Deep Dive: Solana NFT Market - May 2024

Deep Dive: Solana NFT Market - May 2024

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana NFT Market - May 2024

Trading Volume & Flows:

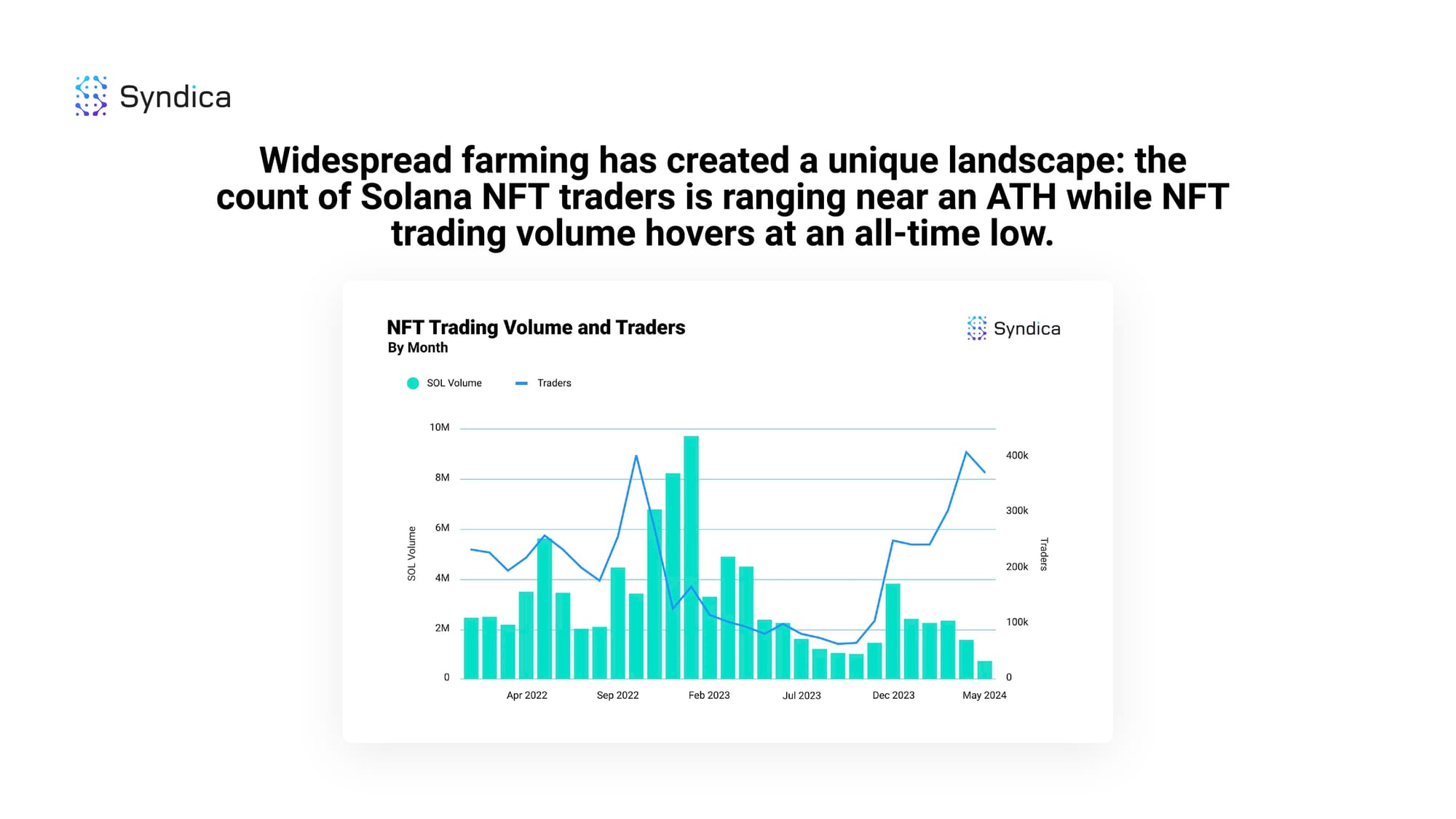

Widespread farming has created a unique landscape: the count of Solana NFT traders is ranging near an ATH while NFT trading volume hovers at an all-time low.

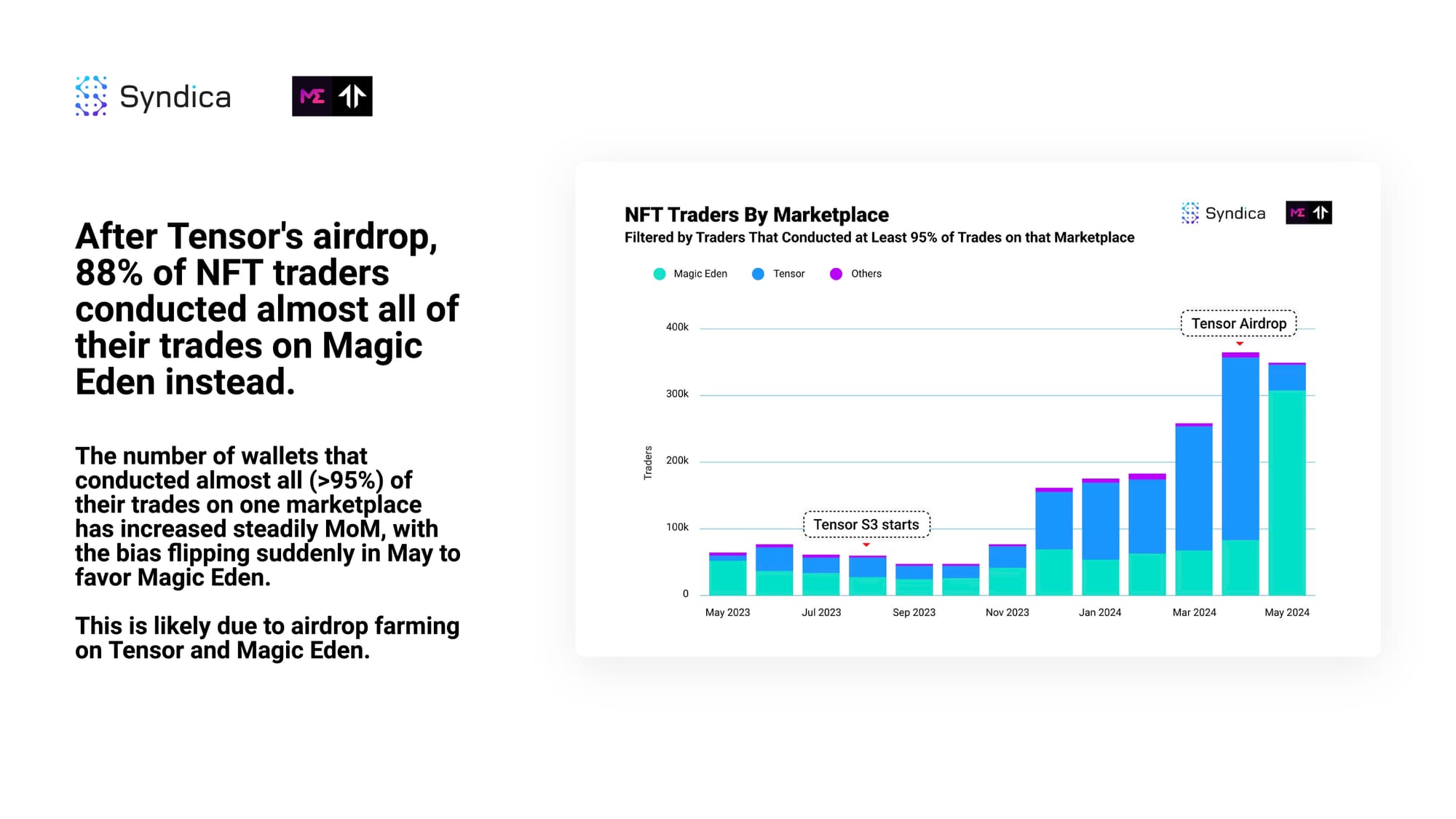

After Tensor's airdrop, 88% of NFT traders conducted almost all of their trades on Magic Eden instead.

