Deep Dive: Solana DeFi - May 2024

Deep Dive: Solana DeFi - May 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - May 2024

1. Spot DEXes

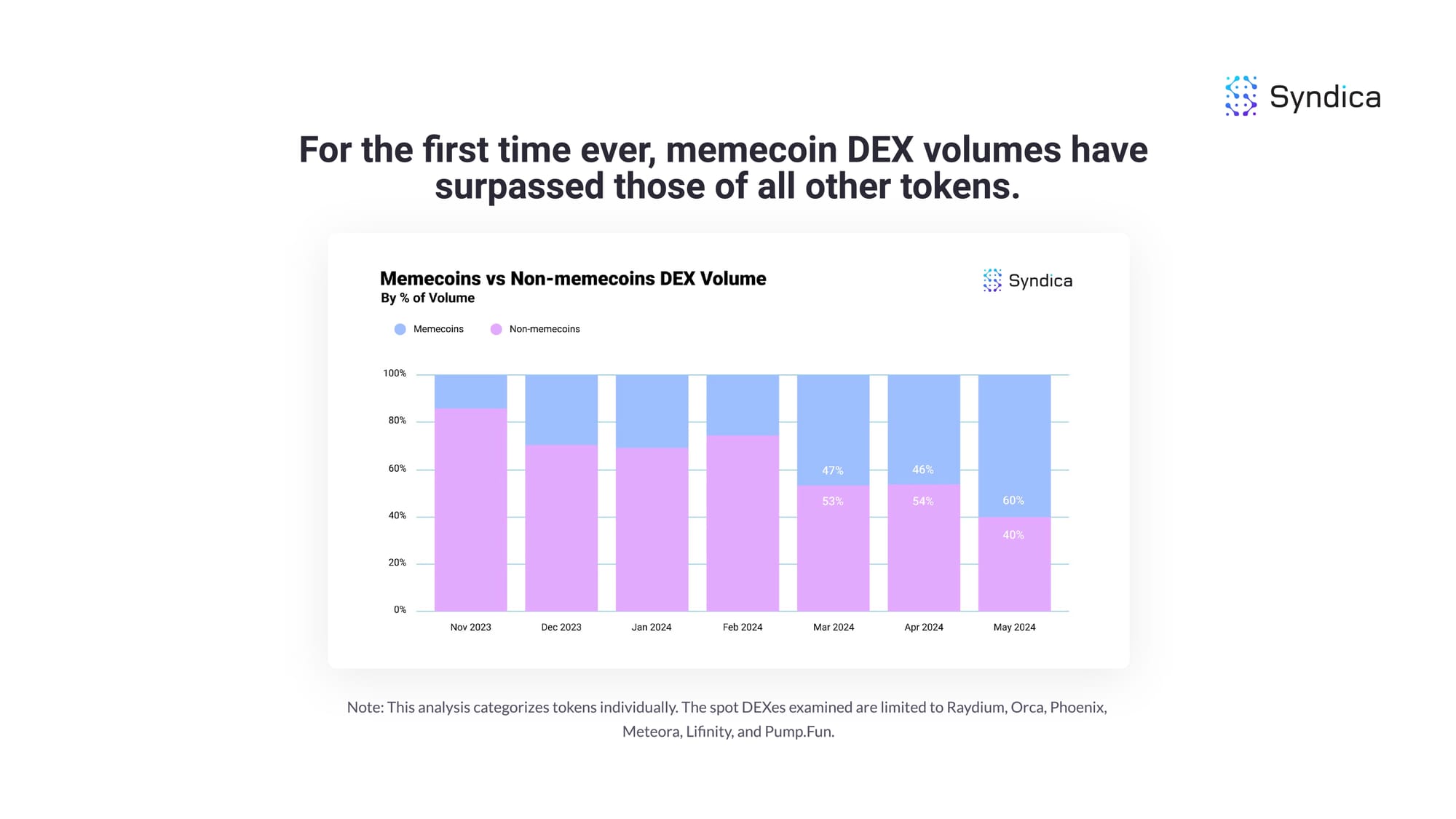

For the first time ever, memecoin DEX volumes have surpassed those of all other tokens.

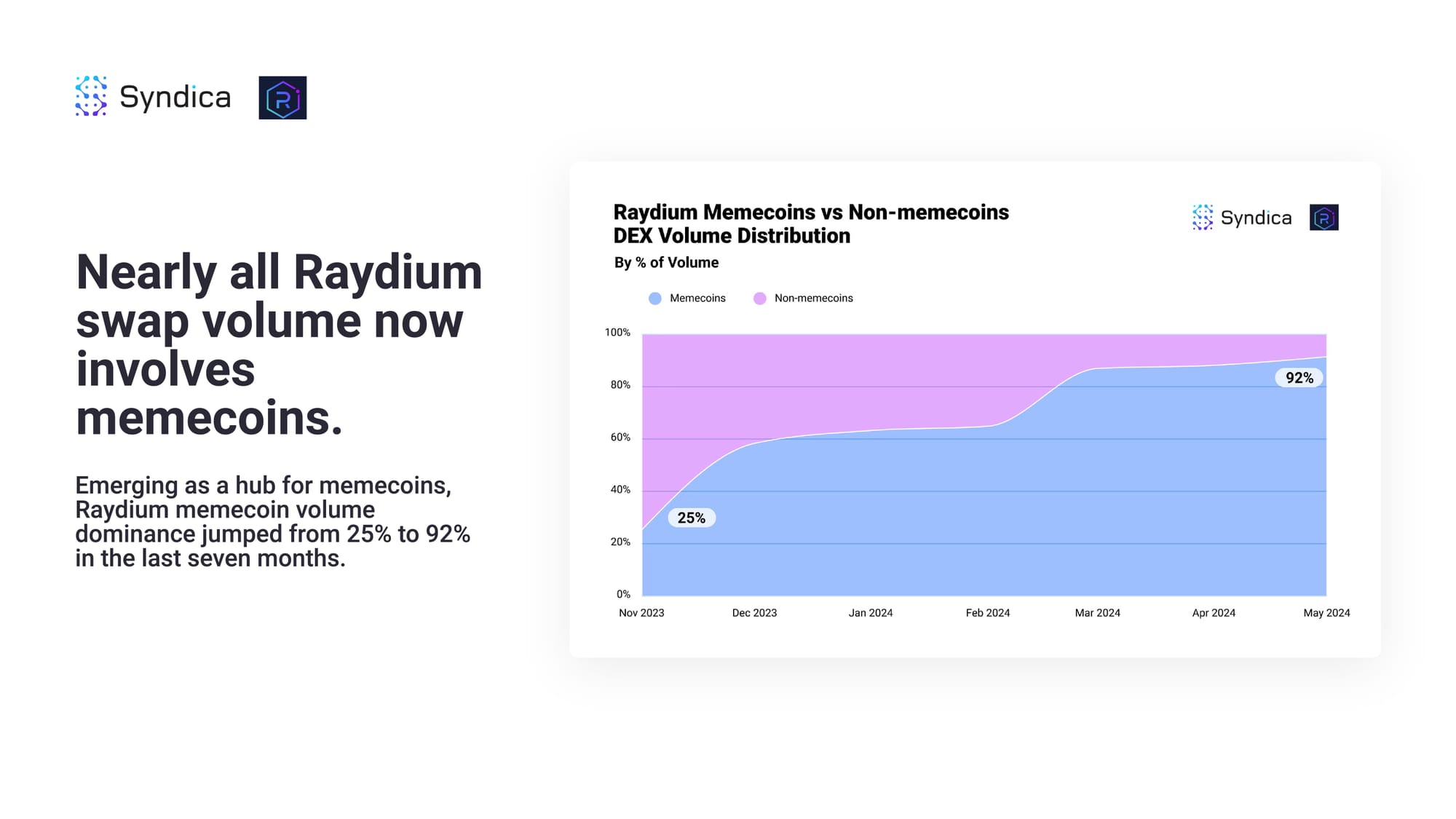

Nearly all Raydium swap volume now involves memecoins. Emerging as a hub for memecoins, Raydium memecoin volume dominance jumped from 25% to 92% in the last seven months.

