Deep Dive: Solana DeFi - November 2024

Deep Dive: Solana DeFi - November 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - November 2024

Part I: Spot DEXes

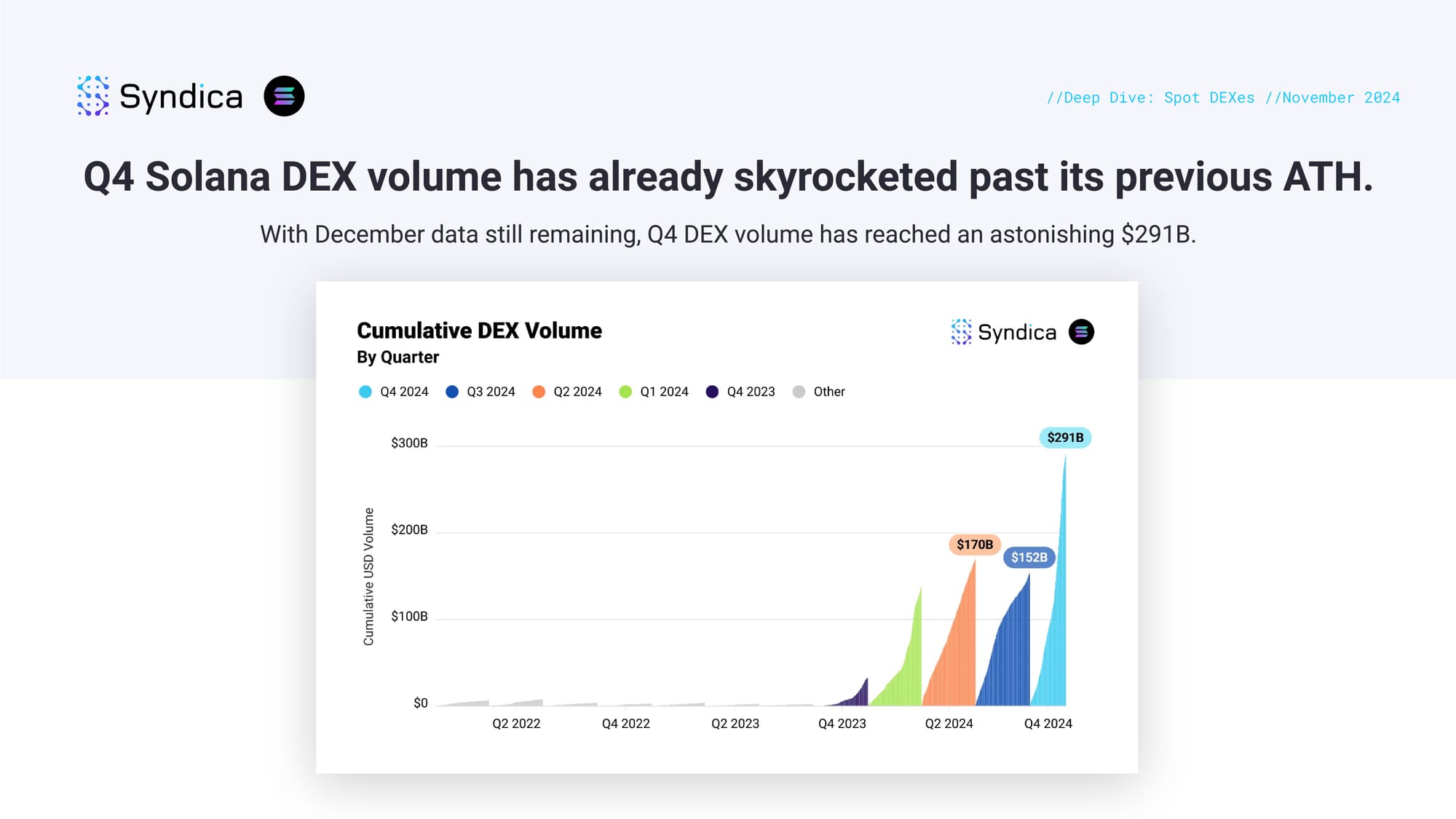

Q4 Solana DEX volume has already skyrocketed past its previous ATH. With December data still remaining, Q4 DEX volume has reached an astonishing $291B.