The number of wallets that conducted almost all (>95%) of their trades on one marketplace has increased steadily MoM, with the bias flipping suddenly in May to favor Magic Eden.

This is likely due to airdrop farming on Tensor and Magic Eden.

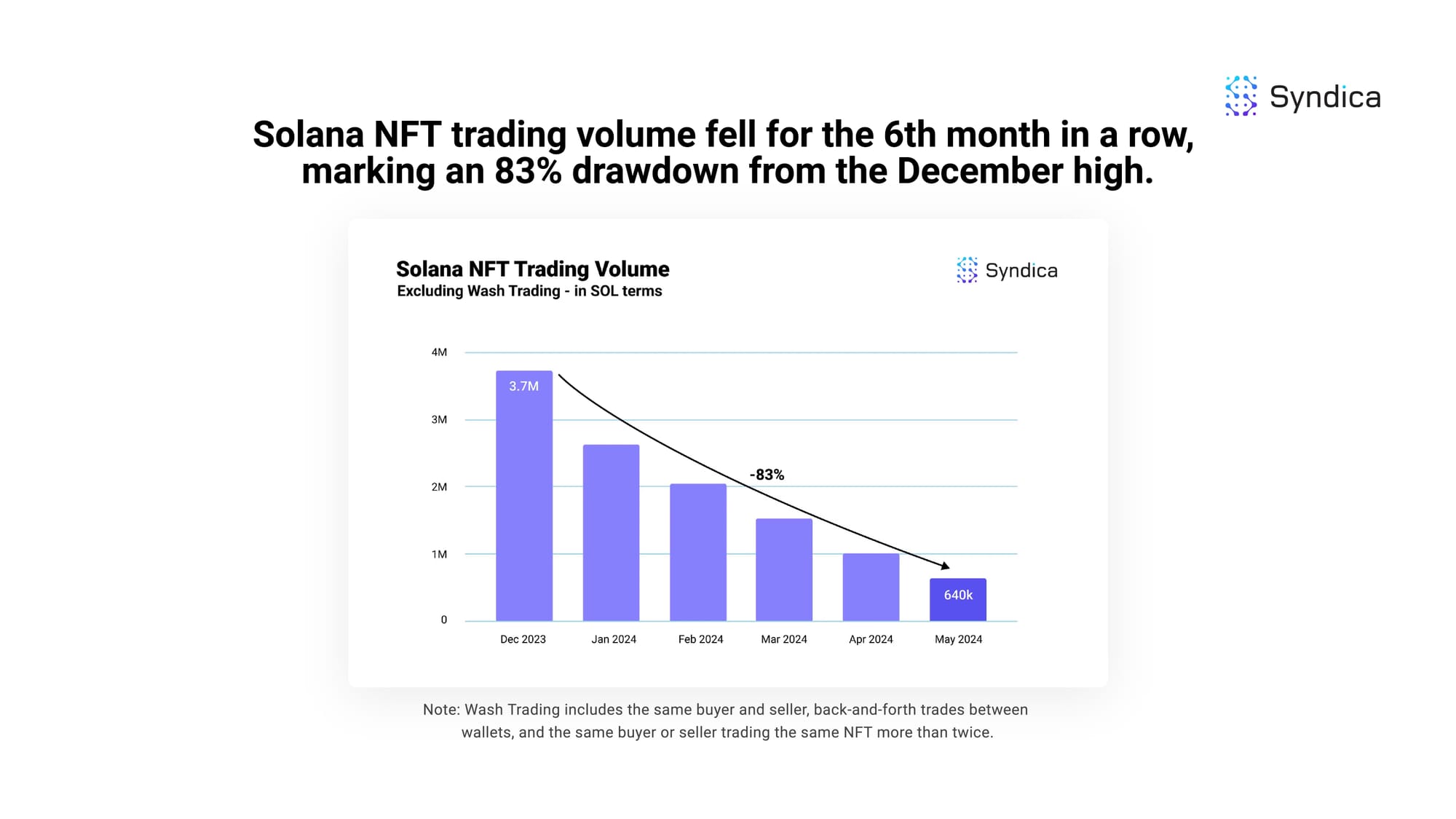

Solana NFT trading volume fell for the 6th month in a row, marking an 83% drawdown from the December high.

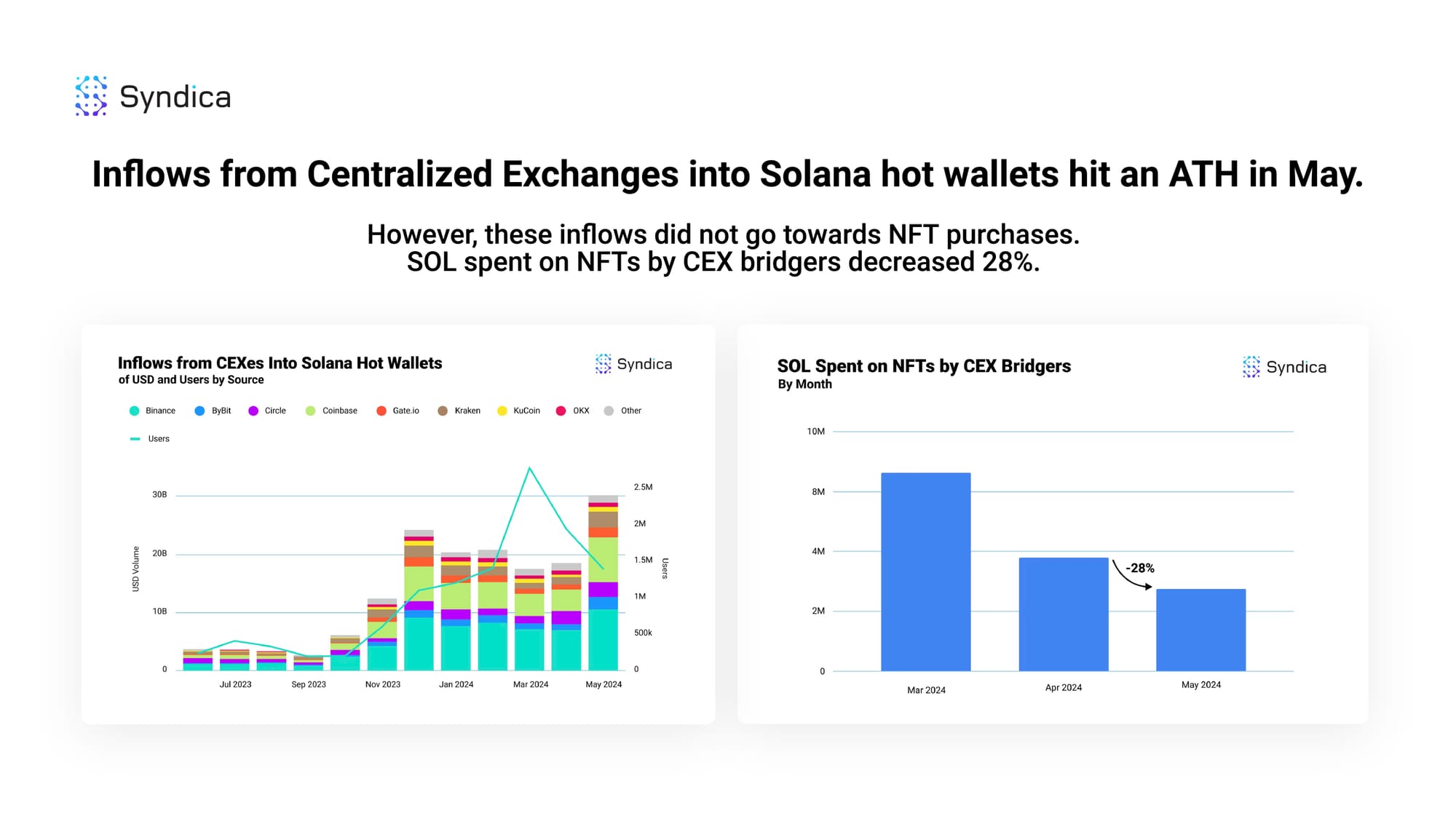

Inflows from Centralized Exchanges into Solana hot wallets hit an ATH in May.

