Deep Dive: Solana Onchain Activity - September 2025

Deep Dive: Solana Onchain Activity - September 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Deep Dive: Solana Onchain Activity - September 2025

Part I - Network

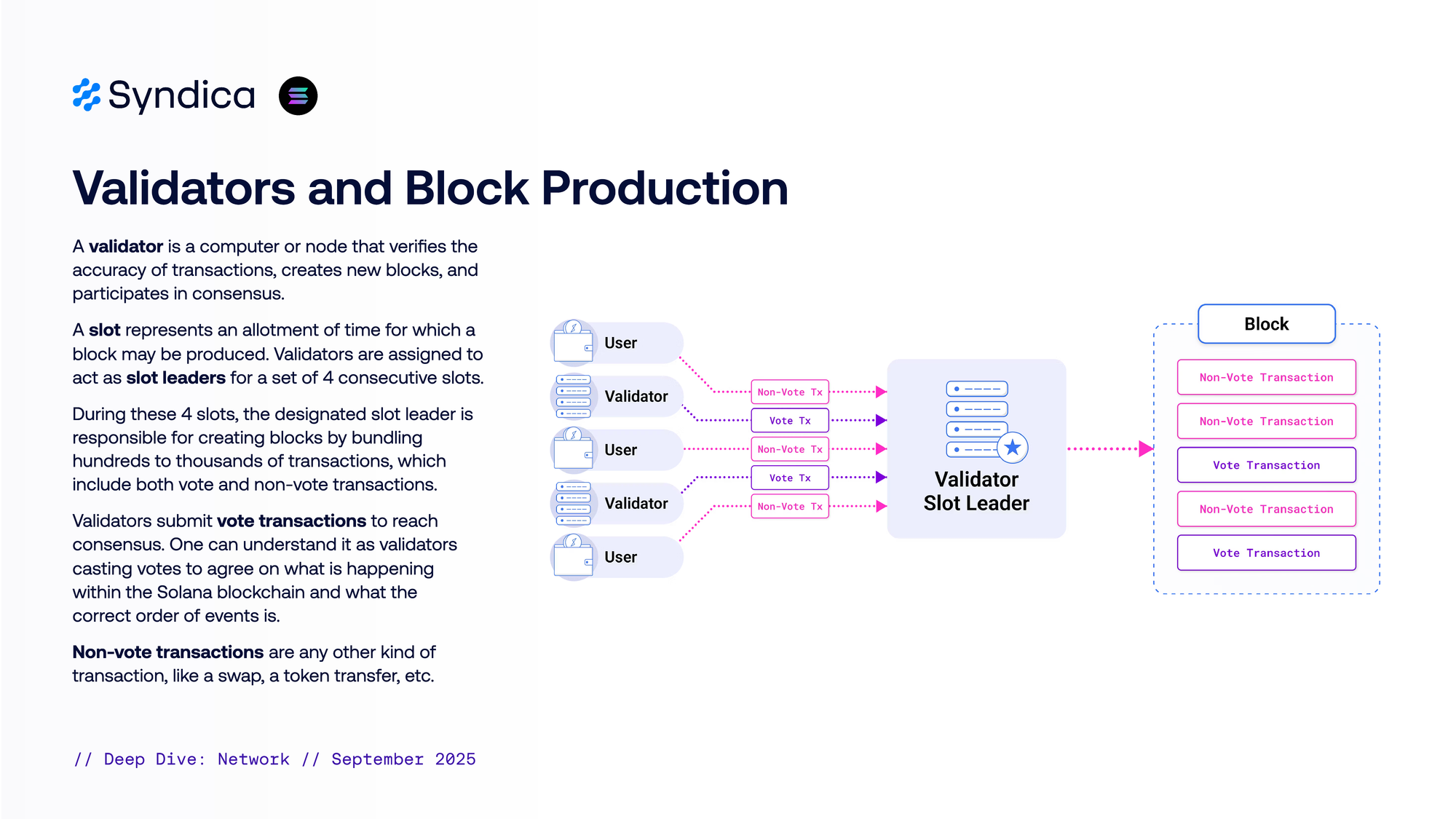

Validators and Block Production

A validator is a computer or node that verifies the accuracy of transactions, creates new blocks, and participates in consensus.

A slot represents an allotment of time for which a block may be produced. Validators are assigned to act as slot leaders for a set of 4 consecutive slots.

During these 4 slots, the designated slot leader is responsible for creating blocks by bundling hundreds to thousands of transactions, which include both vote and non-vote transactions.

Validators submit vote transactions to reach consensus. One can understand it as validators casting votes to agree on what is happening within the Solana blockchain and what the

correct order of events is.

Non-vote transactions are any other kind of transaction, like a swap, a token transfer, etc.

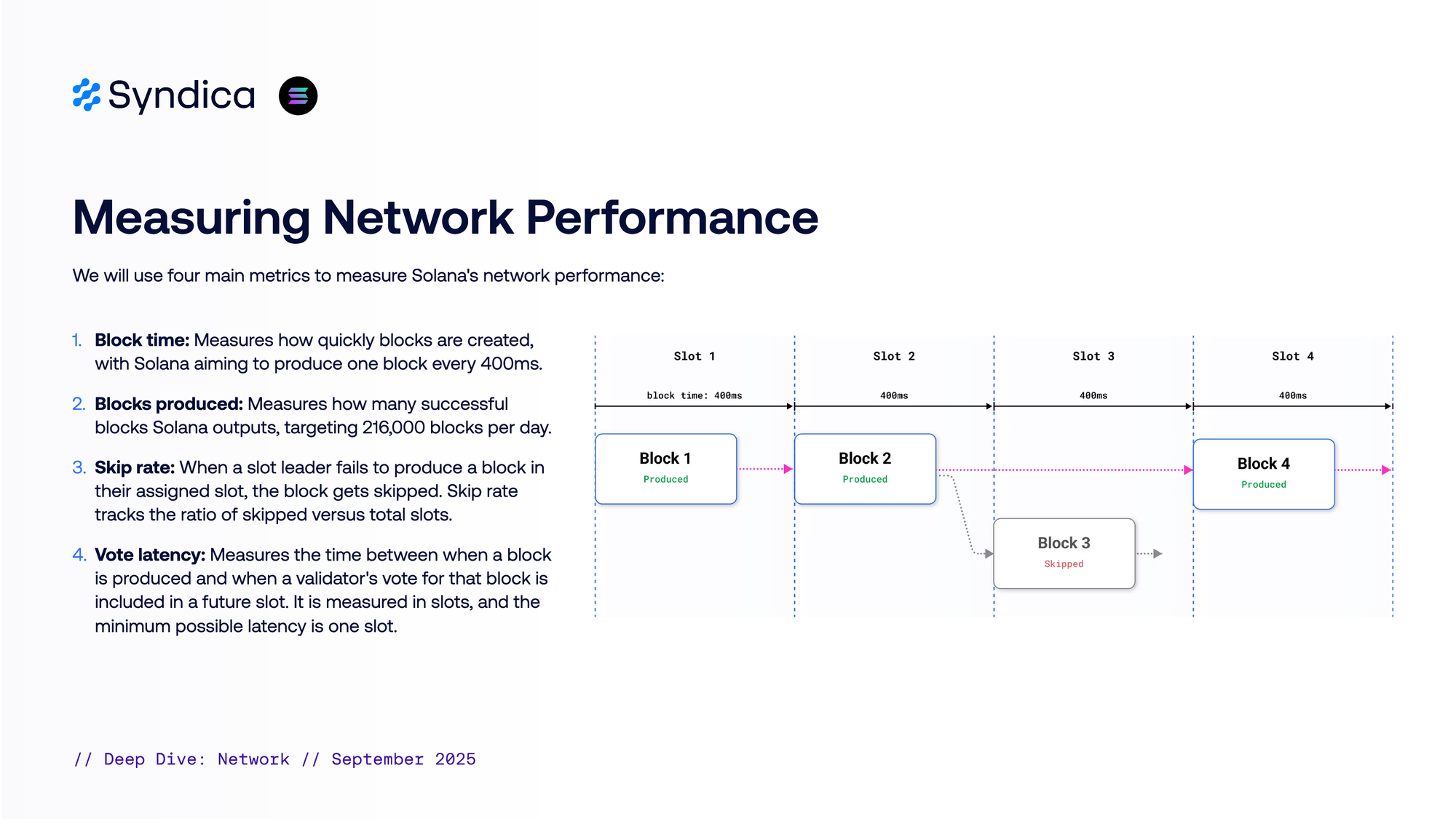

Measuring Network Performance

We will use four main metrics to measure Solana's network performance:

- Block time: Measures how quickly blocks are created, with Solana aiming to produce one block every 400ms.

- Blocks produced: Measures how many successful blocks Solana outputs, targeting 216,000 blocks per day.

- Skip rate: When a slot leader fails to produce a block in their assigned slot, the block gets skipped. Skip rate tracks the ratio of skipped versus total slots.

- Vote latency: Measures the time between when a block is produced and when a validator's vote for that block is included in a future slot. It is measured in slots, and the minimum possible latency is one slot.

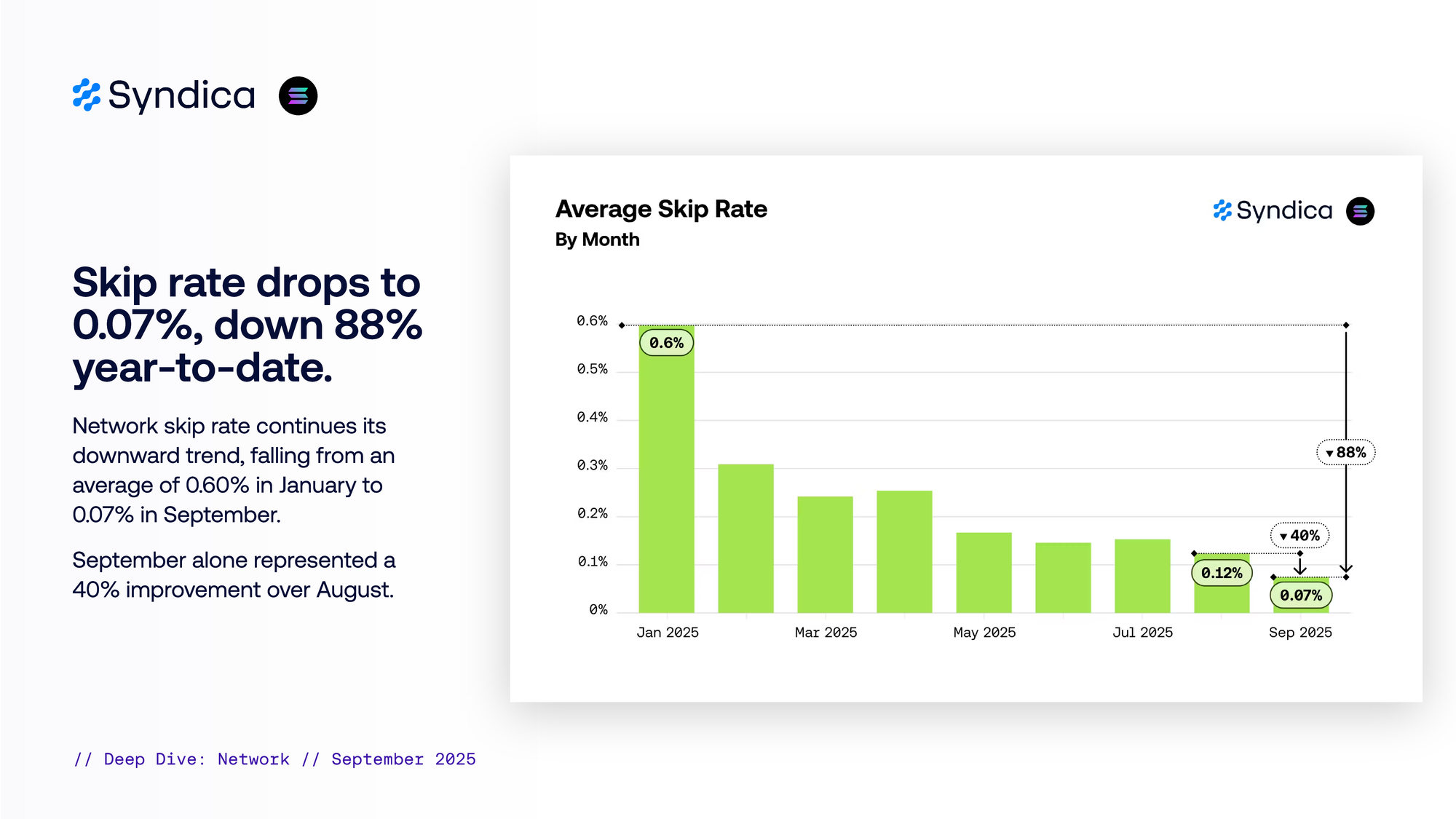

Skip rate drops to 0.07%, down 88% year-to-date. Network skip rate continues its downward trend, falling from an average of 0.60% in January to 0.07% in September. September alone represented a 40% improvement over August.

