Deep Dive: Solana NFT Market - April 2024

Deep Dive: Solana NFT Market - April 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana NFT Market - April 2024

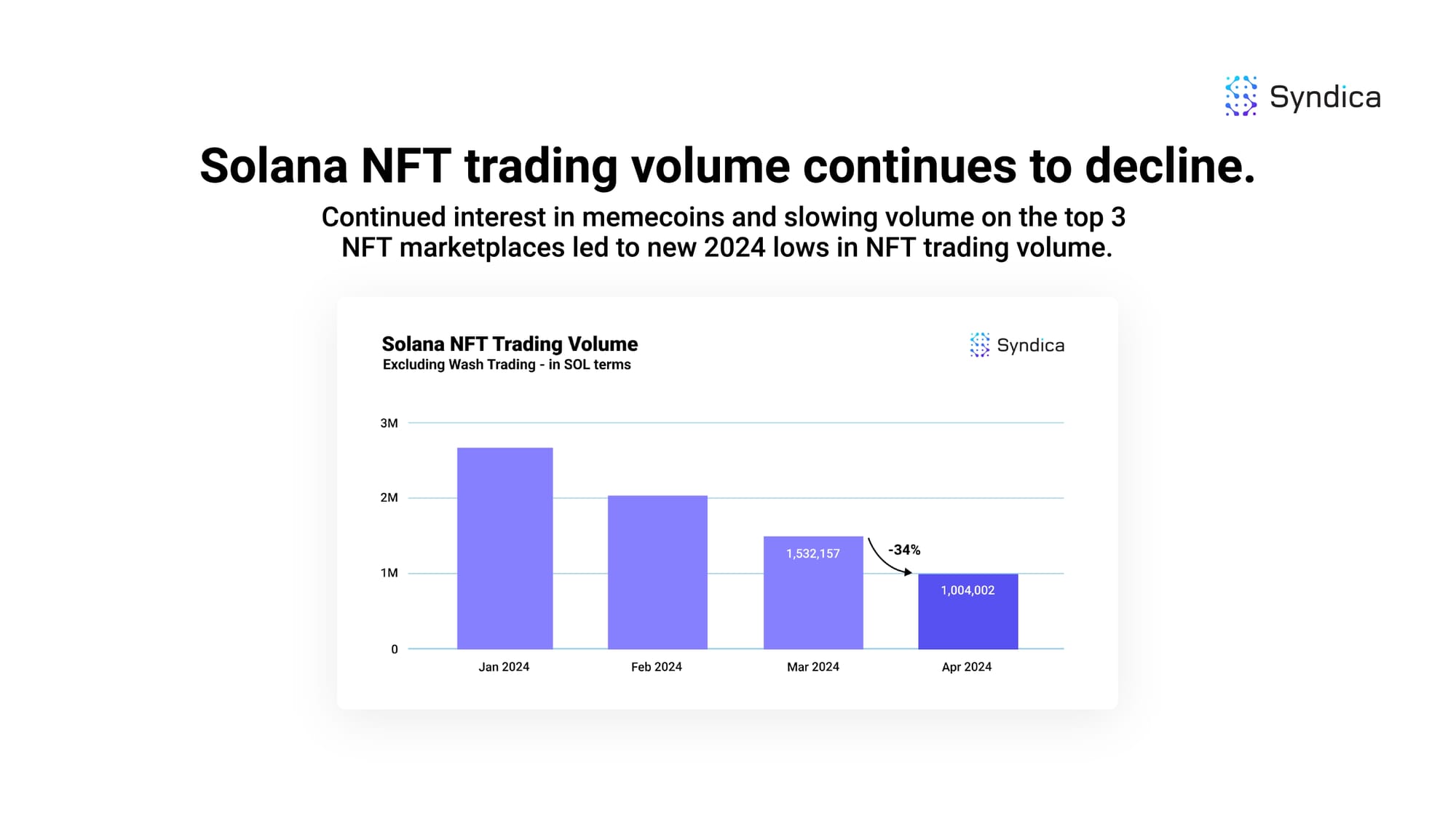

Solana NFT trading volume continues to decline. Continued interest in memecoins and slowing volume on the top 3 NFT marketplaces led to new 2024 lows in NFT trading volume.

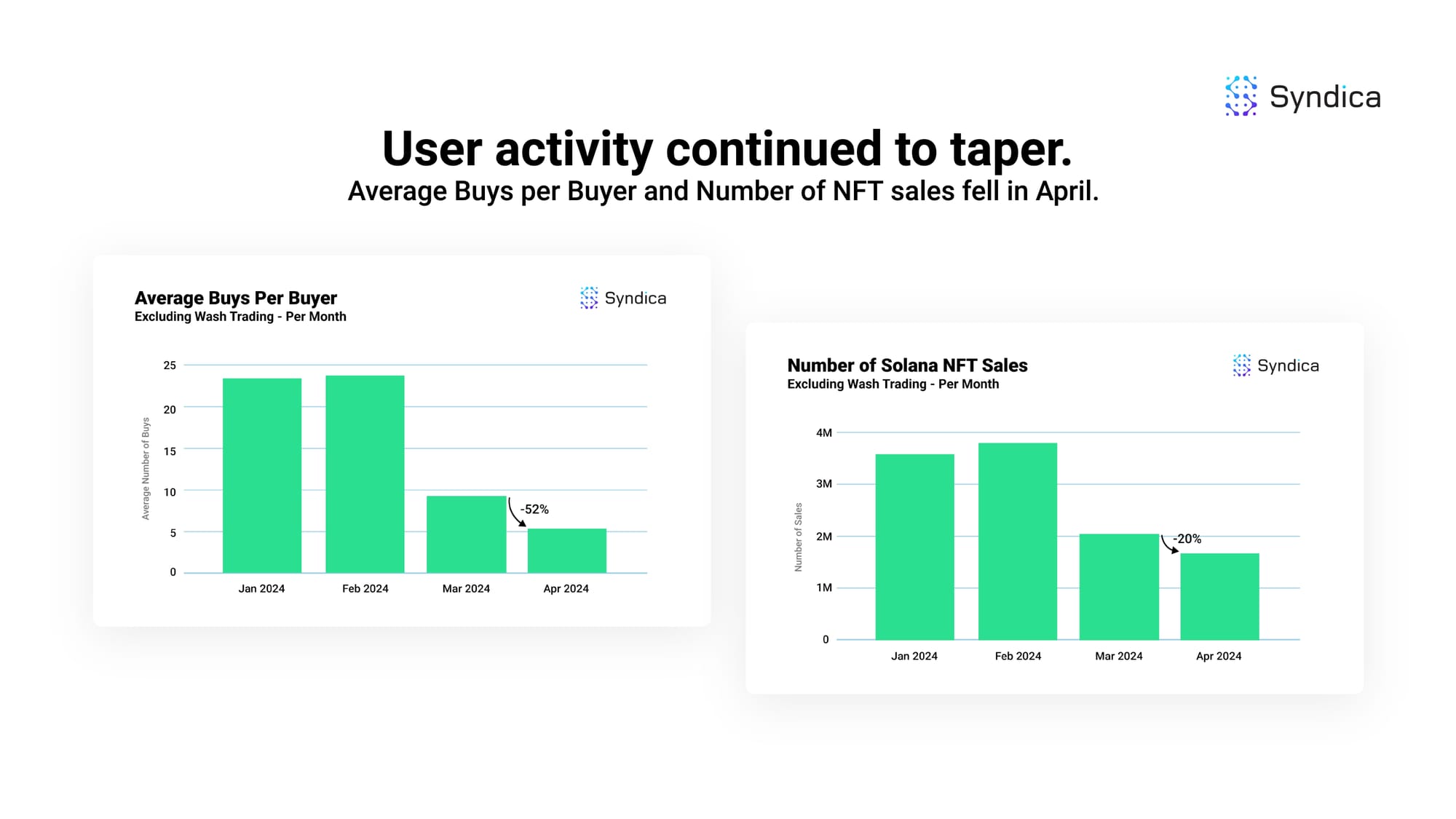

User activity continued to taper. Average Buys per Buyer and Number of NFT sales fell in April.

