Deep Dive: Solana DeFi - March 2025

Deep Dive: Solana DeFi - March 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - March 2025

Part I: DeFi Overview

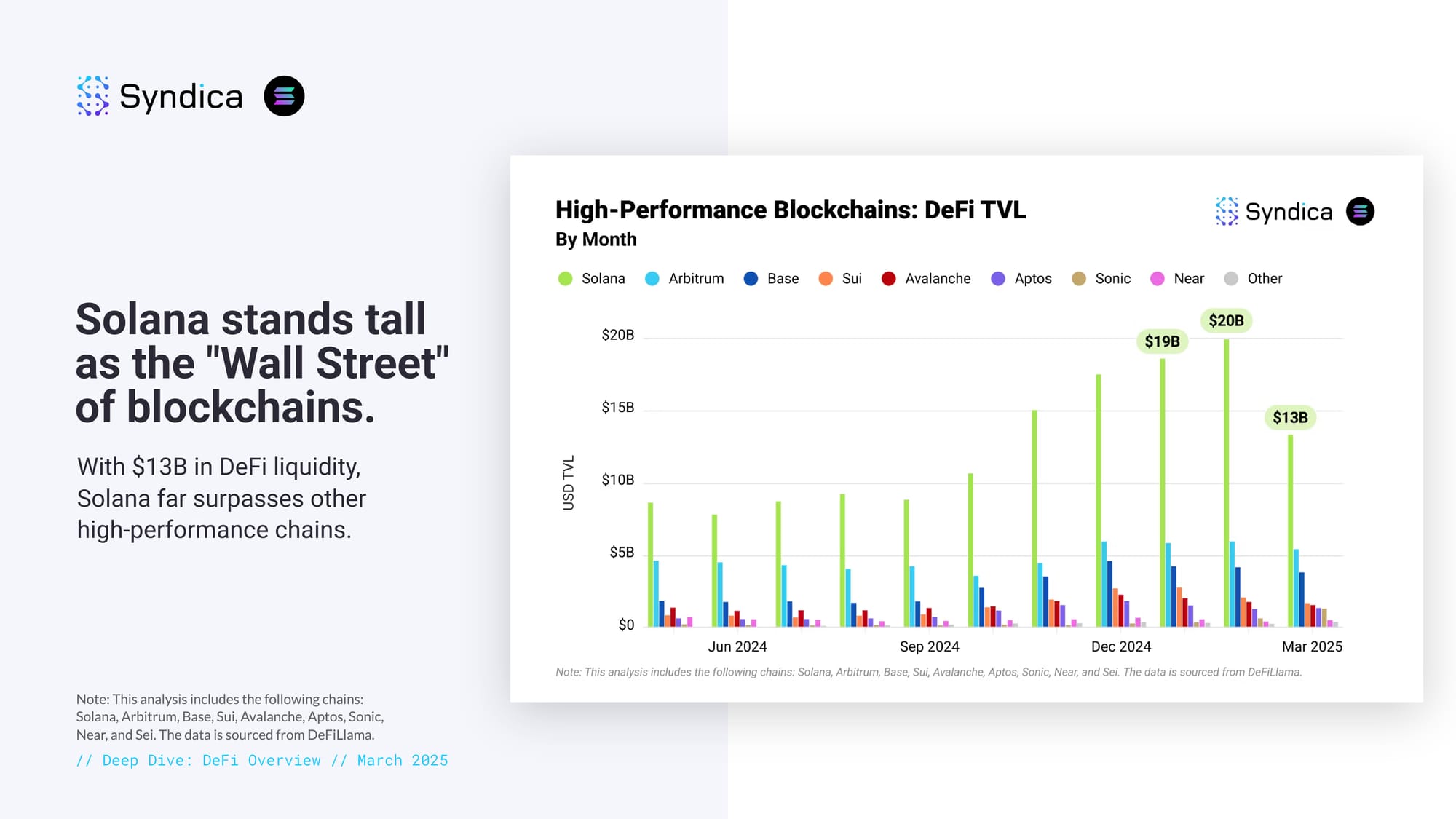

Solana stands tall as the "Wall Street" of blockchains. With $13B in DeFi liquidity, Solana far surpasses other high-performance chains.

