Insights: Layer 1 & 2 Chains - March 2025

Insights: Layer 1 & 2 Chains

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Insights: Layer 1 & 2 Chains - March 2025

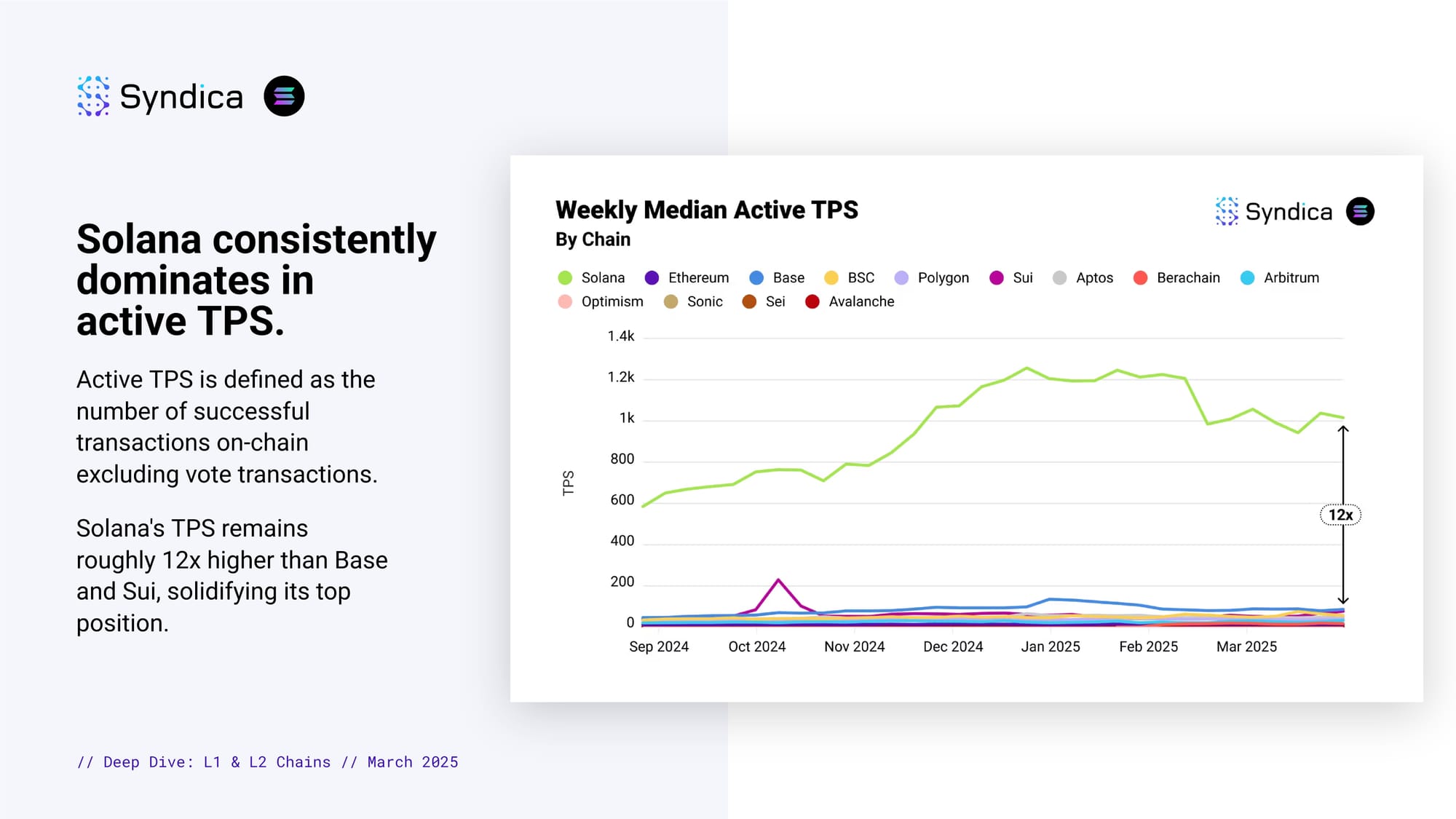

Solana consistently dominates in active TPS. Active TPS is defined as the number of successful transactions on-chain excluding vote transactions. Solana's TPS remains roughly 12x higher than Base and Sui, solidifying its top position.