However, these inflows did not go towards NFT purchases. SOL spent on NFTs by CEX bridgers decreased 28%.

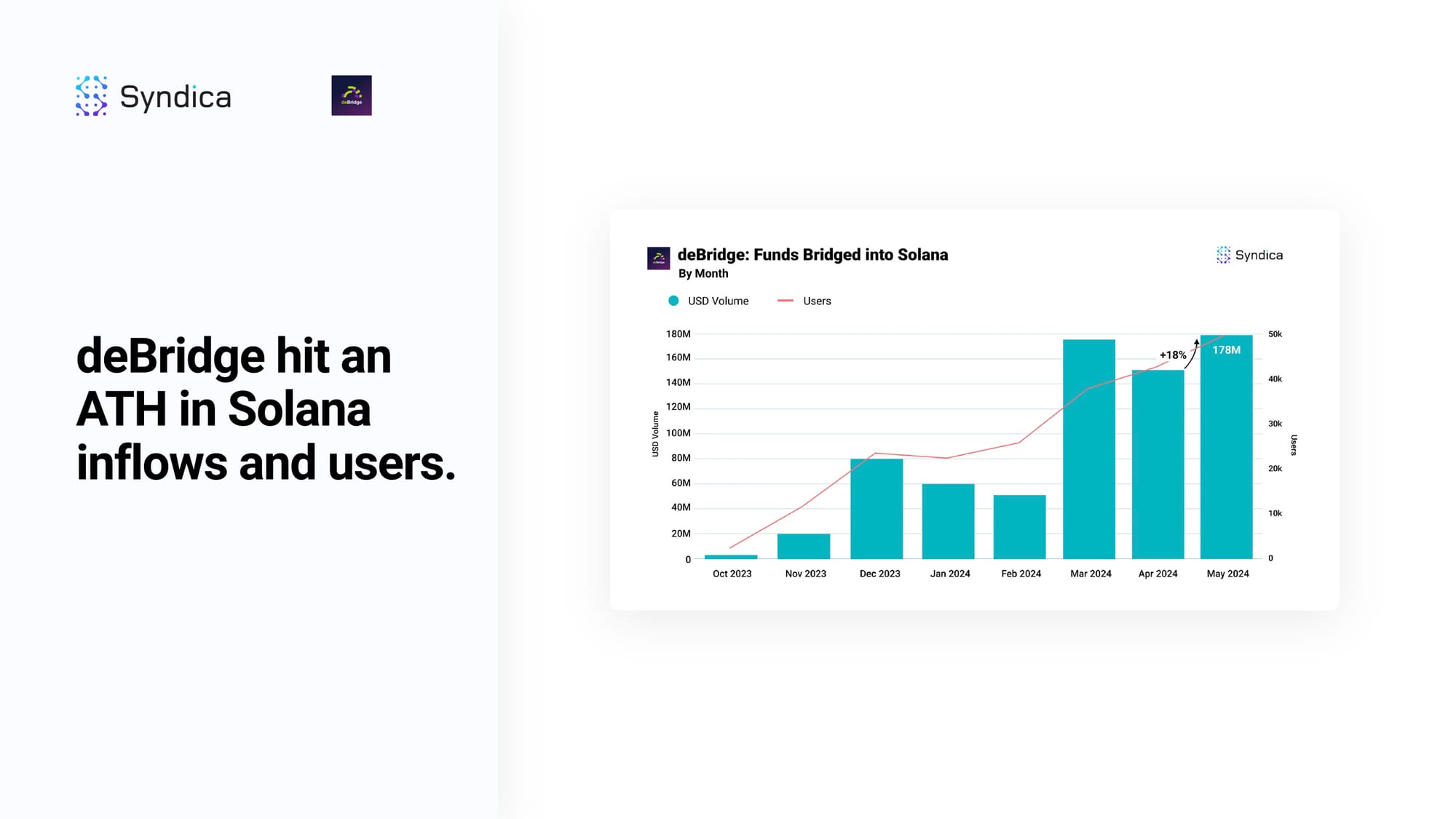

deBridge hit an ATH in Solana inflows and users.