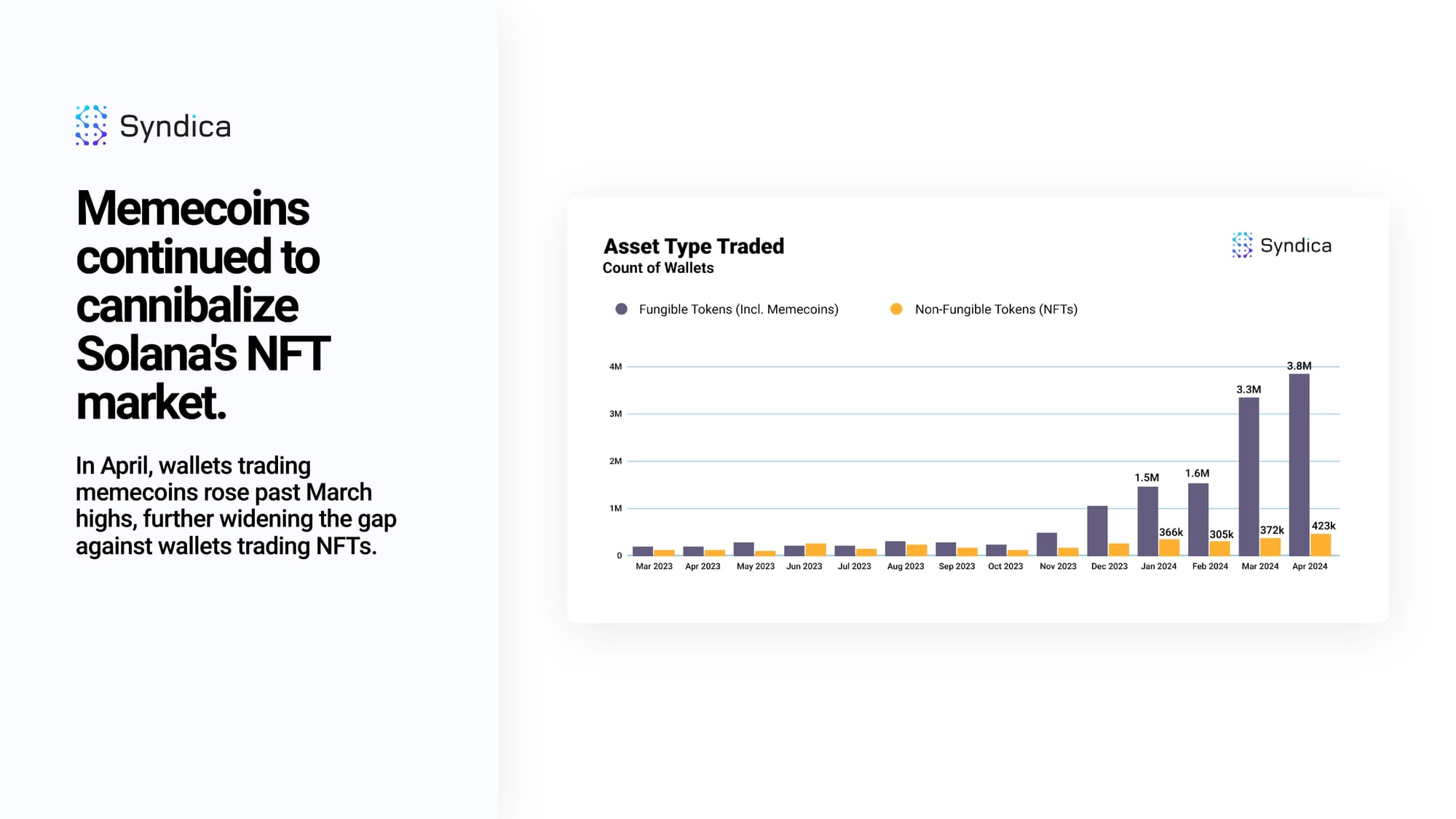

Memecoins continued to cannibalize Solana's NFT market. In April, wallets trading memecoins rose past March highs, further widening the gap against wallets trading NFTs.

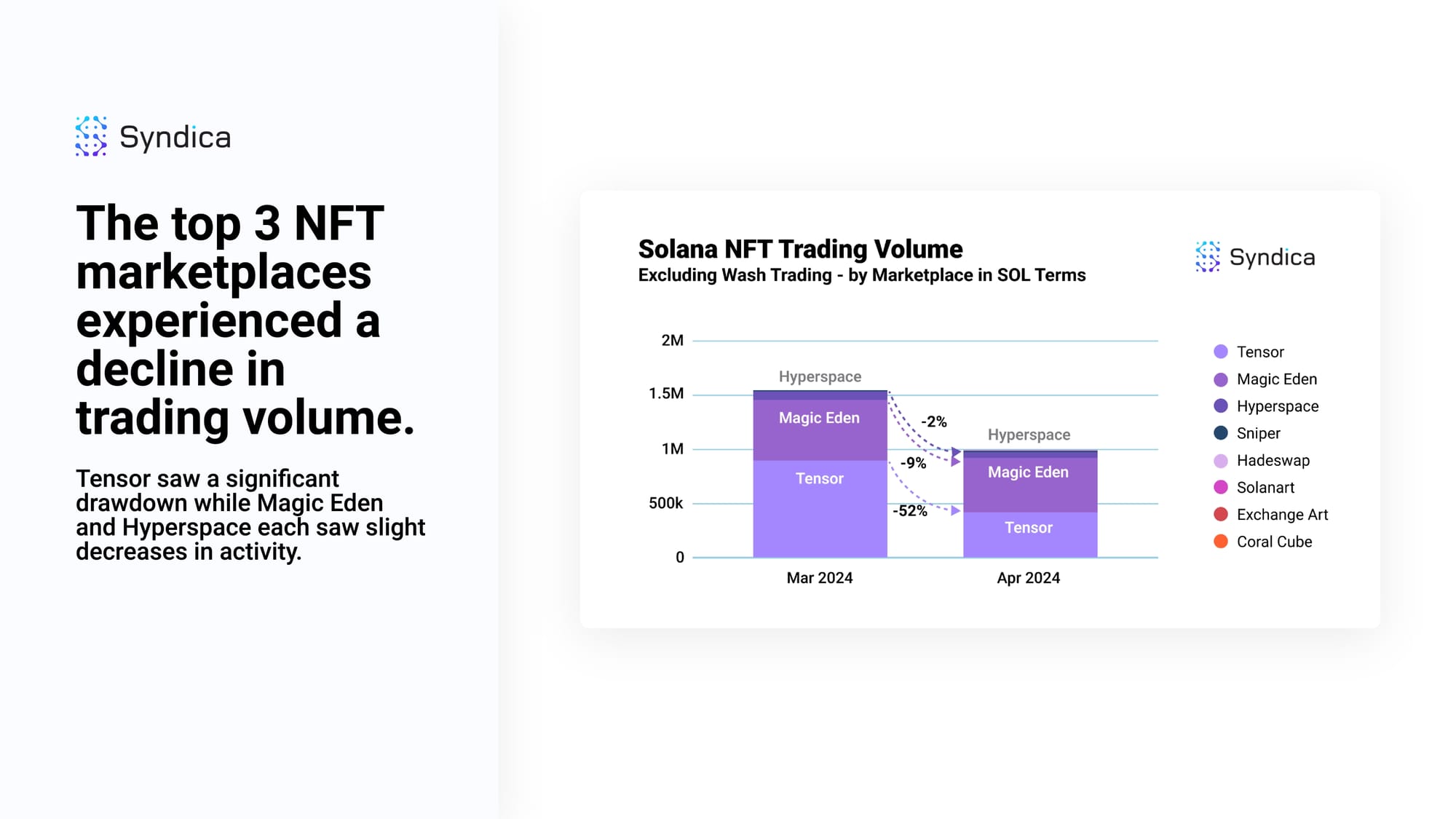

The top 3 NFT marketplaces experienced a decline in trading volume. Tensor saw a significant drawdown while Magic Eden and Hyperspace each saw slight decreases in activity.

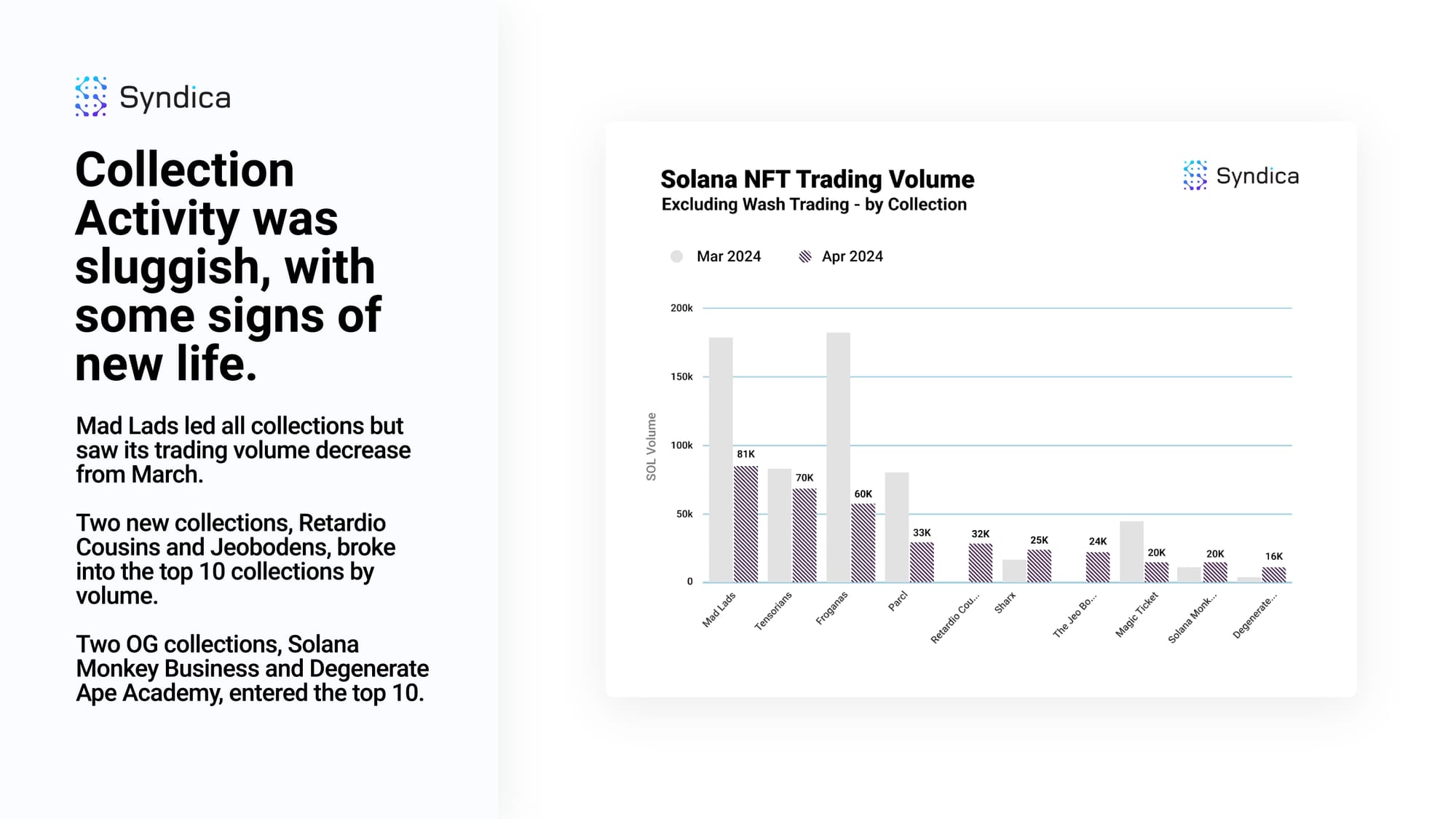

Collection Activity was sluggish, with some signs of new life. Mad Lads led all collections but saw its trading volume decrease from March.

