Insights: Layer 1 & 2 Chains - June 2025

Insights: Layer 1 & 2 Chains - June 2025

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Insights: Layer 1 & 2 Chains - June 2025

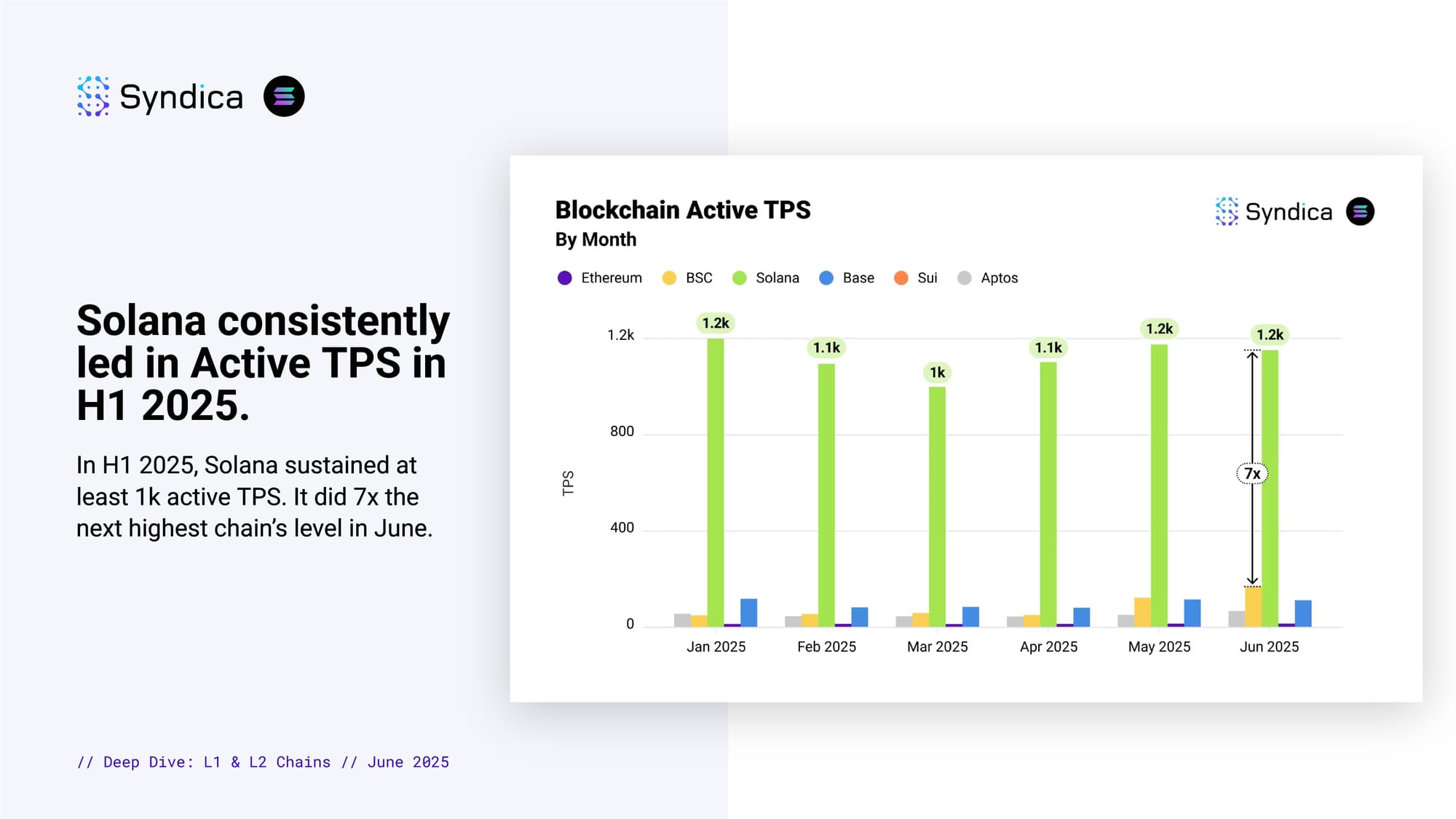

Solana consistently led in Active TPS in H1 2025. In H1 2025, Solana sustained at least 1k active TPS. It did 7x the next highest chain’s level in June.

