Deep Dive: Solana DePIN - September 2024

Deep Dive: Solana DePIN - September 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana DePIN - September 2024

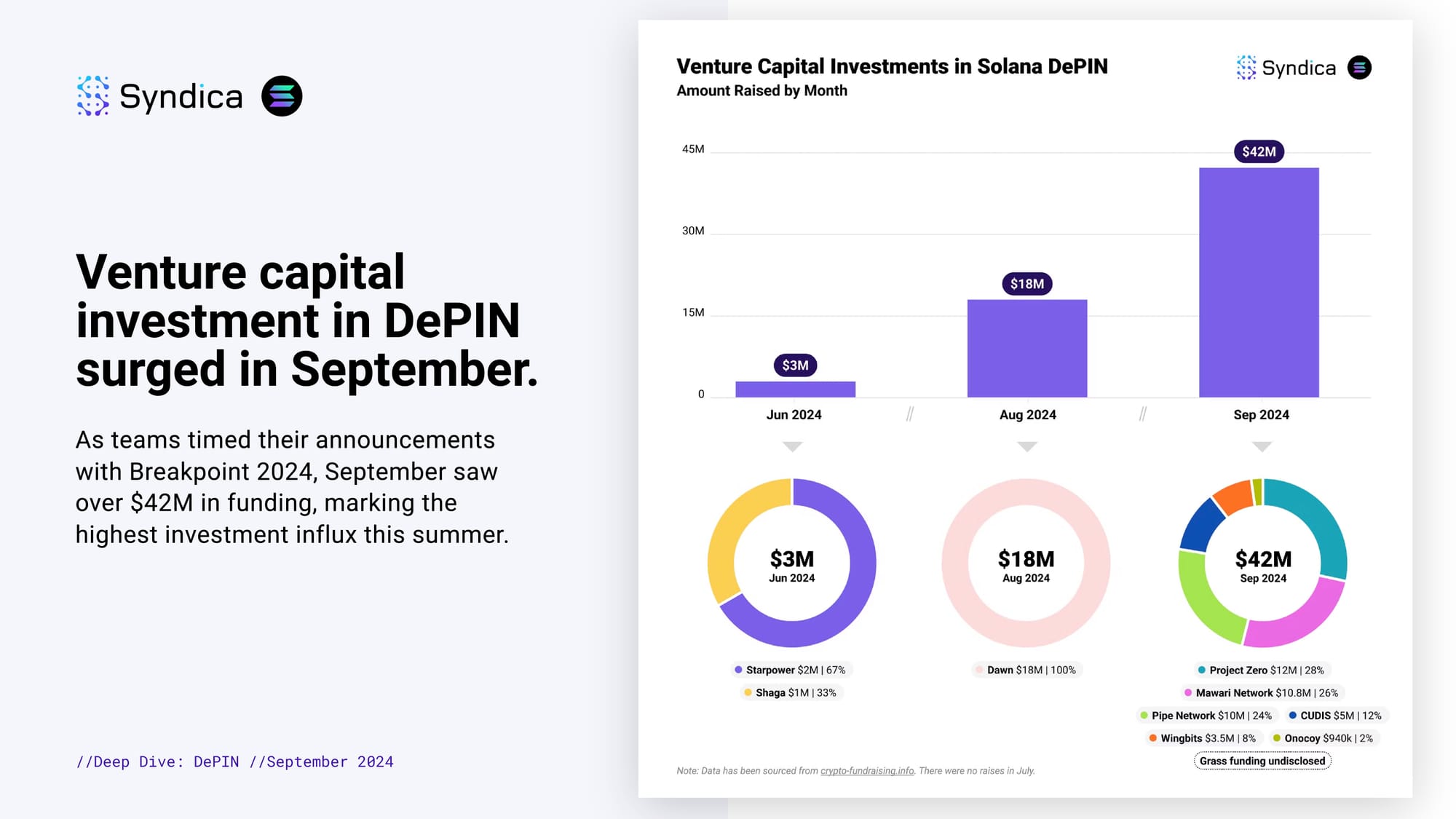

Venture capital investment in DePIN surged in September. As teams timed their announcements with Breakpoint 2024, September saw over $42M in funding, marking the highest investment influx this summer.

Notable Raises:

Pipe Network is developing a decentralized Content Delivery Network and has successfully raised $10M.

Project Zero is a decentralized renewable energy network that recently raised $12M.

Mawari Network is enabling spatial computing at scale, bringing 3D content quickly. The network raised $10.8M.

Starpower is connecting a network of energy devices to form a virtual power plant and raised $2M.

CUDIS is an AI-empowered wearable DePIN that announced a $5M raise.

Wingbits is developing a flight tracking network and has raised $3.5M.

