Deep Dive: Solana DePIN - December 2025

Deep Dive: Solana DePIN - December 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DePIN - December 2025

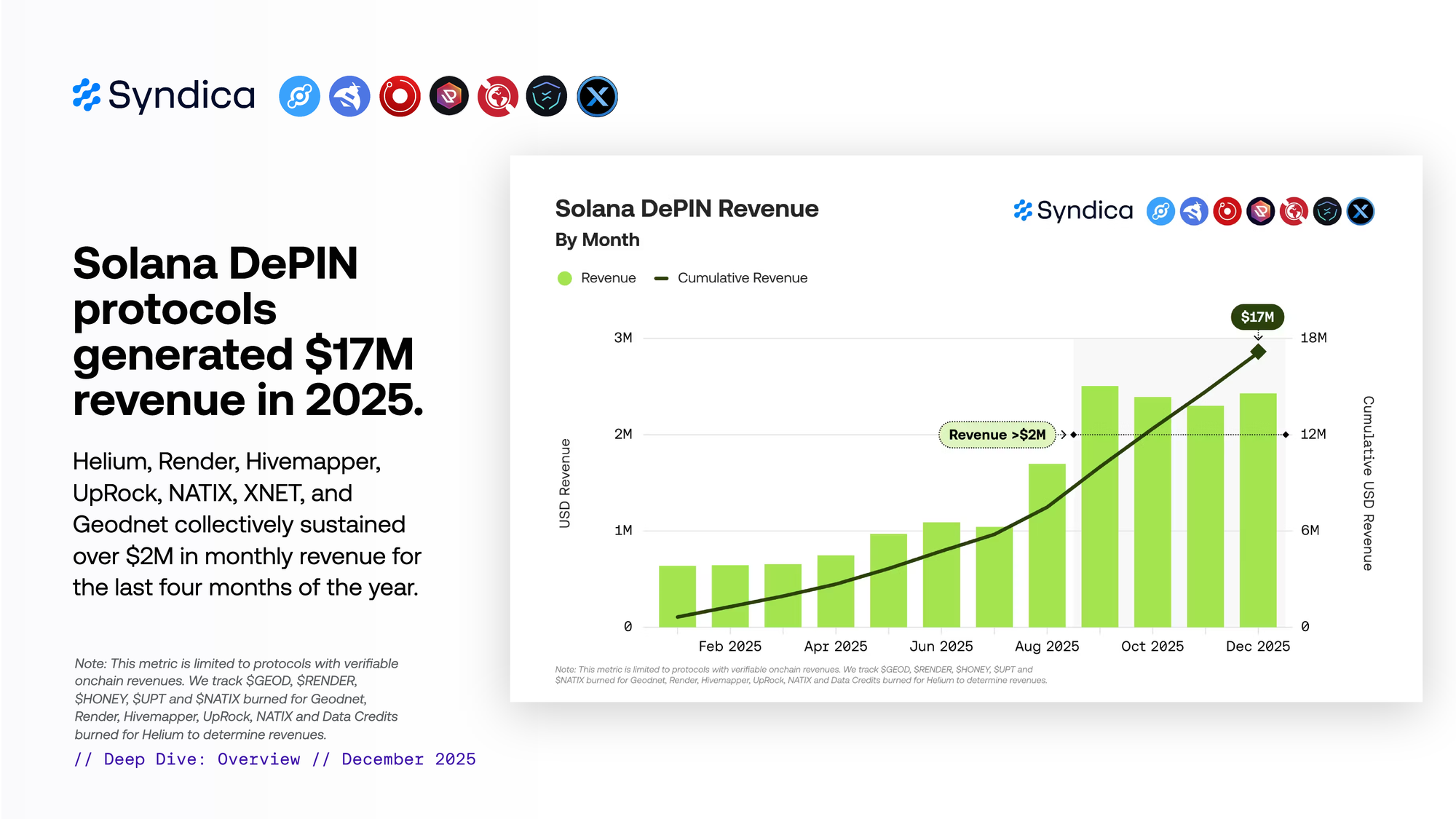

Solana DePIN protocols generated $17M revenue in 2025. Helium, Render, Hivemapper, UpRock, NATIX, XNET, and Geodnet collectively sustained over $2M in monthly revenue for the last four months of the year.

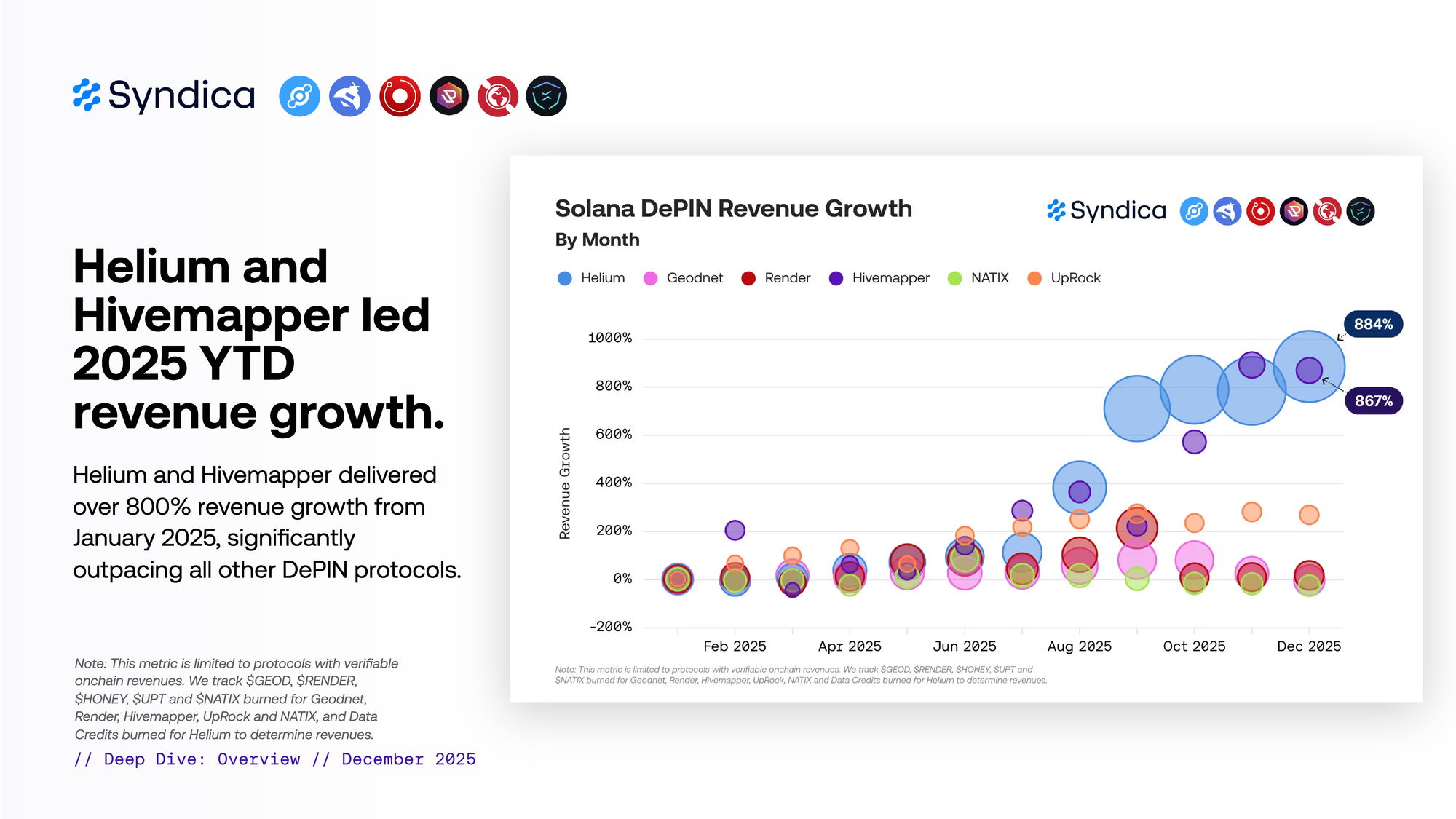

Helium and Hivemapper led 2025 YTD revenue growth. Helium and Hivemapper delivered over 800% revenue growth from January 2025, significantly outpacing all other DePIN protocols.

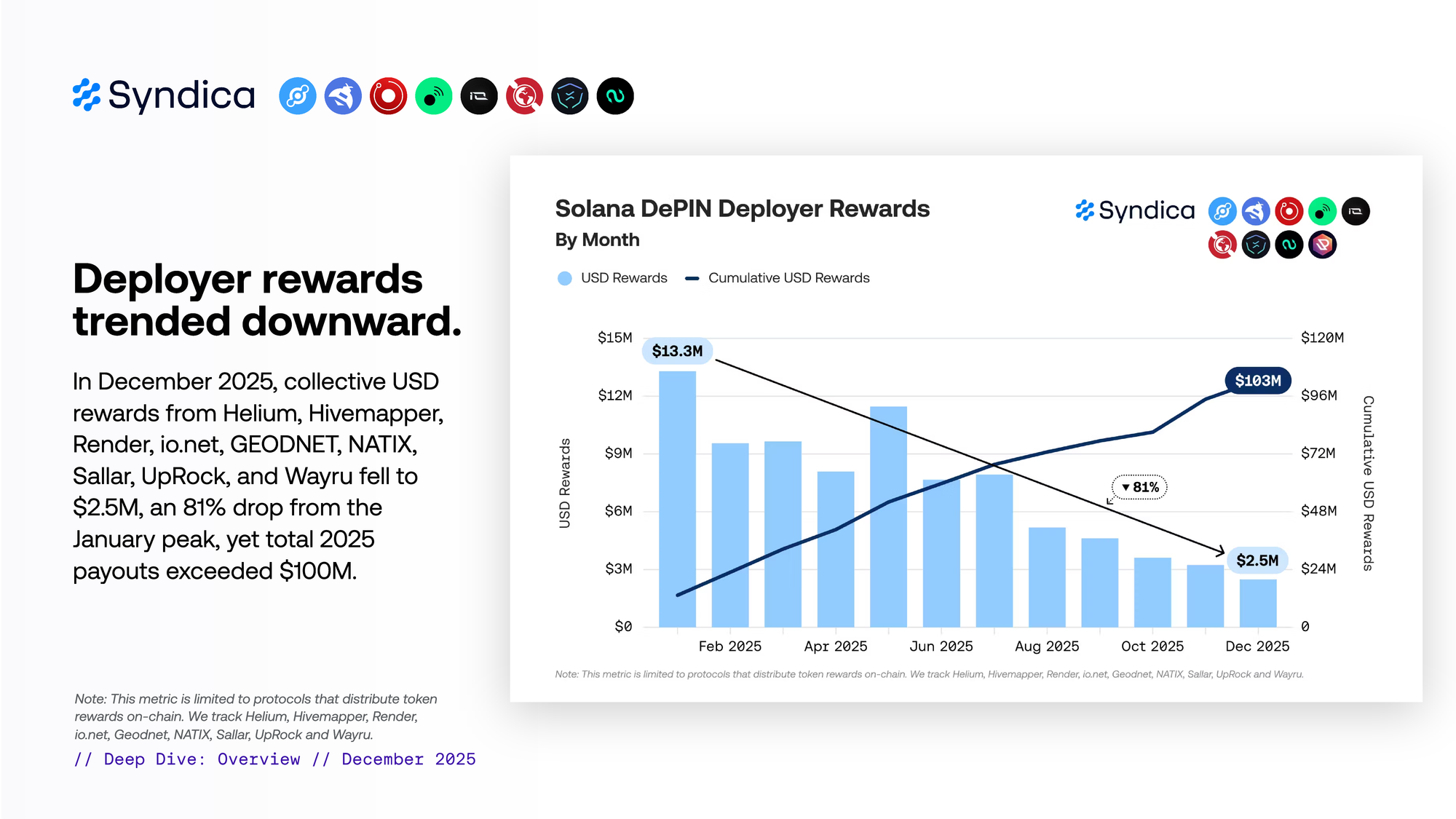

Deployer rewards trended downward. In December 2025, collective USD rewards from Helium, Hivemapper, Render, io.net, GEODNET, NATIX, Sallar, UpRock, and Wayru fell to $2.5M, an 81% drop from the January peak, yet total 2025 payouts exceeded $100M.

