Deep Dive: Solana DeFi - February 2025

Deep Dive: Solana DeFi - February 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - February 2025

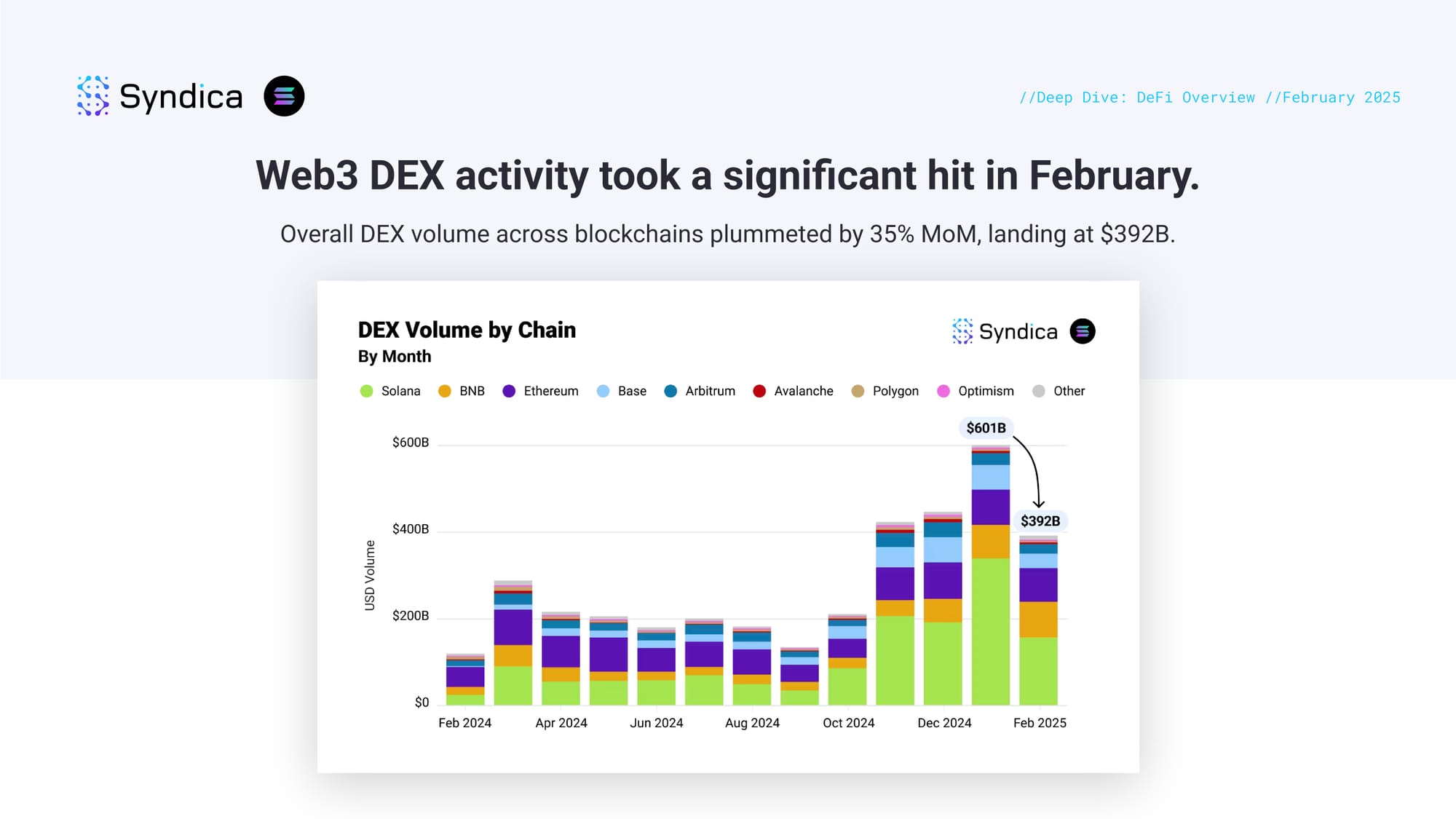

Web3 DEX activity took a significant hit in February. Overall DEX volume across blockchains plummeted by 35% MoM, landing at $392B.

