Deep Dive: Solana DePIN - August 2024

Deep Dive: Solana DePIN - August 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DePIN - August 2024

Part I: Solana AI, Compute, & Data

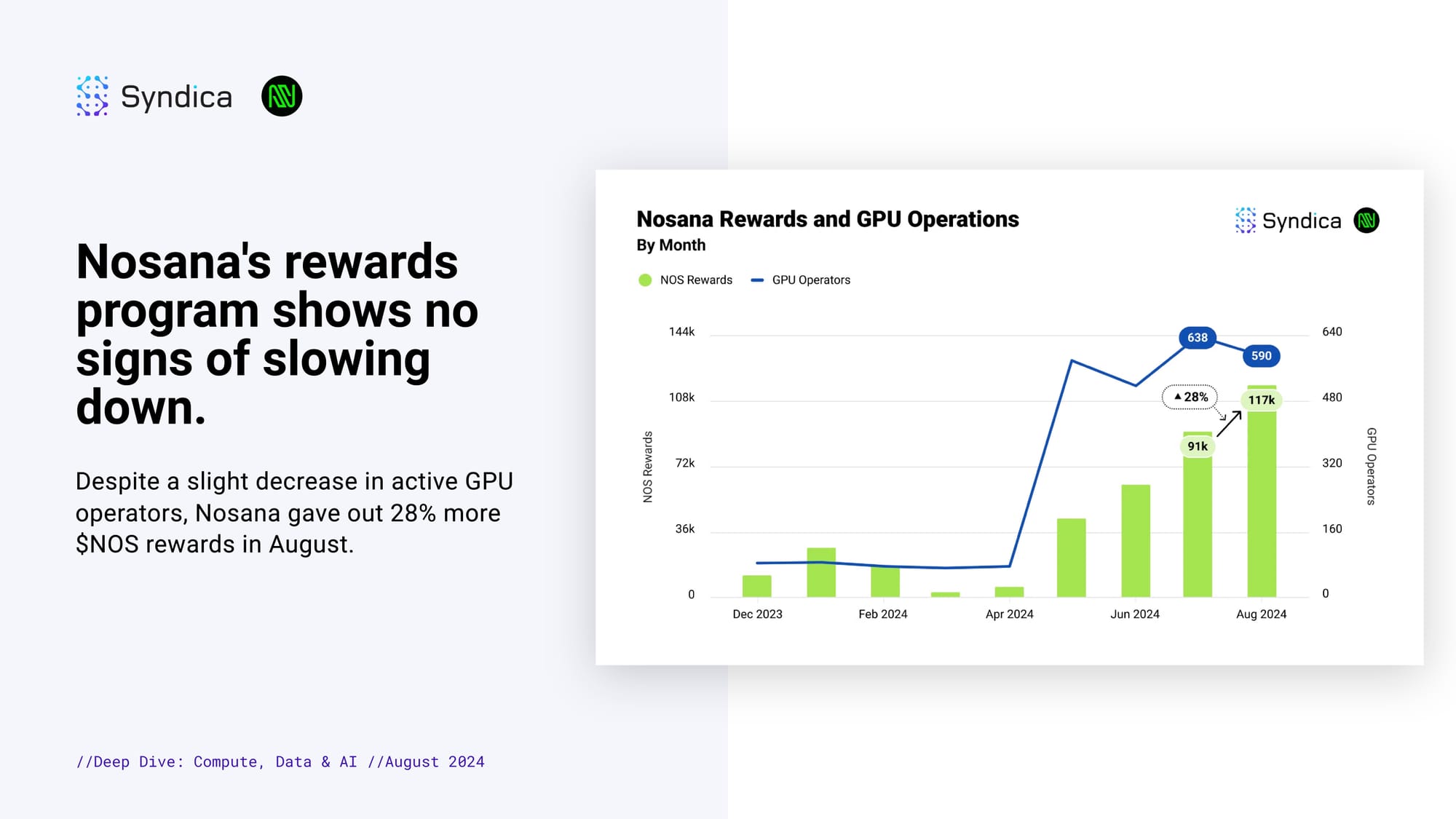

Nosana's rewards program shows no signs of slowing down. Despite a slight decrease in active GPU operators, Nosana gave out 28% more $NOS rewards in August.

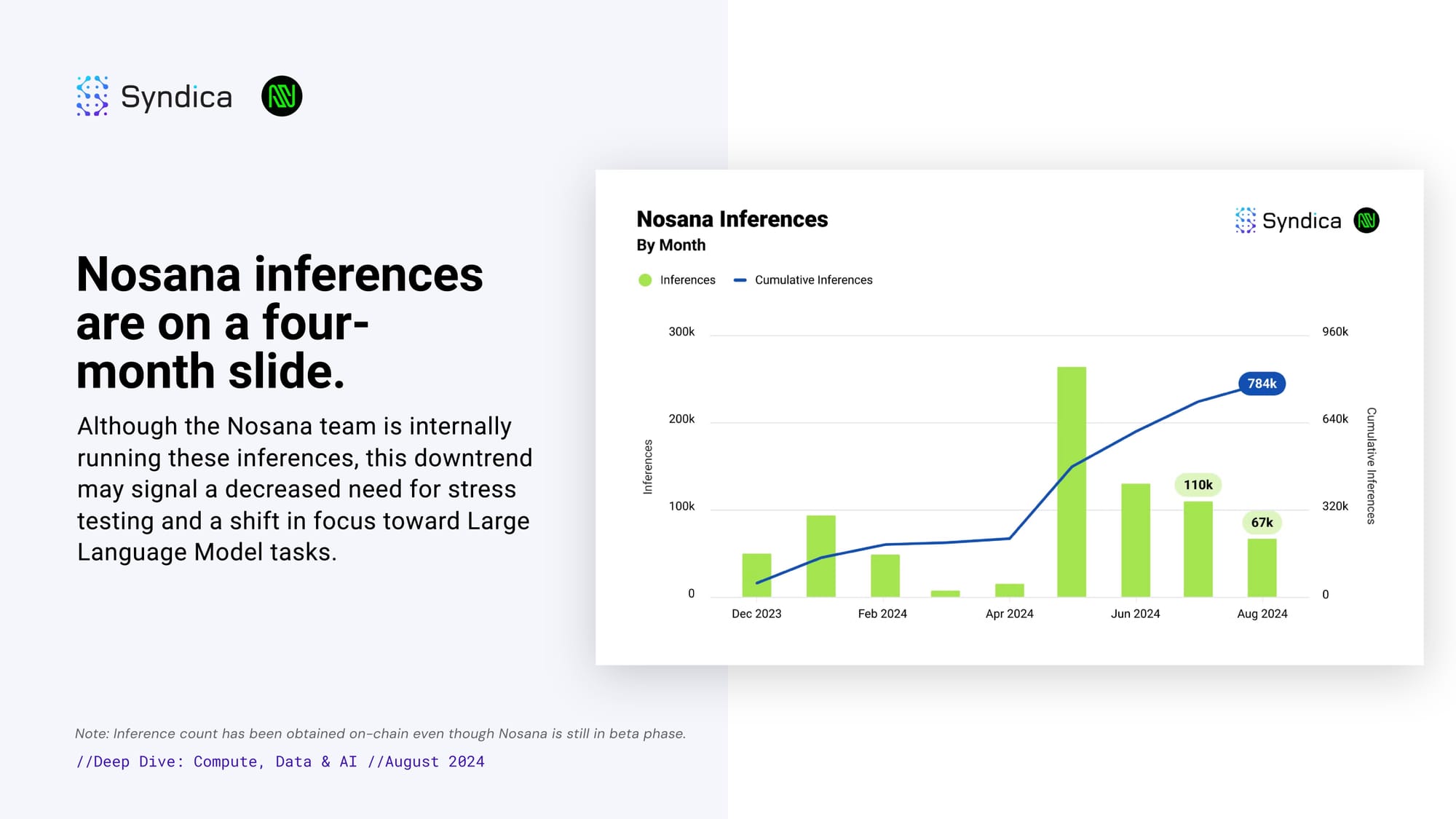

Nosana inferences are on a four-month slide. Although the Nosana team is internally running these inferences, this downtrend may signal a decreased need for stress testing and a shift in focus toward Large Language Model tasks.