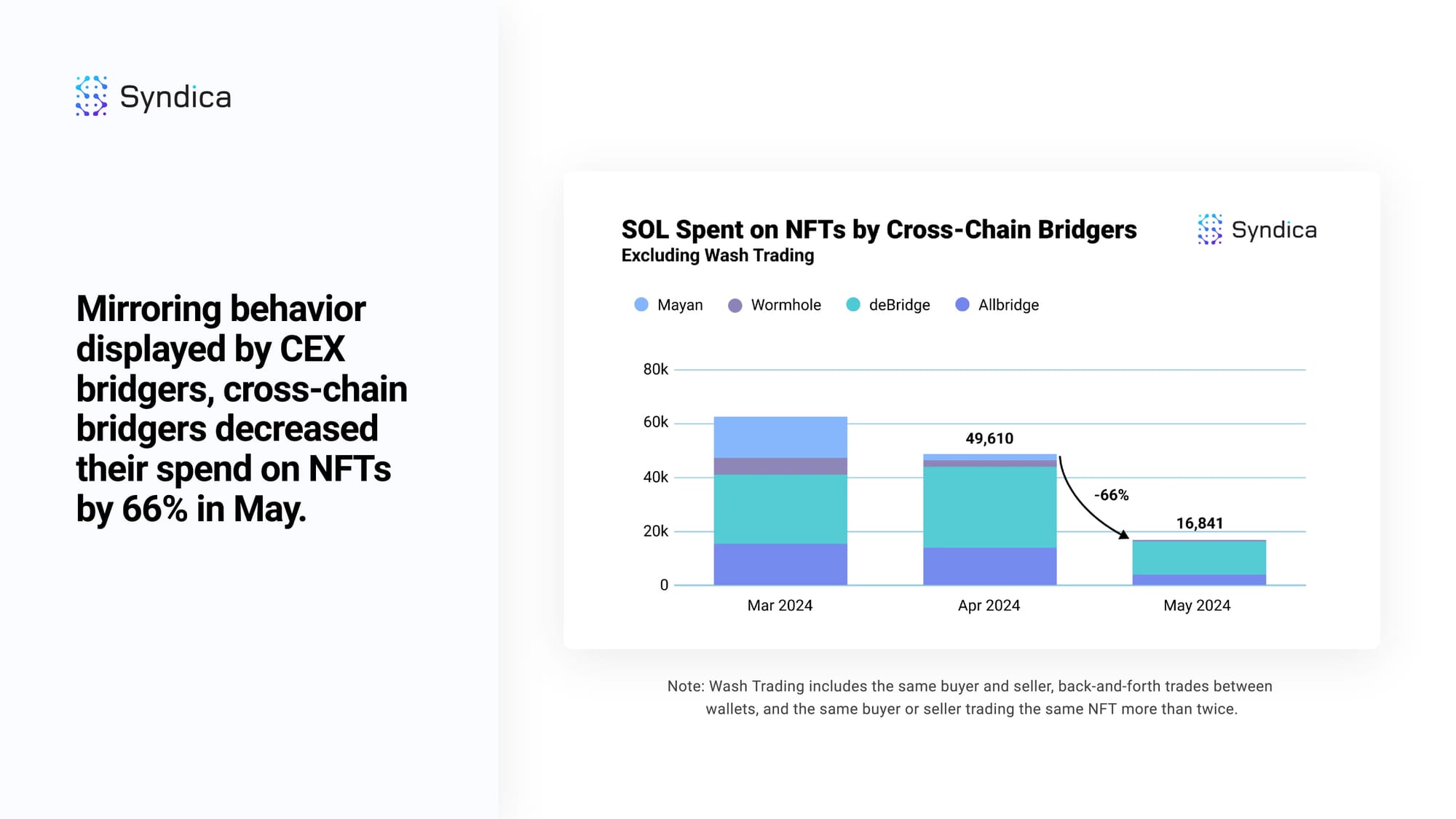

Mirroring behavior displayed by CEX bridgers, cross-chain bridgers decreased their spend on NFTs by 66% in May.

Market and Creator Behavior:

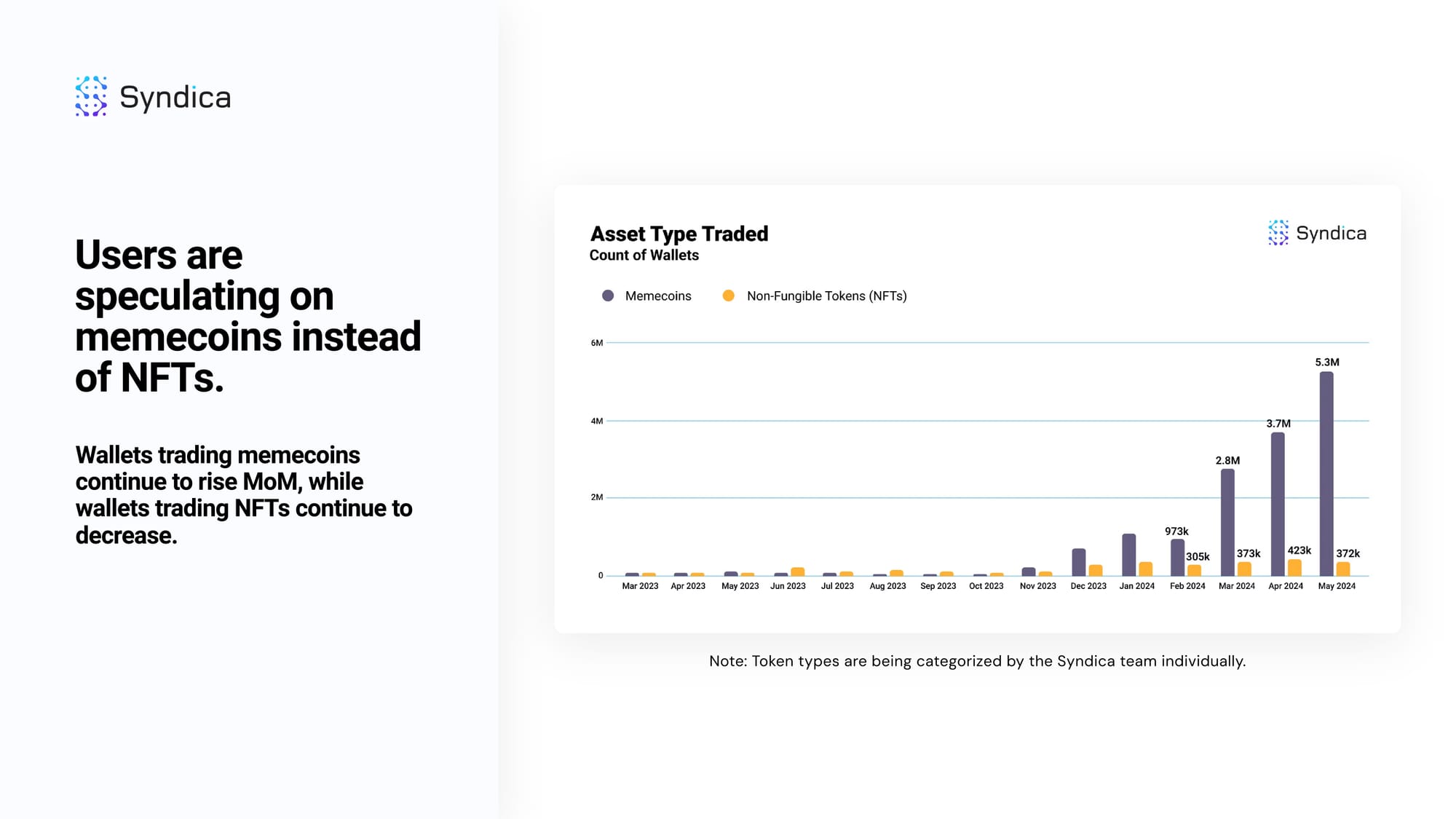

Users are speculating on memecoins instead of NFTs.

Wallets trading memecoins continue to rise MoM, while wallets trading NFTs continue to decrease.

