Deep Dive: Solana DeFi - October 2024

Deep Dive: Solana DeFi - October 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - October 2024

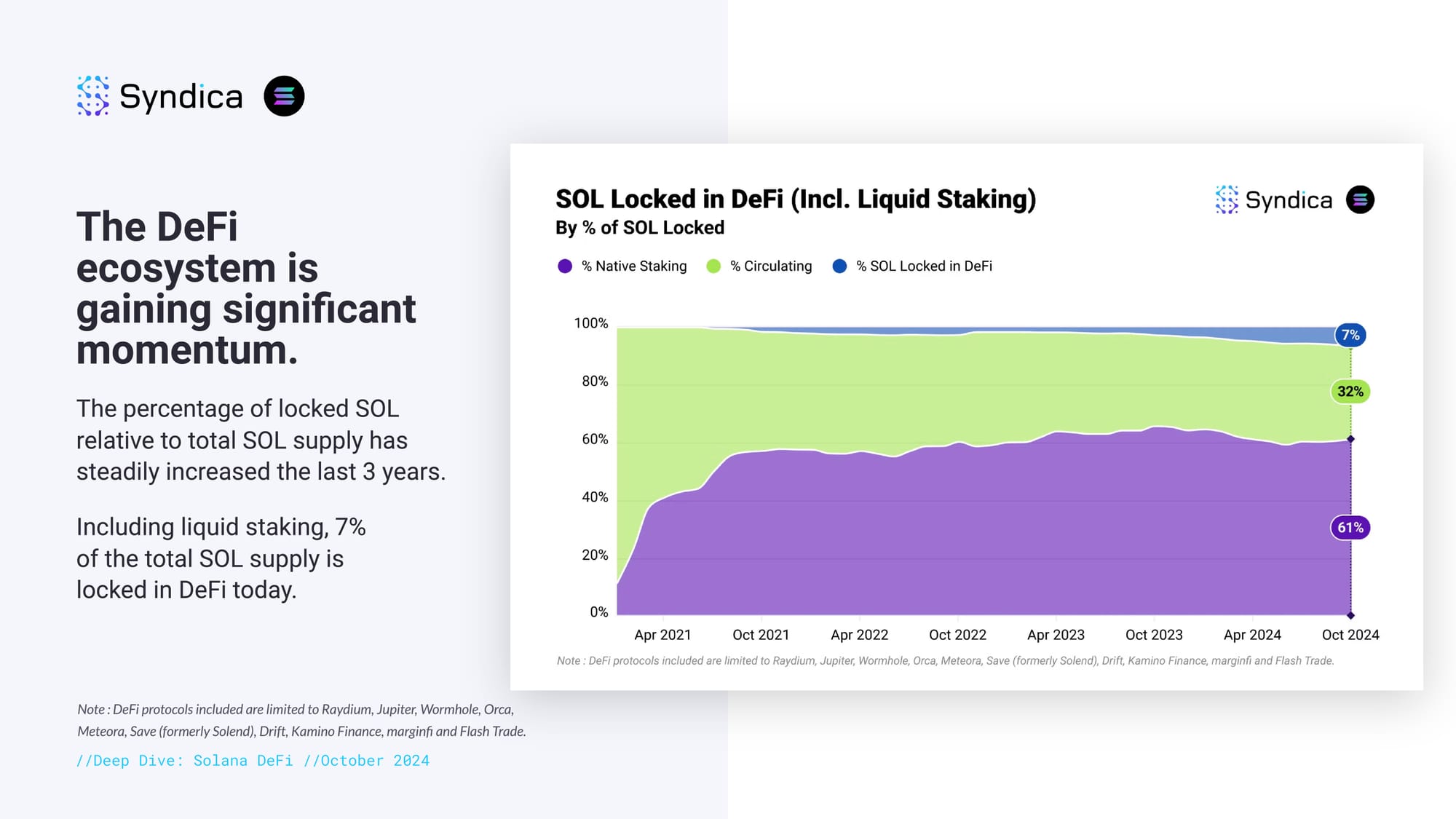

The Solana DeFi ecosystem is gaining significant momentum. The percentage of locked SOL relative to total SOL supply has steadily increased the last 3 years. Including liquid staking, 7% of the total SOL supply is locked in DeFi today.

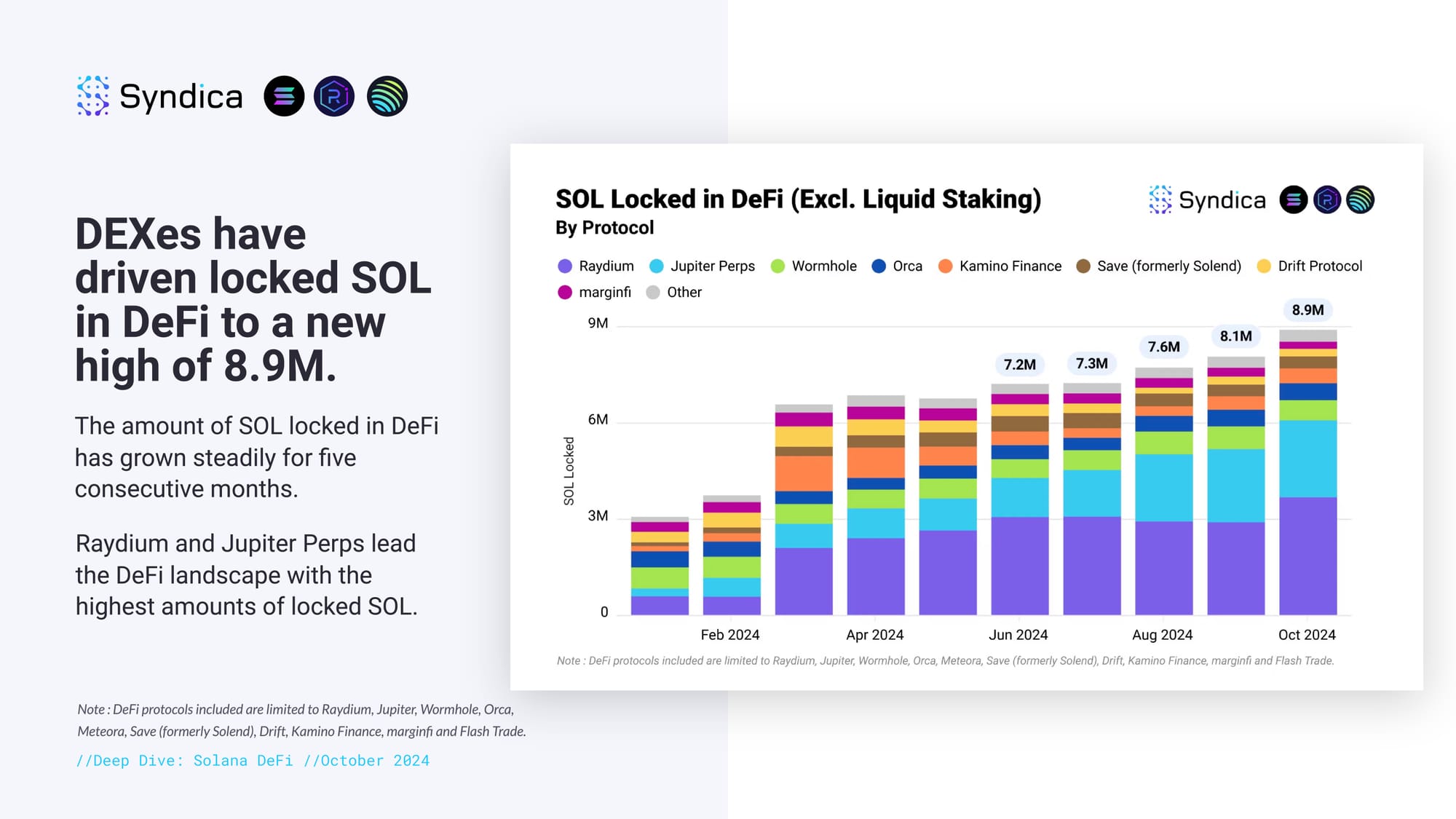

DEXes have driven locked SOL in DeFi to a new high of 8.9M. The amount of SOL locked in DeFi has grown steadily for five consecutive months. Raydium and Jupiter Perps lead the DeFi landscape with the highest amounts of locked SOL.

