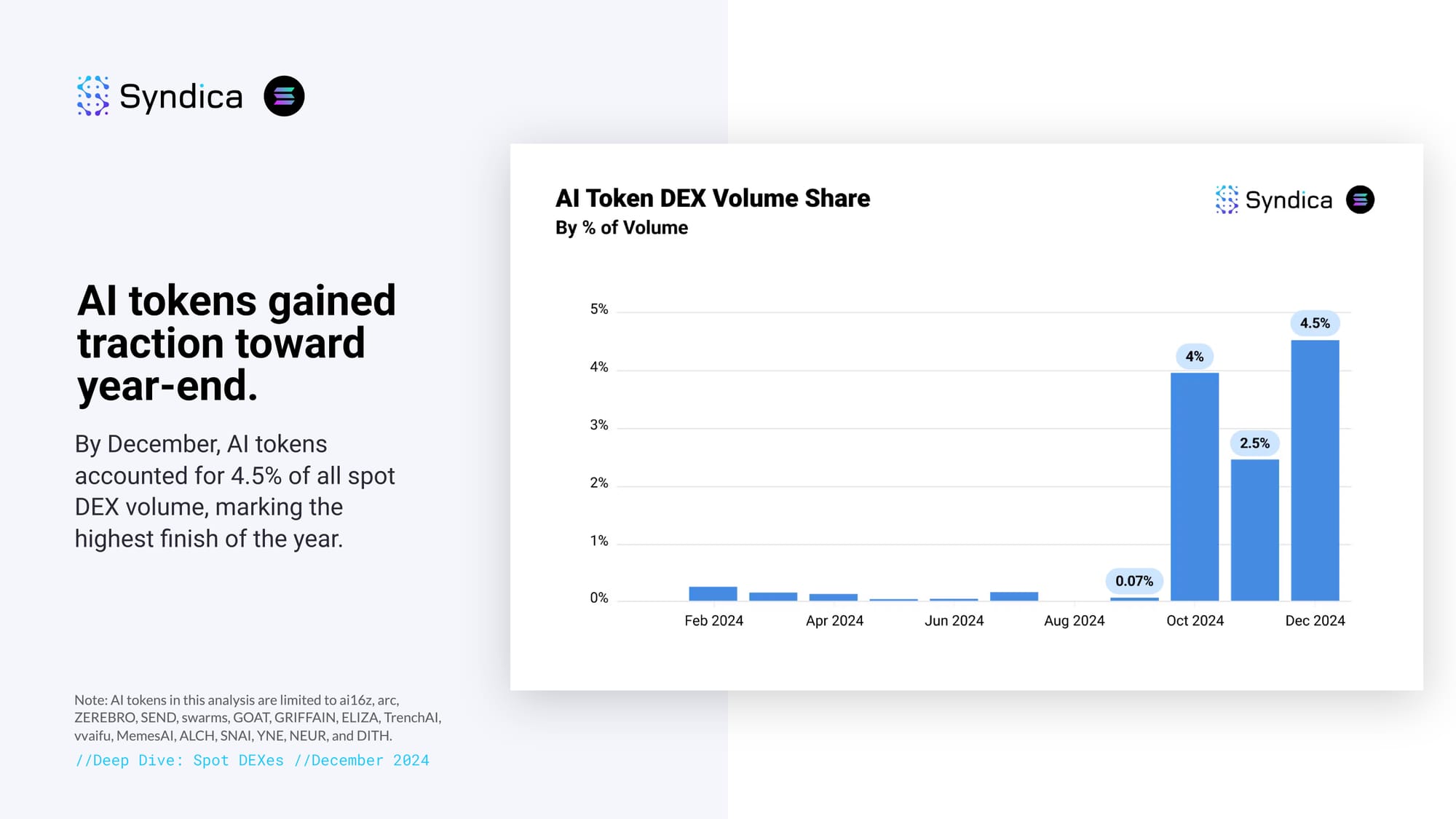

AI tokens gained traction toward year-end. By December, AI tokens accounted for 4.5% of all spot DEX volume, marking the highest finish of the year.

Part II: Lending and Stablecoins

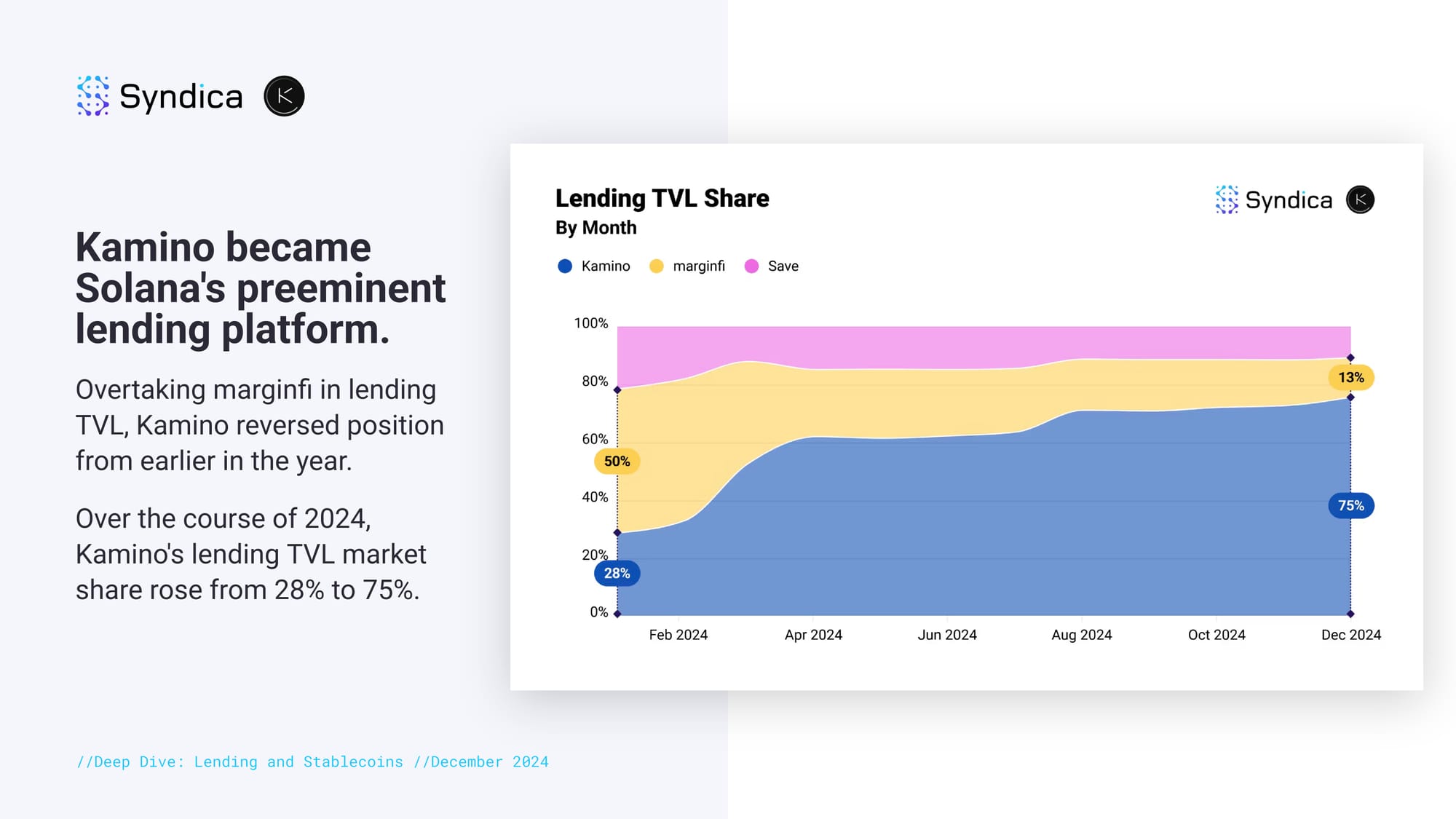

Kamino became Solana's preeminent lending platform. Overtaking marginfi in lending TVL, Kamino reversed position from earlier in the year. Over the course of 2024, Kamino's lending TVL market share rose from 28% to 75%.

