Deep Dive: Solana DeFi - January 2025

Deep Dive: Solana DeFi - January 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - January 2025

Part I: Spot DEXes and Aggregators

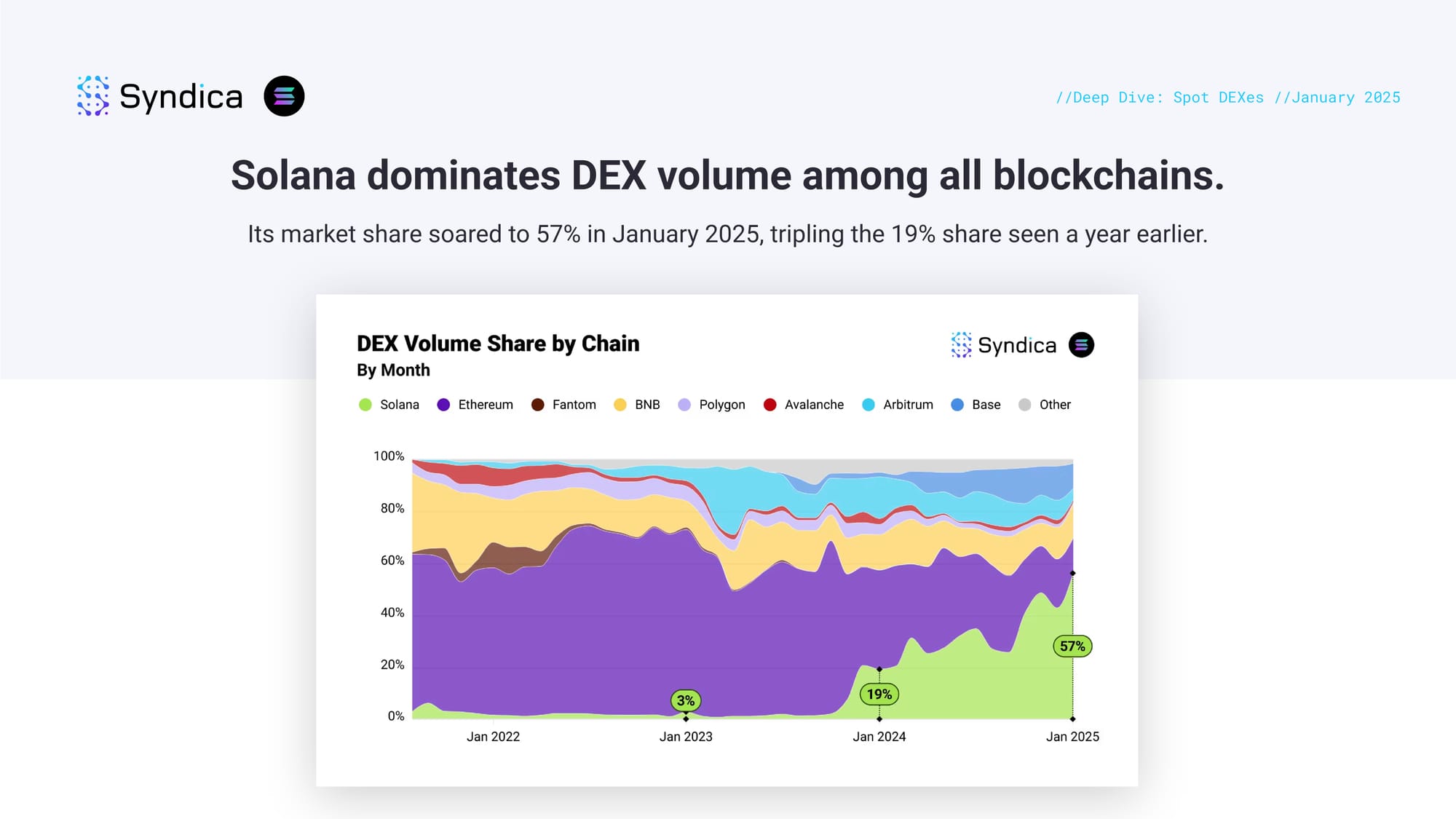

Solana dominates DEX volume among all blockchains. Its market share soared to 57% in January 2025, tripling the 19% share seen a year earlier.

2025 DEX volume is off to a strong start. January DEX volume reached $355B, already surpassing the cumulative total of the first six months of 2024.

