Insights: Layer 1 & 2 Chains - August 2025

Insights: Layer 1 & 2 Chains - August 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Insights: Layer 1 & 2 Chains - August 2025

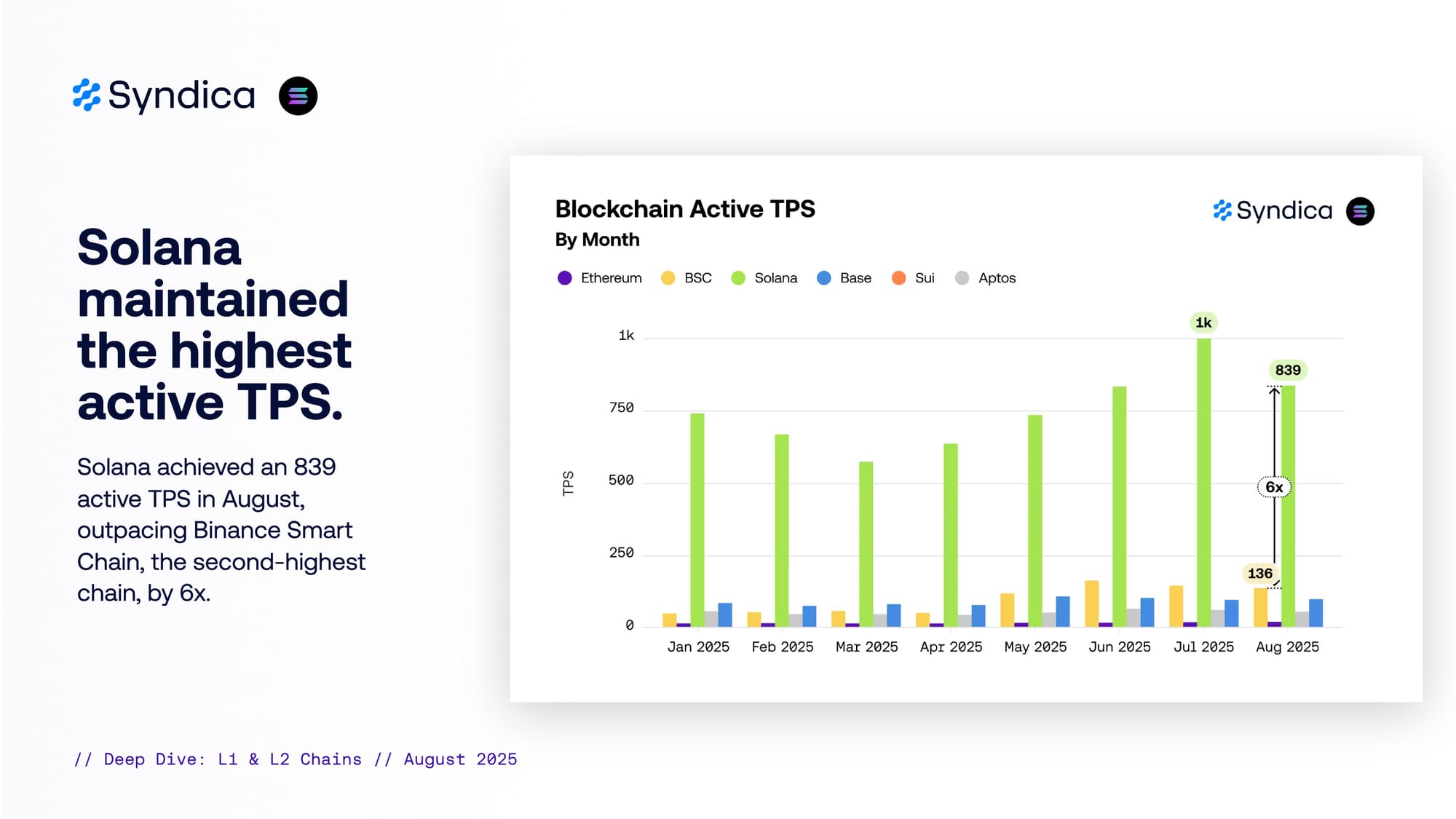

Solana maintained the highest active TPS. Solana achieved an 839 active TPS in August, outpacing Binance Smart Chain, the second-highest chain, by 6x.

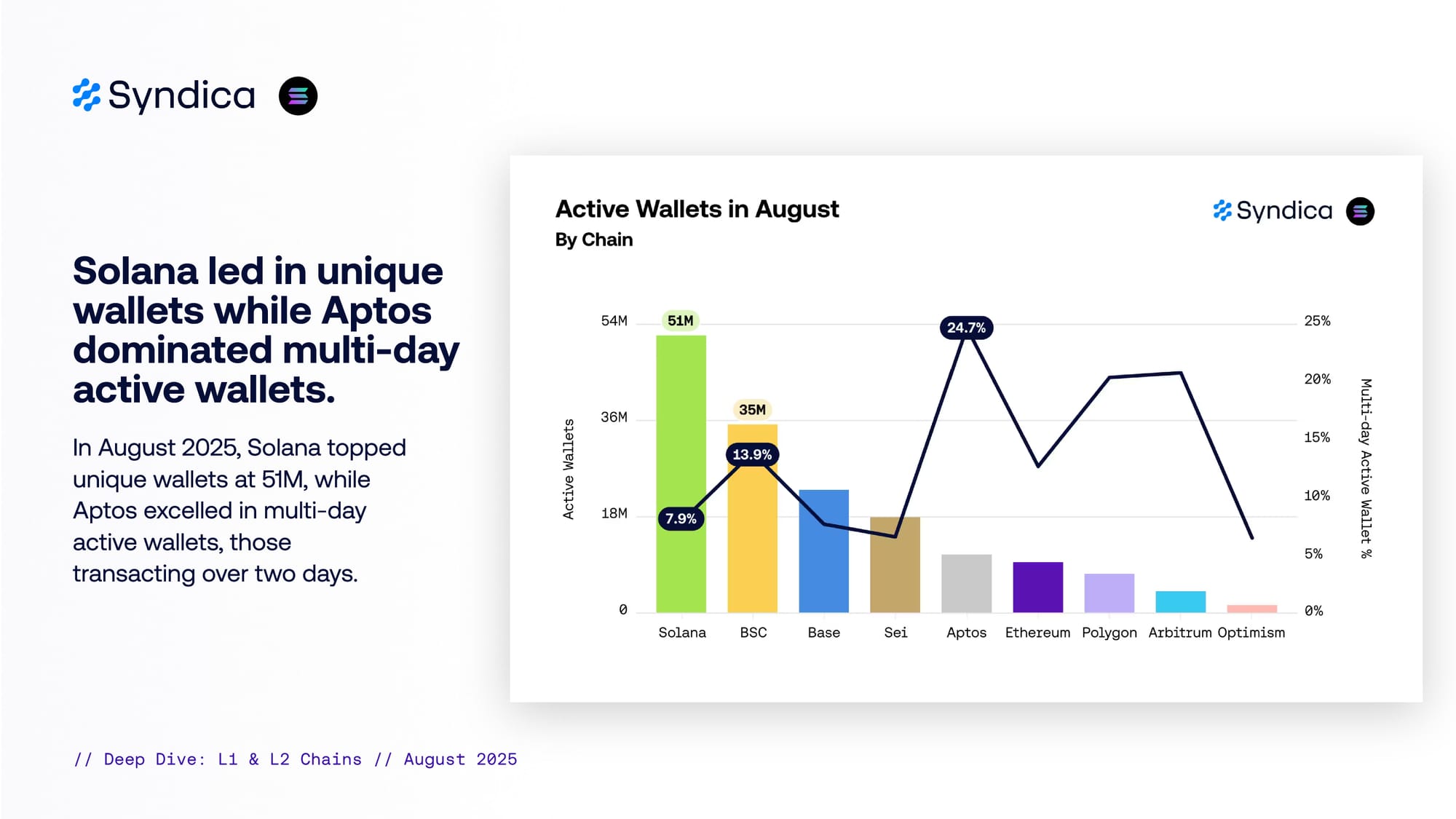

Solana led in unique wallets while Aptos dominated multi-day active wallets. In August 2025, Solana topped unique wallets at 51M, while Aptos excelled in multi-day active wallets, those transacting over two days.