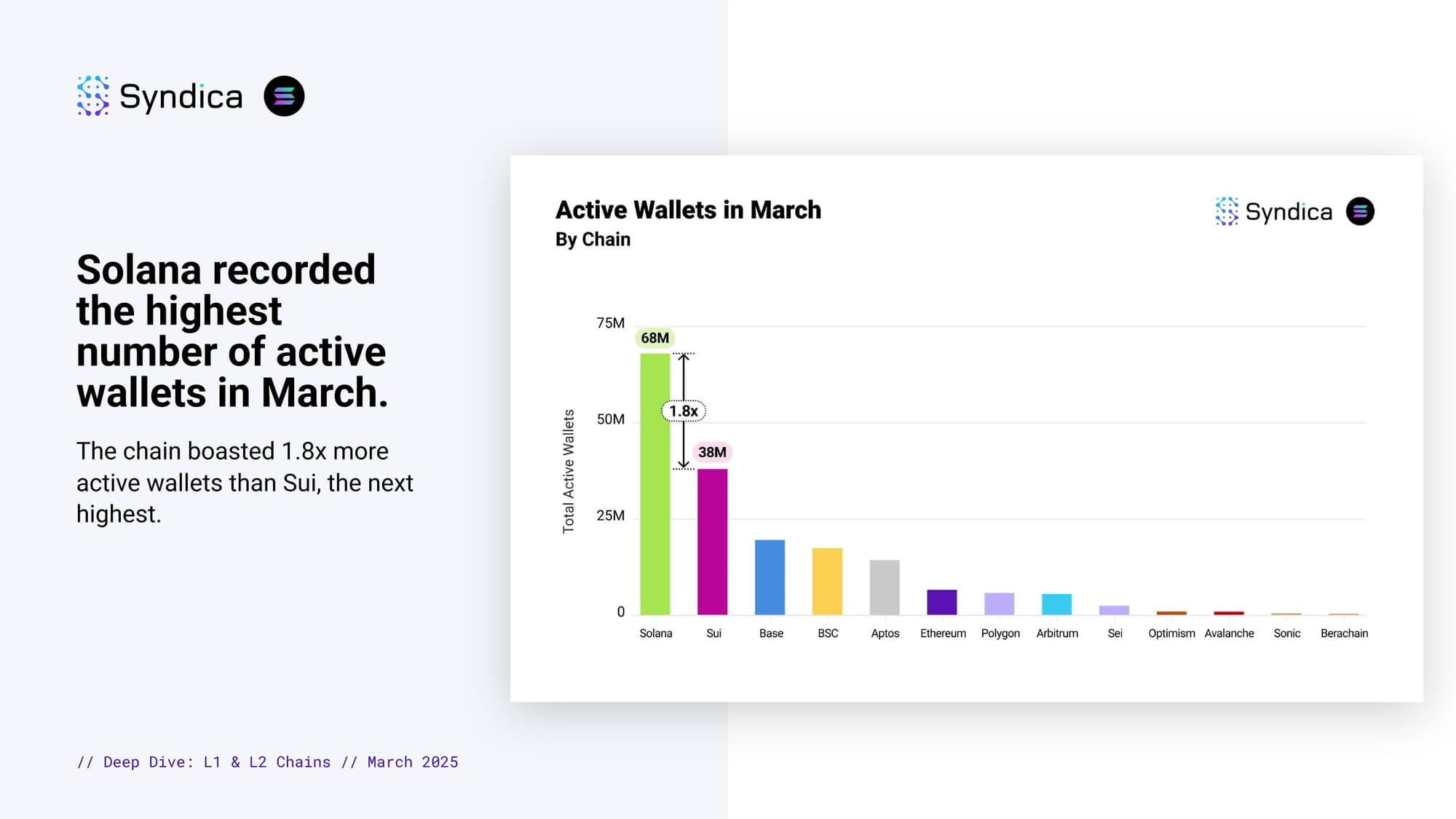

Solana recorded the highest number of active wallets in March. The chain boasted 1.8x more active wallets than Sui, the next highest.

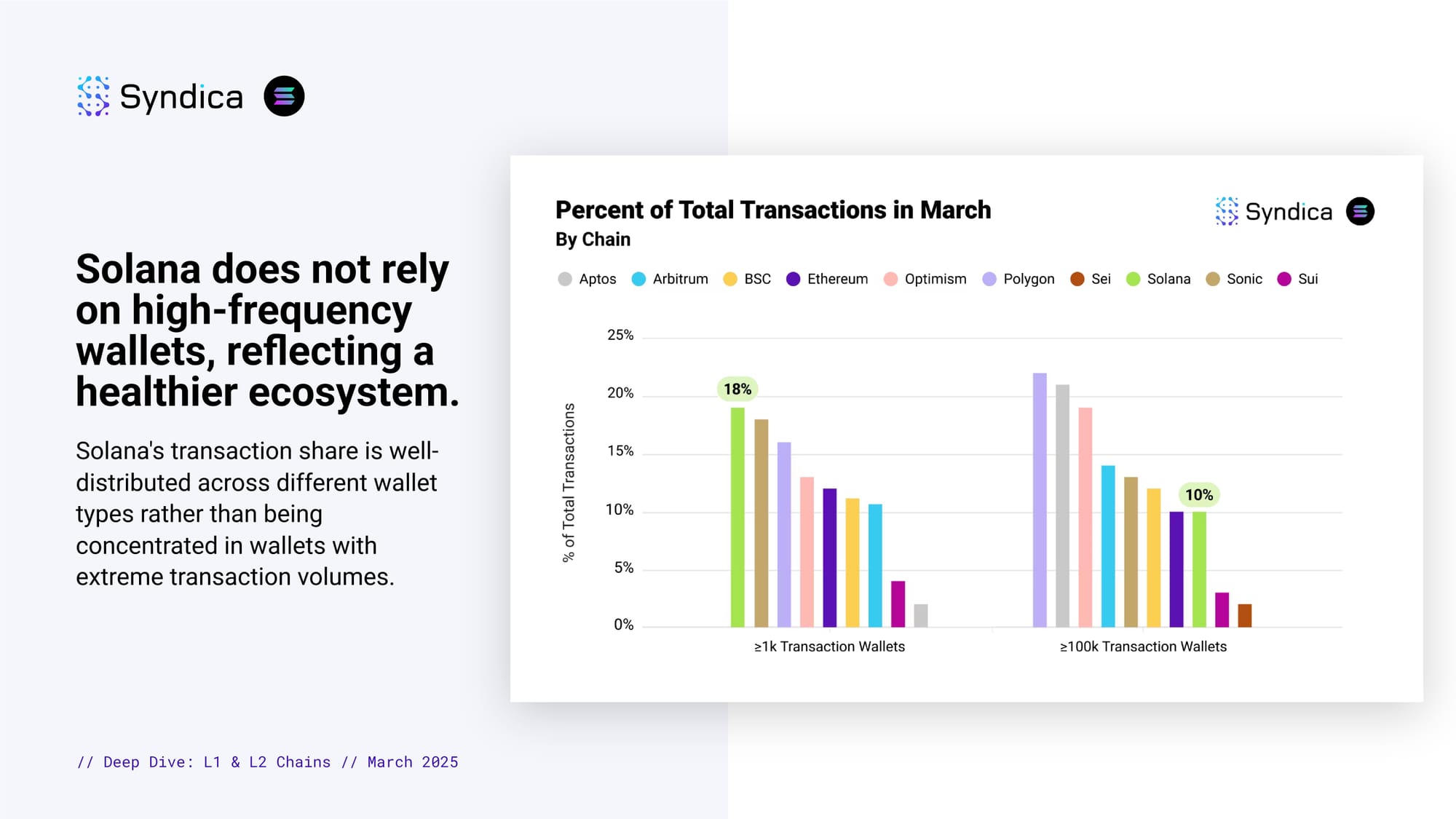

Solana does not rely on high-frequency wallets, reflecting a healthier ecosystem. Solana's transaction share is well-distributed across different wallet types rather than being concentrated in wallets with extreme transaction volumes.