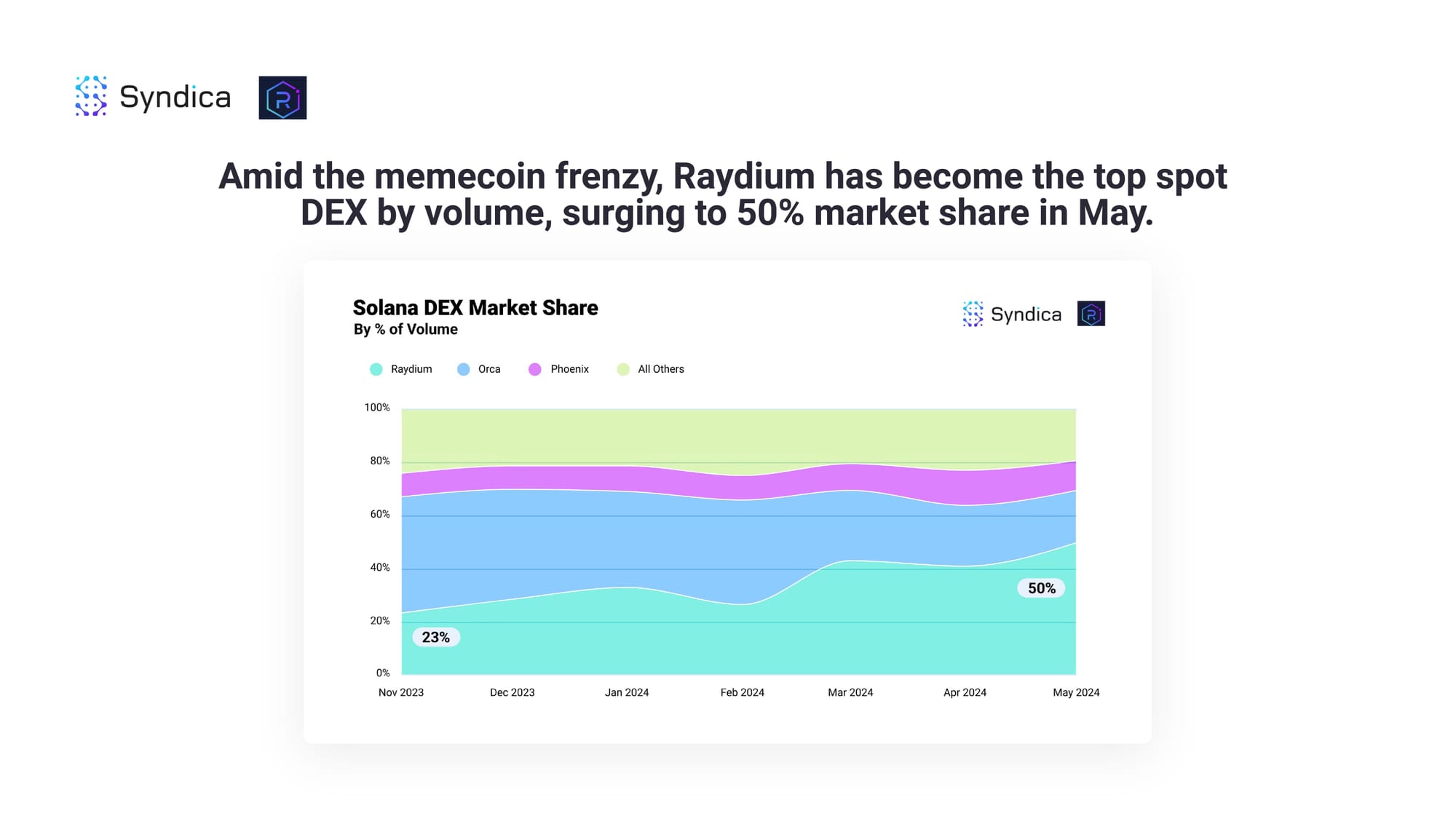

Amid the memecoin frenzy, Raydium has become the top spot DEX by volume, surging to 50% market share in May.

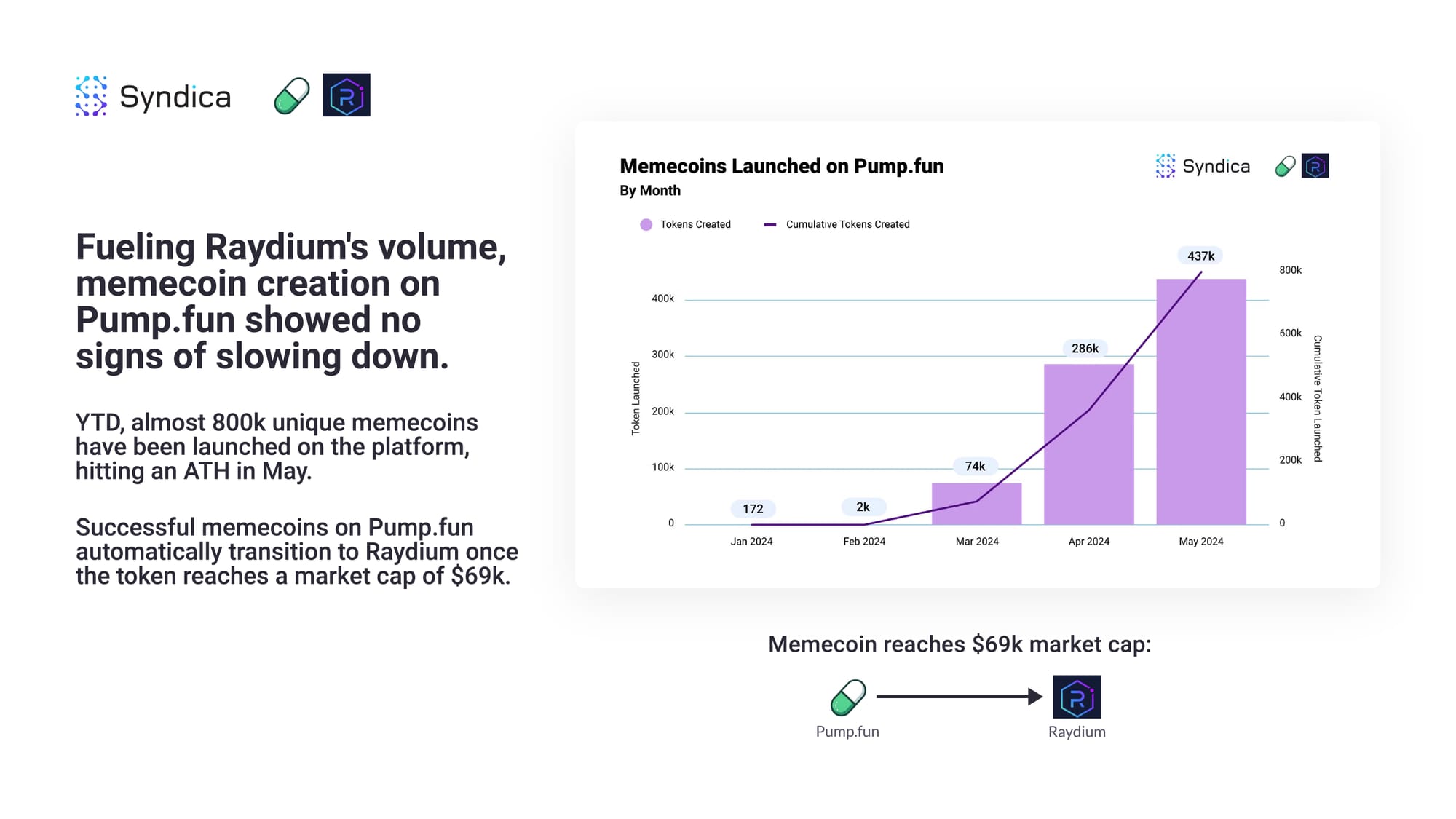

Fueling Raydium's volume, memecoin creation on Pump.fun showed no signs of slowing down. YTD, almost 800k unique memecoins have been launched on the platform, hitting an ATH in May.

Successful memecoins on Pump.fun automatically transition to Raydium once the token reaches a market cap of $69k.

2. Perpetuals

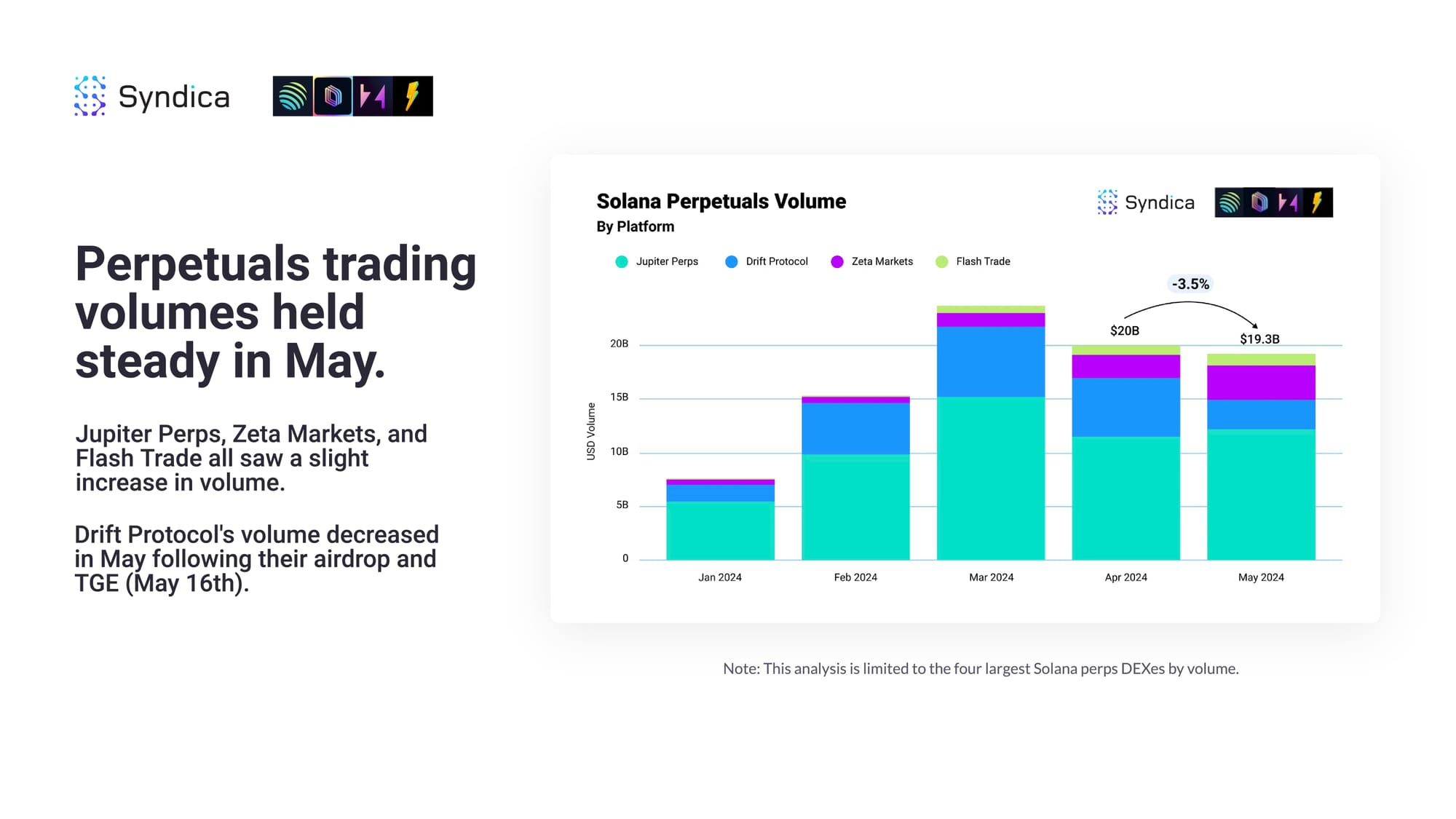

Perpetuals trading volumes held steady in May. Jupiter Perps, Zeta Markets, and Flash Trade all saw a slight increase in volume. Drift Protocol's volume decreased in May following their airdrop and TGE (May 16th).

