Deep Dive: Solana DePIN - October 2024

Deep Dive: Solana DePIN - October 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DePIN - October 2024

Part I: Wireless

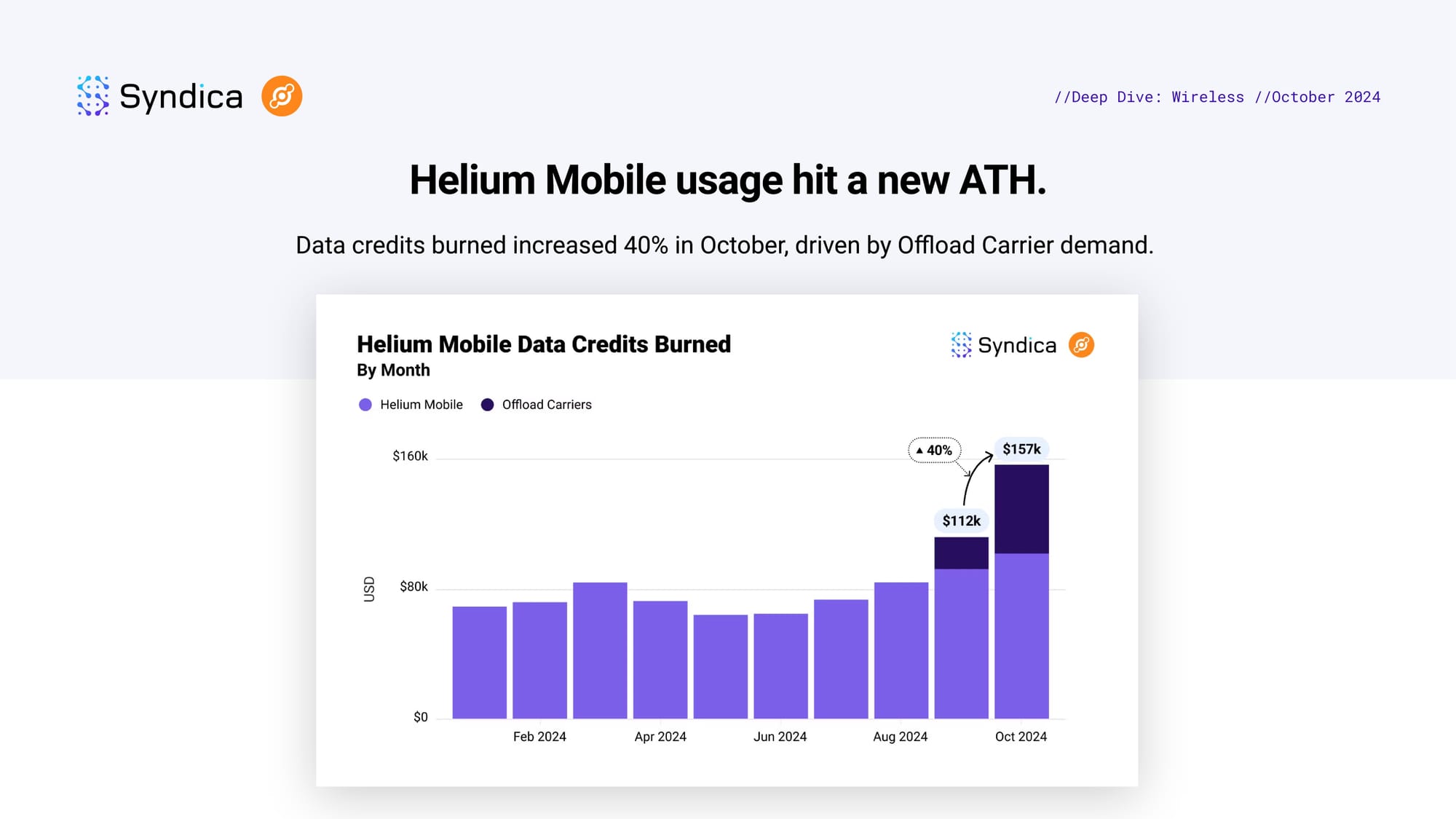

Helium Mobile usage hit a new ATH. Data credits burned increased 40% in October, driven by Offload Carrier demand.

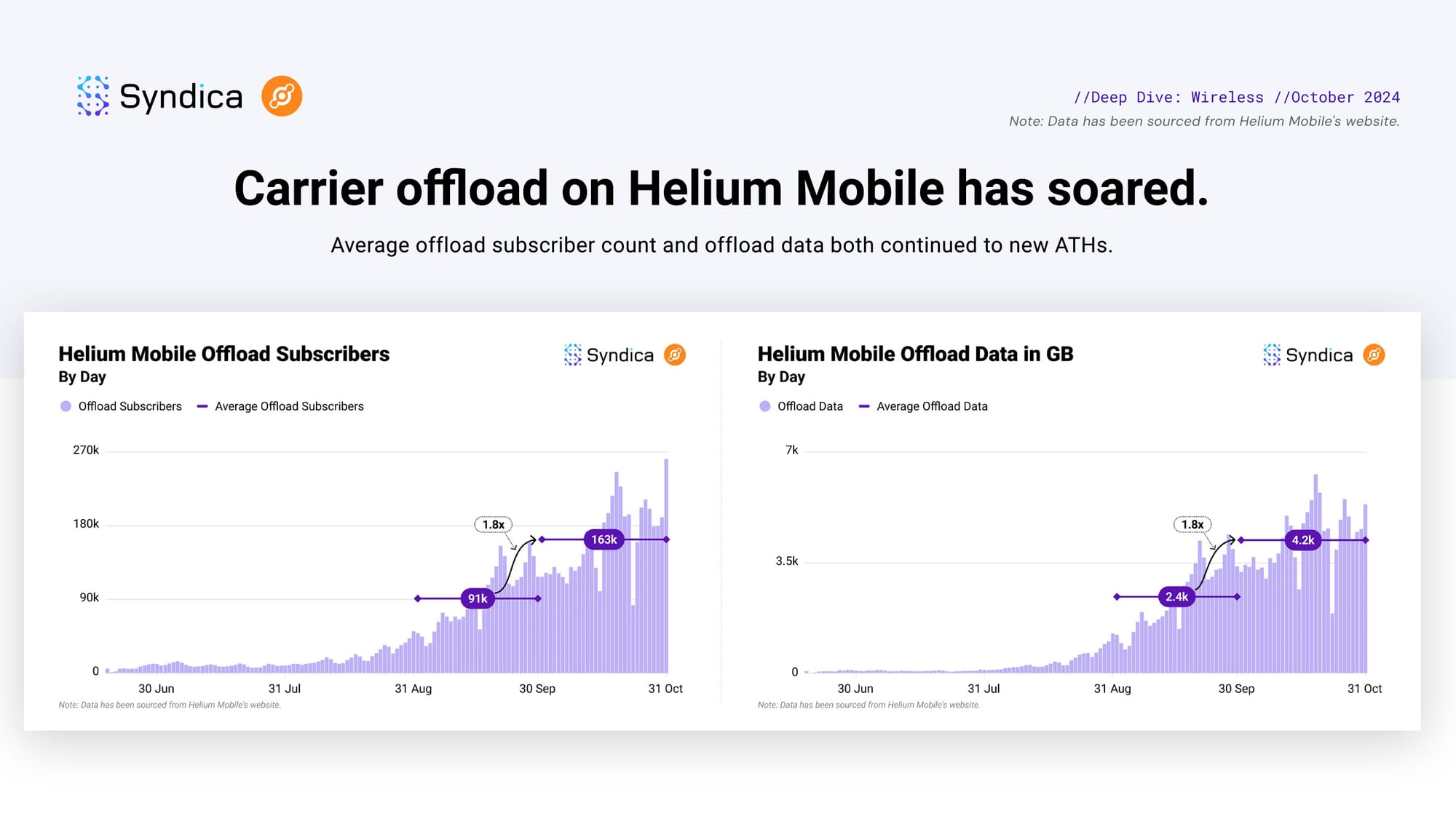

Carrier offload on Helium Mobile has soared. Average offload subscriber count and offload data both continued to new ATHs.

