Deep Dive: Solana DeFi - June 2024

Deep Dive: Solana DeFi - June 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - June 2024

Part I: Solana Perps

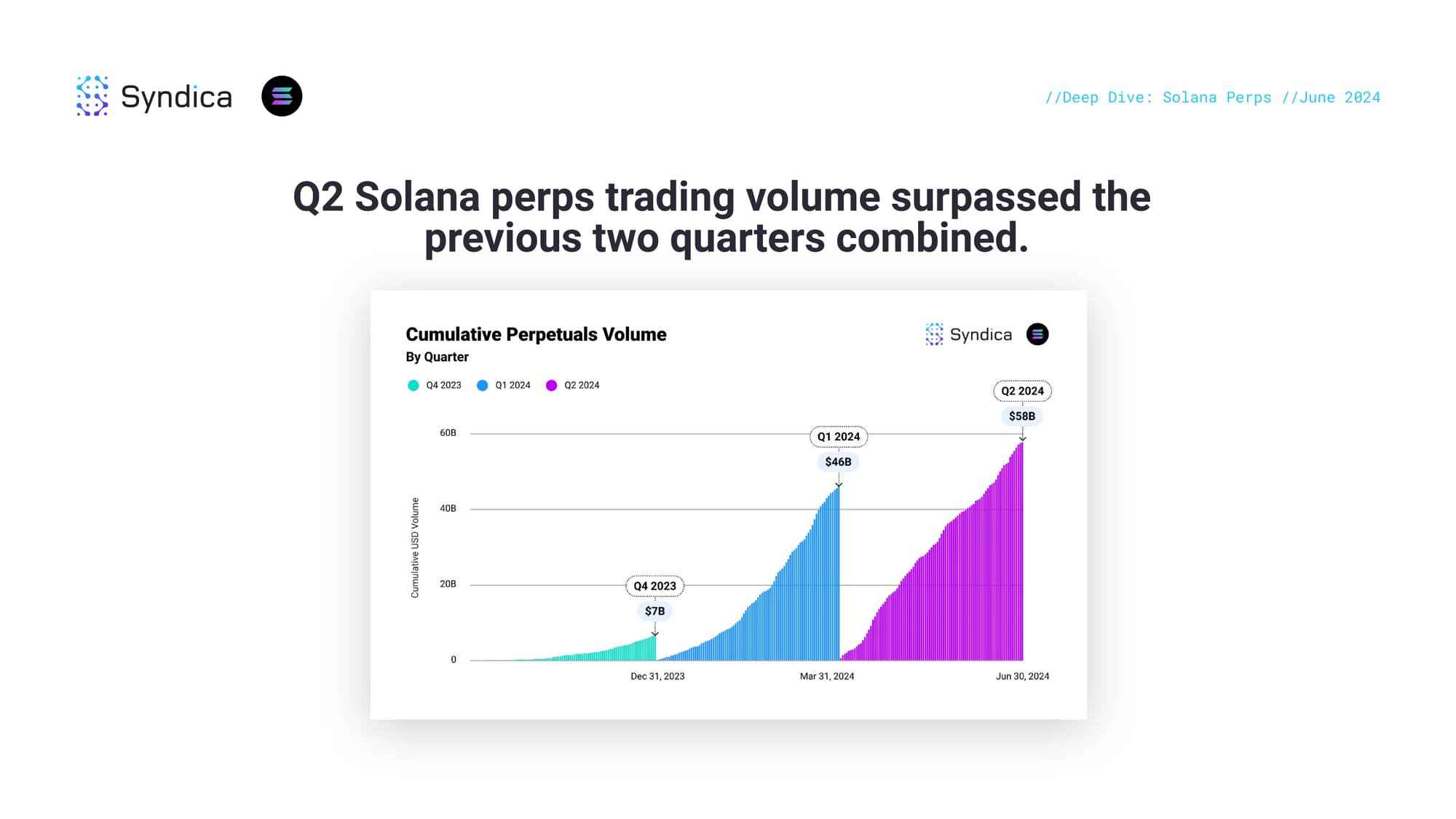

Q2 Solana perps trading volume surpassed the previous two quarters combined.

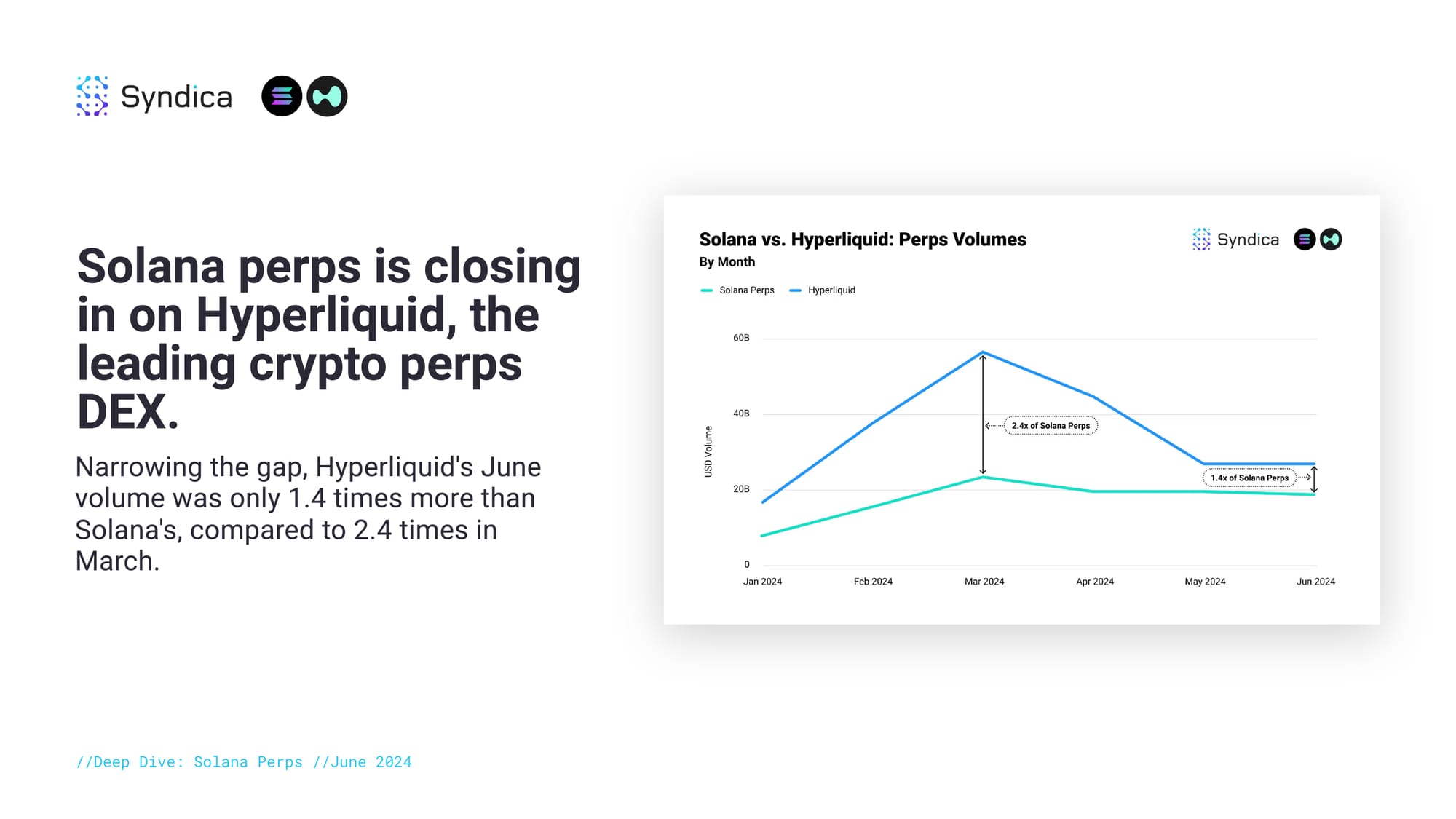

Solana perps is closing in on Hyperliquid, the leading crypto perps DEX. Narrowing the gap, Hyperliquid's June volume was only 1.4 times more than Solana's, compared to 2.4 times in March.