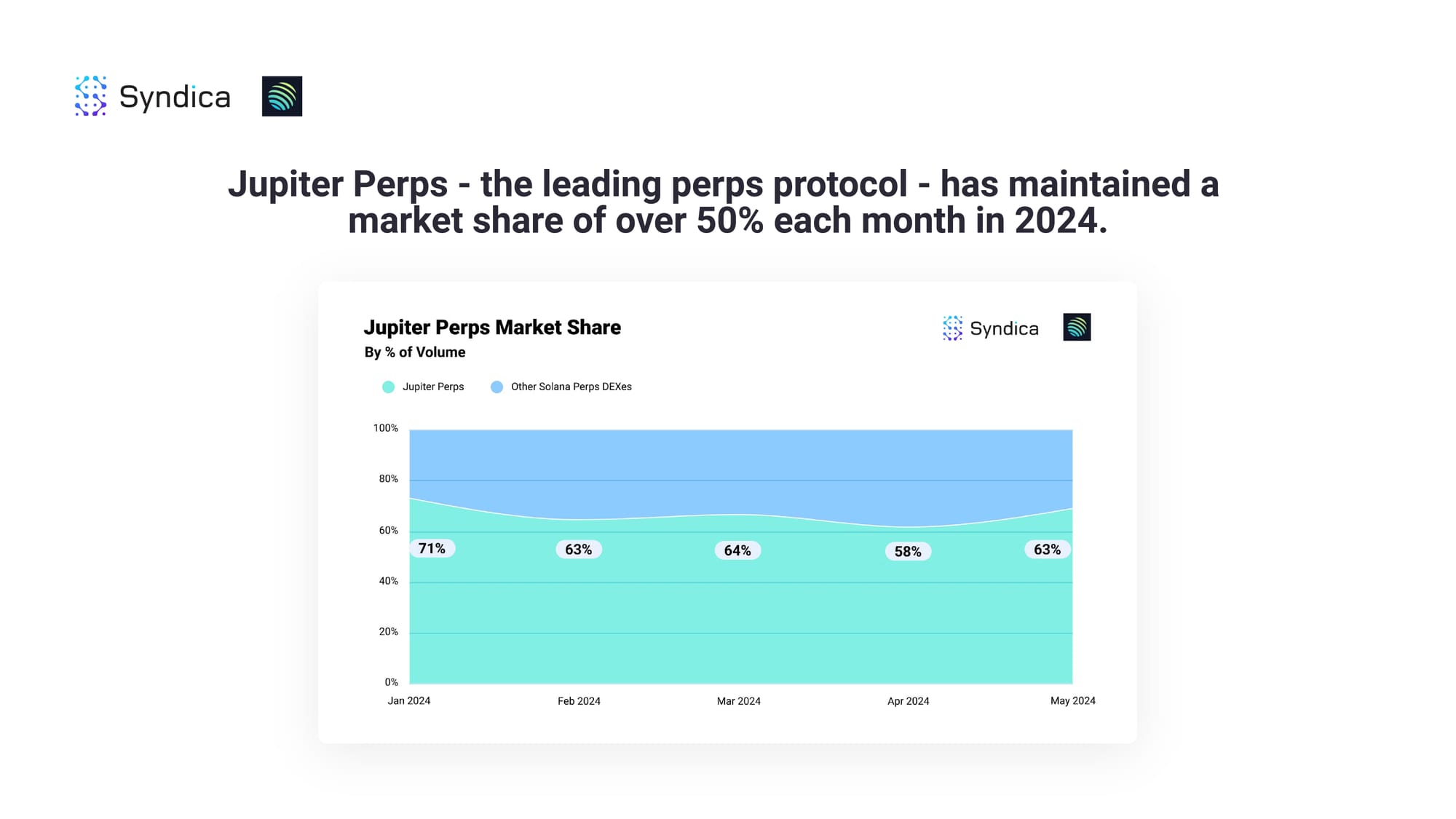

Jupiter Perps - the leading perps protocol - has maintained a market share of over 50% each month in 2024.

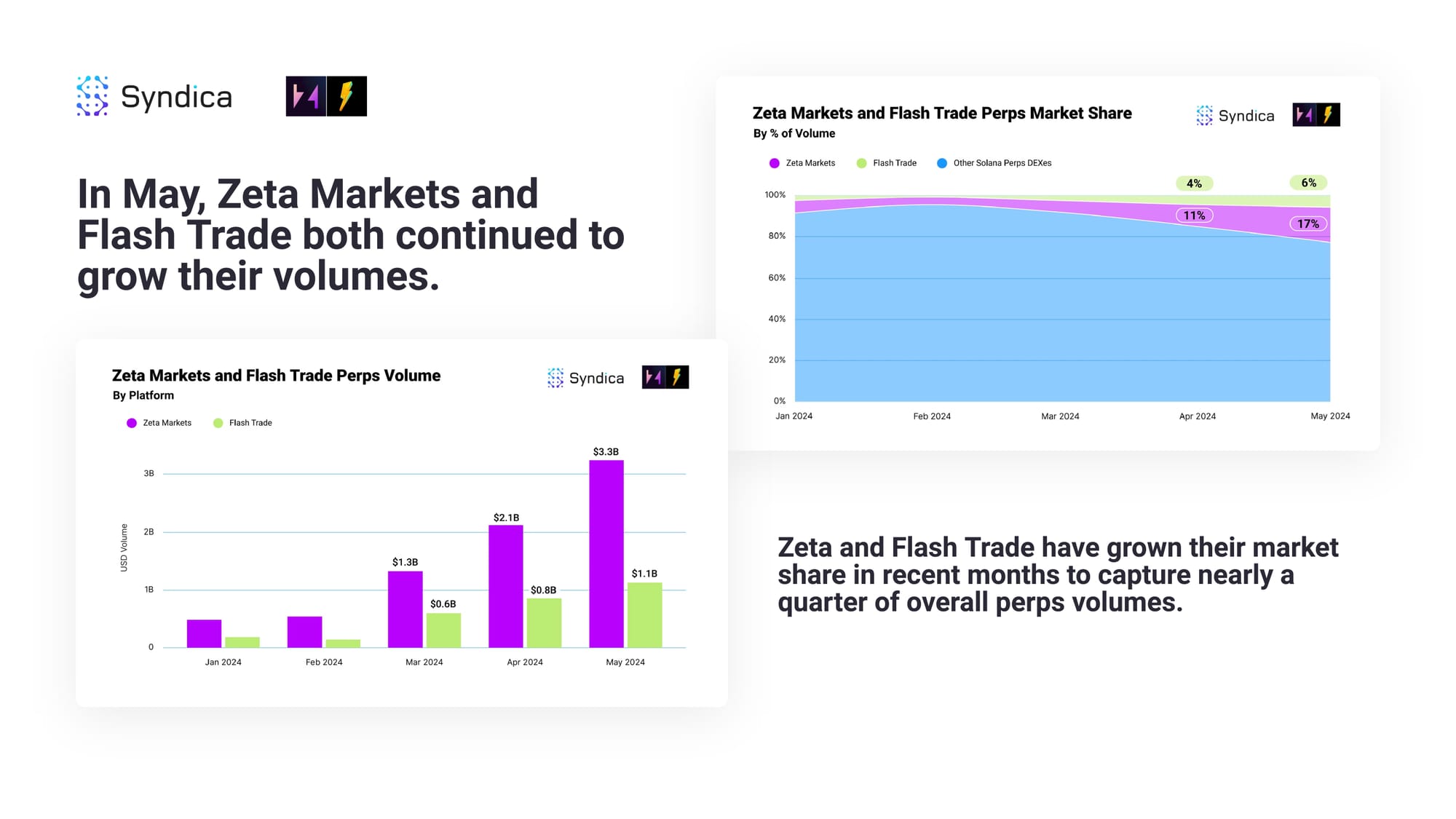

In May, Zeta Markets and Flash Trade both continued to grow their volumes. Zeta and Flash Trade have grown their market share in recent months to capture nearly a quarter of overall perps volumes.