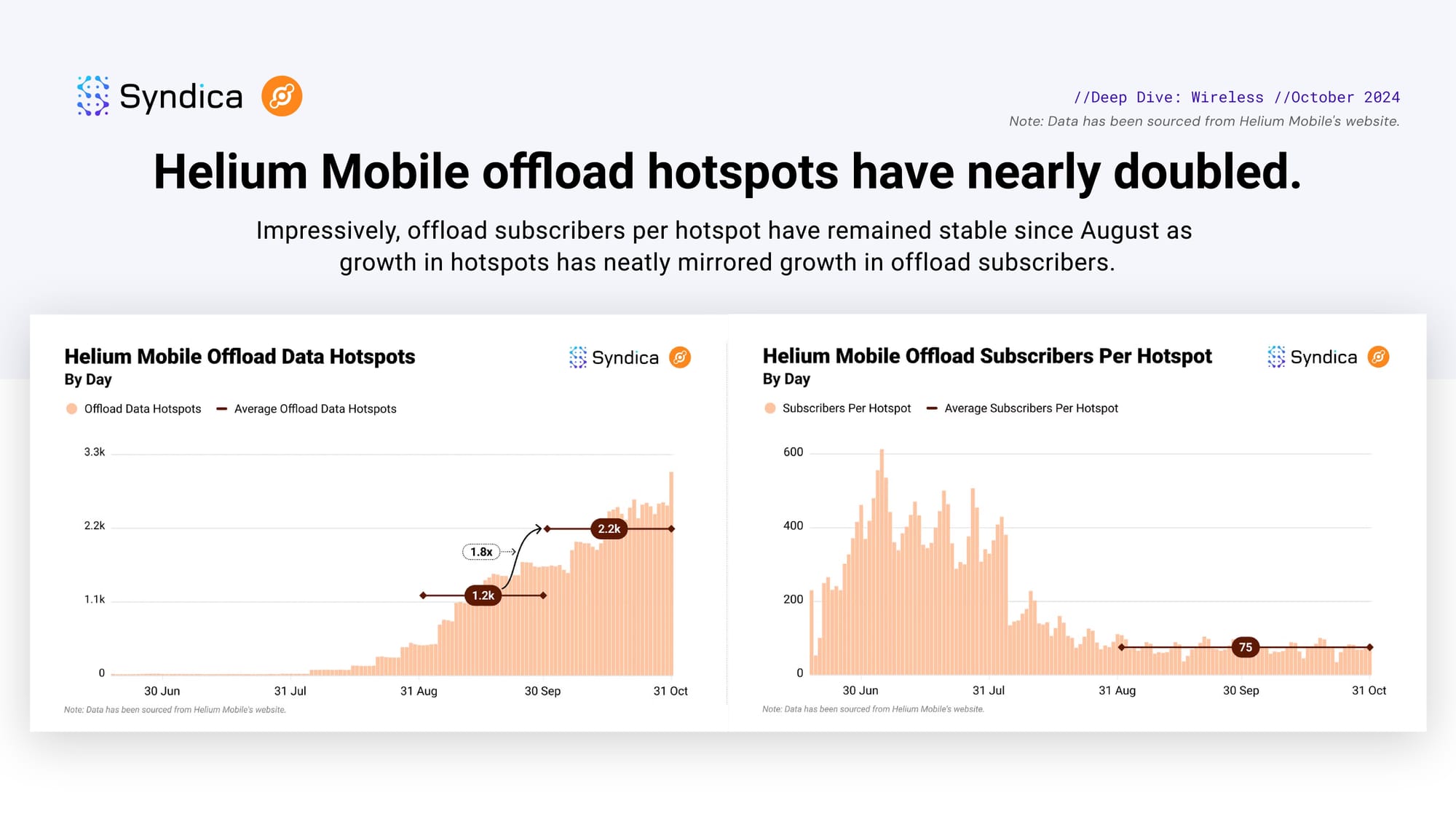

Helium Mobile offload hotspots have nearly doubled. Impressively, offload subscribers per hotspot have remained stable since August as growth in hotspots has neatly mirrored growth in offload subscribers.

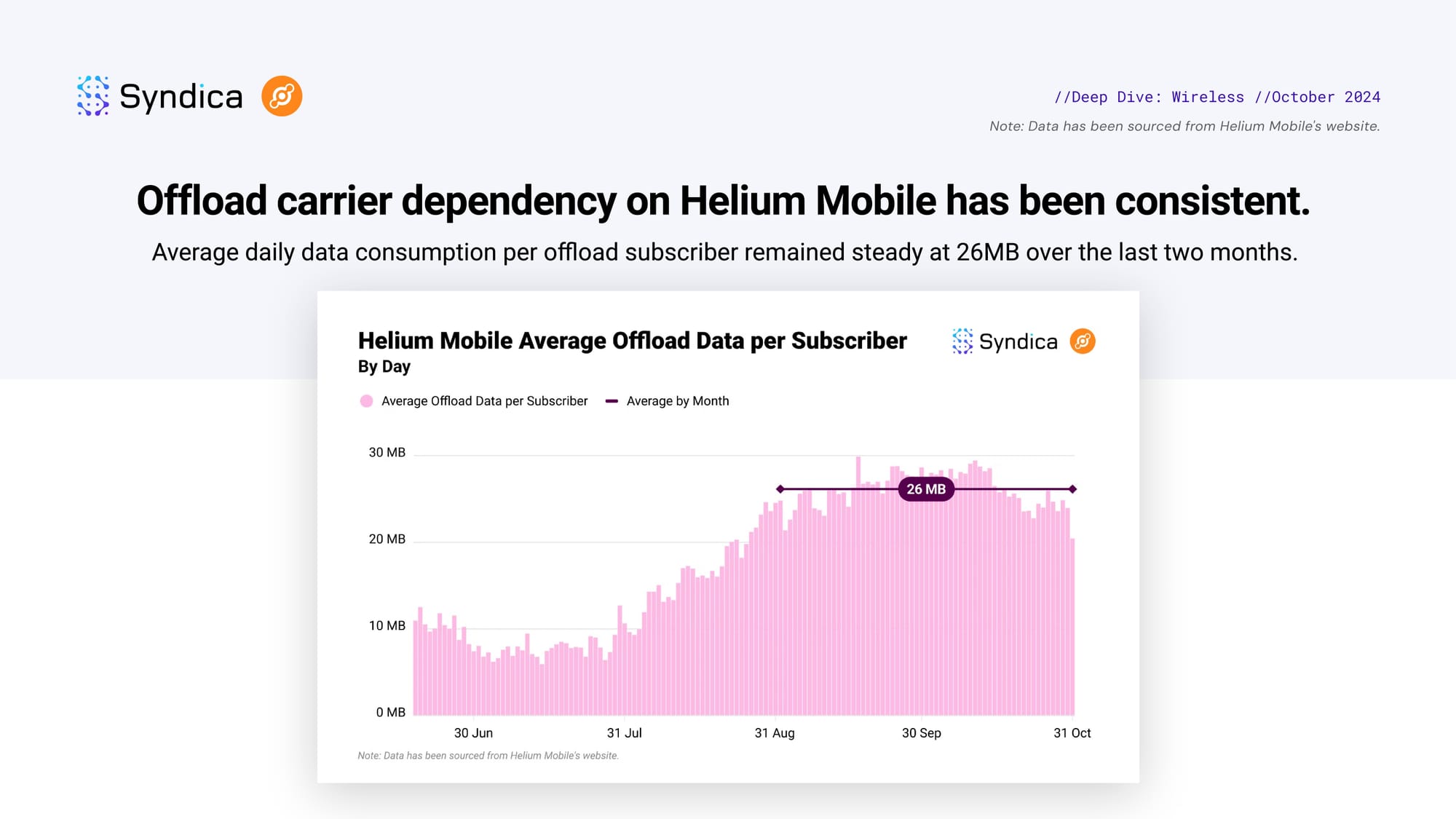

Offload carrier dependency on Helium Mobile has been consistent. Average daily data consumption per offload subscriber remained steady at 26MB over the last two months.

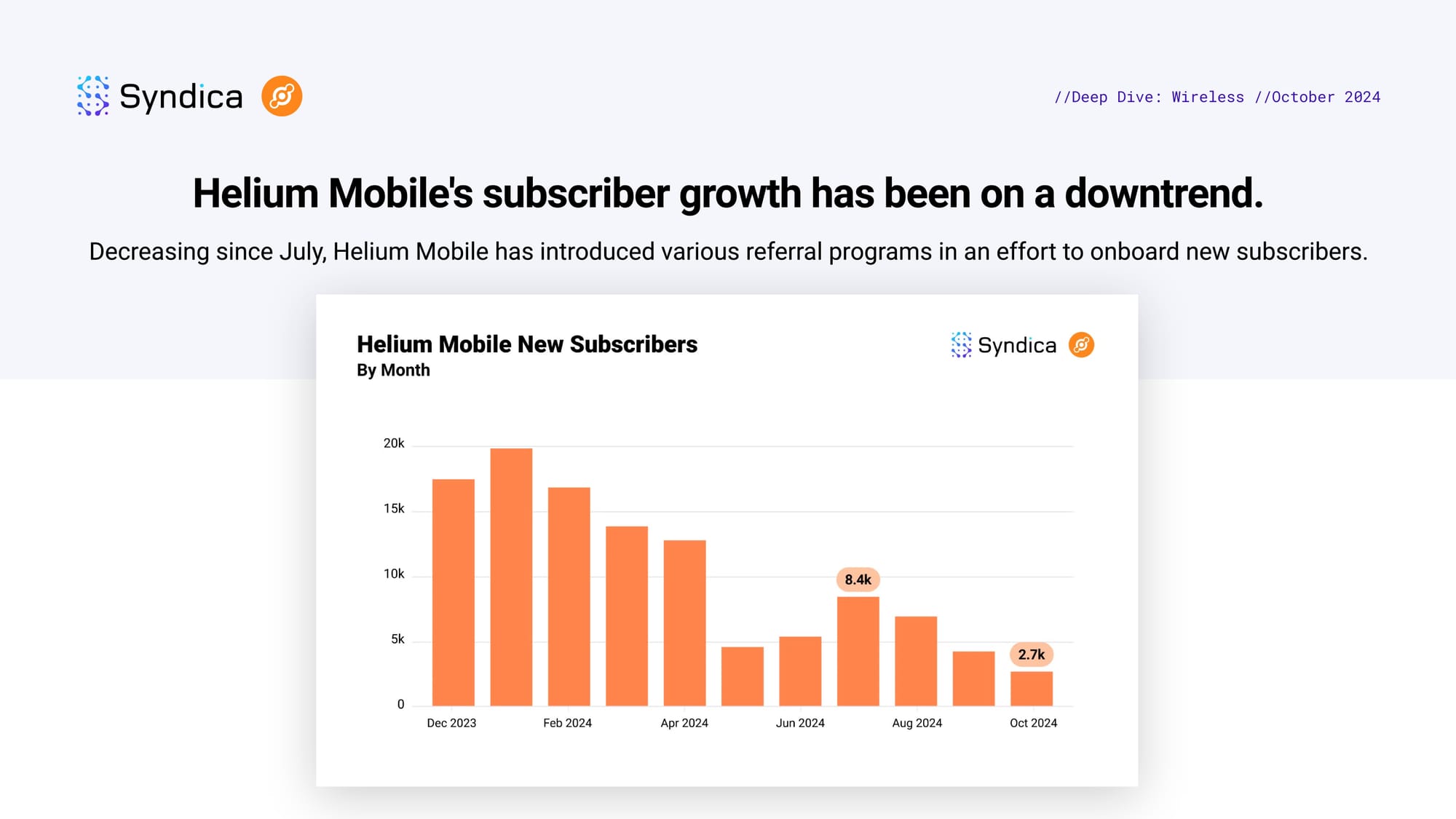

Helium Mobile's subscriber growth has been on a downtrend. Decreasing since July, Helium Mobile has introduced various referral programs in an effort to onboard new subscribers.

