Insights: Layer 1 & 2 Chains - April 2025

Insights: Layer 1 & 2 Chains - April 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Insights: Layer 1 & 2 Chains - April 2025

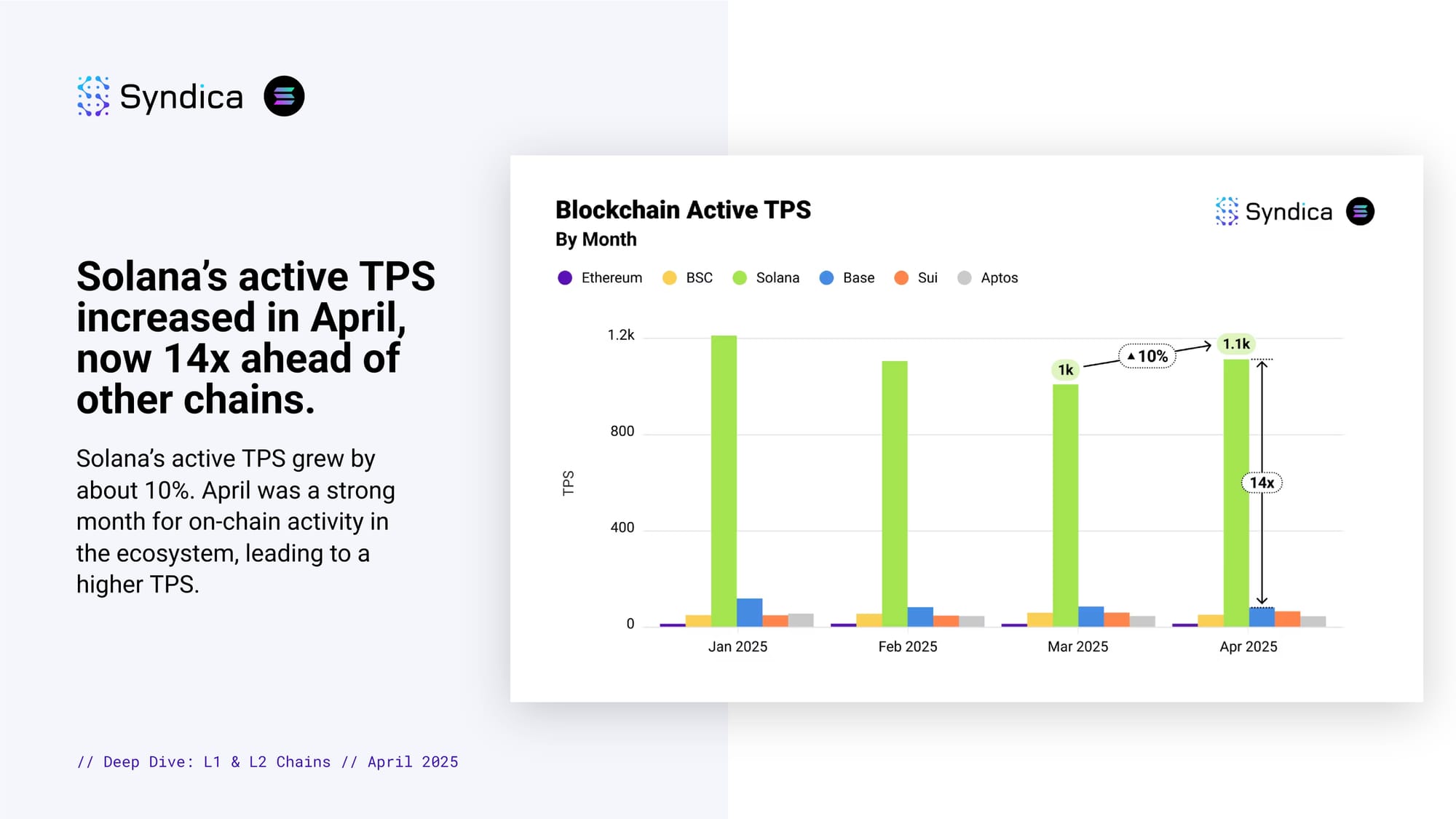

Solana’s active TPS increased in April, now 14x ahead of other chains. Solana’s active TPS grew by about 10%. April was a strong month for on-chain activity in the ecosystem, leading to a higher TPS.