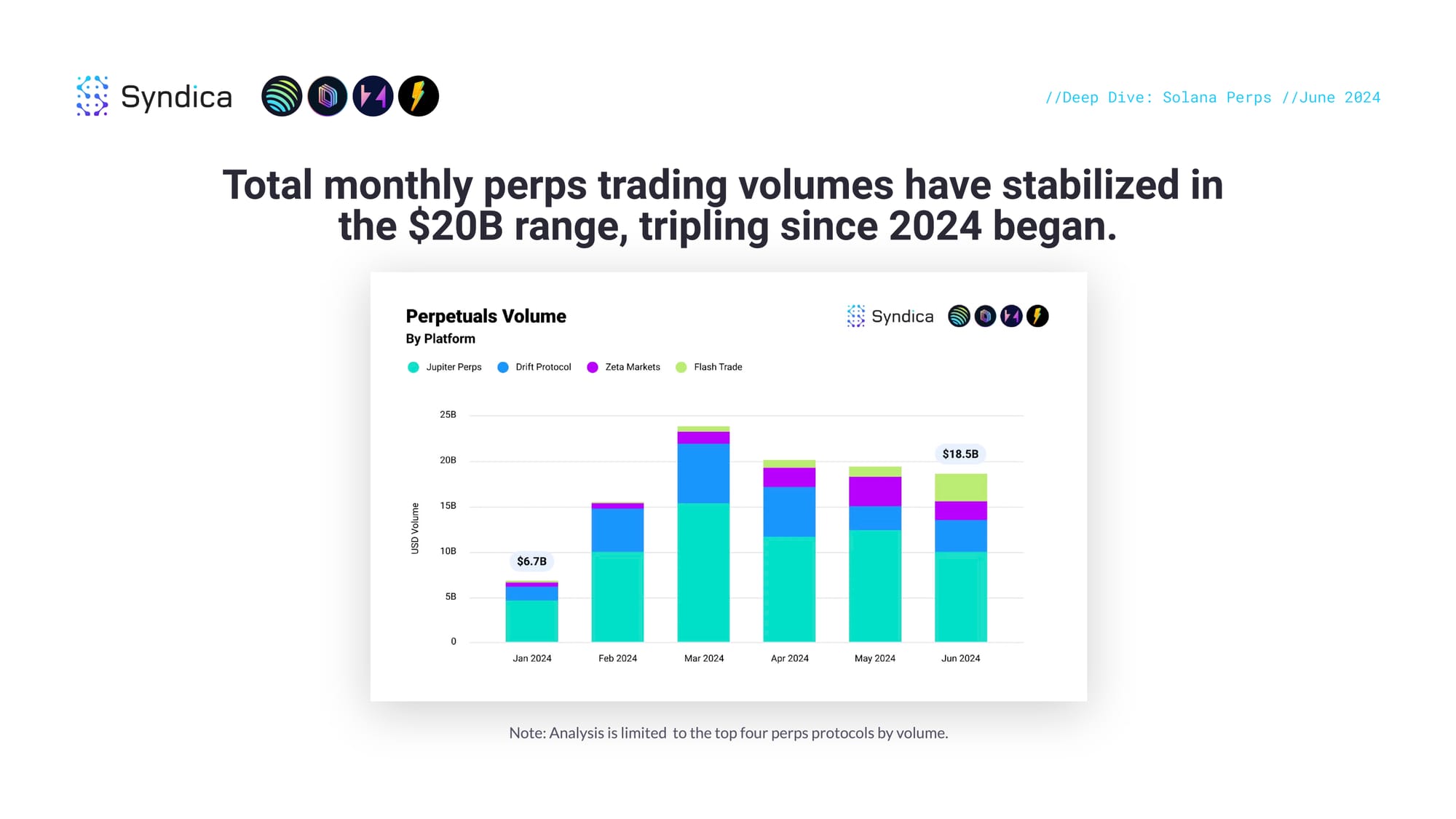

Monthly Solana perps trading volumes have stabilized in the $20B range, tripling since 2024 began.

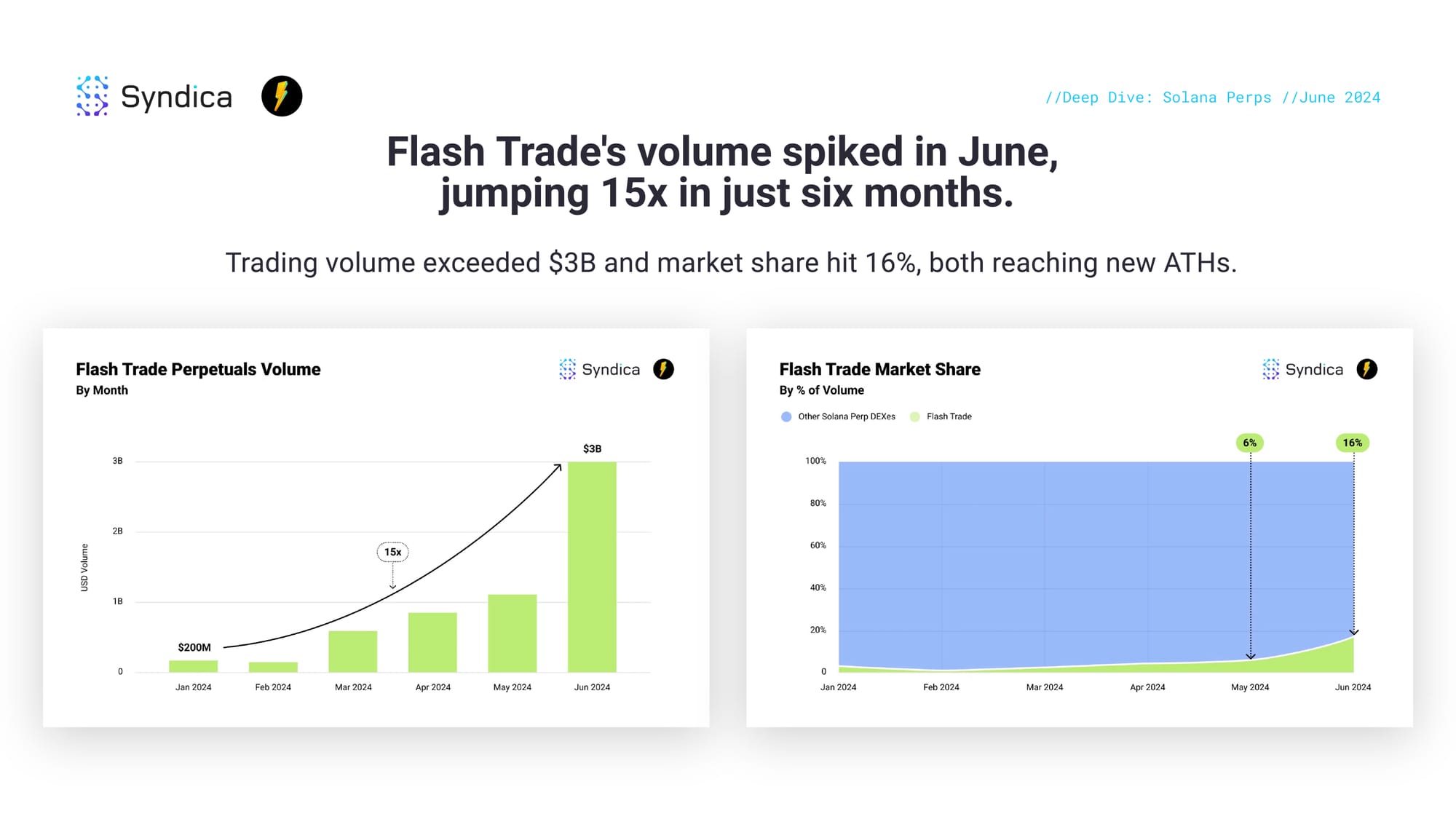

Flash Trade's volume spiked in June, jumping 15x in just six months. Trading volume exceeded $3B and market share hit 16%, both reaching new ATHs.

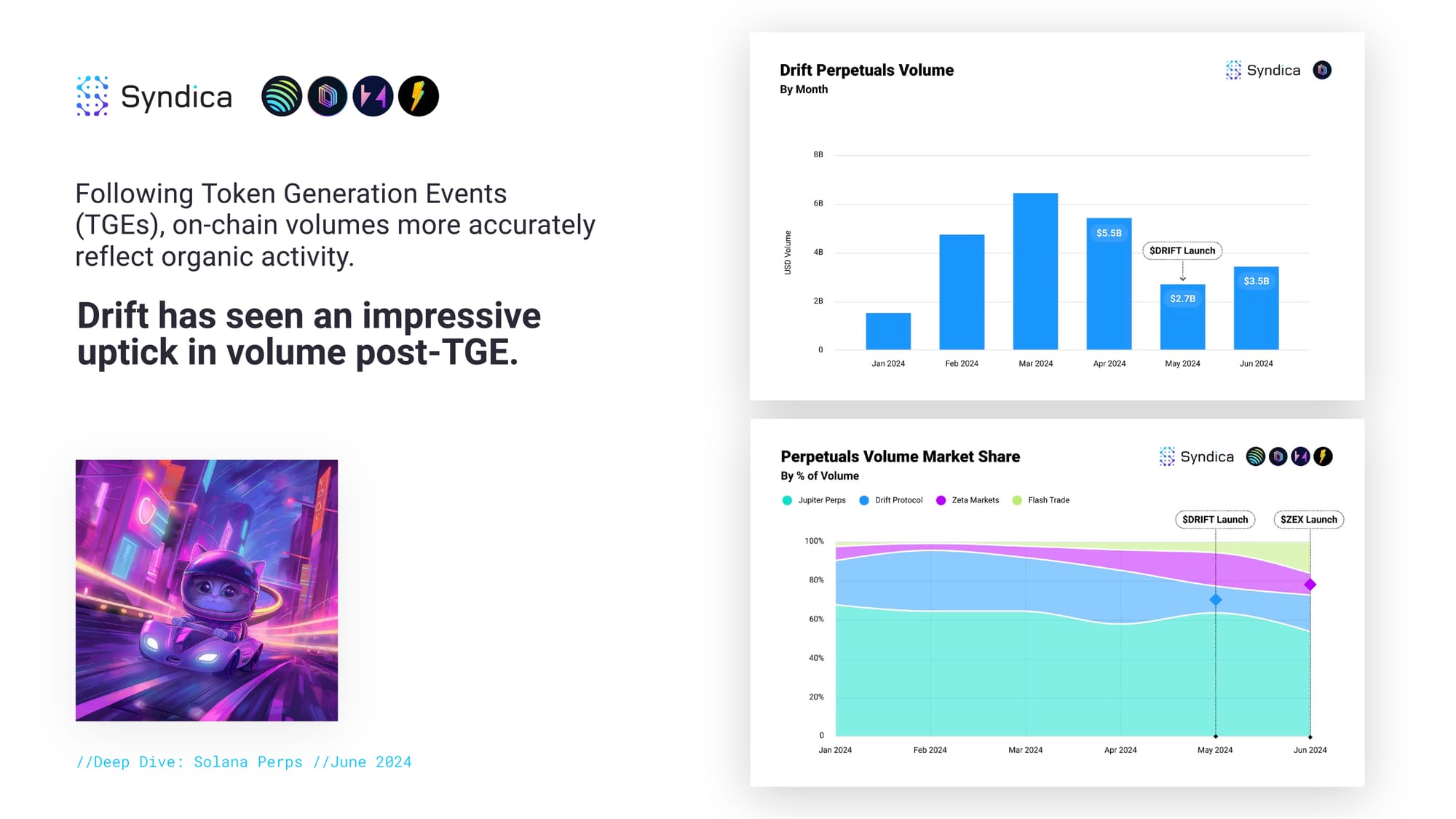

Following Token Generation Events (TGEs), on-chain volumes more accurately reflect organic activity. Drift has seen an impressive uptick in volume post-TGE.