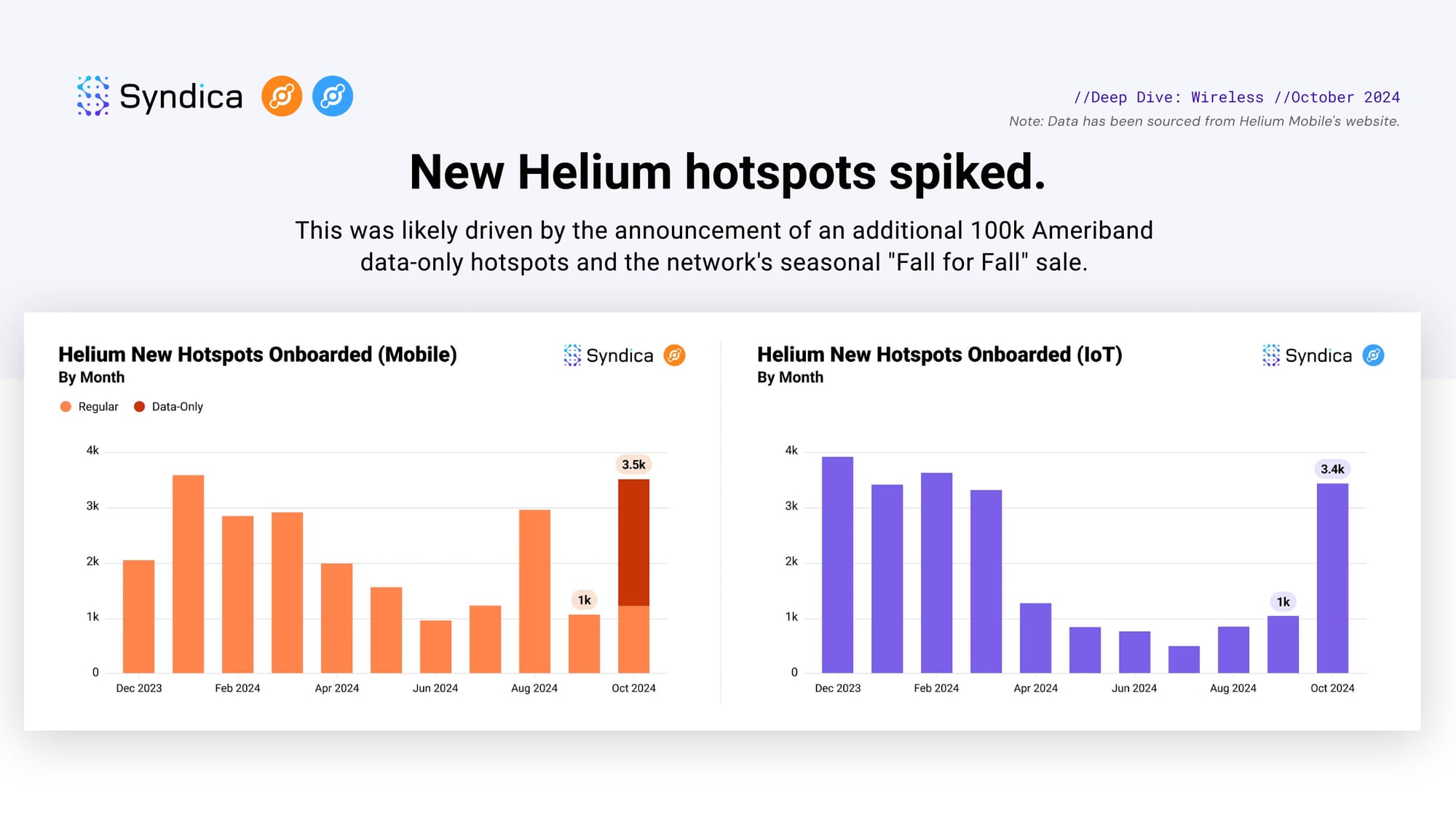

New Helium hotspots spiked. This was likely driven by the announcement of an additional 100k Ameriband data-only hotspots and the network's seasonal "Fall for Fall" sale.

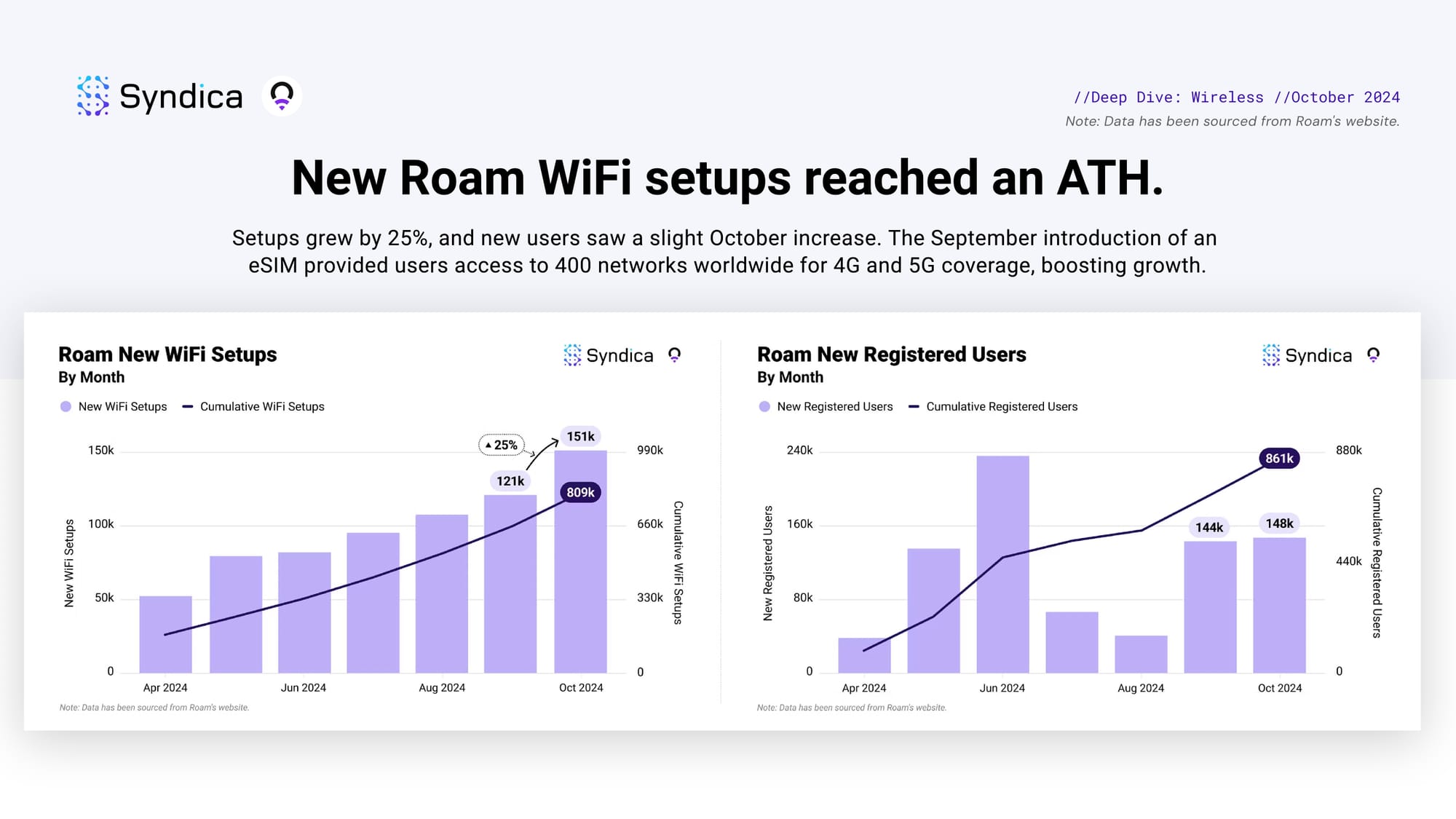

New Roam WiFi setups reached an ATH. Setups grew by 25%, and new users saw a slight October increase. The September introduction of an eSIM provided users access to 400 networks worldwide for 4G and 5G coverage, boosting growth.