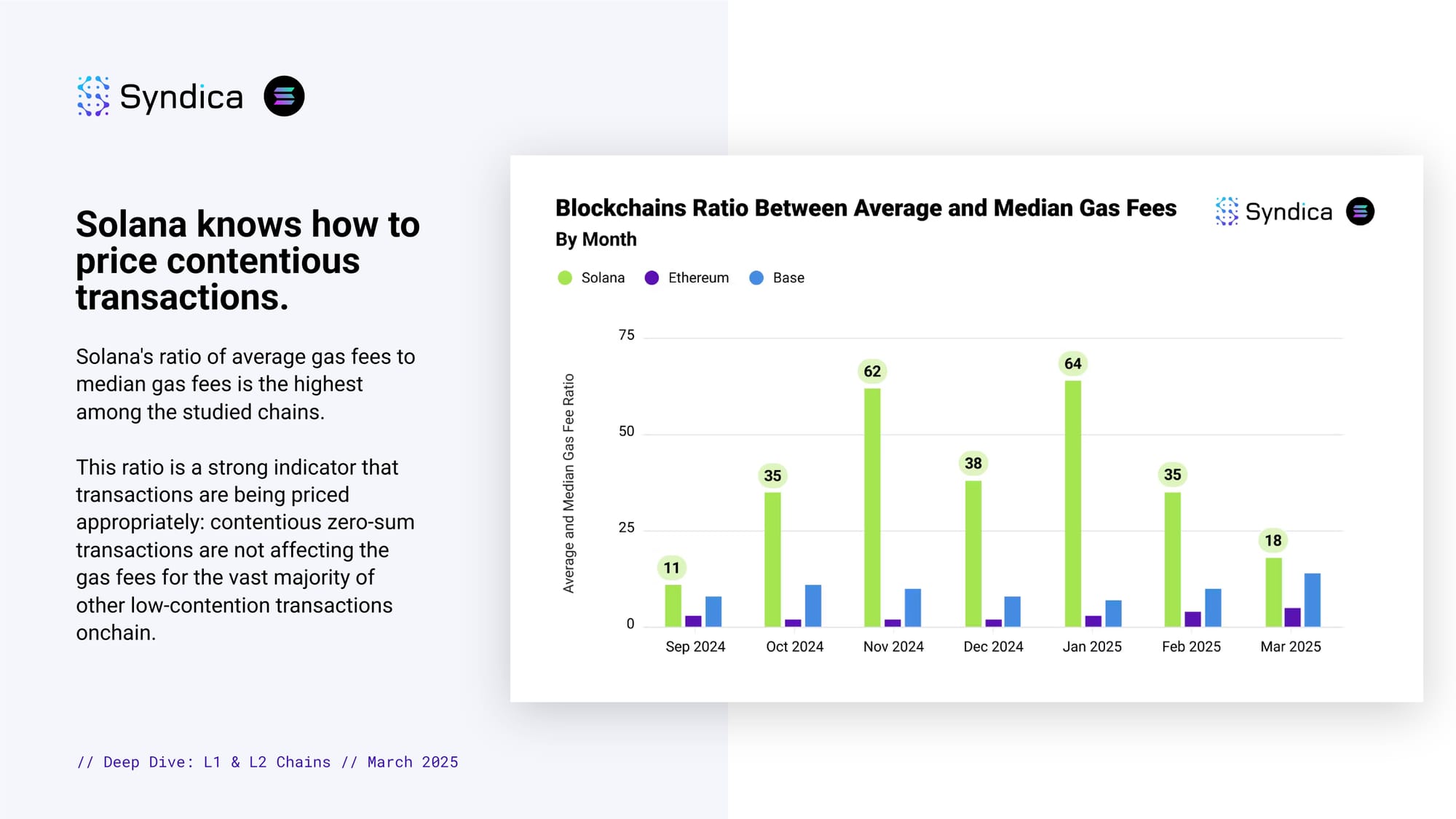

Solana knows how to price contentious transactions. Solana's ratio of average gas fees to median gas fees is highest amongst the studied chains. This ratio is a strong indicator that transactions are being priced appropriately: contentious zero-sum transactions are not affecting the gas fees for the vast majority of other low-contention transactions onchain.

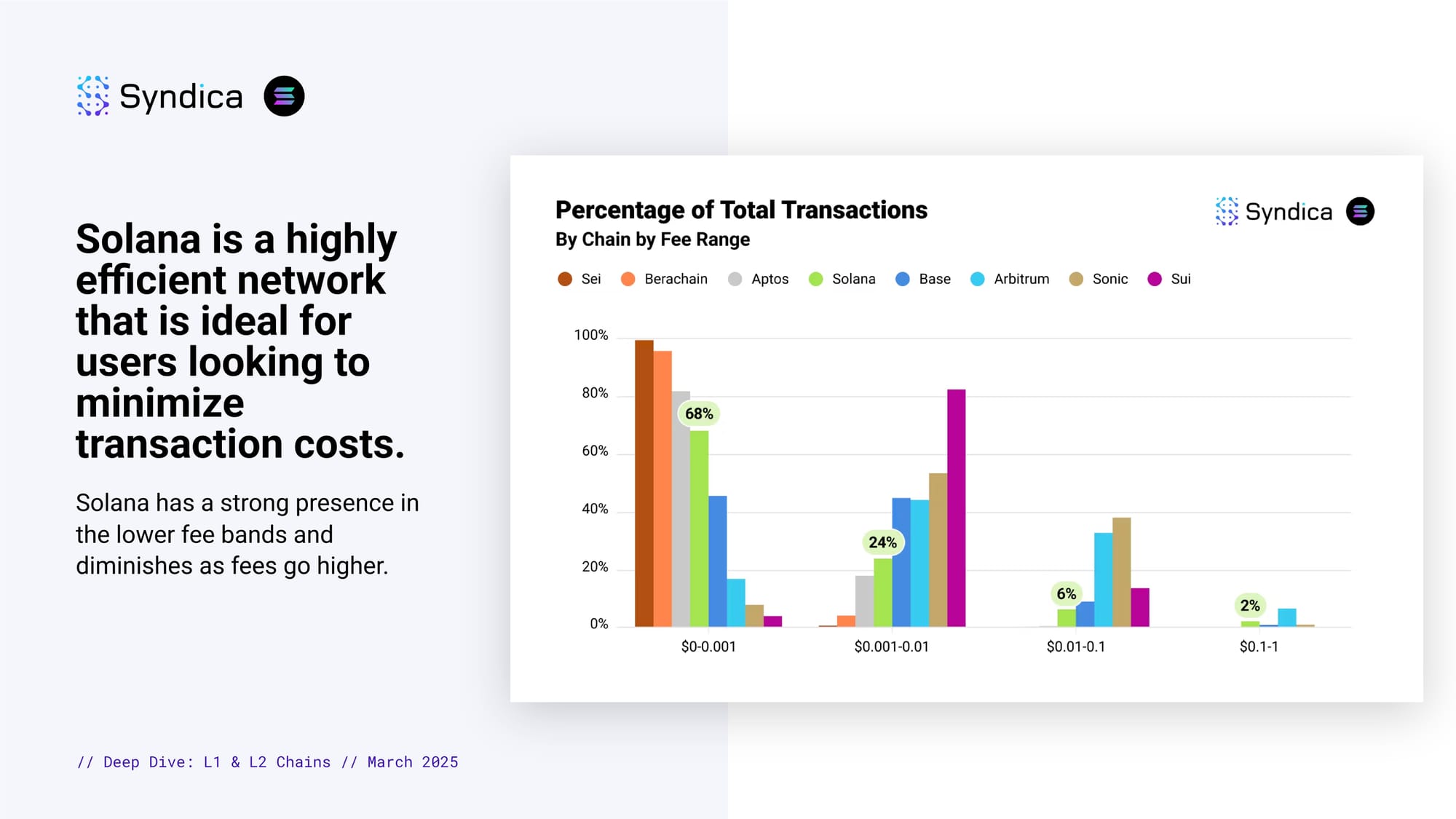

Solana is a highly efficient network that is ideal for users looking to minimize transaction costs. Solana has a strong presence in the lower fee bands and diminishes as fees go higher.