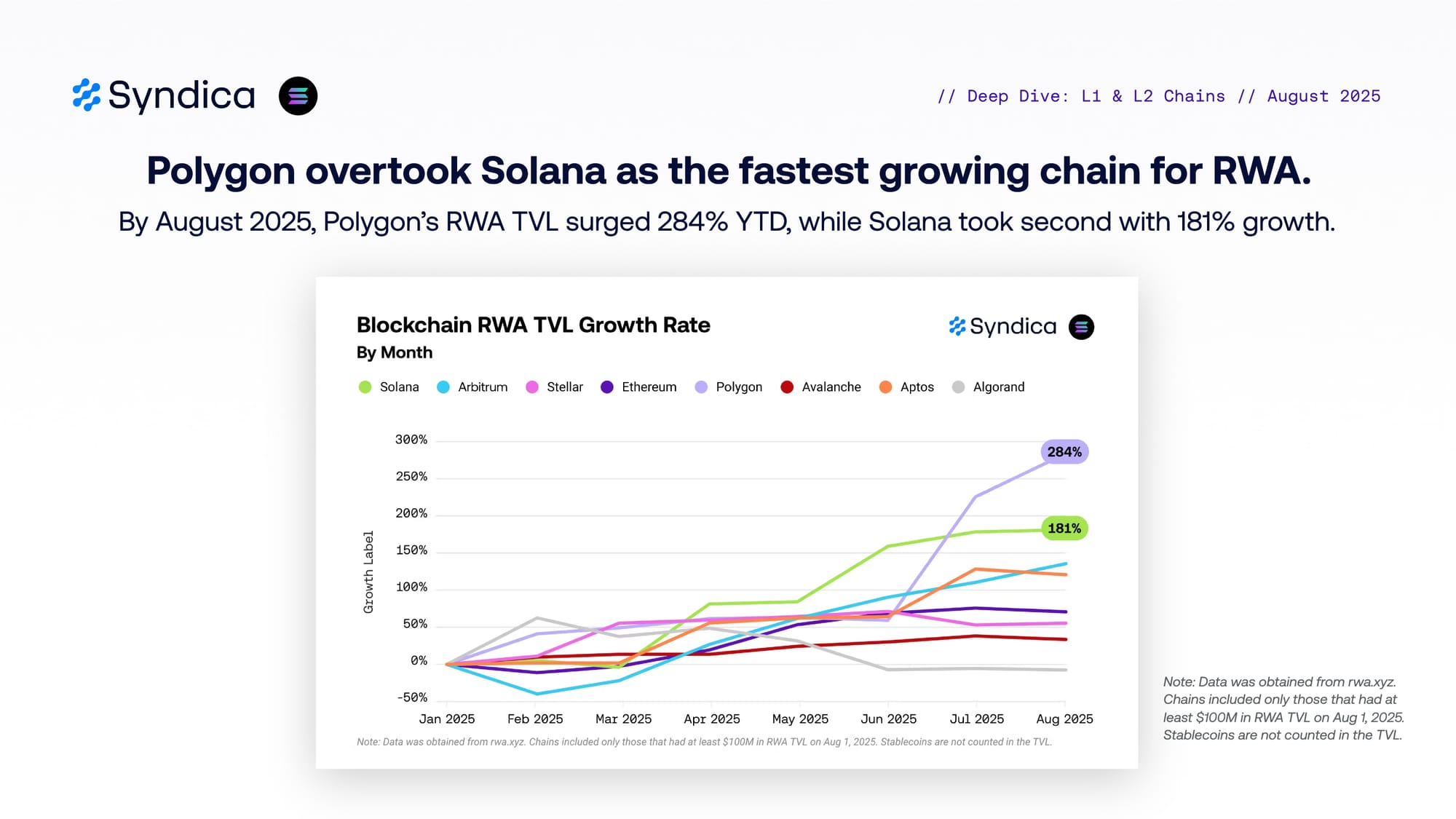

Polygon overtook Solana as the fastest growing chain for RWA. By August 2025, Polygon’s RWA TVL surged 284% YTD, while Solana took second with 181% growth.

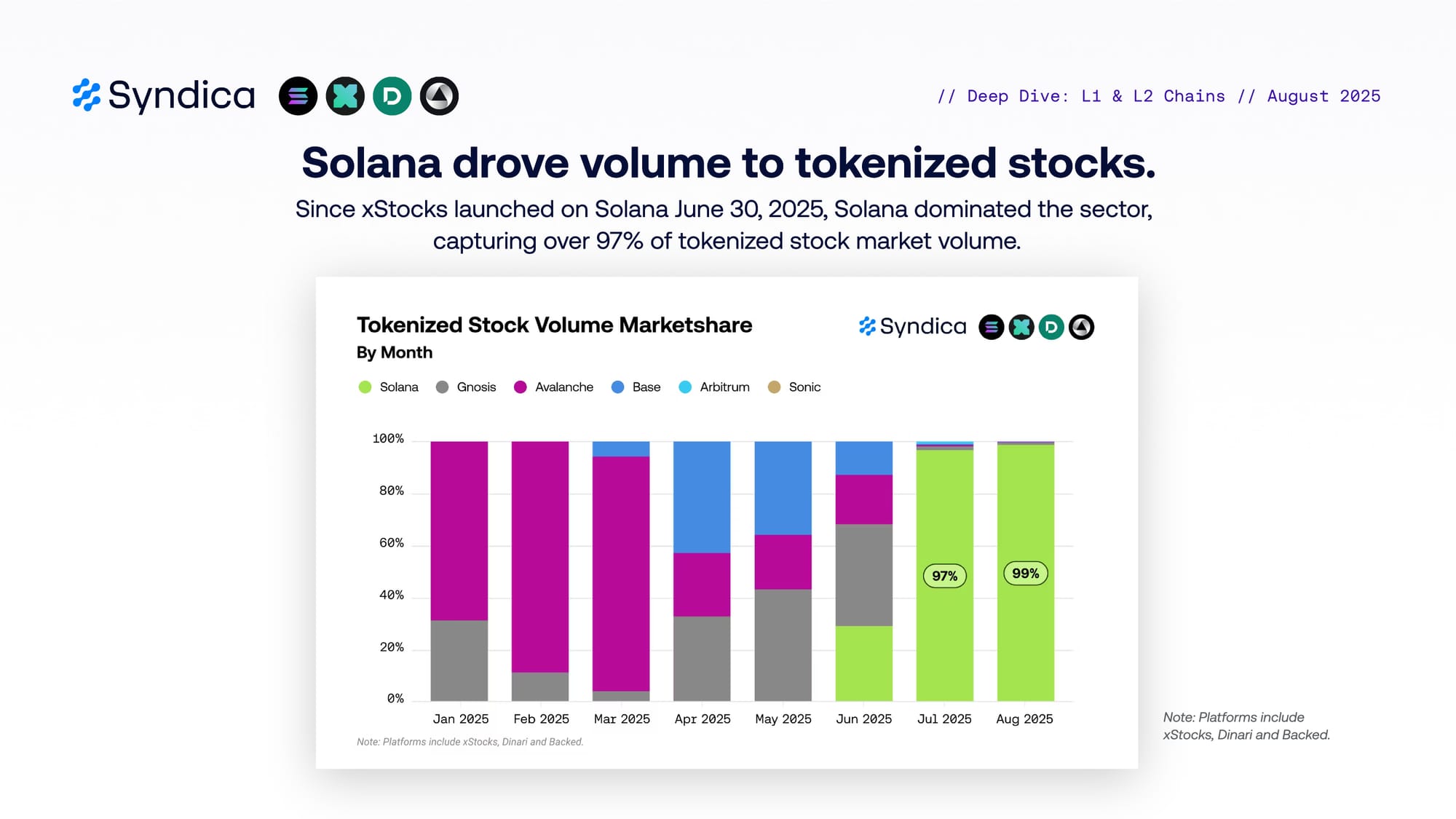

Solana drove volume to tokenized stocks. Since xStocks launched on Solana June 30, 2025, Solana dominated the sector, capturing over 97% of tokenized stock market volume.

