Deep Dive: Solana DeFi - September 2025

Deep Dive: Solana DeFi - September 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DeFi - September 2025

Part I - Digital Assets Treasuries (DATs) on Solana

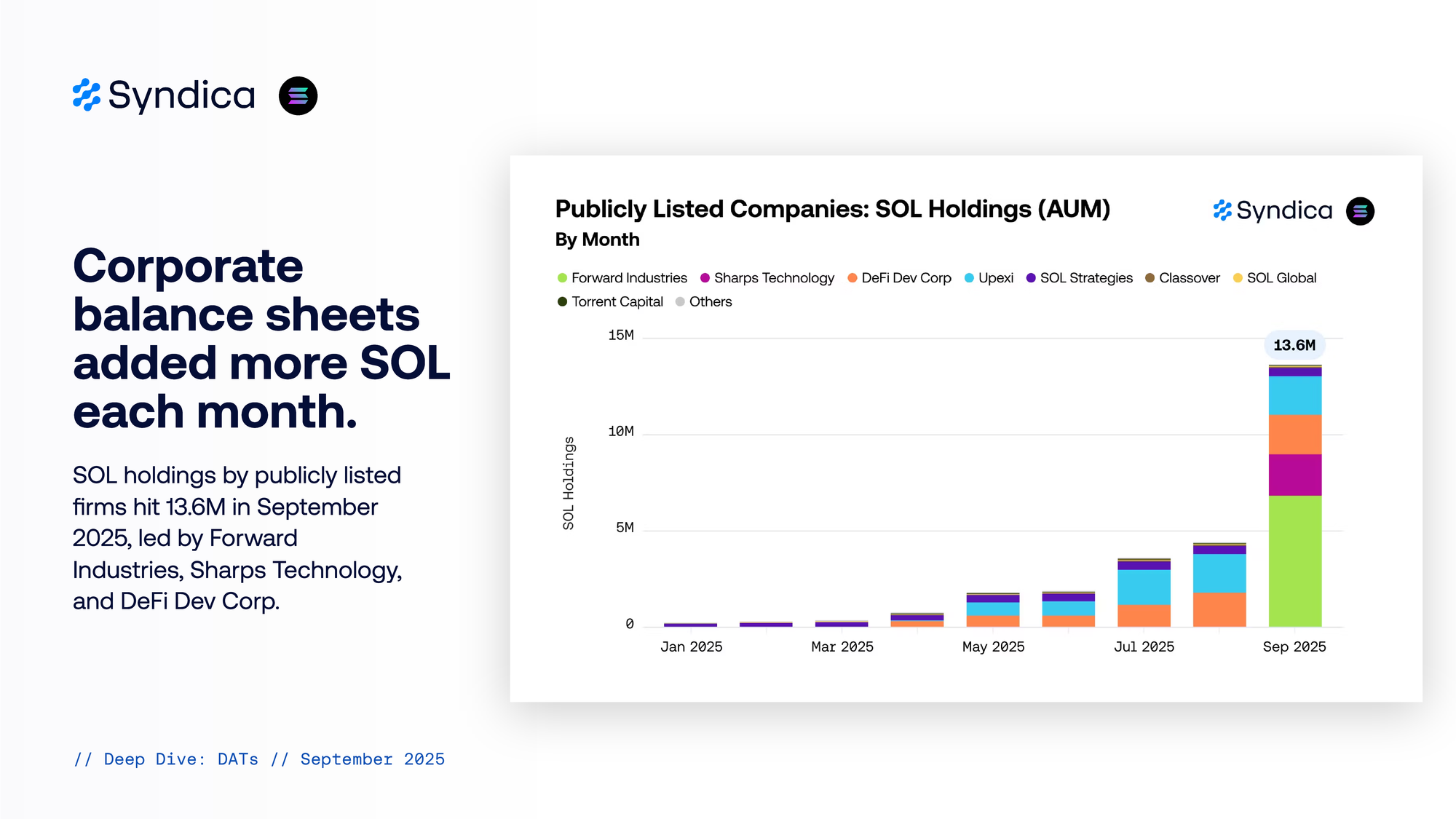

Corporate balance sheets added more SOL each month. SOL holdings by publicly listed firms hit 13.6M in September 2025, led by Forward Industries, Sharps Technology, and DeFi Dev Corp.

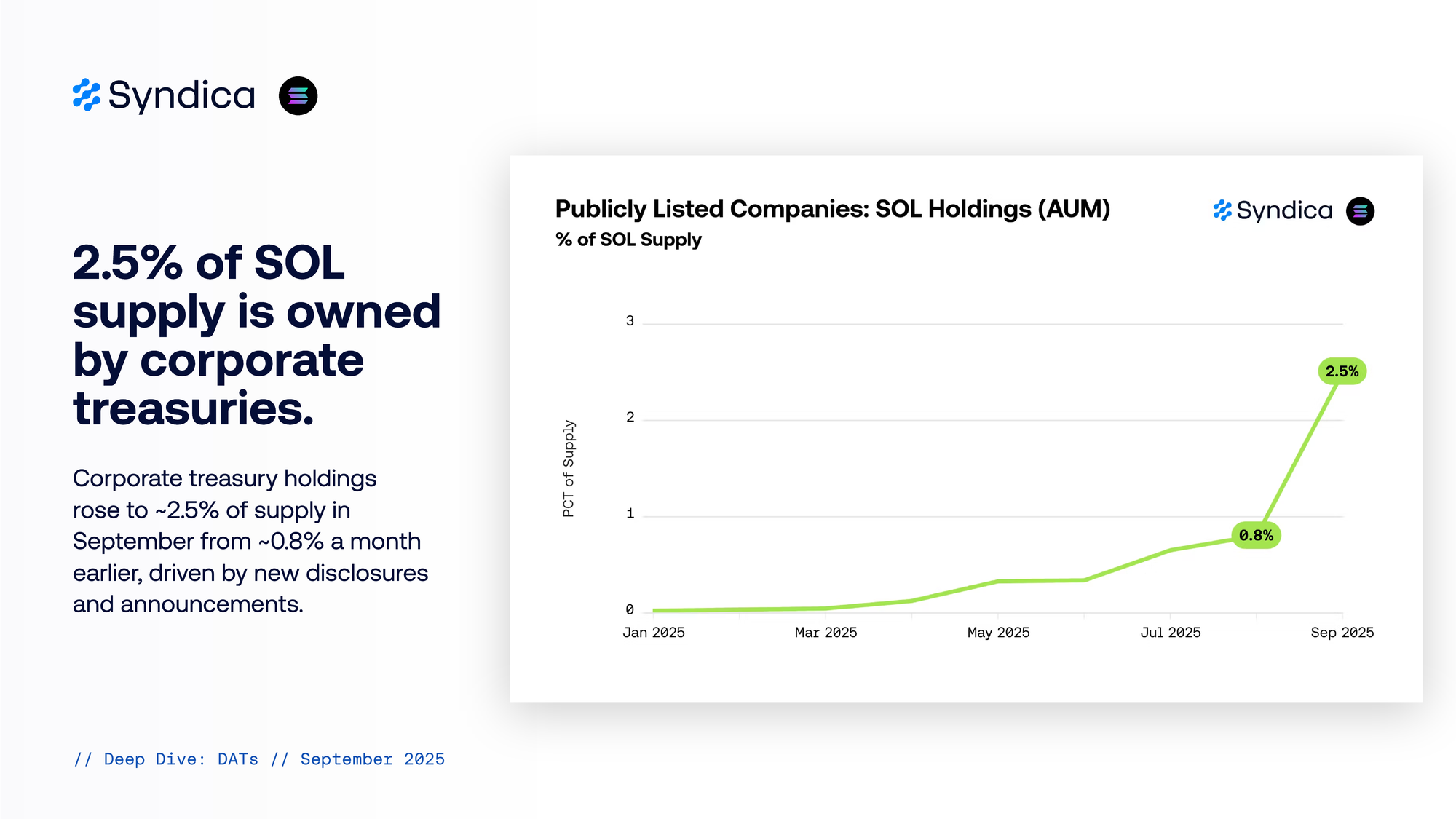

2.5% of SOL supply is owned by corporate treasuries. Corporate treasury holdings rose to ~2.5% of supply in September from ~0.8% a month earlier, driven by new disclosures and announcements.