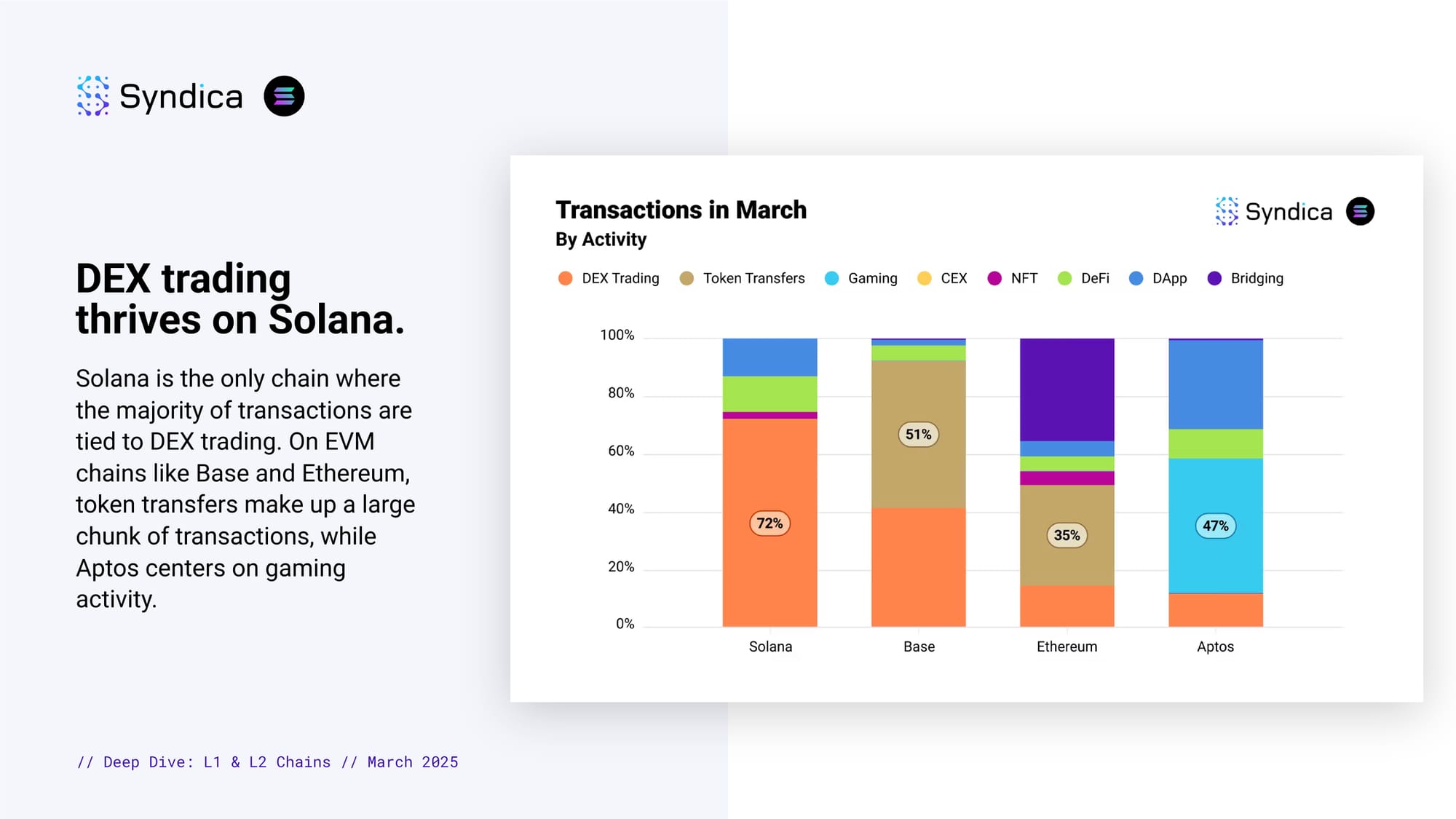

DEX trading thrives on Solana. Solana is the only chain where the majority of transactions are tied to DEX trading. On EVM chains like Base and Ethereum, token transfers make up a large chunk of transactions, while Aptos centers on gaming activity.

