Deep Dive: Solana DeFi - June 2025

Deep Dive: Solana DeFi - June 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - June 2025

Part I - DeFi Overview

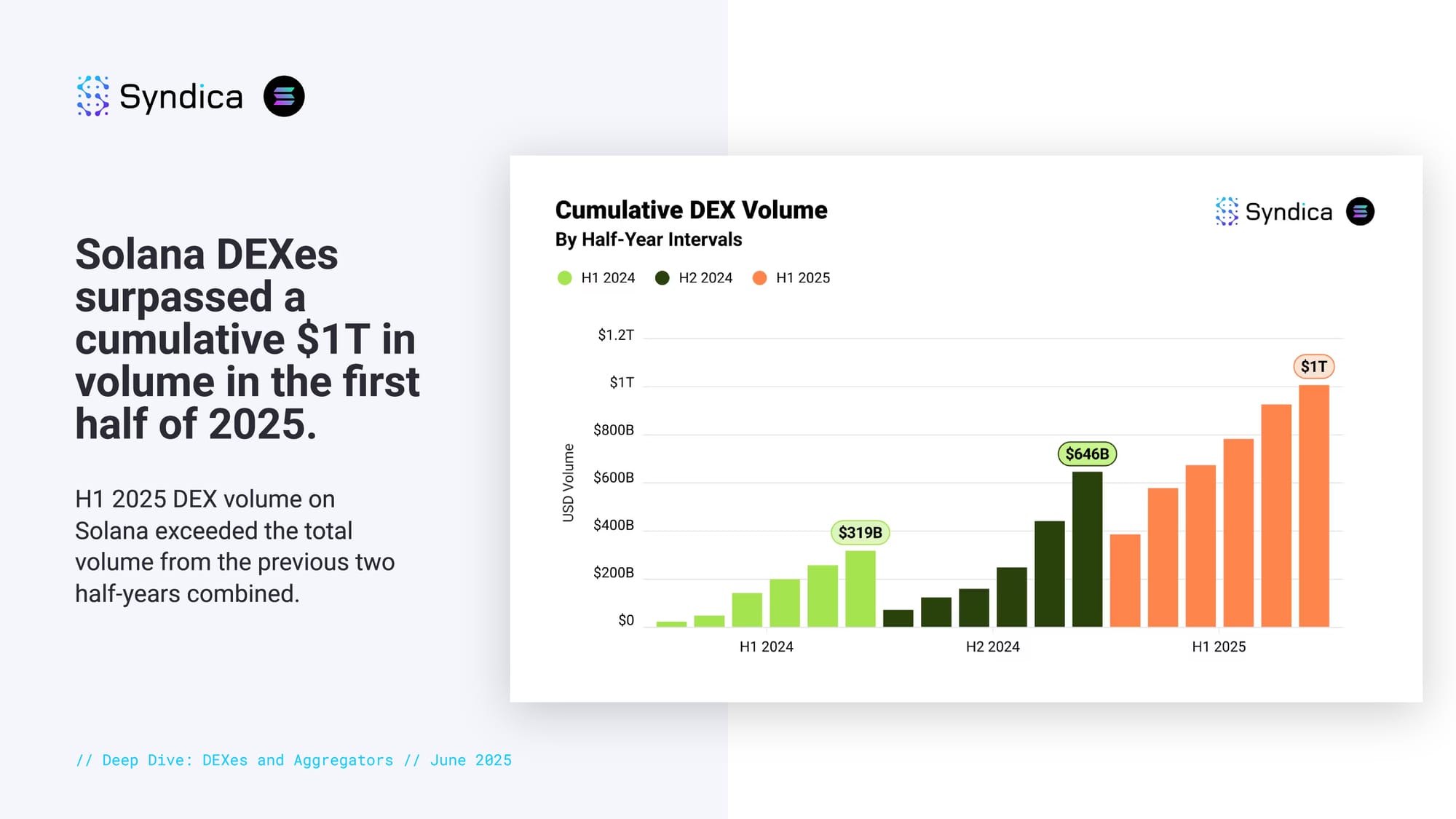

Solana DEXes surpassed a cumulative $1T in volume in the first half of 2025.

H1 2025 DEX volume on Solana exceeded the total volume from the previous two half-years combined.