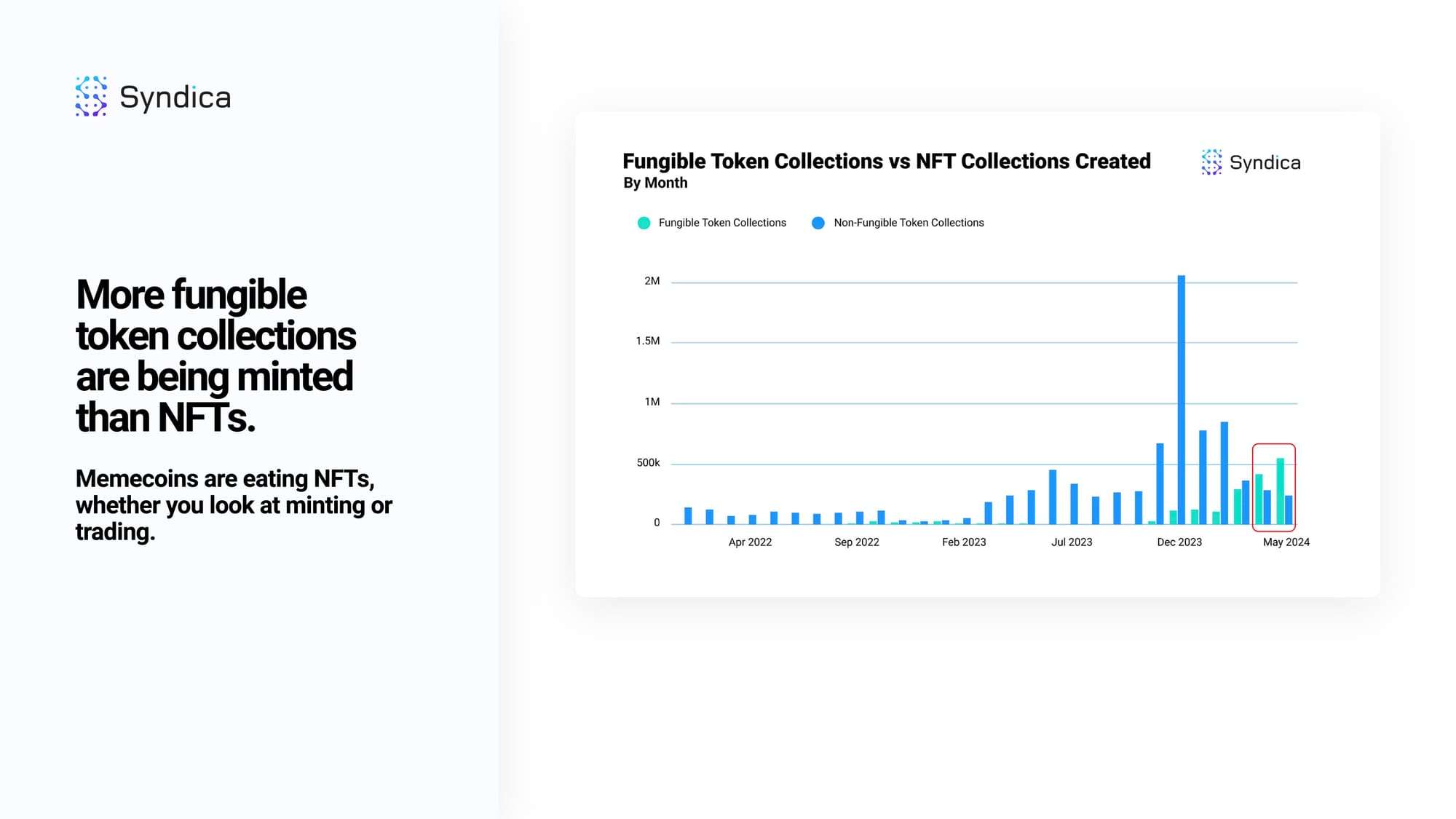

More fungible token collections are being minted than NFTs. Memecoins are eating NFTs, whether you look at minting or trading.

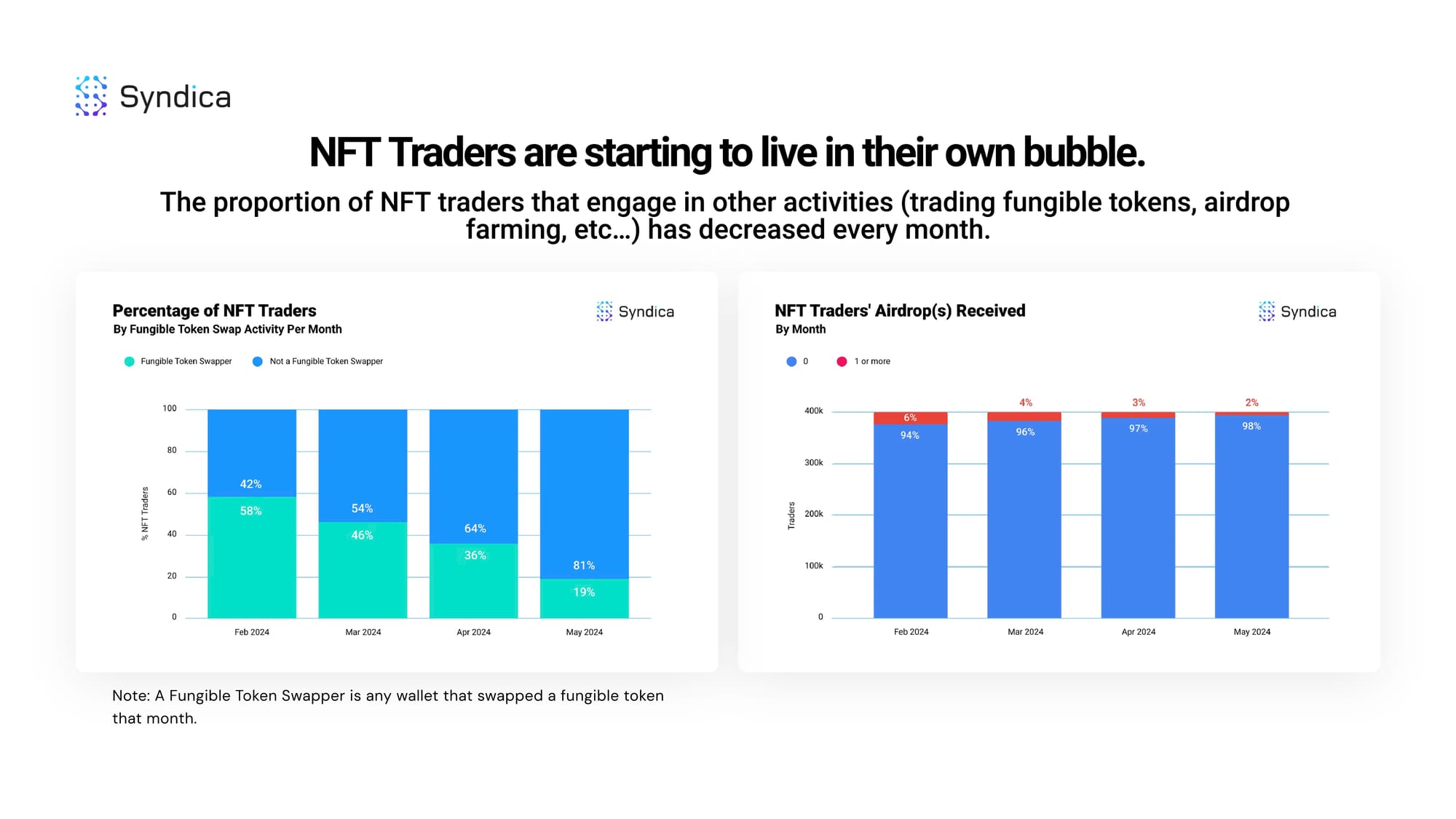

NFT Traders are starting to live in their own bubble. The proportion of NFT traders that engage in other activities (trading fungible tokens, airdrop farming, etc…) has decreased every month.