Part I - Wireless

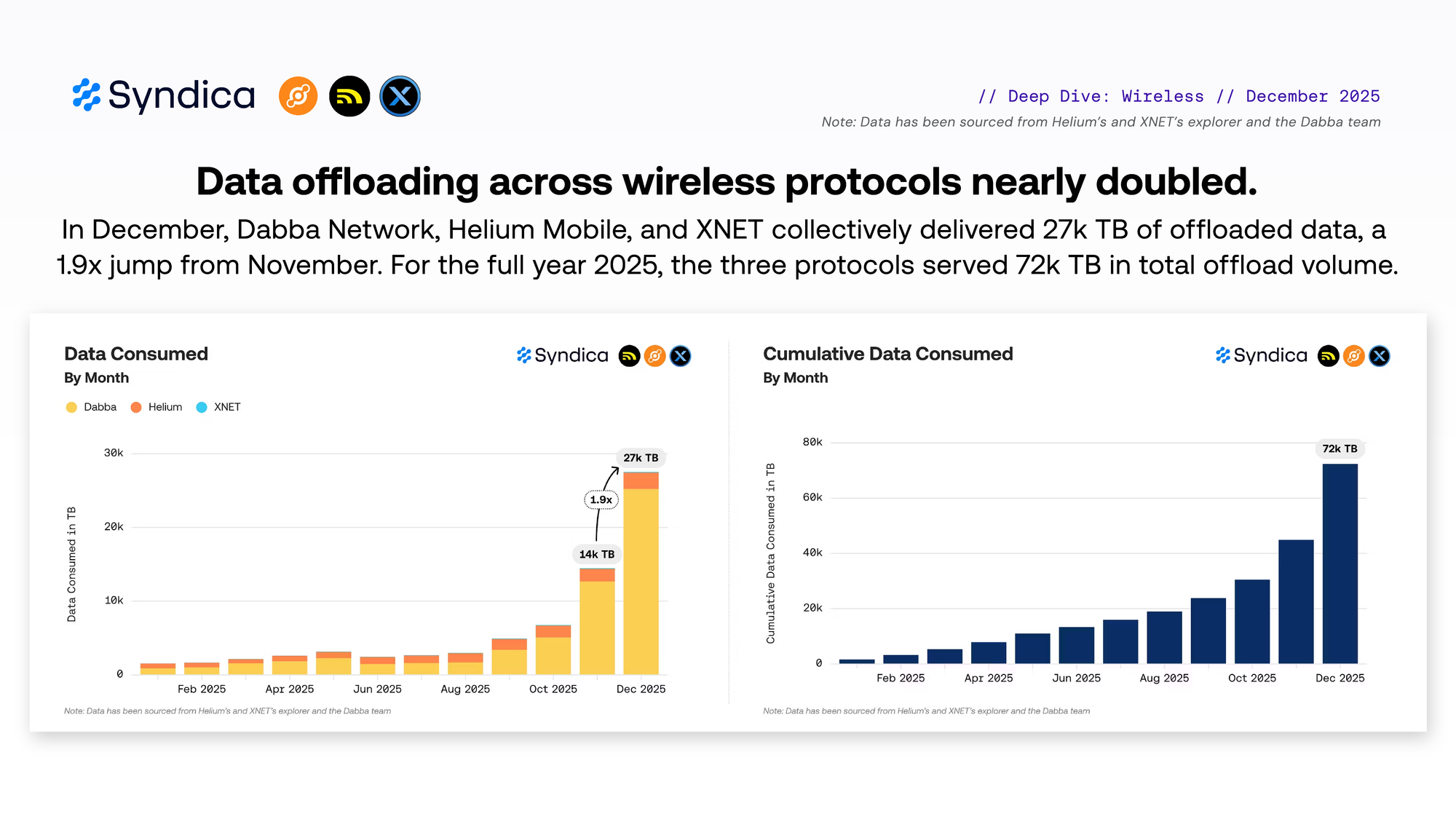

Data offloading across wireless protocols nearly doubled. In December, Dabba Network, Helium Mobile, and XNET collectively delivered 27k TB of offloaded data, a 1.9x jump from November. For the full year 2025, the three protocols served 72k TB in total offload volume.

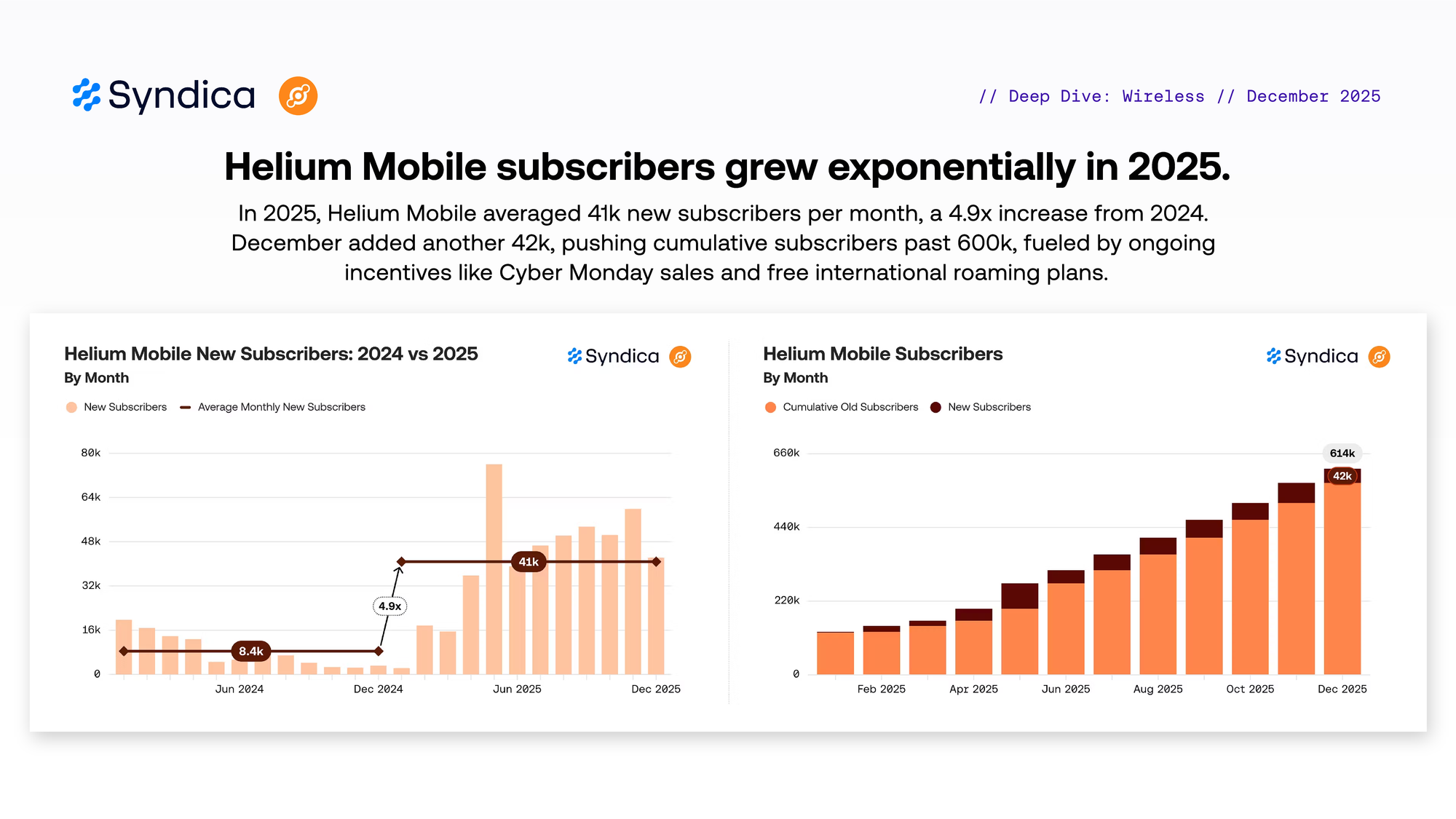

Helium Mobile subscribers grew exponentially in 2025. In 2025, Helium Mobile averaged 41k new subscribers per month, a 4.9x increase from 2024. December added another 42k, pushing cumulative subscribers past 600k, fueled by ongoing incentives like Cyber Monday sales and free international roaming plans.

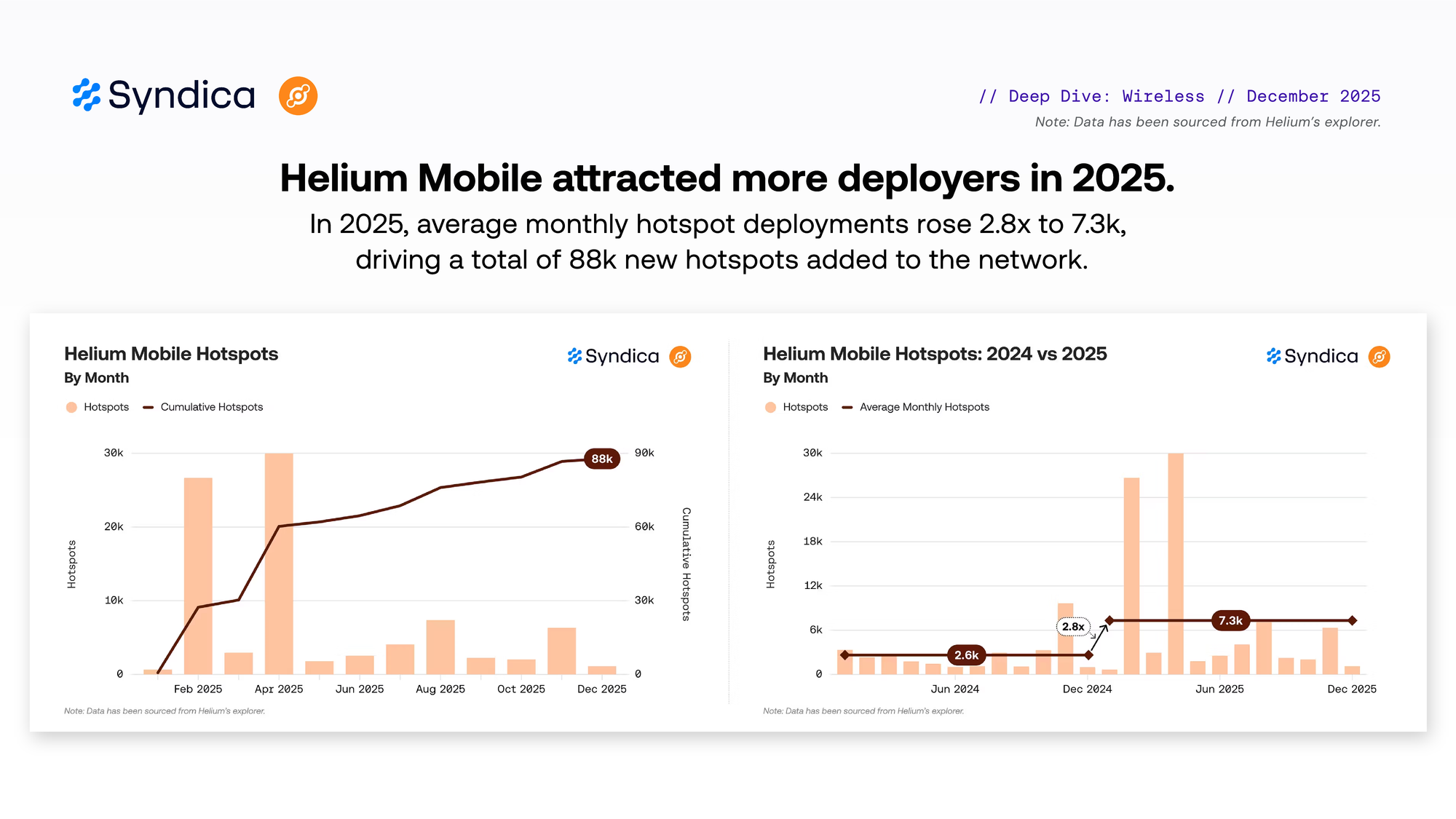

Helium Mobile attracted more deployers in 2025. In 2025, average monthly hotspot deployments rose 2.8x to 7.3k, driving a total of 88k new hotspots added to the network.