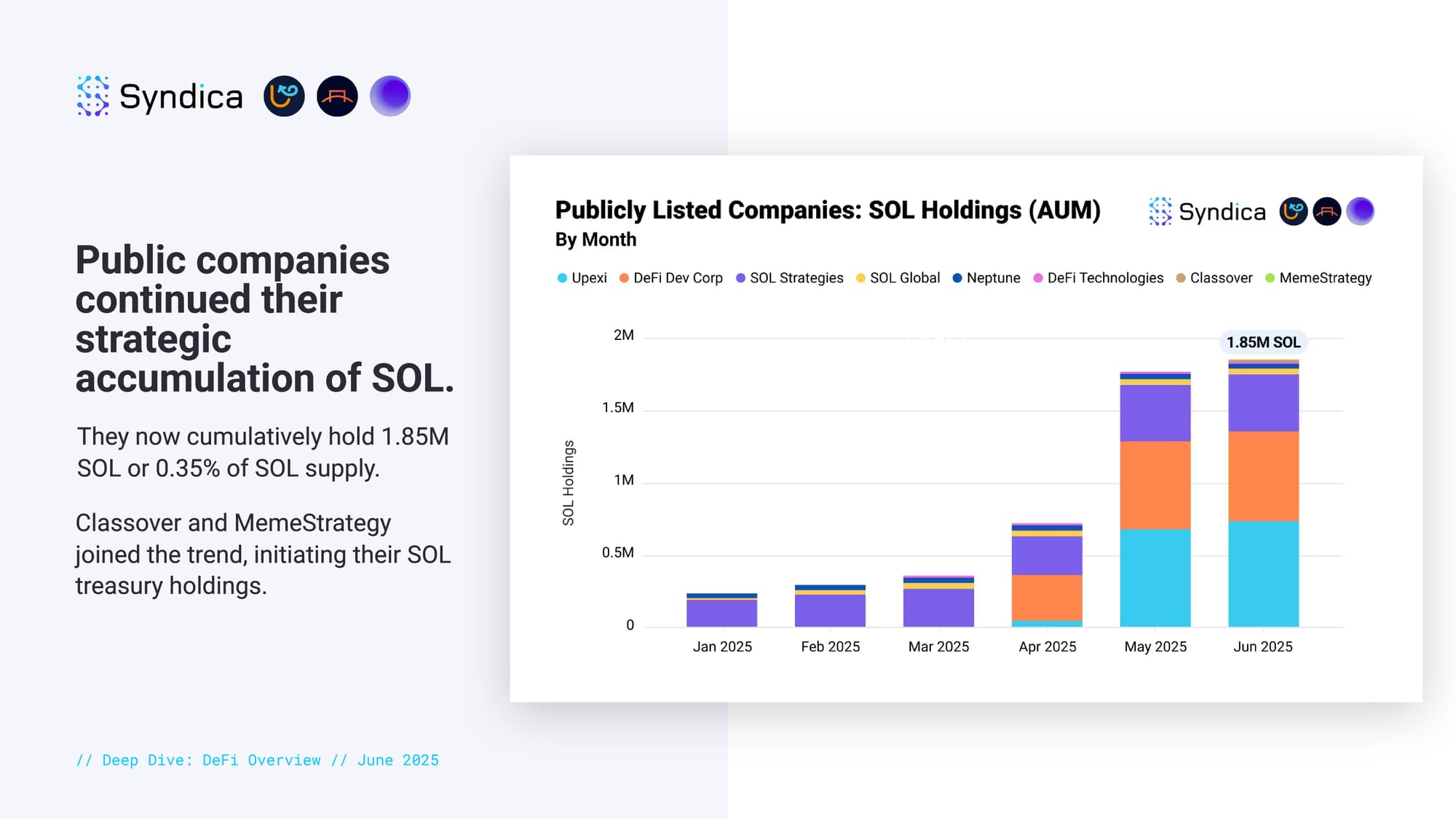

Public companies continued their strategic accumulation of SOL.

They now cumulatively hold 1.85M SOL or 0.35% of SOL supply. Classover and MemeStrategy joined the trend, initiating their SOL treasury holdings.

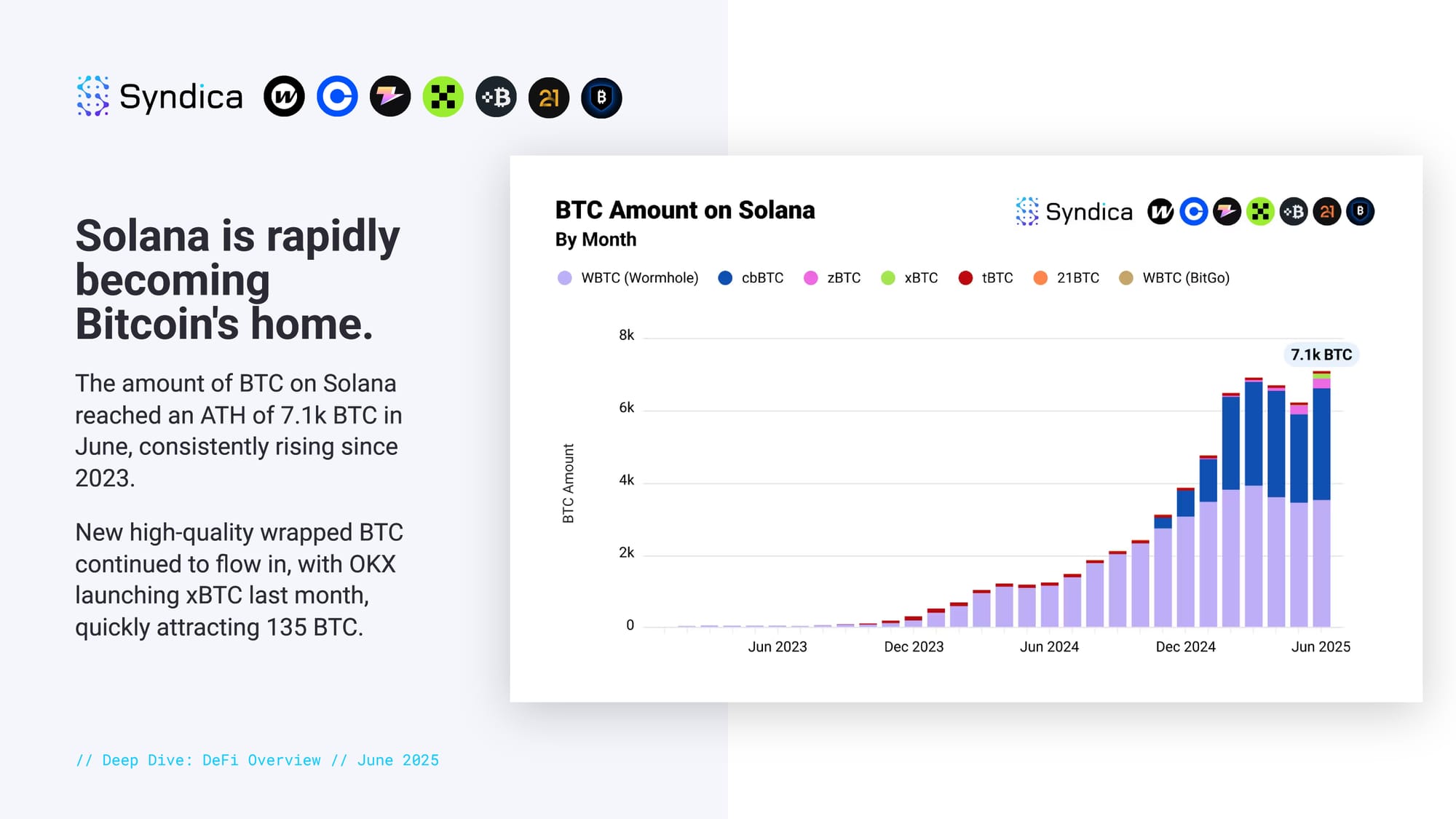

Solana is rapidly becoming Bitcoin's home.

The amount of BTC on Solana reached an ATH of 7.1k BTC in June, consistently rising since 2023. New high-quality wrapped BTC continued to flow in, with OKX launching xBTC last month, quickly attracting 135 BTC.