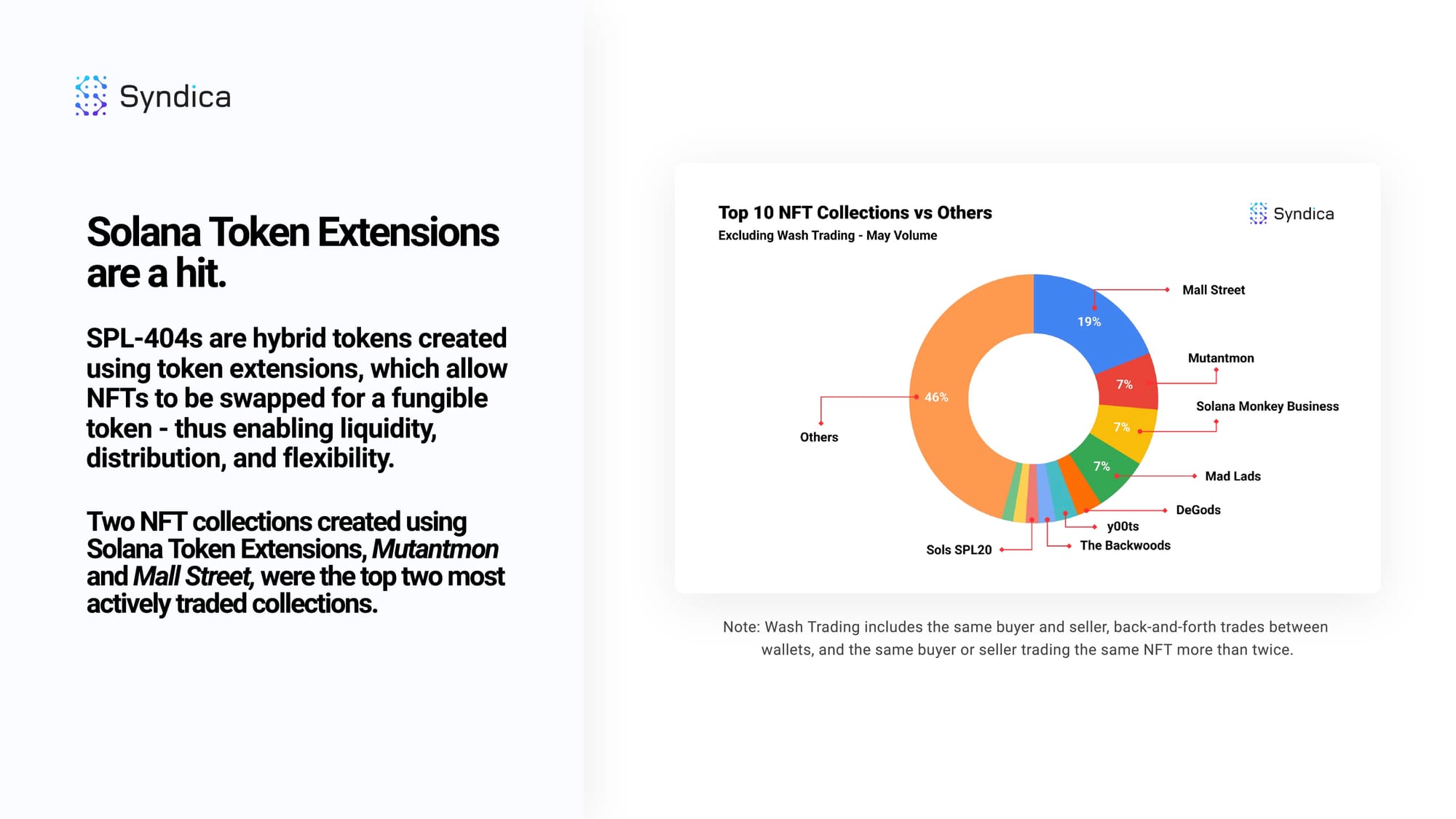

Solana Token Extensions are a hit. SPL-404s are hybrid tokens created using token extensions, which allow NFTs to be swapped for a fungible token - thus enabling liquidity, distribution, and flexibility.

Two NFT collections created using Solana Token Extensions, Mutantmon and Mall Street, were the top two most actively traded collections.

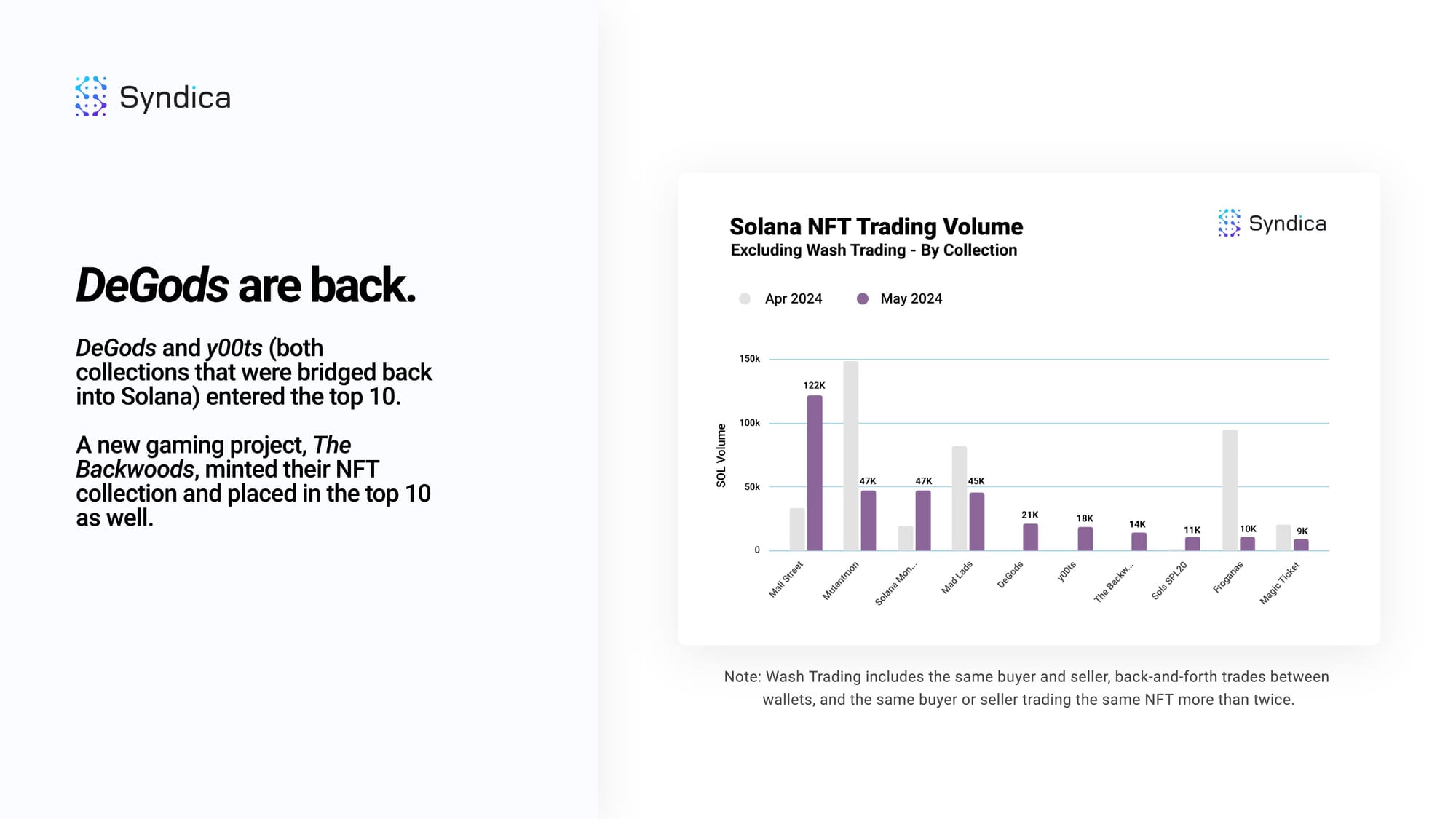

DeGods are back. DeGods and y00ts (both collections that were bridged back into Solana) entered the top 10.

A new gaming project, The Backwoods, minted their NFT collection and placed in the top 10 as well.