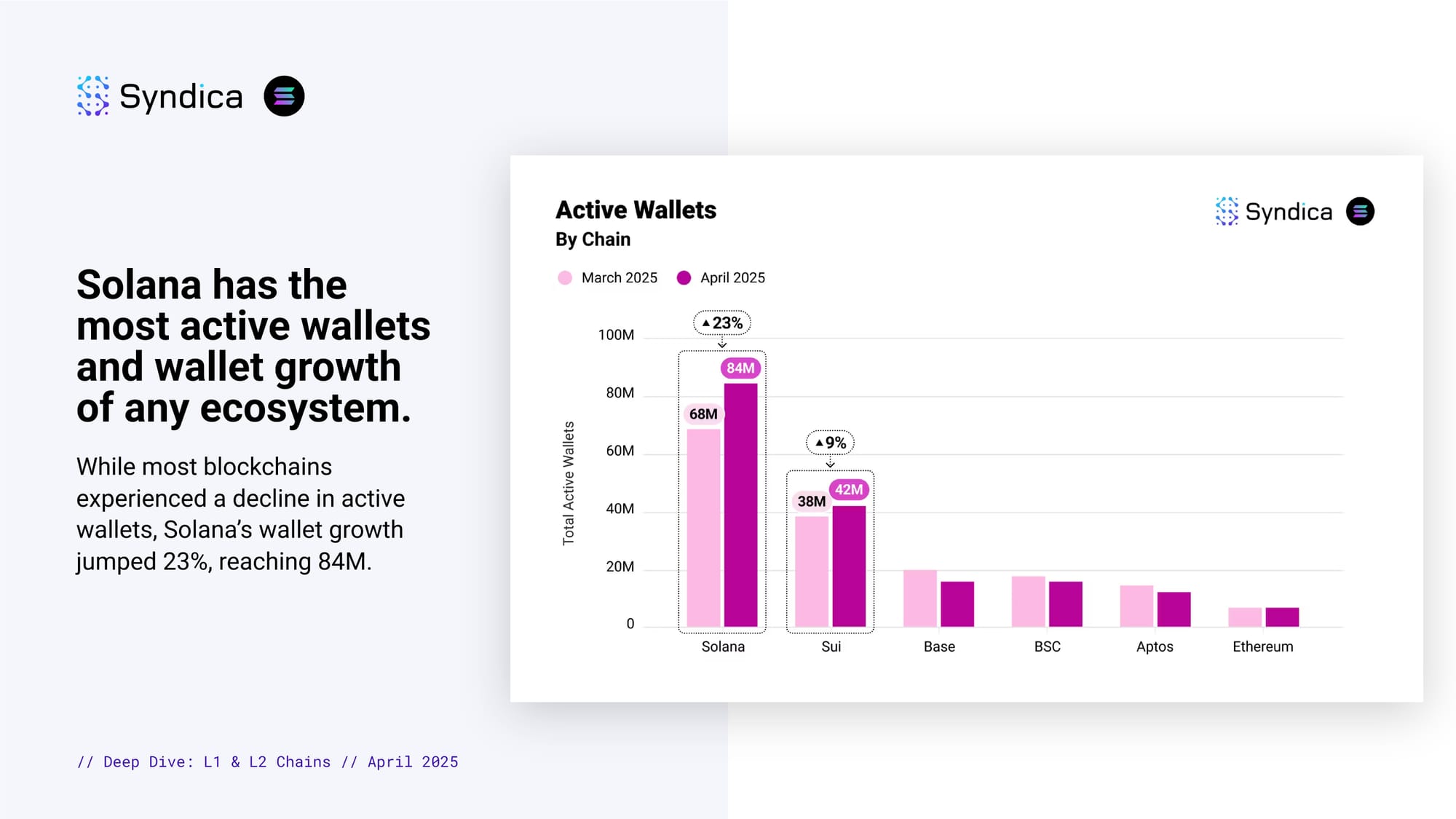

Solana has the most active wallets and wallet growth of any ecosystem. While most blockchains experienced a decline in active wallets, Solana’s wallet growth jumped 23%, reaching 84M.

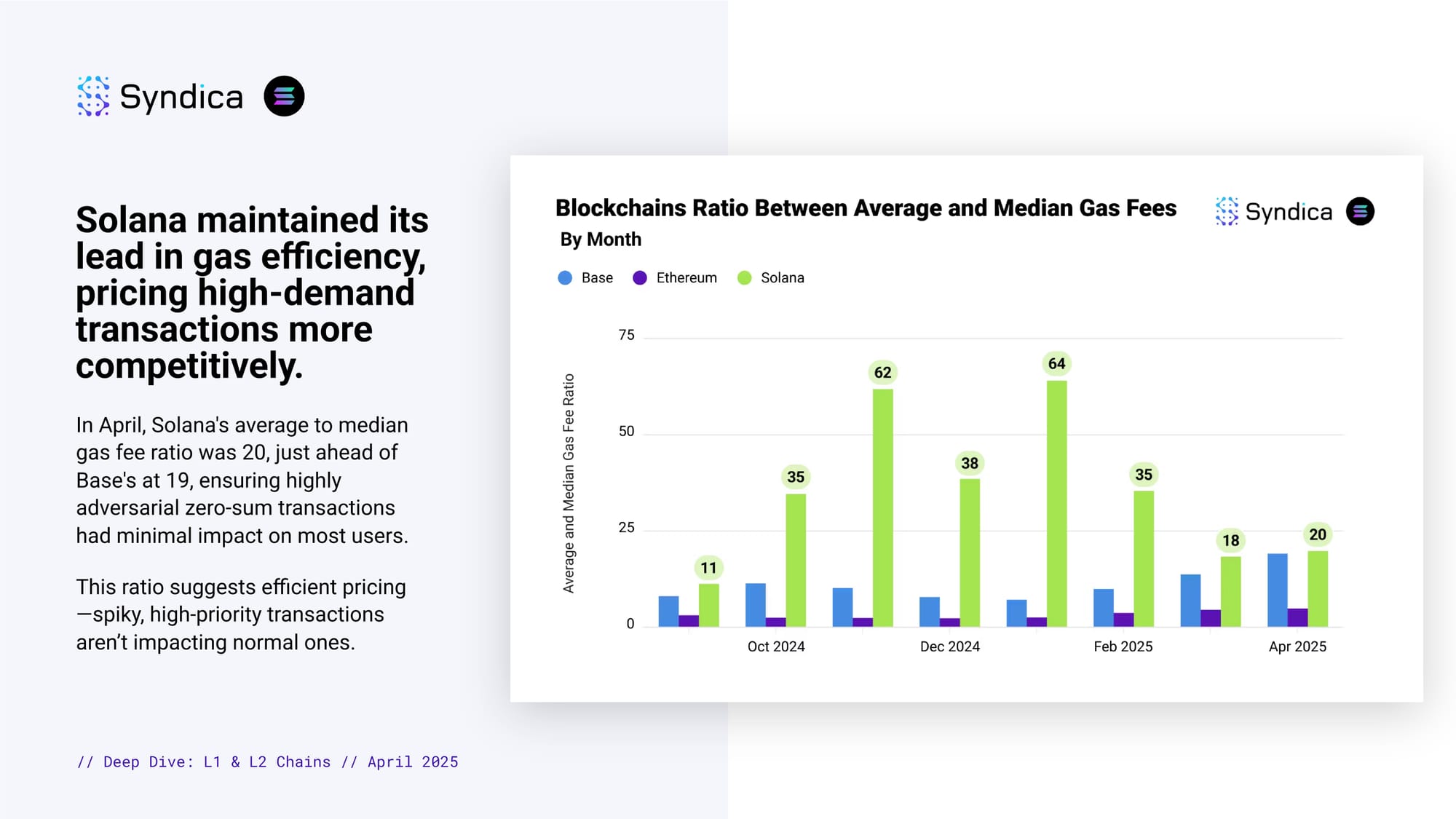

Solana maintained its lead in gas efficiency, pricing high-demand transactions more competitively. In April, Solana's average to median gas fee ratio was 20, just ahead of Base's at 19, ensuring highly adversarial zero-sum transactions had minimal impact on most users. This ratio suggests efficient pricing—spiky, high-priority transactions aren’t impacting normal ones.