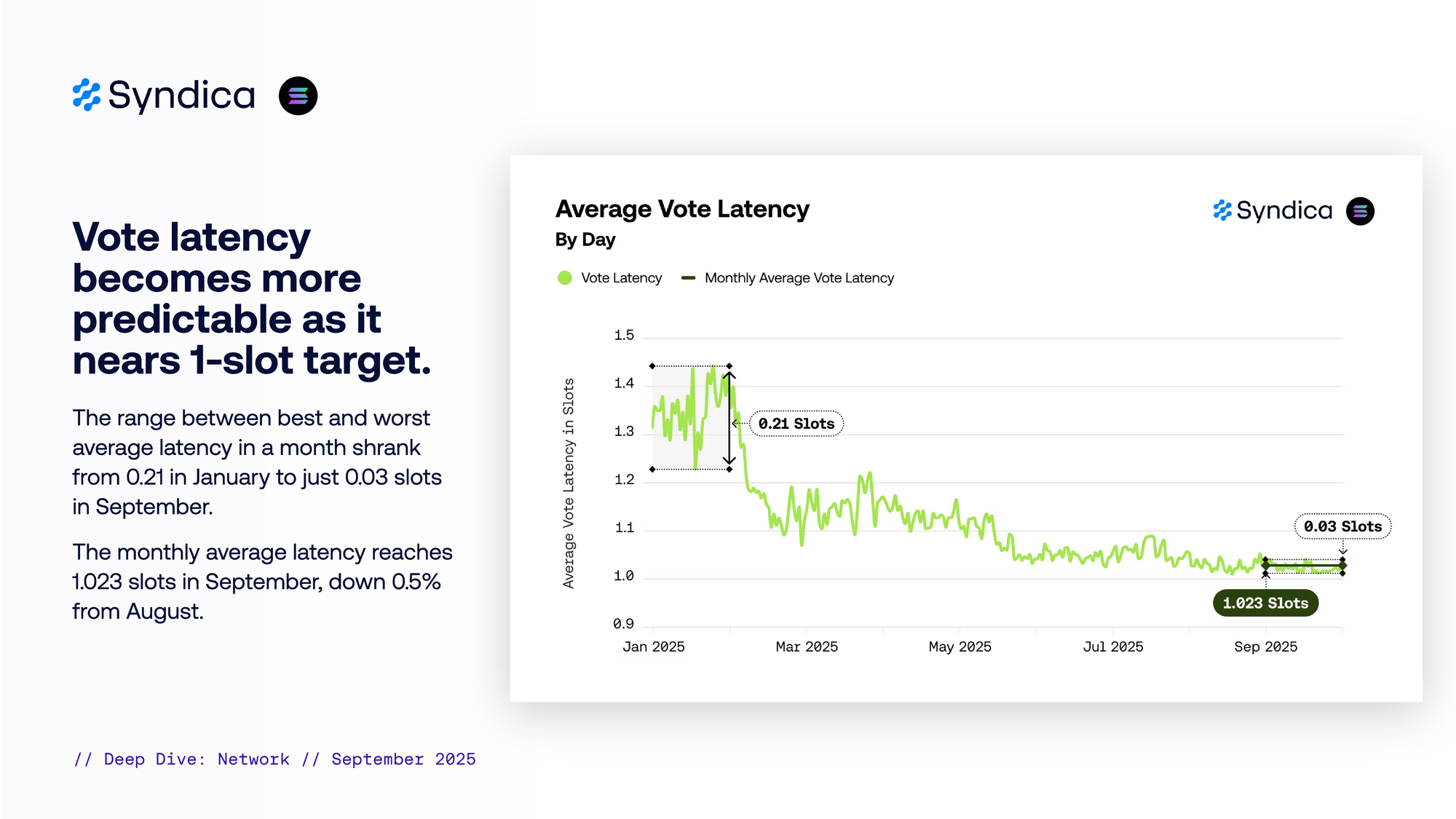

Vote latency becomes more predictable as it nears 1-slot target. The range between best and worst average latency in a month shrank from 0.21 in January to just 0.03 slots in September. The monthly average latency reaches 1.023 slots in September, down 0.5% from August.

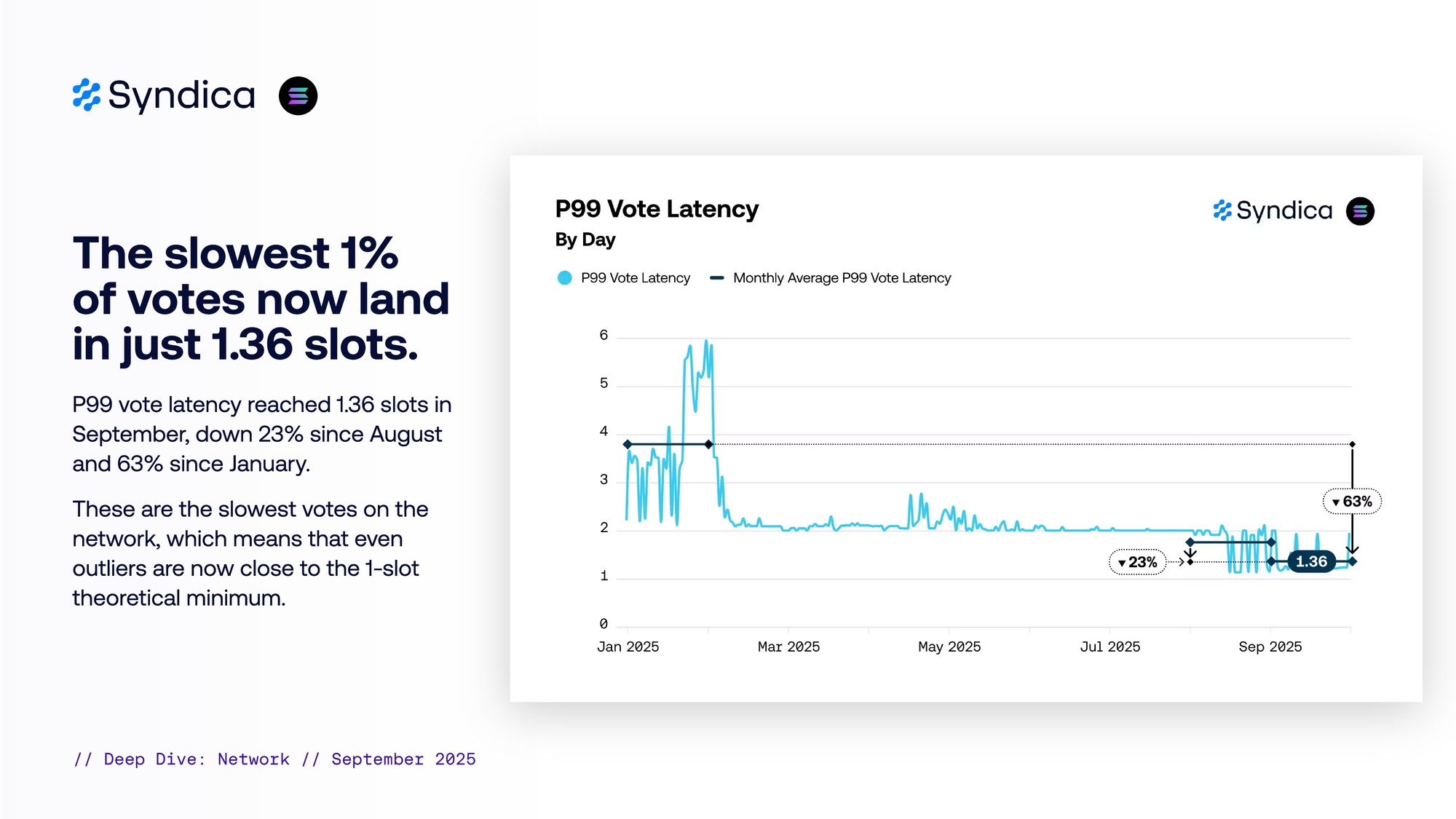

The slowest 1% of votes now land in just 1.36 slots. P99 vote latency reached 1.36 slots in September, down 23% since August and 63% since January. These are the slowest votes on the network, which means that even outliers are now close to the 1-slot theoretical minimum.

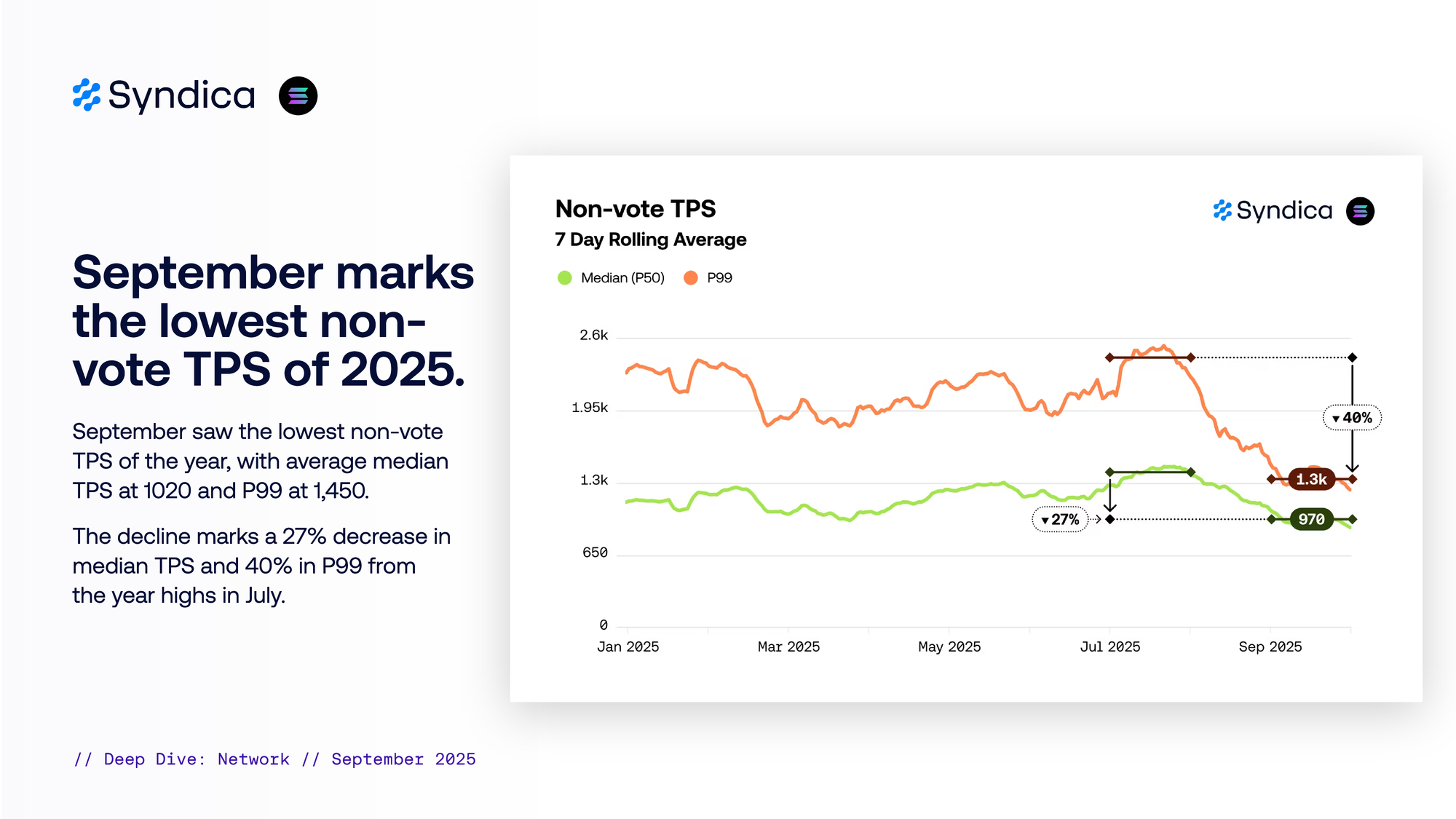

September marked 2025's lowest non-vote TPS, with 7-day rolling median at 970 and P99 at 1,300. This represents a 27% decline in median TPS and 40% in P99 from July's peak.