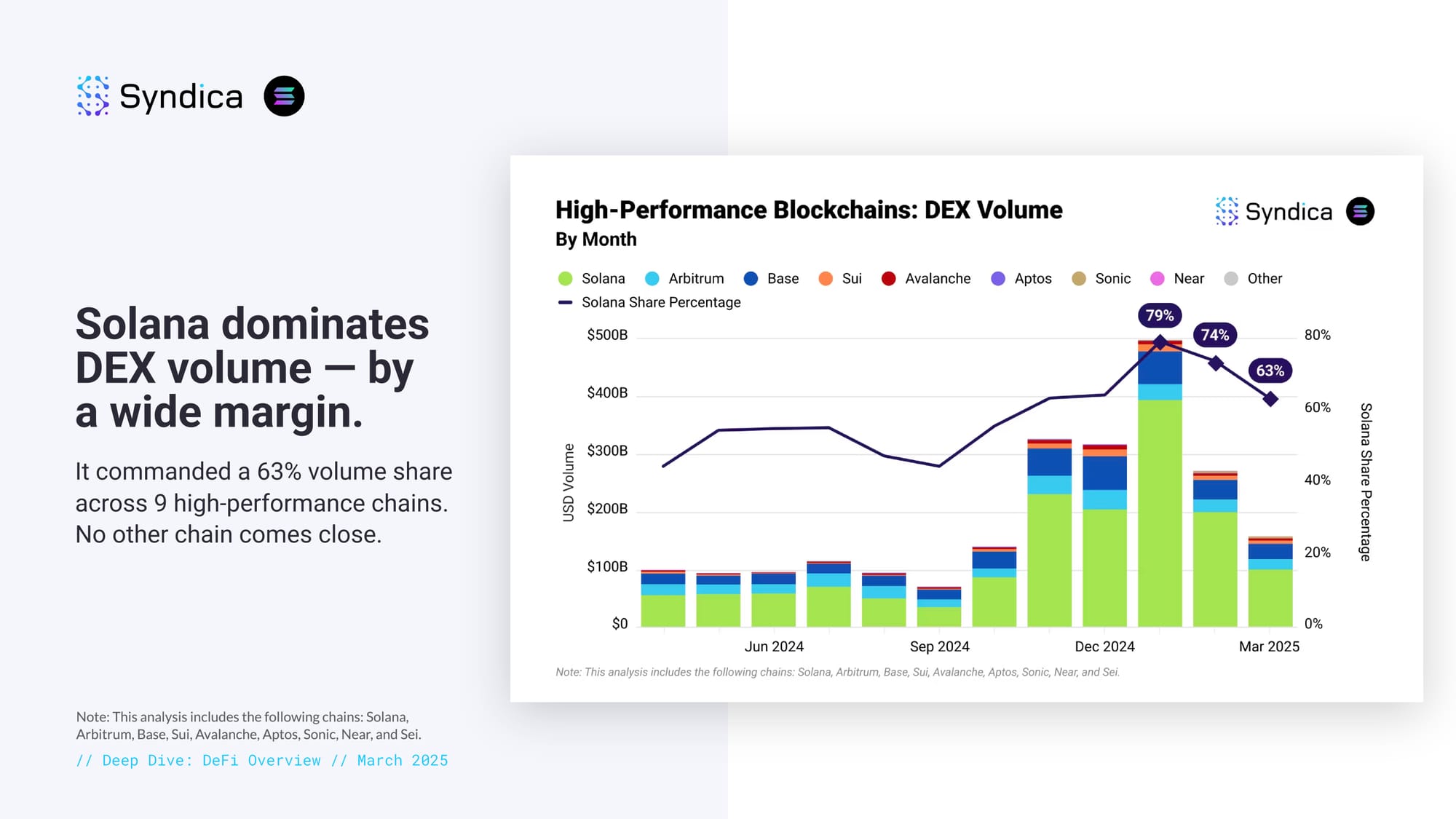

Solana dominates DEX volume — by a wide margin. It commanded a 63% volume share across 9 high-performance chains. No other chain comes close.

Part II: DEXes and Aggregators

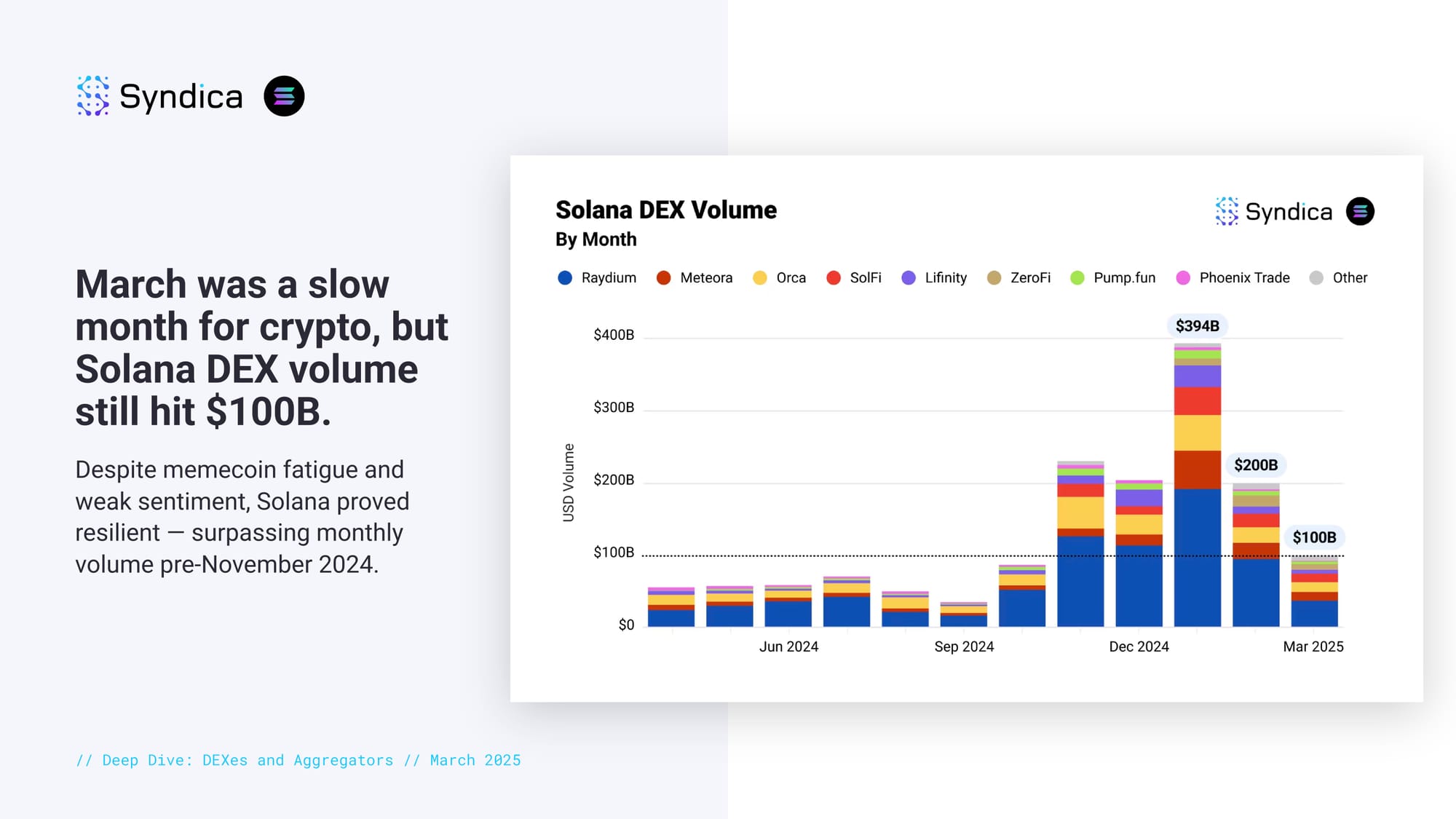

March was a slow month for crypto, but Solana DEX volume still hit $100B. Despite memecoin fatigue and weak sentiment, Solana proved resilient — surpassing monthly volume pre-November 2024.