Part II - Spot DEXes and Aggregators

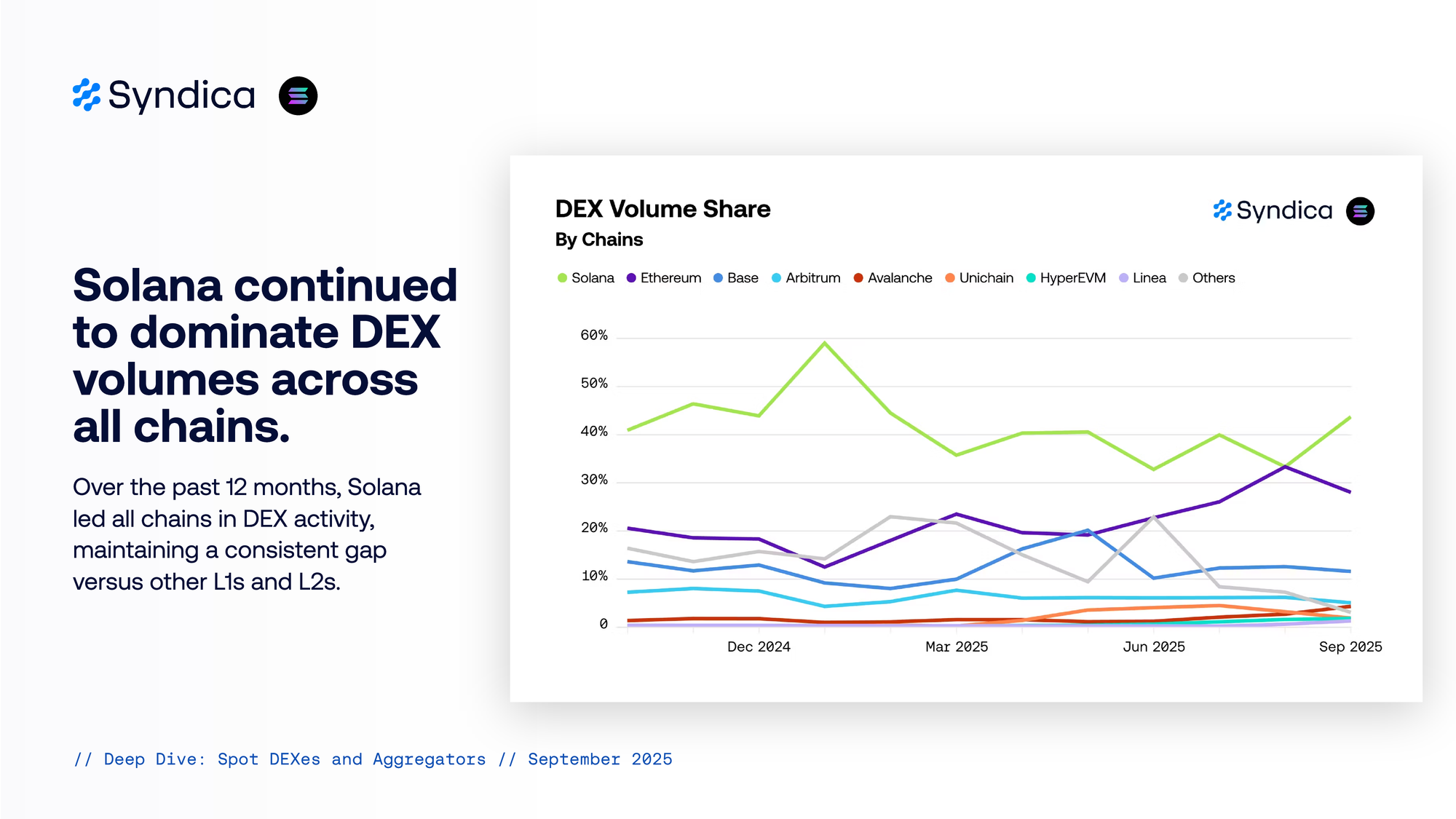

Solana continued to dominate DEX volumes across all chains. Over the past 12 months, Solana led all chains in DEX activity, maintaining a consistent gap versus other L1s and L2s.

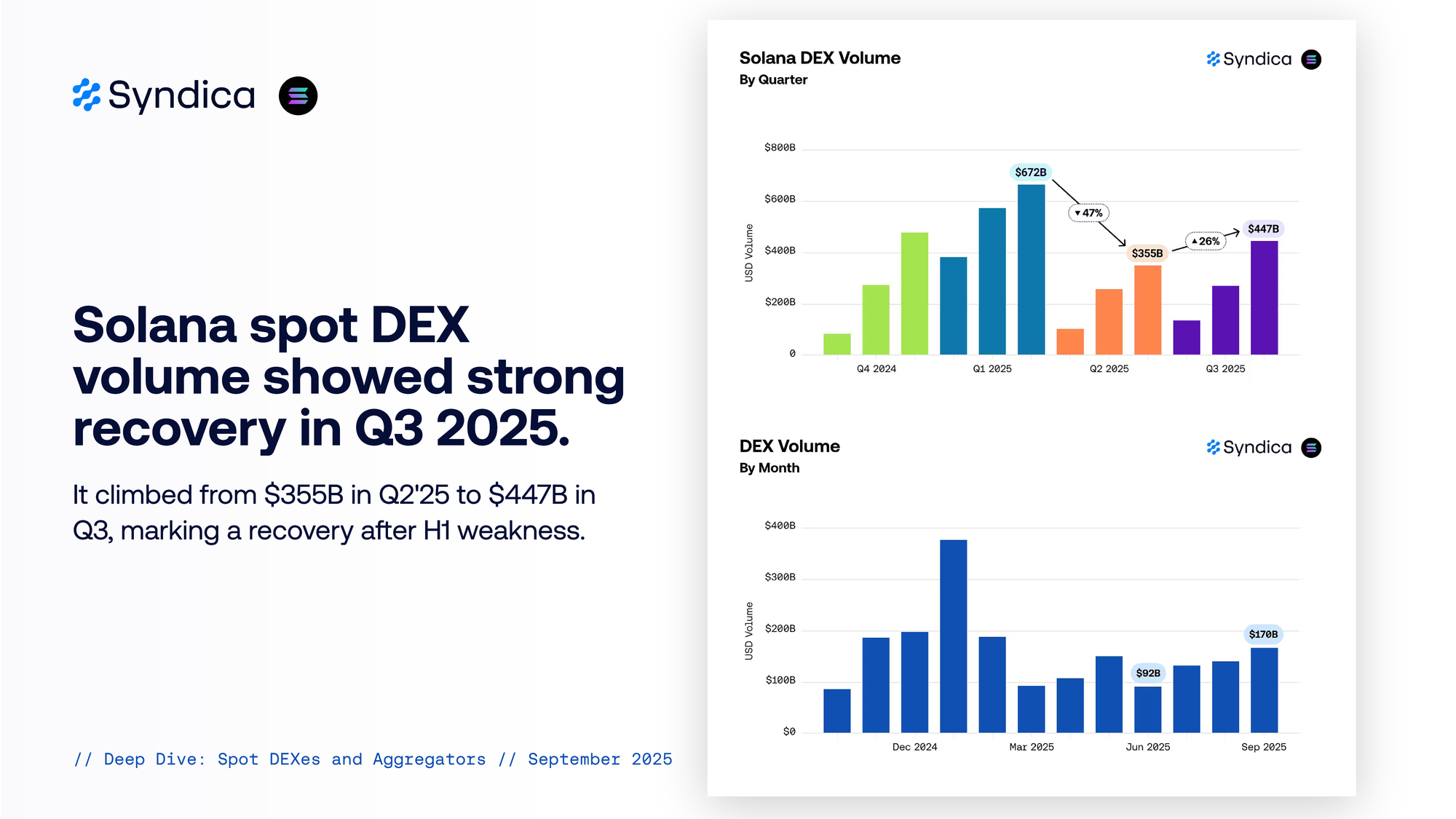

Solana spot DEX volume showed strong recovery in Q3 2025. It climbed from $355B in Q2'25 to $447B in Q3, marking a recovery after H1 weakness.