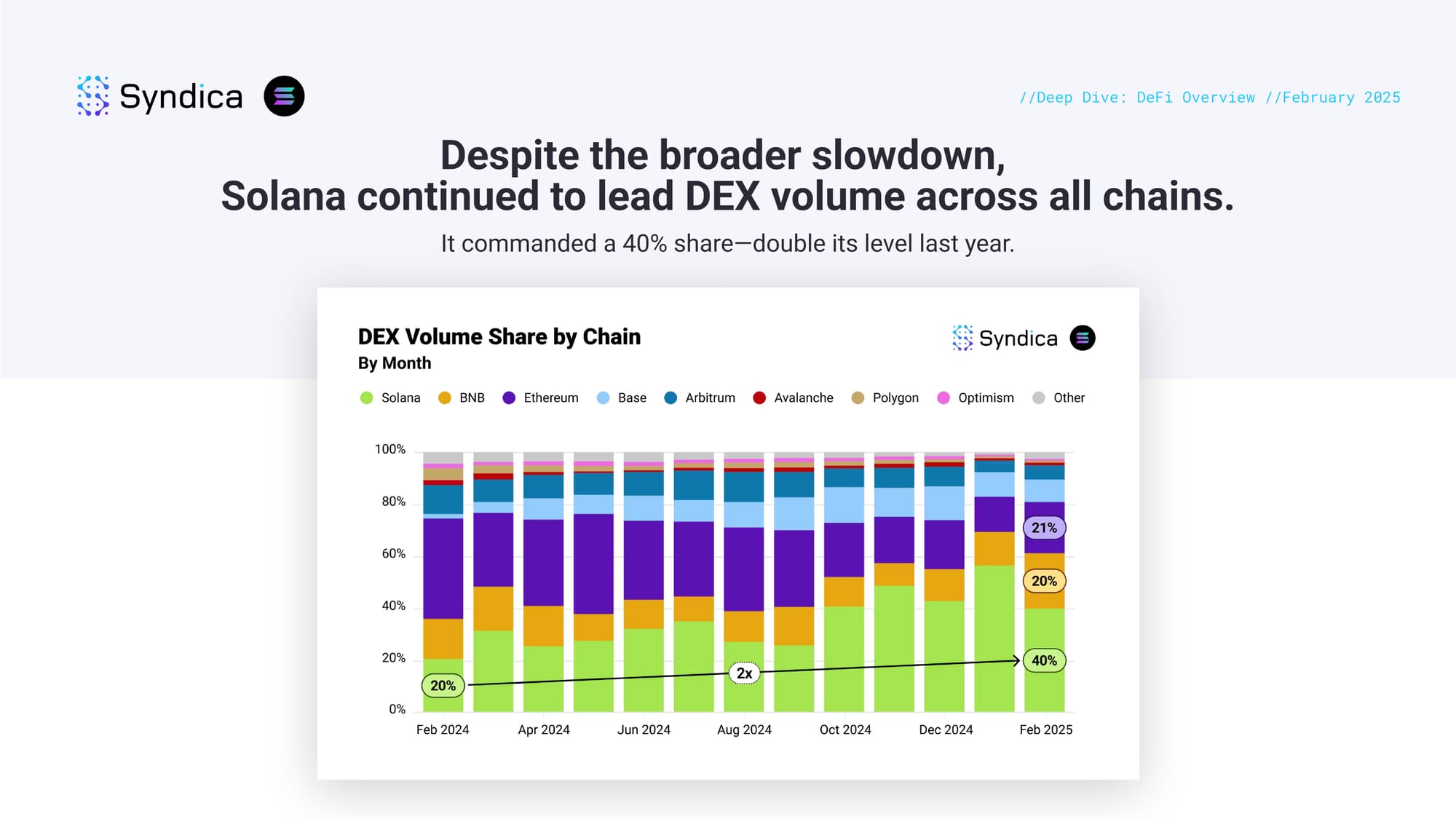

Despite the broader slowdown, Solana continued to lead DEX volume across all chains. It commanded a 40% share—double its level last year.

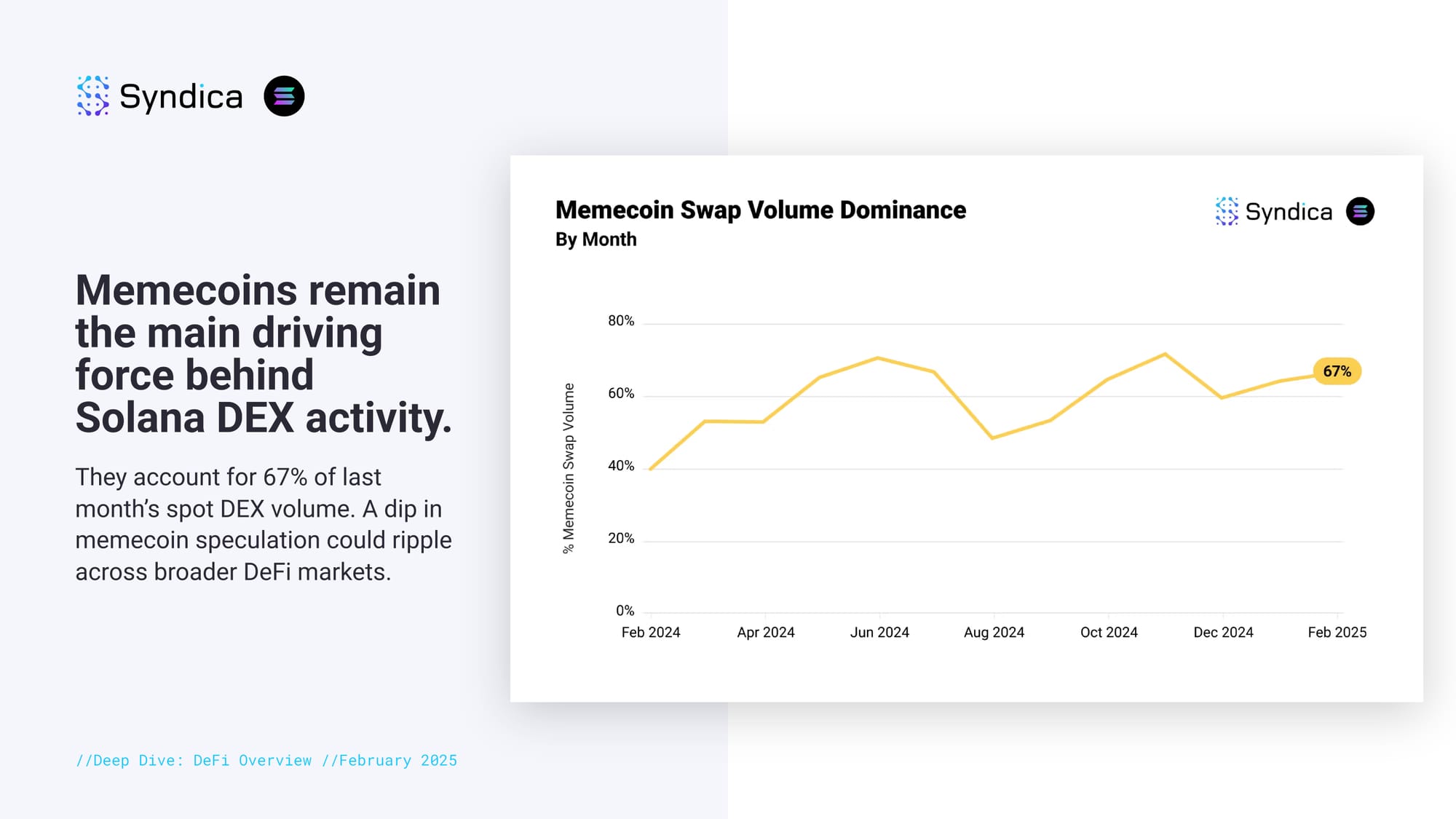

Memecoins remain the main driving force behind Solana DEX activity. They account for 67% of last month’s spot DEX volume. A dip in memecoin speculation could ripple across broader DeFi markets.