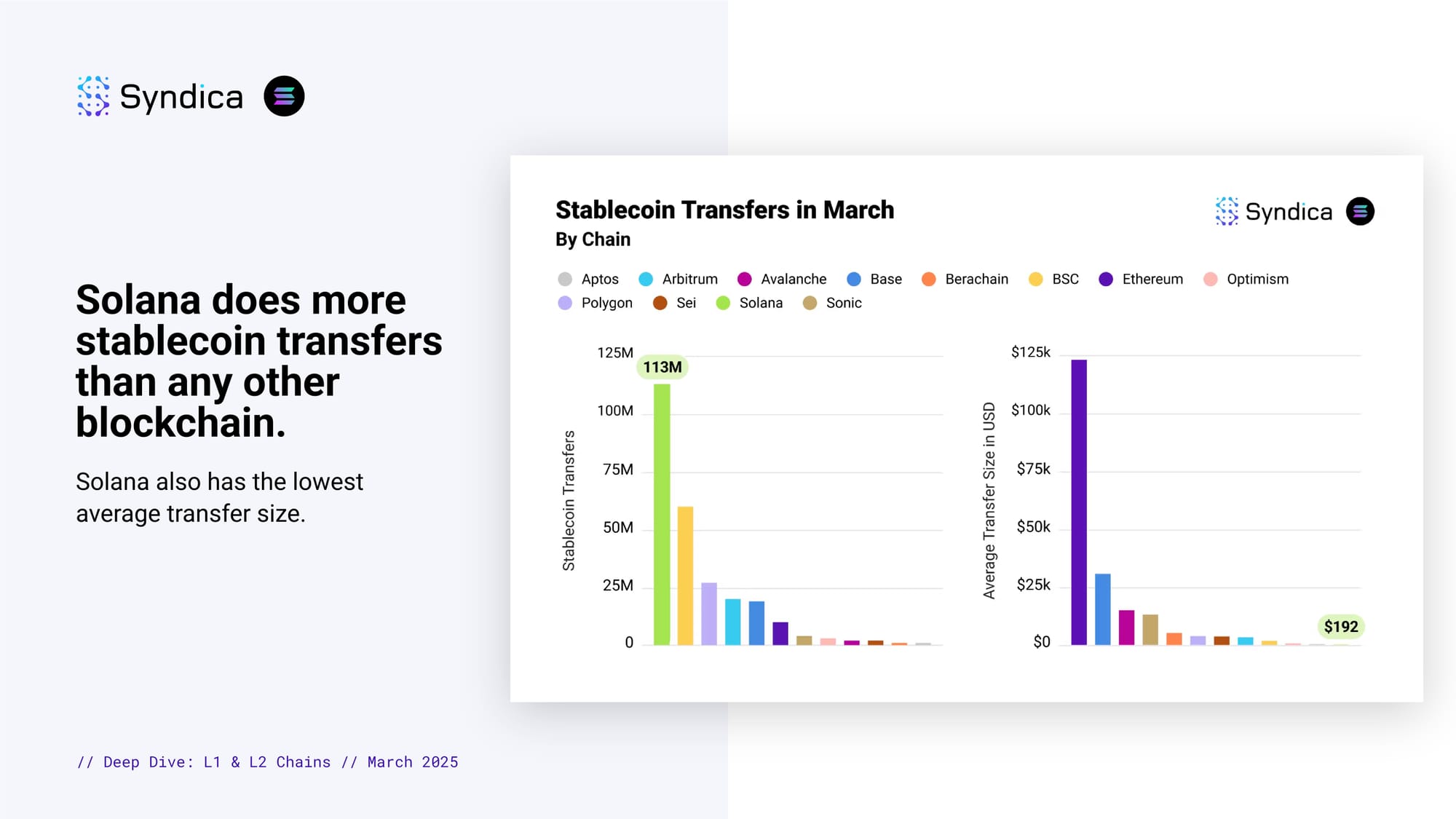

Solana does more stablecoin transfers than any other blockchain. Solana also has the lowest average transfer size.

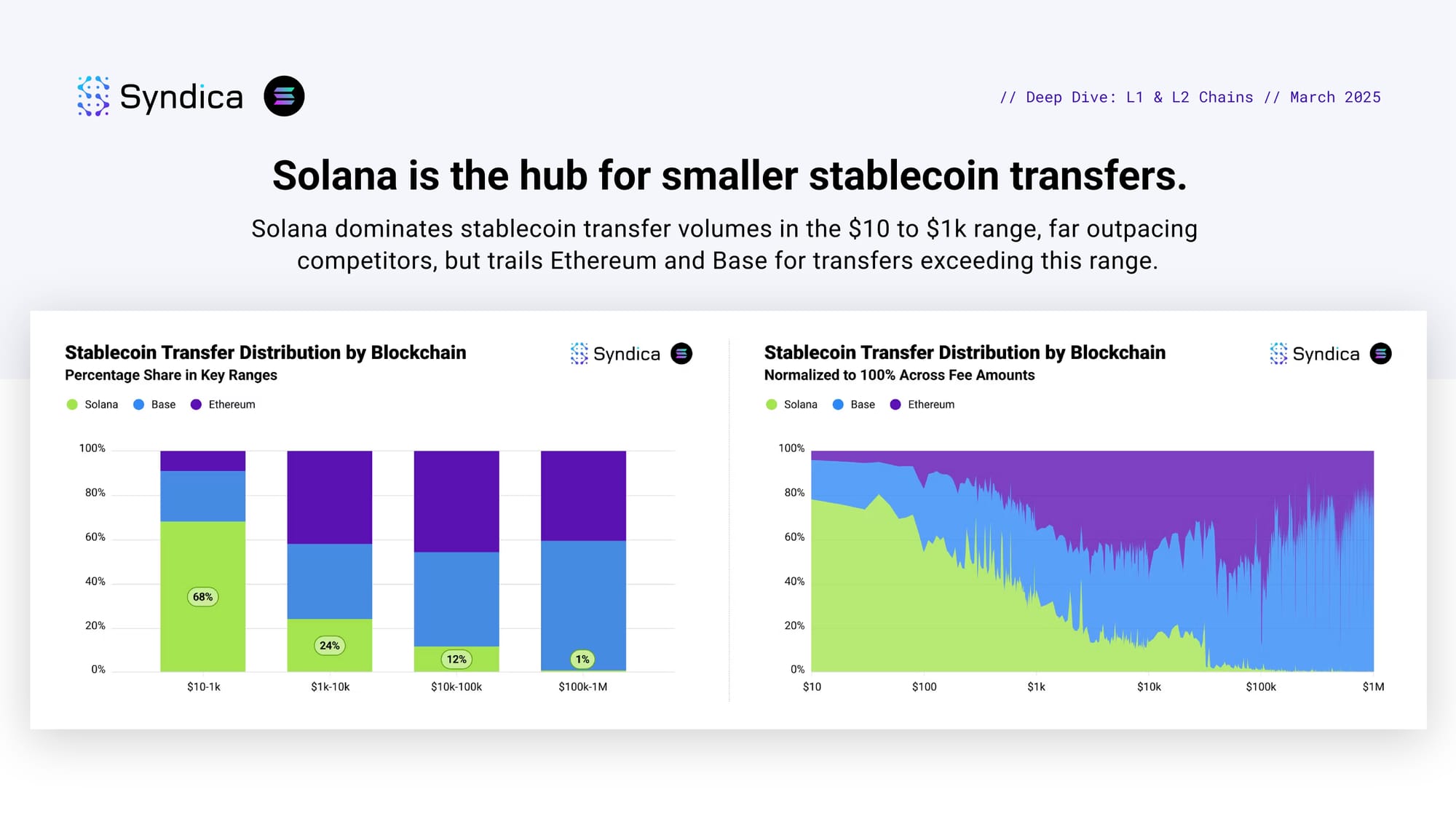

Solana is the hub for smaller stablecoin transfers. Solana dominates stablecoin transfer volumes in the $10 to $1k range, far outpacing competitors, but trails Ethereum and Base for transfers exceeding this range.

