Deep Dive: Solana NFT Market - February 2024

Deep Dive: Solana NFT Market - February 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana NFT Market - February 2024

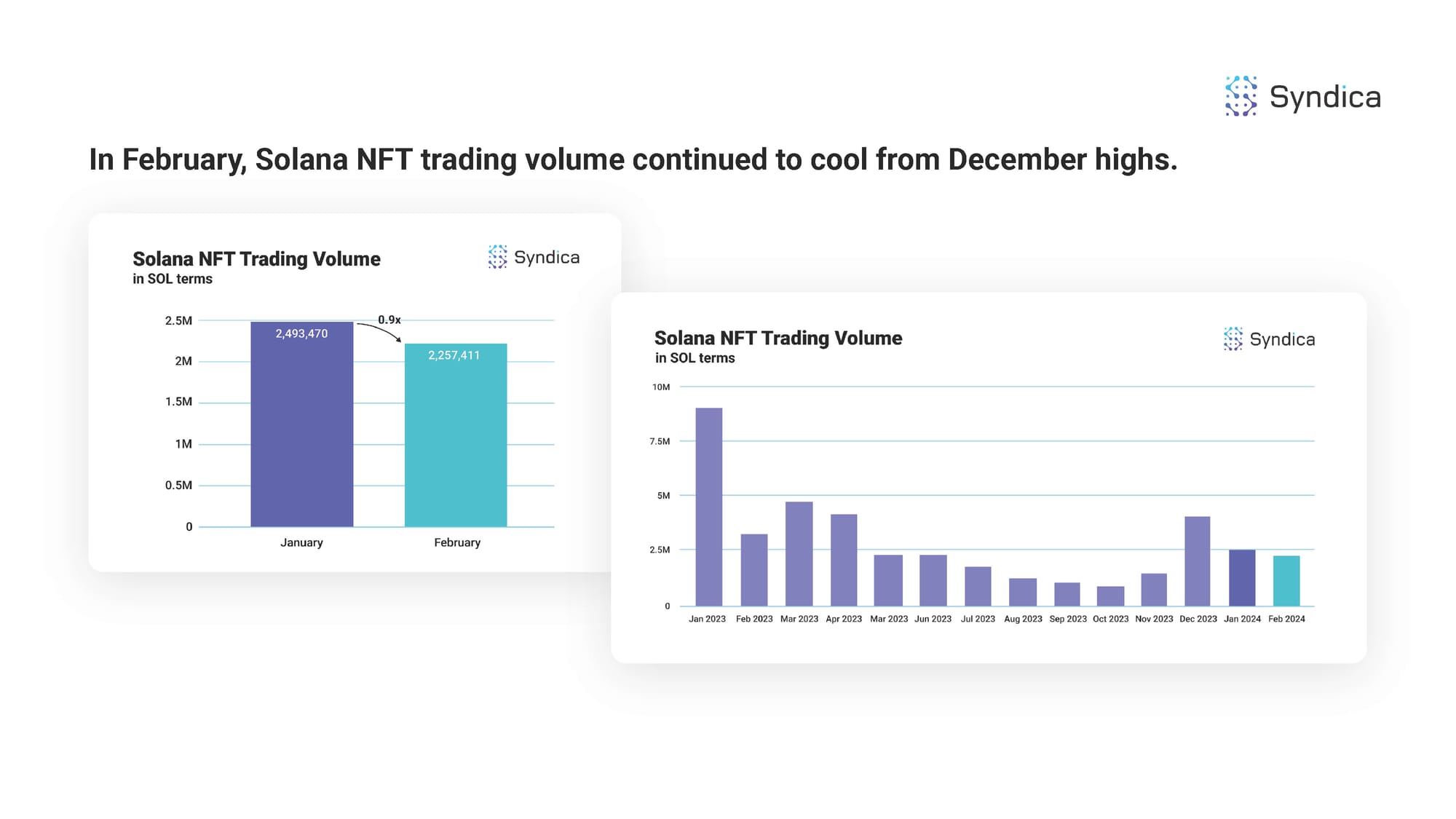

In February, Solana NFT trading volume continued to cool from December highs.

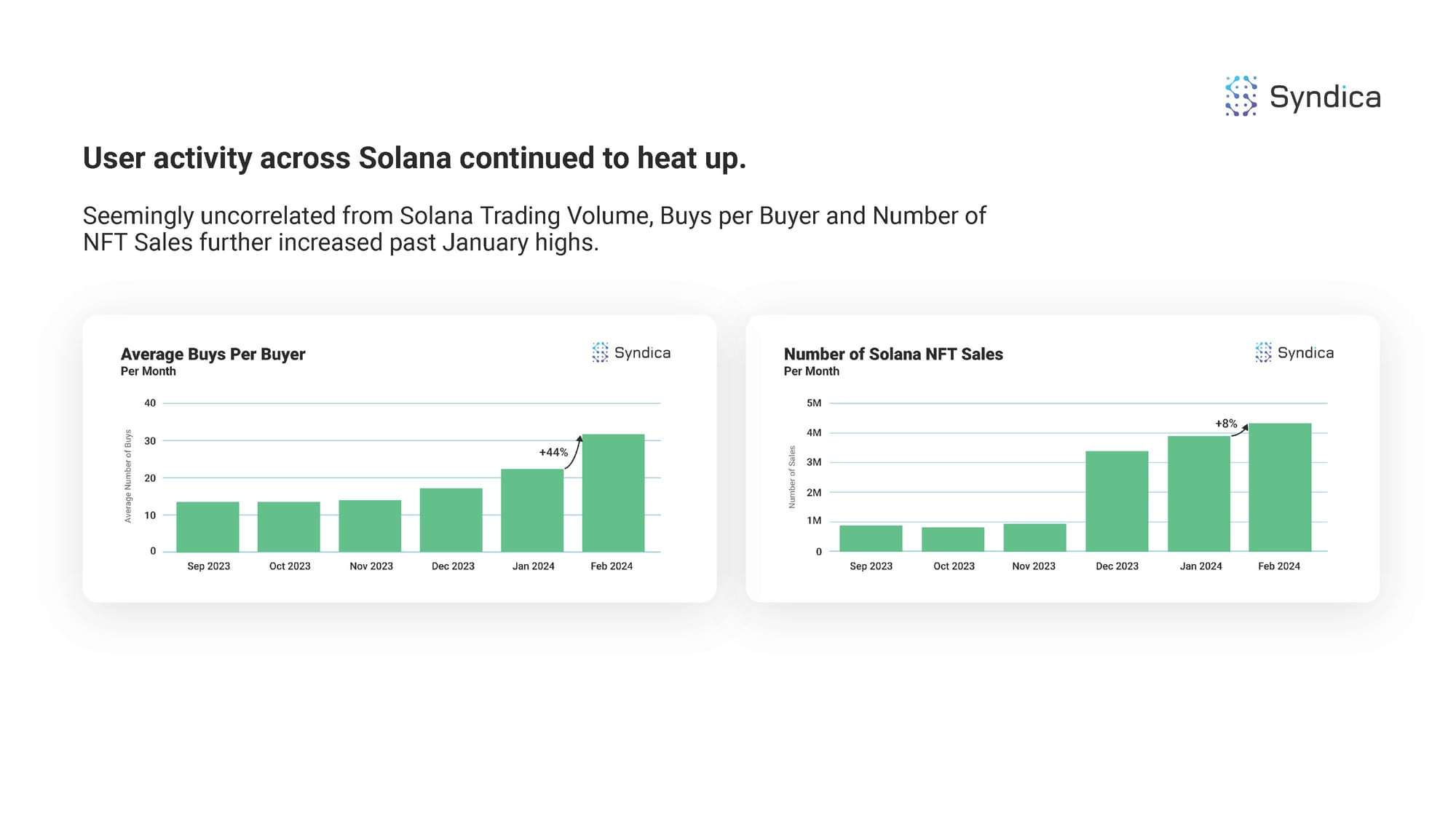

User activity across Solana continued to heat up. Seemingly uncorrelated from Solana Trading Volume, Buys per Buyer and Number of NFT Sales further increased past January highs.

