Deep Dive: Solana DePIN - May 2024

Deep Dive: Solana DePIN - May 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DePIN - May 2024

Solana is the mecca of DePIN.

Live: This report covers six Solana DePIN projects that have a live product, most of which have transactions settling on-chain. Beta: This report also includes a handful of Solana DePIN projects currently in the beta testing stage.

Compute, Data, AI:

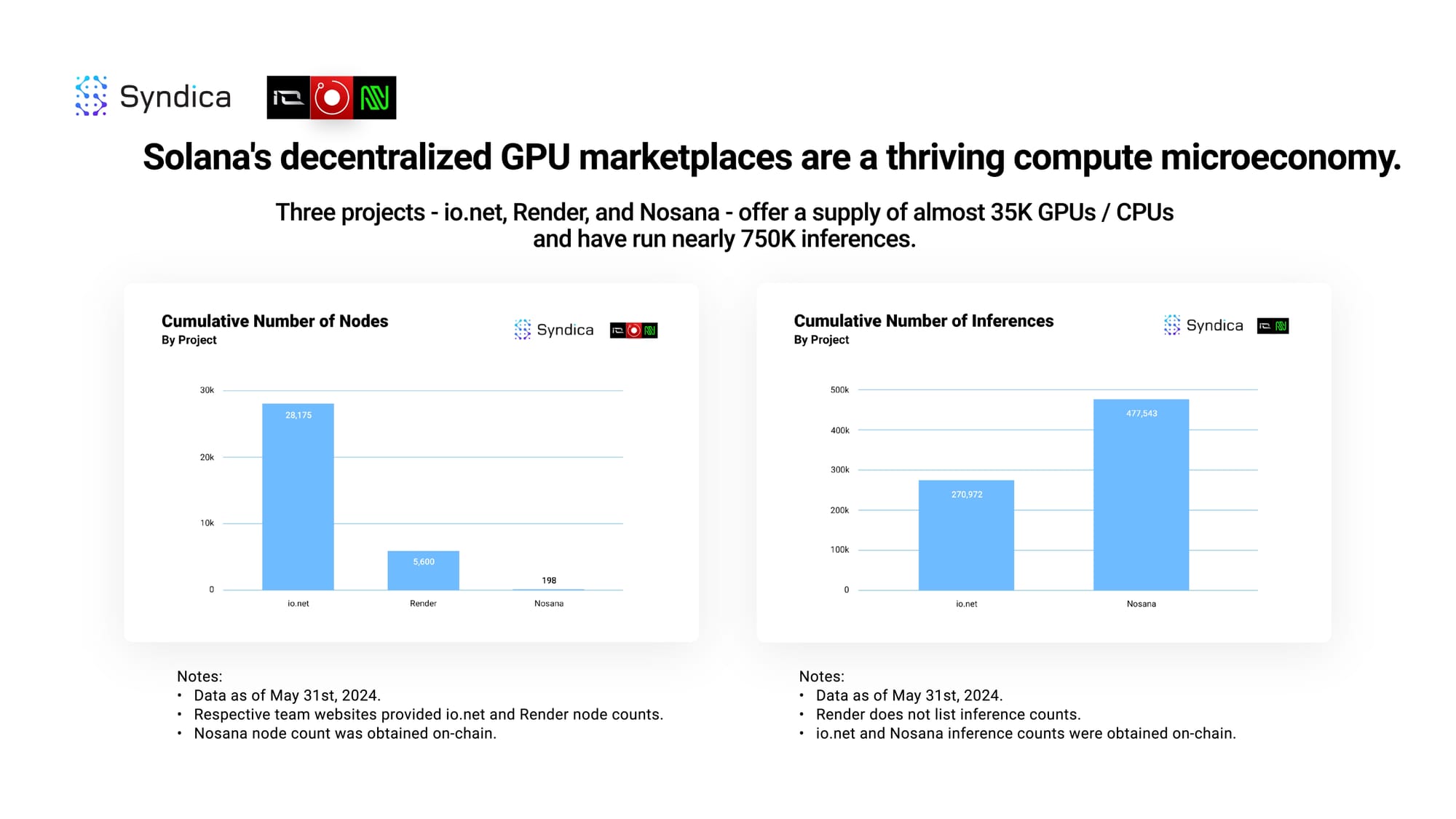

Solana's decentralized GPU marketplaces are a thriving compute microeconomy. Three projects - io.net, Render, and Nosana - offer a supply of almost 35K GPUs / CPUs and have run nearly 750K inferences.

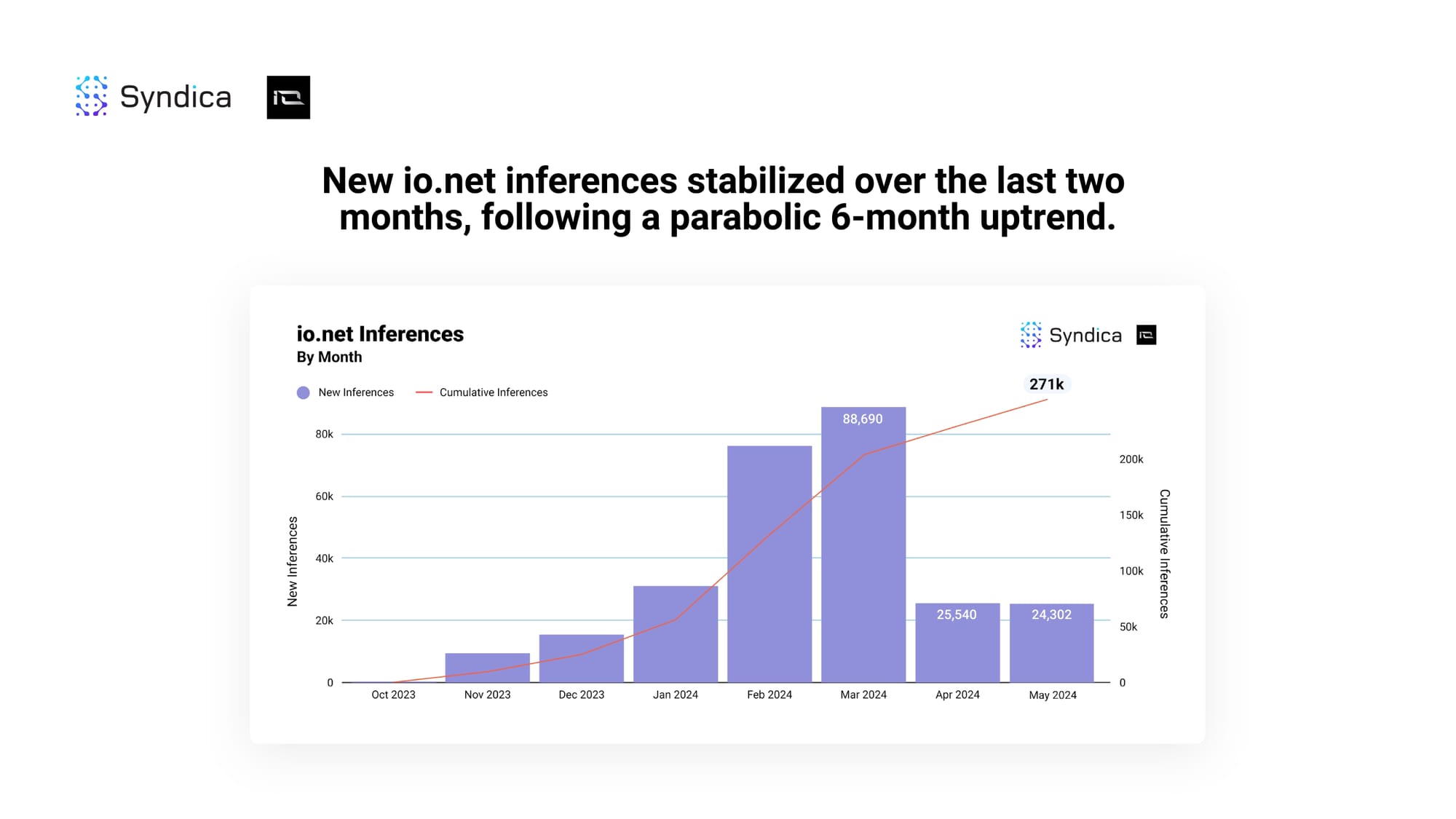

New io.net inferences stabilized over the last two months, following a parabolic 6-month uptrend.