Part I: Spot and Perp DEXes

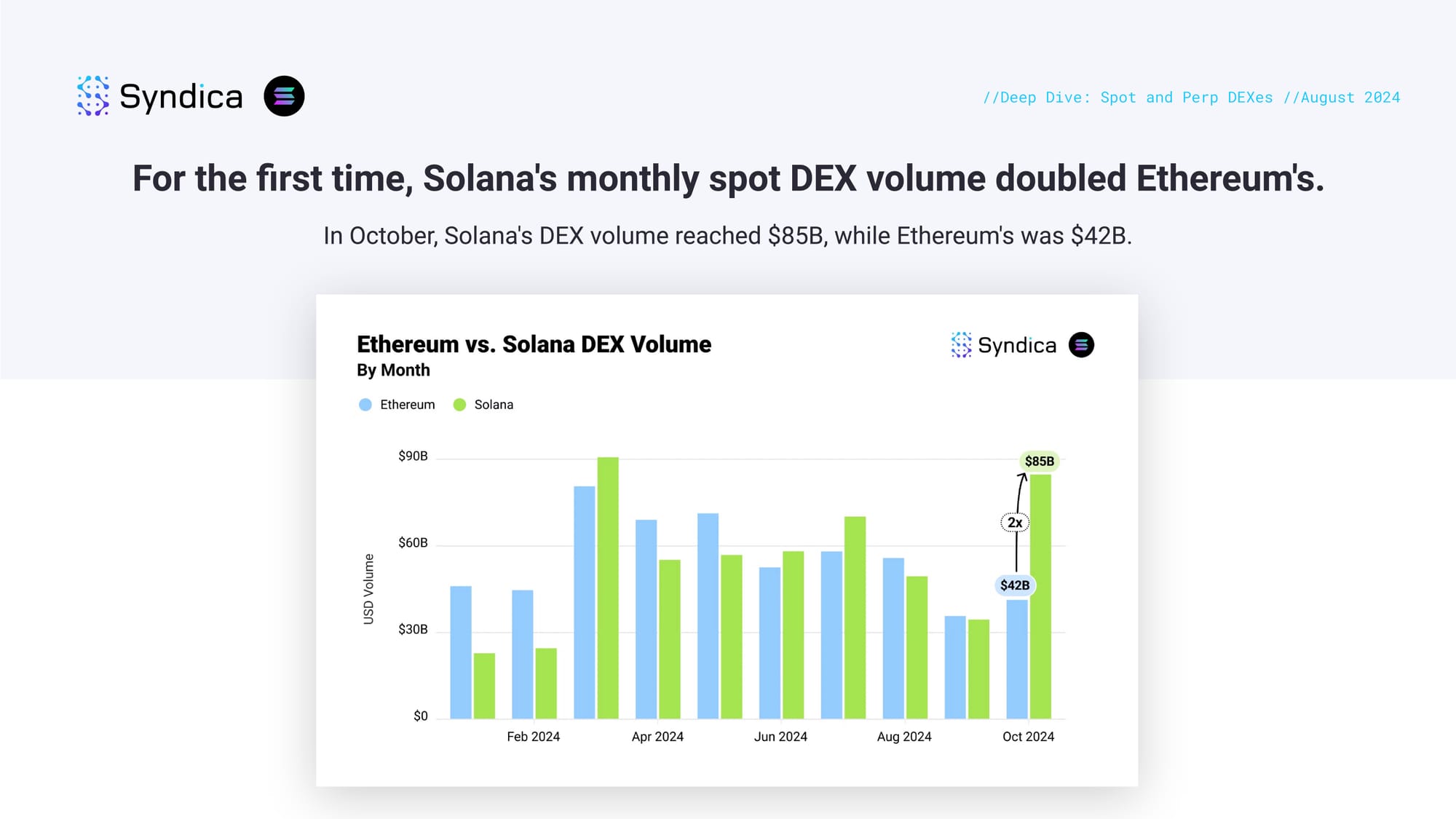

For the first time, Solana's monthly spot DEX volume doubled Ethereum's. In October, Solana's DEX volume reached $85B, while Ethereum's was $42B.