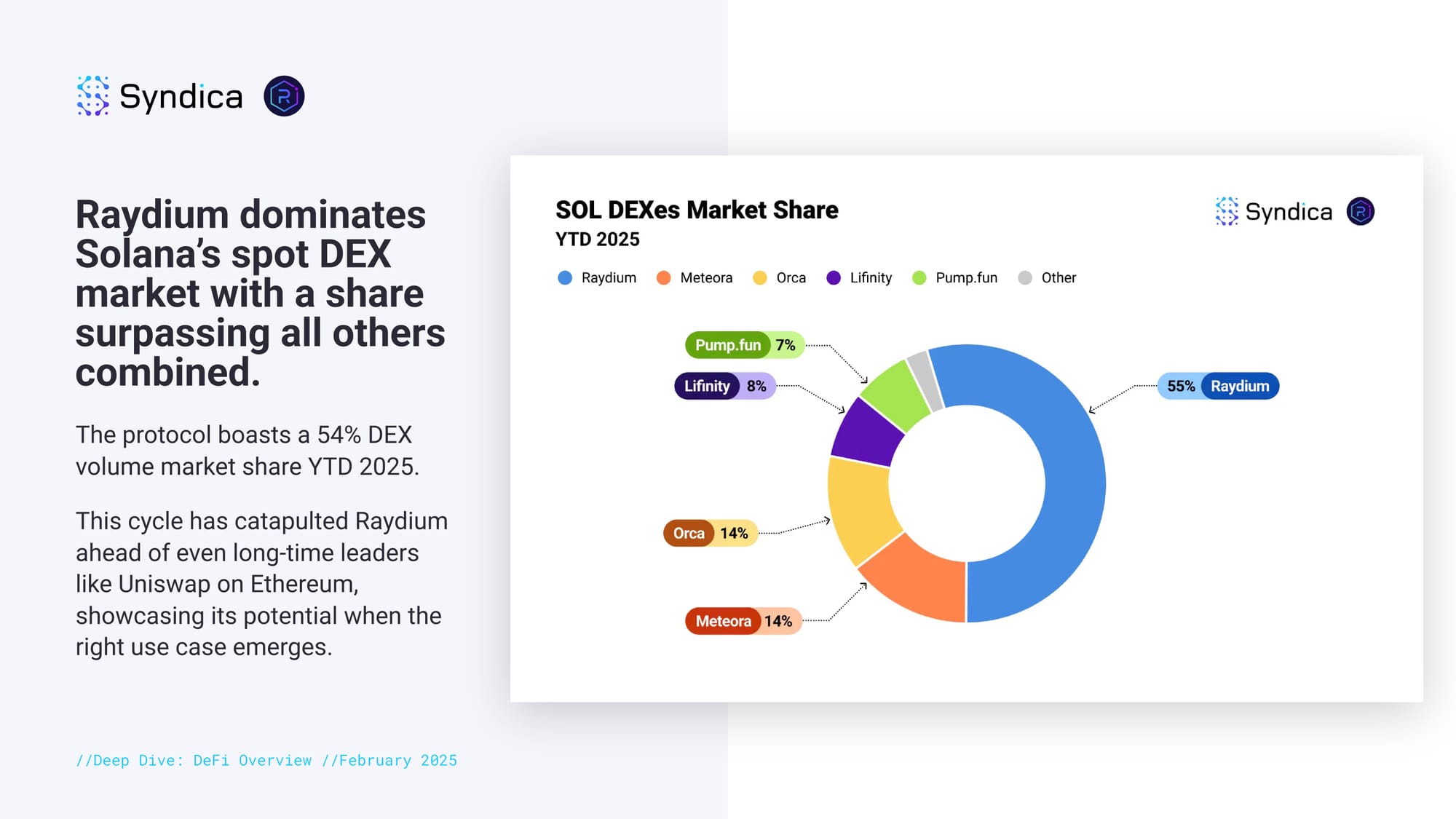

Raydium dominates Solana’s spot DEX market with a share surpassing all others combined. The protocol boasts a 54% DEX volume market share YTD 2025. This cycle has catapulted Raydium ahead of even long-time leaders like Uniswap on Ethereum, showcasing its potential when the right use case emerges.

