Deep Dive: Solana DeFi - July 2024

Deep Dive: Solana DeFi - July 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - July 2024

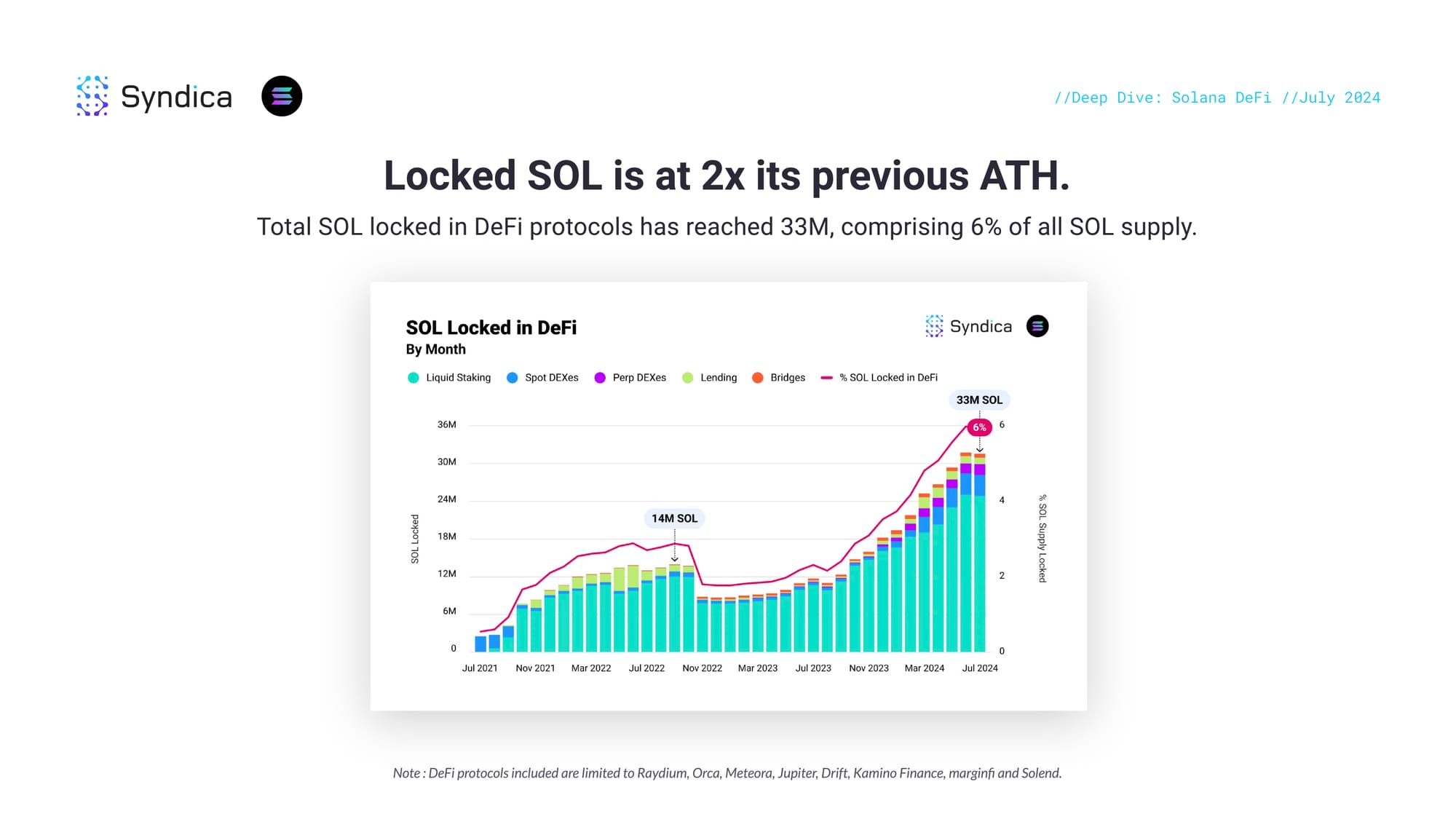

Locked SOL is at 2x its previous ATH. Total SOL locked in DeFi protocols has reached 33M, comprising 6% of all SOL supply.

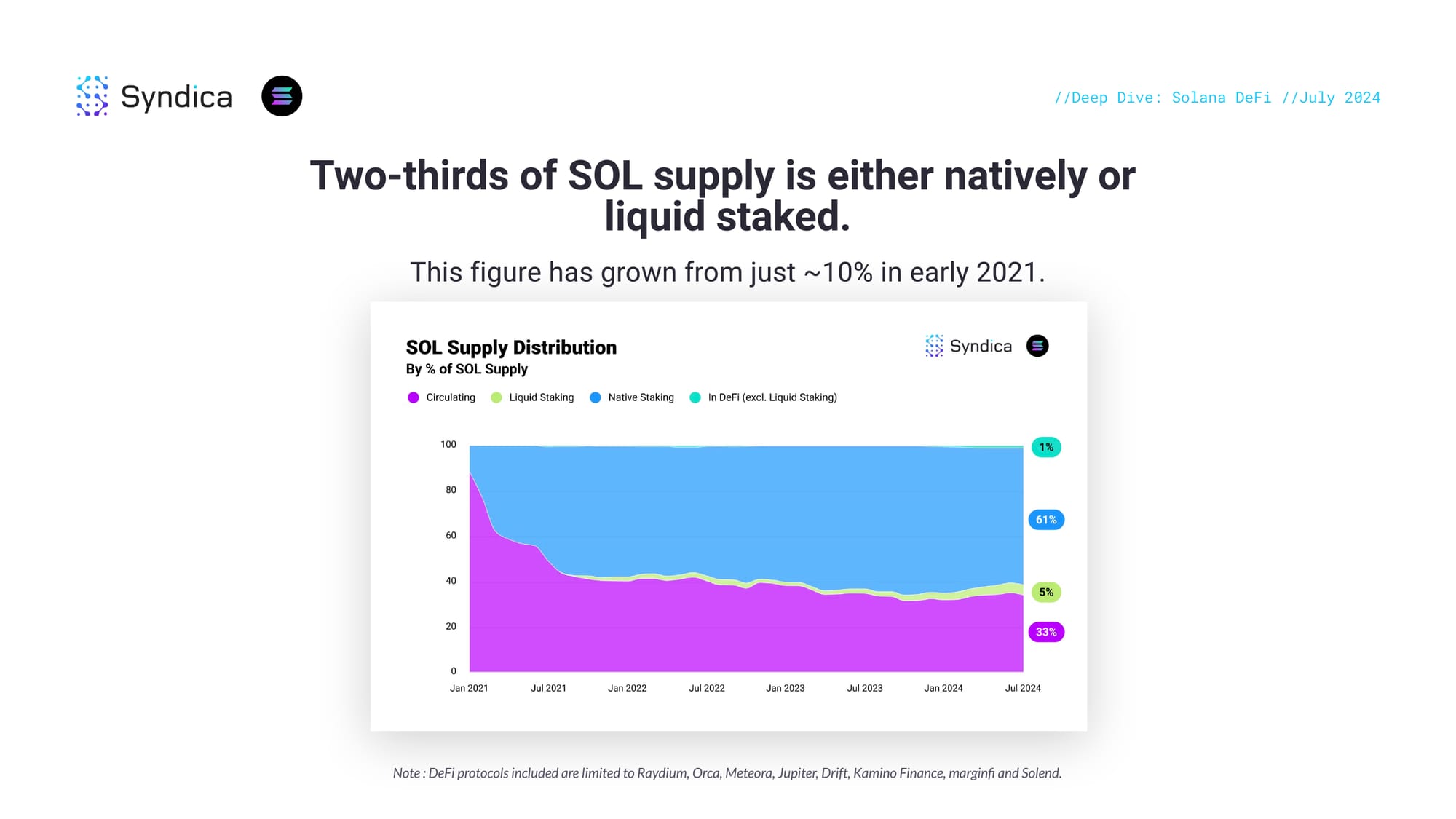

Two-thirds of SOL supply is either natively or liquid staked. This figure has grown from just ~10% in early 2021.