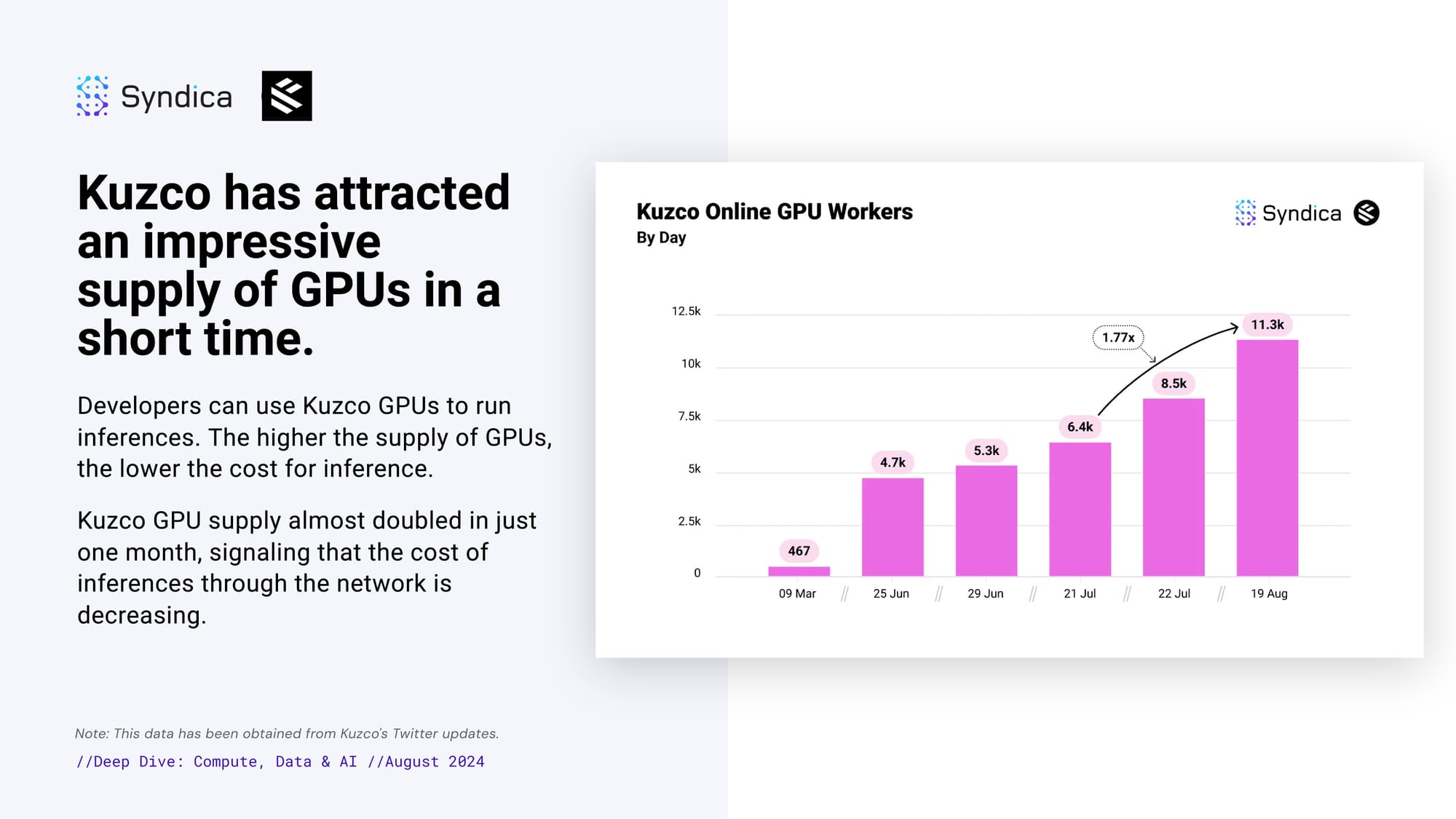

Kuzco has attracted an impressive supply of GPUs in a short time. Developers can use Kuzco GPUs to run inferences. The higher the supply of GPUs, the lower the cost for inference. Kuzco GPU supply almost doubled in just one month, signaling that the cost of inferences through the network is decreasing.

