Deep Dive: Solana DeFi - May 2025

Deep Dive: Solana DeFi - May 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - May 2025

Part I: DeFi Overview

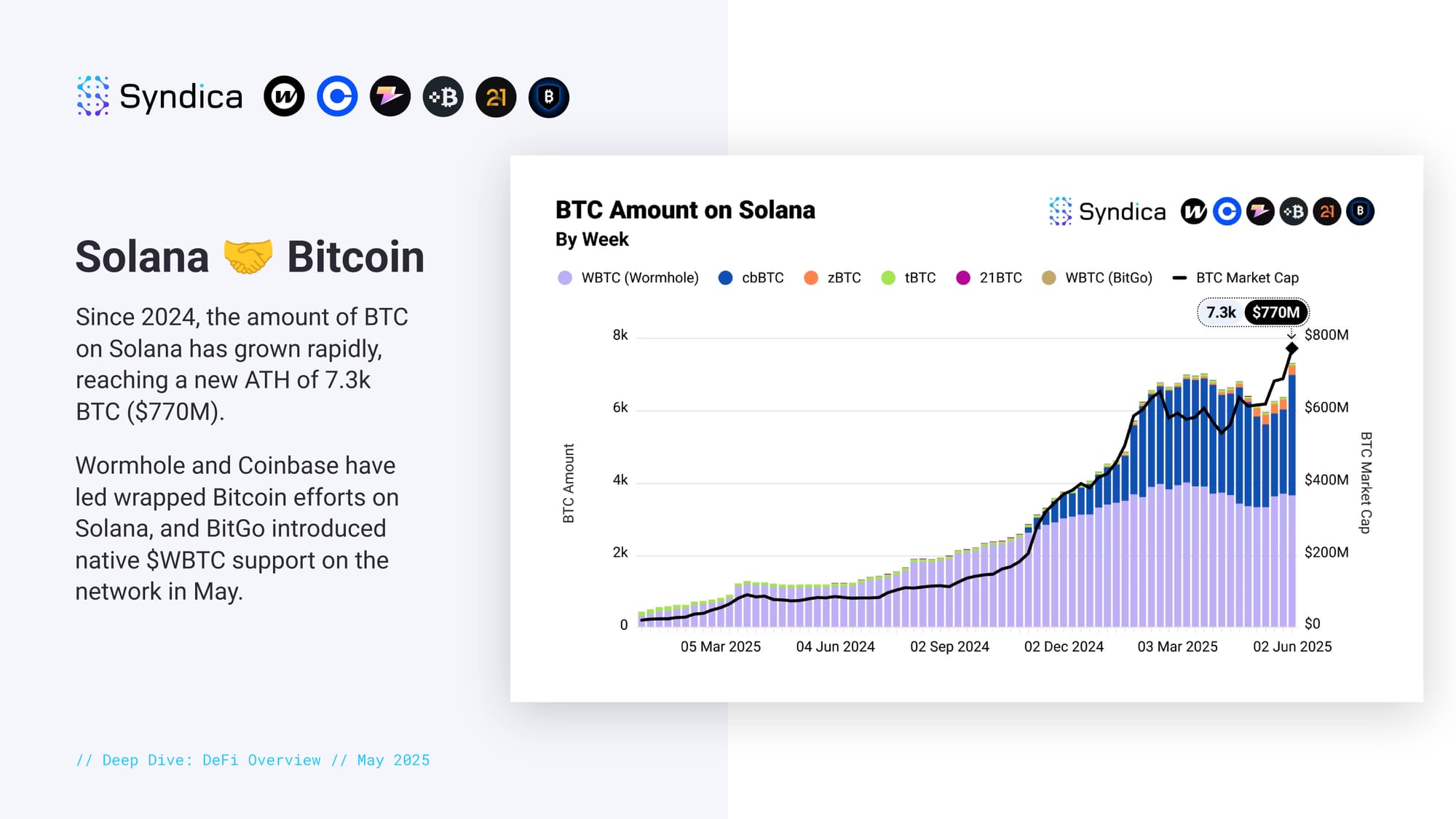

Solana 🤝 Bitcoin. Since 2024, the amount of BTC on Solana has grown rapidly, reaching a new ATH of 7.3k BTC ($770M). Wormhole and Coinbase have led wrapped Bitcoin efforts on Solana, and BitGo introduced native $WBTC support on the network in May.