Part I: Spot and Perp DEXes

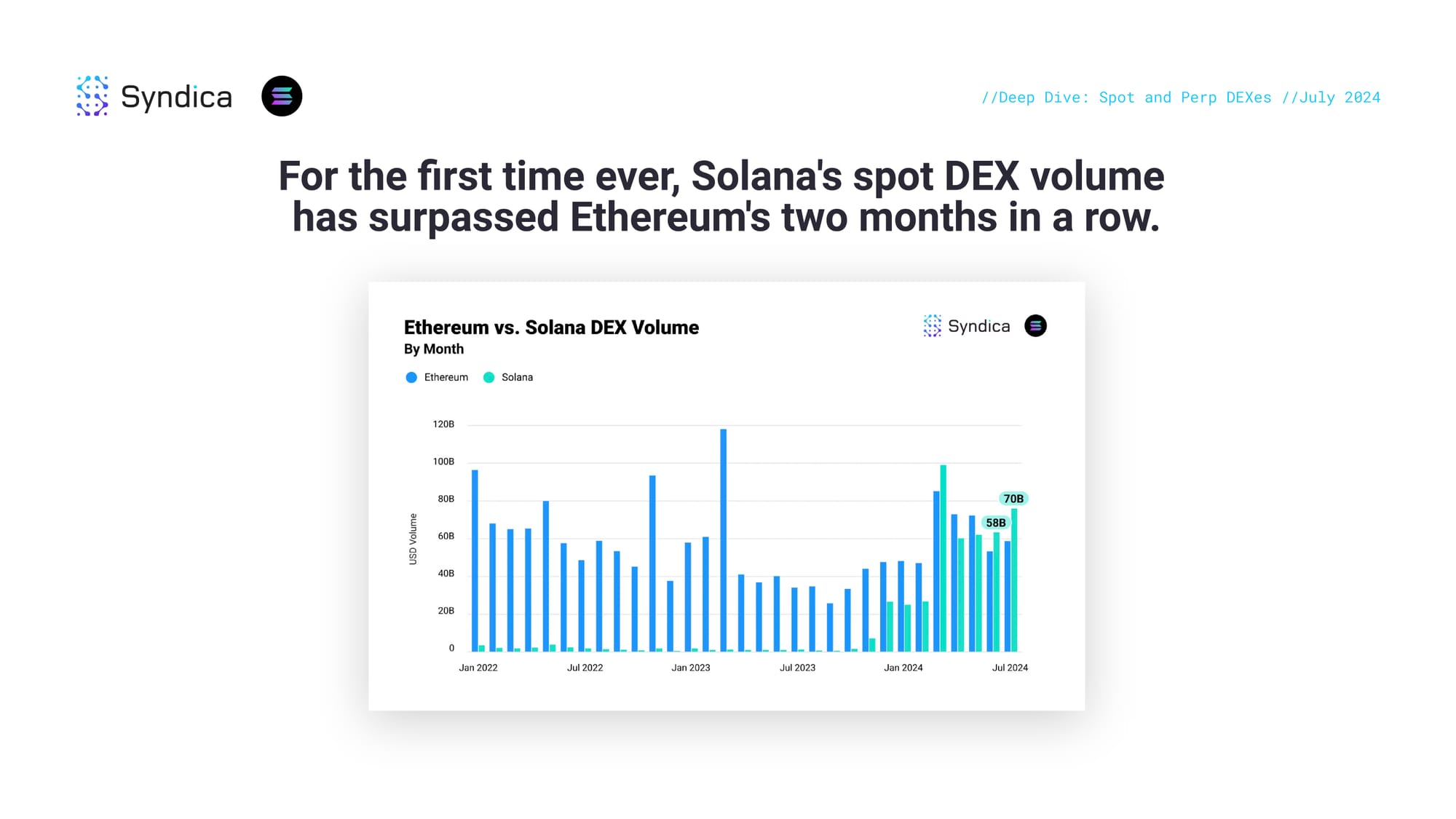

For the first time ever, Solana's spot DEX volume has surpassed Ethereum's two months in a row.

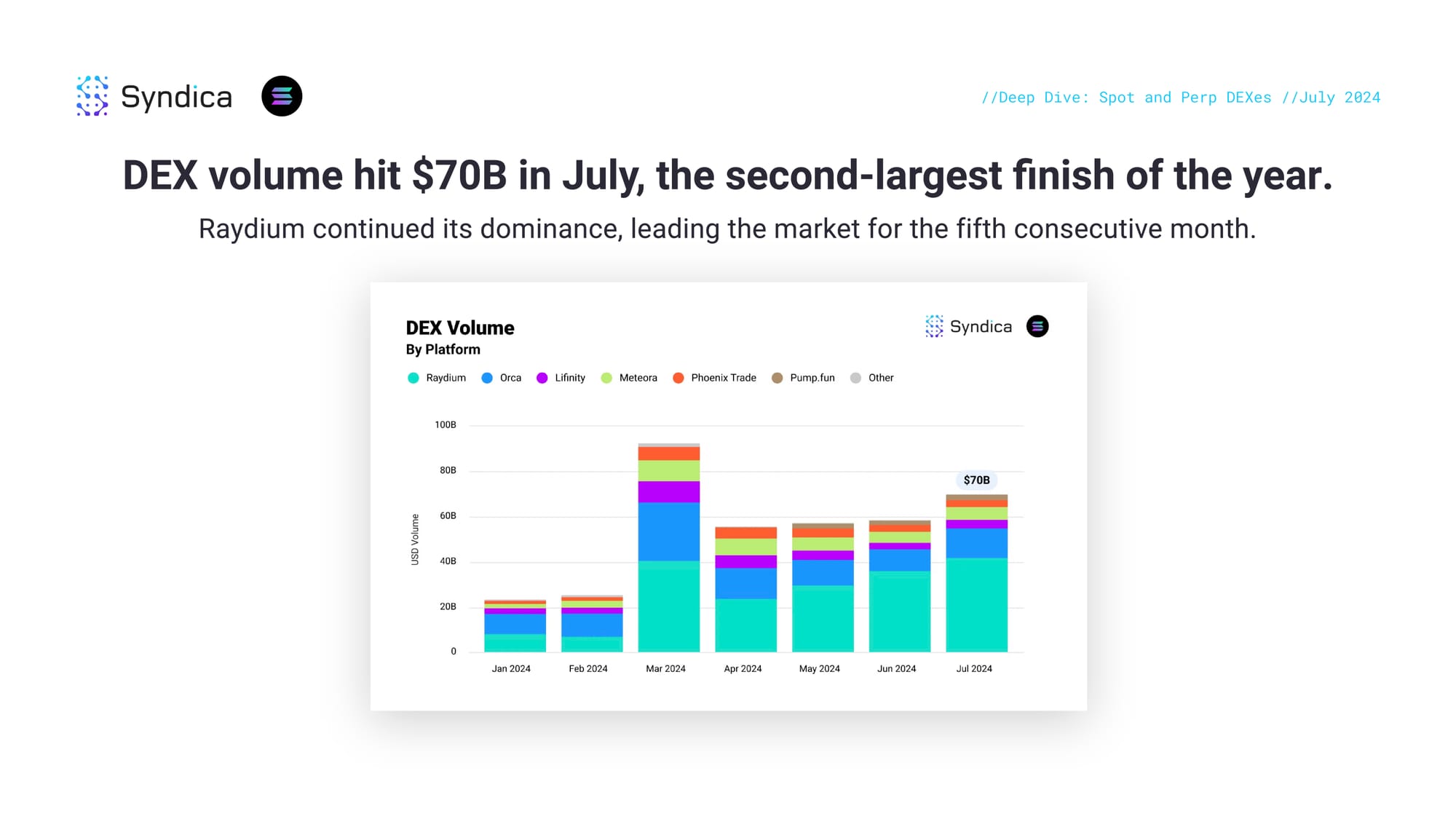

DEX volume hit $70B in July, the second-largest finish of the year. Raydium continued its dominance, leading the market for the fifth consecutive month.