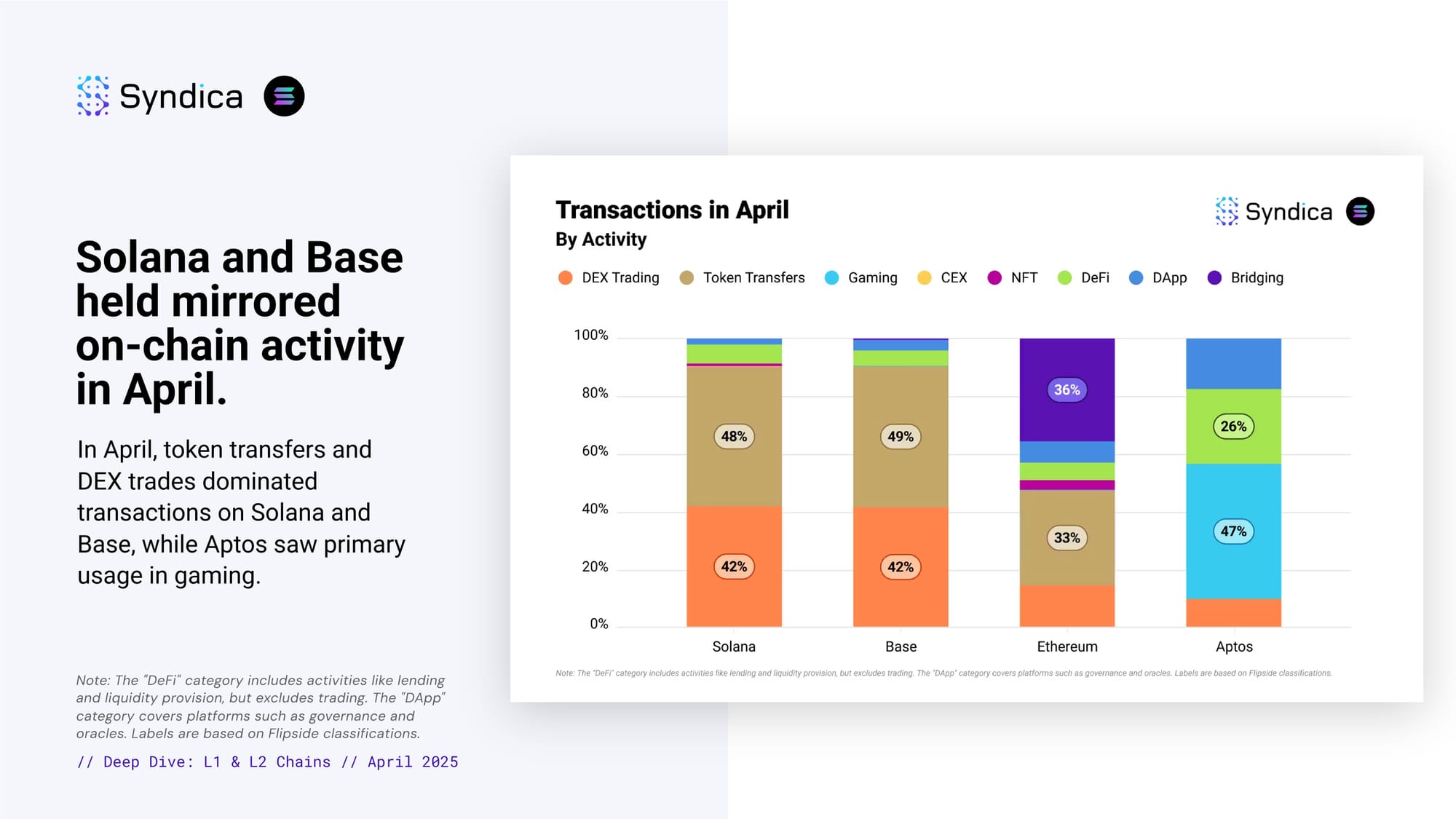

Solana and Base held mirrored on-chain activity in April. In April, token transfers and DEX trades dominated transactions on Solana and Base, while Aptos saw primary usage in gaming.

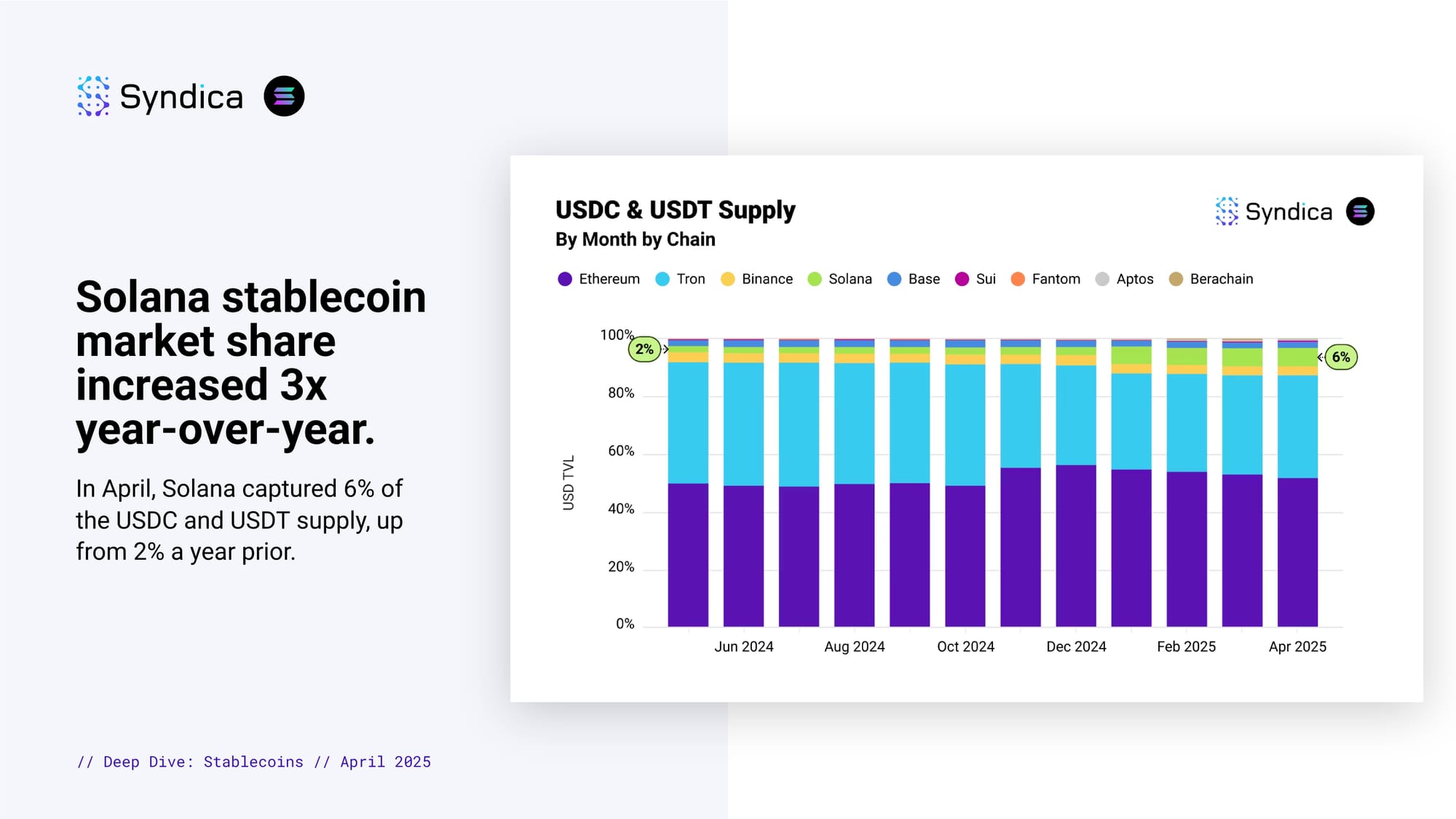

Solana stablecoin market share increased 3x year-over-year. In April, Solana captured 6% of the USDC and USDT supply, up from 2% a year prior.

