Deep Dive: Solana DeFi - September 2024

Deep Dive: Solana DeFi - September 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - September 2024

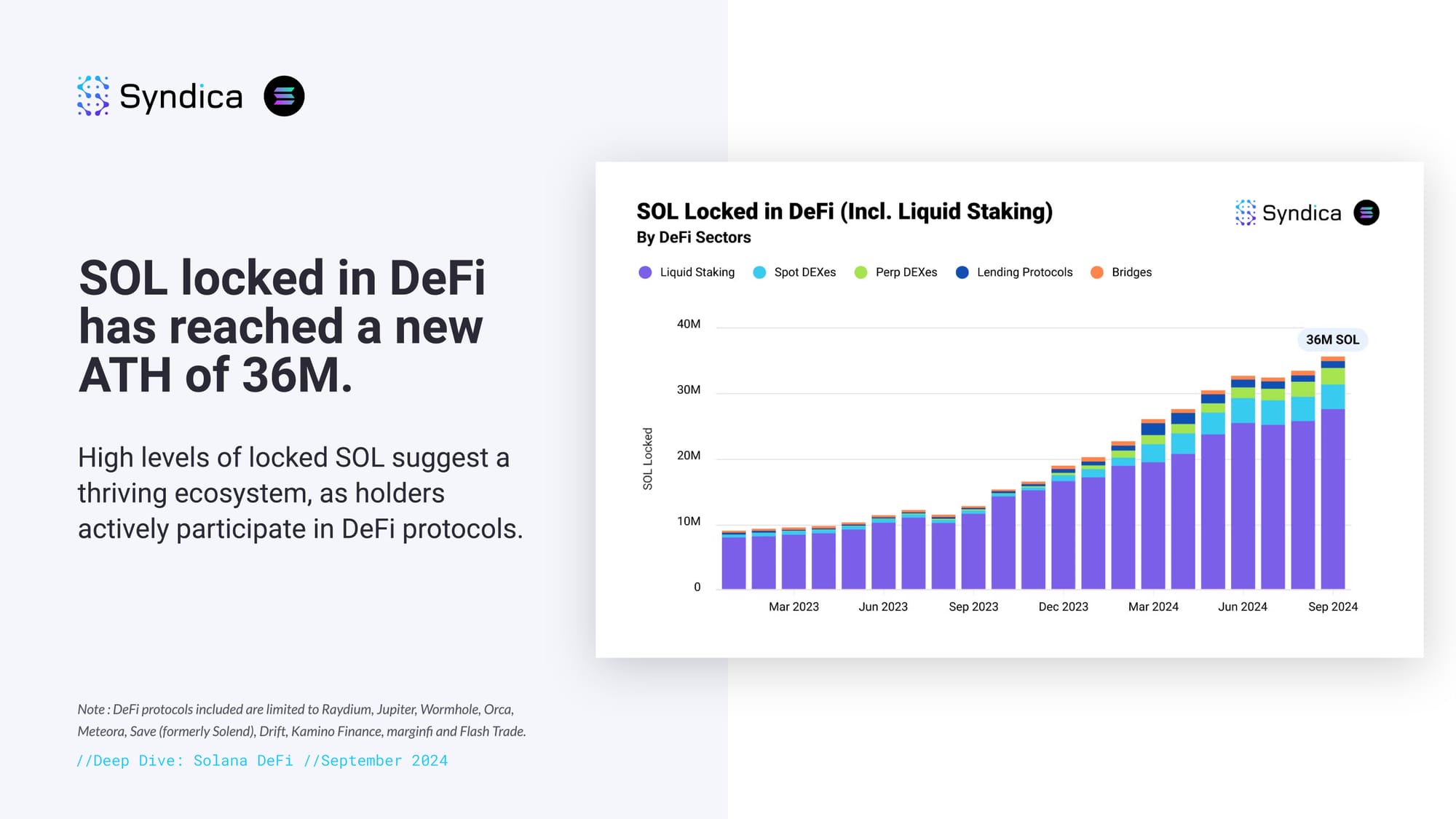

SOL locked in DeFi has reached a new ATH of 36M. High levels of locked SOL suggest a thriving ecosystem, as holders actively participate in DeFi protocols.