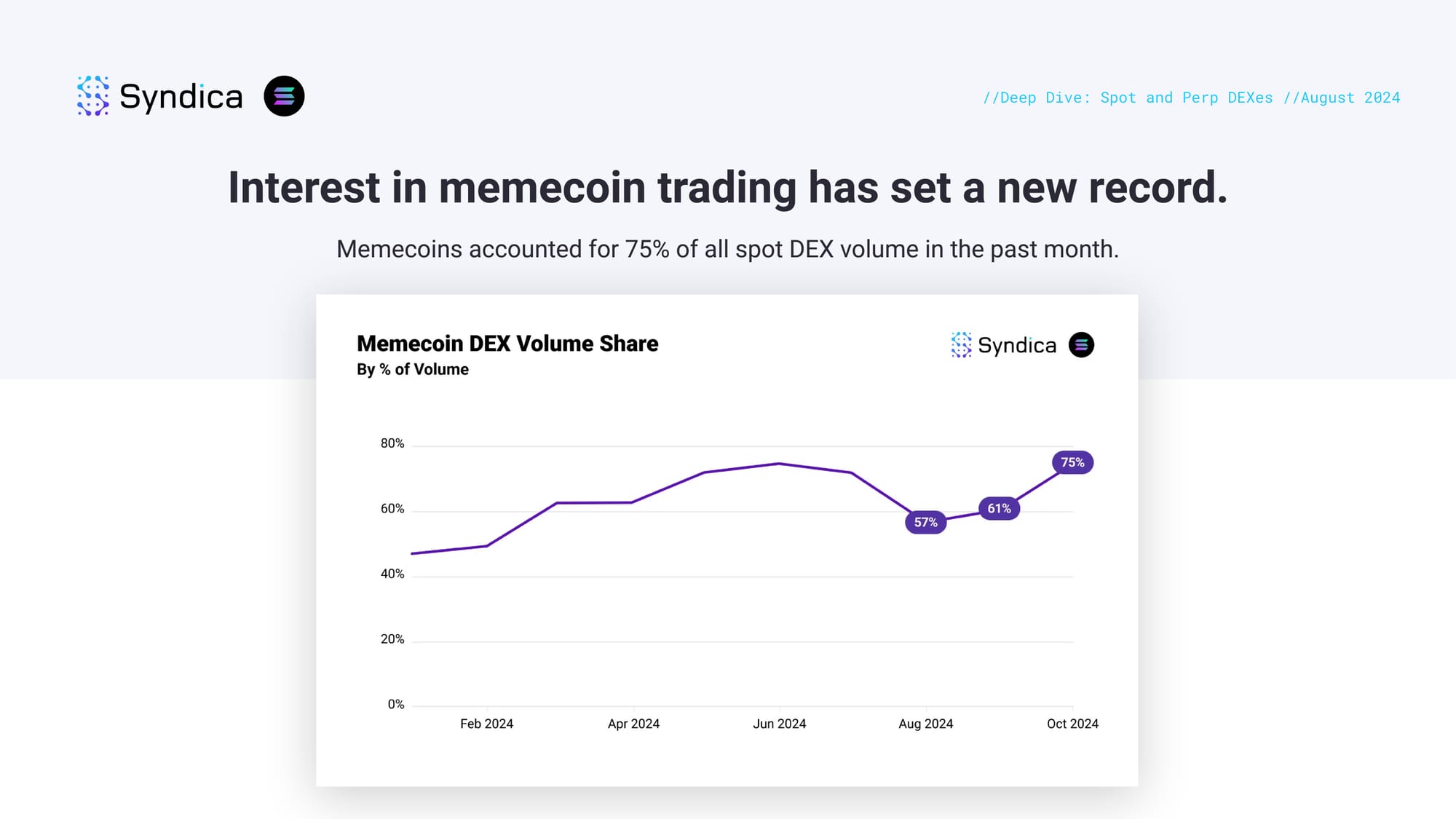

Interest in memecoin trading has set a new record. Memecoins accounted for 75% of all spot DEX volume in the past month.

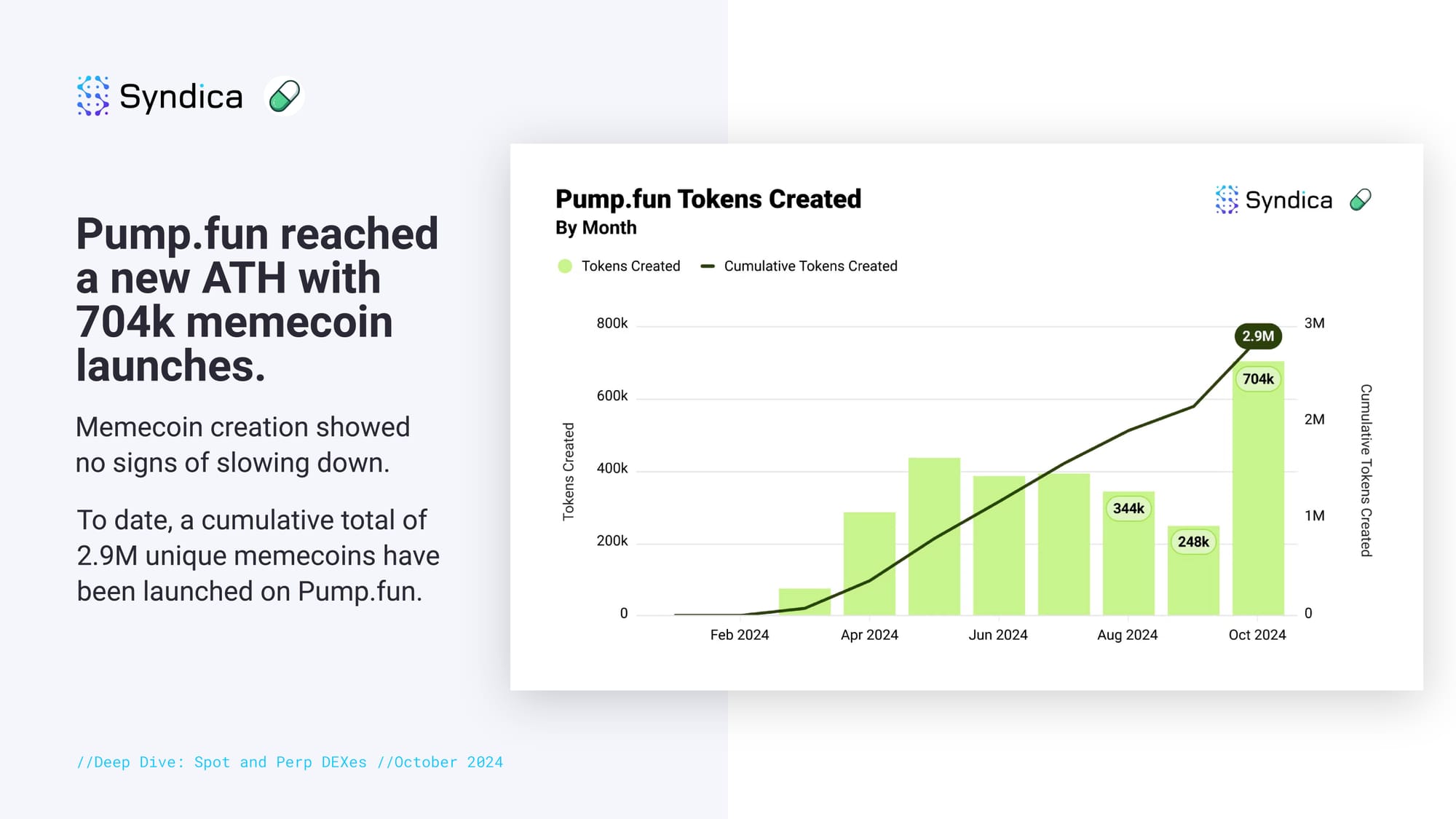

Pump.fun reached a new ATH with 704k memecoin launches. Memecoin creation showed no signs of slowing down. To date, a cumulative total of 2.9M unique memecoins have been launched on Pump.fun.