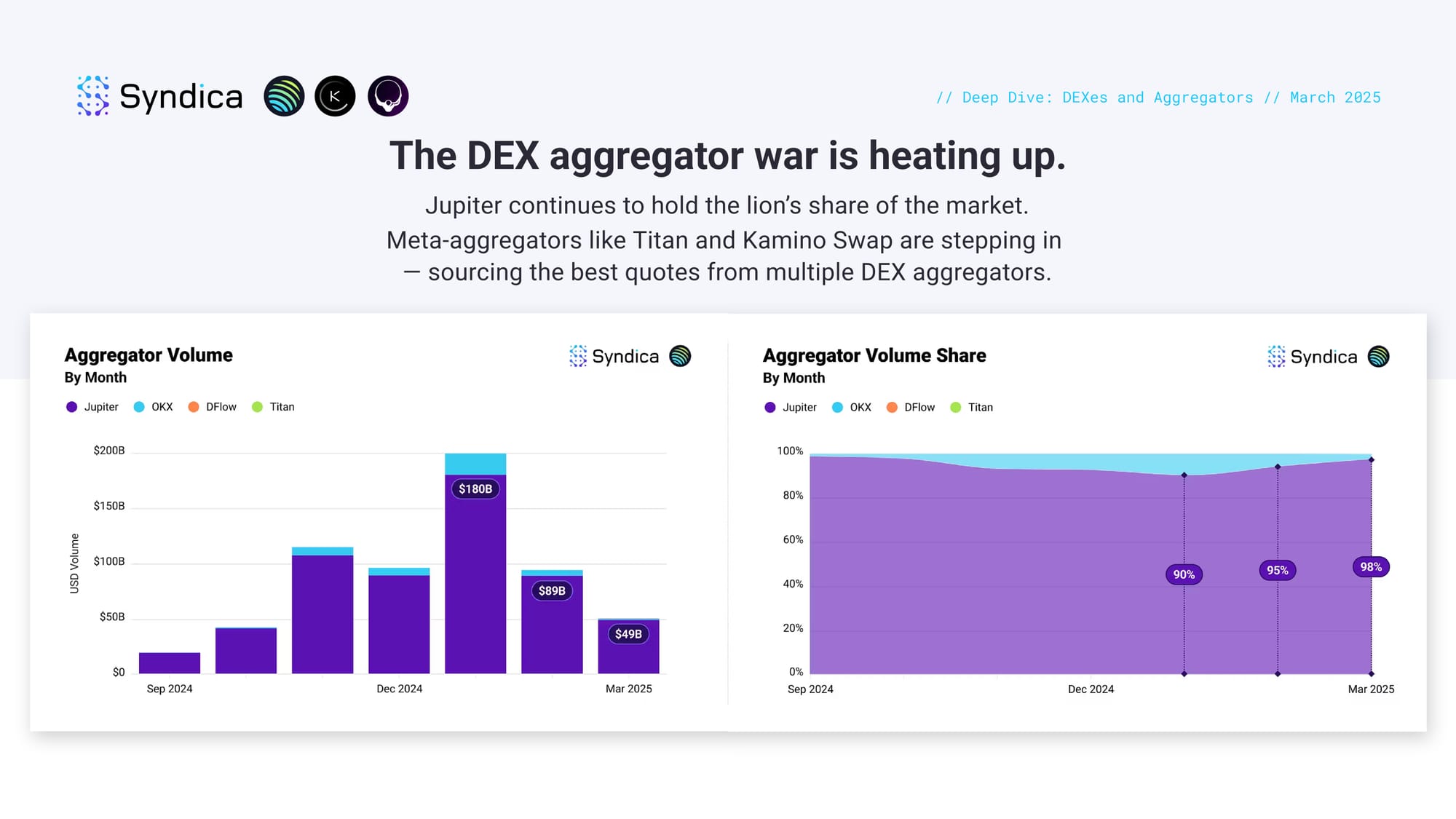

The DEX aggregator war is heating up. Jupiter continues to hold the lion’s share of the market. Meta-aggregators like Titan and Kamino Swap are stepping in — sourcing the best quotes from multiple DEX aggregators.