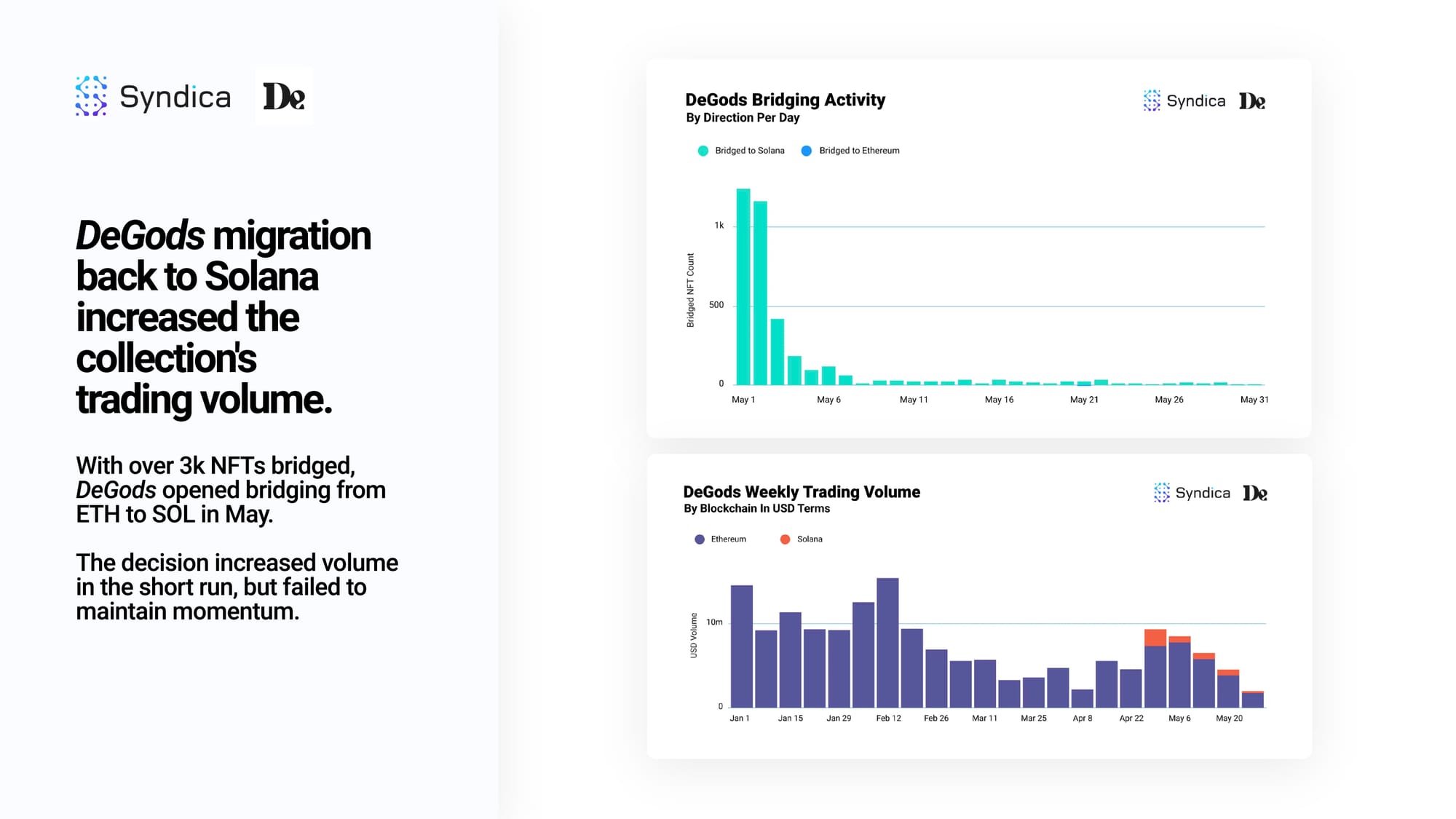

DeGods migration back to Solana increased the collection's trading volume. With over 3k NFTs bridged, DeGods opened bridging from ETH to SOL in May. The decision increased volume in the short run but failed to maintain momentum.

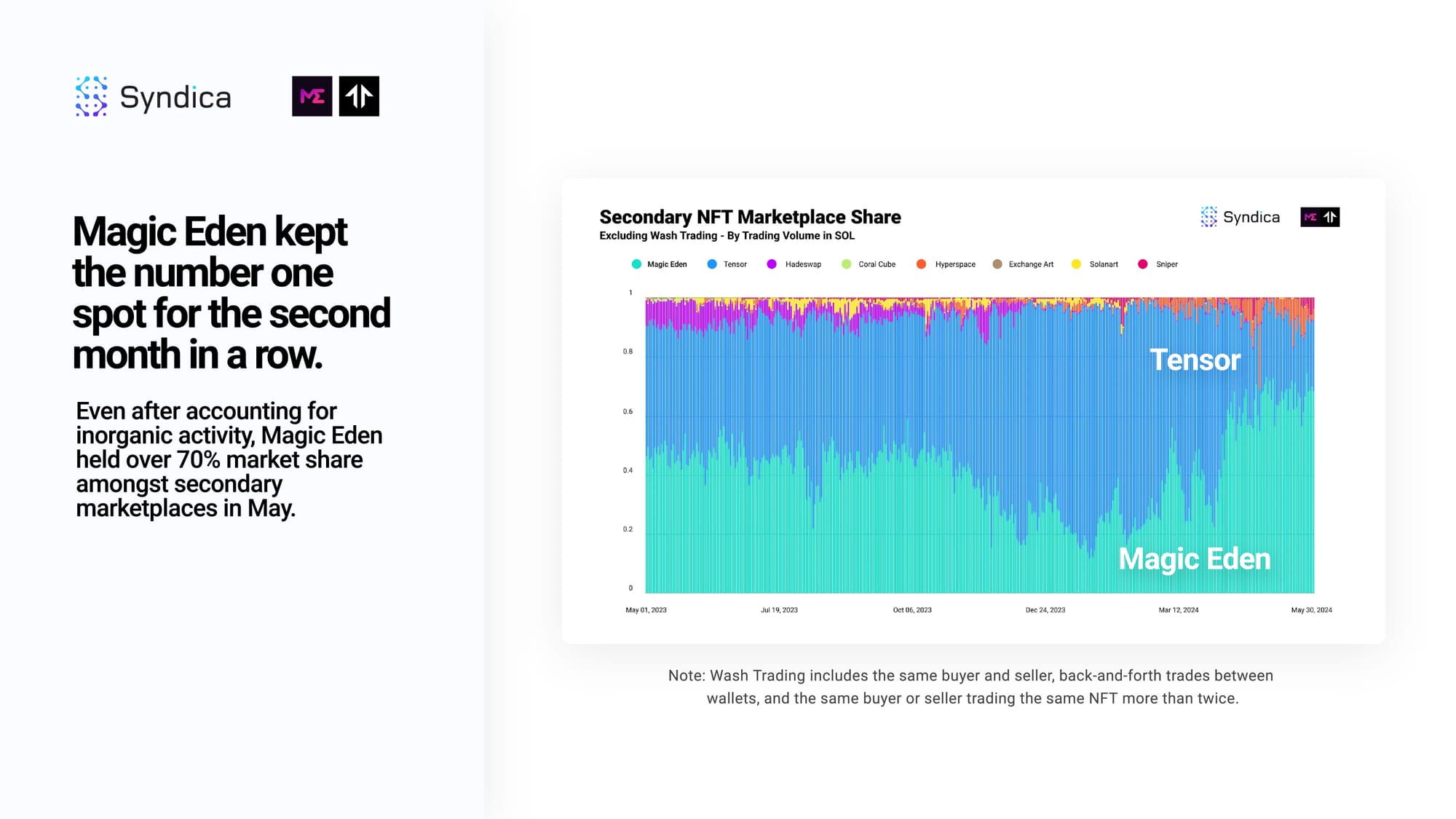

Magic Eden kept the number one spot for the second month in a row. Even after accounting for inorganic activity, Magic Eden held over 70% market share amongst secondary marketplaces in May.