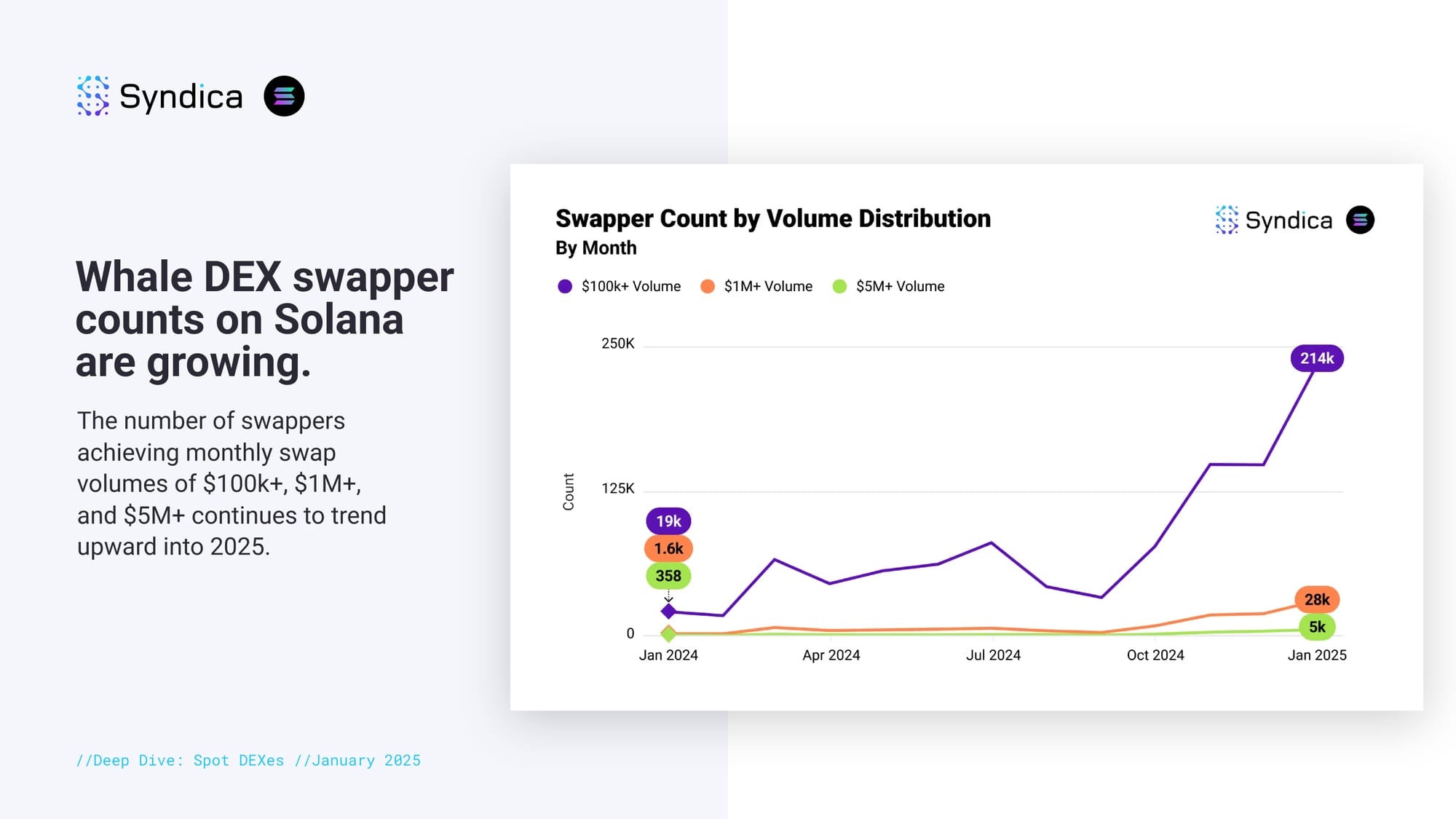

Whale DEX swapper counts on Solana are growing. The number of swappers achieving monthly swap volumes of $100k+, $1M+, and $5M+ continues to trend upward into 2025.

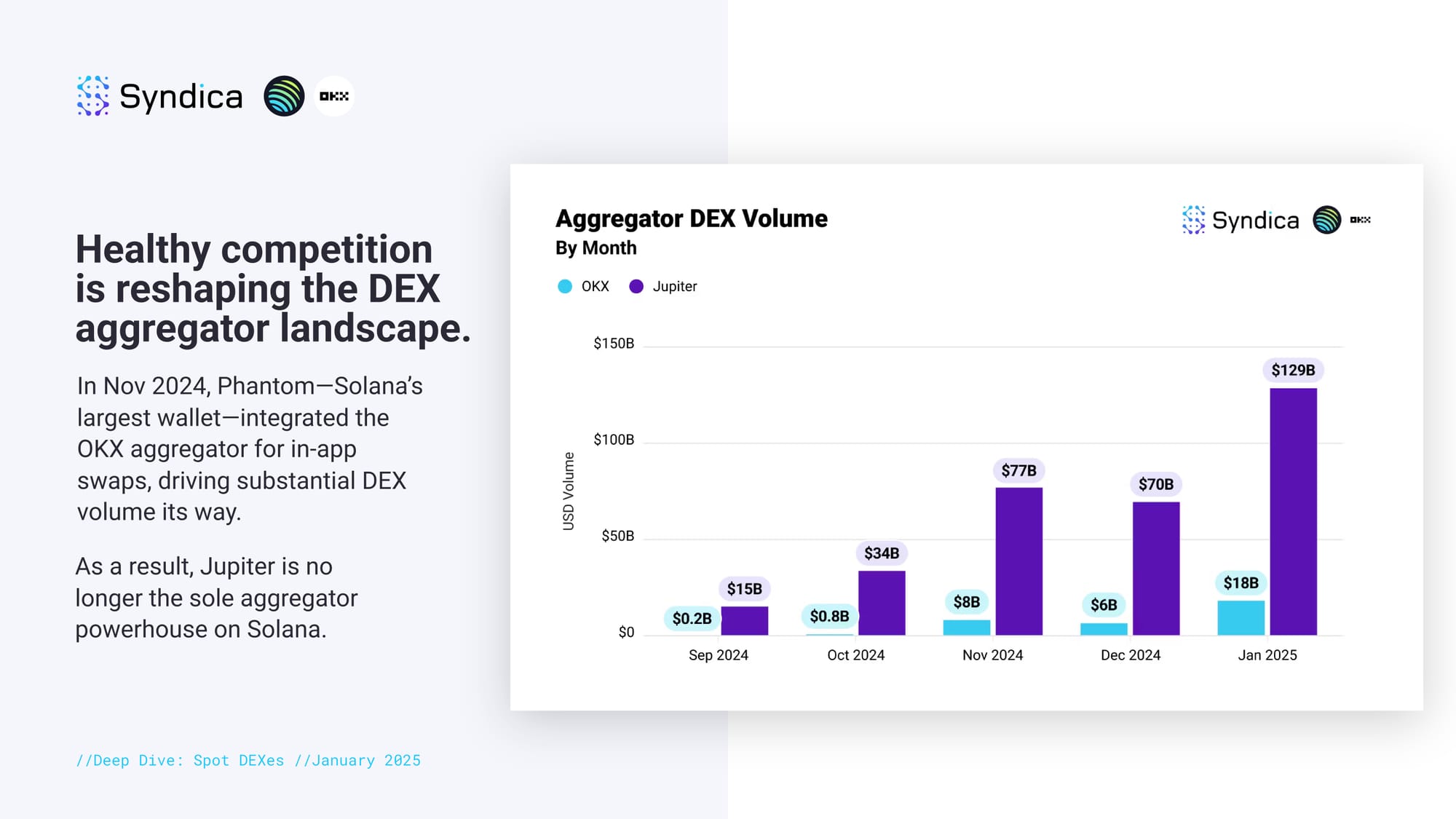

Healthy competition is reshaping the DEX aggregator landscape. In Nov 2024, Phantom—Solana’s largest wallet—integrated the OKX aggregator for in-app swaps, driving substantial DEX volume its way. As a result, Jupiter is no longer the sole aggregator powerhouse on Solana.