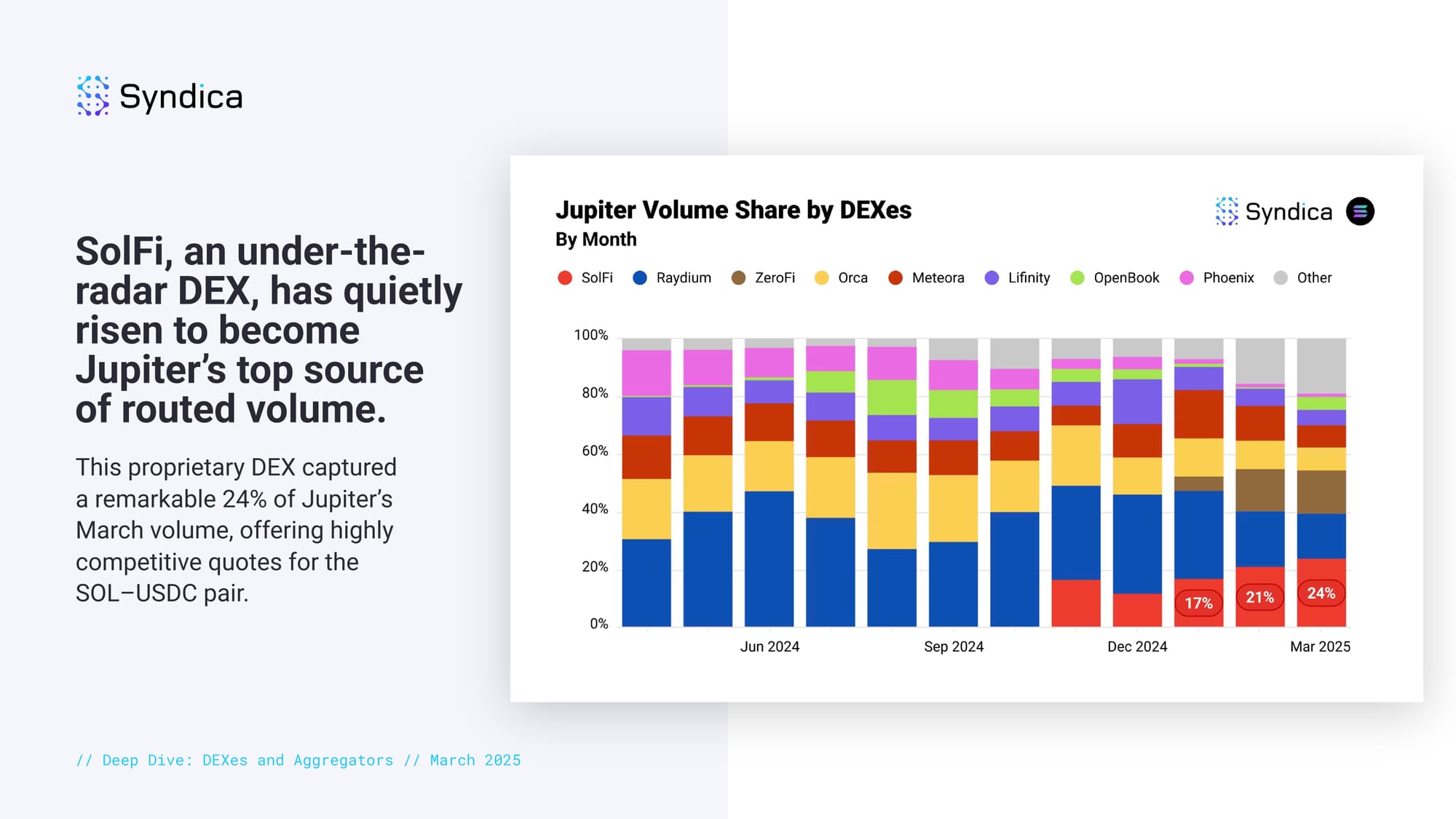

SolFi, an under-the-radar DEX, has quietly risen to become Jupiter’s top source of routed volume. This proprietary DEX captured a remarkable 24% of Jupiter’s March volume, offering highly competitive quotes for the SOL–USDC pair.

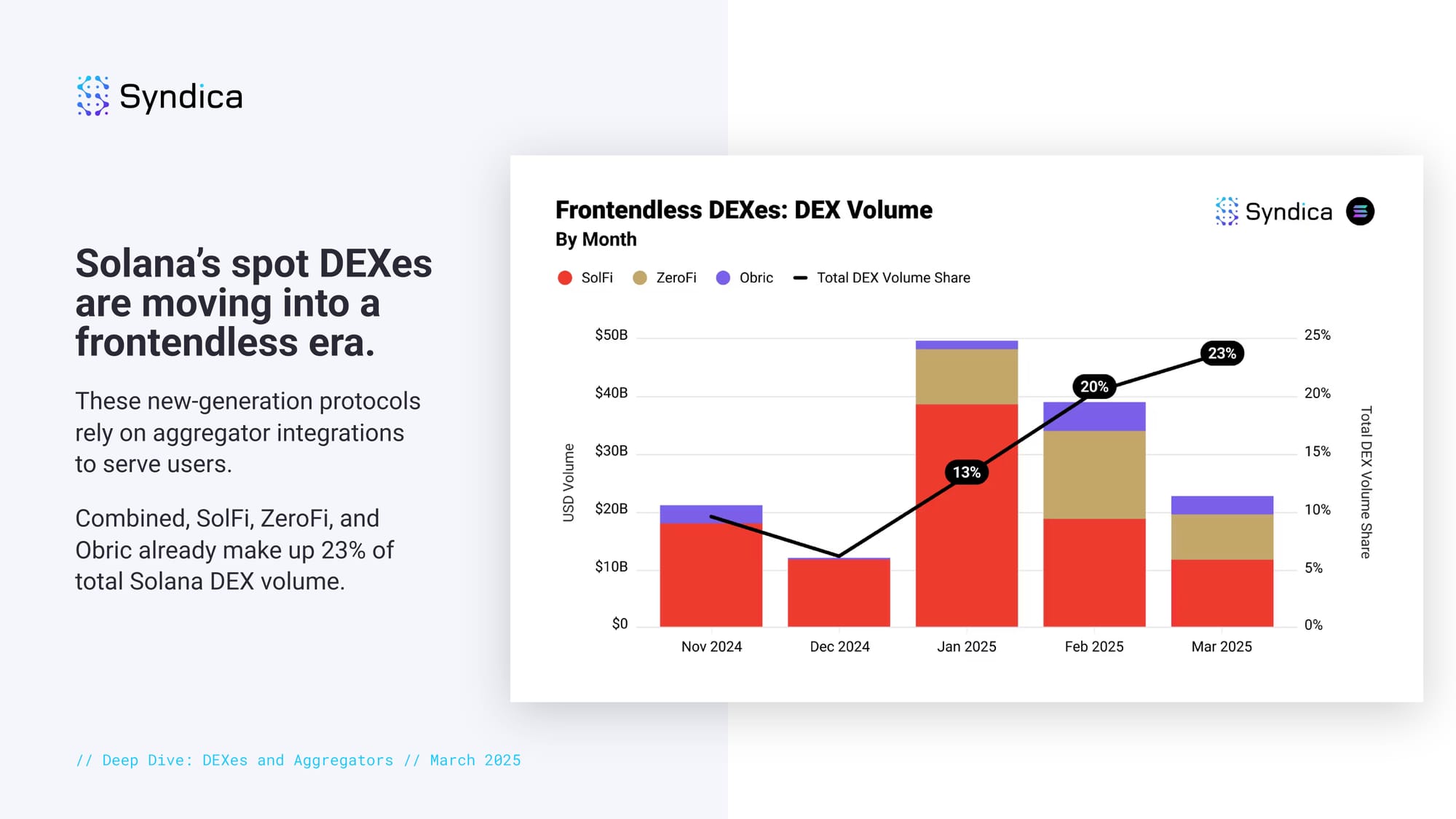

Solana’s spot DEXes are moving into a frontendless era. These new-generation protocols rely on aggregator integrations to serve users. Combined, SolFi, ZeroFi, and Obric already make up 23% of total Solana DEX volume.