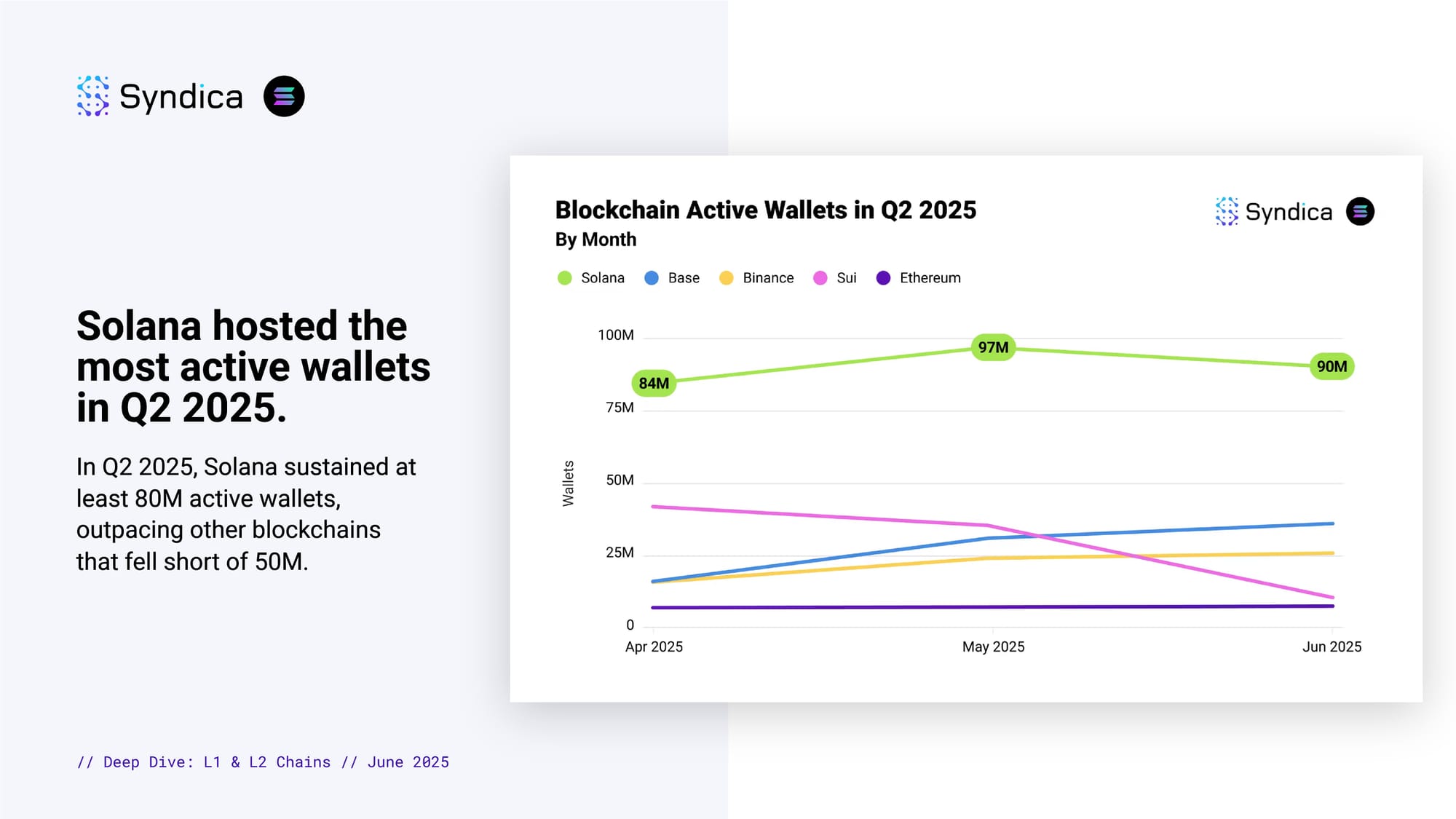

Solana hosted the most active wallets in Q2 2025. In Q2 2025, Solana sustained at least 80M active wallets, outpacing other blockchains that fell short of 50M.

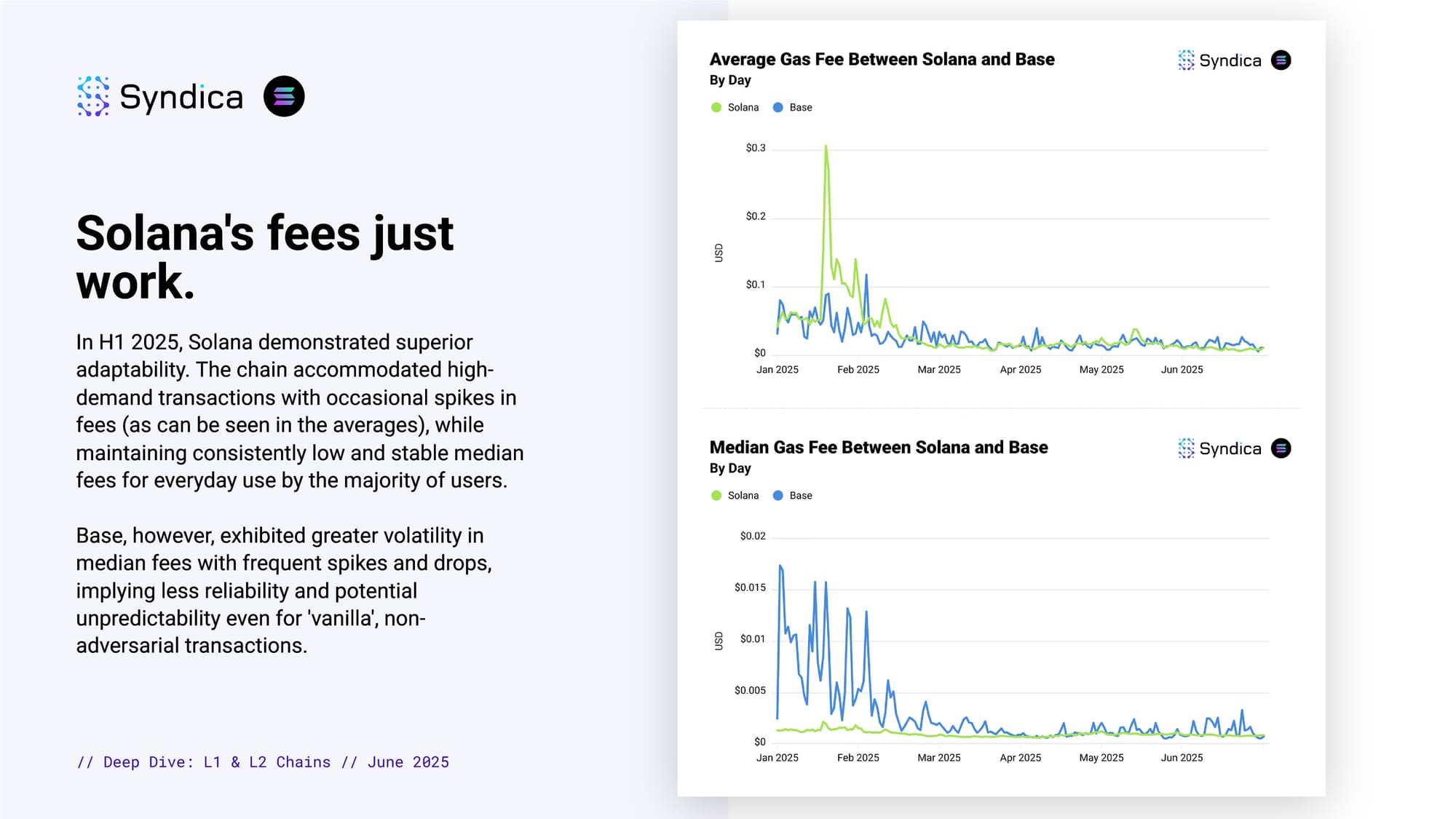

Solana's fees just work. In H1 2025, Solana demonstrated superior adaptability. The chain accommodated high-demand transactions with occasional spikes in fees (as can be seen in the averages), while maintaining consistently low and stable median fees for everyday use by the majority of users. Base, however, exhibited greater volatility in median fees with frequent spikes and drops, implying less reliability and potential unpredictability even for 'vanilla', non-adversarial transactions.

