Deep Dive: Solana DePIN - October 2025

Deep Dive: Solana DePIN - October 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DePIN - October 2025

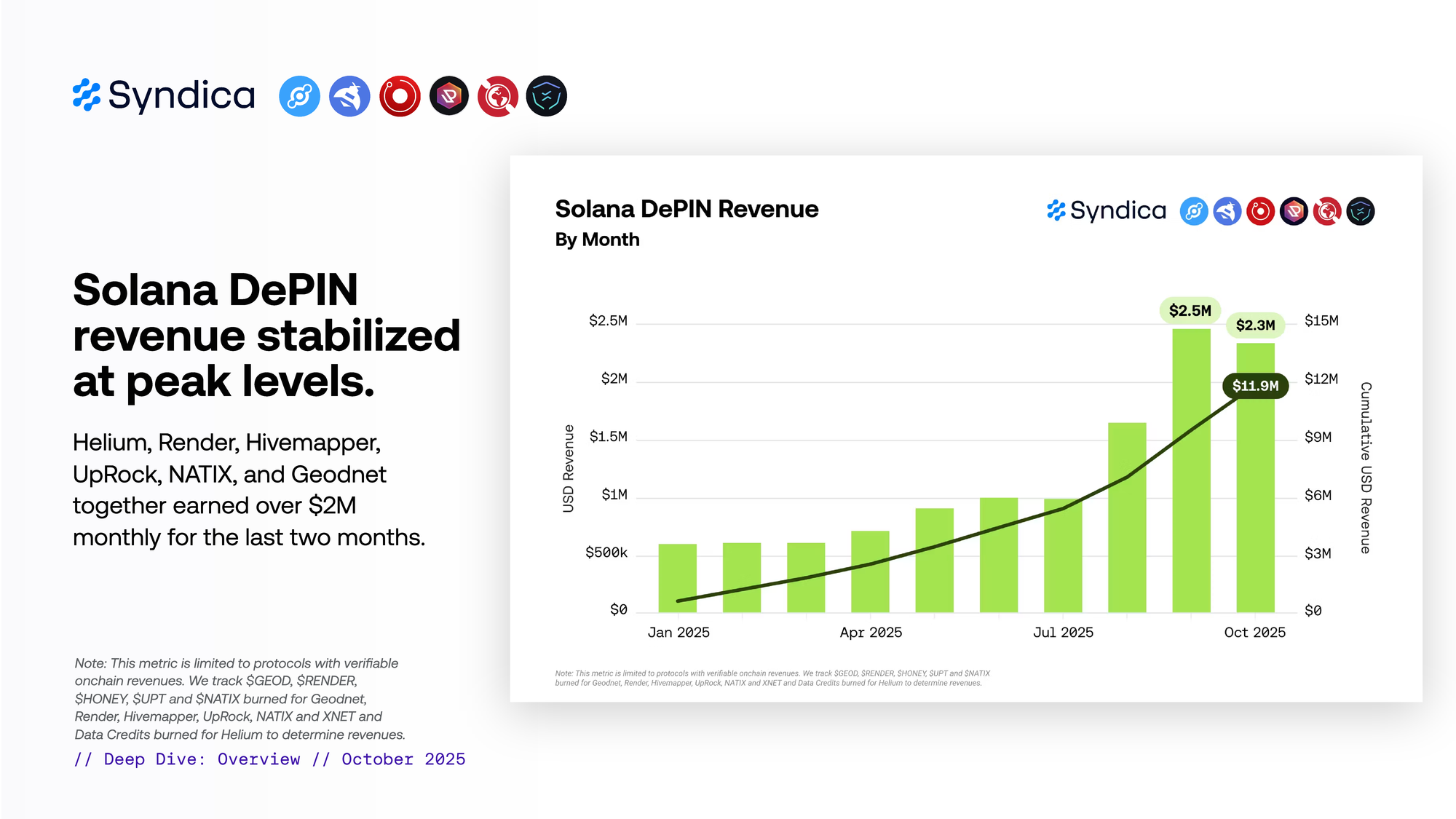

Solana DePIN revenue stabilized at peak levels. Helium, Render, Hivemapper, UpRock, NATIX, and Geodnet together earned over $2M monthly for the last two months.

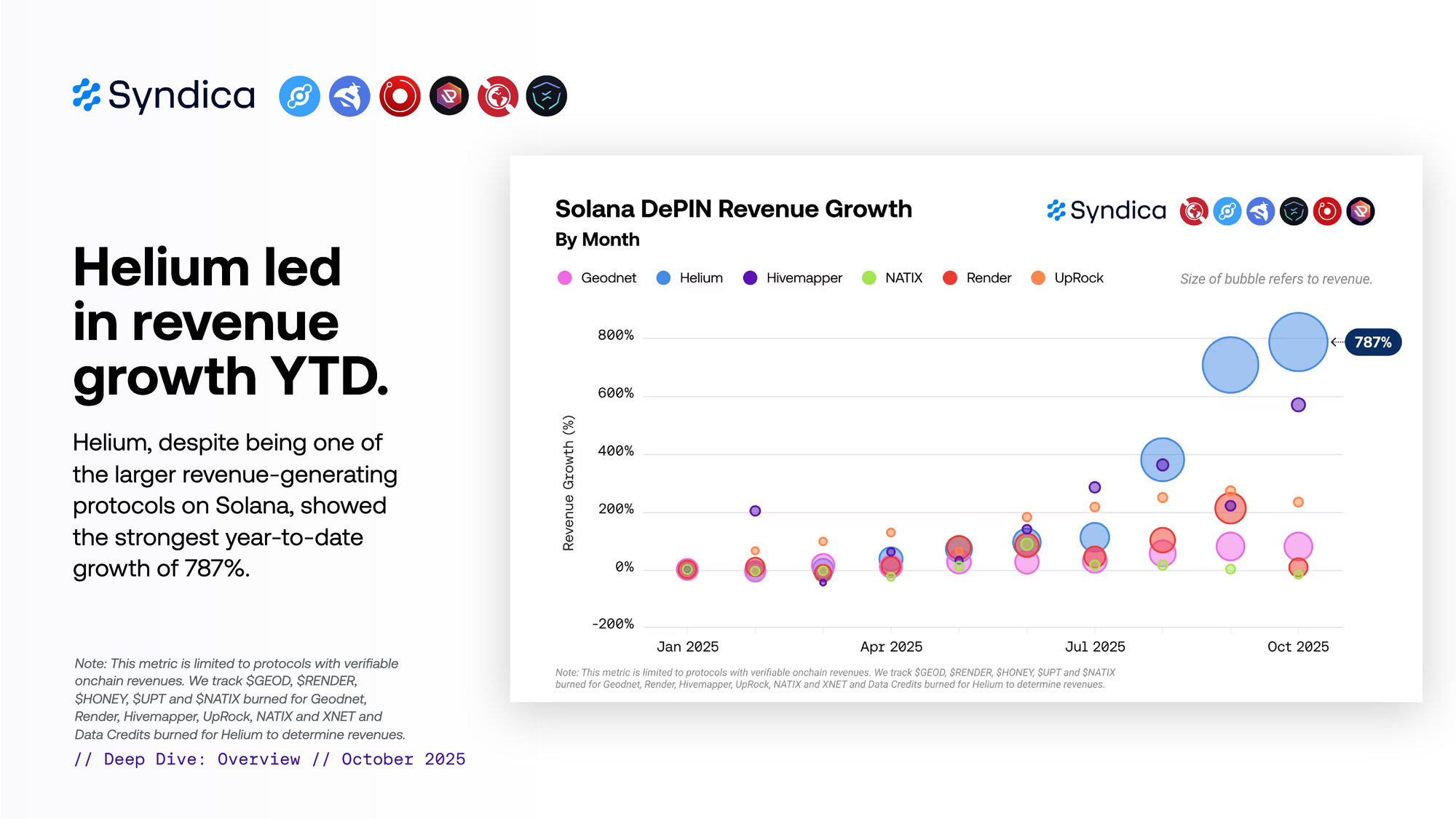

Helium led in revenue growth YTD. Helium, despite being one of the larger revenue-generating protocols on Solana, showed the strongest year-to-date growth of 787%.