Part I: Solana AI, Compute, & Data

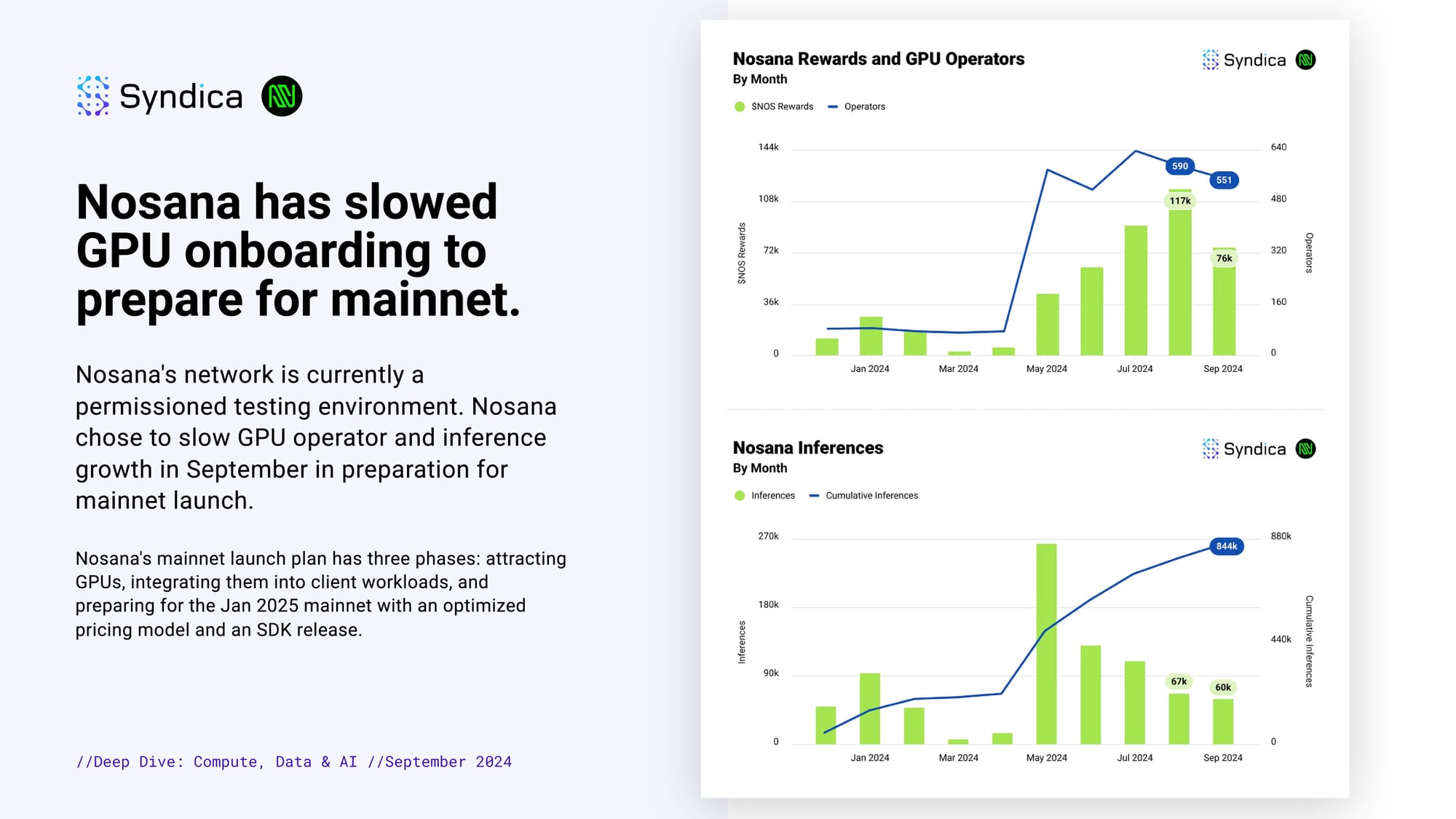

Nosana has slowed GPU onboarding to prepare for mainnet. Nosana's network is currently a permissioned testing environment. Nosana chose to slow GPU operator and inference growth in September in preparation for mainnet launch. Nosana's mainnet launch plan has three phases: attracting GPUs, integrating them into client workloads, and preparing for the Jan 2025 mainnet with an optimized pricing model and an SDK release.

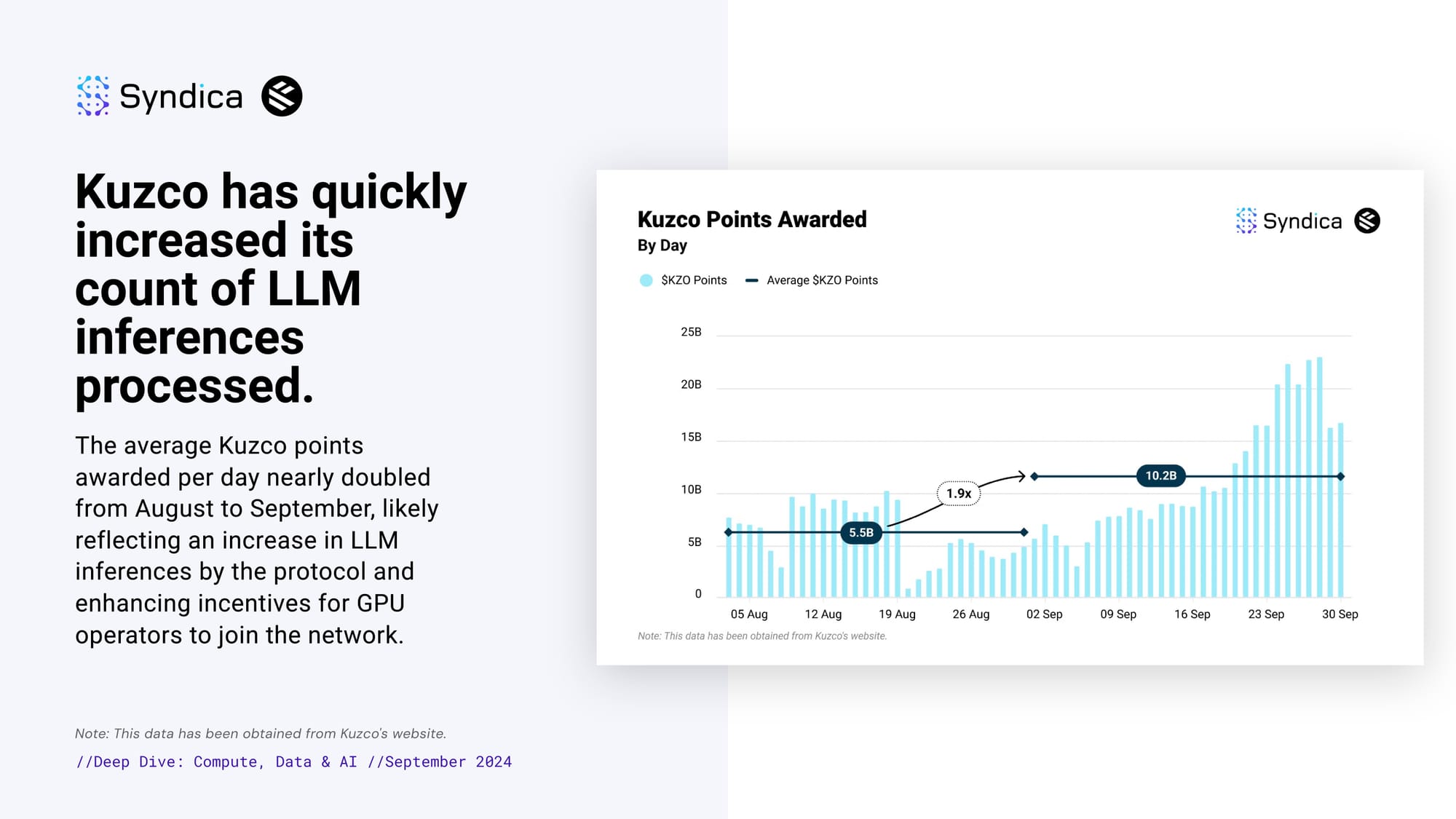

Kuzco has quickly increased its count of LLM inferences processed. The average Kuzco points awarded per day nearly doubled from August to September, likely reflecting an increase in LLM inferences by the protocol and enhancing incentives for GPU operators to join the network.

Notable Developments:

Render Network has developed several features for its platform, including integration with Dropbox and AWS cloud storage, as well as a 4D Wizard for Redshift.

UpRock has achieved major milestones, including integrating with Bright Data and launching a $100,000 developer grant program to accelerate innovation.

Nosana is set to launch its mainnet on January 14, 2025. Meanwhile, the protocol began the third and final phase of its test grid on September 30.

Grass announced the closure of a Series A funding round in September, led by Hack VC. The protocol also launched an airdrop checker.