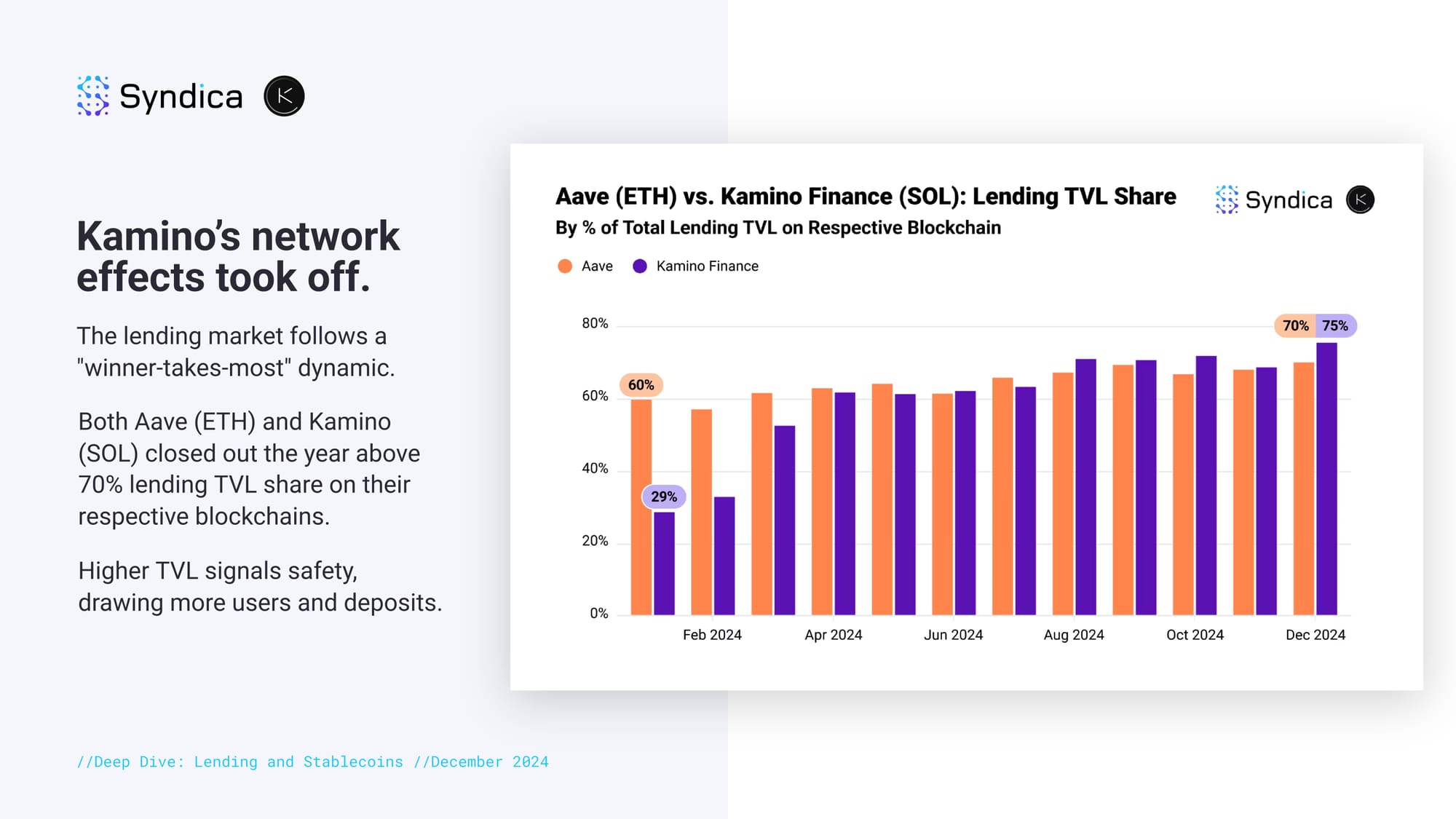

Kamino’s network effects took off. The lending market follows a "winner-takes-most" dynamic. Both Aave (ETH) and Kamino (SOL) closed out the year above 70% lending TVL share on their respective blockchains. Higher TVL signals safety, drawing more users and deposits.

Kamino excelled in both TVL and risk management. The protocol's TVL grew by 4.5x and market count expanded from 1 to 5 in 2024. Isolated markets allow higher borrowing limits by preventing risk spillover across assets.