Stablecoin activity thrives on Solana. Solana led in the number of stablecoin transfers while ranking third in USD volume.

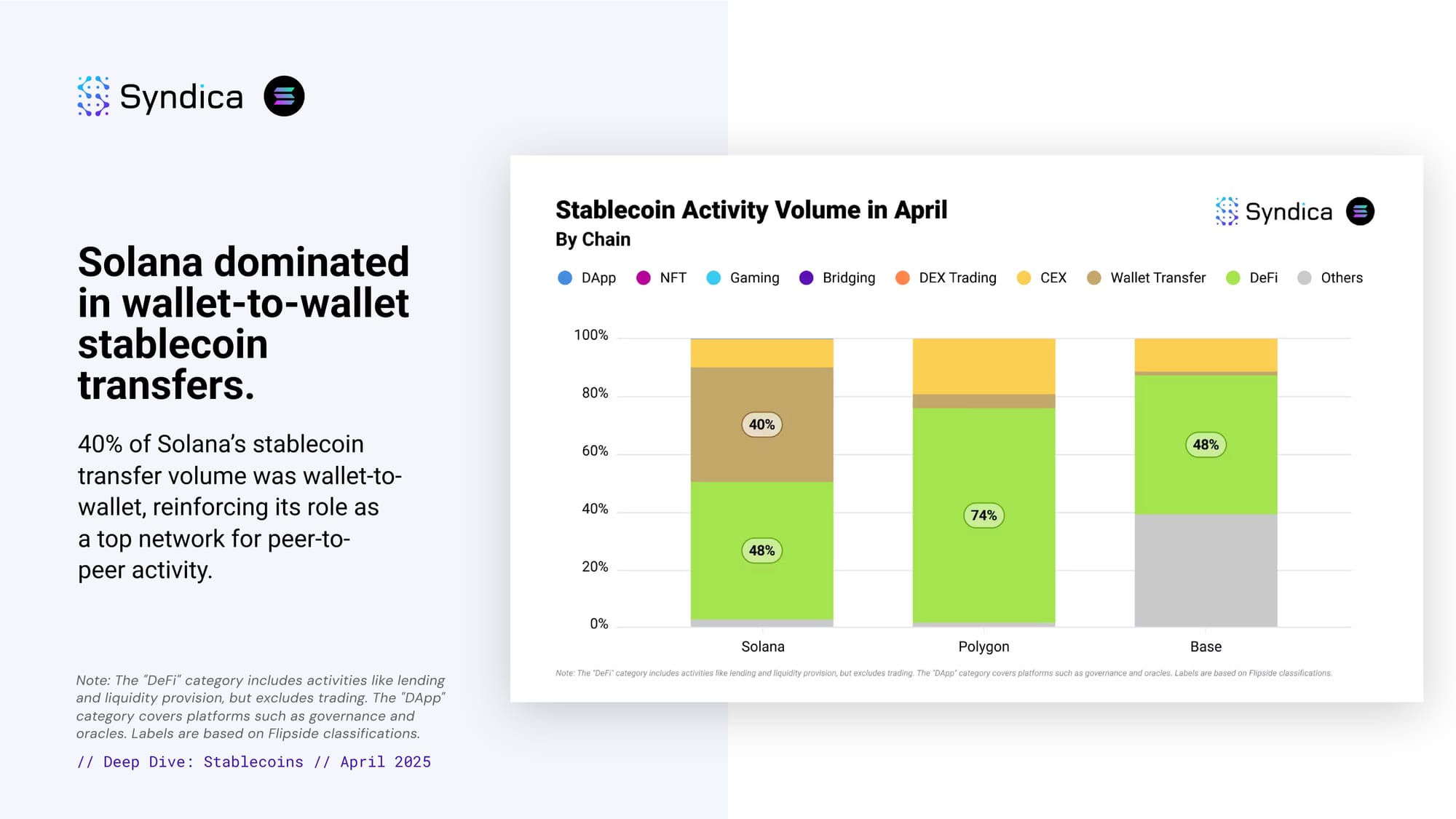

Solana dominated in wallet-to-wallet stablecoin transfers. 40% of Solana’s stablecoin transfer volume was wallet-to-wallet, reinforcing its role as a top network for peer-to-peer activity.