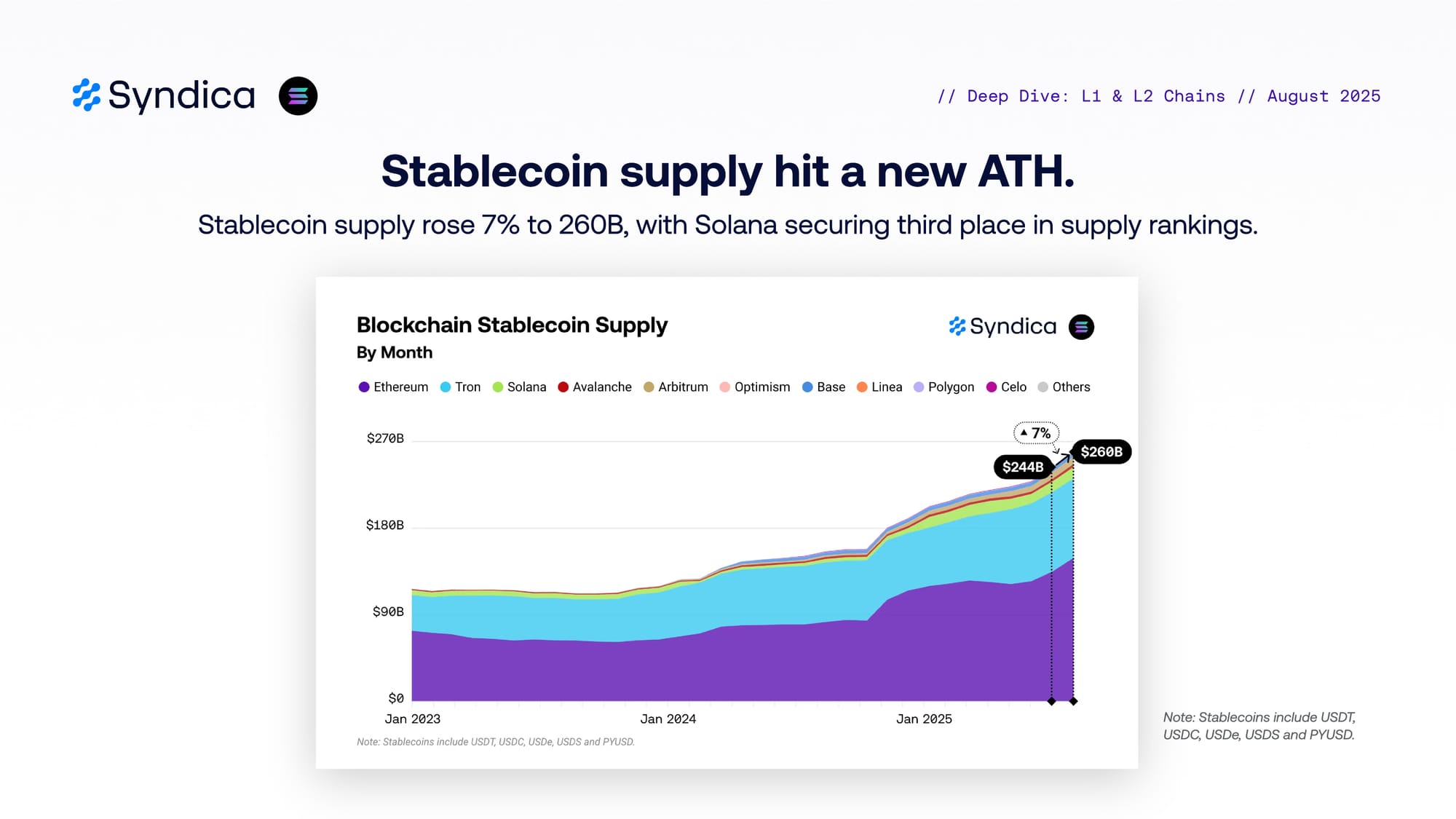

Stablecoin supply hit a new ATH. Stablecoin supply rose 7% to 260B, with Solana securing third place in supply rankings.

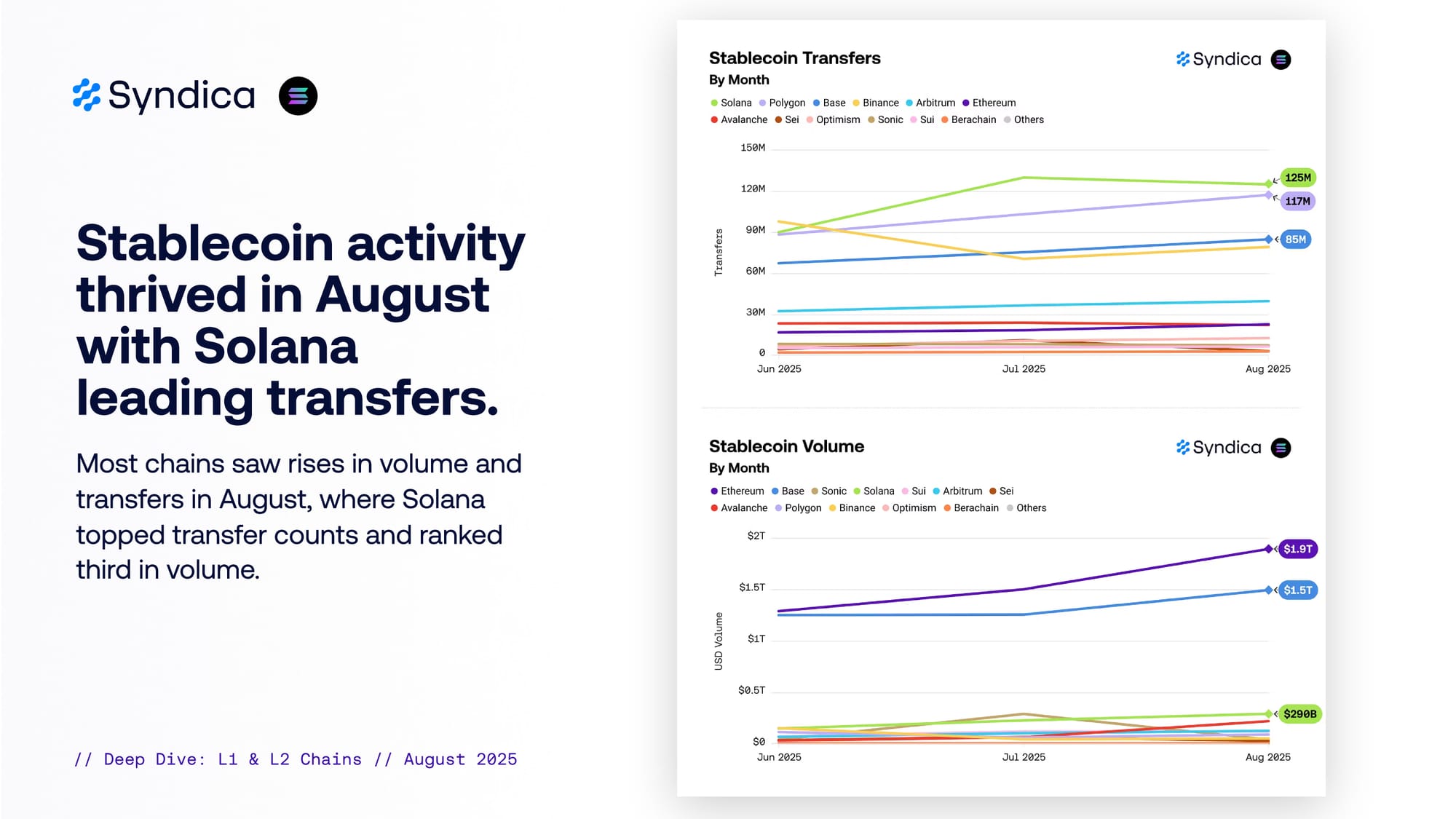

Stablecoin activity thrived in August with Solana leading transfers. Most chains saw rises in volume and transfers in August, where Solana topped transfer counts and ranked third in volume.