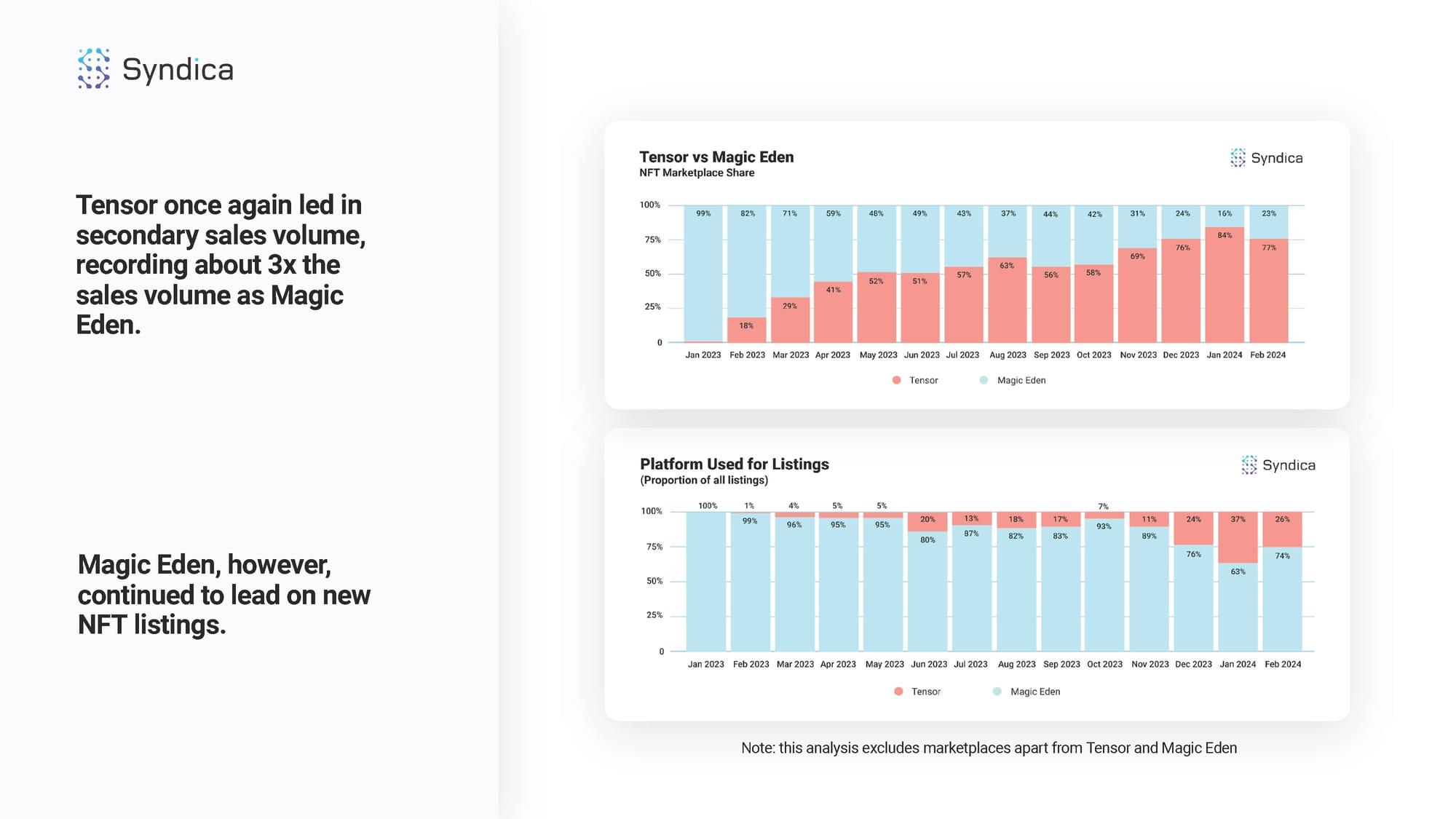

Tensor once again led in secondary sales volume, recording about 3x the sales volume as Magic Eden. Magic Eden, however, continued to lead on new NFT listings.