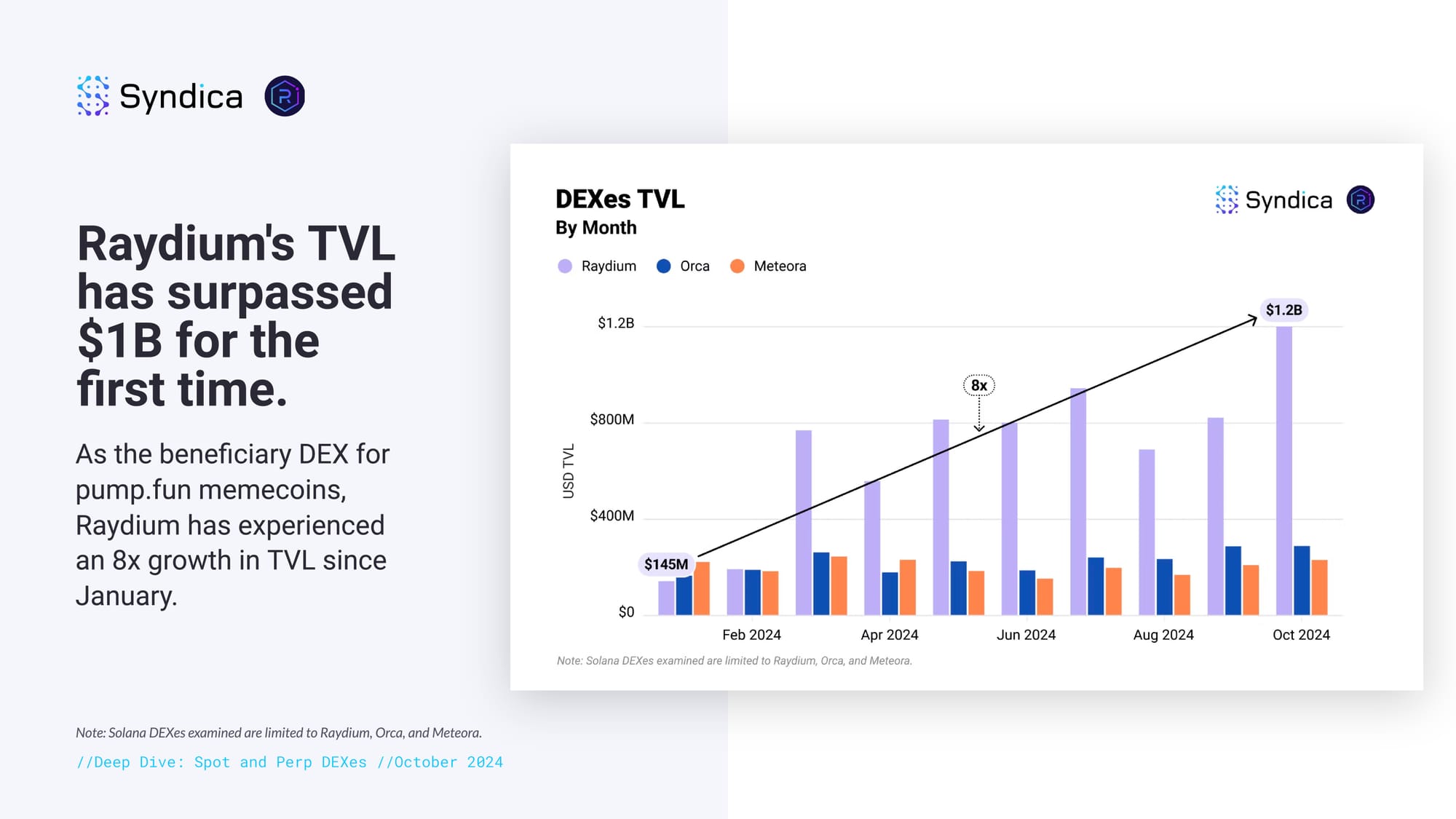

Raydium's TVL has surpassed $1B for the first time. As the beneficiary DEX for pump.fun memecoins, Raydium has experienced an 8x growth in TVL since January.

Jupiter Perps set new records in perpetuals volume and TVL. The protocol achieved $16B in trading volume and $870M in TVL, marking significant new milestones.

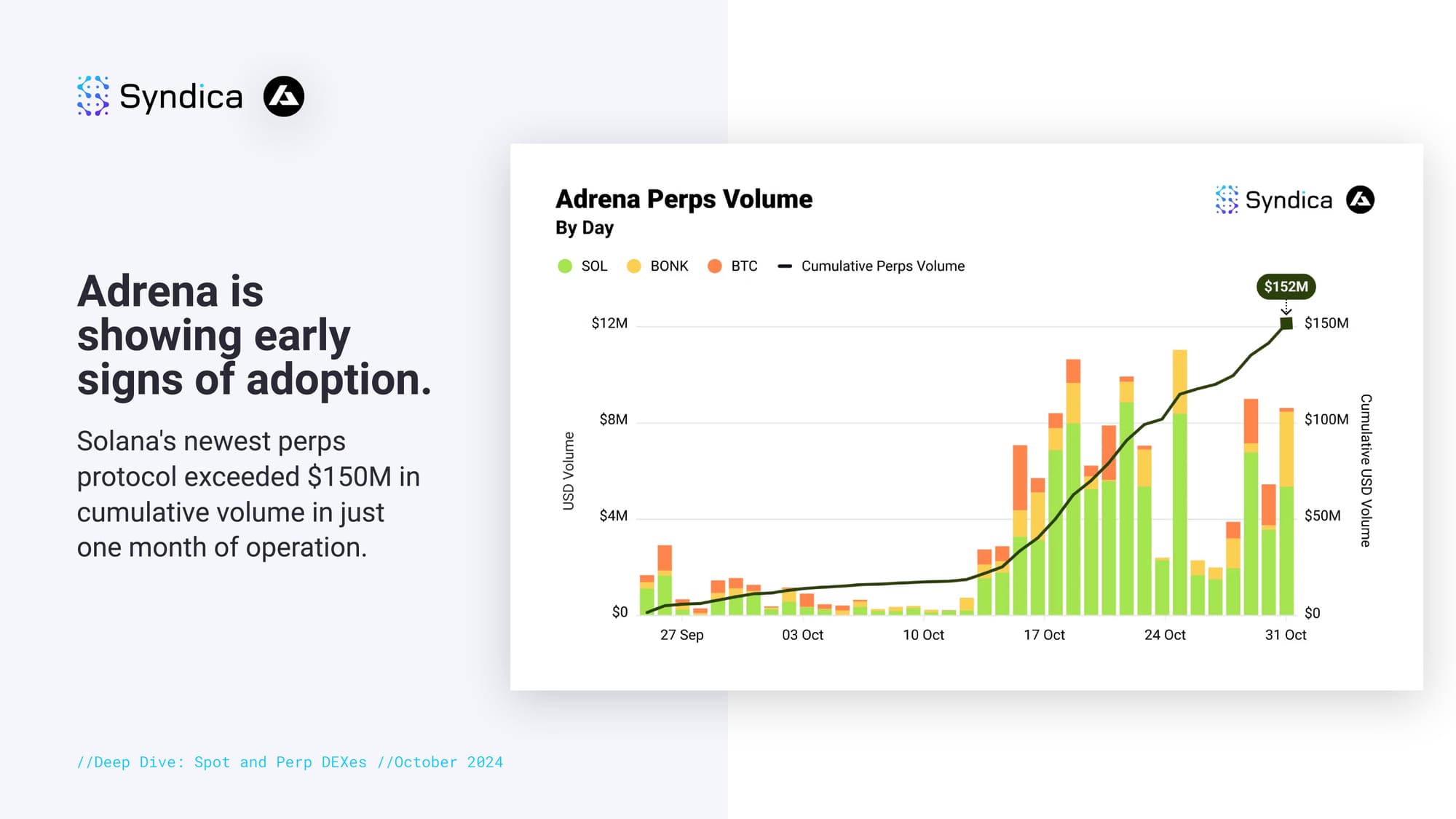

Adrena is showing early signs of adoption. Solana's newest perps protocol exceeded $150M in cumulative volume in just one month of operation.