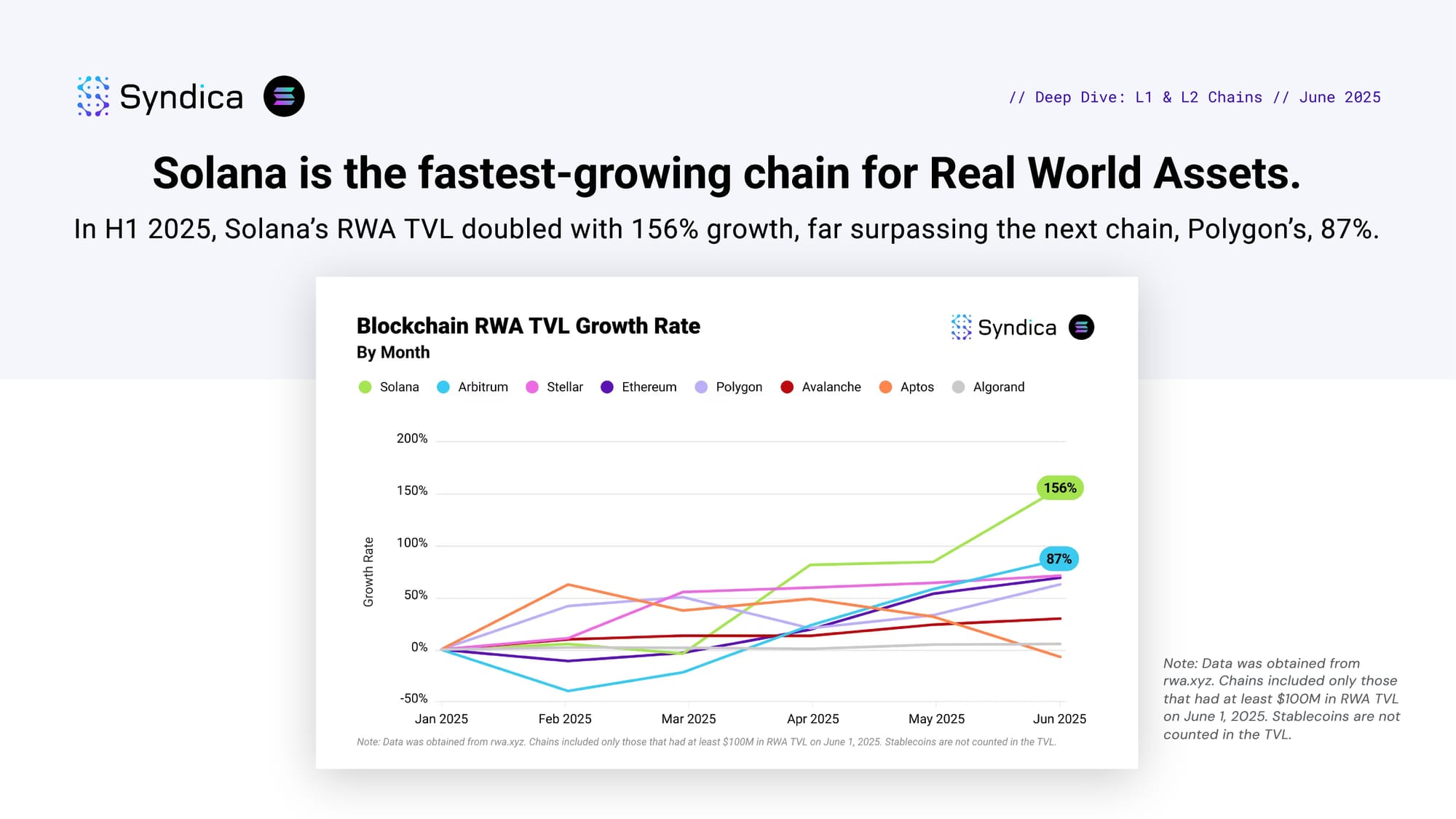

Solana is the fastest-growing chain for Real World Assets. In H1 2025, Solana’s RWA TVL doubled with 156% growth, far surpassing the next chain, Polygon’s, 87%.