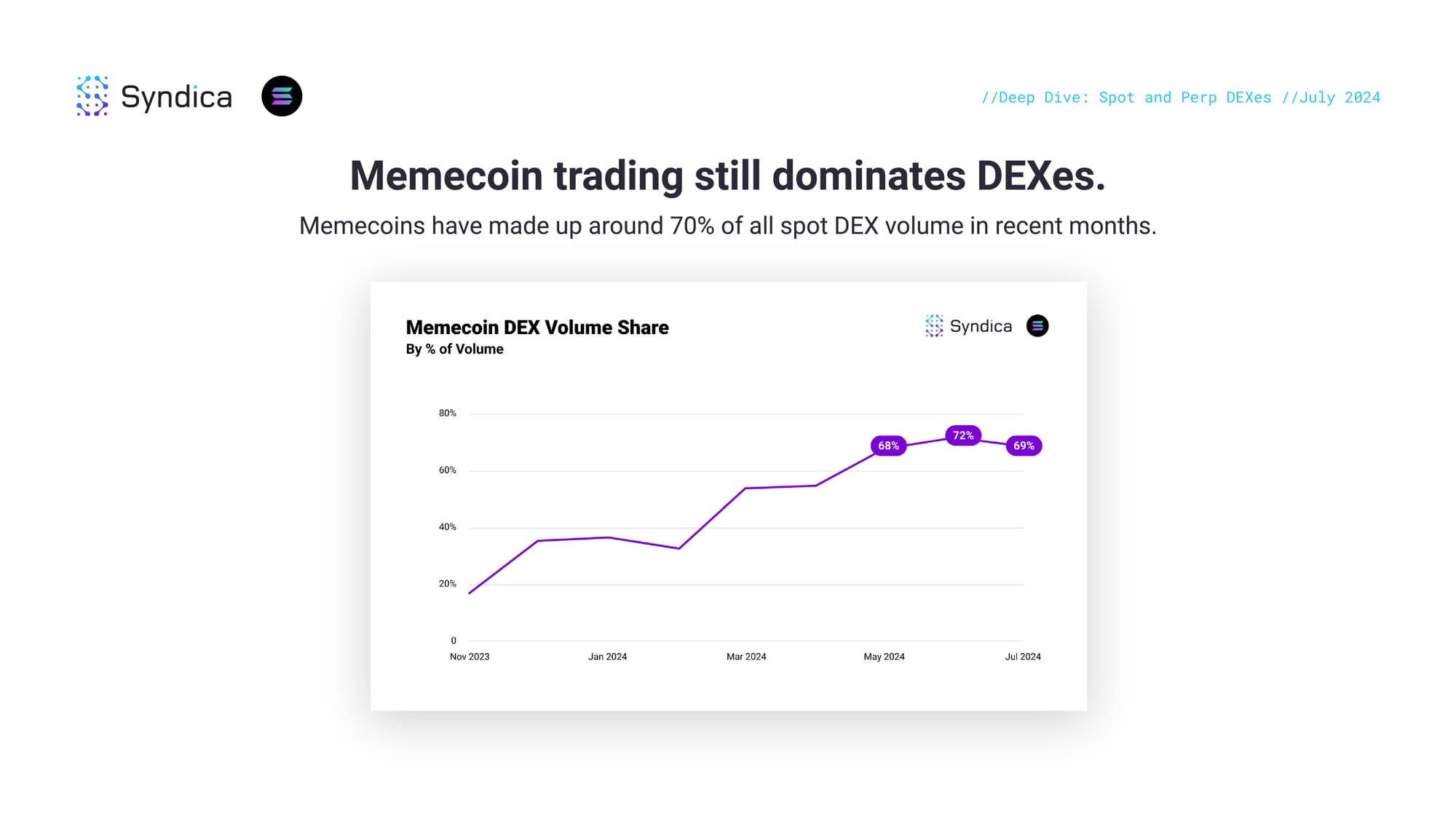

Memecoin trading still dominates DEXes. Memecoins have made up around 70% of all spot DEX volume in recent months.

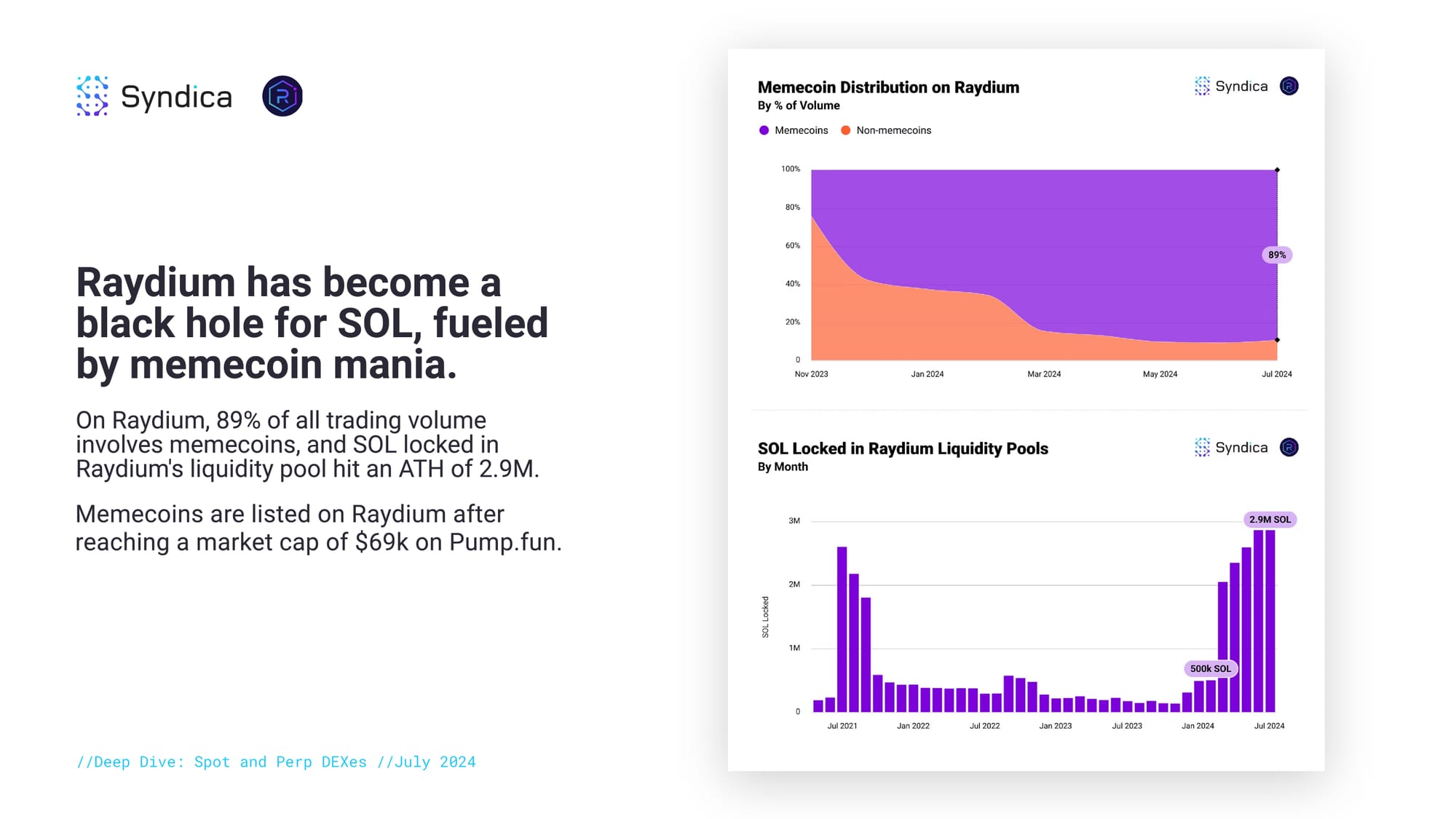

Raydium has become a black hole for SOL, fueled by memecoin mania. On Raydium, 89% of all trading volume involves memecoins, and SOL locked in Raydium's liquidity pool hit an ATH of 2.9M. Memecoins are listed on Raydium after reaching a market cap of $69k on Pump.fun.