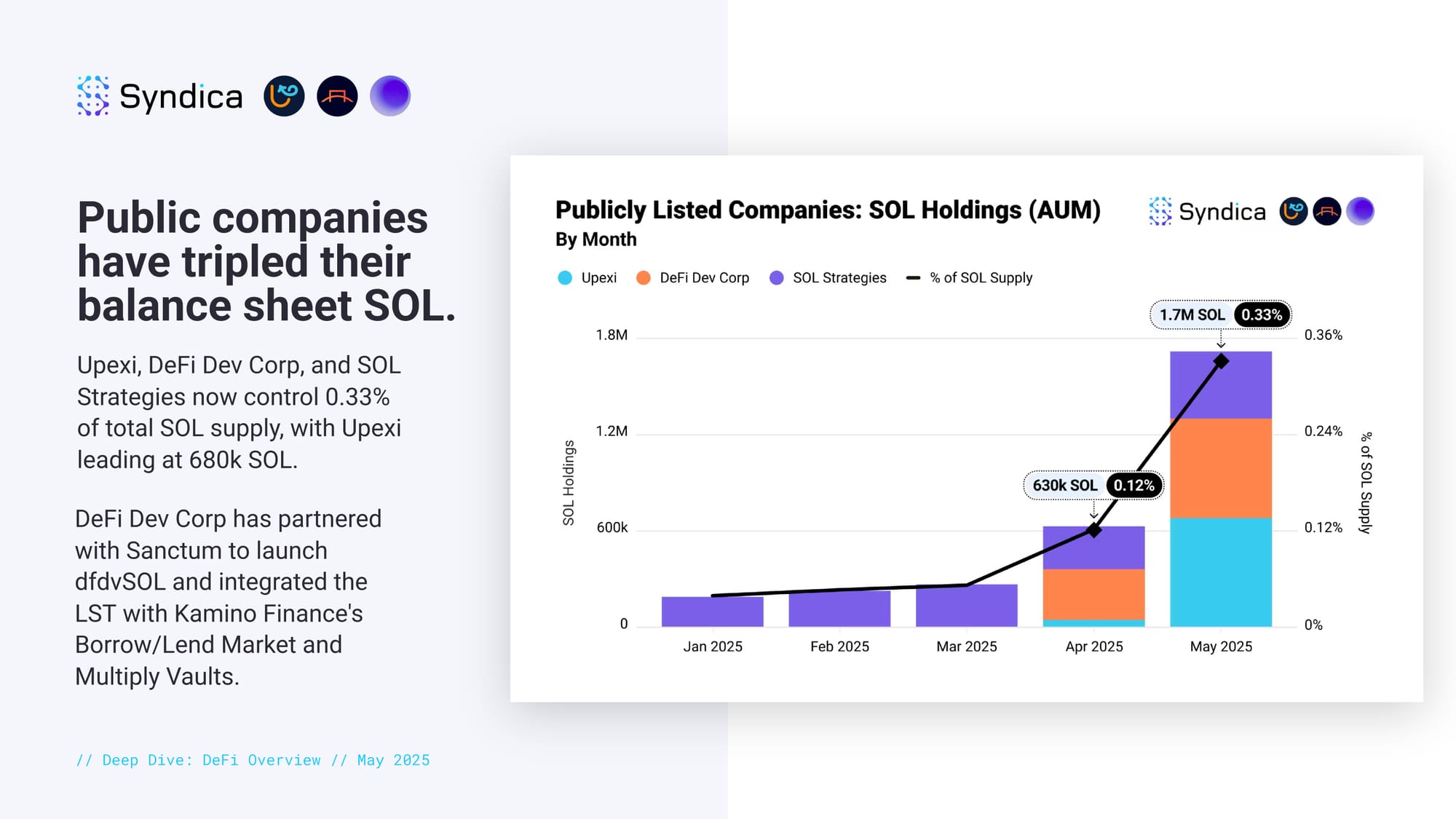

Public companies have tripled their balance sheet SOL. Upexi, DeFi Dev Corp, and SOL Strategies now control 0.33% of total SOL supply, with Upexi leading at 680k SOL. DeFi Dev Corp has partnered with Sanctum to launch dfdvSOL and integrated the LST with Kamino Finance's Borrow/Lend Market and Multiply Vaults.

Part II: Liquid Staking

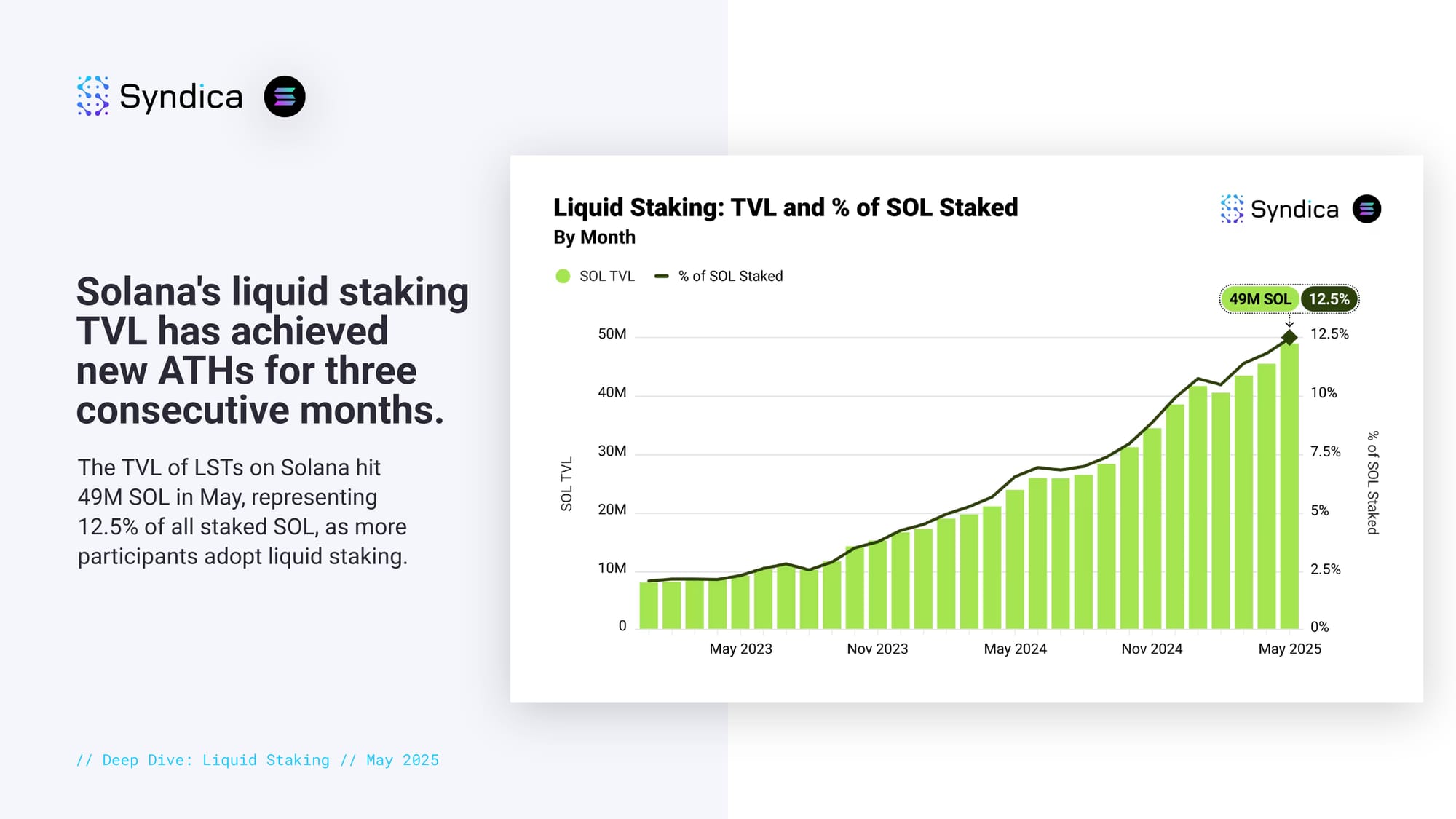

Solana's liquid staking TVL has achieved new ATHs for three consecutive months. The TVL of LSTs on Solana hit 49M SOL in May, representing 12.5% of all staked SOL, as more participants adopt liquid staking.