Part II - DEXes and Aggregators

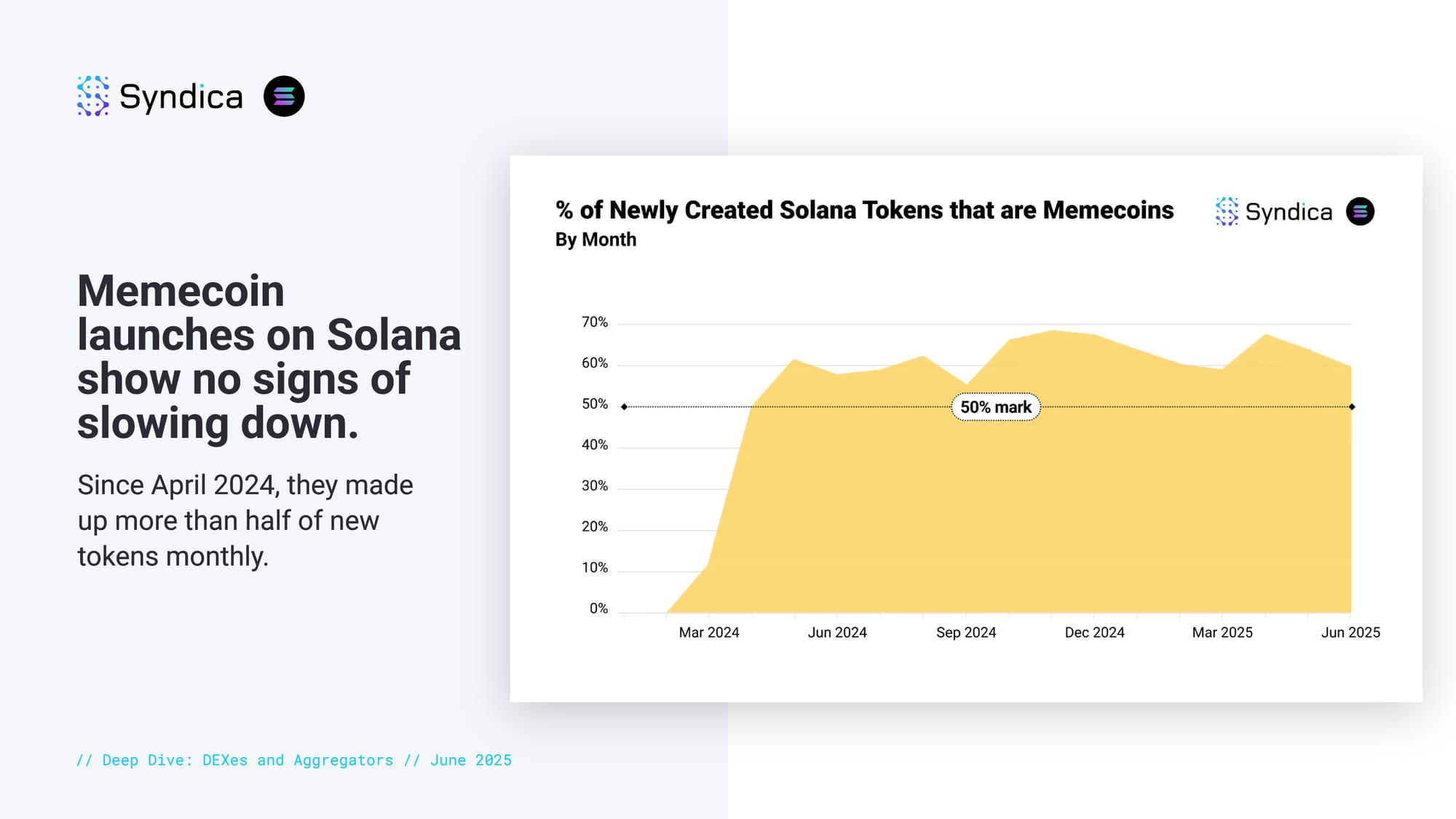

Memecoin launches on Solana show no signs of slowing down.

Since April 2024, they made up more than half of new tokens monthly.

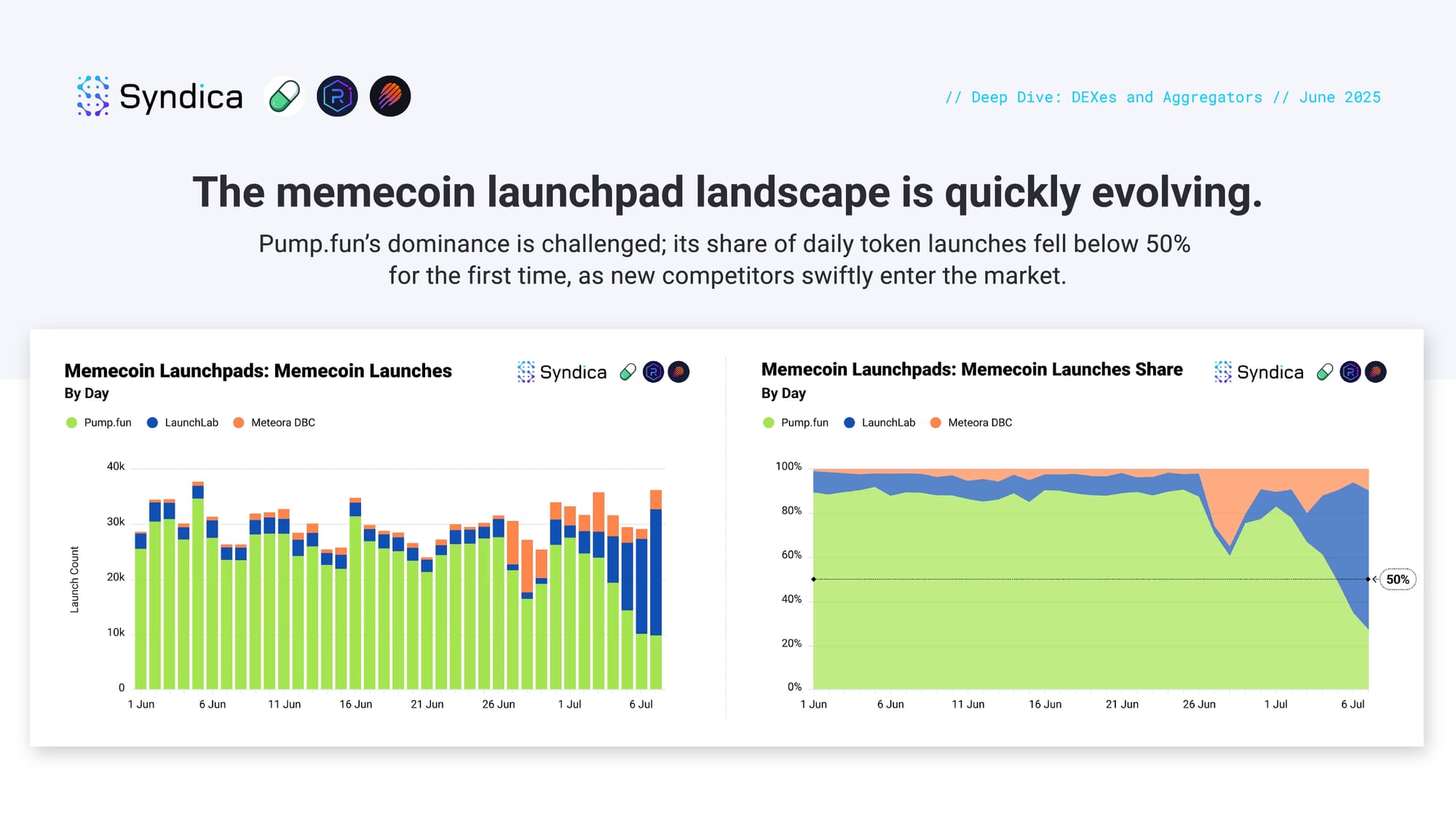

The memecoin launchpad landscape is quickly evolving.