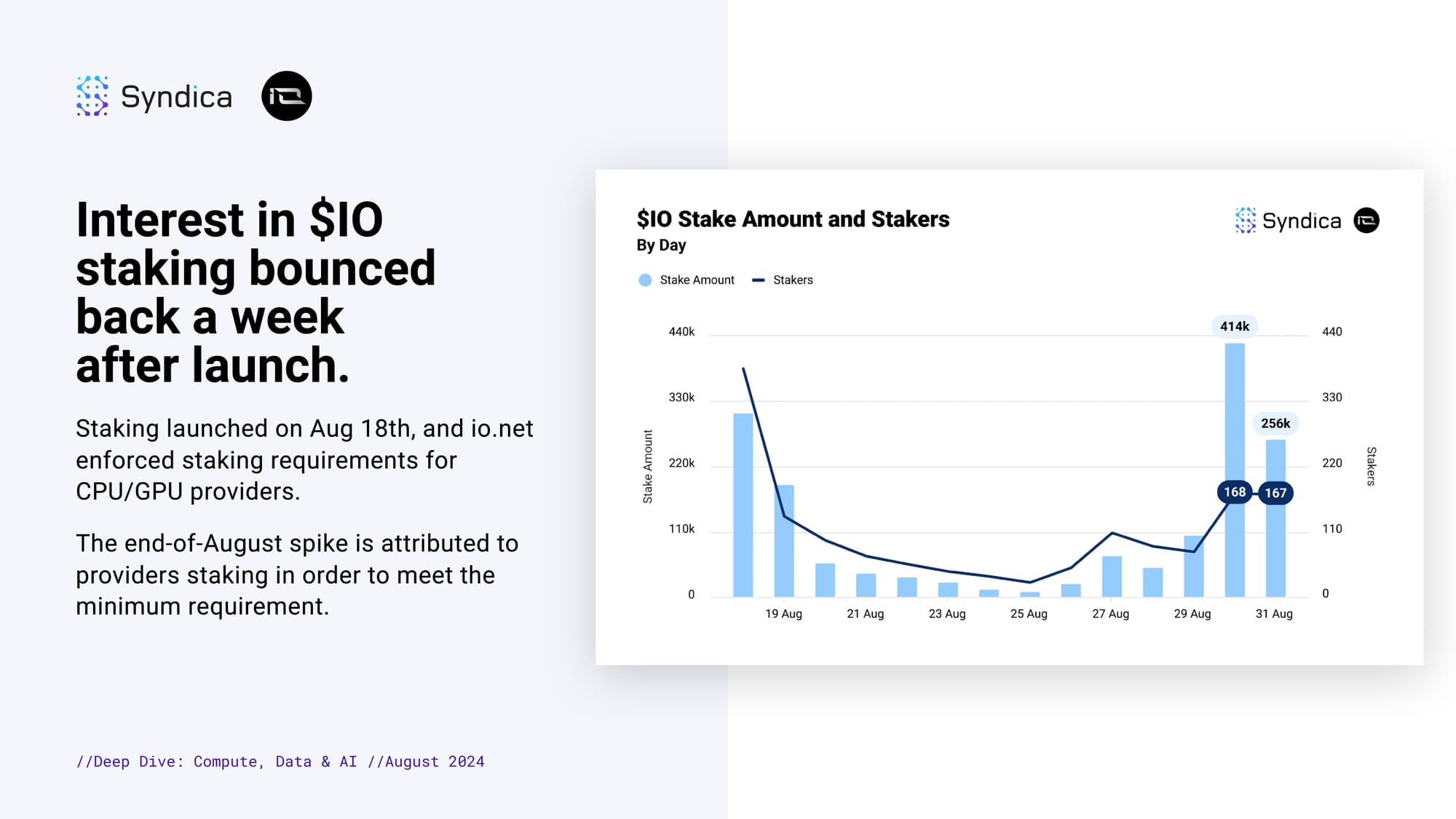

Interest in $IO staking bounced back a week after launch. Staking launched on Aug 18th, and io.net enforced staking requirements for CPU/GPU providers. The end-of-August spike is attributed to providers staking in order to meet the minimum requirement.

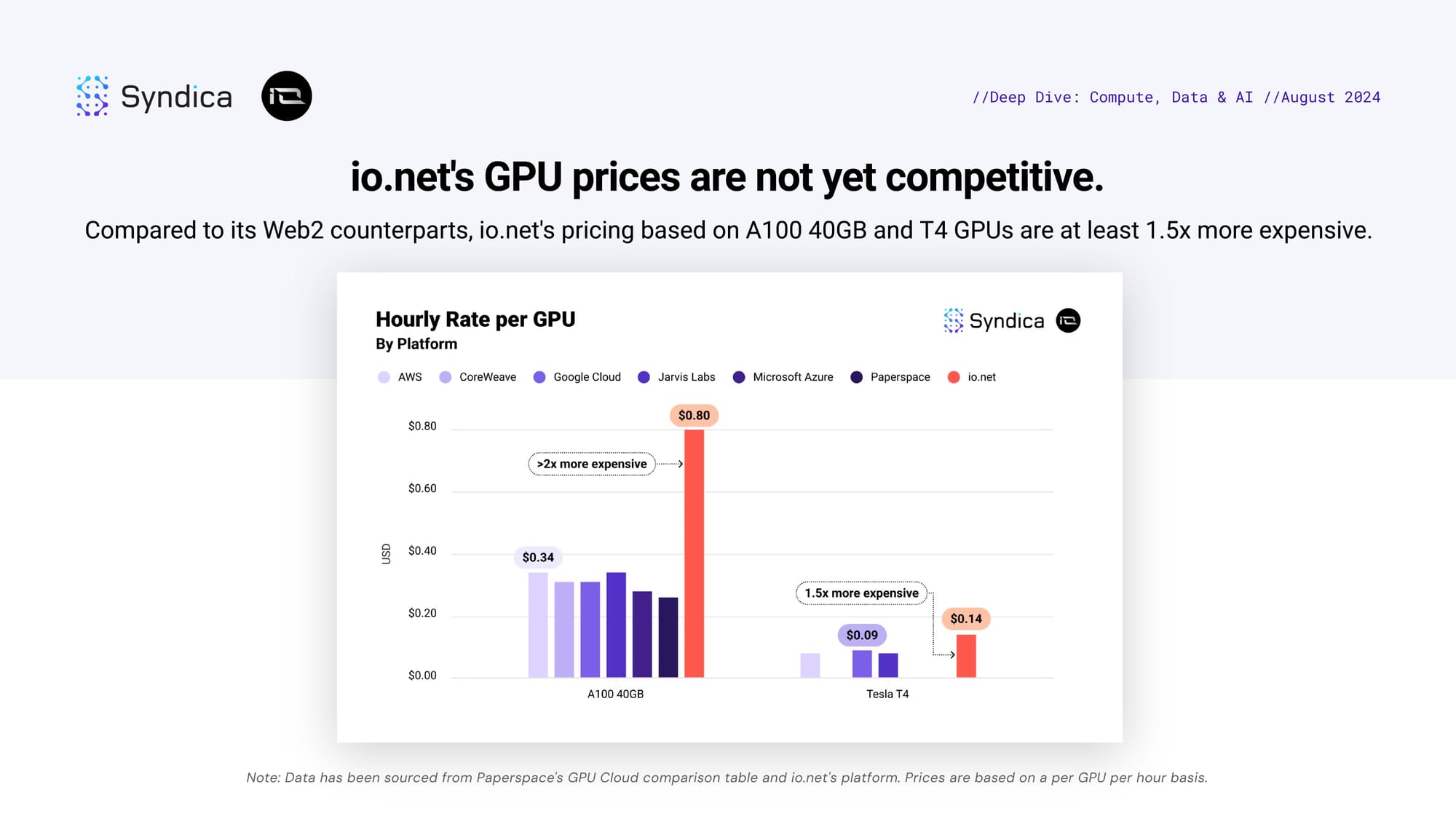

io.net's GPU prices are not yet competitive. Compared to its Web2 counterparts, io.net's pricing based on A100 40GB and T4 GPUs are at least 1.5x more expensive.