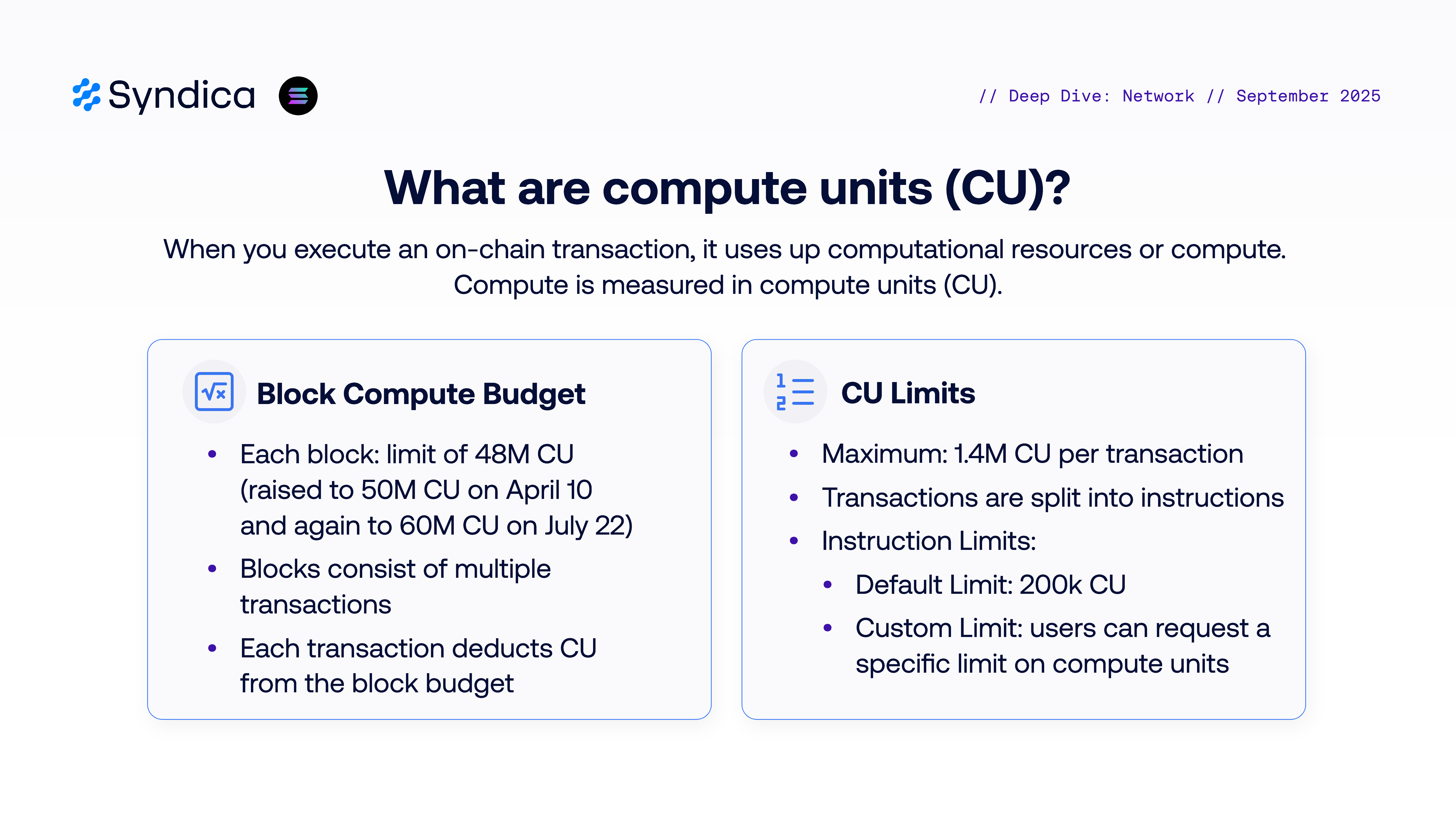

What are compute units (CU)? When you execute an on-chain transaction, it uses up computational resources or compute. Compute is measured in compute units (CU).

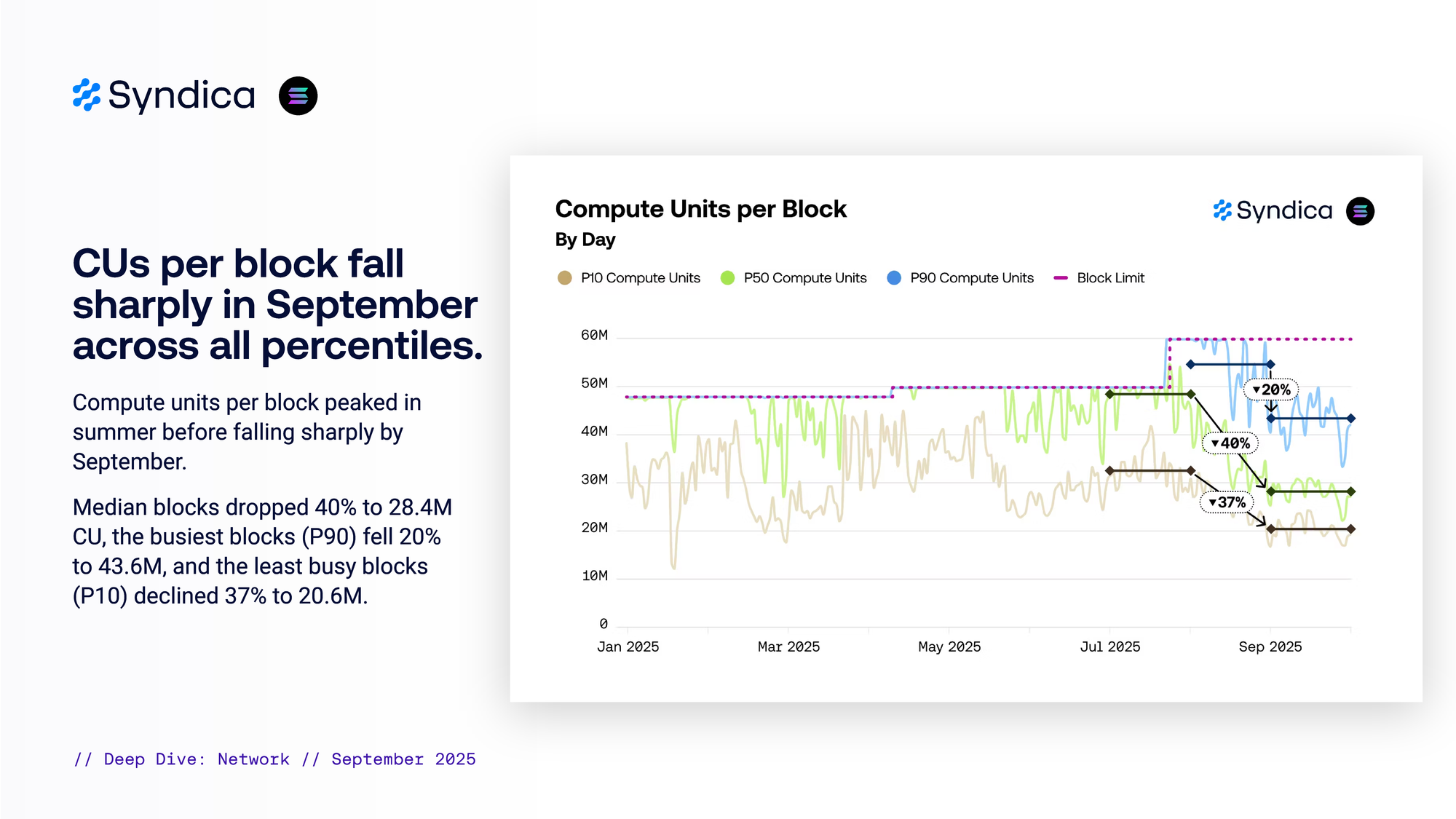

CUs per block fall sharply in September across all percentiles. Compute units per block peaked in summer before falling sharply by September. Median blocks dropped 40% to 28.4M CU, the busiest blocks (P90) fell 20% to 43.6M, and the least busy blocks (P10) declined 37% to 20.6M.

Understanding Solana's fee structure.

There are three types of transaction fees in Solana: base, vote, and priority.

- Base fees are mandatory for all transactions and are set at 5,000 lamports per signature. 50% of the base fee goes to the block leader, and 50% is burnt.

- Vote fees are base fees validators pay for participating in consensus by emitting vote transactions.

- Priority fees are optional user payments to prioritize transaction inclusion. They are calculated by multiplying the compute unit limit of the transaction by a user-defined price per compute unit. For example, a simple transaction using the default 200,000 CU limit with a price of 0.01 lamports/CU would pay 2,000 lamports in priority fees. Initially 50% of priority fees went to validators and 50% was burned, but since SIMD-0096 passed in February 2025, 100% goes to validators.