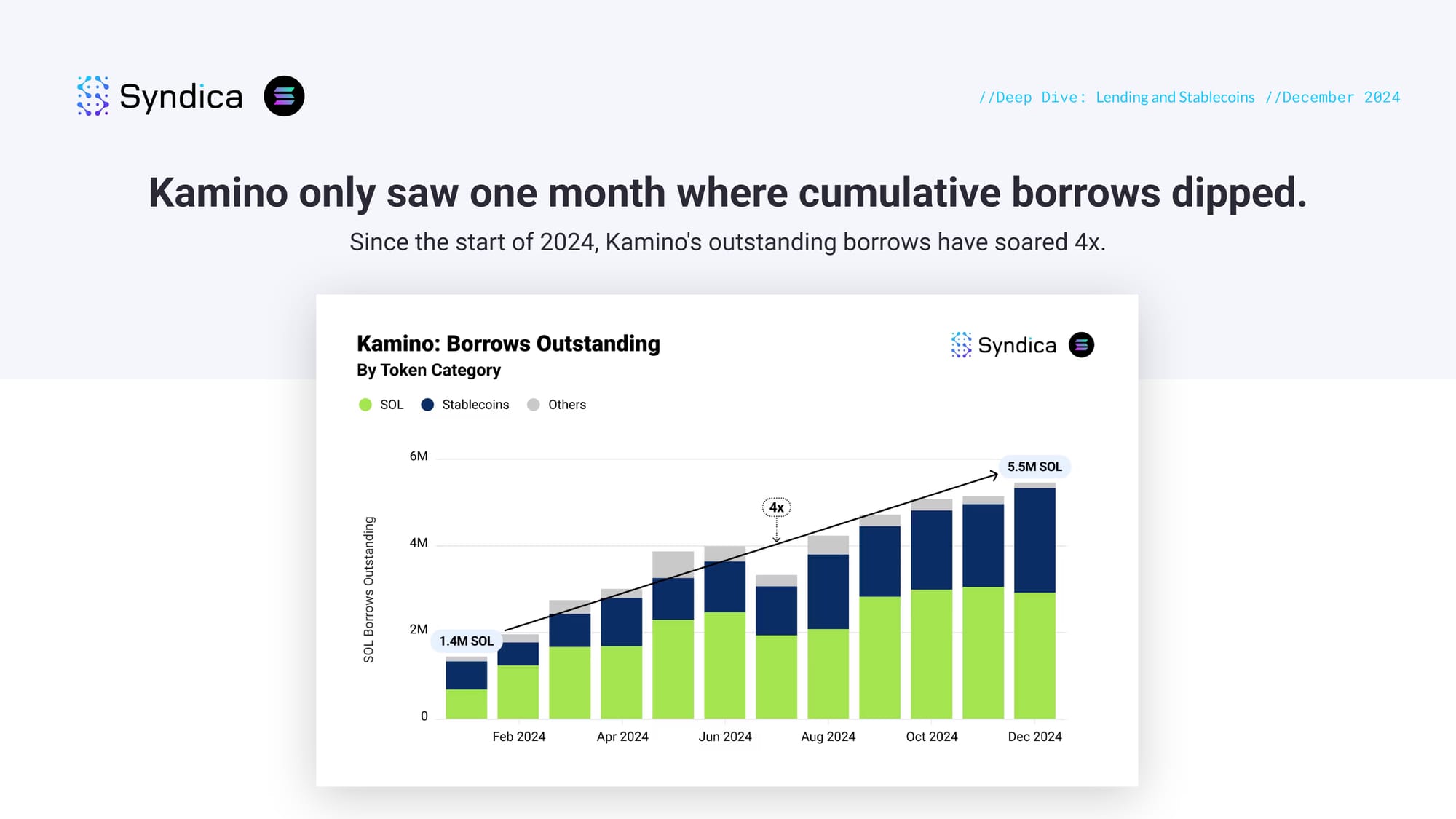

Kamino only saw one month where cumulative borrows dipped. Since the start of 2024, Kamino's outstanding borrows have soared 4x.

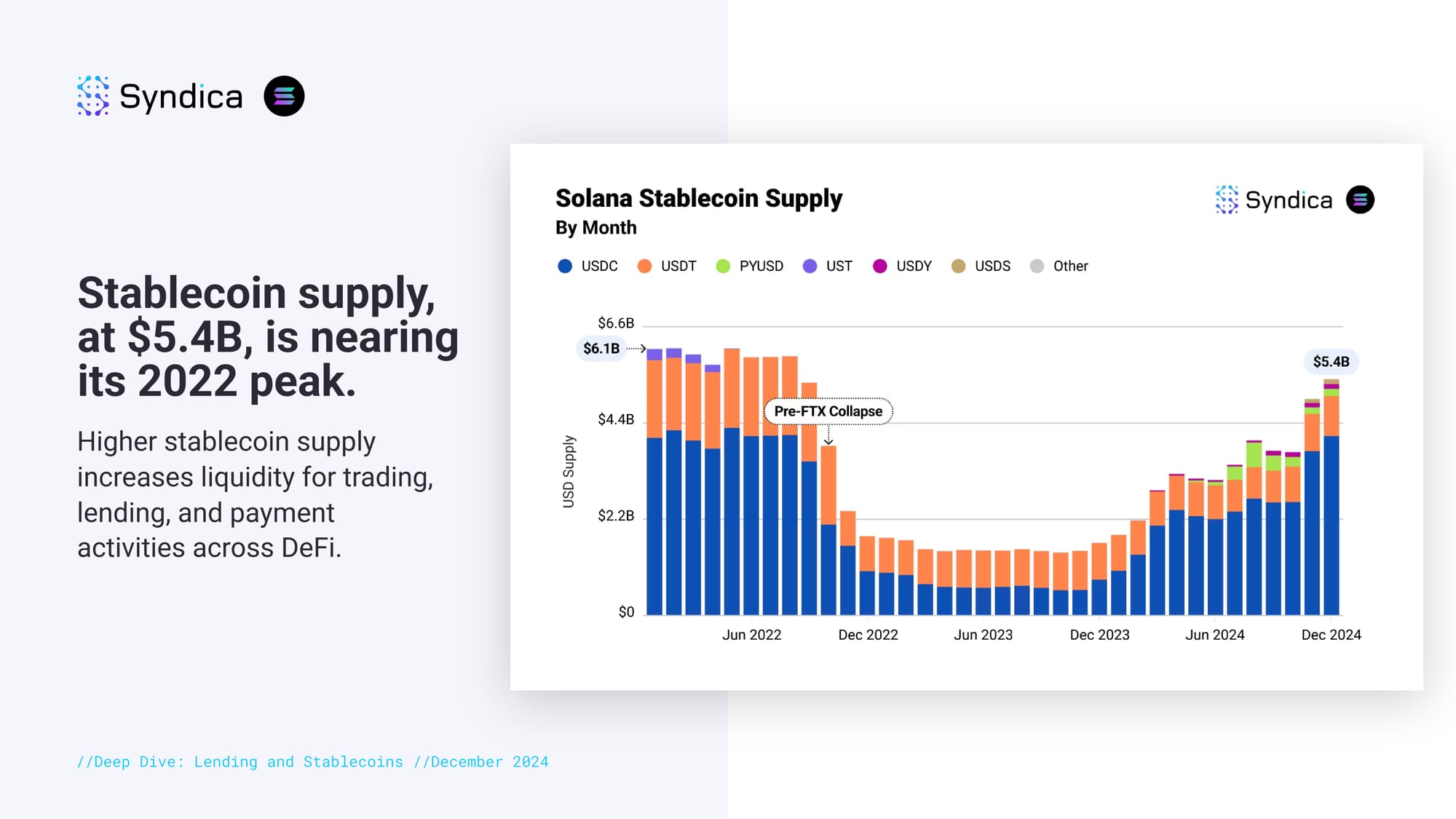

Stablecoin supply, at $5.4B, is nearing its 2022 peak. Higher stablecoin supply increases liquidity for trading, lending, and payment activities across DeFi.