Part II: Wireless

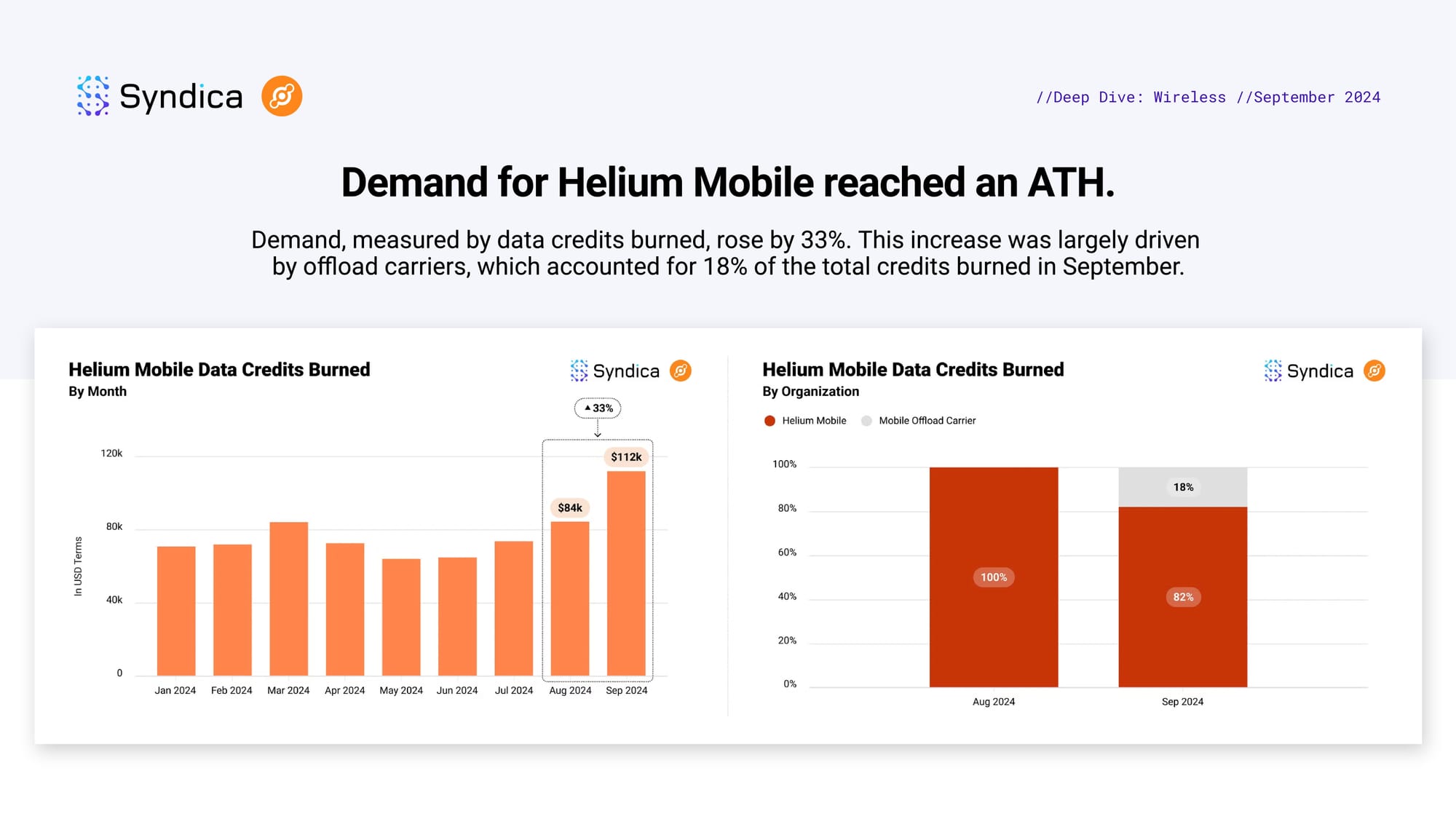

Demand for Helium Mobile reached an ATH. Demand, measured by data credits burned, rose by 33%. This increase was largely driven by offload carriers, which accounted for 18% of the total credits burned in September.