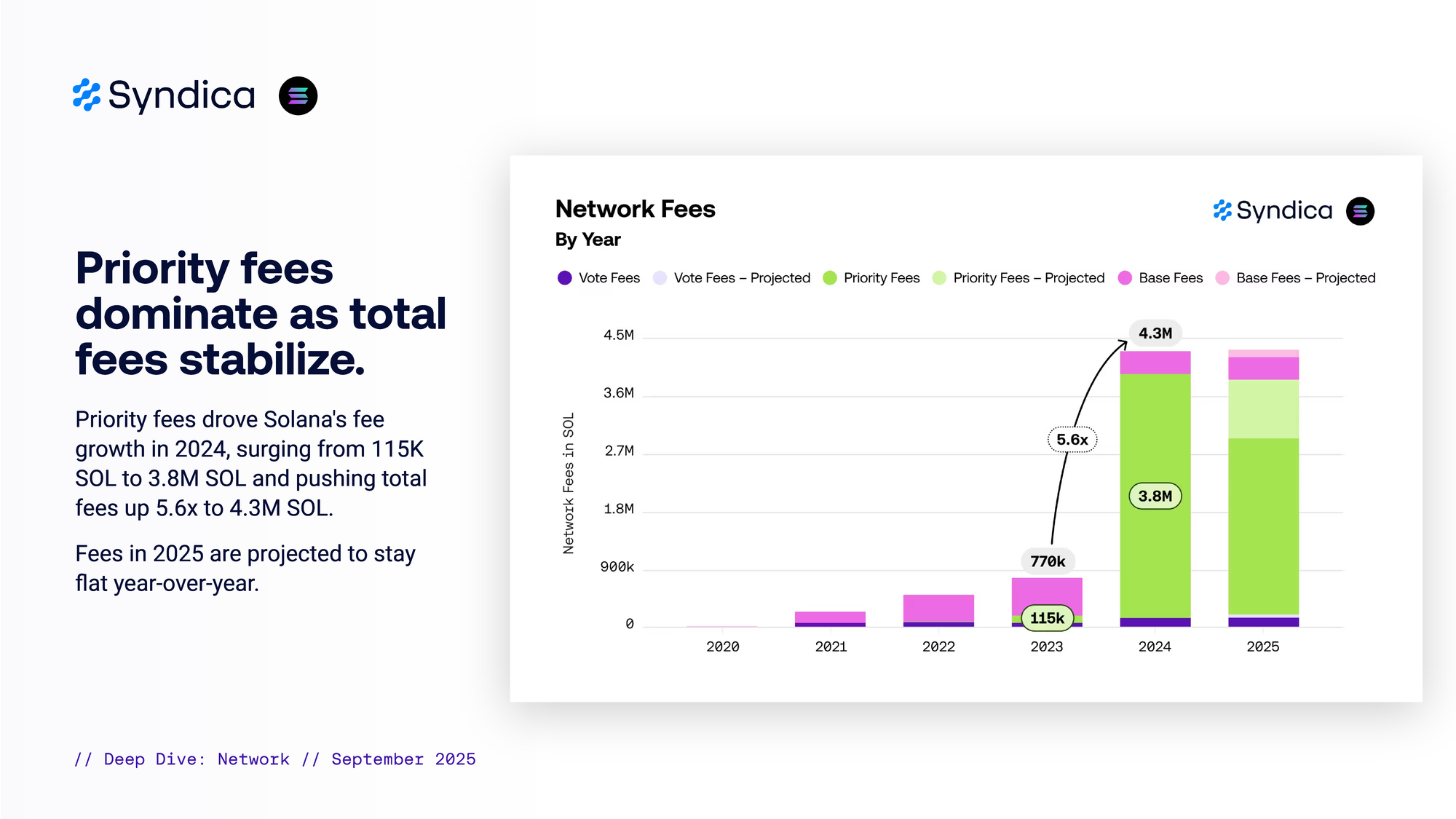

Priority fees dominate as total fees stabilize. Priority fees drove Solana's fee growth in 2024, surging from 115K SOL to 3.8M SOL and pushing total fees up 5.6x to 4.3M SOL. Fees in 2025 are projected to stay flat year-over-year.

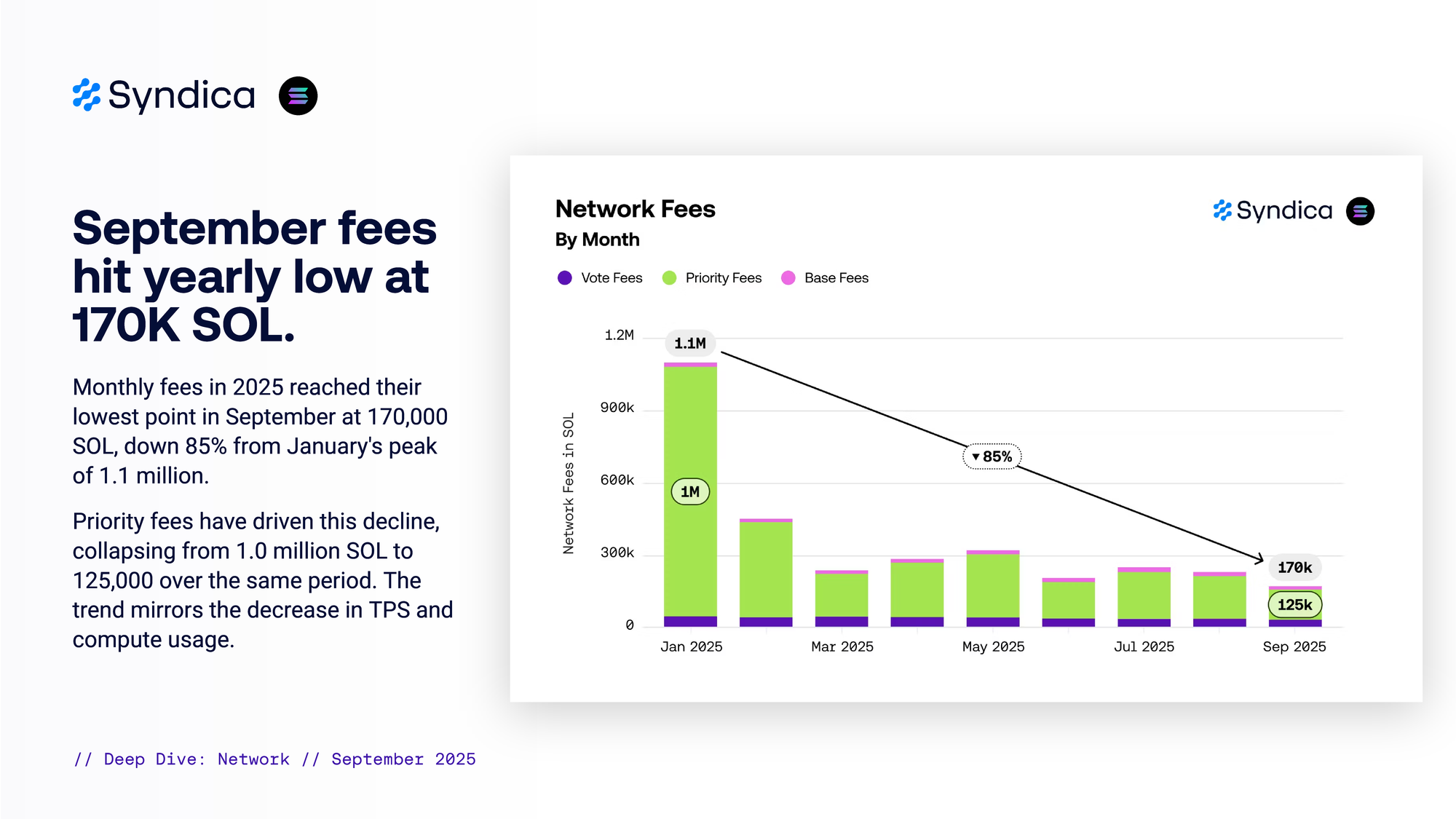

September fees hit yearly low at 170K SOL. Monthly fees in 2025 reached their lowest point in September at 170,000 SOL, down 85% from January's peak of 1.1 million. Priority fees have driven this decline, collapsing from 1.0 million SOL to 125,000 over the same period. The trend mirrors the decrease in TPS and compute usage.

Tips for Transaction Inclusion Tips are extra payments users make to prioritize their transactions for faster inclusion in blocks, especially during network congestion. Unlike base or priority fees, tips are extra payments made directly to validators. Users attach tips in SOL to incentivize validators running specialized clients (like Jito's) that optimize block production for MEV opportunities. Jito pioneered this market and takes a 6% protocol fee, distributing the rest to validators and stakers. As demand grew, independent providers emerged. Here's a list of all providers we track: Jito, BloXroute, NextBlock, Temporal (aka Nozomi), 0slot, Astralane, BlockRazor, Helius, Node1, Fast, Flashblock. Early on, alternatives like BloXroute routed most tips through Jito. Today, most providers keep all or most tips themselves. The analysis below tracks net tips by provider after subtracting amounts sent to Jito.