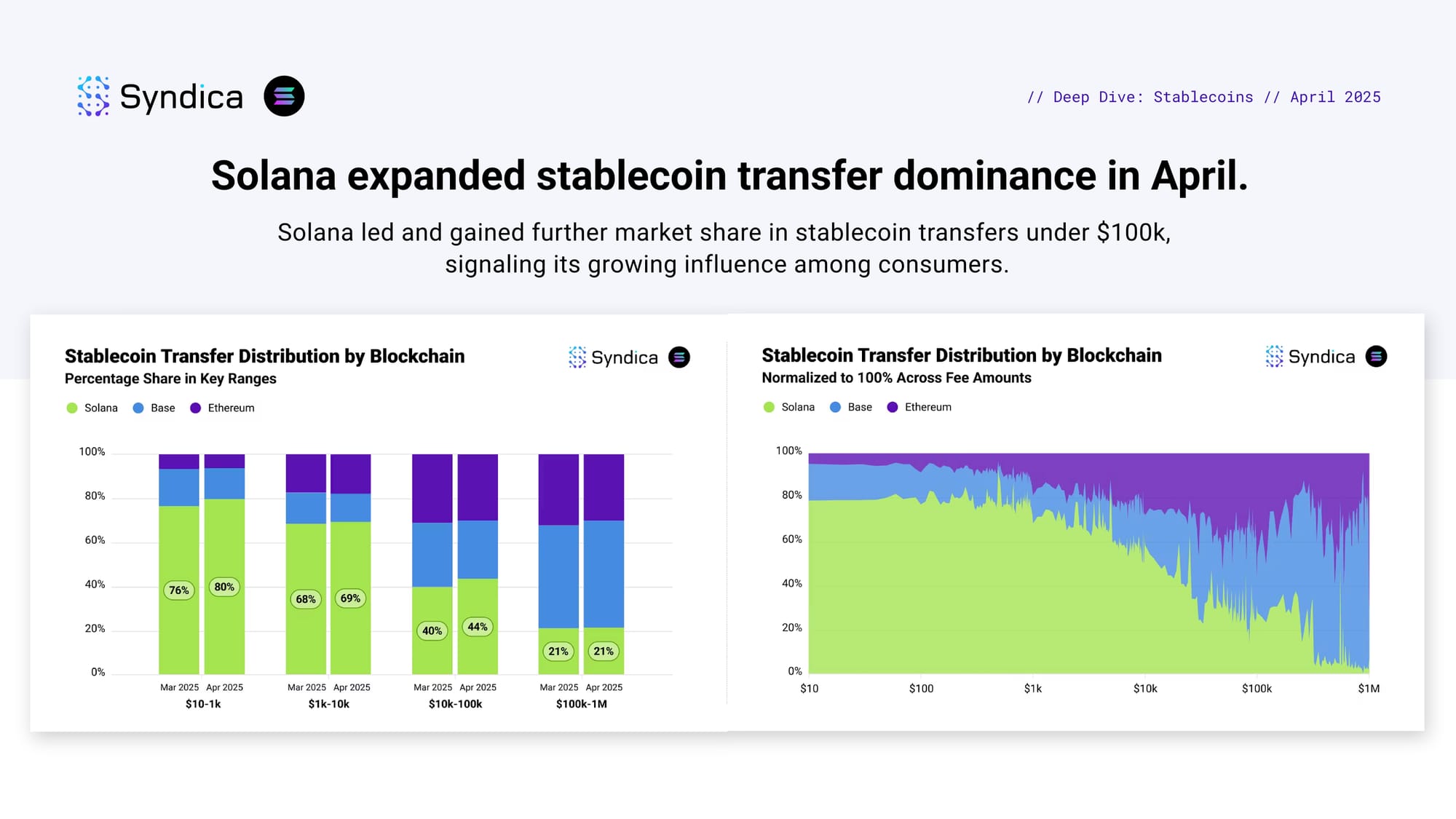

Solana expanded stablecoin transfer dominance in April. Solana led and gained further market share in stablecoin transfers under $100k, signaling its growing influence among consumers.

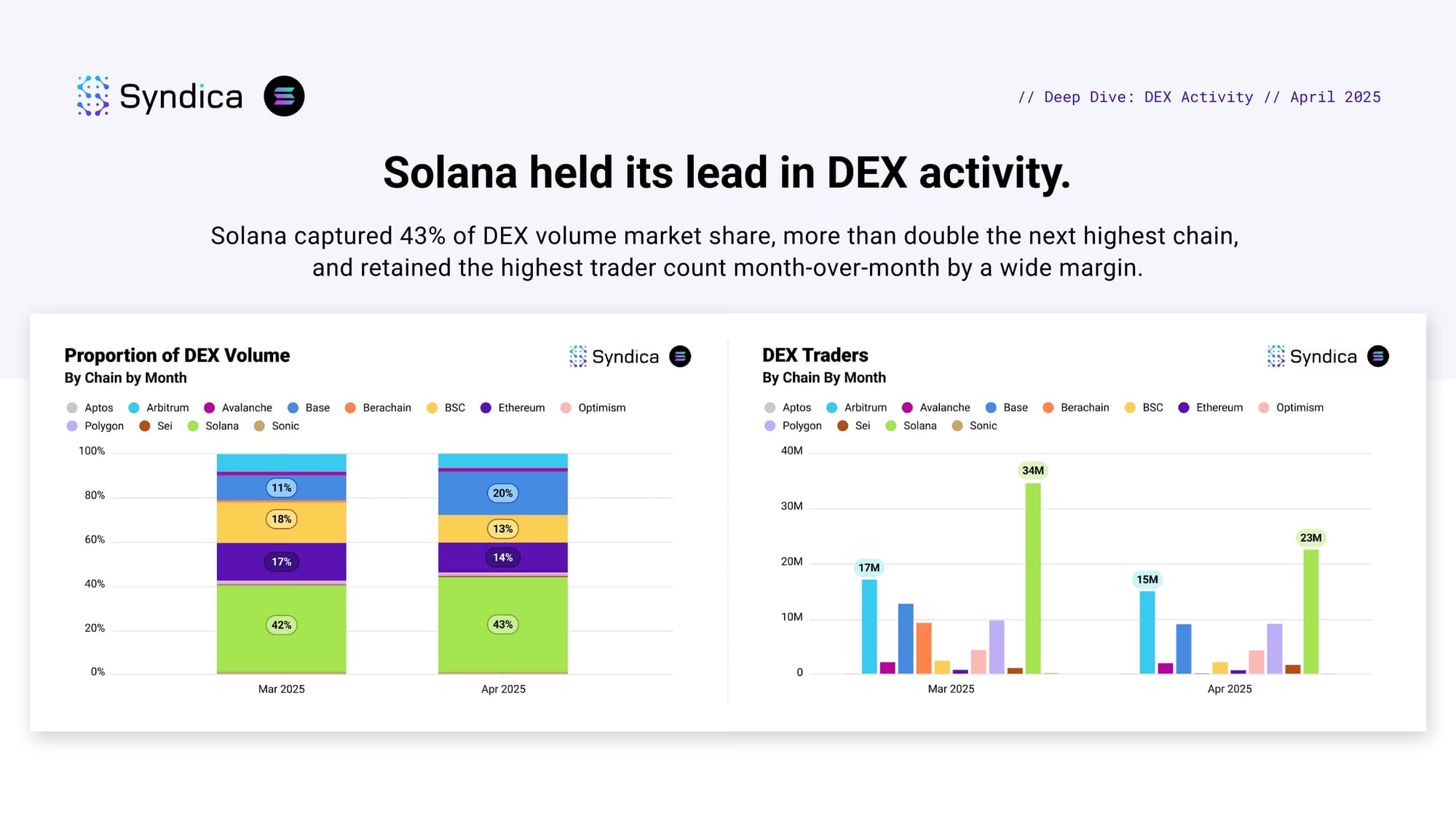

Solana held its lead in DEX activity. Solana captured 43% of DEX volume market share, more than double the next highest chain, and retained the highest trader count month-over-month by a wide margin.