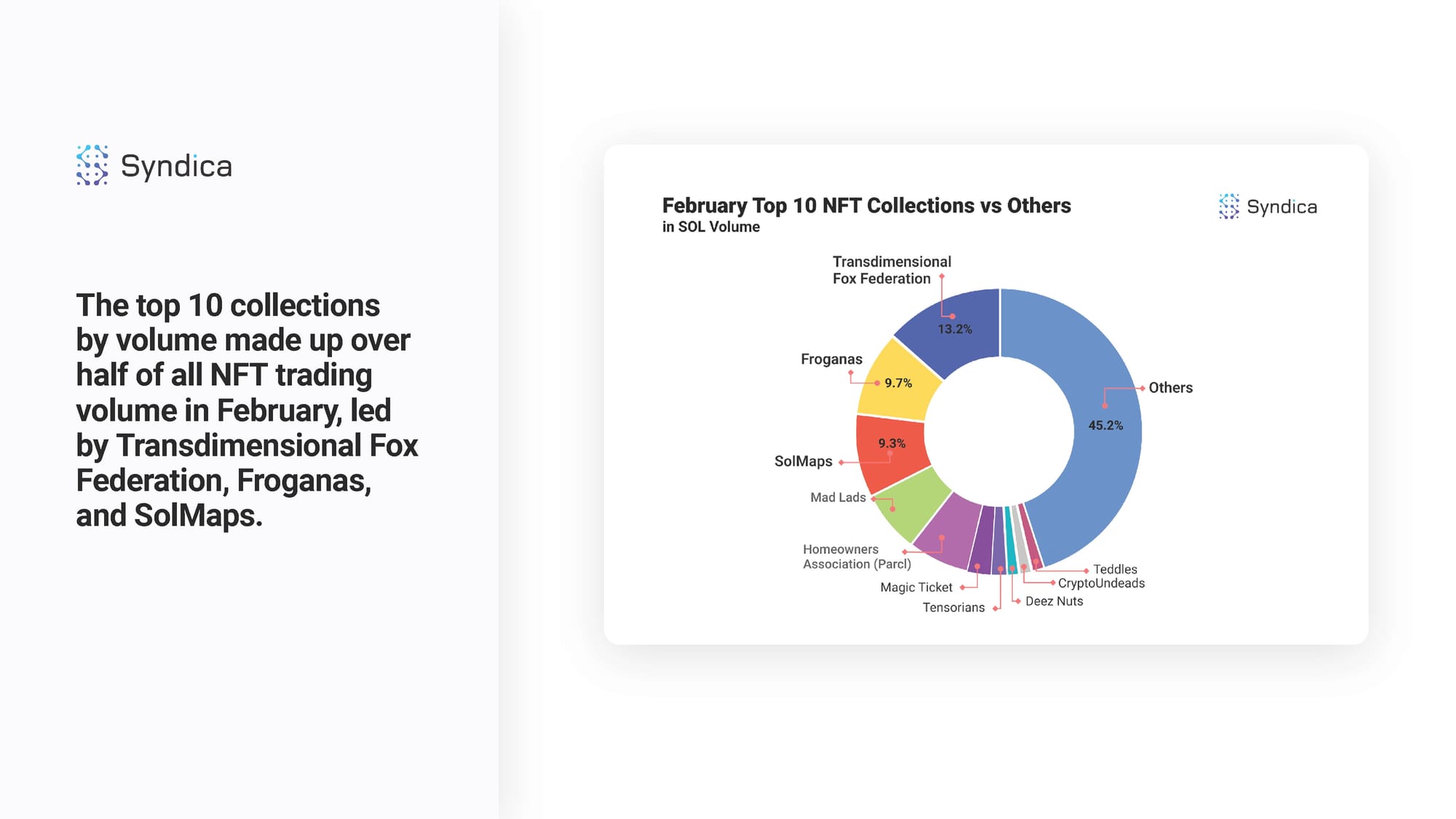

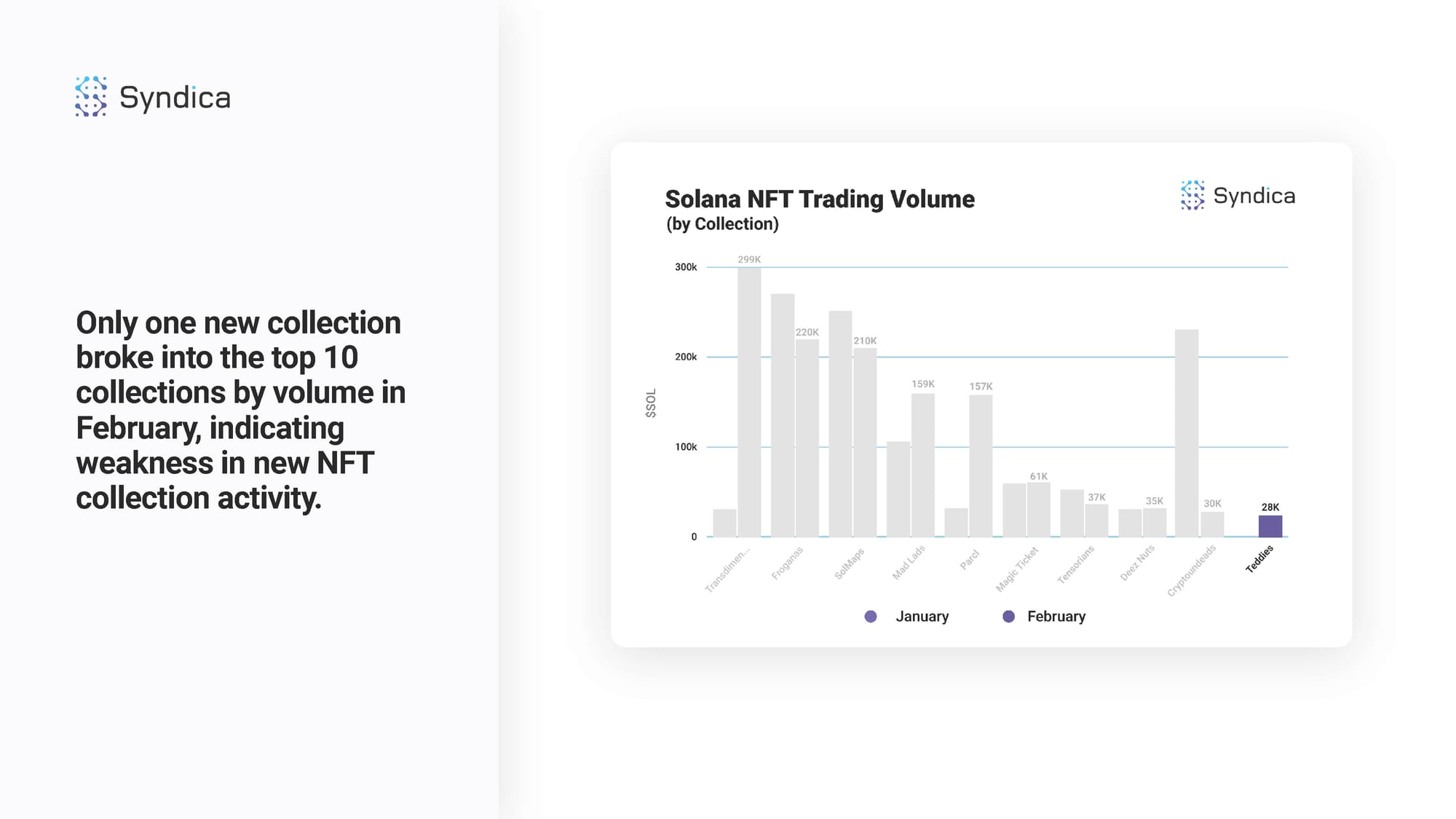

The top 10 collections by volume made up over half of all NFT trading volume in February, led by Transdimensional Fox Federation, Froganas, and SolMaps.

Only one new collection broke into the top 10 collections by volume in February, indicating weakness in new NFT collection activity.

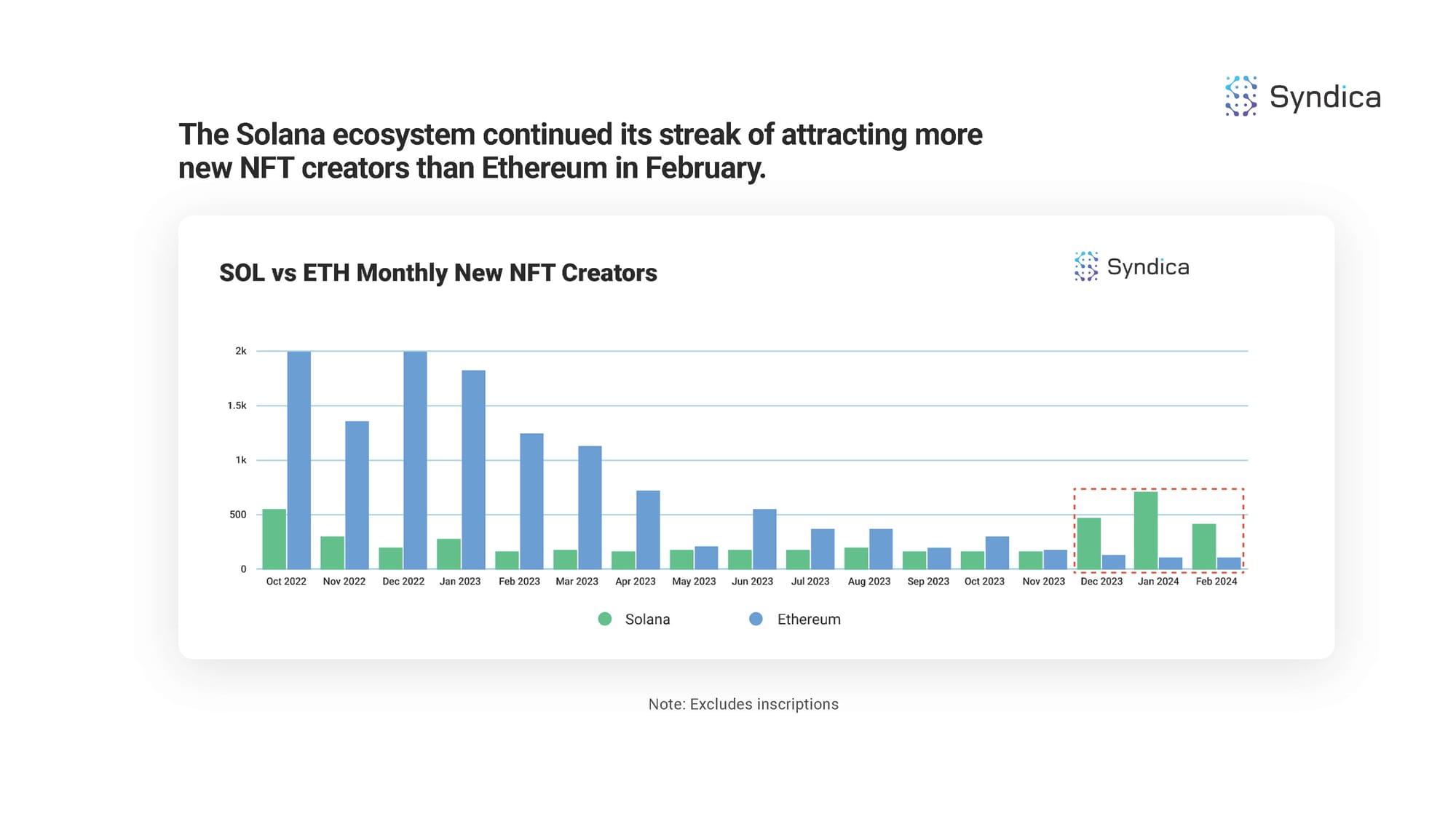

The Solana ecosystem continued its streak of attracting more new NFT creators than Ethereum in February.

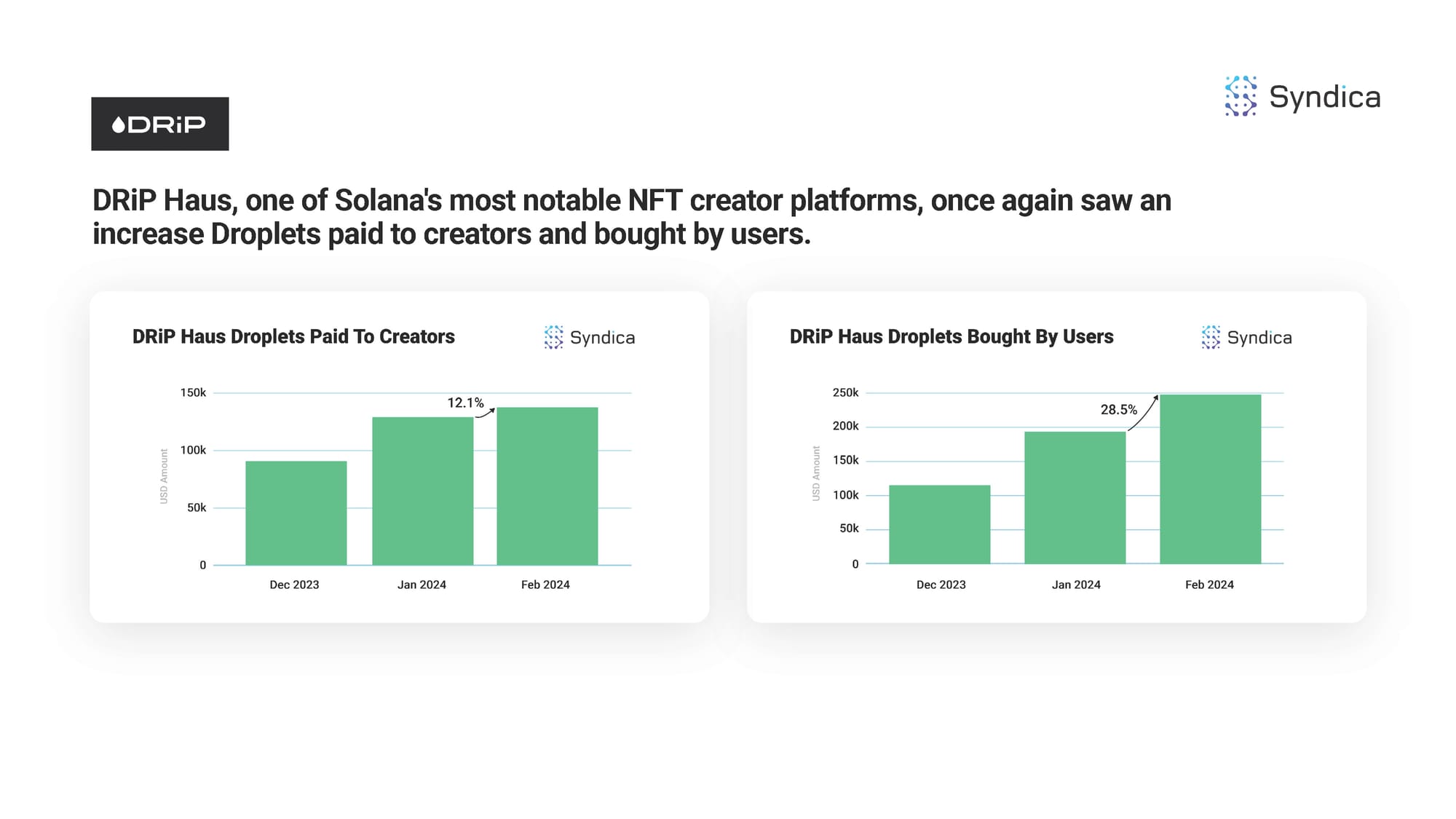

DRiP Haus, one of Solana's most notable NFT creator platforms, once again saw an increase Droplets paid to creators and bought by users.