Two new collections, Retardio Cousins and Jeobodens, broke into the top 10 collections by volume. Two OG collections, Solana Monkey Business and Degenerate Ape Academy, entered the top 10.

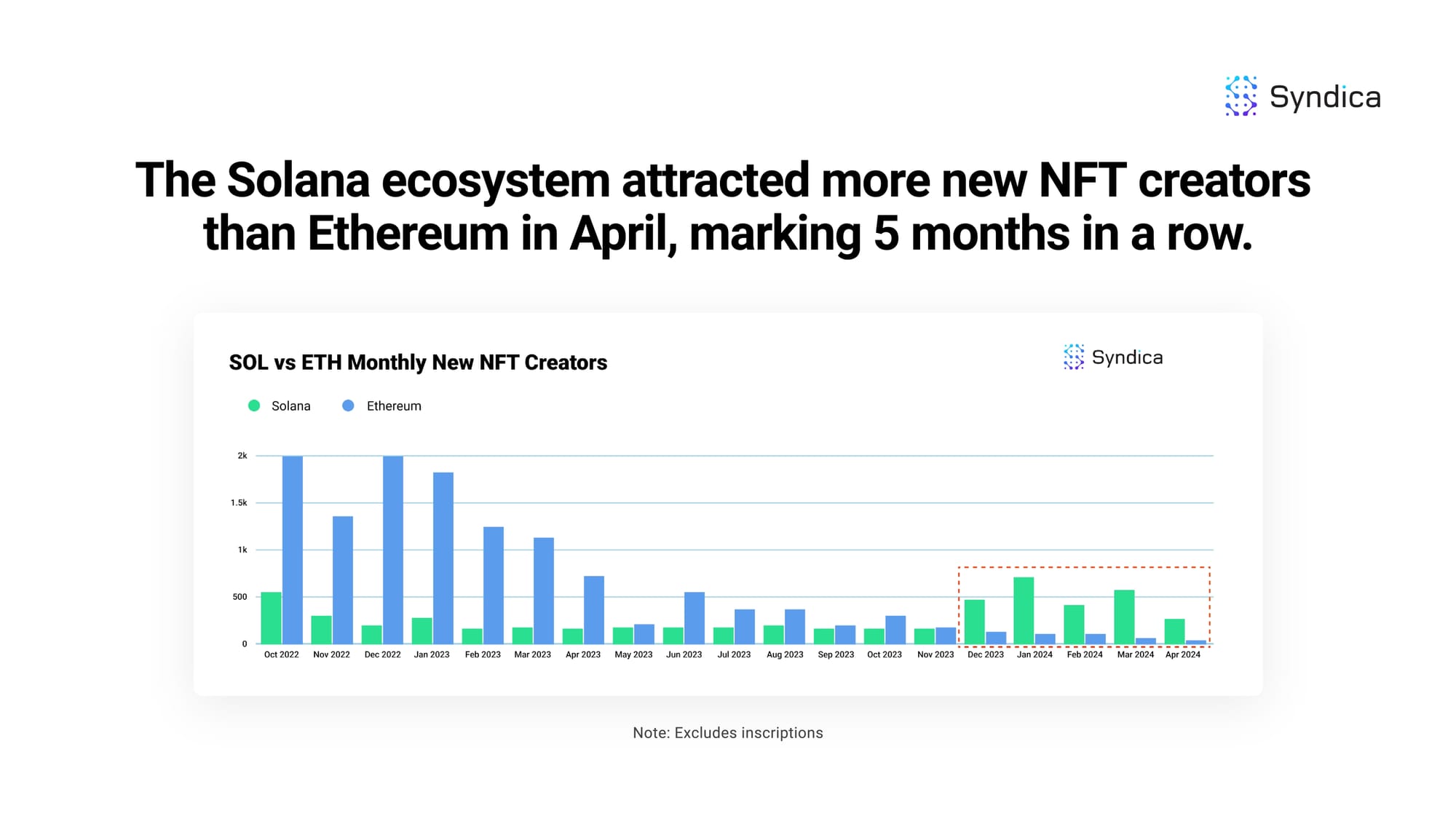

The Solana ecosystem attracted more new NFT creators than Ethereum in April, marking 5 months in a row.

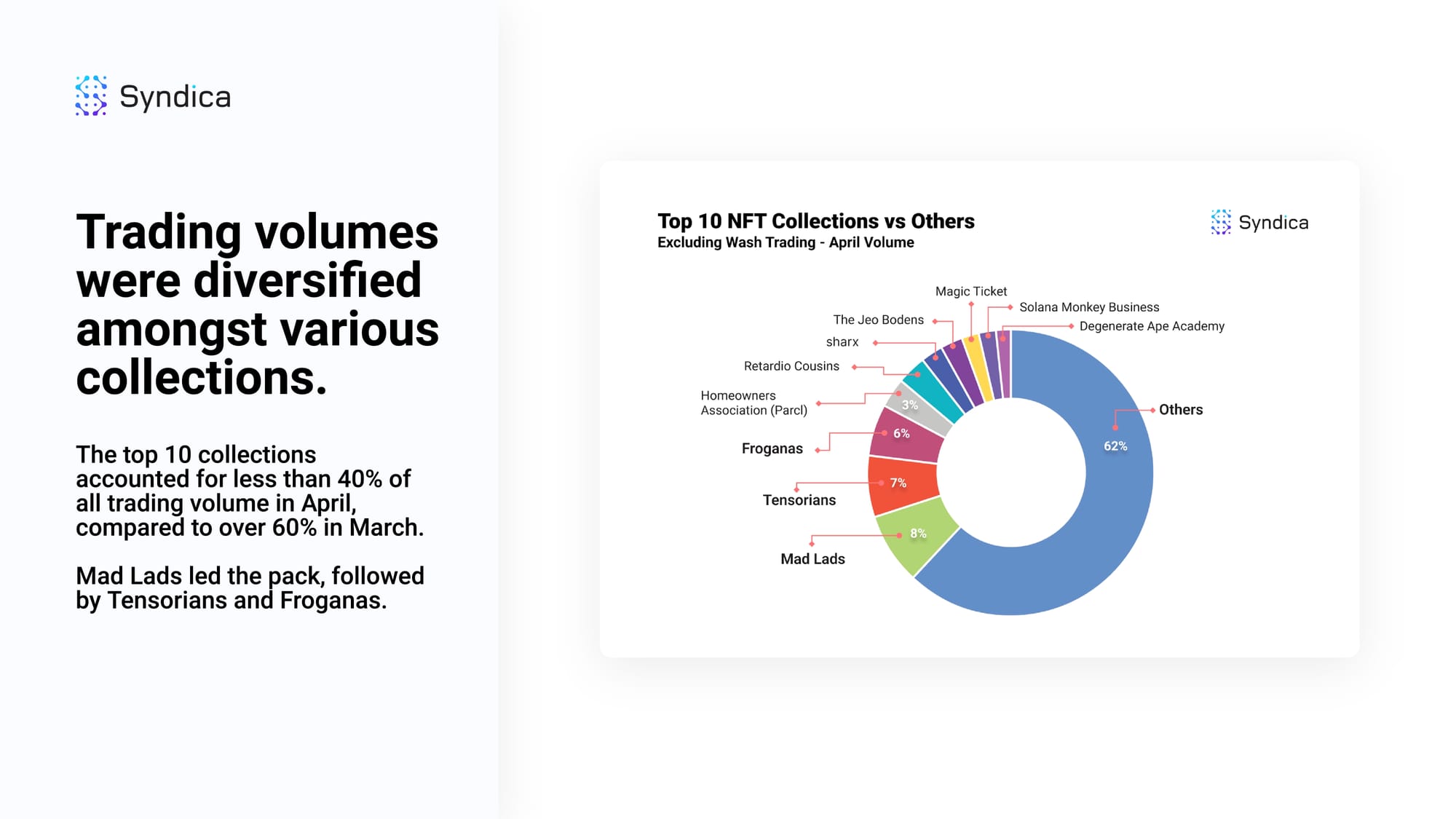

Trading volumes were diversified amongst various collections. The top 10 collections accounted for less than 40% of all trading volume in April, compared to over 60% in March. Mad Lads led the pack, followed by Tensorians and Froganas.