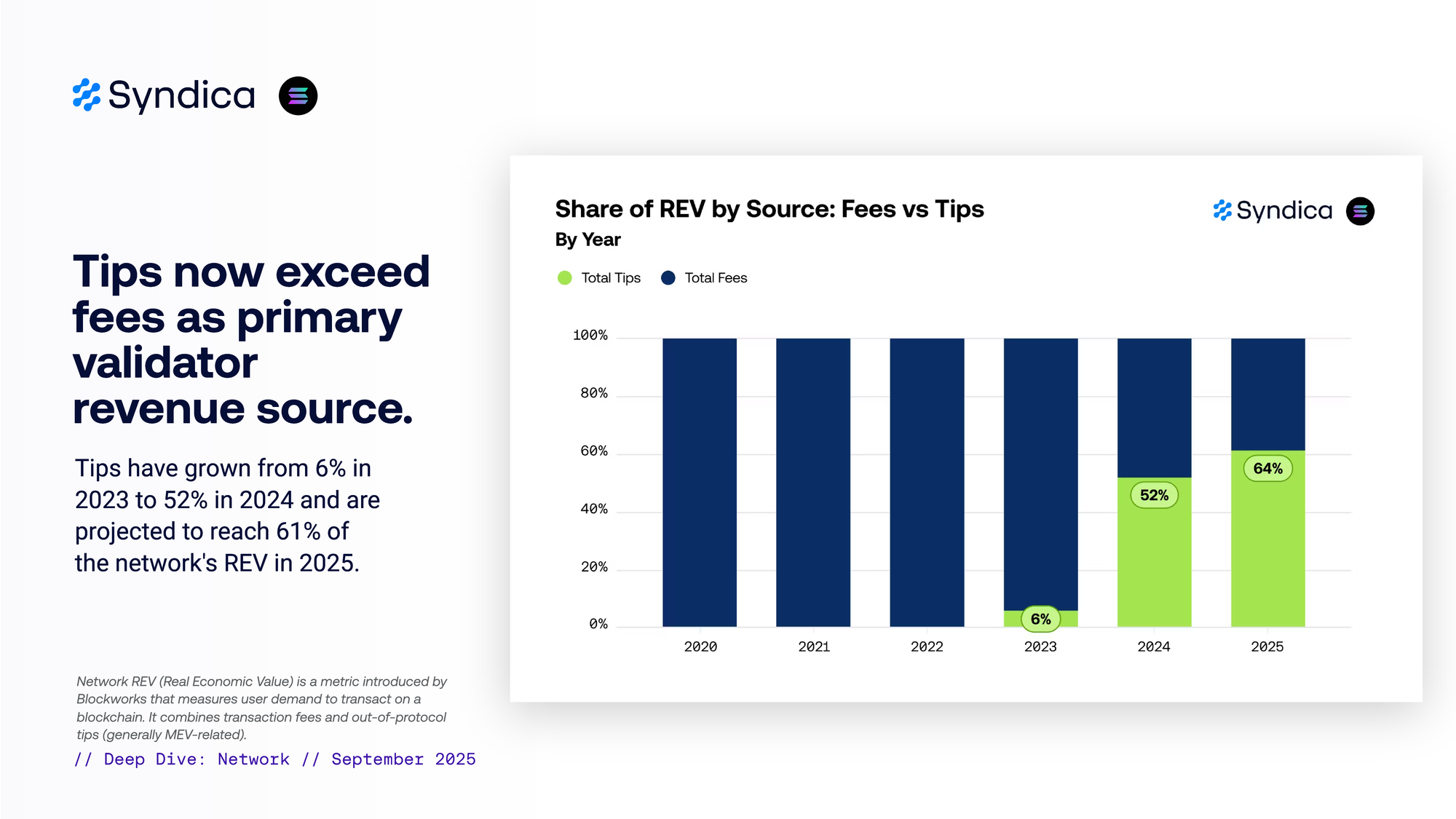

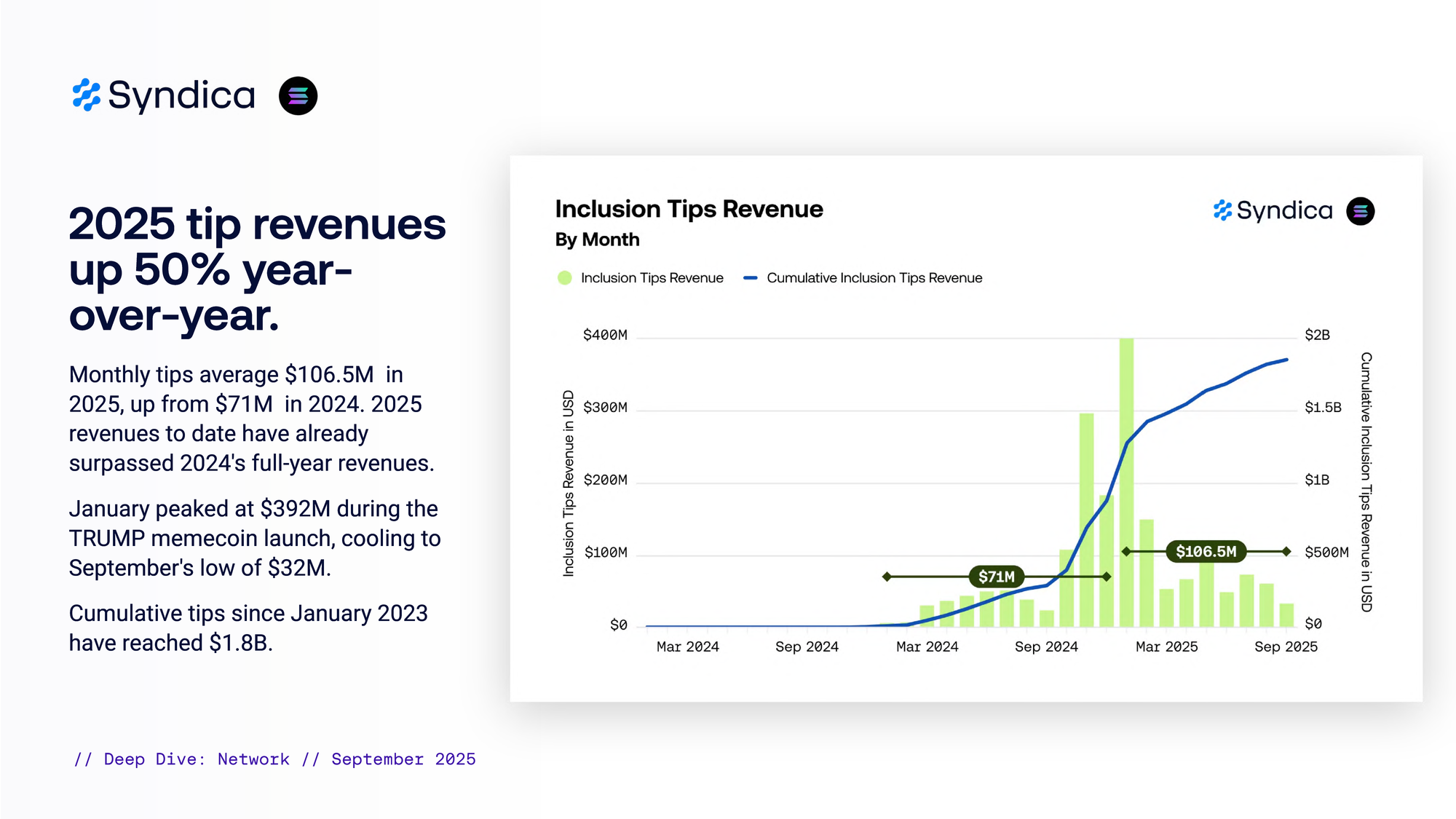

Tips now exceed fees as primary validator revenue source. Tips have grown from 6% in 2023 to 52% in 2024 and are projected to reach 61% of the network's REV in 2025. 2025 tip revenues up 50% year-over-year. Monthly tips average $106.5M in 2025, up from $71M in 2024. 2025 revenues to date have already surpassed 2024's full-year revenues. January peaked at $392M during the TRUMP memecoin launch, cooling to September's low of $32M. Cumulative tips since January 2023 have reached $1.8B.

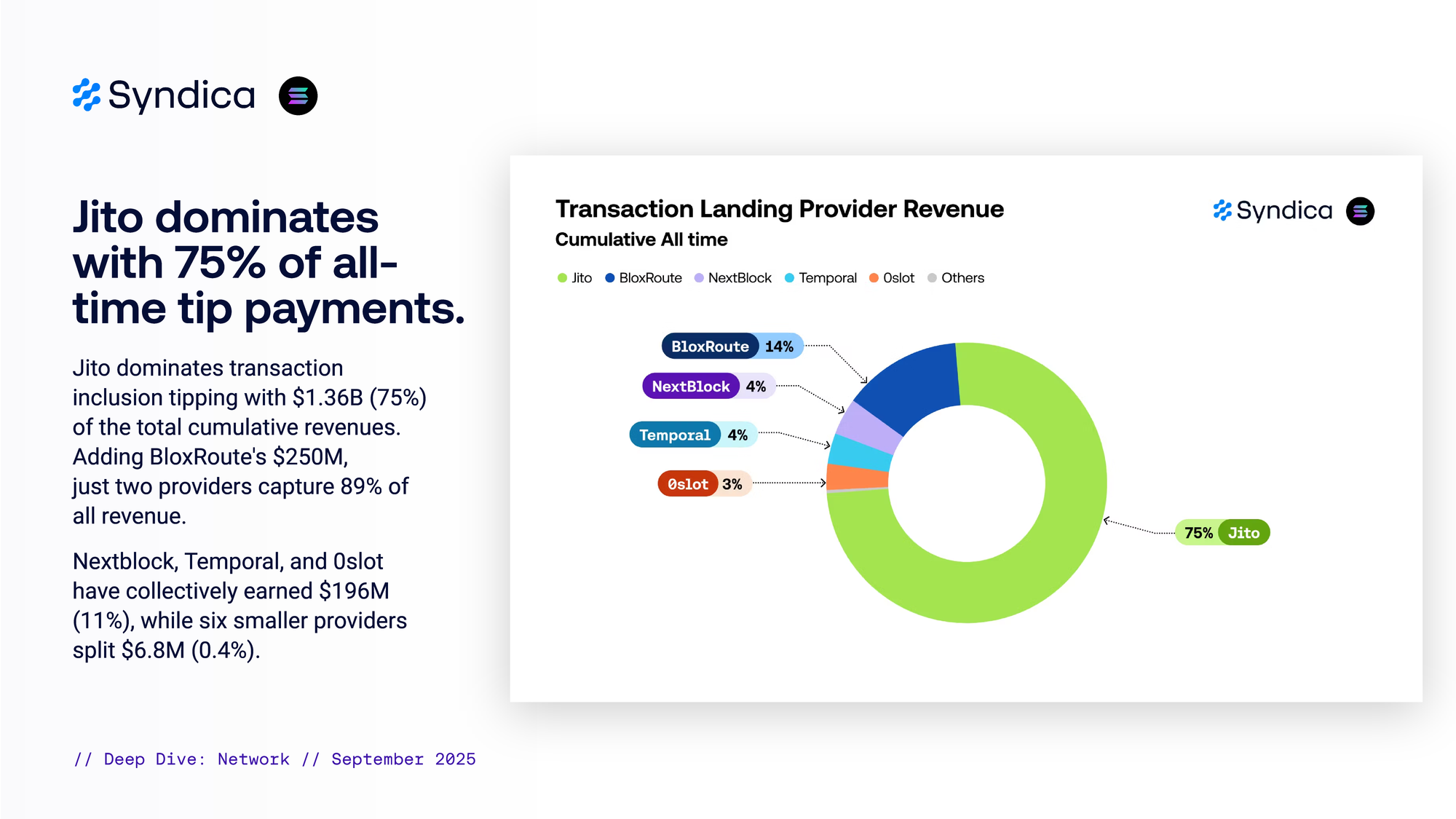

Jito dominates with 75% of all-time tip payments. Jito dominates transaction inclusion tipping with $1.36B (75%) of the total cumulative revenues. Adding BloxRoute's $250M, just two providers capture 89% of all revenue. Nextblock, Temporal, and 0slot have collectively earned $196M (11%), while six smaller providers split $6.8M (0.4%).

Transaction inclusion tip market fragments as total pie shrinks. Jito dominated the early market and maintains 61.5% by Q3 2025. BloxRoute reached 20% share in H2 2024, followed by Nextblock and Temporal in late 2024 (7.5% each at peak). 0slot surged to 21% in Q3 2025 alongside numerous smaller providers. However, new entrants captured share in a shrinking market, earning less revenue.

DoubleZero launches mainnet with 22% of Solana stake. DoubleZero launched on mainnet October 2nd, aiming to address the limitations of the public internet when interconnecting distributed systems.

Blockchain performance is increasingly limited by network infrastructure rather than computational capacity. DoubleZero addresses this by creating a decentralized network of contributed fiber links that offer two key advantages:

- Specialized hardware filters inbound transactions, removing spam and duplicates before they reach validators

- Outbound messages are explicitly routed and prioritized, reducing jitter and improving consensus speed.

This delivers the performance benefits that companies like Amazon and Google achieve through private networks, but without introducing trusted intermediaries.

Part II - Validator Clients

Clients live on mainnet

Base Clients

- Agave: main Solana validator Client maintained by Anza, continuing the work of the Solana Labs client. Serves as the reference implementation for the network.

- Frankendancer: hybrid client as a transitional step towards the full Firedancer client being developed by Jump Crypto. It combines the original consensus and runtime components from Agave with Firedancer's new, optimized networking components, signature verification, and block packing.

Flavours of Base Client

- Vanilla: default Agave/Frankendancer clients.

- Jito: modified version of the core client with built-in Maximum Extractable Value (MEV) auction and block engine to maximize revenue and potentially increase reliability and performance.

- Paladin: modified Jito client that aims to protect validators from sandwhiching and distribute MEV rewards across Paladin validators.