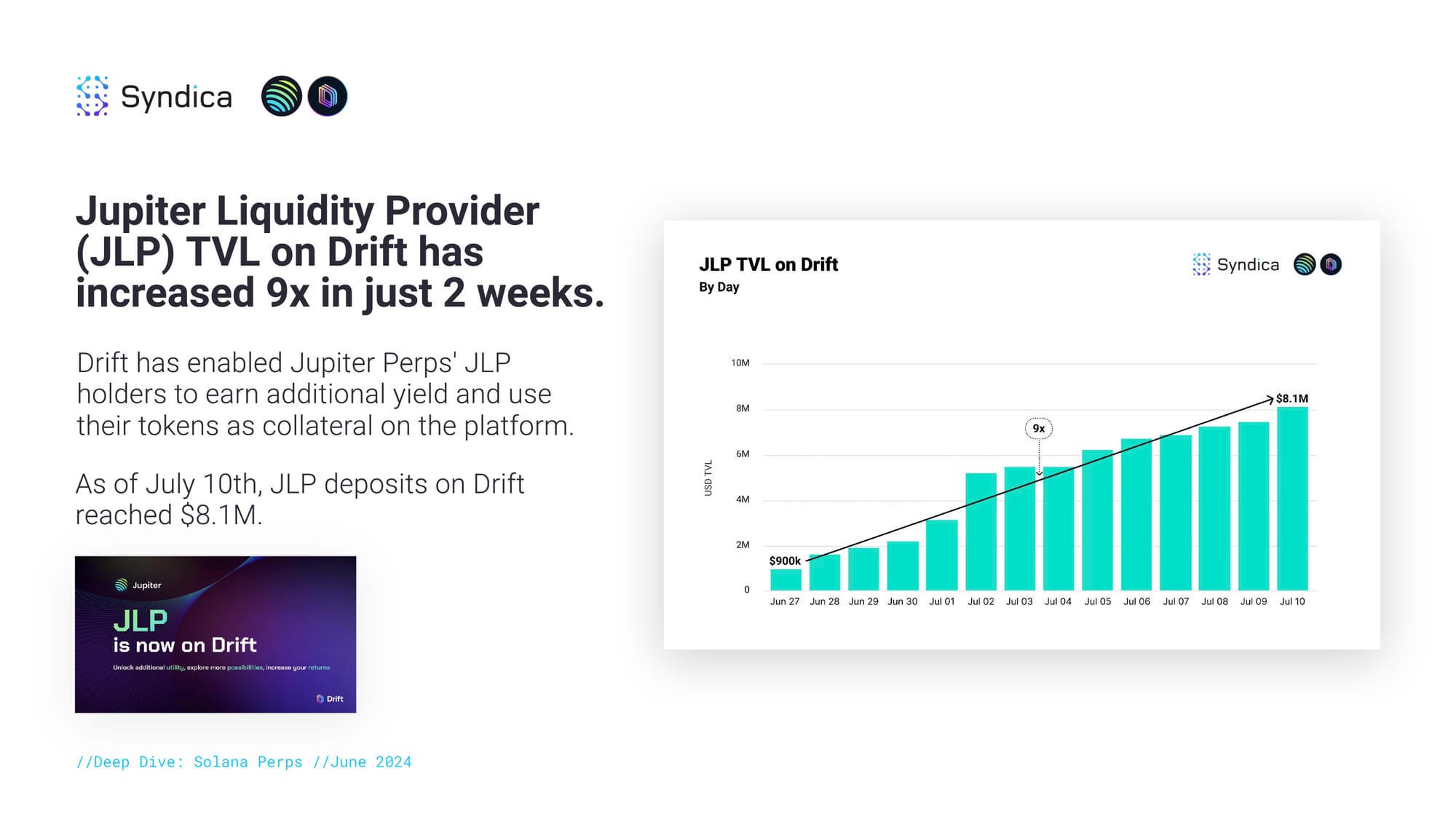

Jupiter Liquidity Provider (JLP) TVL on Drift has increased 9x in just 2 weeks. Drift has enabled Jupiter Perps' JLP holders to earn additional yield and use their tokens as collateral on the platform. As of July 10th, JLP deposits on Drift reached $8.1M.

Part II: Solana Lending & Borrowing

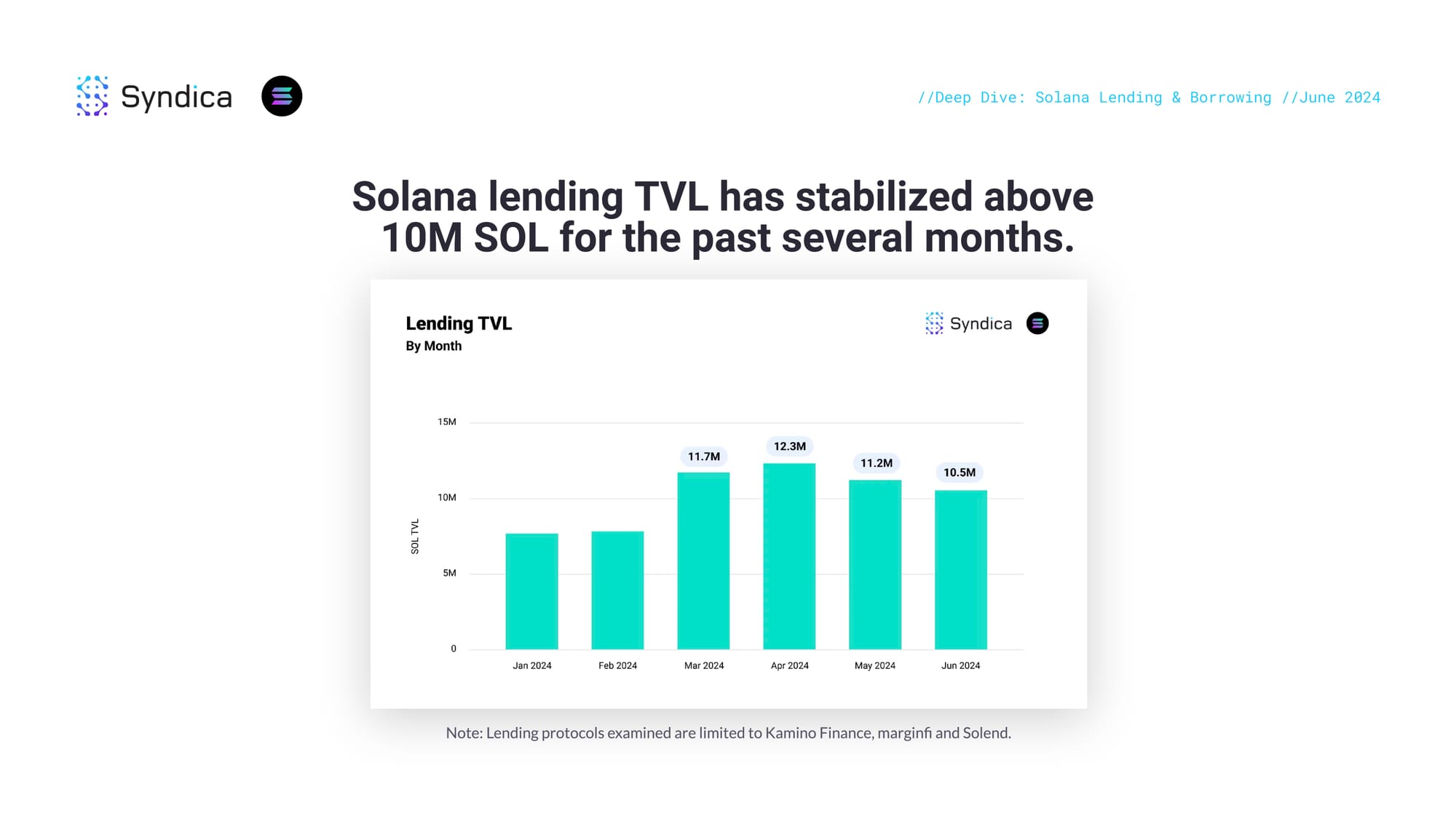

Solana lending TVL has stabilized above 10M SOL for the past several months.