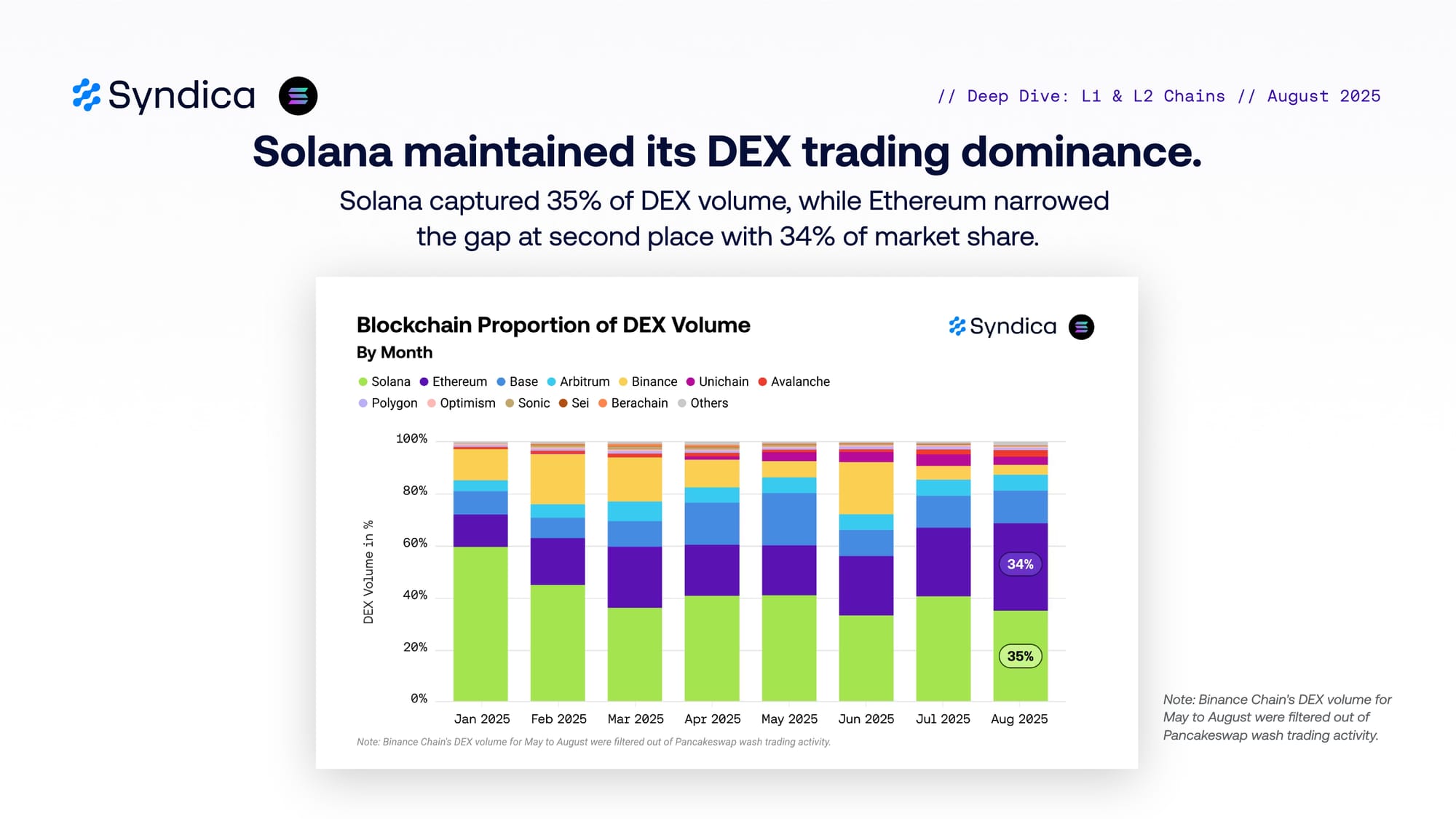

Solana maintained its DEX trading dominance. Solana captured 35% of DEX volume, while Ethereum narrowed the gap at second place with 34% of market share.

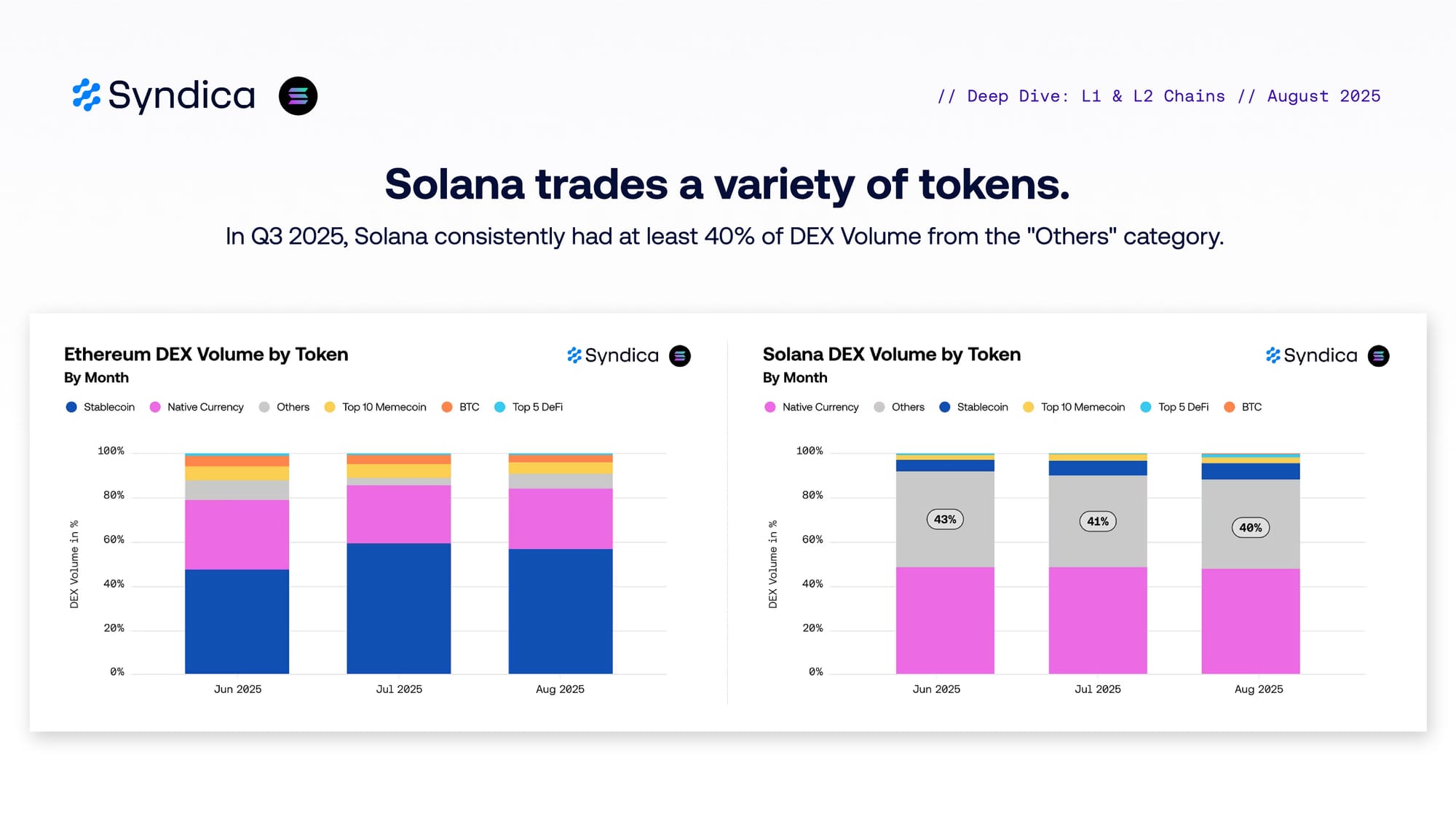

Solana trades a variety of tokens. In Q3 2025, Solana consistently had at least 40% of DEX Volume from the "Others" category.

Solana widened its lead in BTC trading activity. In August 2025, Solana maintained its dominance in BTC traders and saw BTC utilization in trades relative to supply grow even stronger.