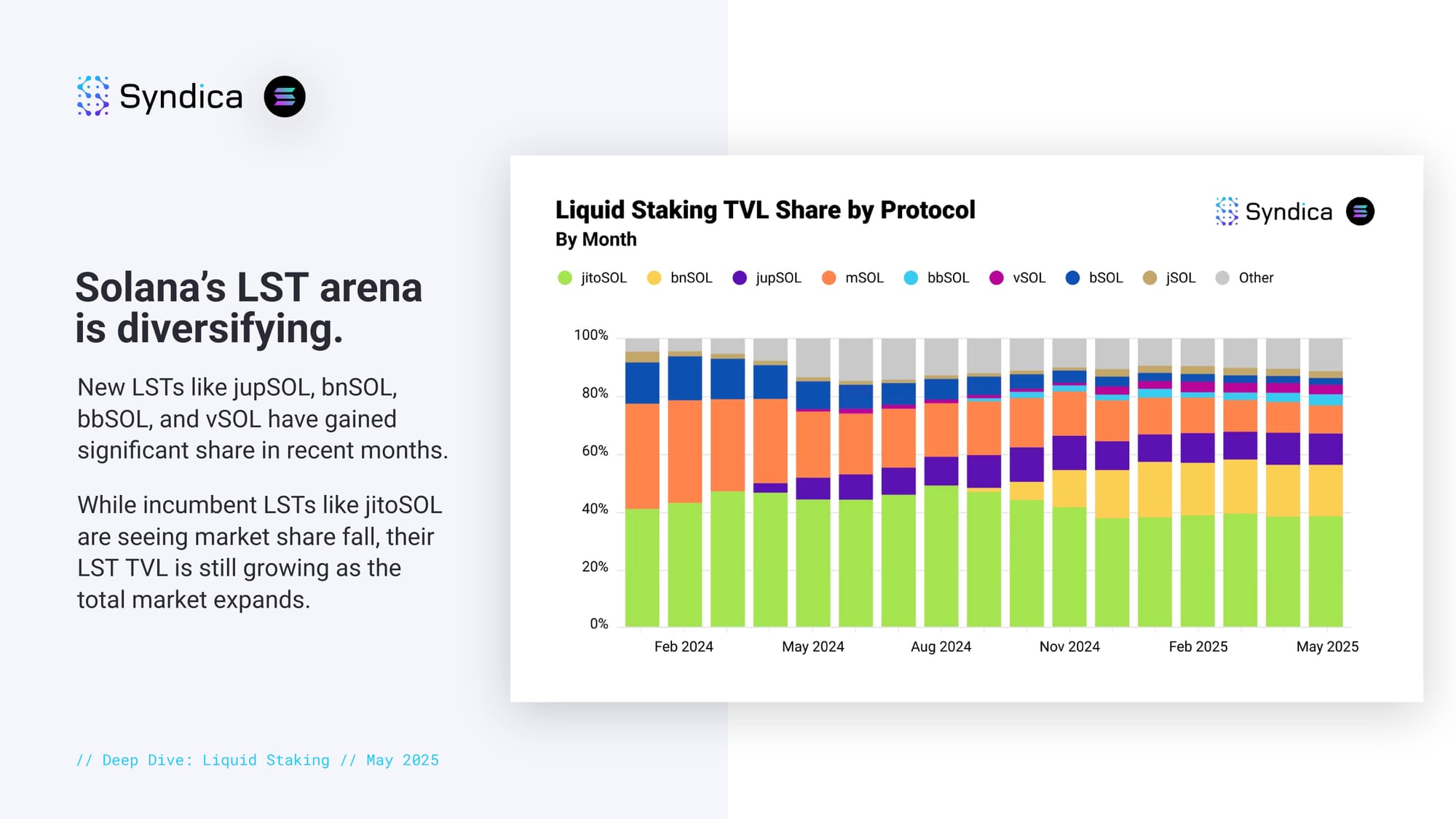

Solana’s LST arena is diversifying. New LSTs like jupSOL, bnSOL, bbSOL, and vSOL have gained significant share in recent months. While incumbent LSTs like jitoSOL are seeing market share fall, their LST TVL is still growing as the total market expands.

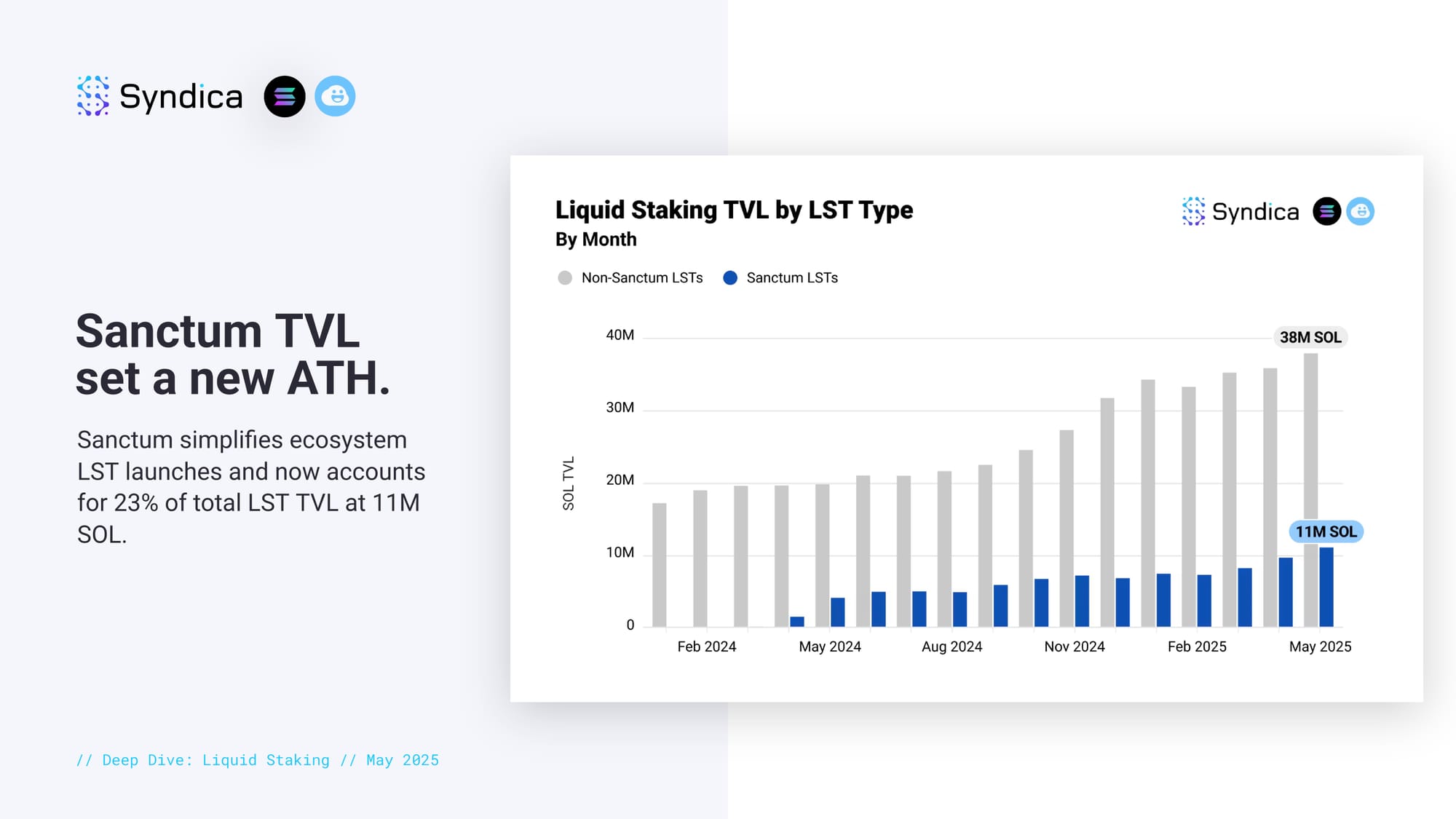

Sanctum TVL set a new ATH. Sanctum simplifies ecosystem LST launches and now accounts for 23% of total LST TVL at 11M SOL.