Pump.fun’s dominance is challenged; its share of daily token launches fell below 50% for the first time, as new competitors swiftly enter the market.

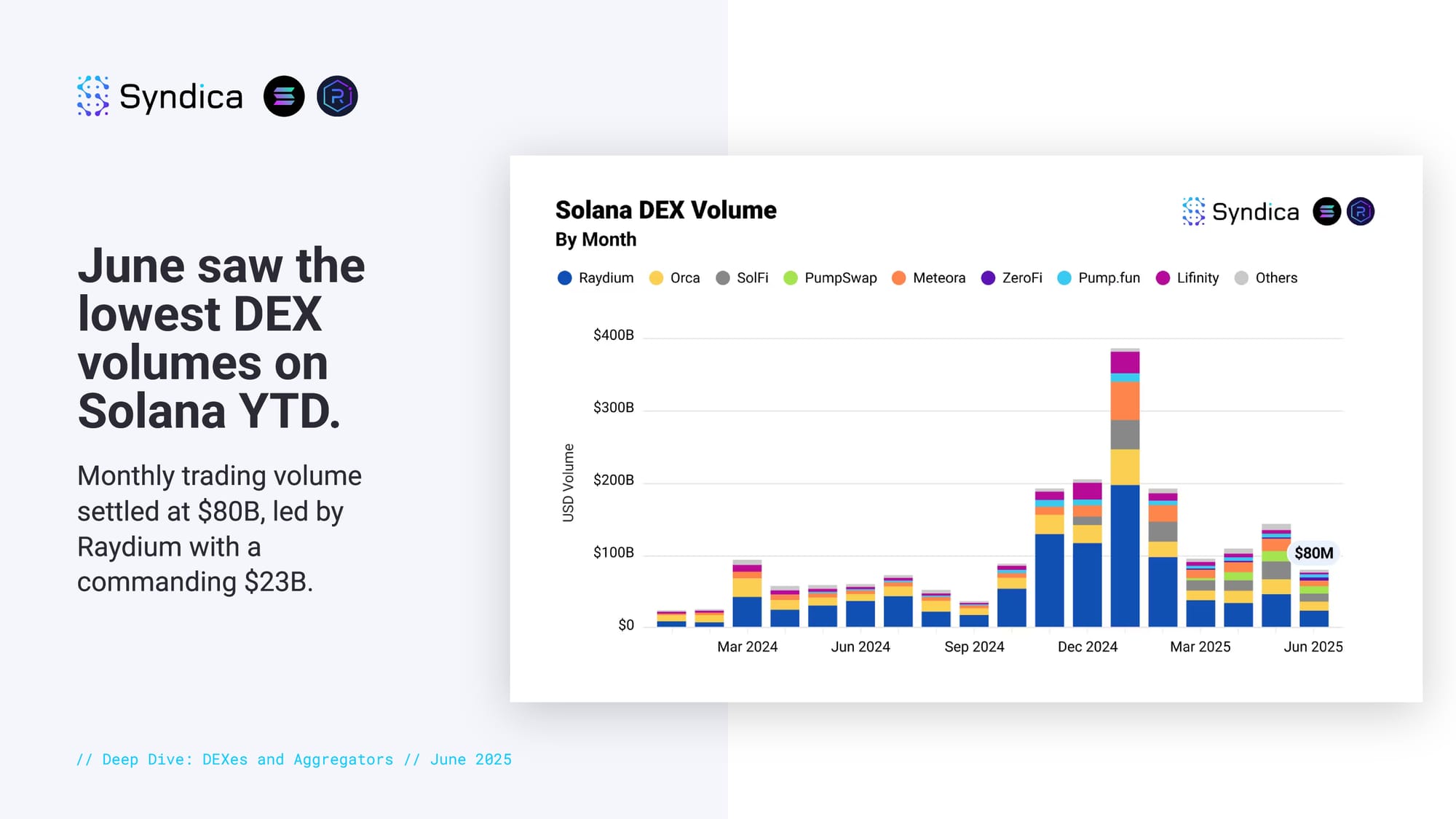

June saw the lowest DEX volumes on Solana YTD.

Monthly trading volume settled at $80B, led by Raydium with a commanding $23B.