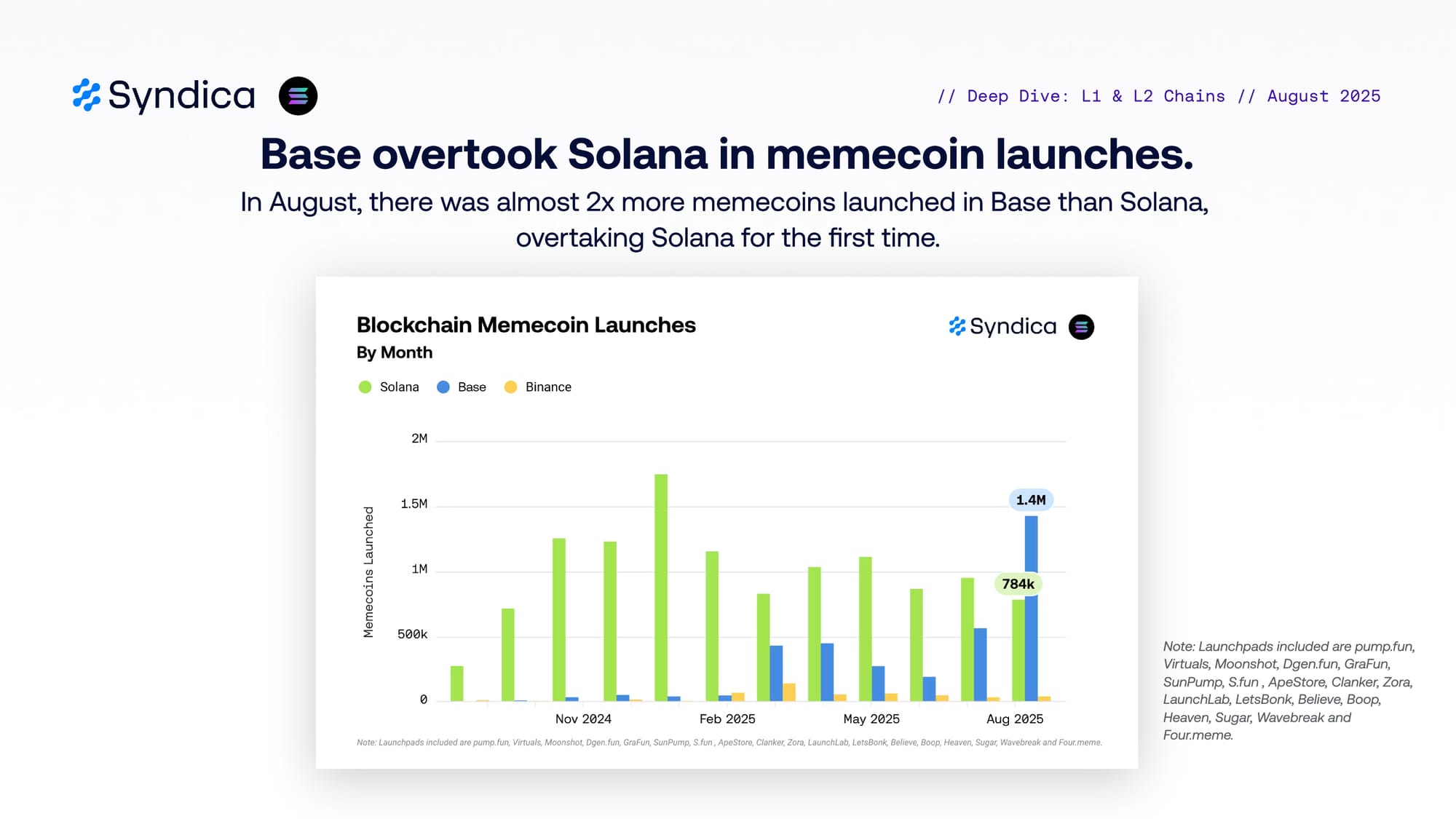

Base overtook Solana in memecoin launches. In August, there was almost 2x more memecoins launched in Base than Solana, overtaking Solana for the first time.

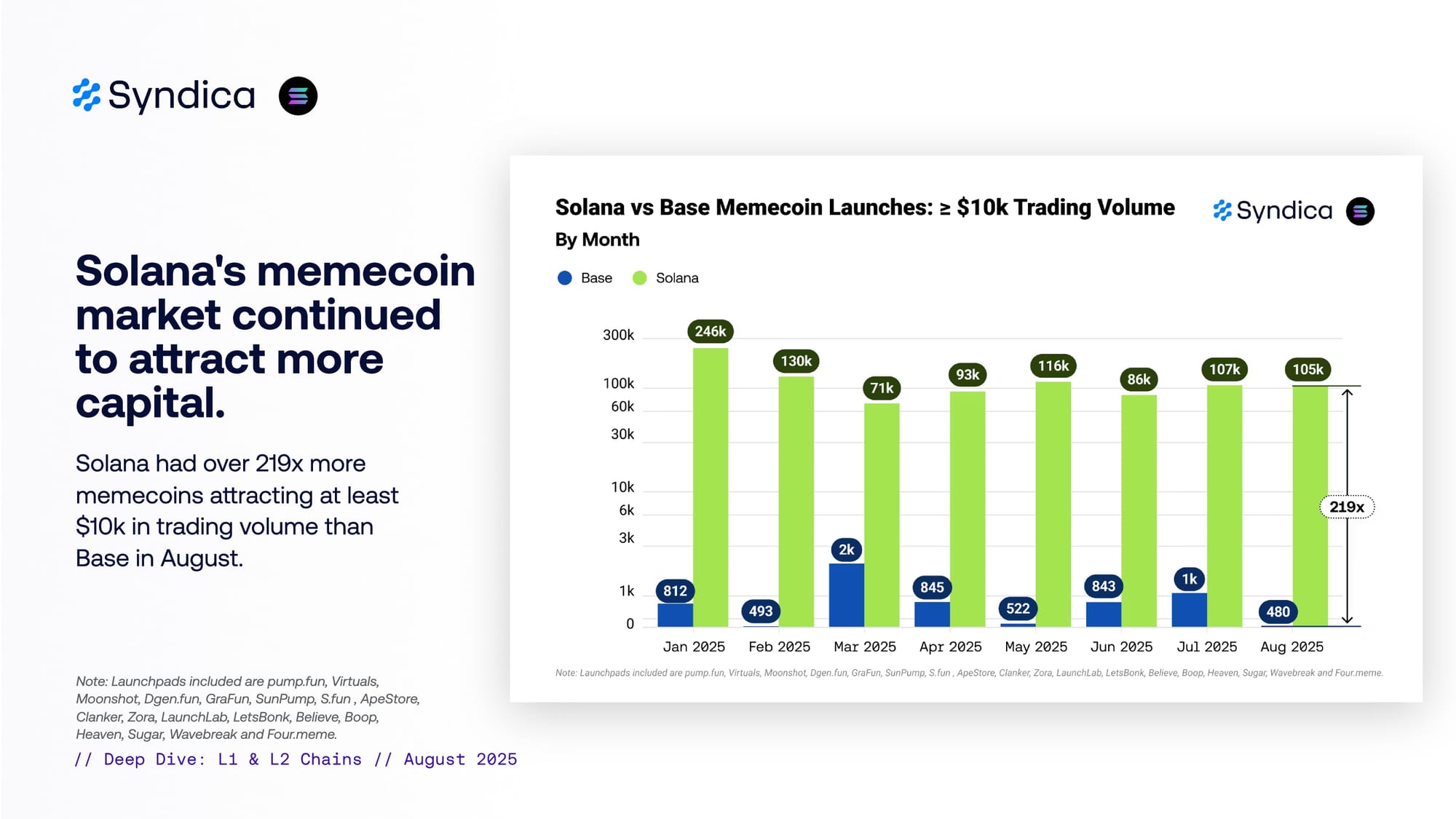

Solana's memecoin market continued to attract more capital. Solana had over 219x more memecoins attracting at least $10k in trading volume than Base in August.

