Insights: Layer 1 & 2 Chains - December 2025

Insights: Layer 1 & 2 Chains - December 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Insights: Layer 1 & 2 Chains - December 2025

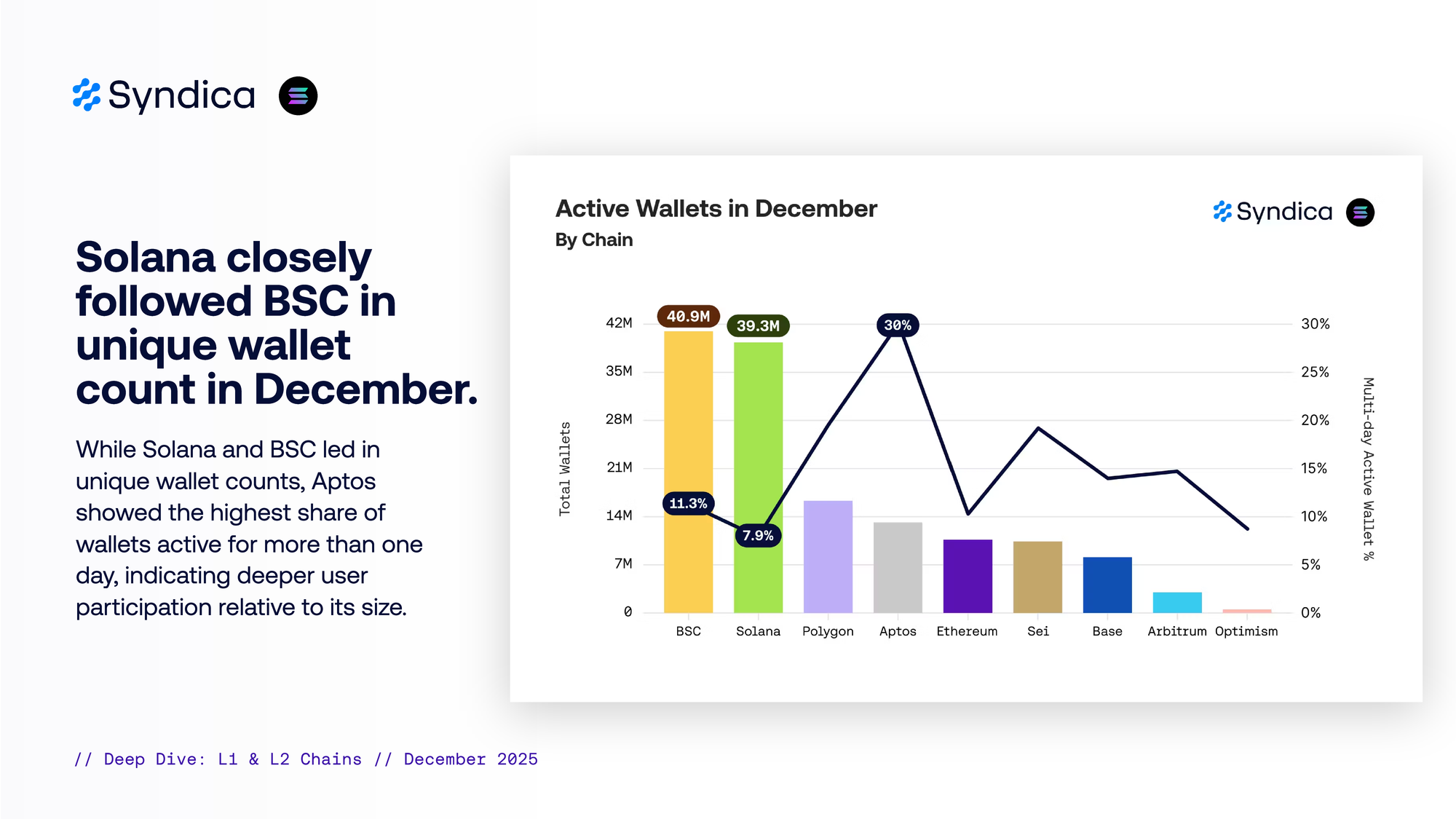

Solana closely followed BSC in unique wallet count in December

While Solana and BSC led in unique wallet counts, Aptos showed the highest share of wallets active for more than one day, indicating deeper user participation relative to its size.