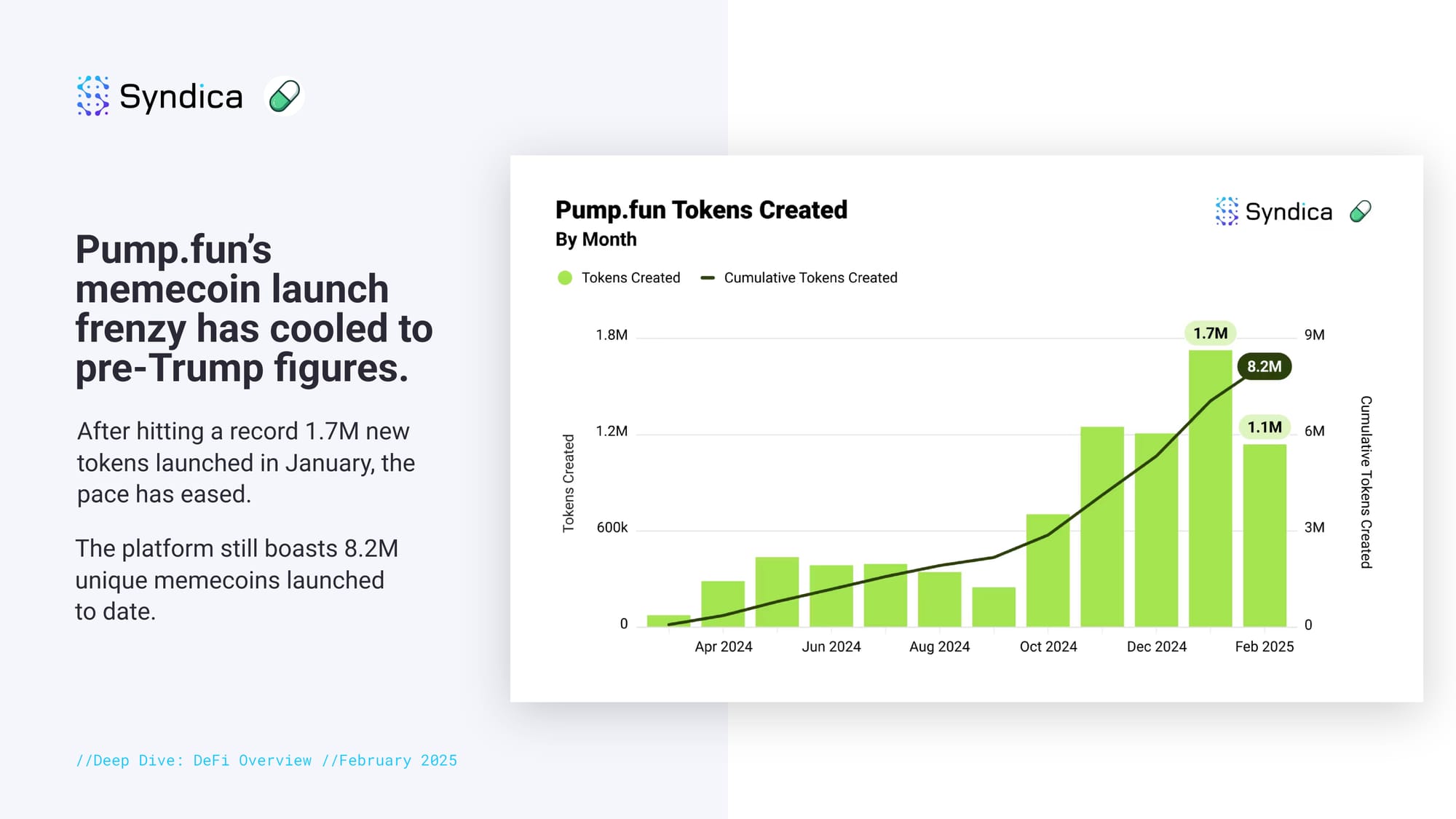

Pump.fun’s memecoin launch frenzy has cooled to pre-Trump figures. After hitting a record 1.7M new tokens launched in January, the pace has eased. The platform still boasts 8.2M unique memecoins launched to date.

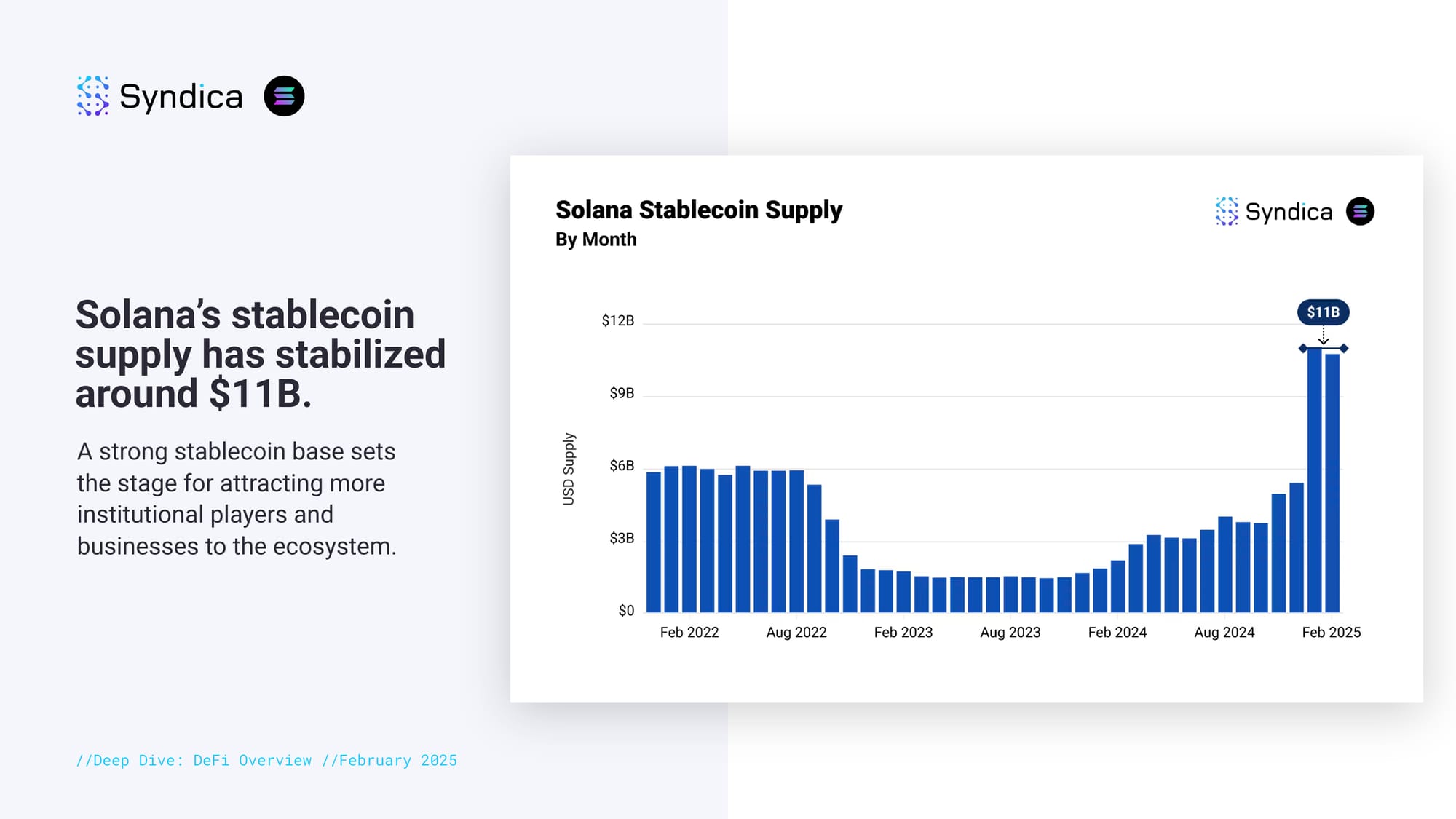

Solana’s stablecoin supply has stabilized around $11B. A strong stablecoin base sets the stage for attracting more institutional players and businesses to the ecosystem.