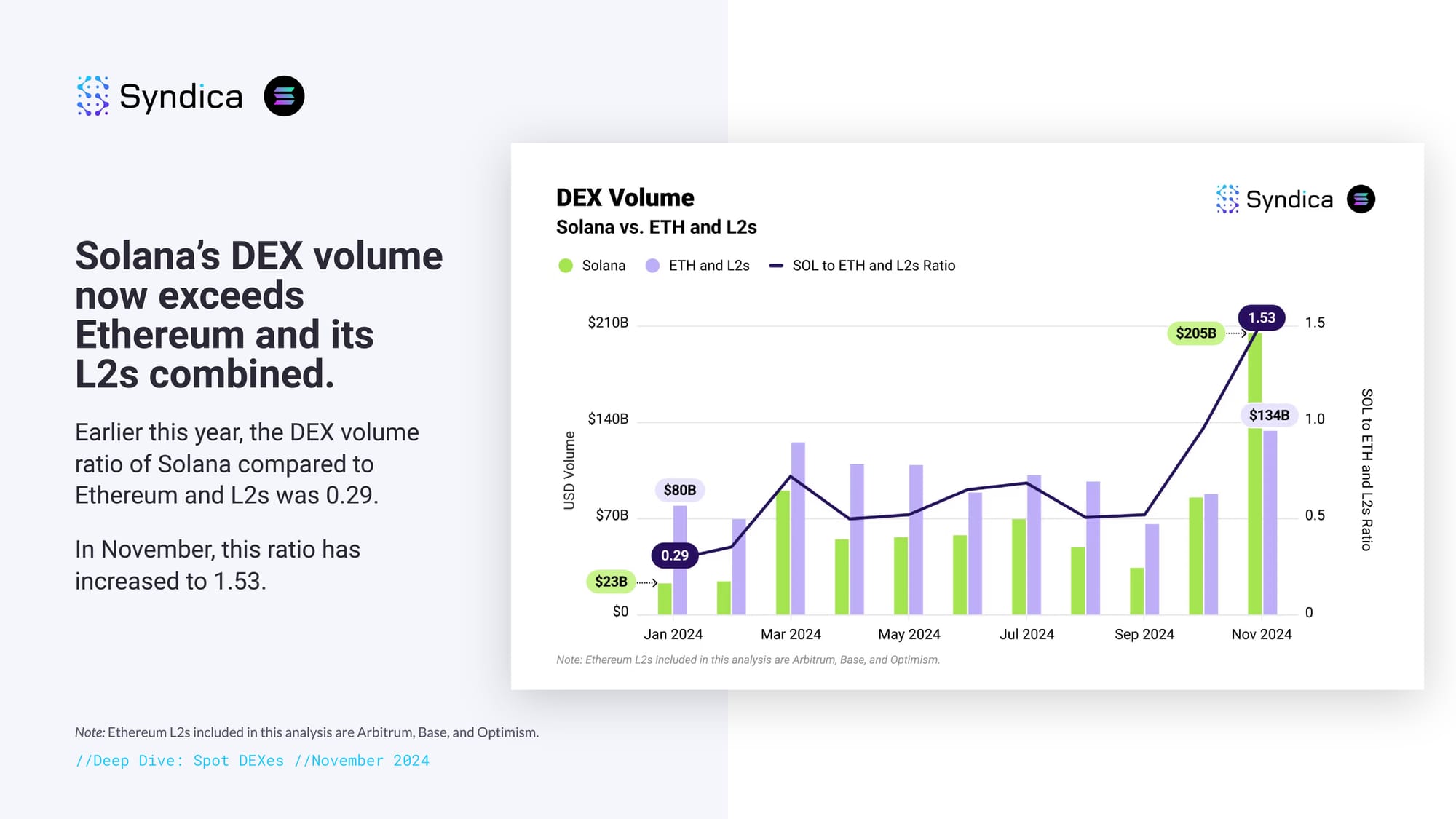

Solana’s DEX volume now exceeds Ethereum and its L2s combined. Earlier this year, the DEX volume ratio of Solana compared to Ethereum and L2s was 0.29. In November, this ratio has increased to 1.53.