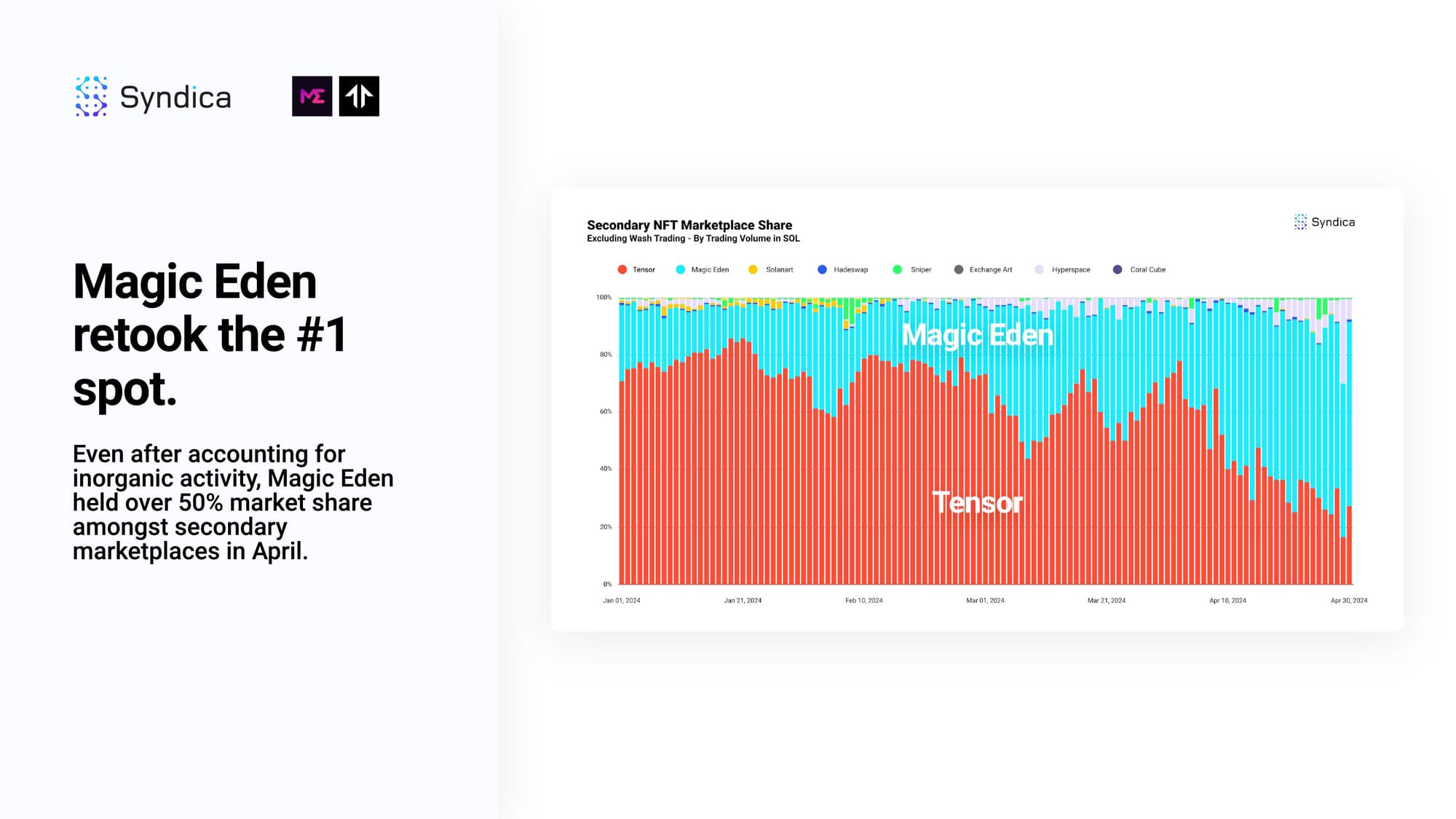

Magic Eden retook the #1 spot. Even after accounting for inorganic activity, Magic Eden held over 50% market share amongst secondary marketplaces in April.

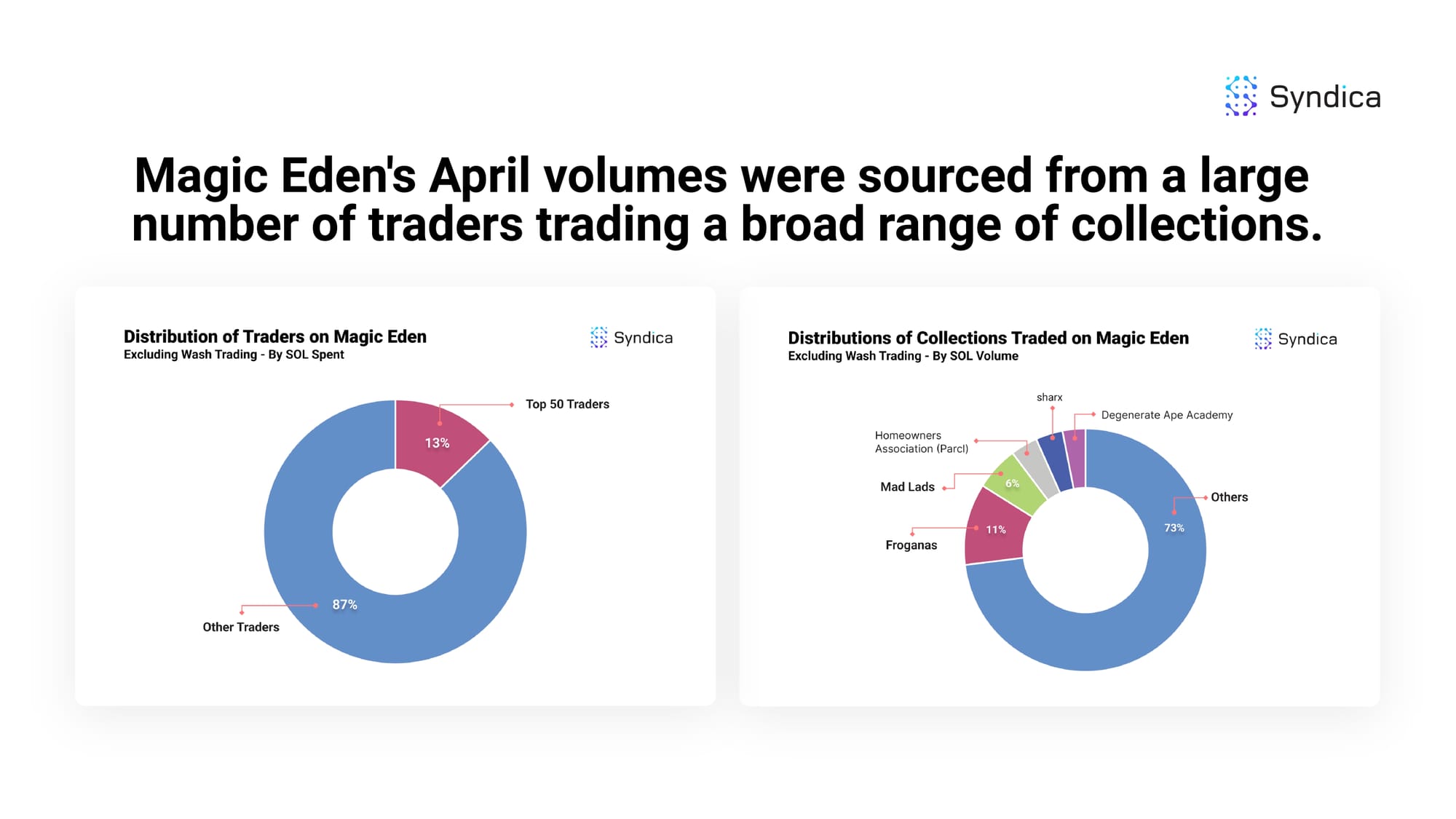

Magic Eden's April volumes were sourced from a large number of traders trading a broad range of collections.

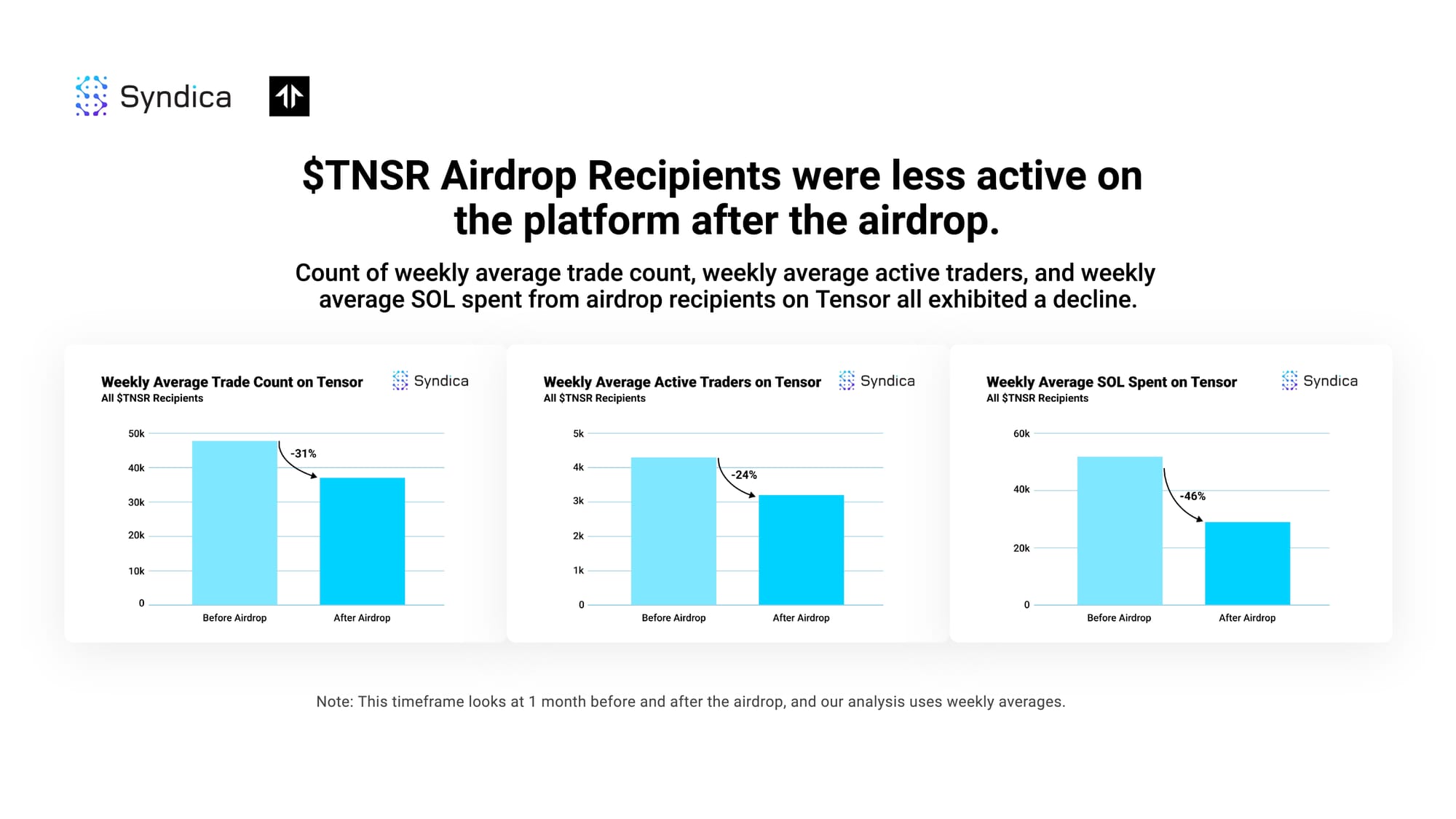

$TNSR Airdrop Recipients were less active on the platform after the airdrop. Count of weekly average trade count, weekly average active traders, and weekly average SOL spent from airdrop recipients on Tensor all exhibited a decline.