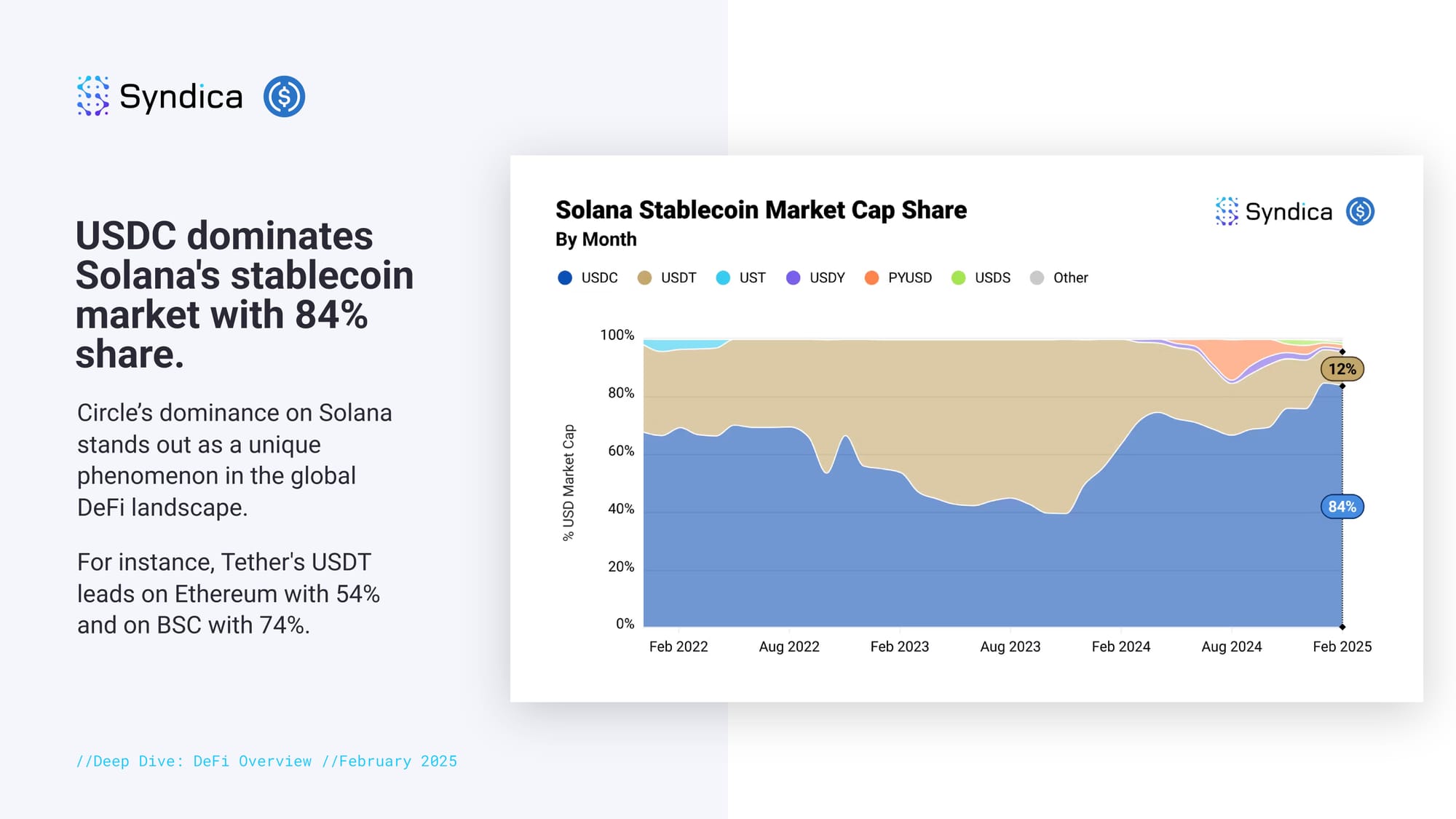

USDC dominates Solana's stablecoin market with 84% share. Circle’s dominance on Solana stands out as a unique phenomenon in the global DeFi landscape. For instance, Tether's USDT leads on Ethereum with 54% and on BSC with 74%.