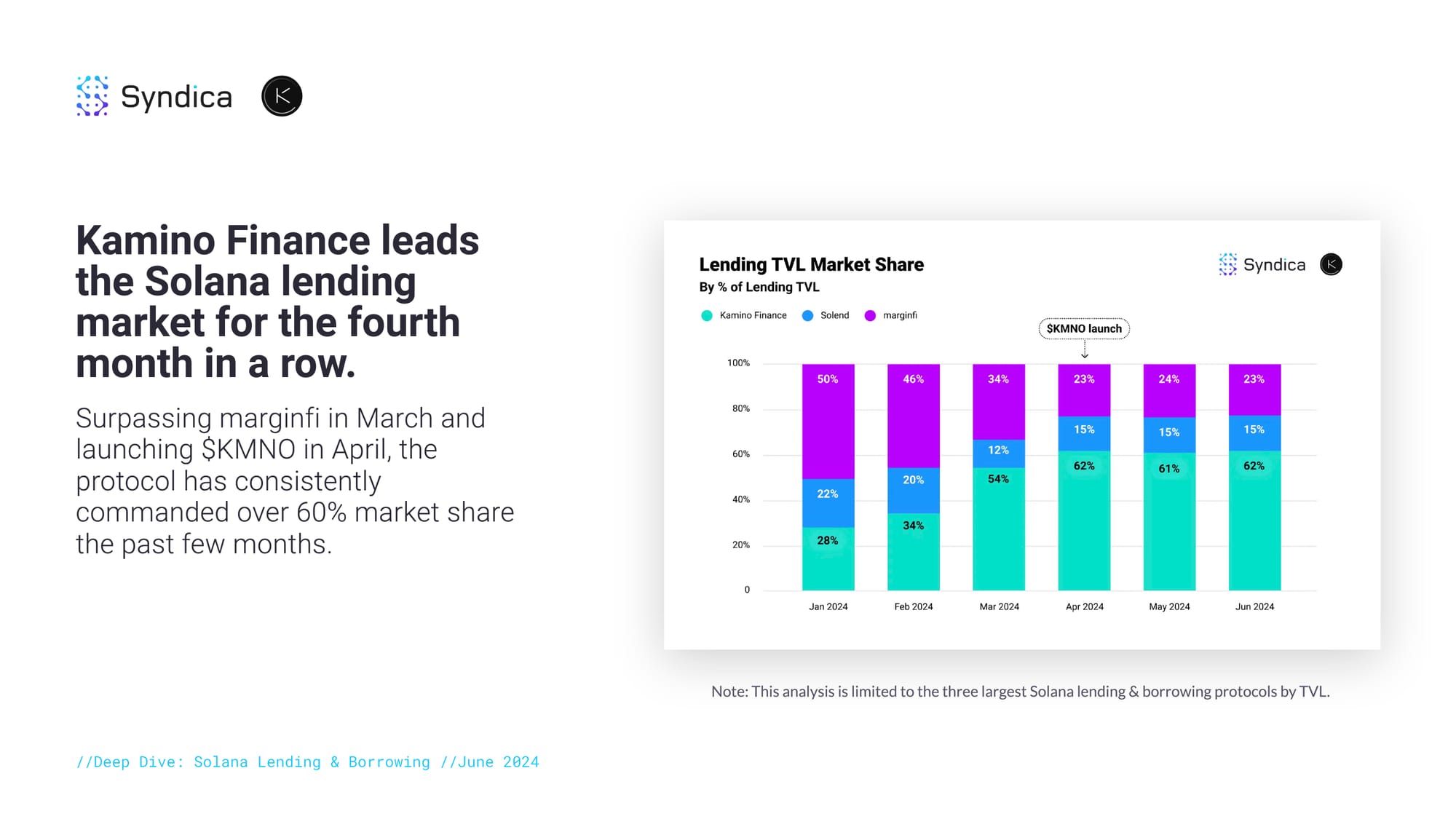

Kamino Finance leads the Solana lending market for the fourth month in a row. Surpassing marginfi in March and launching $KMNO in April, the protocol has consistently commanded over 60% market share the past few months.

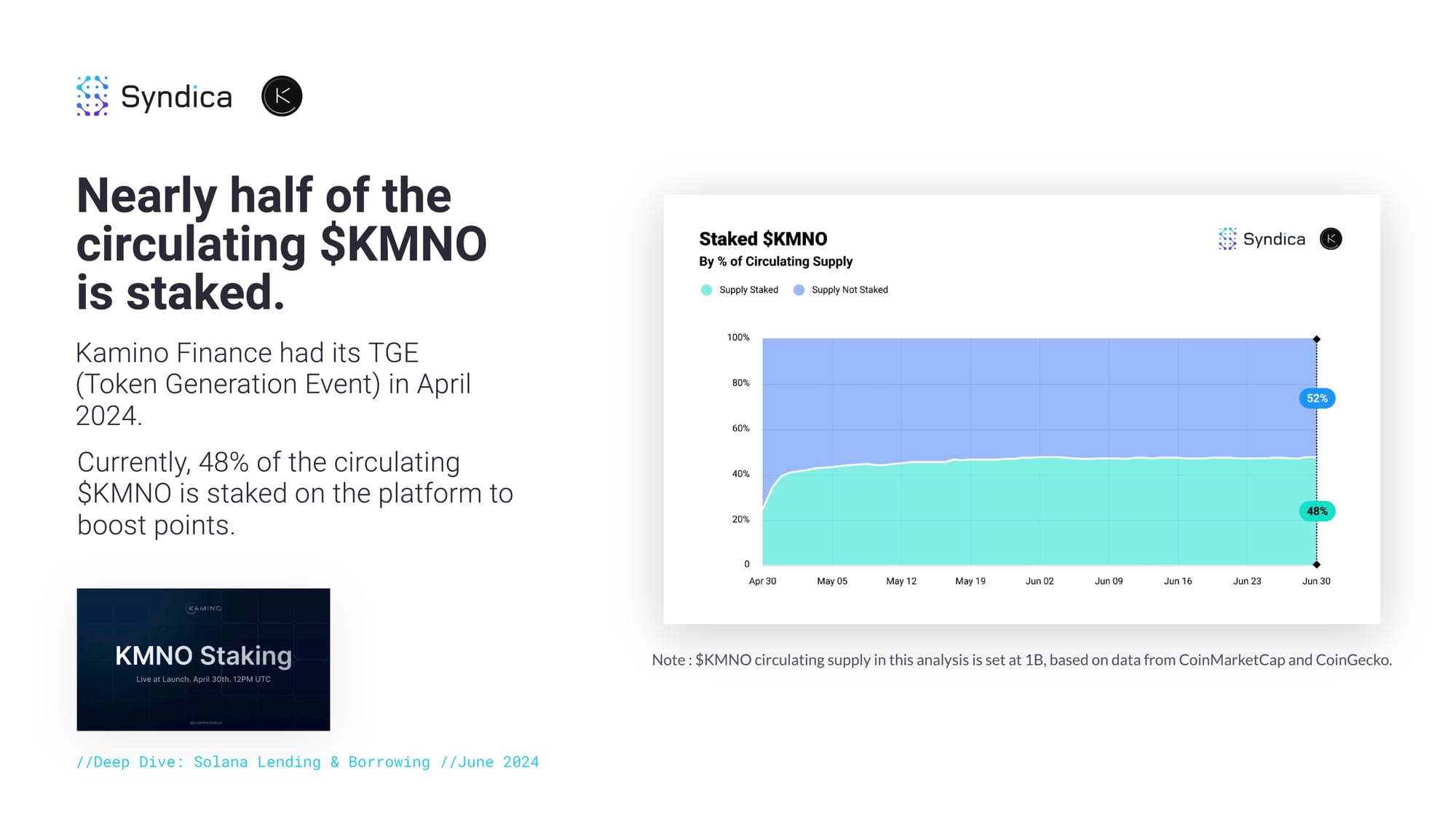

Nearly half of the circulating $KMNO is staked. Kamino Finance had its TGE (Token Generation Event) in April 2024. Currently, 48% of the circulating $KMNO is staked on the platform to boost points.