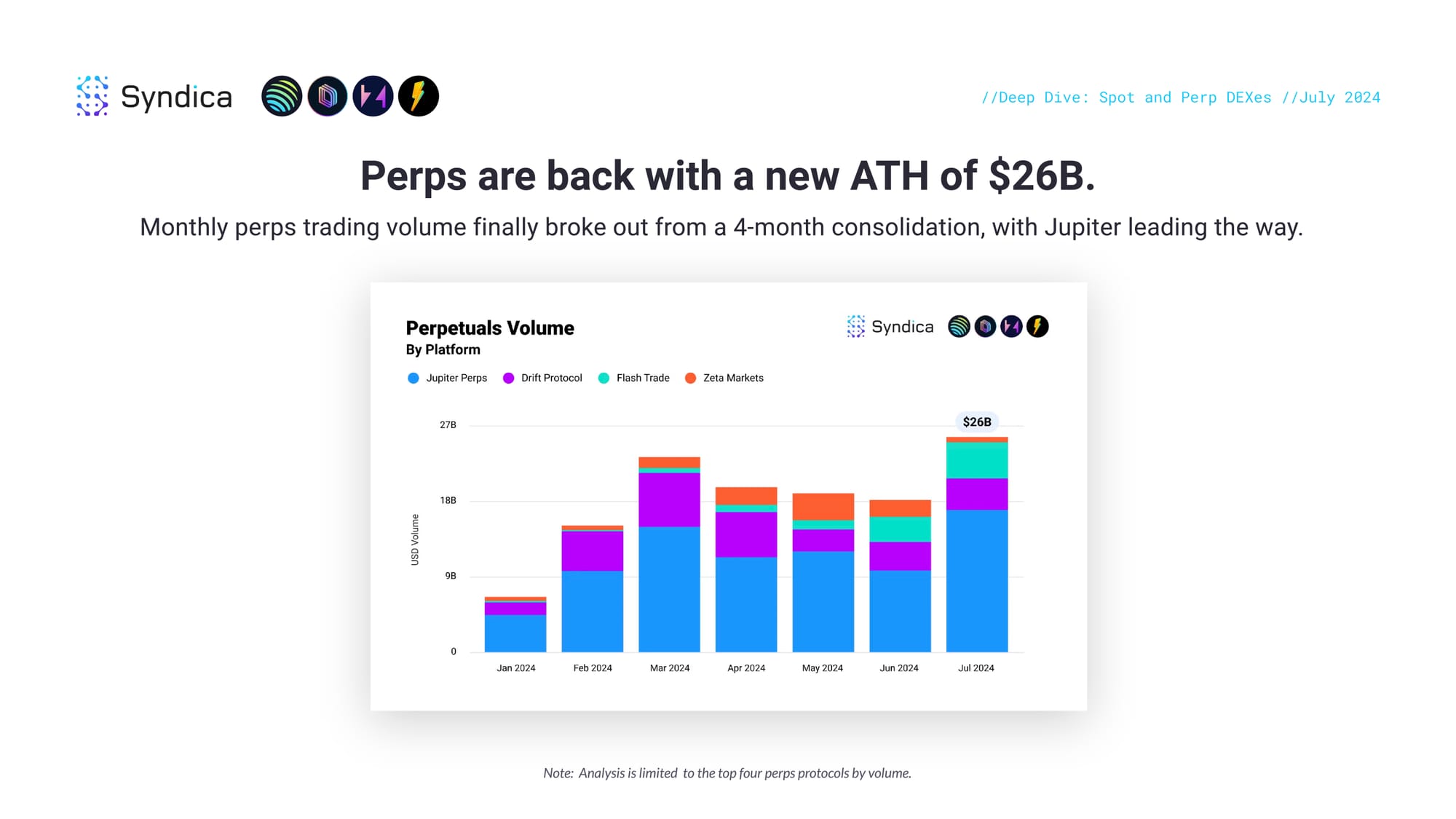

Perps are back with a new ATH of $26B. Monthly perps trading volume finally broke out from a 4-month consolidation, with Jupiter leading the way.

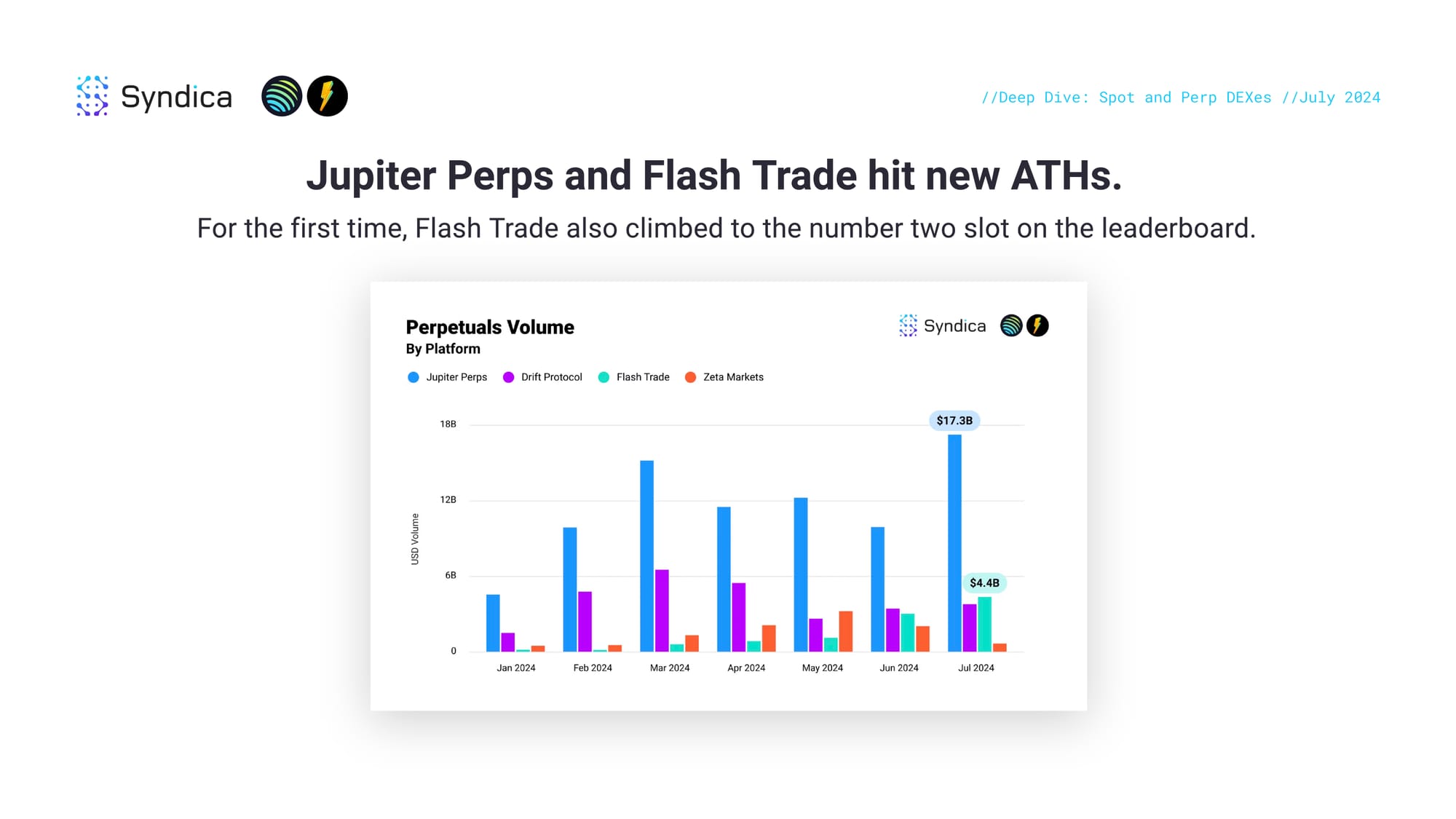

Jupiter Perps and Flash Trade hit new ATHs. For the first time, Flash Trade also climbed to the number two slot on the leaderboard.