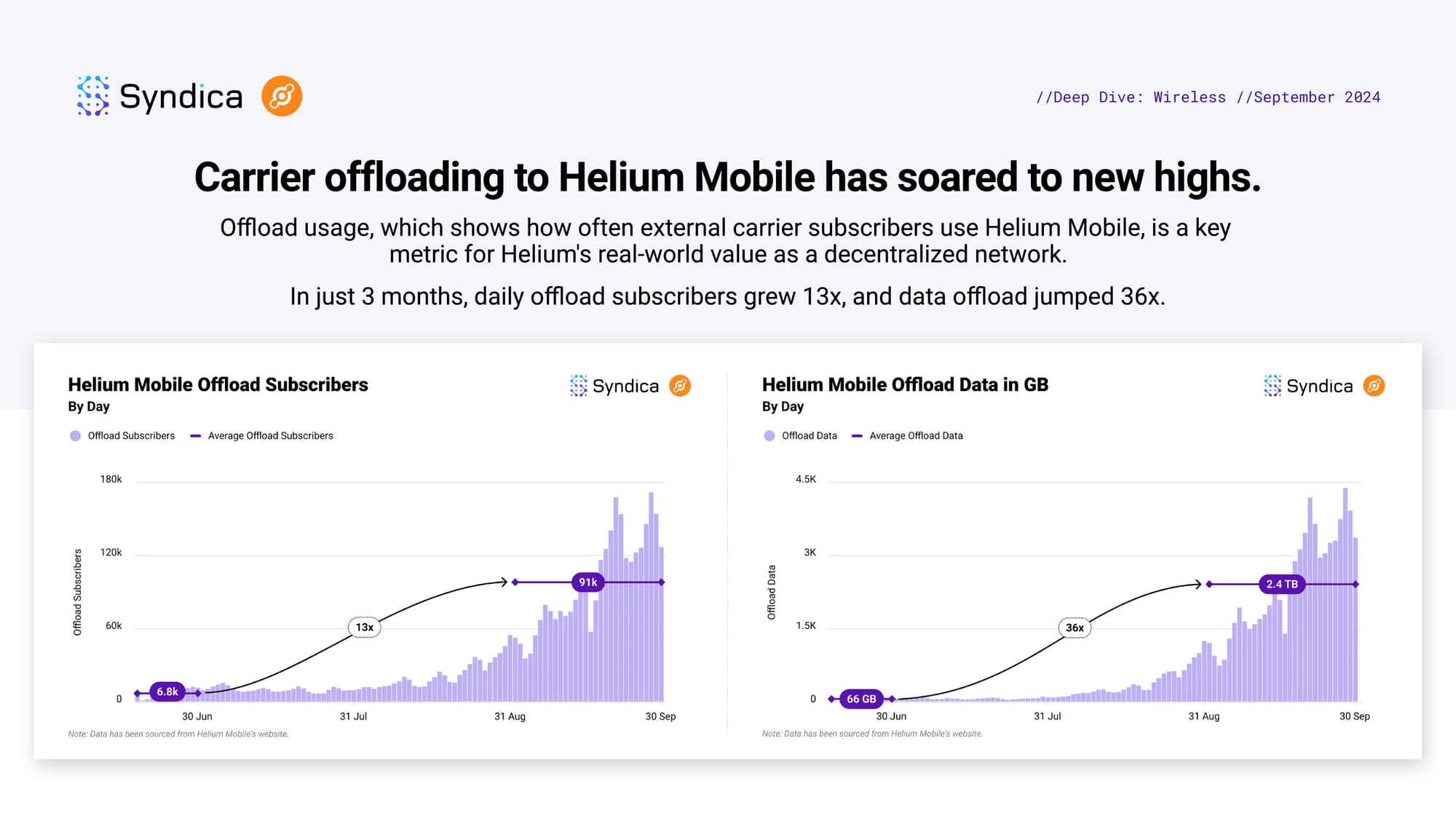

Carrier offloading to Helium Mobile has soared to new highs. Offload usage, which shows how often external carrier subscribers use Helium Mobile, is a key metric for Helium's real-world value as a decentralized network. In just 3 months, daily offload subscribers grew 13x, and data offload jumped 36x.

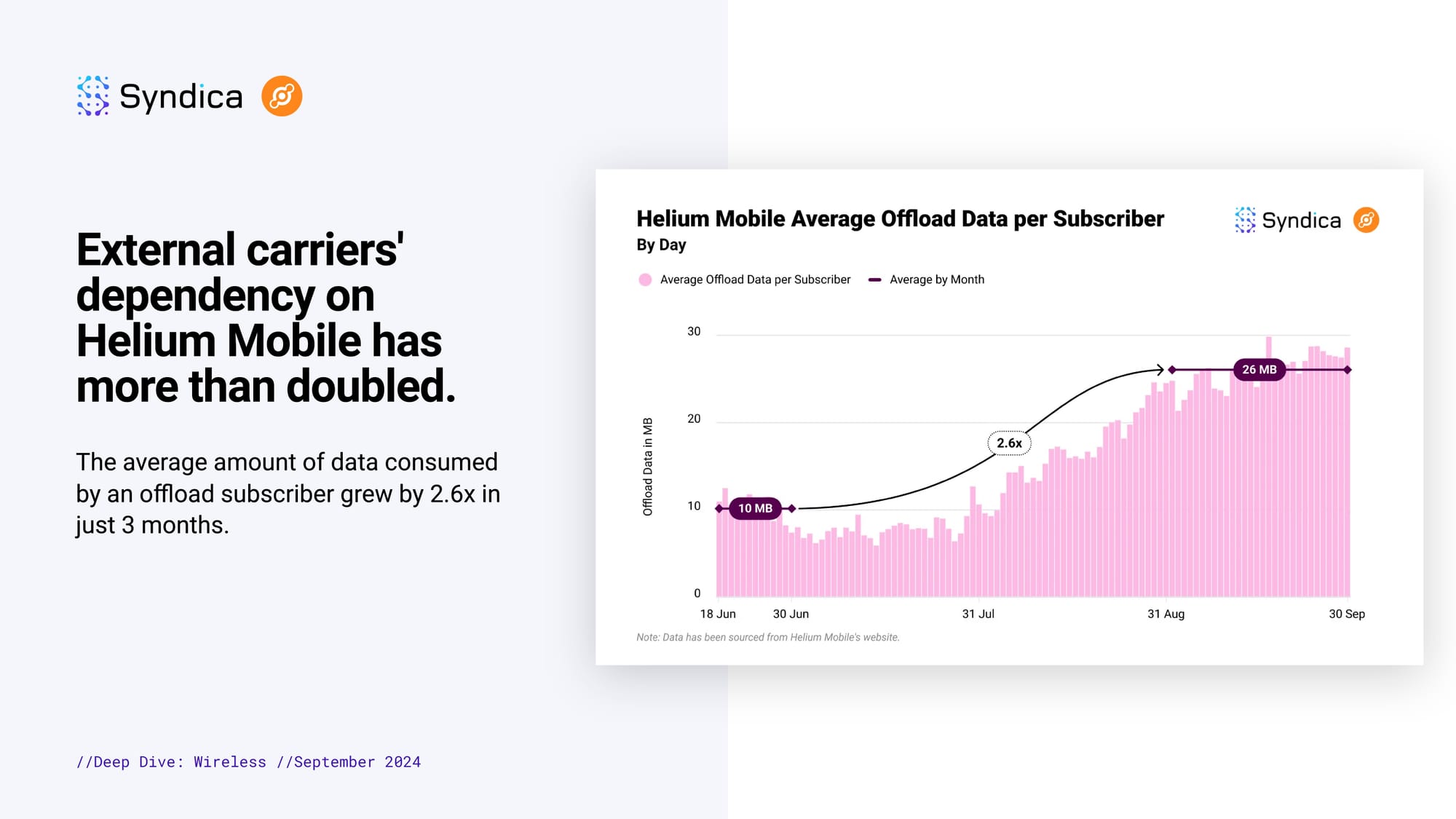

External carriers' dependency on Helium Mobile has more than doubled. The average amount of data consumed by an offload subscriber grew by 2.6x in just 3 months.