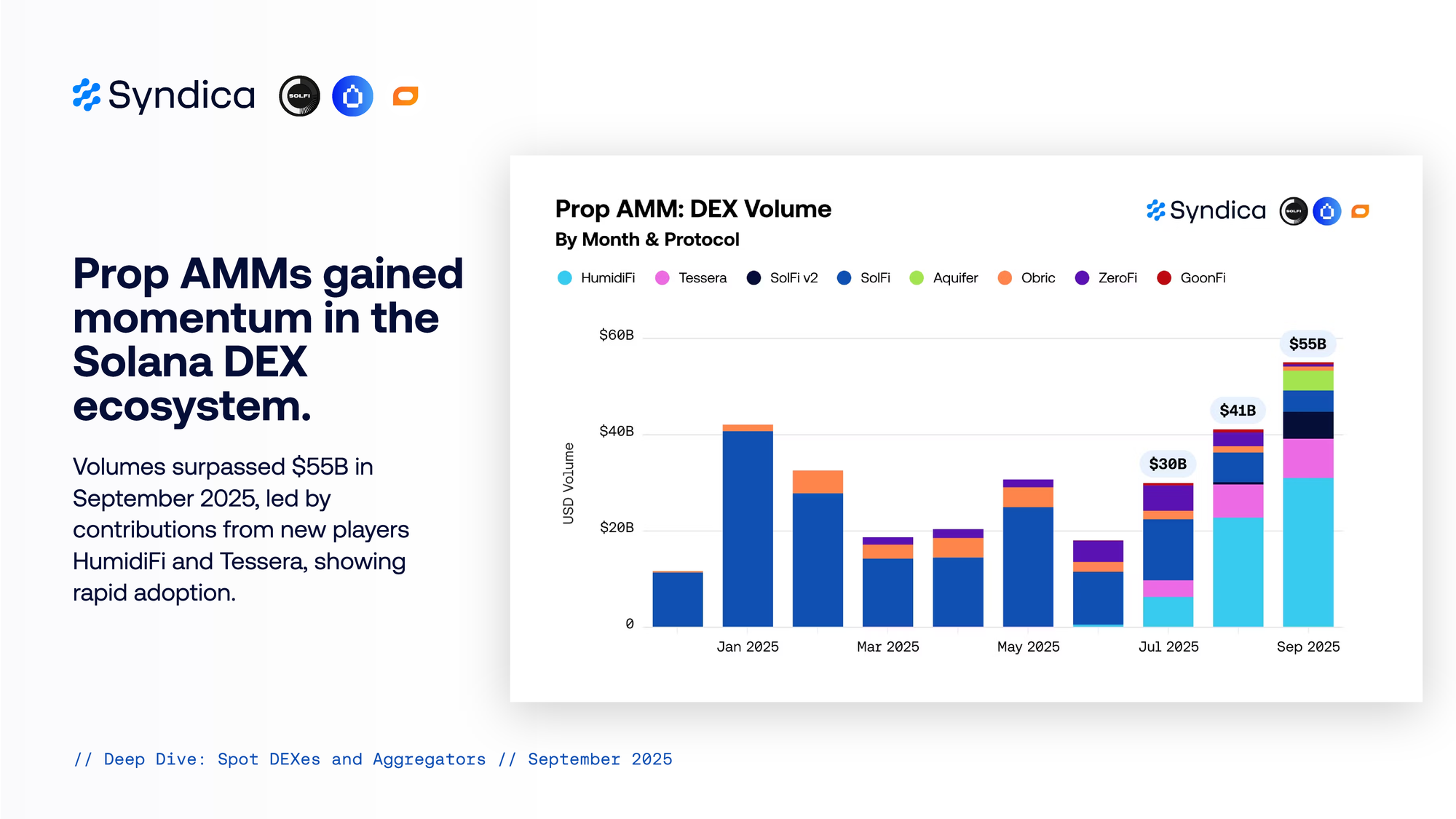

Prop AMMs gained momentum in the Solana DEX ecosystem. Volumes surpassed $55B in September 2025, led by contributions from new players HumidiFi and Tessera, showing rapid adoption.