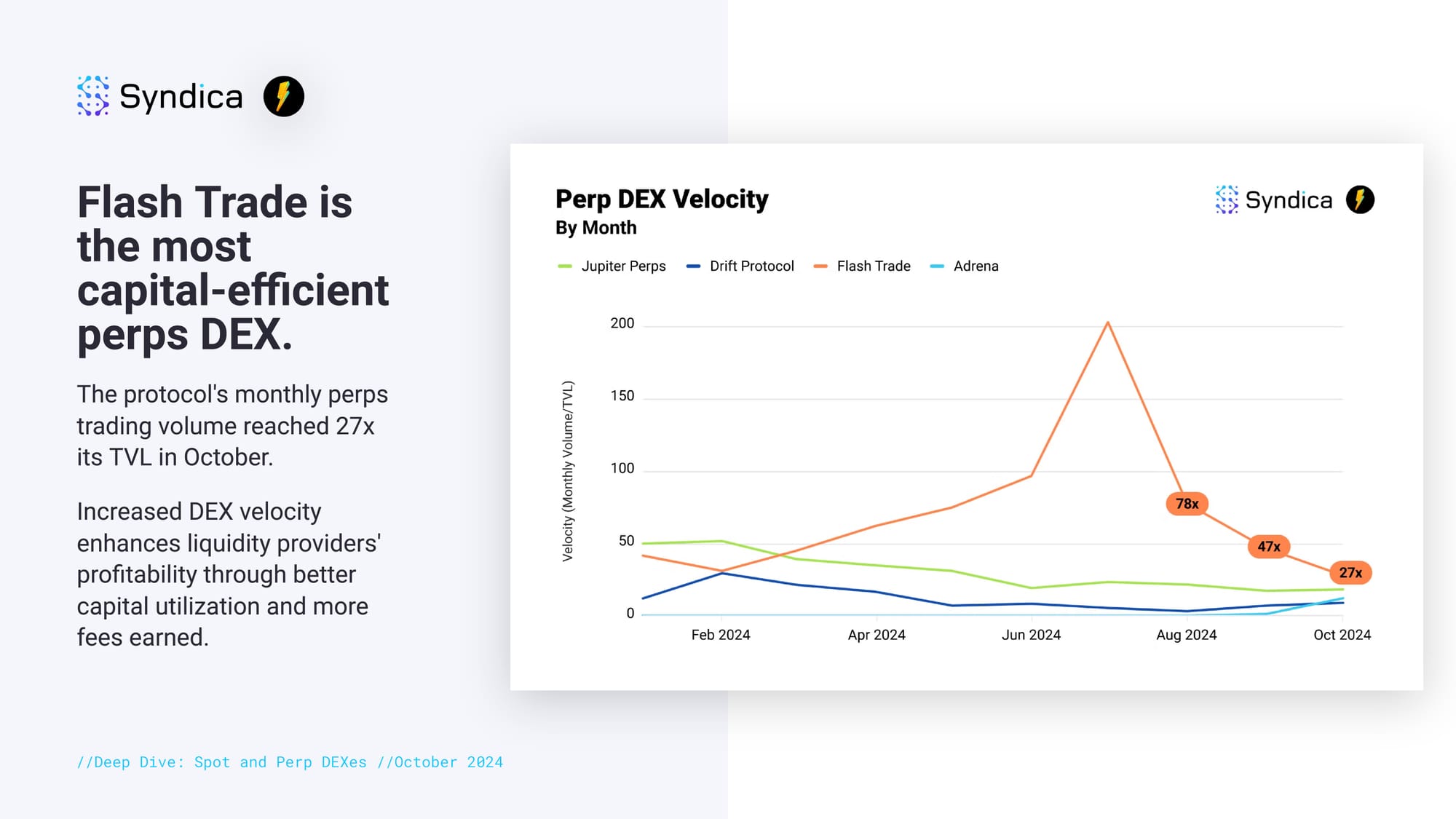

Flash Trade is the most capital-efficient perps DEX. The protocol's monthly perps trading volume reached 27x its TVL in October. Increased DEX velocity enhances liquidity providers' profitability through better capital utilization and more fees earned.

Part II: Lending and Stablecoins

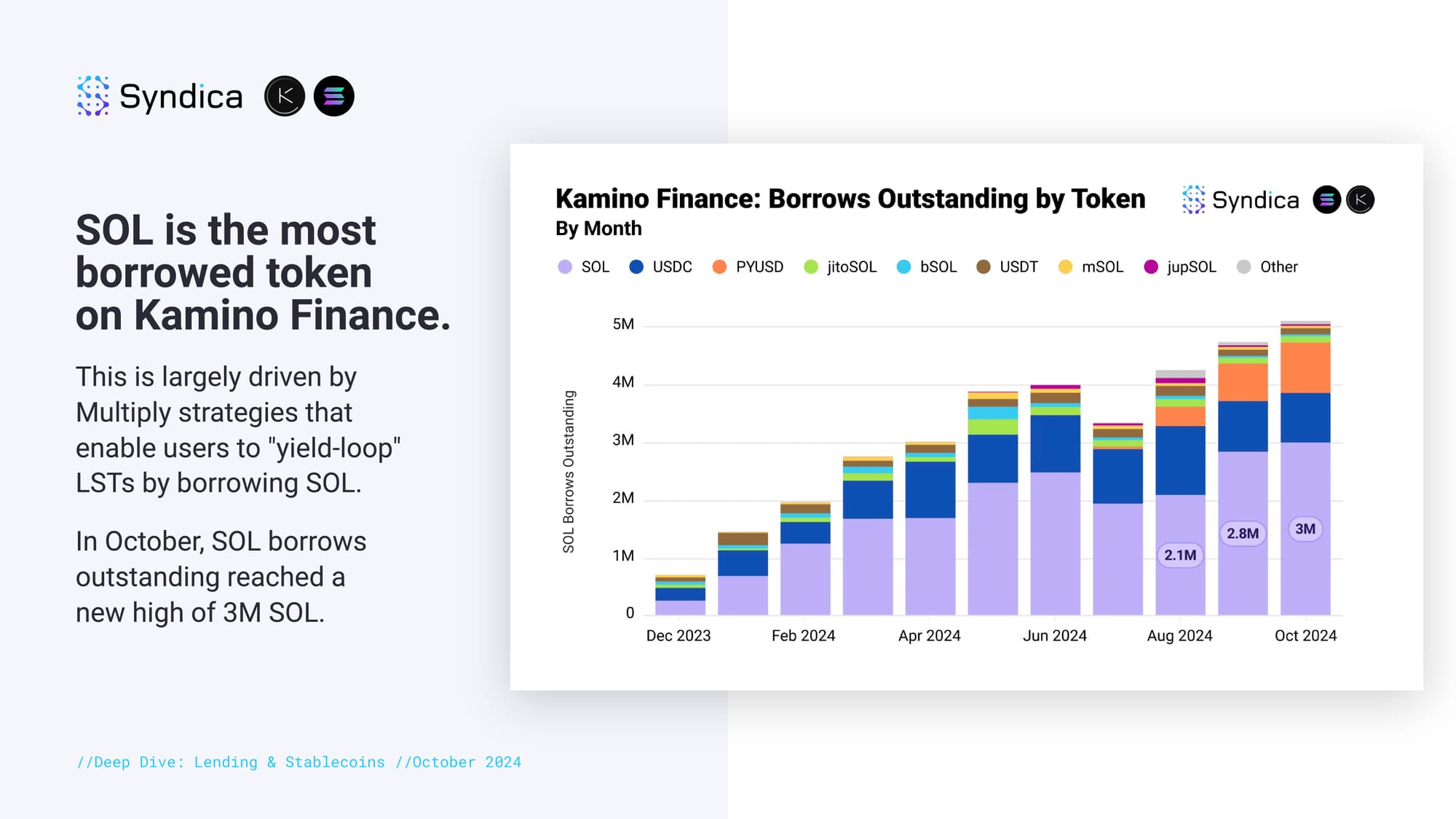

Kamino's borrows outstanding reached an ATH of 5.1M SOL. Higher levels of borrows signal effective liquidity use and serve as a key indicator of a healthy lending market.