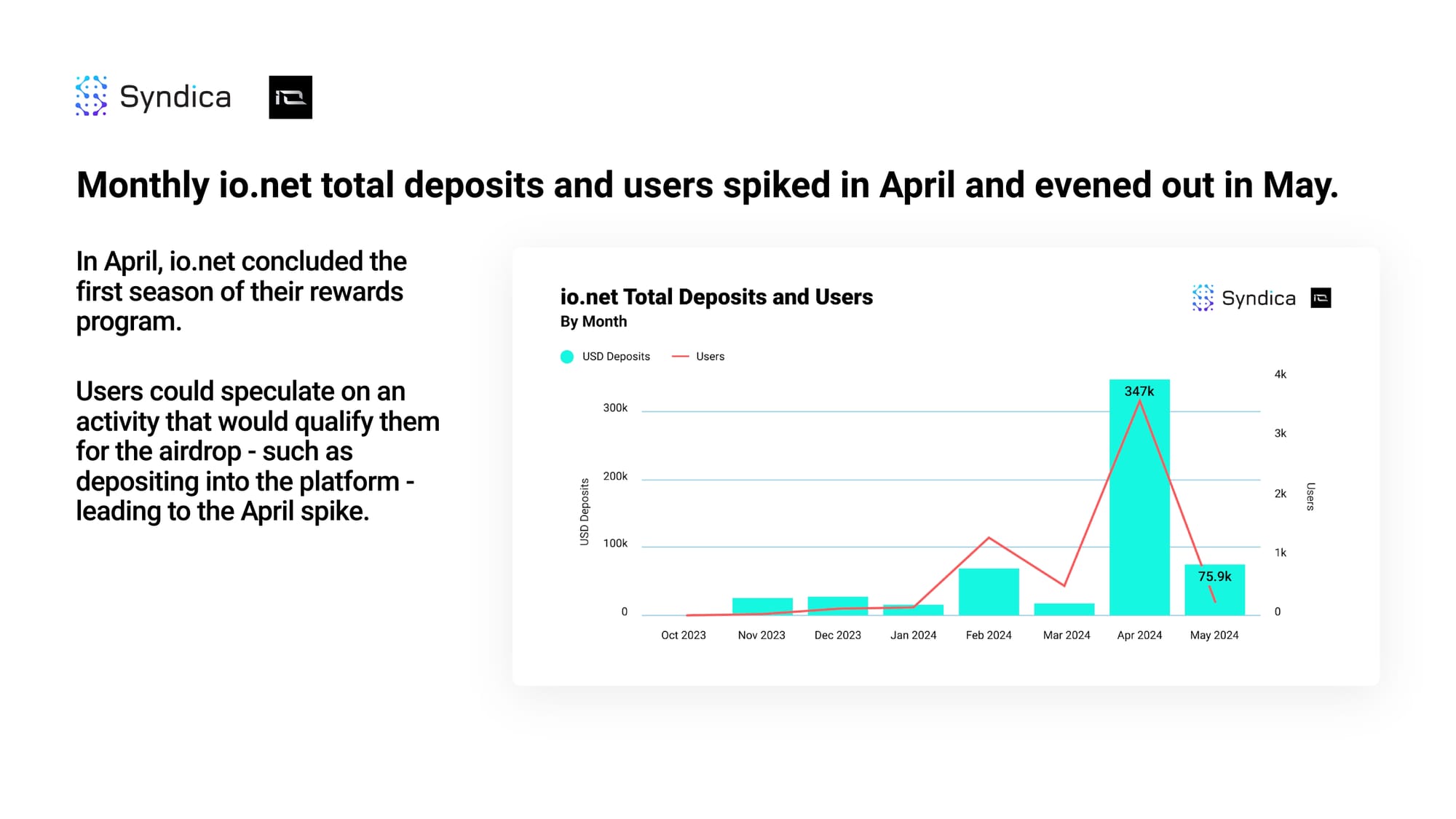

Monthly io.net total deposits and users spiked in April and evened out in May. In April, io.net concluded the first season of their rewards program. Users could speculate on an activity that would qualify them for the airdrop - such as depositing into the platform - leading to the April spike.

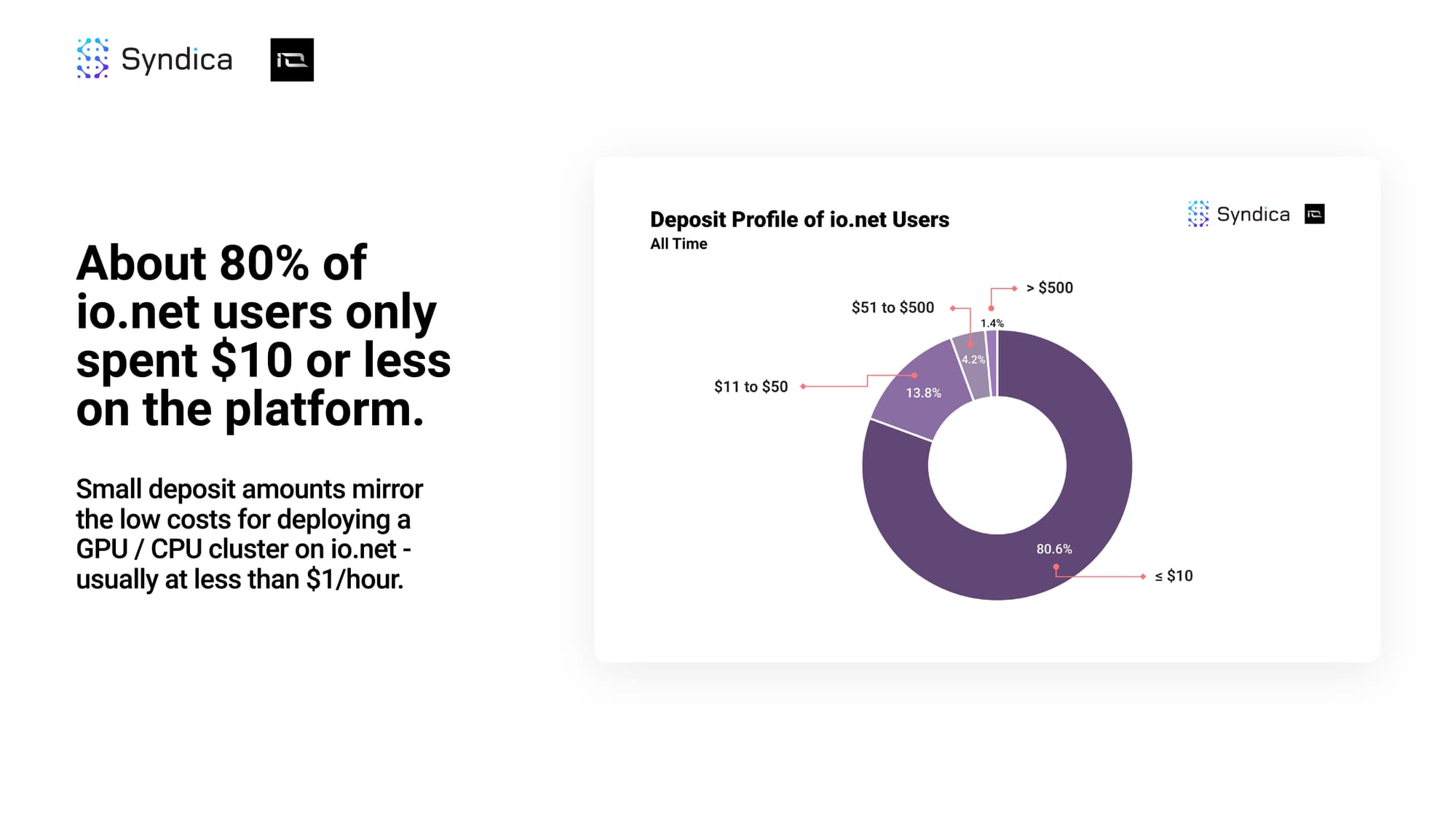

About 80% of io.net users only spent $10 or less on the platform. Small deposit amounts mirror the low costs for deploying a GPU / CPU cluster on io.net - usually at less than $1/hour.

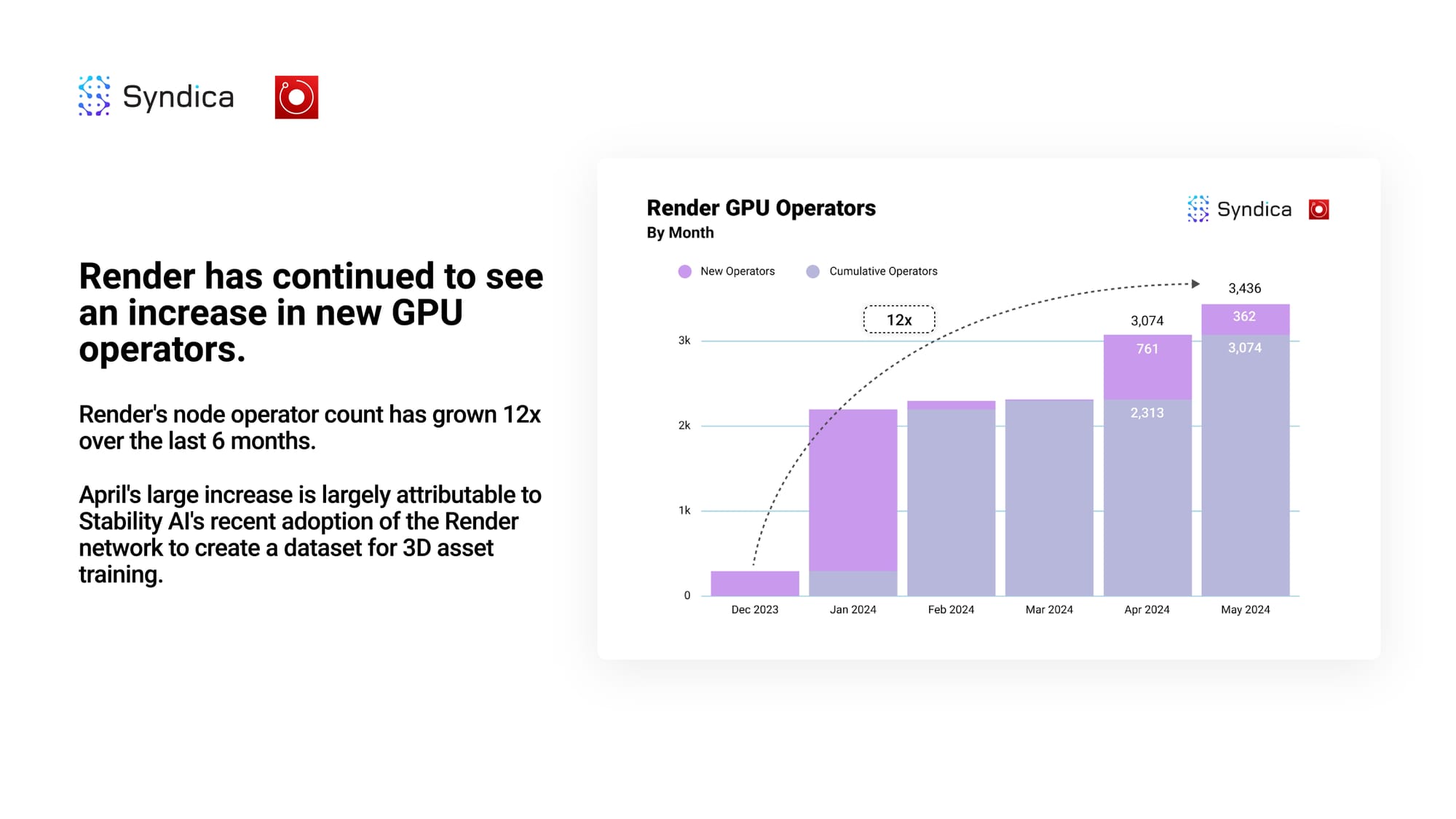

Render has continued to see an increase in new GPU operators. Render's node operator count has grown 12x over the last 6 months.