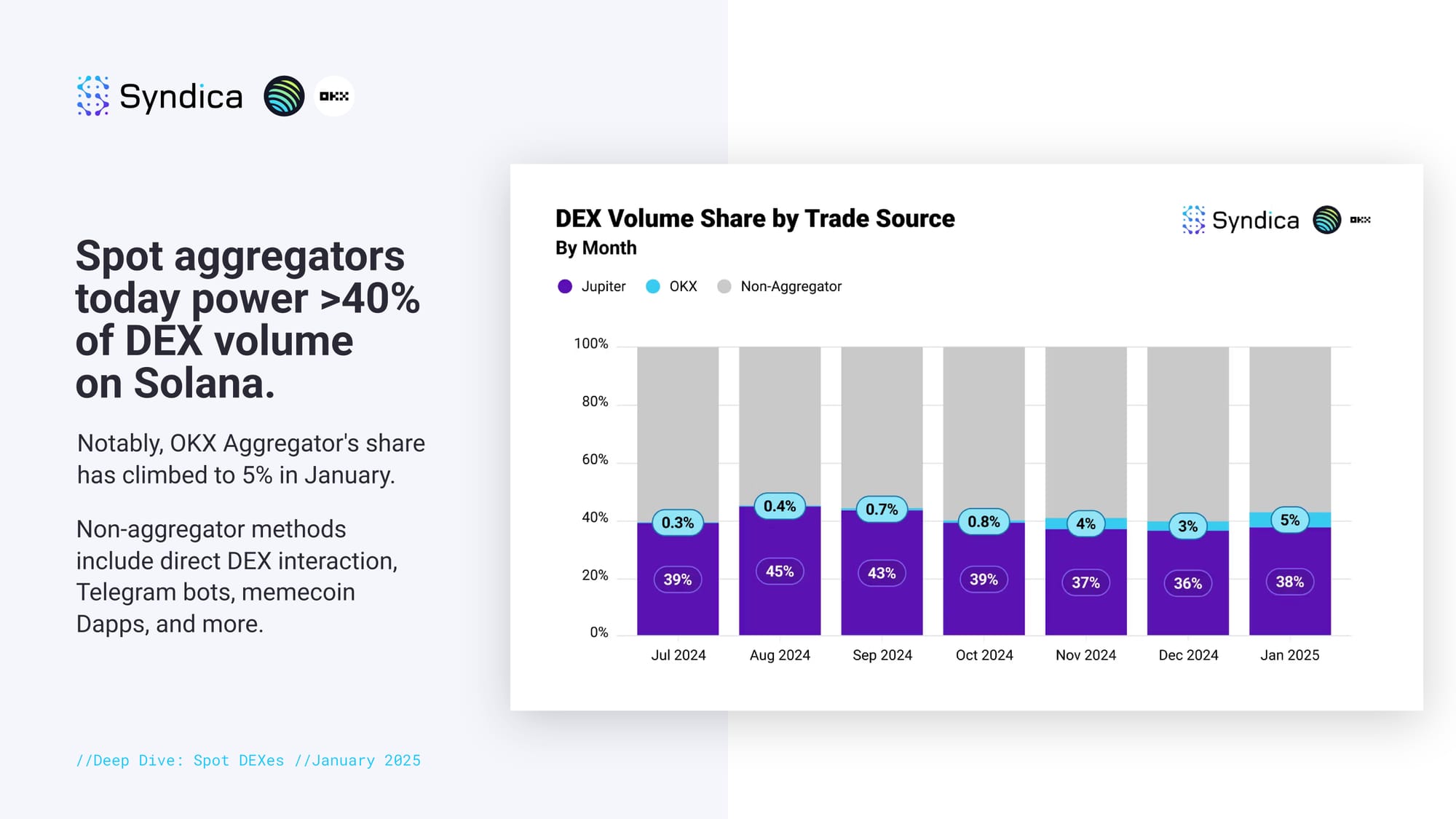

Spot aggregators today power >40% of DEX volume on Solana. Notably, OKX Aggregator's share has climbed to 5% in January. Non-aggregator methods include direct DEX interaction, Telegram bots, memecoin Dapps, and more.

Raydium continued to raise the bar for DEX volumes. Raydium is the first DEX ever to surpass $100B in monthly trading volume—and it has done so for three consecutive months. For the first time, Meteora secured the second-highest DEX volume on Solana.

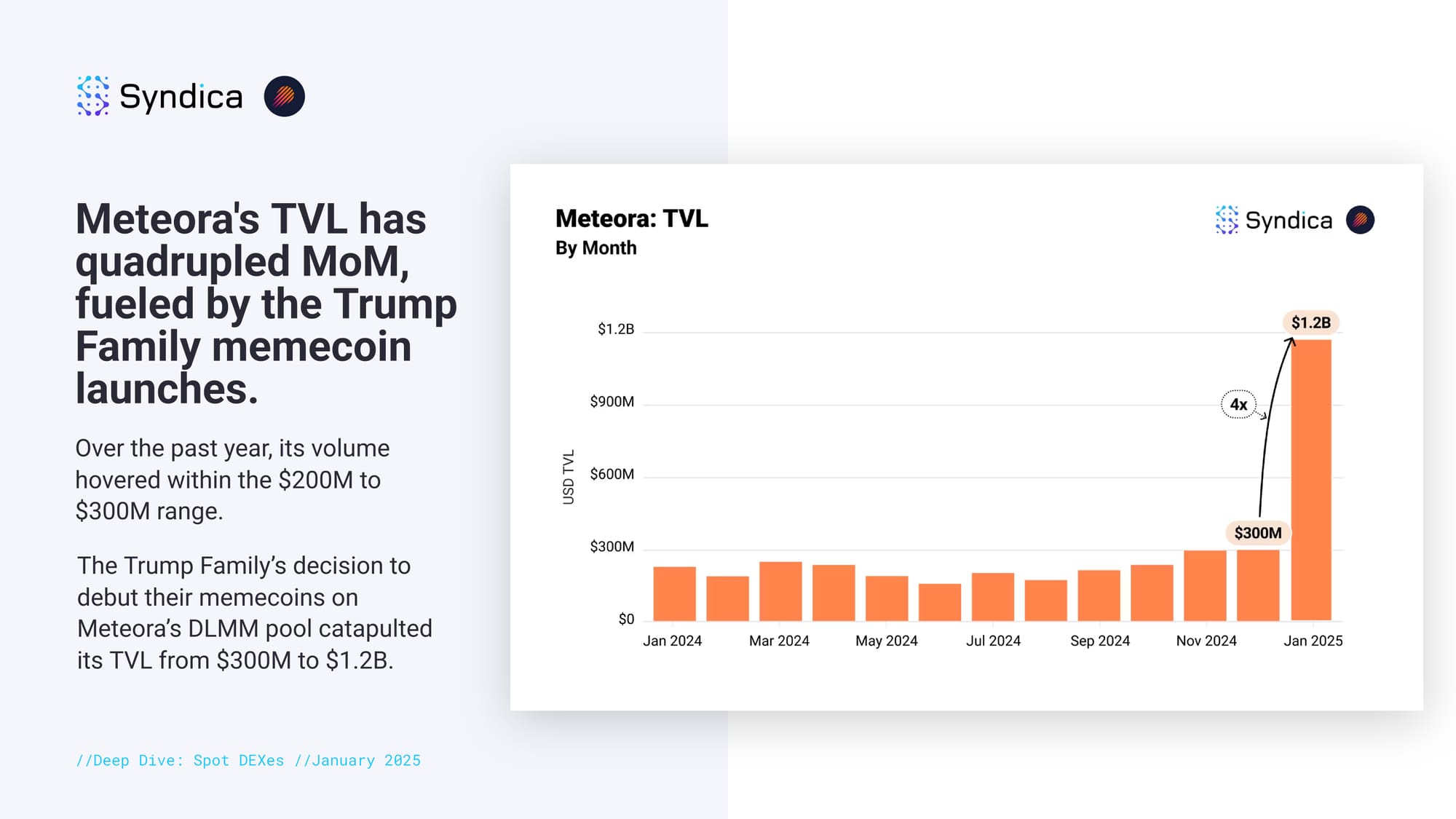

Meteora's TVL has quadrupled MoM, fueled by the Trump Family memecoin launches. Over the past year, its volume hovered within the $200M to $300M range. The Trump Family’s decision to debut their memecoins on Meteora’s DLMM pool catapulted its TVL from $300M to $1.2B.