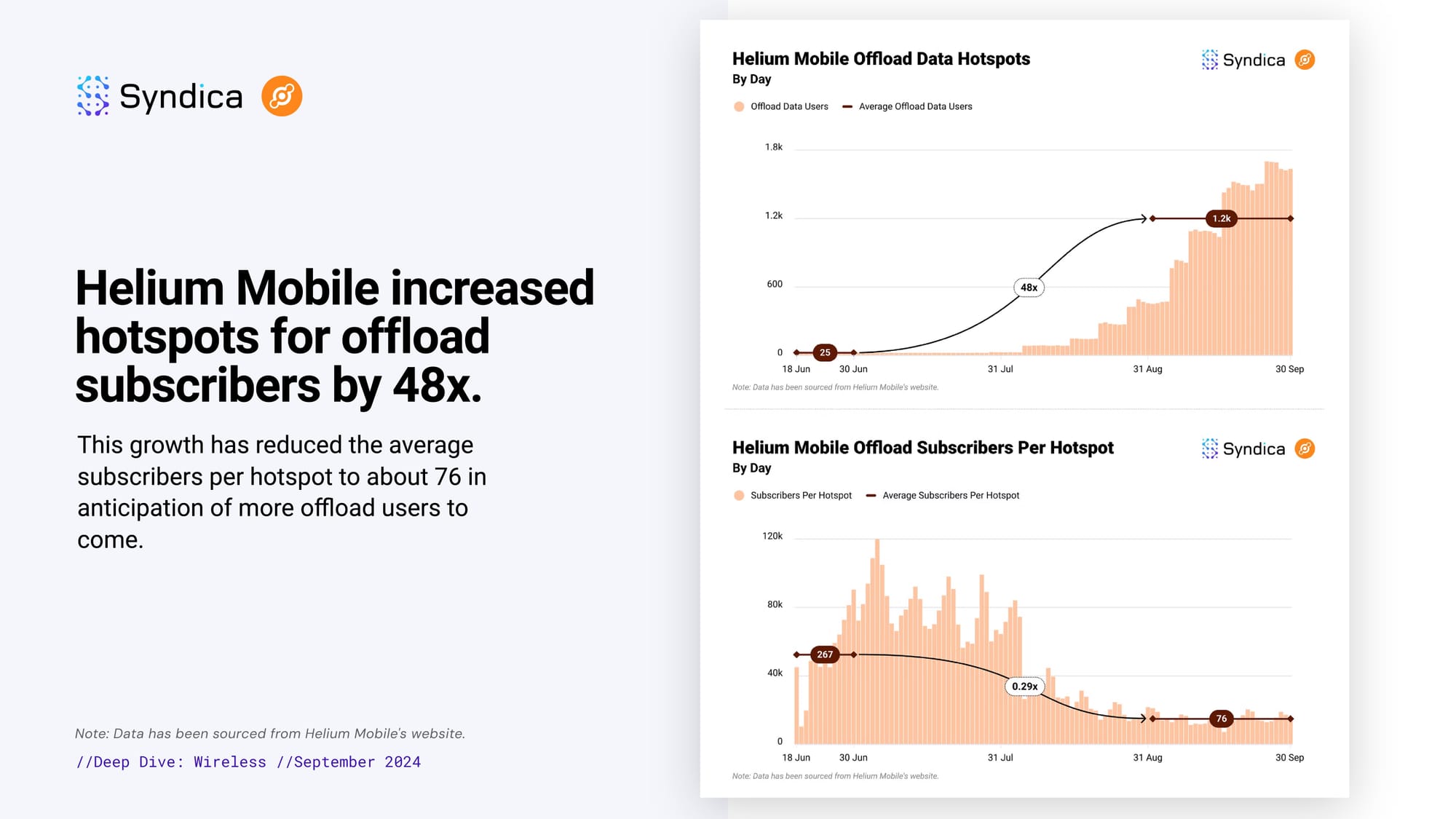

Helium Mobile increased hotspots for offload subscribers by 48x. This growth has reduced the average subscribers per hotspot to about 76 in anticipation of more offload users to come.

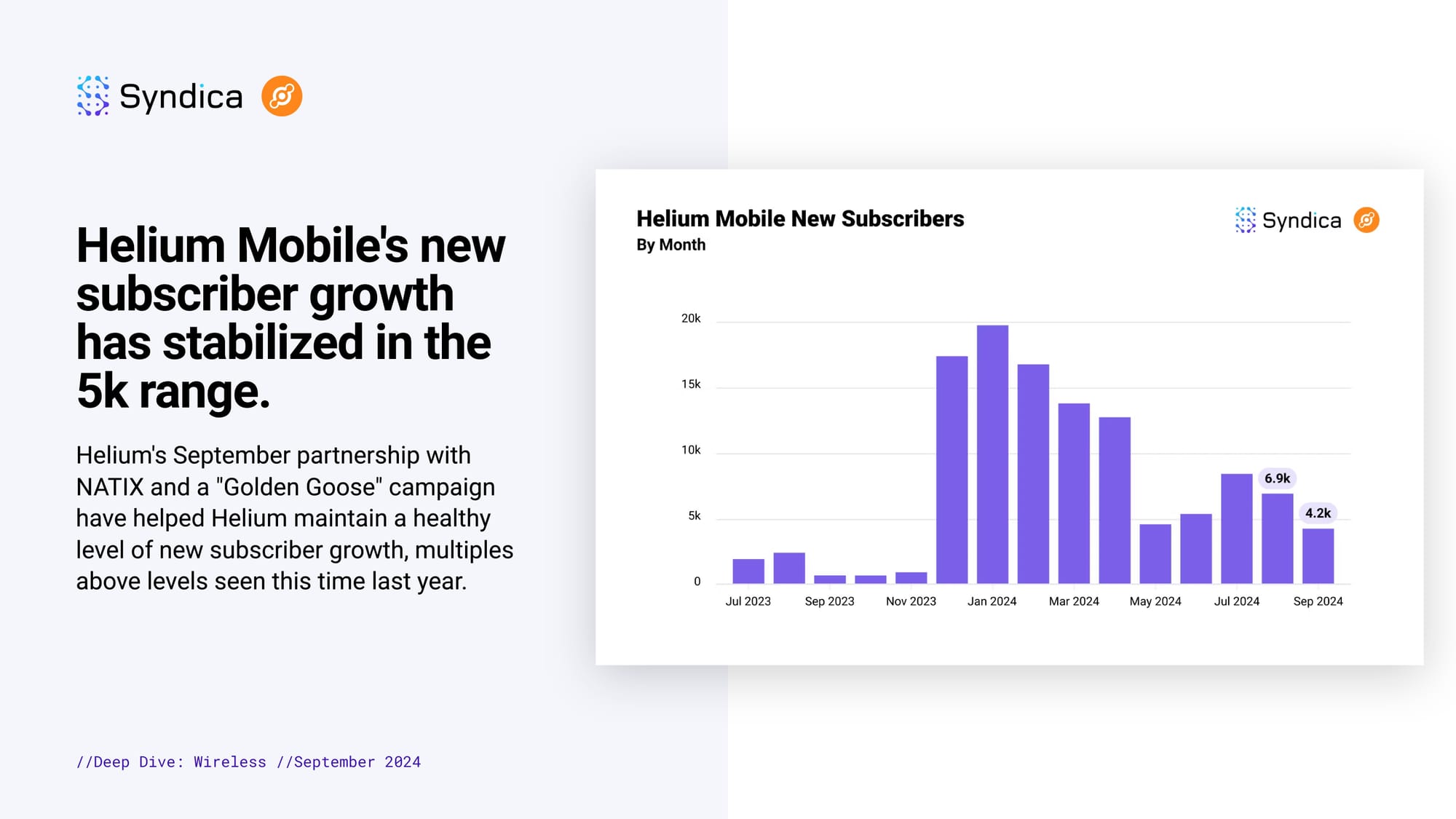

Helium Mobile's new subscriber growth has stabilized in the 5k range. Helium's September partnership with NATIX and a "Golden Goose" campaign have helped Helium maintain a healthy level of new subscriber growth, multiples above levels seen this time last year.