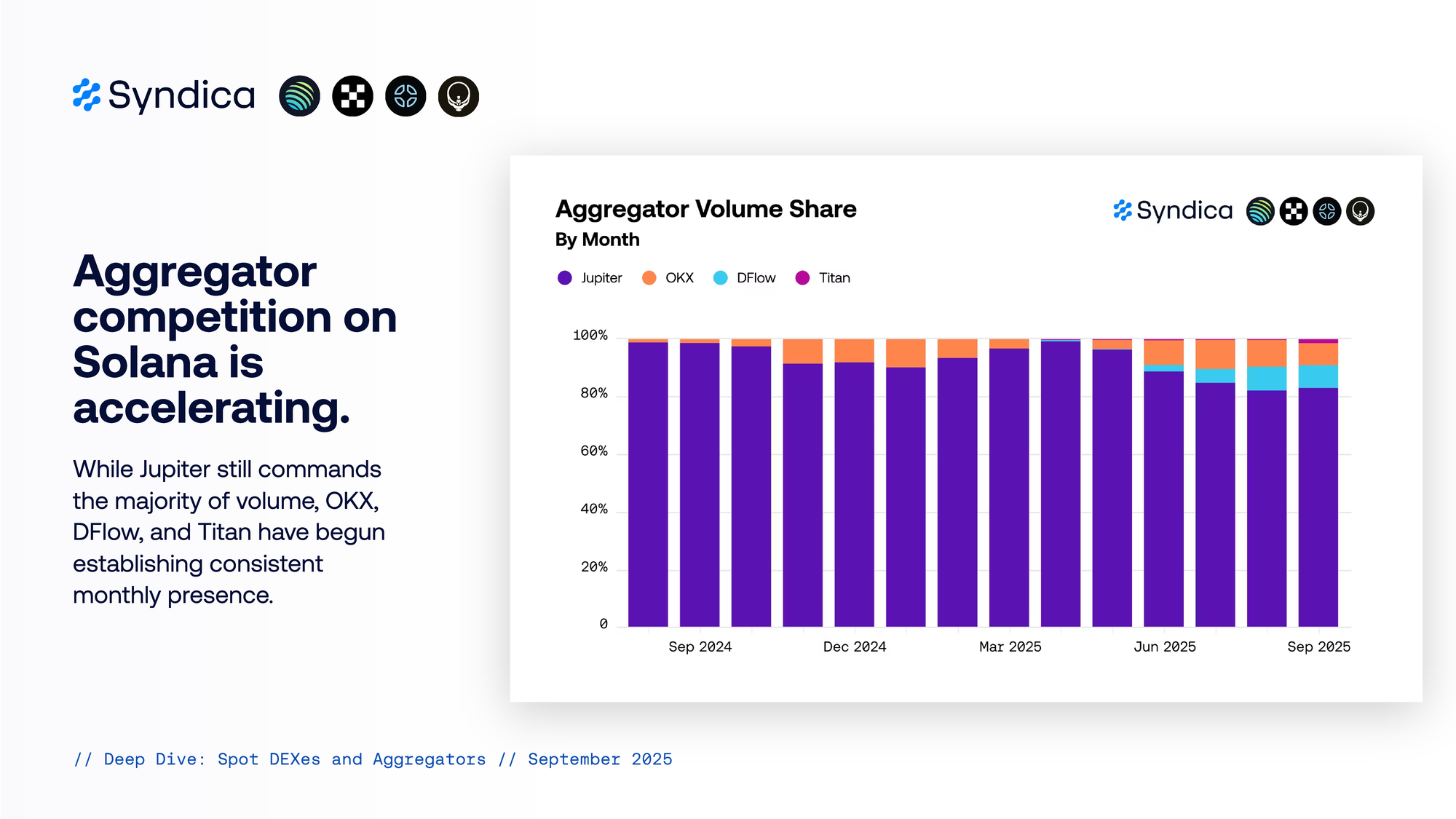

Aggregator competition on Solana is accelerating. While Jupiter still commands the majority of volume, OKX, DFlow, and Titan have begun establishing consistent monthly presence.

Part III - Solana Perpetuals

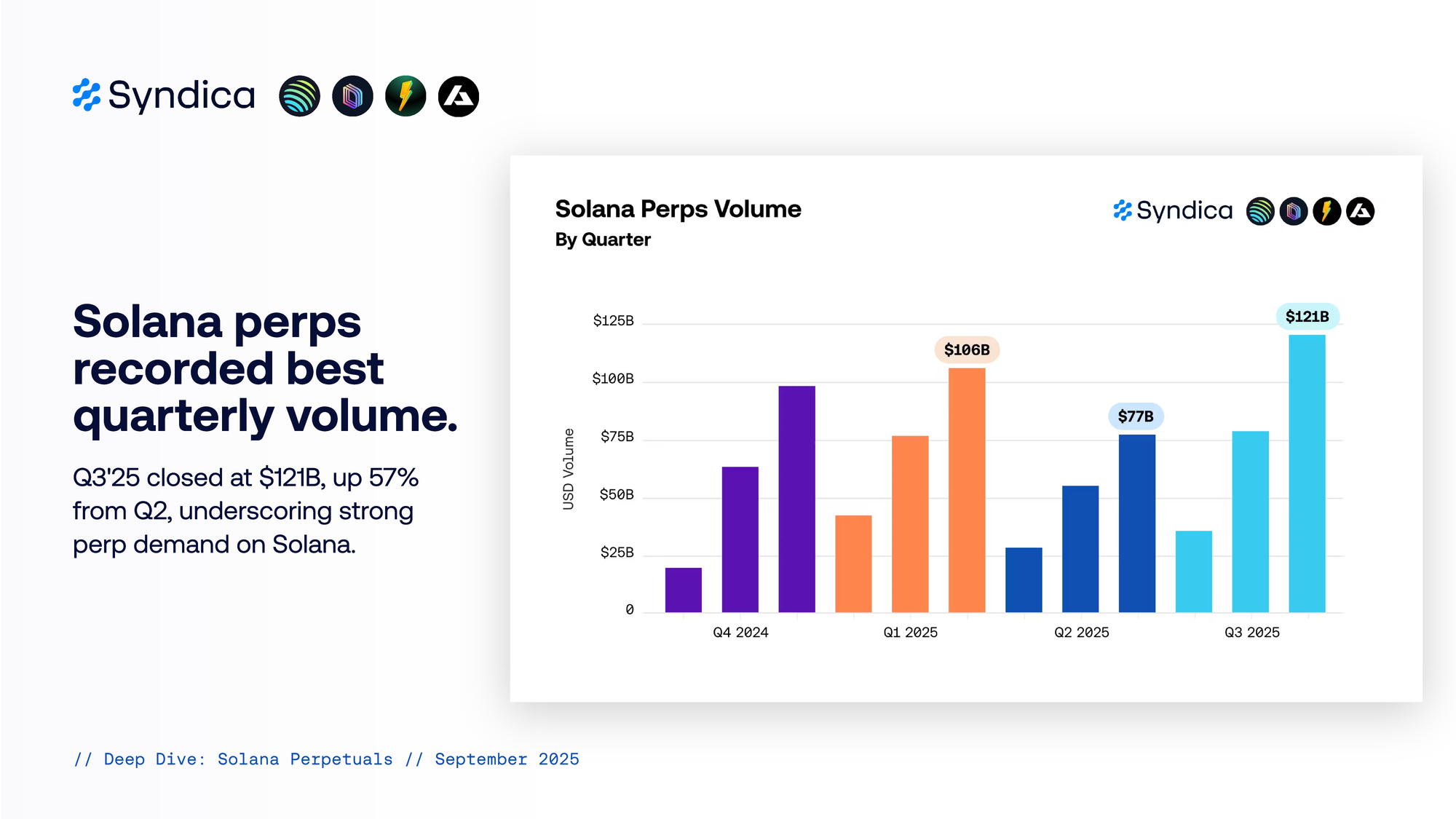

Solana perps recorded best quarterly volume. Q3'25 closed at $121B, up 57% from Q2, underscoring strong perp demand on Solana.