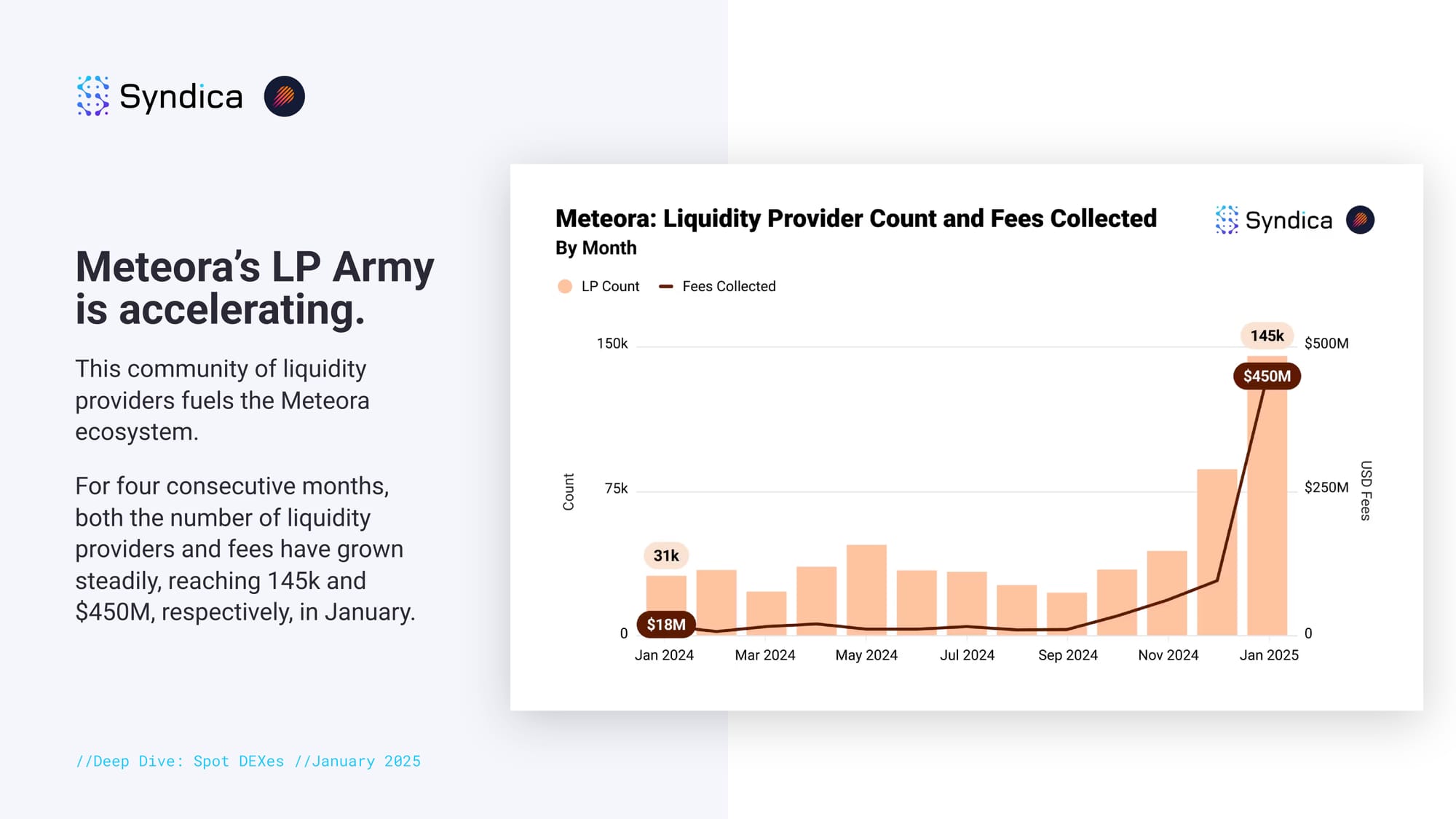

Meteora’s LP Army is accelerating. This community of liquidity providers fuels the Meteora ecosystem. For four consecutive months, both the number of liquidity providers and fees have grown steadily, reaching 145k and $450M, respectively, in January.

Part II: Lending and Stablecoins

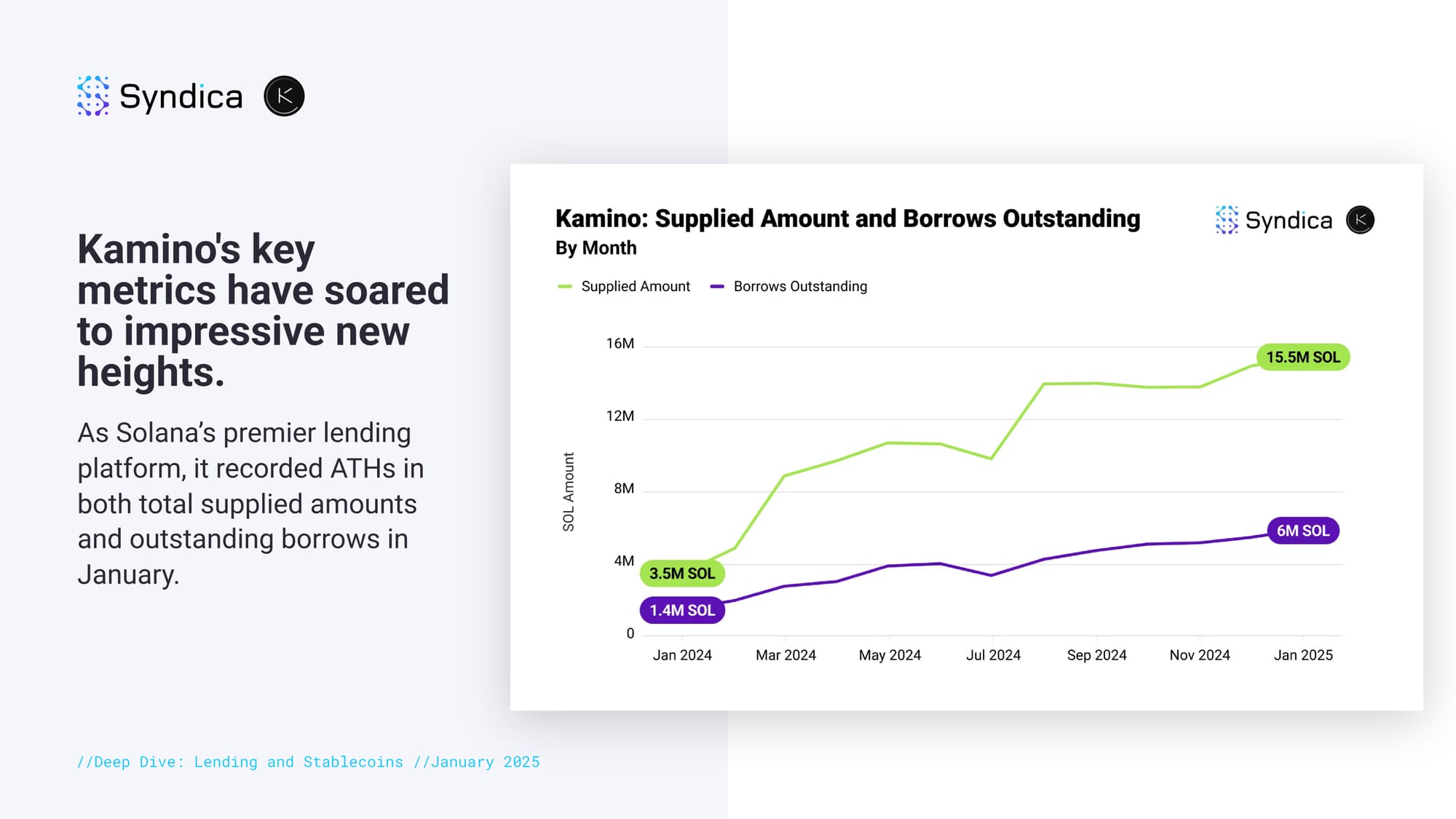

Kamino's key metrics have soared to impressive new heights. As Solana’s premier lending platform, it recorded ATHs in both total supplied amounts and outstanding borrows in January.