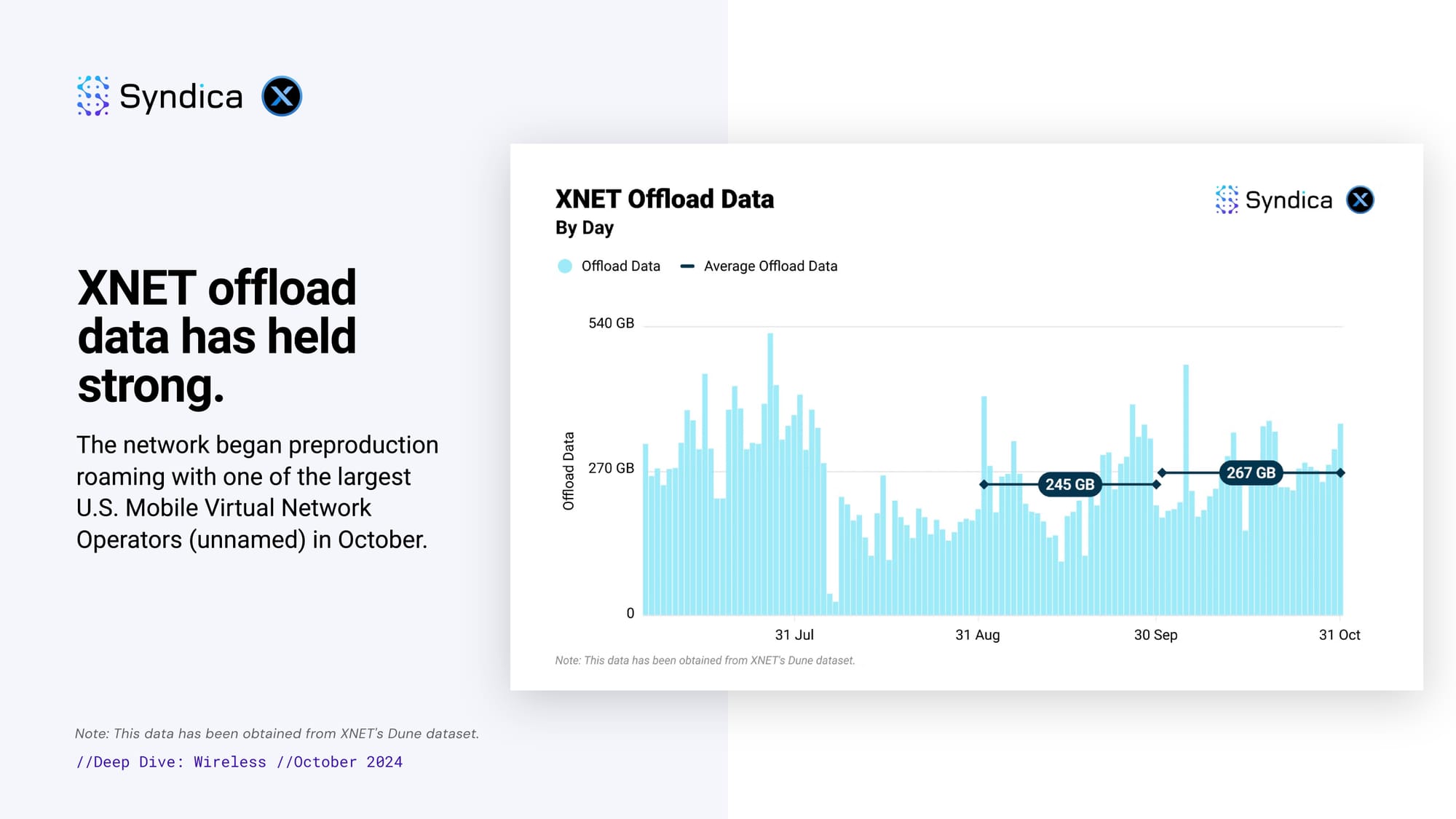

XNET offload data has held strong. The network began preproduction roaming with one of the largest U.S. Mobile Virtual Network Operators (unnamed) in October.

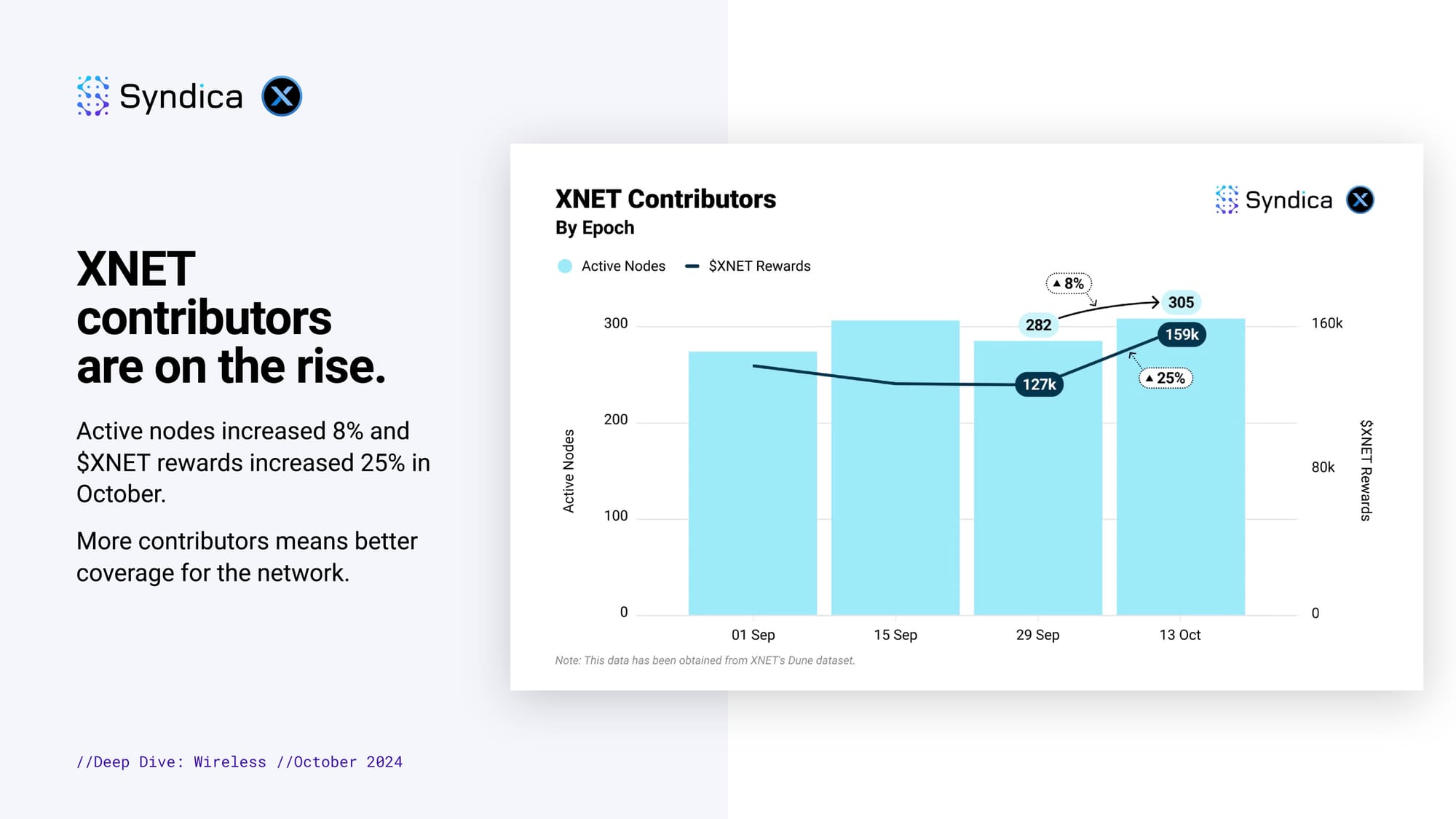

XNET contributors are on the rise. Active nodes increased 8% and $XNET rewards increased 25% in October. More contributors means better coverage for the network.

Part II: Compute, AI, & Data

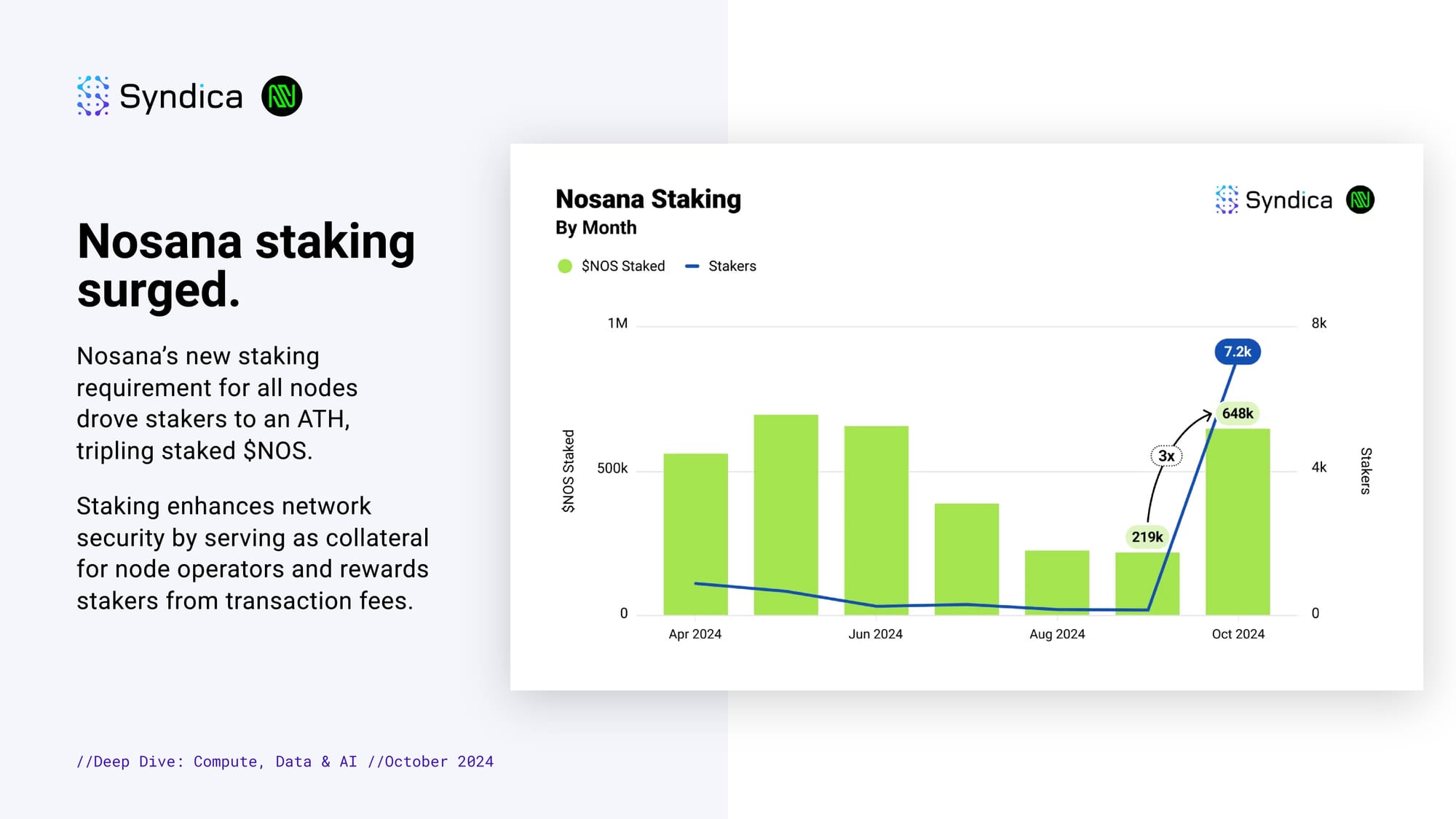

Nosana staking surged. Nosana’s new staking requirement for all nodes drove stakers to an ATH, tripling staked $NOS. Staking enhances network security by serving as collateral for node operators and rewards stakers from transaction fees.