Part III: DEXes and Aggregators

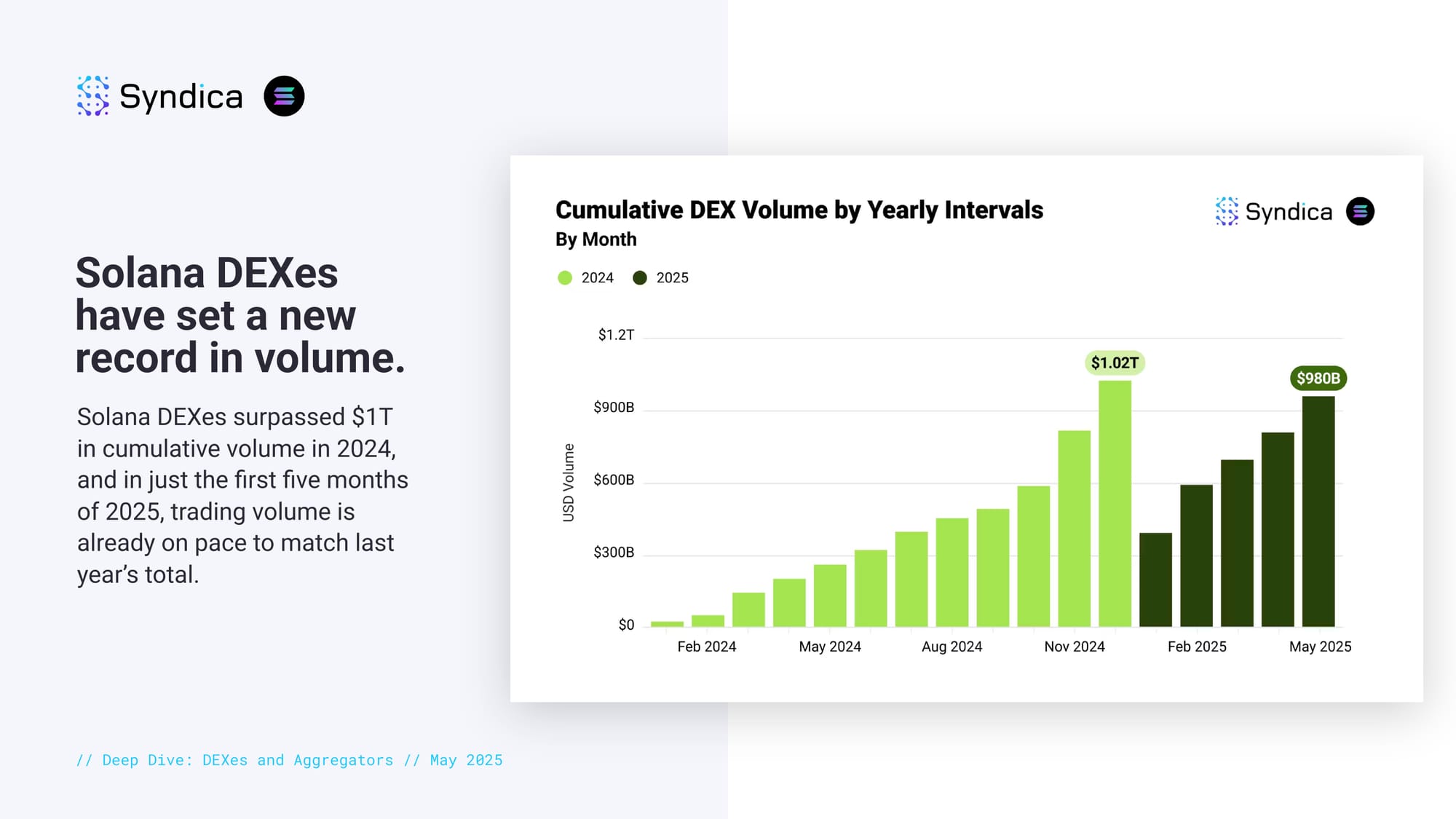

Solana DEXes have set a new record in volume. Solana DEXes surpassed $1T in cumulative volume in 2024, and in just the first five months of 2025, trading volume is already on pace to match last year’s total.