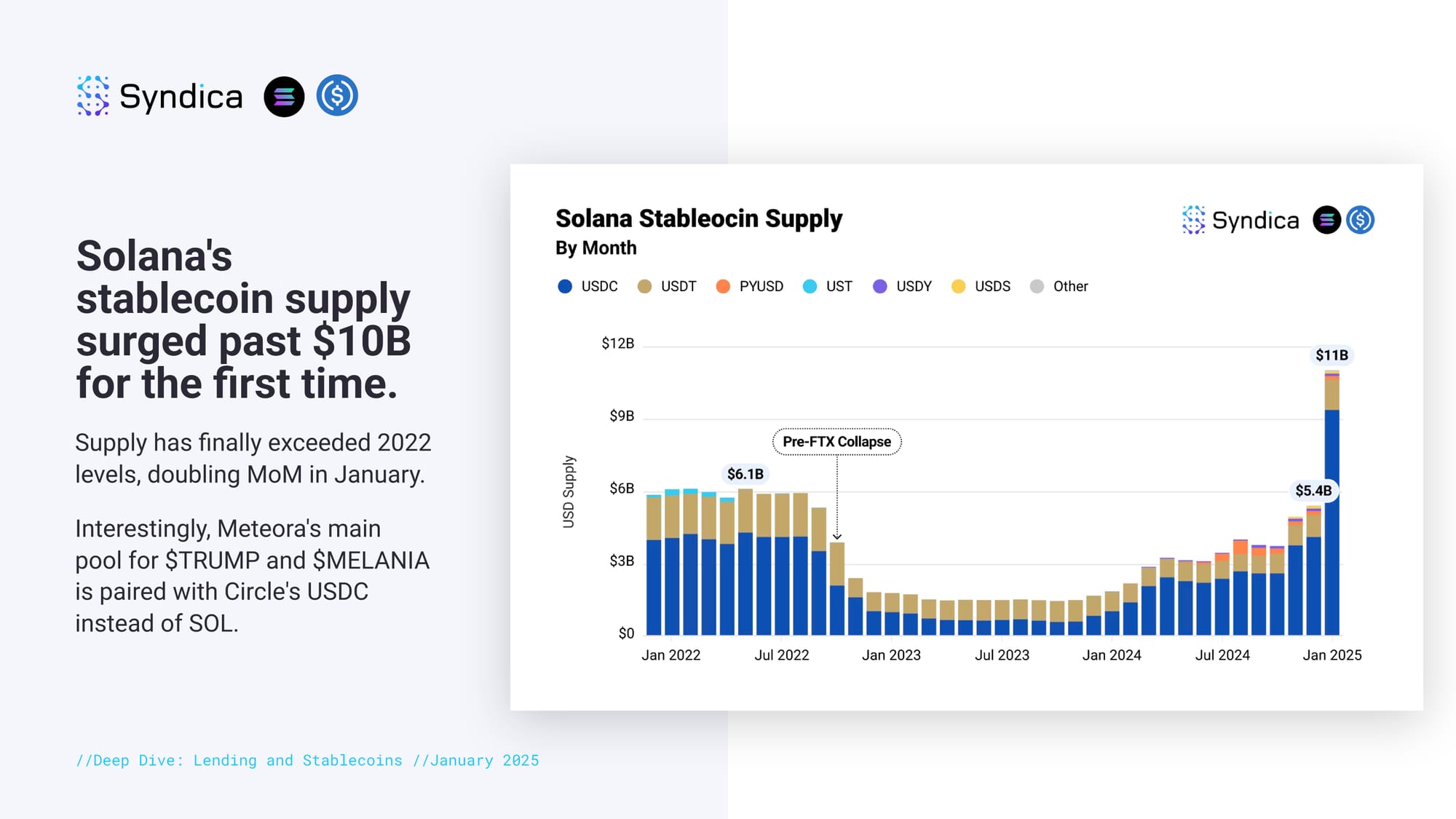

Solana's stablecoin supply surged past $10B for the first time. Supply has finally exceeded 2022 levels, doubling MoM in January. Interestingly, Meteora's main pool for $TRUMP and $MELANIA is paired with Circle's USDC instead of SOL.