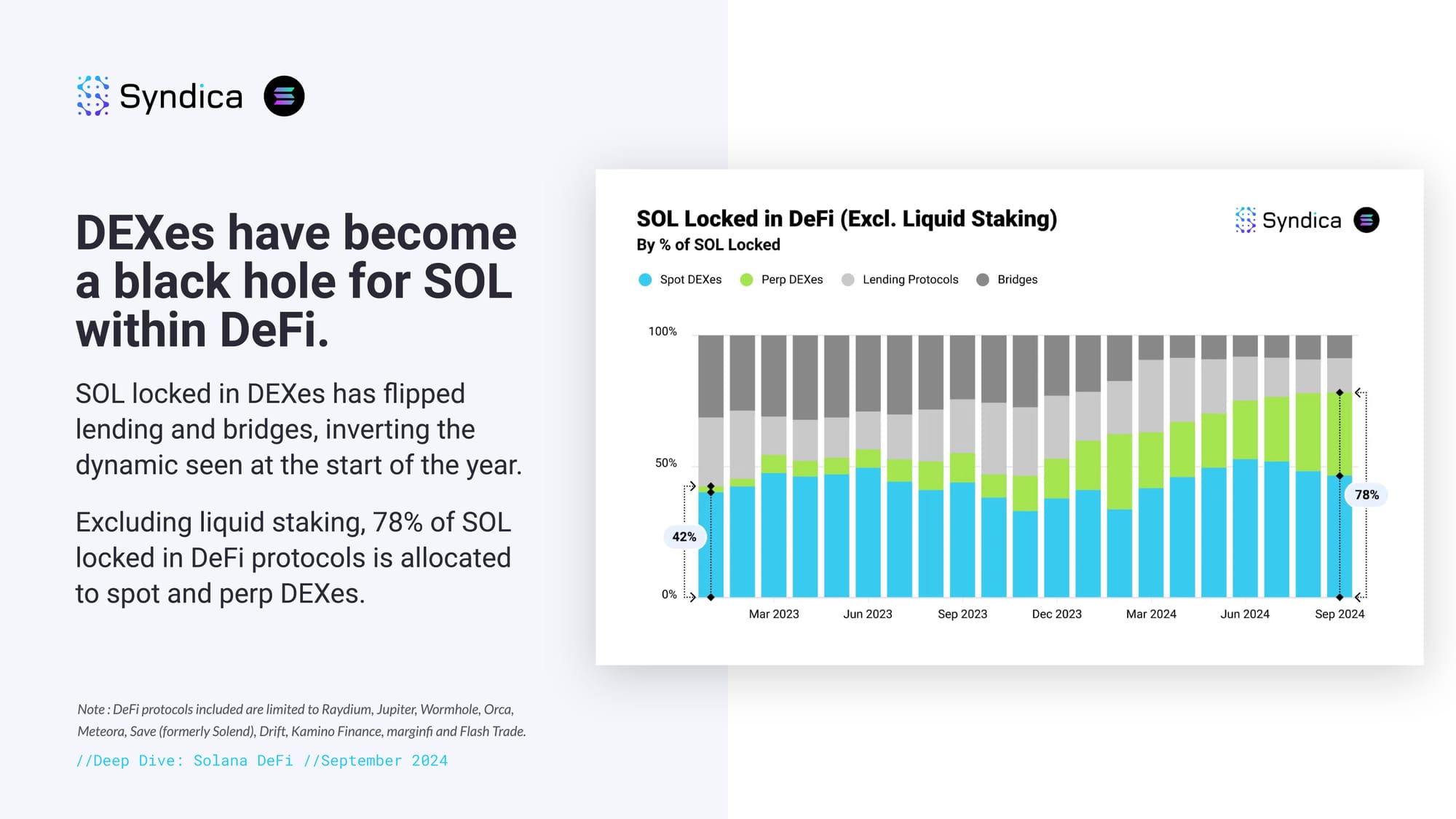

DEXes have become a black hole for SOL within DeFi. SOL locked in DEXes has flipped lending and bridges, inverting the dynamic seen at the start of the year. Excluding liquid staking, 78% of SOL locked in DeFi protocols is allocated to spot and perp DEXes.

Part I: Liquid Staking

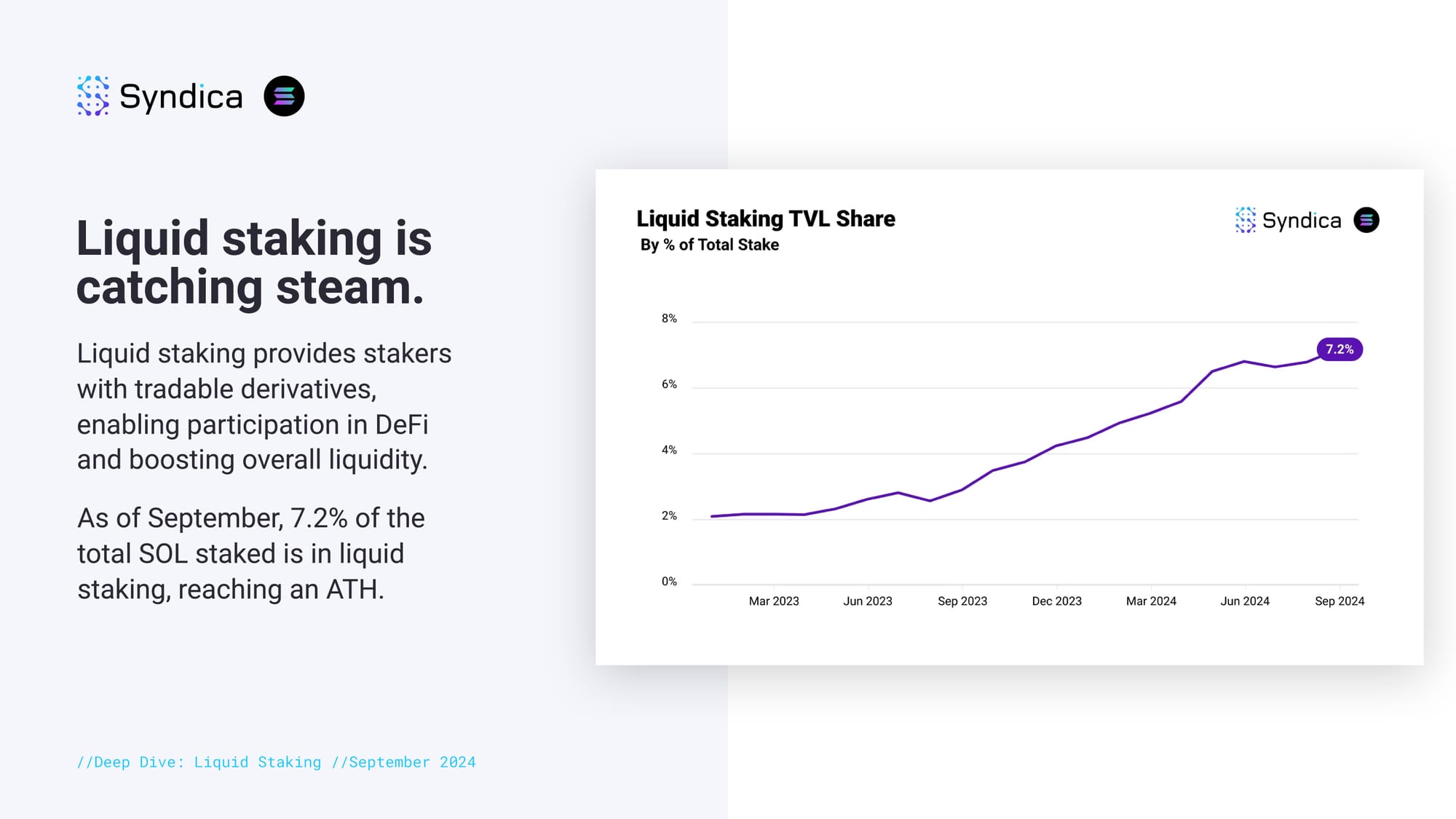

Liquid staking is catching steam. Liquid staking provides stakers with tradable derivatives, enabling participation in DeFi and boosting overall liquidity. As of September, 7.2% of the total SOL staked is in liquid staking, reaching an ATH.