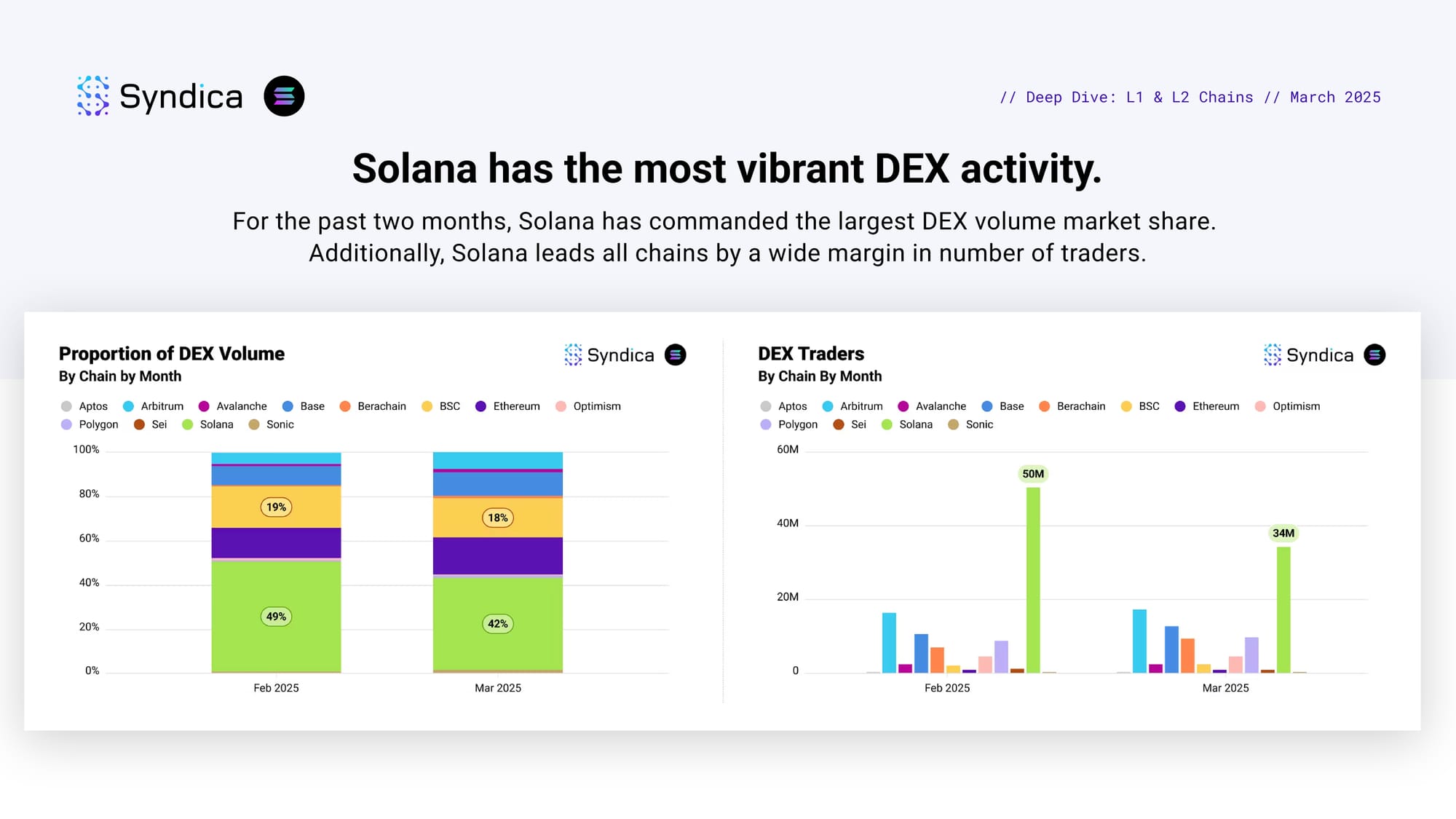

Solana has the most vibrant DEX activity. For the past two months, Solana has commanded the largest DEX volume market share. Additionally, Solana leads all chains by a wide margin in number of traders.