Part III: Liquid Staking

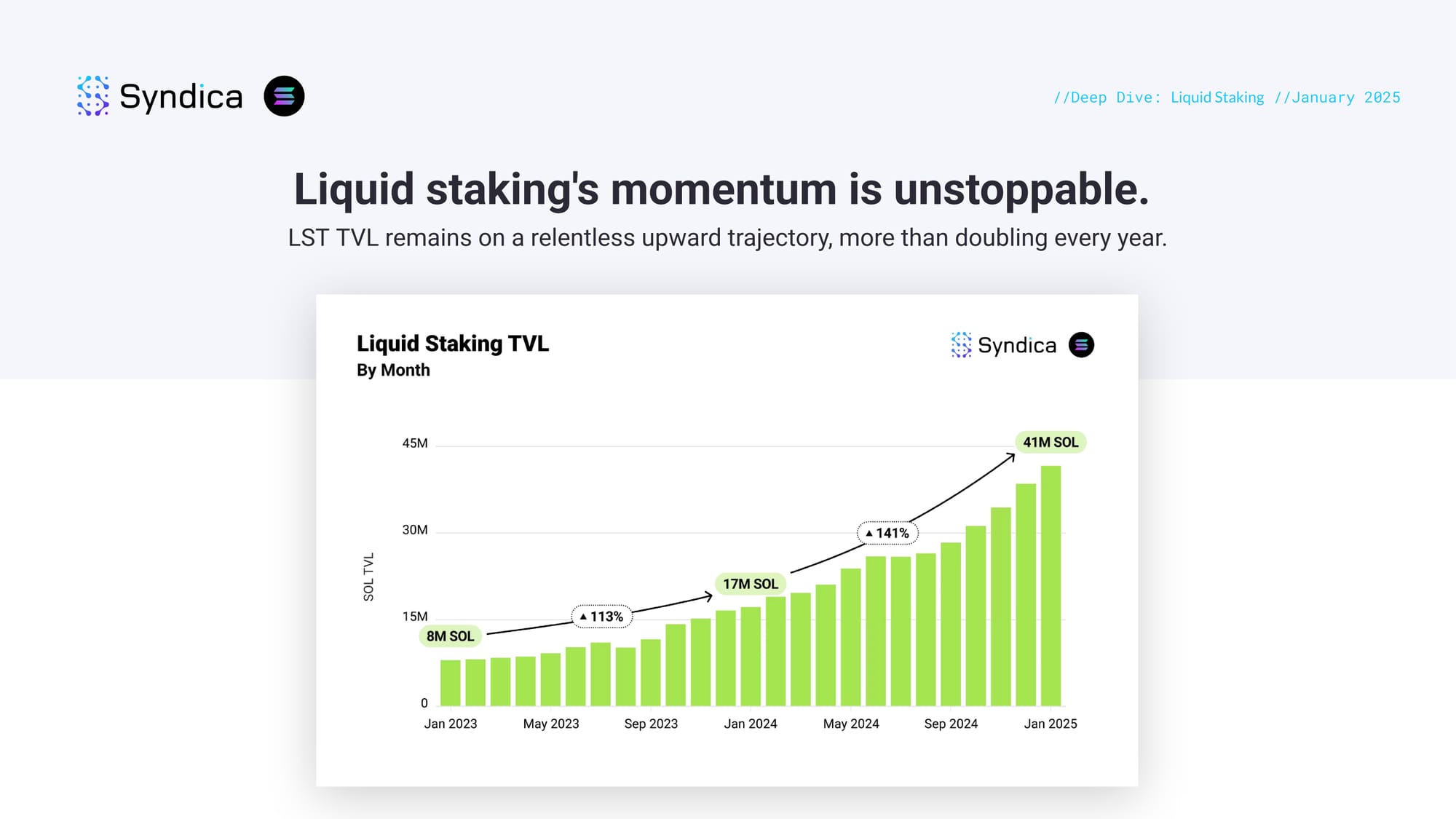

Liquid staking's momentum is unstoppable. LST TVL remains on a relentless upward trajectory, more than doubling every year.

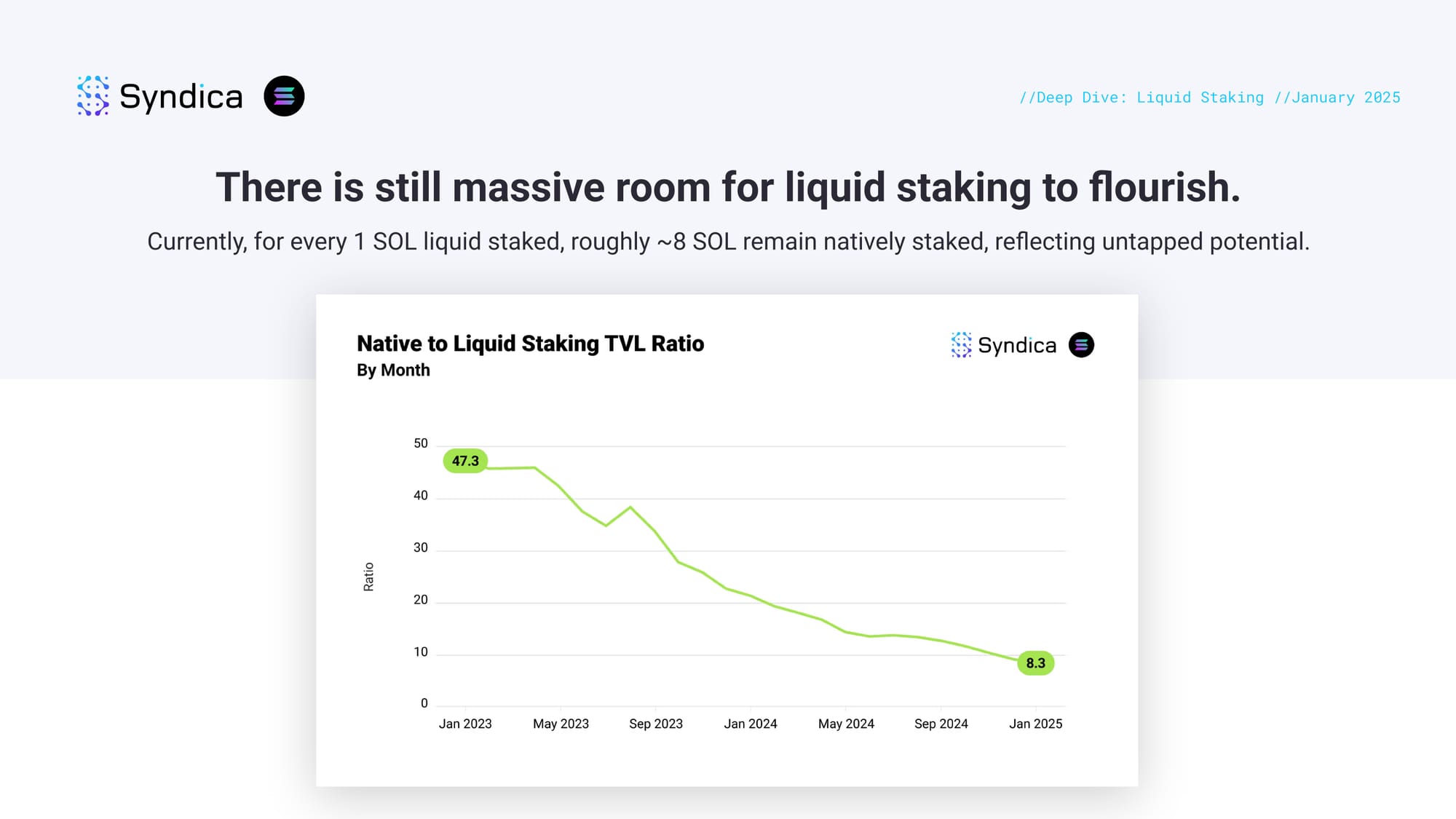

There is still massive room for liquid staking to flourish. Currently, for every 1 SOL liquid staked, roughly ~8 SOL remain natively staked, reflecting untapped potential.