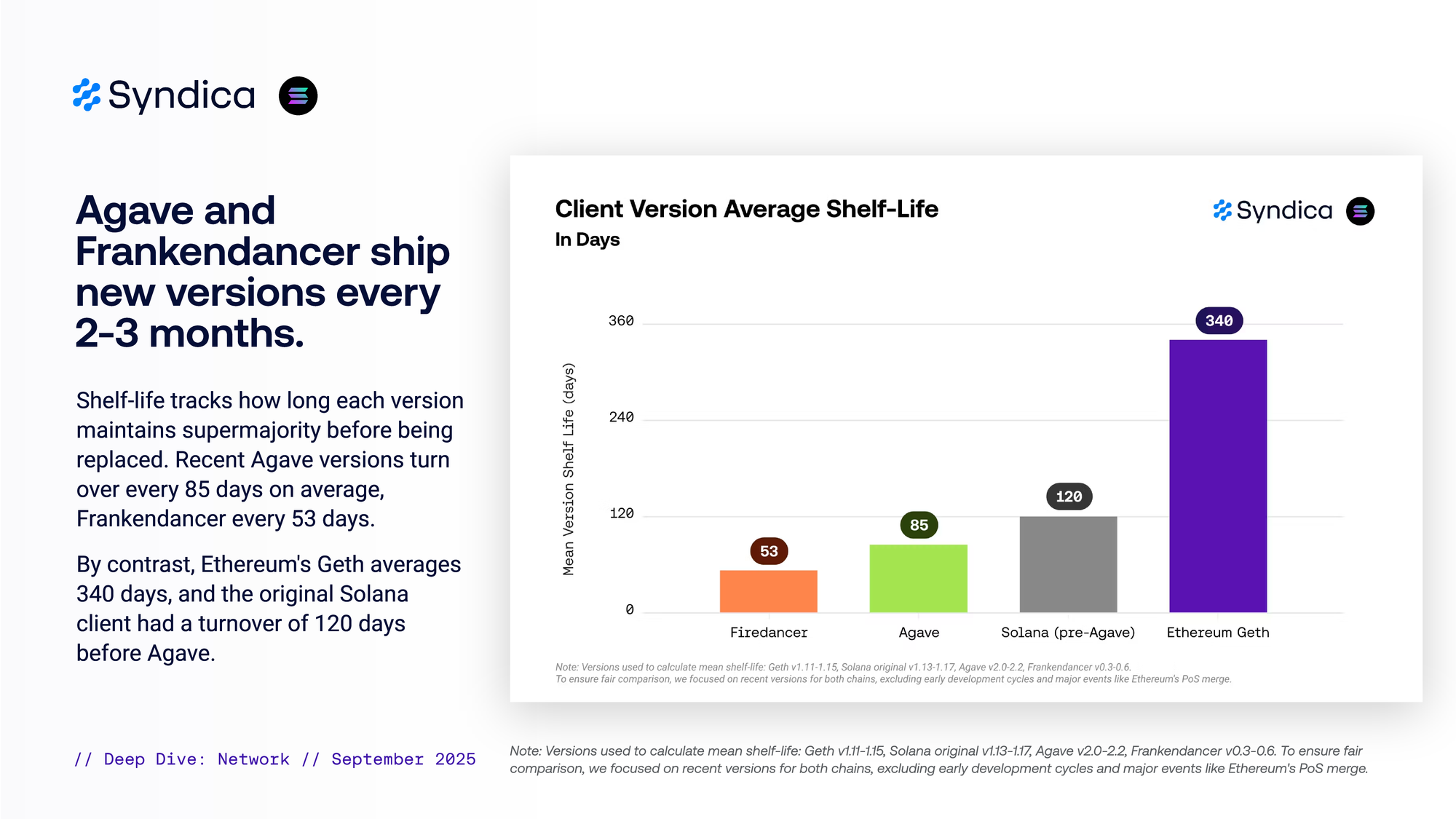

Agave and Frankendancer ship new versions every 2-3 months. Shelf-life tracks how long each version maintains supermajority before being replaced. Recent Agave versions turn over every 85 days on average, Frankendancer every 53 days.

By contrast, Ethereum's Geth averages 340 days, and the original Solana client had a turnover of 120 days before Agave.

Part II.A - Stake

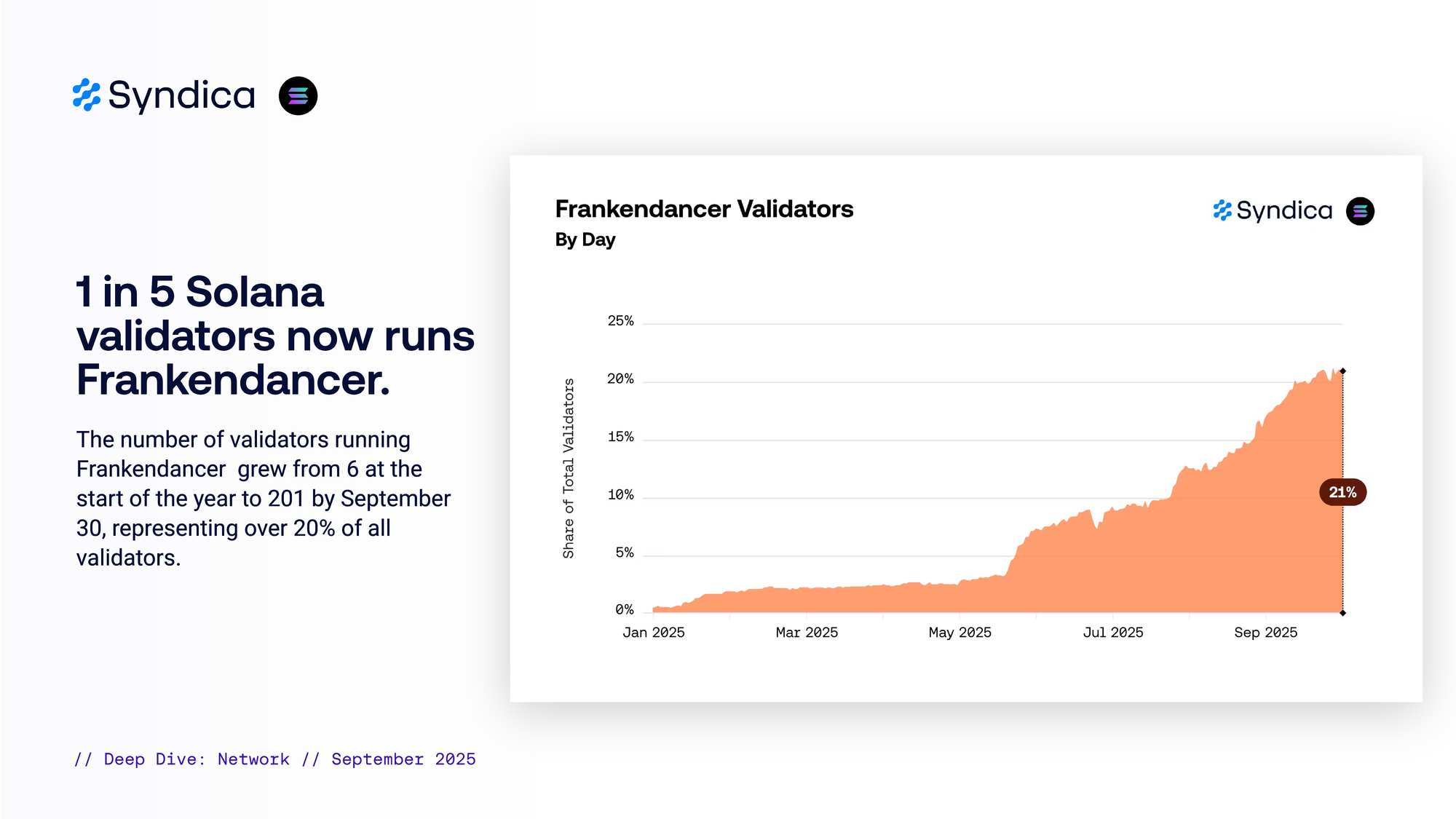

1 in 5 Solana validators now runs Frankendancer. The number of validators running Frankendancer grew from 6 at the start of the year to 201 by September 30, representing over 20% of all validators.

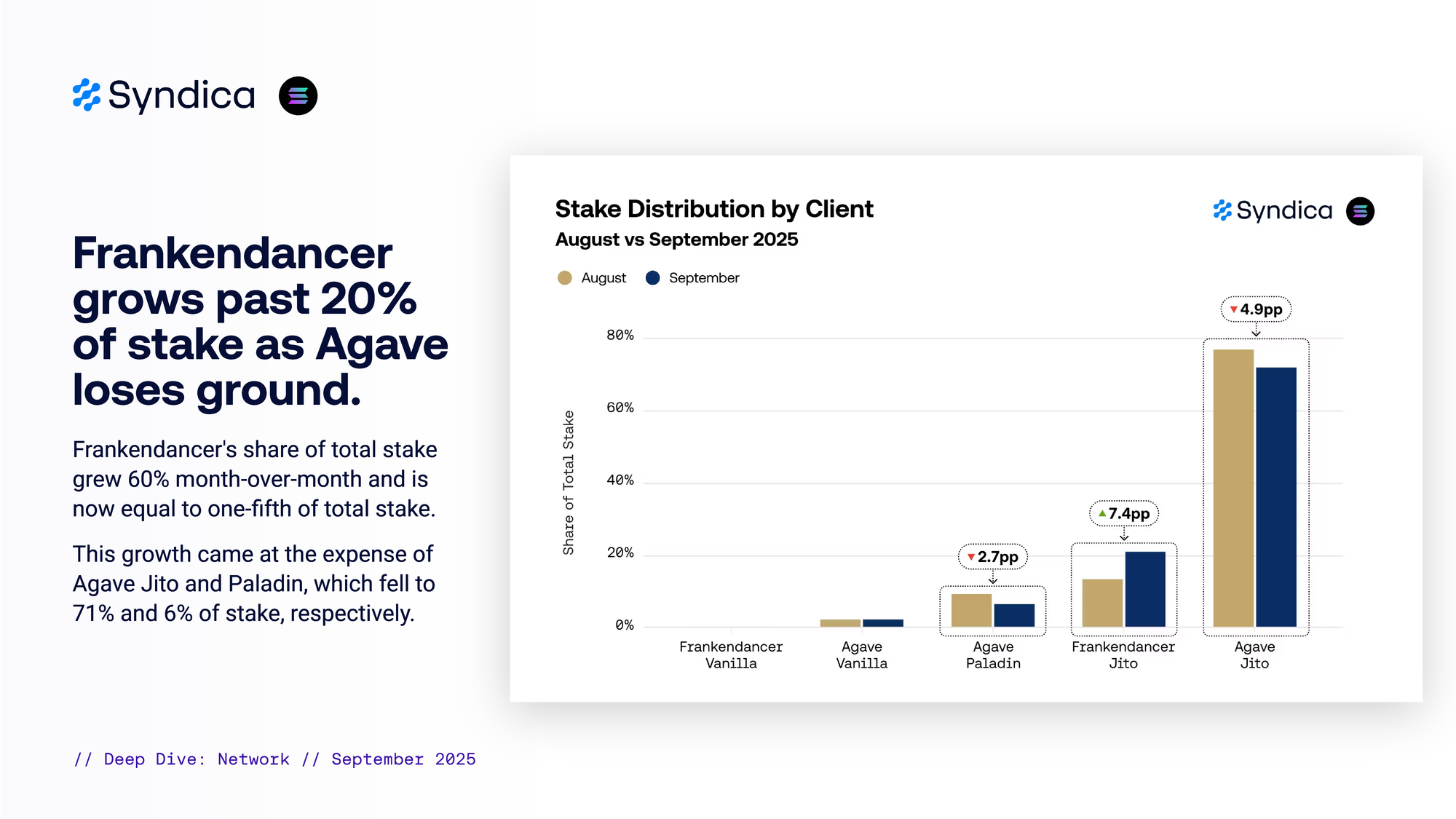

Frankendancer grows past 20% of stake as Agave loses ground. Frankendancer's share of total stake grew 60% month-over-month and is now equal to one-fifth of total stake. This growth came at the expense of Agave Jito and Paladin, which fell to 71% and 6% of stake, respectively.