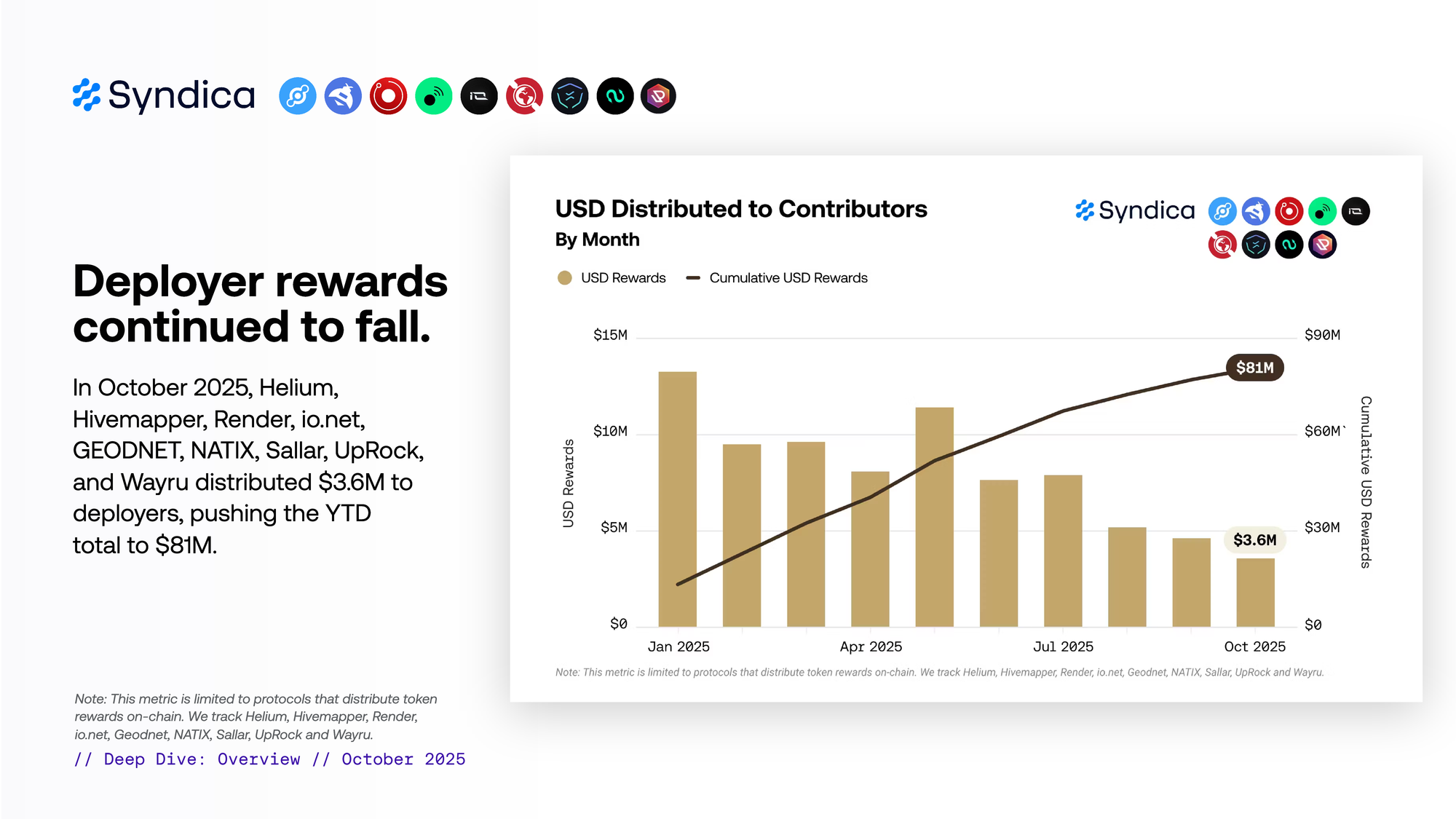

Deployer rewards continued to fall. In October 2025, Helium, Hivemapper, Render, io.net, GEODNET, NATIX, Sallar, UpRock, and Wayru distributed $3.6M to deployers, pushing the YTD total to $81M.

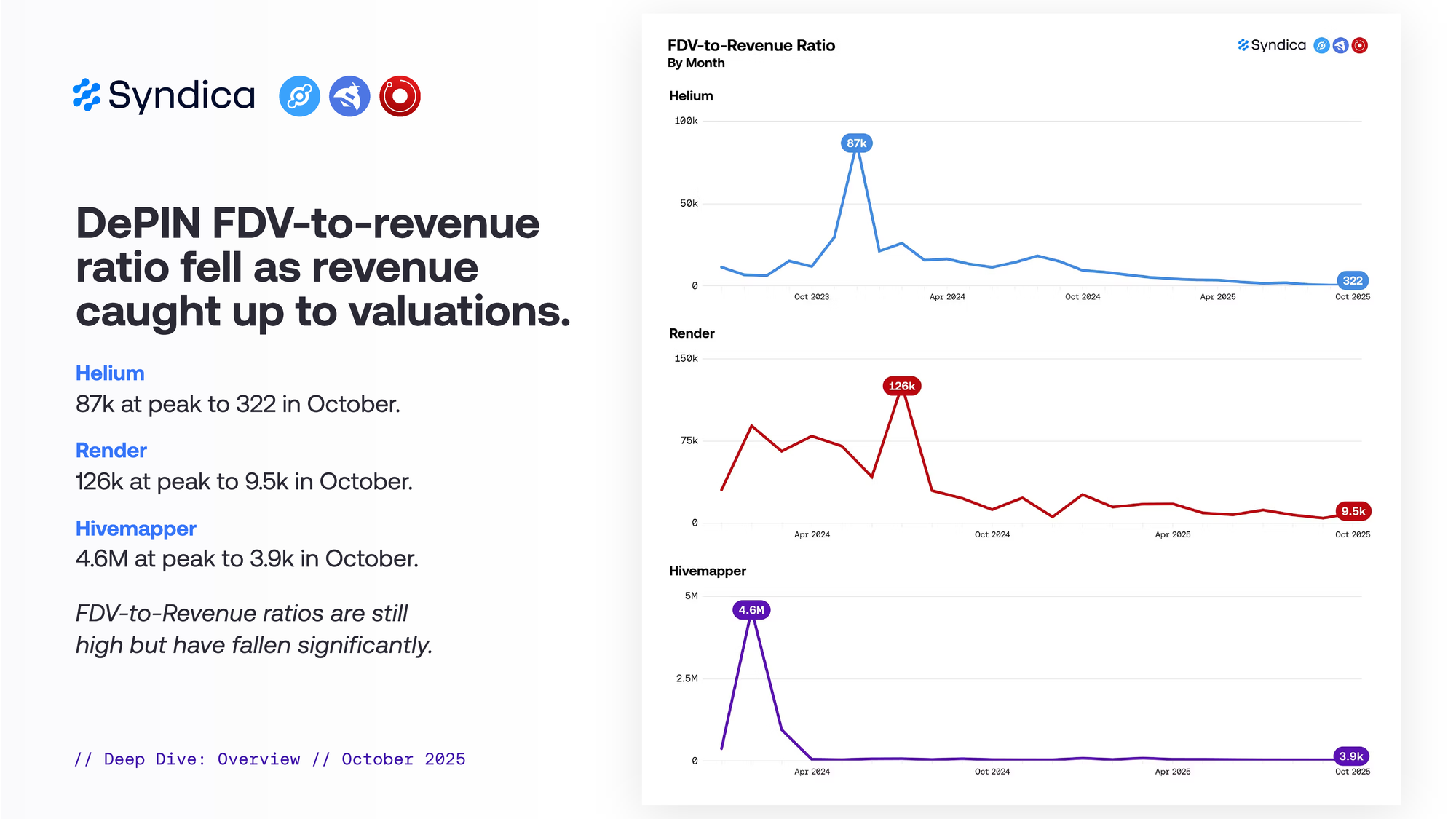

DePIN FDV-to-revenue ratio fell as revenue caught up to valuations.

Helium

87k at peak to 322 at present.

Render

126k at peak to 9.5k at present.

Hivemapper

4.6M at peak to 3.9k at present.

FDV-to-Revenue ratios are still high but have fallen significantly.