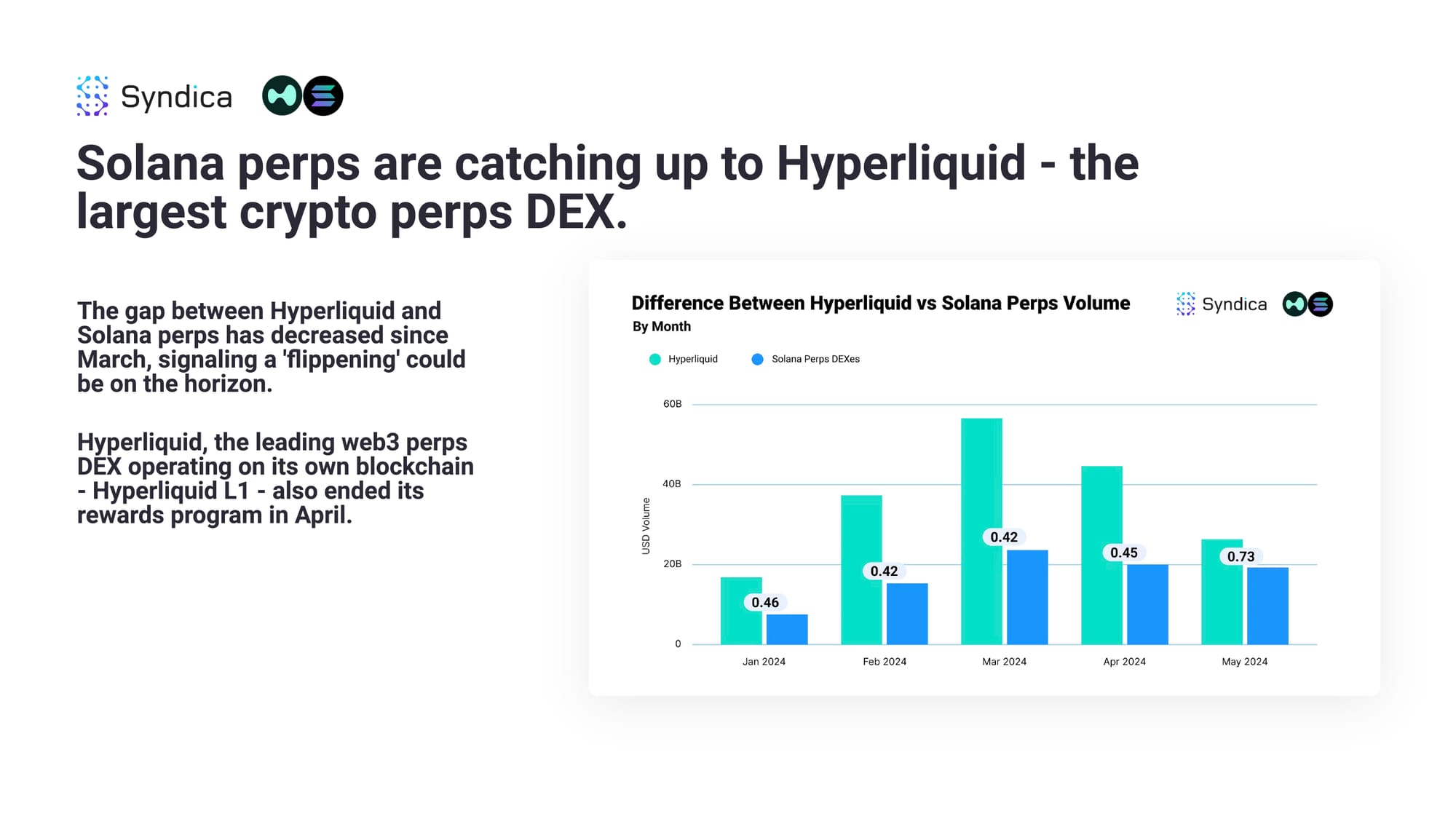

Solana perps are catching up to Hyperliquid - the largest crypto perps DEX. The gap between Hyperliquid and Solana perps has decreased since March, signaling a 'flippening' could be on the horizon.

Hyperliquid, the leading web3 perps DEX operating on its own blockchain - Hyperliquid L1 - also ended its rewards program in April.

3. Lending and Borrowing

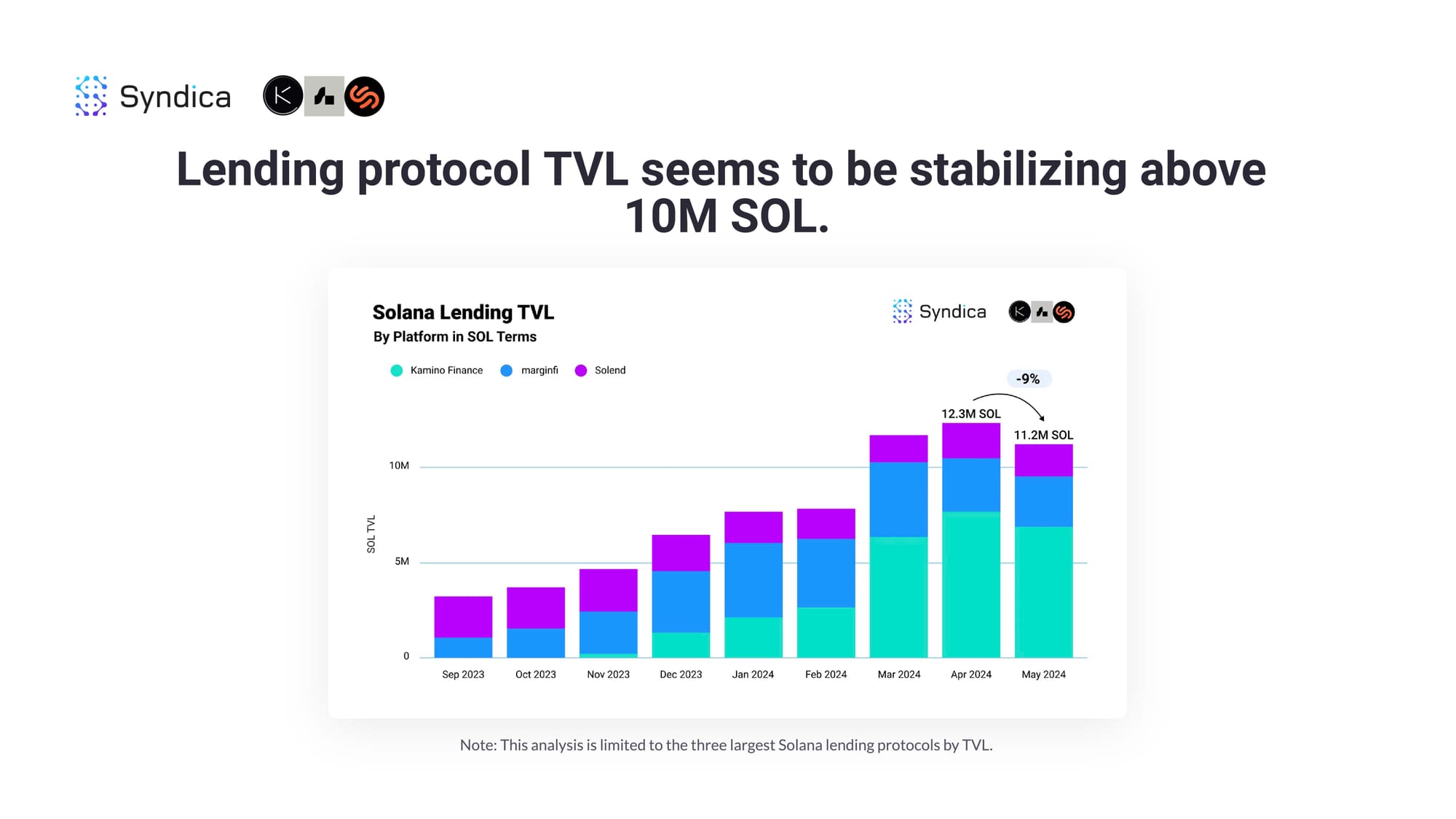

Lending protocol TVL seems to be stabilizing above 10M SOL.