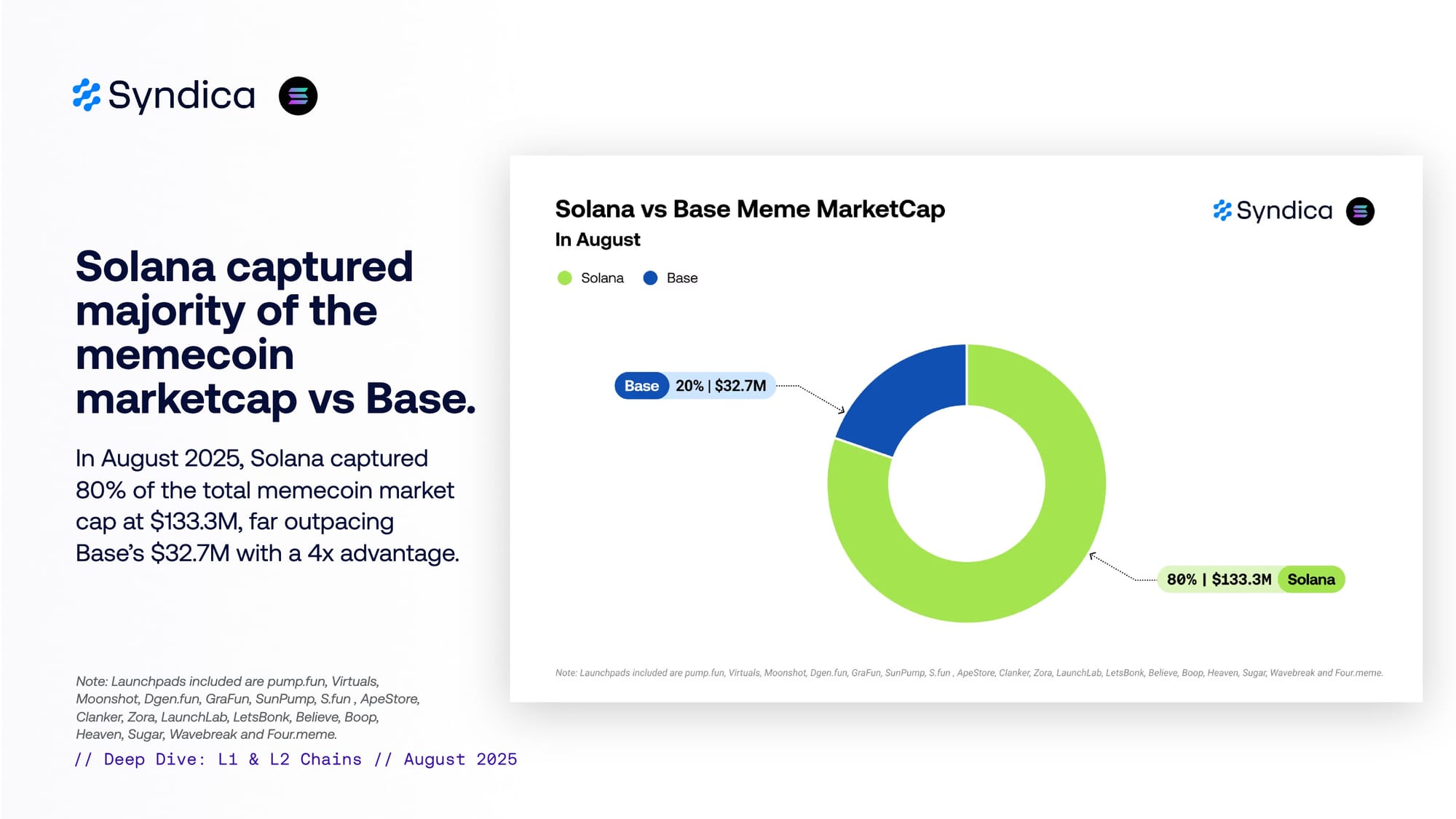

Solana captured majority of the memecoin marketcap vs Base. In August 2025, Solana captured 80% of the total memecoin market cap at $133.3M, far outpacing Base’s $32.7M with a 4x advantage.

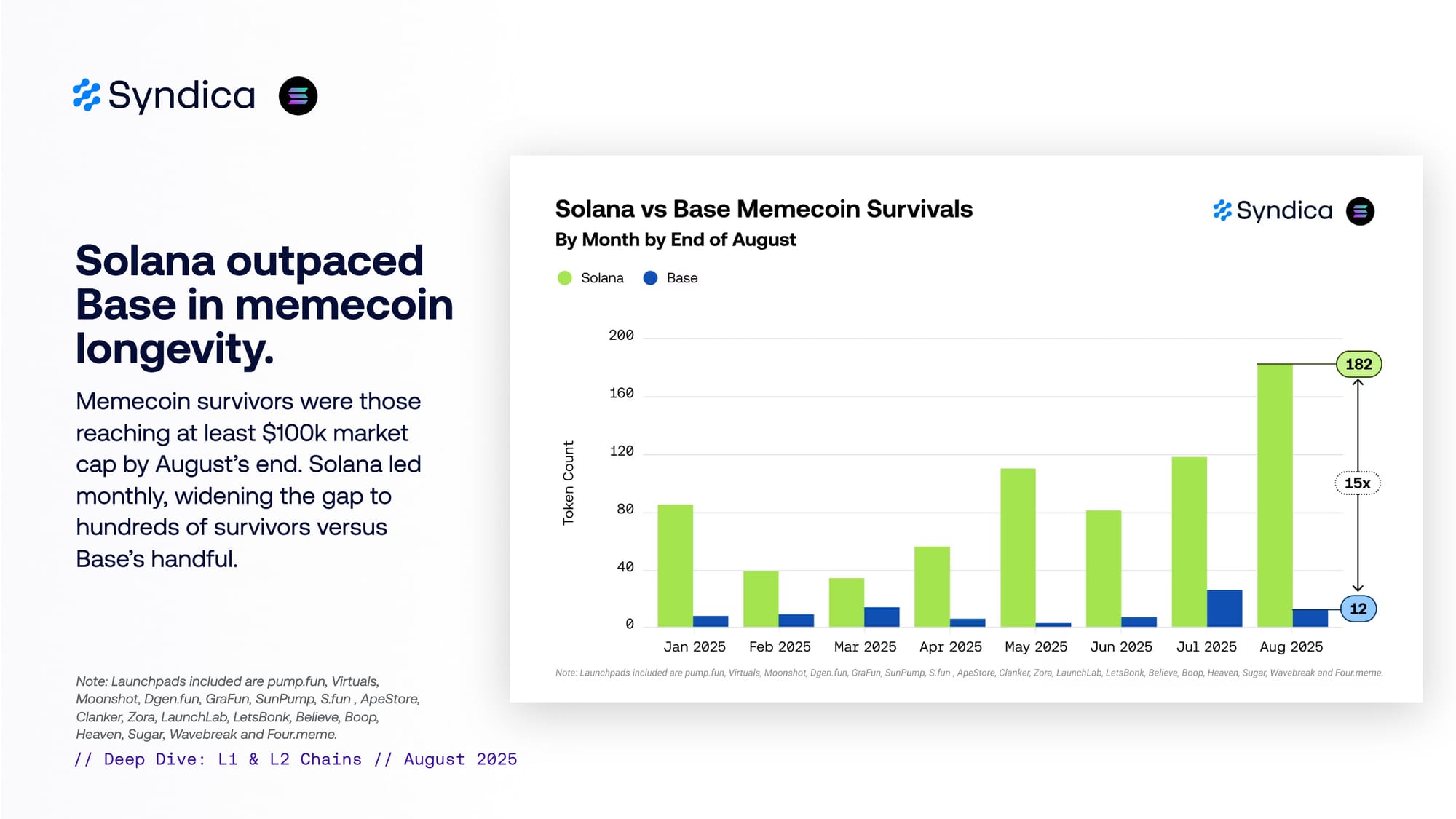

Solana outpaced Base in memecoin longevity. Memecoin survivors were those reaching at least $100k market cap by August’s end. Solana led monthly, widening the gap to hundreds of survivors versus Base’s handful.