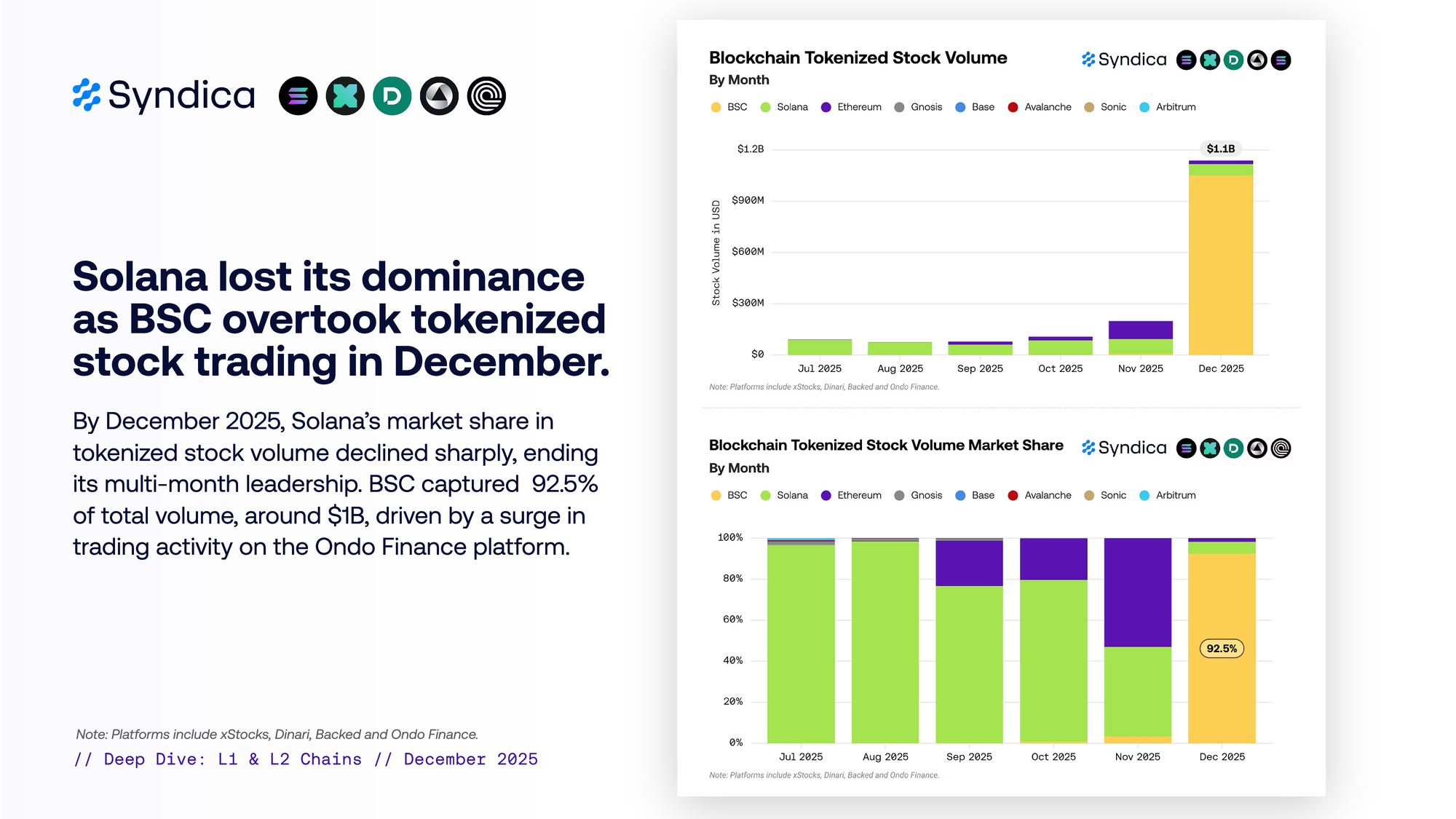

Solana lost its dominance as BSC overtook tokenized stock trading in December

By December 2025, Solana’s market share in tokenized stock volume declined sharply, ending its multi-month leadership. BSC captured 92.5% of total volume, around $1B, driven by a surge in trading activity on the Ondo Finance platform.

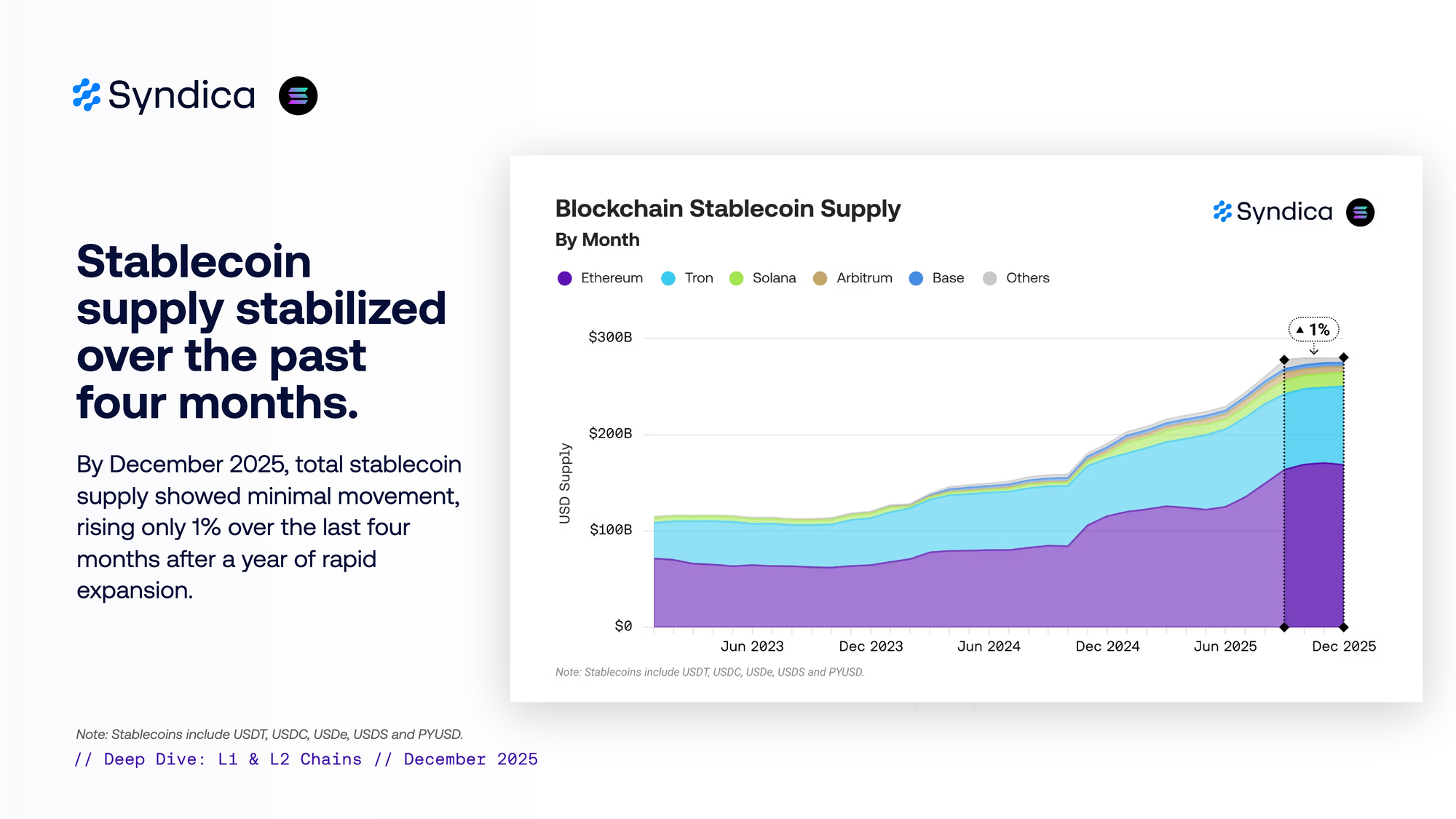

Stablecoin supply stabilized over the past four months

By December 2025, total stablecoin supply showed minimal movement, rising only 1% over the last four months after a year of rapid expansion.