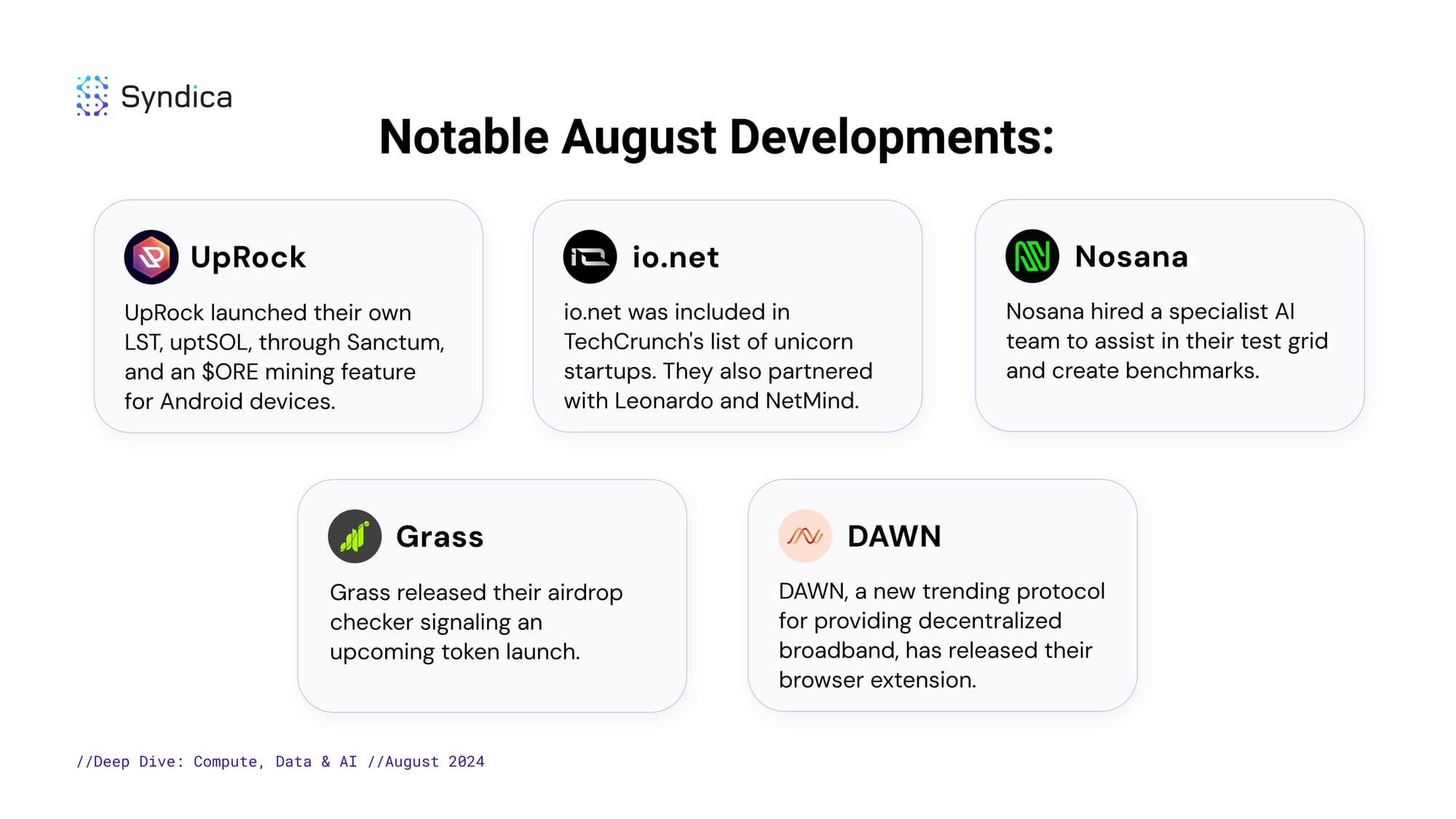

Notable August Developments:

UpRock launched their own LST, uptSOL, through Sanctum, and an $ORE mining feature for Android devices.

io.net was included in TechCrunch's list of unicorn startups. They also partnered with Leonardo and NetMind.

Nosana hired a specialist AI team to assist in their test grid and create benchmarks.

Grass released their airdrop checker, signaling an upcoming token launch.

DAWN, a new trending protocol for providing decentralized broadband, has released its browser extension.

Part II: Wireless

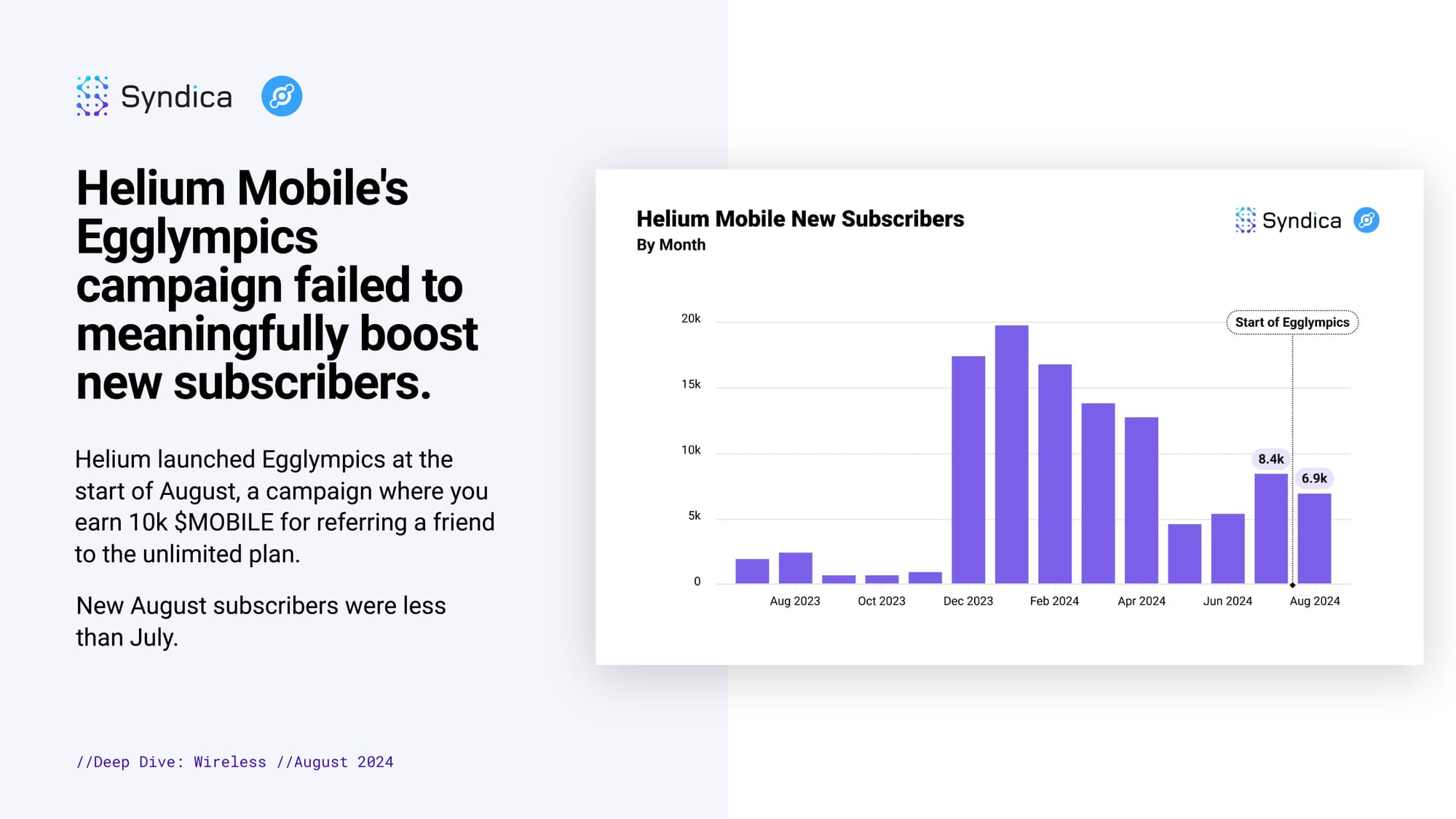

Helium Mobile's Egglympics campaign failed to meaningfully boost new subscribers. Helium launched Egglympics at the start of August, a campaign where you earn 10k $MOBILE for referring a friend to the unlimited plan. New August subscribers were less than July.