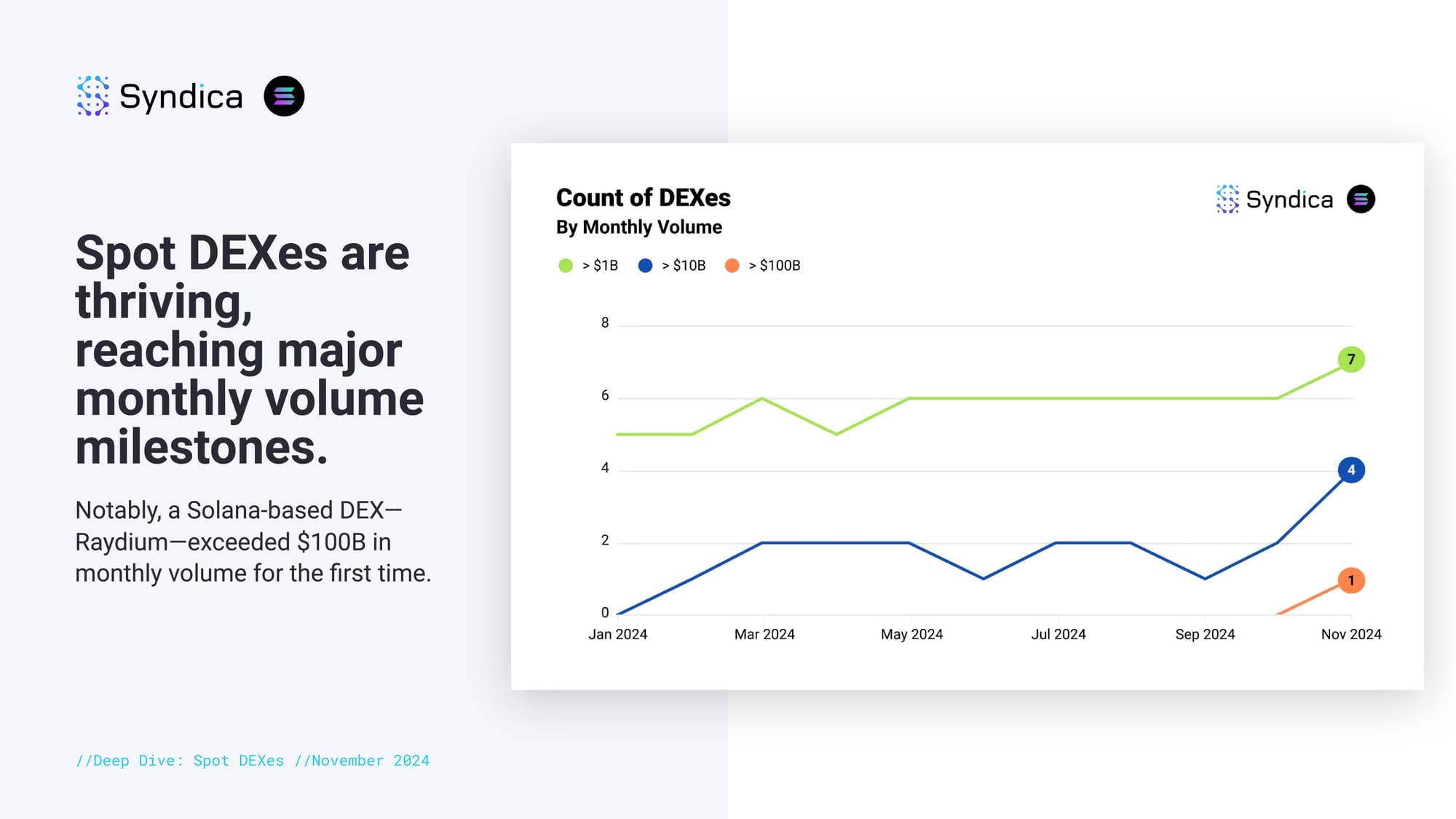

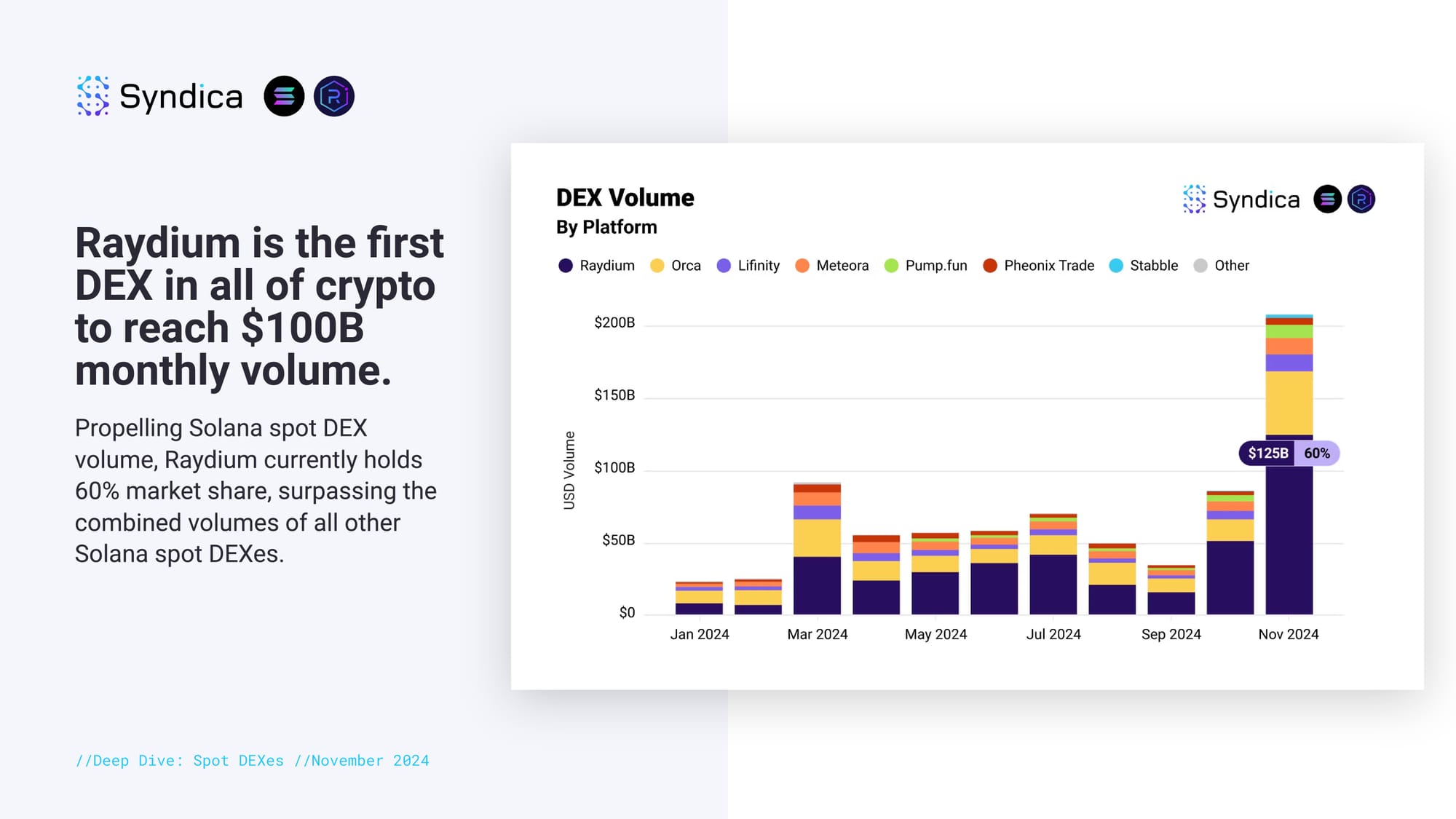

Spot DEXes are thriving, reaching major monthly volume milestones. Notably, a Solana-based DEX—Raydium—exceeded $100B in monthly volume for the first time.

Raydium is the first DEX in all of crypto to reach $100B monthly volume. Propelling Solana spot DEX volume, Raydium currently holds 60% market share, surpassing the combined volumes of all other Solana spot DEXes.

Part II: Lending and Stablecoins

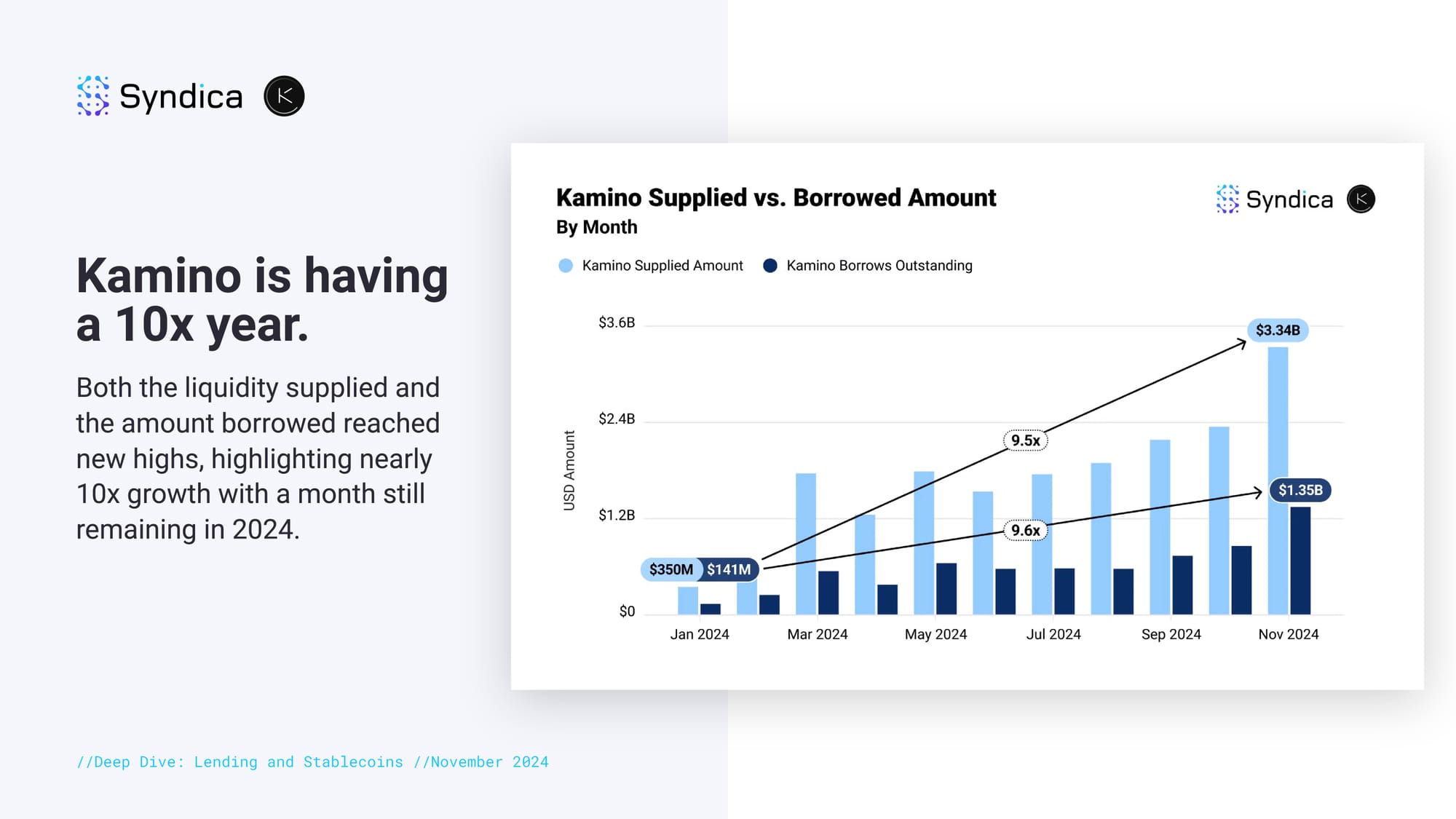

Kamino Finance is having a 10x year. Both the liquidity supplied and the amount borrowed reached new highs, highlighting nearly 10x growth with a month still remaining in 2024.