SOL is the most borrowed token on Kamino Finance. This is largely driven by Multiply strategies that enable users to "yield-loop" LSTs by borrowing SOL. In October, SOL borrows outstanding reached a new high of 3M SOL.

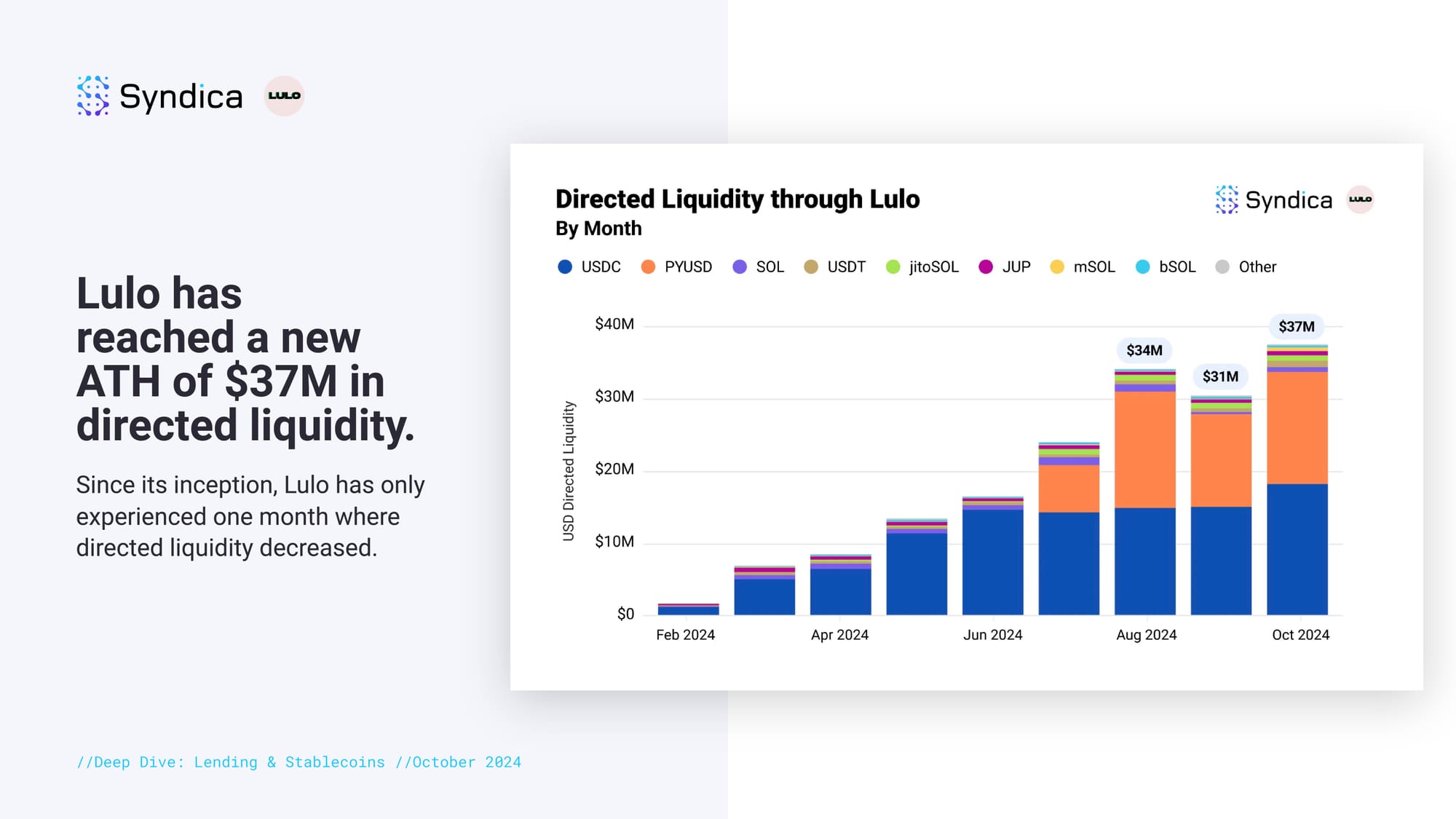

Lulo has reached a new ATH of $37M in directed liquidity. Since its inception, Lulo has only experienced one month where directed liquidity decreased.