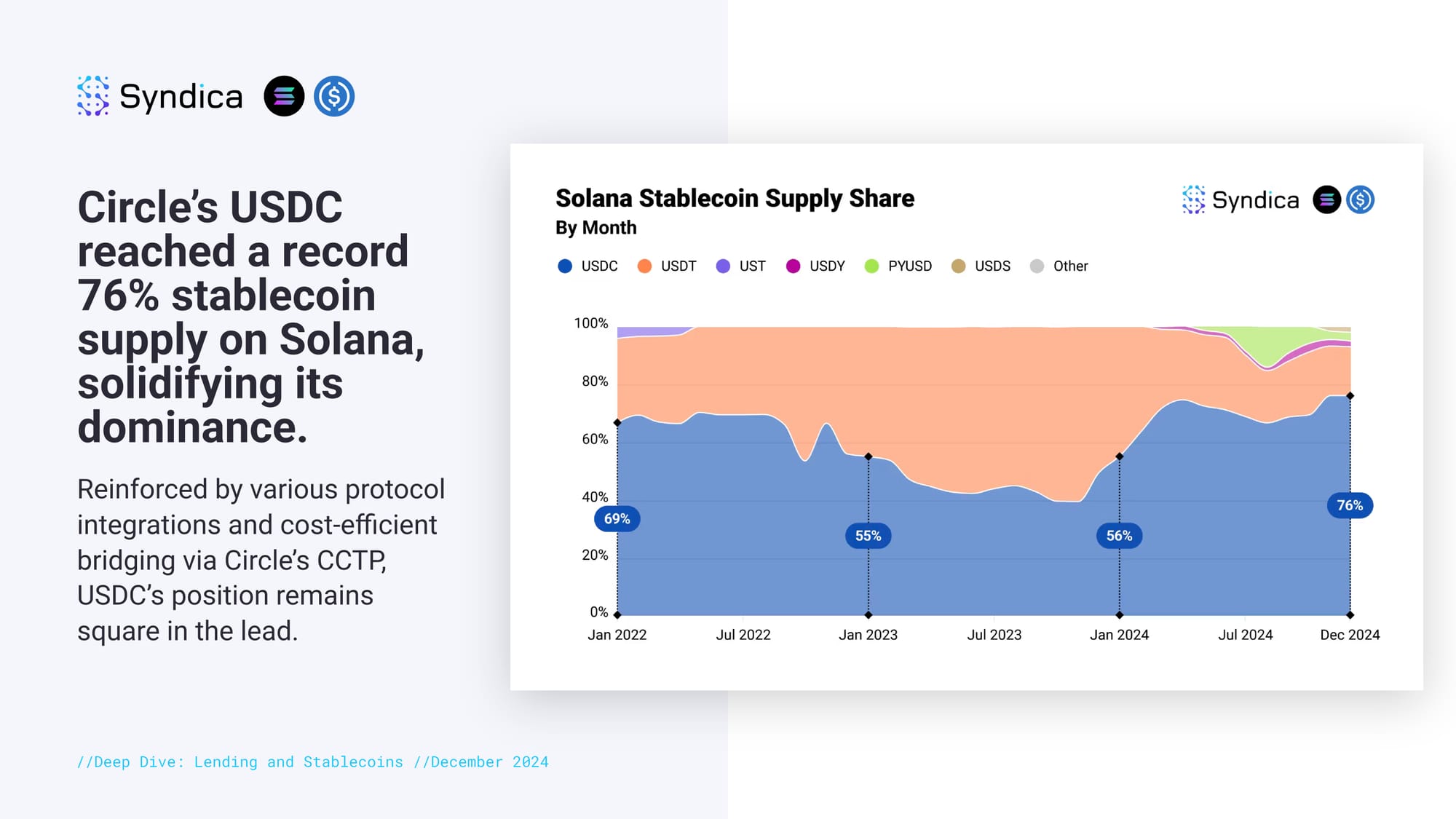

Circle’s USDC reached a record 76% stablecoin supply on Solana, solidifying its dominance. Reinforced by various protocol integrations and cost-efficient bridging via Circle’s CCTP, USDC’s position remains square in the lead.

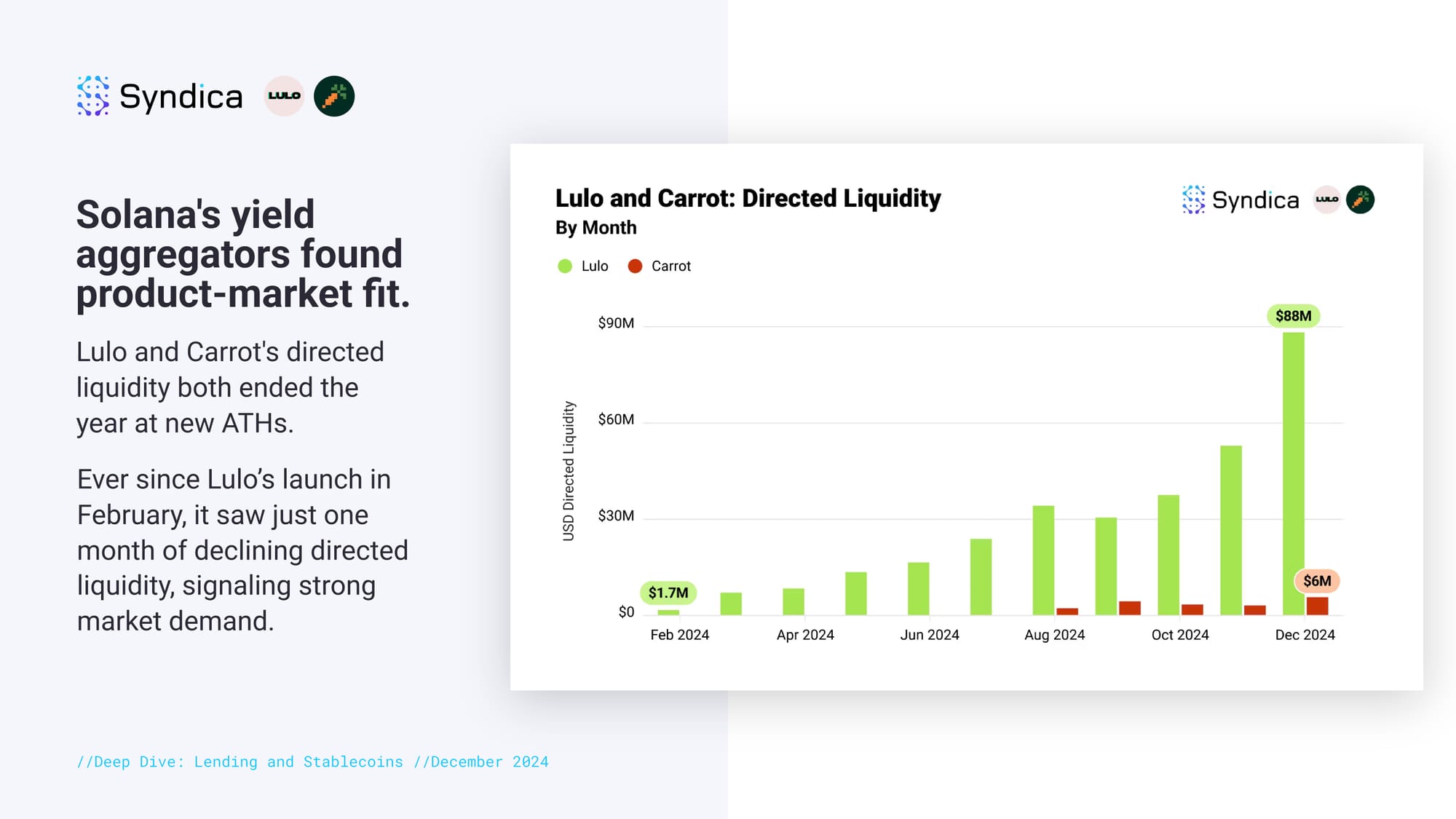

Solana's yield aggregators found product-market fit. Lulo and Carrot's directed liquidity both ended the year at new ATHs. Ever since Lulo’s launch in February, it saw just one month of declining directed liquidity, signaling strong market demand.

