Insights: Layer 1 & 2 Chains- September 2025

Insights: Layer 1 & 2 Chains

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Insights: Layer 1 & 2 Chains - September 2025

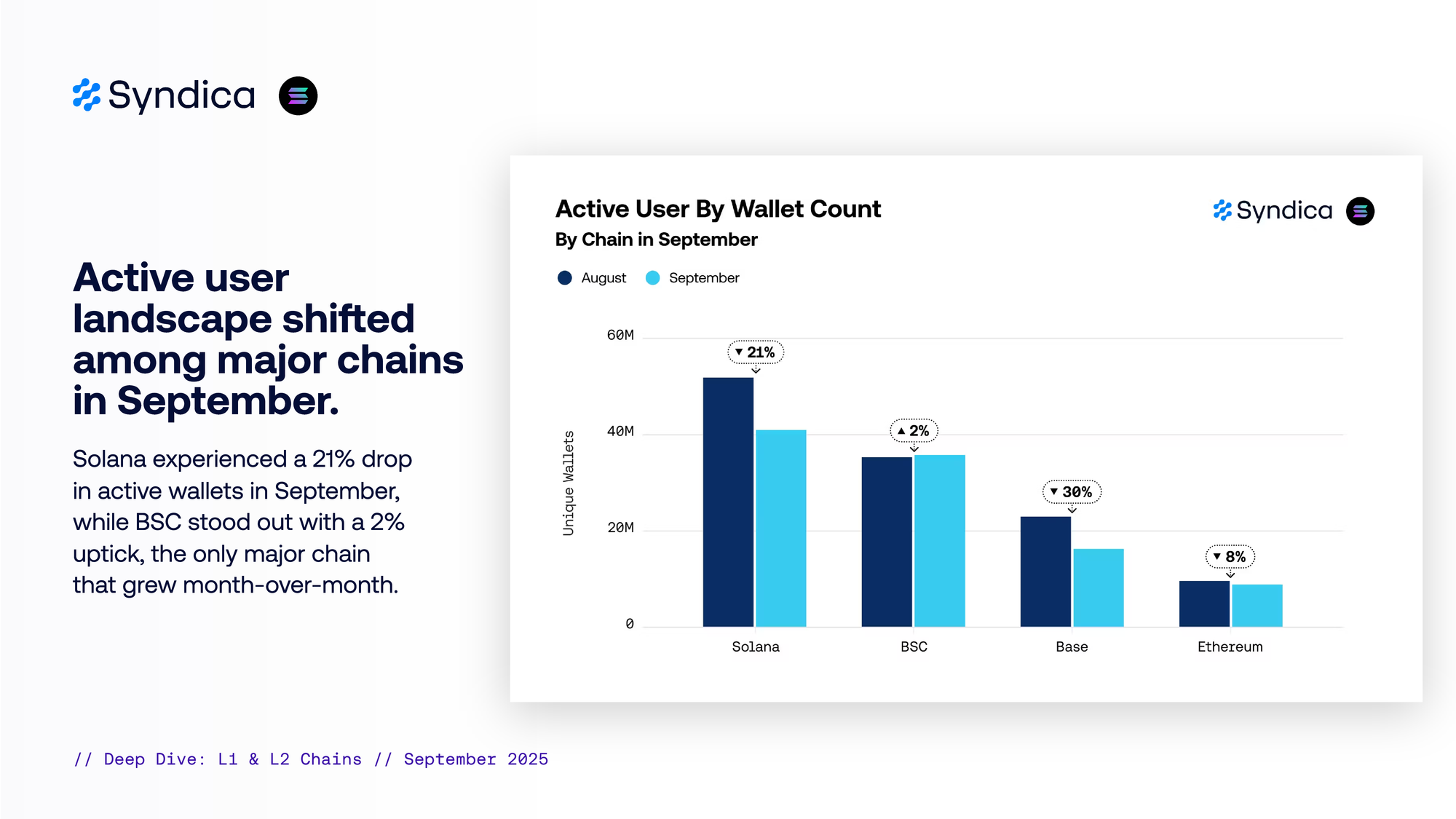

Active user landscape shifted among major chains in September. Solana experienced a 21% drop in active wallets in September, while BSC stood out with a 2% uptick, the only major chain that grew month-over-month.