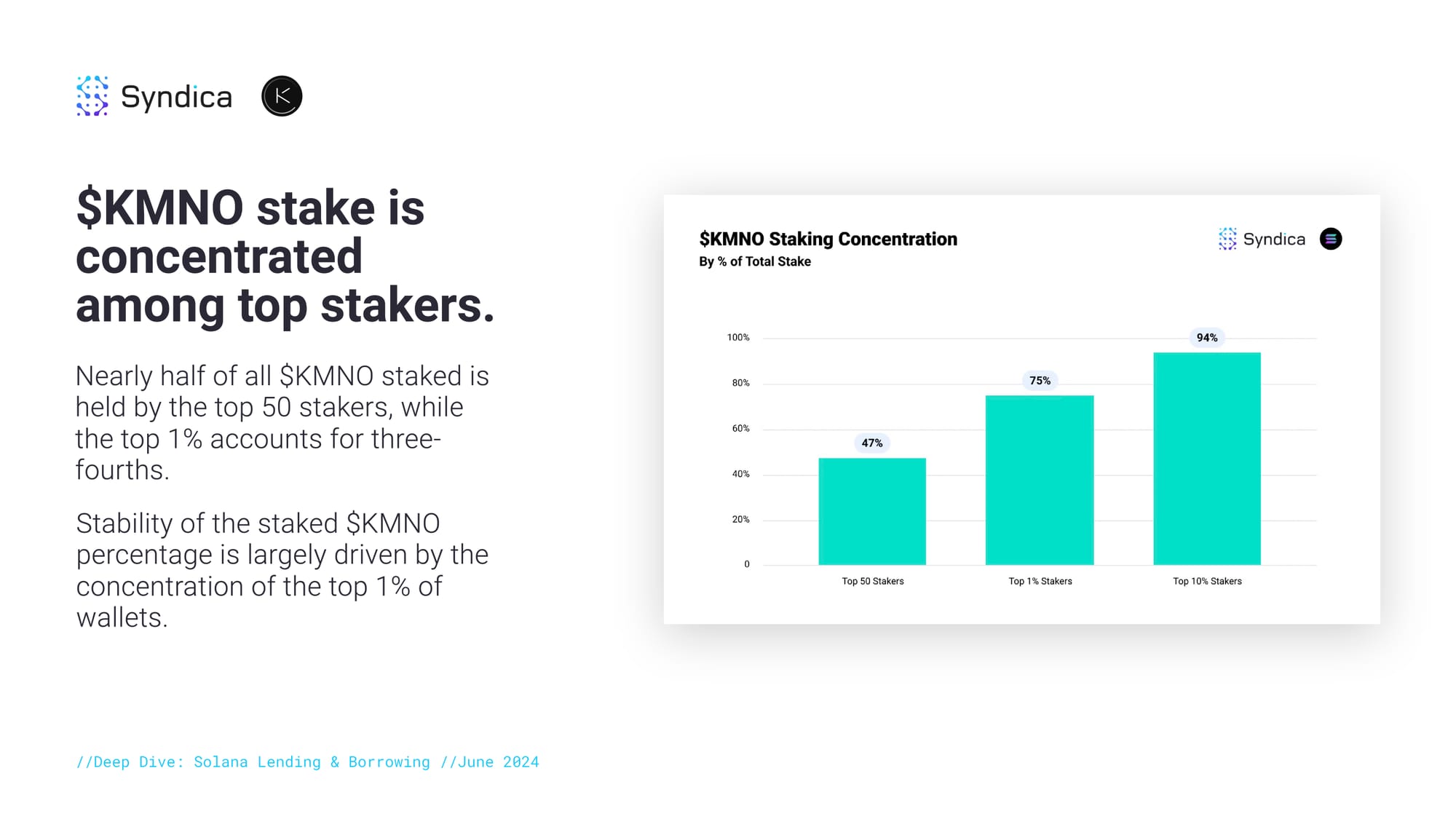

$KMNO stake is concentrated among top stakers. Nearly half of all $KMNO staked is held by the top 50 stakers, while the top 1% accounts for three-fourths. Stability of the staked $KMNO percentage is largely driven by the concentration of $KMNO in the top 1% of wallets.

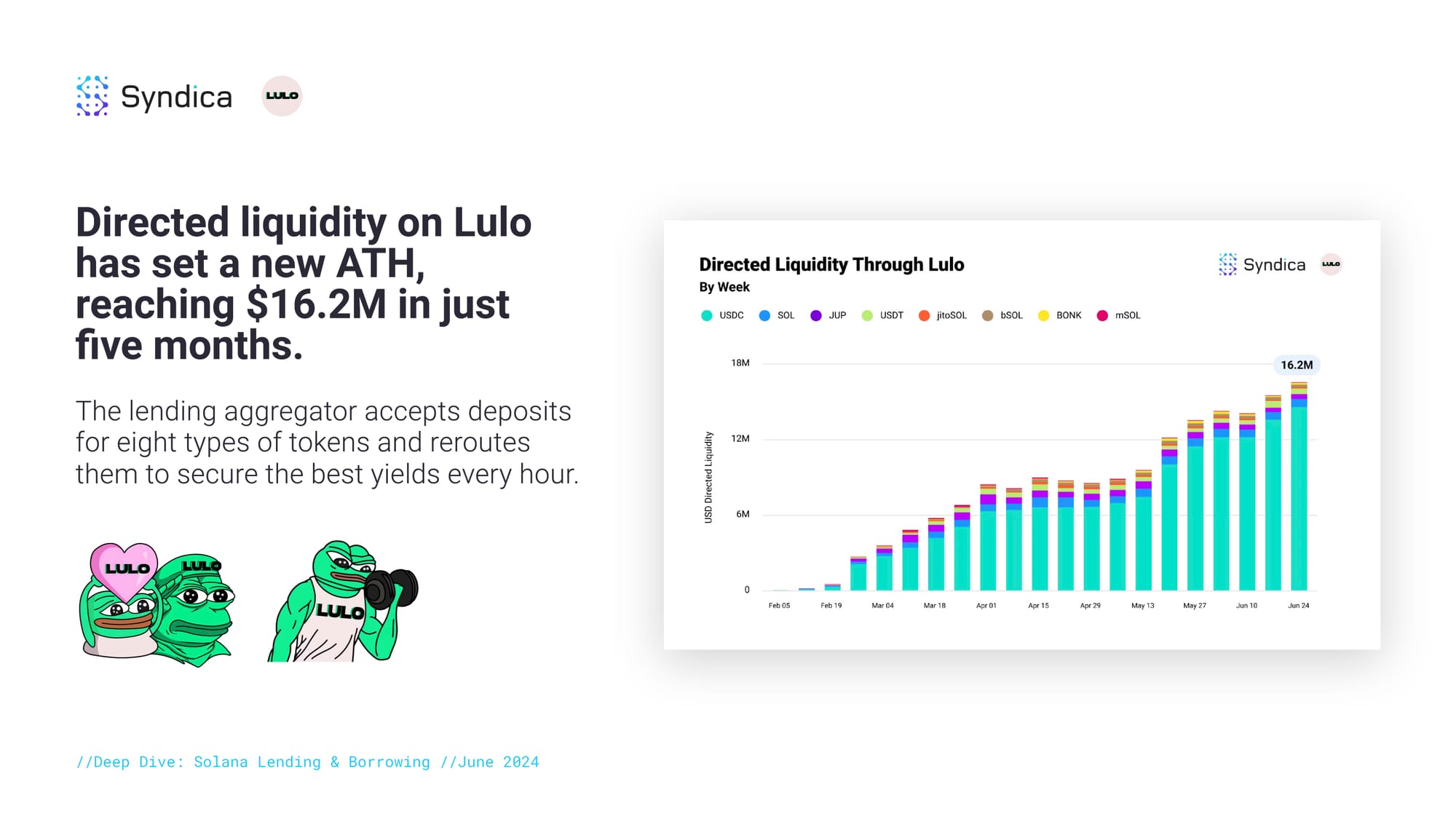

Directed liquidity on Lulo has set a new ATH, reaching $16.2M in just five months. The lending aggregator accepts deposits for eight types of tokens and reroutes them to secure the best yields every hour.

Part III: Solana Liquid Staking

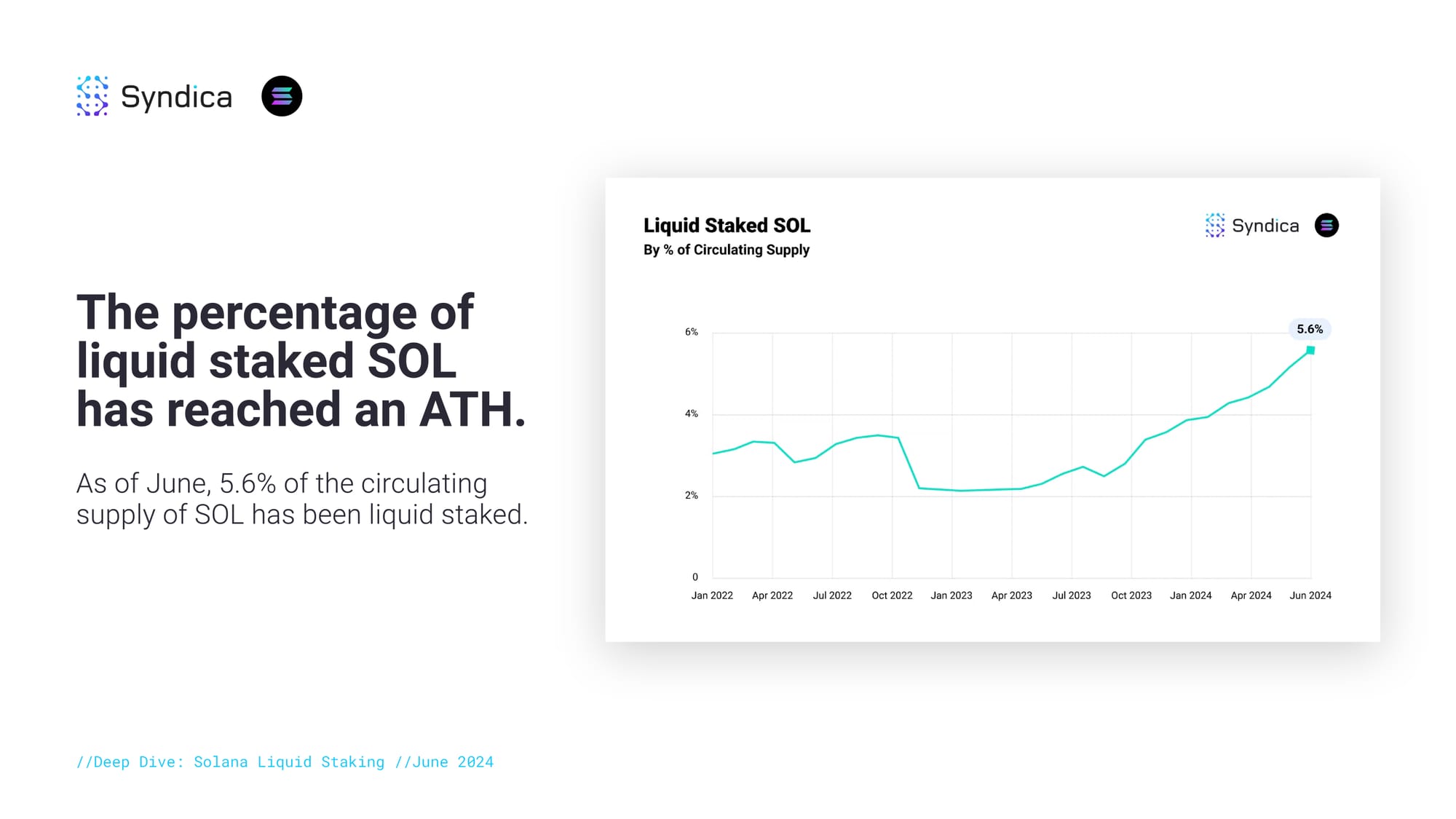

The percentage of liquid-staked SOL has reached an ATH. As of June, 5.6% of the circulating supply of SOL has been liquid-staked.