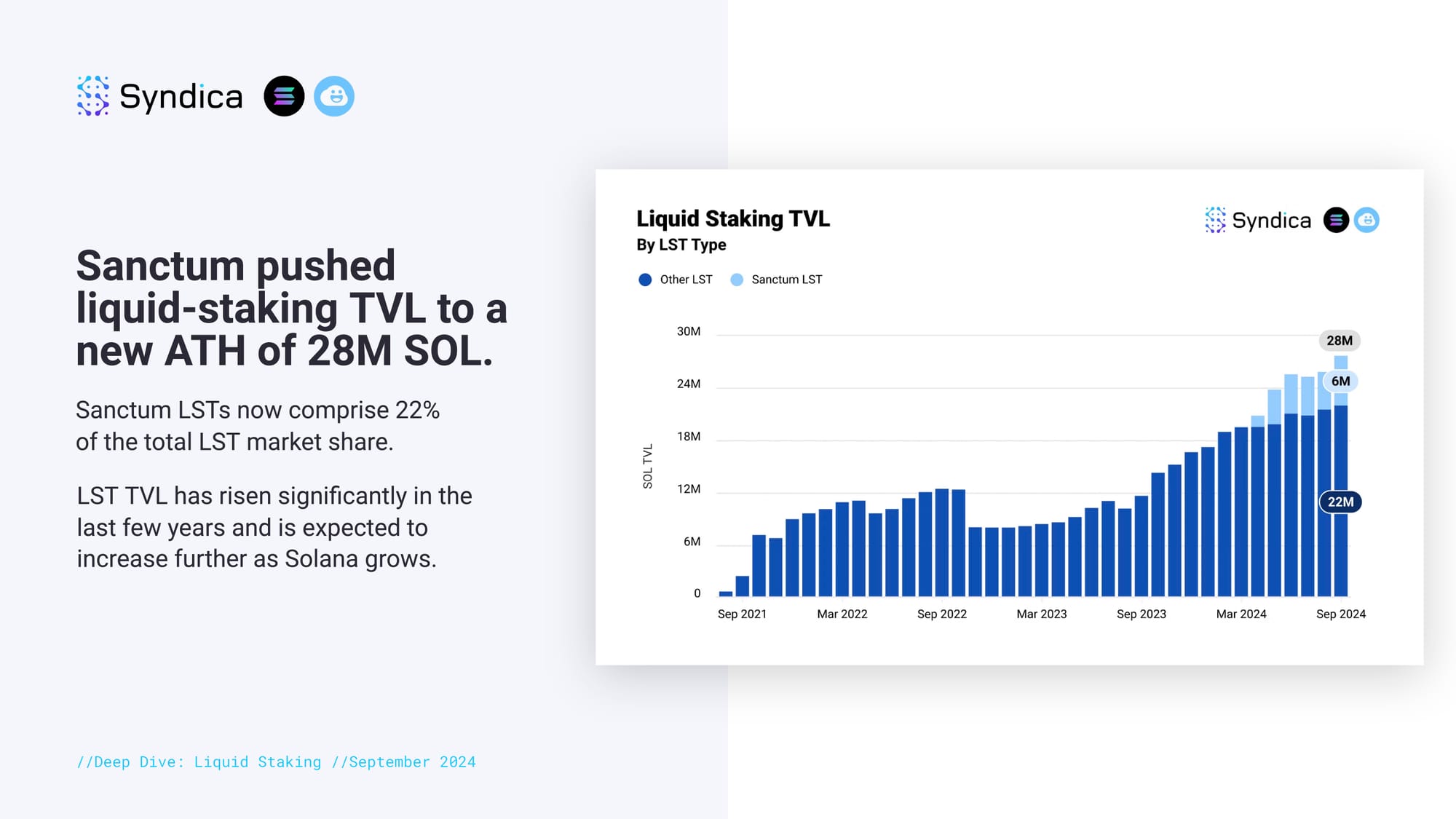

Sanctum pushed liquid-staking TVL to a new ATH of 28M SOL. Sanctum LSTs now comprise 22% of the total LST market share. LST TVL has risen significantly in the last few years and is expected to increase further as Solana grows.

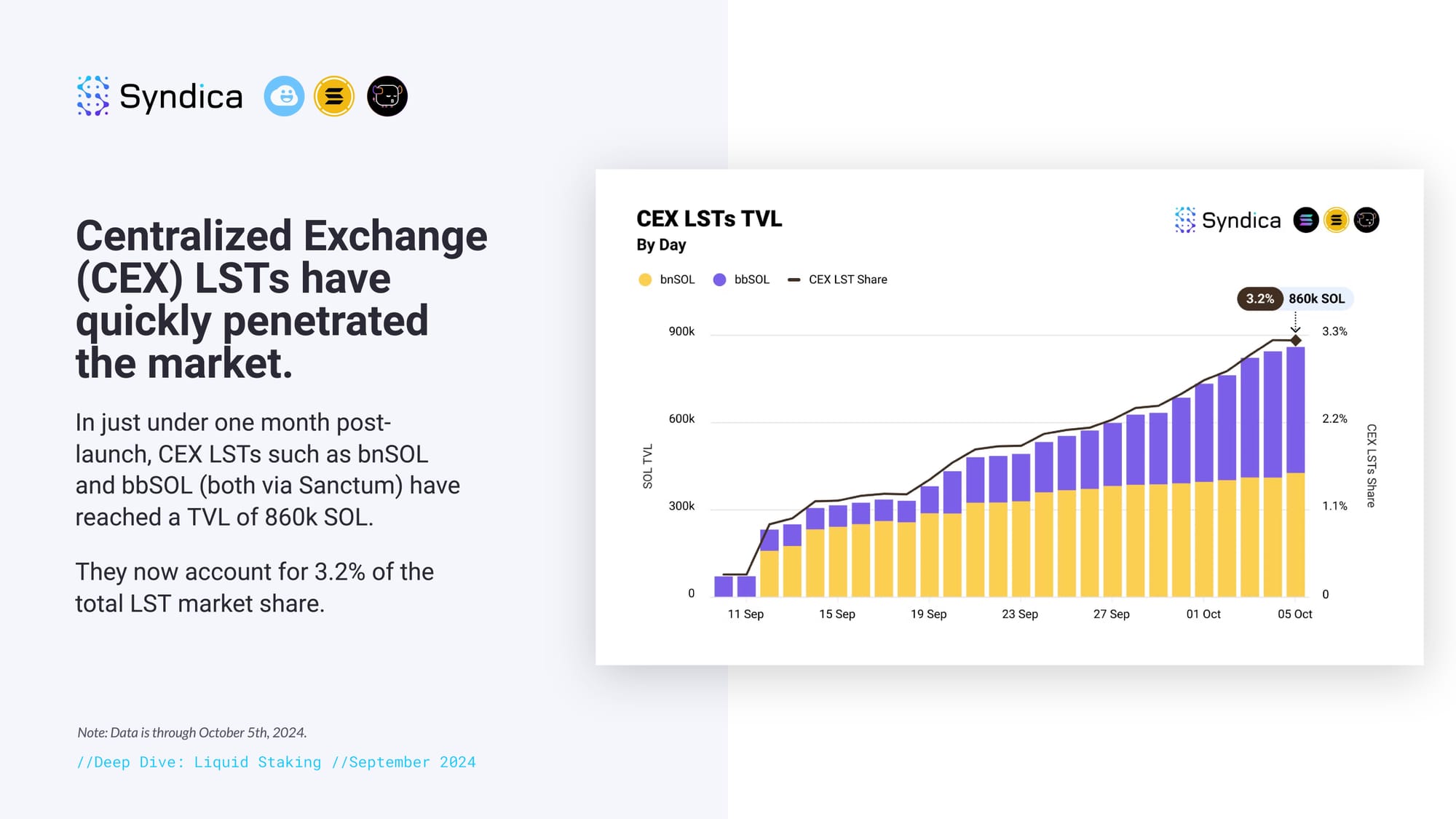

Centralized Exchange (CEX) LSTs have quickly penetrated the market. In just under one month post-launch, CEX LSTs such as bnSOL and bbSOL (both via Sanctum) have reached a TVL of 860k SOL. They now account for 3.2% of the total LST market share.