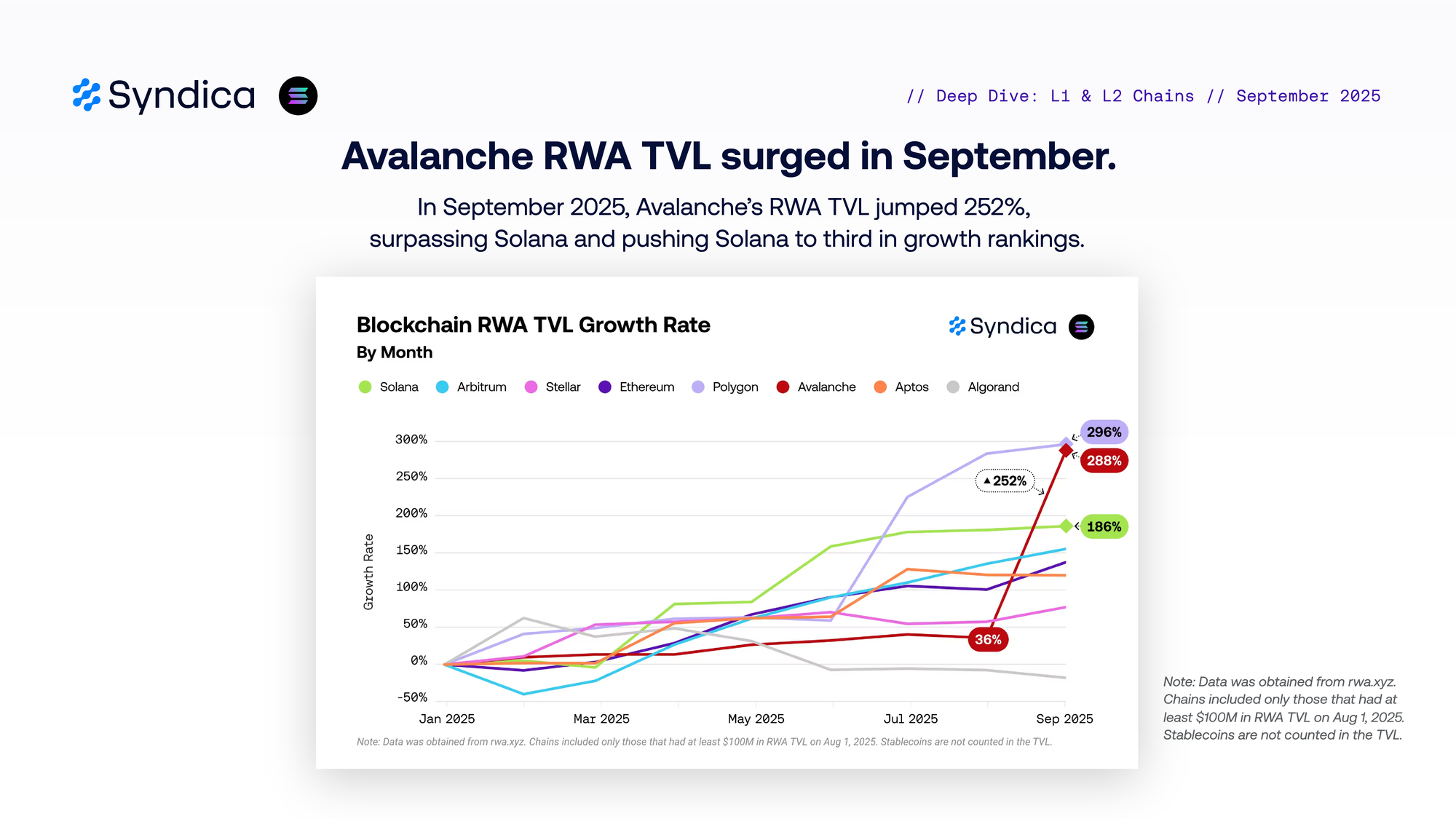

Avalanche RWA TVL surged in September. In September 2025, Avalanche’s RWA TVL jumped 252%, surpassing Solana and pushing Solana to third in growth rankings.