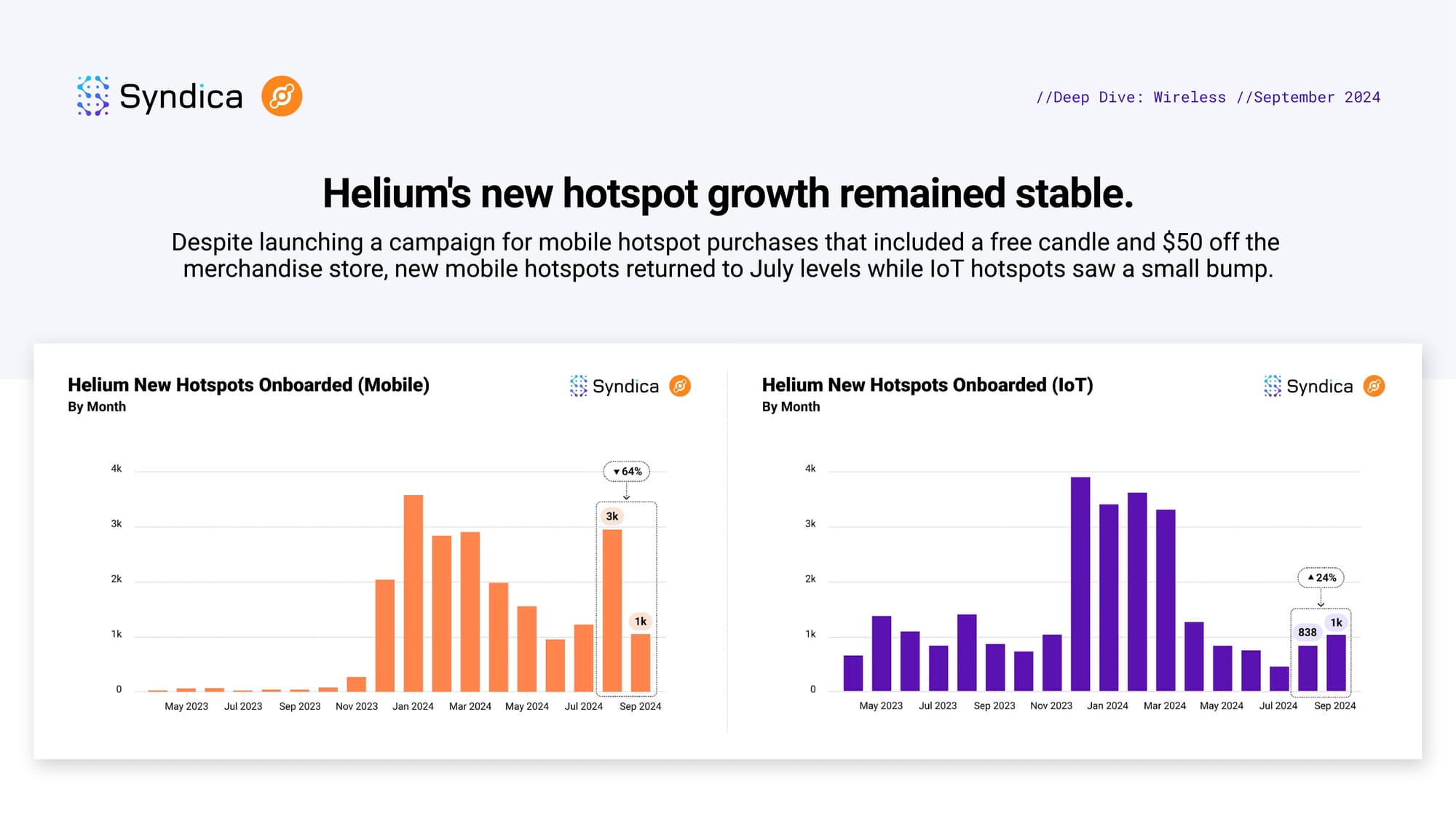

Helium's new hotspot growth remained stable. Despite launching a campaign for mobile hotspot purchases that included a free candle and $50 off the merchandise store, new mobile hotspots returned to July levels while IoT hotspots saw a small bump.

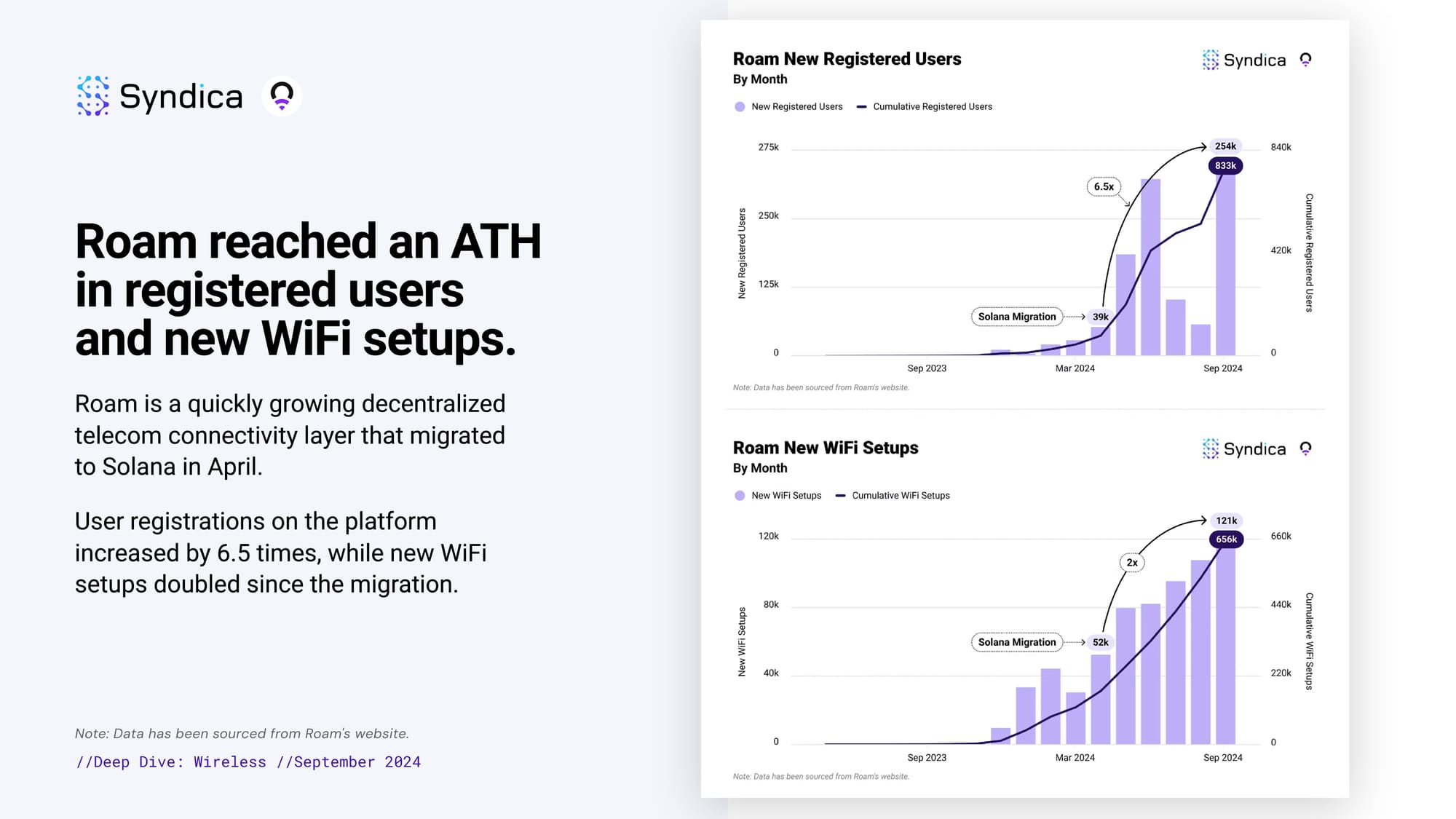

Roam reached an ATH in registered users and new WiFi setups. Roam is a quickly growing decentralized telecom connectivity layer that migrated to Solana in April. User registrations on the platform increased by 6.5 times, while new WiFi setups doubled since the migration.