Part III: Liquid Staking

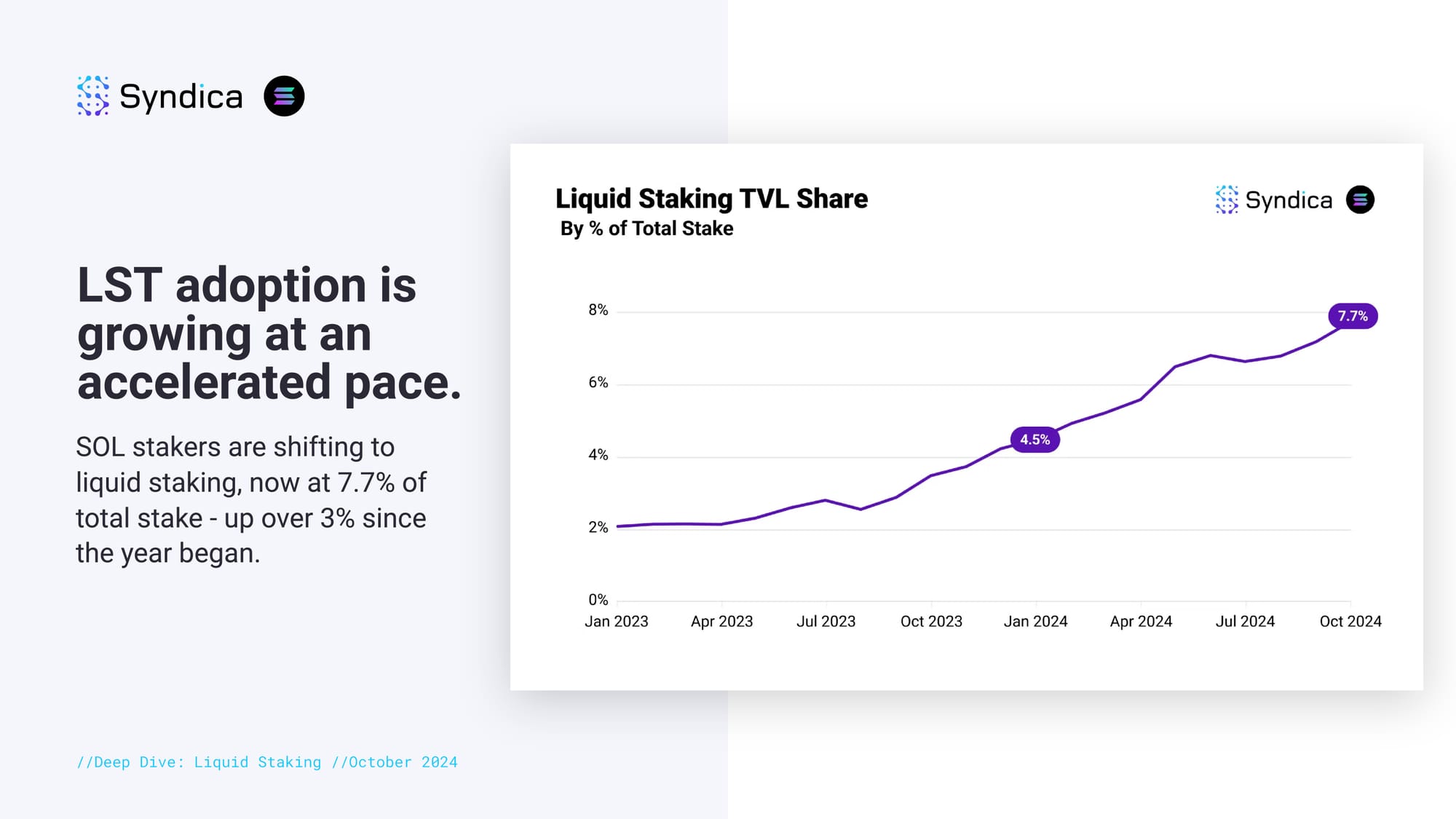

LST adoption is growing at an accelerated pace. SOL stakers are shifting to liquid staking, now at 7.7% of total stake - up over 3% since the year began.

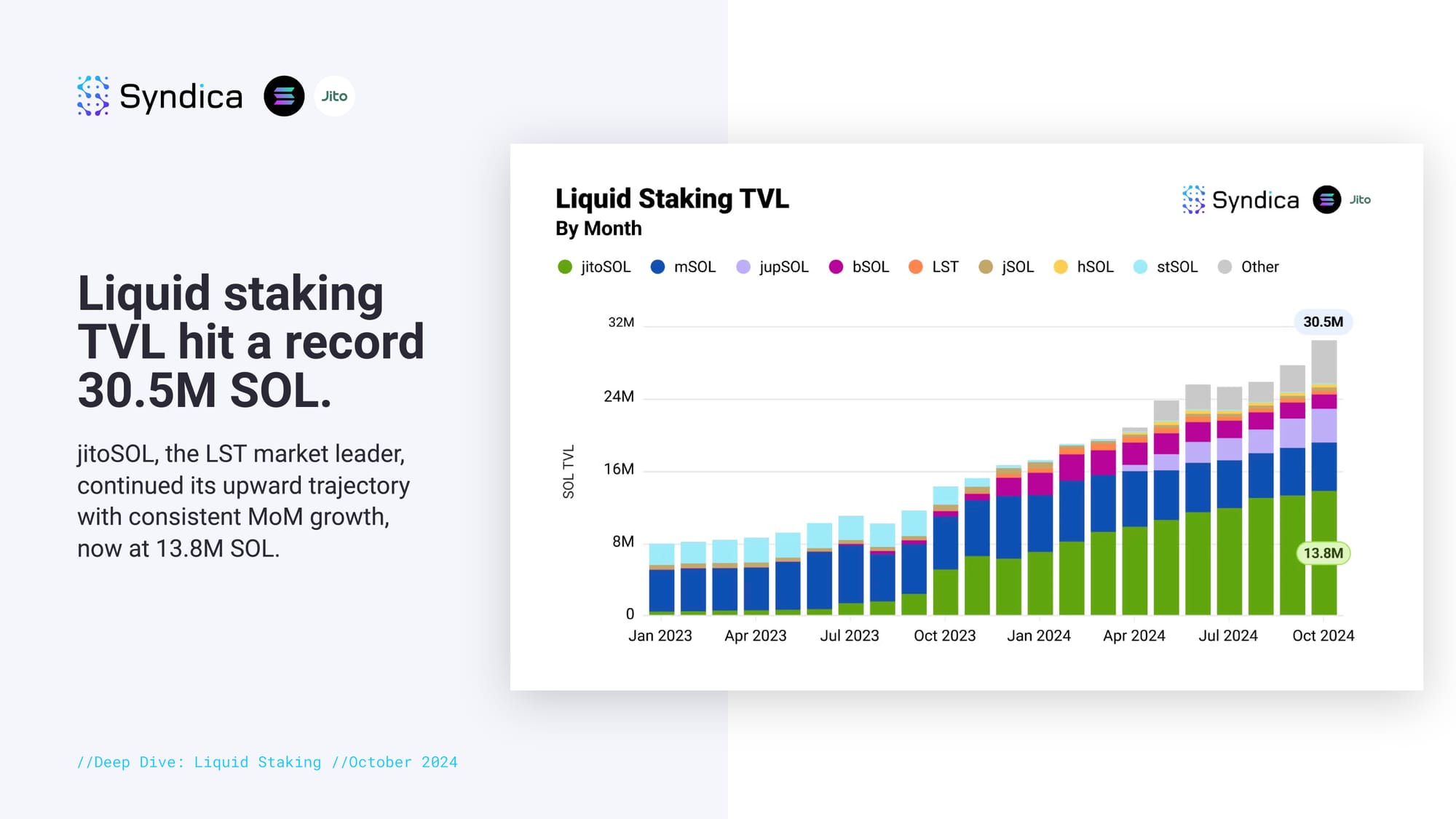

Liquid staking TVL hit a record 30.5M SOL. jitoSOL, the LST market leader, continued its upward trajectory with consistent MoM growth, now at 13.8M SOL.