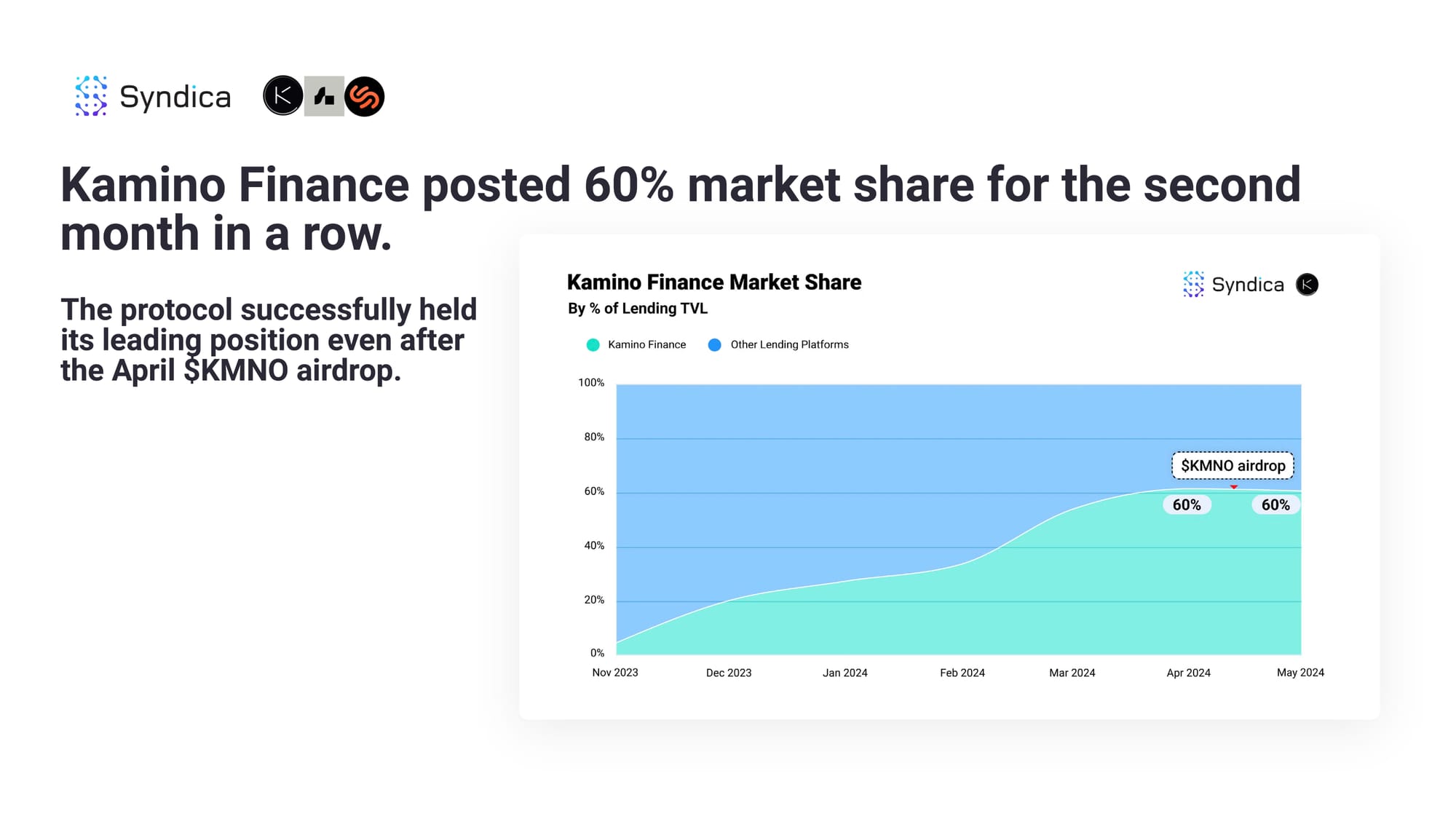

Kamino Finance posted 60% market share for the second month in a row. The protocol successfully held its leading position even after the April $KMNO airdrop.

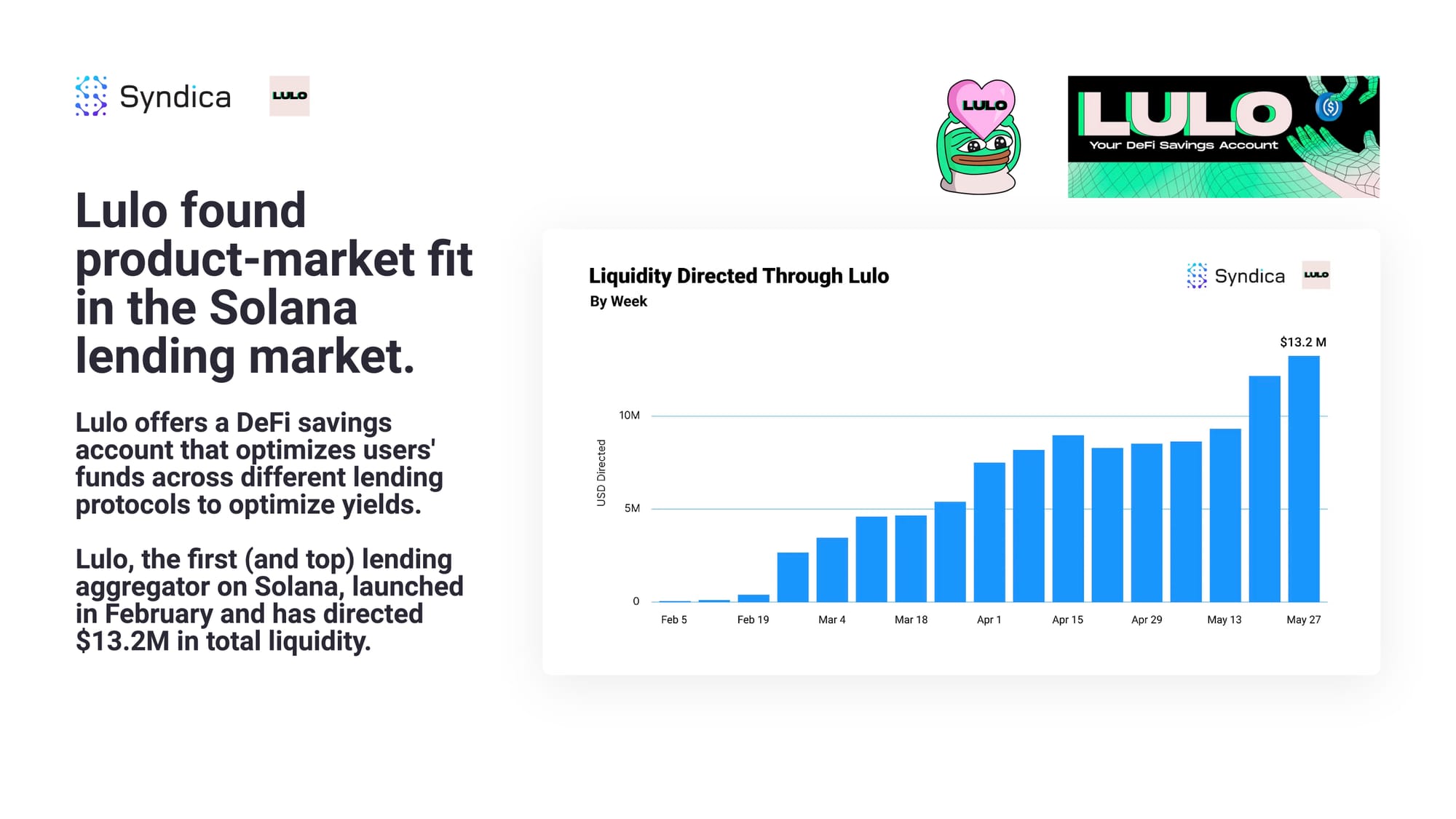

Lulo found product-market fit in the Solana lending market. Lulo offers a DeFi savings account that optimizes users' funds across different lending protocols to optimize yields. Lulo, the first (and top) lending aggregator on Solana, launched in February and has directed $13.2M in total liquidity.

4. Liquid Staking

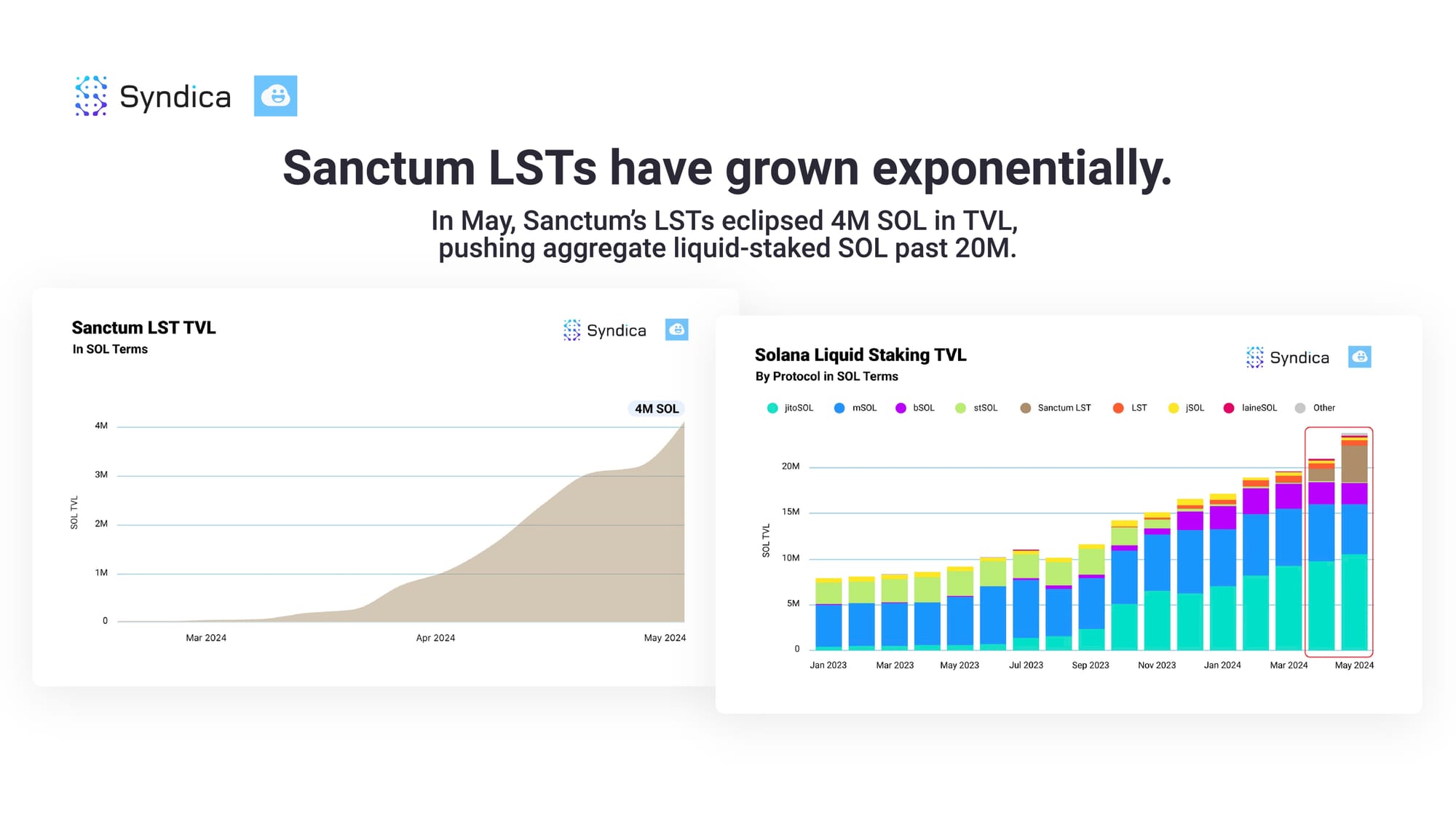

Sanctum LSTs have grown exponentially. In May, Sanctum’s LSTs eclipsed 4M SOL in TVL, pushing aggregate liquid-staked SOL past 20M.