Part II: Spot and Perp DEXes

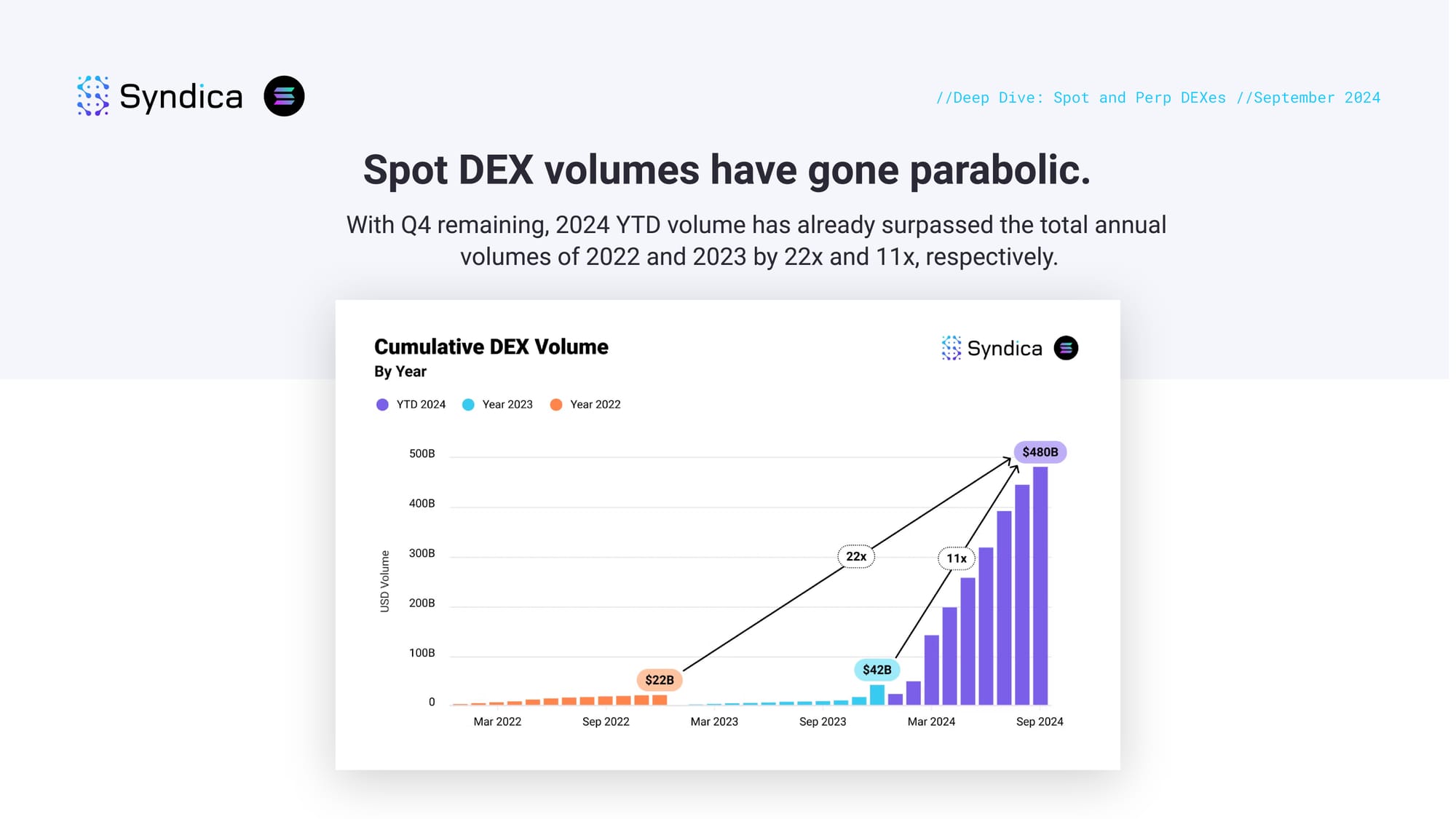

Spot DEX volumes have gone parabolic. With Q4 remaining, 2024 YTD volume has already surpassed the total annual volumes of 2022 and 2023 by 22x and 11x, respectively.