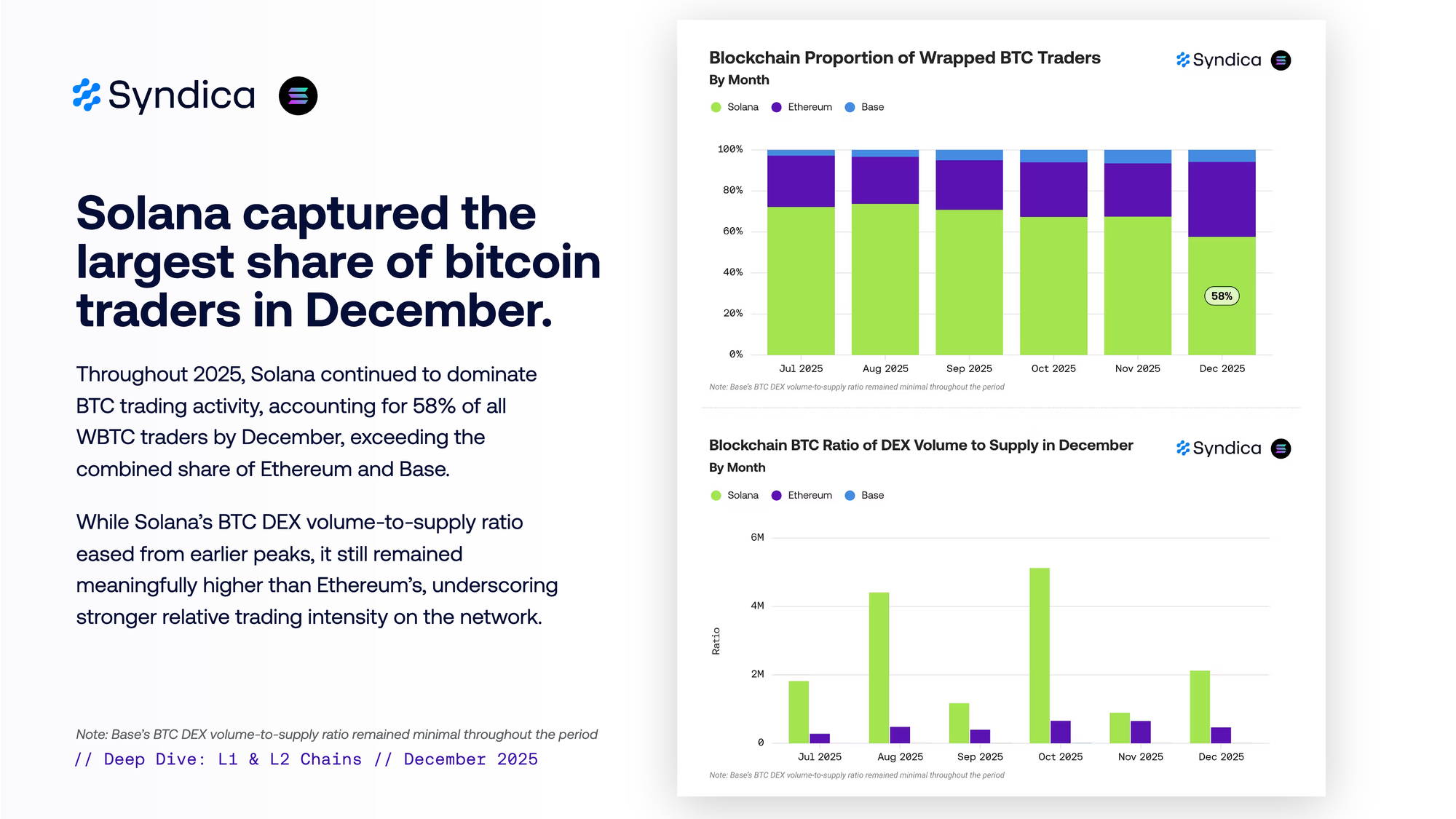

Solana captured the largest share of bitcoin traders in December

Throughout 2025, Solana continued to dominate BTC trading activity, accounting for 58% of all WBTC traders by December, exceeding the combined share of Ethereum and Base. While Solana’s BTC DEX volume-to-supply ratio eased from earlier peaks, it still remained meaningfully higher than Ethereum’s, underscoring stronger relative trading intensity on the network.