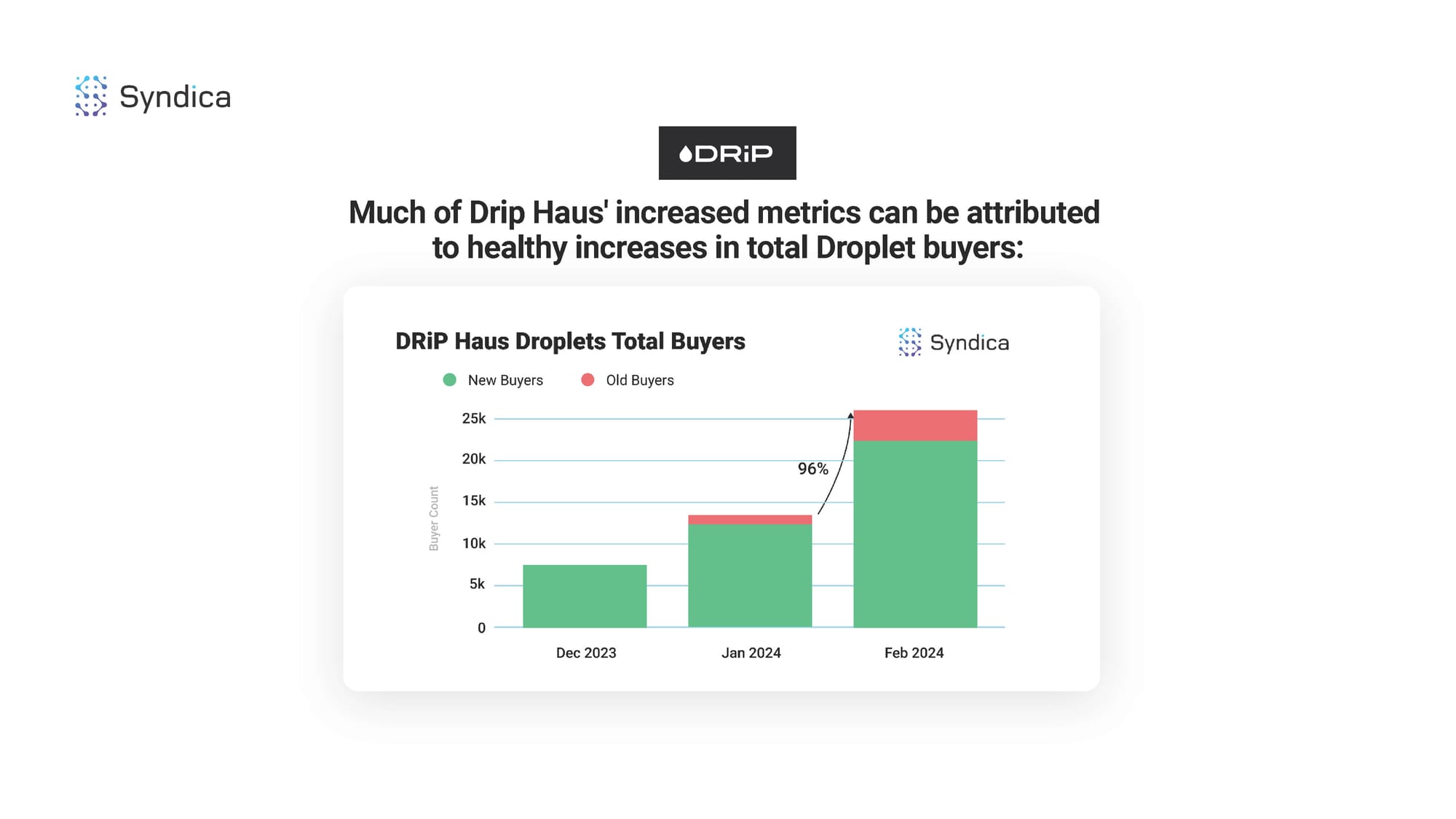

Much of Drip Haus' increased metrics can be attributed to healthy increases in total Droplet buyers.

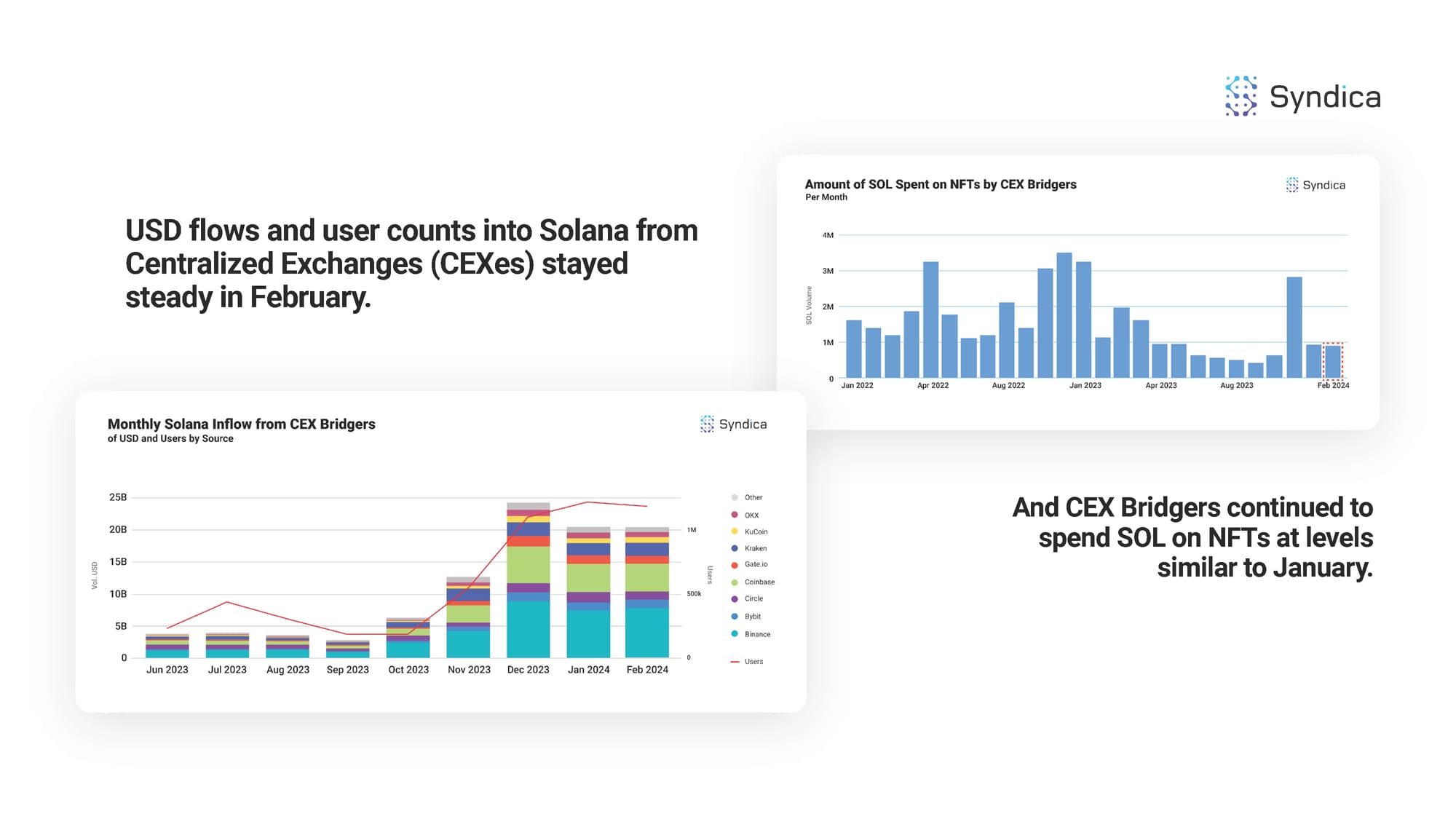

USD flows and user counts into Solana from Centralized Exchanges (CEXes) stayed steady in February. And CEX Bridgers continued to spend SOL on NFTs at levels similar to those in January.