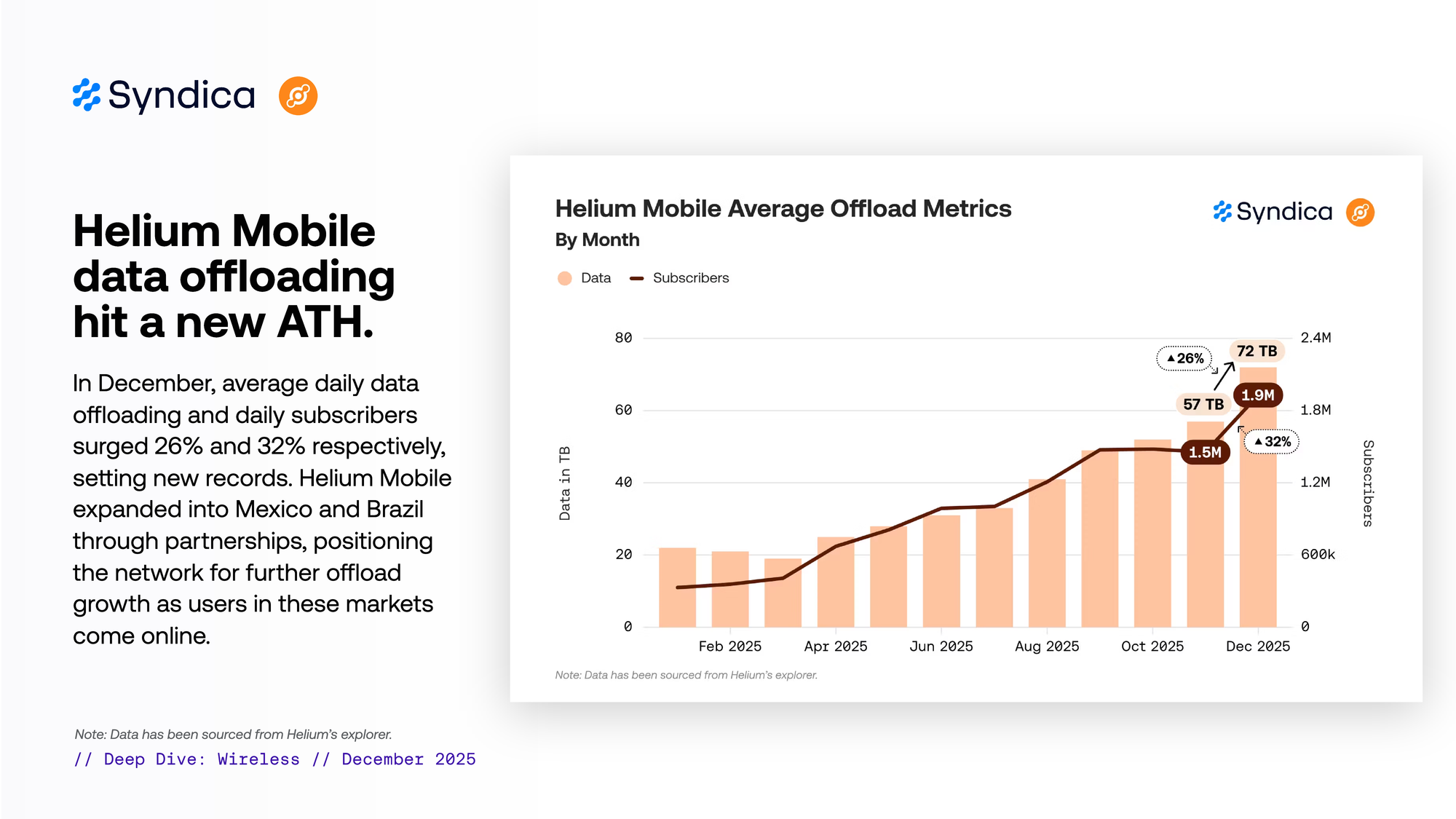

Helium Mobile data offloading hit a new ATH. In December, average daily data offloading and daily subscribers surged 26% and 32% respectively, setting new records. Helium Mobile expanded into Mexico and Brazil through partnerships, positioning the network for further offload growth as users in these markets come online.

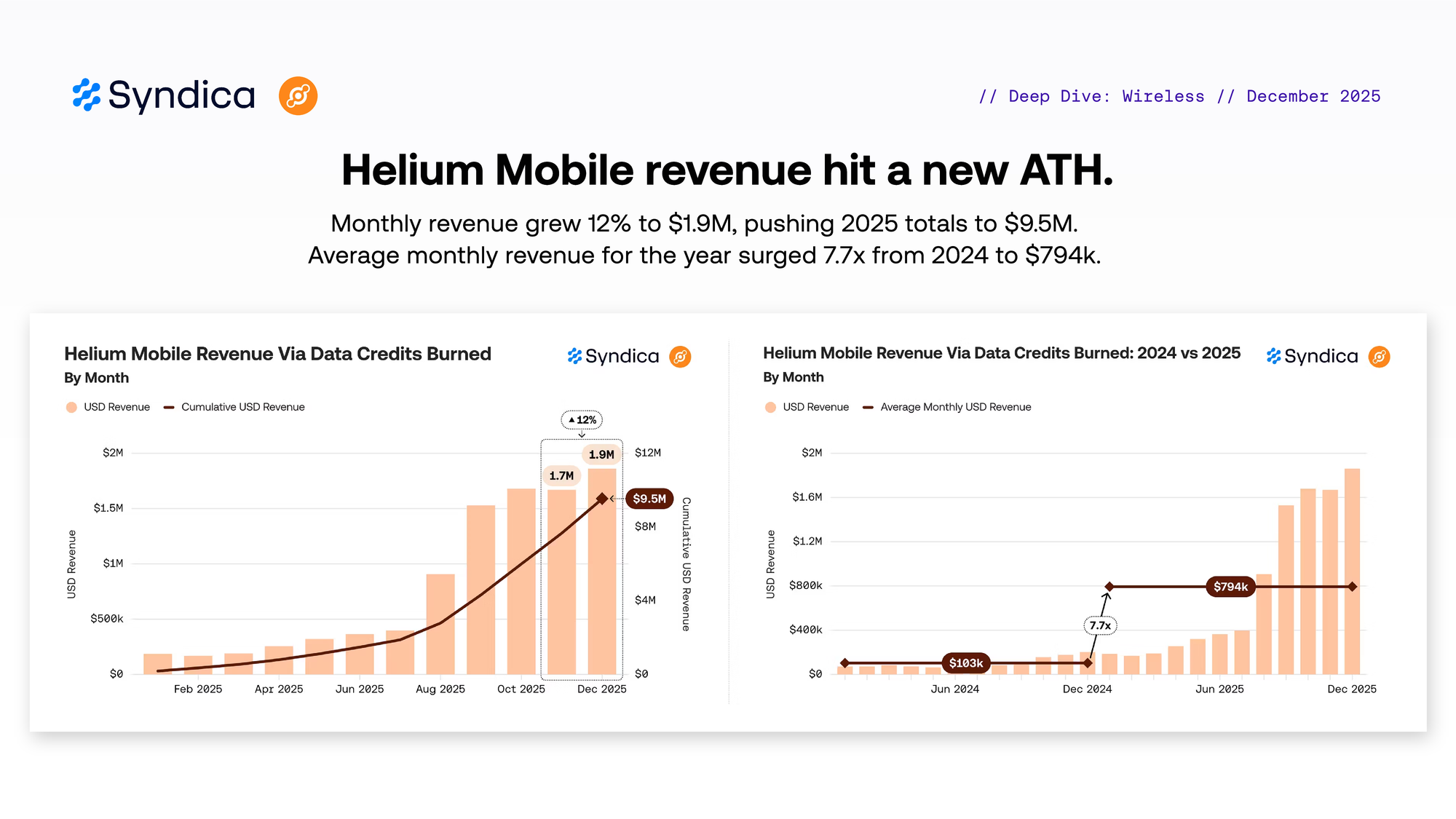

Helium Mobile revenue hit a new ATH. Monthly revenue grew 12% to $1.9M, pushing 2025 totals to $9.5M. Average monthly revenue for the year surged 7.7x from 2024 to $794k.

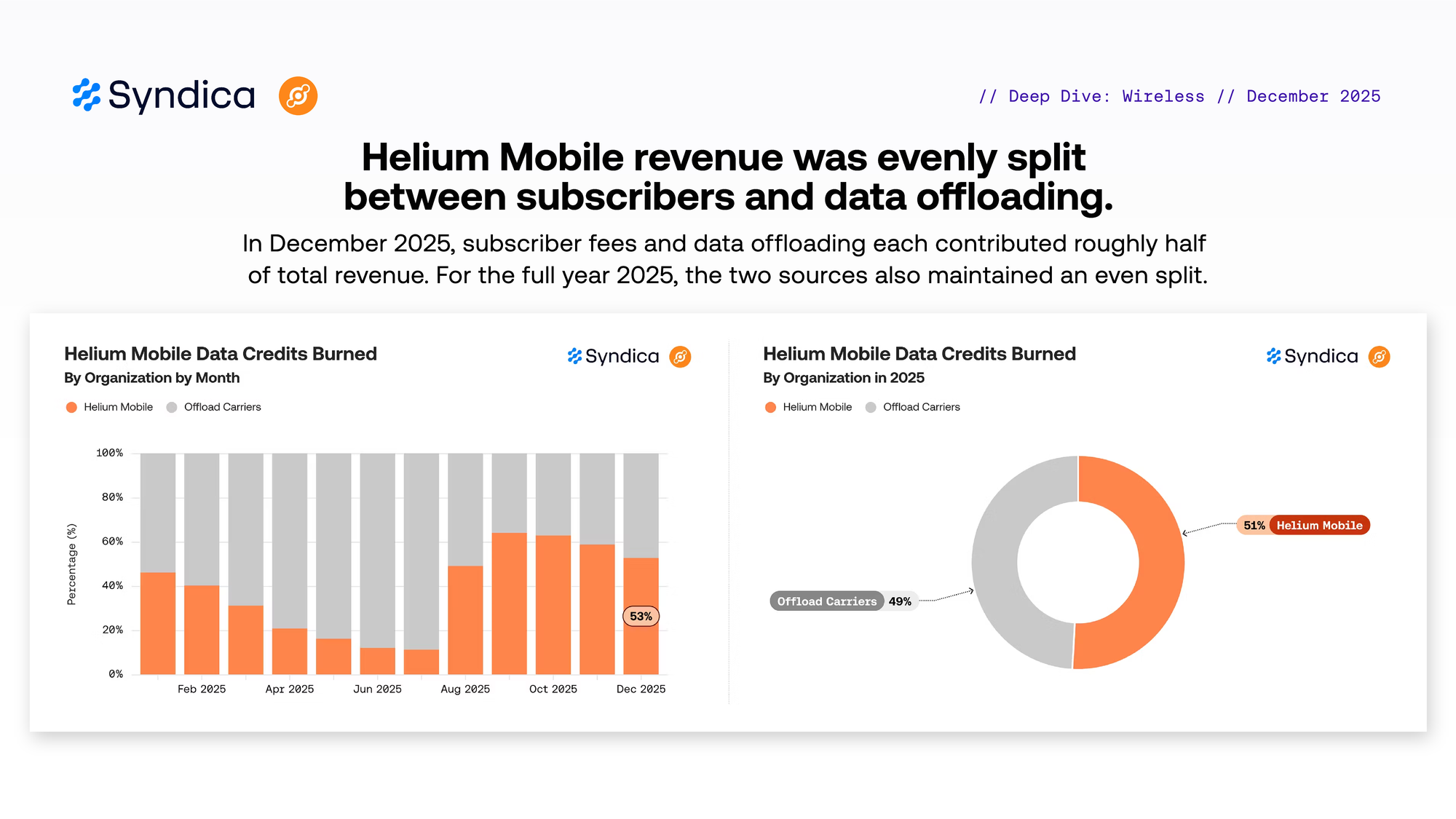

Helium Mobile revenue was evenly split between subscribers and data offloading. In December 2025, subscriber fees and data offloading each contributed roughly half of total revenue. For the full year 2025, the two sources also maintained an even split.