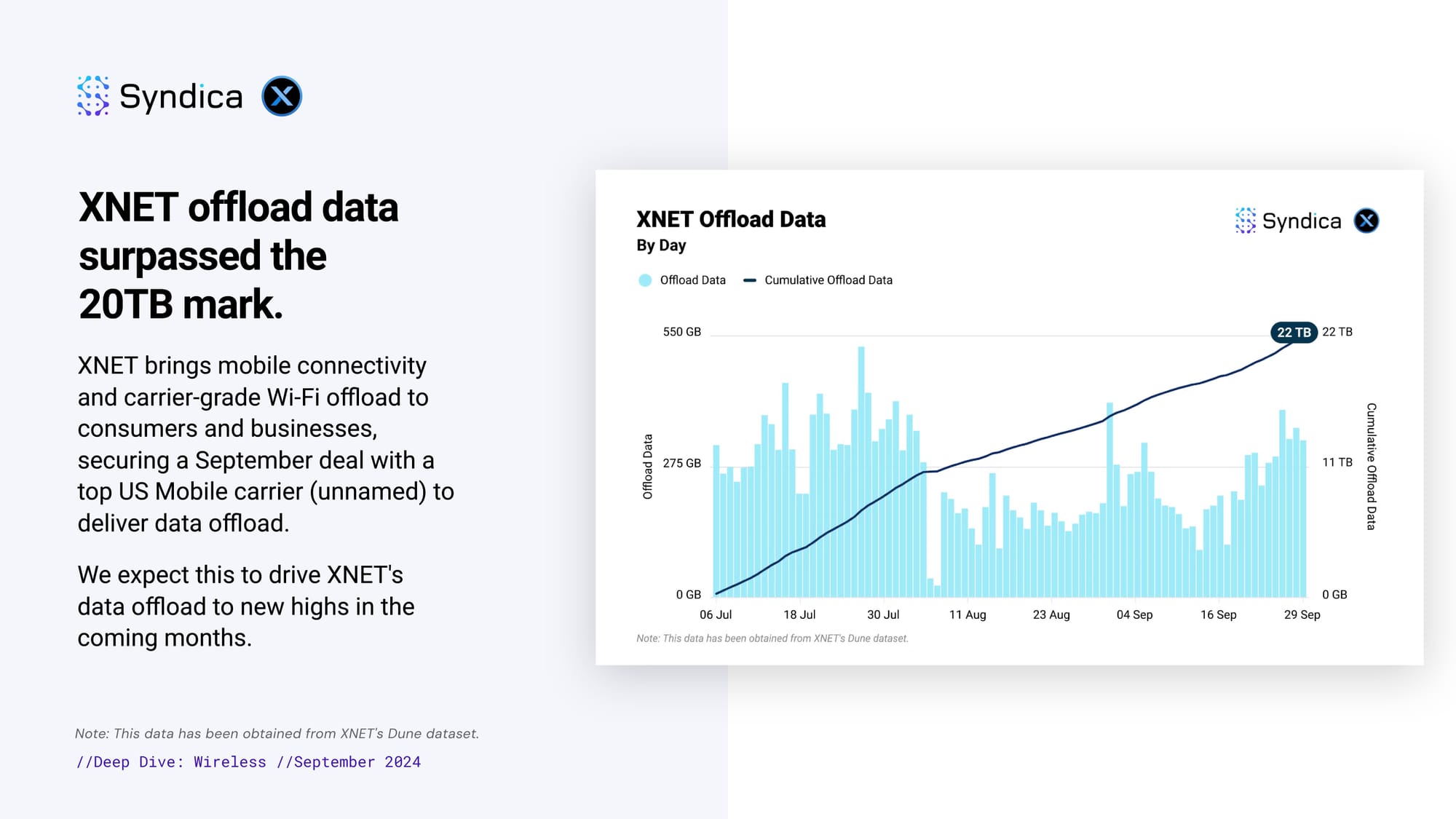

XNET offload data surpassed the 20TB mark. XNET brings mobile connectivity and carrier-grade Wi-Fi offload to consumers and businesses, securing a September deal with a top US Mobile carrier (unnamed) to deliver data offload. We expect this to drive XNET's data offload to new highs in the coming months.

Notable Developments:

Helium partnered with the USC Trojans to boost awareness of Helium Mobile. Additionally, Helium Mobile has expanded its services to Puerto Rico.

Dabba became the first DePIN project to launch a genesis NFT drop through DRiP in September.

XNET officially migrated from Polygon to Solana in August.

Roam launched their eSIM product with access to over 400 networks worldwide in September.

Part III: Mapping

Hivemapper is showing early signs of product-market fit. At Breakpoint, Hivemapper revealed that they are selling data to 3 of the world's top 10 mapmakers, marking a significant milestone. Average map data demand, measured by $HONEY tokens burned, has increased 6x since April.