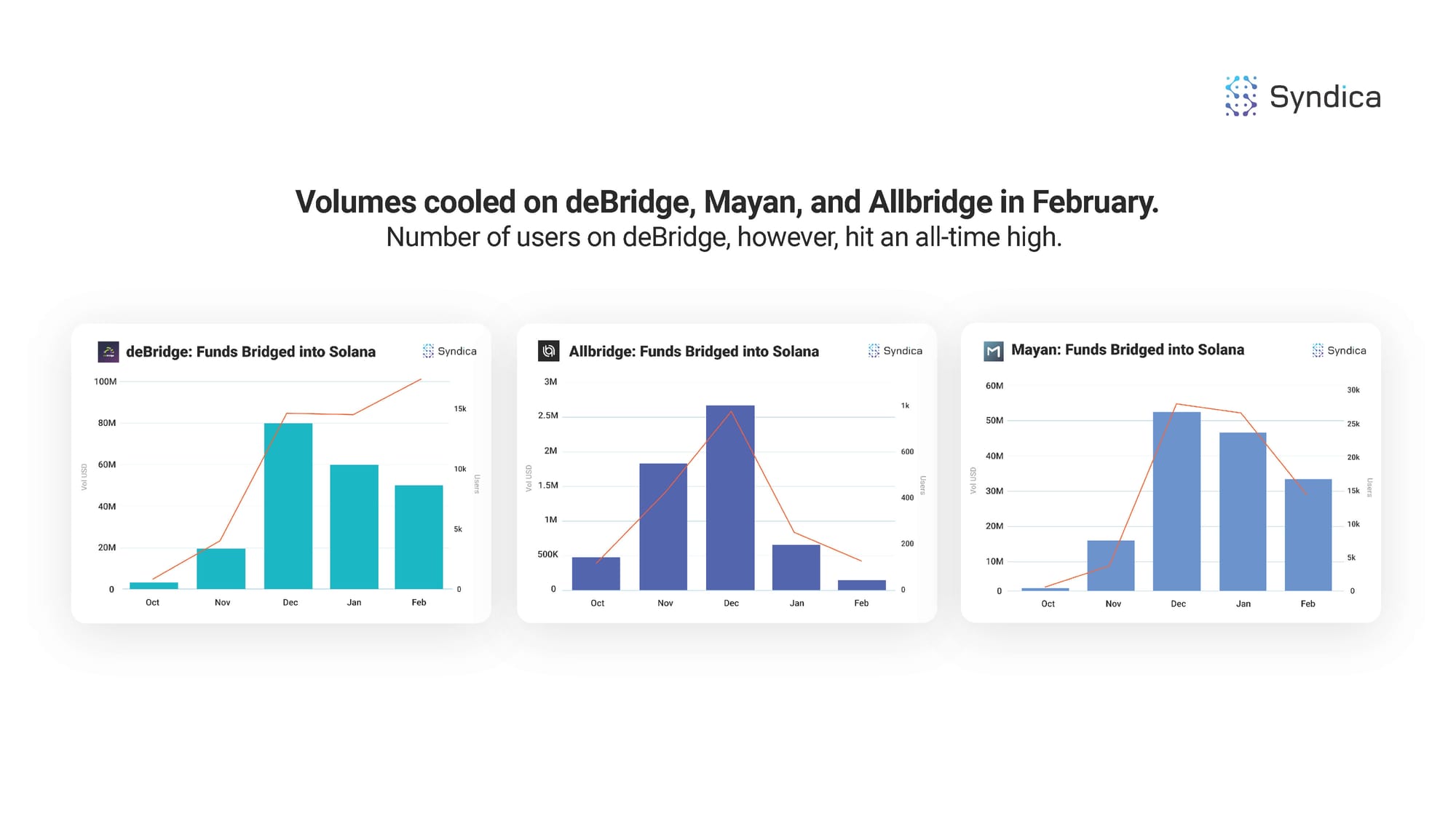

Volumes cooled on deBridge, Mayan, and Allbridge in February. Number of users on deBridge, however, hit an all-time high.

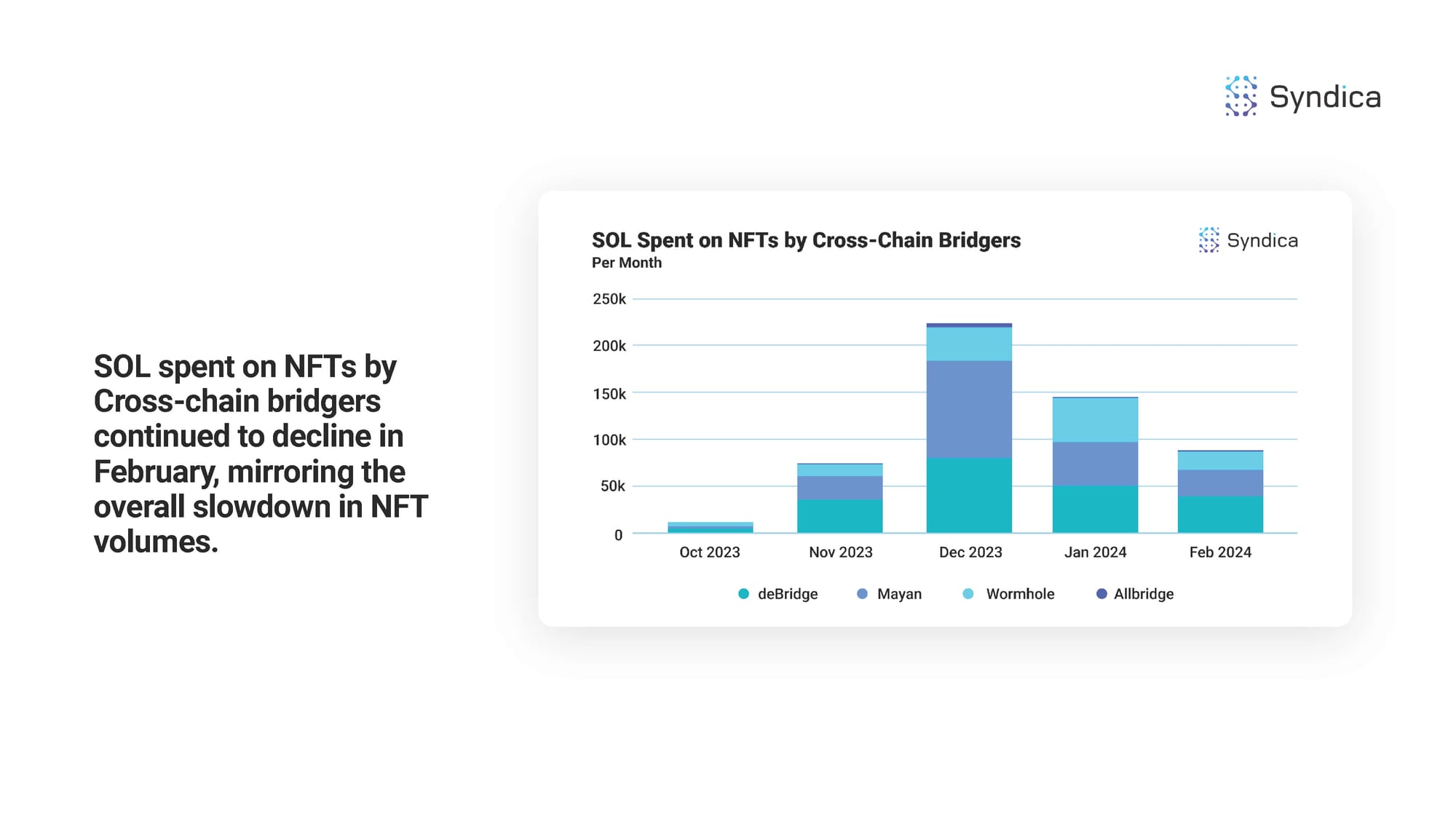

SOL spent on NFTs by Cross-chain bridgers continued to decline in February, mirroring the overall slowdown in NFT volumes.