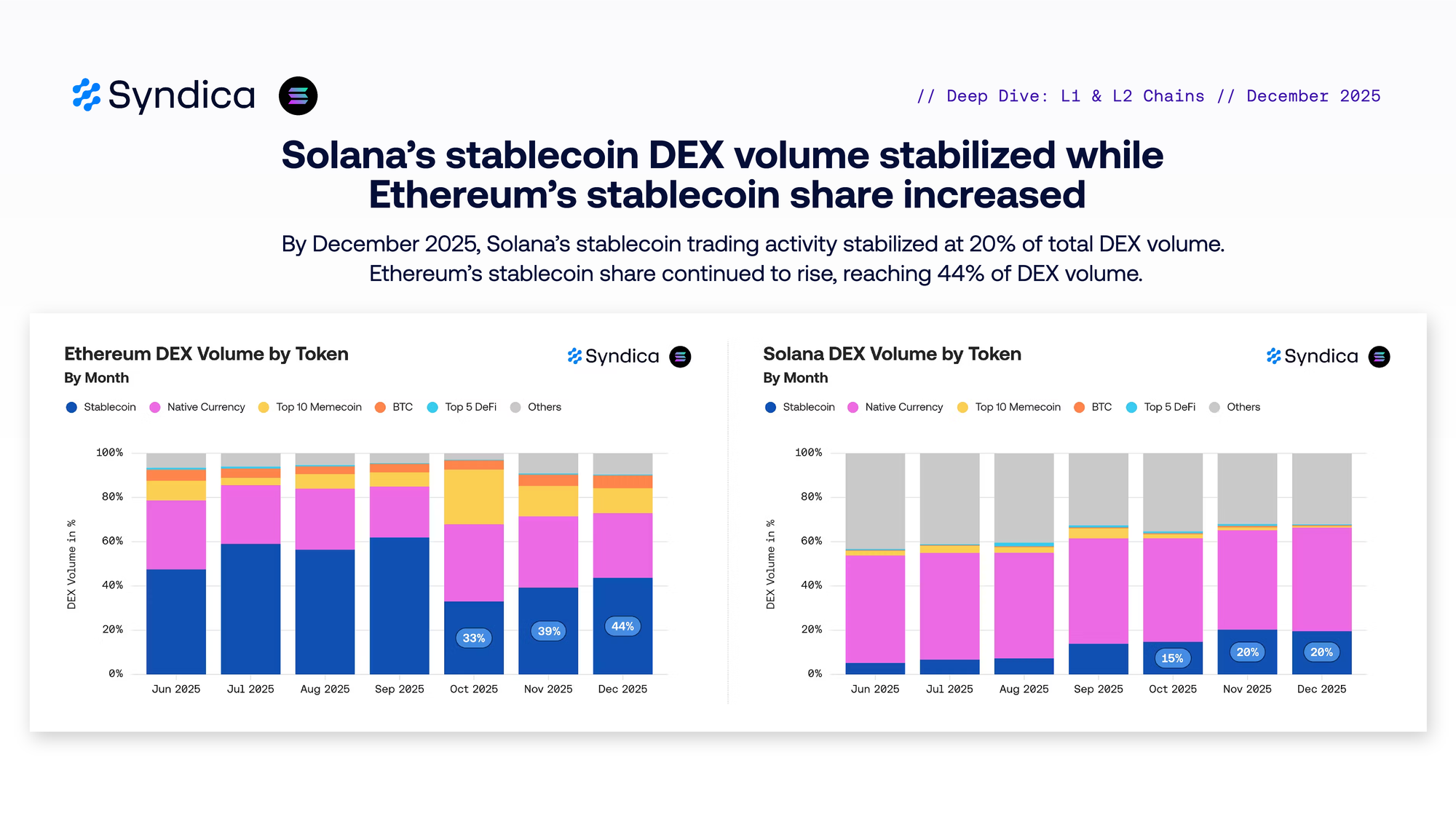

Solana’s stablecoin DEX volume stabilized while Ethereum’s stablecoin share increased

By December 2025, Solana’s stablecoin trading activity stabilized at 20% of total DEX volume. Ethereum’s stablecoin share continued to rise, reaching 44% of DEX volume.

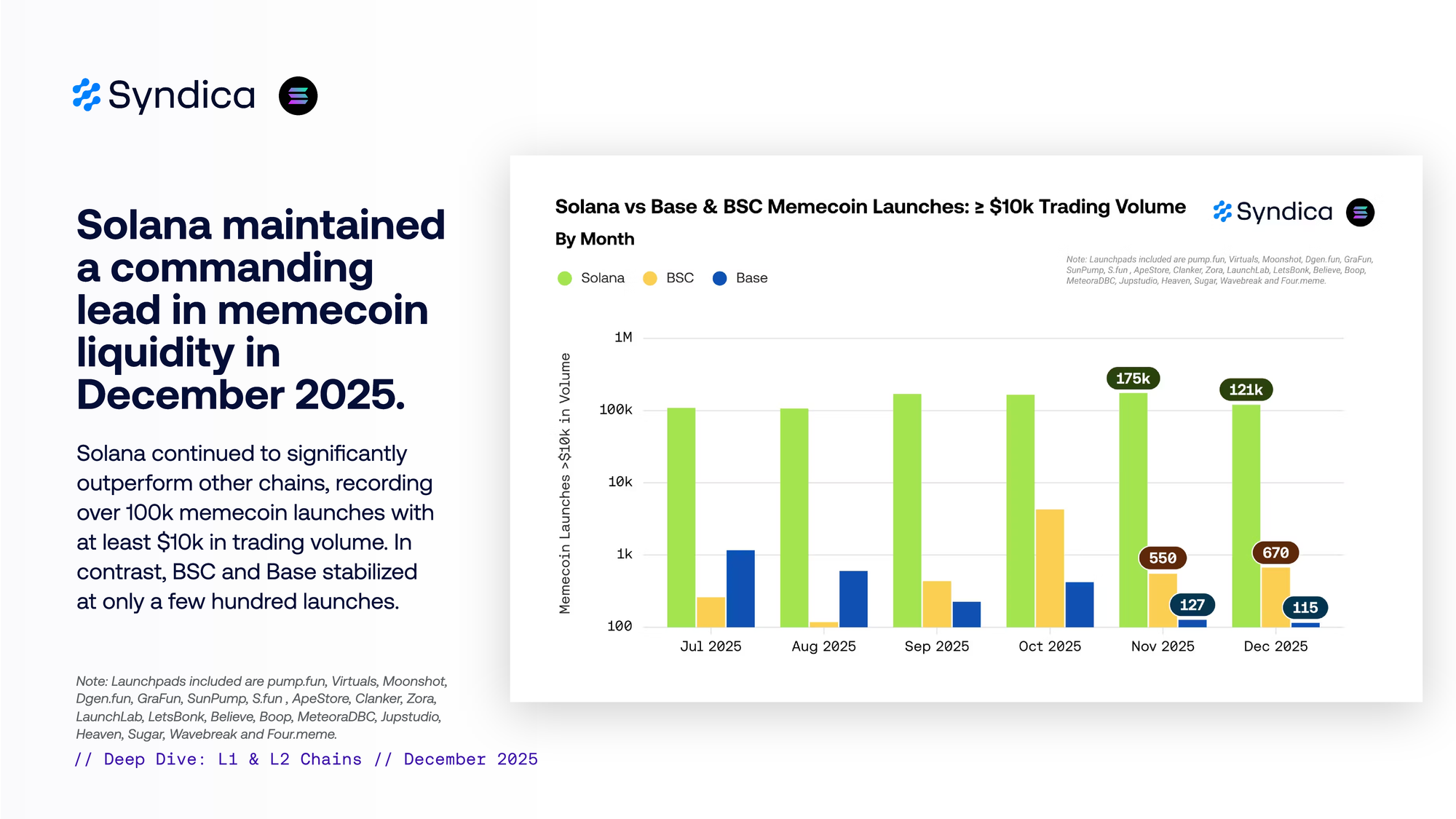

Solana maintained a commanding lead in memecoin liquidity in December 2025

Solana continued to significantly outperform other chains, recording over 100k memecoin launches with at least $10k in trading volume. In contrast, BSC and Base stabilized at only a few hundred launches.