Part I - Wireless

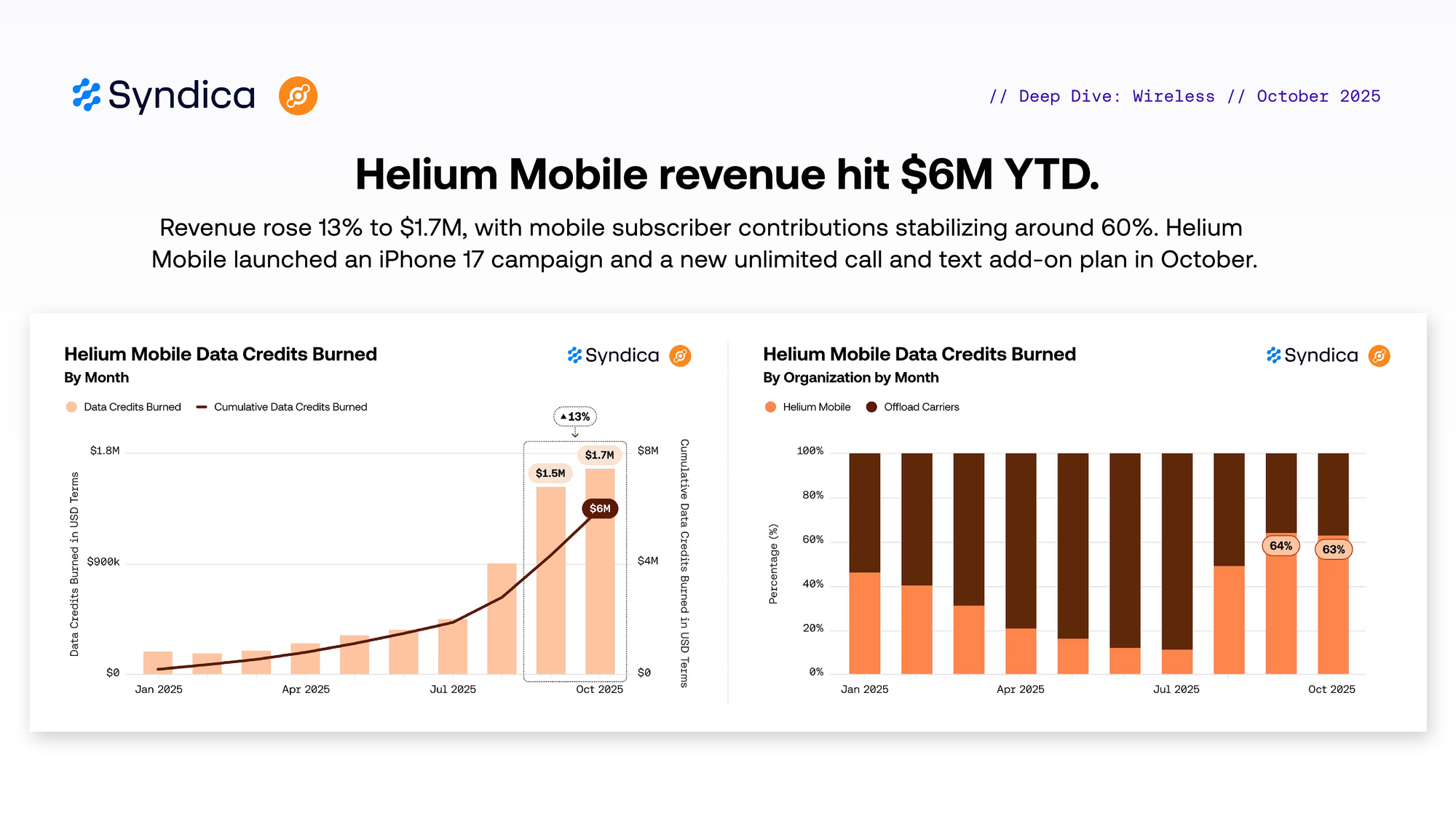

Helium Mobile revenue hit $6M YTD. Revenue rose 13% to $1.7M, with mobile subscriber contributions stabilizing around 60%. Helium Mobile launched an iPhone 17 campaign and a new unlimited call and text add-on plan in October.

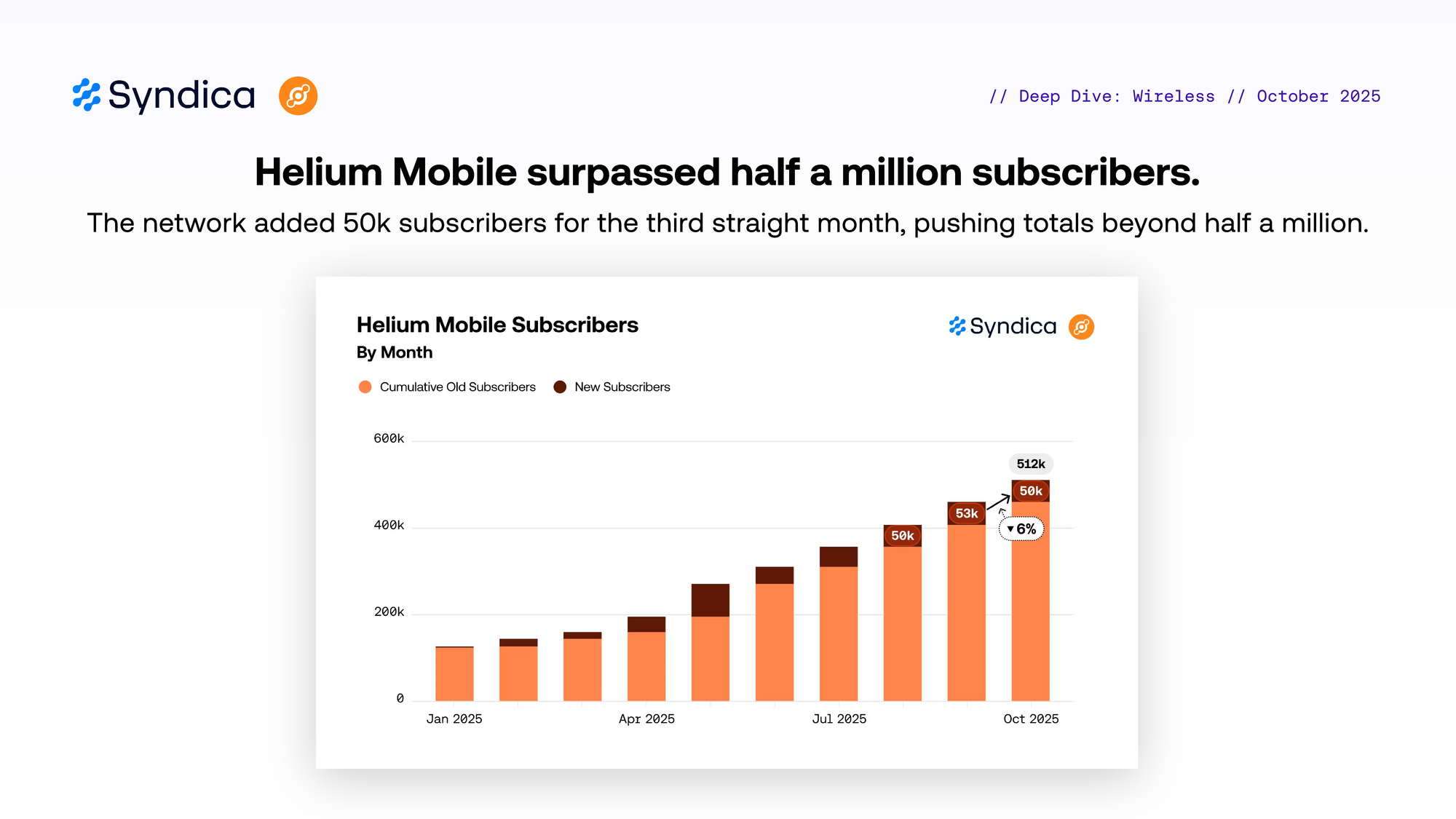

Helium Mobile surpassed half a million subscribers. The network added 50k subscribers for the third straight month, pushing totals beyond half a million.