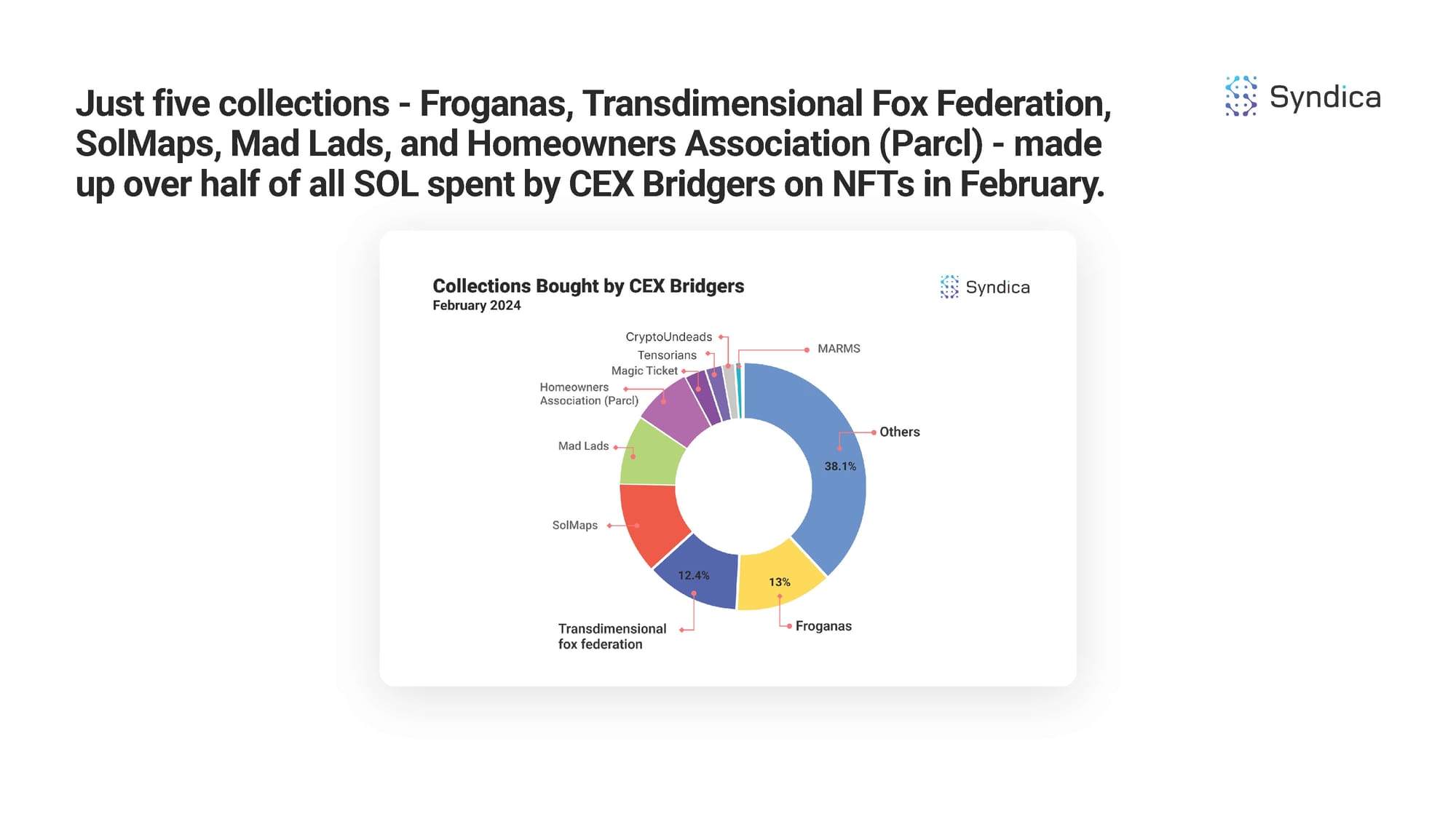

Just five collections - Froganas, Transdimensional Fox Federation, SolMaps, Mad Lads, and Homeowners Association (Parcl) - made up over half of all SOL spent by CEX Bridgers on NFTs in February.

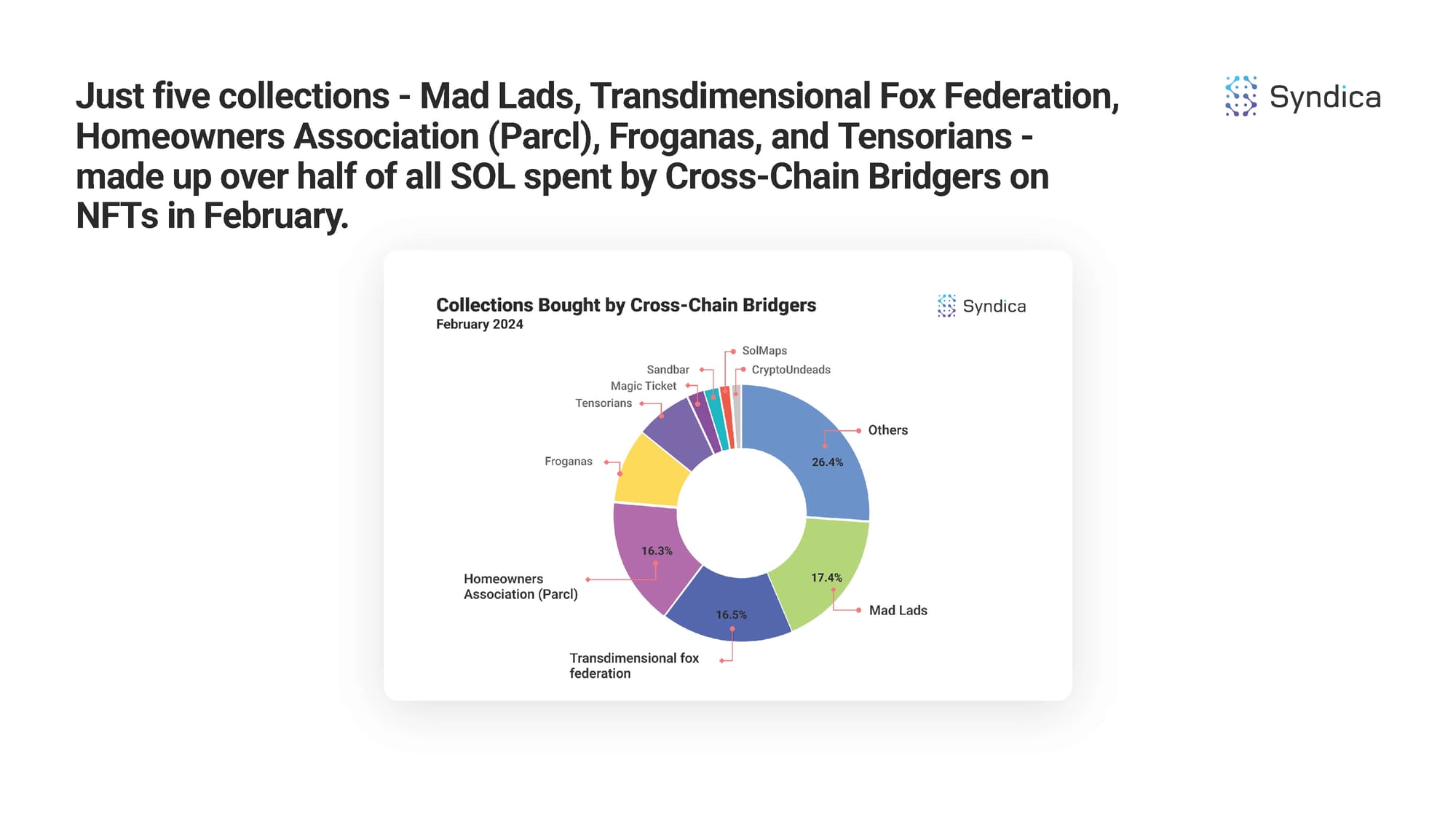

Just five collections - Mad Lads, Transdimensional Fox Federation, Homeowners Association (Parcl), Froganas, and Tensorians - made up over half of all SOL spent by Cross-Chain Bridgers on NFTs in February.