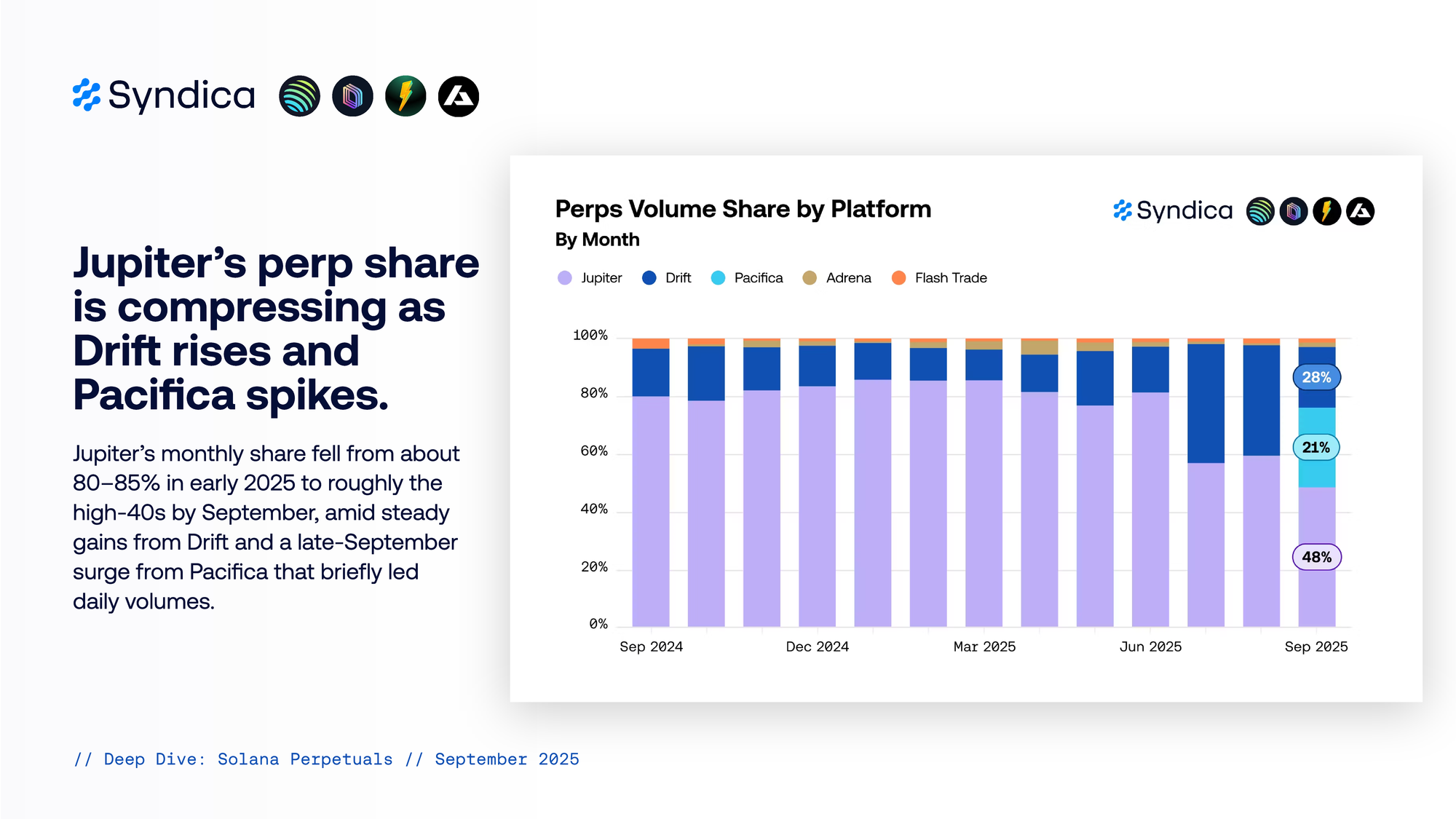

Jupiter’s perp share is compressing as Drift rises and Pacifica spikes. Jupiter’s monthly share fell from about 80–85% in early 2025 to roughly the high‑40s by September, amid steady gains from Drift and a late‑September surge from Pacifica that briefly led daily volumes.

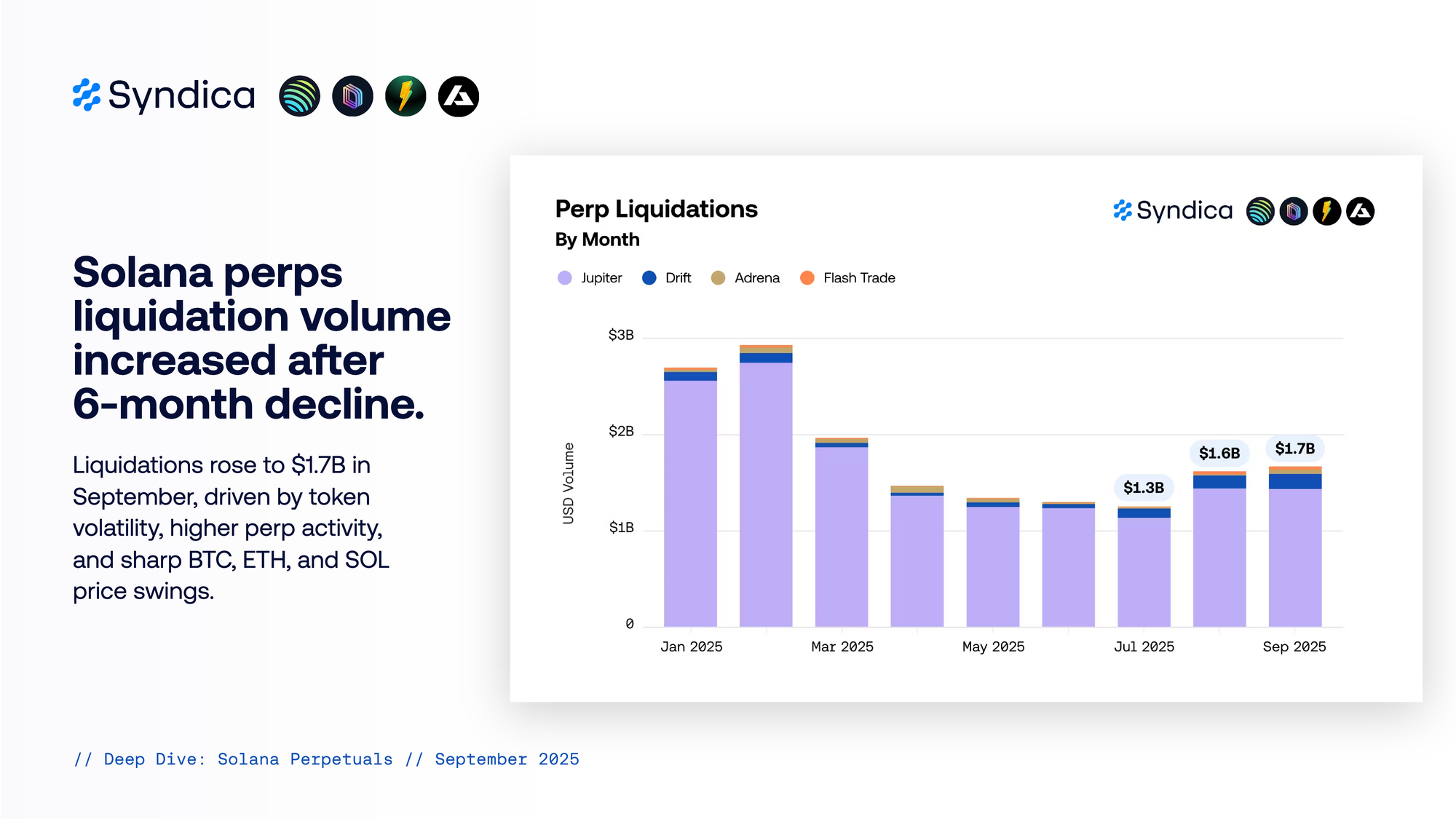

Solana perps liquidation volume increased after 6-month decline. Liquidations rose to $1.7B in September, driven by token volatility, higher perp activity, and sharp BTC, ETH, and SOL price swings.