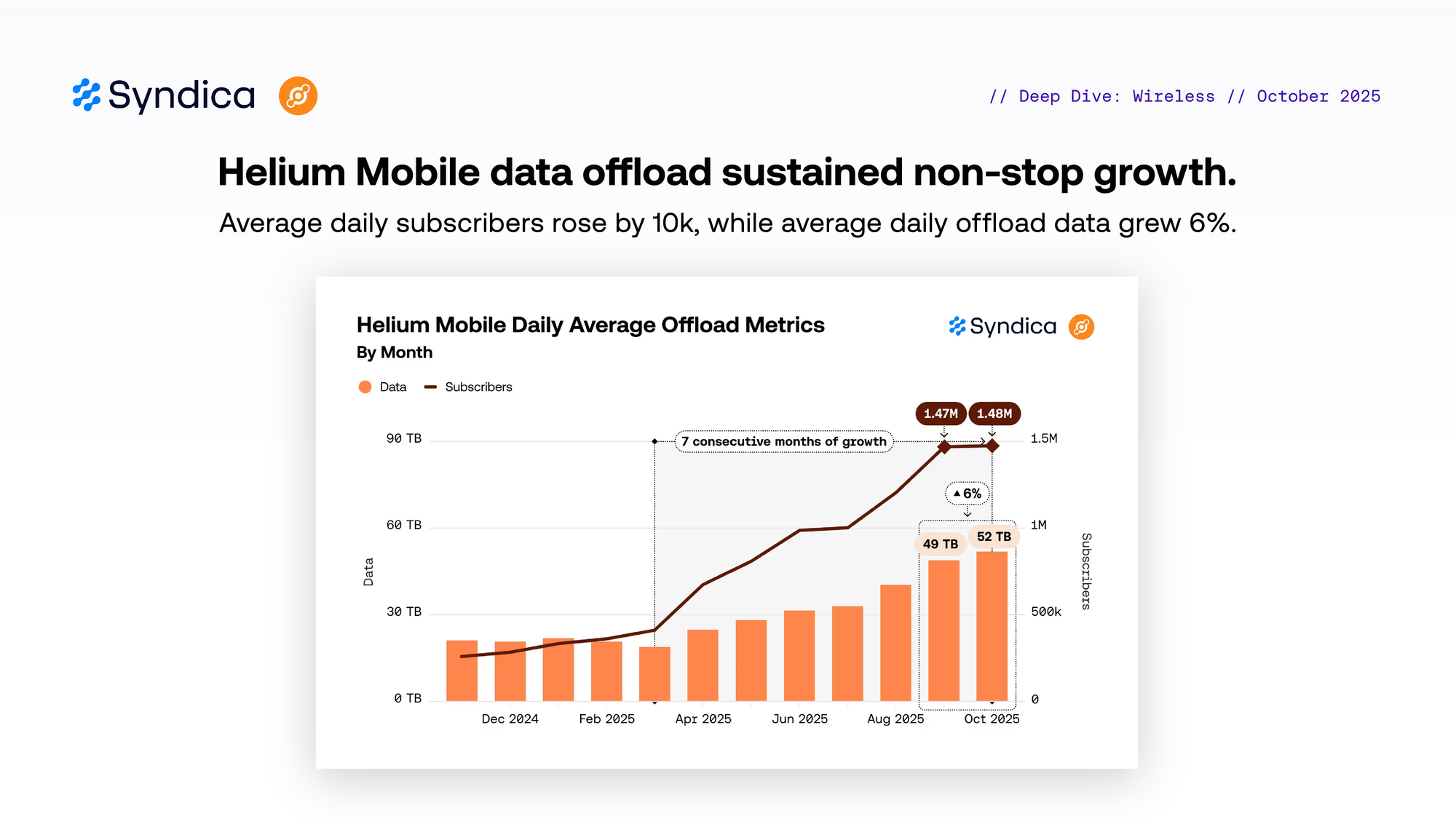

Helium Mobile data offload sustained non-stop growth. Average daily subscribers rose by 10k, while average daily offload data grew 6%.

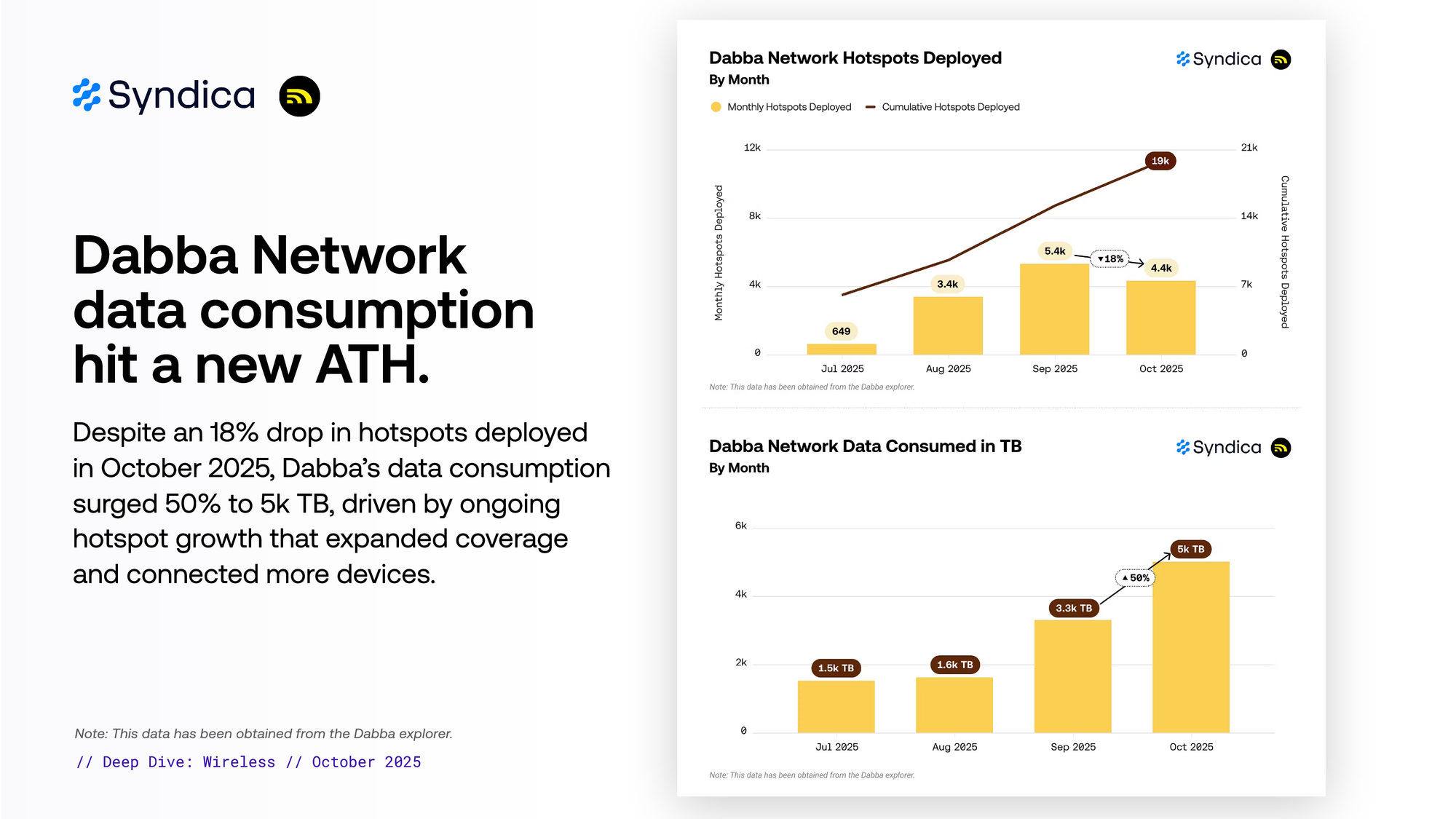

Dabba Network data consumption hit a new ATH. Despite an 18% drop in hotspots deployed in October 2025, Dabba’s data consumption surged 50% to 5k TB, driven by ongoing hotspot growth that expanded coverage and connected more devices.