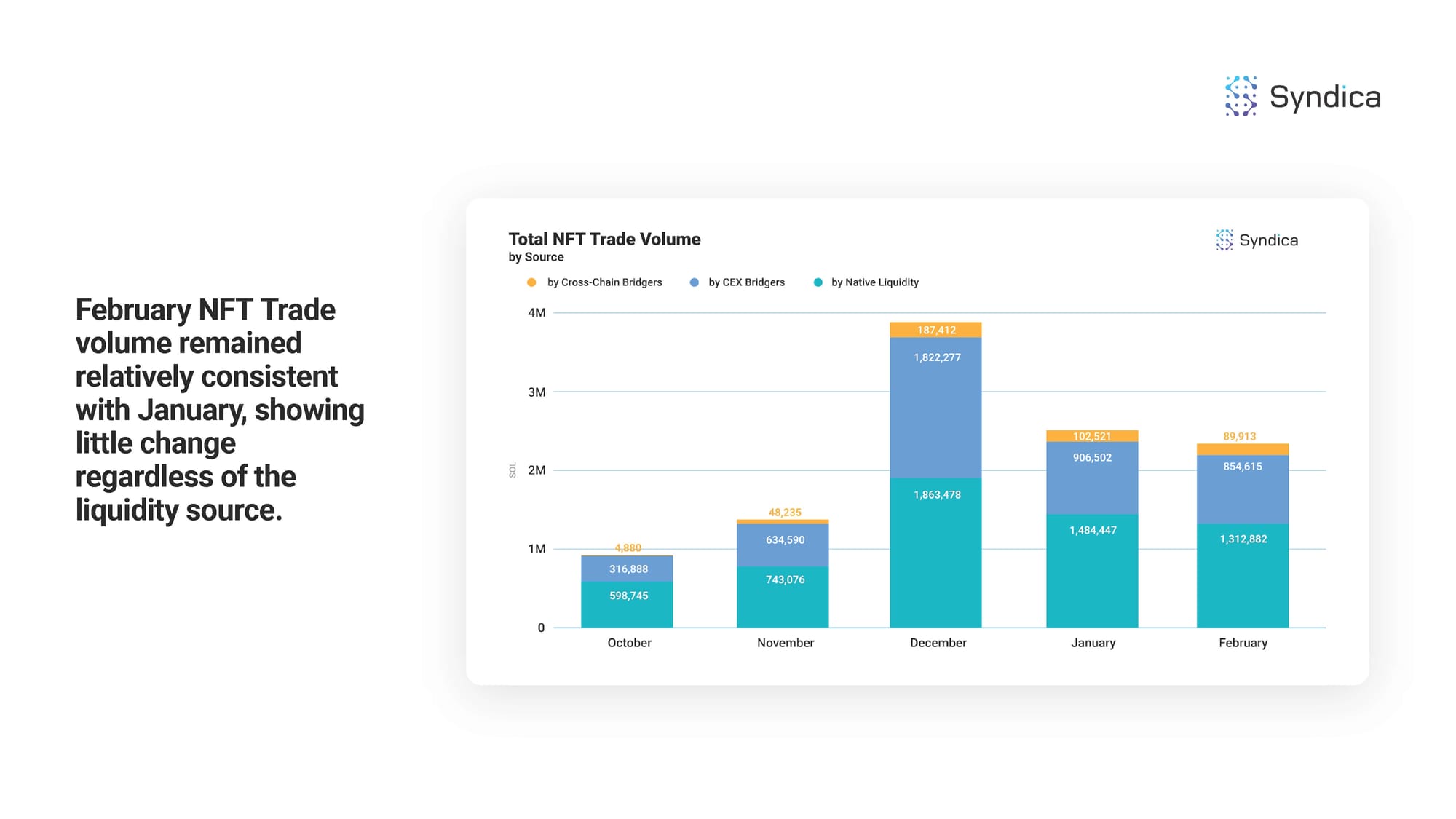

February NFT Trade volume remained relatively consistent with January, showing little change regardless of the liquidity source.

Our Trends To Watch:

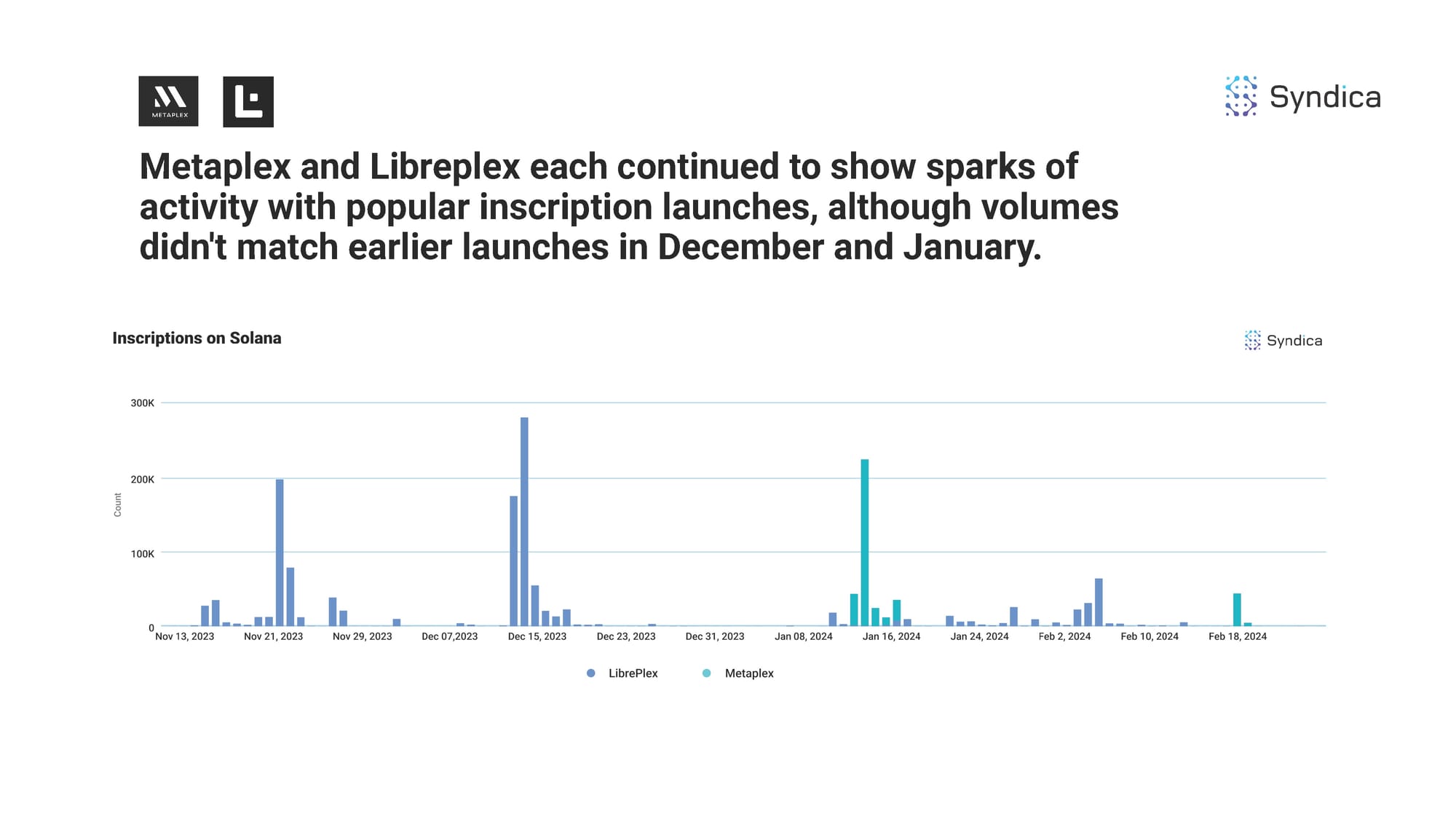

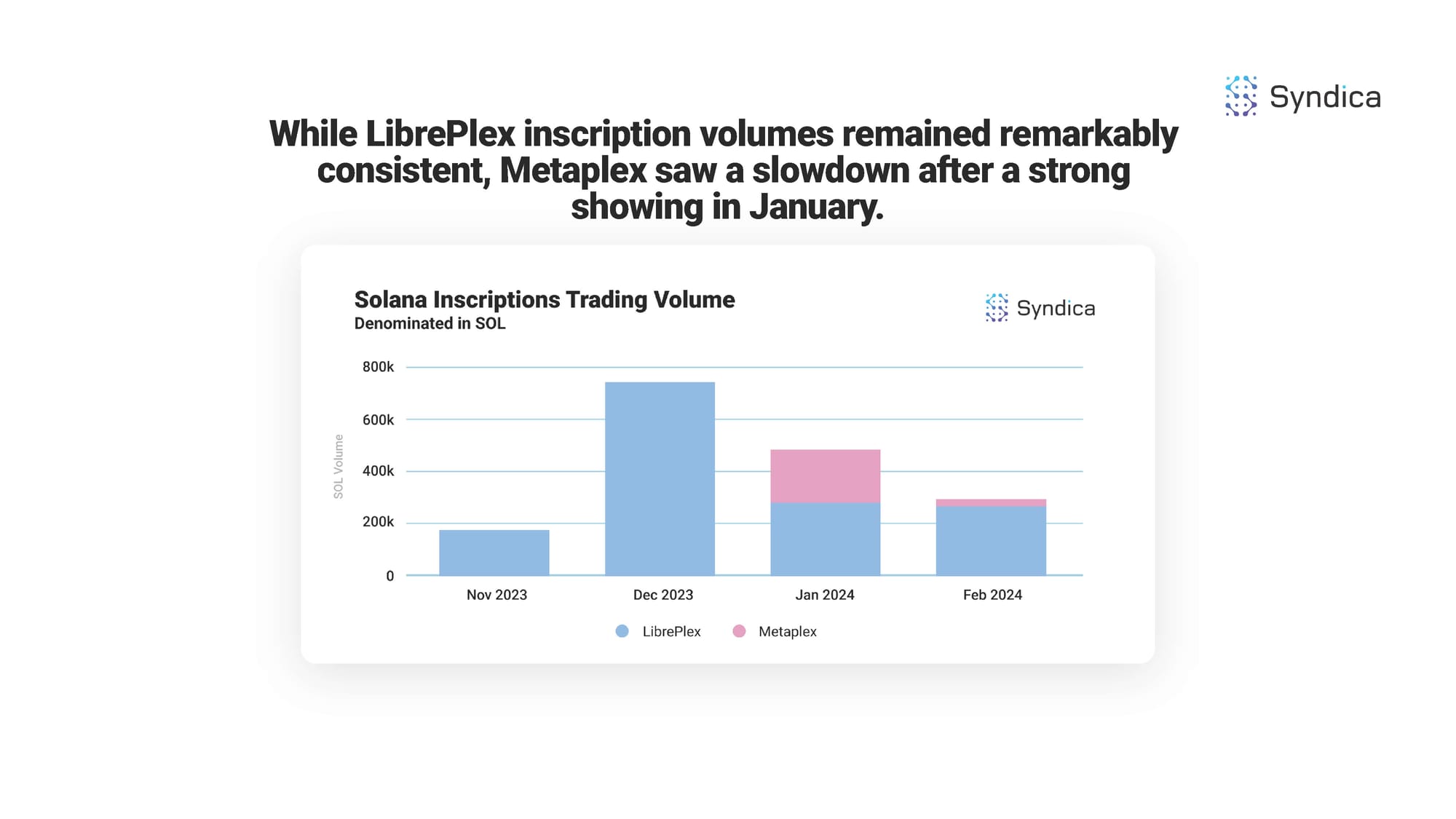

Metaplex and Libreplex each continued to show sparks of activity with popular inscription launches, although volumes didn't match earlier launches in December and January.