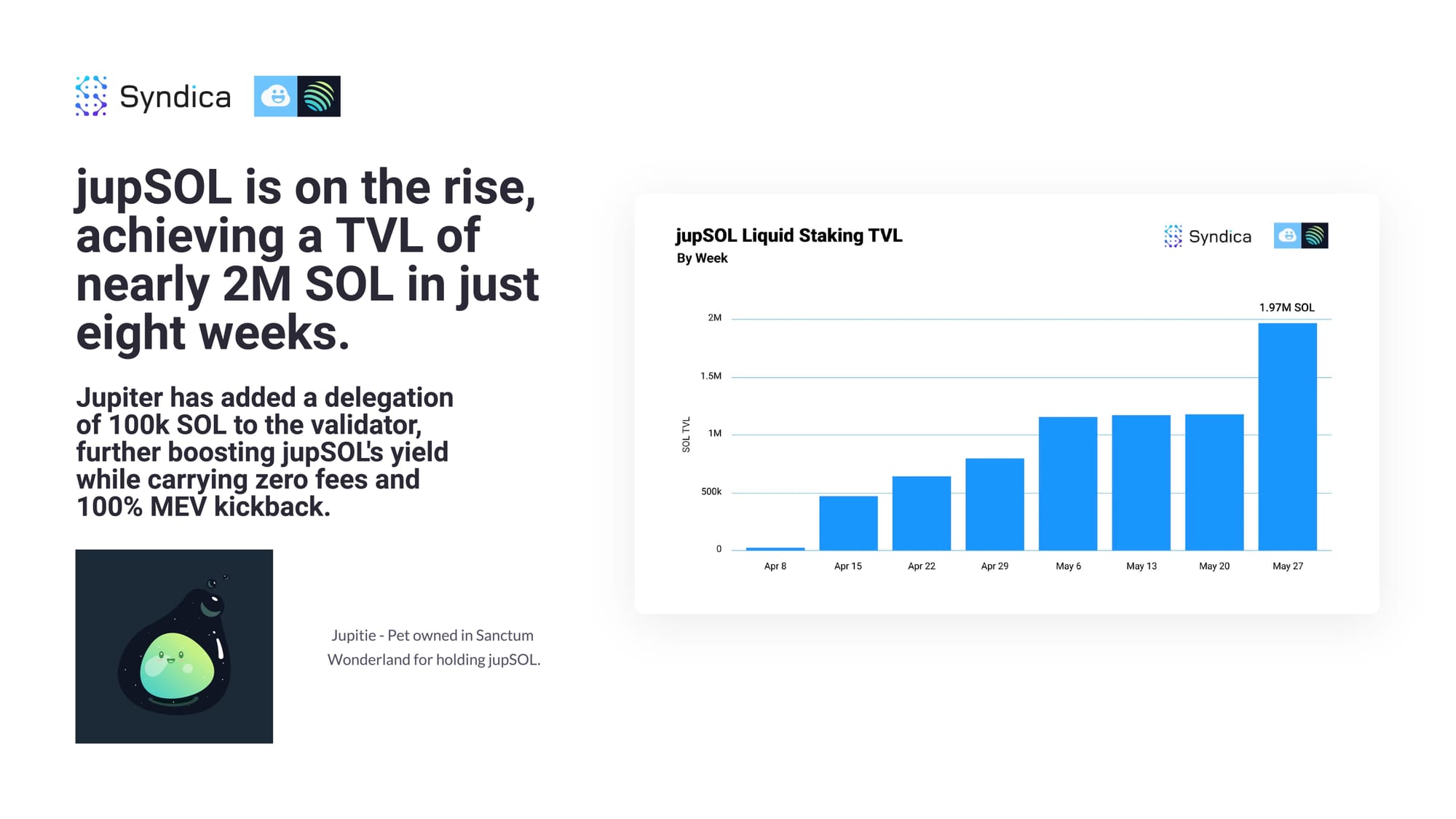

jupSOL is on the rise, achieving a TVL of nearly 2M SOL in just eight weeks. Jupiter has added a delegation of 100k SOL to the validator, further boosting jupSOL's yield while carrying zero fees and 100% MEV kickback.

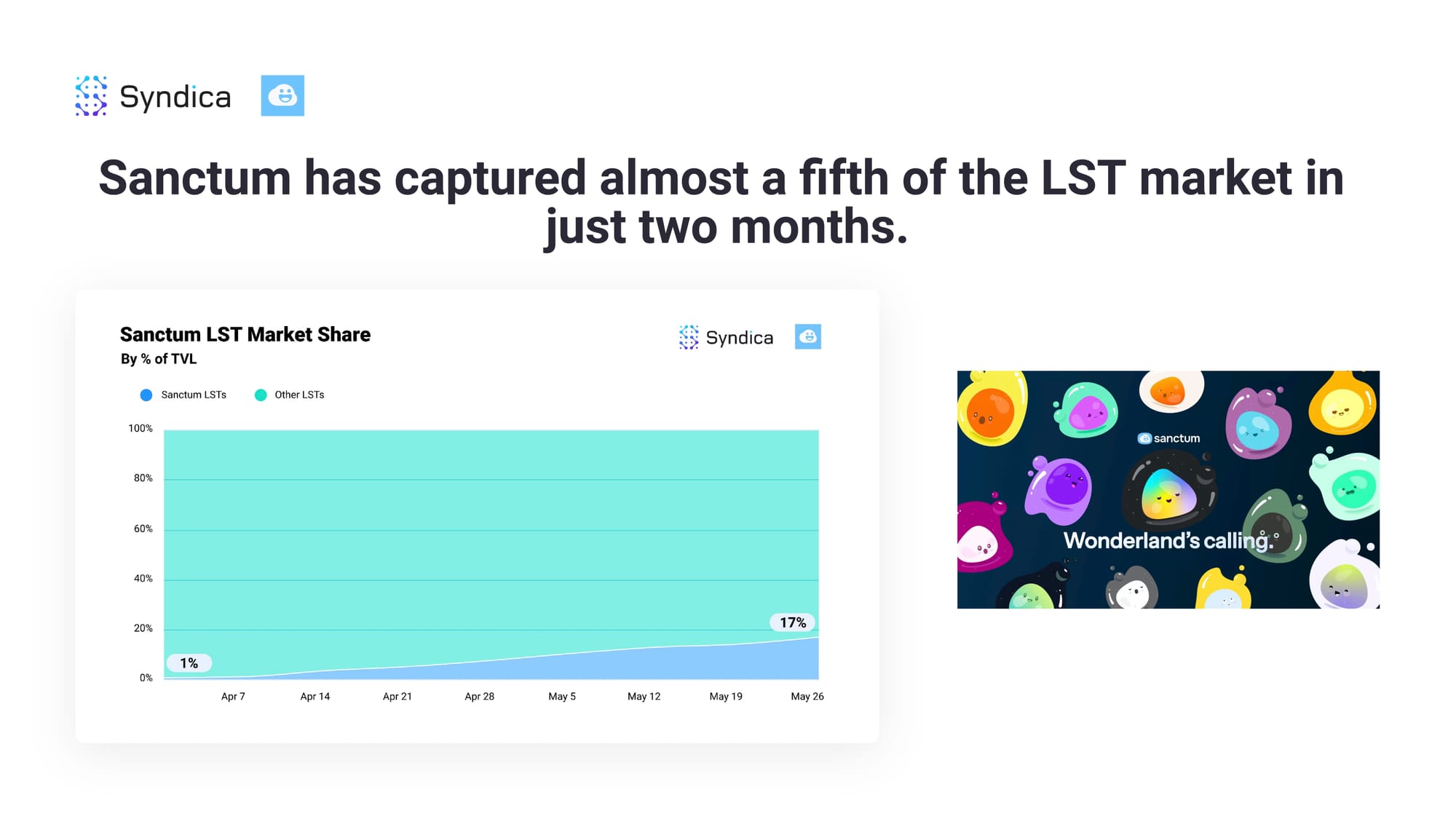

Sanctum has captured almost a fifth of the LST market in just two months.