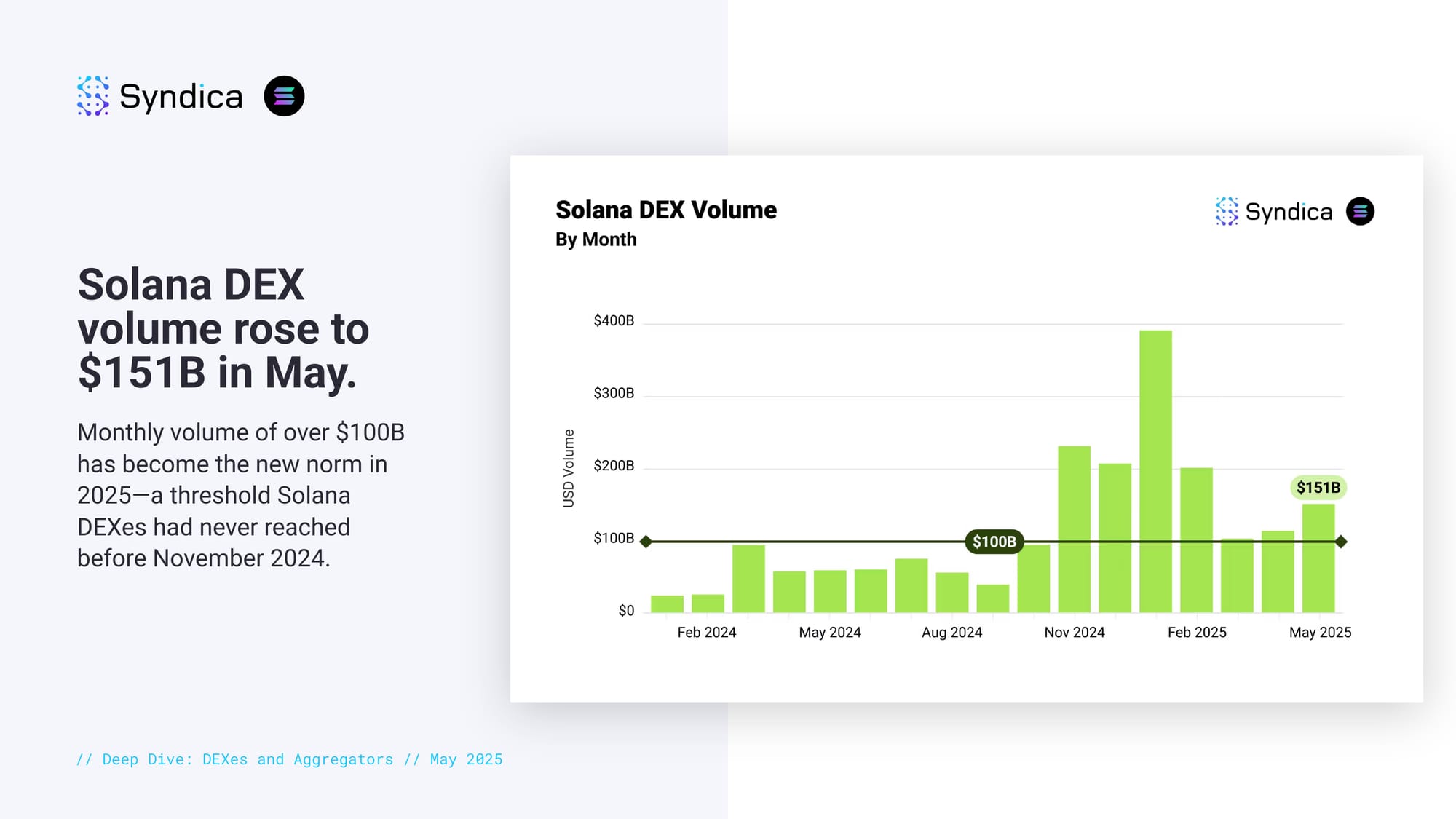

Solana DEX volume rose to $151B in May. Monthly volume of over $100B has become the new norm in 2025—a threshold Solana DEXes had never reached before November 2024.

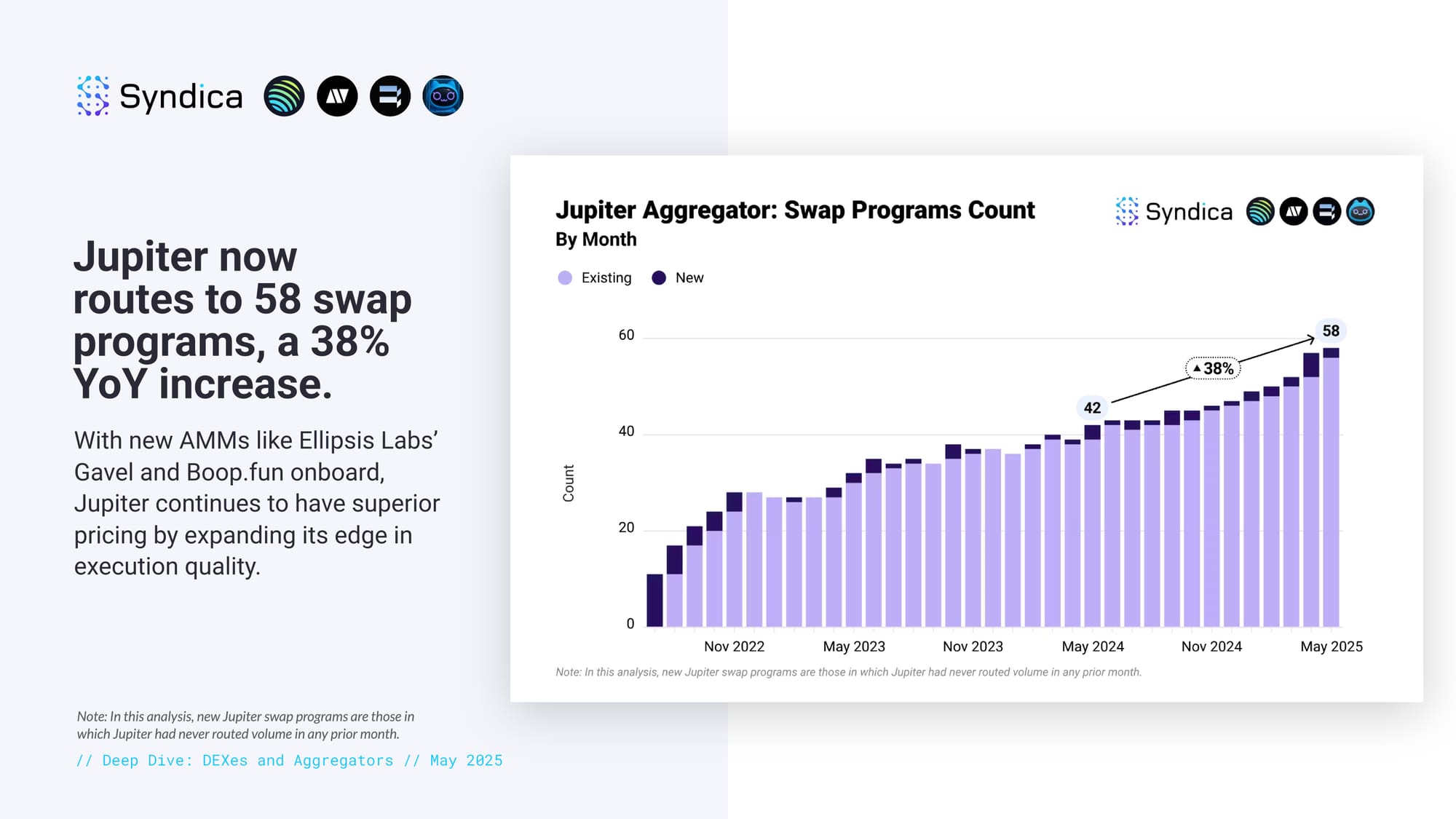

Jupiter now routes to 58 swap programs, a 38% YoY increase. With new AMMs like Ellipsis Labs’ Gavel and Boop.fun onboard, Jupiter continues to have superior pricing by expanding its edge in execution quality.