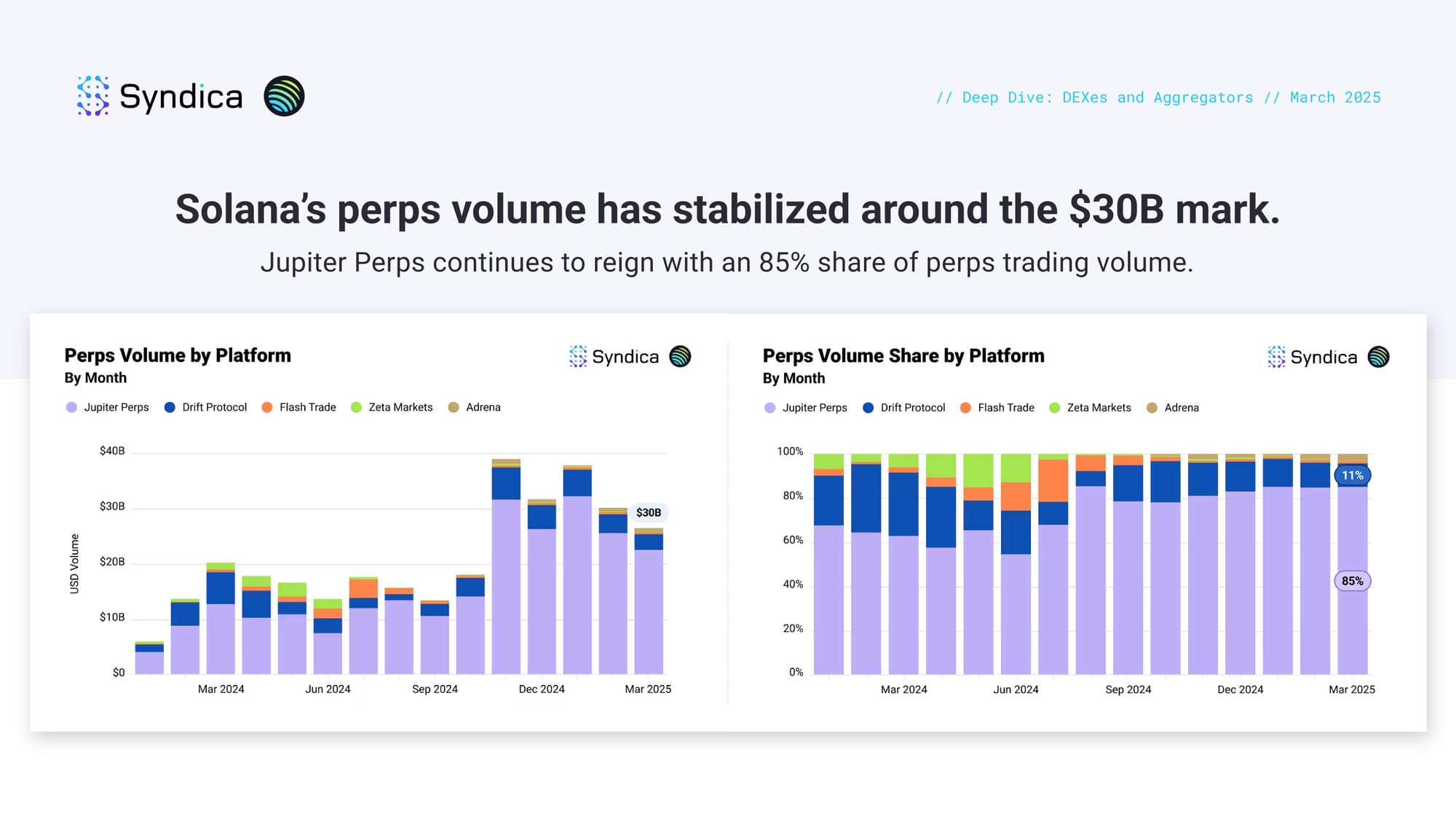

Solana’s perps volume has stabilized around the $30B mark. Jupiter Perps continues to reign with an 85% share of perps trading volume.