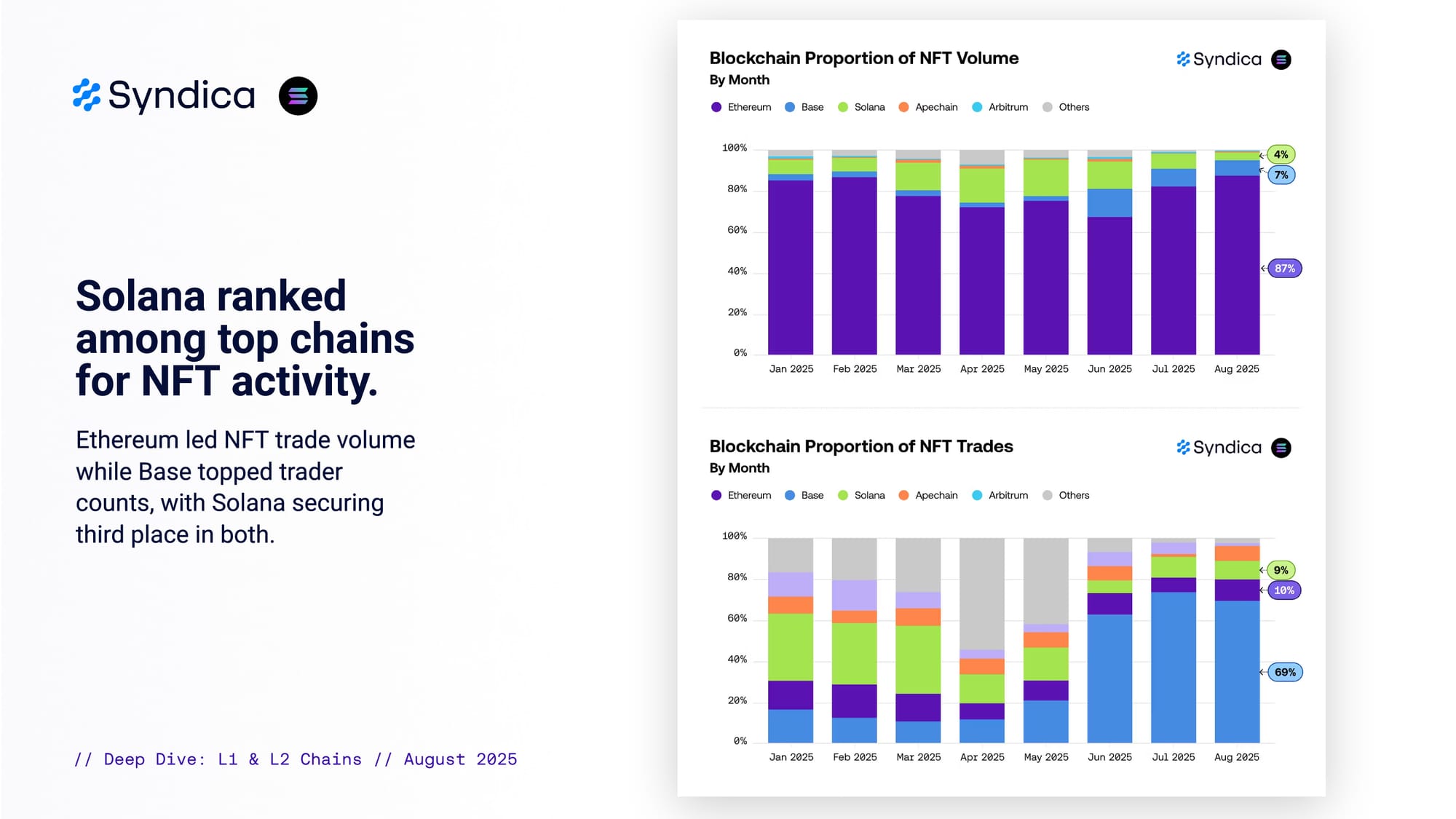

Solana ranked among top chains for NFT activity. Ethereum led NFT trade volume while Base topped trader counts, with Solana securing third place in both.

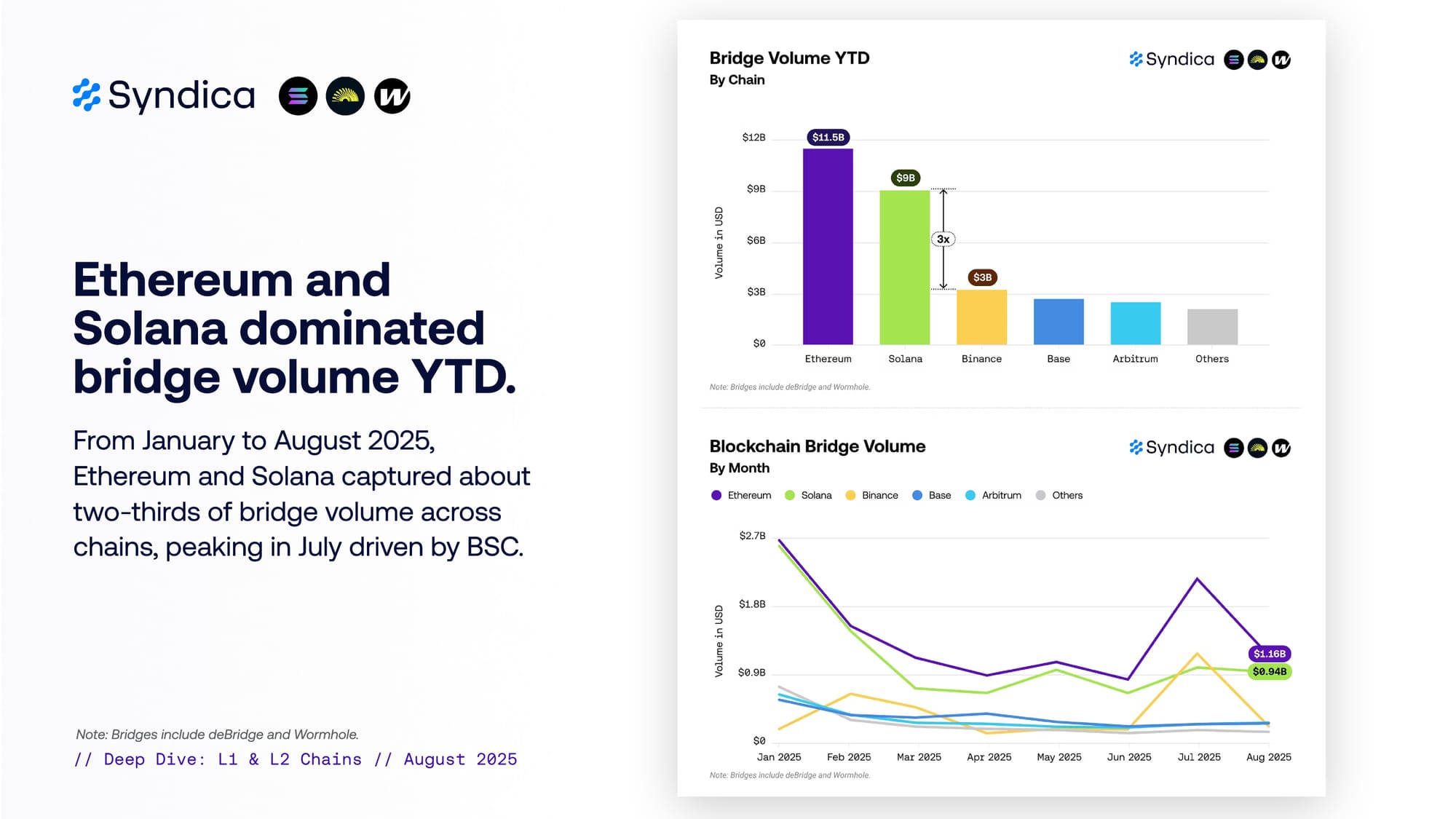

Ethereum and Solana dominated bridge volume YTD. From January to August 2025, Ethereum and Solana captured about two-thirds of bridge volume across chains, peaking in July driven by BSC.