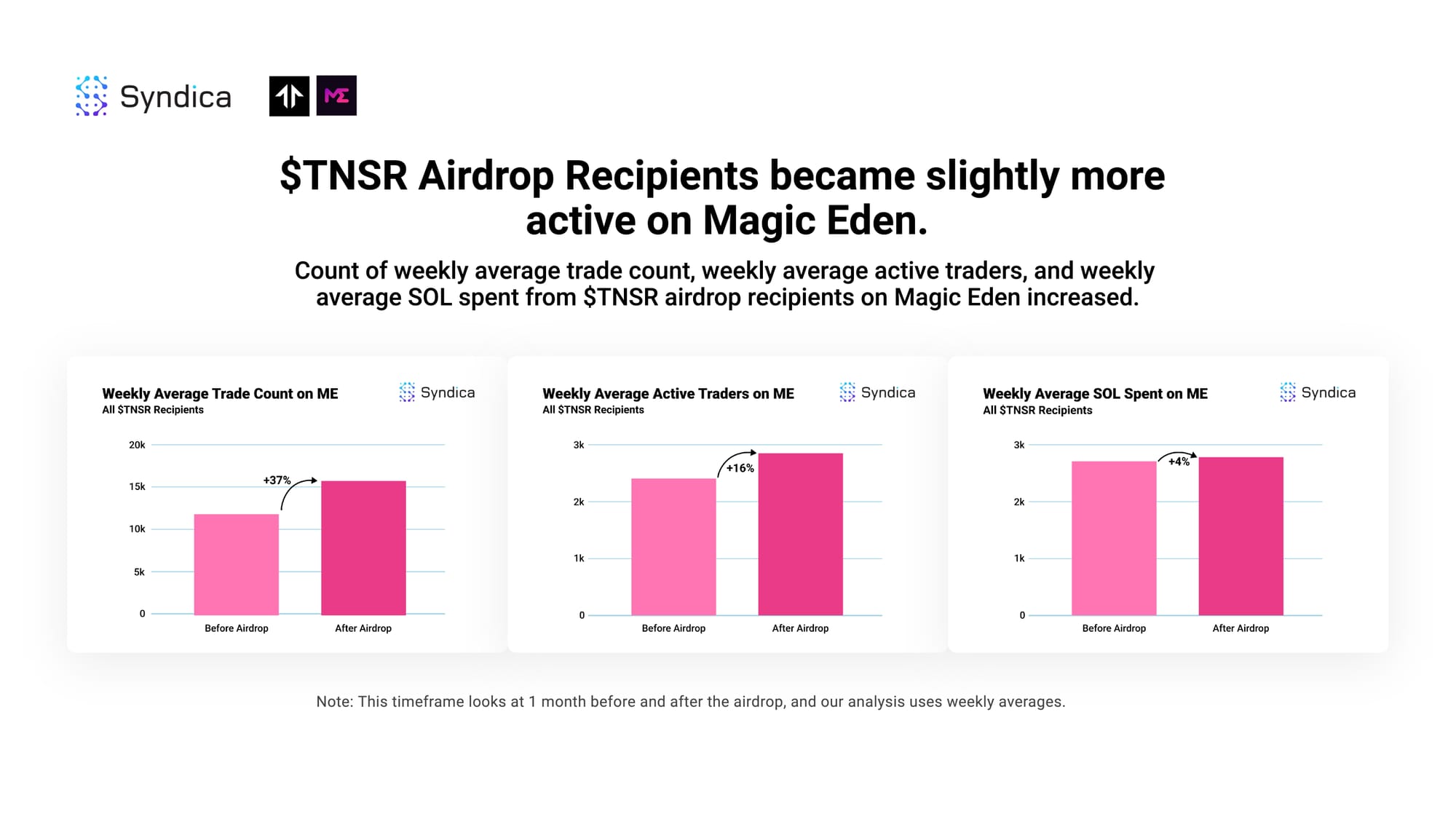

$TNSR Airdrop Recipients became slightly more active on Magic Eden. Count of weekly average trade count, weekly average active traders, and weekly average SOL spent from $TNSR airdrop recipients on Magic Eden increased.

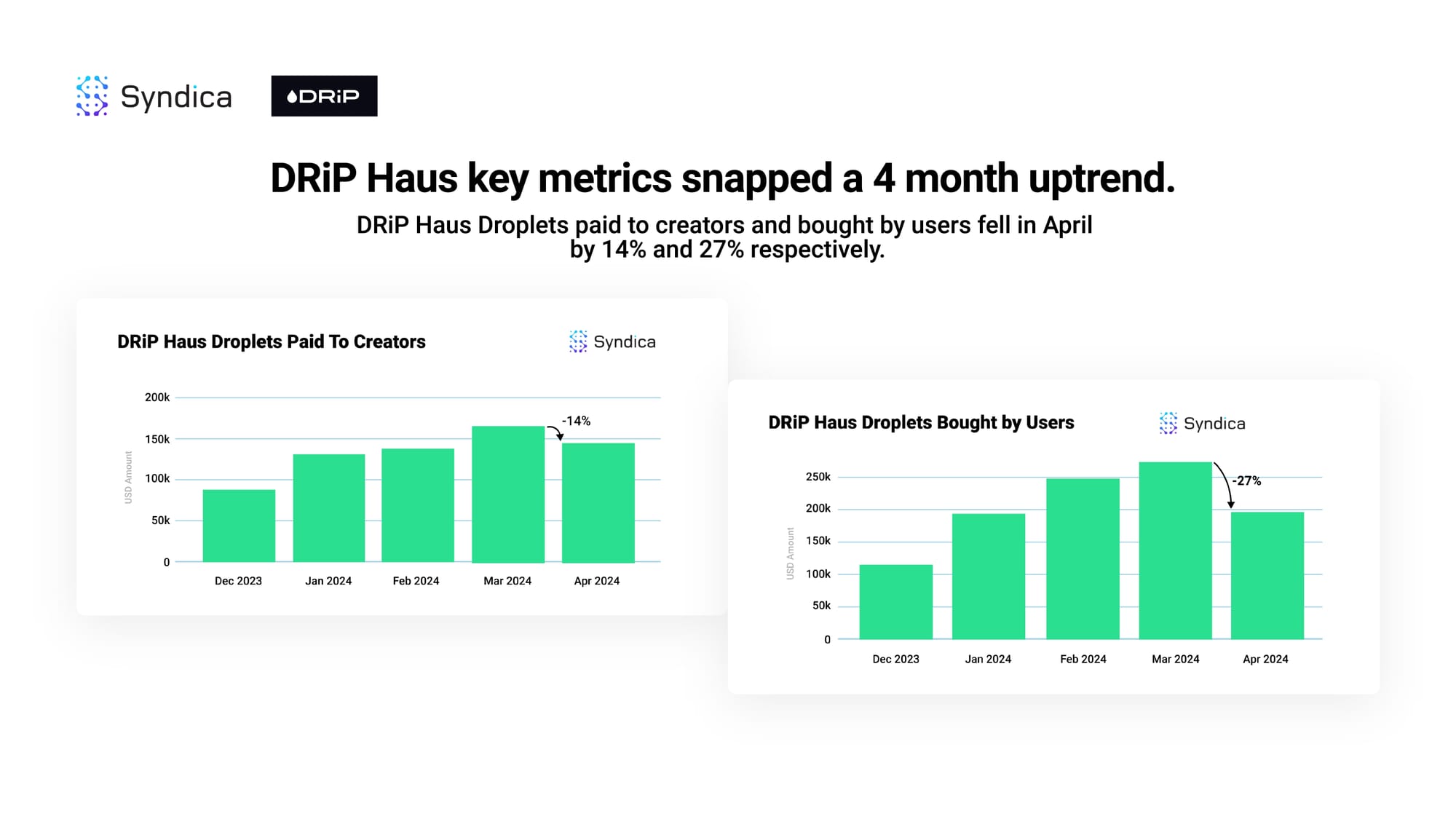

DRiP Haus key metrics snapped a 4-month uptrend. DRiP Haus Droplets paid to creators and bought by users fell in April by 14% and 27% respectively.