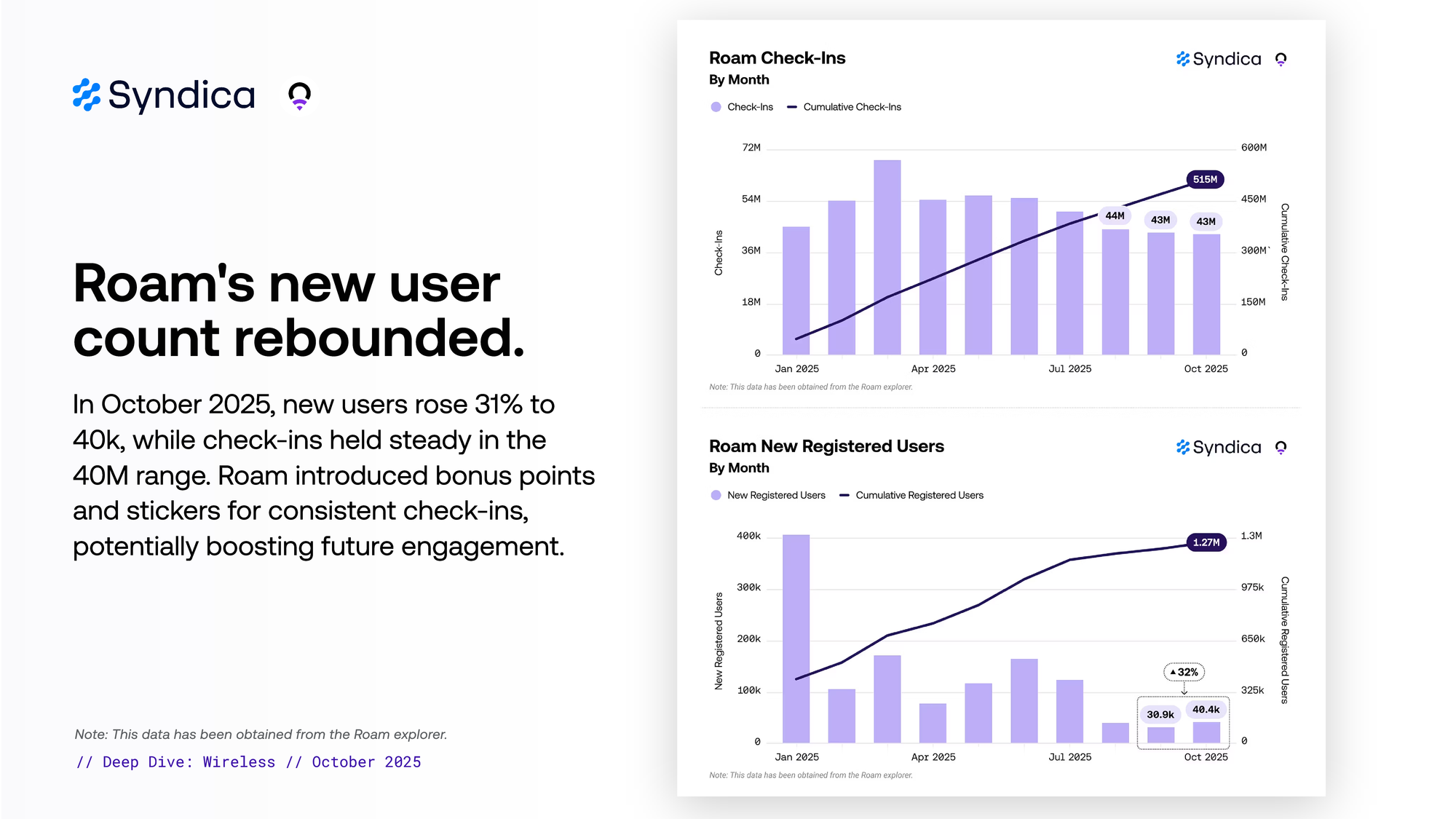

Roam's new user count rebounded. In October 2025, new users rose 31% to 40k, while check-ins held steady in the 40M range. Roam introduced bonus points and stickers for consistent check-ins, potentially boosting future engagement.

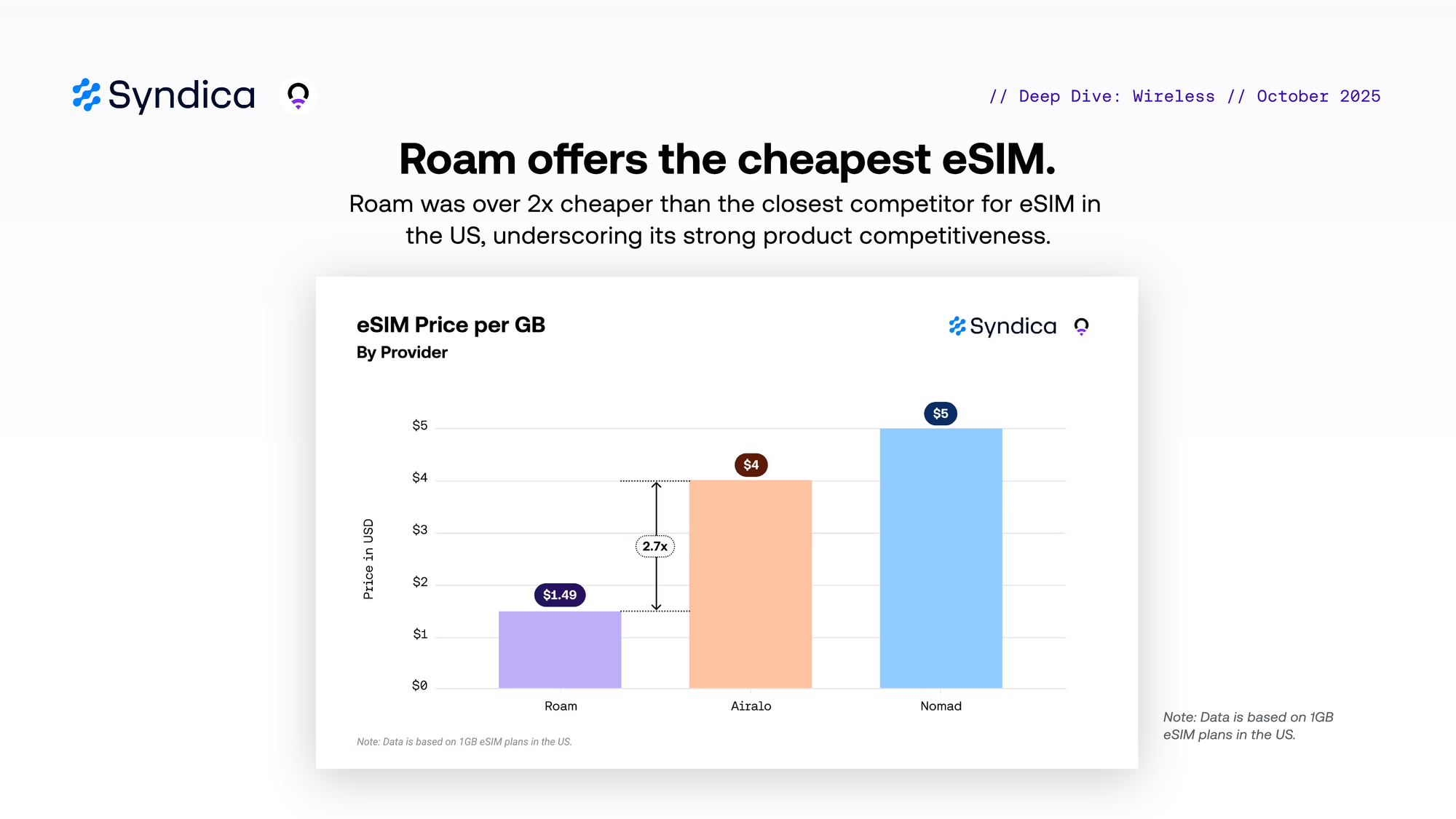

Roam offers the cheapest eSIM. Roam was over 2x cheaper than the closest competitor for eSIM in the US, underscoring its strong product competitiveness.

Part II - Mapping and Location

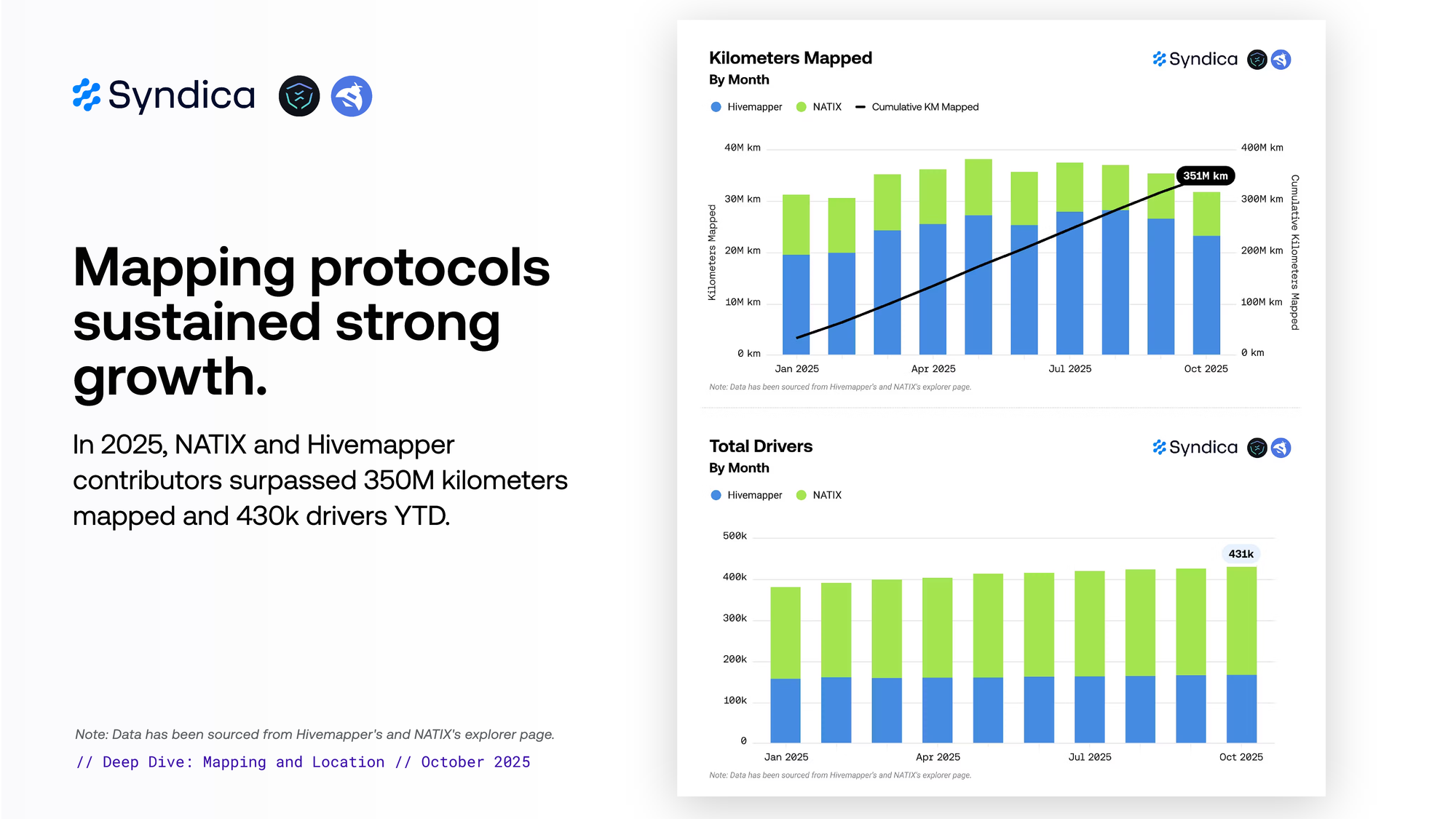

Mapping protocols sustained strong growth. In 2025, NATIX and Hivemapper contributors surpassed 350M kilometers mapped and 430k drivers YTD.