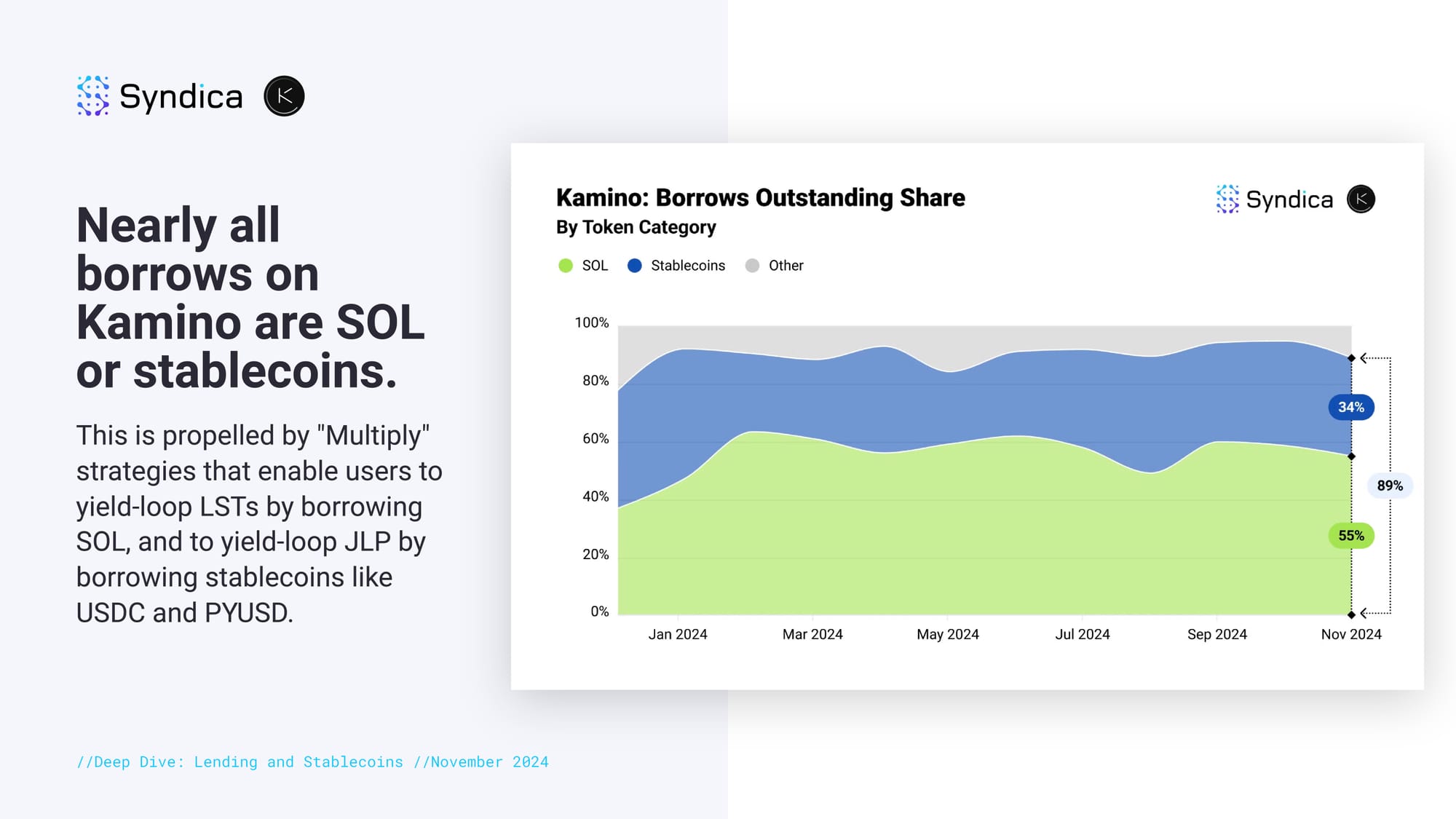

Nearly all borrows on Kamino are SOL or stablecoins. This is propelled by "Multiply" strategies that enable users to yield-loop LSTs by borrowing SOL, and to yield-loop JLP by borrowing stablecoins like USDC and PYUSD.

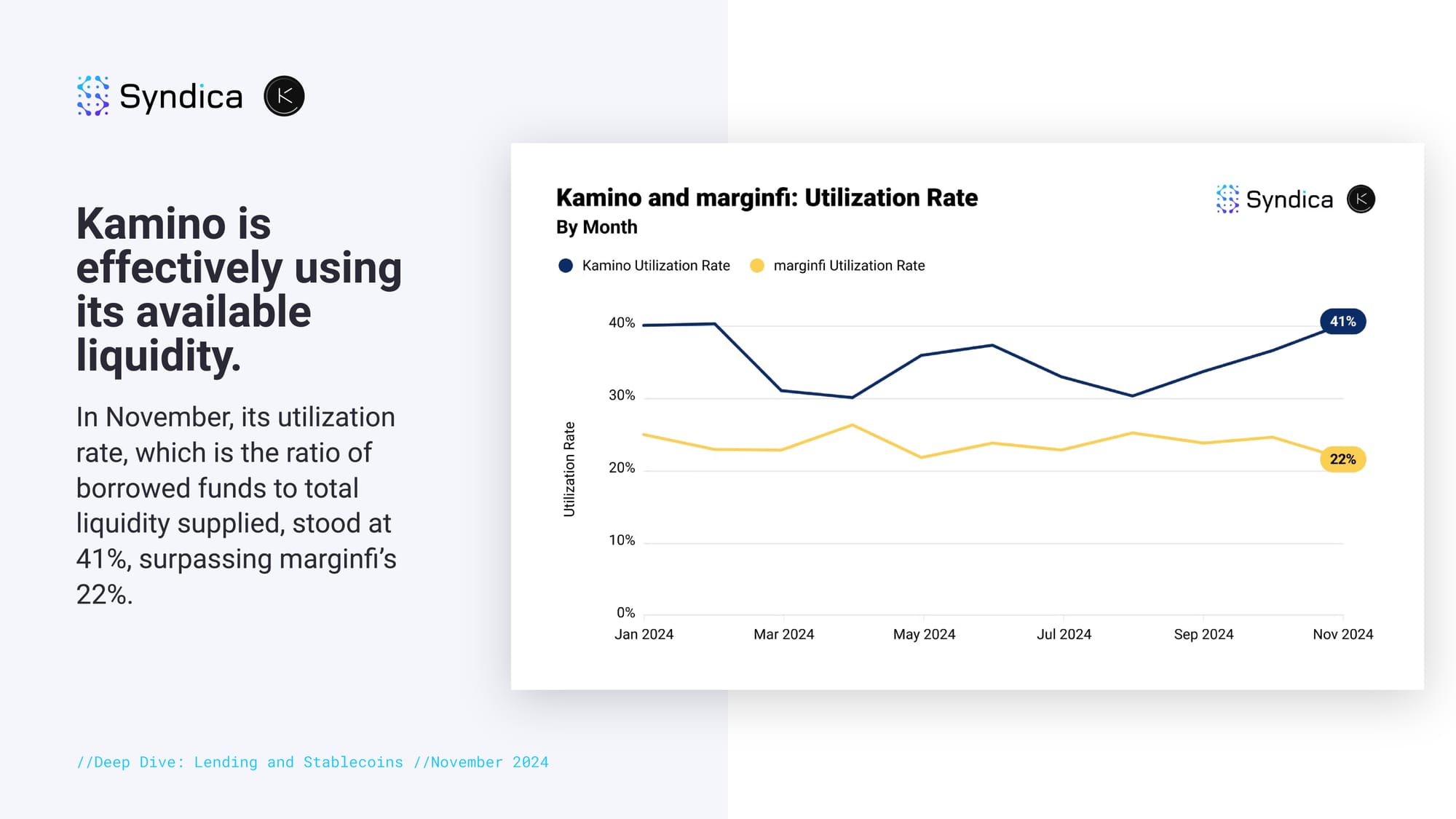

Kamino is effectively using its available liquidity. In November, its utilization rate, which is the ratio of borrowed funds to total liquidity supplied, stood at 41%, surpassing marginfi’s 22%.