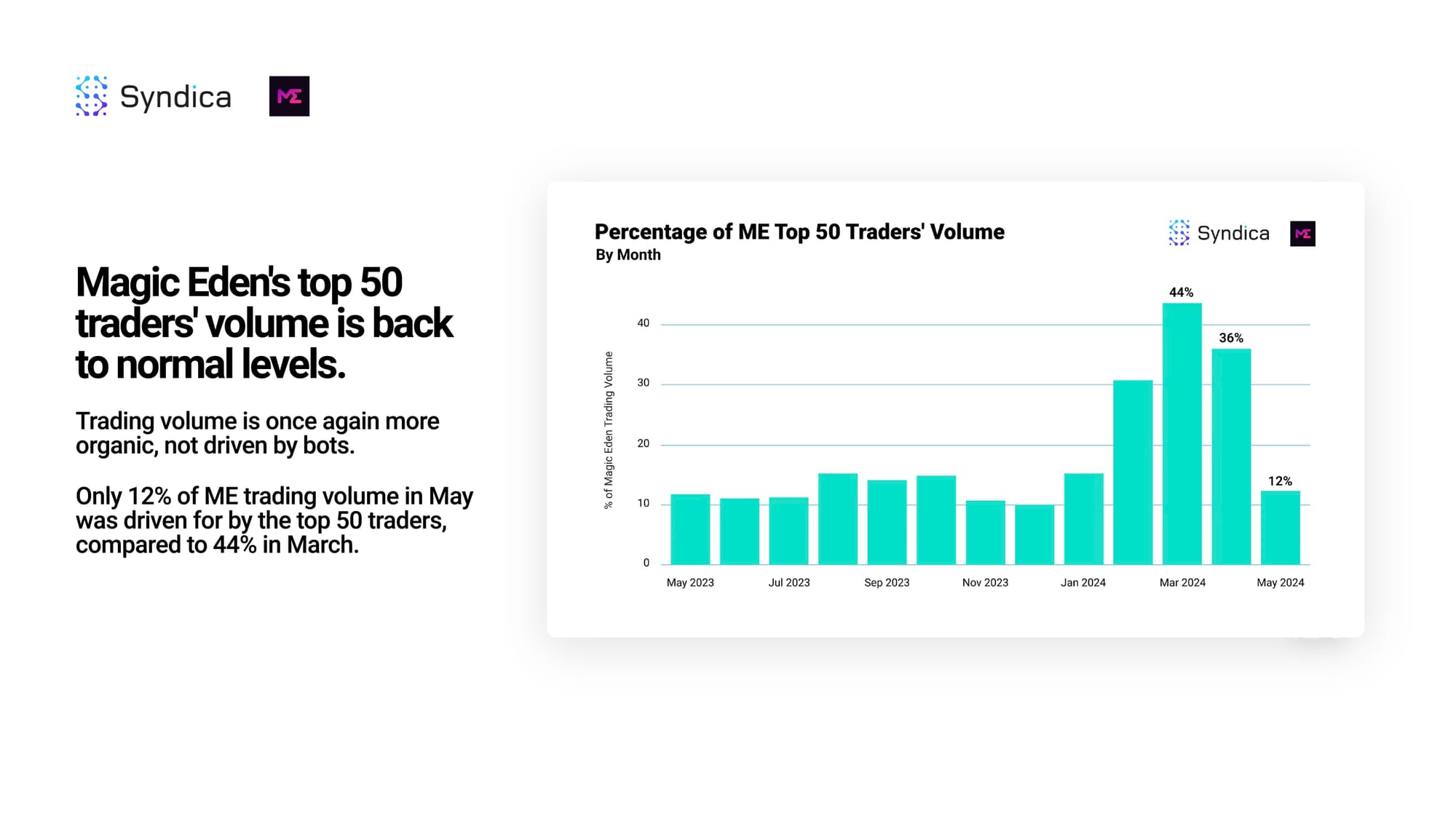

Magic Eden's top 50 traders' volume is back to normal levels. Trading volume is once again more organic, not driven by bots. Only 12% of ME trading volume in May was driven for by the top 50 traders, compared to 44% in March.

Project Dynamics:

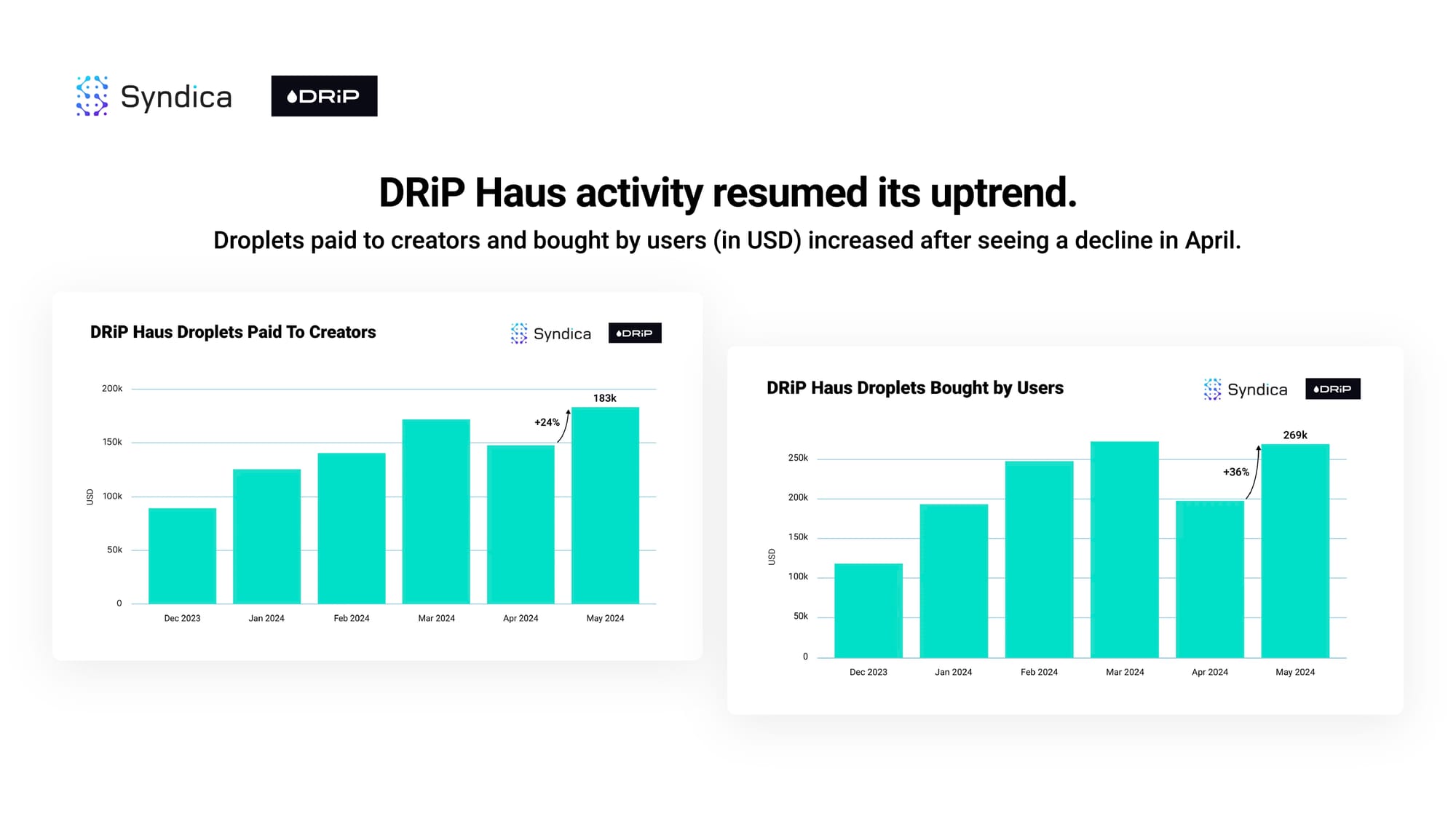

DRiP Haus activity resumed its uptrend. Droplets paid to creators and bought by users (in USD) increased after seeing a decline in April.