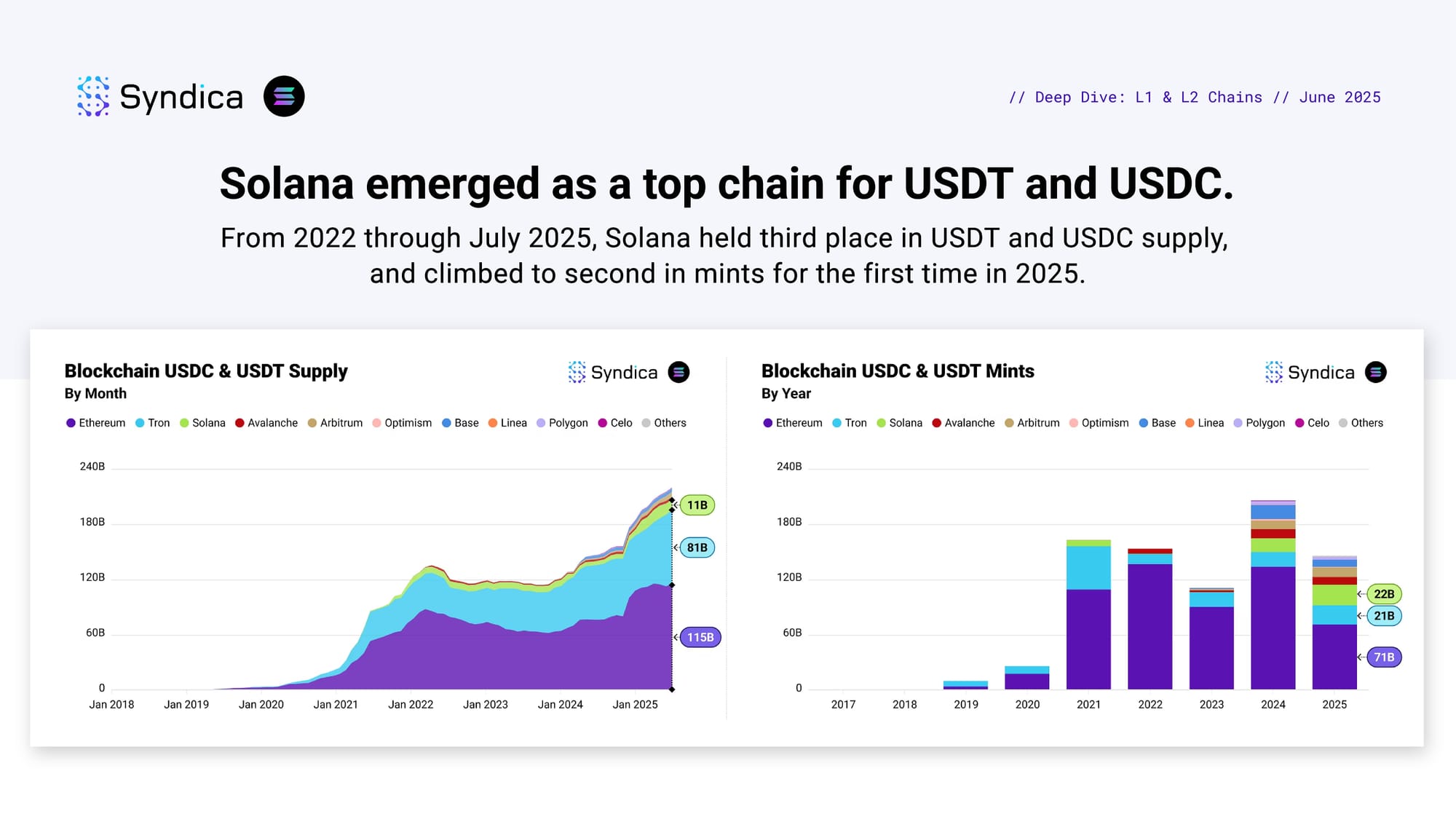

Solana emerged as a top chain for USDT and USDC. From 2022 through July 2025, Solana held third place in USDT and USDC supply, and climbed to second in mints for the first time in 2025.

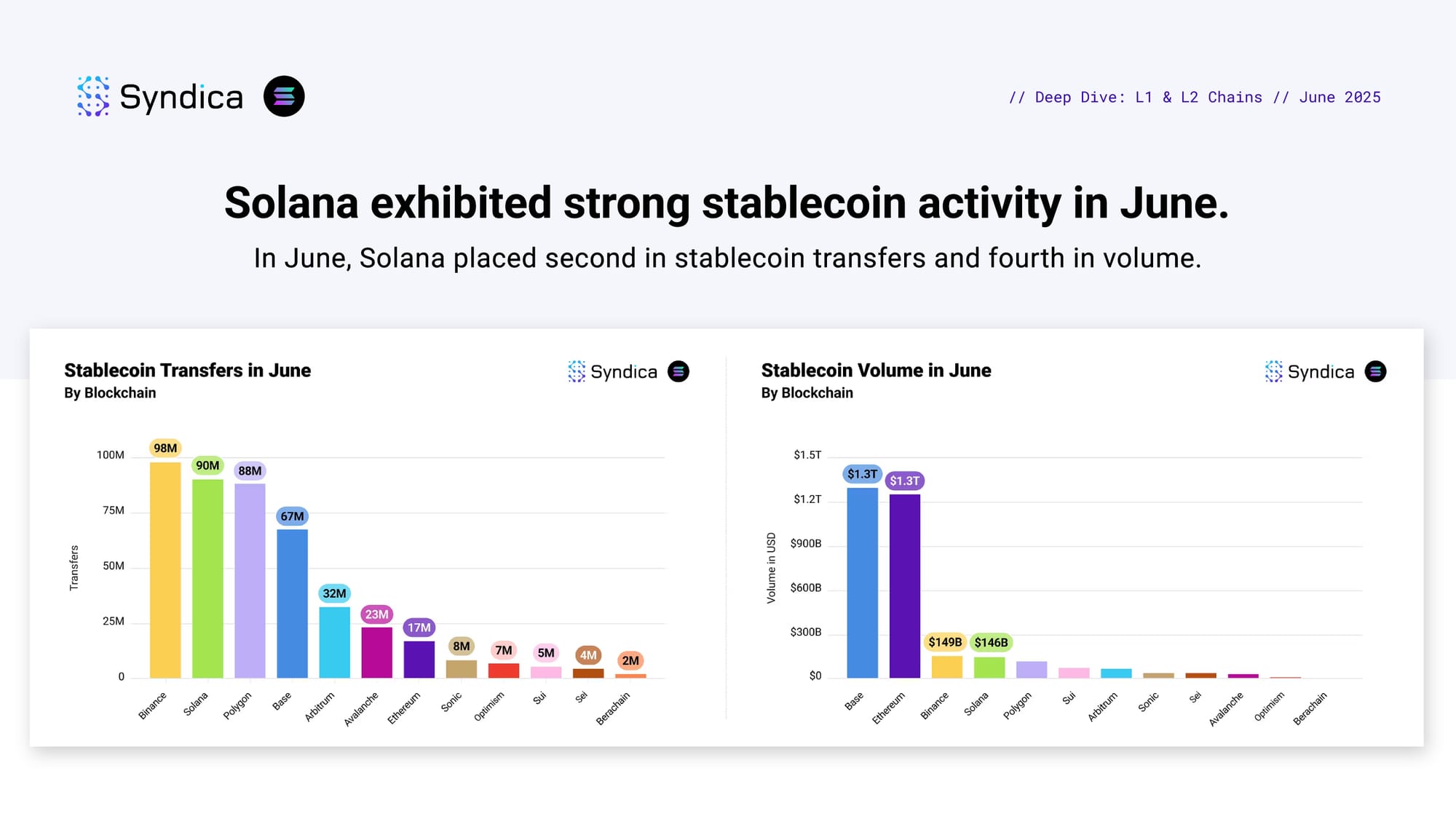

Solana exhibited strong stablecoin activity in June. In June, Solana placed second in stablecoin transfers and fourth in volume.