Part III: Lending and Stablecoins

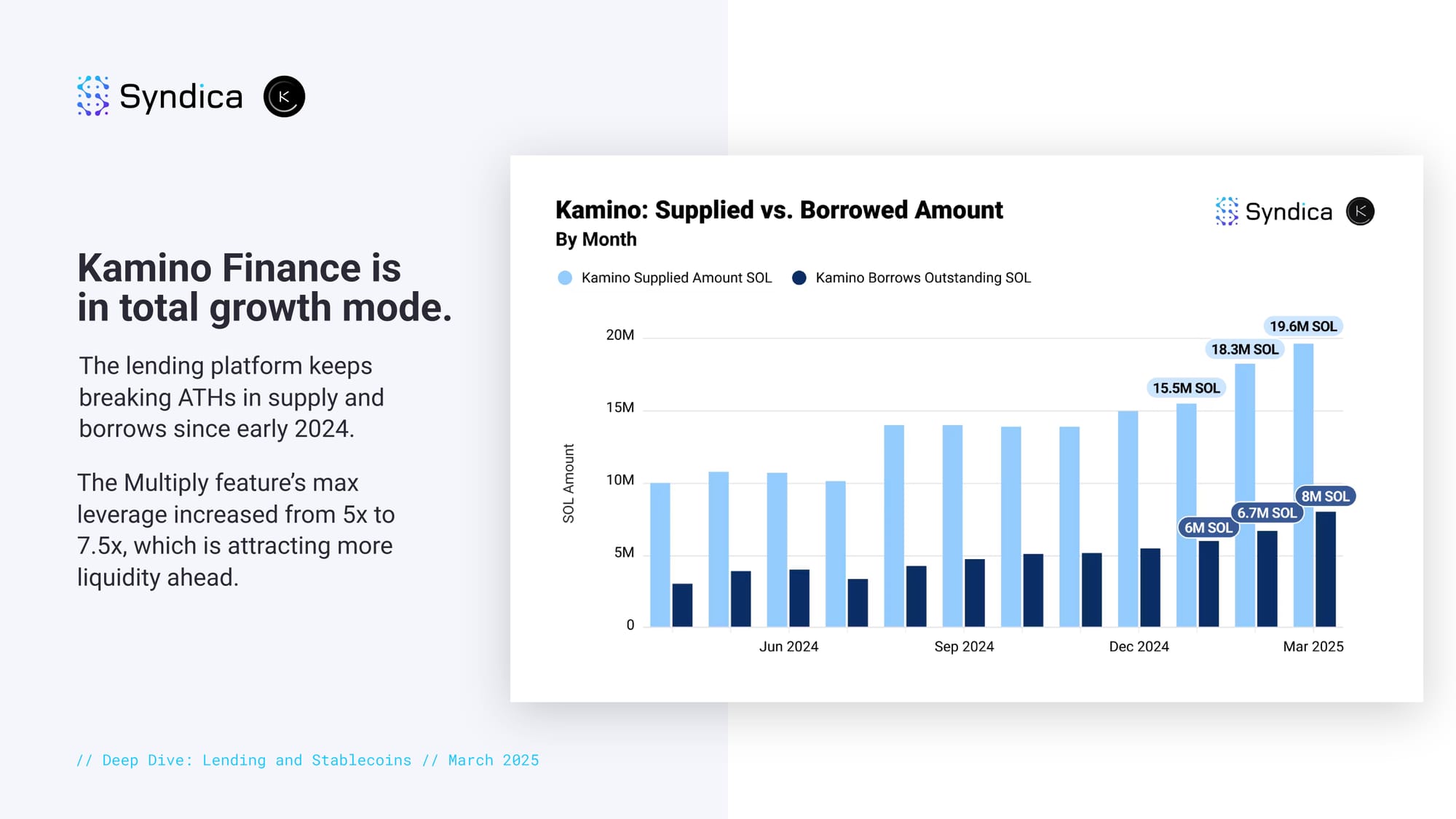

Kamino Finance is in total growth mode. The lending platform keeps breaking ATHs in supply and borrows since early 2024. The Multiply feature’s max leverage increased from 5x to 7.5x, which is attracting more liquidity ahead.

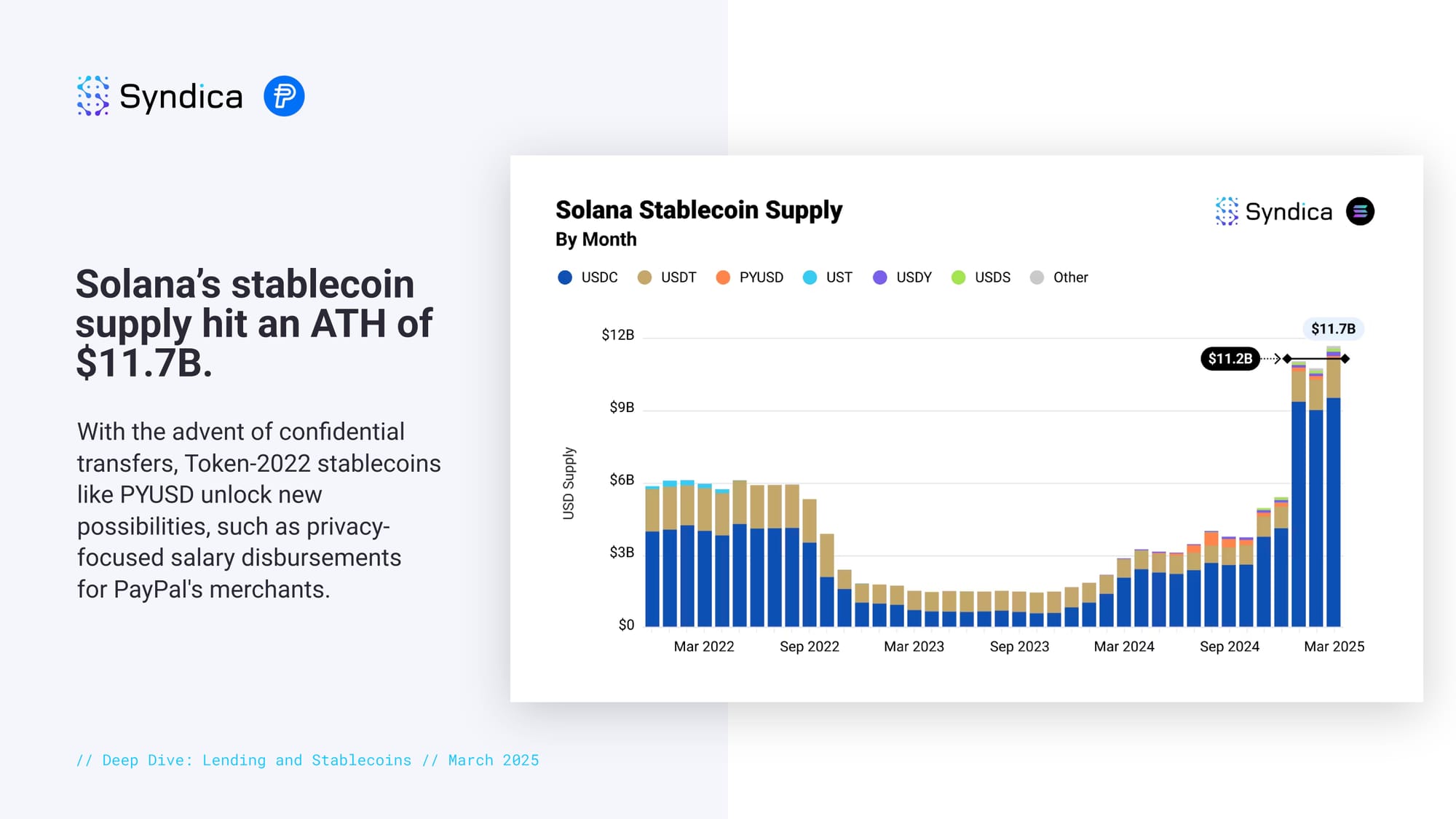

Solana’s stablecoin supply hit an ATH of $11.7B. With the advent of confidential transfers, Token-2022 stablecoins like PYUSD unlock new possibilities, such as privacy-focused salary disbursements for PayPal's merchants.