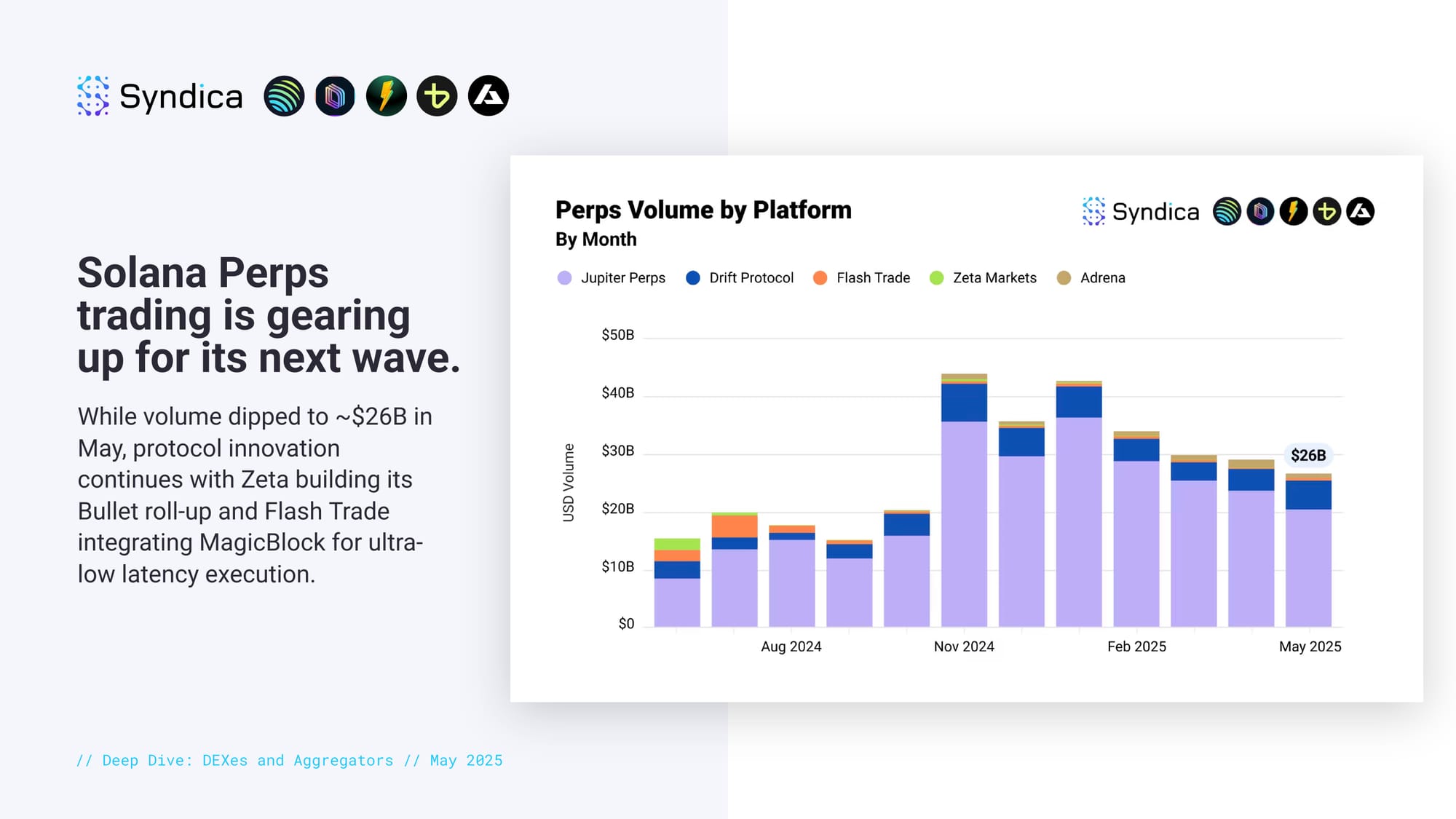

Solana Perps trading is gearing up for its next wave. While volume dipped to ~$26B in May, protocol innovation continues with Zeta building its Bullet roll-up and Flash Trade integrating MagicBlock for ultra-low latency execution.