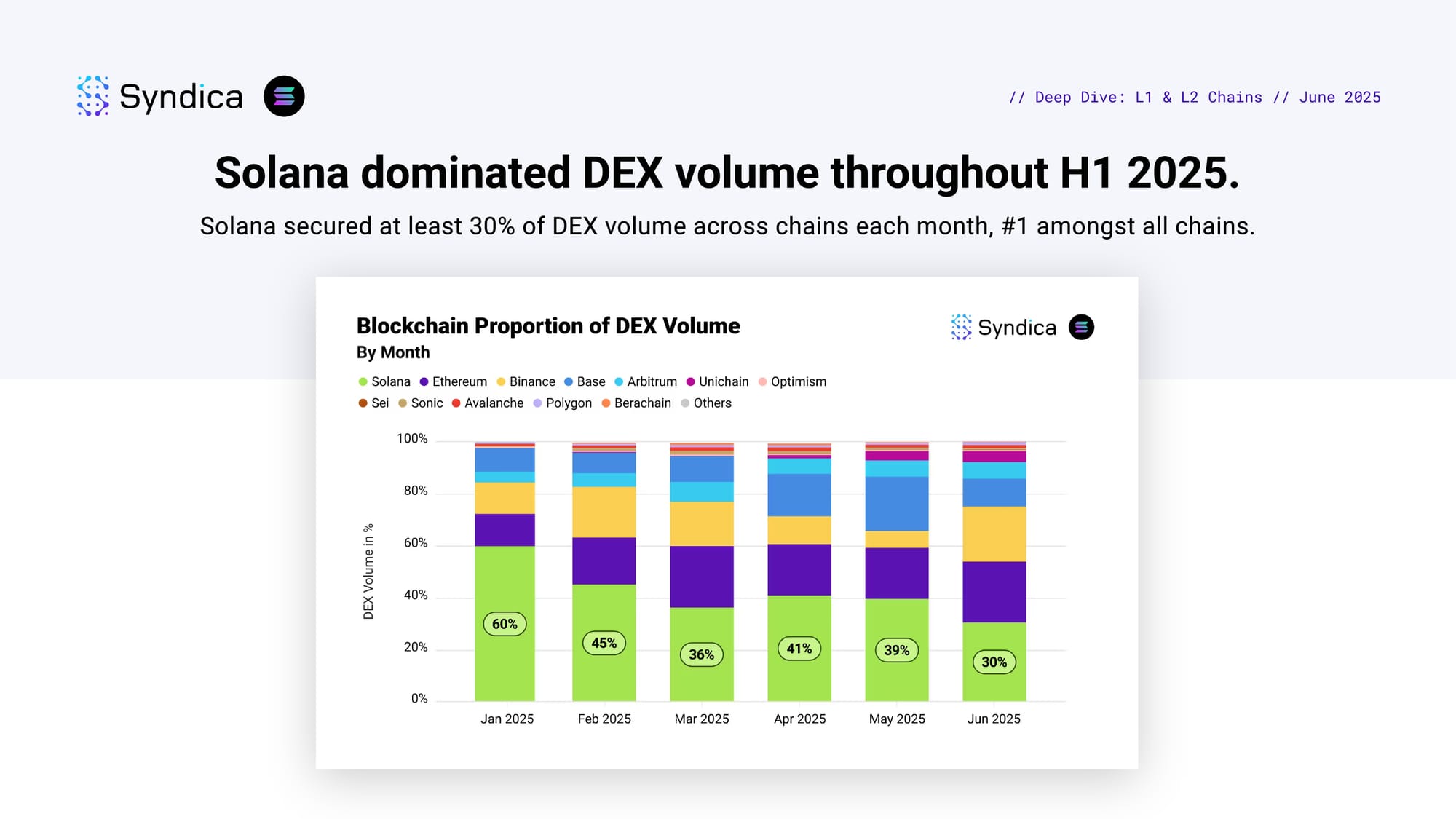

Solana dominated DEX volume throughout H1 2025. Solana secured at least 30% of DEX volume across chains each month, #1 amongst all chains.