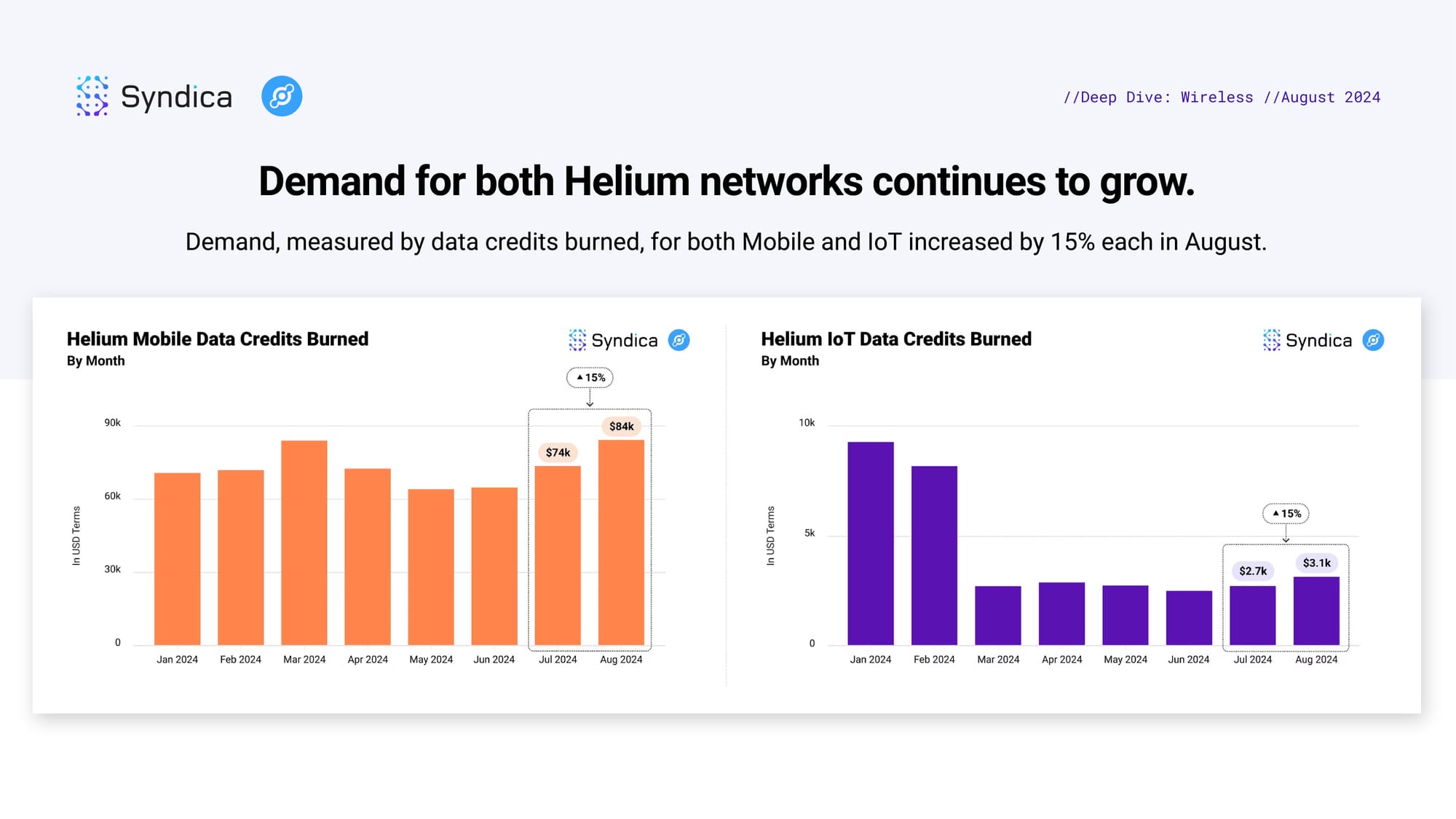

Demand for both Helium networks continues to grow. Demand, measured by data credits burned, for both Mobile and IoT increased by 15% each in August.

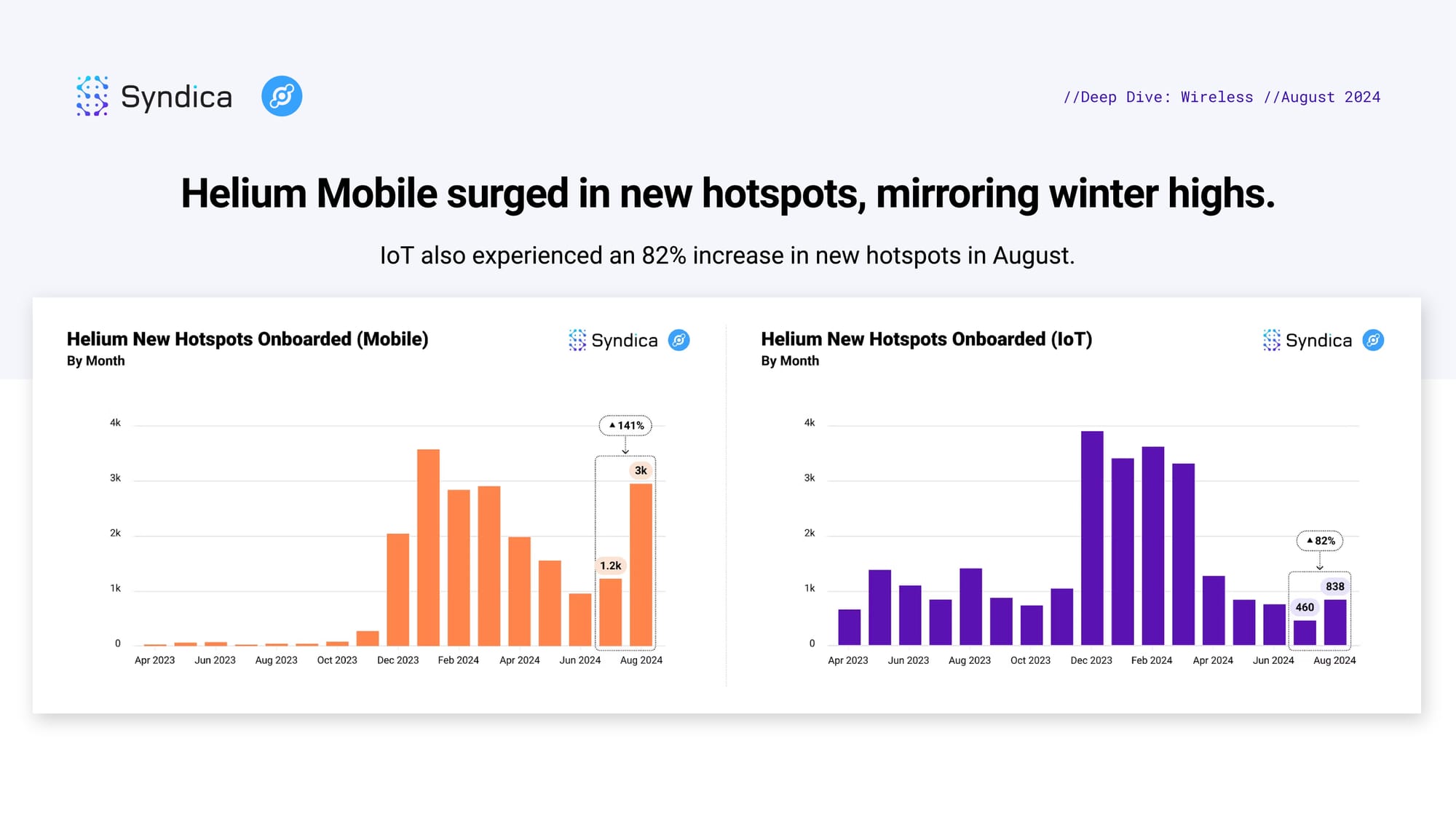

Helium Mobile surged in new hotspots, mirroring winter highs. IoT also experienced an 82% increase in new hotspots in August.