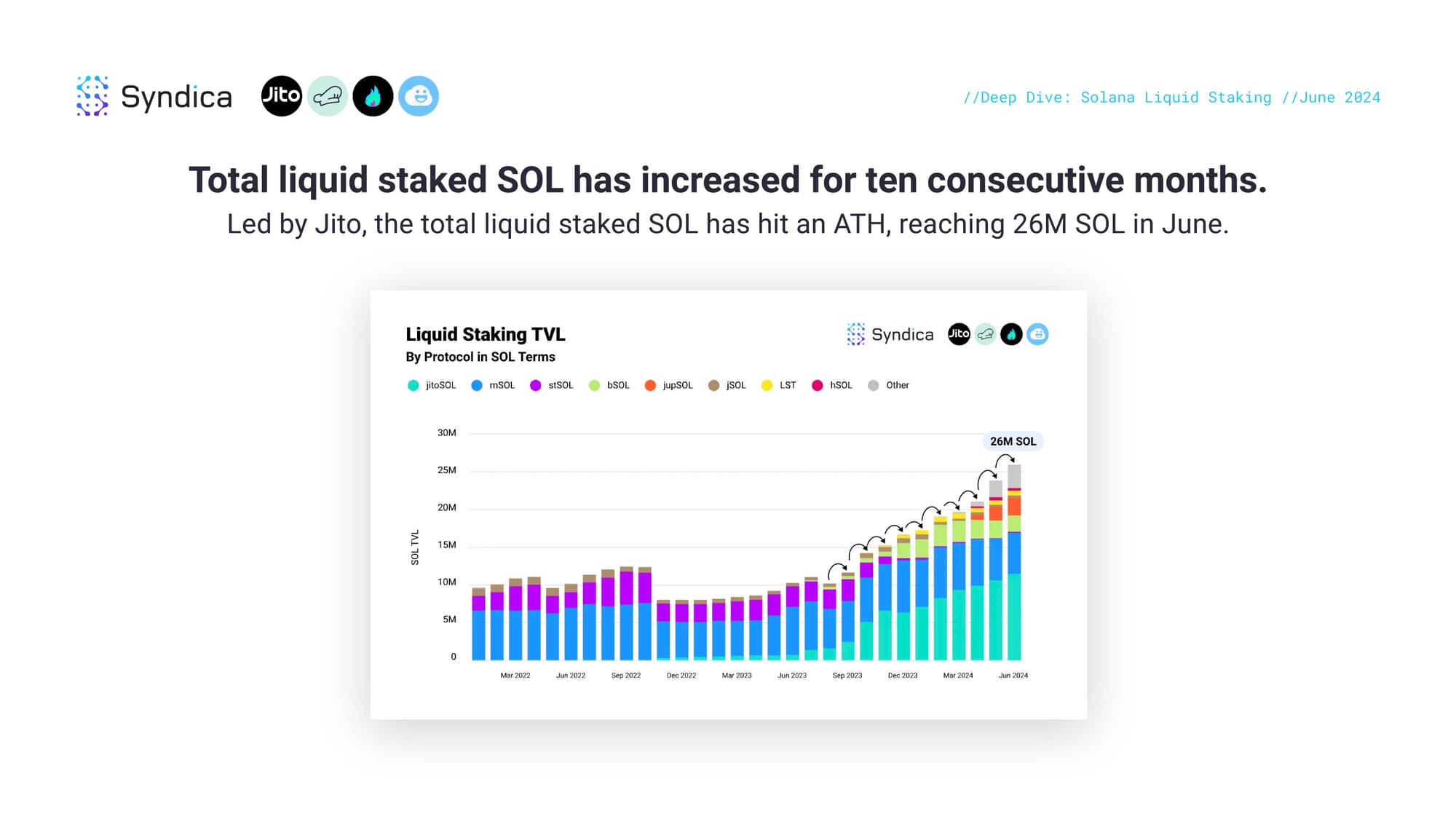

Total liquid-staked SOL has increased for ten consecutive months. Led by Jito, the total liquid-staked SOL has hit an ATH, reaching 26M SOL in June.

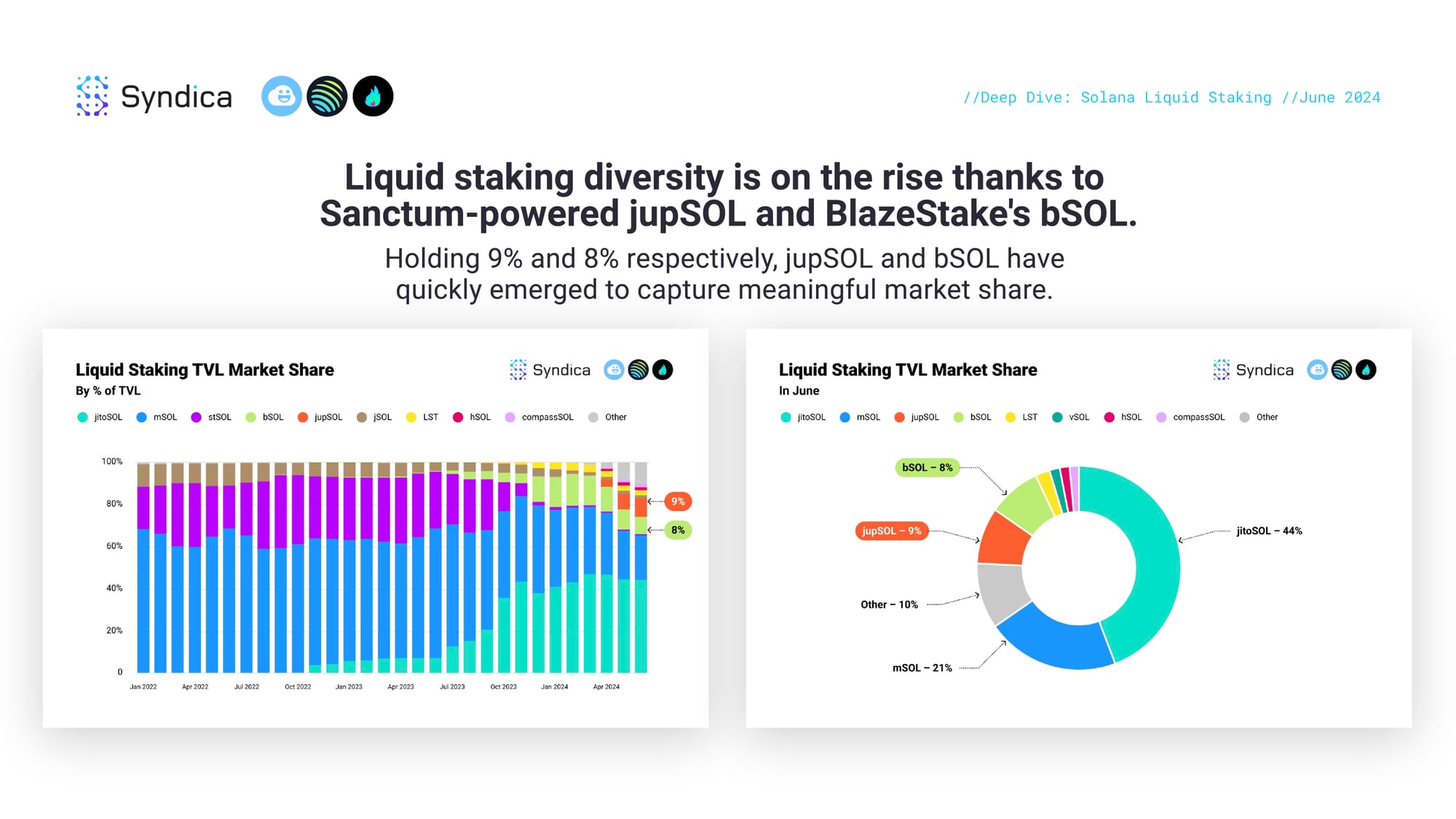

Liquid staking diversity is on the rise thanks to Sanctum-powered jupSOL and BlazeStake's bSOL. Holding 9% and 8% respectively, jupSOL and bSOL have quickly emerged to capture meaningful market share.