April's large increase is largely attributable to Stability AI's recent adoption of the Render network to create a dataset for 3D asset training.

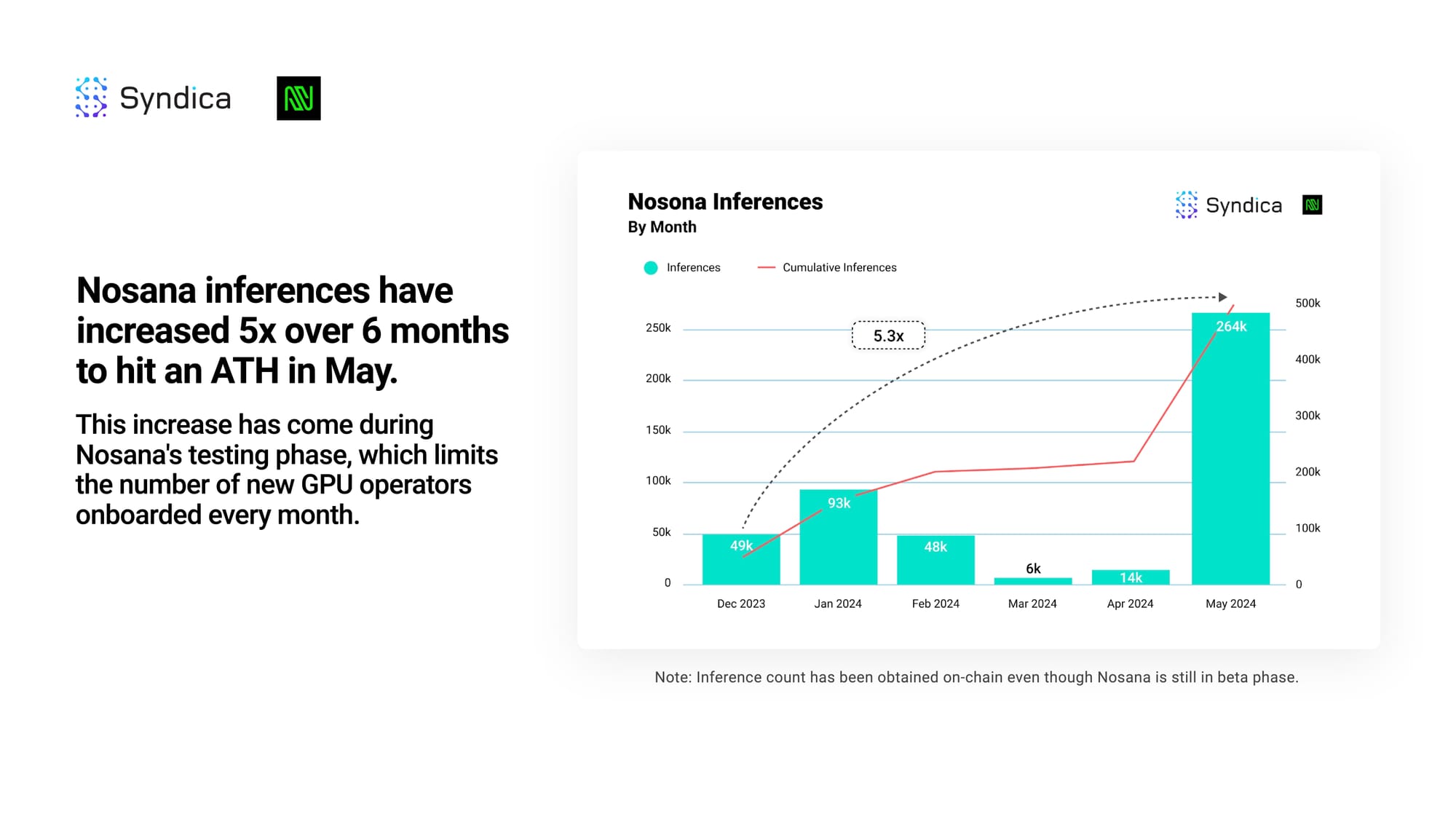

Nosana inferences have increased 5x over 6 months to hit an ATH in May. This increase has come during Nosana's testing phase, which limits the number of new GPU operators onboarded every month.

DAIN Protocol and Autonolas are autonomous agent protocols live in early stages. These two will supply users with AI agents capable of trading on their behalf.

DAIN Protocol has developed autonomous agents that Asset Shield AI is currently being used in two capacities: as one of the multisig signers for Squads, and as an AI trading tool named DAIN Trader.

With over 100k weekly transactions on the Gnosis blockchain, Autonolas is establishing an ecosystem for autonomous services, enabling anyone to construct AI agents. Their venture into Solana begins with BabyDegen, an agent facilitating buy and sell strategies on Jupiter.

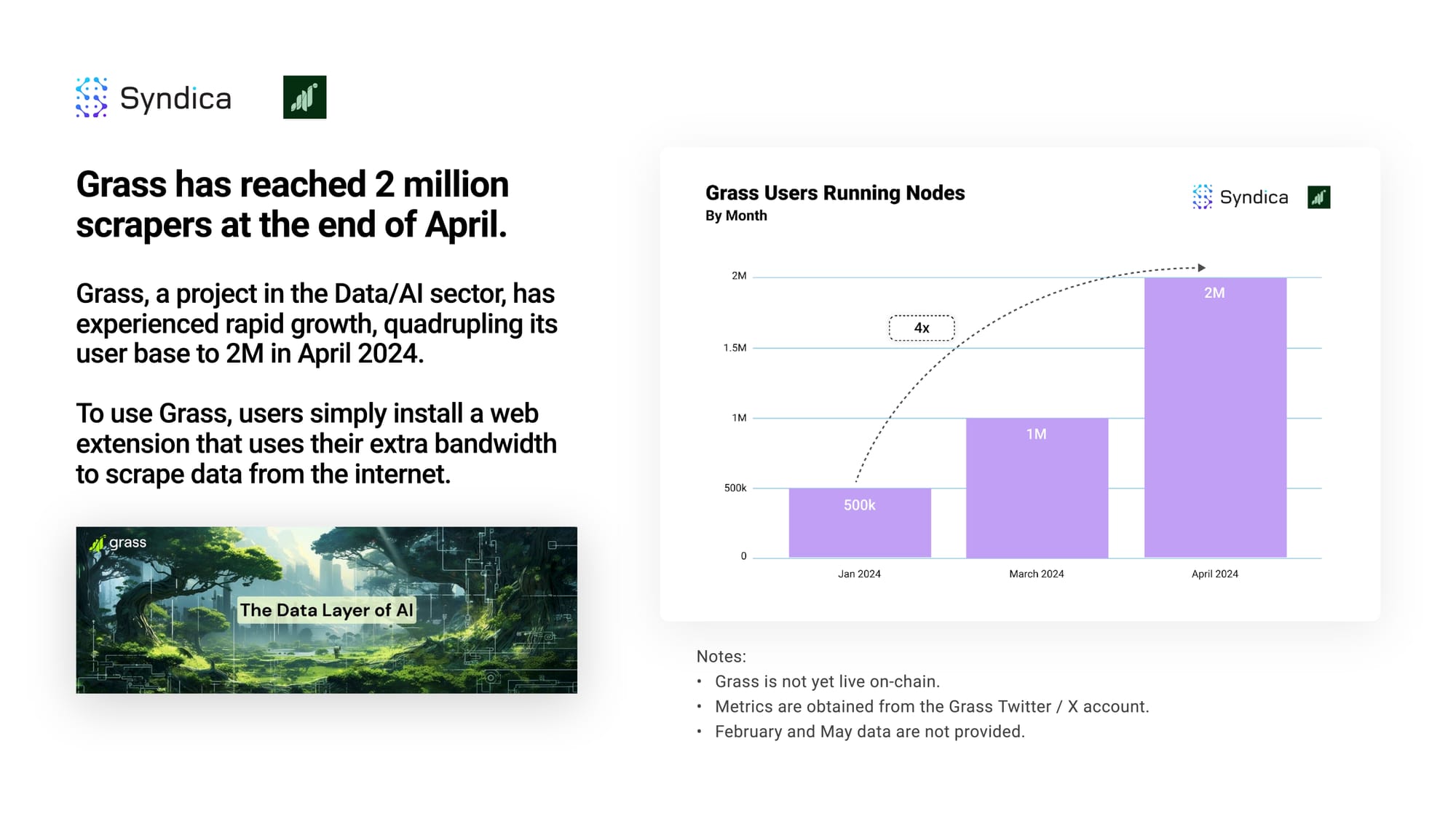

Grass has reached 2 million scrapers at the end of April. Grass, a project in the Data/AI sector, has experienced rapid growth, quadrupling its user base to 2M in April 2024.

To use Grass, users simply install a web extension that uses their extra bandwidth to scrape data from the internet.