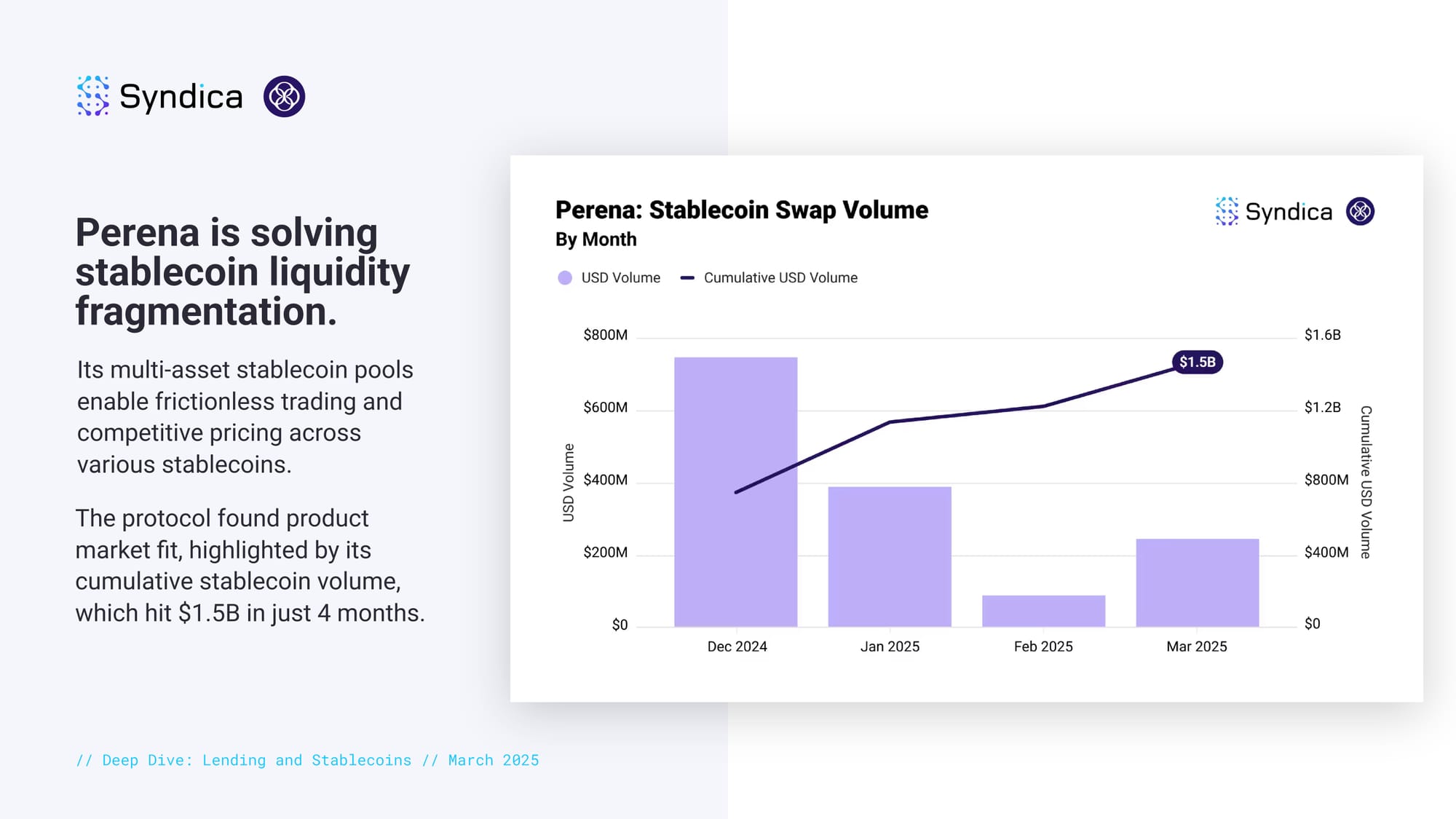

Perena is solving stablecoin liquidity fragmentation. Its multi-asset stablecoin pools enable frictionless trading and competitive pricing across various stablecoins. The protocol found product market fit, highlighted by its cumulative stablecoin volume, which hit $1.5B in just 4 months.

Part IV: Liquid Staking

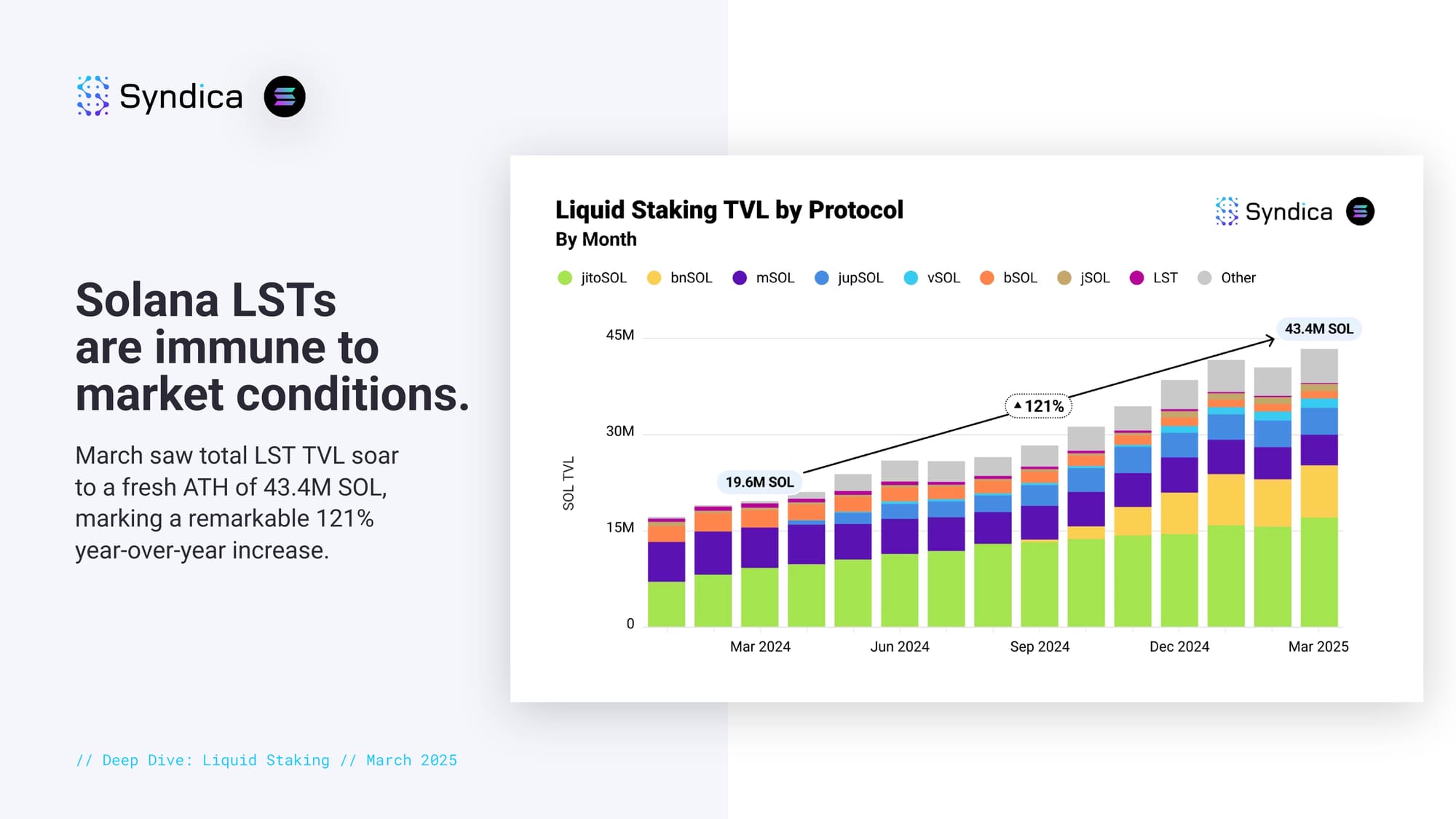

Solana LSTs are immune to market conditions. March saw total LST TVL soar to a fresh ATH of 43.4M SOL, marking a remarkable 121% year-over-year increase.