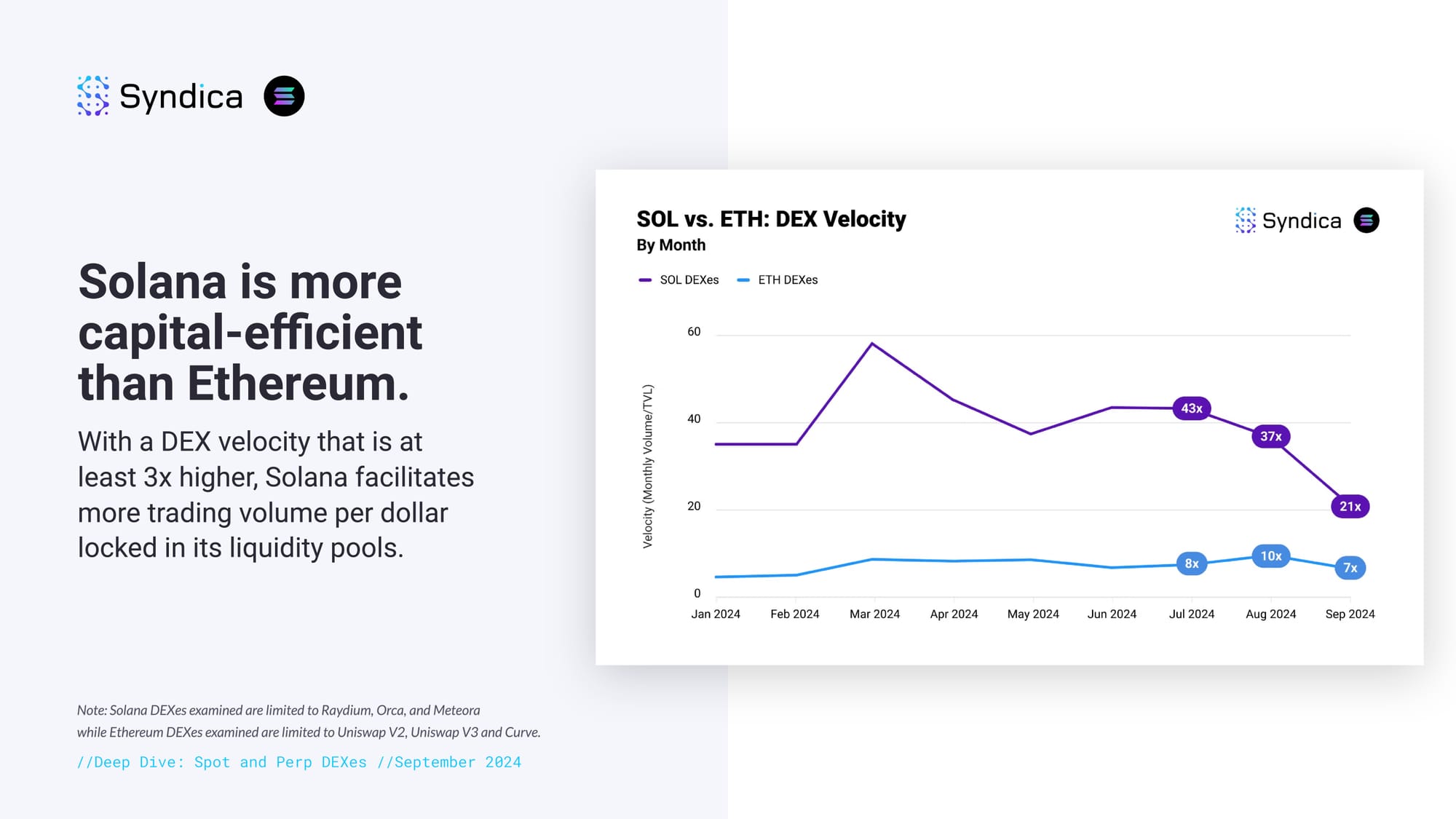

Solana is more capital-efficient than Ethereum. With a DEX velocity that is at least 3x higher, Solana facilitates more trading volume per dollar locked in its liquidity pools.

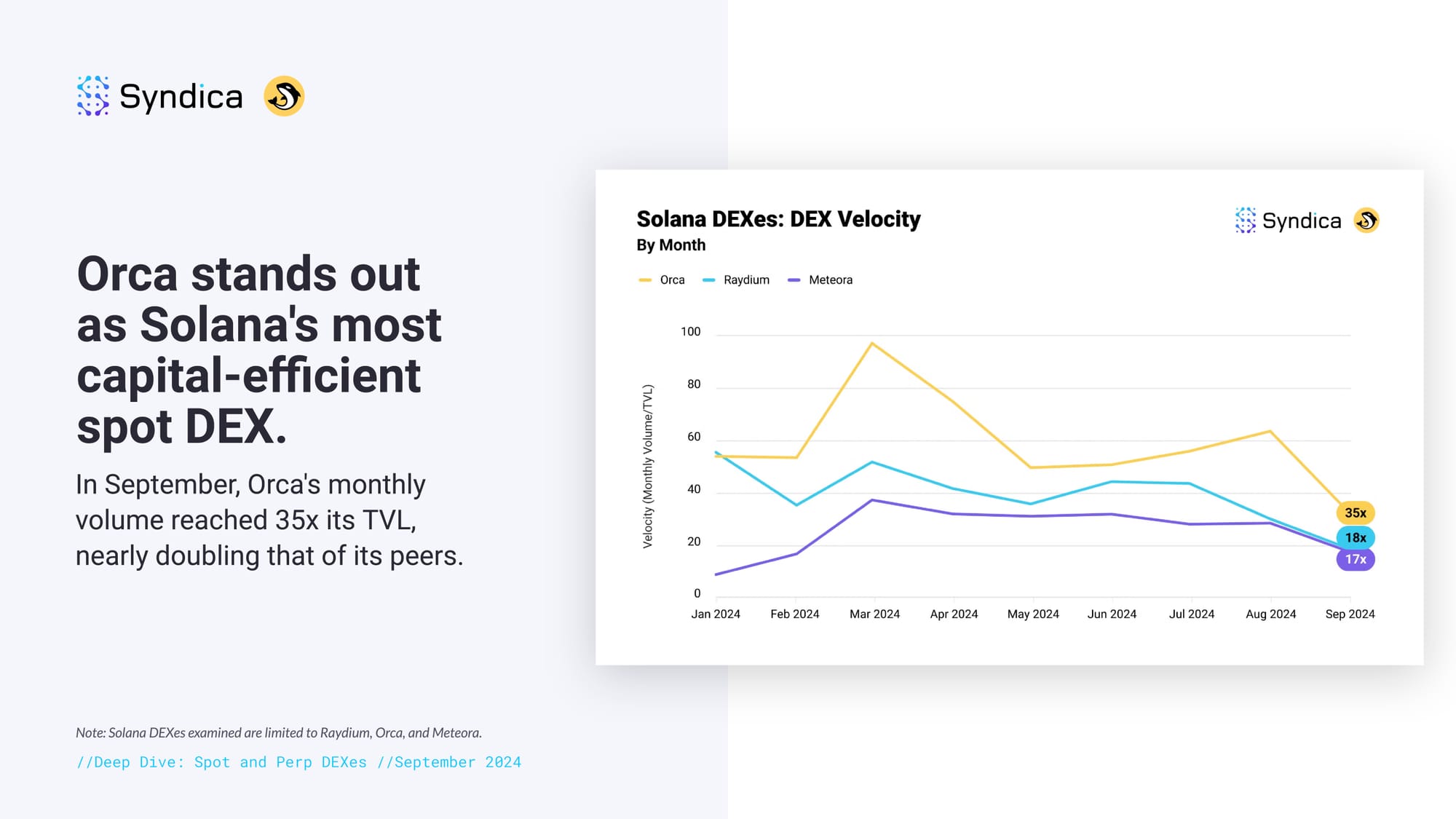

Orca stands out as Solana's most capital-efficient spot DEX. In September, Orca's monthly volume reached 35x its TVL, nearly doubling that of its peers.