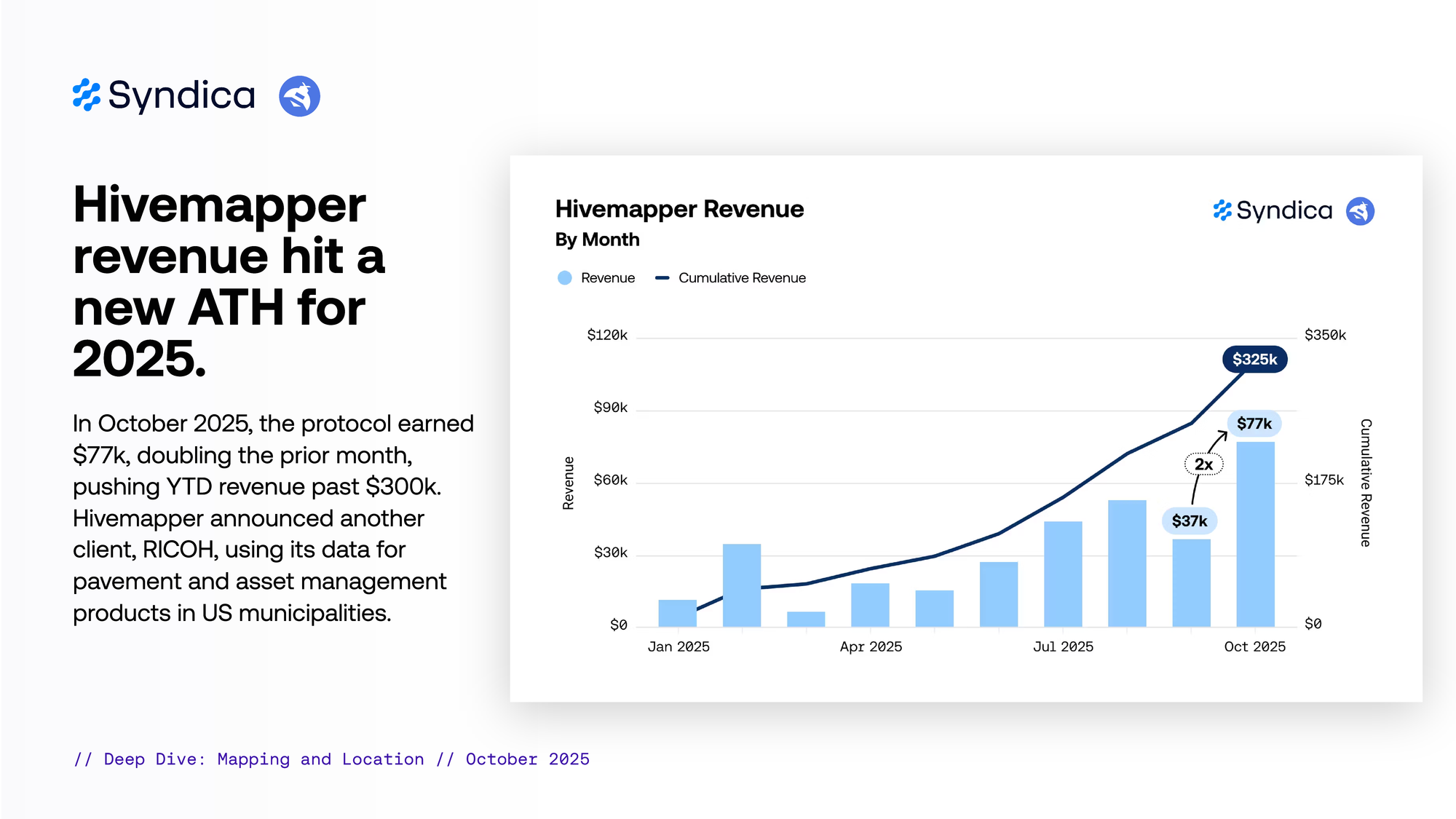

Hivemapper revenue hit a new ATH for 2025. In October 2025, the protocol earned $77k, doubling the prior month, pushing YTD revenue past $300k. Hivemapper announced another client, RICOH, using its data for pavement and asset management products in US municipalities.

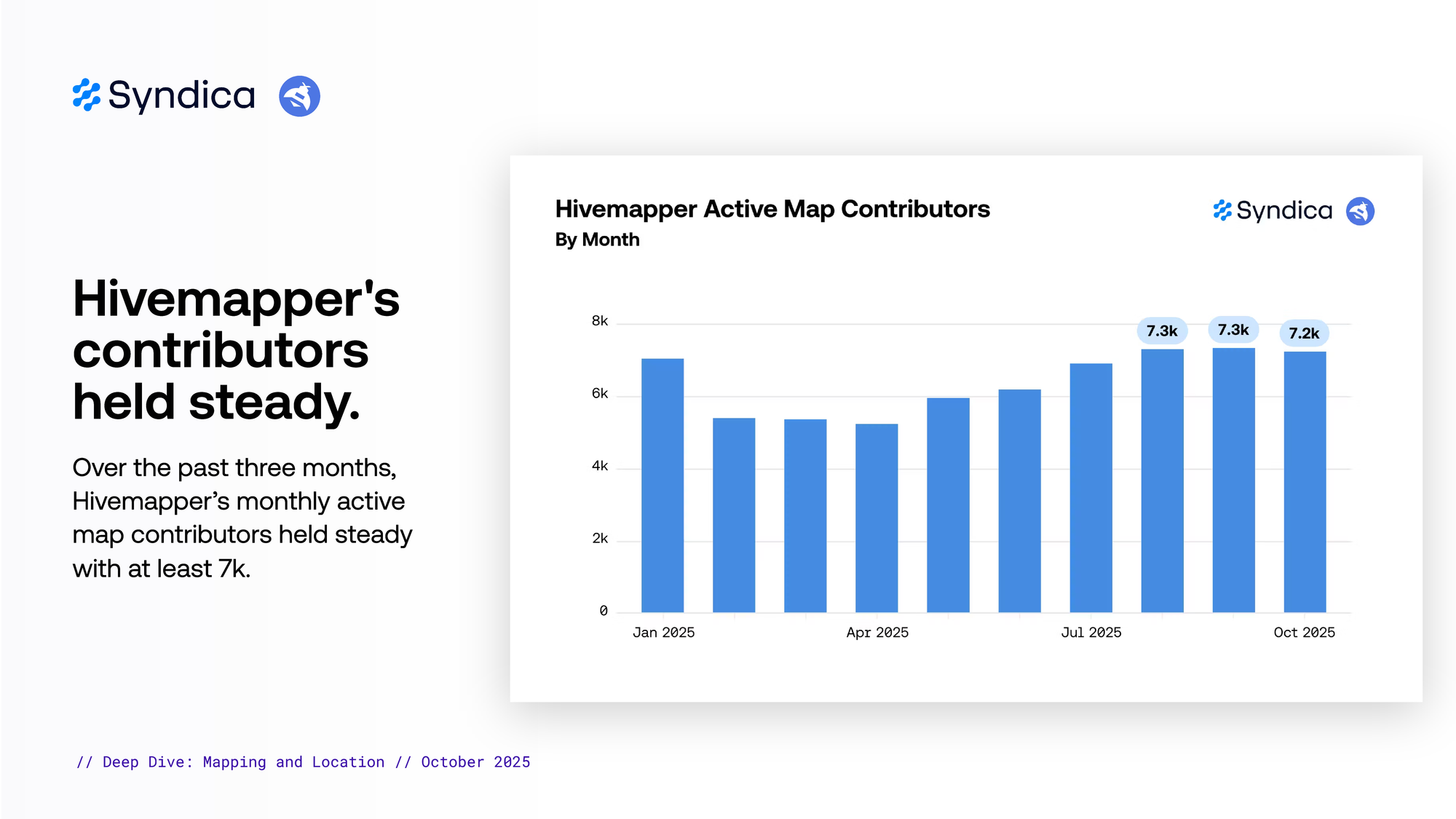

Hivemapper's contributors held steady. Over the past three months, Hivemapper’s monthly active map contributors held steady with at least 7k.