Wireless:

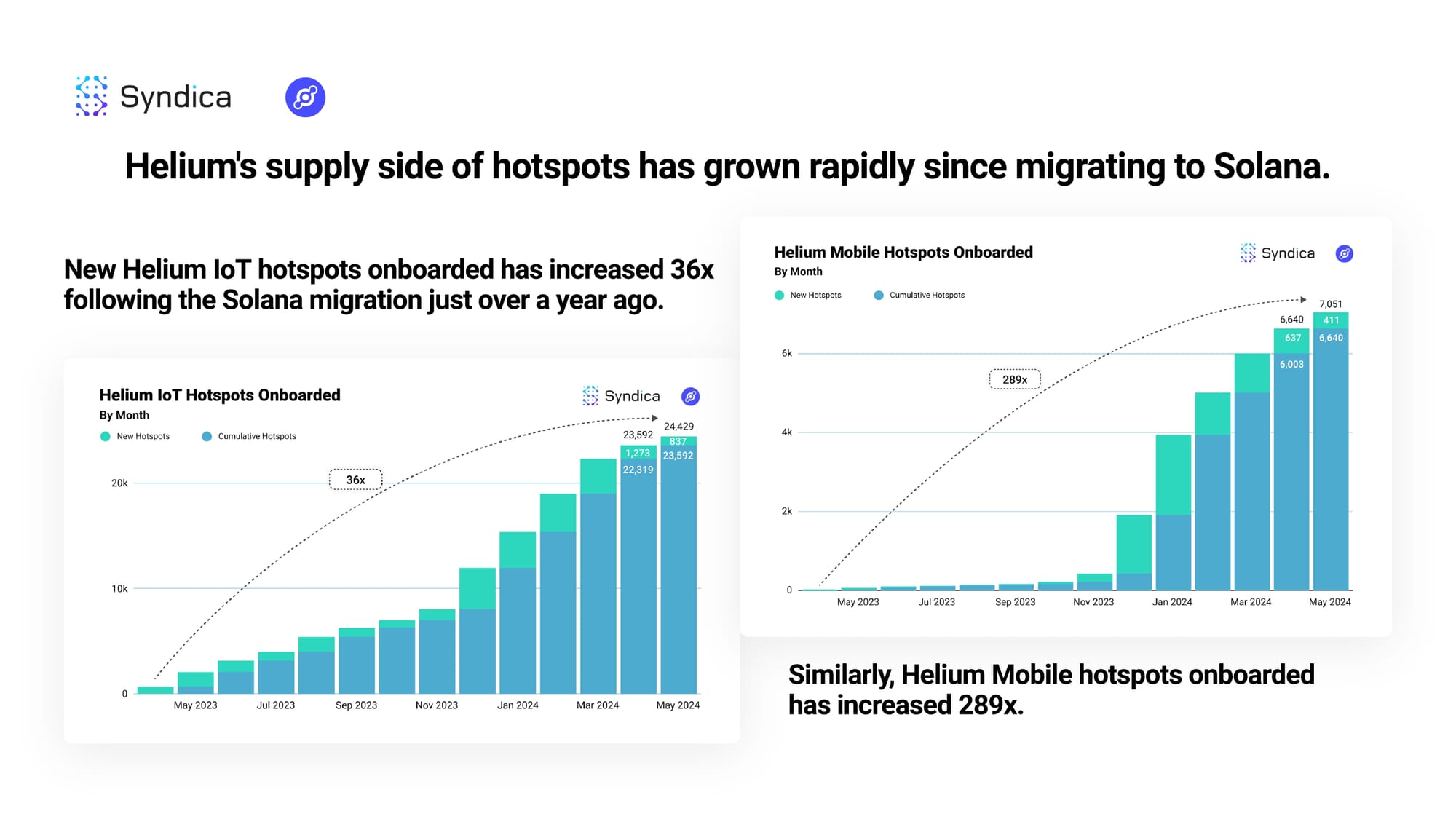

Helium's supply side of hotspots has grown rapidly since migrating to Solana. New Helium IoT hotspots onboarded has increased 36x following the Solana migration just over a year ago. Similarly, Helium Mobile hotspots onboarded has increased 289x.

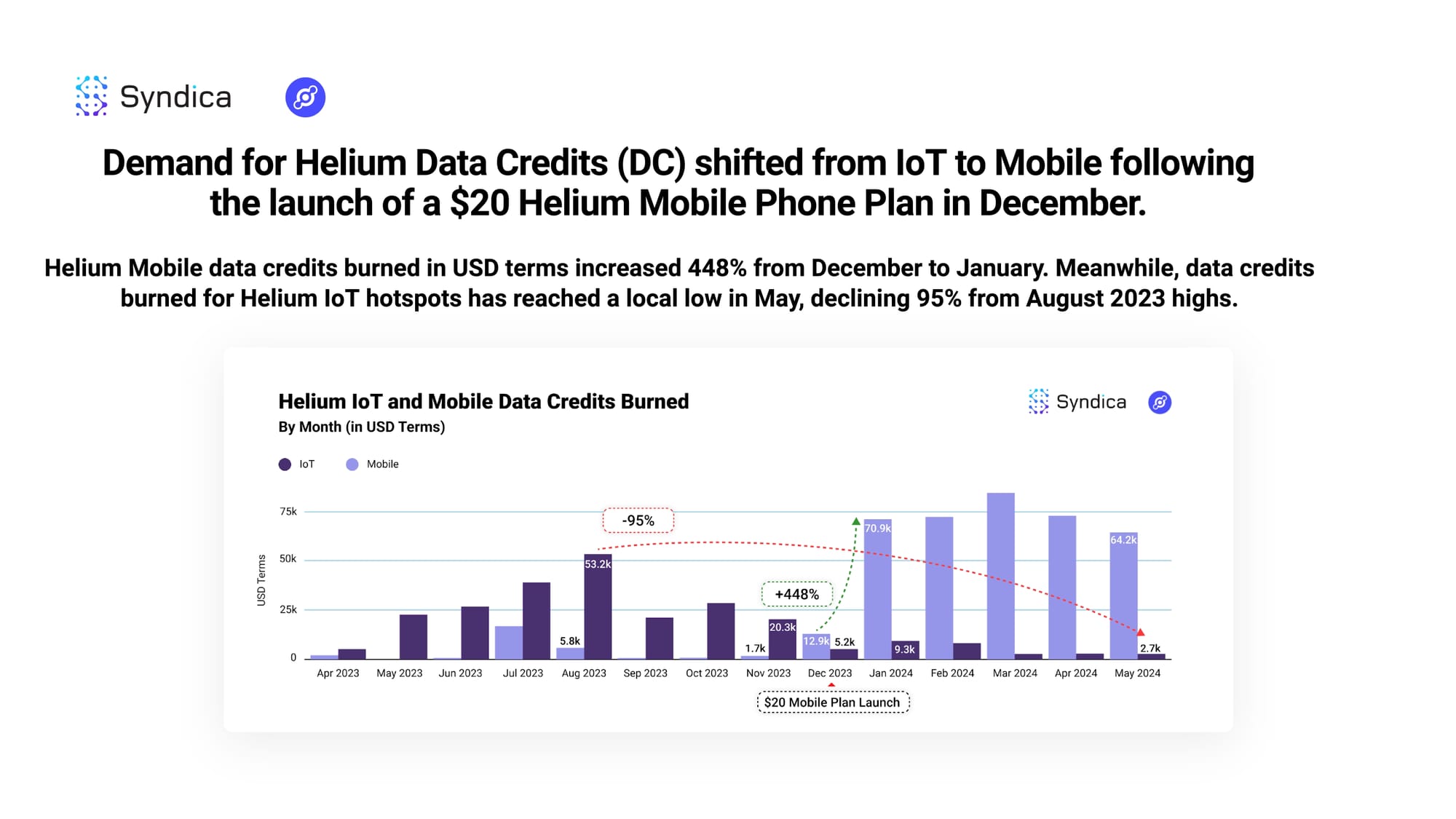

Demand for Helium Data Credits (DC) shifted from IoT to Mobile following the launch of a $20 Helium Mobile Phone Plan in December. Helium Mobile data credits burned in USD terms increased 448% from December to January. Meanwhile, data credits burned for Helium IoT hotspots has reached a local low in May, declining 95% from August 2023 highs.