Part IV: Cross-chain Bridges

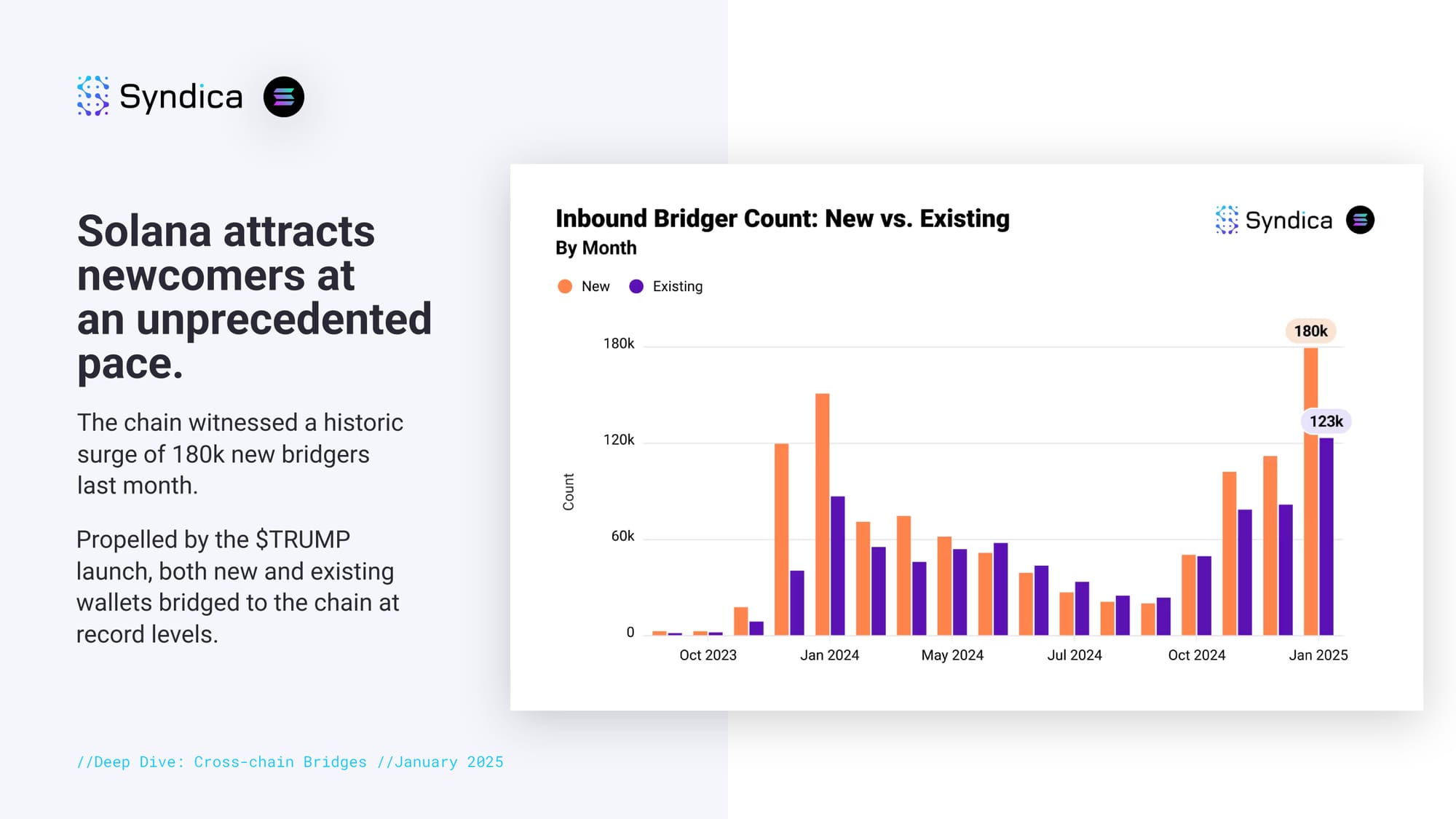

Solana attracts newcomers at an unprecedented pace. The chain witnessed a historic surge of 180k new bridgers last month. Propelled by the $TRUMP launch, both new and existing wallets bridged to the chain at record levels.

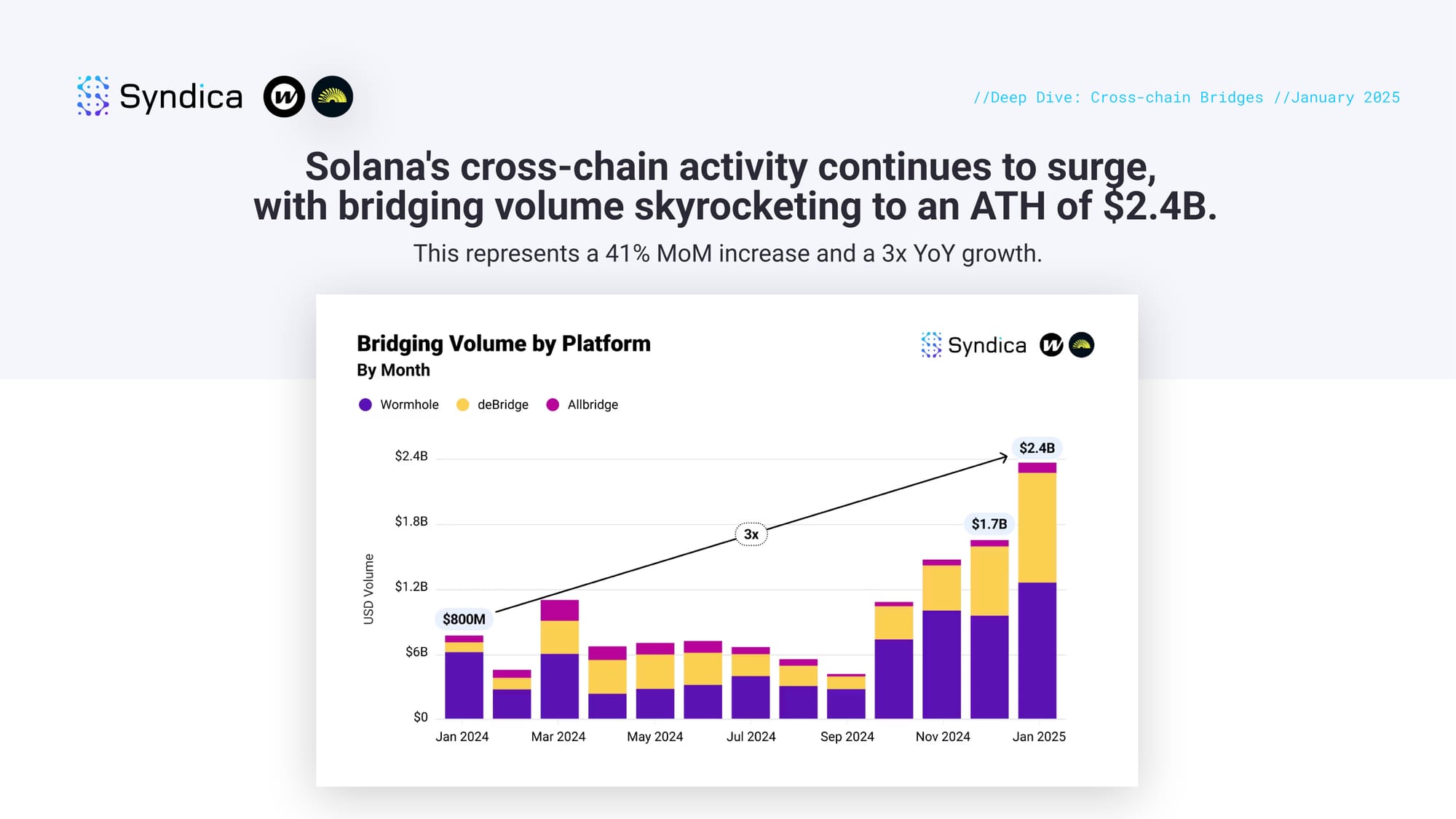

Solana's cross-chain activity continues to surge, with bridging volume skyrocketing to an ATH of $2.4B. This represents a 41% MoM increase and a 3x YoY growth.