Backpack joins the LST arena with bpSOL. Launched in partnership with Sanctum, bpSOL reached 10.5k SOL TVL in just 4 weeks. Higher stake translates to greater bandwidth — and faster performance for users. This development may spark a trend of wallet-based LSTs from providers like Phantom and Solflare.

Bybit’s bbSOL is bouncing back after the Lazarus $3B hack. TVL dipped below 1M SOL in February; however, user trust has been restored. With leadership proving credible not only during the crisis but also afterward, bbSOL's TVL is on the rise again.

Part V: Cross-chain Bridges

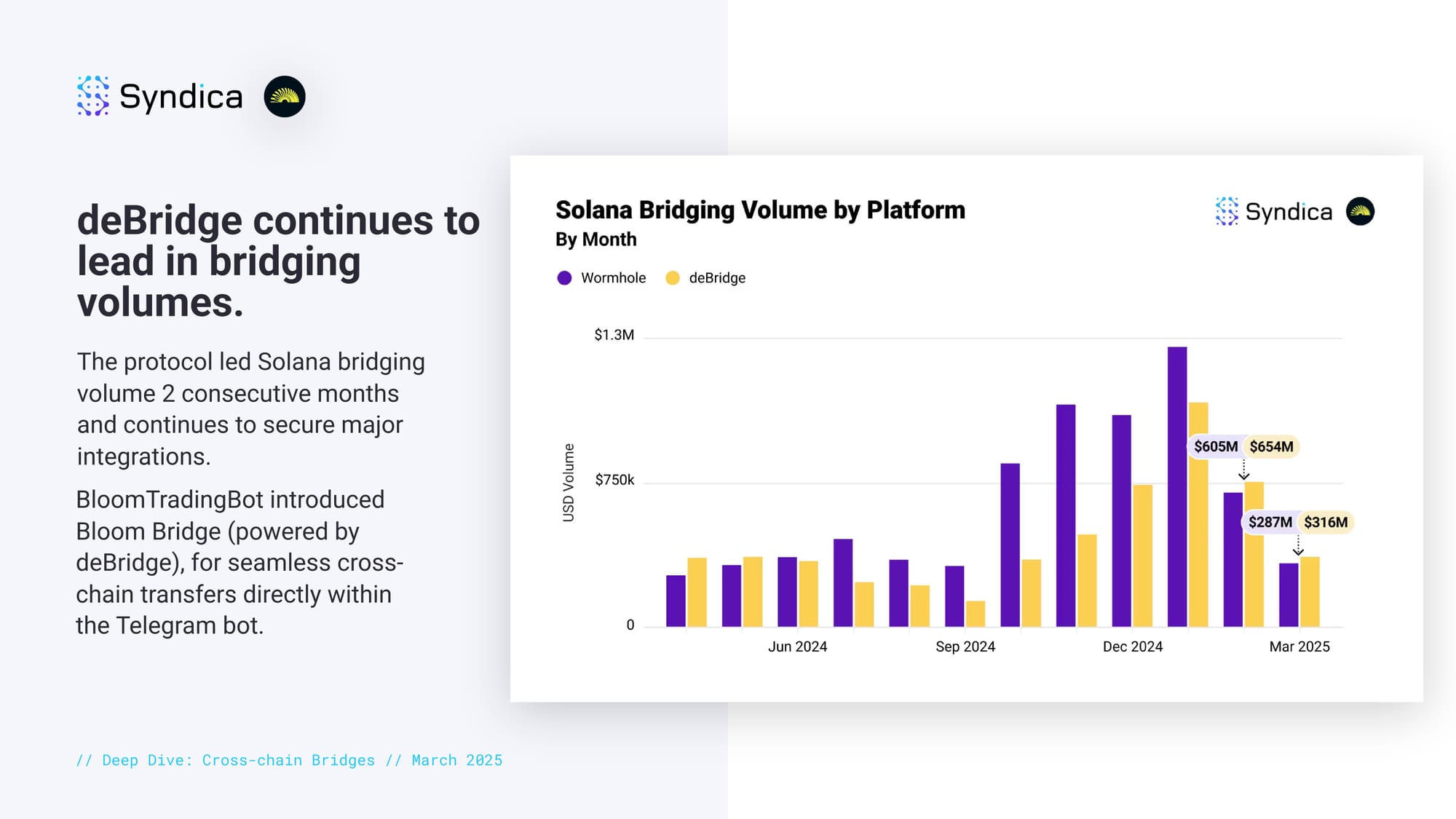

deBridge continues to lead in bridging volumes. The protocol led Solana bridging volume 2 consecutive months and continues to secure major integrations. BloomTradingBot introduced Bloom Bridge (powered by deBridge), for seamless cross-chain transfers directly within the Telegram bot.

Part VI: Projects to Watch

Flash Trade’s $FAF TGE is set for April 15, 2025, unlocking user perks and community engagement. The protocol partnered with MagicBlock, aiming to achieve sub-50ms trade execution.

Bullet is Zeta Markets’ new low-latency trading layer that promises a CEX-like experience. Zeta launched Bullet’s public testnet in March 2025.

Adrena ran its second perps trading competition—“Expanse” and made all locked $ALP liquid for wider DeFi integration.

time.fun lets creators mint tradable tokens representing minutes of their time. It gained attention when Solana co-founder Anatoly tokenized his time.

dev.fun allows anyone to build mini-apps without code by leveraging AI tools and composable templates. Users can link their apps with pump.fun tokens, profiting when the app goes viral.