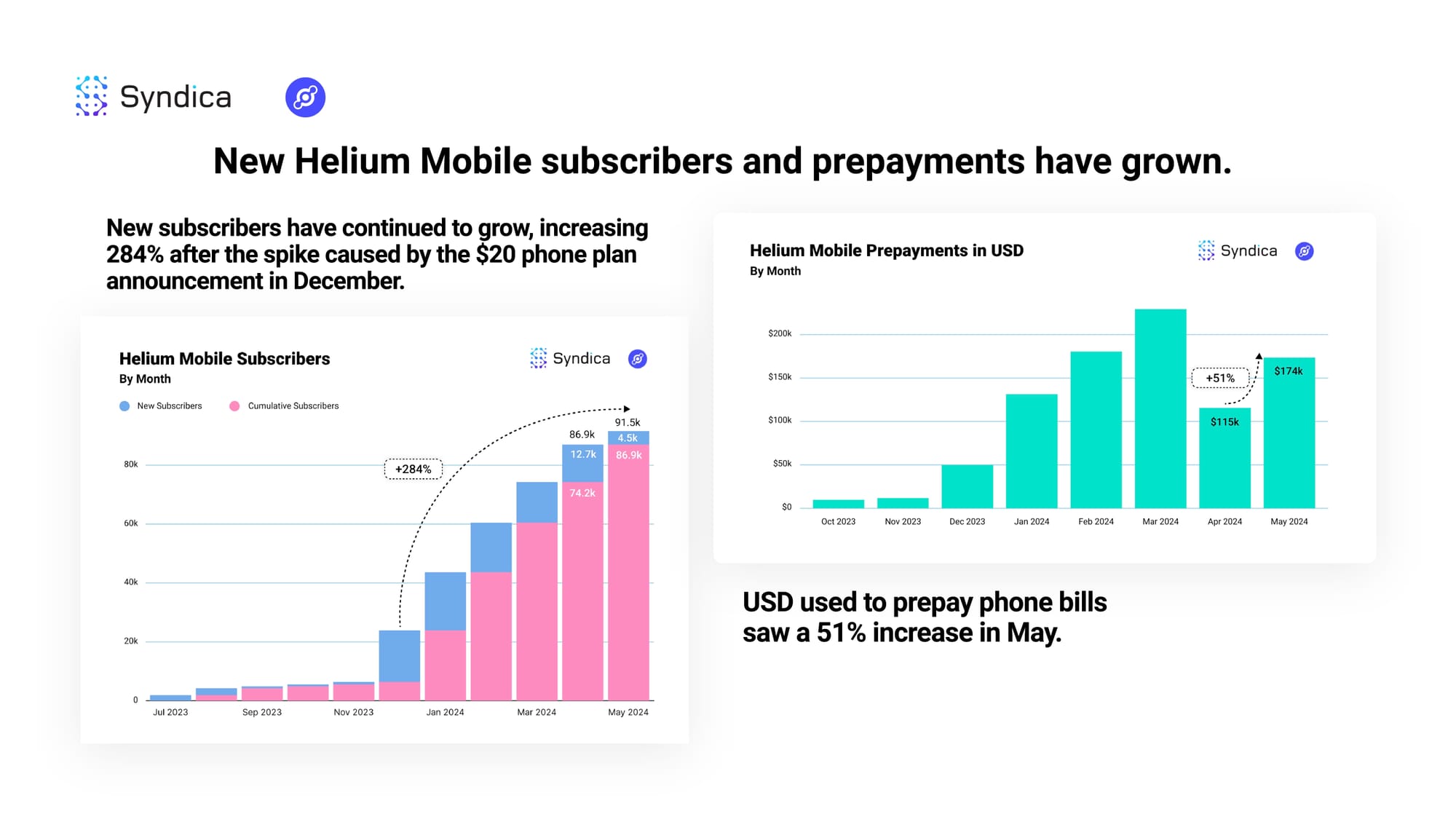

New Helium Mobile subscribers and prepayments have grown.

New subscribers have continued to grow, increasing 284% after the spike caused by the $20 phone plan announcement in December. USD used to prepay phone bills saw a 51% increase in May.

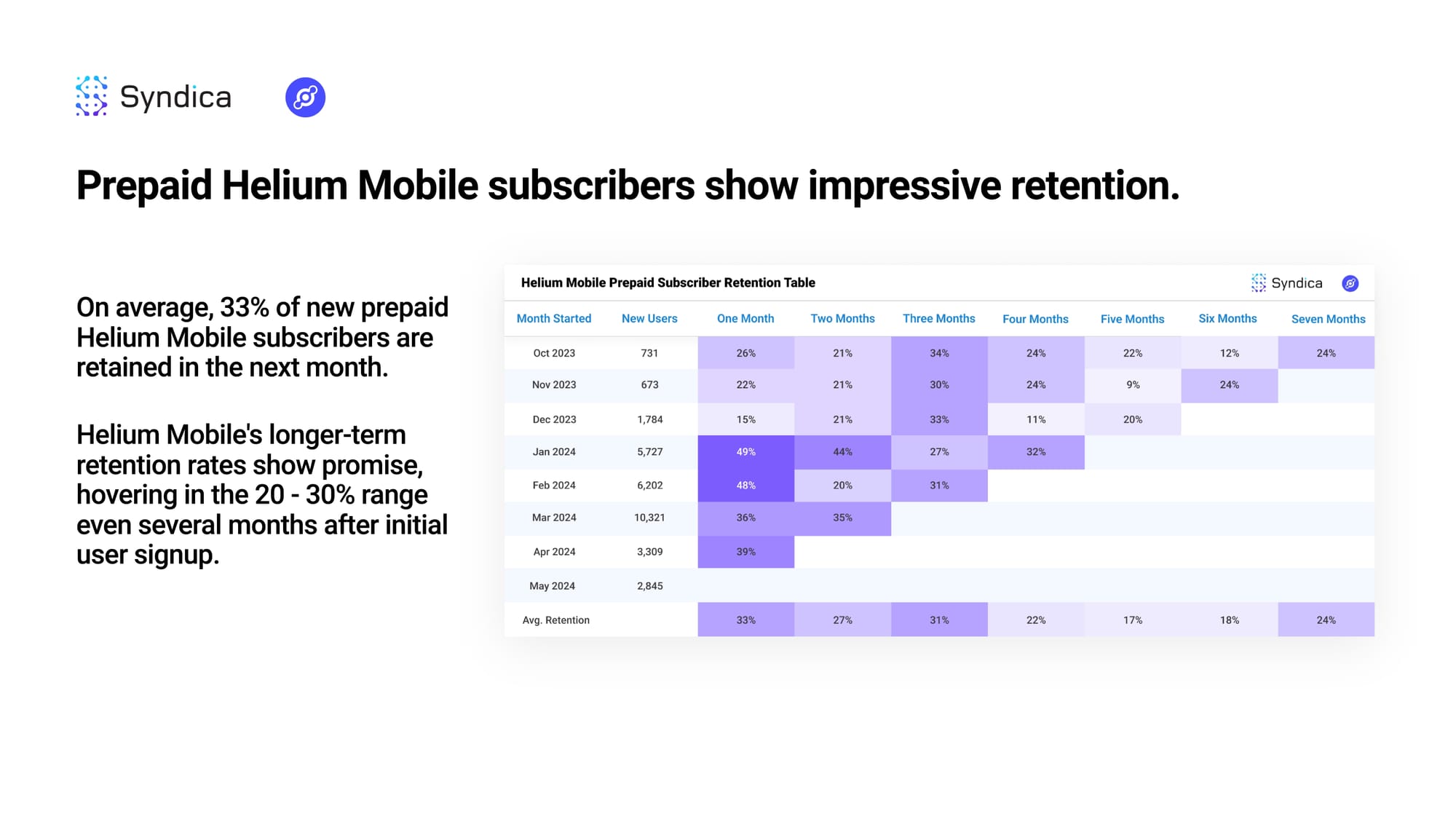

Prepaid Helium Mobile subscribers show impressive retention. On average, 33% of new prepaid Helium Mobile subscribers are retained in the next month. Helium Mobile's longer-term retention rates show promise, hovering in the 20 - 30% range even several months after initial user signup.

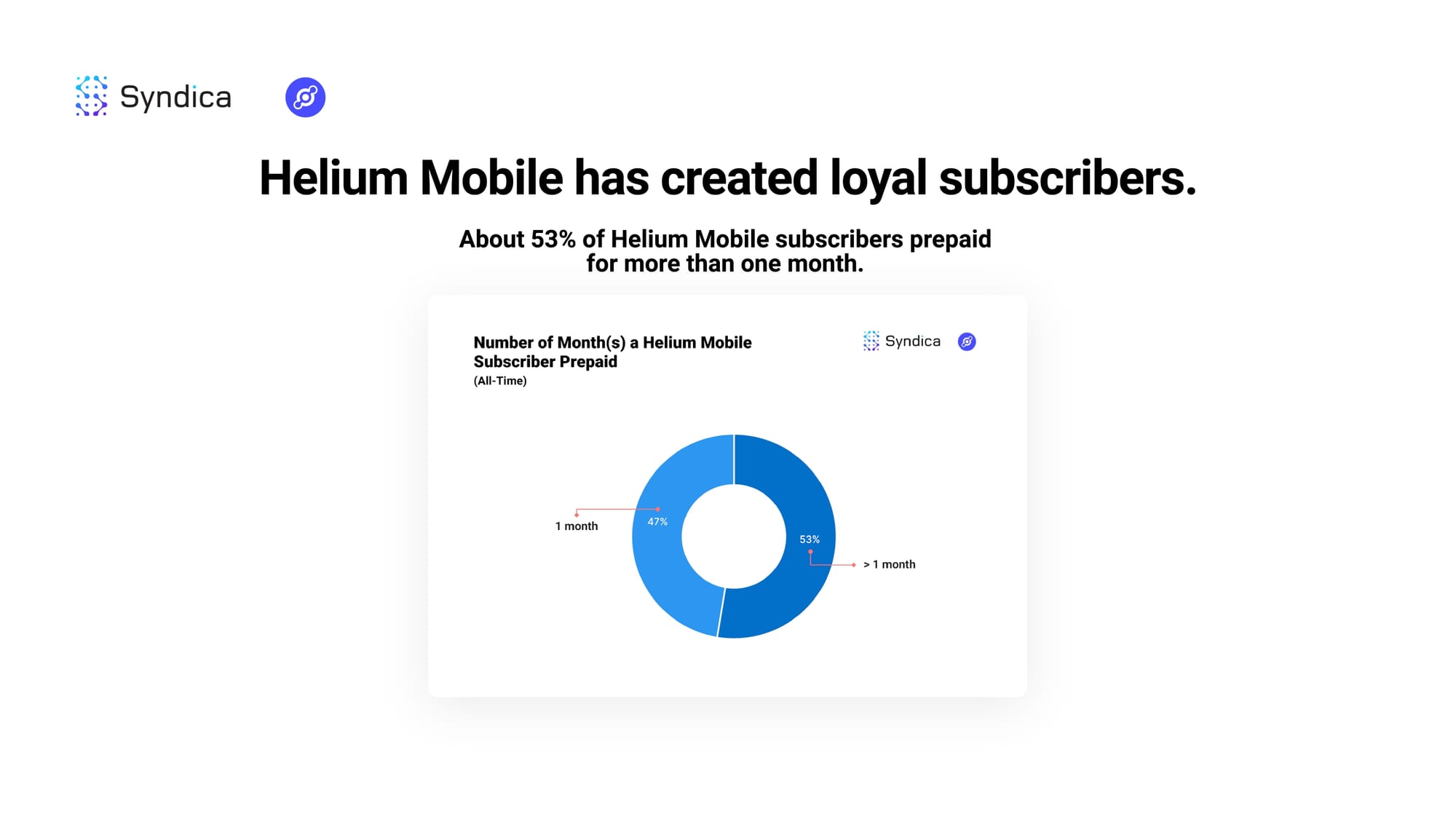

Helium Mobile has created loyal subscribers. About 53% of Helium Mobile subscribers prepaid for more than one month.