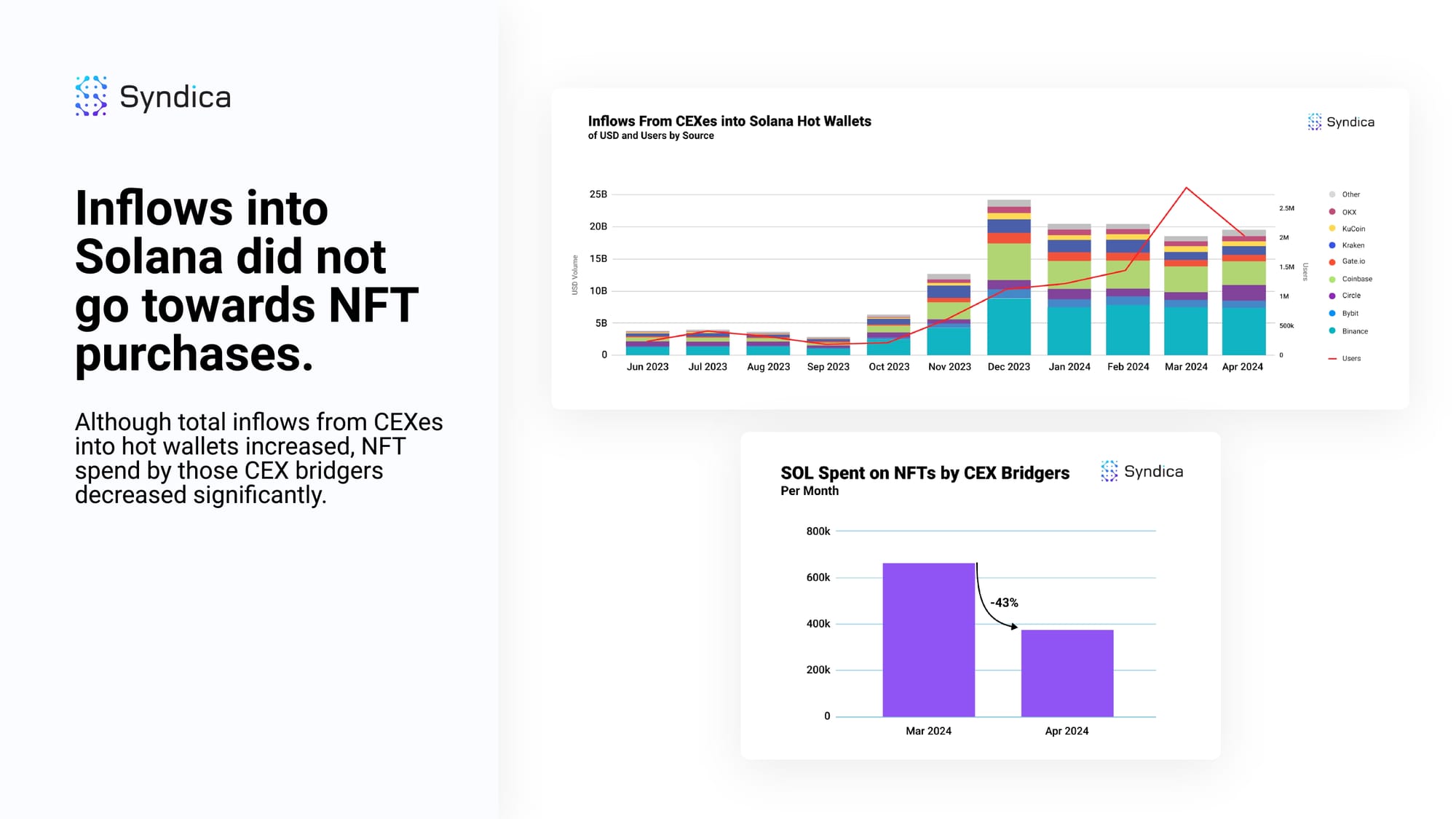

Inflows into Solana did not go towards NFT purchases. Although total inflows from CEXes into hot wallets increased, NFT spend by those CEX bridgers decreased significantly.

Cross-chain bridging volumes dropped after a local March high. deBridge seemed to hold up best, experiencing an increase in user count and only a slight decrease in funds bridged into Solana.

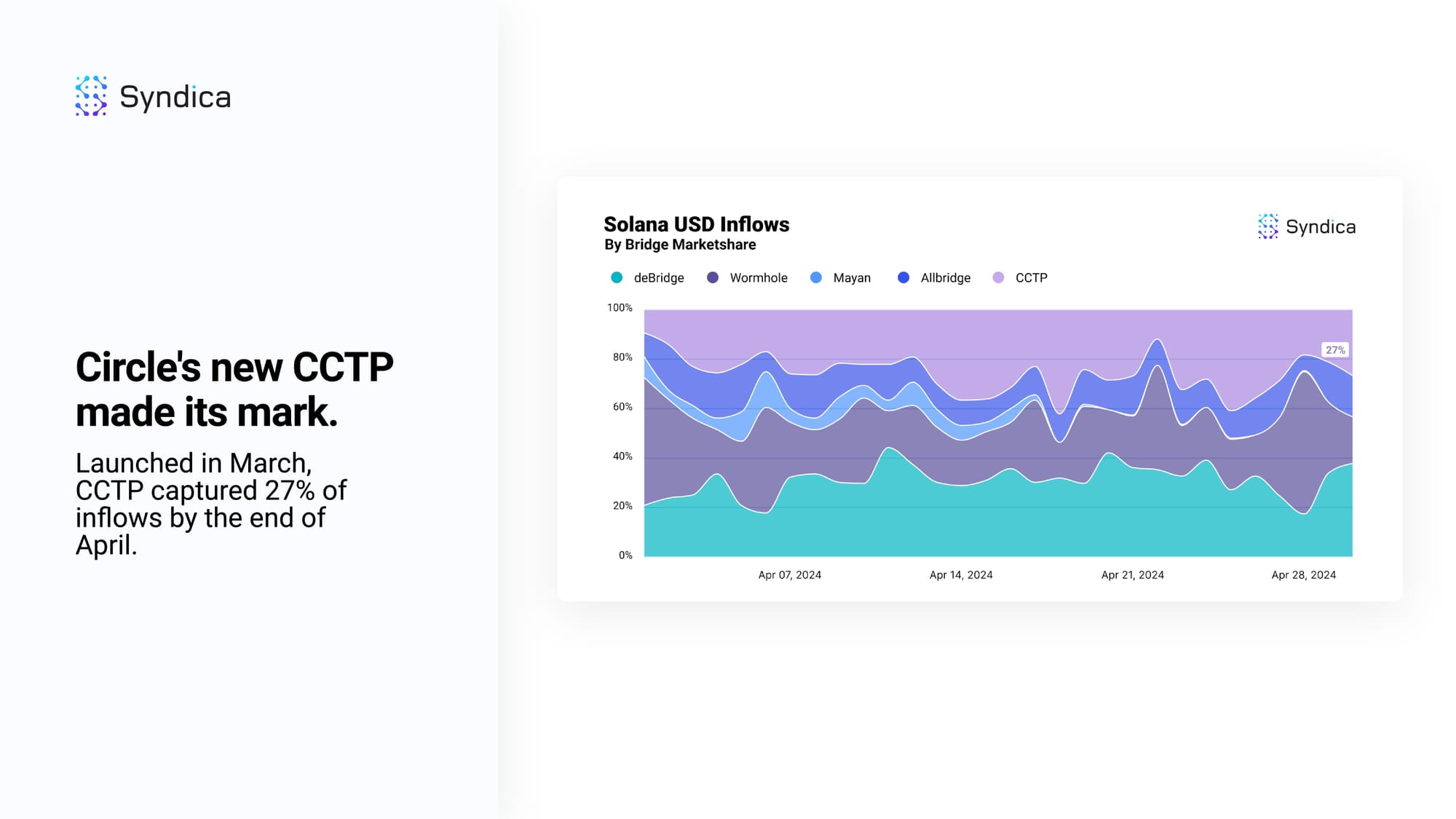

Circle's new CCTP made its mark. Launched in March, CCTP captured 27% of inflows by the end of April.

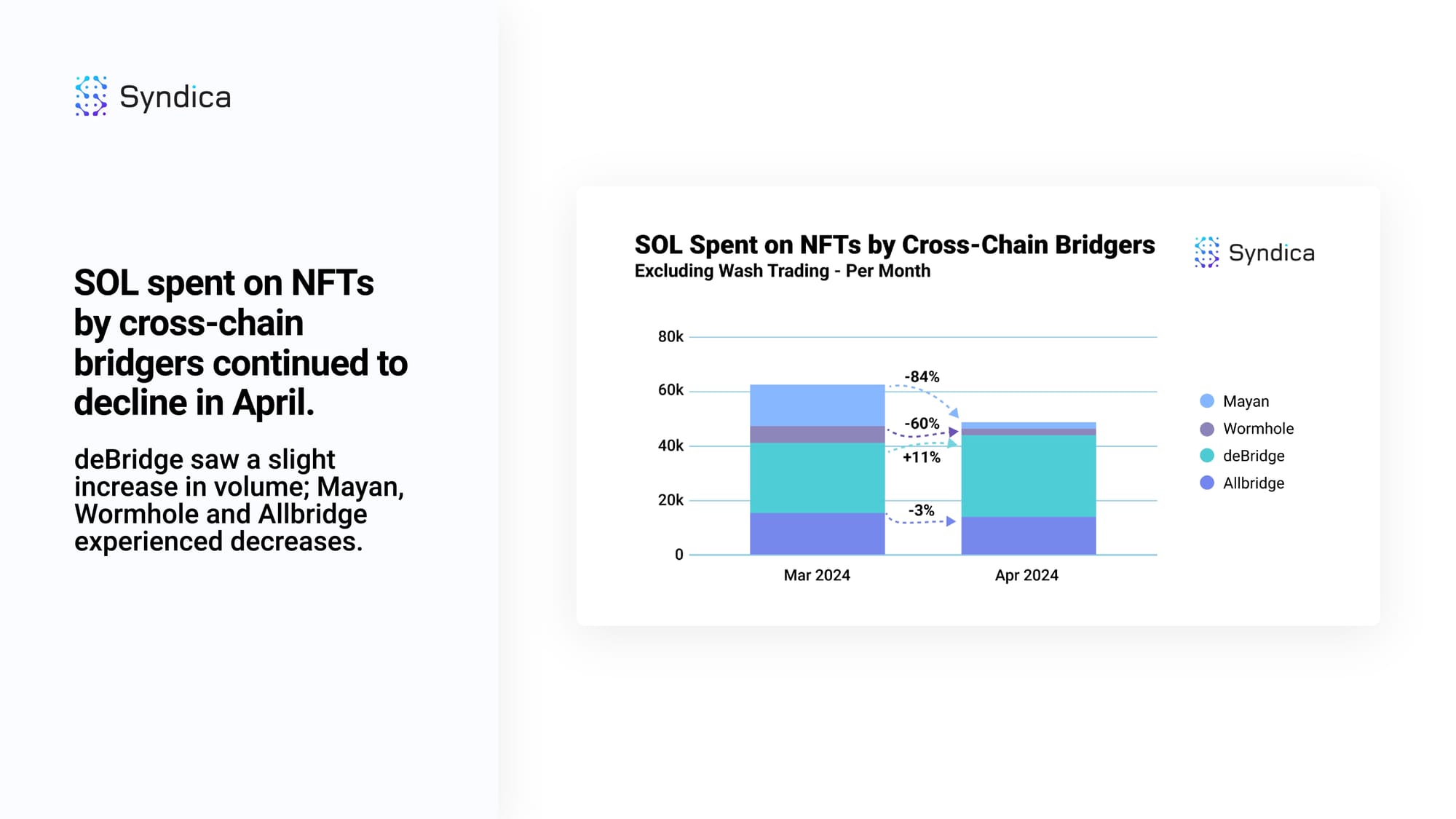

SOL spent on NFTs by cross-chain bridgers continued to decline in April. deBridge saw a slight increase in volume; Mayan, Wormhole and Allbridge experienced decreases.