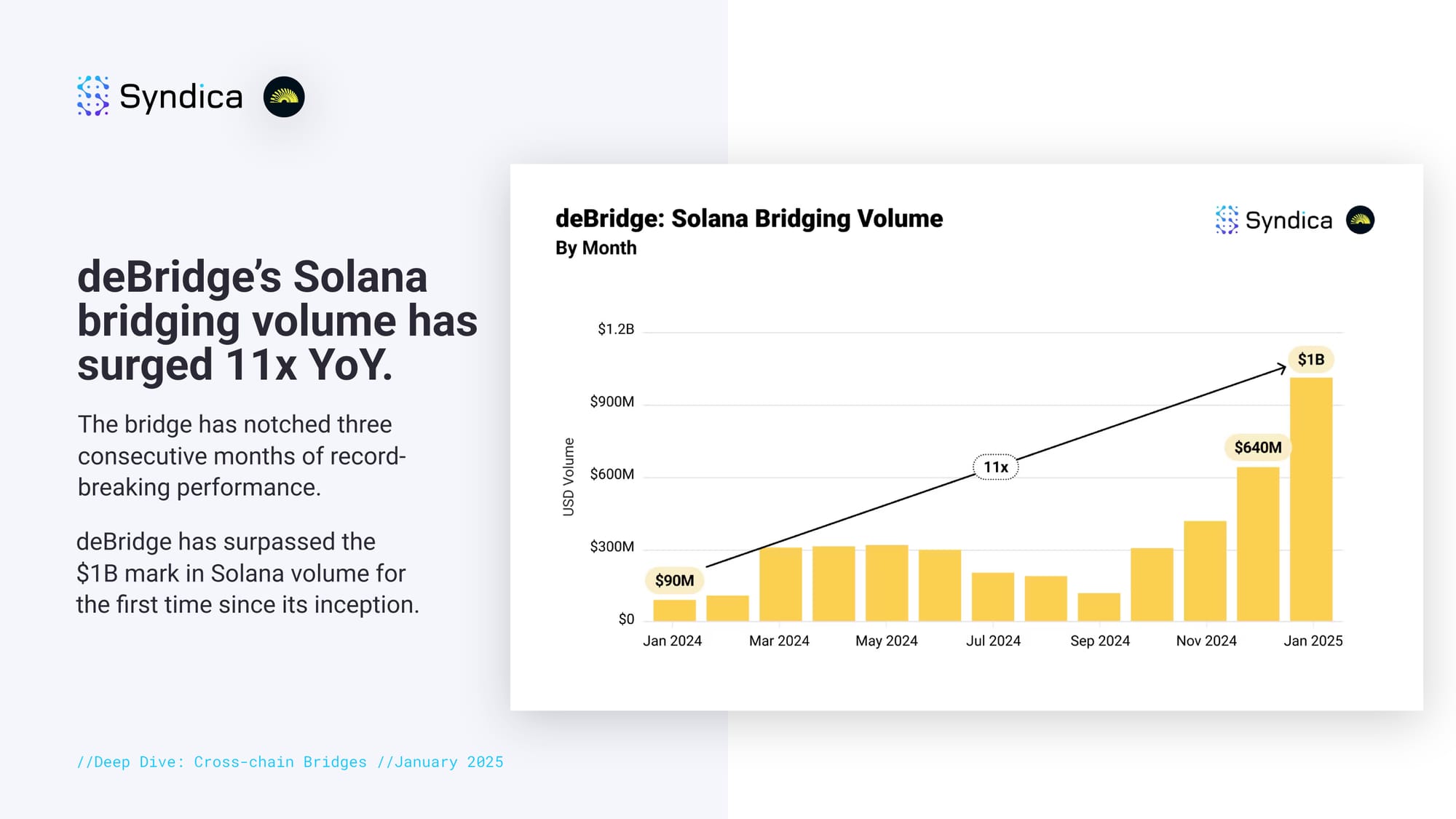

deBridge’s bridging volume has surged 11x YoY. The bridge has notched three consecutive months of record-breaking performance. For the first time since its inception, deBridge has surpassed the $1B mark.

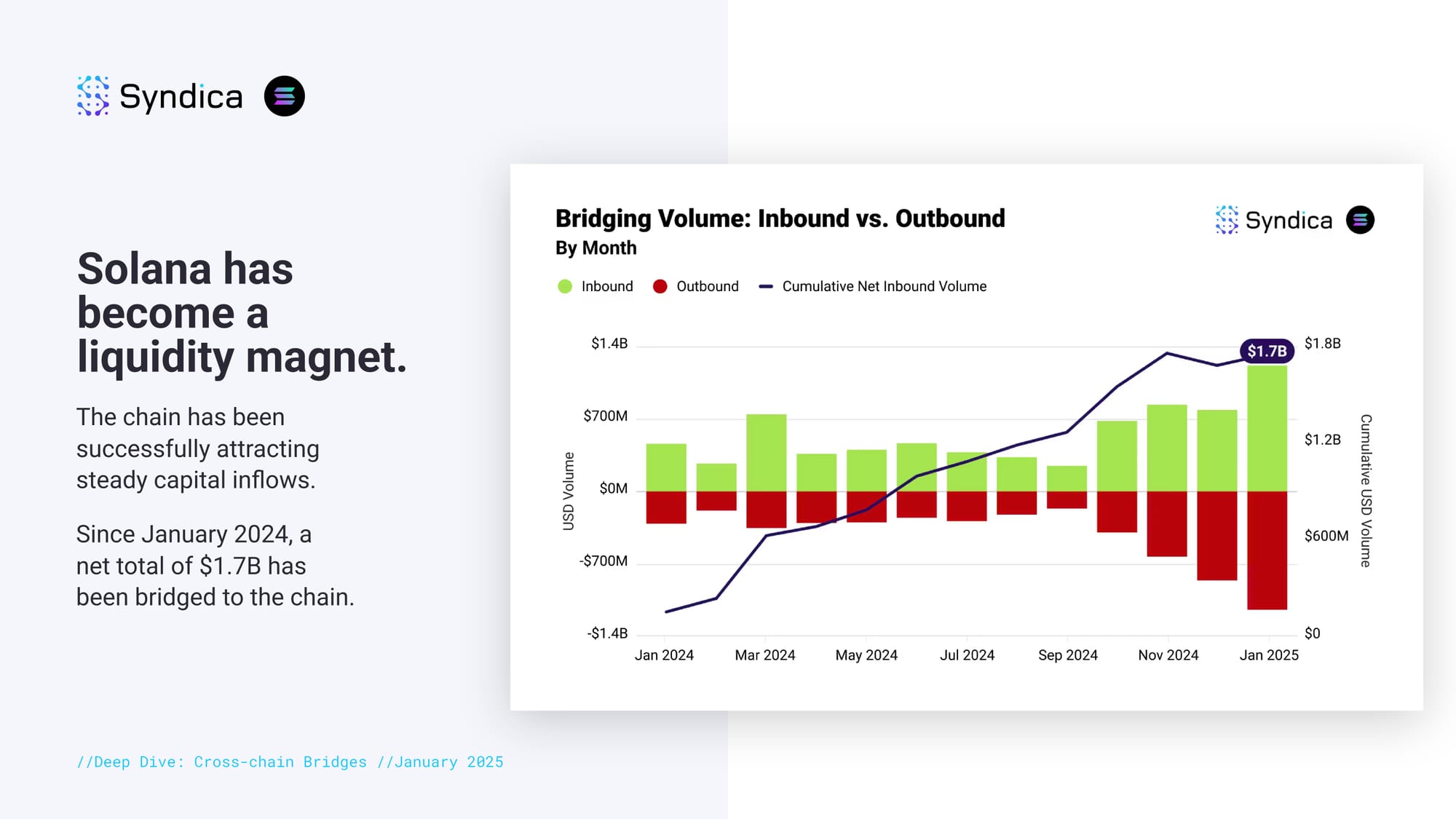

Solana has become a liquidity magnet. The chain has been successfully attracting steady capital inflows. Since January 2024, a net total of $1.7B has been bridged to the chain.