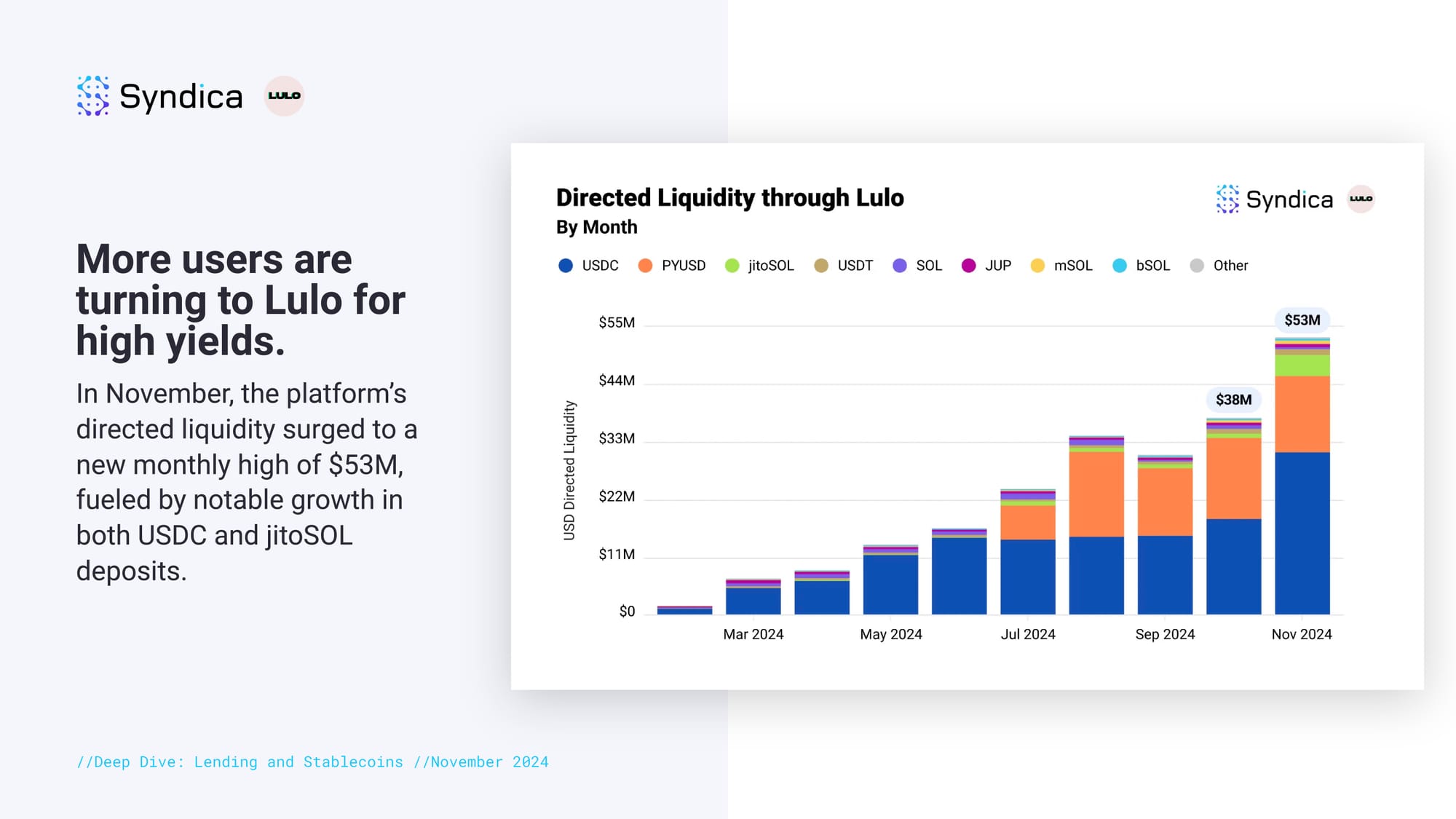

More users are turning to Lulo for high yields. In November, the platform’s directed liquidity surged to a new monthly high of $53M, fueled by notable growth in both USDC and jitoSOL deposits.

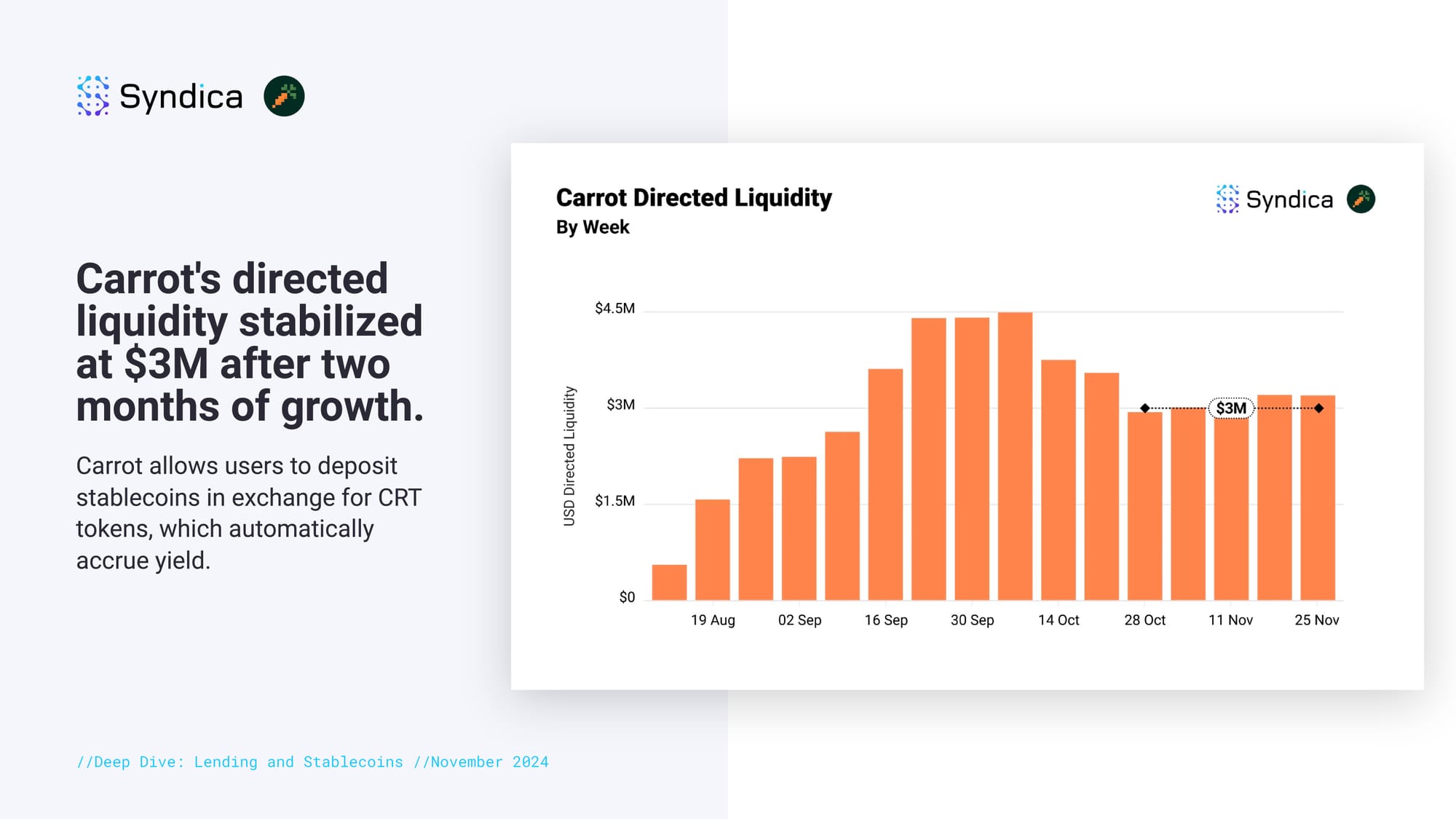

Carrot's directed liquidity stabilized at $3M after two months of growth. Carrot allows users to deposit stablecoins in exchange for CRT tokens, which automatically accrue yield.