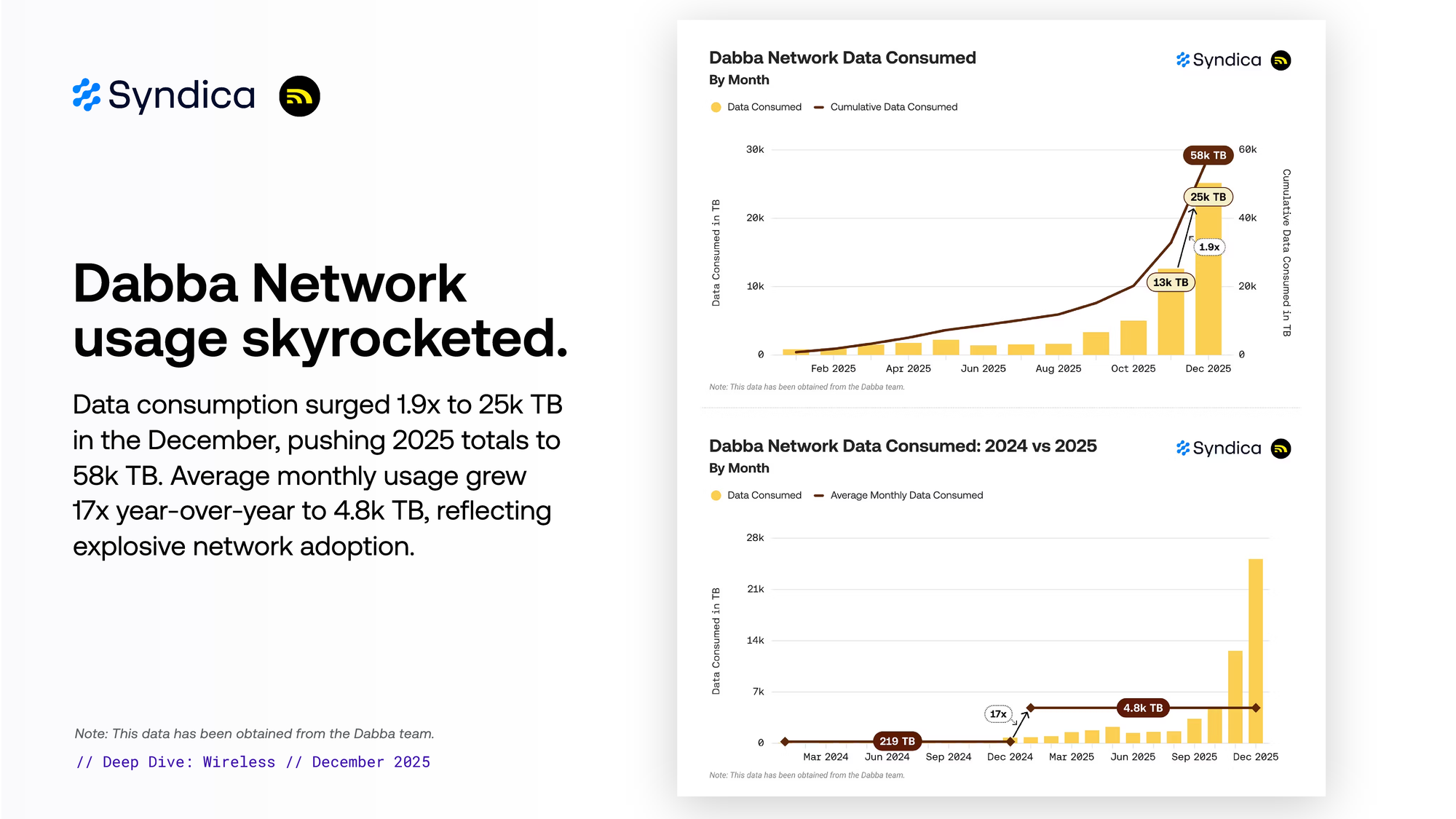

Dabba Network usage skyrocketed. Data consumption surged 1.9x to 25k TB in the December, pushing 2025 totals to 58k TB. Average monthly usage grew 17x year-over-year to 4.8k TB, reflecting explosive network adoption.

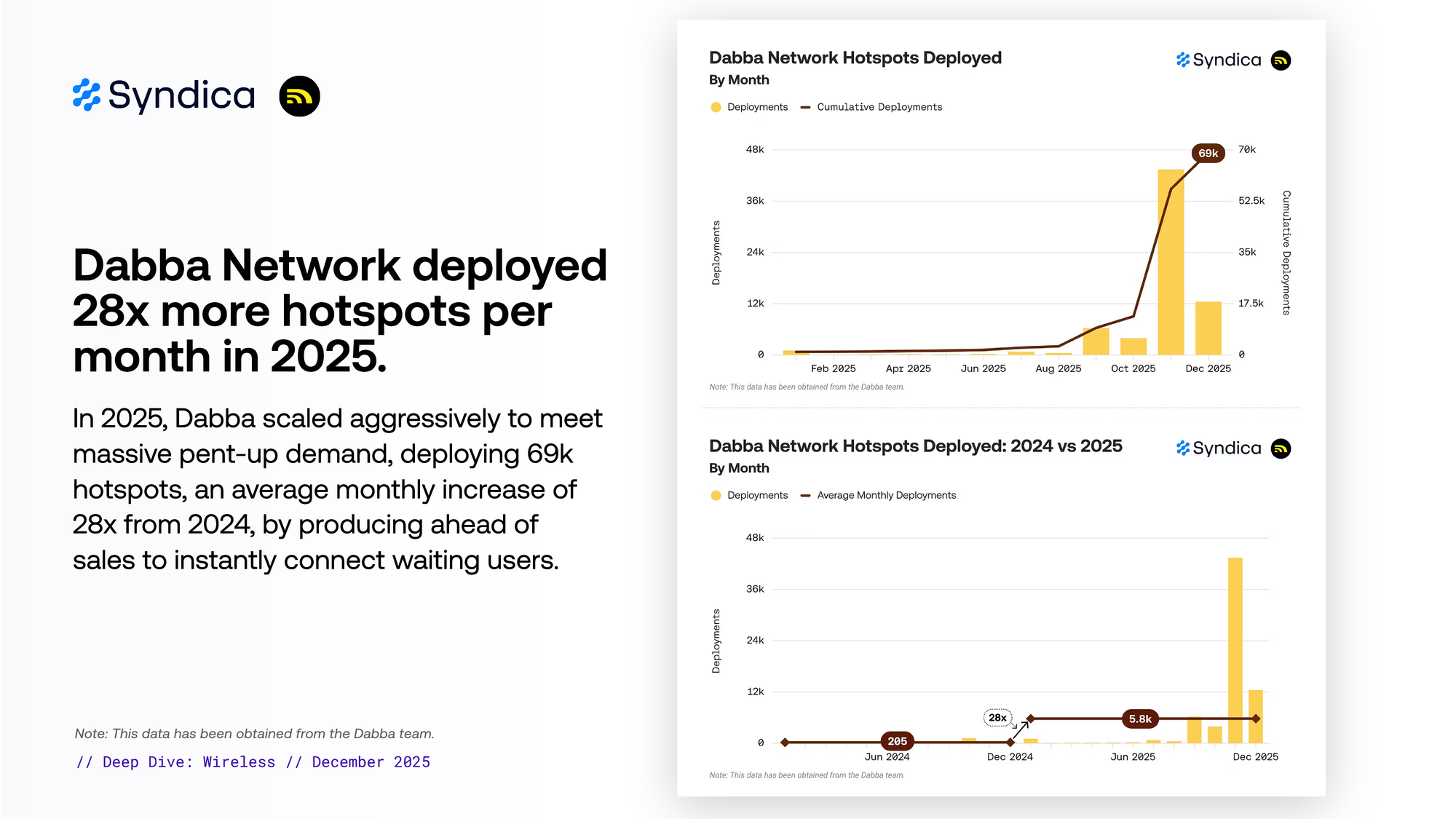

Dabba Network deployed 28x more hotspots per month in 2025. In 2025, Dabba scaled aggressively to meet massive pent-up demand, deploying 69k hotspots, an average monthly increase of 28x from 2024, by producing ahead of sales to instantly connect waiting users.

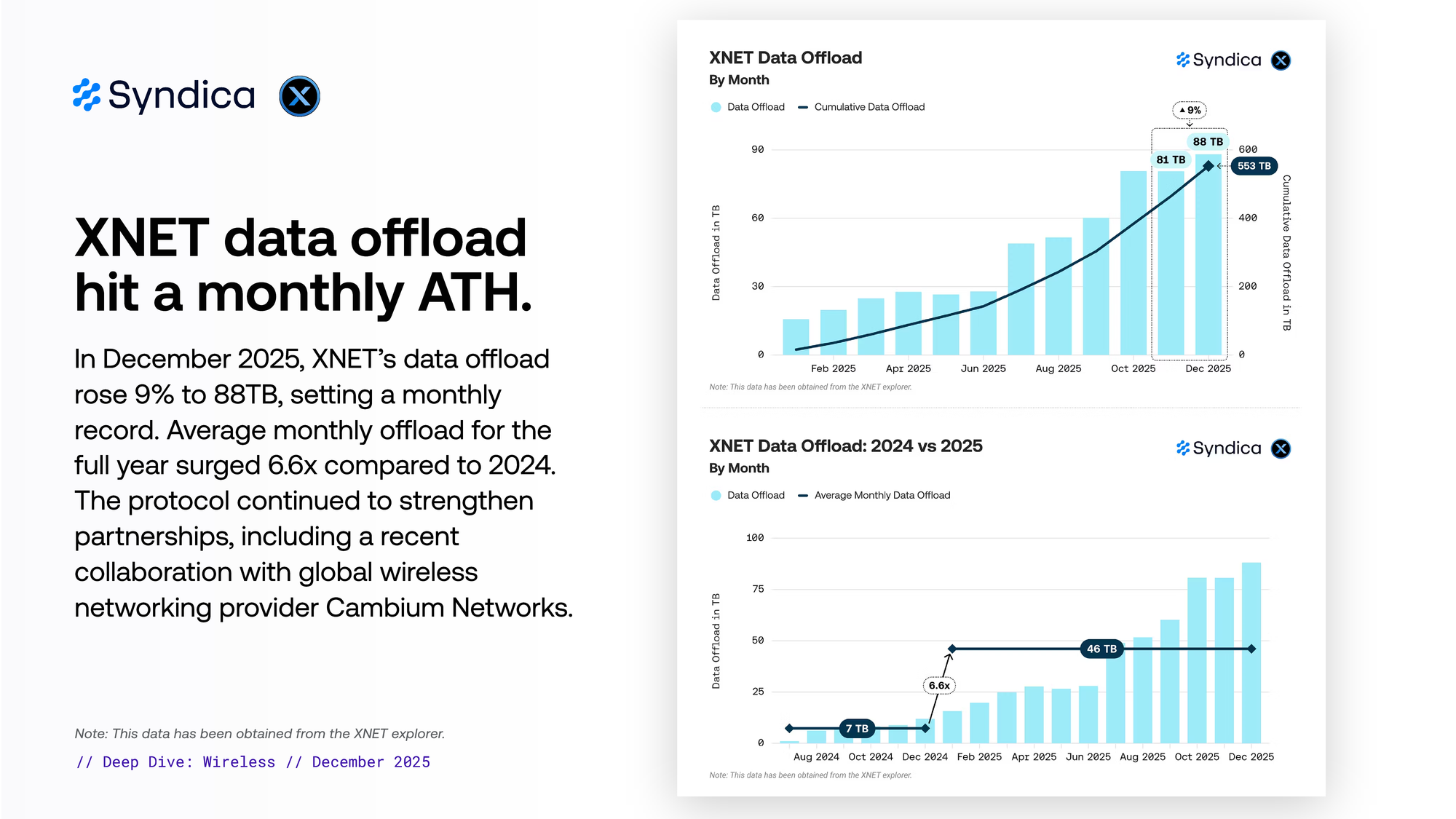

XNET data offload hit a monthly ATH. In December 2025, XNET’s data offload rose 9% to 88TB, setting a monthly record. Average monthly offload for the full year surged 6.6x compared to 2024. The protocol continued to strengthen partnerships, including a recent collaboration with global wireless networking provider Cambium Networks.