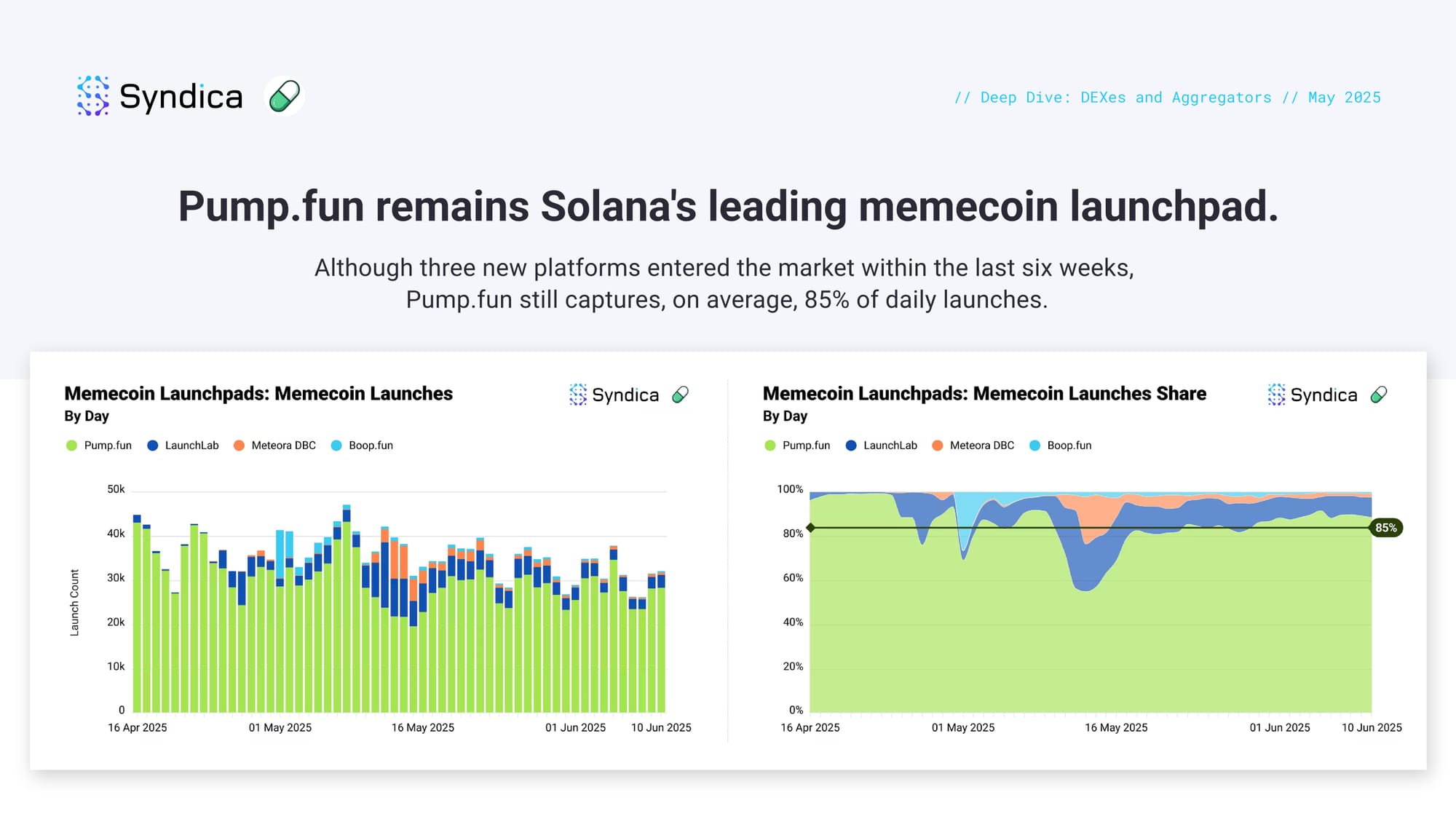

Pump.fun remains Solana's leading memecoin launchpad. Although three new platforms entered the market within the last six weeks, Pump.fun still captures, on average, 85% of daily launches.

Part IV: Stablecoins

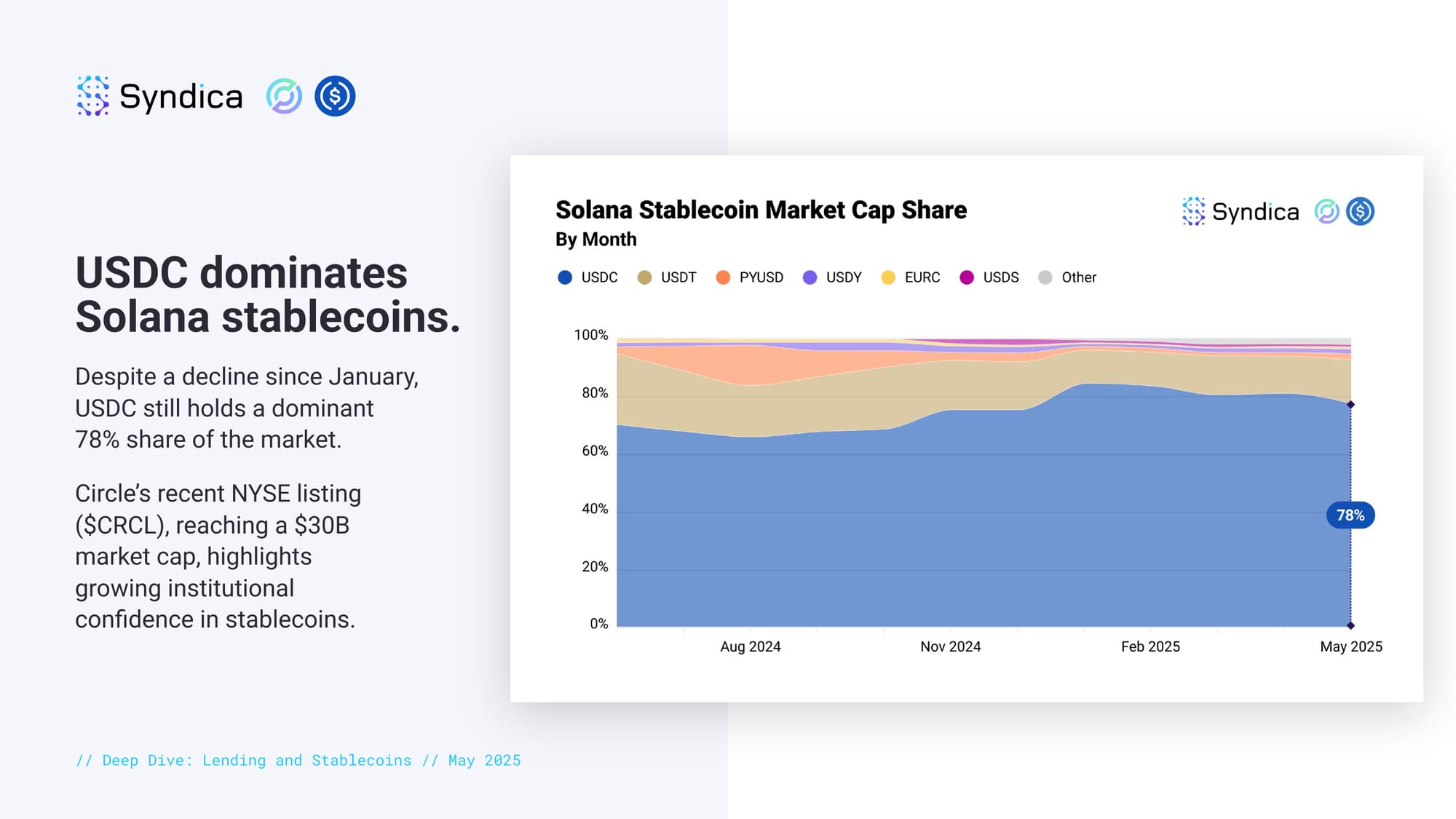

USDC dominates Solana stablecoins. Despite a decline since January, USDC still holds a dominant 78% share of the market. Circle’s recent NYSE listing ($CRCL), reaching a $30B market cap, highlights growing institutional confidence in stablecoins.