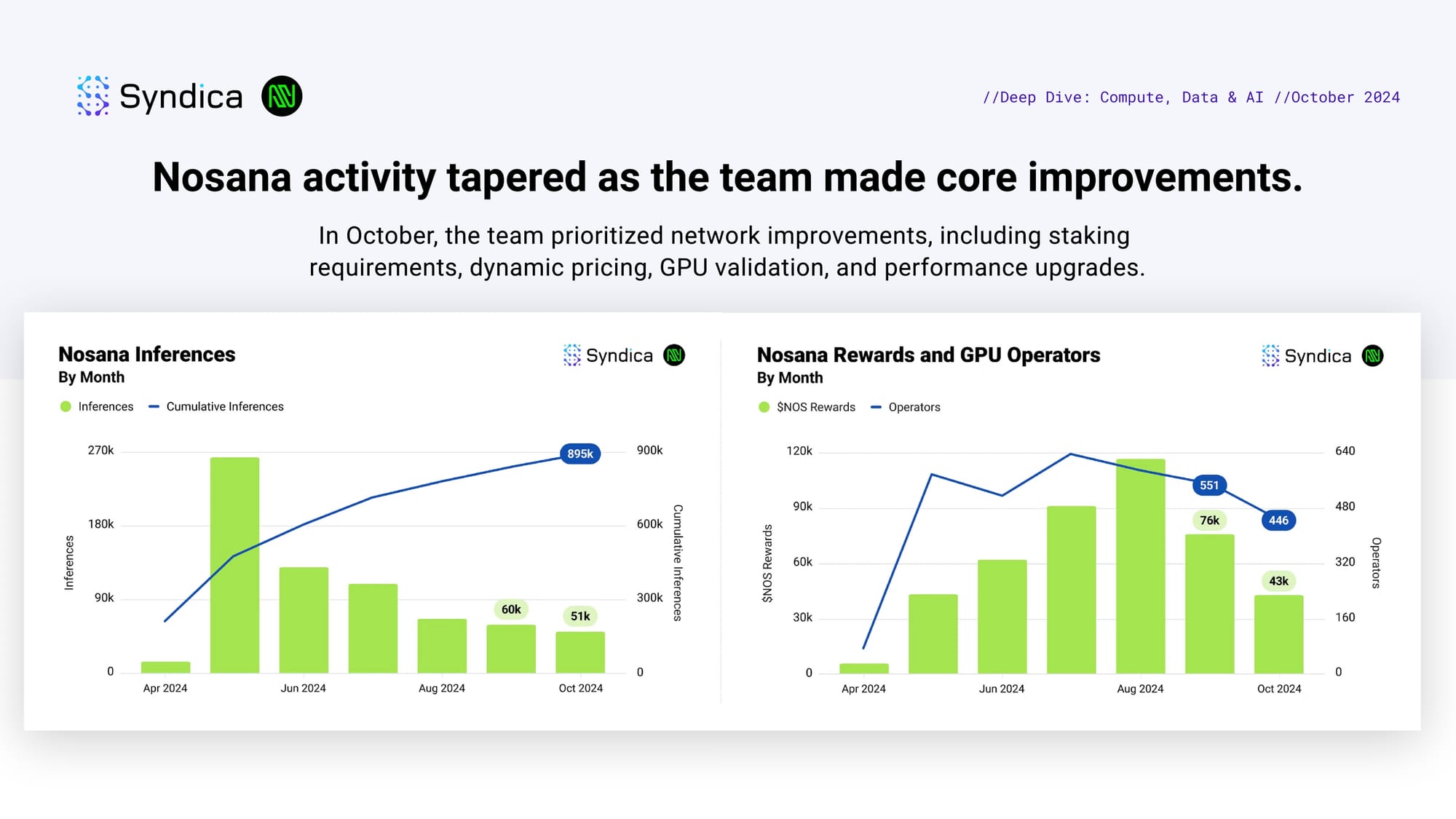

Nosana activity tapered as the team made core improvements. In October, the team prioritized network improvements, including staking requirements, dynamic pricing, GPU validation, and performance upgrades.

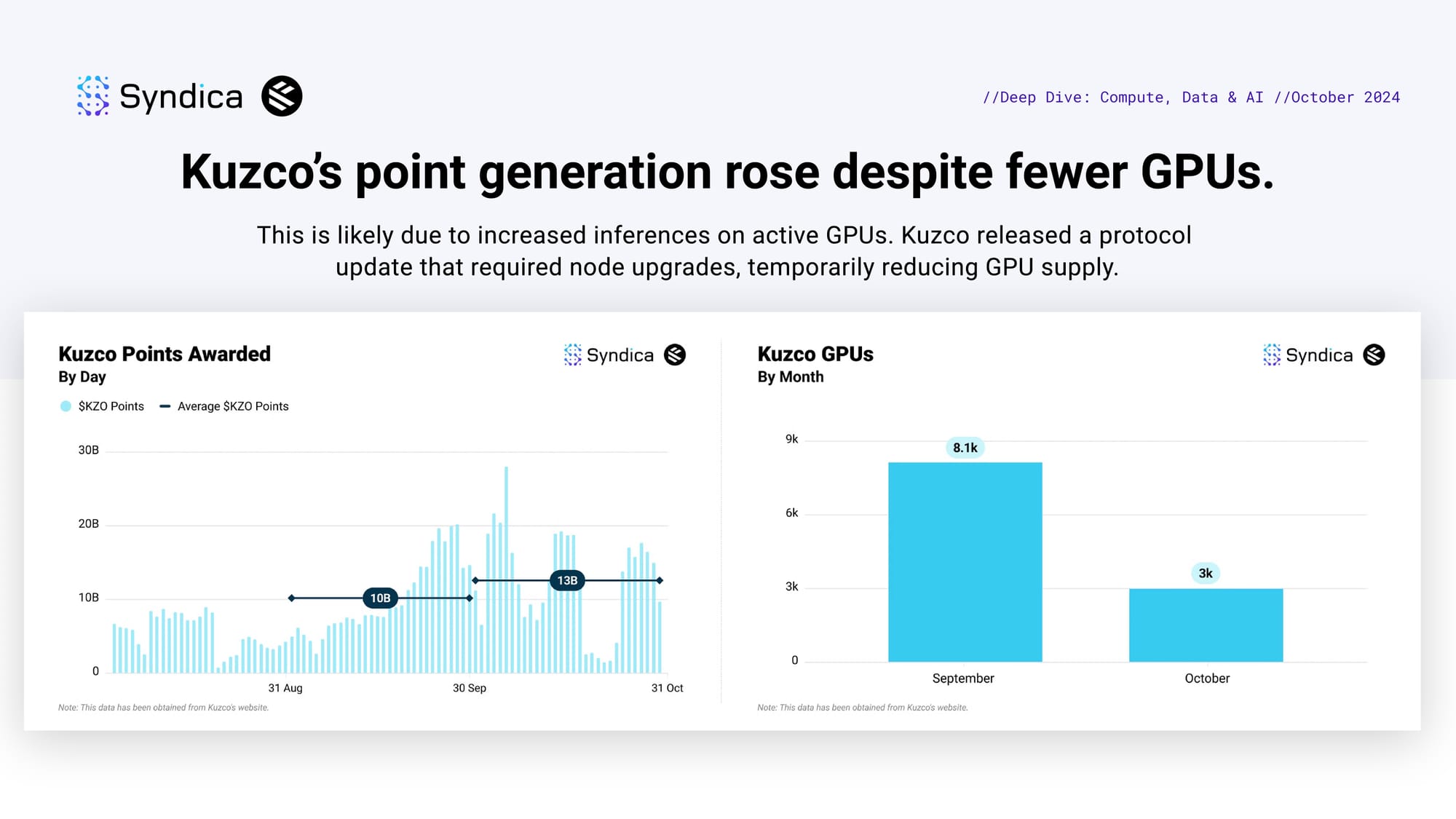

Kuzco’s point generation rose despite fewer GPUs. This is likely due to increased inferences on active GPUs. Kuzco released a protocol update that required node upgrades, temporarily reducing GPU supply.