While LibrePlex inscription volumes remained remarkably consistent, Metaplex saw a slowdown after a strong showing in January.

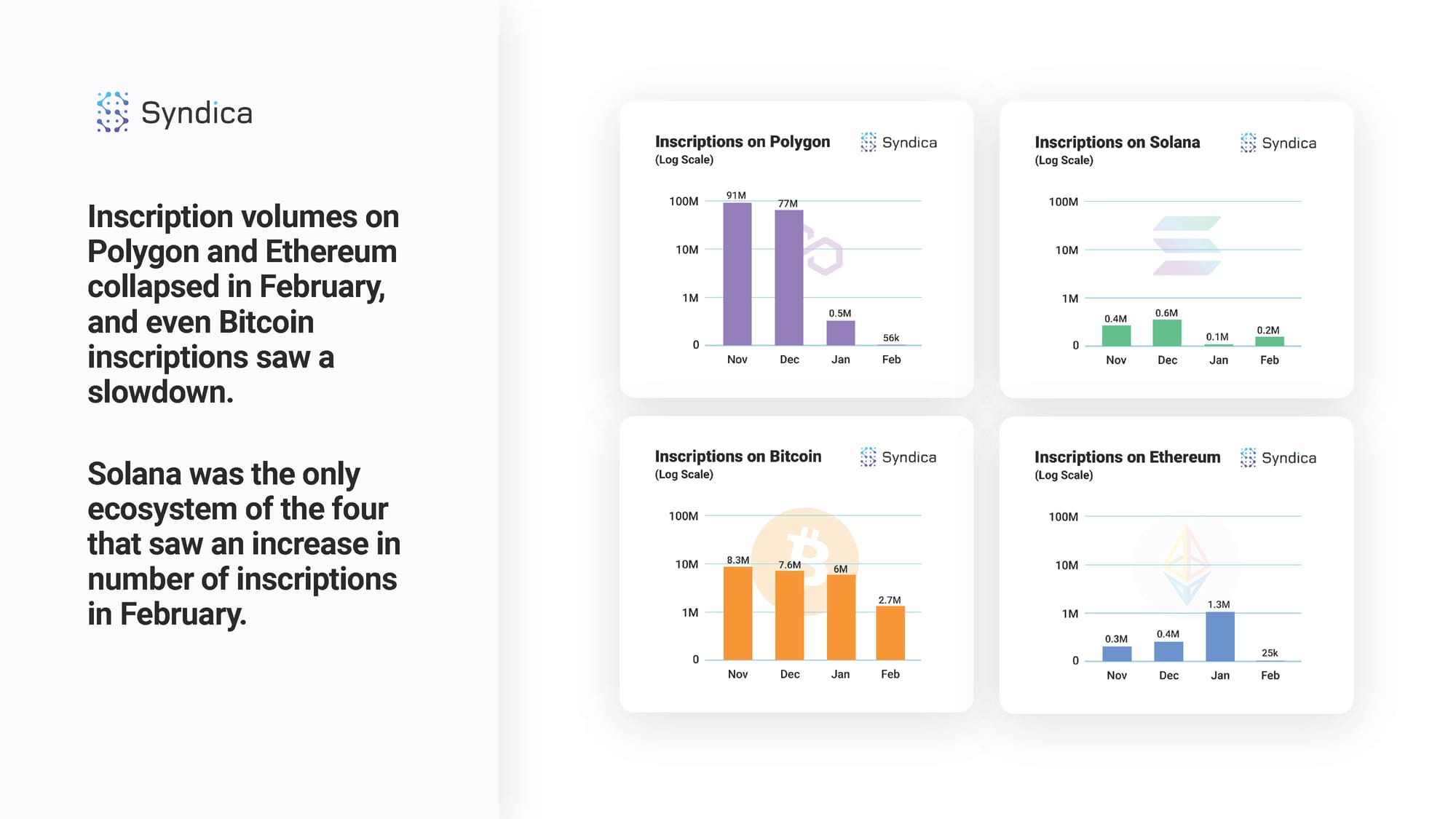

Inscription volumes on Polygon and Ethereum collapsed in February, and even Bitcoin inscriptions saw a slowdown.

Solana was the only ecosystem of the four that saw an increase in number of inscriptions in February.

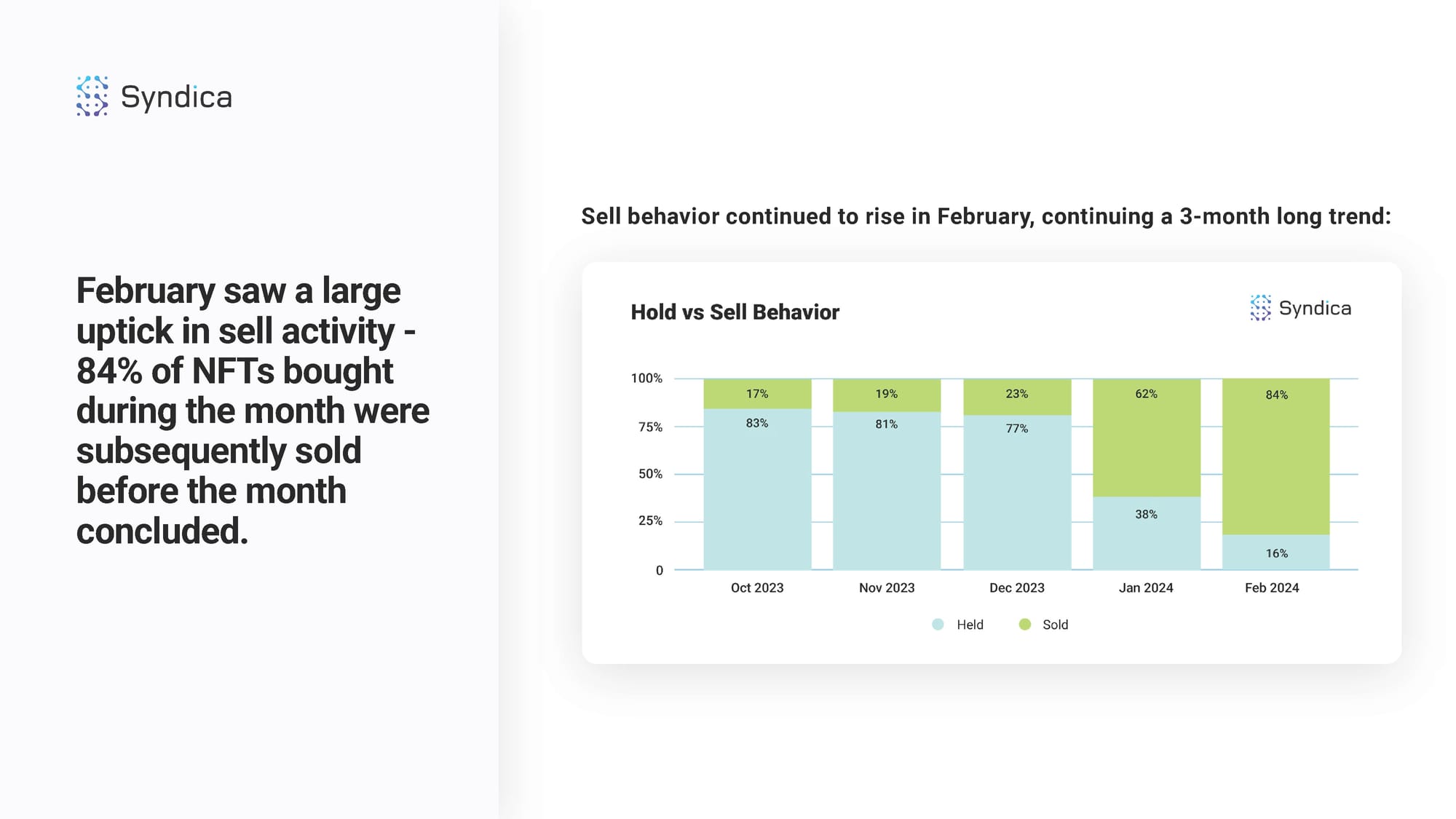

February saw a large uptick in sell activity - 84% of NFTs bought during the month were subsequently sold before the month concluded.

Sell behavior continued to rise in February, continuing a 3-month long trend.