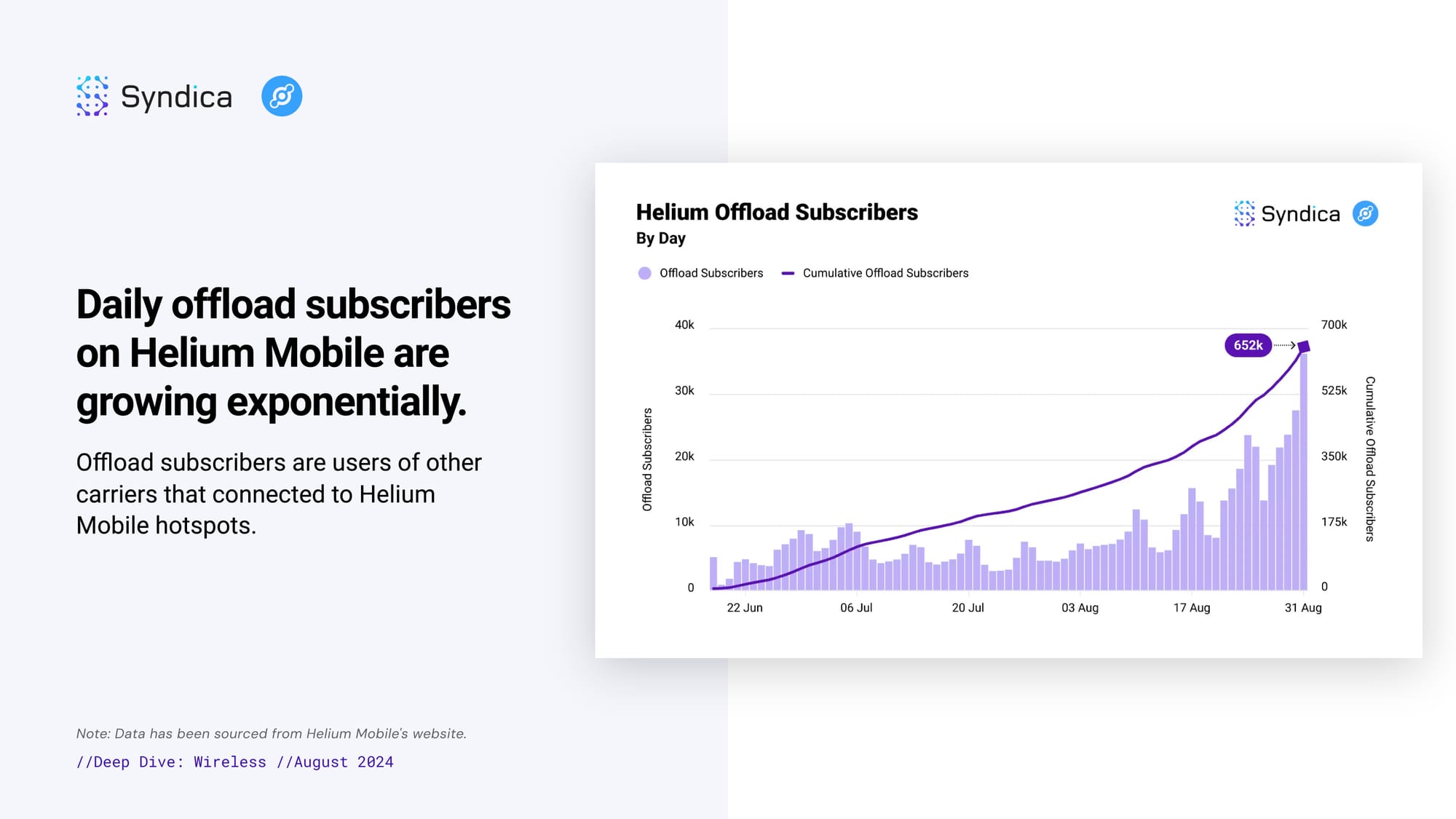

Daily offload subscribers on Helium Mobile are growing exponentially. Offload subscribers are users of other carriers that connected to Helium Mobile hotspots.

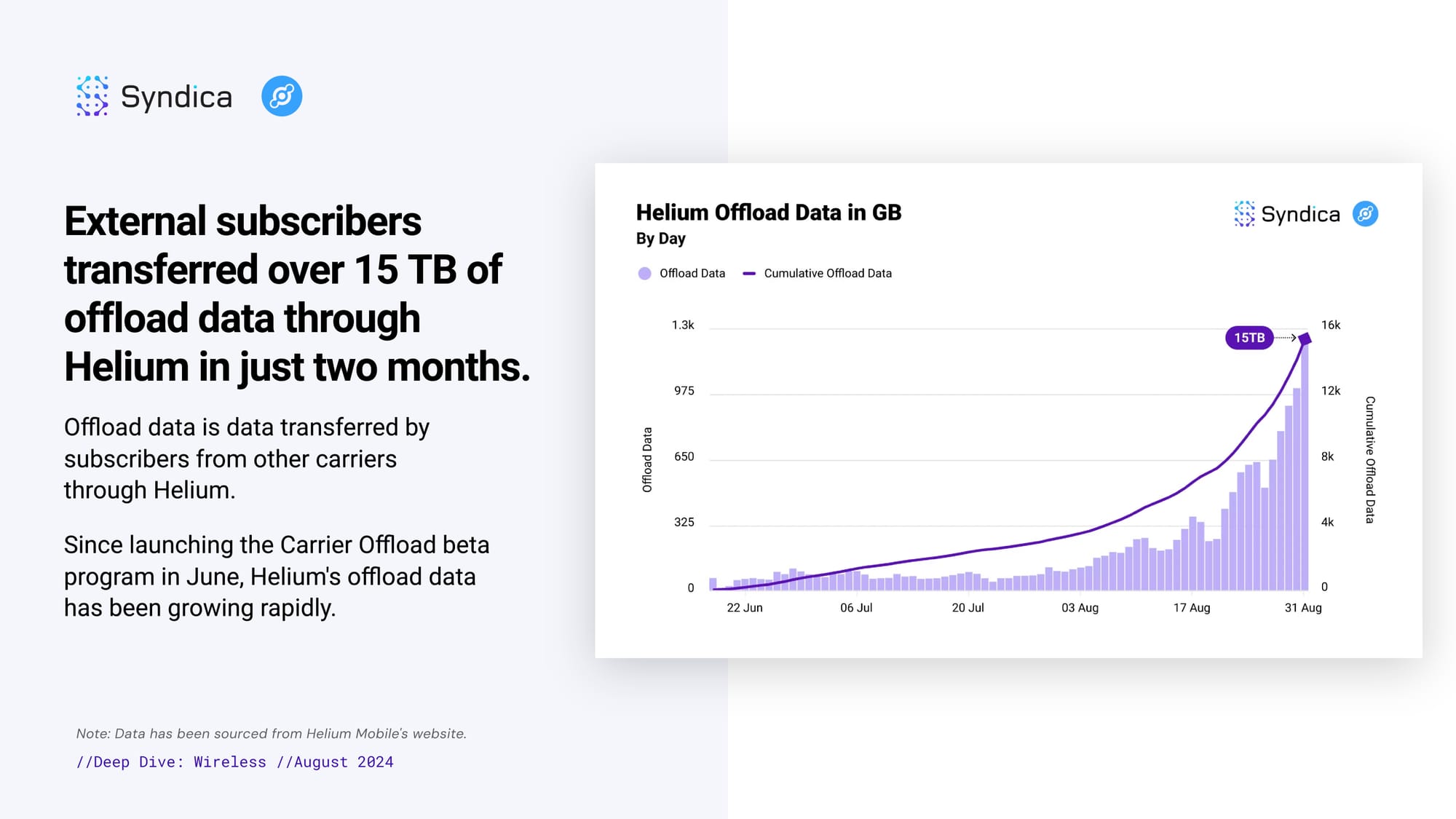

External subscribers transferred over 15 TB of offload data through Helium in just two months. Offload data is data transferred by subscribers from other carriers through Helium. Since launching the Carrier Offload beta program in June, Helium's offload data has grown rapidly.