5. Bridges

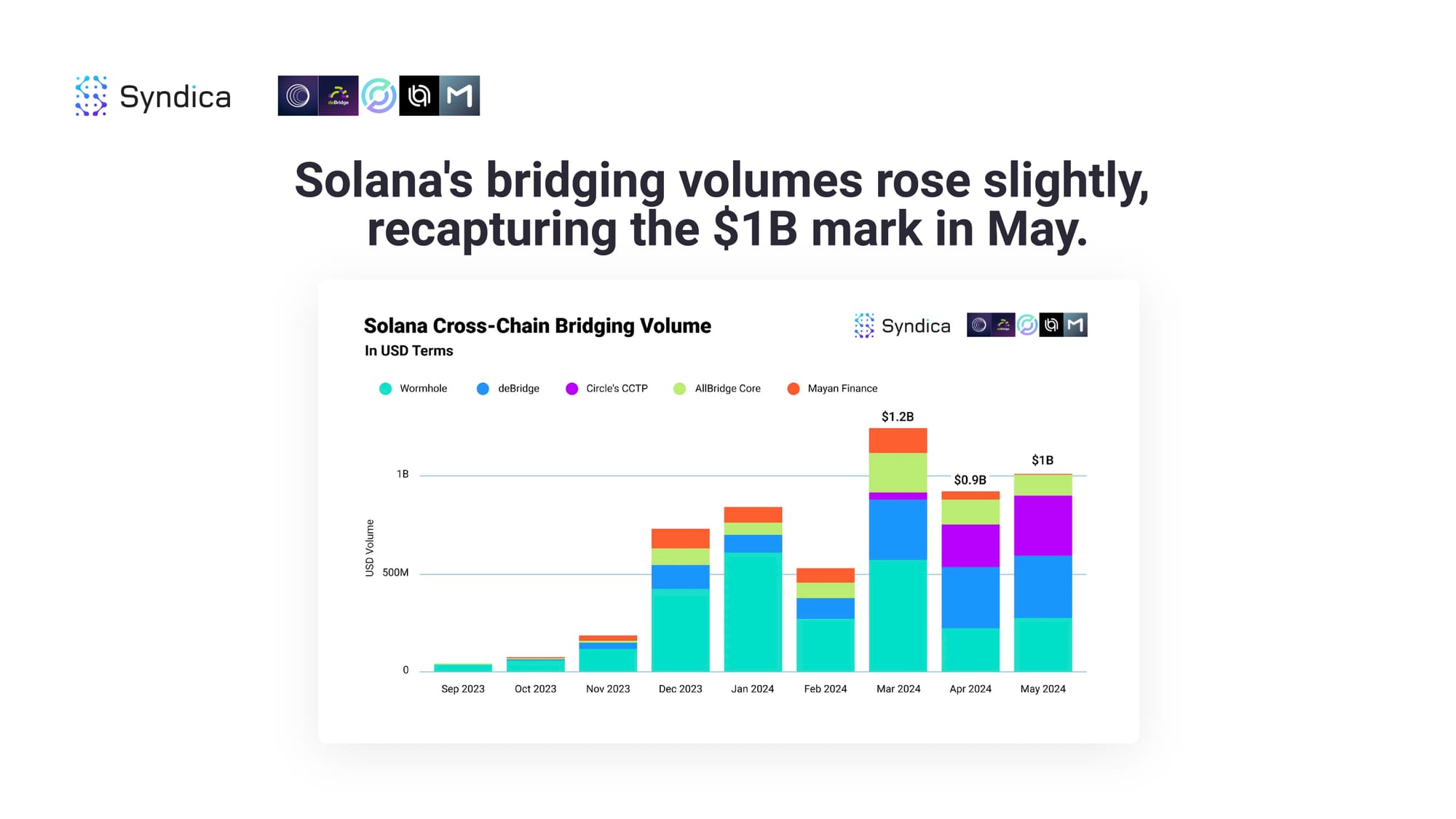

Solana's bridging volumes rose slightly, recapturing the $1B mark in May.

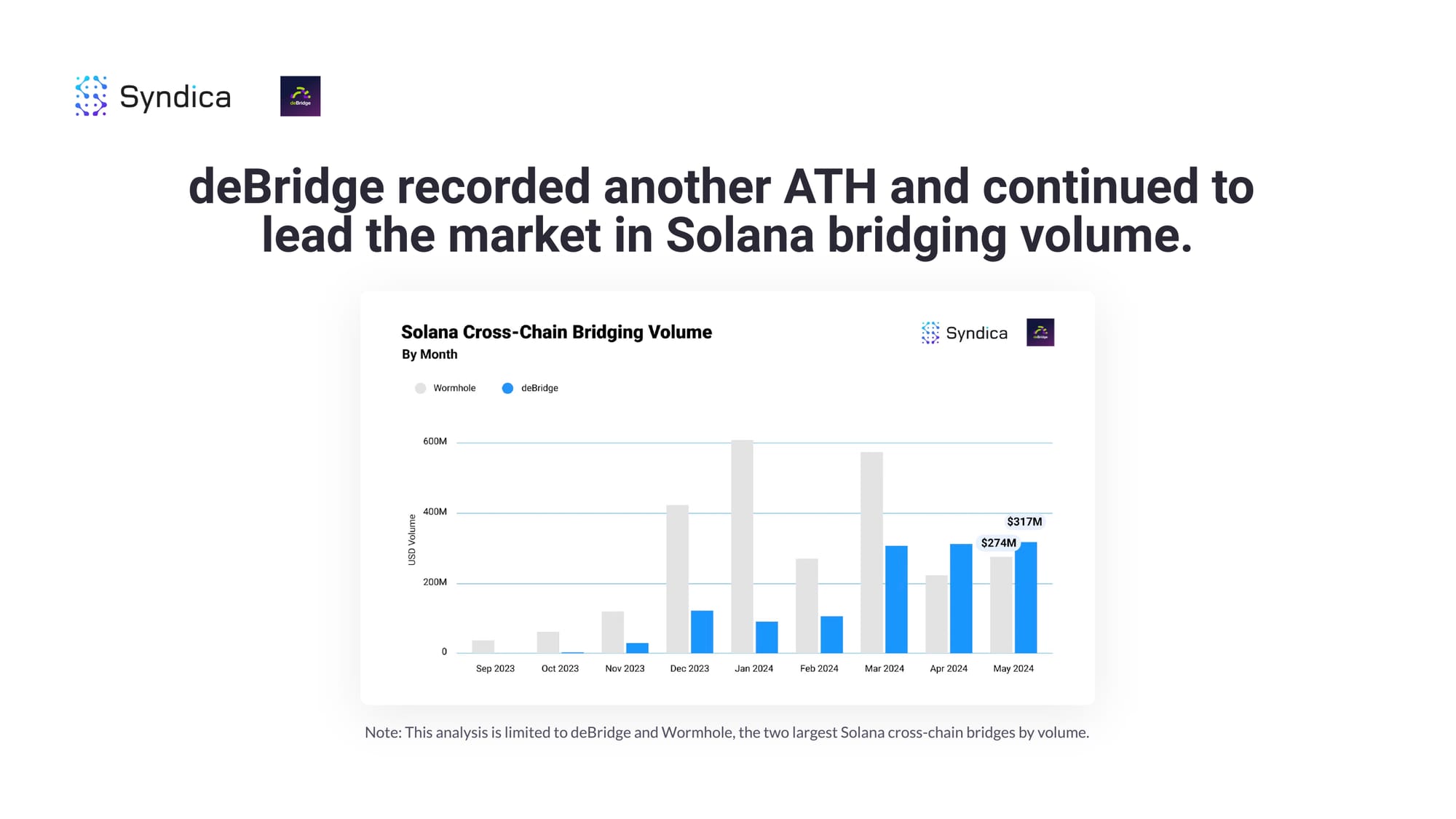

deBridge recorded another ATH and continued to lead the market in Solana bridging volume.