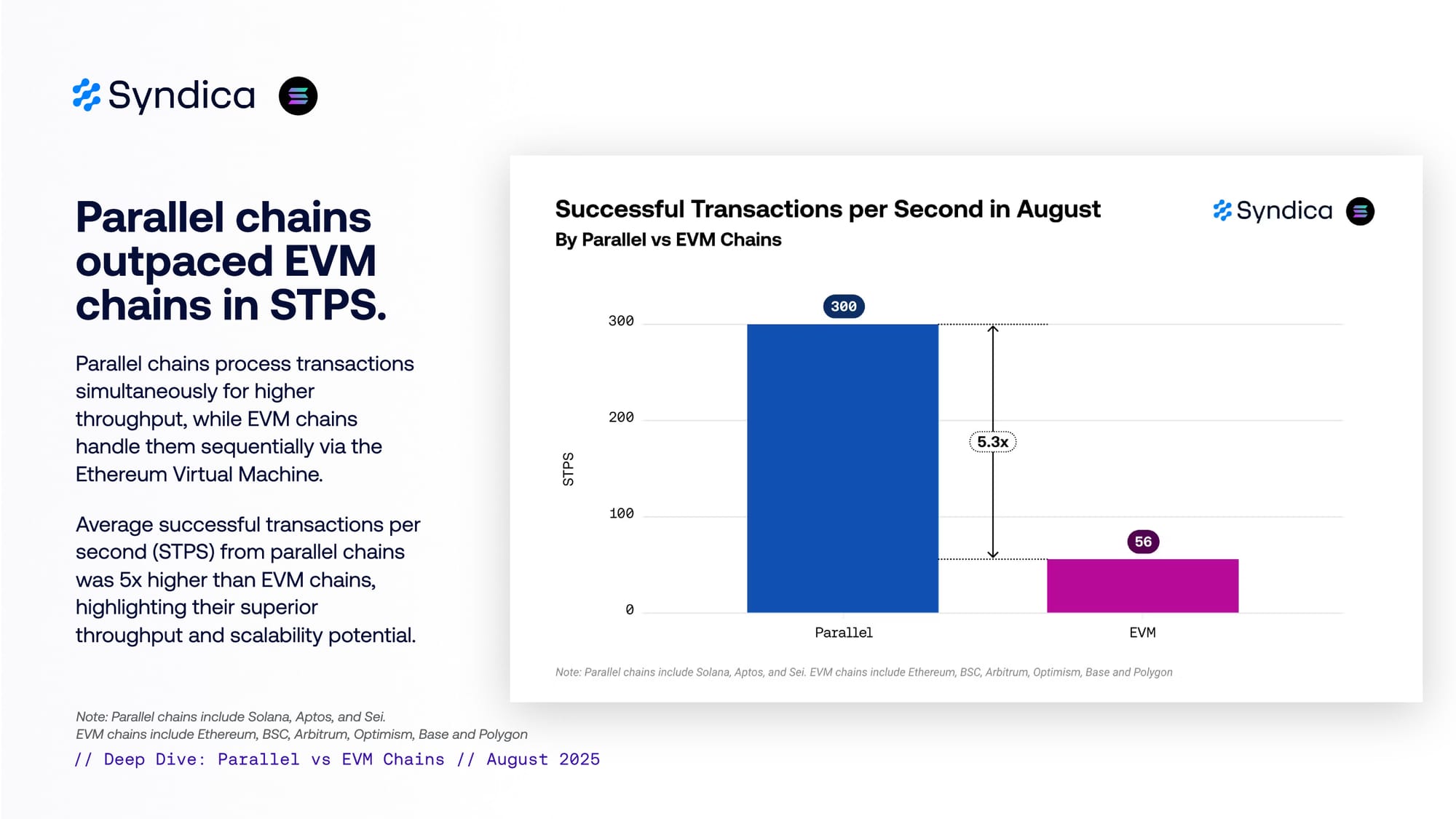

Parallel chains outpaced EVM chains in STPS. Parallel chains process transactions simultaneously for higher throughput, while EVM chains handle them sequentially via the Ethereum Virtual Machine. Average successful transactions per second (STPS) from parallel chains was 5x higher than EVM chains, highlighting their superior throughput and scalability potential.

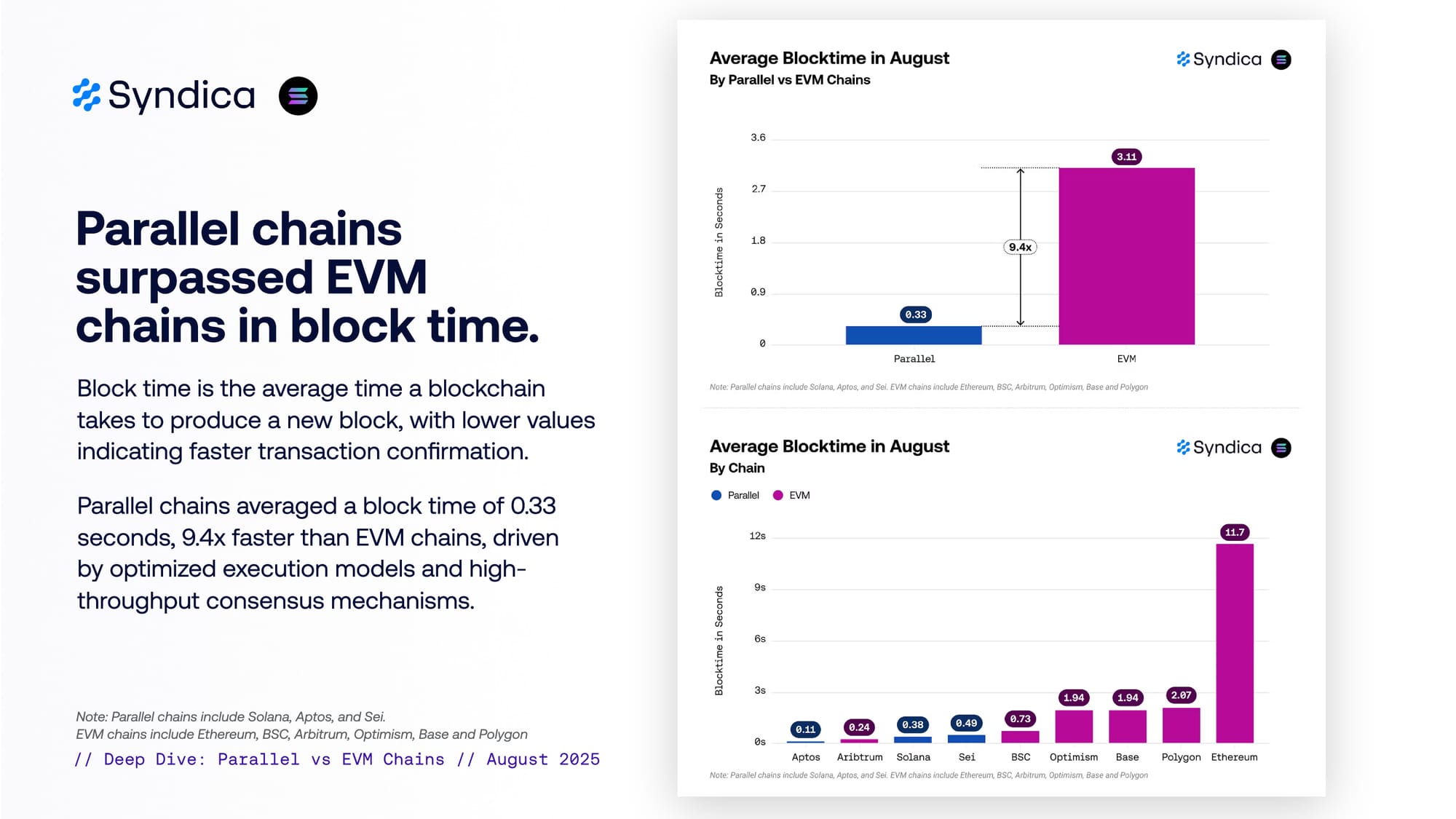

Parallel chains surpassed EVM chains in block time. Block time is the average time a blockchain takes to produce a new block, with lower values indicating faster transaction confirmation. Parallel chains averaged a block time of 0.33 seconds, 9.4x faster than EVM chains, driven by optimized execution models and high-throughput consensus mechanisms.