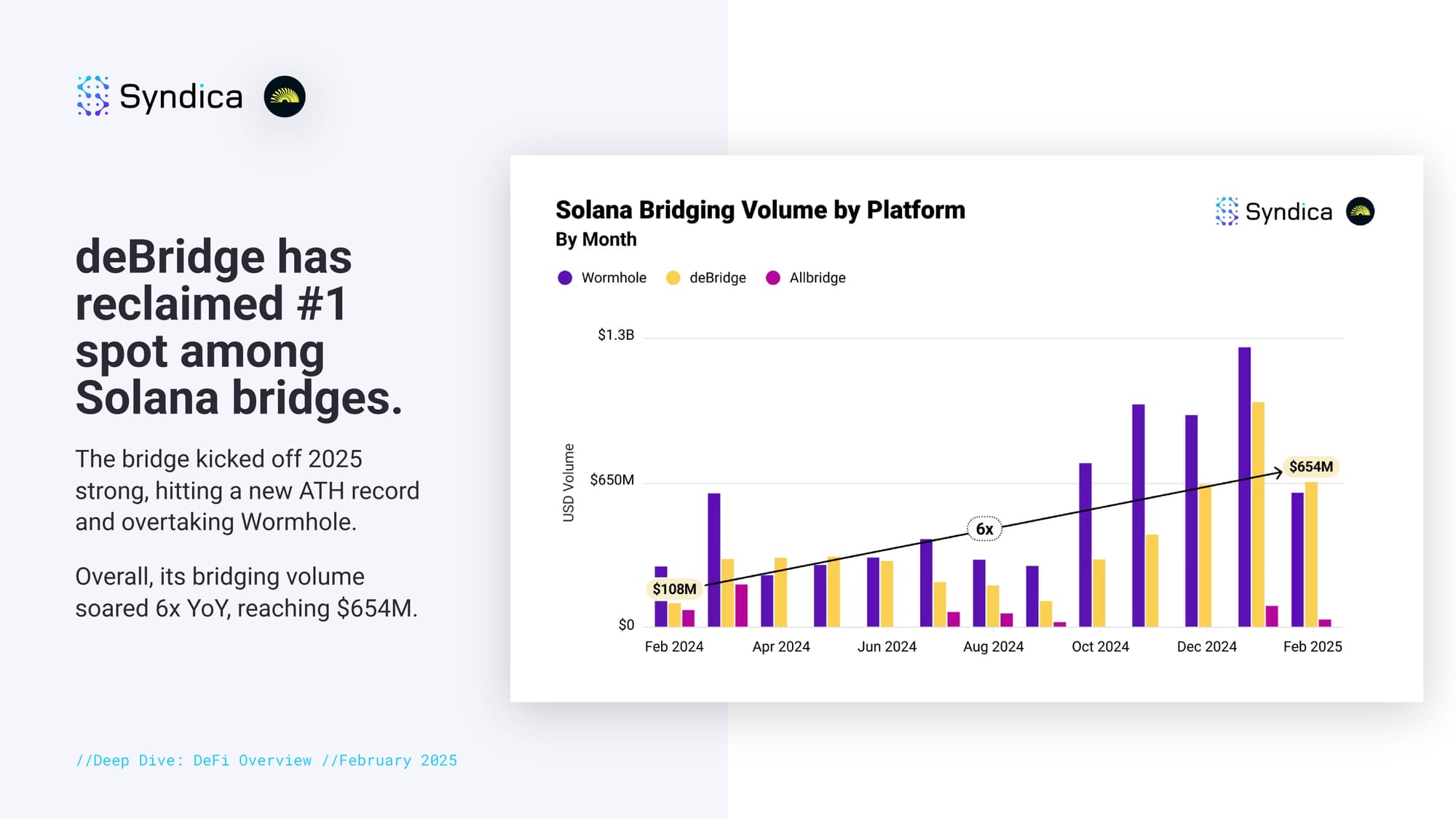

deBridge has reclaimed #1 spot among Solana bridges. The bridge kicked off 2025 strong, hitting a new ATH record and overtaking Wormhole. Overall, its bridging volume soared 6x YoY, reaching $654M.

DeFi Implications with SIMD-0228

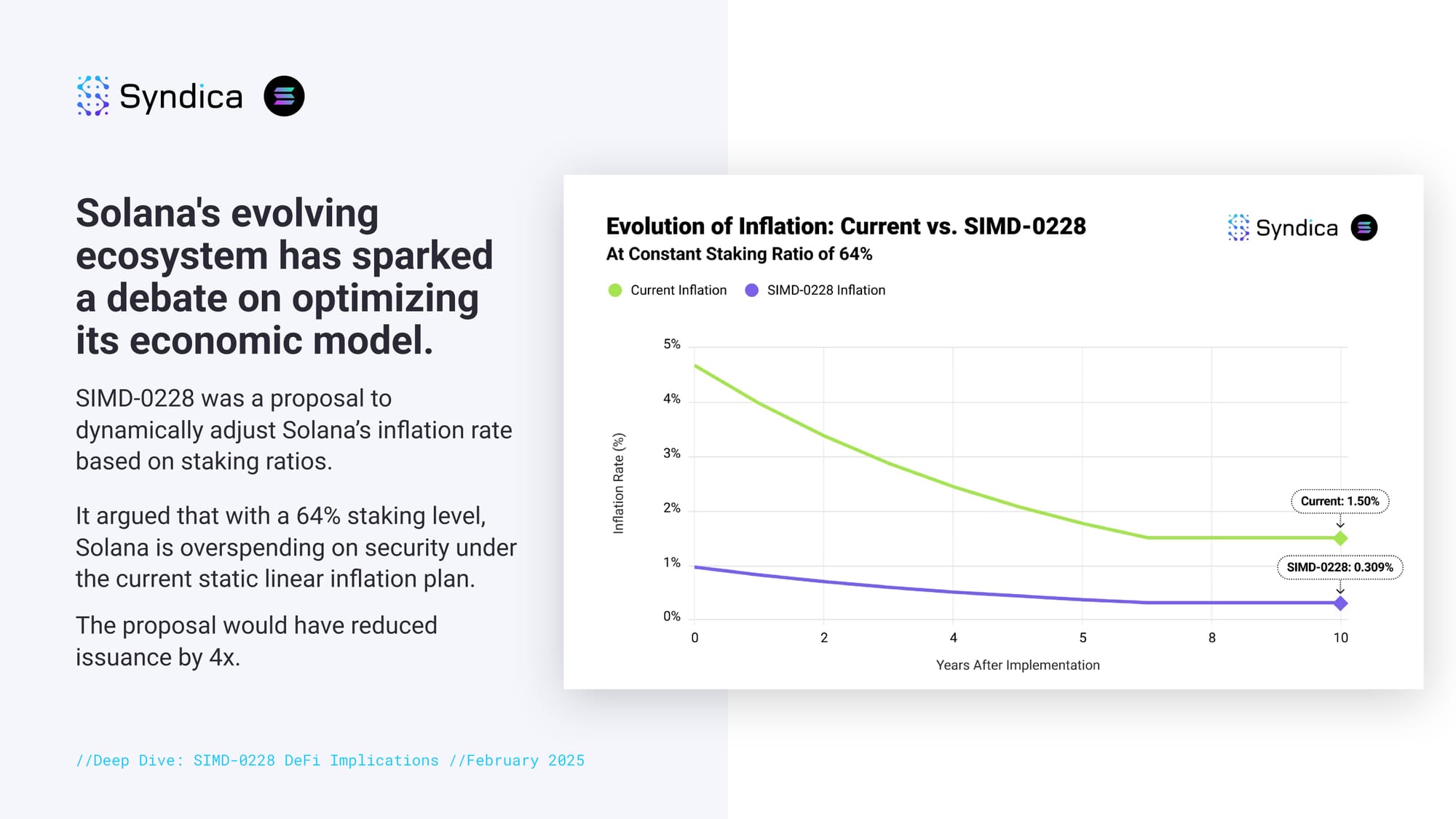

Solana's evolving ecosystem has sparked a debate on optimizing its economic model. SIMD-0228 was a proposal to dynamically adjust Solana’s inflation rate based on staking ratios. It argued that with a 64% staking level, Solana is overspending on security under the current static linear inflation plan. The proposal would have reduced issuance by 4x.