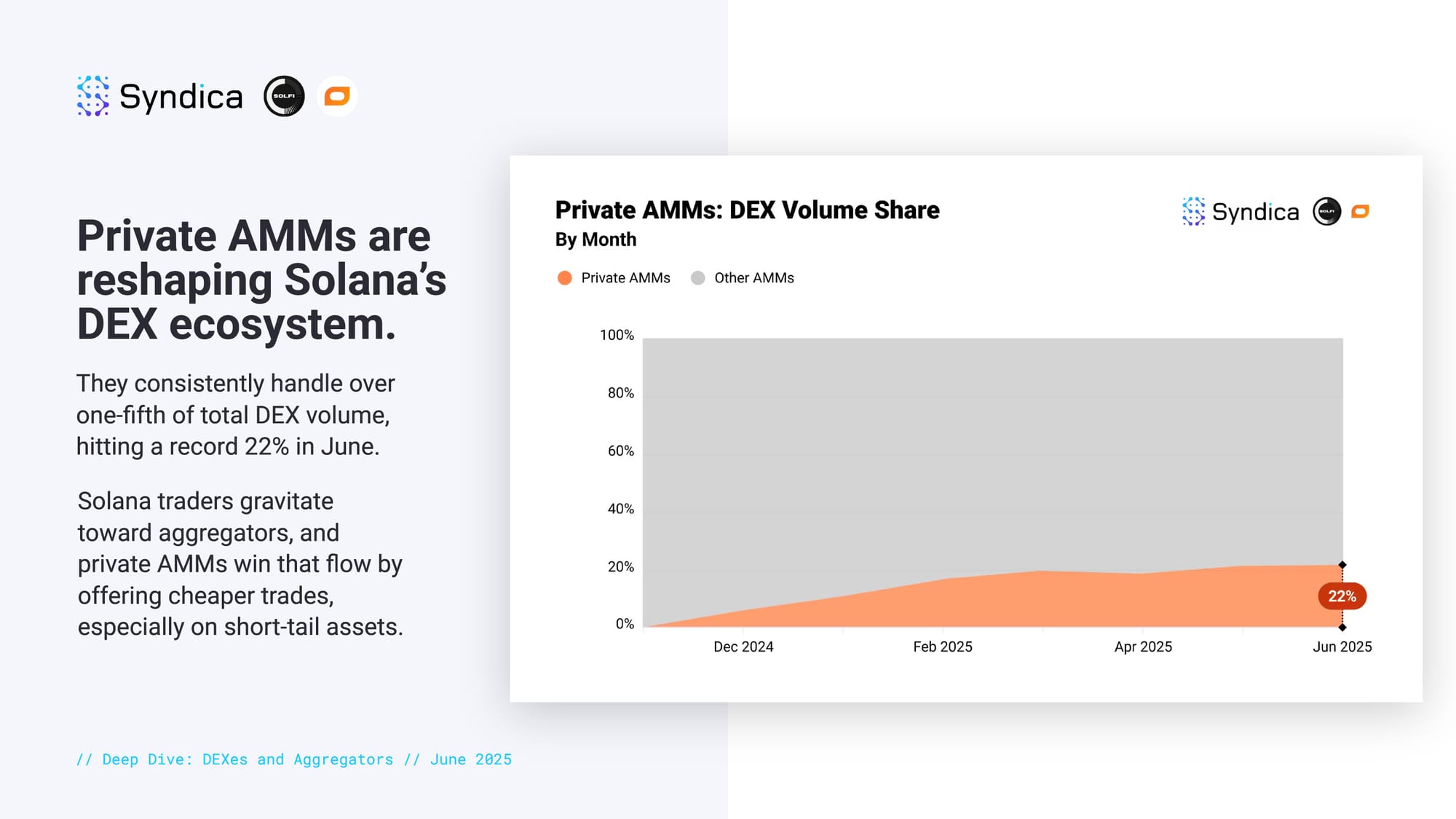

Private AMMs are reshaping Solana’s DEX ecosystem.

They consistently handle over one-fifth of total DEX volume, hitting a record 22% in June. Solana traders gravitate toward aggregators, and private AMMs win that flow by offering cheaper trades, especially on short-tail assets.

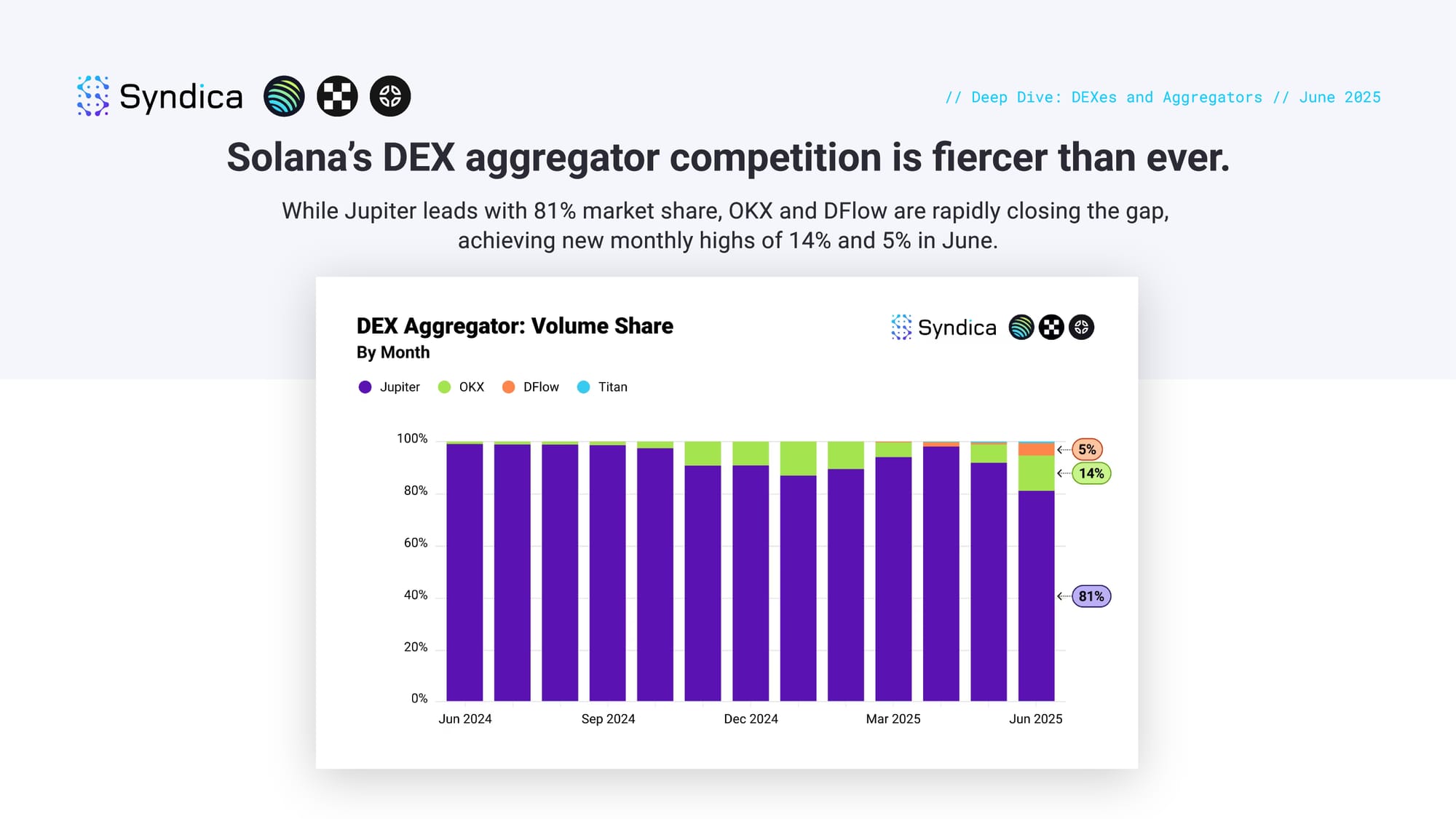

Solana’s DEX aggregator competition is fiercer than ever.

While Jupiter leads with 81% market share, OKX and DFlow are rapidly closing the gap, achieving new monthly highs of 14% and 5% in June.