Mapping:

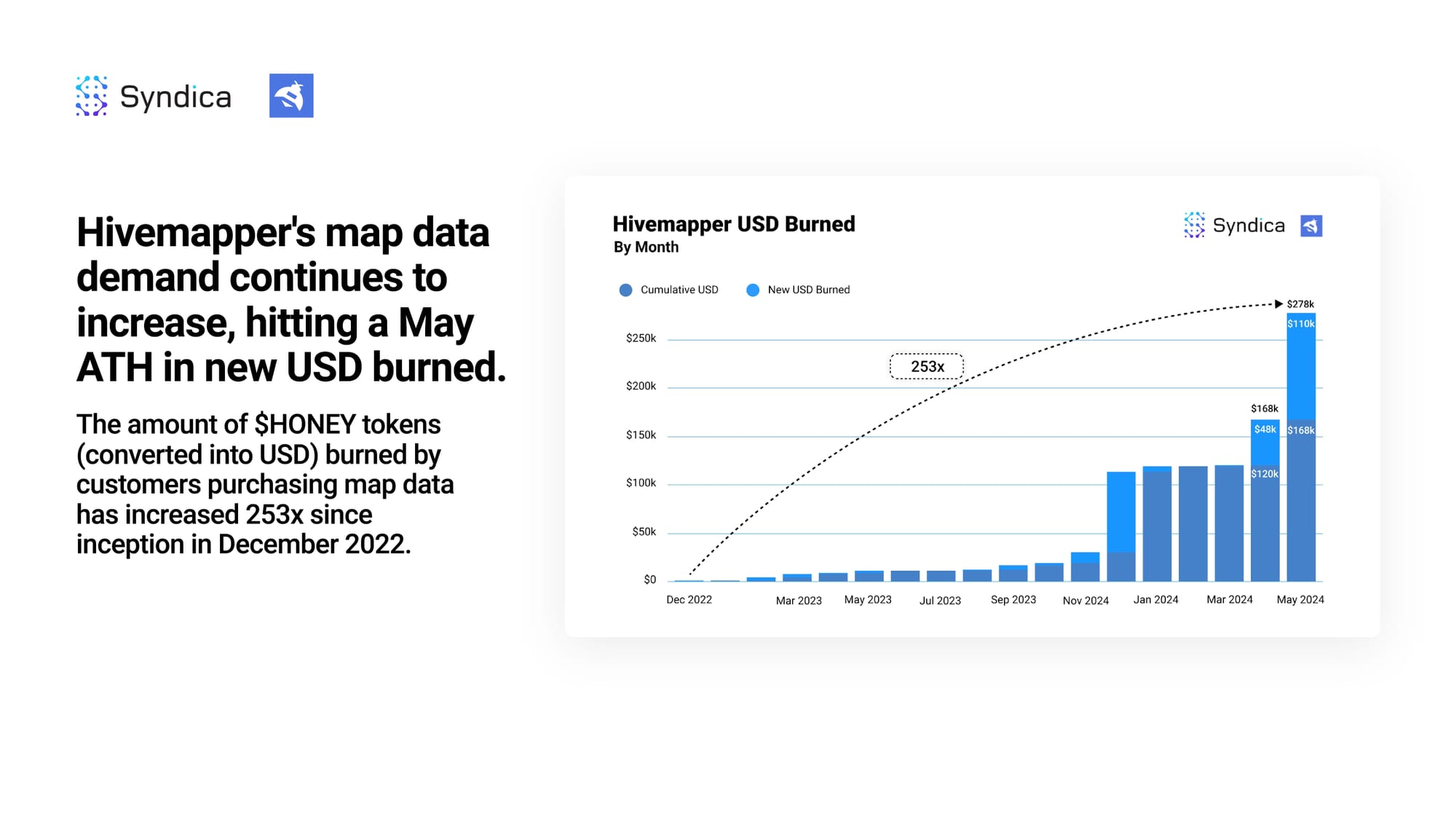

Hivemapper's map data demand continues to increase, hitting a May ATH in new USD burned. The amount of $HONEY tokens (converted into USD) burned by customers purchasing map data has increased 253x since inception in December 2022.

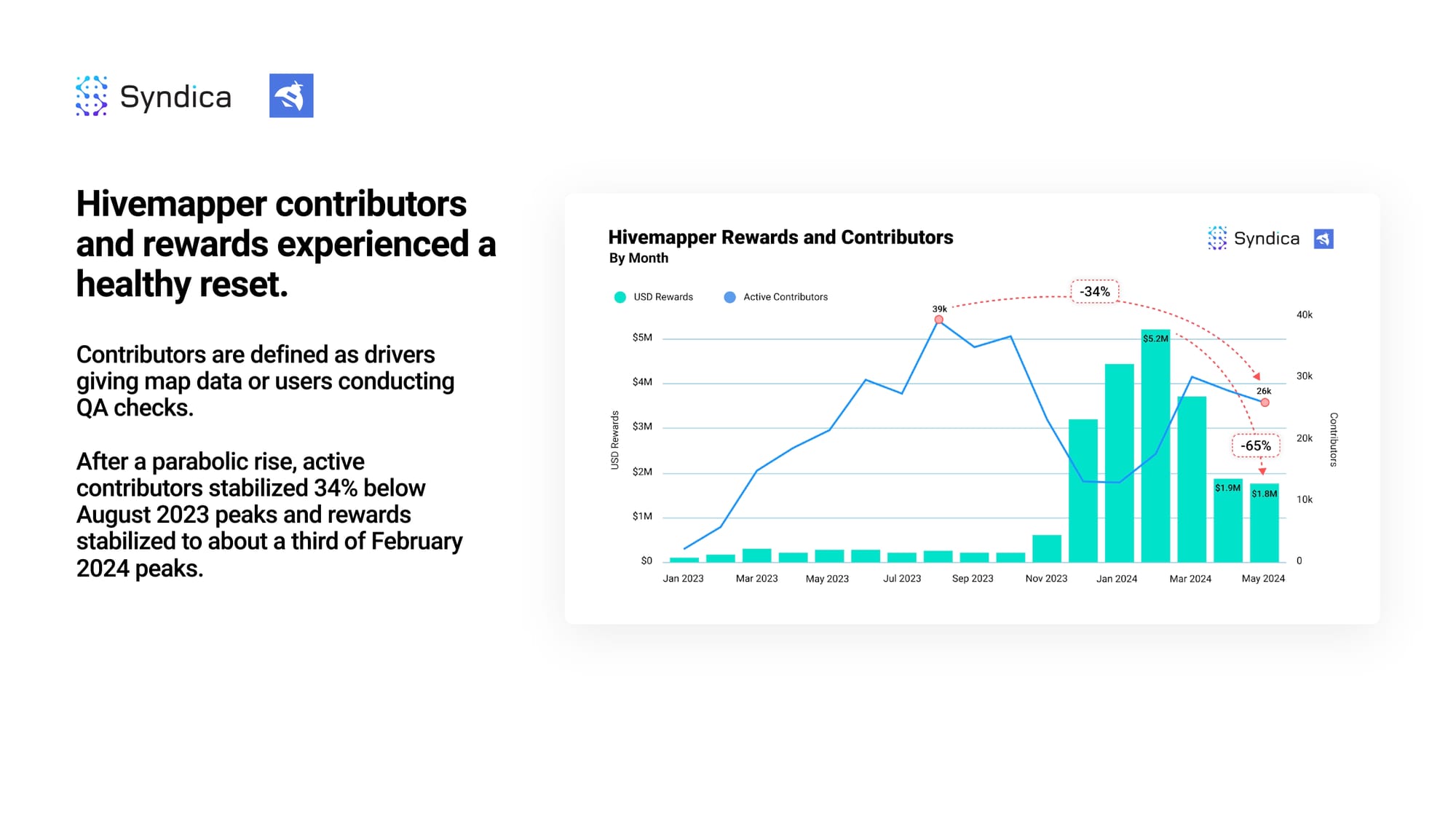

Hivemapper contributors and rewards experienced a healthy reset. Contributors are defined as drivers giving map data or users conducting QA checks.

After a parabolic rise, active contributors stabilized 34% below August 2023 peaks, and rewards stabilized to about a third of February 2024 peaks.