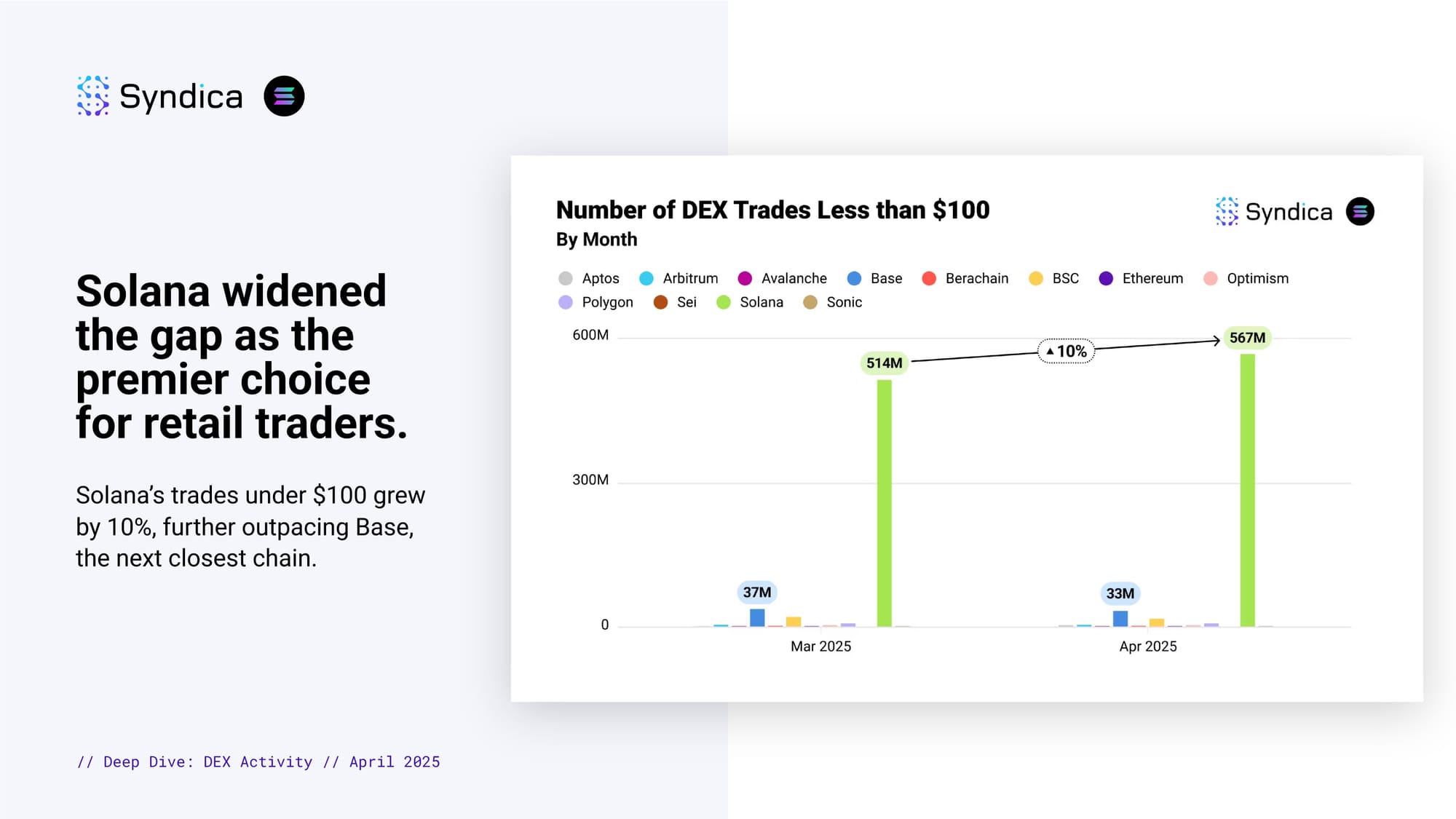

Solana widened the gap as the premier choice for retail traders. Solana’s trades under $100 grew by 10%, further outpacing Base, the next closest chain.