Part II: Lending and Stablecoins

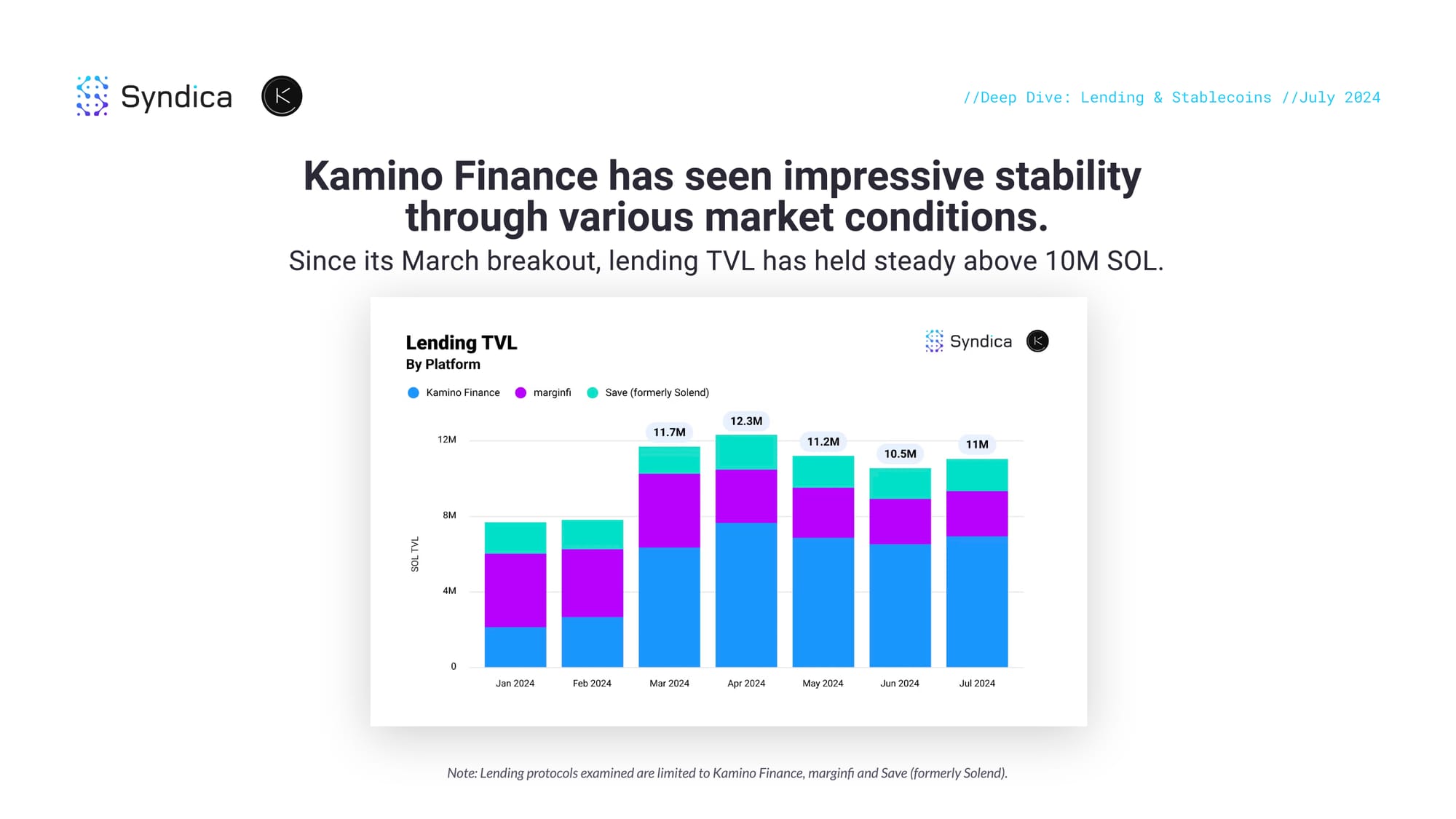

Kamino Finance has seen impressive stability through various market conditions. Since its March breakout, lending TVL has held steady above 10M SOL.

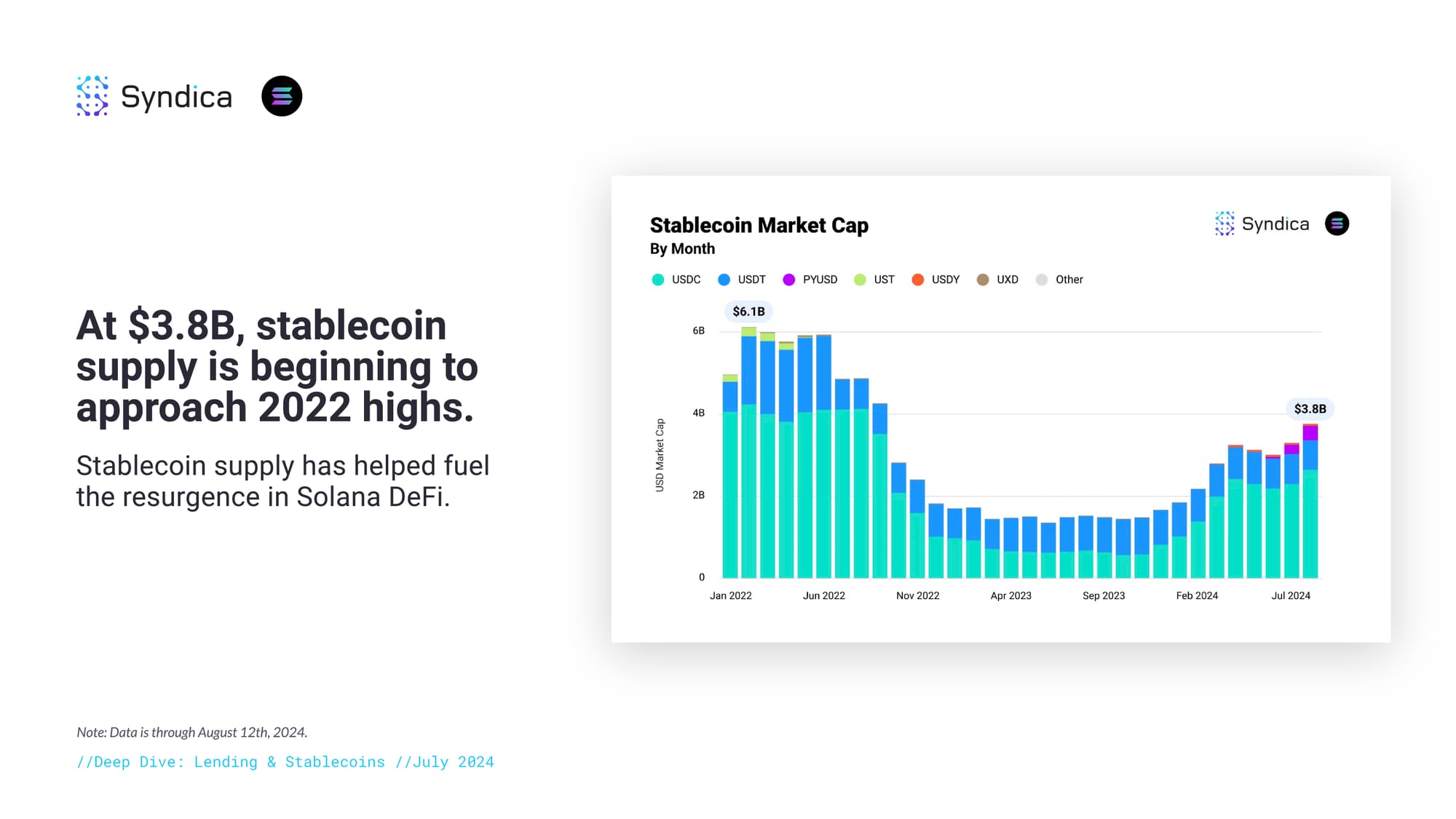

At $3.8B, stablecoin supply is beginning to approach 2022 highs. Stablecoin supply has helped fuel the resurgence in Solana DeFi.

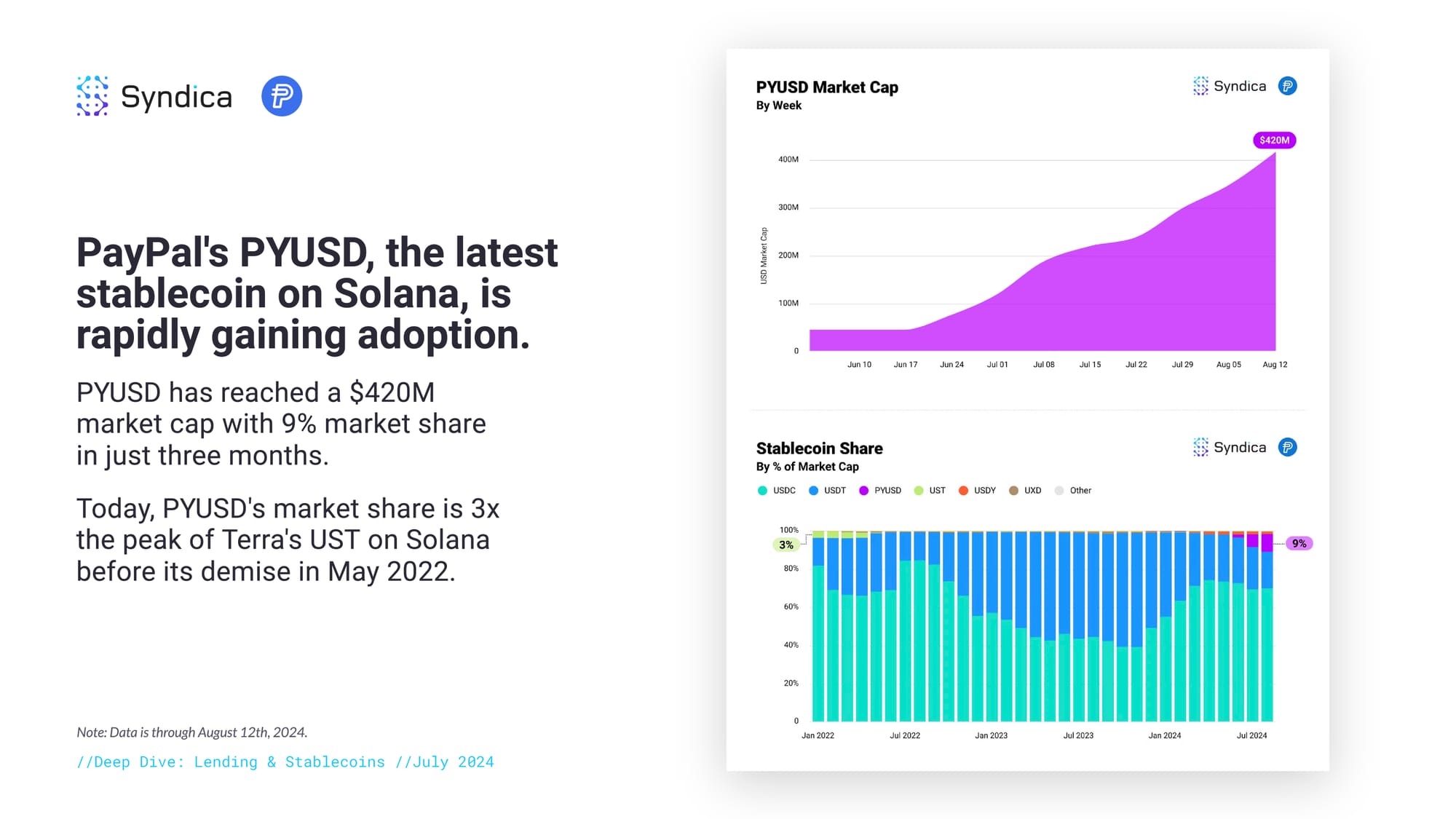

PayPal's PYUSD, the latest stablecoin on Solana, is rapidly gaining adoption. PYUSD has reached a $420M market cap with 9% market share in just three months. Today, PYUSD's market share is 3x the peak of Terra's UST on Solana before its demise in May 2022.