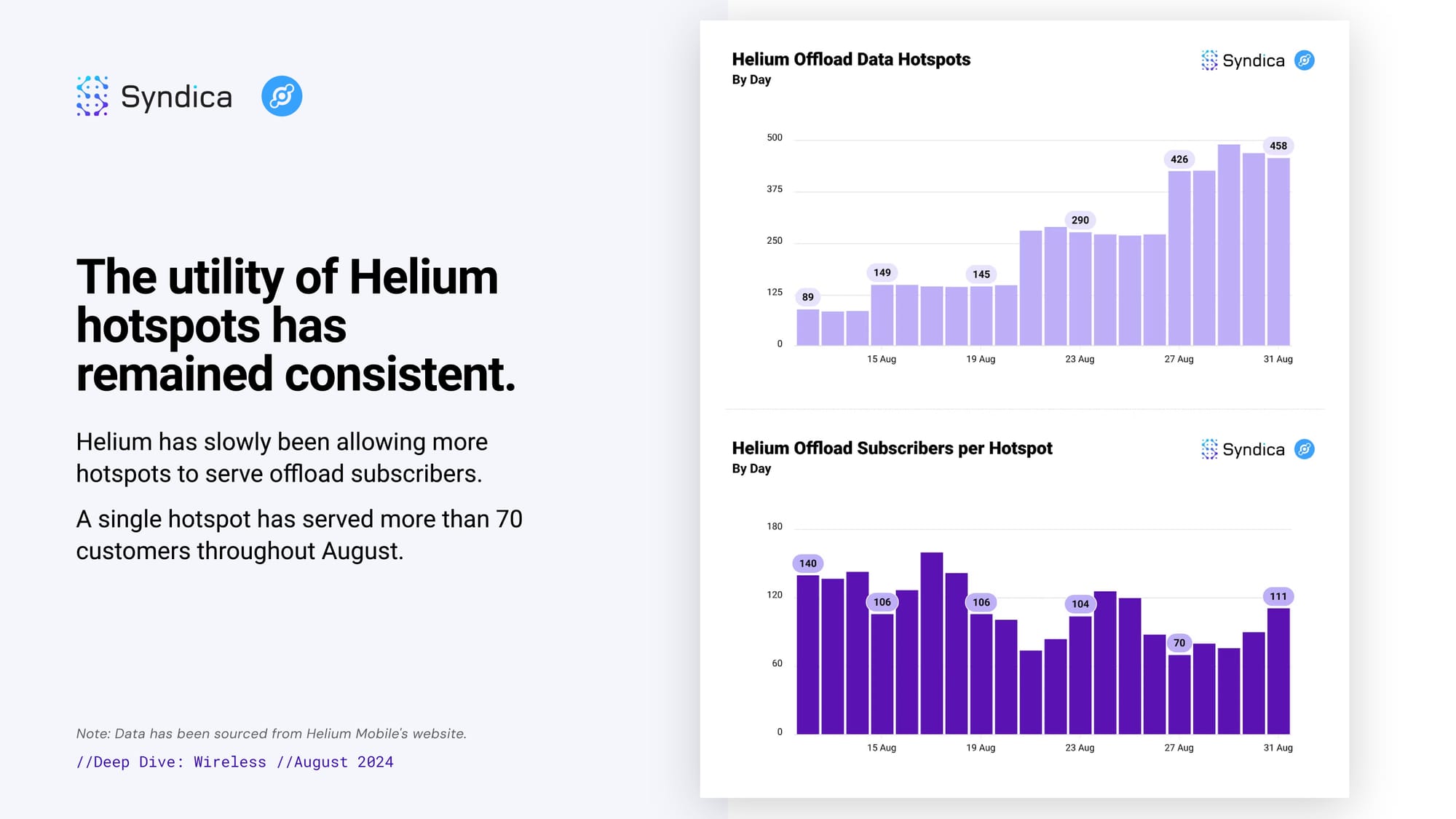

The utility of Helium hotspots has remained consistent. Helium has slowly been allowing more hotspots to serve offload subscribers. A single hotspot has served more than 70 customers throughout August.

Part III: Mapping

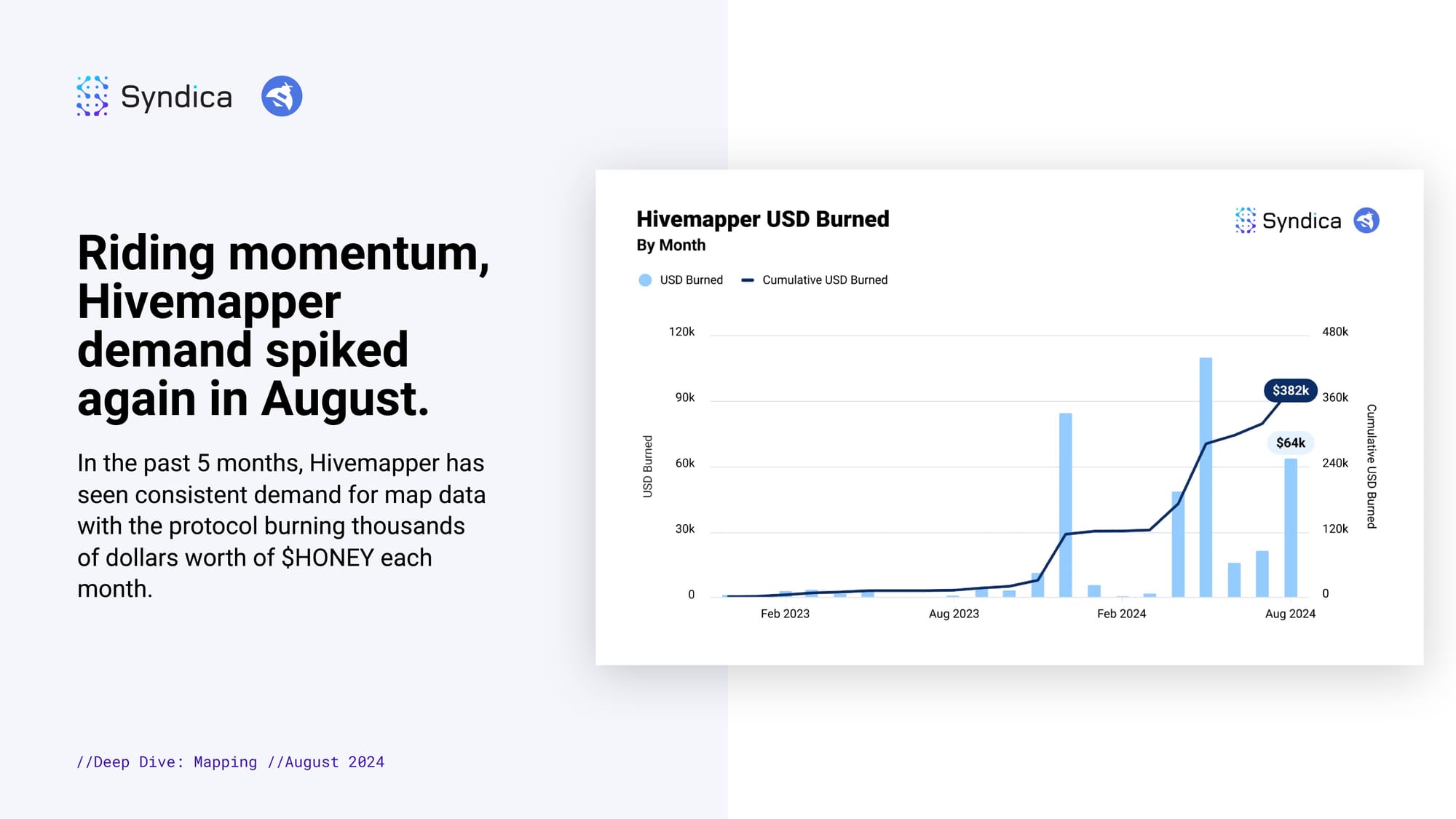

Riding momentum, Hivemapper demand spiked again in August. In the past 5 months, Hivemapper has seen consistent demand for map data with the protocol burning thousands of dollars worth of $HONEY each month.