Part III: Liquid Staking

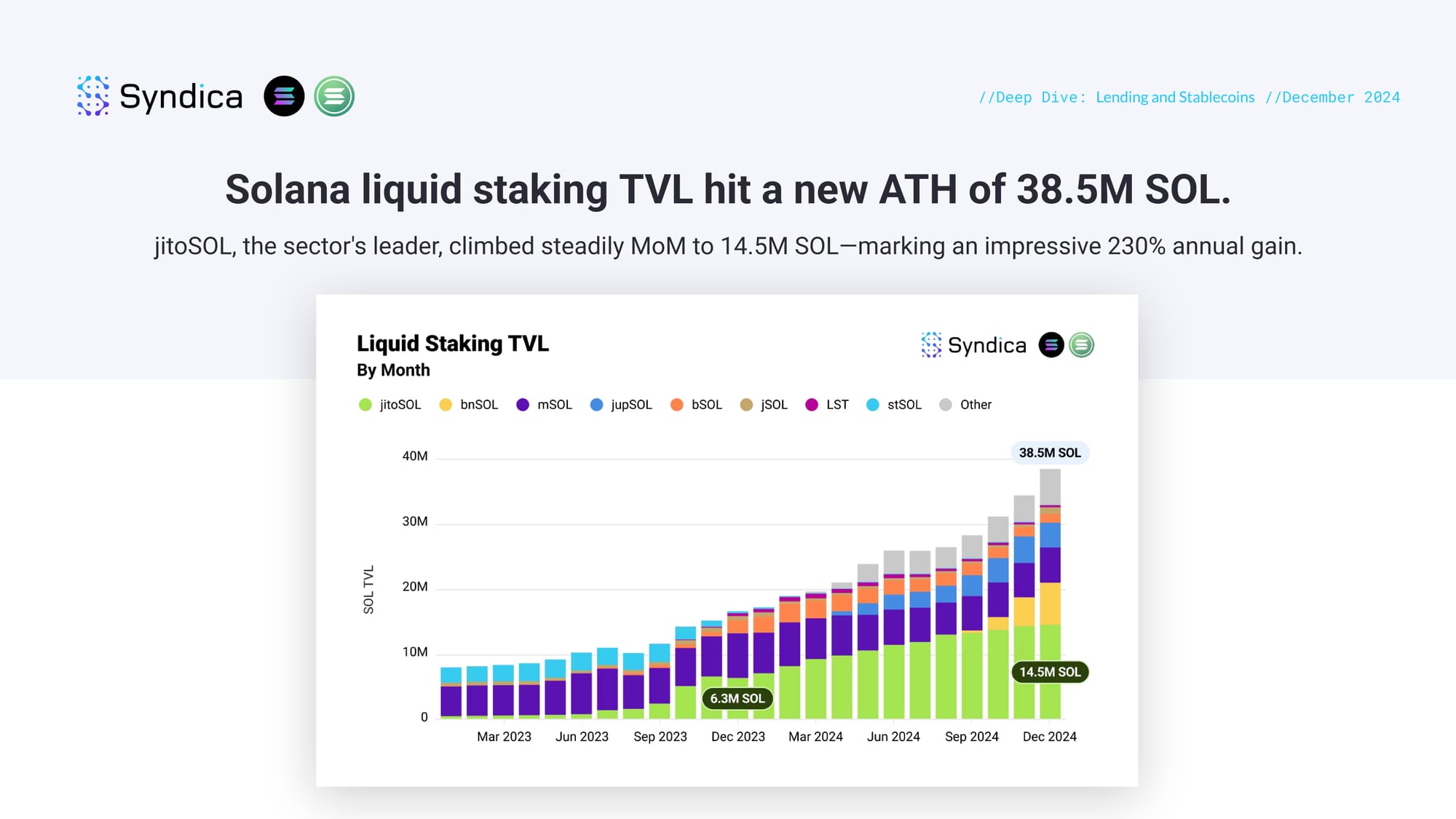

Solana liquid staking TVL hit a new ATH of 38.5M SOL. jitoSOL, the sector's leader, climbed steadily MoM to 14.5M SOL—marking an impressive 230% annual gain.

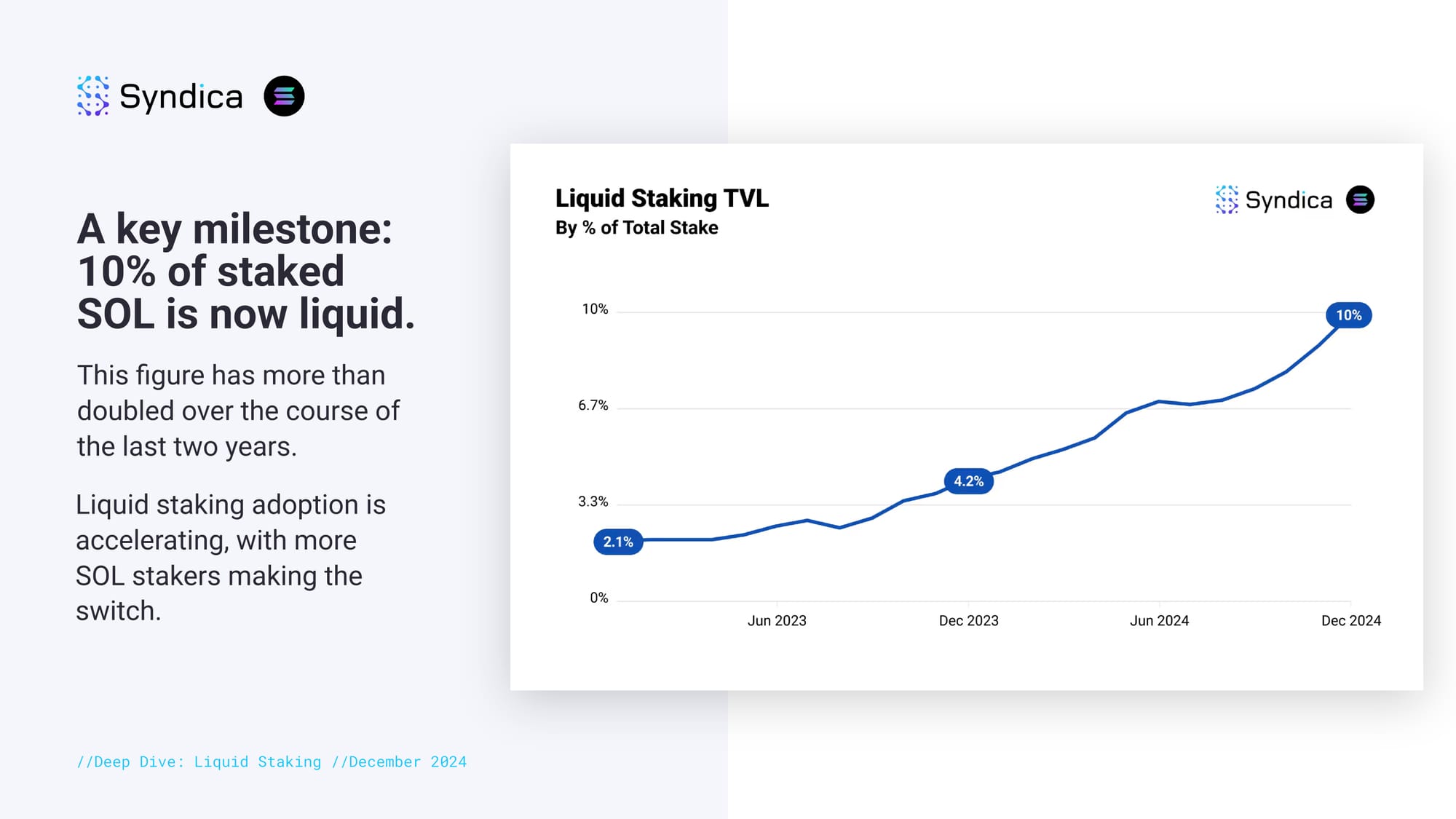

A key milestone: 10% of staked SOL is now liquid. This figure has more than doubled over the course of the last two years. Liquid staking adoption is accelerating, with more SOL stakers making the switch.