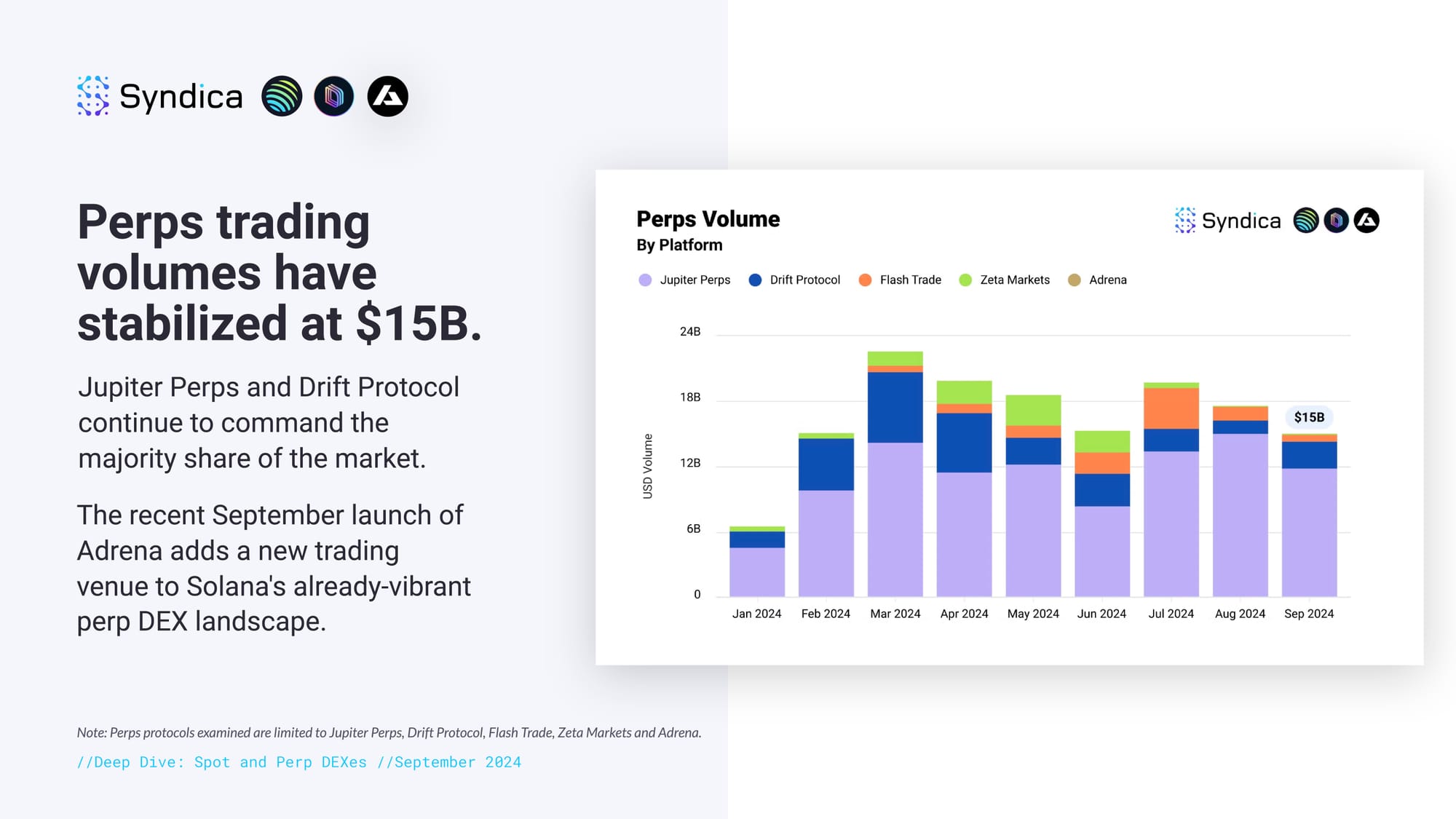

Perps trading volumes have stabilized at $15B. Jupiter Perps and Drift Protocol continue to command the majority share of the market. The recent September launch of Adrena adds a new trading venue to Solana's already-vibrant perp DEX landscape.

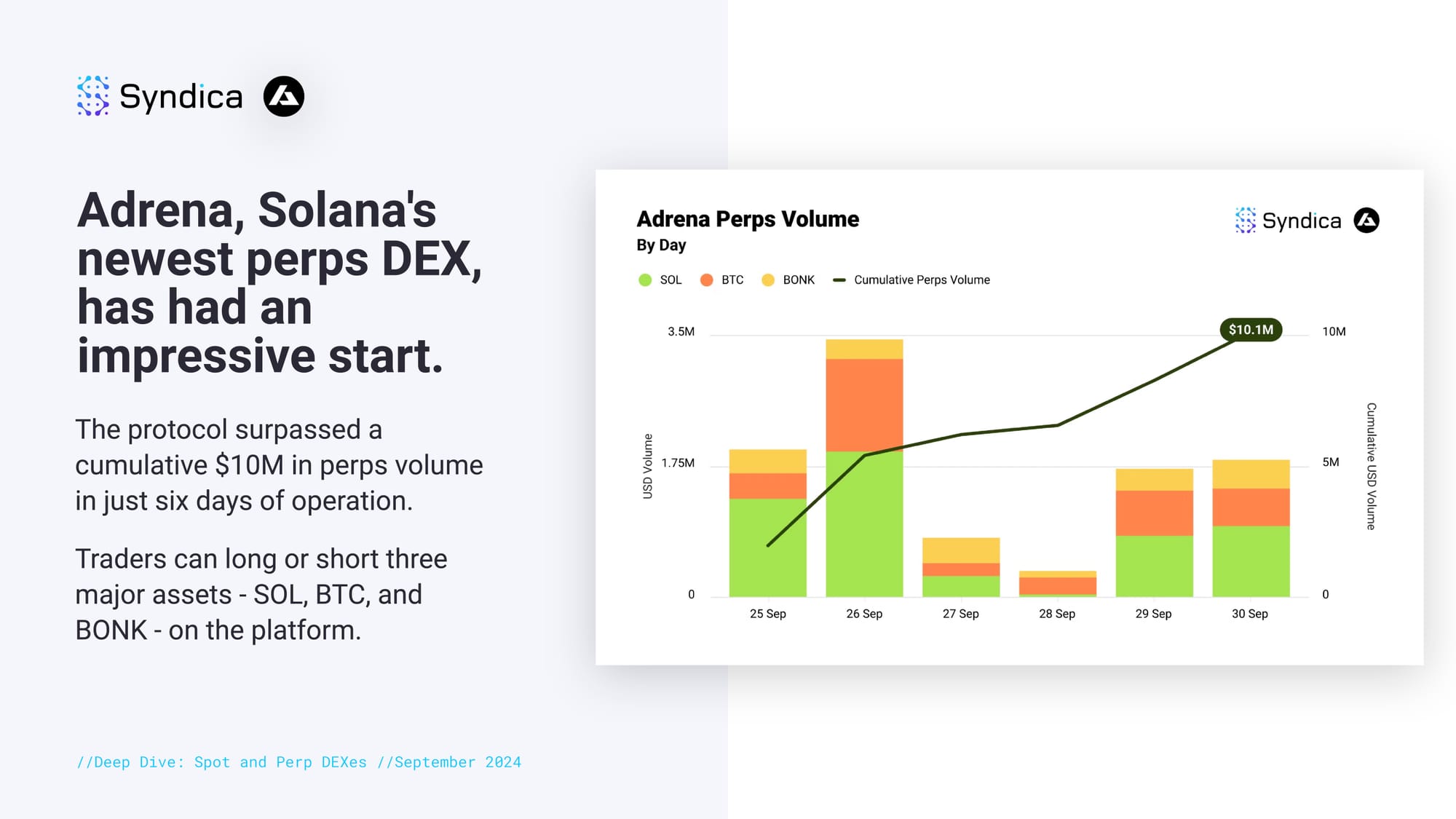

Adrena, Solana's newest perps DEX, has had an impressive start. The protocol surpassed a cumulative $10M in perps volume in just six days of operation. Traders can long or short three major assets - SOL, BTC, and BONK - on the platform.