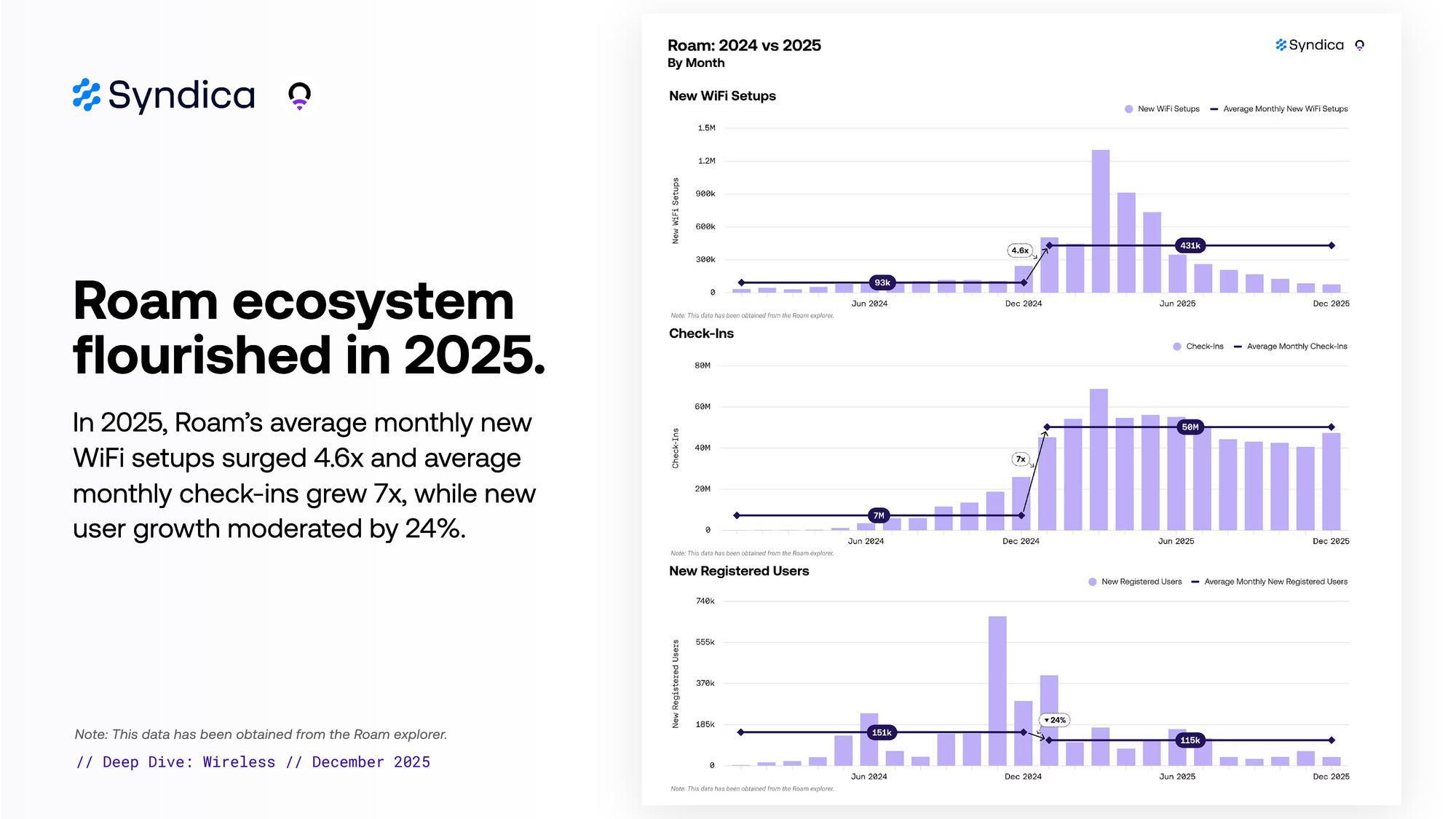

Roam ecosystem flourished in 2025. In 2025, Roam’s average monthly new WiFi setups surged 4.6x and average monthly check-ins grew 7x, while new user growth moderated by 24%.

Part II - Mapping & Location

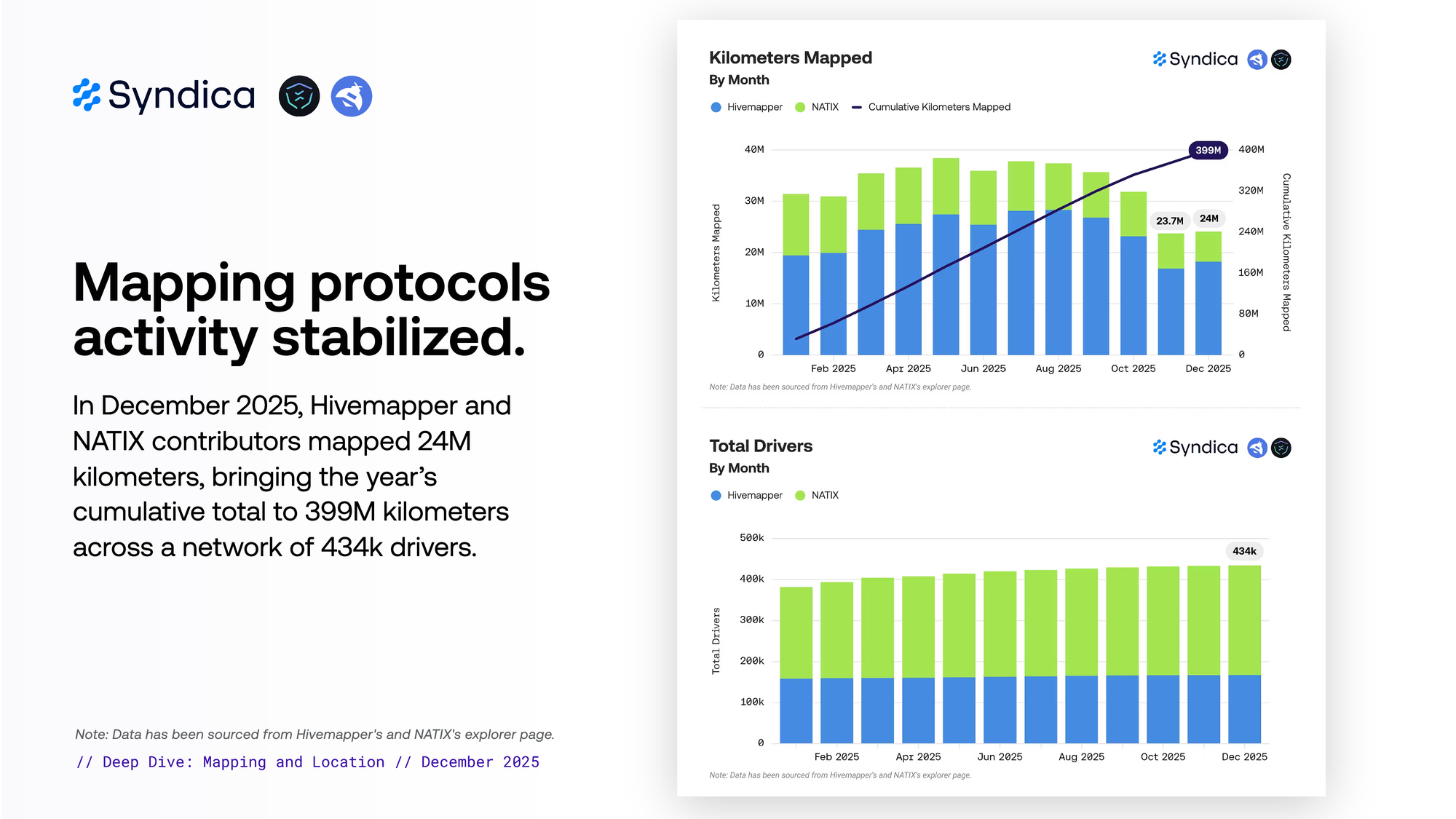

Mapping protocols activity stabilized. In December 2025, Hivemapper and NATIX contributors mapped 24M kilometers, bringing the year’s cumulative total to 399M kilometers across a network of 434k drivers.

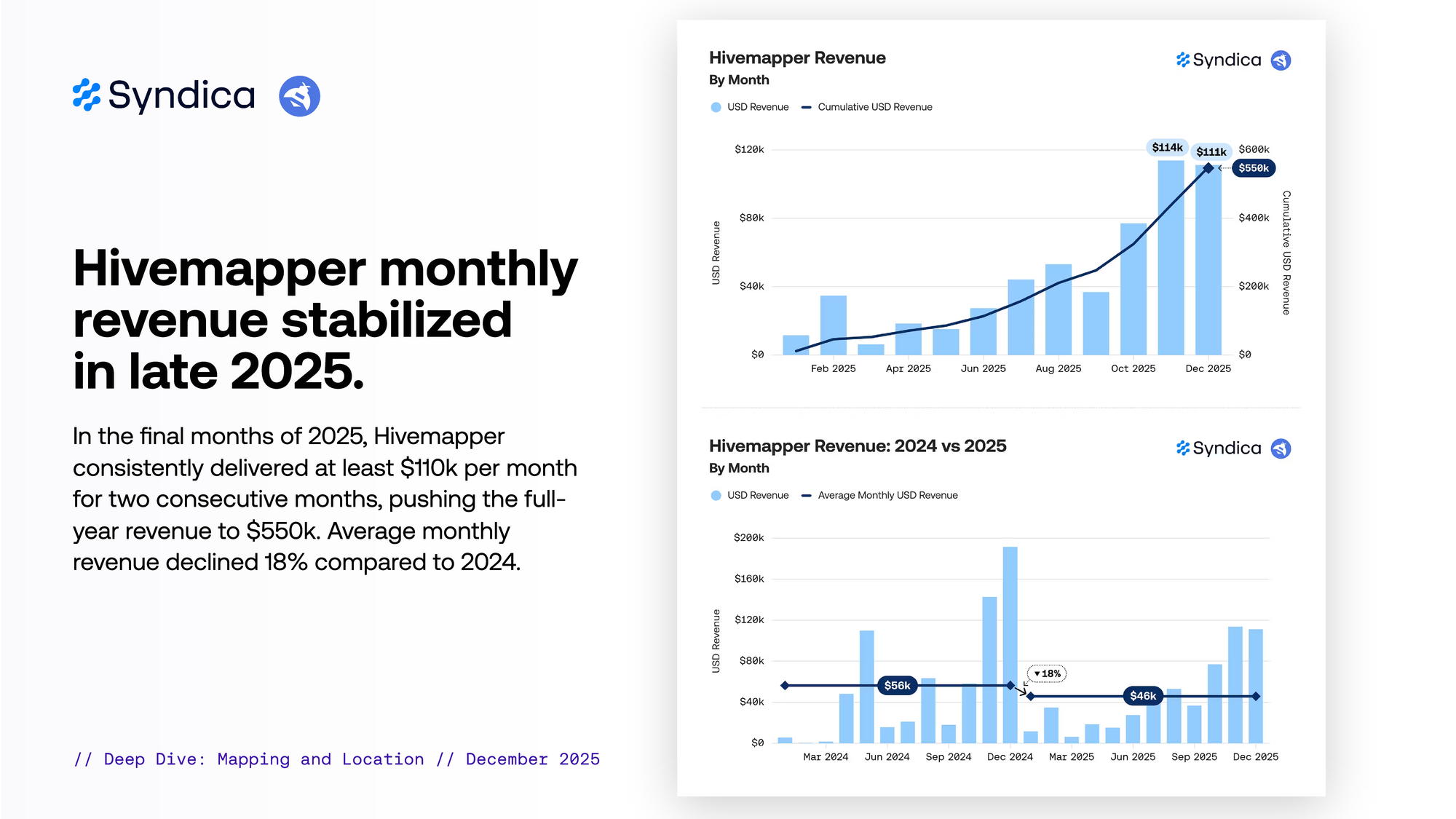

Hivemapper monthly revenue stabilized in late 2025. In the final months of 2025, Hivemapper consistently delivered at least $110k per month for two consecutive months, pushing the full-year revenue to $550k. Average monthly revenue declined 18% compared to 2024.

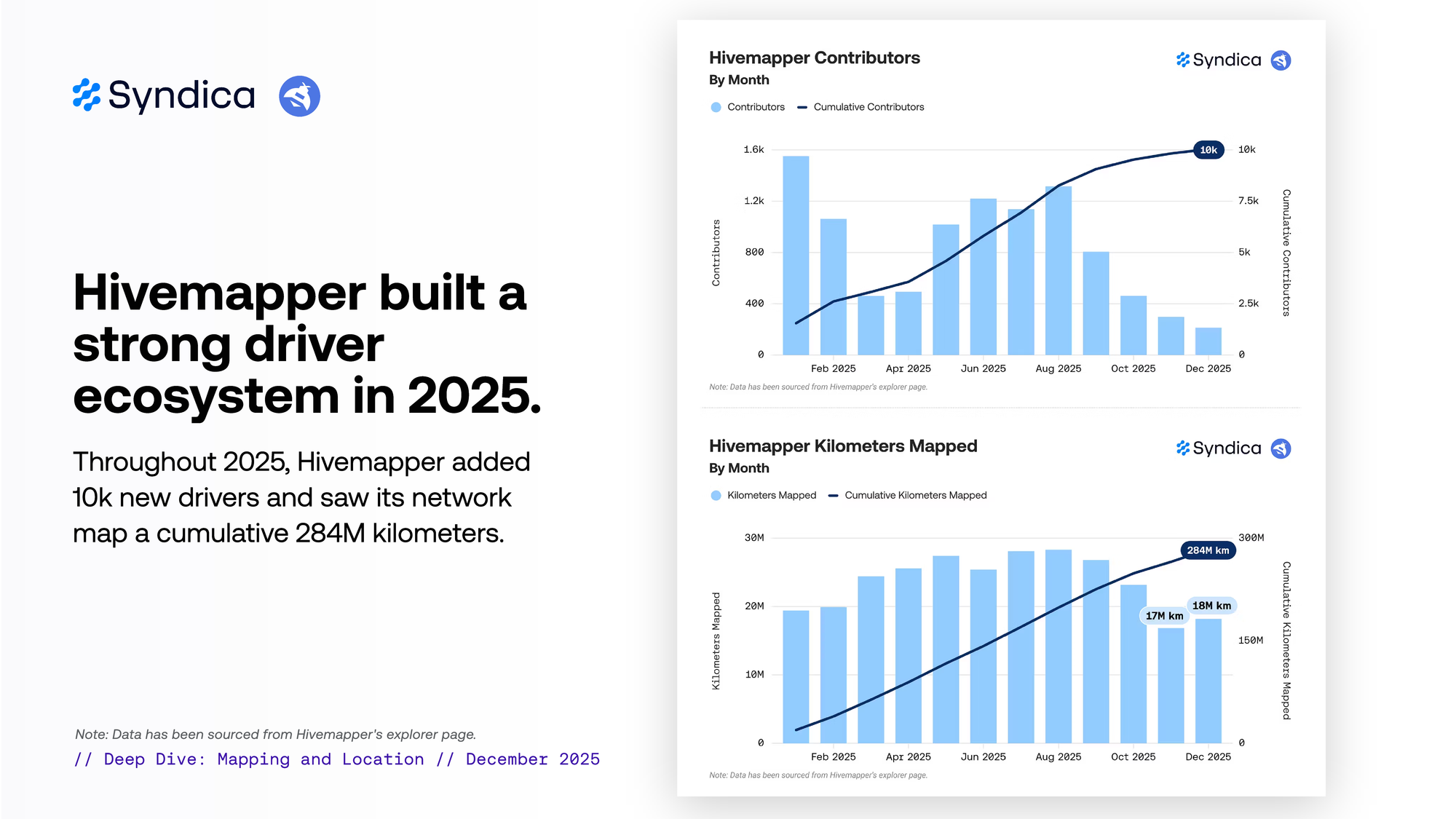

Hivemapper built a strong driver ecosystem in 2025. Throughout 2025, Hivemapper added 10k new drivers and saw its network map a cumulative 284M kilometers.