Part III - Lending and Stablecoins

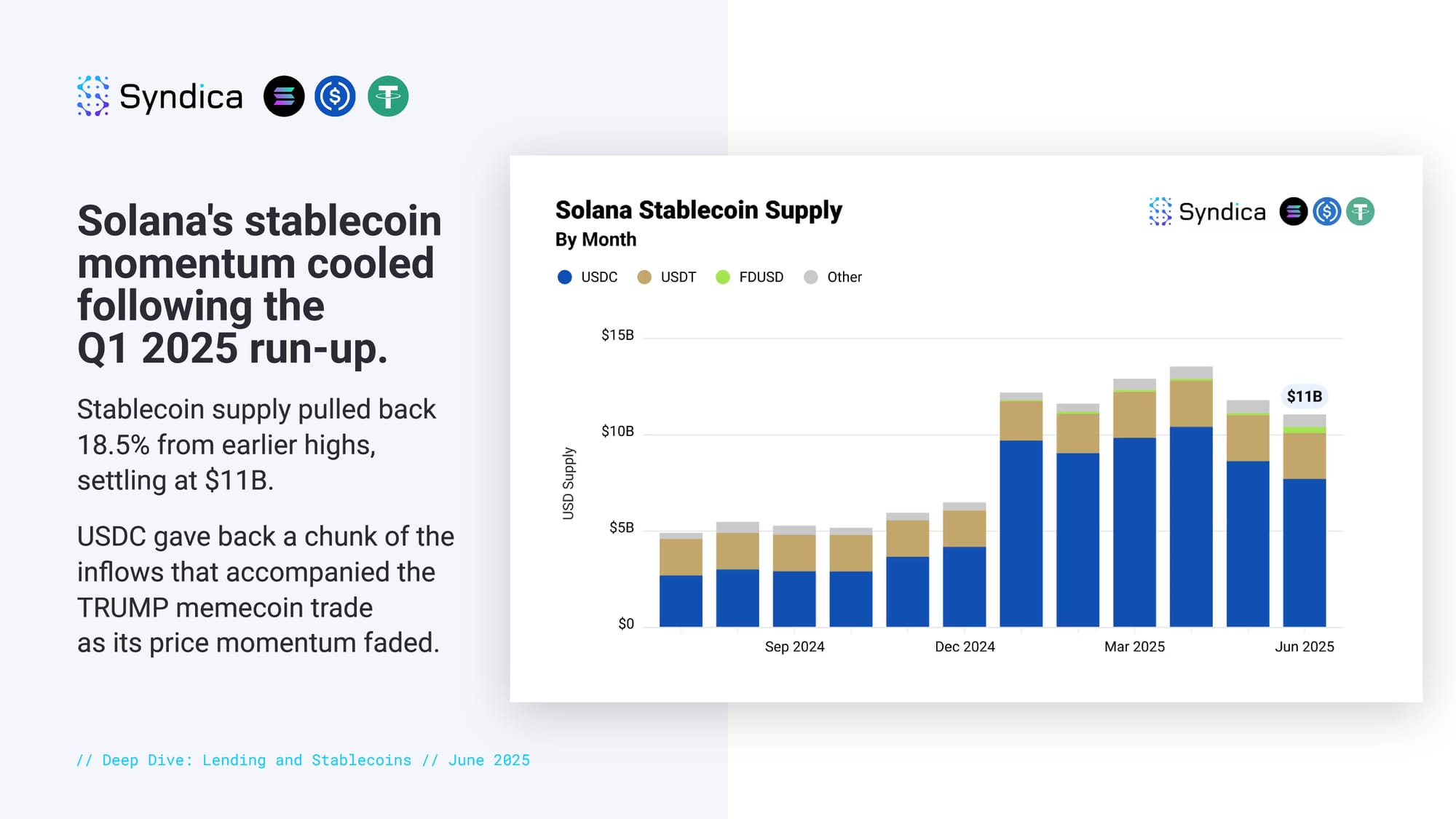

Solana's stablecoin momentum cooled following the Q1 2025 run-up.

Stablecoin supply pulled back 18.5% from earlier highs, settling at $11B. USDC gave back a chunk of the inflows that accompanied the TRUMP memecoin trade as its price momentum faded.

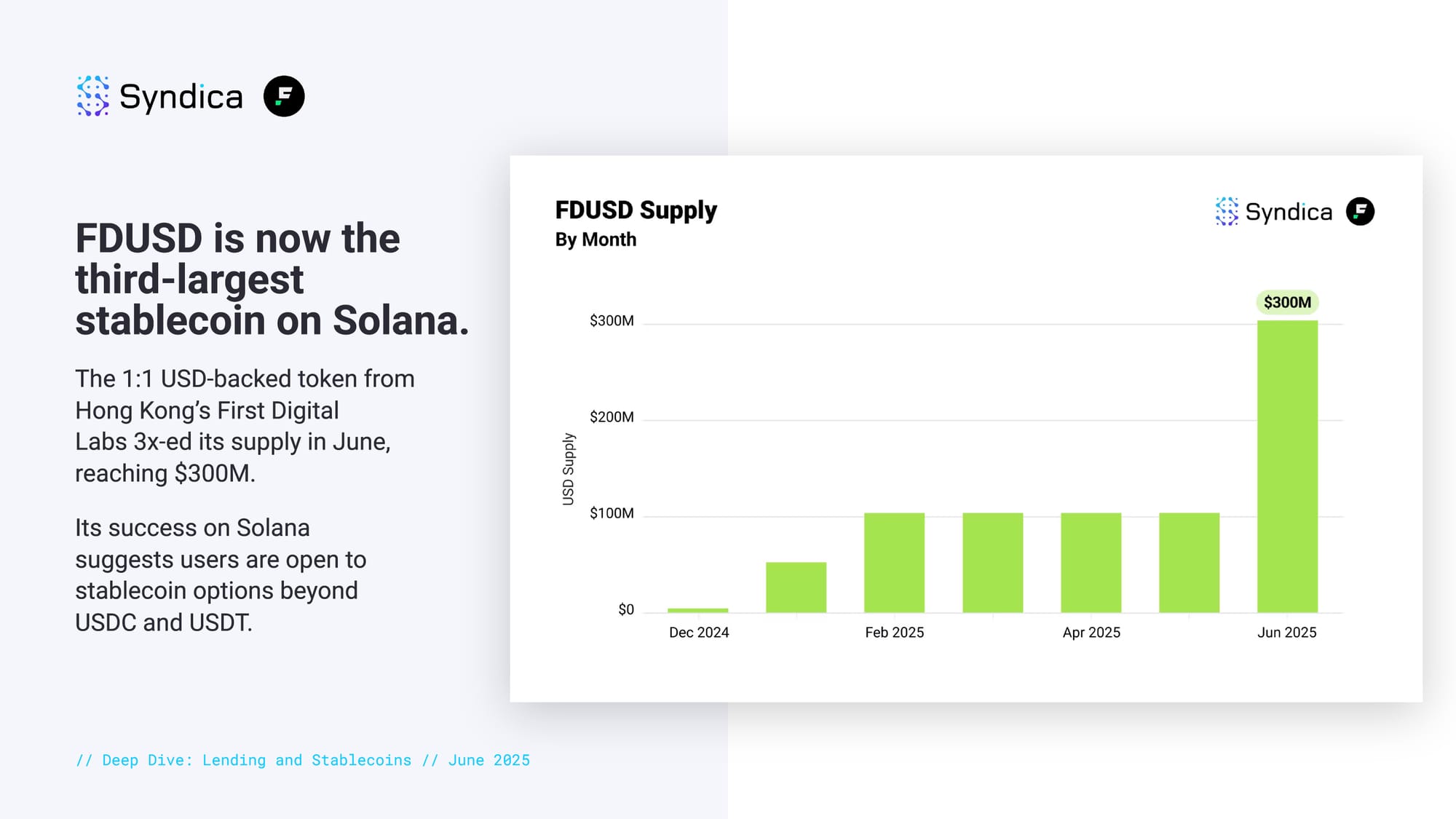

FDUSD is now the third-largest stablecoin on Solana.