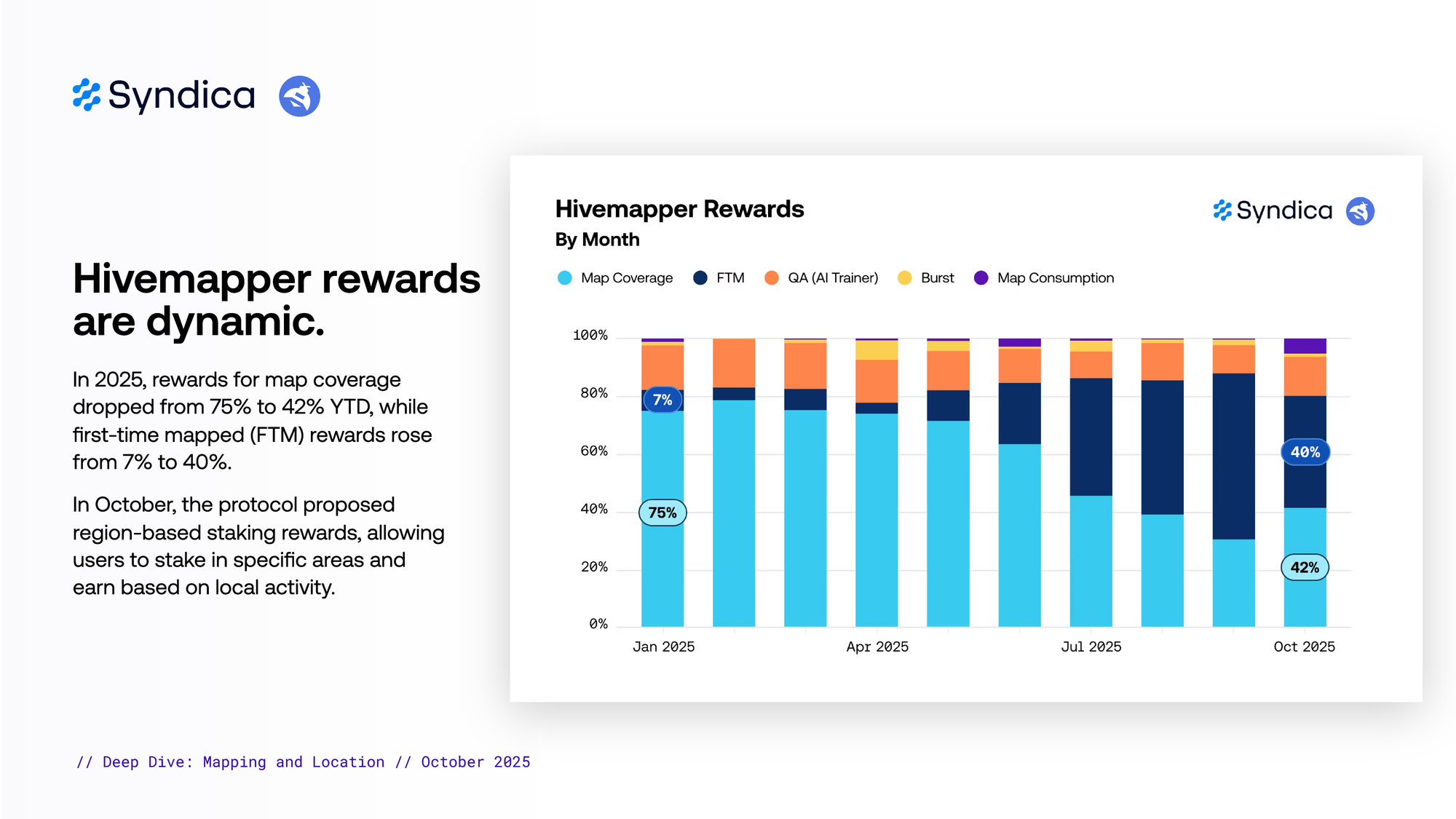

Hivemapper rewards are dynamic. In 2025, rewards for map coverage dropped from 75% to 42% YTD, while first-time mapped (FTM) rewards rose from 7% to 40%. In October, the protocol proposed region-based staking rewards, allowing users to stake in specific areas and earn based on local activity.

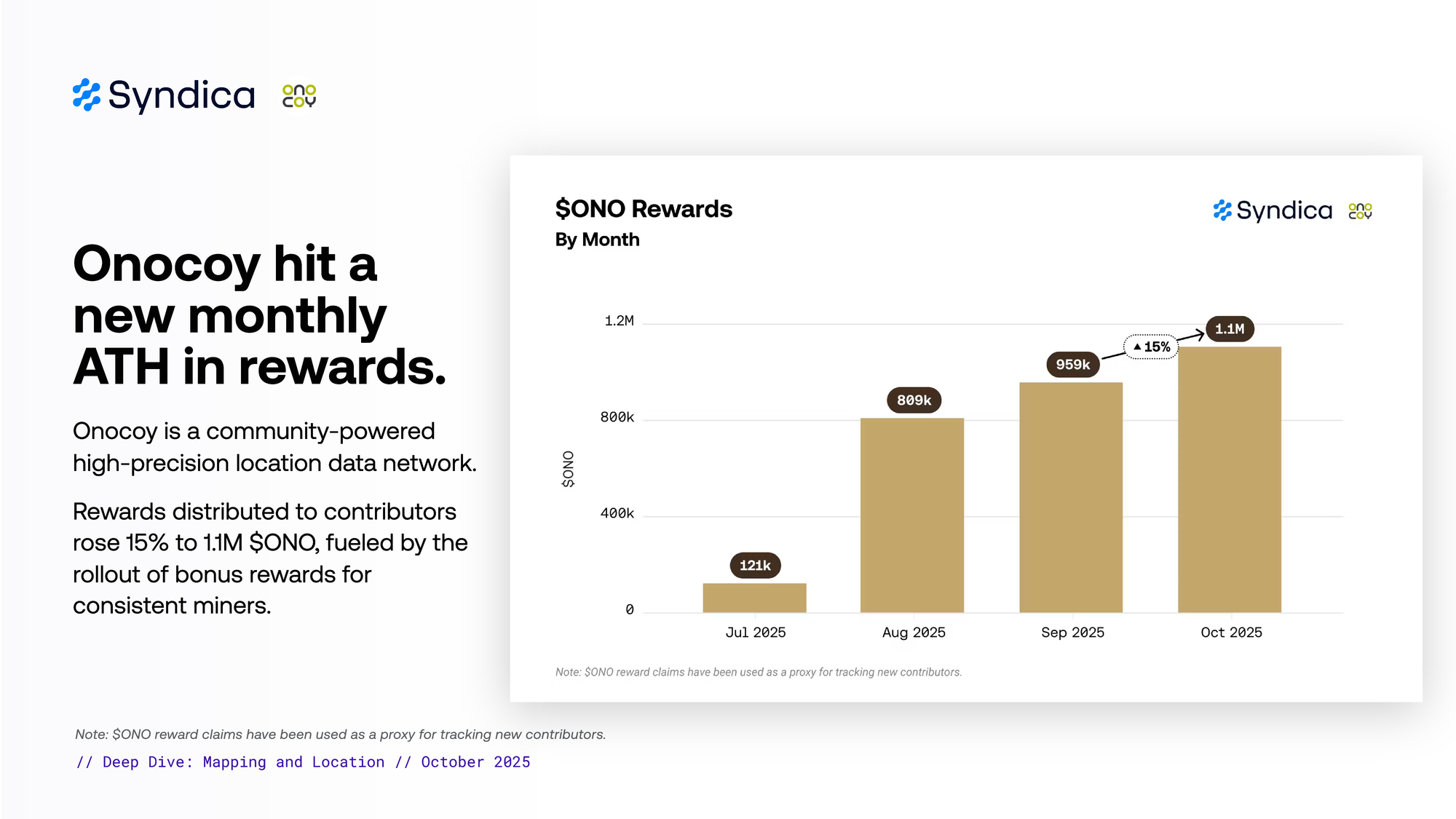

Onocoy hit a new monthly ATH in rewards. Onocoy is a community-powered high-precision location data network. Rewards distributed to contributors rose 15% to 1.1M $ONO, fueled by the rollout of bonus rewards for consistent miners.