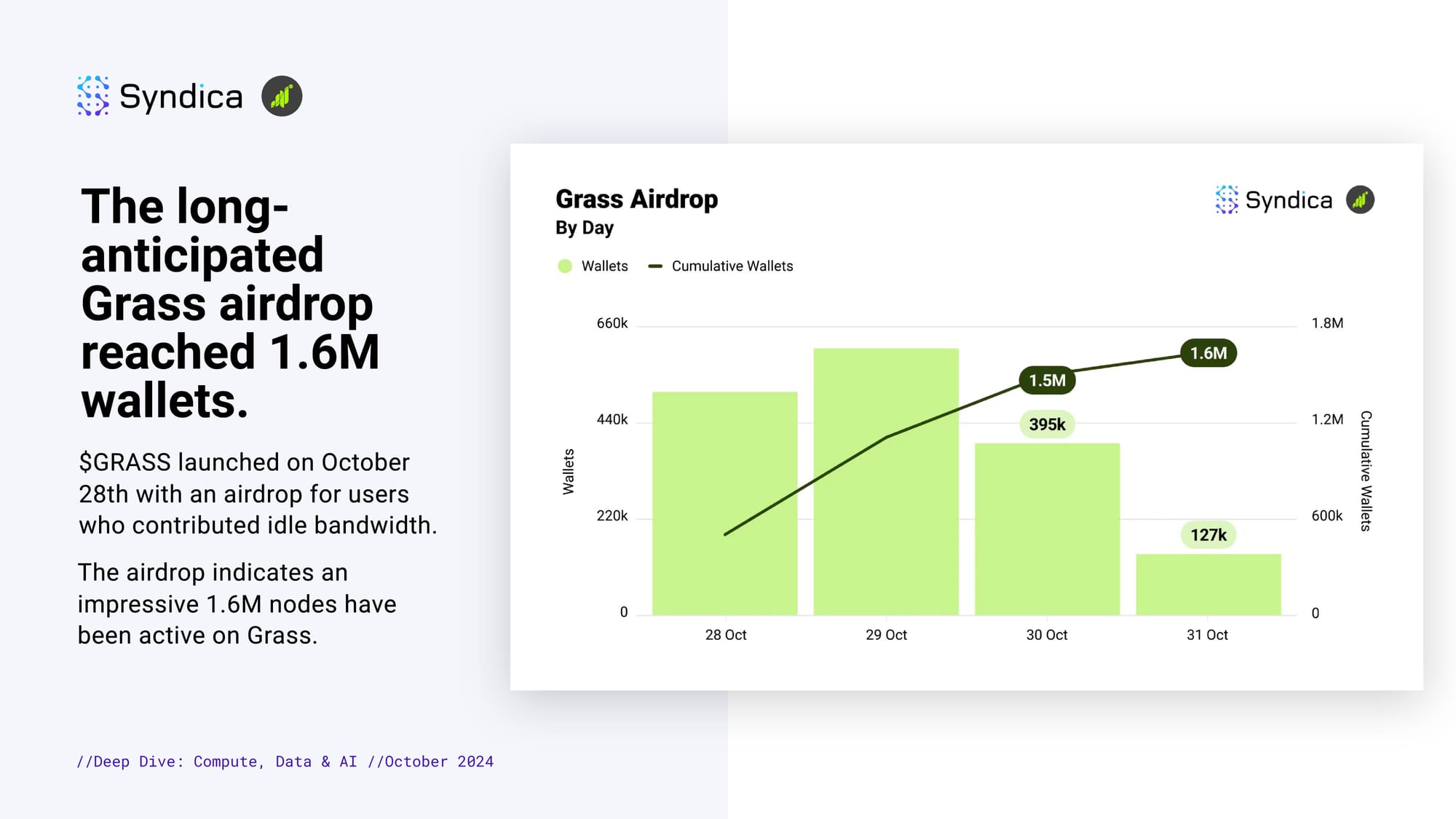

The long-anticipated Grass airdrop reached 1.6M wallets. $GRASS launched on October 28th with an airdrop for users who contributed idle bandwidth. The airdrop indicates an impressive 1.6M nodes have been active on Grass.

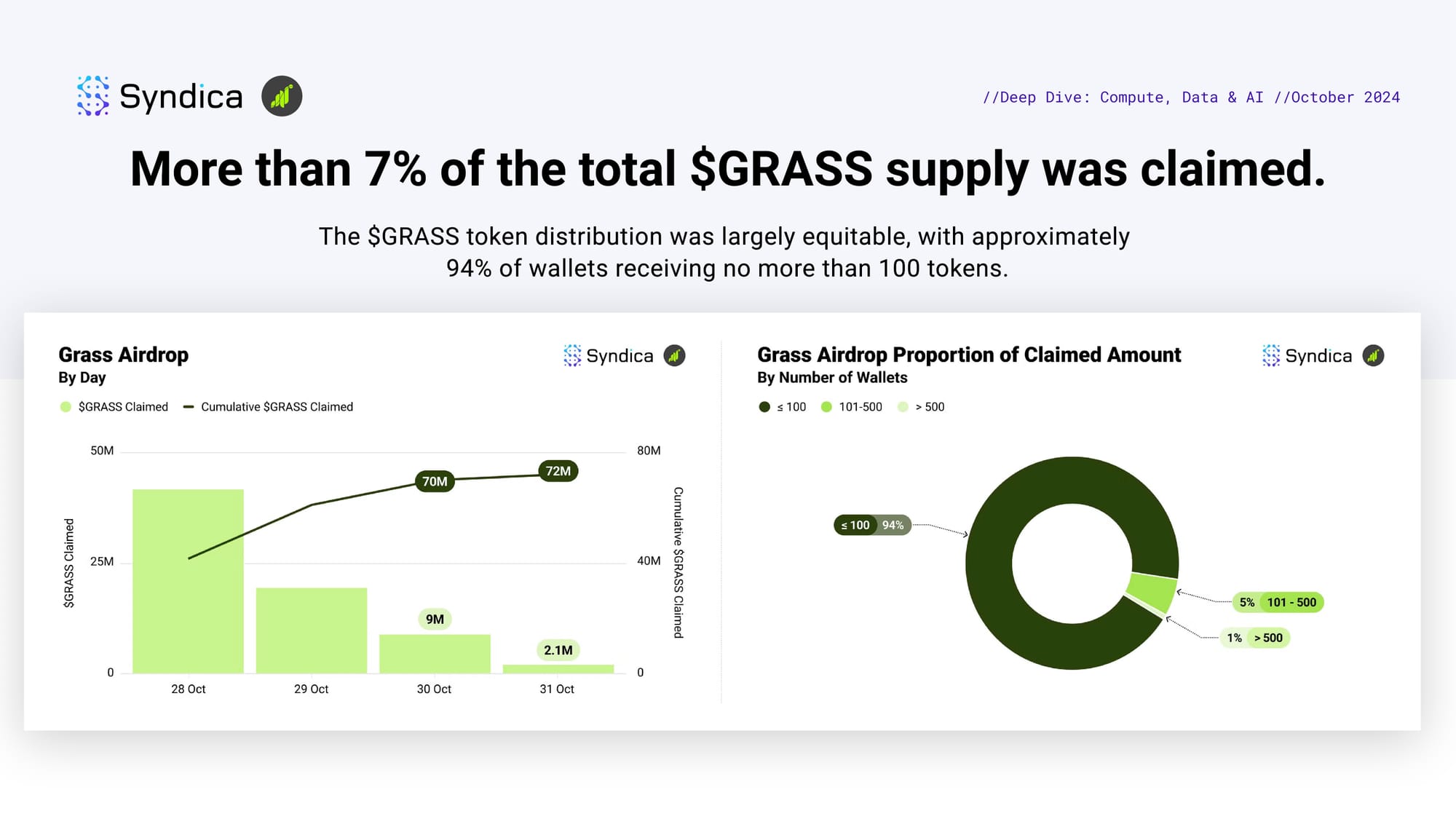

More than 7% of the total $GRASS supply was claimed. The $GRASS token distribution was largely equitable, with approximately 94% of wallets receiving no more than 100 tokens.

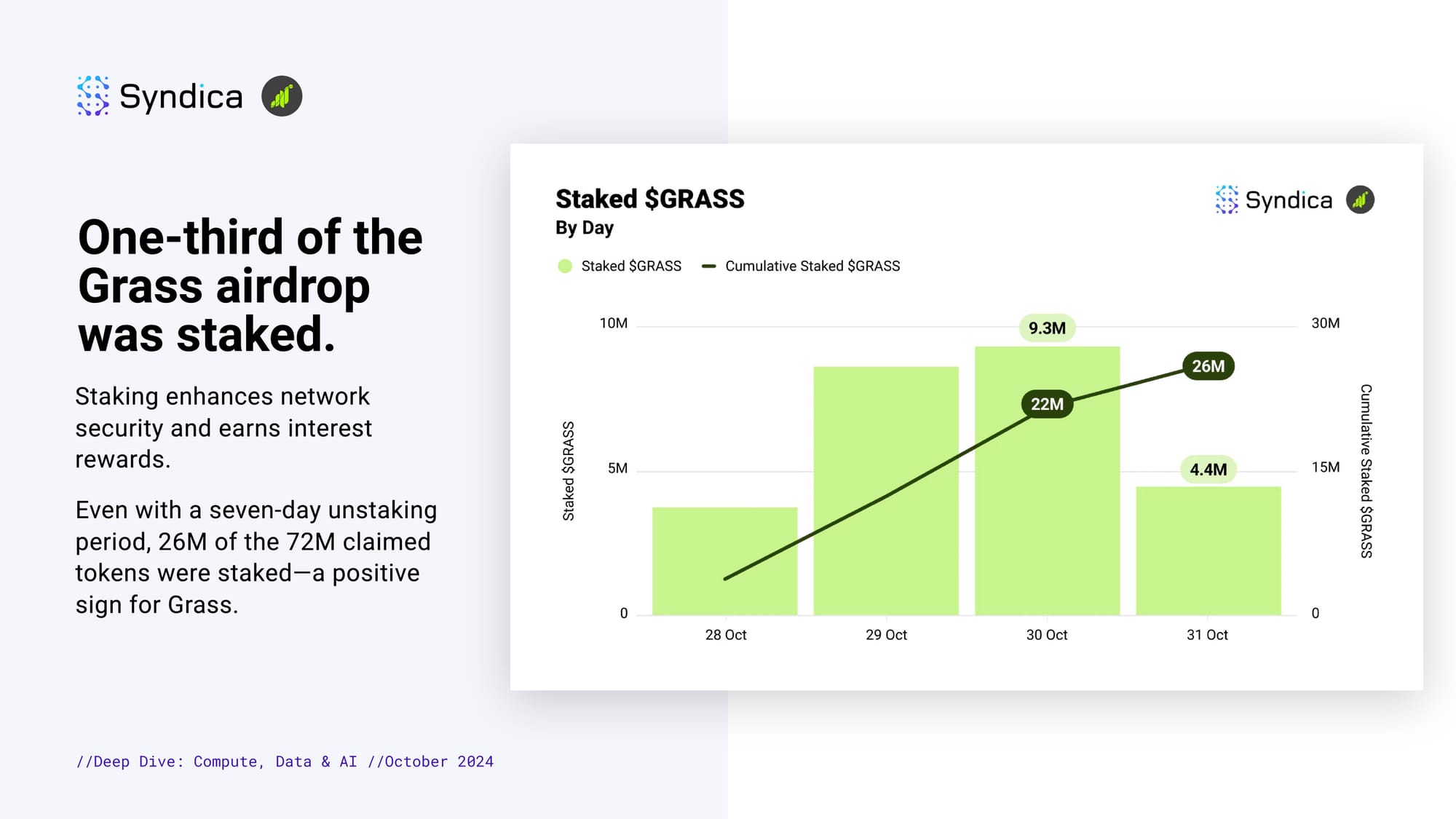

One-third of the Grass airdrop was staked. Staking enhances network security and earns interest rewards. Even with a seven-day unstaking period, 26M of the 72M claimed tokens were staked—a positive sign for Grass.

Notable Developments

Render Network Cinema 4D Wizard has been expanded to support Redshift. The team also spoke at different conferences such as Pemissionless 2024 in October.

UpRock's $UPT token was listed in several centralized exchanges such as MEXC. The team introduced device verification to eliminate fraud.

Nosana's LLM Benchmarking research showed that consumer-grade hardware has advantages in cost efficiency and performance over enterprise hardware.

Grass launched its token and staking mechanism. The team is now focused on stage 2 of the network, capturing the web by building a user-owned map.