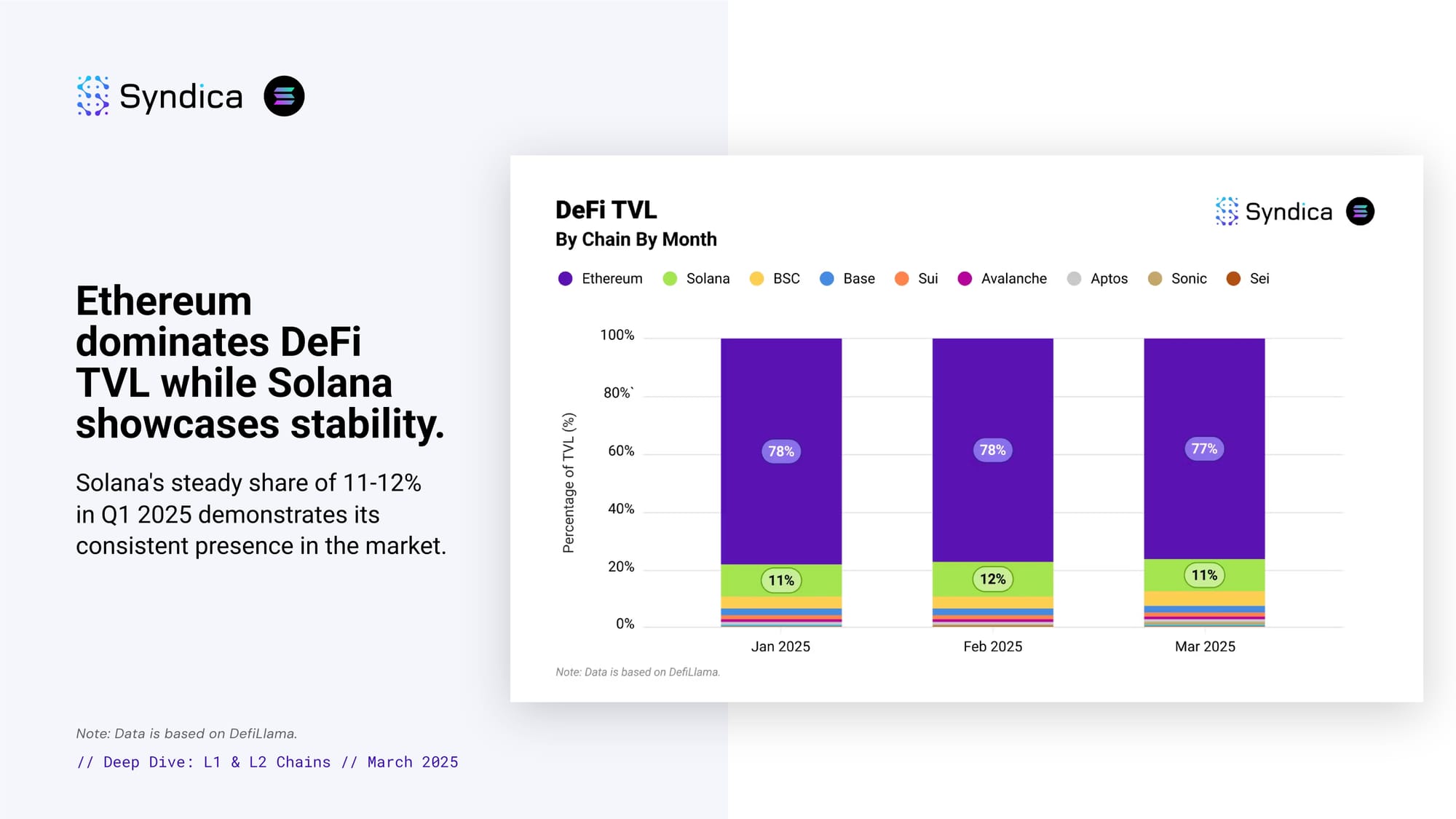

Ethereum dominates DeFi TVL while Solana showcases stability. Solana's steady share of 11-12% in Q1 2025 demonstrates its consistent presence in the market.

Solana is the chain for retail. Solana recorded the highest number of trades under $100, indicating its widespread use among users who transact in smaller amounts.

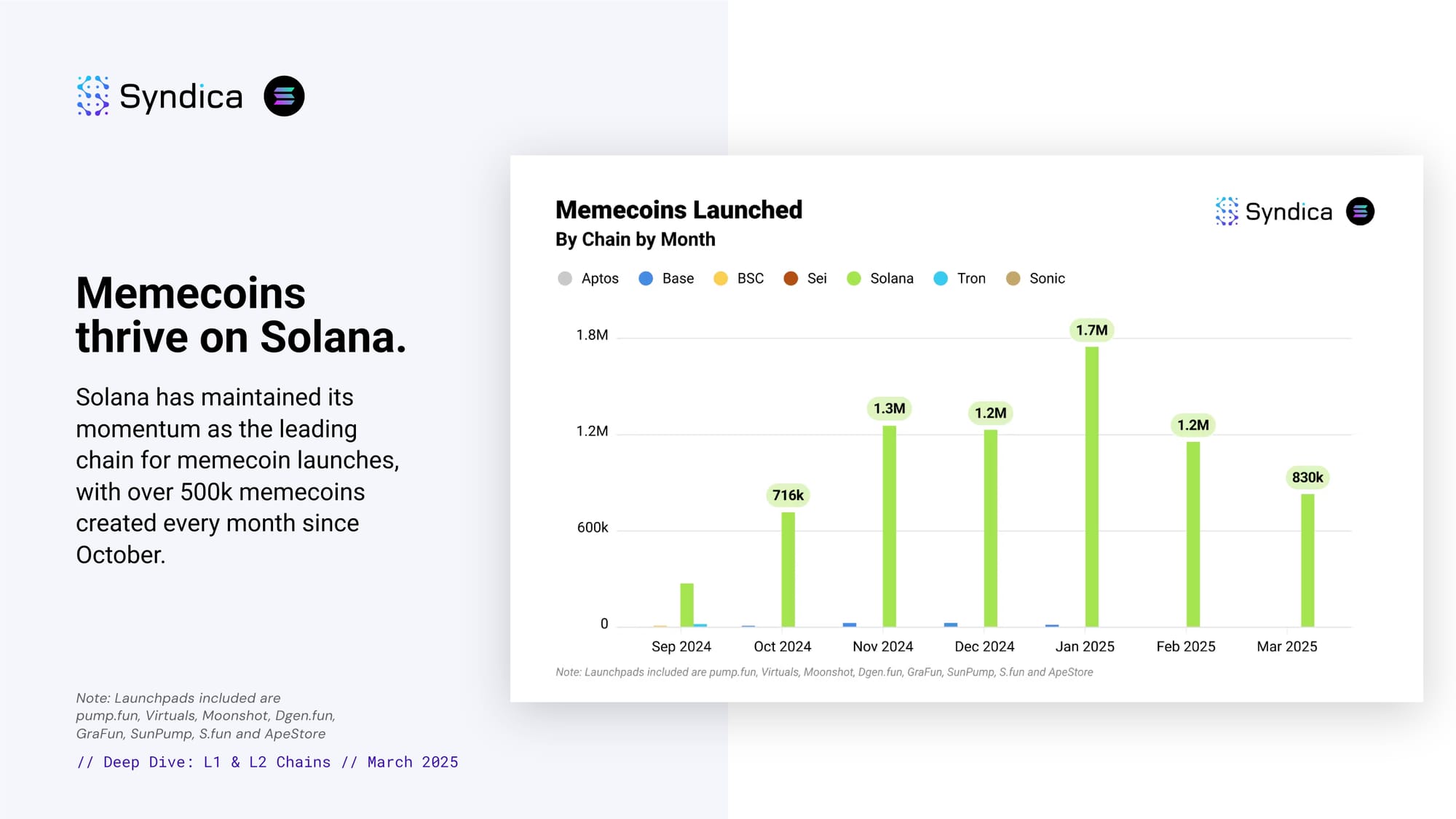

Memecoins thrive on Solana. Solana has maintained its momentum as the leading chain for memecoin launches, with over 500k memecoins created every month since October.