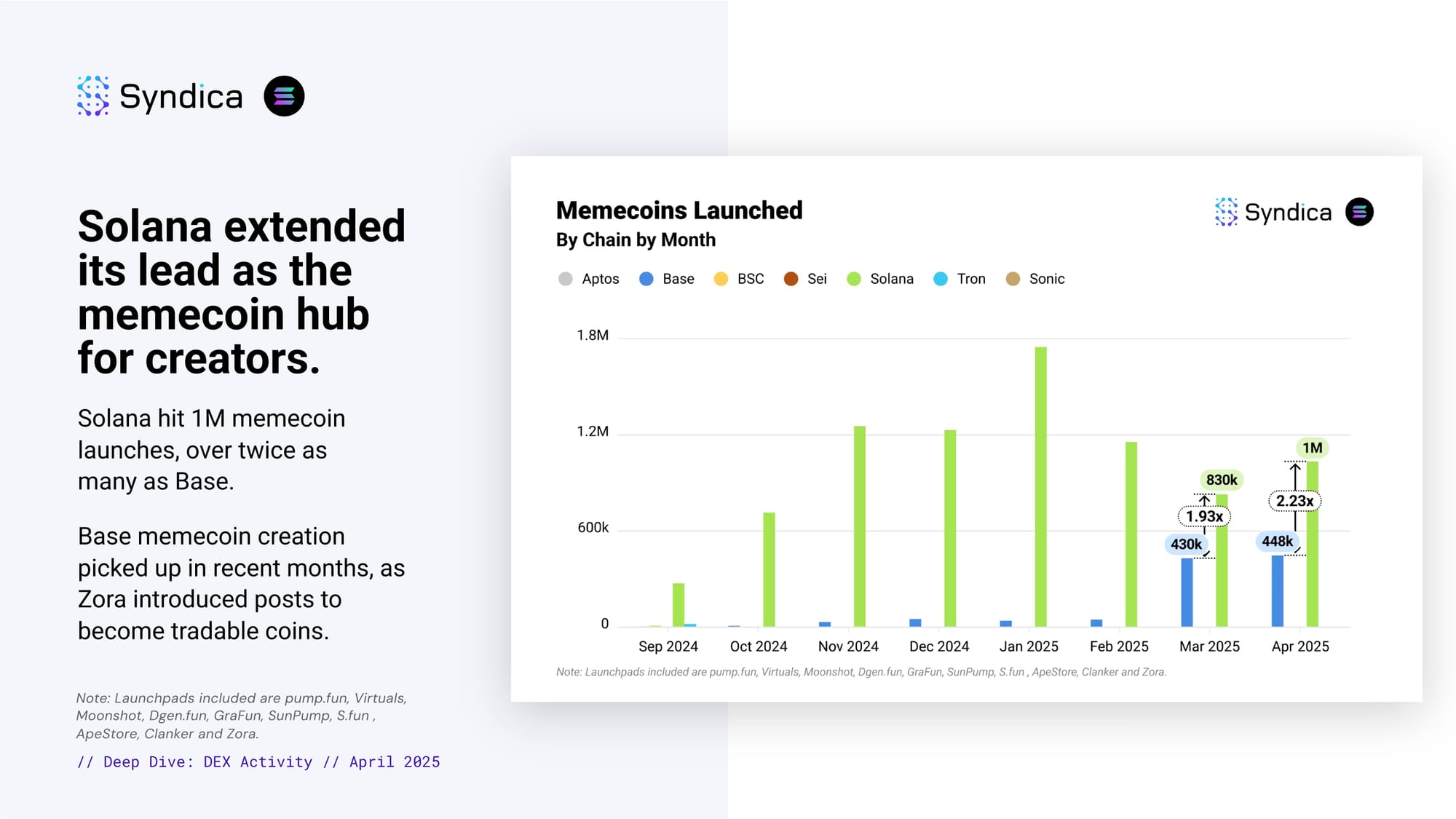

Solana extended its lead as the memecoin hub for creators. Solana hit 1M memecoin launches, over twice as many as Base. Base memecoin creation picked up in recent months, as Zora introduced posts to become tradable coins.

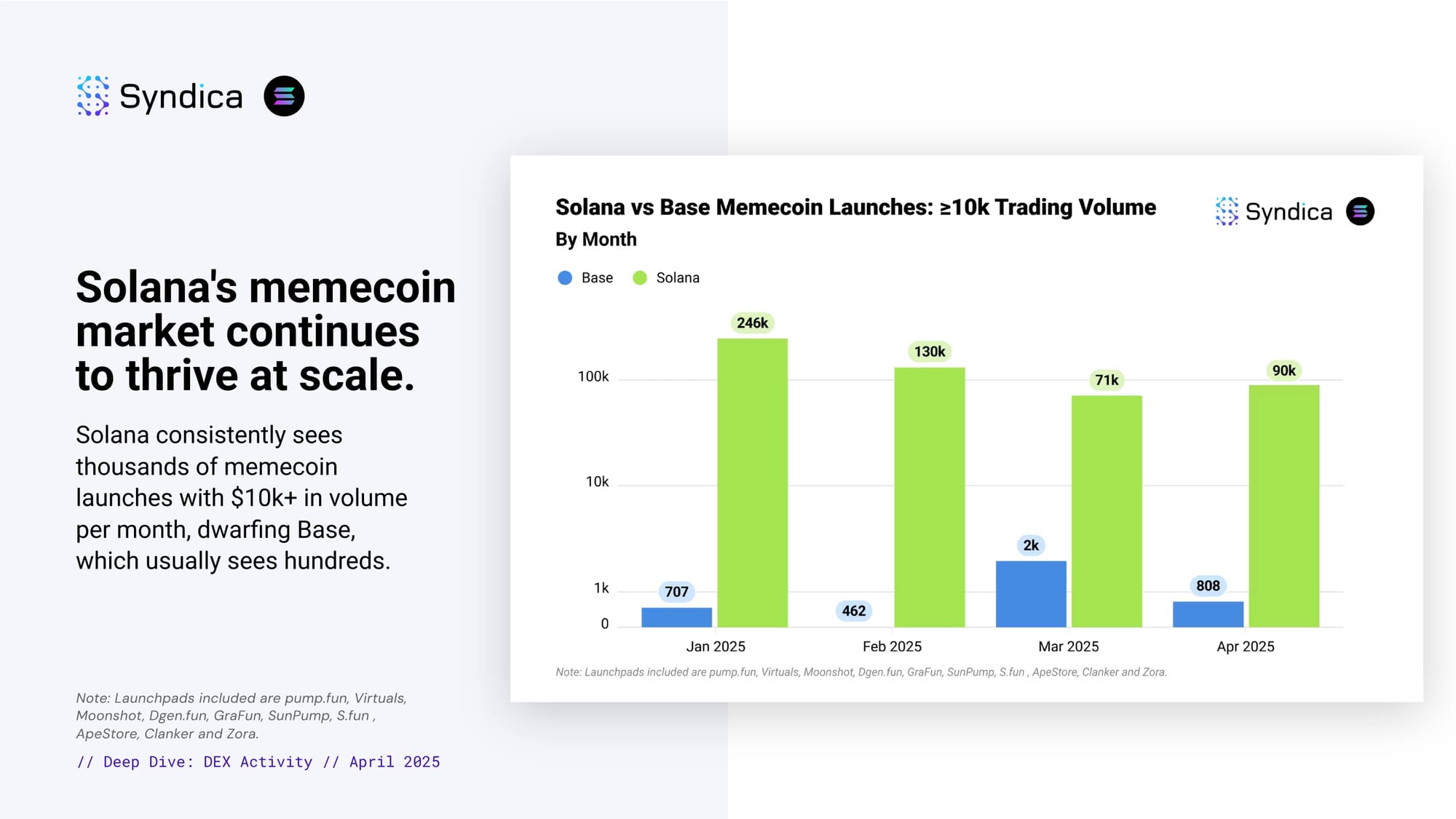

Solana's memecoin market continues to thrive at scale. Solana consistently sees thousands of memecoin launches with $10k+ in volume per month, dwarfing Base, which usually sees hundreds.