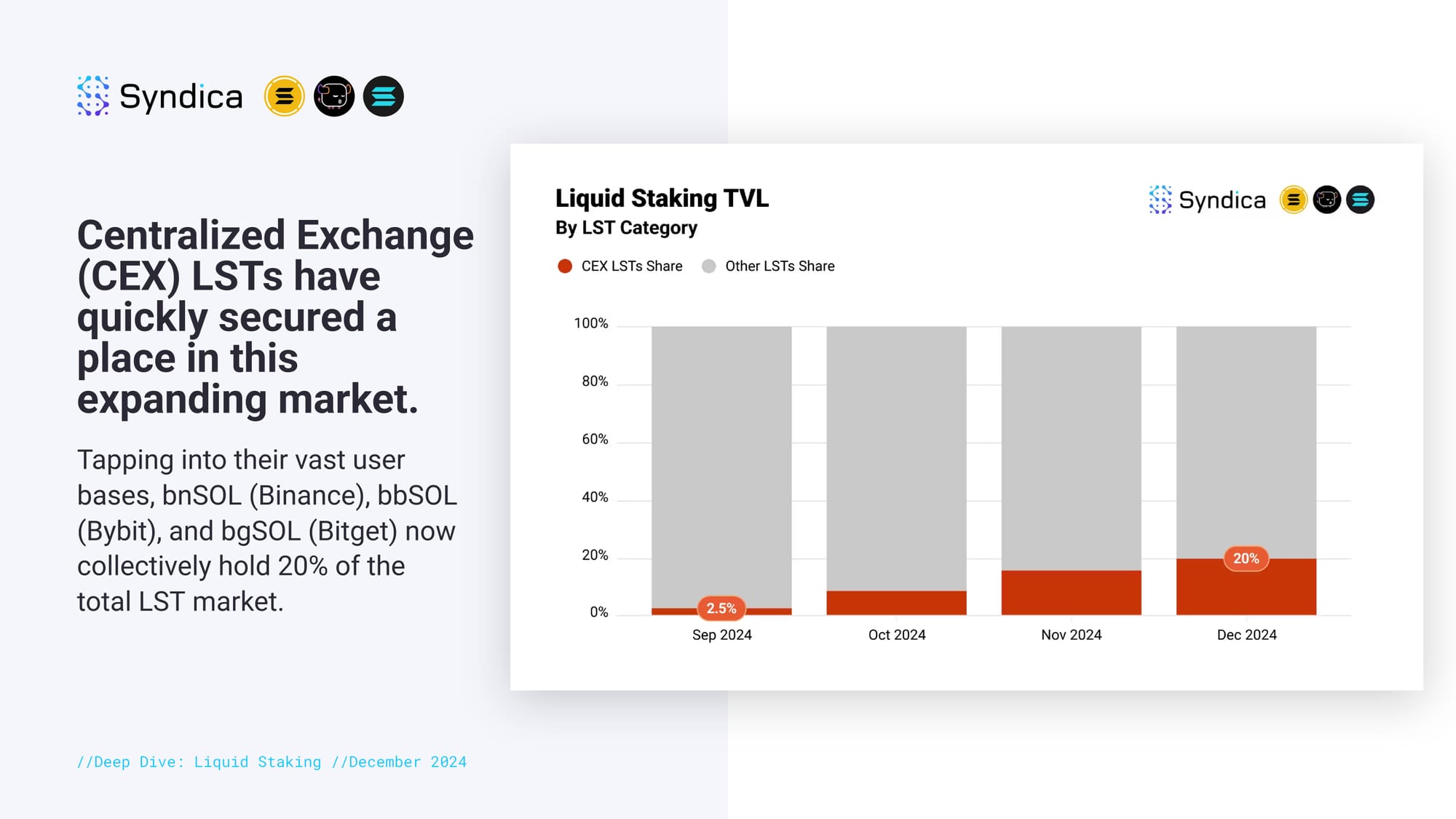

Centralized Exchange (CEX) LSTs have quickly secured a place in this expanding market. Tapping into their vast user bases, bnSOL (Binance), bbSOL (Bybit), and bgSOL (Bitget) now collectively hold 20% of the total LST market.