Part IV - Pegged Assets

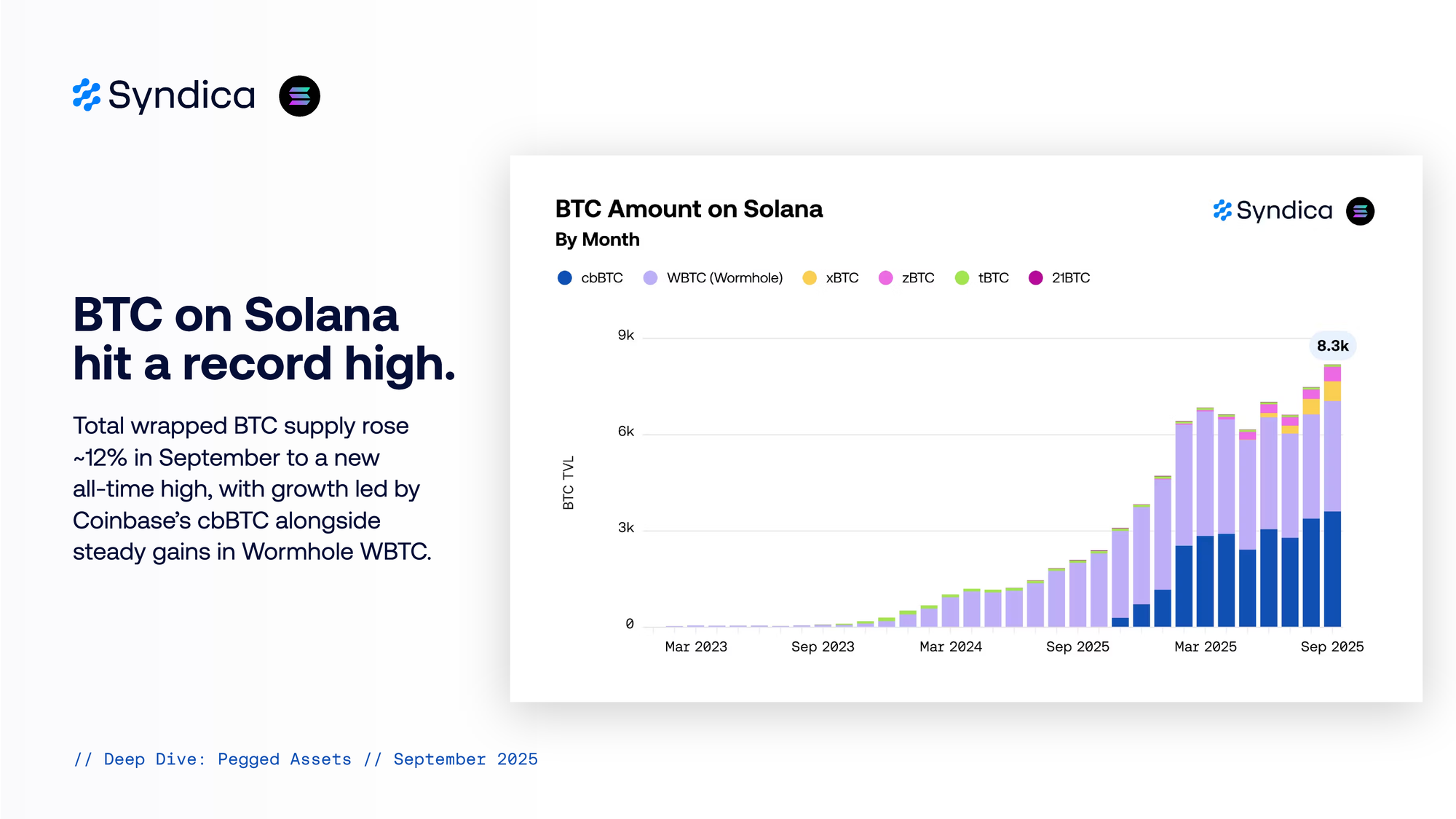

BTC on Solana hit a record high. Total wrapped BTC supply rose ~12% in September to a new all‑time high, with growth led by Coinbase’s cbBTC alongside steady gains in Wormhole WBTC.

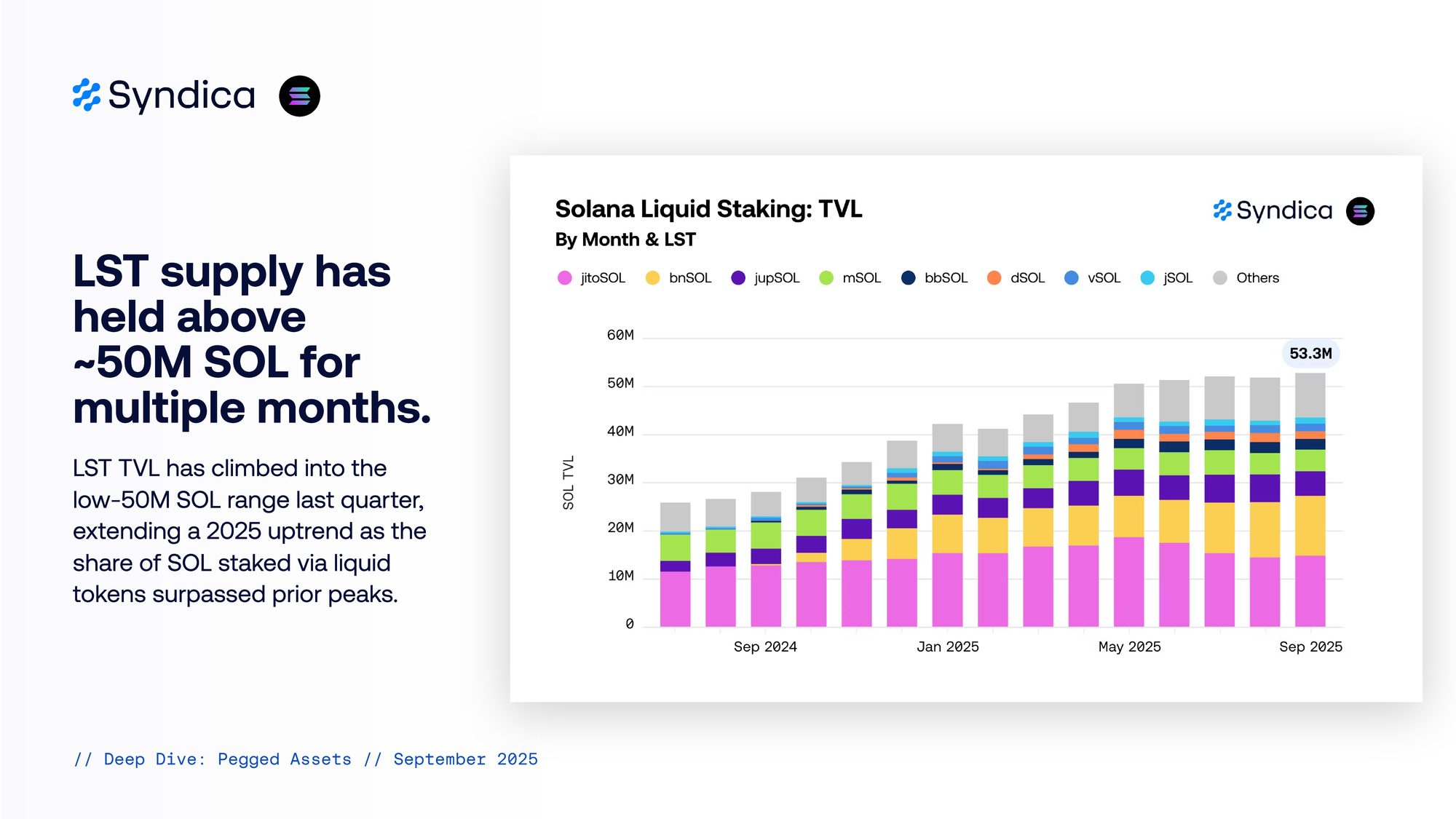

LST supply has held above ~50M SOL for multiple months. LST TVL has climbed into the low‑50M SOL range last quarter, extending a 2025 uptrend as the share of SOL staked via liquid tokens surpassed prior peaks.