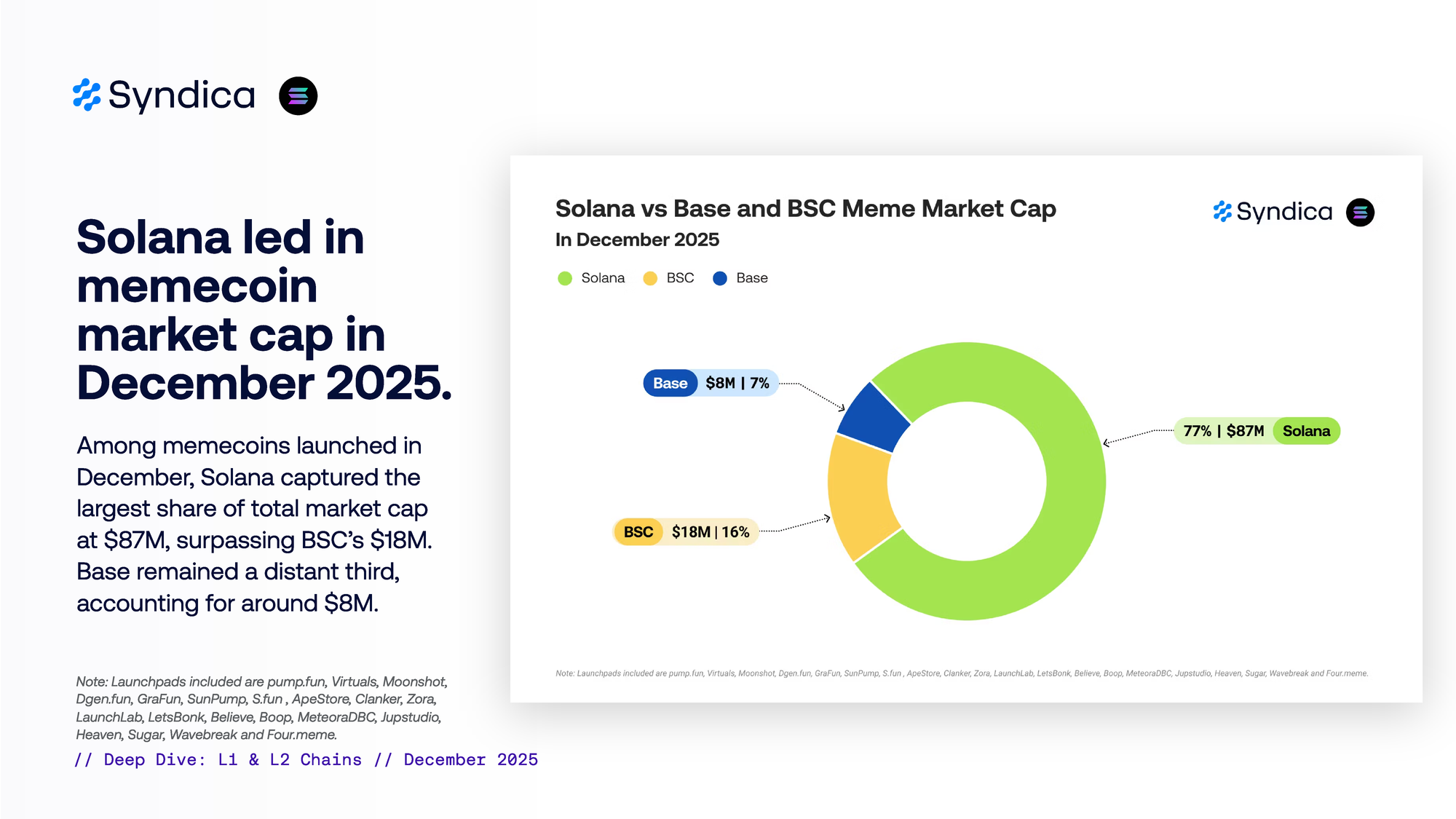

Solana led in memecoin market cap in December 2025

Among memecoins launched in December, Solana captured the largest share of total market cap at $87M, surpassing BSC’s $18M. Base remained a distant third, accounting for around $8M.