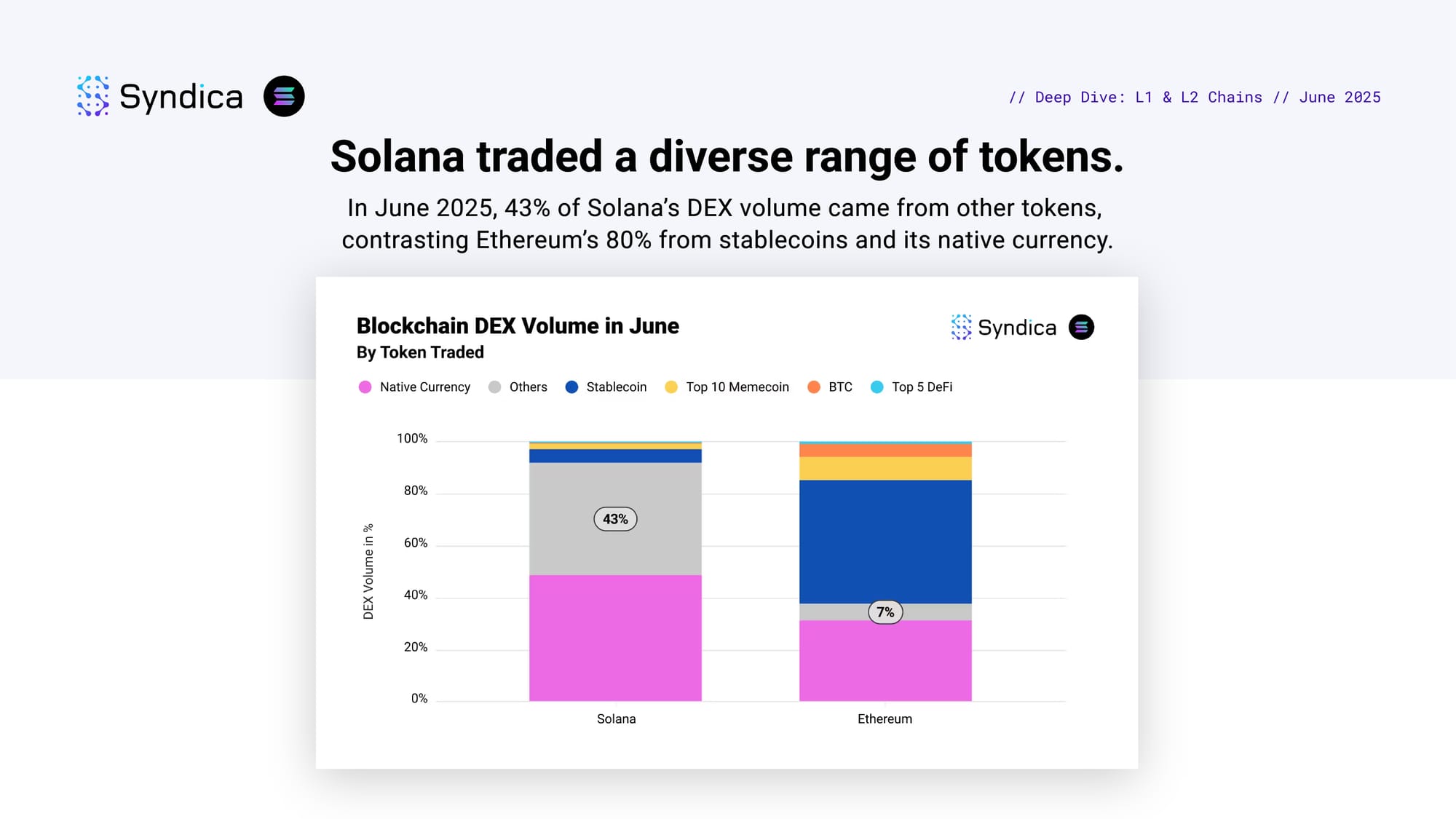

Solana traded a diverse range of tokens. In June 2025, 43% of Solana’s DEX volume came from other tokens, contrasting Ethereum’s 80% from stablecoins and its native currency.

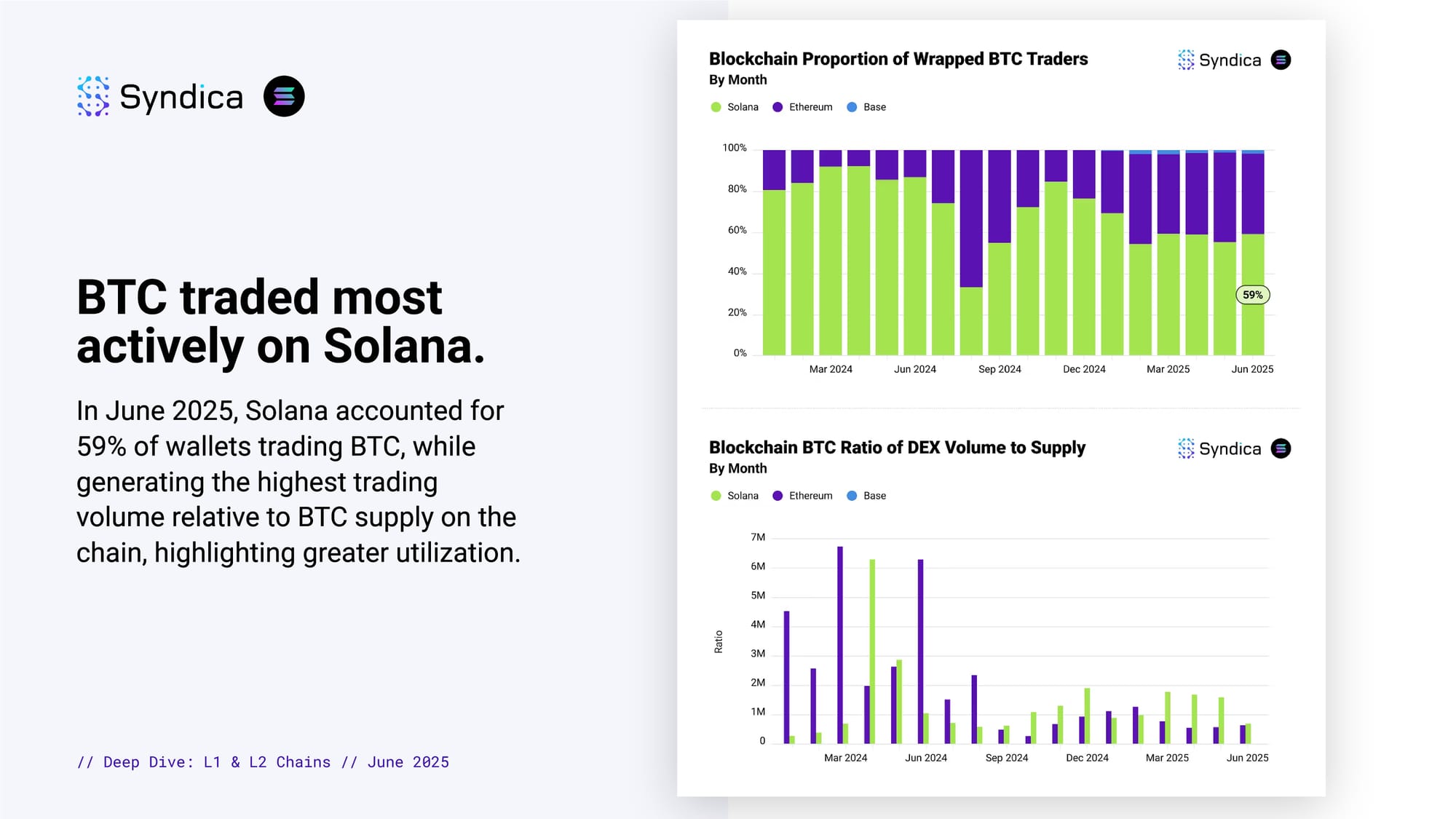

BTC traded most actively on Solana. In June 2025, Solana accounted for 59% of wallets trading BTC, while generating the highest trading volume relative to BTC supply on the chain, highlighting greater utilization.