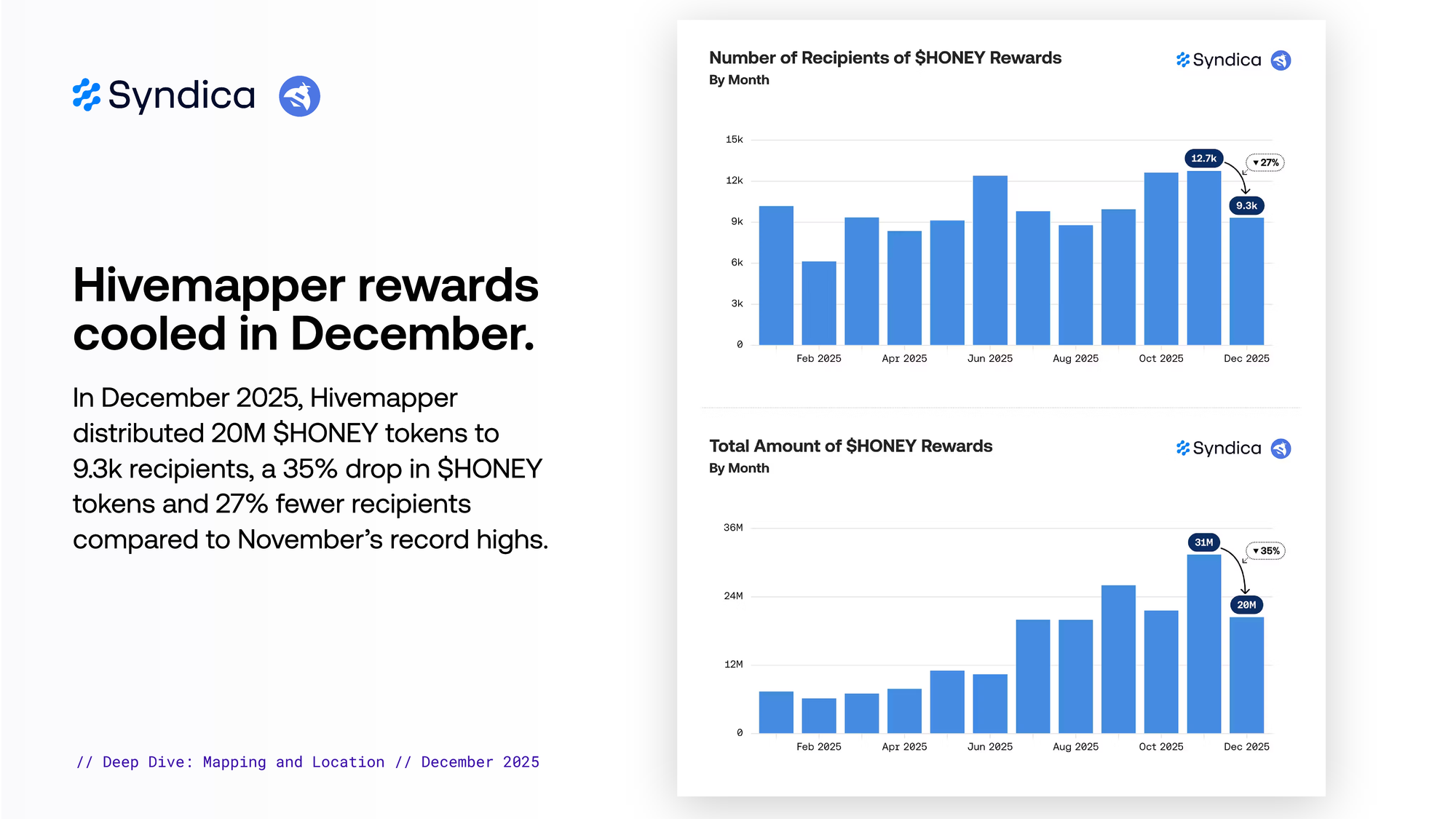

Hivemapper rewards cooled in December. In December 2025, Hivemapper distributed 20M $HONEY tokens to 9.3k recipients, a 35% drop in $HONEY tokens and 27% fewer recipients compared to November’s record highs.

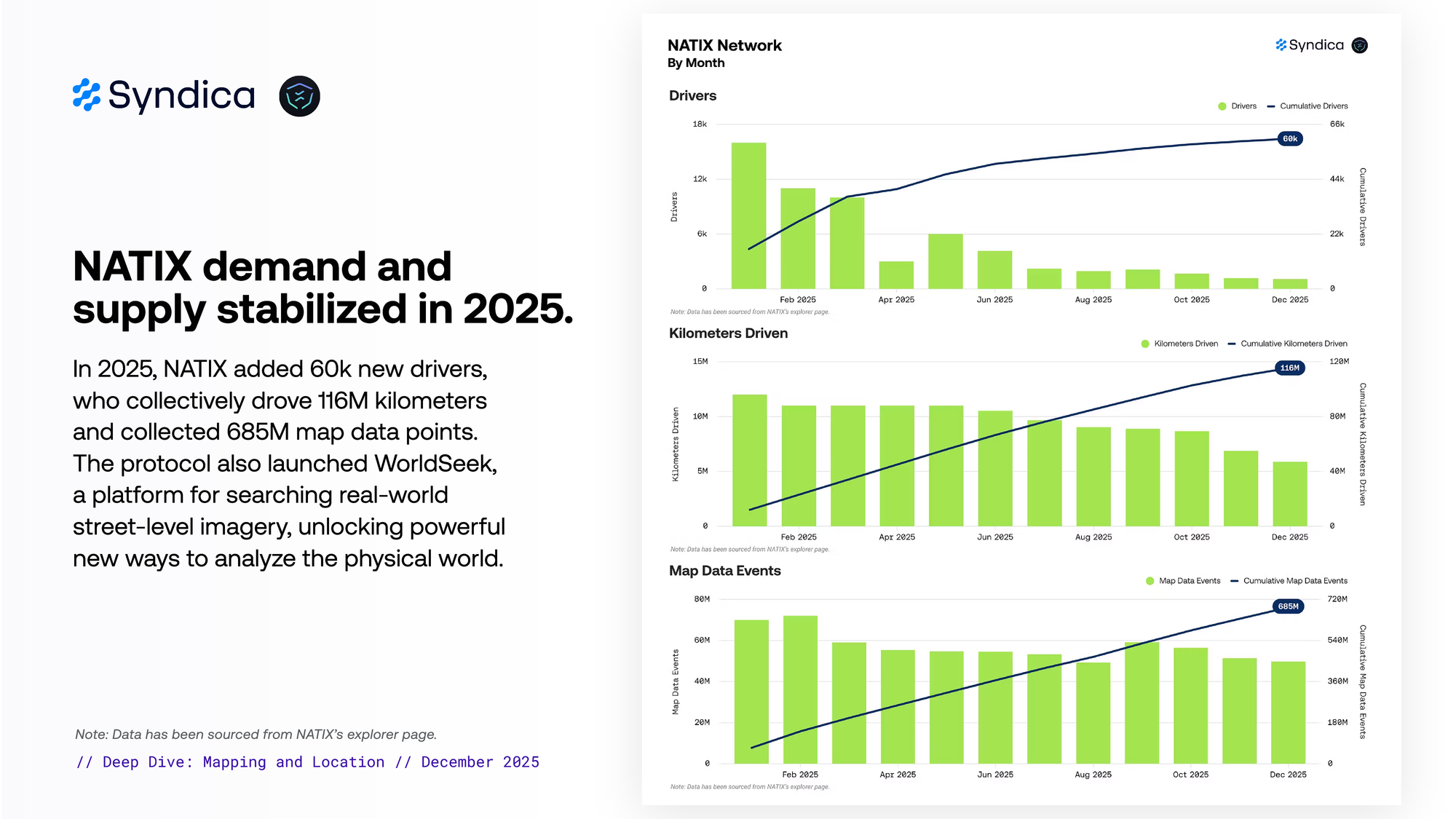

NATIX demand and supply stabilized in 2025. In 2025, NATIX added 60k new drivers, who collectively drove 116M kilometers and collected 685M map data points. The protocol also launched WorldSeek, a platform for searching real-world street-level imagery, unlocking powerful new ways to analyze the physical world.

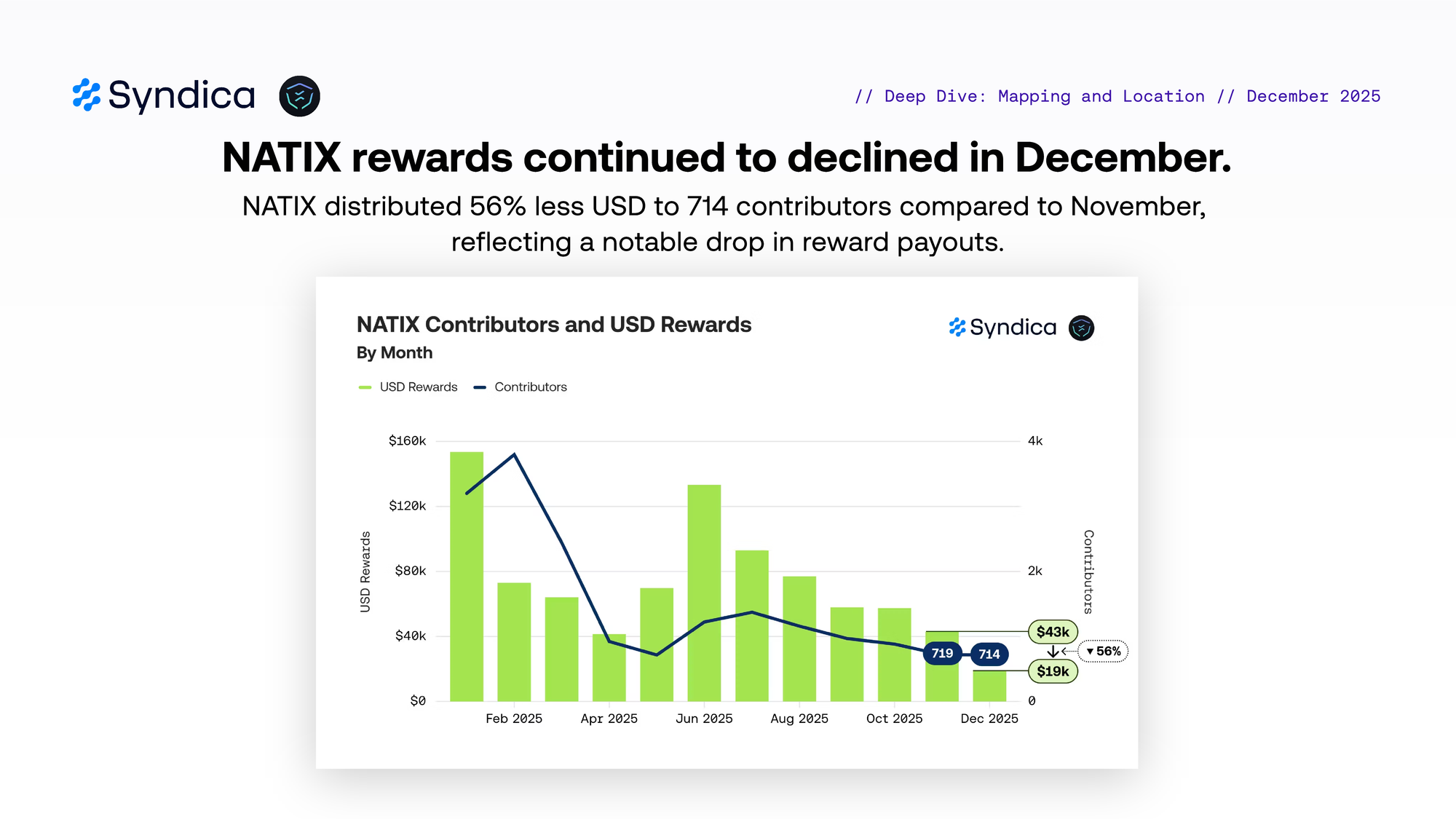

NATIX rewards continued to decline in December. NATIX distributed 56% less USD to 714 contributors compared to November, reflecting a notable drop in reward payouts.