Part III: Mapping

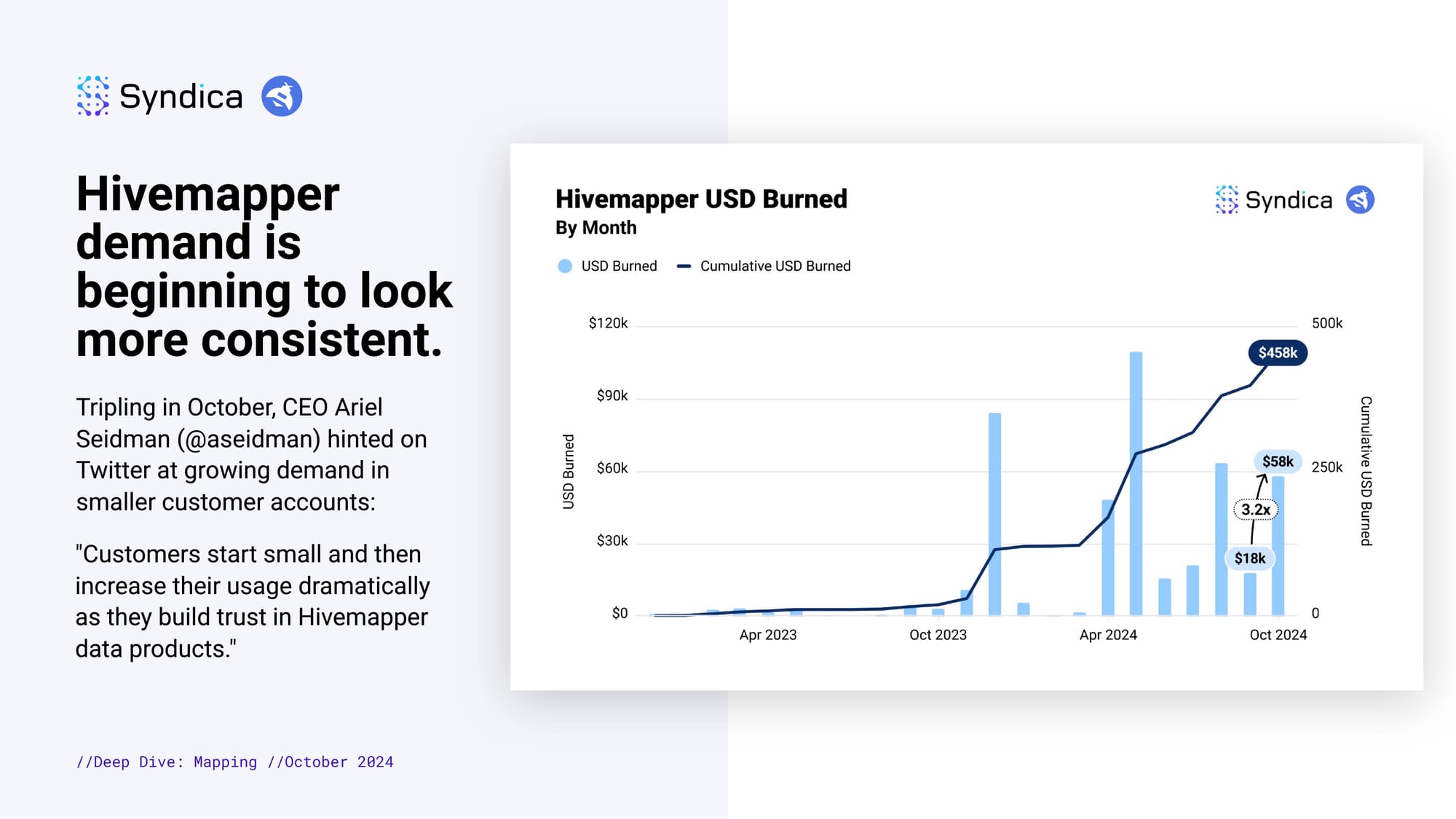

Hivemapper demand is beginning to look more consistent. Tripling in October, CEO Ariel Seidman (@aseidman) hinted on Twitter at growing demand in smaller customer accounts: "Customers start small and then increase their usage dramatically as they build trust in Hivemapper data products."

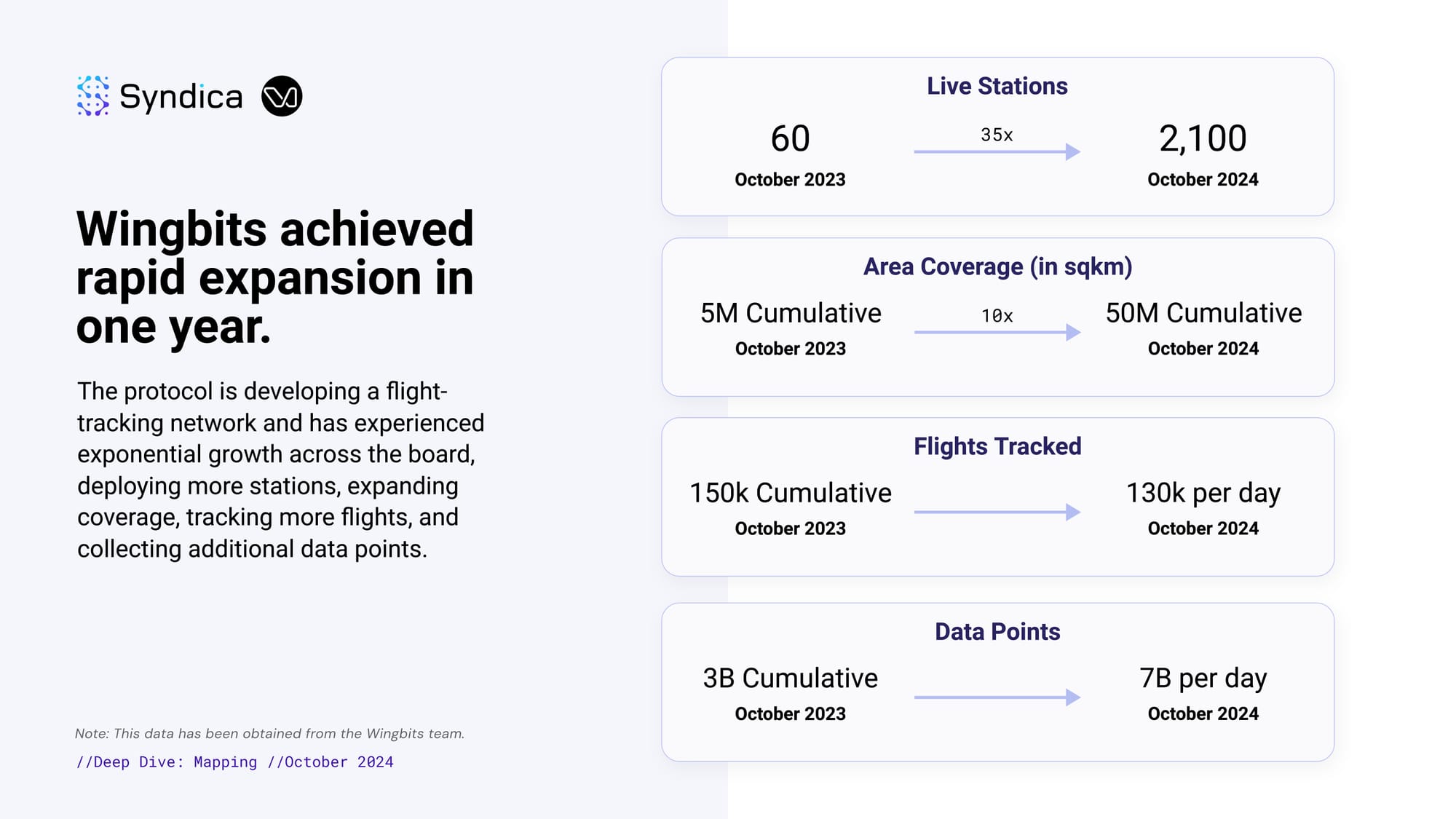

Wingbits achieved rapid expansion in one year. The protocol is developing a flight-tracking network and has experienced exponential growth across the board, deploying more stations, expanding coverage, tracking more flights, and collecting additional data points.