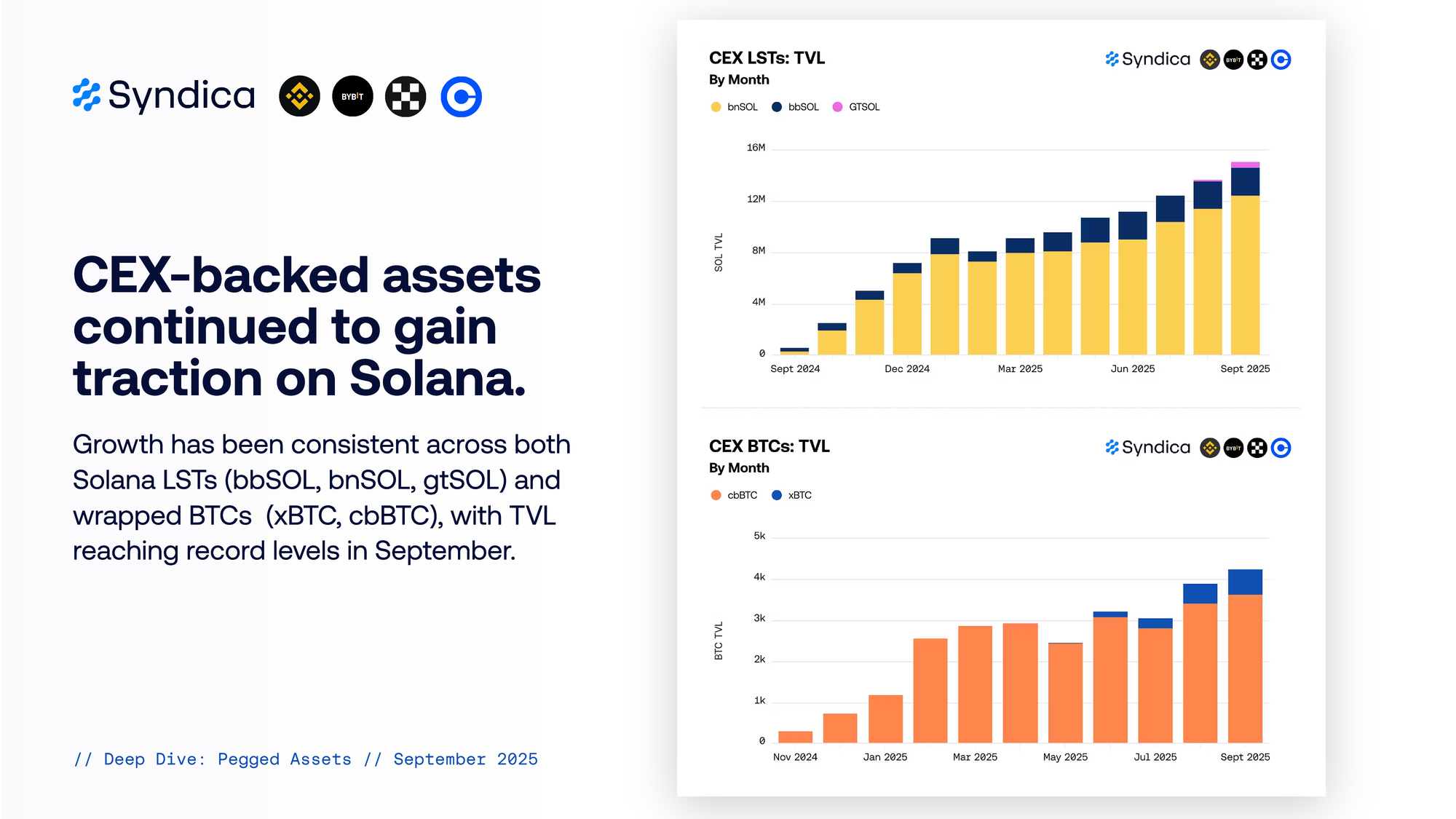

CEX-backed assets continued to gain traction on Solana. Growth has been consistent across both Solana LSTs (bbSOL, bnSOL, gtSOL) and wrapped BTCs (xBTC, cbBTC), with TVL reaching record levels in September.

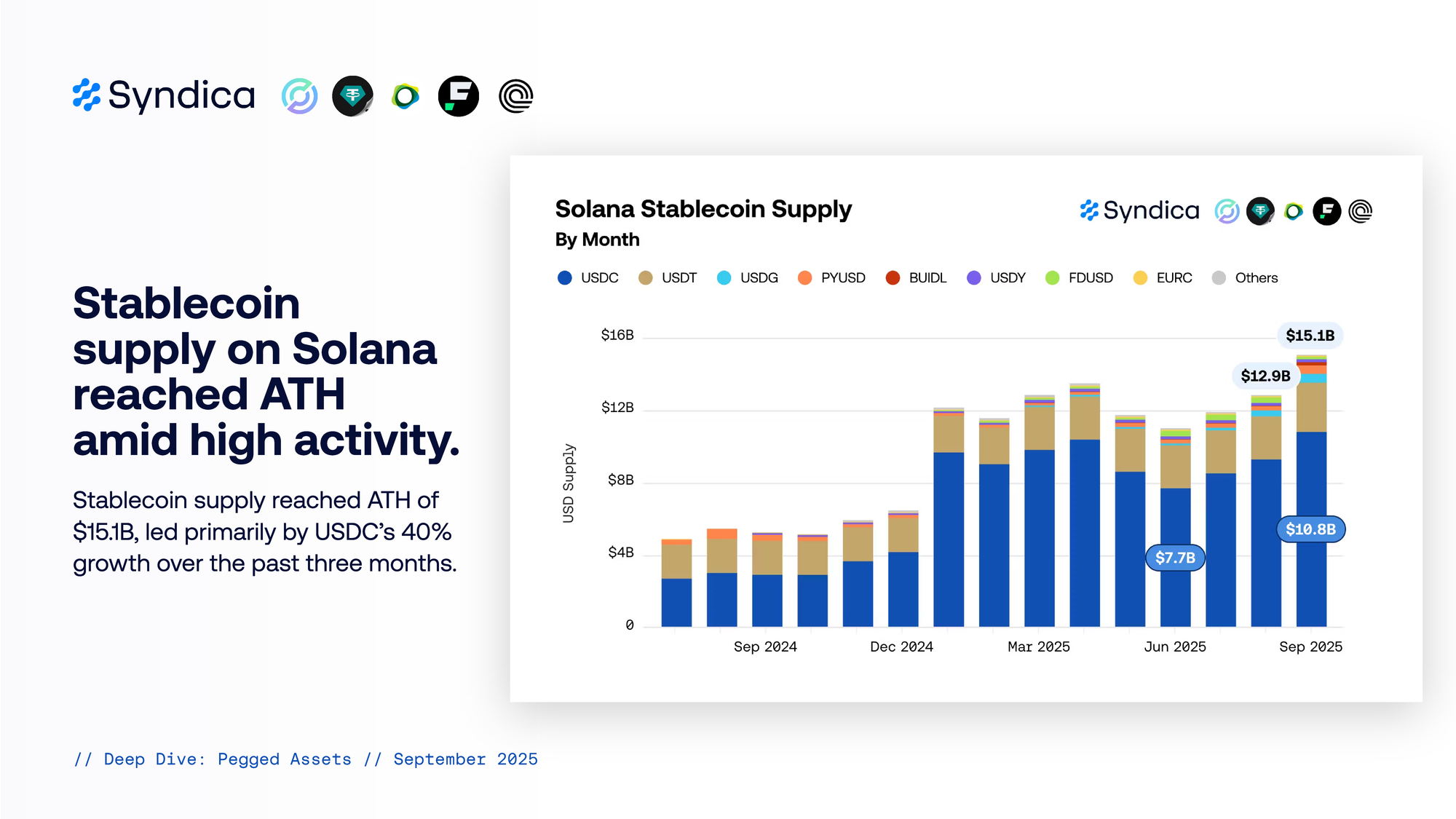

Stablecoin supply on Solana reached ATH amid high activity. Stablecoin supply reached ATH of $15.1B, led primarily by USDC’s 40% growth over the past three months.