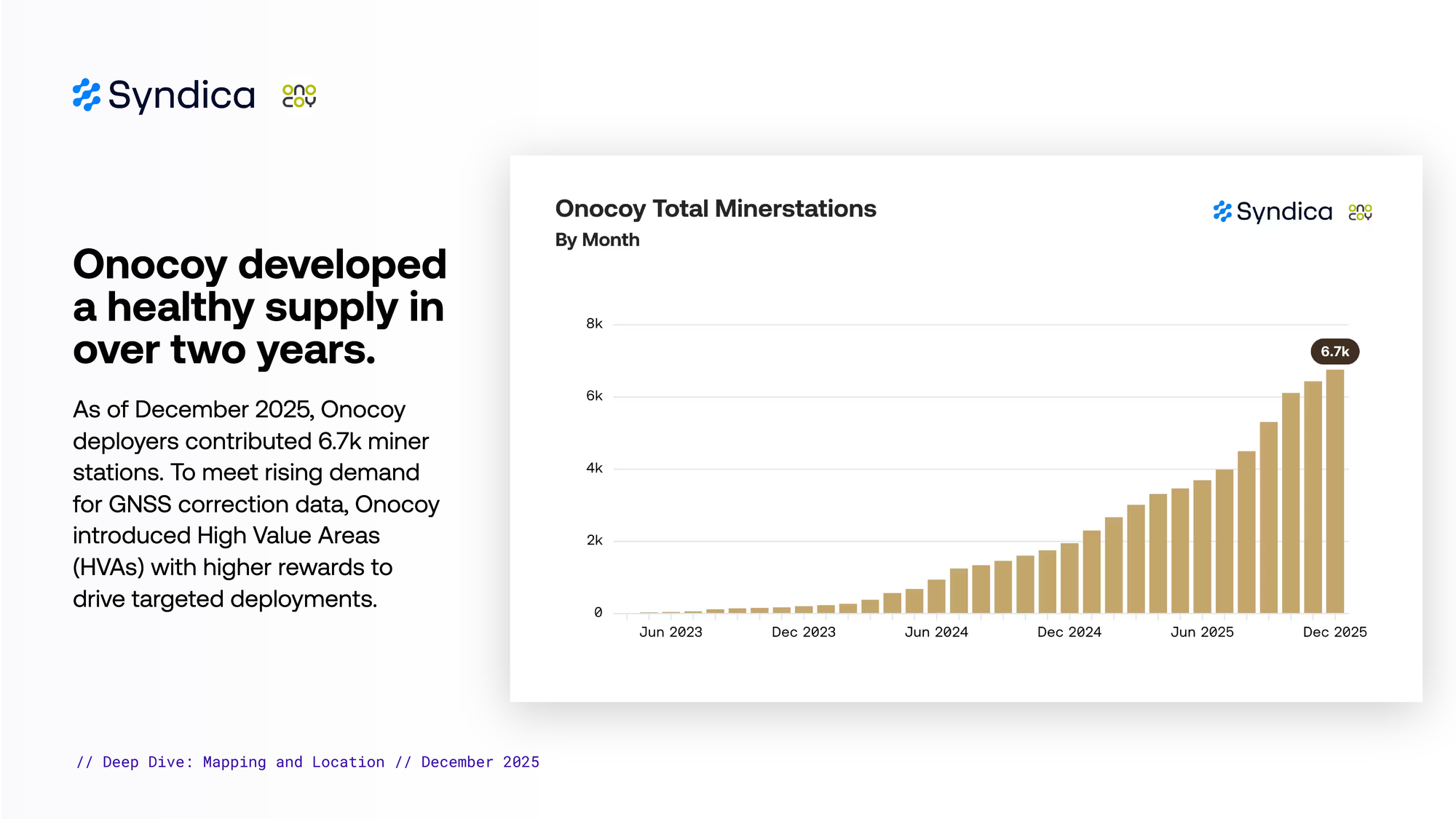

Onocoy developed a healthy supply in over two years. As of December 2025, Onocoy deployers contributed 6.7k miner stations. To meet rising demand for GNSS correction data, Onocoy introduced High Value Areas (HVAs) with higher rewards to drive targeted deployments.

Part III - Compute, AI, & Data

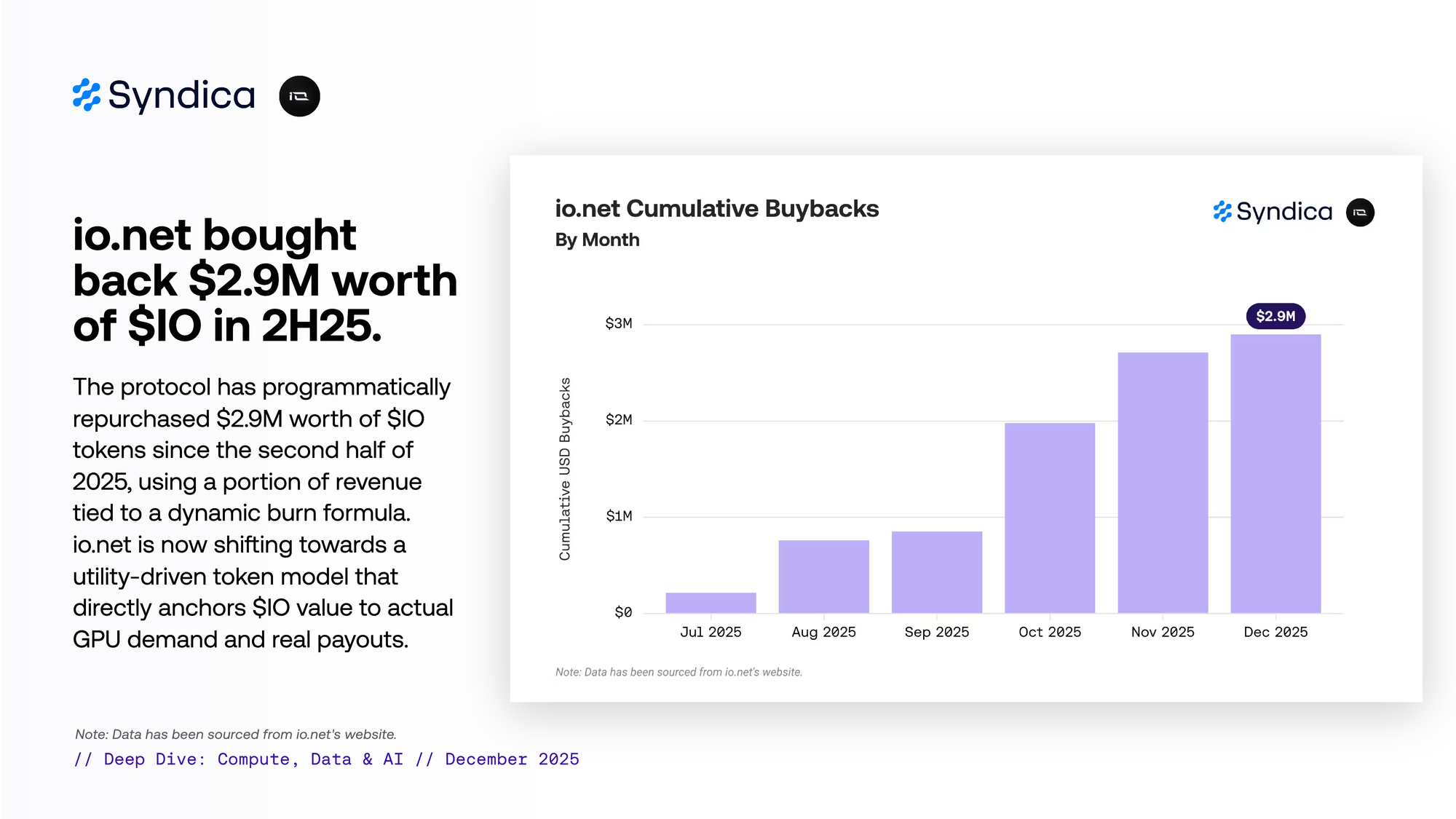

io.net bought back $2.9M in $IO since 2H25. The protocol has programmatically repurchased $2.9M worth of $IO tokens since the second half of 2025, using a portion of revenue tied to a dynamic burn formula. io.net is now shifting towards a utility-driven token model that directly anchors $IO value to actual GPU demand and real payouts.

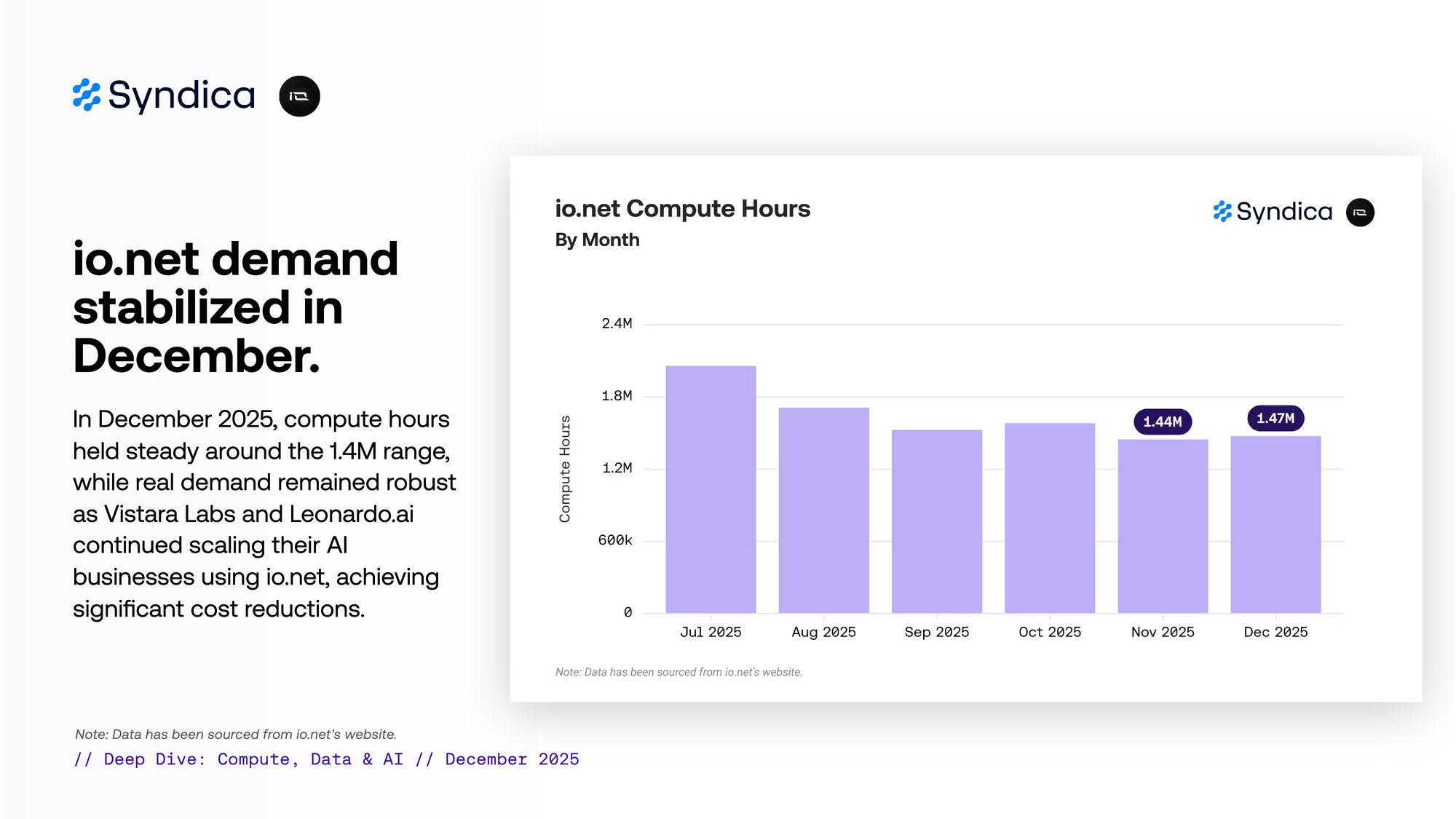

io.net demand stabilized in December. In December 2025, compute hours held steady around the 1.4M range, while real demand remained robust as Vistara Labs and Leonardo.ai continued scaling their AI businesses using io.net, achieving significant cost reductions.