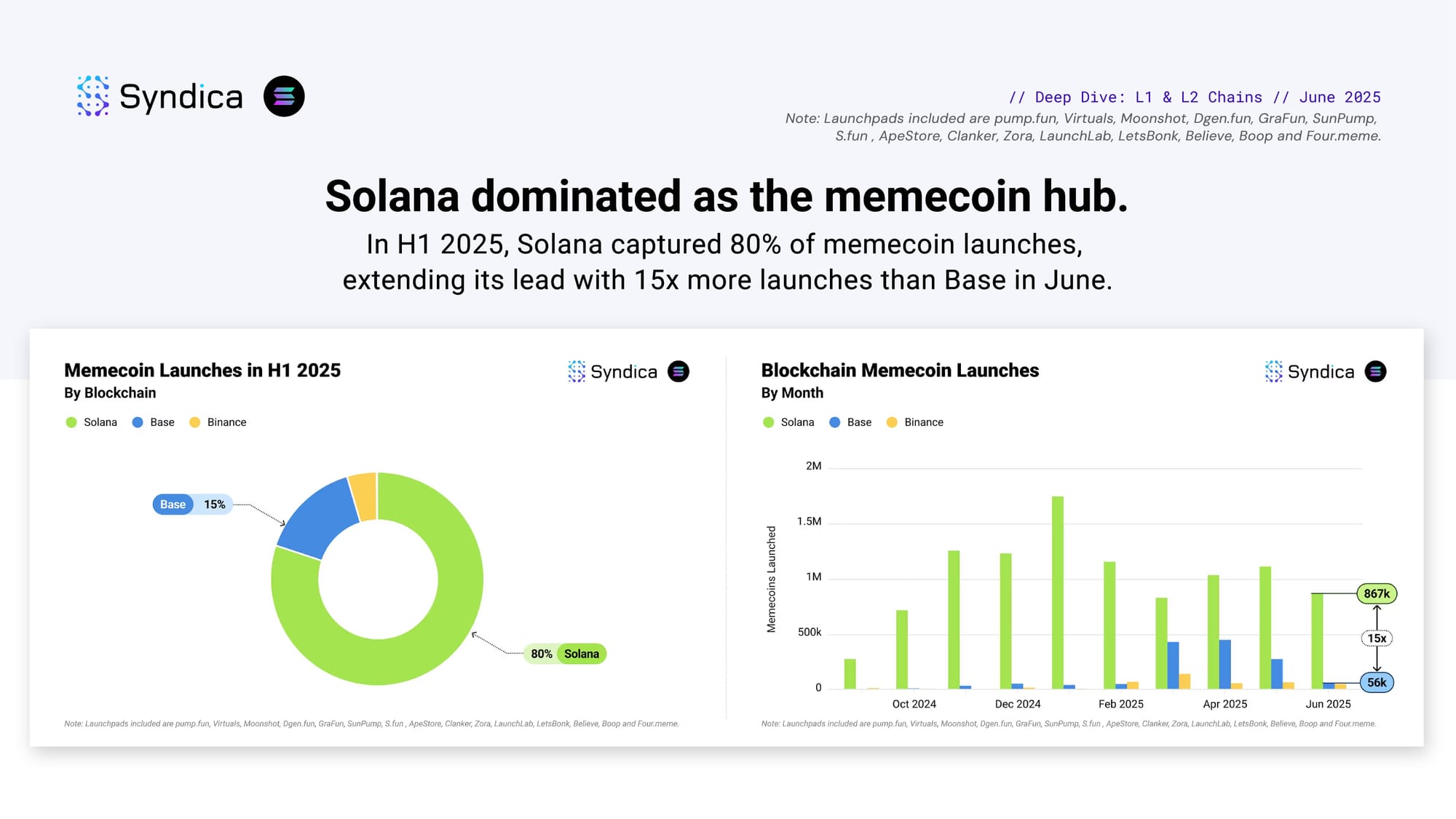

Solana dominated as the memecoin hub. In H1 2025, Solana captured 80% of memecoin launches, extending its lead with 15x more launches than Base in June.