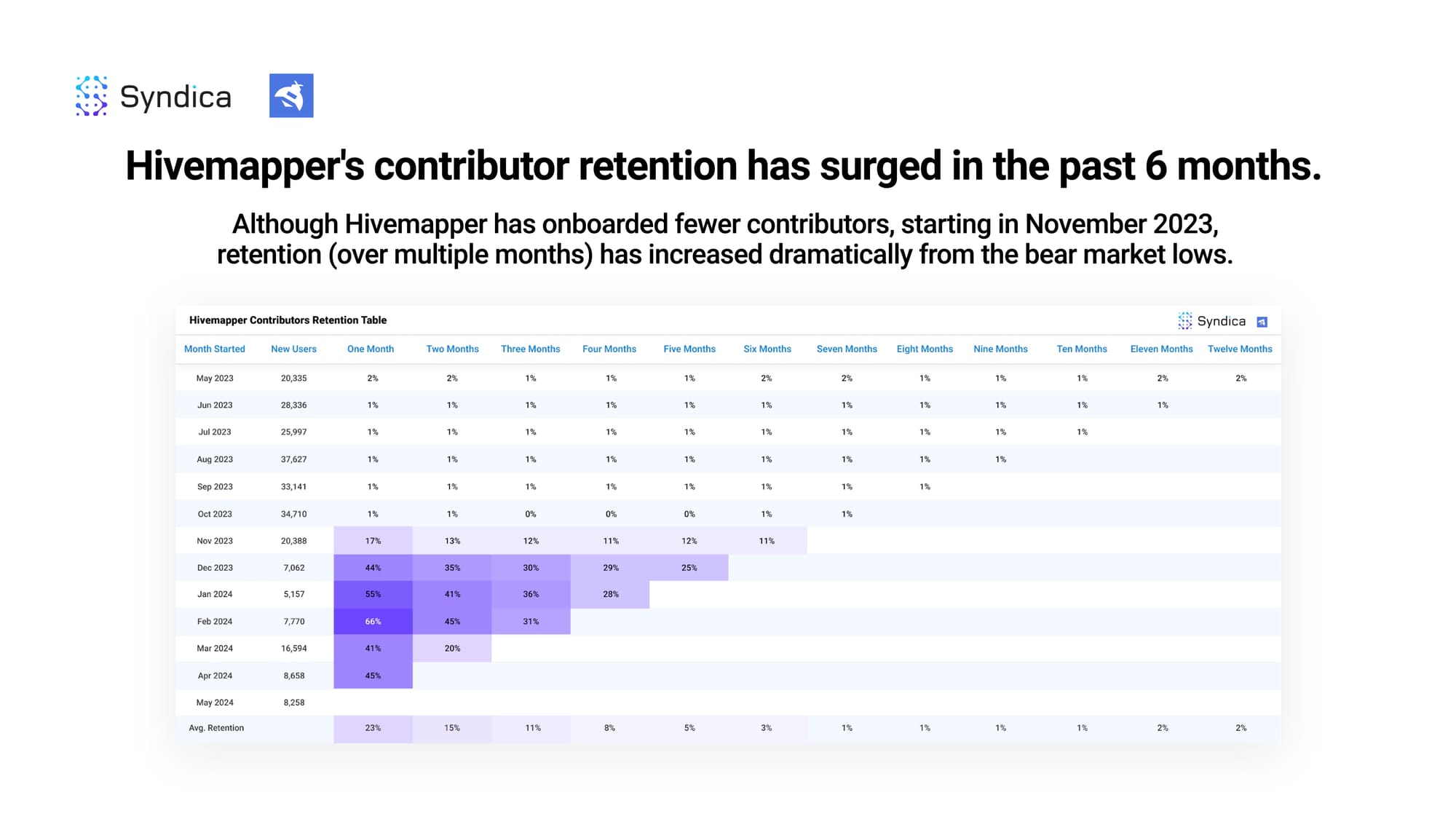

Hivemapper's contributor retention has surged in the past 6 months. Although Hivemapper has onboarded fewer contributors, starting in November 2023, retention (over multiple months) has increased dramatically from the bear market lows.

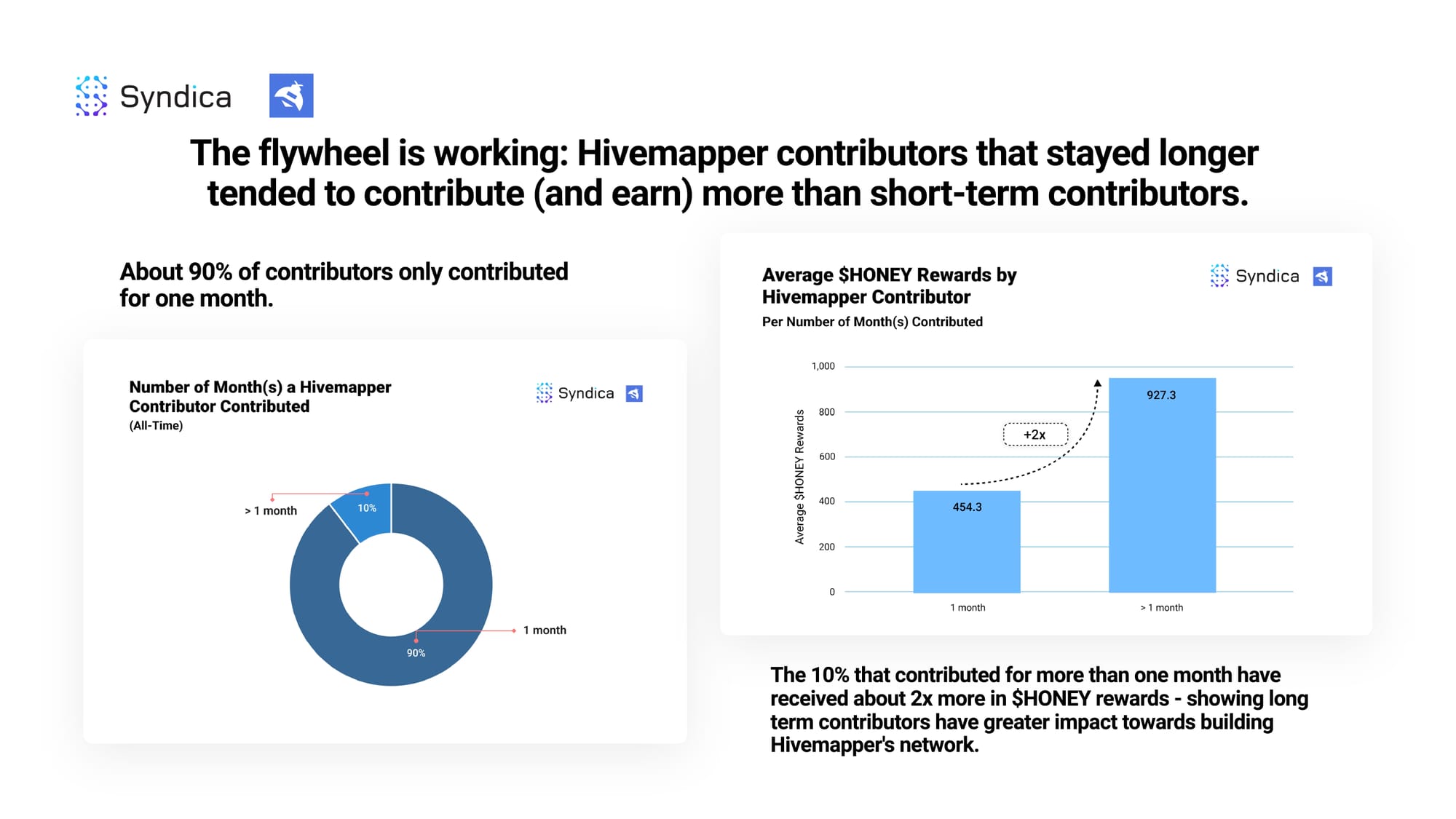

The flywheel is working: Hivemapper contributors that stayed longer tended to contribute (and earn) more than short-term contributors.

About 90% of contributors only contributed for one month. The 10% that contributed for more than one month have received about 2x more in $HONEY rewards - showing long-term contributors have greater impact towards building Hivemapper's network.

Storage:

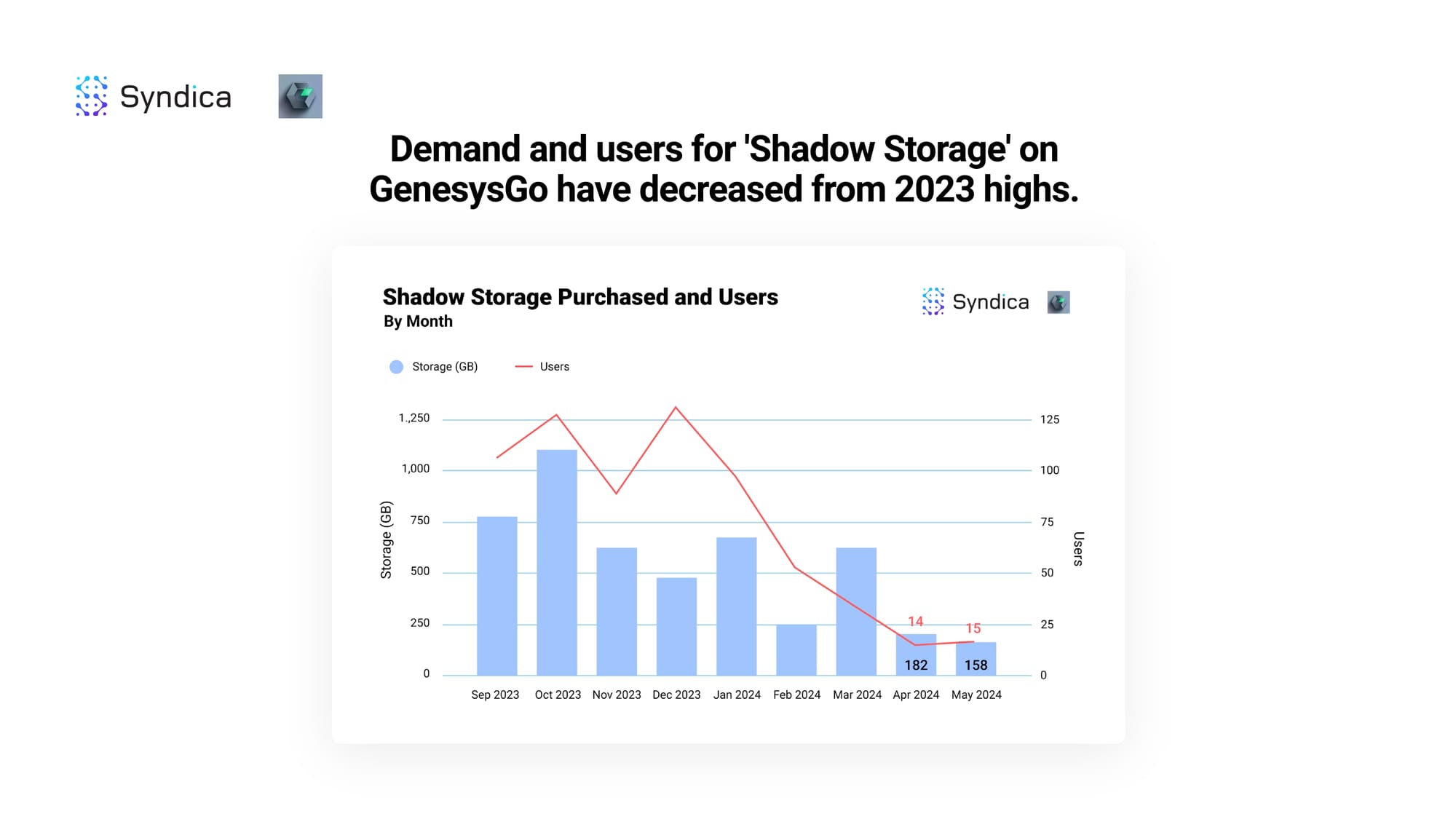

Demand and users for 'Shadow Storage' on GenesysGo have decreased from 2023 highs.