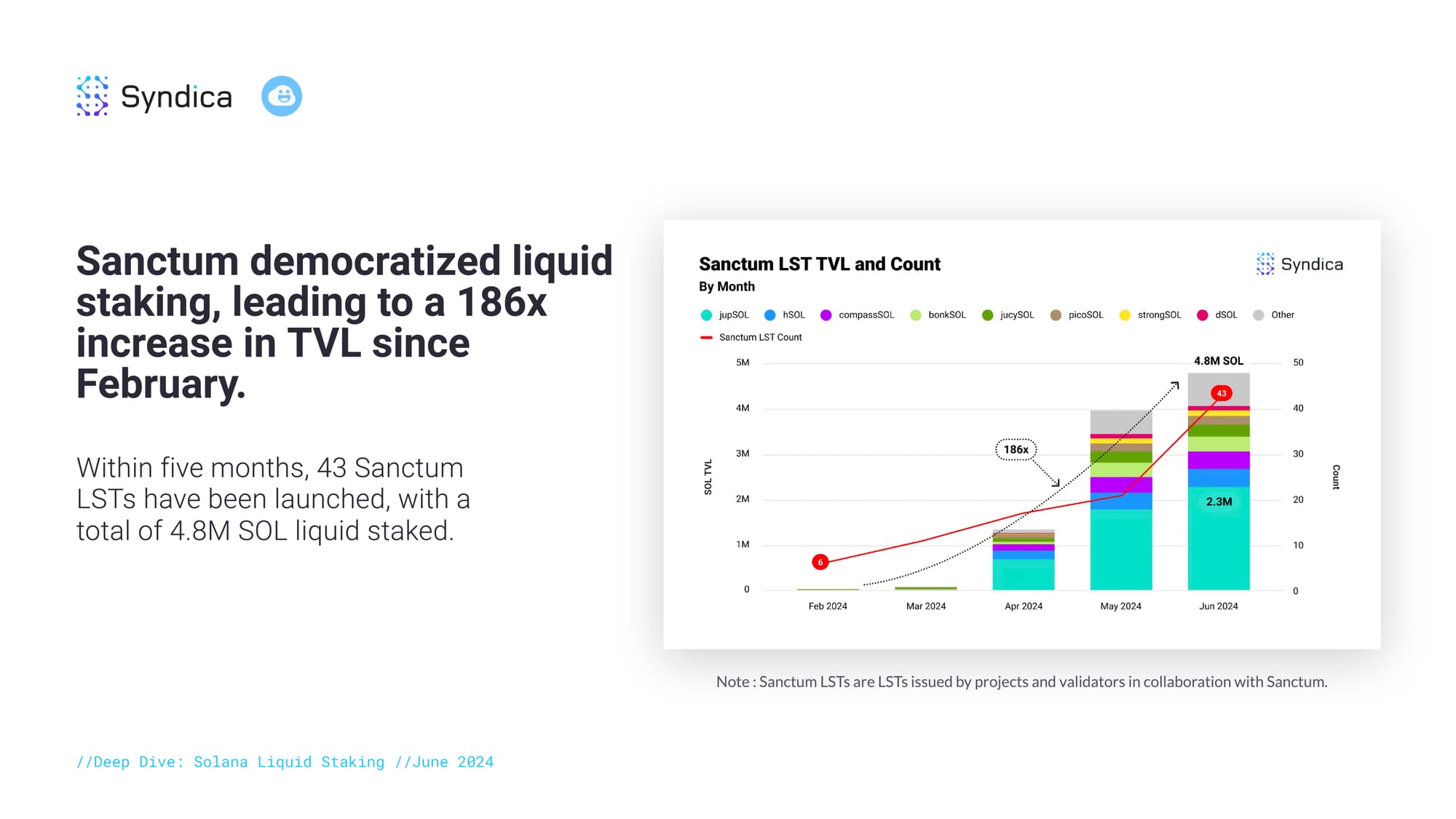

By democratizing liquid staking, Sanctum garnered a 186x increase in TVL since February. Within five months, 43 Sanctum LSTs have been launched, with a total of 4.8M SOL liquid staked.

Part IV: Solana Cross-Chain Bridging

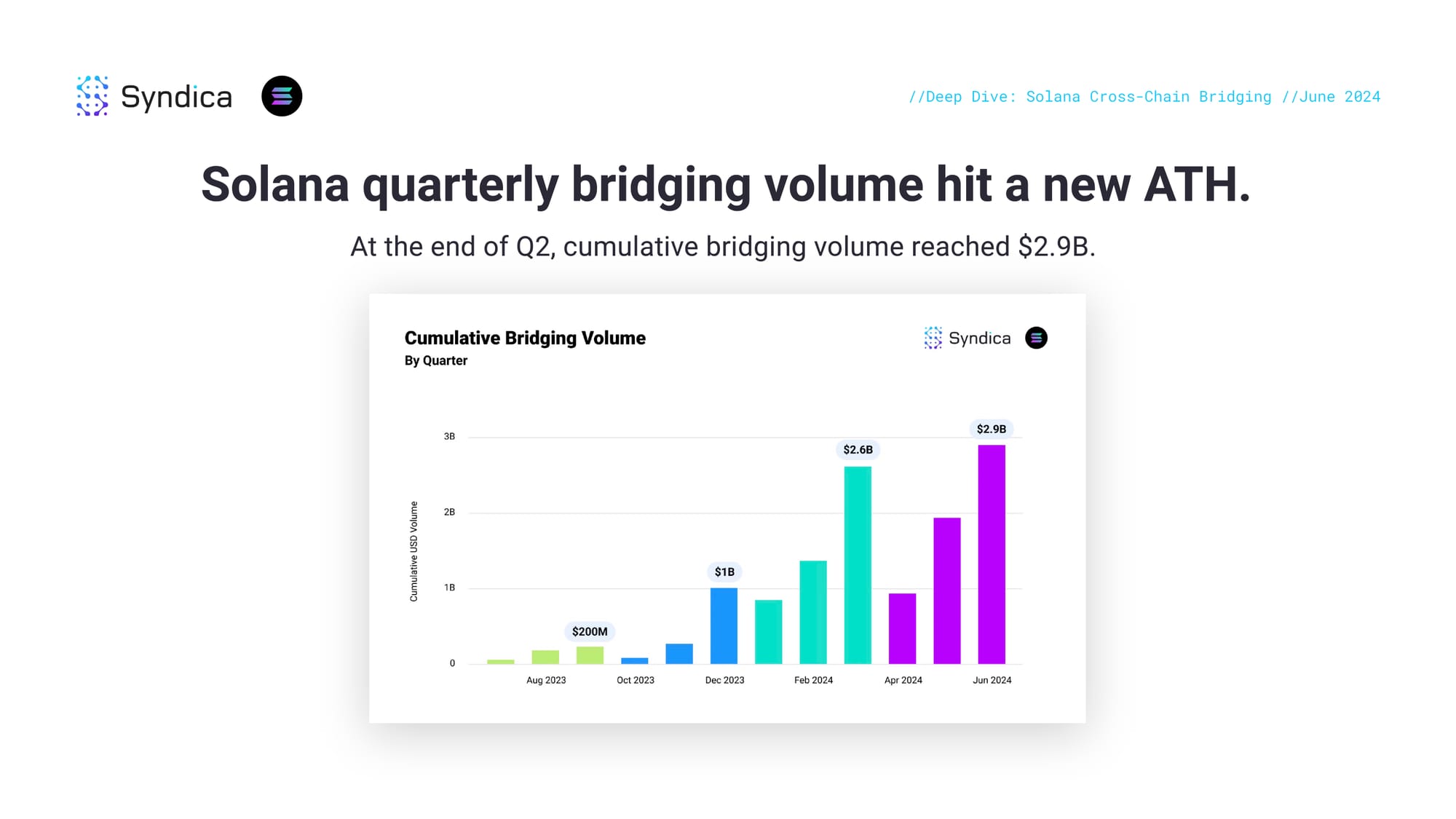

Solana quarterly bridging volume hit a new ATH. At the end of Q2, cumulative bridging volume reached $2.9B.