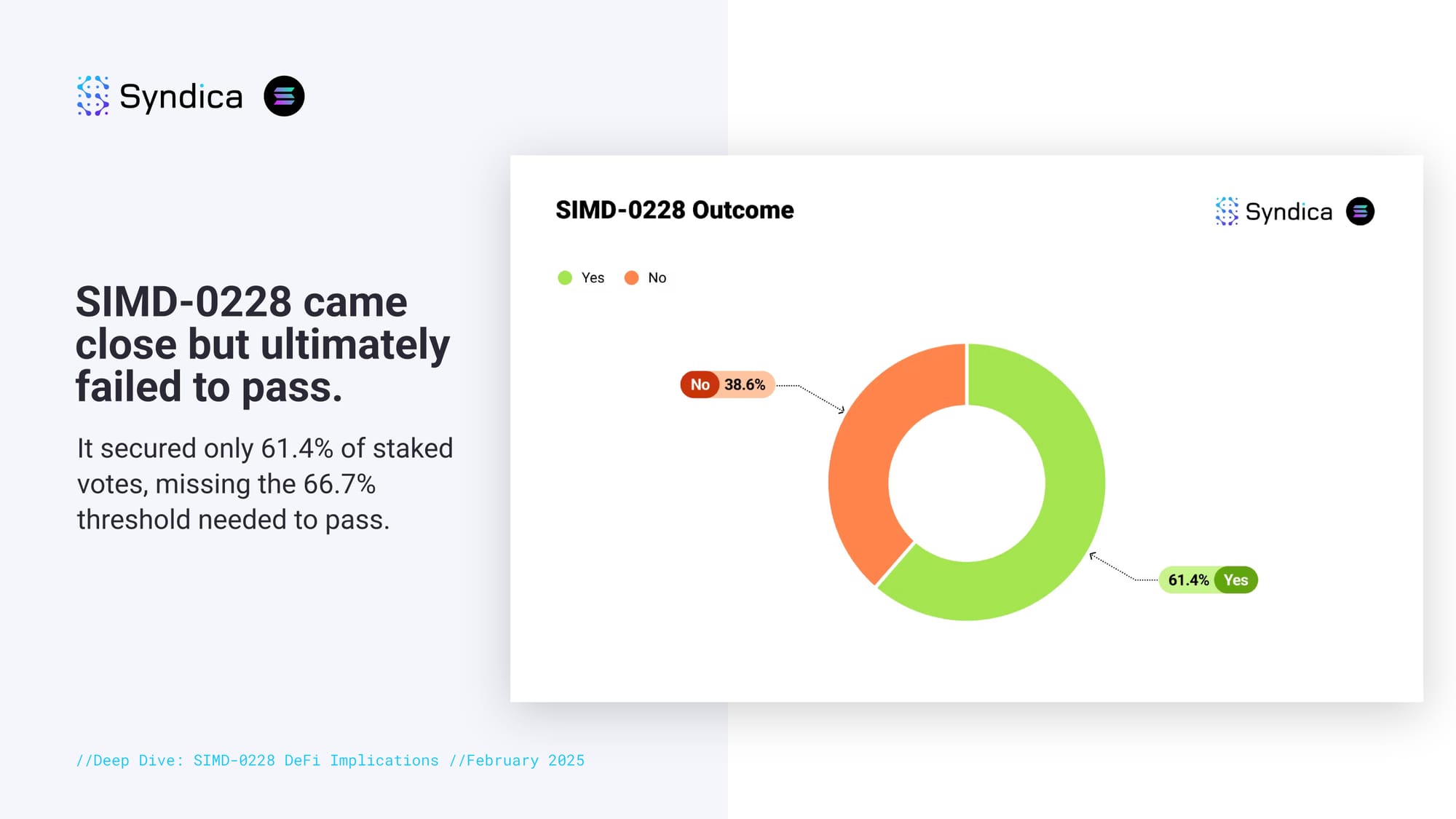

SIMD-0228 came close but ultimately failed to pass. It secured only 61.4% of staked votes, missing the 66.7% threshold needed to pass.