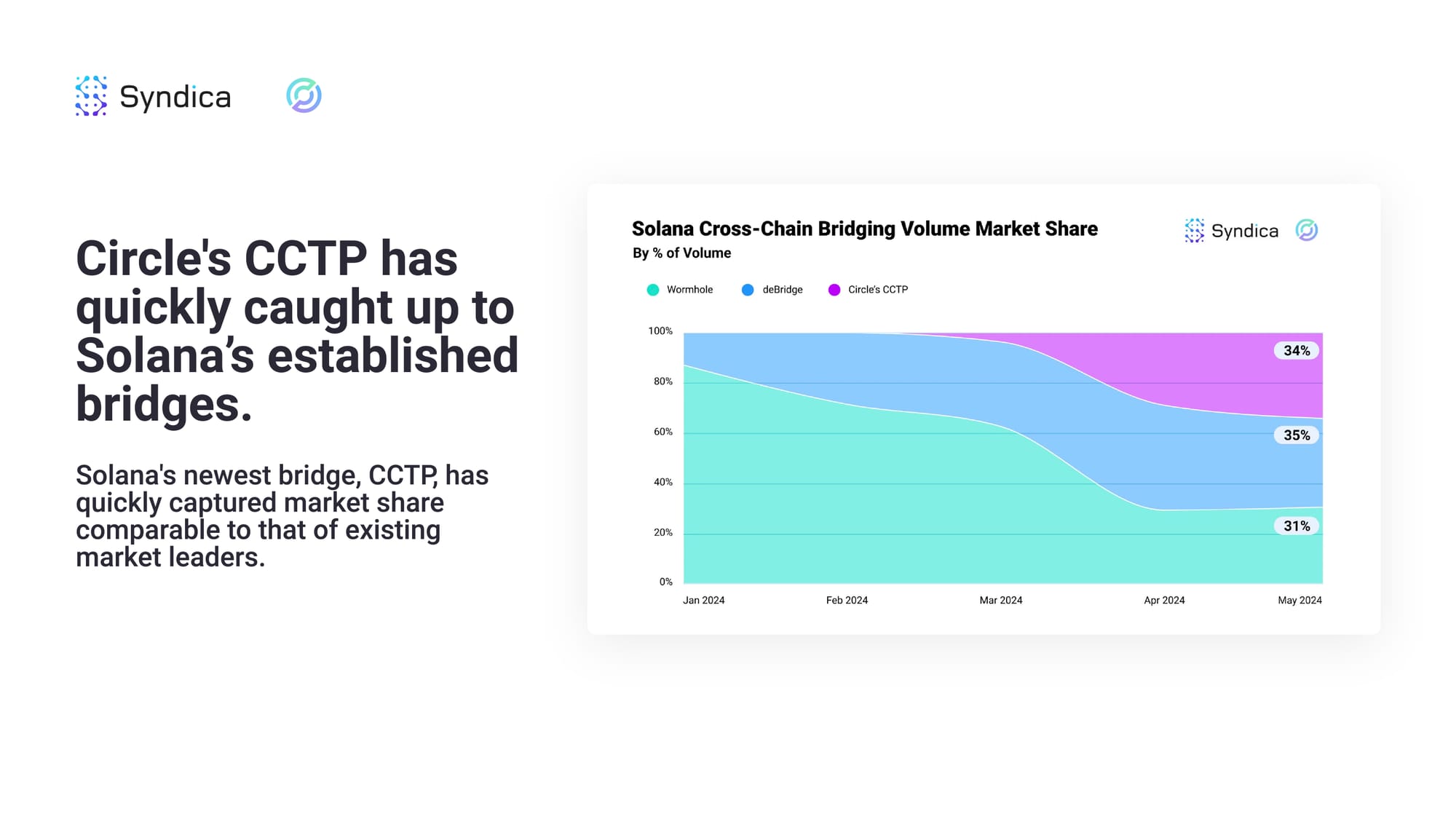

Circle's CCTP has quickly caught up to Solana’s established bridges. Solana's newest bridge, CCTP, has quickly captured market share comparable to that of existing market leaders.

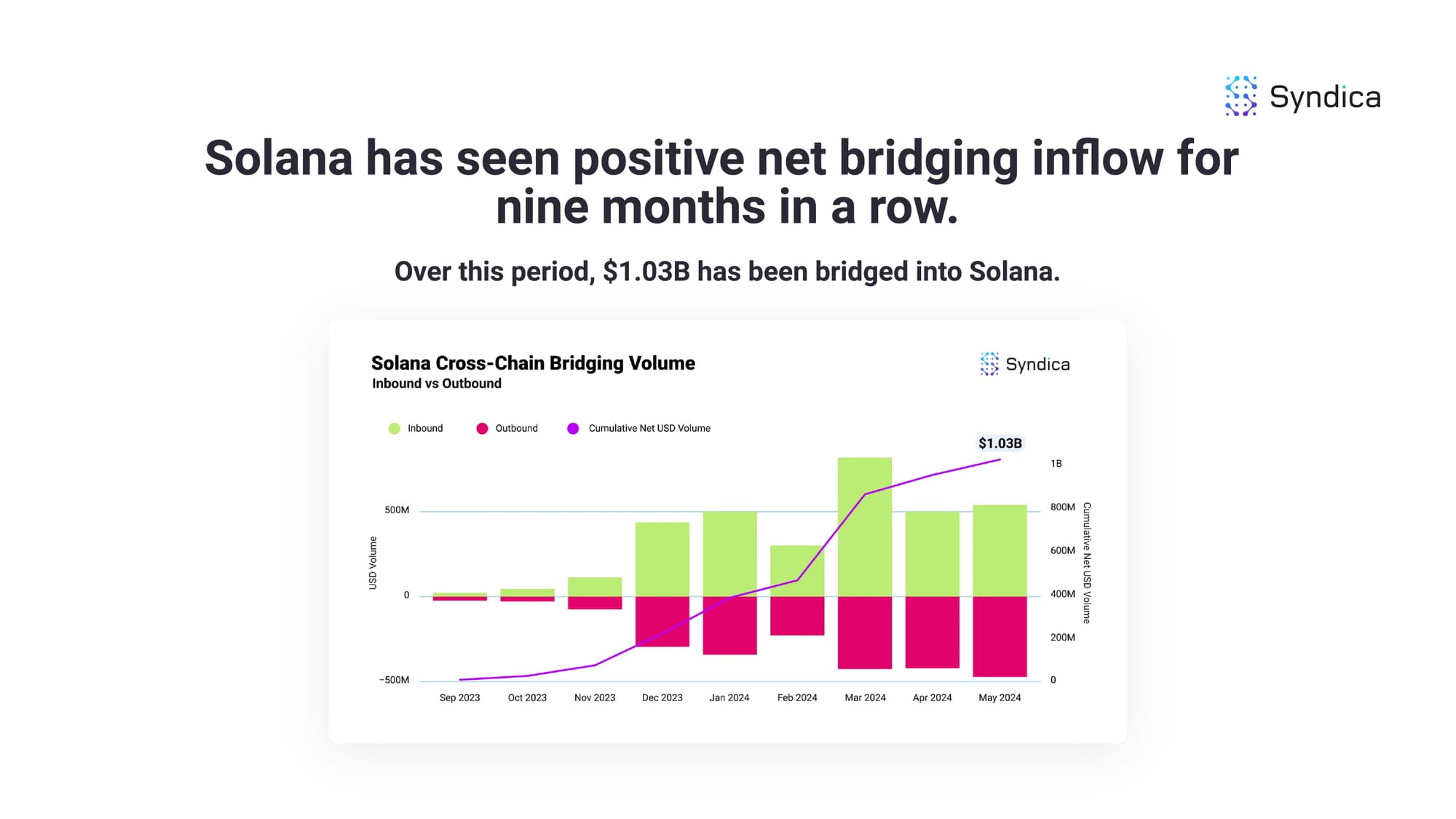

Solana has seen positive net bridging inflow for nine months in a row. Over this period, $1.03B has been bridged into Solana.

Our Trends to Watch:

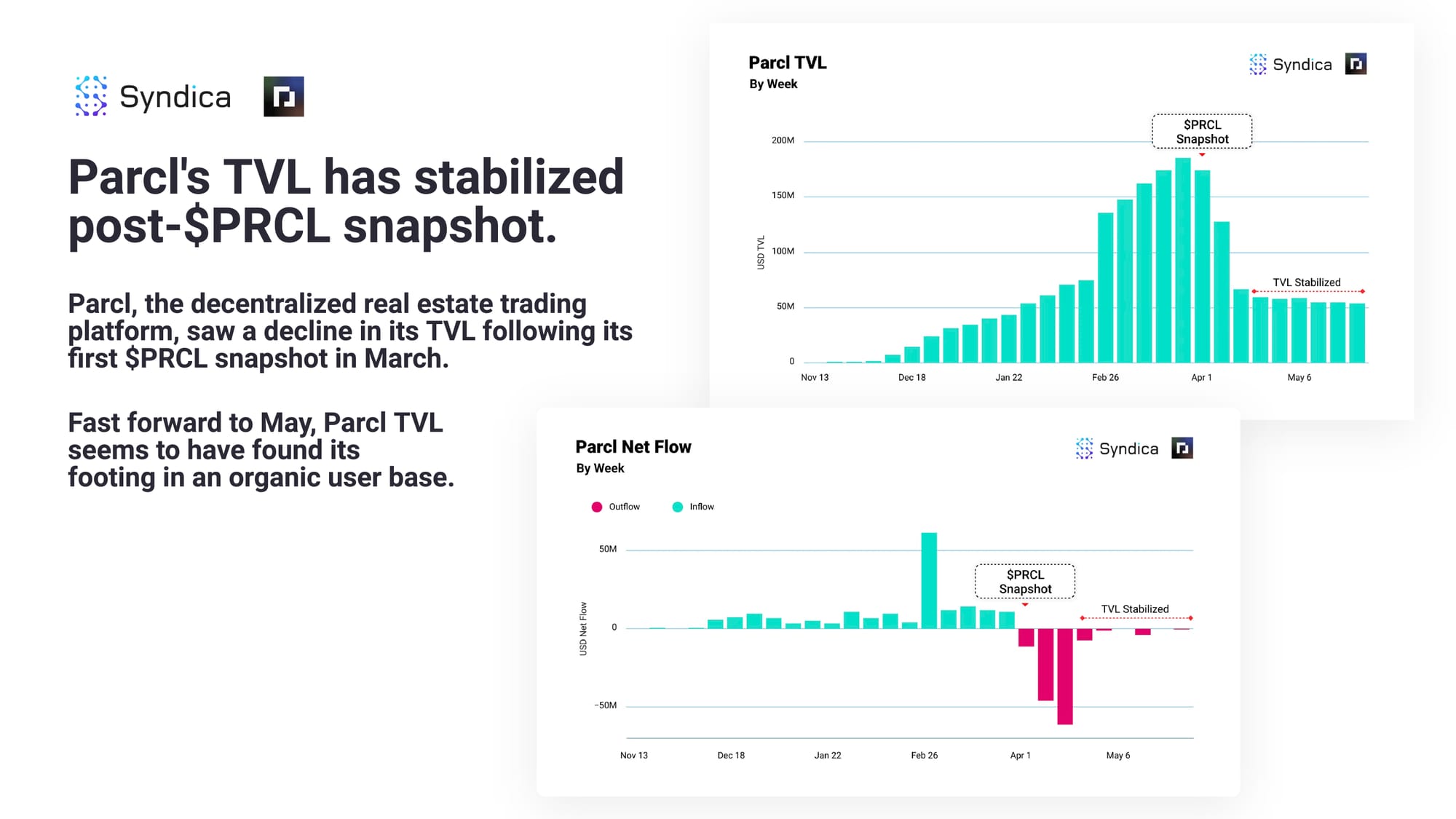

Parcl's TVL has stabilized post-$PRCL snapshot. Parcl, the decentralized real estate trading platform, saw a decline in its TVL following its first $PRCL snapshot in March. Fast forward to May, Parcl TVL seems to have found its footing in an organic user base.