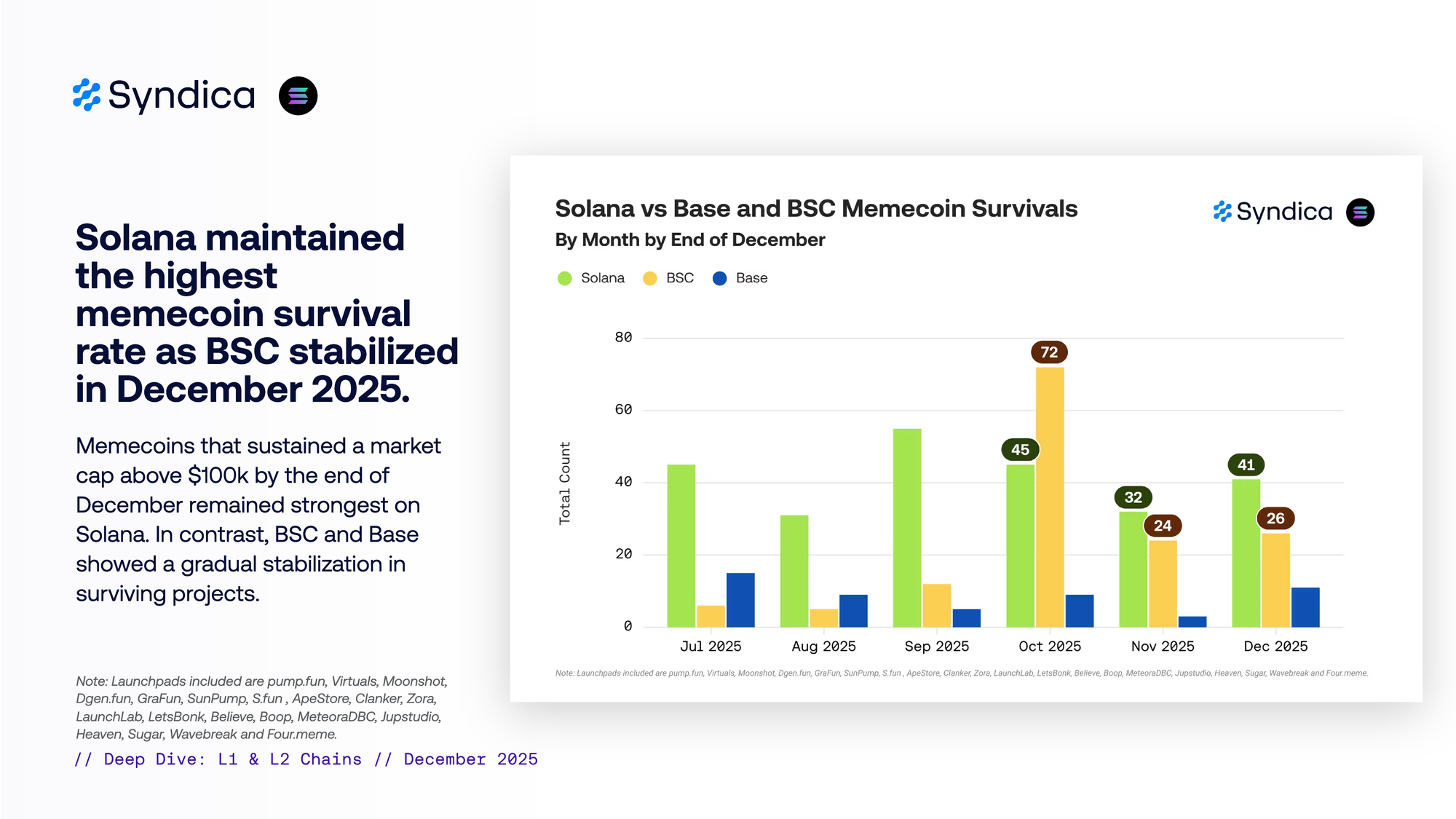

Solana maintained the highest memecoin survival rate as BSC stabilized in December 2025

Memecoins that sustained a market cap above $100k by the end of December remained strongest on Solana. In contrast, BSC and Base showed a gradual stabilization in surviving projects.

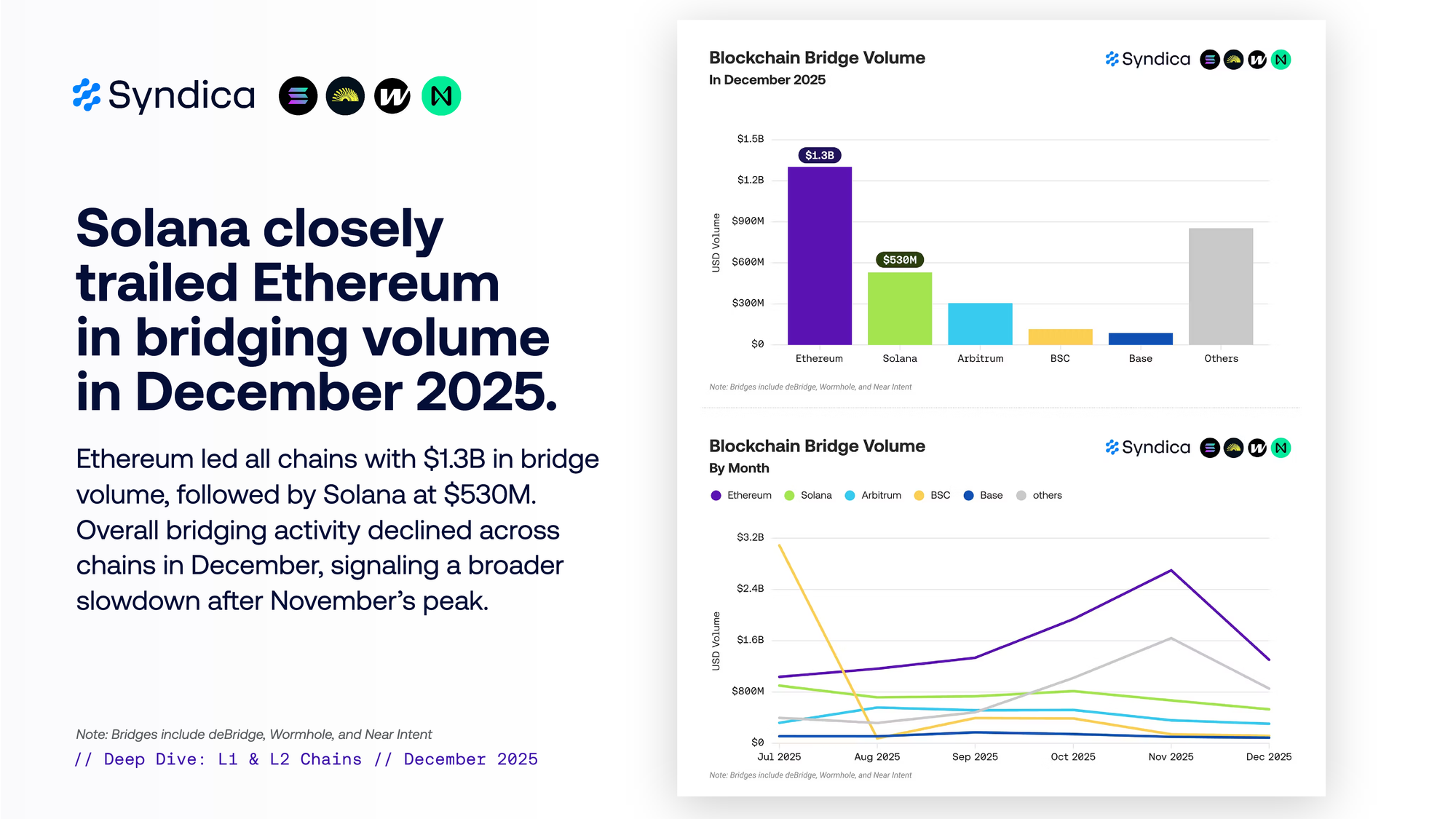

Solana closely trailed Ethereum in bridging volume in December 2025

Ethereum led all chains with $1.3B in bridge volume, followed by Solana at $530M. Overall bridging activity declined across chains in December, signaling a broader slowdown after November’s peak.