Part III: Lending and Stablecoins

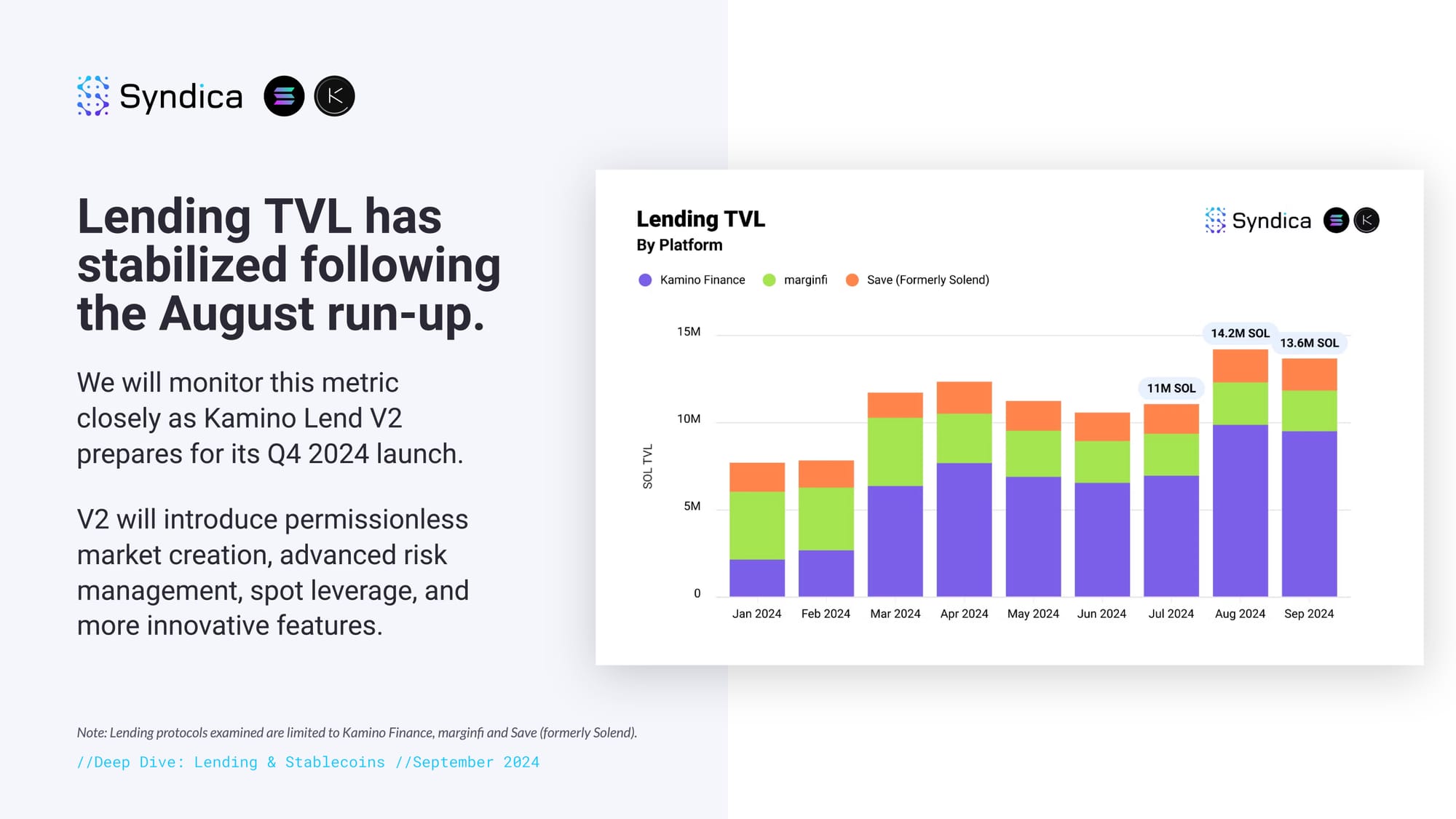

Lending TVL has stabilized following the August run-up. We will monitor this metric closely as Kamino Lend V2 prepares for its Q4 2024 launch. V2 will introduce permissionless market creation, advanced risk management, spot leverage, and more innovative features.

Solana PYUSD's lead has been eclipsed by Ethereum. Following a reduction in liquidity incentives, PYUSD's supply on Solana has halved, while its supply on Ethereum has increased slightly.