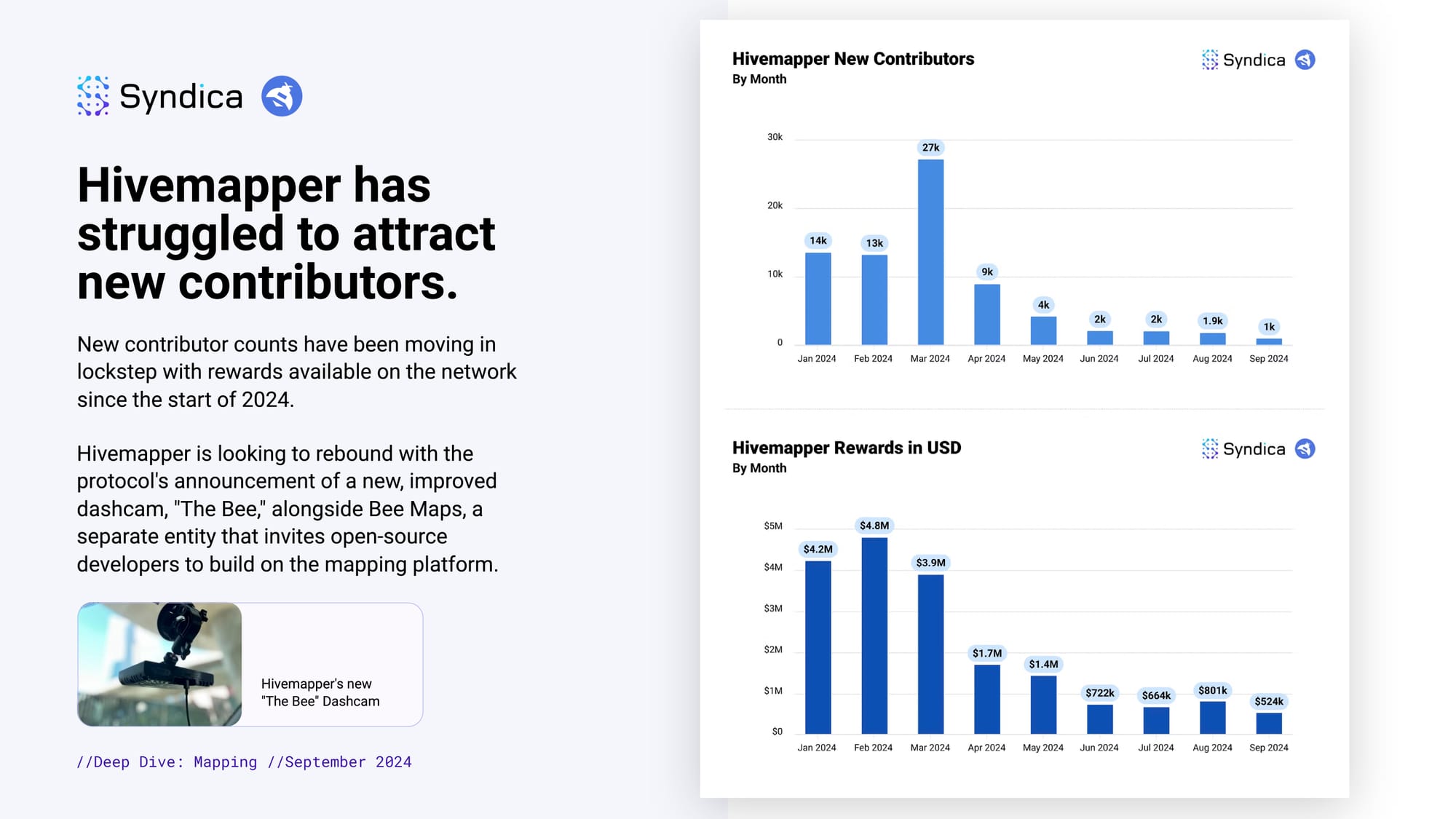

Hivemapper has struggled to attract new contributors. New contributor counts have been moving in lockstep with rewards available on the network since the start of 2024. Hivemapper is looking to rebound with the protocol's announcement of a new, improved dashcam, "The Bee," alongside Bee Maps, a separate entity that invites open-source developers to build on the mapping platform.

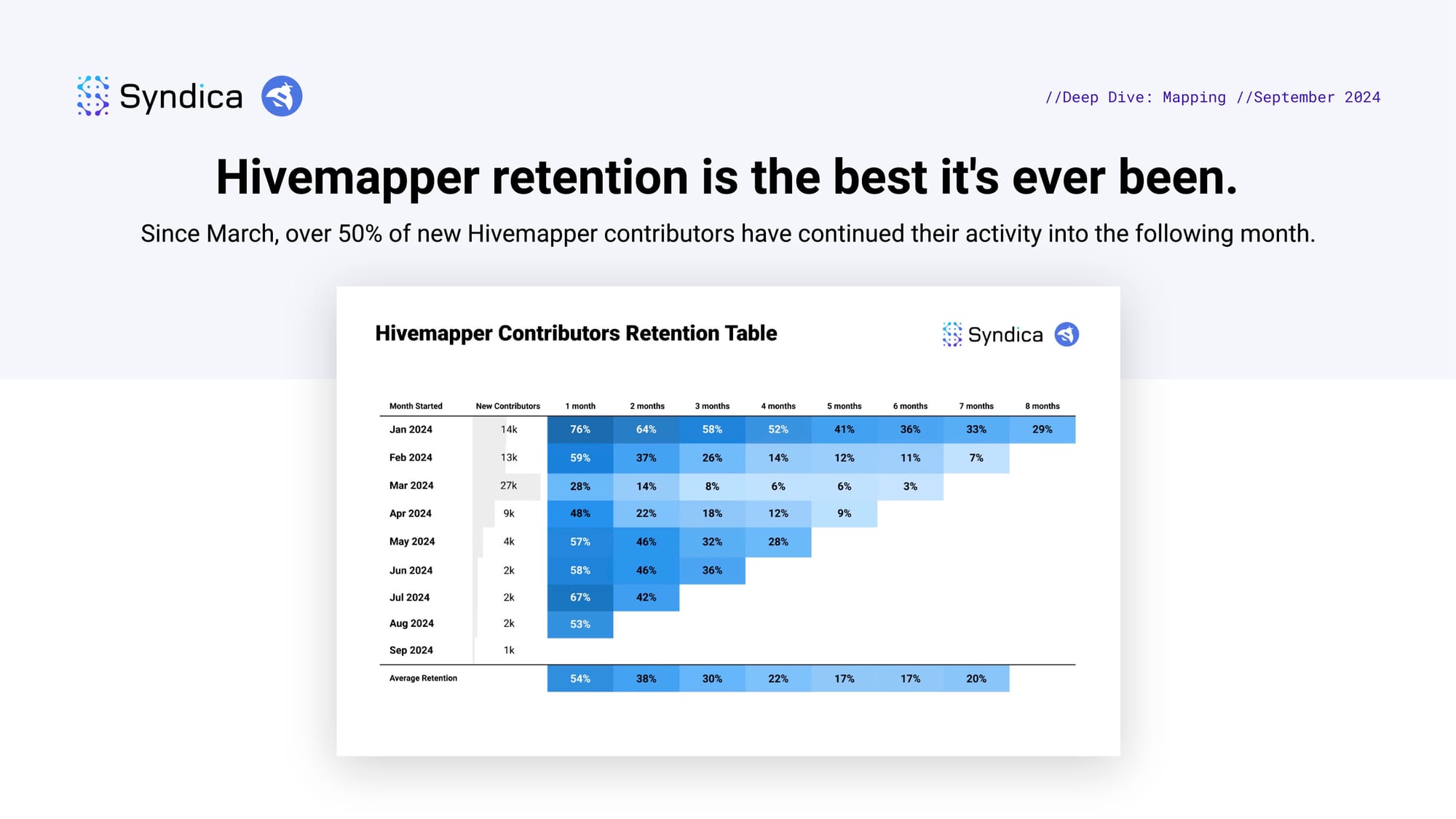

Hivemapper retention is the best it's ever been. Since March, over 50% of new Hivemapper contributors have continued their activity into the following month.