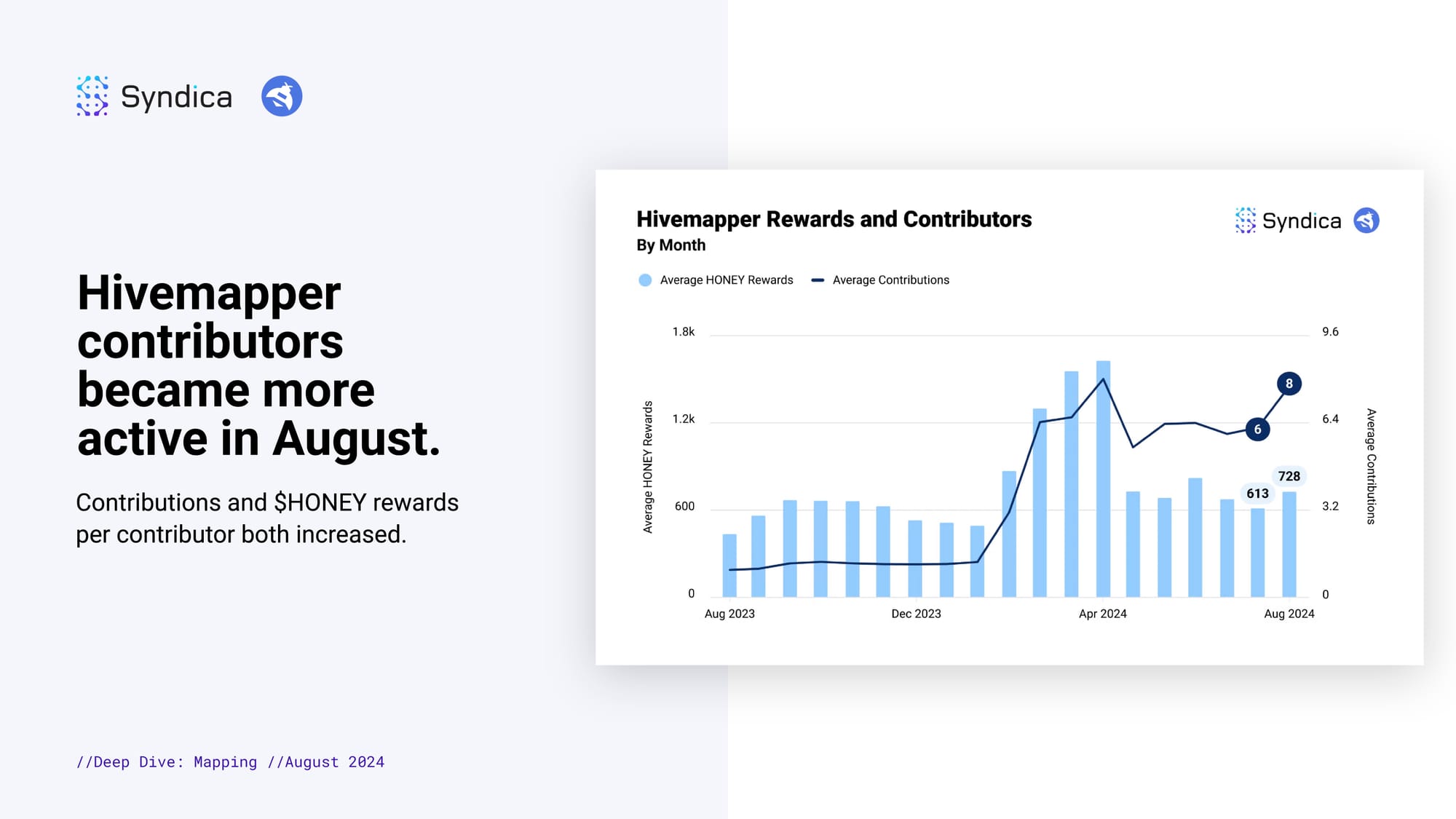

Hivemapper contributors became more active in August. Contributions and $HONEY rewards per contributor both increased.

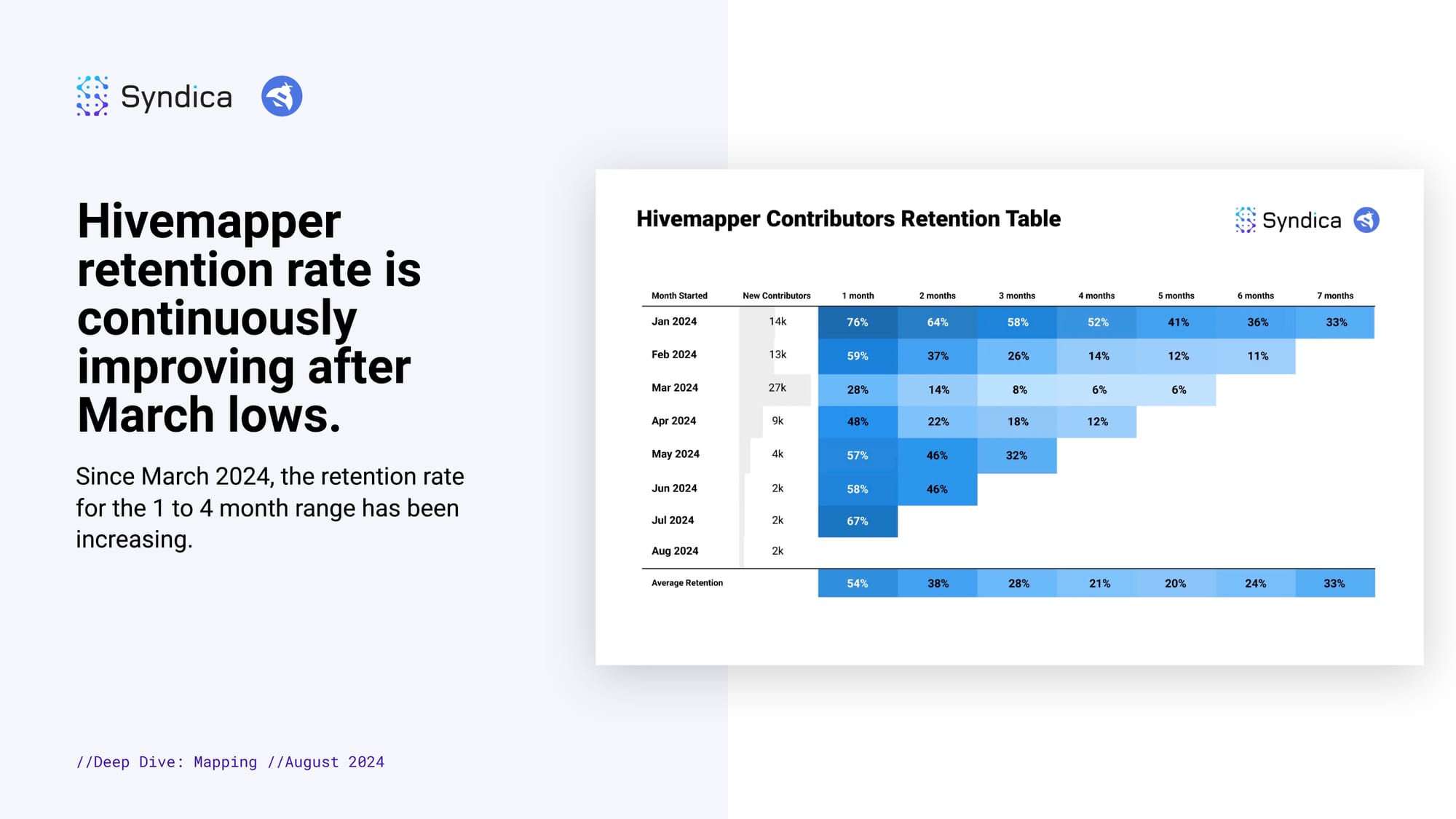

Hivemapper's retention rate has continuously improved since the March lows. Since March 2024, the retention rate for the 1 to 4-month range has been increasing.