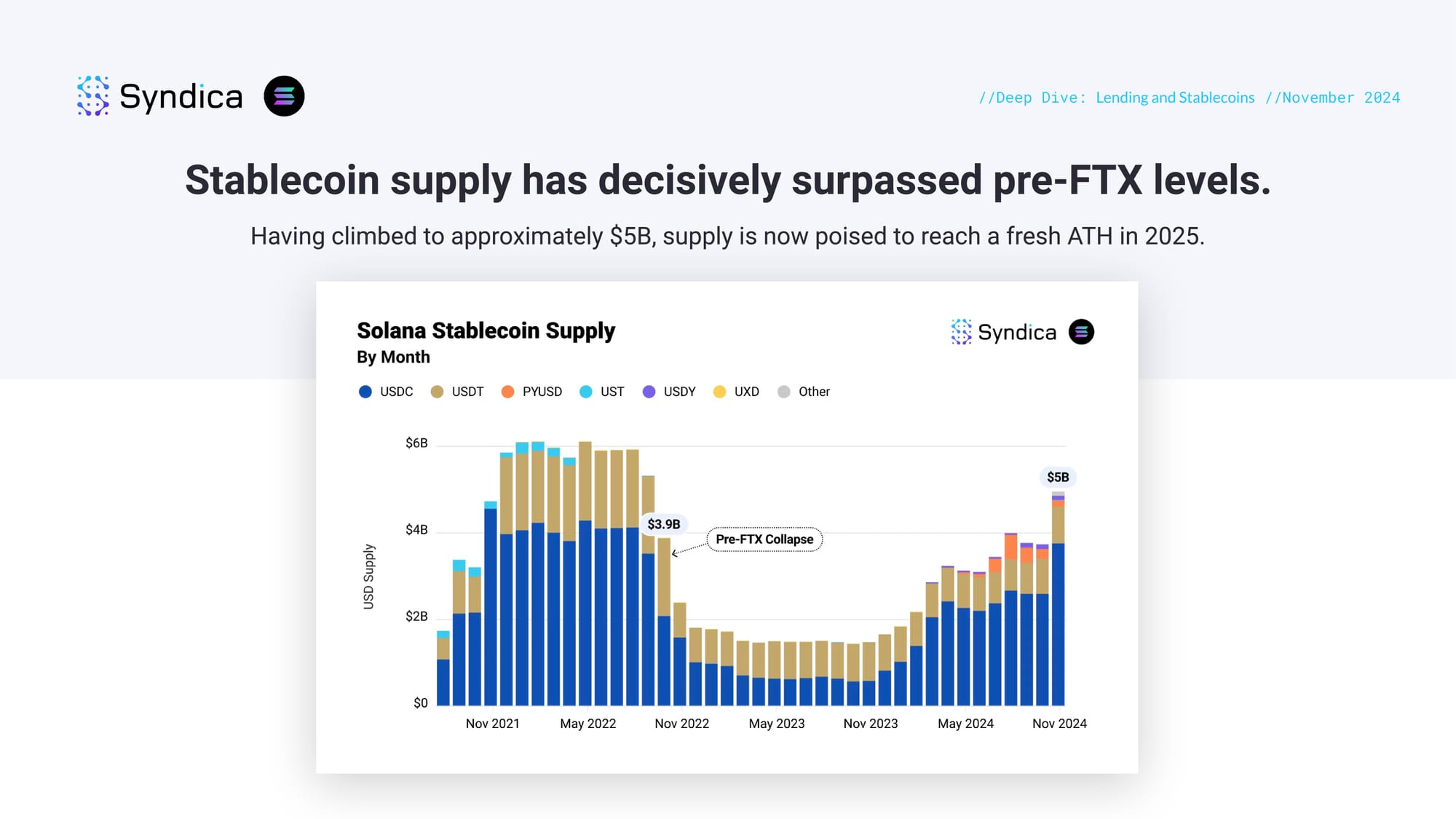

Stablecoin supply has decisively surpassed pre-FTX levels. Having climbed to approximately $5B, supply is now poised to reach a fresh ATH in 2025.