Part II.B - Priority Fees

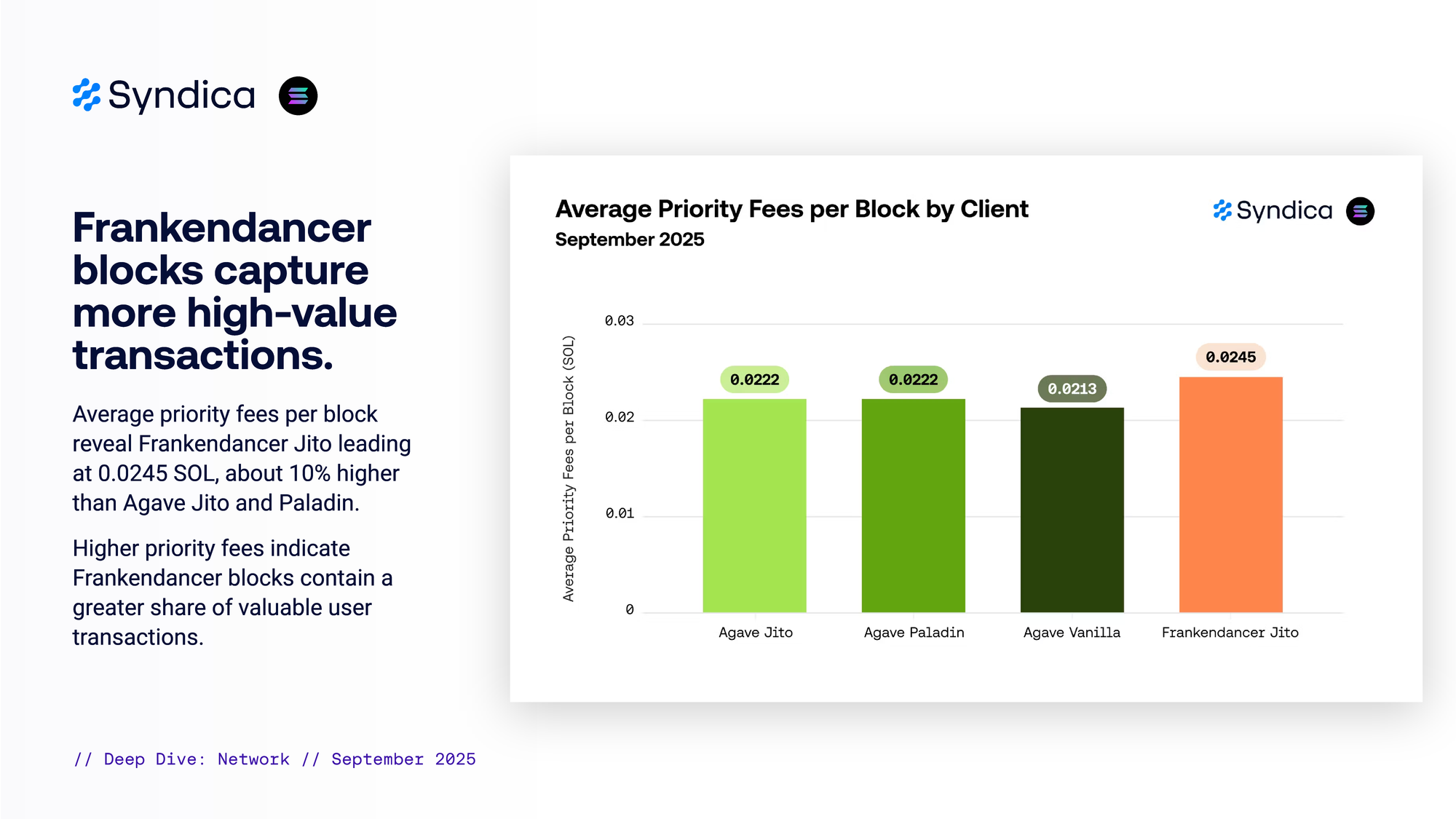

Frankendancer blocks capture more high-value transactions. Average priority fees per block reveal Frankendancer Jito leading at 0.0245 SOL, about 10% higher than Agave Jito and Paladin.

Higher priority fees indicate Frankendancer blocks contain a greater share of valuable user transactions.

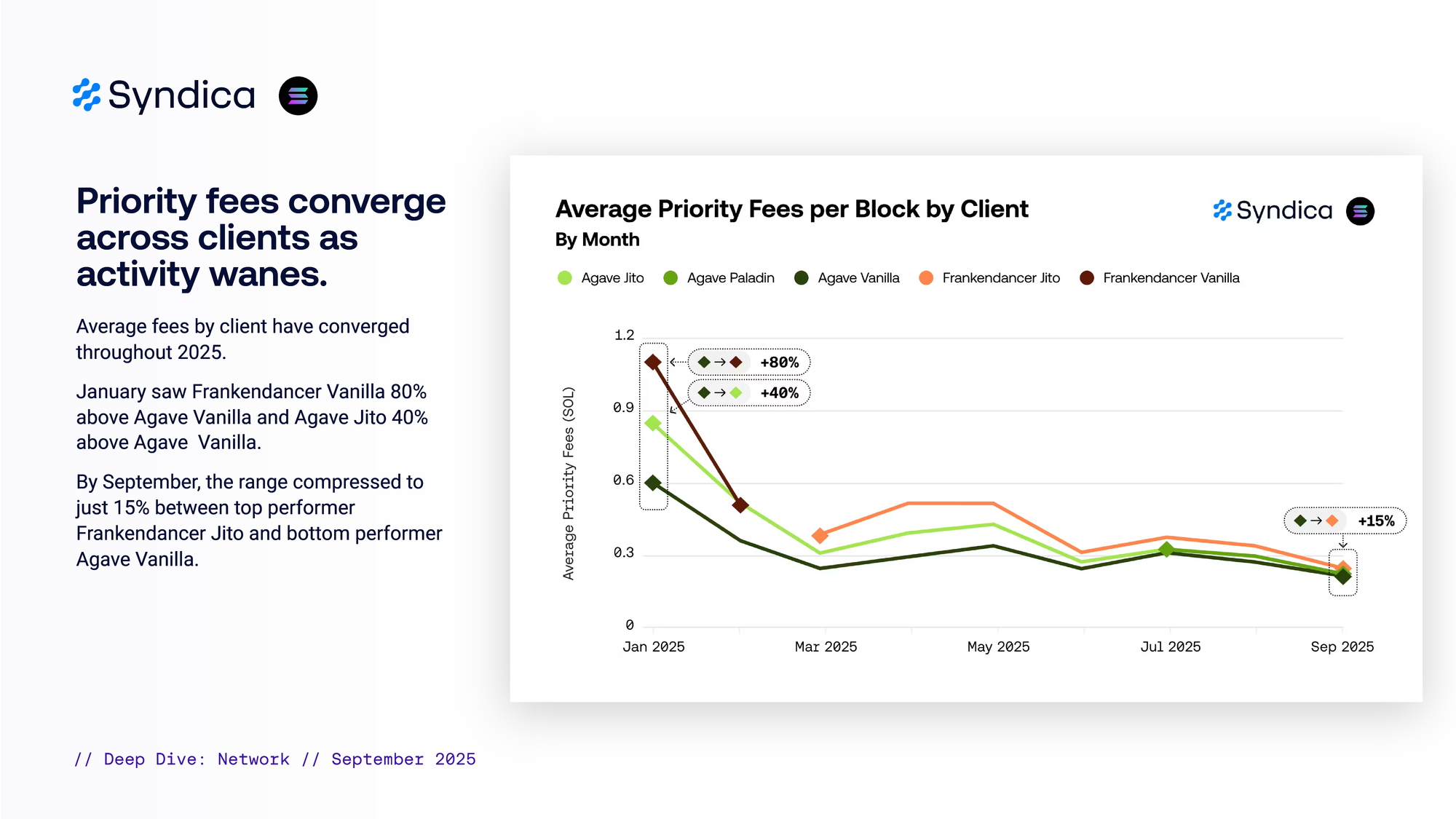

Priority fees converge across clients as activity wanes. Average fees by client have converged throughout 2025.

January saw Frankendancer Vanilla 80% above Agave Vanilla and Agave Jito 40% above Agave Vanilla.

By September, the range compressed to just 15% between top performer Frankendancer Jito and bottom performer Agave Vanilla.

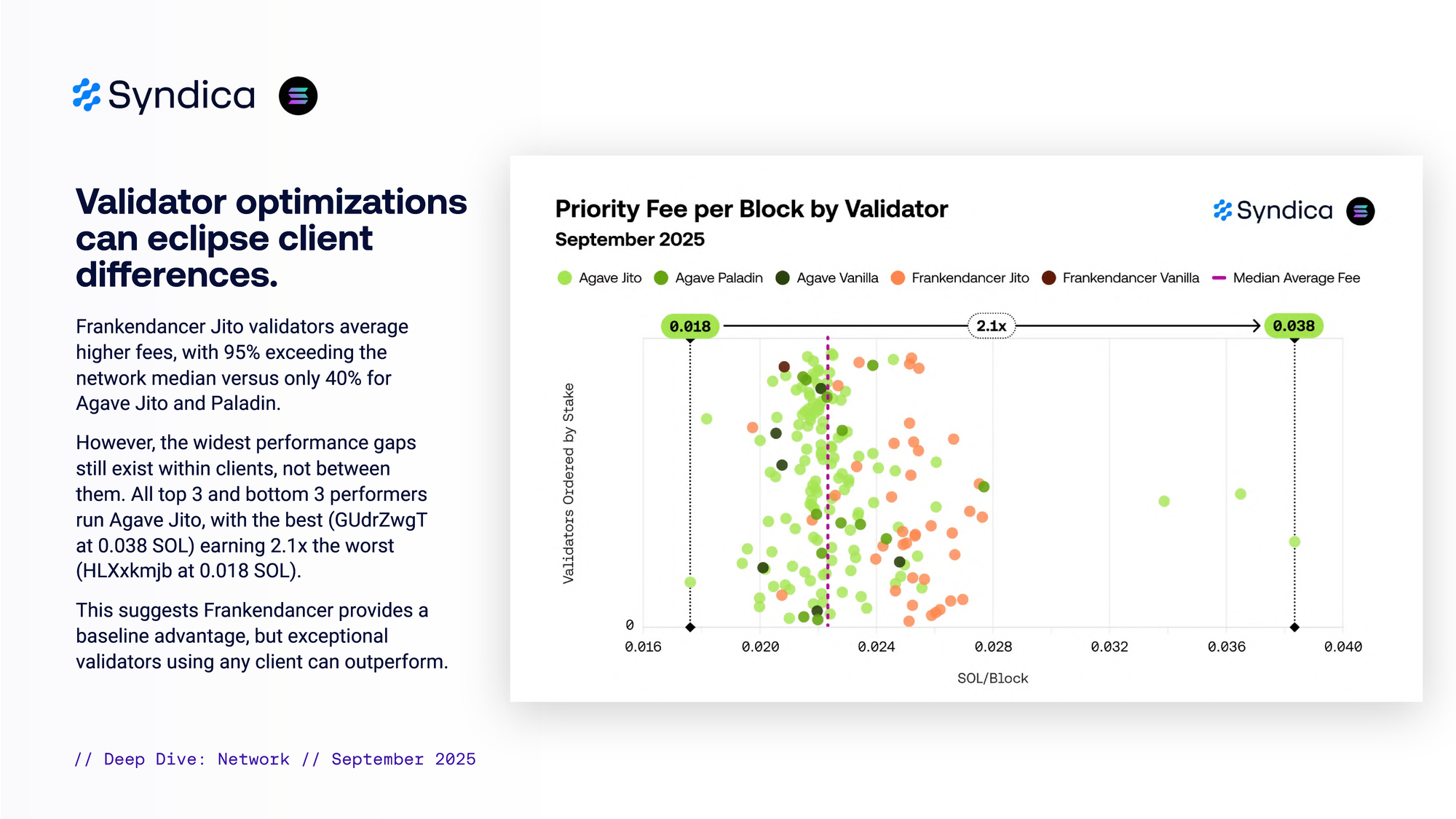

Validator optimizations can eclipse client differences. Frankendancer Jito validators average higher fees, with 95% exceeding the network median versus only 40% for Agave Jito and Paladin.

However, the widest performance gaps still exist within clients, not between them. All top 3 and bottom 3 performers run Agave Jito, with the best (GUdrZwgT at 0.038 SOL) earning 2.1x the worst (HLXxkmjb at 0.018 SOL).

This suggests Frankendancer provides a baseline advantage, but exceptional validators using any client can outperform.