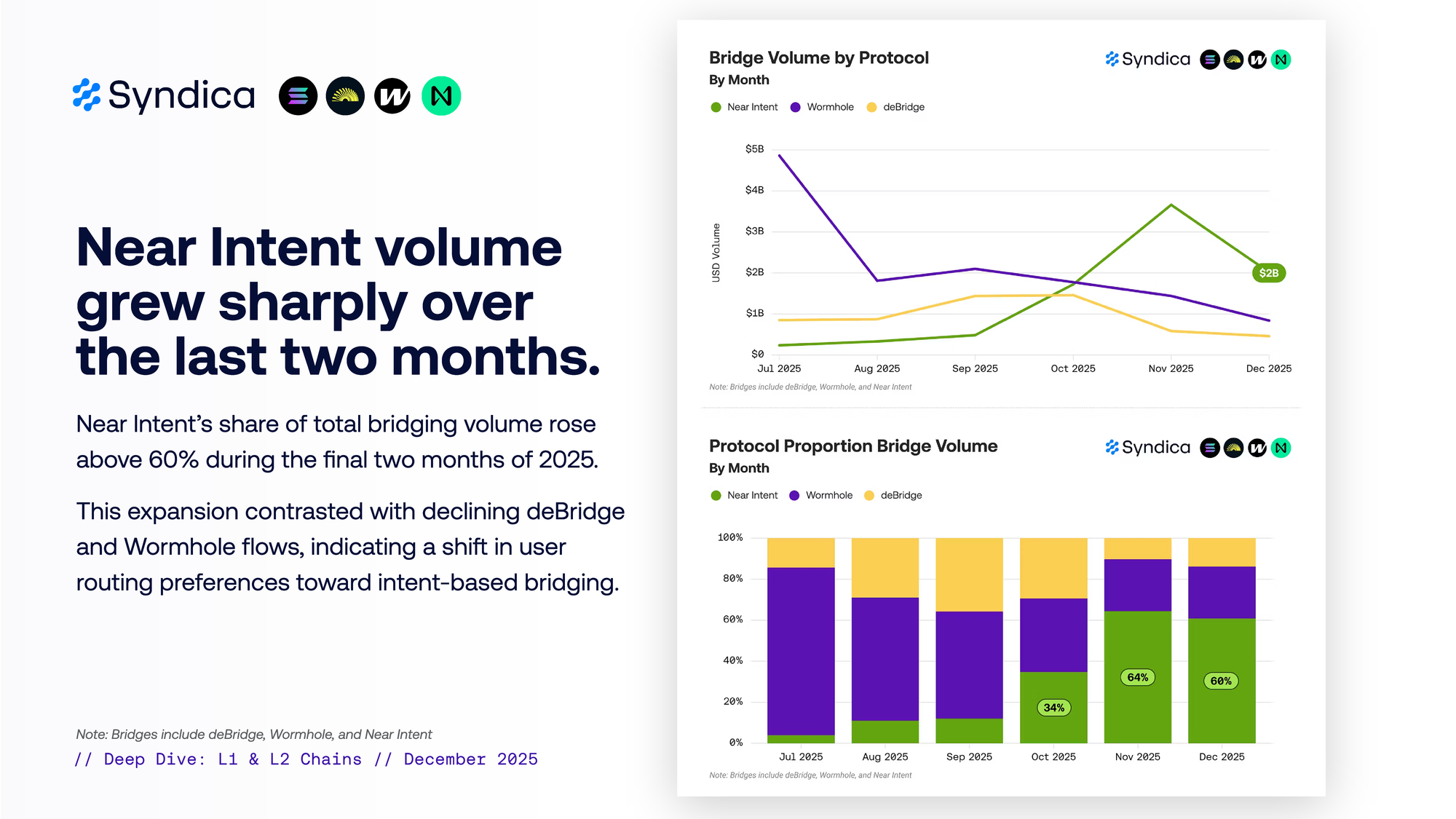

Near Intent volume grew sharply over the last two months

Near Intent’s share of total bridging volume rose above 60% during the final two months of 2025. This expansion contrasted with declining deBridge and Wormhole flows, indicating a shift in user routing preferences toward intent-based bridging.