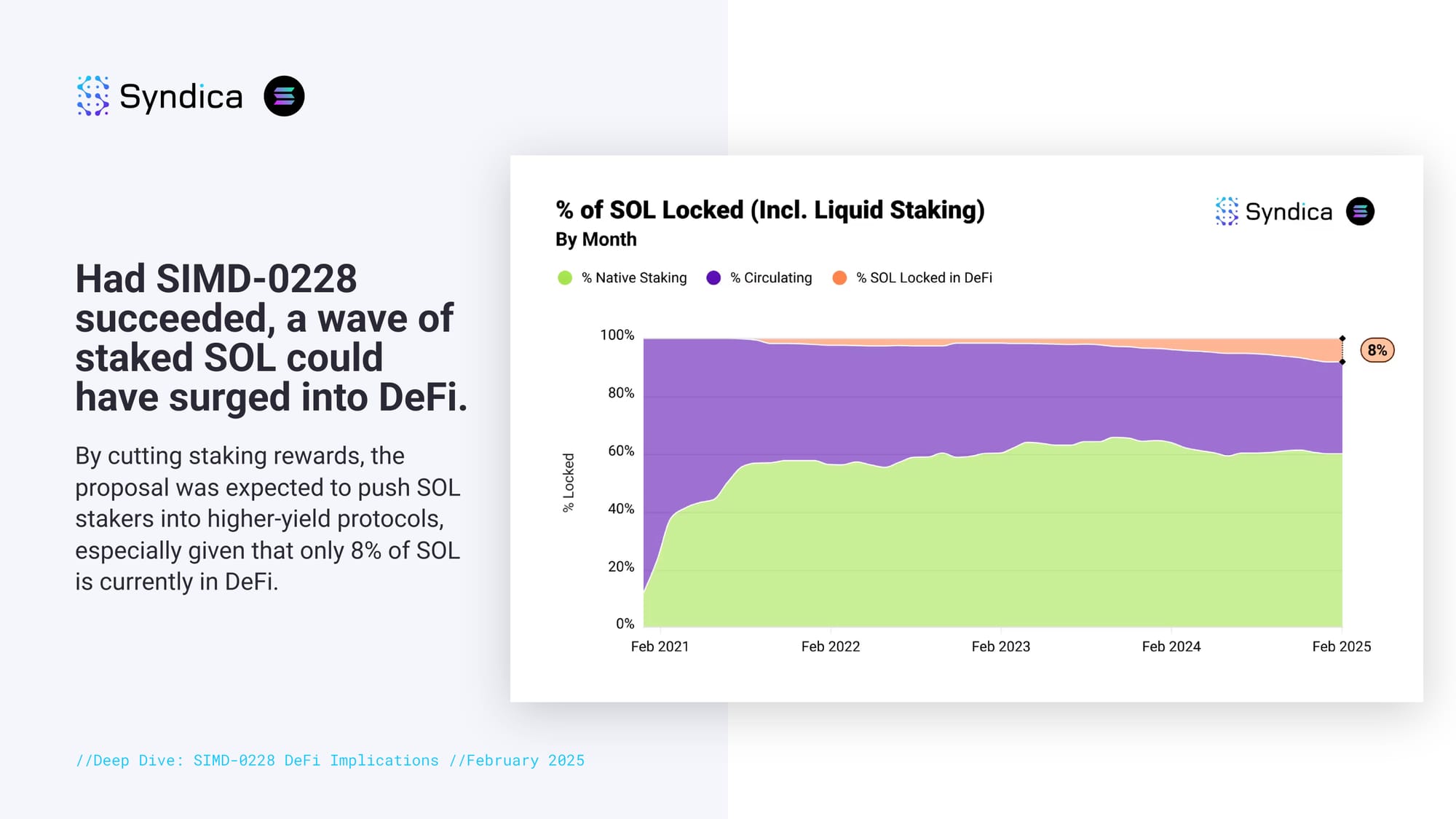

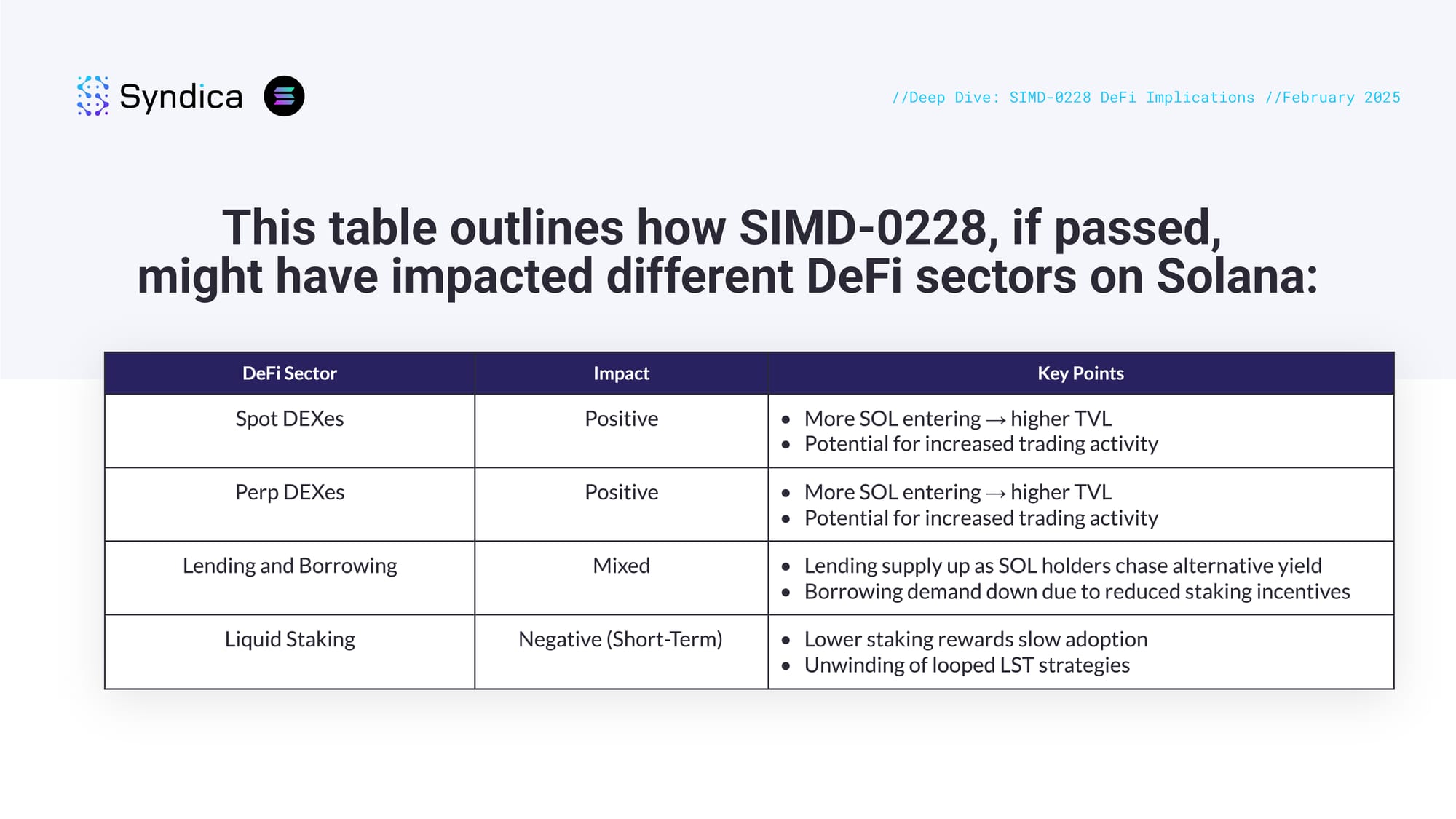

Had SIMD-0228 succeeded, a wave of staked SOL could have surged into DeFi. By cutting staking rewards, the proposal was expected to push SOL stakers into higher-yield protocols, especially given that only 8% of SOL is currently in DeFi.