Our Trends To Watch:

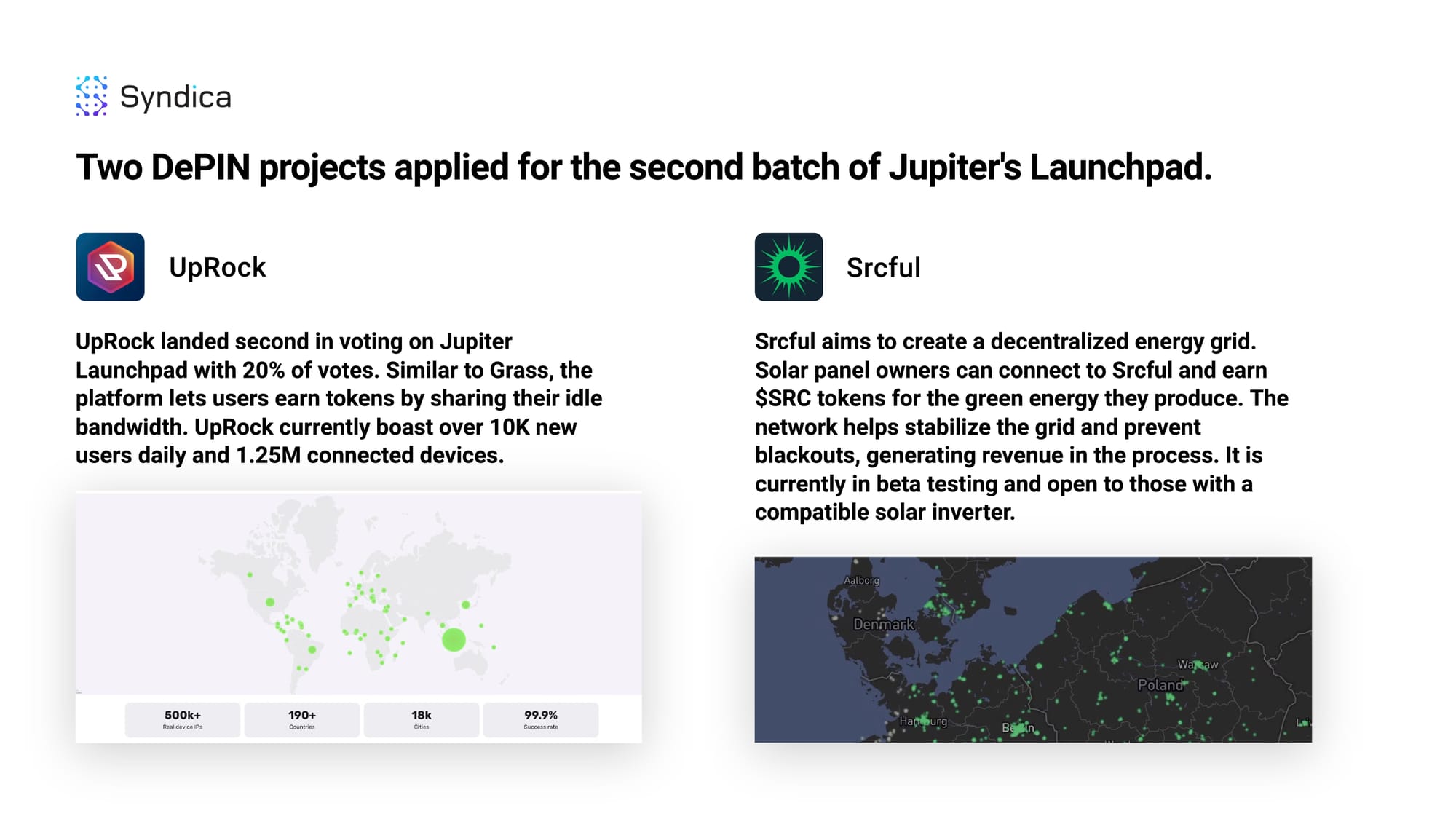

Two DePIN projects applied for the second batch of Jupiter's Launchpad.

UpRock: UpRock landed second in voting on Jupiter Launchpad with 20% of votes. Similar to Grass, the platform lets users earn tokens by sharing their idle bandwidth. UpRock currently boast over 10K new users daily and 1.25M connected devices.

Srcful: Srcful aims to create a decentralized energy grid. Solar panel owners can connect to Srcful and earn $SRC tokens for the green energy they produce. The network helps stabilize the grid and prevent blackouts, generating revenue in the process. It is currently in beta testing and open to those with a compatible solar inverter.

Closing Thoughts:

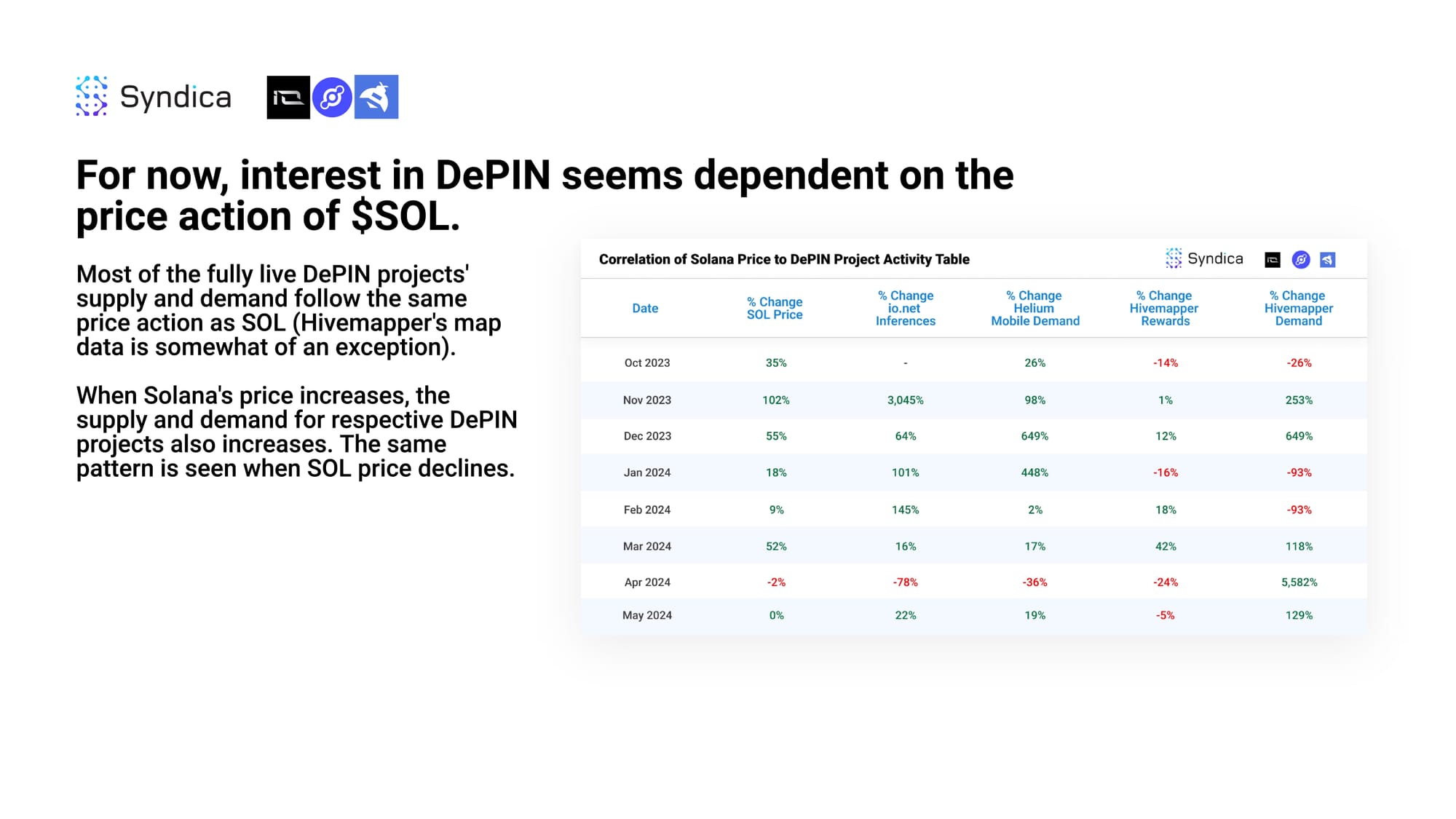

For now, interest in DePIN seems dependent on the price action of $SOL. Most of the fully live DePIN projects' supply and demand follow the same price action as SOL (Hivemapper's map data is somewhat of an exception).

When Solana's price increases, the supply and demand for respective DePIN projects also increases. The same pattern is seen when SOL price declines.