Part II.C - Tips

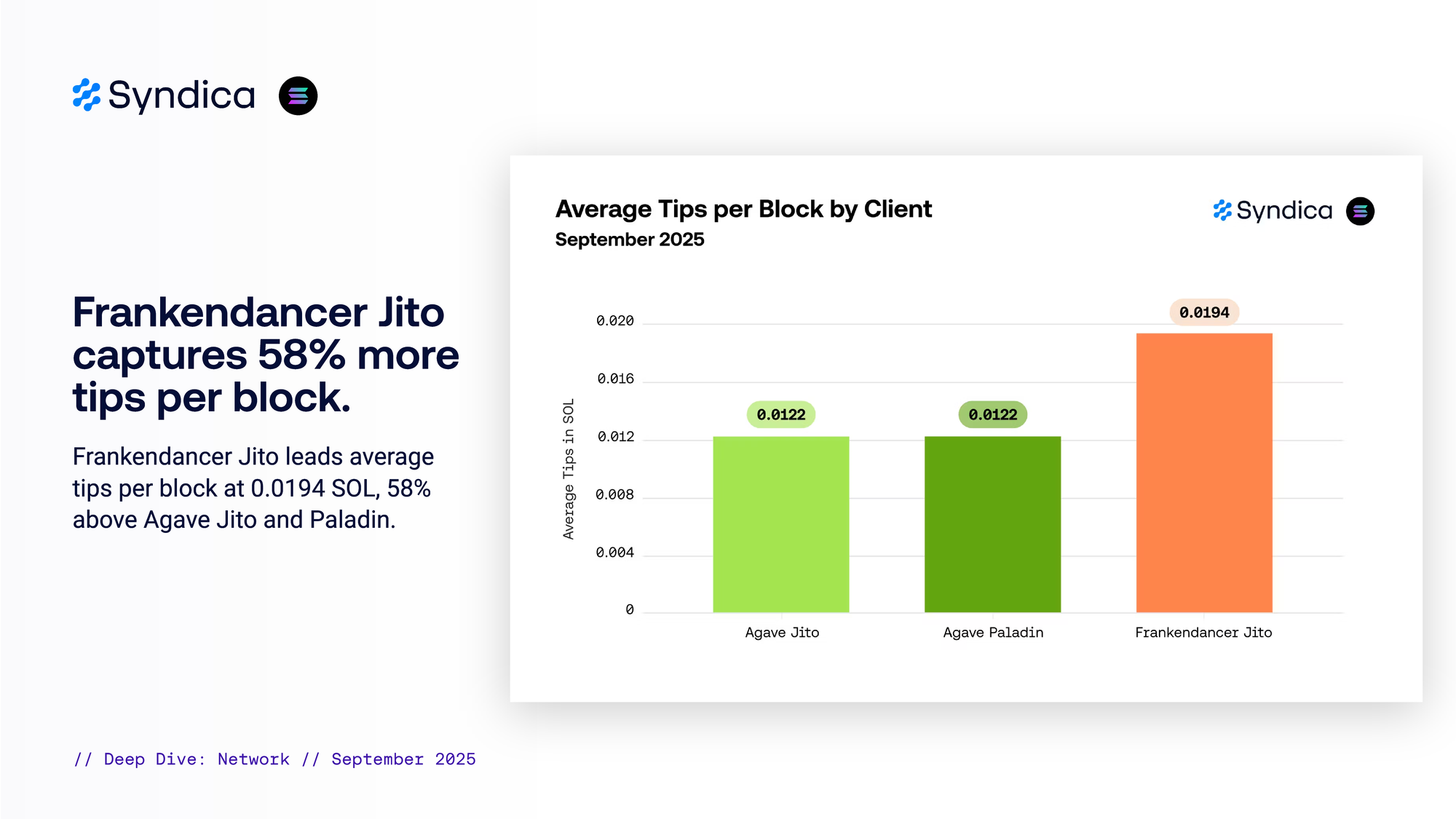

Frankendancer Jito captures 58% more tips per block. Frankendancer Jito leads average tips per block at 0.0194 SOL, 58% above Agave Jito and Paladin.

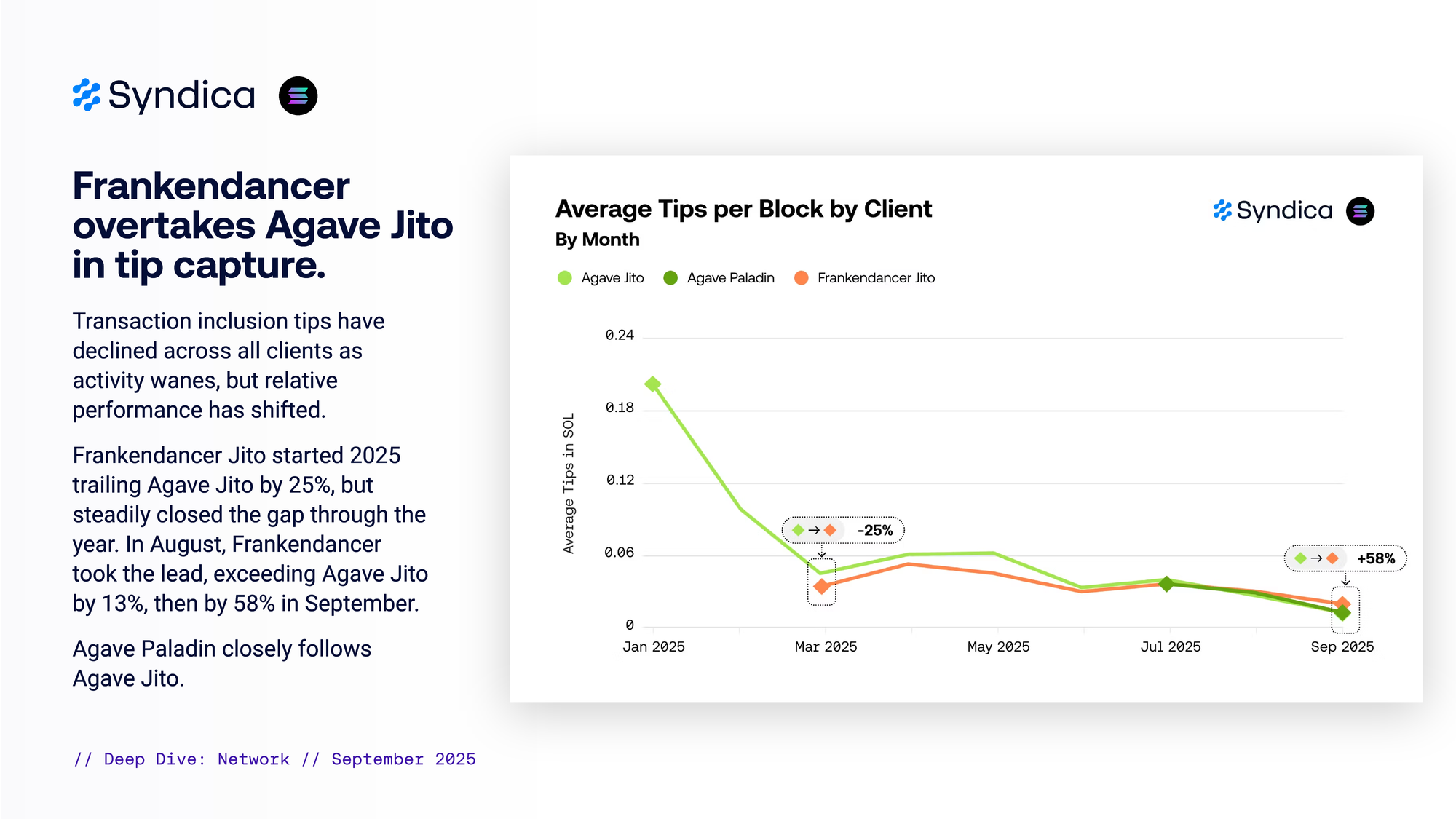

Frankendancer overtakes Agave Jito in tip capture. Transaction inclusion tips have declined across all clients as activity wanes, but relative performance has shifted.

Frankendancer Jito started 2025 trailing Agave Jito by 25%, but steadily closed the gap through the year. In August, Frankendancer took the lead, exceeding Agave Jito by 13%, then by 58% in September.

Agave Paladin closely follows Agave Jito.

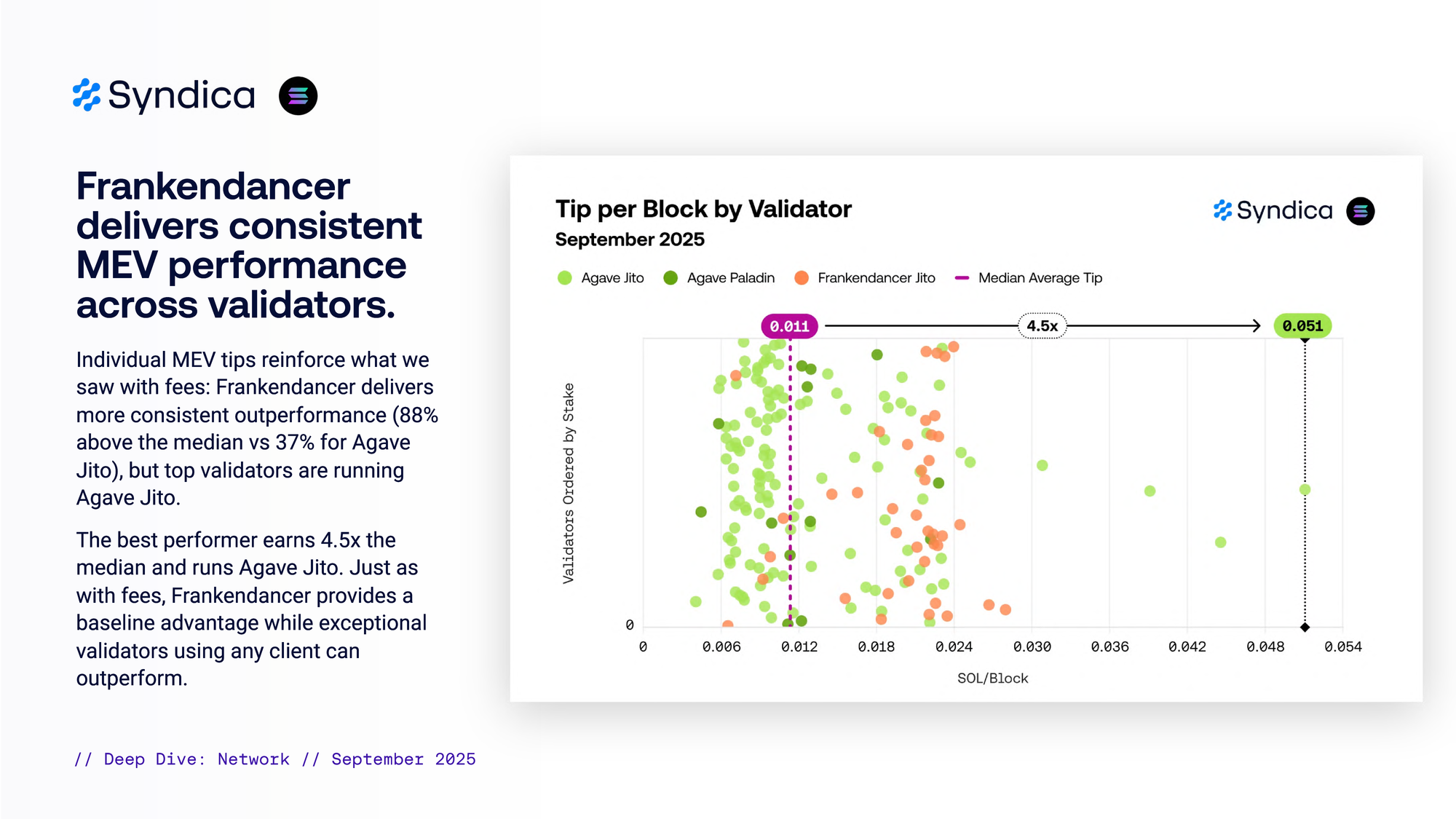

Frankendancer delivers consistent MEV performance across validators. Individual MEV tips reinforce what we saw with fees: Frankendancer delivers more consistent outperformance (88% above the median vs 37% for Agave Jito), but top validators are running Agave Jito.

The best performer earns 4.5x the median and runs Agave Jito. Just as with fees, Frankendancer provides a baseline advantage while exceptional validators using any client can outperform.