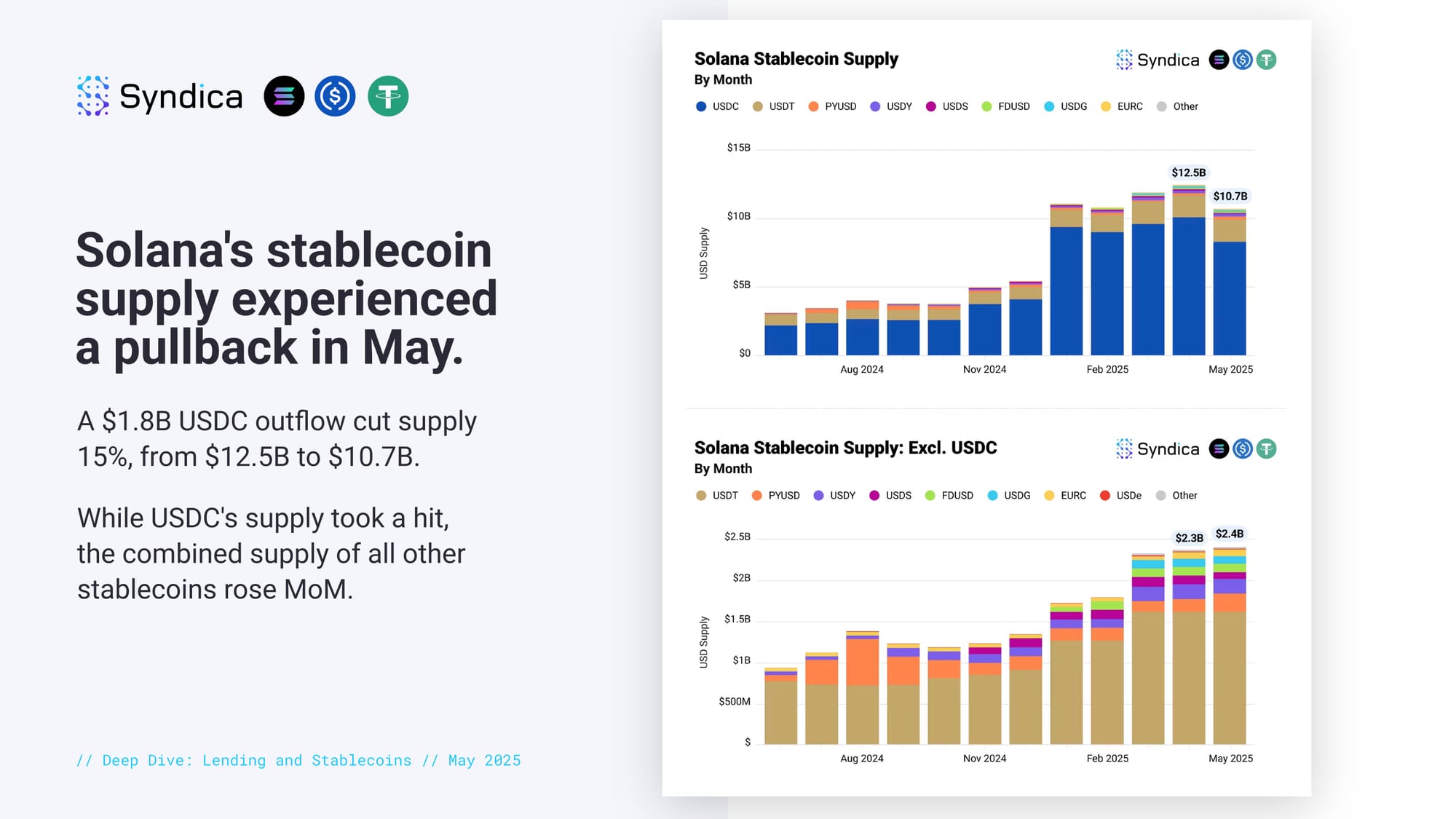

Solana's stablecoin supply experienced a pullback in May. A $1.8B USDC outflow cut supply 15%, from $12.5B to $10.7B. While USDC's supply took a hit, the combined supply of all other stablecoins rose MoM.

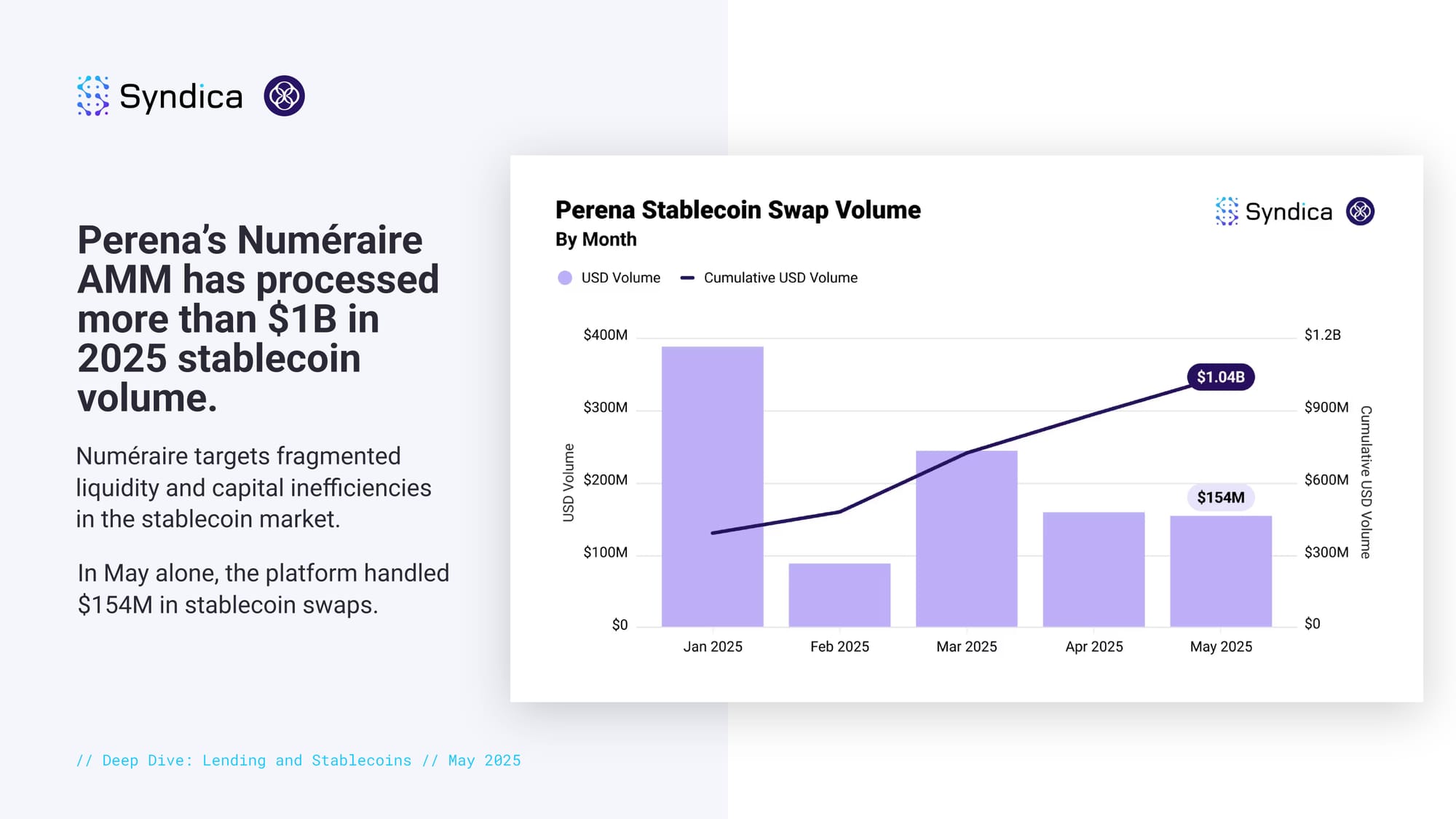

Perena’s Numéraire AMM has processed more than $1B in 2025 stablecoin volume. Numéraire targets fragmented liquidity and capital inefficiencies in the stablecoin market. In May alone, the platform handled $154M in stablecoin swaps.