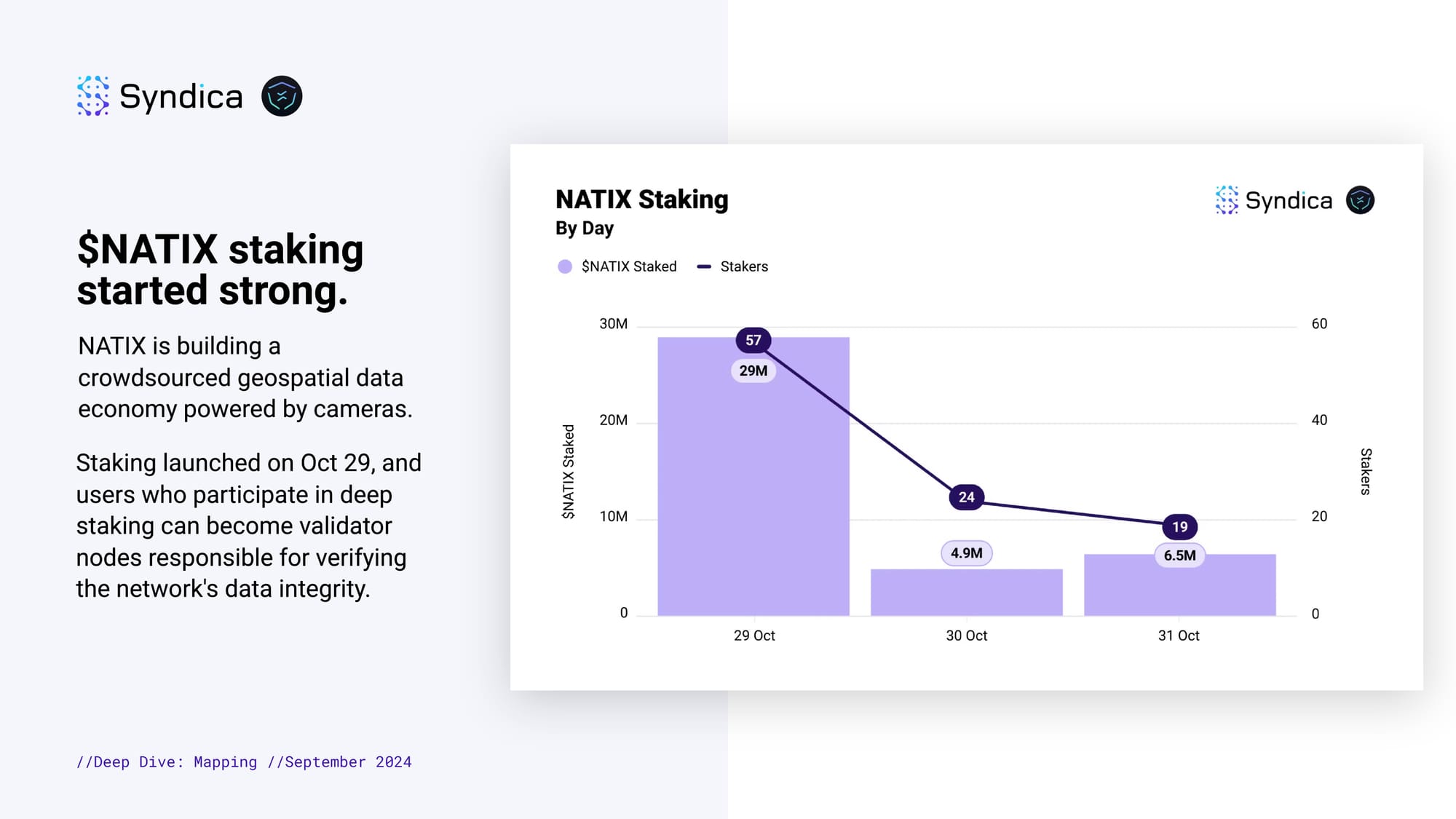

$NATIX staking started strong. NATIX is building a crowdsourced geospatial data economy powered by cameras. Staking launched on Oct 29, and users who participate in deep staking can become validator nodes responsible for verifying the network's data integrity.

Part IV: Energy

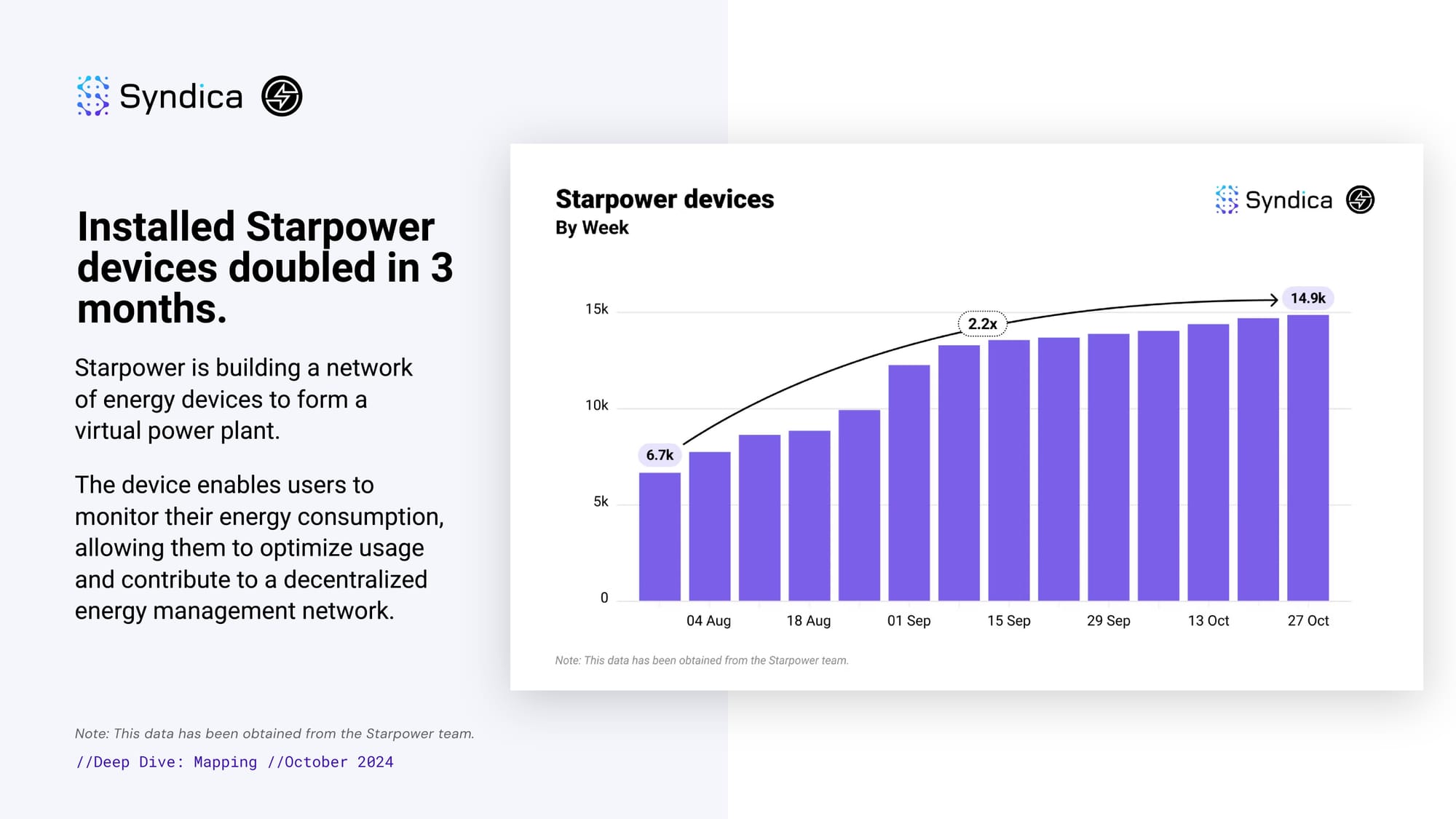

Installed Starpower devices doubled in 3 months. Starpower is building a network of energy devices to form a virtual power plant. The device enables users to monitor their energy consumption, allowing them to optimize usage and contribute to a decentralized energy management network.

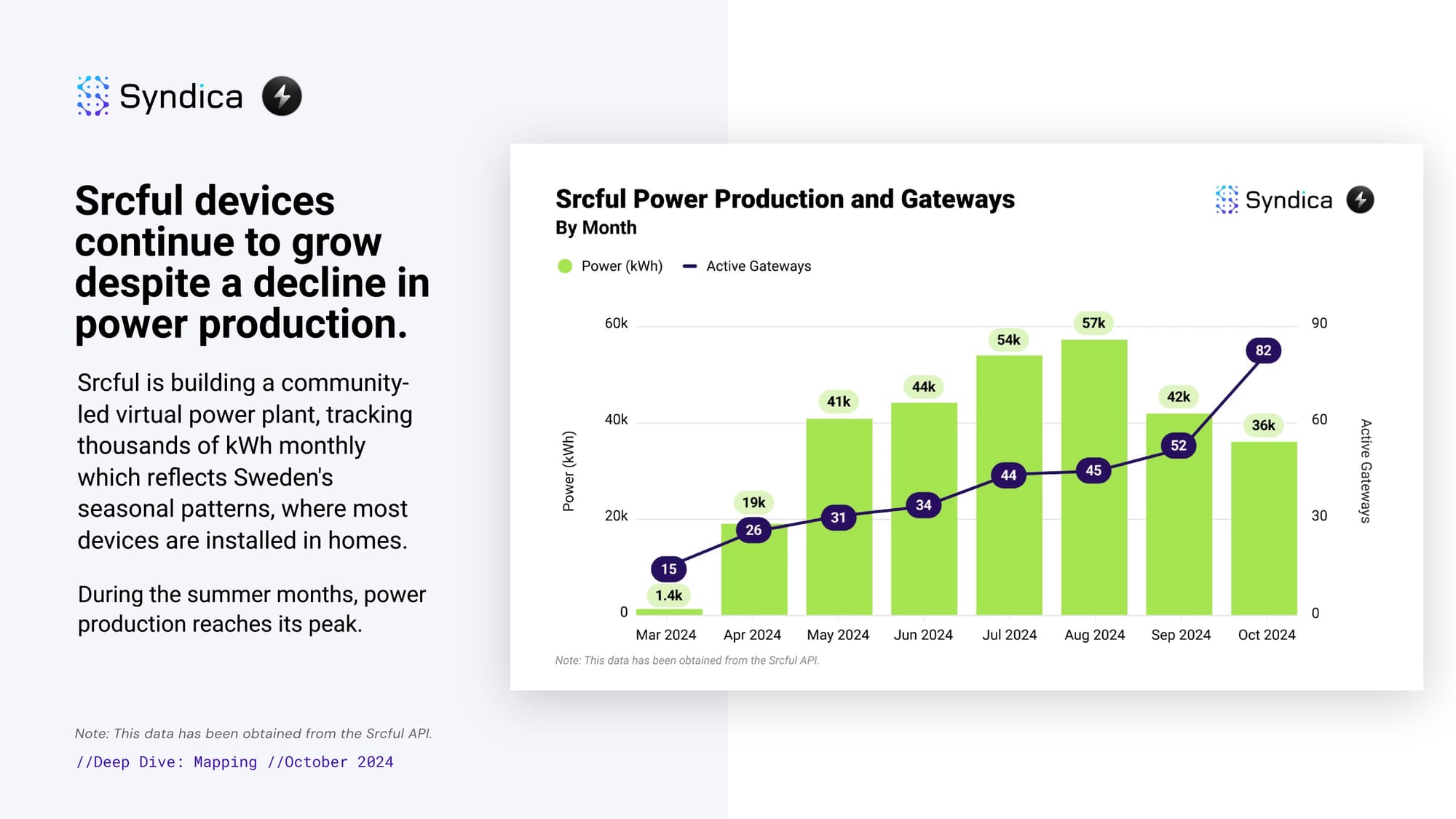

Srcful devices continue to grow despite a decline in power production. Srcful is building a community-led virtual power plant, tracking thousands of kWh monthly, which reflects Sweden's seasonal patterns, where most devices are installed in homes. During the summer months, power production reaches its peak.