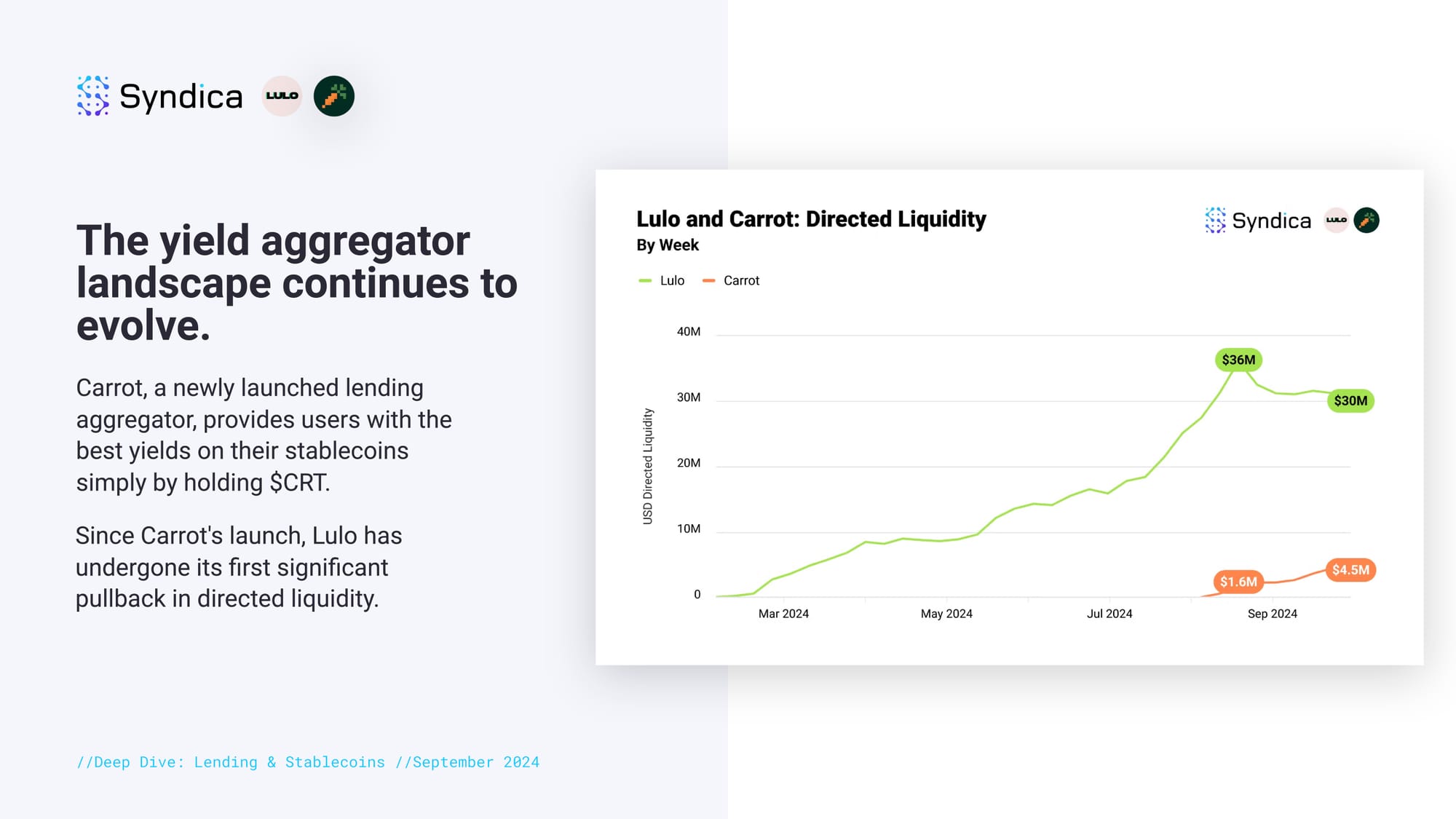

The yield aggregator landscape continues to evolve. Carrot, a newly launched lending aggregator, provides users with the best yields on their stablecoins simply by holding $CRT. Since Carrot's launch, Lulo has undergone its first significant pullback in directed liquidity.

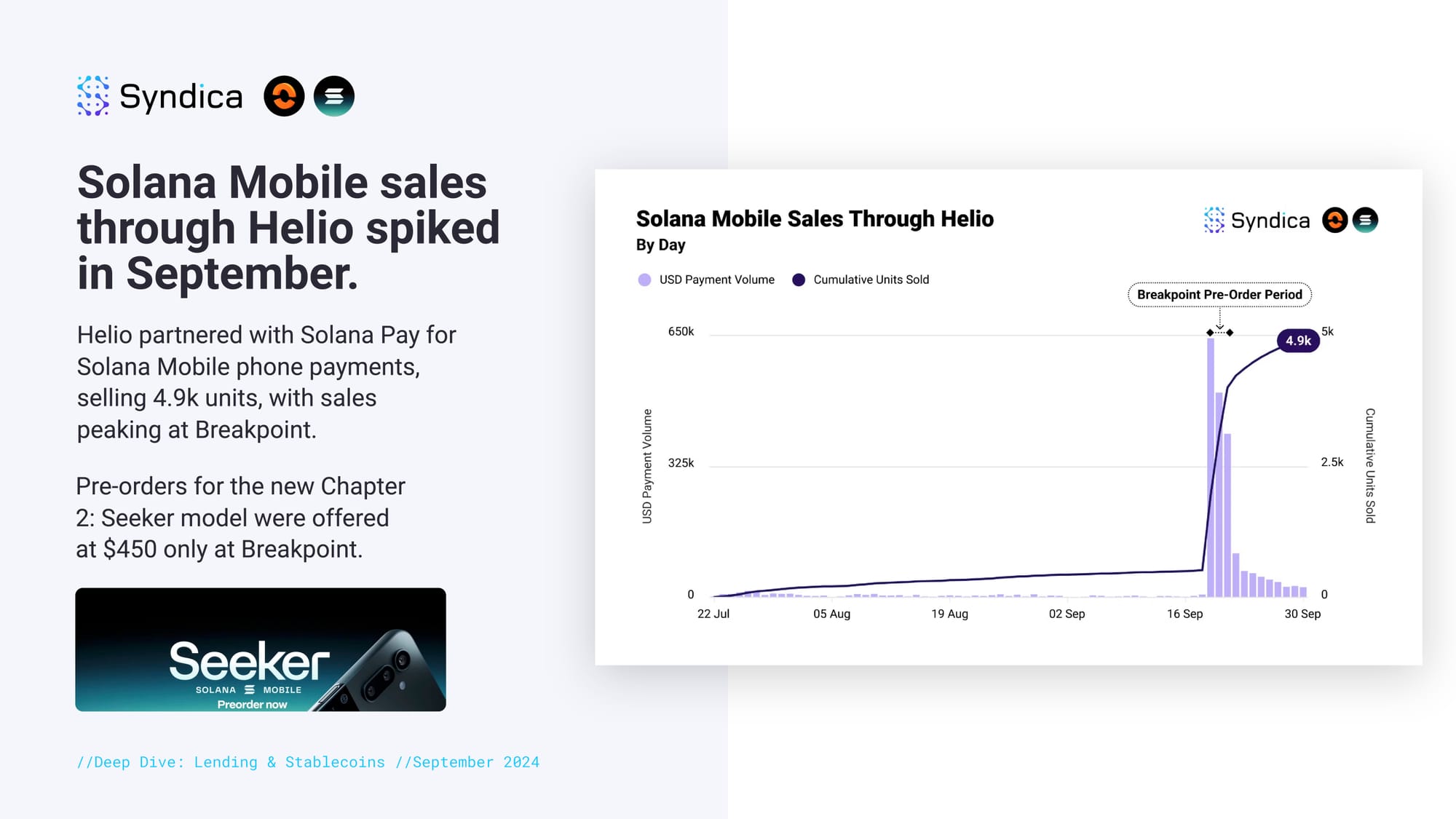

Helio's payment volume has steadily increased in 2024. Helio is the leading payments platform on Solana, with the majority of transactions conducted in SOL and USDC.

Solana Mobile sales through Helio spiked in September. Helio partnered with Solana Pay for Solana Mobile phone payments, selling 4.9k units, with sales peaking at Breakpoint. Pre-orders for the new Chapter 2: Seeker model were offered at $450 only at Breakpoint.

Part IV: Projects to Watch

Sky, formerly MakerDAO, plans to bring an upgraded USDS stablecoin and SKY governance token to Solana.

FluxBot introduced Fluxbeam Infinity, an all-encompassing trading tool that integrates with data terminals and algorithmic platforms.

Perena is set to launch a multi-asset stable swap product focused on efficient liquidity management.

Coins.ph introduced the PHPC stablecoin, backed by cash, with upcoming liquidity pools for PHPC paired with USDC and USDT on Solana.

Zeus Network launched its BTC staking platform on the testnet and a Bitcoin-Solana interaction explorer.