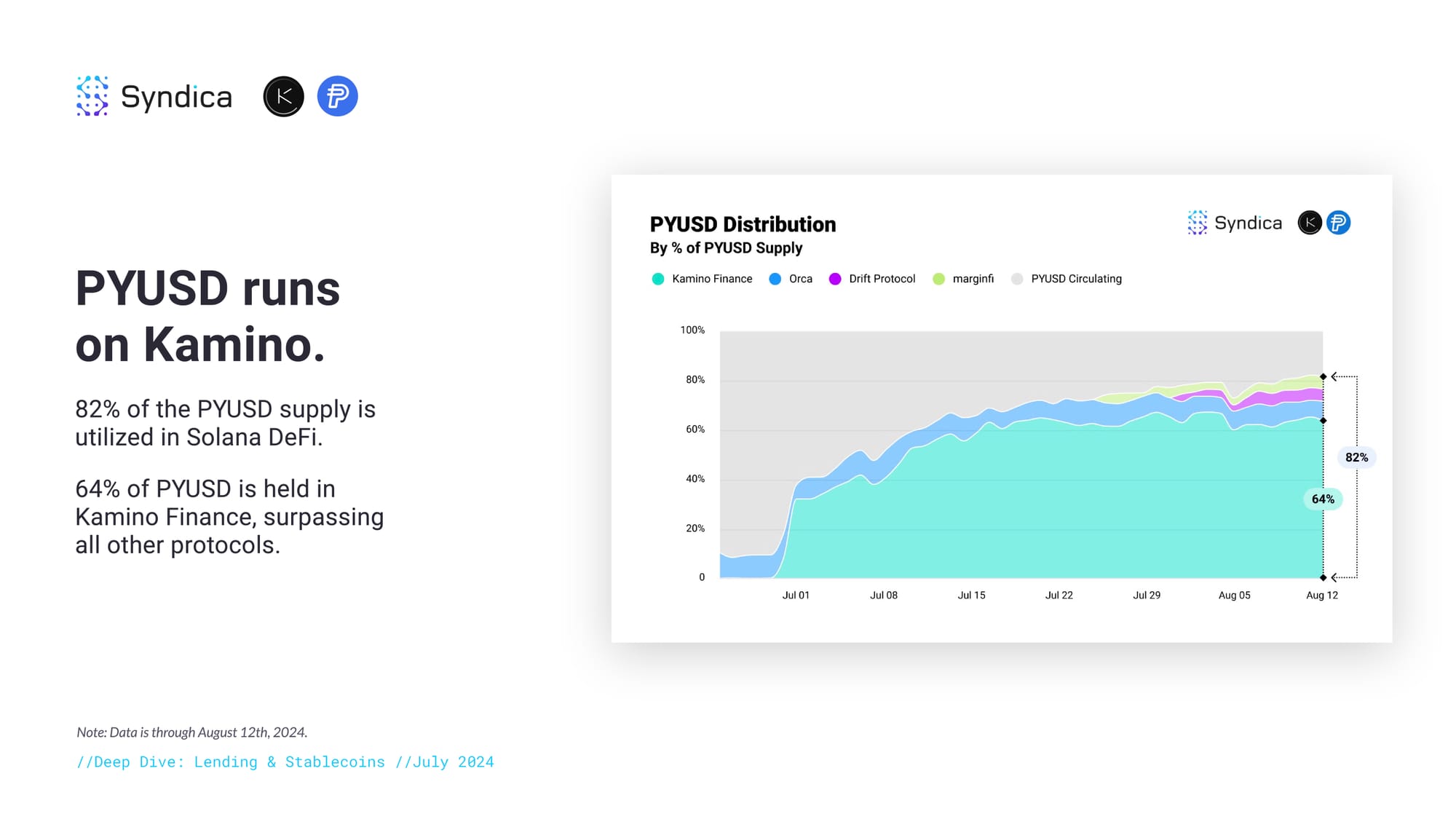

PYUSD runs on Kamino. 82% of the PYUSD supply is utilized in Solana DeFi. 64% of PYUSD is held in Kamino Finance, surpassing all other protocols.

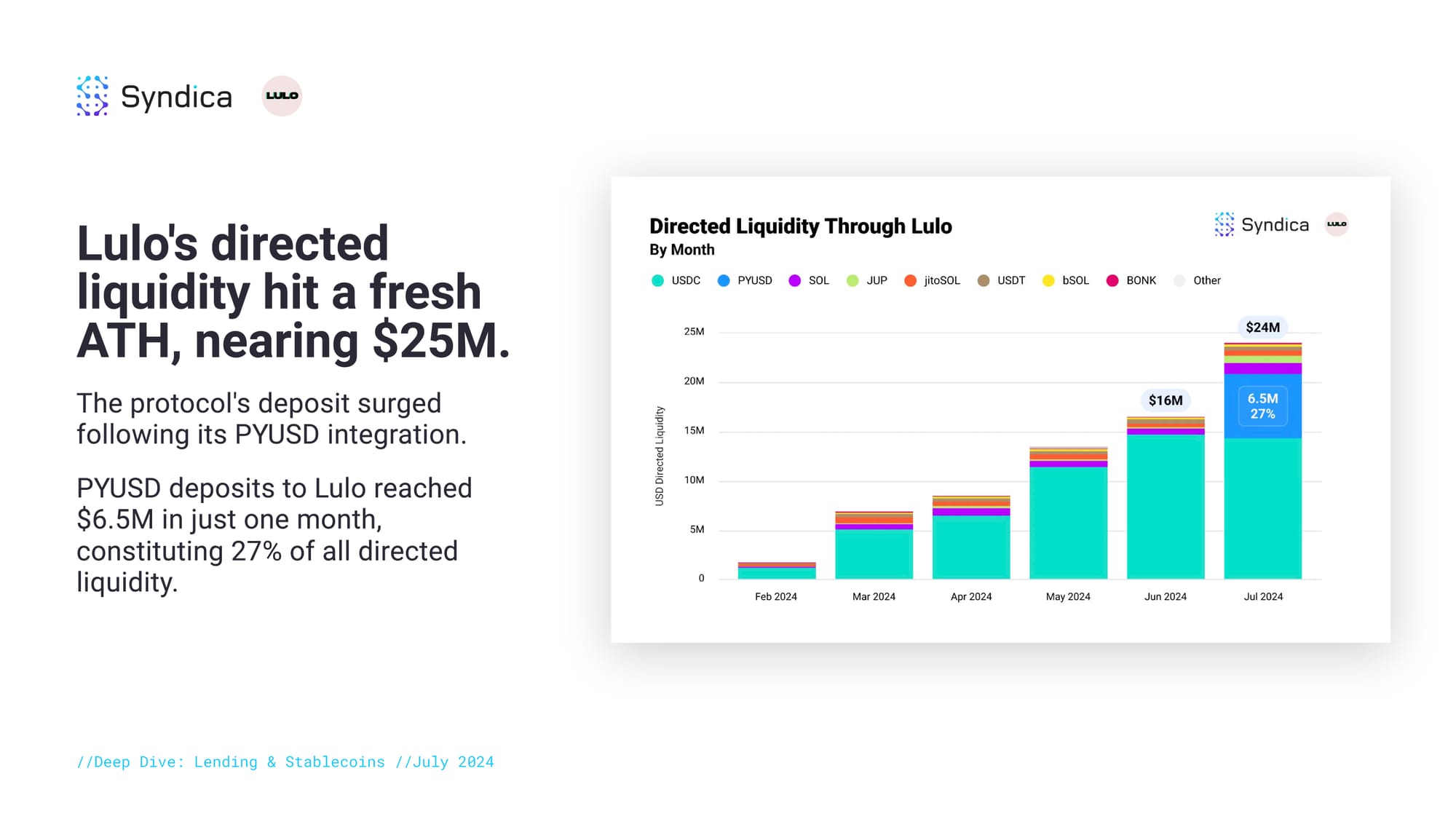

Lulo's directed liquidity hit a fresh ATH, nearing $25M. The protocol's deposit surged following its PYUSD integration. PYUSD deposits to Lulo reached $6.5M in just one month, constituting 27% of all directed liquidity.