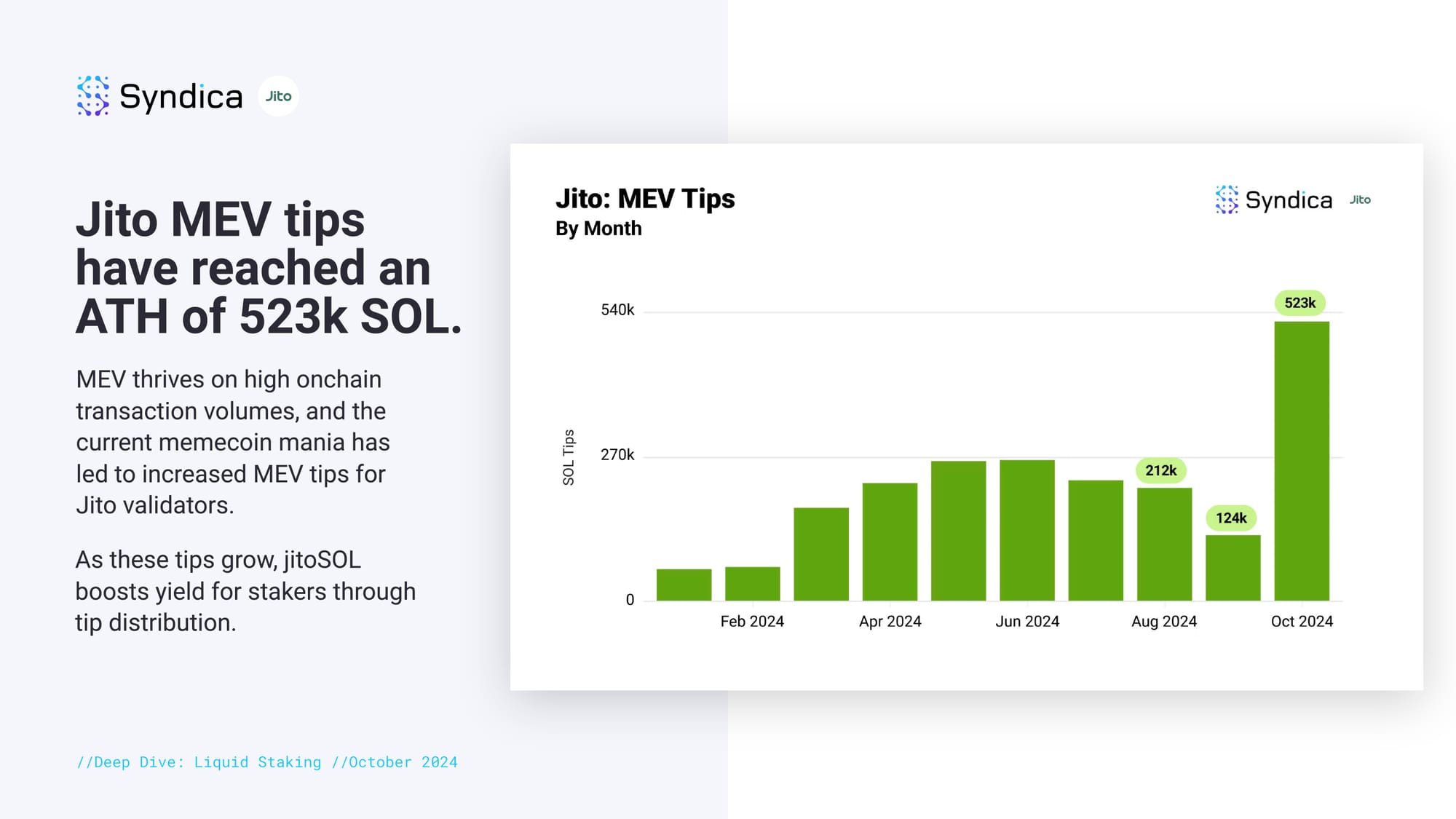

Jito MEV tips have reached an ATH of 523k SOL. MEV thrives on high onchain transaction volumes, and the current memecoin mania has led to increased MEV tips for Jito validators. As these tips grow, jitoSOL boosts yield for stakers through tip distribution.

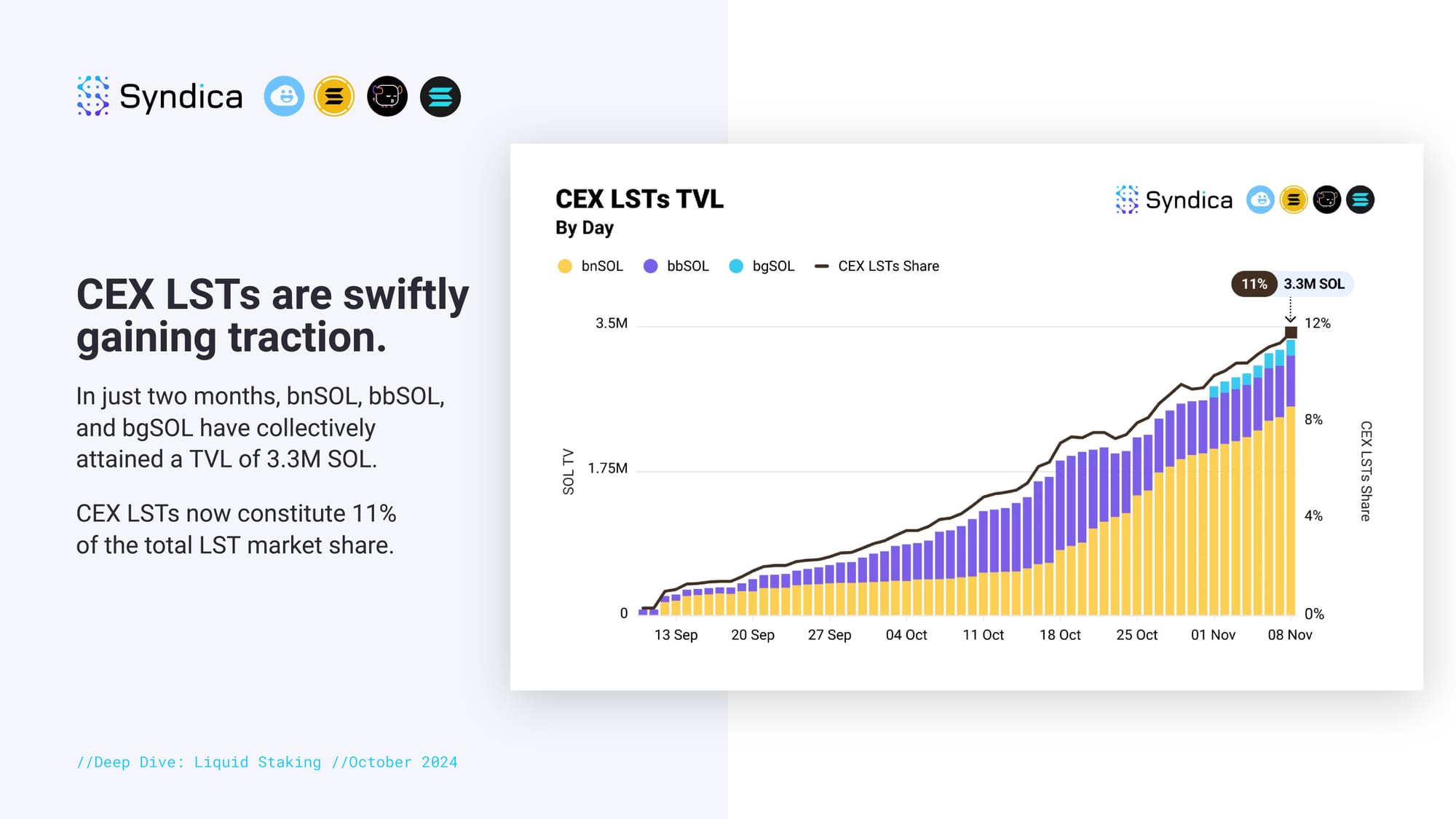

CEX LSTs are swiftly gaining traction. In just two months, bnSOL, bbSOL, and bgSOL have collectively attained a TVL of 3.3M SOL. CEX LSTs now constitute 11% of the total LST market share.

Part IV: Projects to Watch

Flash Trade is launching its native token $FAF in Q4 2024, offering staking utilities like trading discounts, yield boosts, and referral rebates.

Coinbase has launched cbBTC on Solana, enhancing interoperability between Bitcoin and Solana's DeFi ecosystem.

Solayer Labs introduced sUSD on Solana, a U.S. Treasury Bill-backed stablecoin that expands stablecoin options for DeFi users.

WOOFi launched WOOFi Swap on Solana, with day-one support for Phantom.

Huma Finance has launched on Solana to provide on-chain payment financing and expand access to instant liquidity solutions.