Part III: Liquid Staking

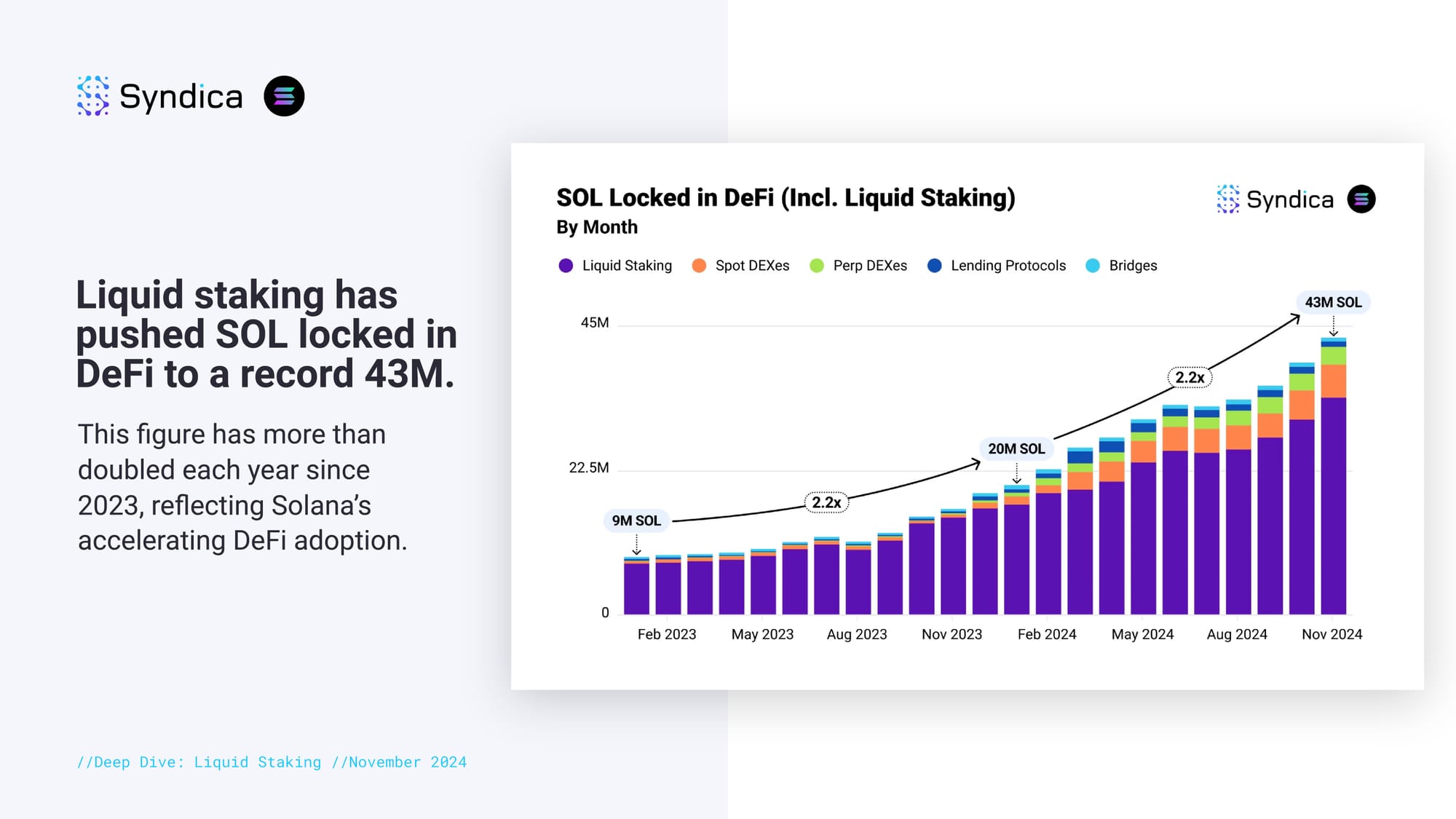

Liquid staking has pushed SOL locked in DeFi to a record 43M. This figure has more than doubled each year since 2023, reflecting Solana’s accelerating DeFi adoption.

Liquid staking share rose 4x since 2023. It now accounts for 8.7% of all staked SOL and 5.8% of the total SOL supply.

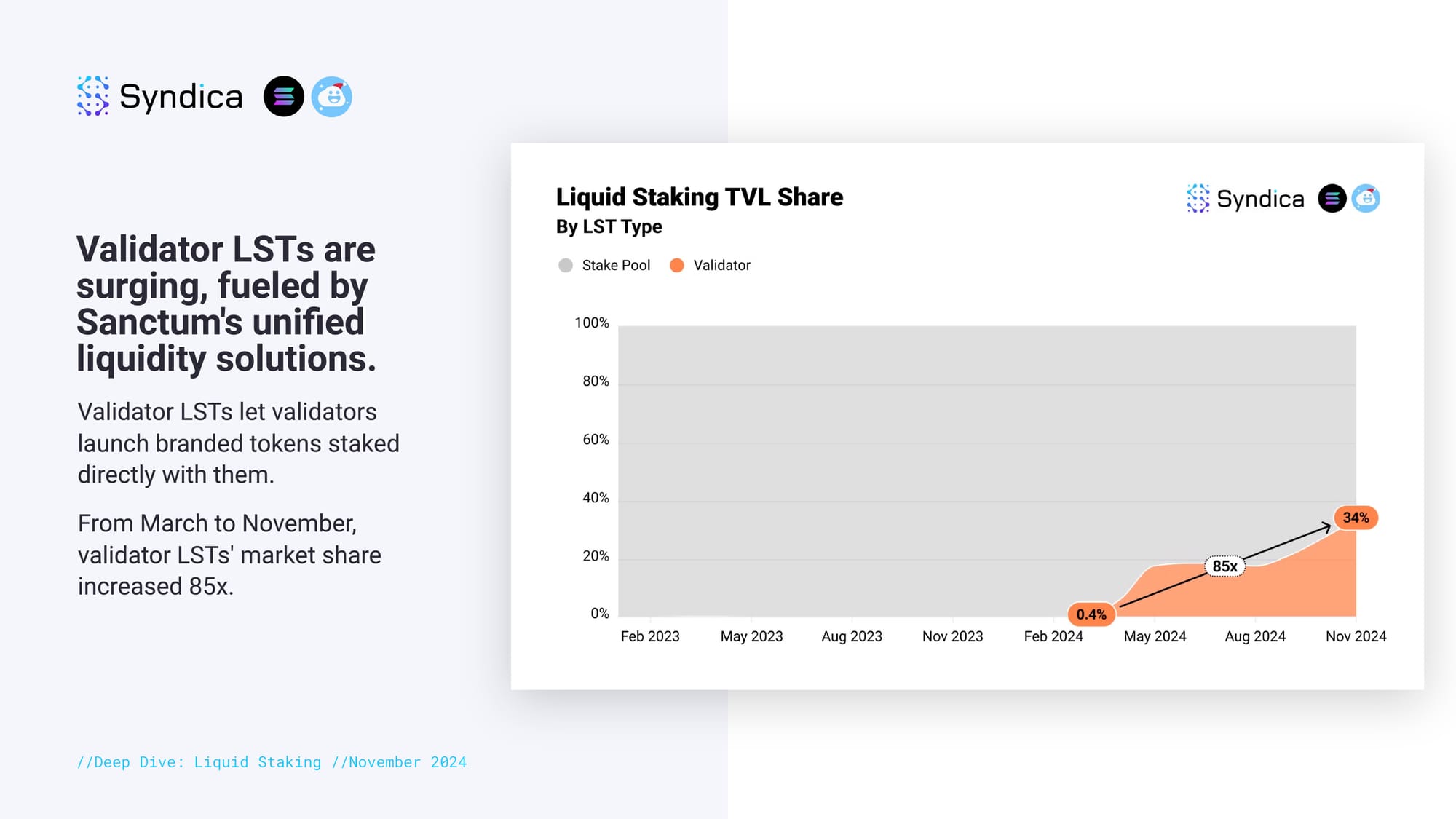

Validator LSTs are surging, fueled by Sanctum's unified liquidity solutions. Validator LSTs let validators launch branded tokens staked directly with them. From March to November, validator LSTs' market share increased 85x.