Part III: Liquid Staking and Restaking

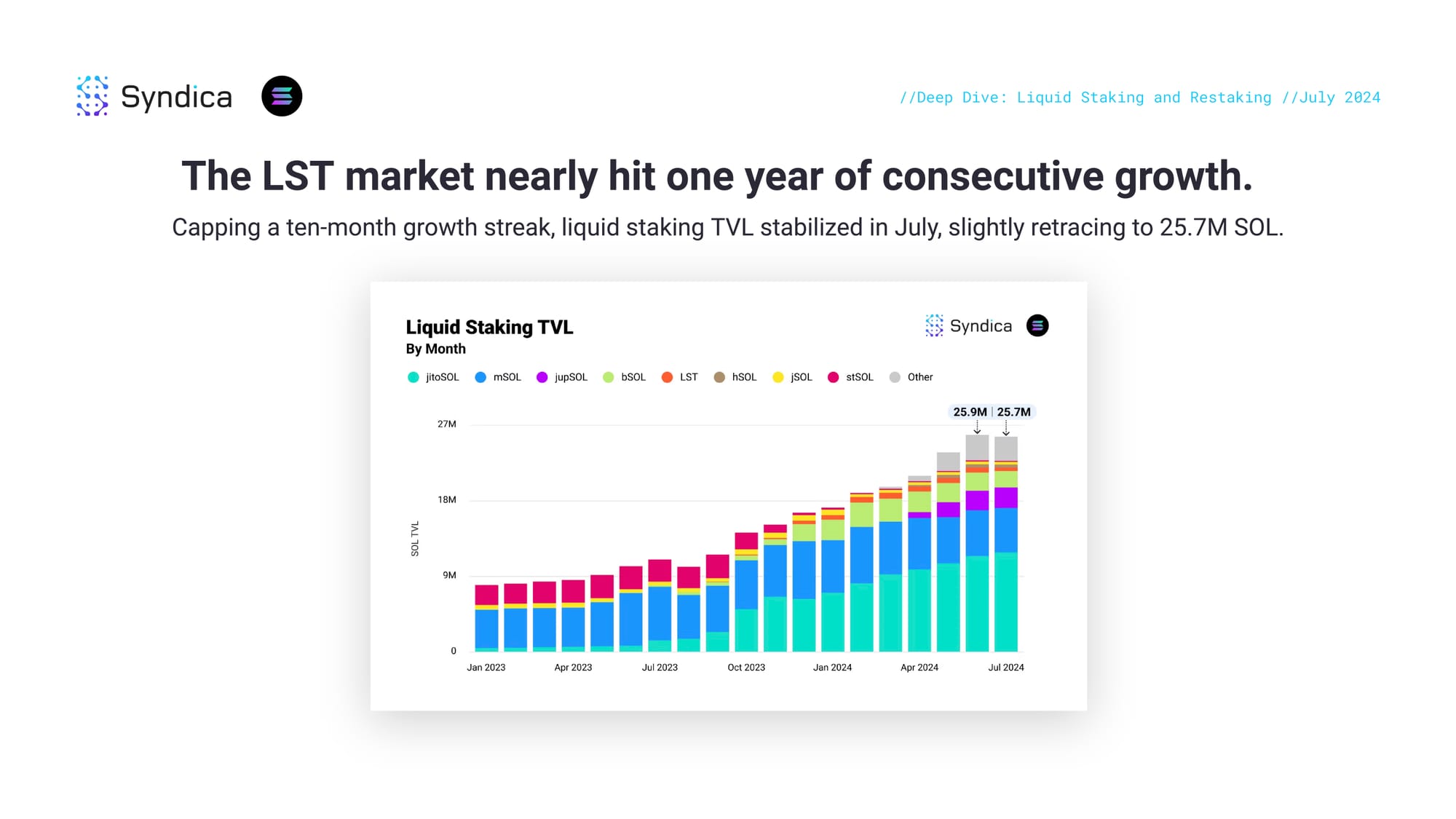

The LST market nearly hit one year of consecutive growth. Capping a ten-month growth streak, liquid staking TVL stabilized in July, slightly retracing to 25.7M SOL.

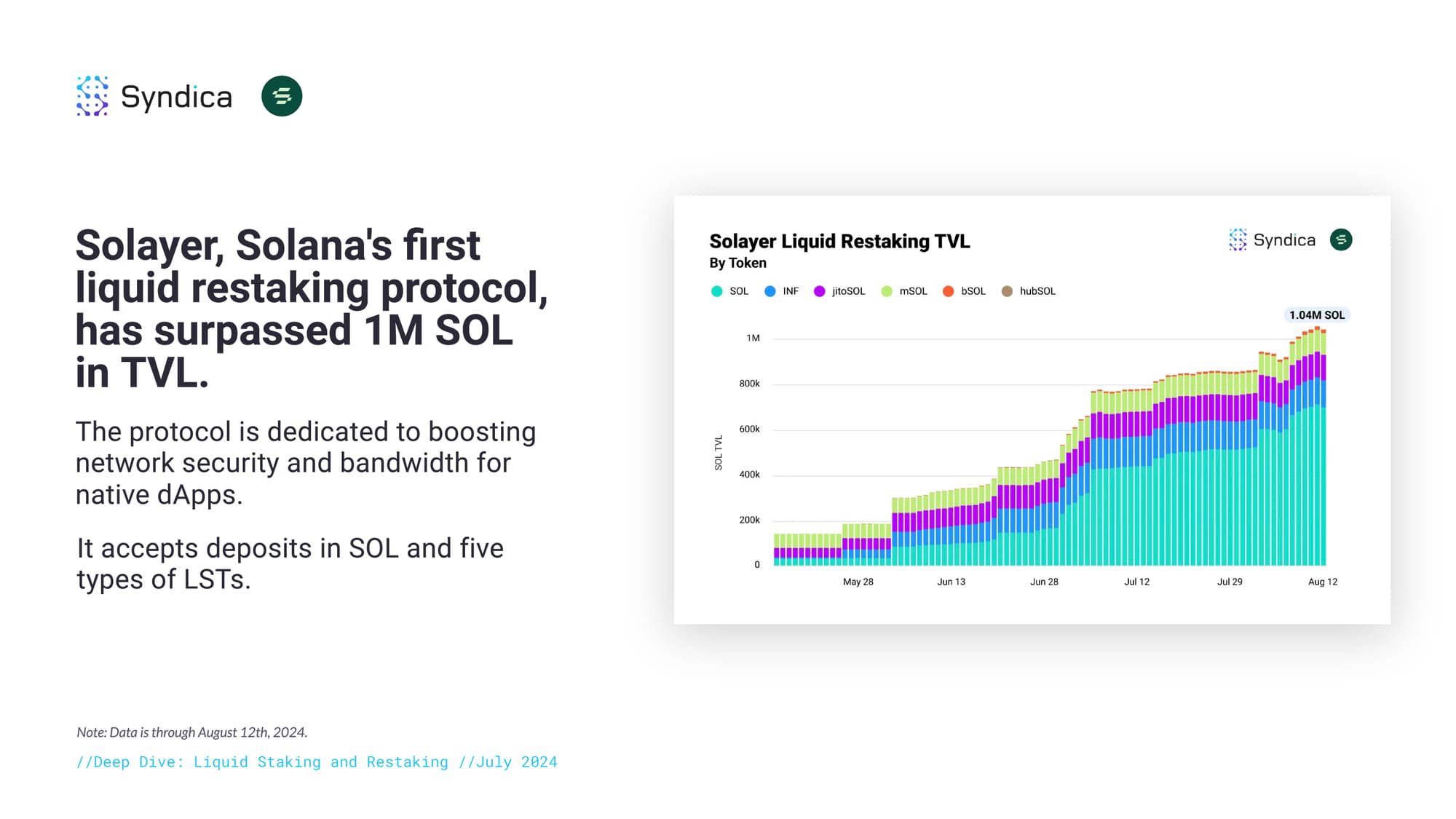

Solayer, Solana's first liquid restaking protocol, has surpassed 1M SOL in TVL. The protocol is dedicated to boosting network security and bandwidth for native dApps. It accepts deposits in SOL and five types of LSTs.