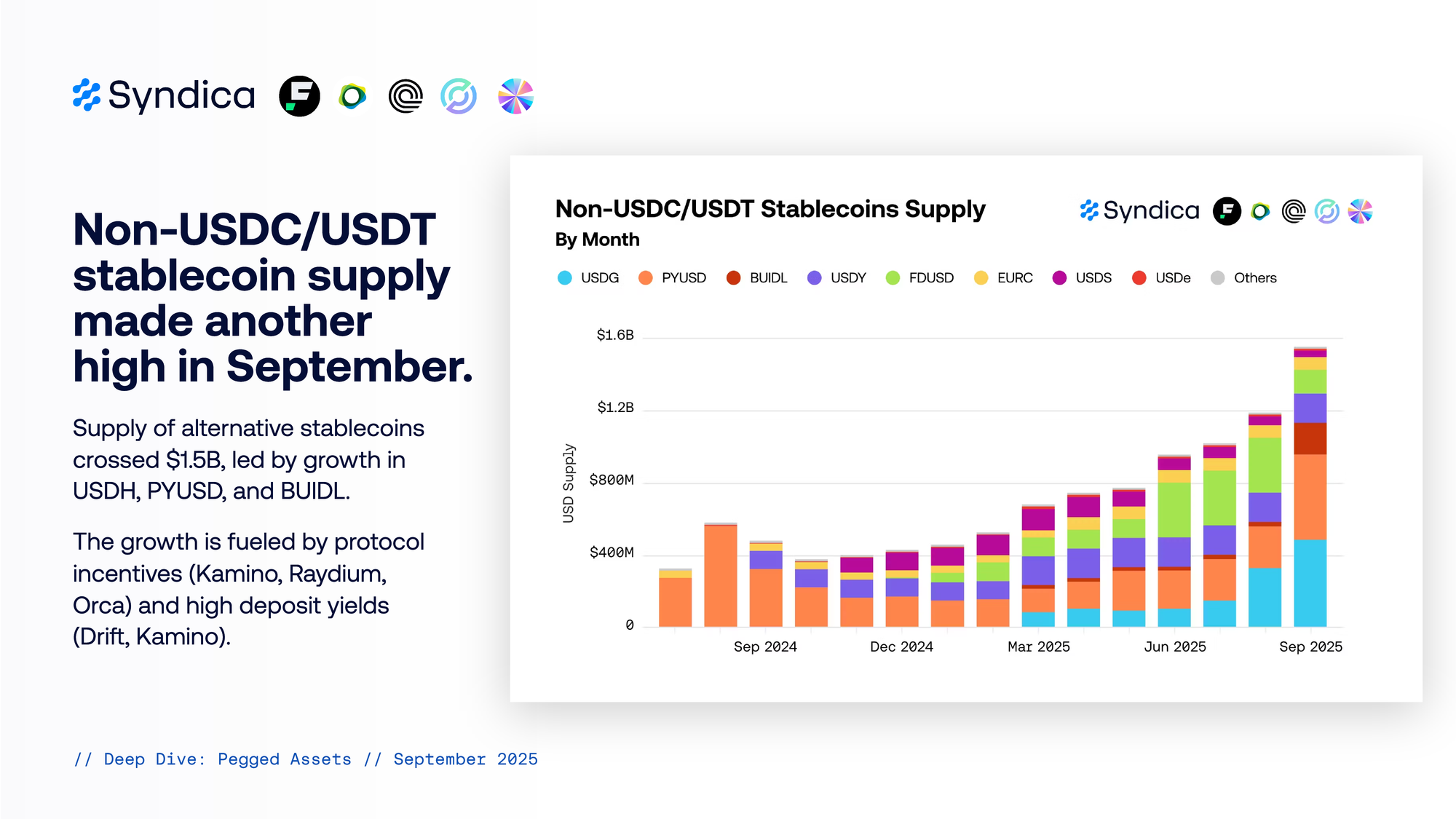

Non-USDC/USDT stablecoin supply made another high in September. Supply of alternative stablecoins crossed $1.5B, led by growth in USDH, PYUSD, and BUIDL. The growth is fueled by protocol incentives (Kamino, Raydium, Orca) and high deposit yields (Drift, Kamino).

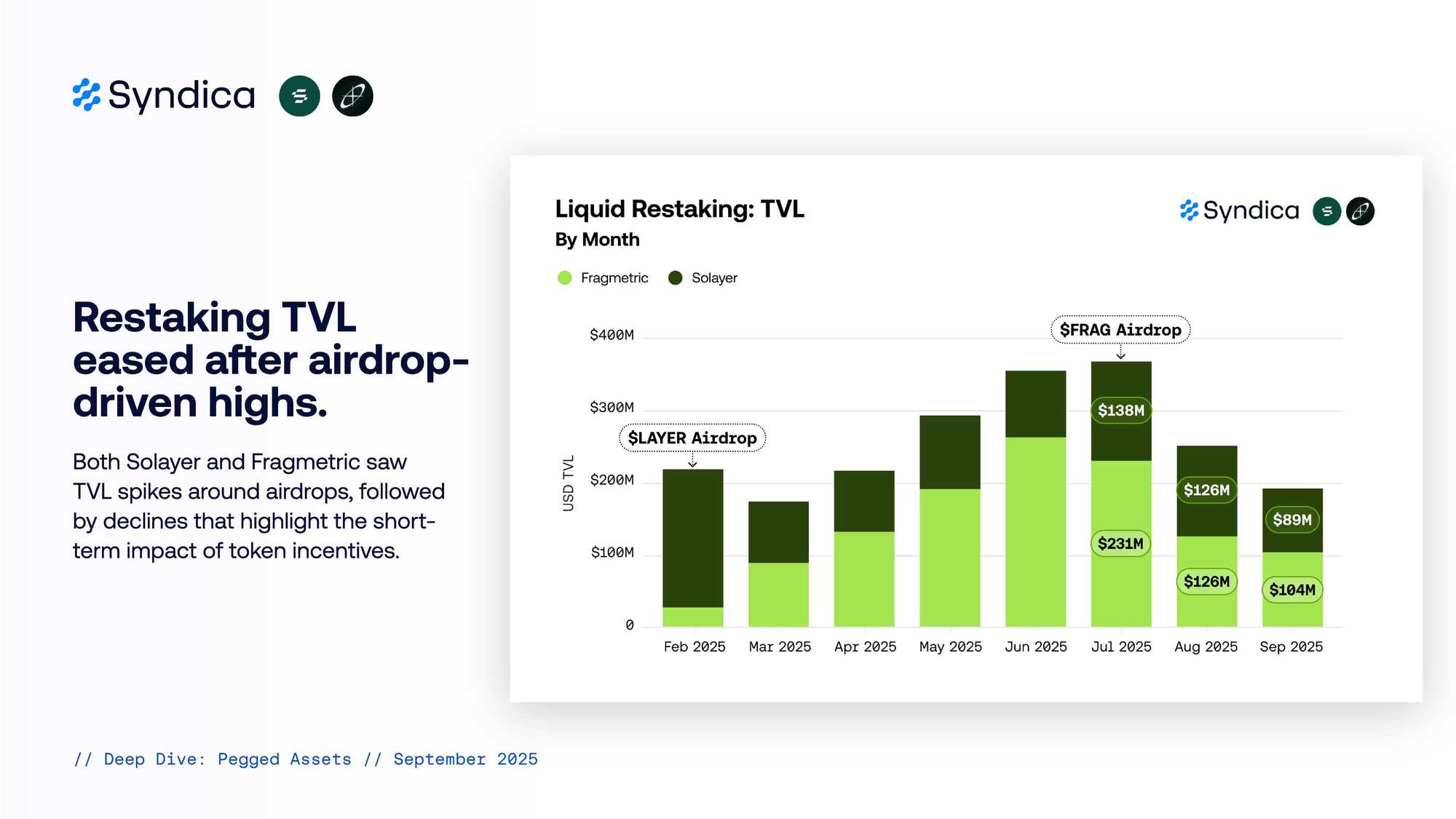

Restaking TVL eased after airdrop-driven highs. Both Solayer and Fragmetric saw TVL spikes around airdrops, followed by declines that highlight the short-term impact of token incentives.