Part IV: Cross-chain Bridges

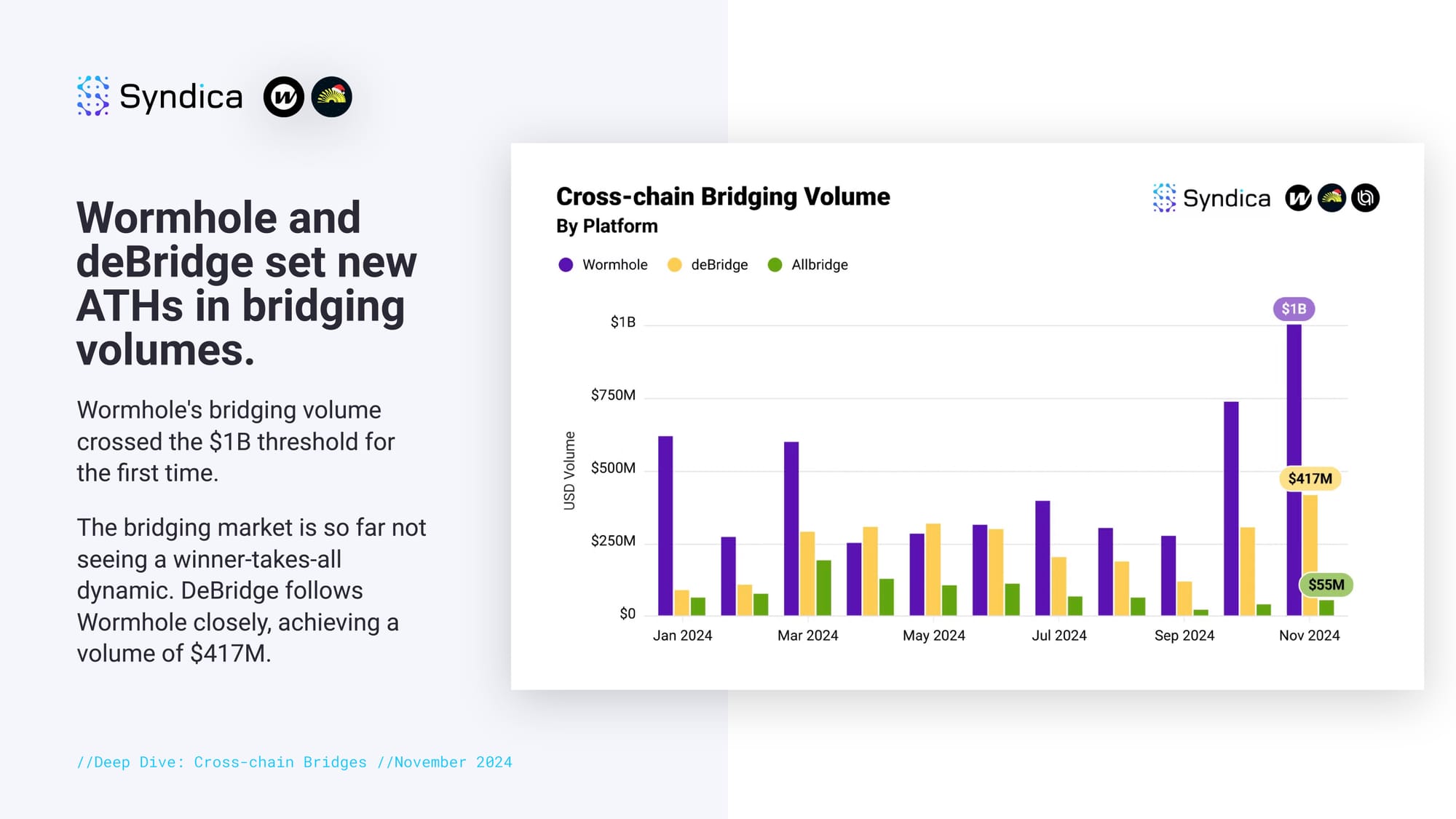

Wormhole and deBridge set new ATHs in bridging volumes. Wormhole's bridging volume crossed the $1B threshold for the first time. The bridging market is so far not seeing a winner-takes-all dynamic. DeBridge follows Wormhole closely, achieving a volume of $417M.

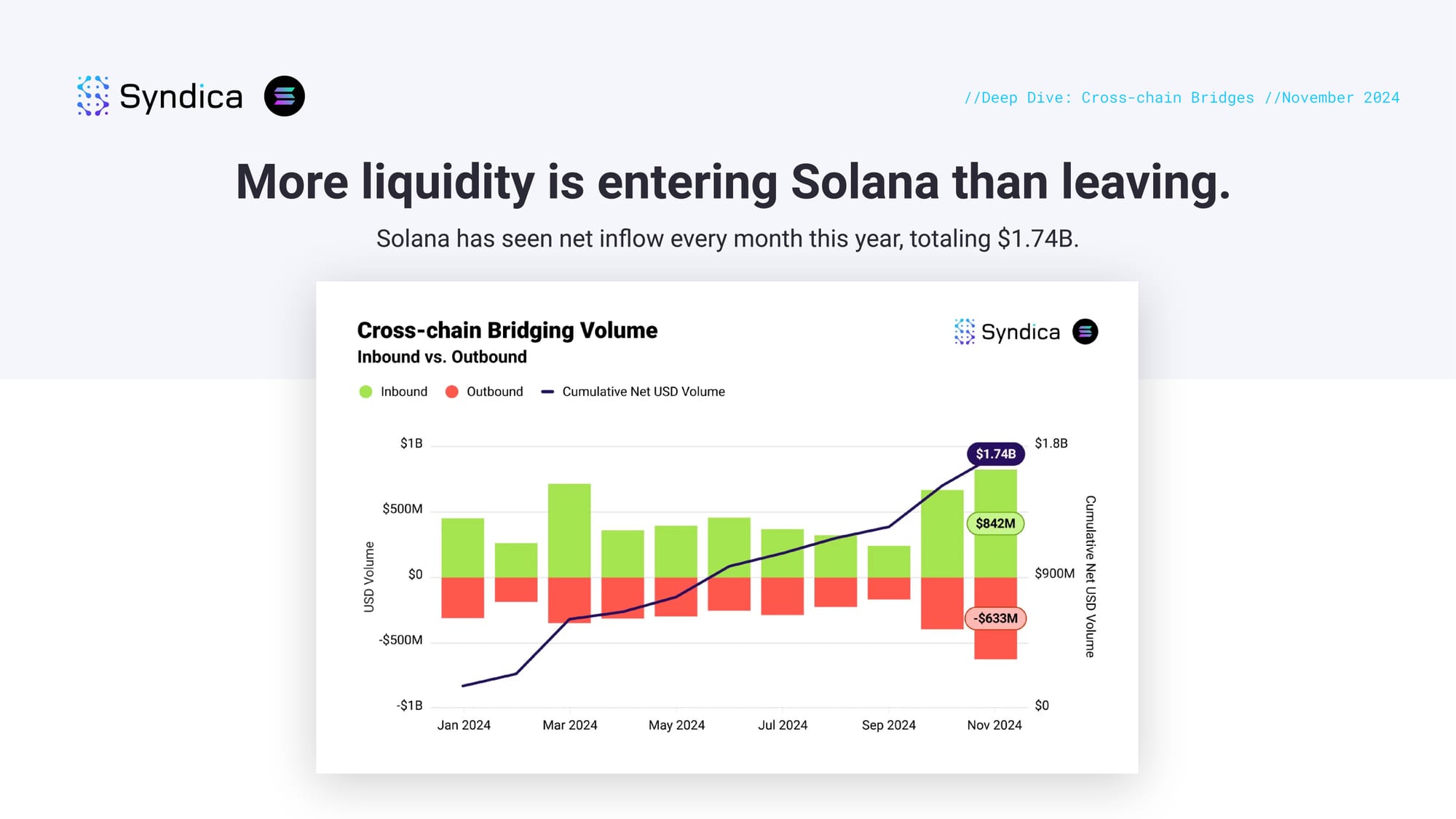

More liquidity is entering Solana than leaving. Solana has seen net inflow every month this year, totaling $1.74B.