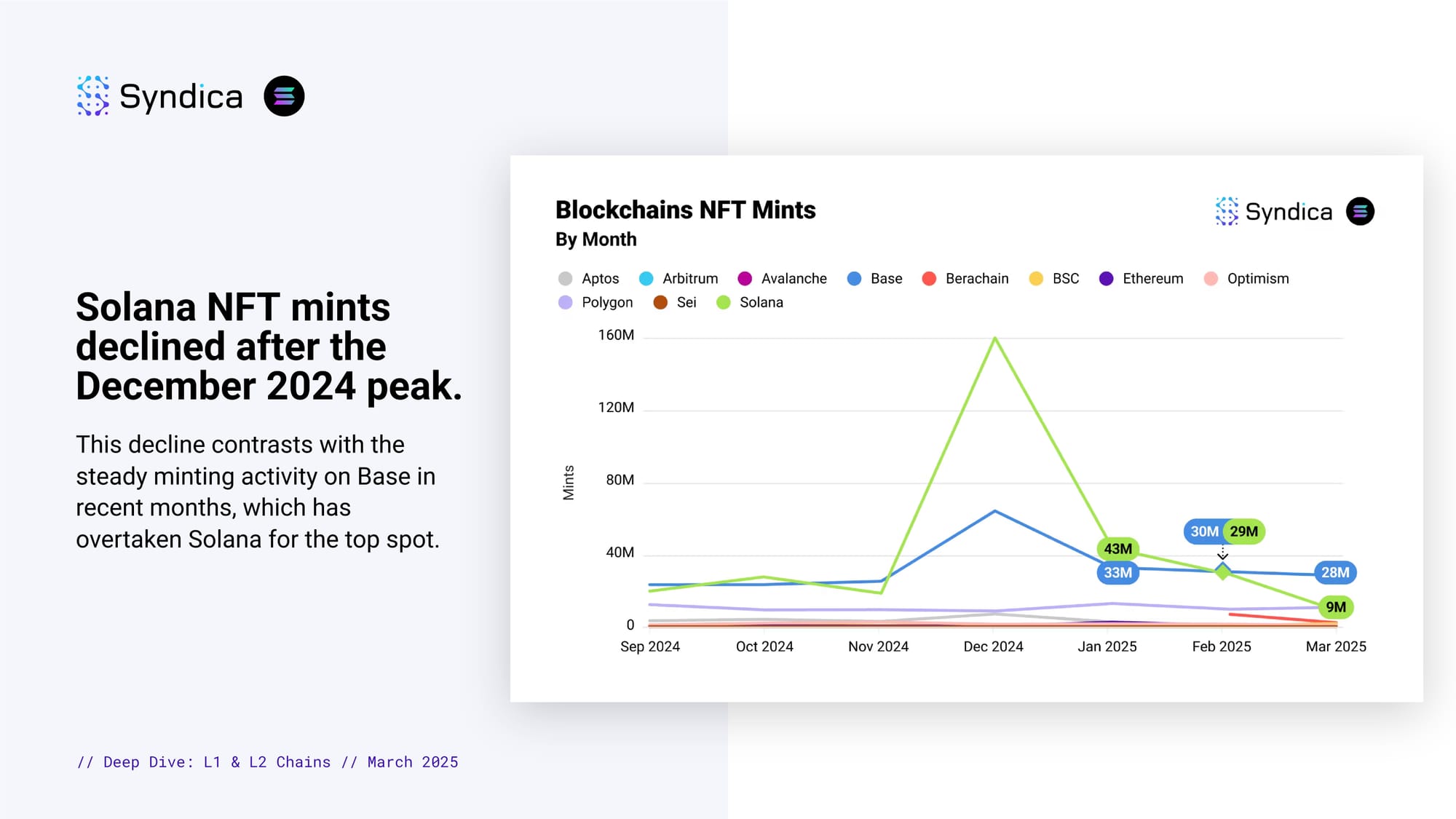

Solana NFT mints declined after the December 2024 peak. This decline contrasts with the steady minting activity on Base in recent months, which has overtaken Solana for the top spot.

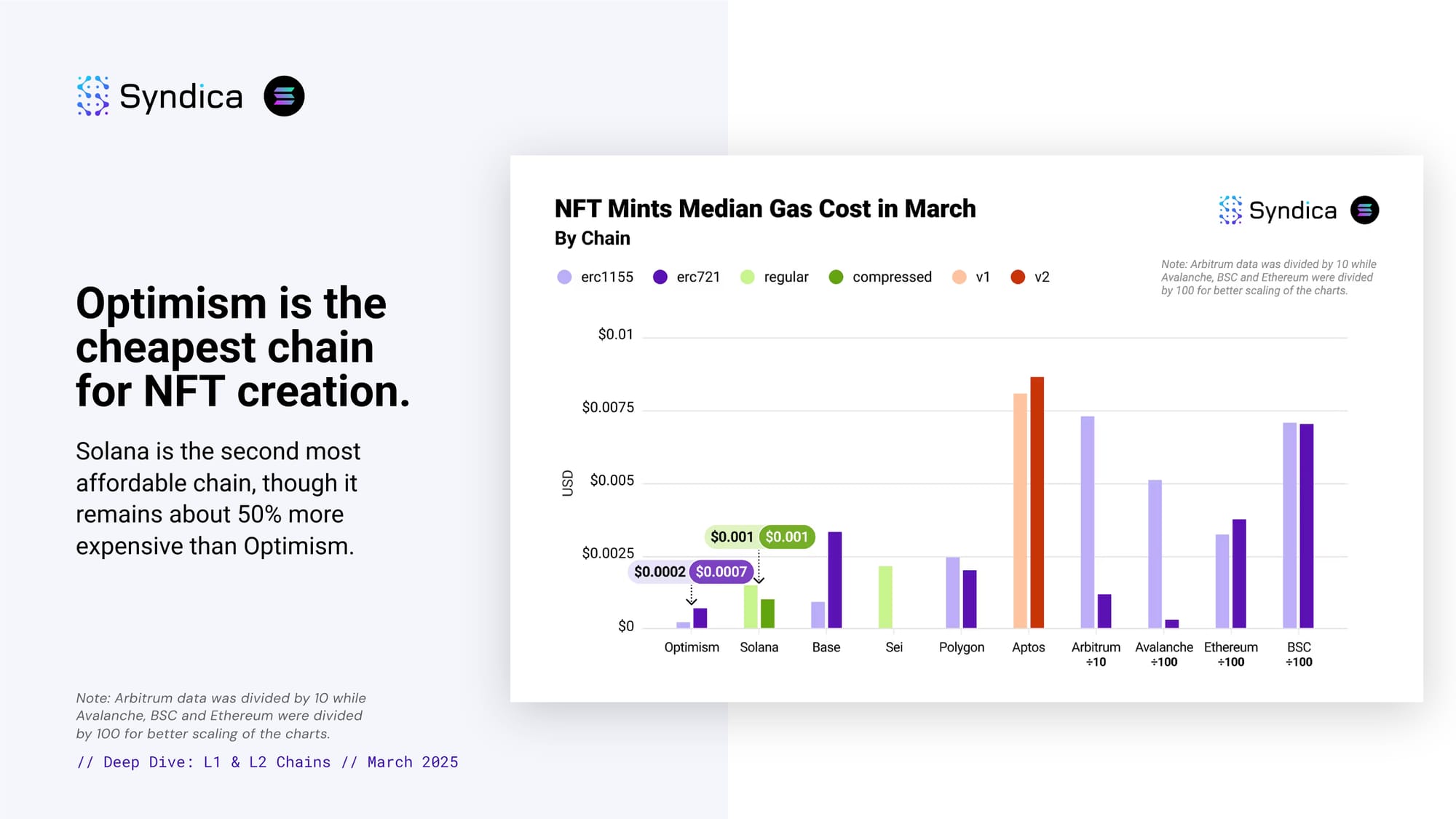

Optimism is the cheapest chain for NFT creation. Solana is the second most affordable chain, though it remains about 50% more expensive than Optimism.