The 1:1 USD-backed token from Hong Kong’s First Digital Labs 3x-ed its supply in June, reaching $300M. Its success on Solana suggests users are open to stablecoin options beyond USDC and USDT.

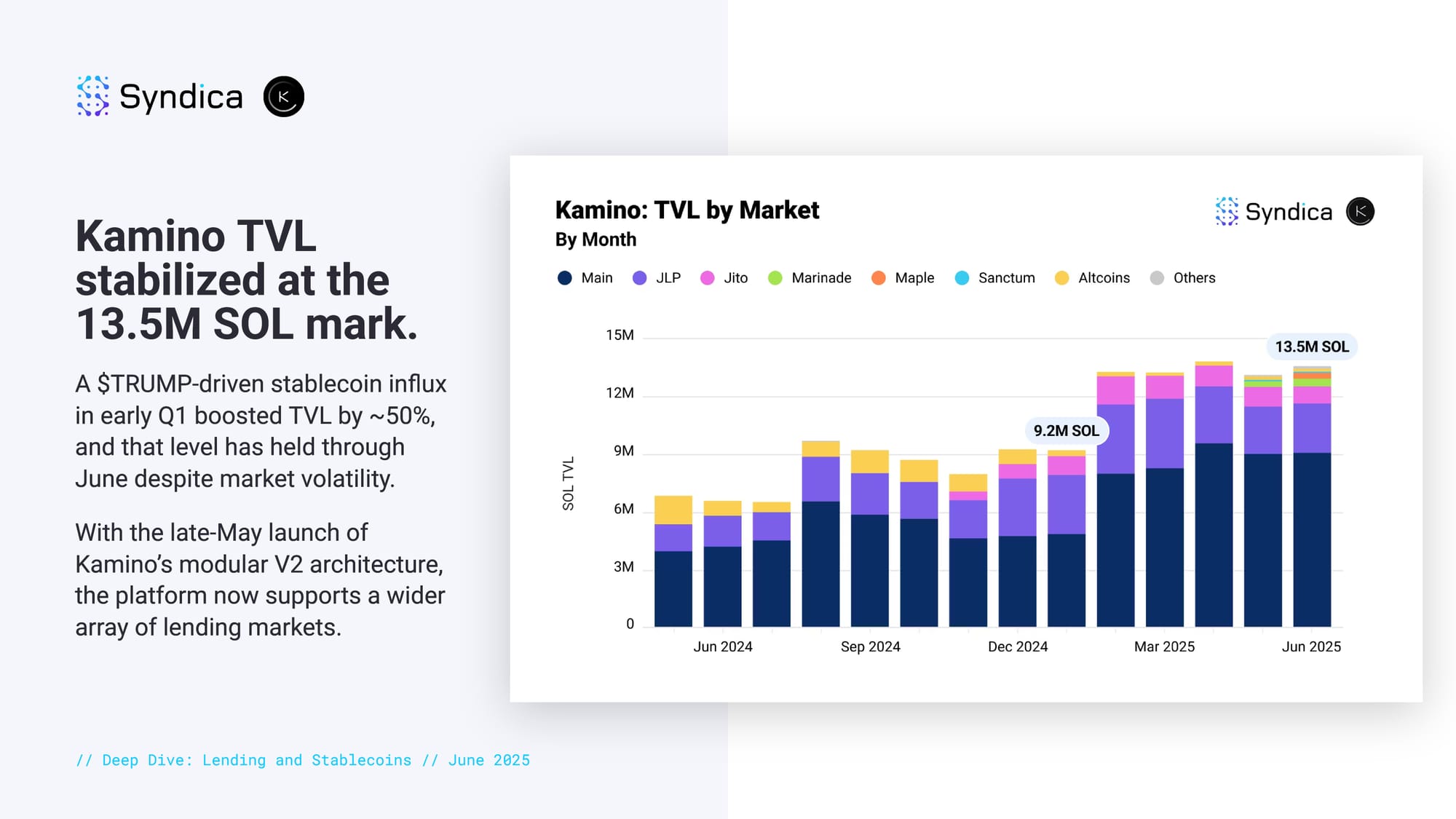

Kamino TVL stabilized at the 13.5M SOL mark.

A $TRUMP-driven stablecoin influx in early Q1 boosted TVL by ~50%, and that level has held through June despite market volatility. With the late-May launch of Kamino’s modular V2 architecture, the platform now supports a wider array of lending markets.