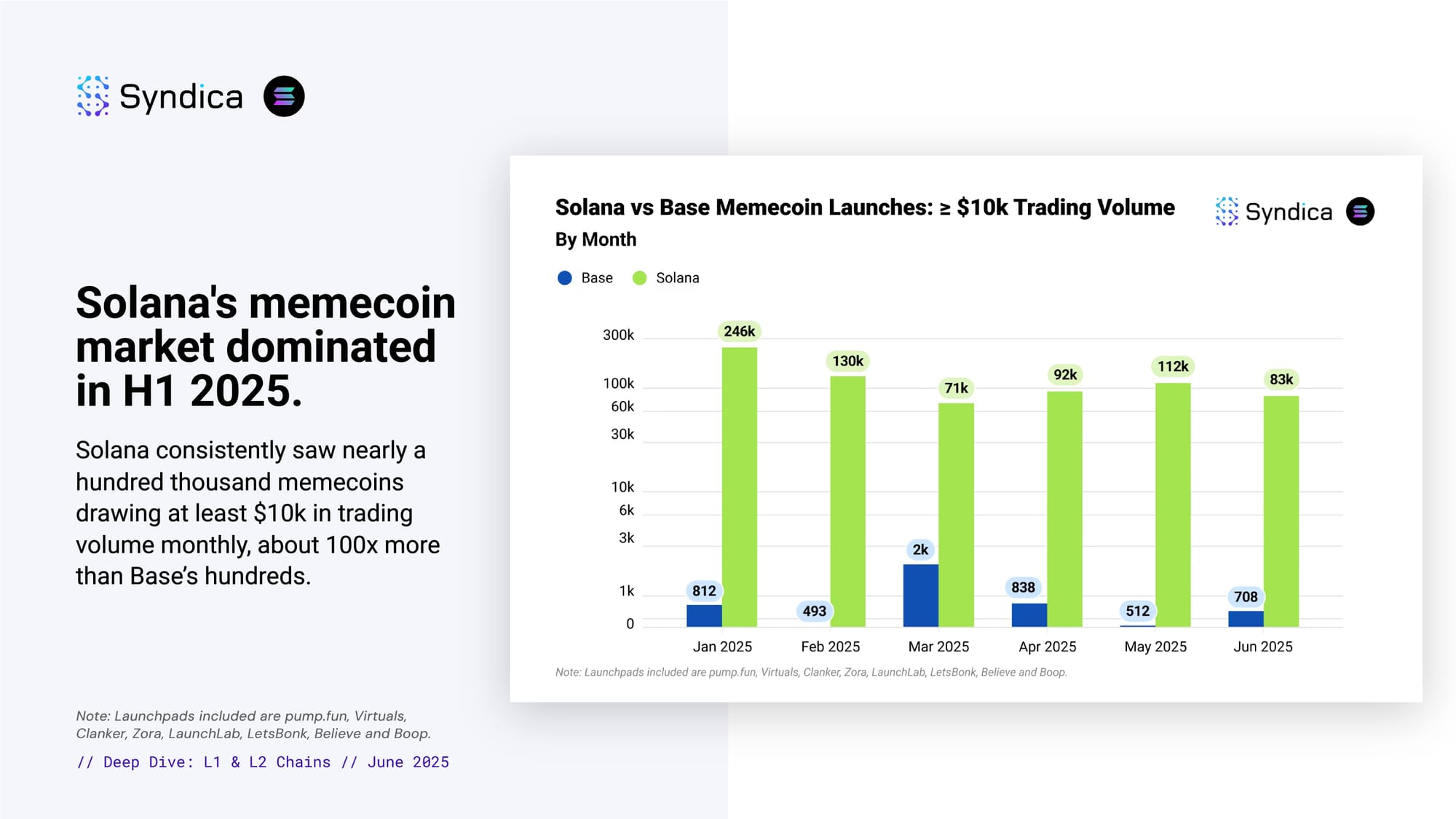

Solana's memecoin market dominated in H1 2025. Solana consistently saw nearly a hundred thousand memecoins drawing at least $10k in trading volume monthly, about 100x more than Base’s hundreds.

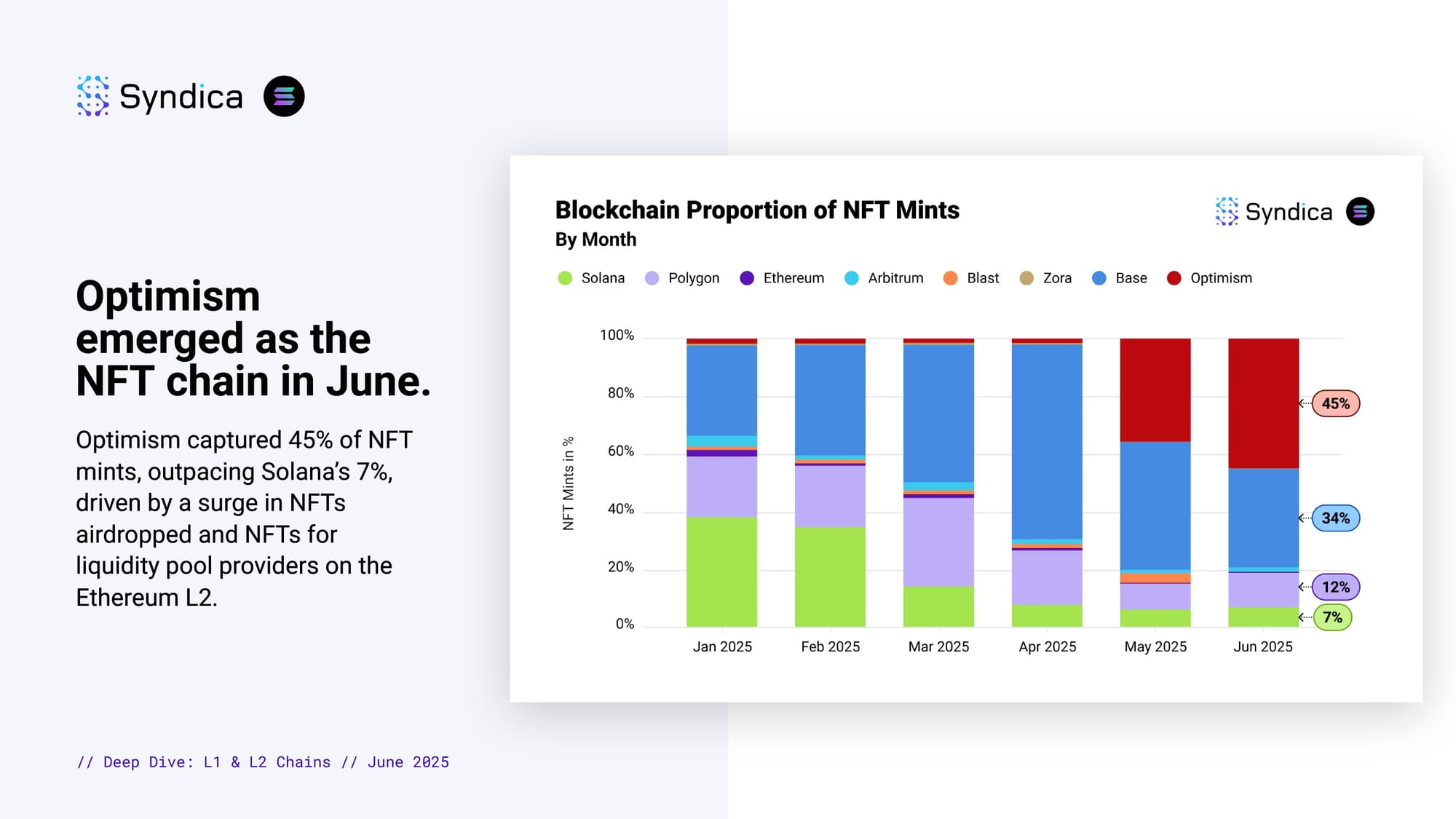

Optimism emerged as the NFT chain in June. Optimism captured 45% of NFT mints, outpacing Solana’s 7%, driven by a surge in NFTs airdropped and NFTs for liquidity pool providers on the Ethereum L2.