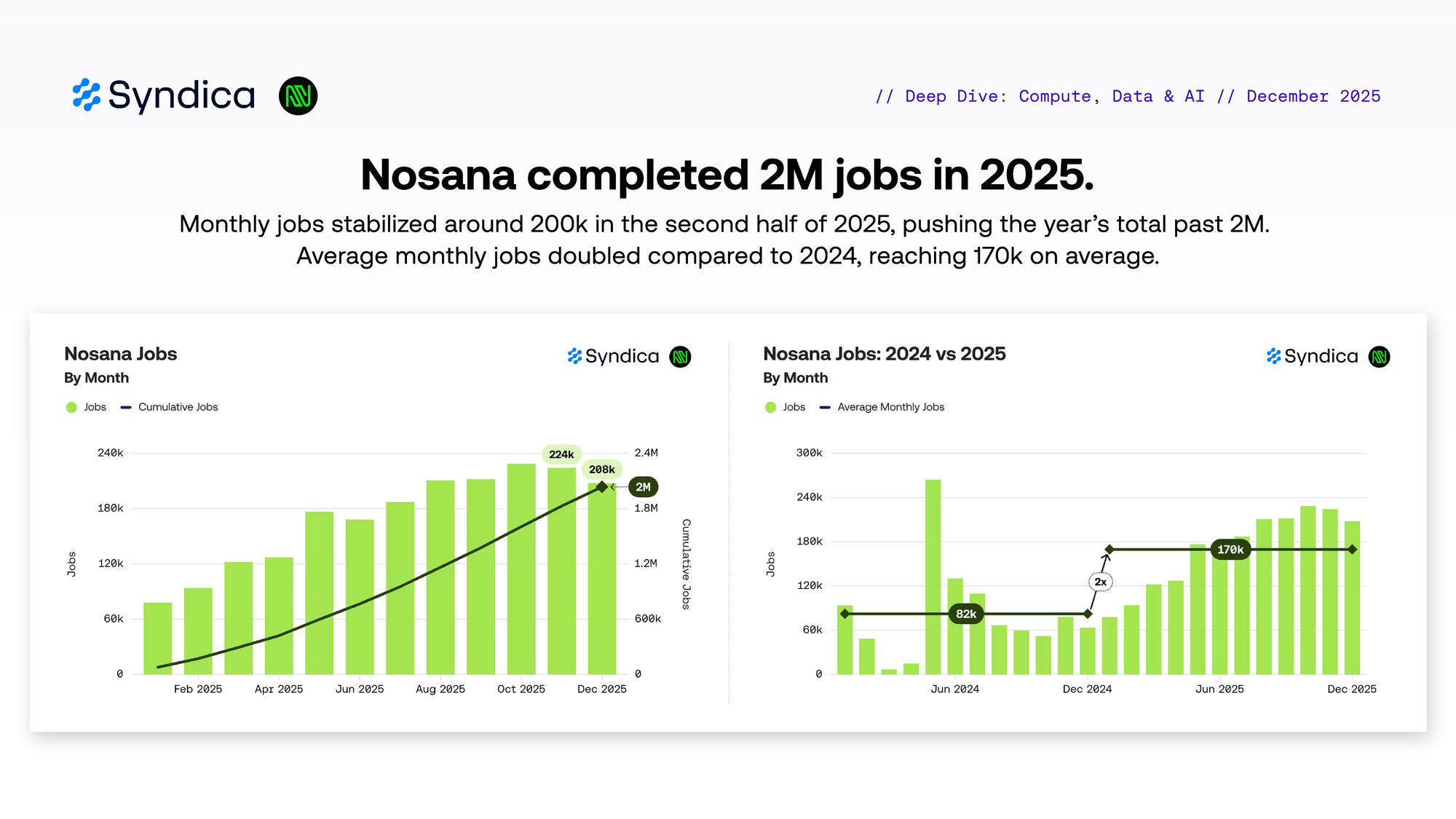

Nosana completed 2M jobs in 2025. Monthly jobs stabilized around 200k in the second half of 2025, pushing the year’s total past 2M. Average monthly jobs doubled compared to 2024, reaching 170k on average.

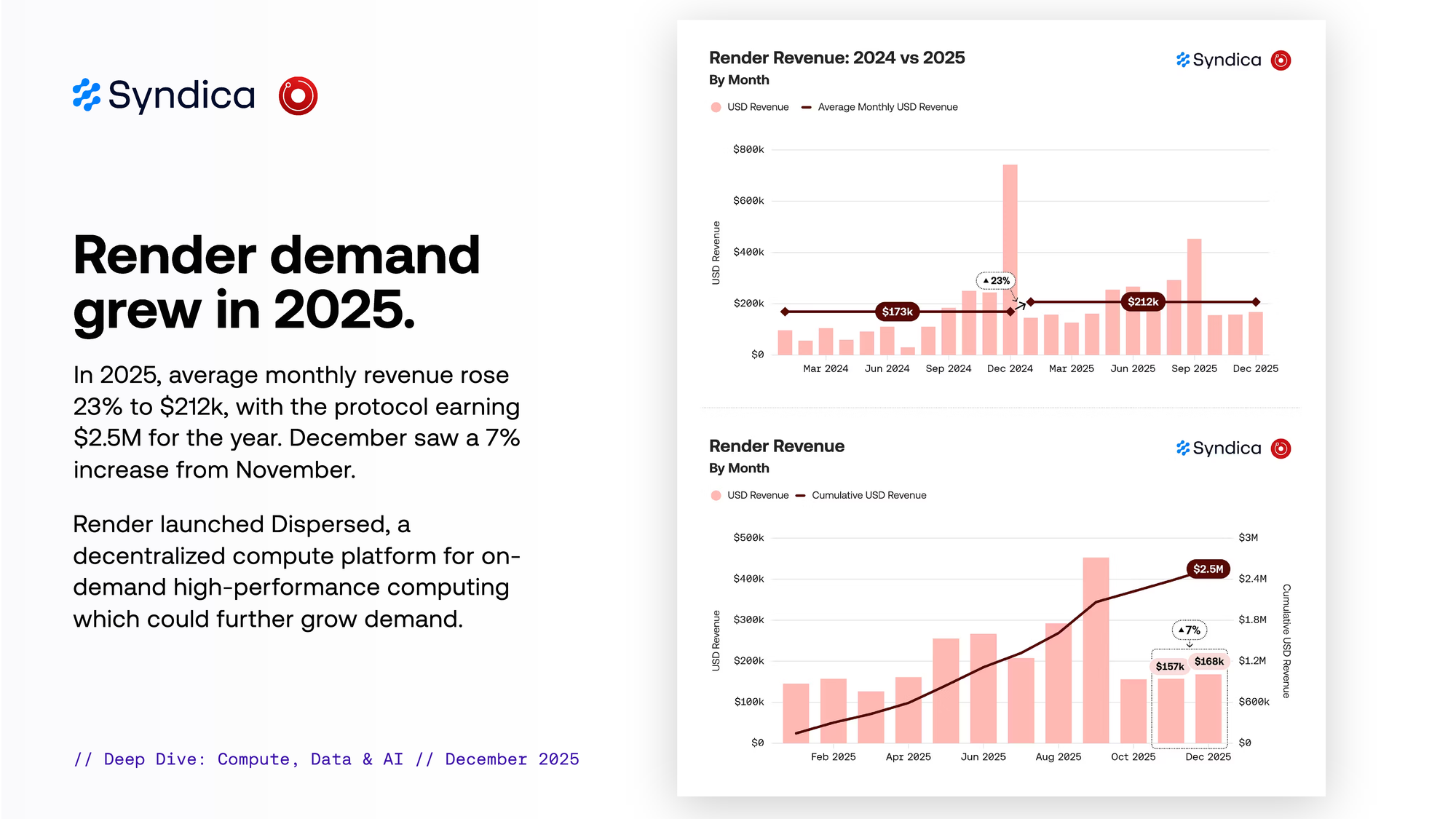

Render demand grew in 2025. In 2025, average monthly revenue rose 23% to $212k, with the protocol earning $2.5M for the year. December saw a 7% increase from November. Render launched Dispersed, a decentralized compute platform for on-demand high-performance computing which could further grow demand.

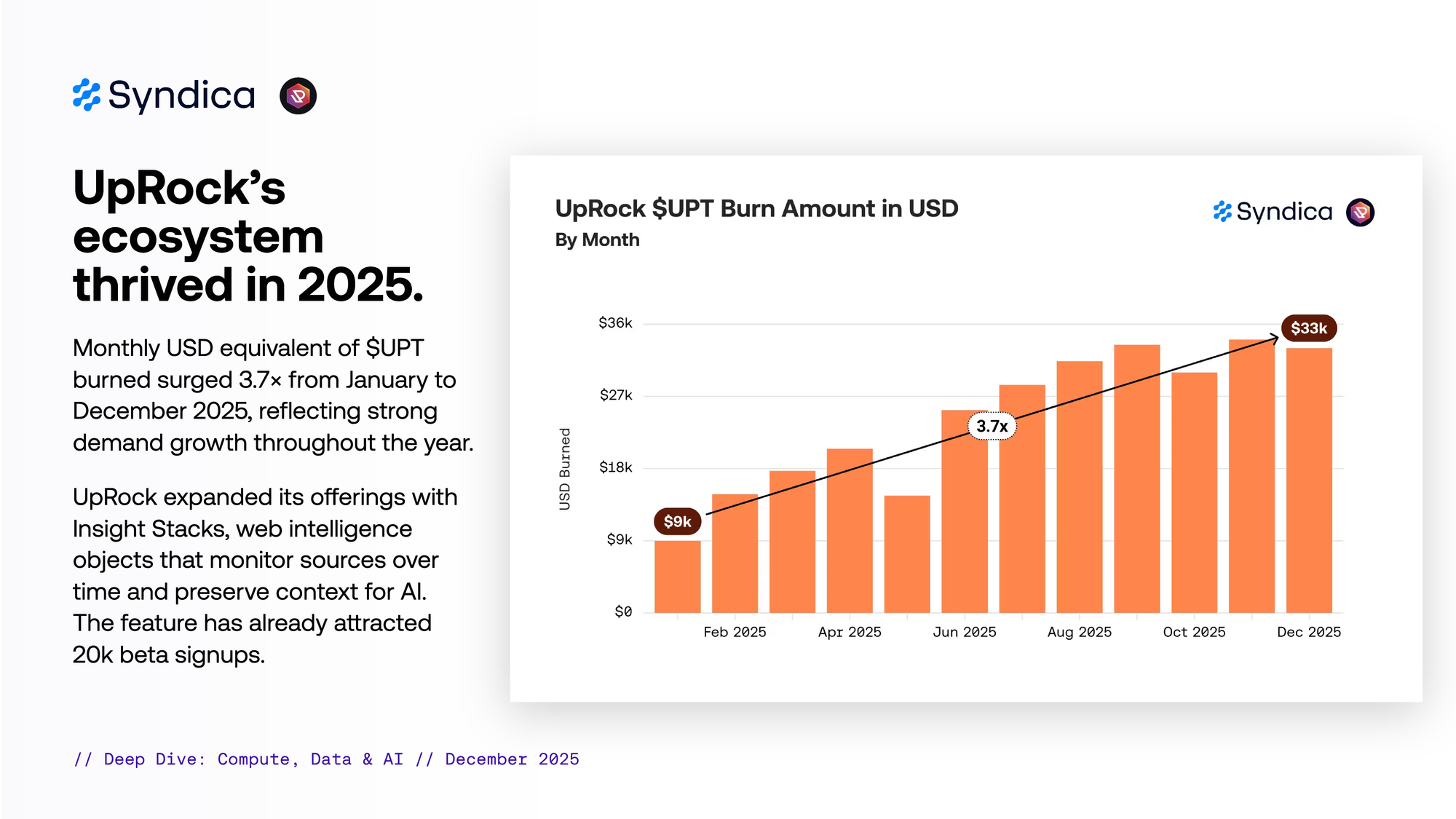

UpRock's ecosystem thrived in 2025.

Monthly USD equivalent of $UPT burned surged 3.7× from January to December 2025, reflecting strong demand growth throughout the year.

UpRock expanded its offerings with Insight Stacks, web intelligence objects that monitor sources over time and preserve context for AI. The feature has already attracted 20k beta signups.