Part III - Compute, AI, & Data

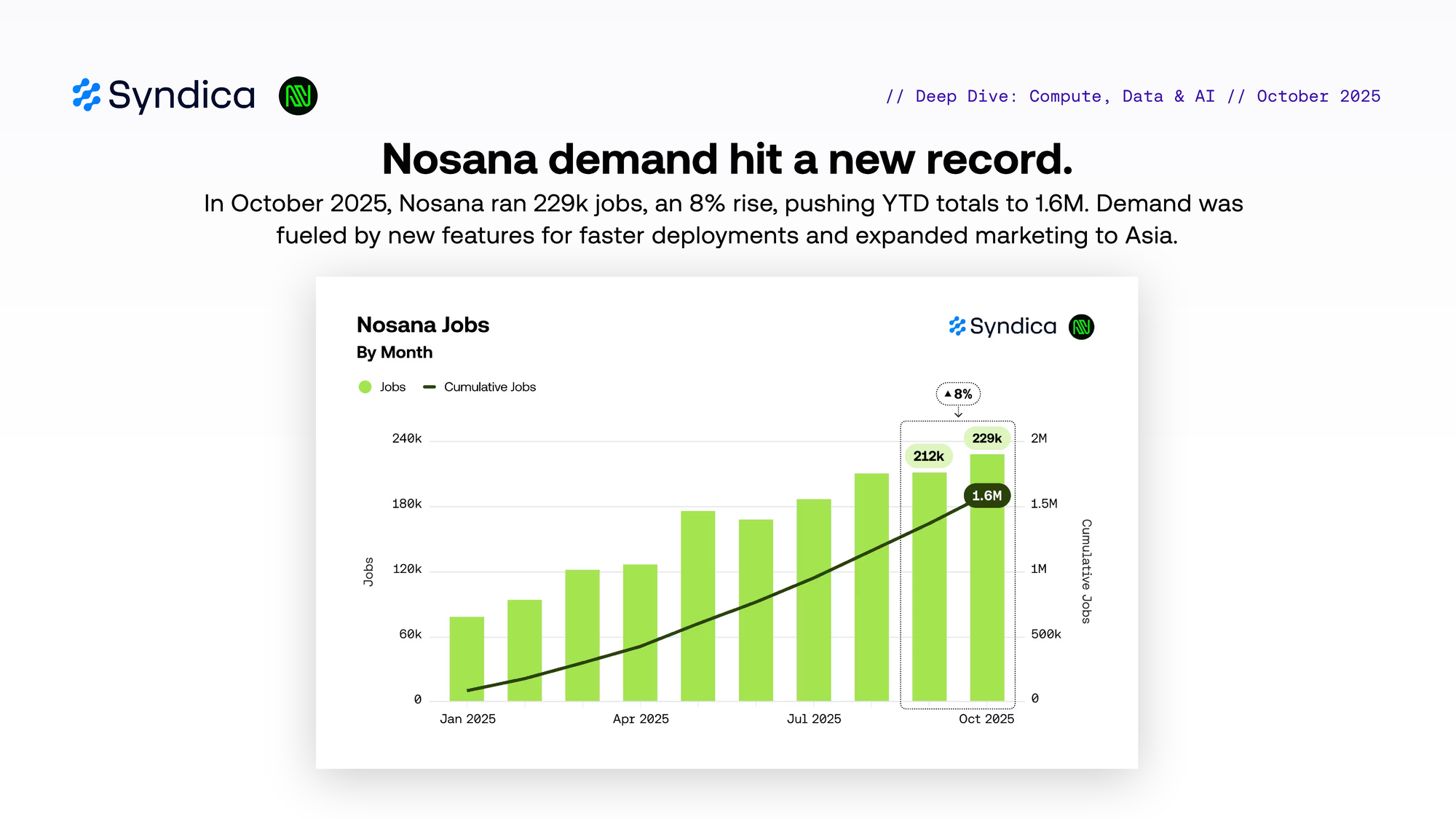

Nosana demand hit a new record. In October 2025, Nosana ran 229k jobs, an 8% rise, pushing YTD totals to 1.6M. Demand was fueled by new features for faster deployments and expanded marketing to Asia.

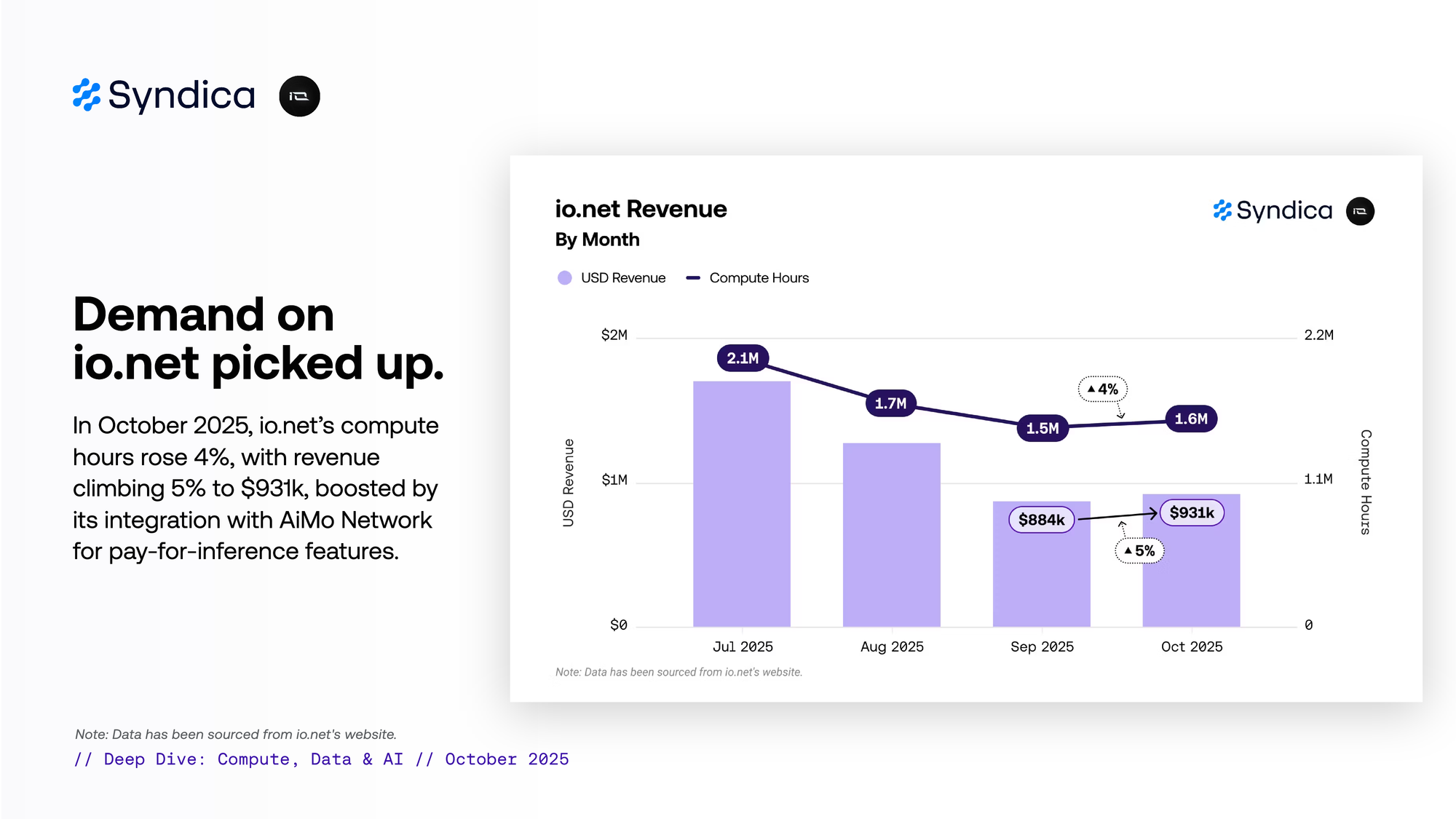

Demand on io.net picked up. In October 2025, io.net’s compute hours rose 4%, with revenue climbing 5% to $931k, boosted by its integration with AiMo Network for pay-for-inference features.

Part IV - News

Notable Developments

Pipe Network launched Pipe's Workdrop Program, a system that pays for "Proof of Work". Contributors receive a 2x reward booster for the first 12 months of mainnet.

Ping Network wrapped up season 1 as season 2 starts soon. The network held an accelerate week with boosted rewards for both new and current contributors.

Starpower launched an AI x Energy Funding powered by their token, $STAR, to build the virtual power plant on-chain in partnership with energy pioneers.

NATIX Network launched Navigation V2 to their Drive& app in collaboration with Magic Lane. This will challenge leading mapping solutions like Waze.