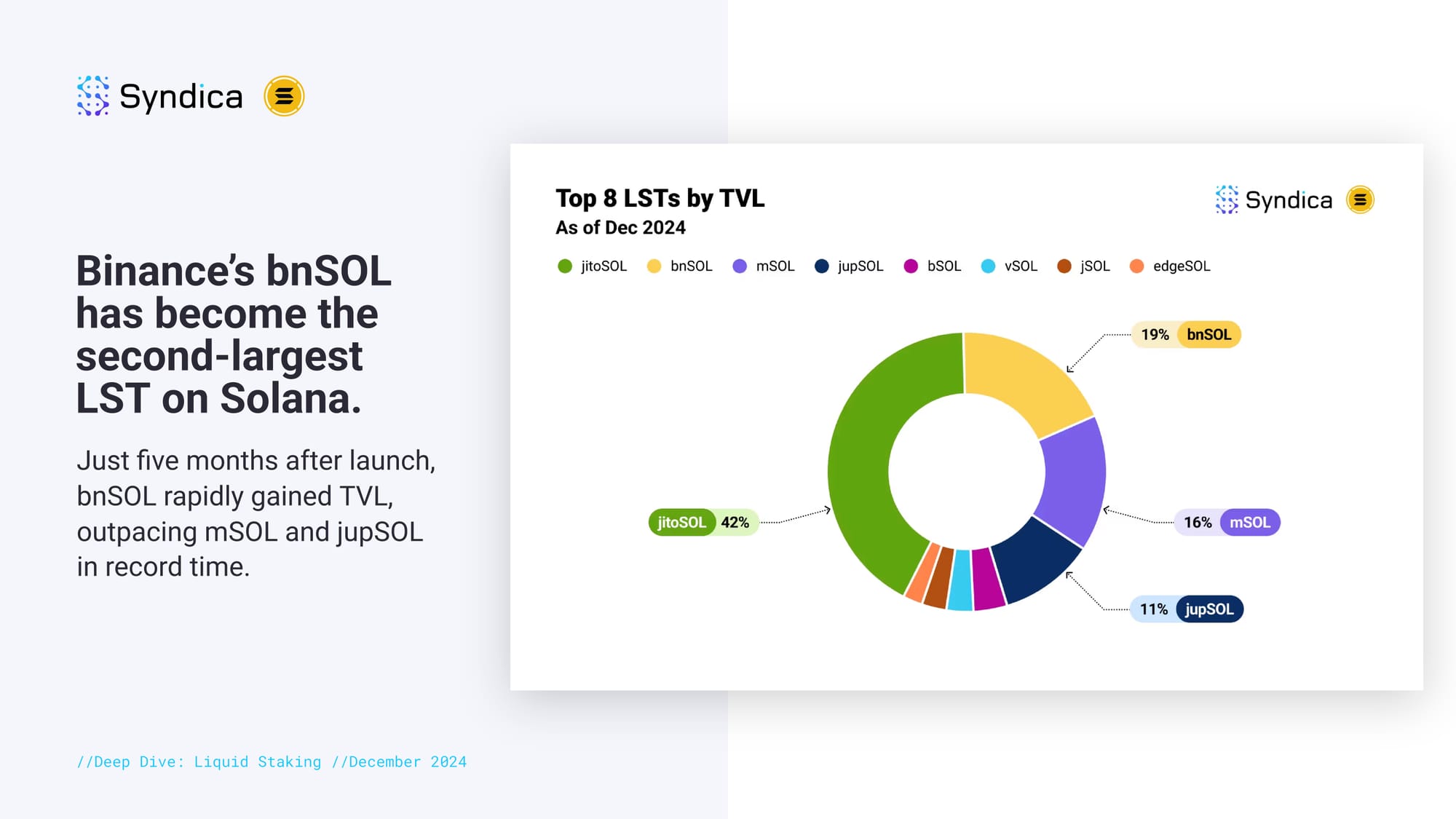

Binance’s bnSOL has become the second-largest LST on Solana. Just five months after launch, bnSOL rapidly gained TVL, outpacing mSOL and jupSOL in record time.

Part IV: Cross-chain Bridges

The bridging market concluded 2024 on a high note. Quarterly bridging volumes reached an ATH of $4.2B in Q4.

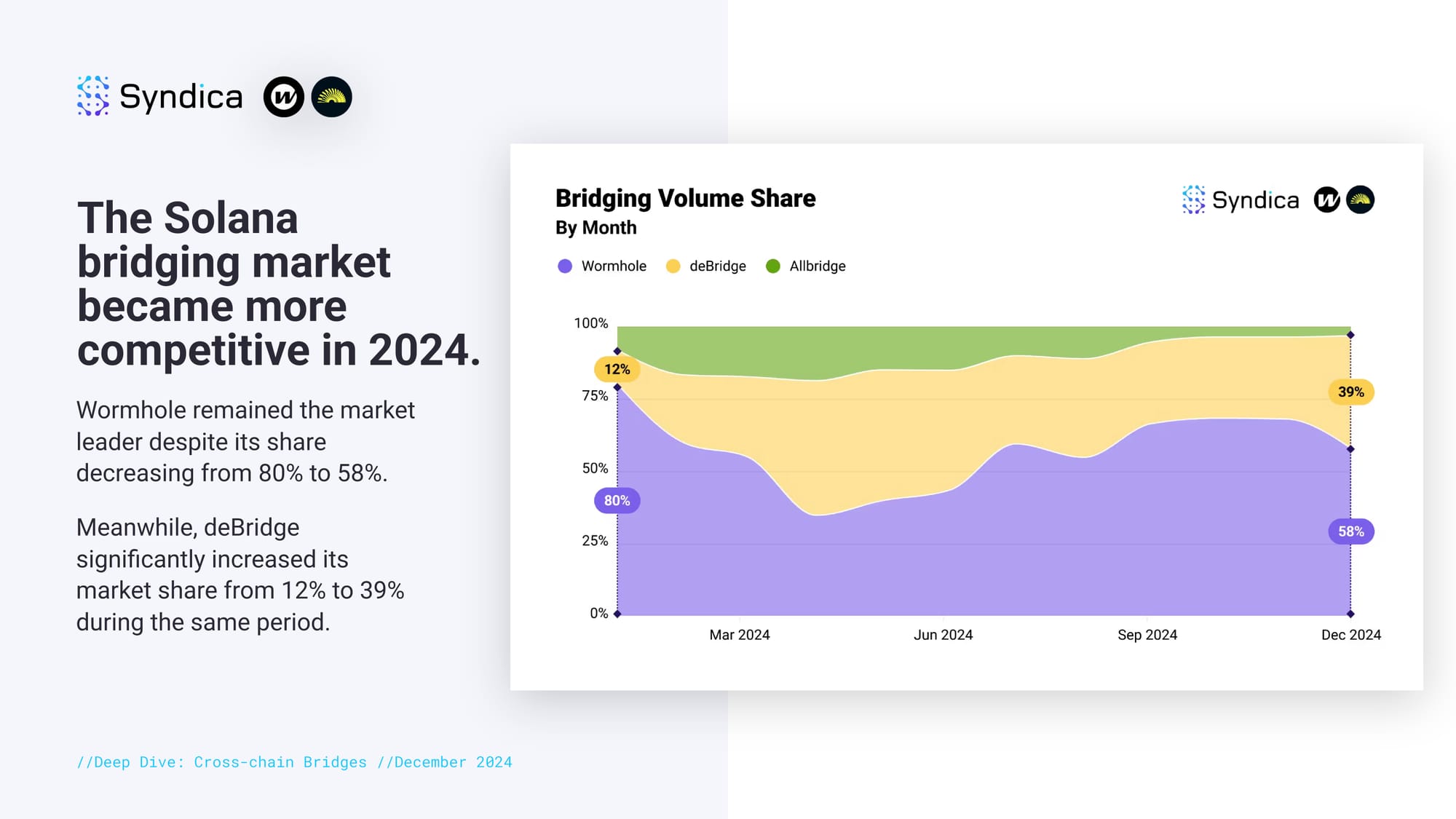

The Solana bridging market became more competitive in 2024. Wormhole remained the market leader despite its share decreasing from 80% to 58%. Meanwhile, deBridge significantly increased its market share from 12% to 39% during the same period.