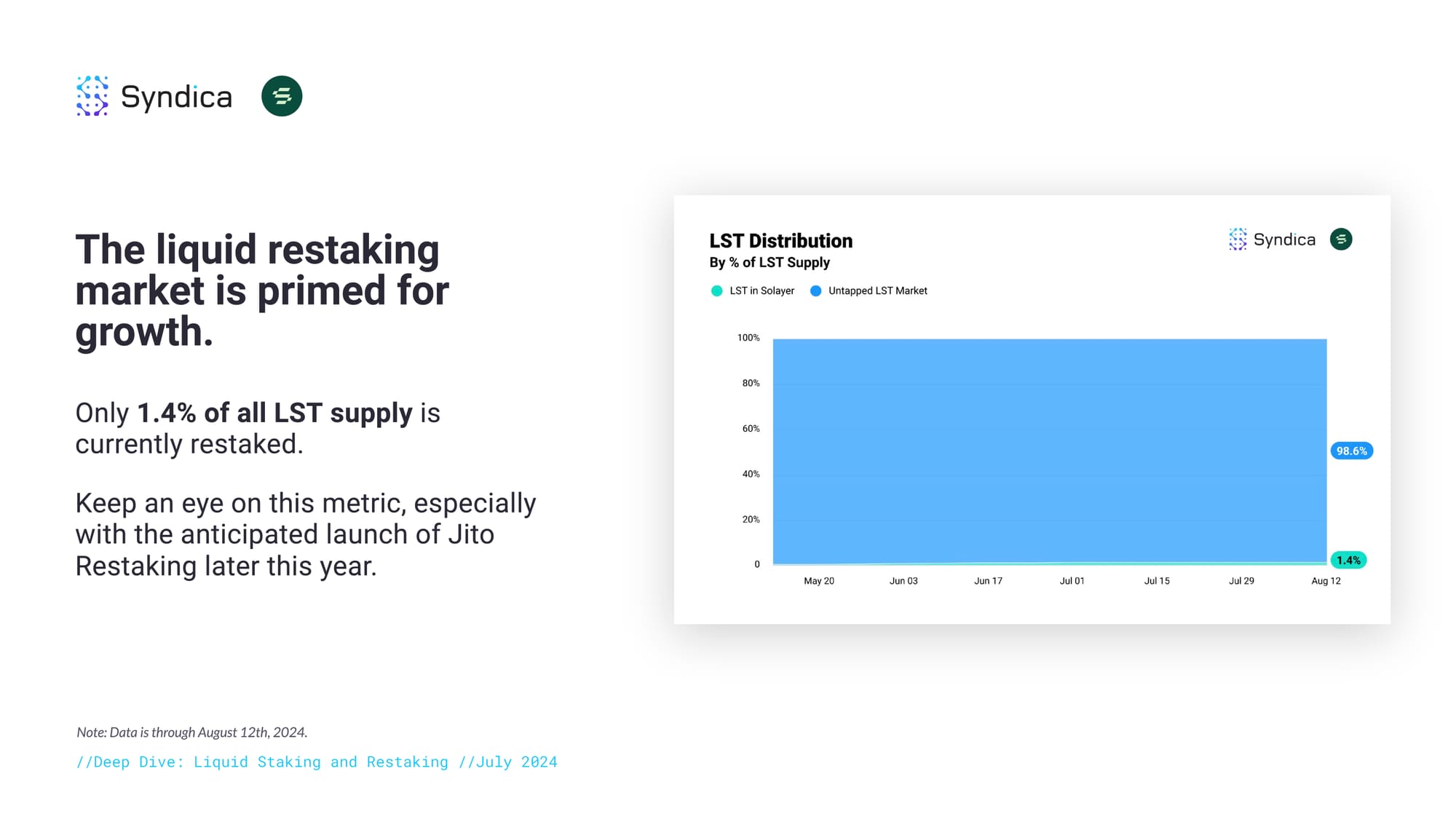

The liquid restaking market is primed for growth. Only 1.4% of all LST supply is currently restaked. Keep an eye on this metric, especially with the anticipated launch of Jito Restaking later this year.

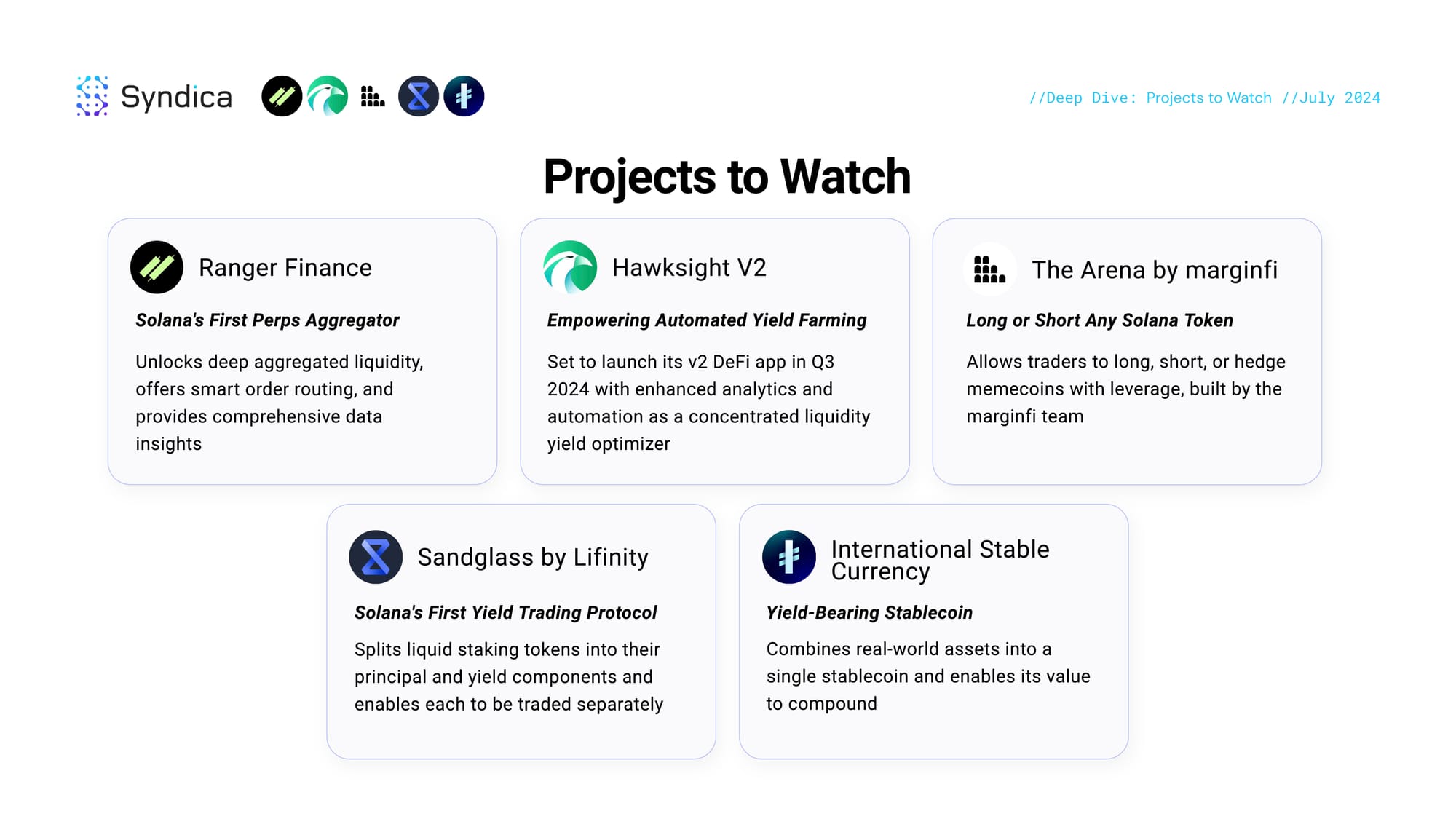

Part IV: Projects to Watch

Ranger Finance: Solana's First Perps Aggregator - Unlocks deep aggregated liquidity, offers smart order routing, and provides comprehensive data insights

Hawksight V2: Empowering Automated Yield Farming - Set to launch its v2 DeFi app in Q3 2024 with enhanced analytics and automation as a concentrated liquidity yield optimizer

The Arena by marginfi: Long or Short Any Solana Token - Allows traders to long, short, or hedge memecoins with leverage, built by the marginfi team

Sandglass by Lifinity: Solana's First Yield Trading Protocol - Splits liquid staking tokens into their principal and yield components and enables each to be traded separately

International Stable Currency: Yield-Bearing Stablecoin - Combines real-world assets into a single stablecoin and enables its value to compound