Part IV - Liquid Staking

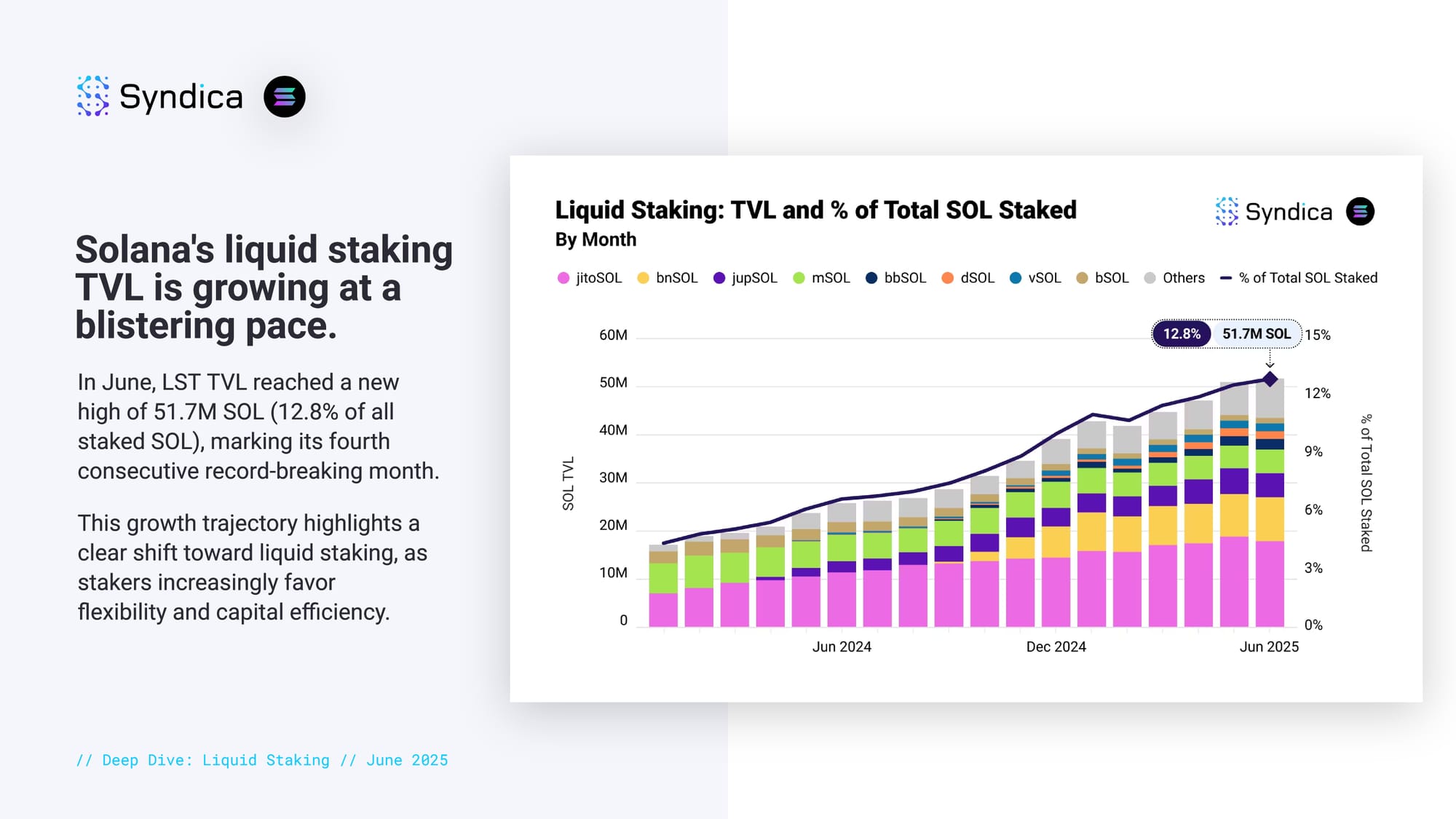

Solana's liquid staking TVL is growing at a blistering pace.

In June, LST TVL reached a new high of 51.7M SOL (12.8% of all staked SOL), marking its fourth consecutive record-breaking month. This growth trajectory highlights a clear shift toward liquid staking, as stakers increasingly favor flexibility and capital efficiency.

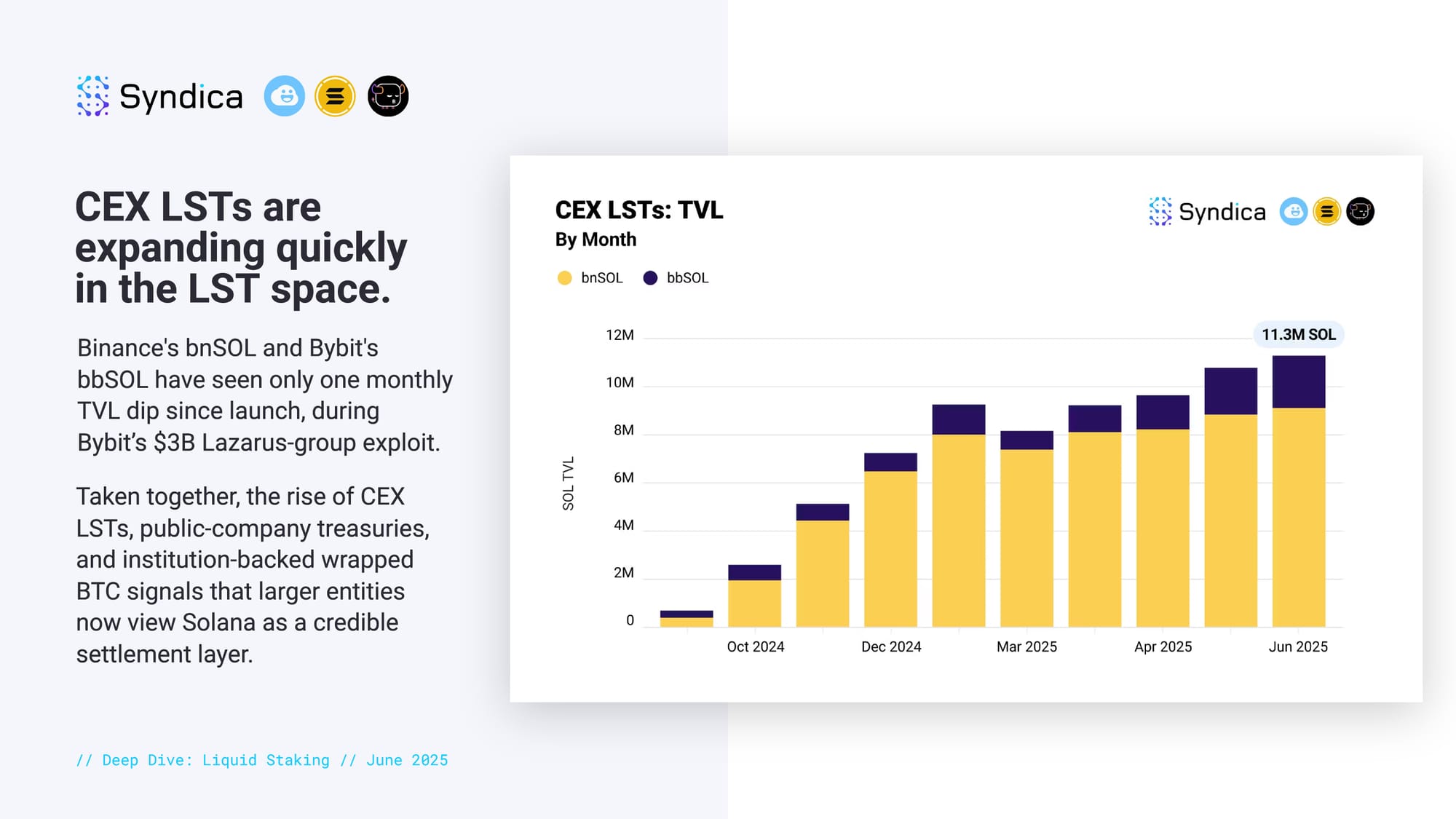

CEX LSTs are expanding quickly in the LST space.

Binance's bnSOL and Bybit's bbSOL have seen only one monthly TVL dip since launch, during Bybit’s $3B Lazarus-group exploit. Taken together, the rise of CEX LSTs, public-company treasuries, and institution-backed wrapped BTC signals that larger entities now view Solana as a credible settlement layer.

Part V - Projects to Watch

Byreal - Bybit unveiled Byreal, a hybrid CEX/DEX that fuses centralized liquidity with on-chain settlement speeds.

Ranger Finance - Ranger Finance broadened its scope with a unified spot exchange now in open beta and rolled out limit orders for its perpetuals markets.

Hylo - Hylo introduced hyUSD and xSOL, delivering stablecoin exposure and leveraged yield with no liquidation risk.

Asgard Finance - Asgard Finance opened its public beta, offering optimized yield strategies across Solana’s DeFi landscape.

Jupiter Studio - Jupiter launched Jupiter Studio, a no-code token-creation suite featuring flexible tokenomics, fair-launch tooling, and seamless integration with Jupiter’s trading ecosystem.