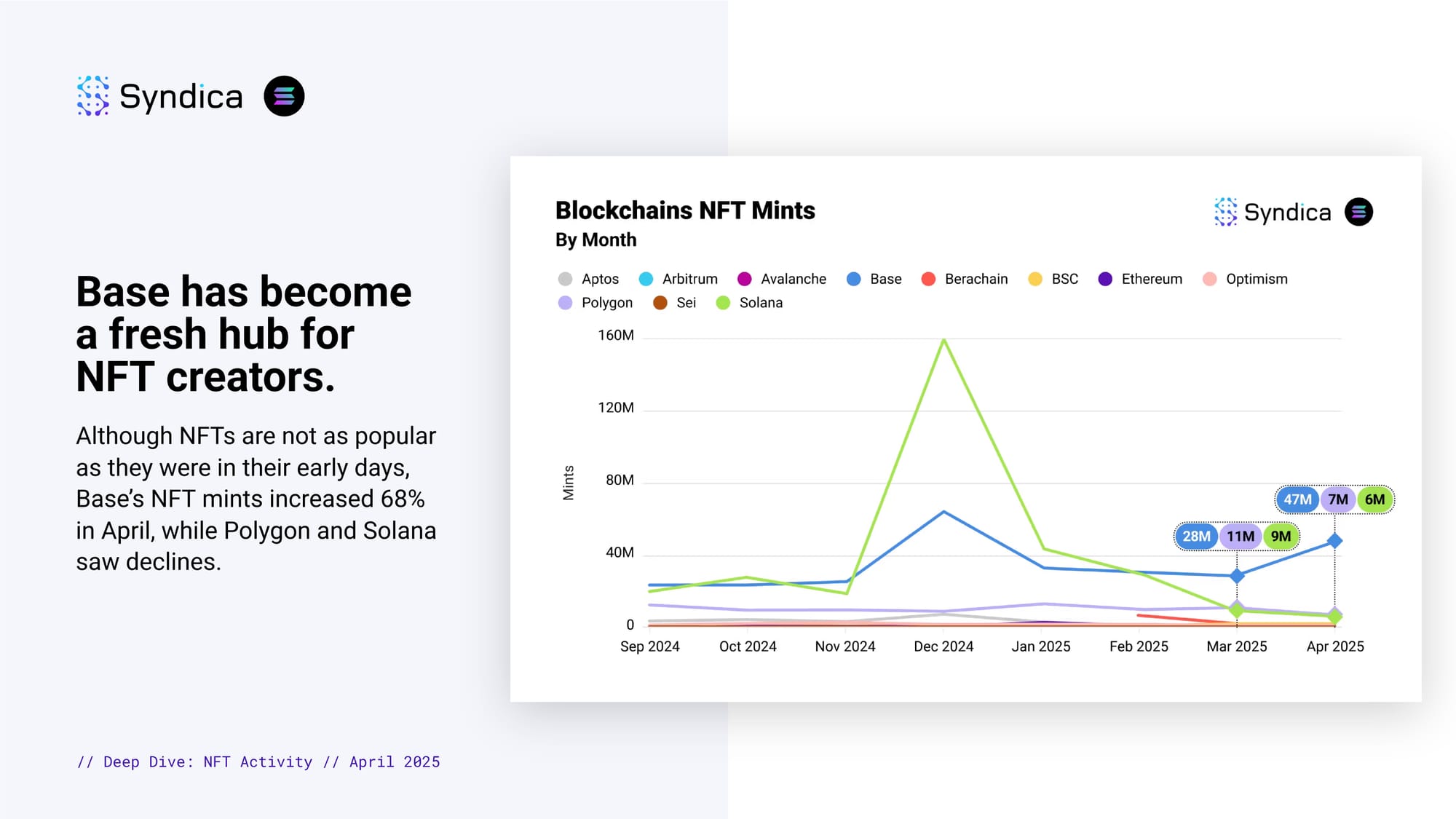

Base has become a fresh hub for NFT creators. Although NFTs are not as popular as they were in their early days, Base’s NFT mints increased 68% in April, while Polygon and Solana saw declines.

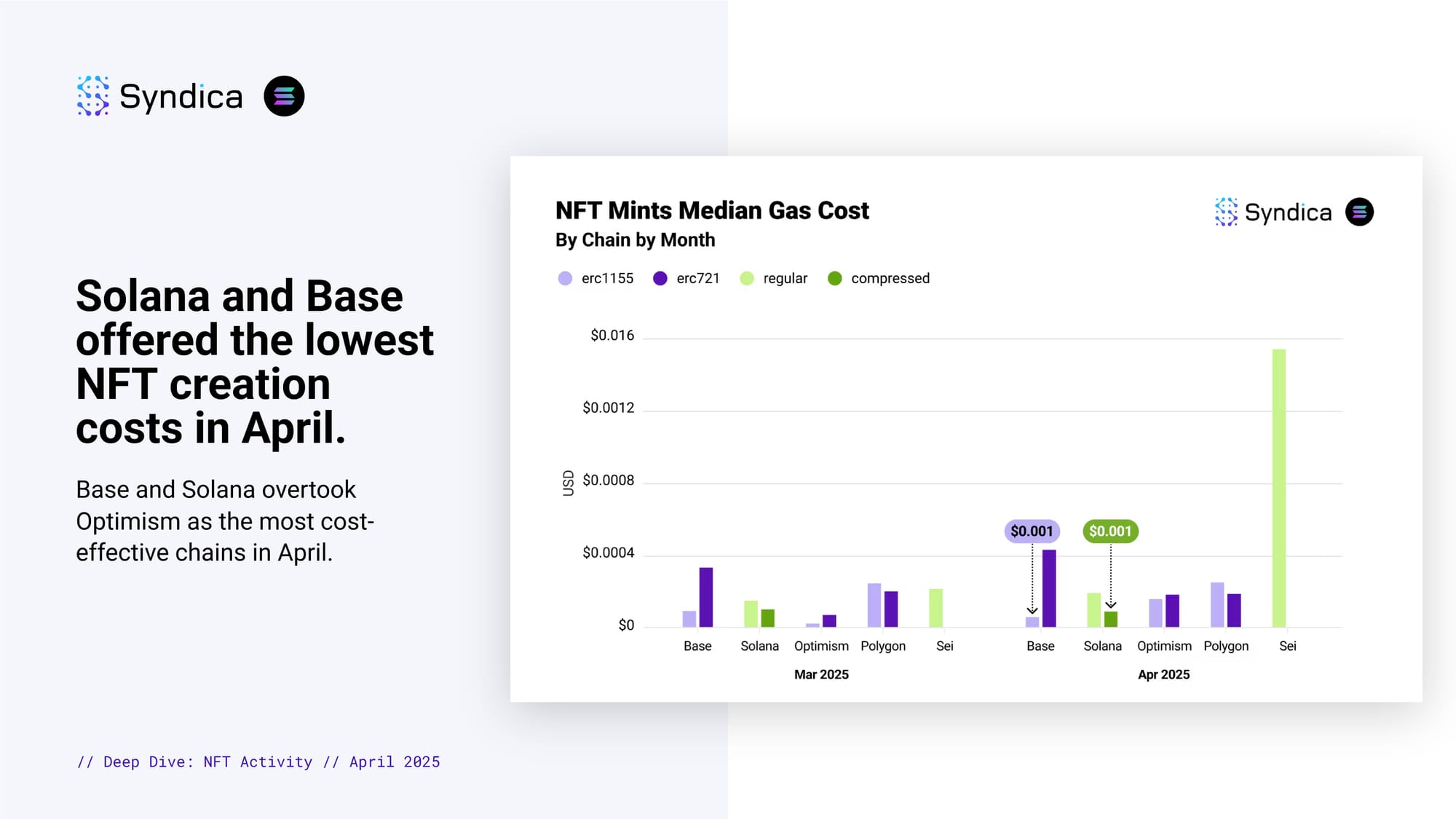

Solana and Base offered the lowest NFT creation costs in April. Base and Solana overtook Optimism as the most cost-effective chains in April.