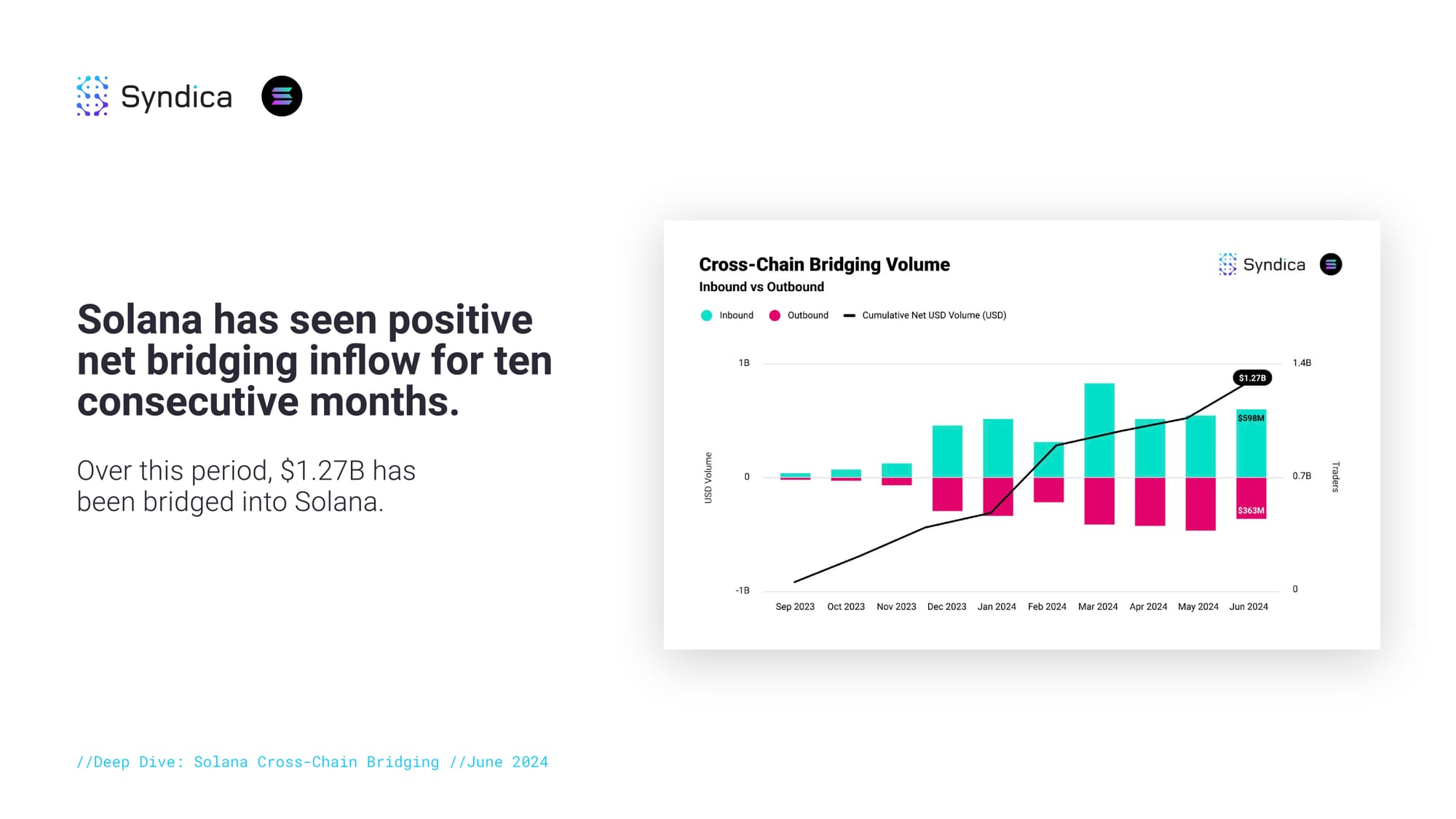

Solana has seen positive net bridging inflow for ten consecutive months. Over this period, $1.27B has been bridged into Solana.

Aggregate Solana cross-chain bridging volumes have stabilized around the $1B mark since April.

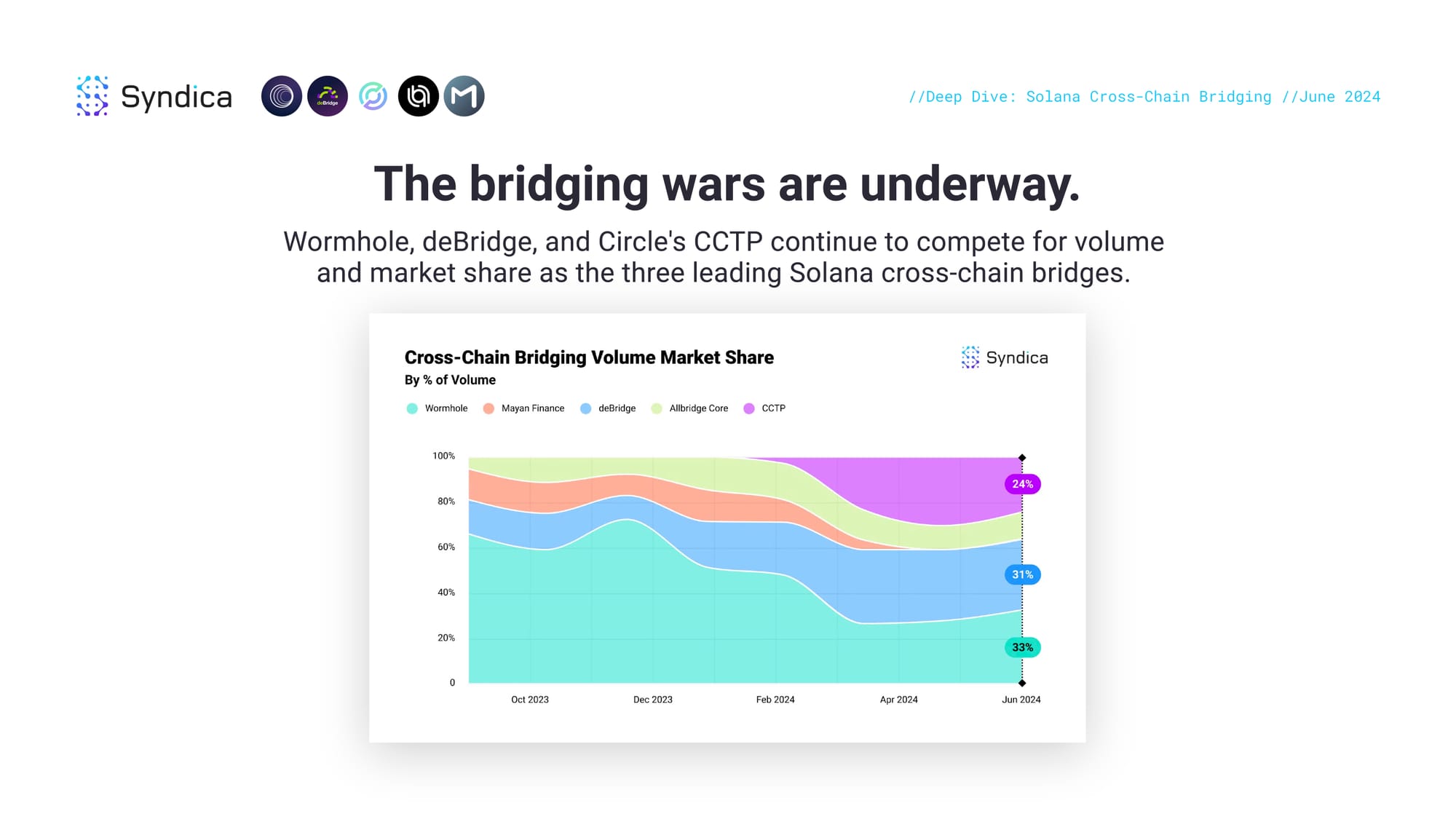

The bridging wars are underway. Wormhole, deBridge, and Circle's CCTP continue to compete for volume and market share as the three leading Solana cross-chain bridges.

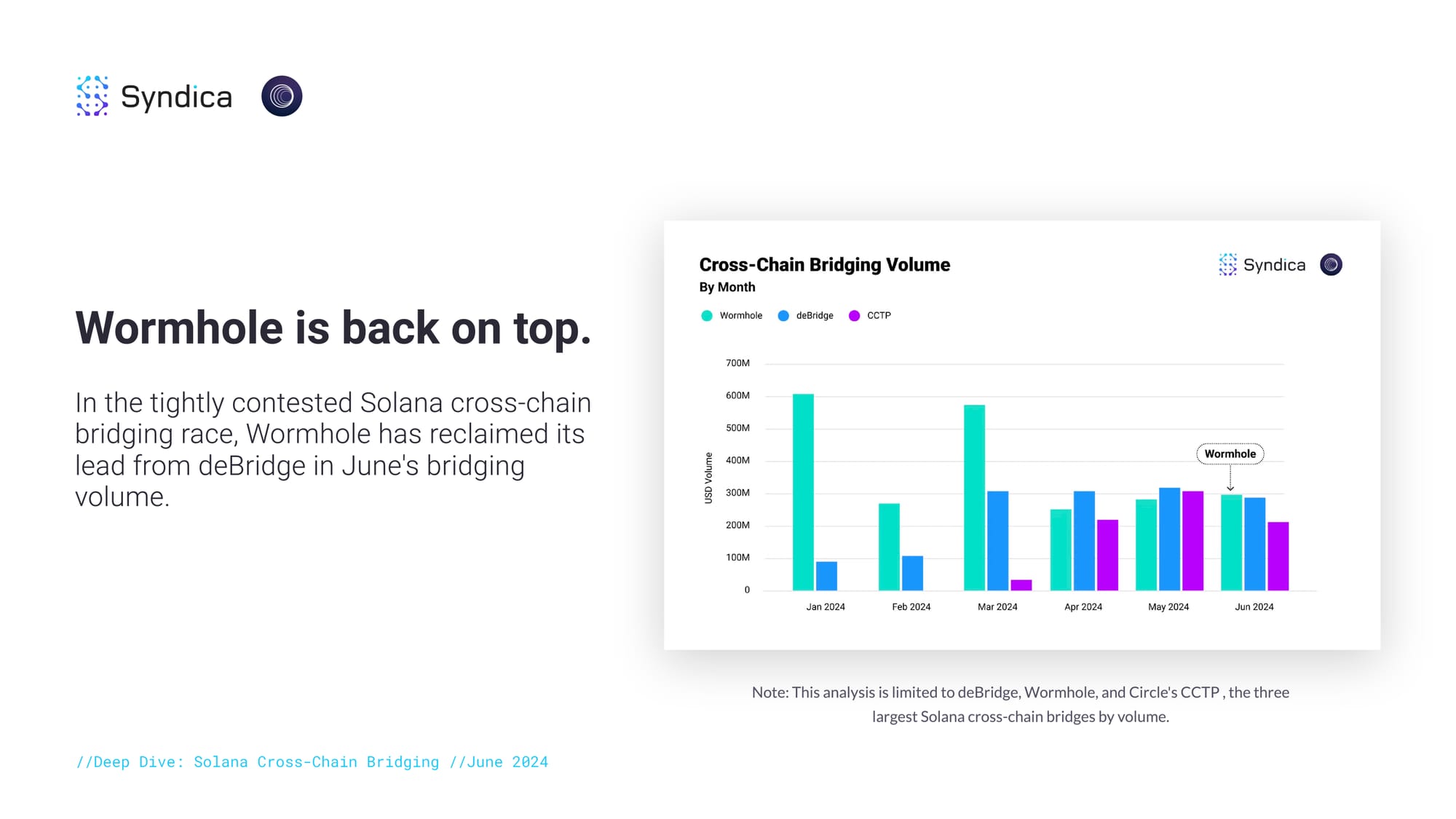

Wormhole is back on top. In the tightly contested Solana cross-chain bridging race, Wormhole has reclaimed its lead from deBridge in June's bridging volume.