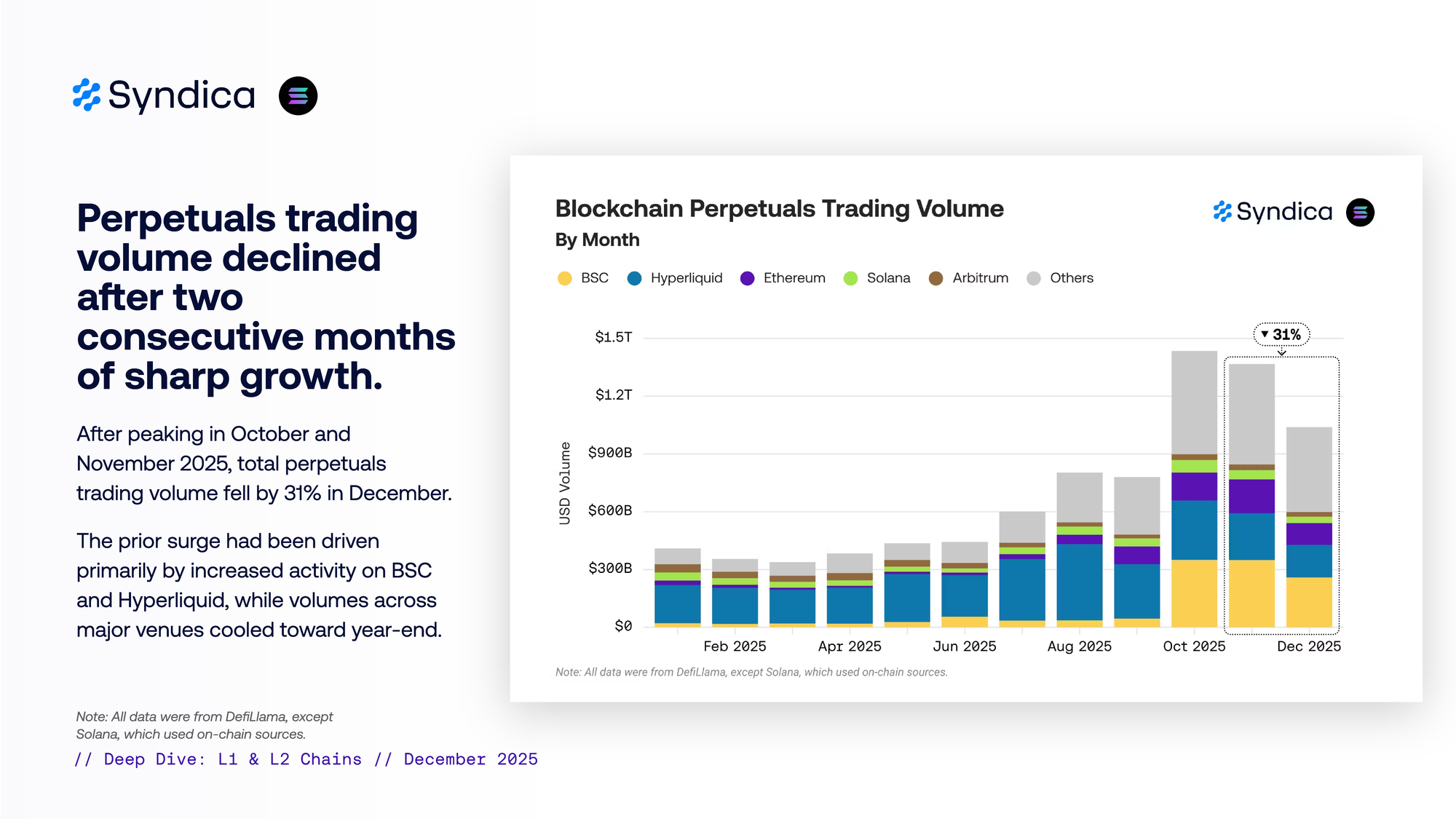

Perpetuals trading volume declined after two consecutive months of sharp growth

After peaking in October and November 2025, total perpetuals trading volume fell by 31% in December. The prior surge had been driven primarily by increased activity on BSC and Hyperliquid, while volumes across major venues cooled toward year-end.

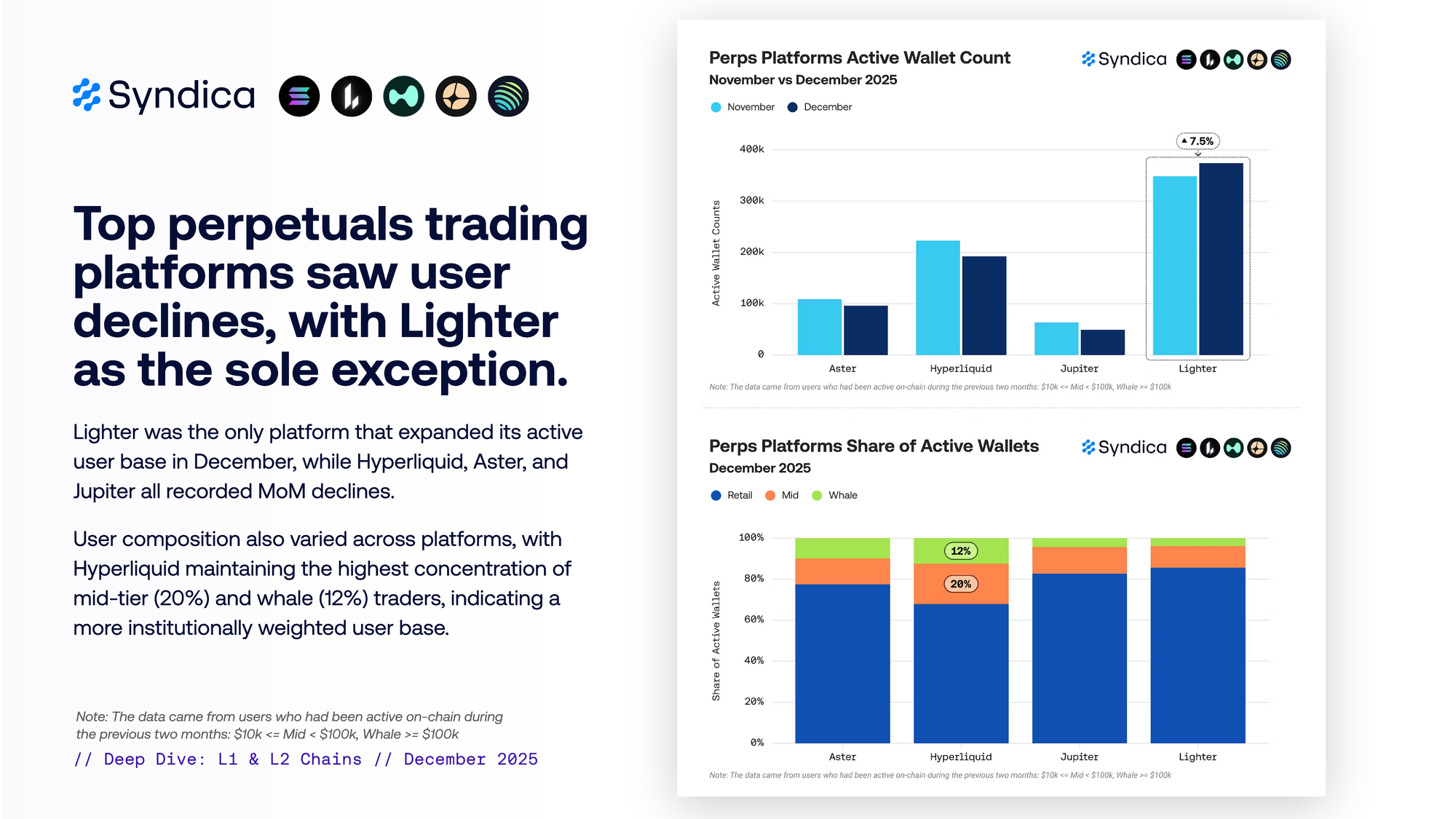

Top perpetuals trading platforms saw user declines, with Lighter as the sole exception

Lighter was the only platform that expanded its active user base in December, while Hyperliquid, Aster, and Jupiter all recorded month-over-month declines. User composition also varied across platforms, with Hyperliquid maintaining the highest concentration of mid-tier and whale traders, indicating a more institutionally weighted user base.