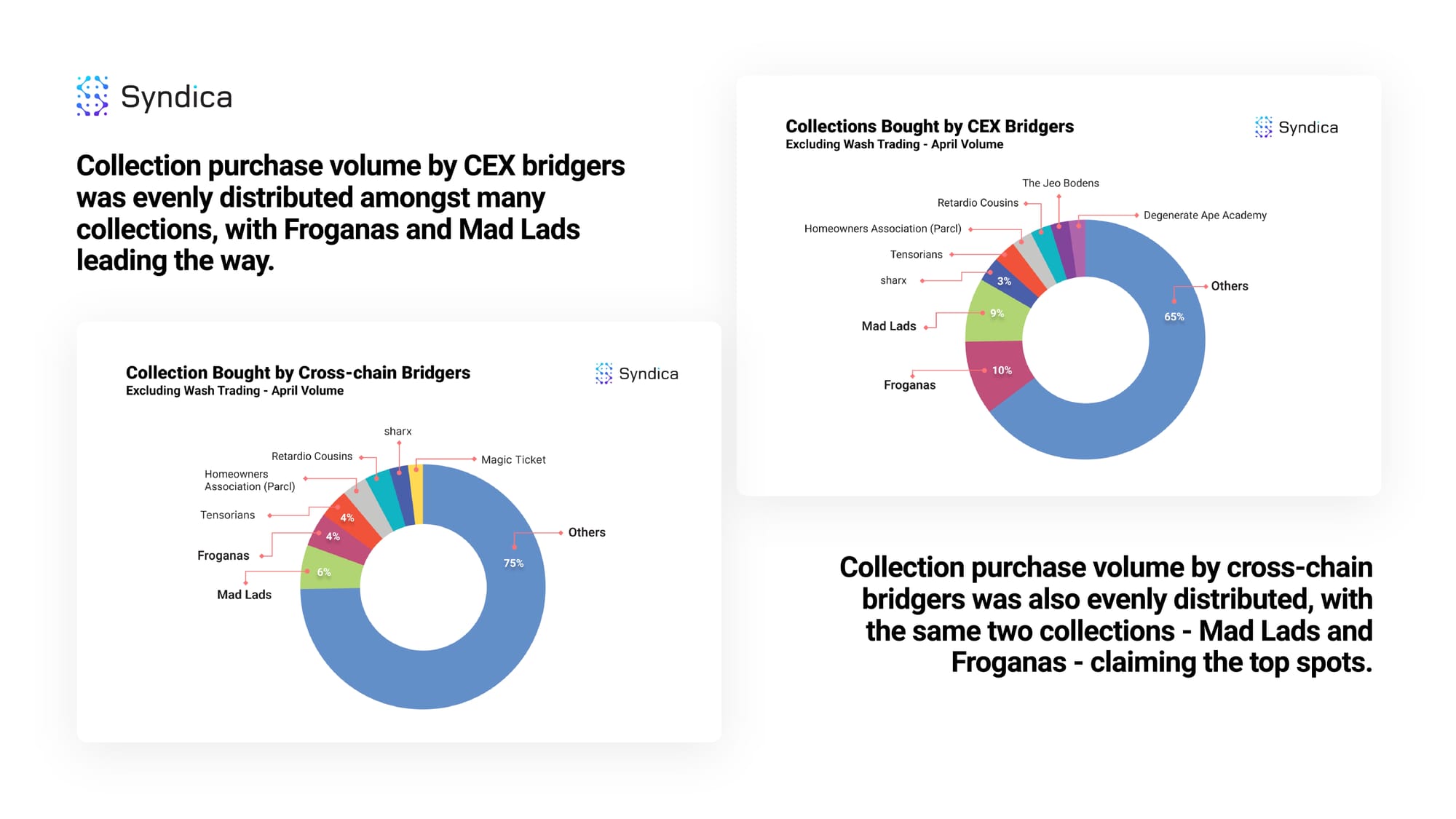

Collection purchase volume by CEX bridgers was evenly distributed amongst many collections, with Froganas and Mad Lads leading the way. Collection purchase volume by cross-chain bridgers was also evenly distributed, with the same two collections - Mad Lads and Froganas - claiming the top spots.

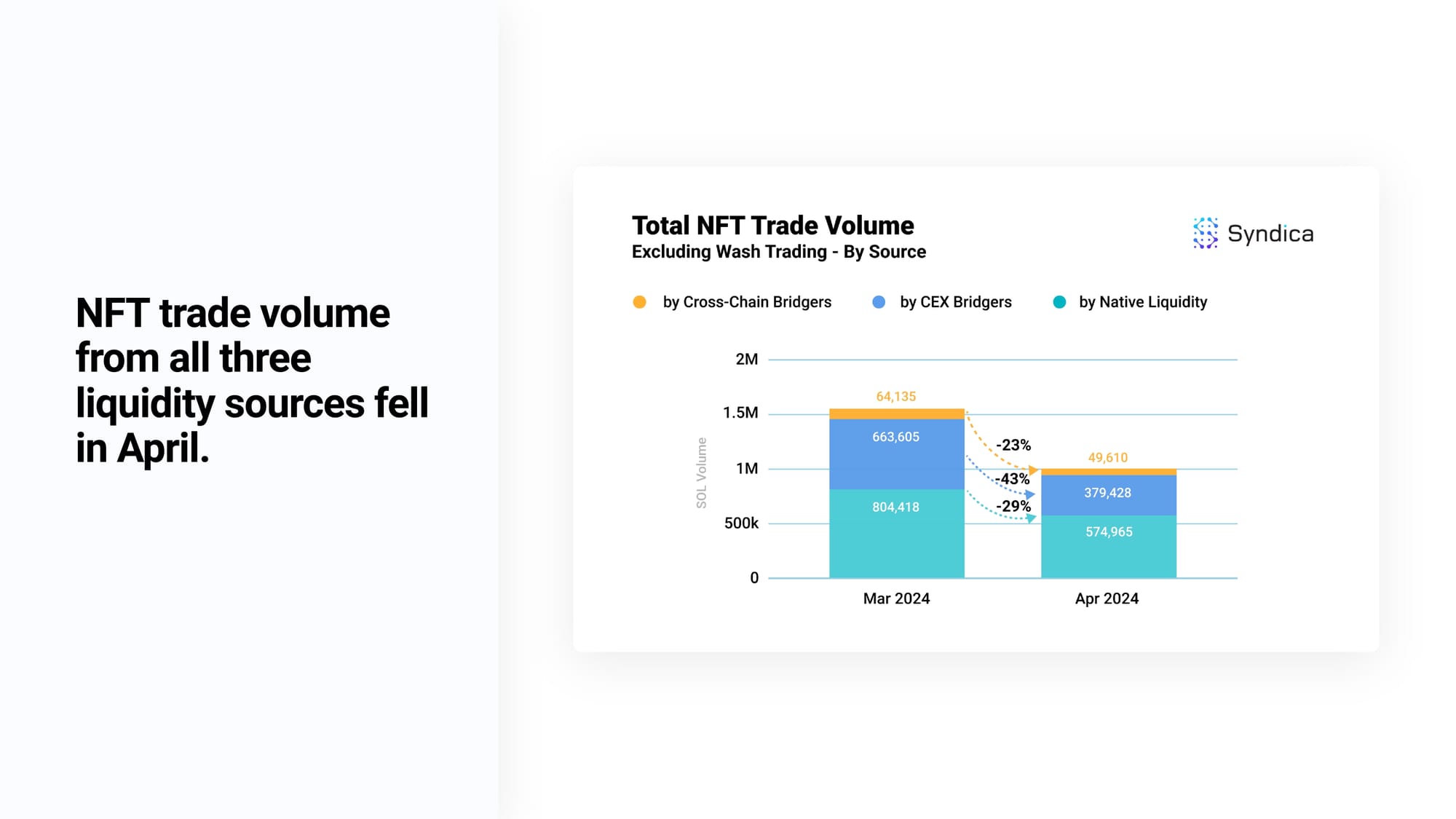

NFT trade volume from all three liquidity sources fell in April.

Our Trends To Watch:

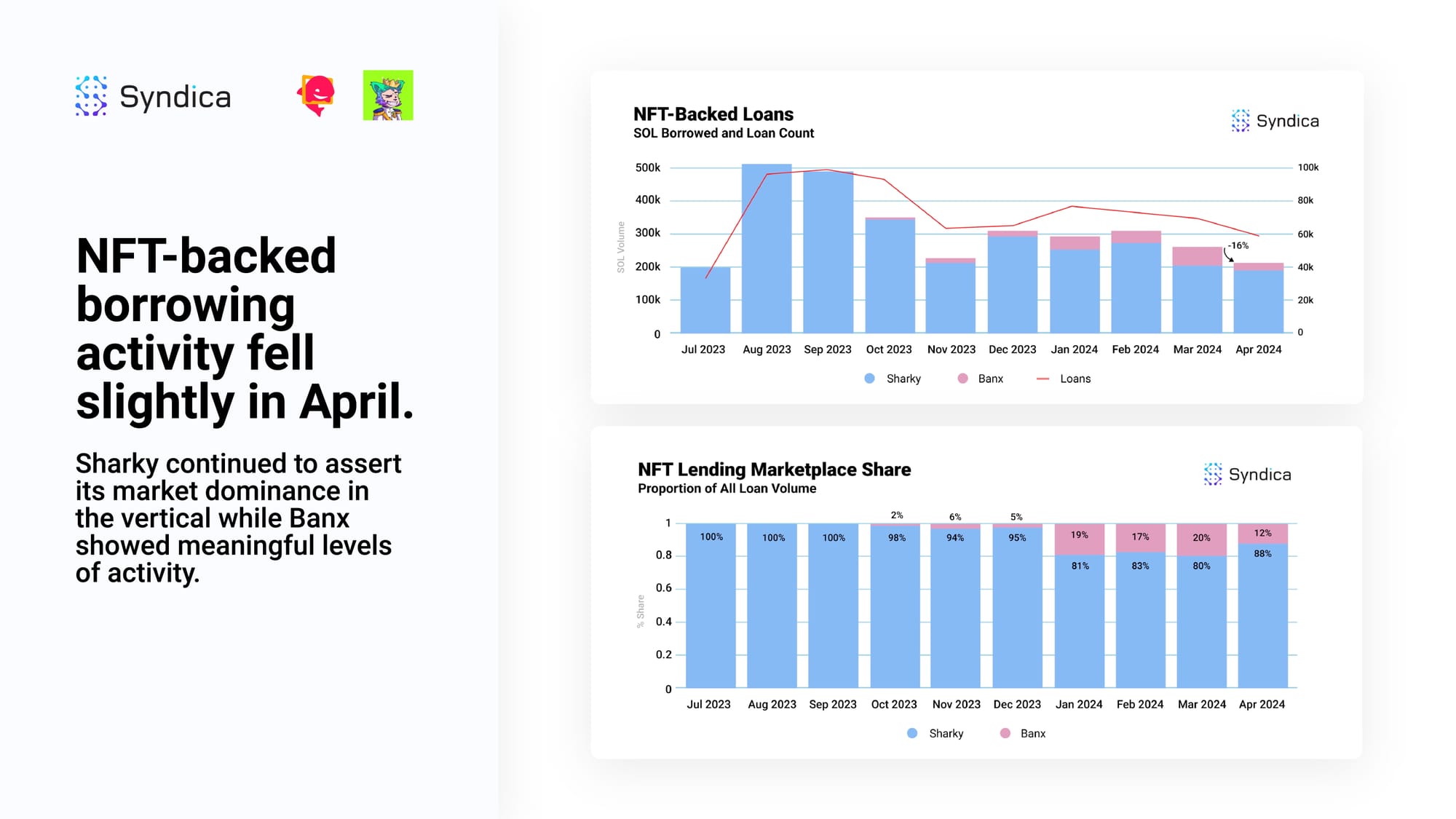

NFT-backed borrowing activity fell slightly in April. Sharky continued to assert its market dominance in the vertical while Banx showed meaningful levels of activity.

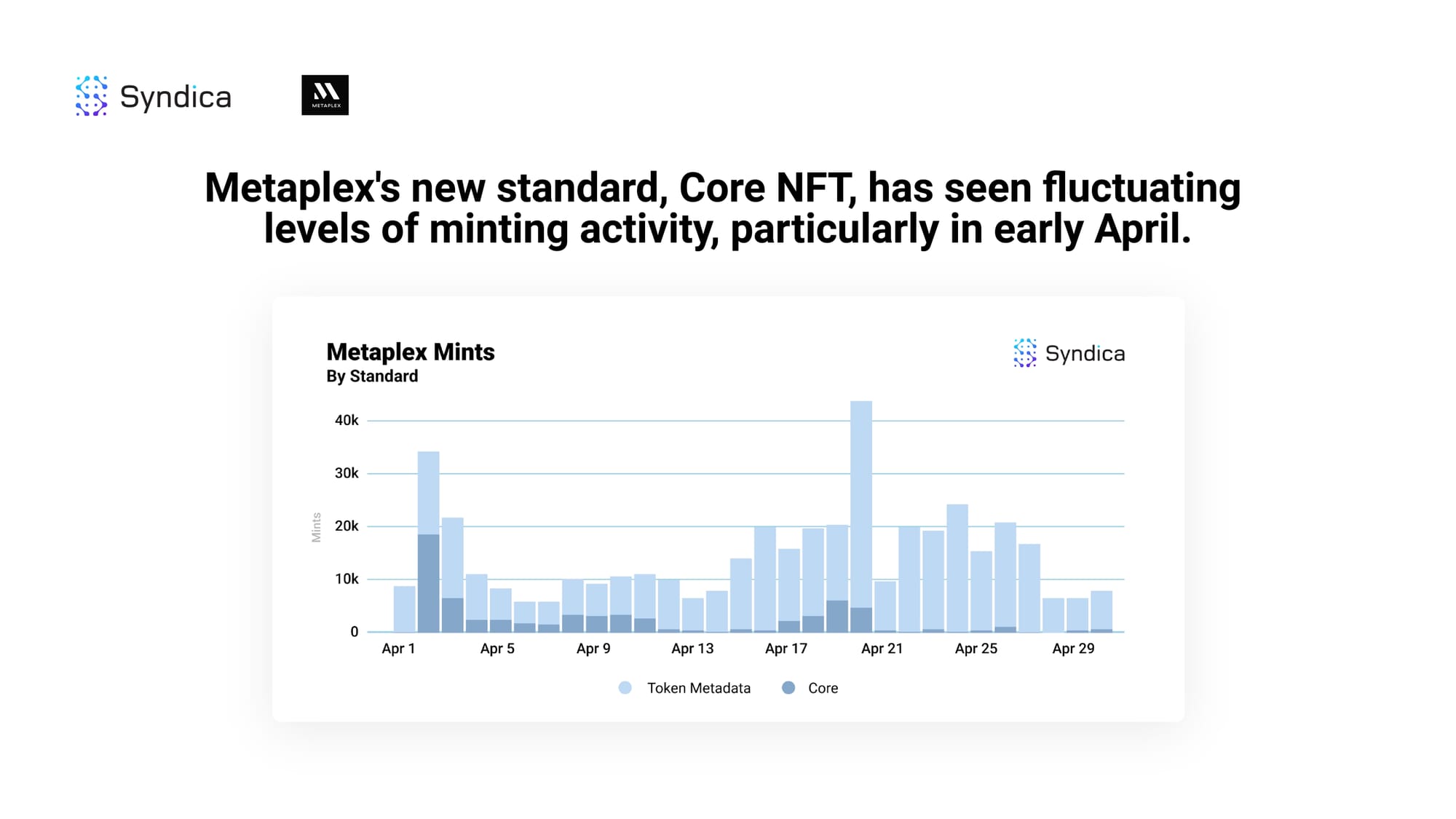

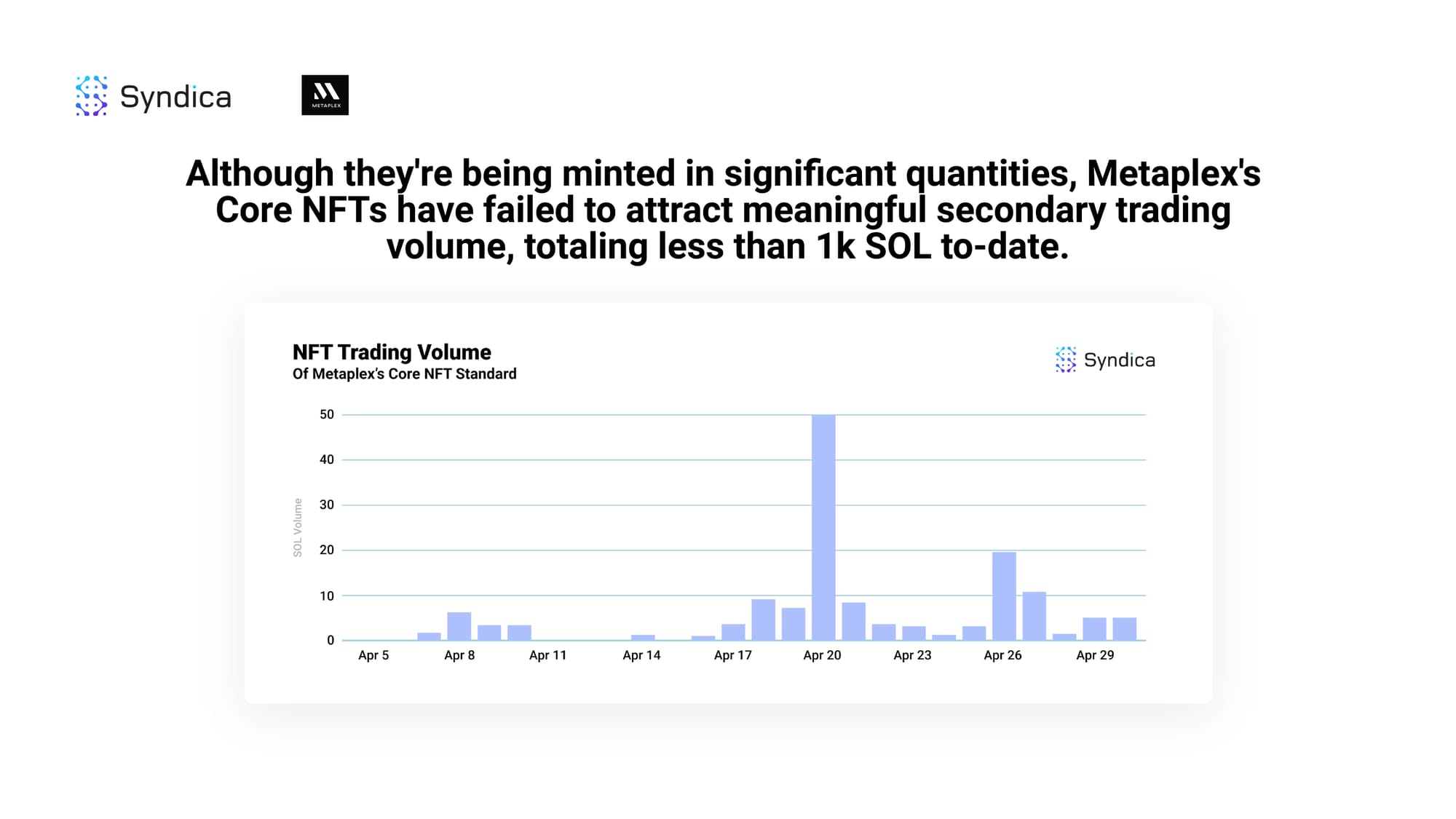

Metaplex's new standard, Core NFT, has seen fluctuating levels of minting activity, particularly in early April.

Although they're being minted in significant quantities, Metaplex's Core NFTs have failed to attract meaningful secondary trading volume, totaling less than 1k SOL to-date.