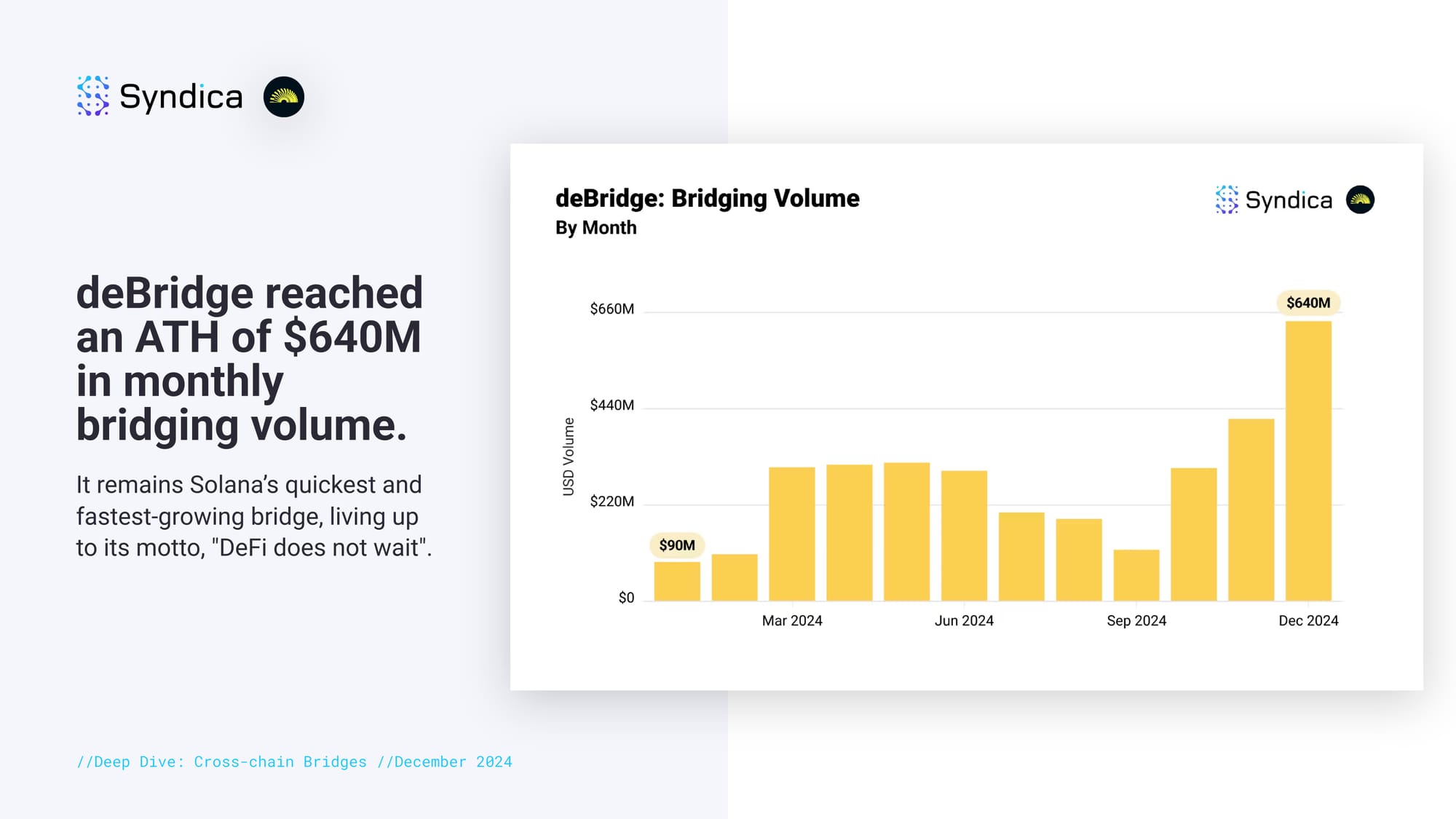

deBridge reached an ATH of $640M in monthly bridging volume. It remains Solana’s quickest and fastest-growing bridge, living up to its motto, "DeFi does not wait".

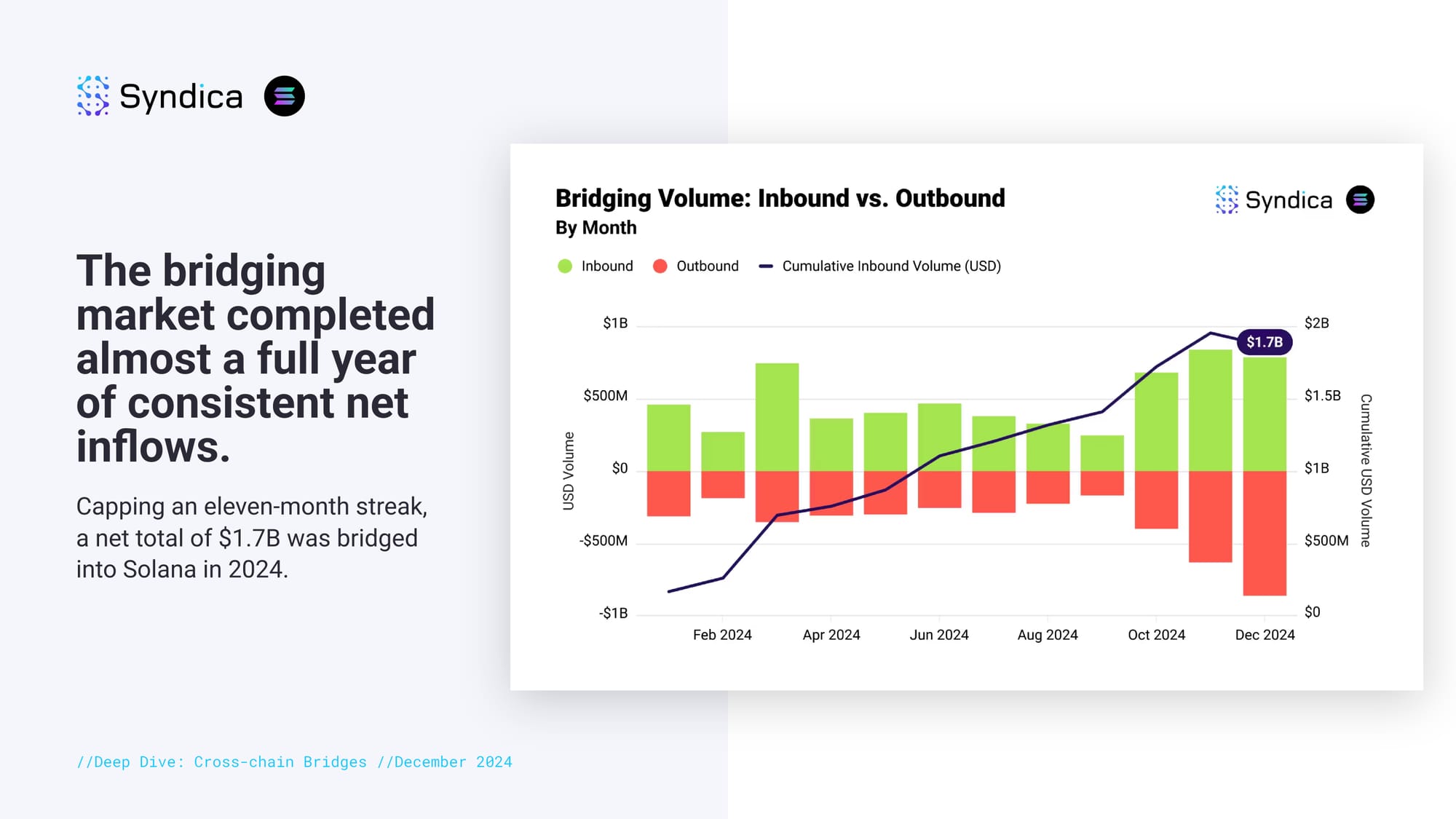

The bridging market completed almost a full year of consistent net inflows. Capping an eleven-month streak, a net total of $1.7B was bridged into Solana in 2024.