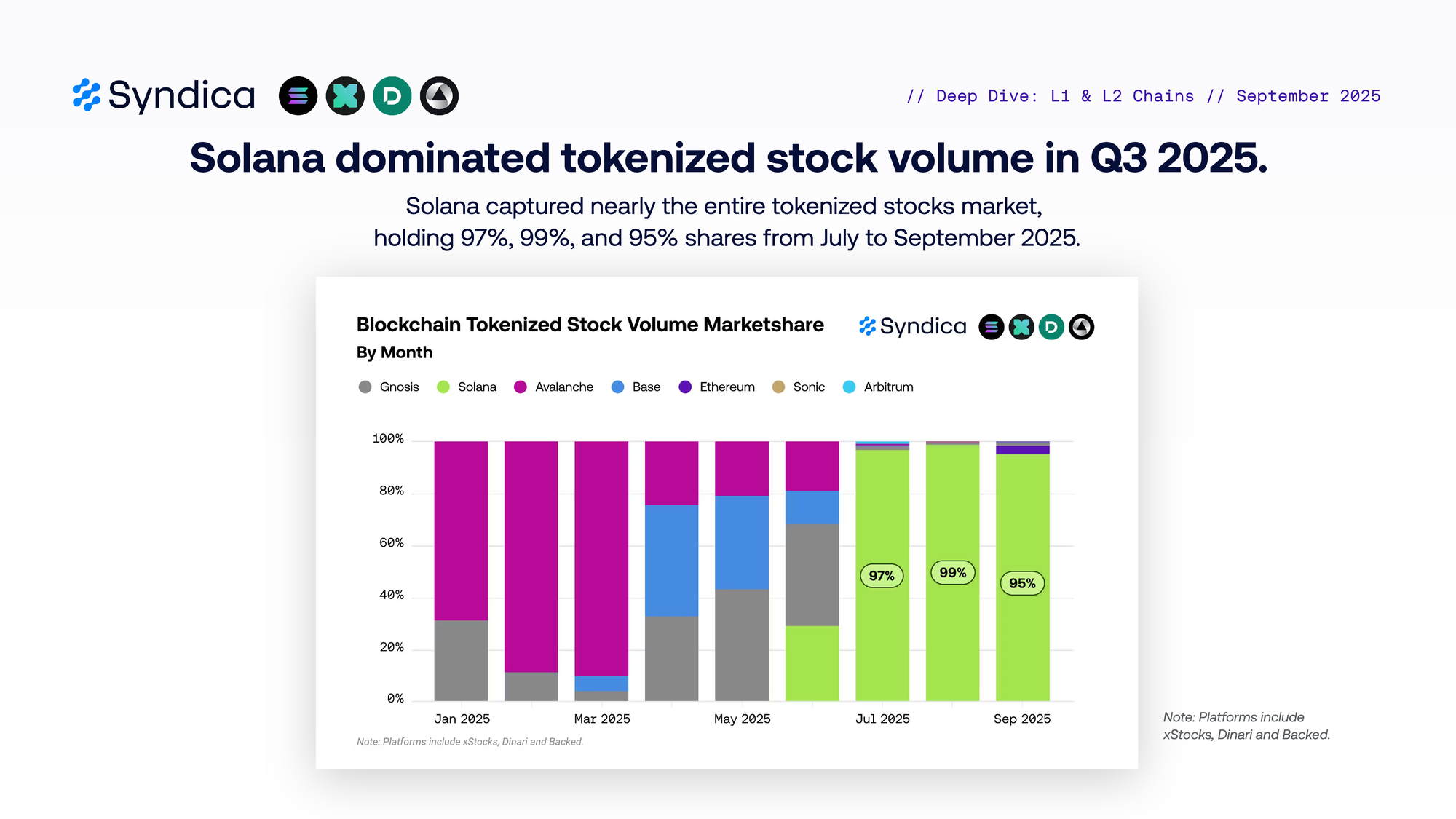

Solana dominated tokenized stock volume in Q3 2025. Solana captured nearly the entire tokenized stocks market, holding 97%, 99%, and 95% shares from July to September 2025.

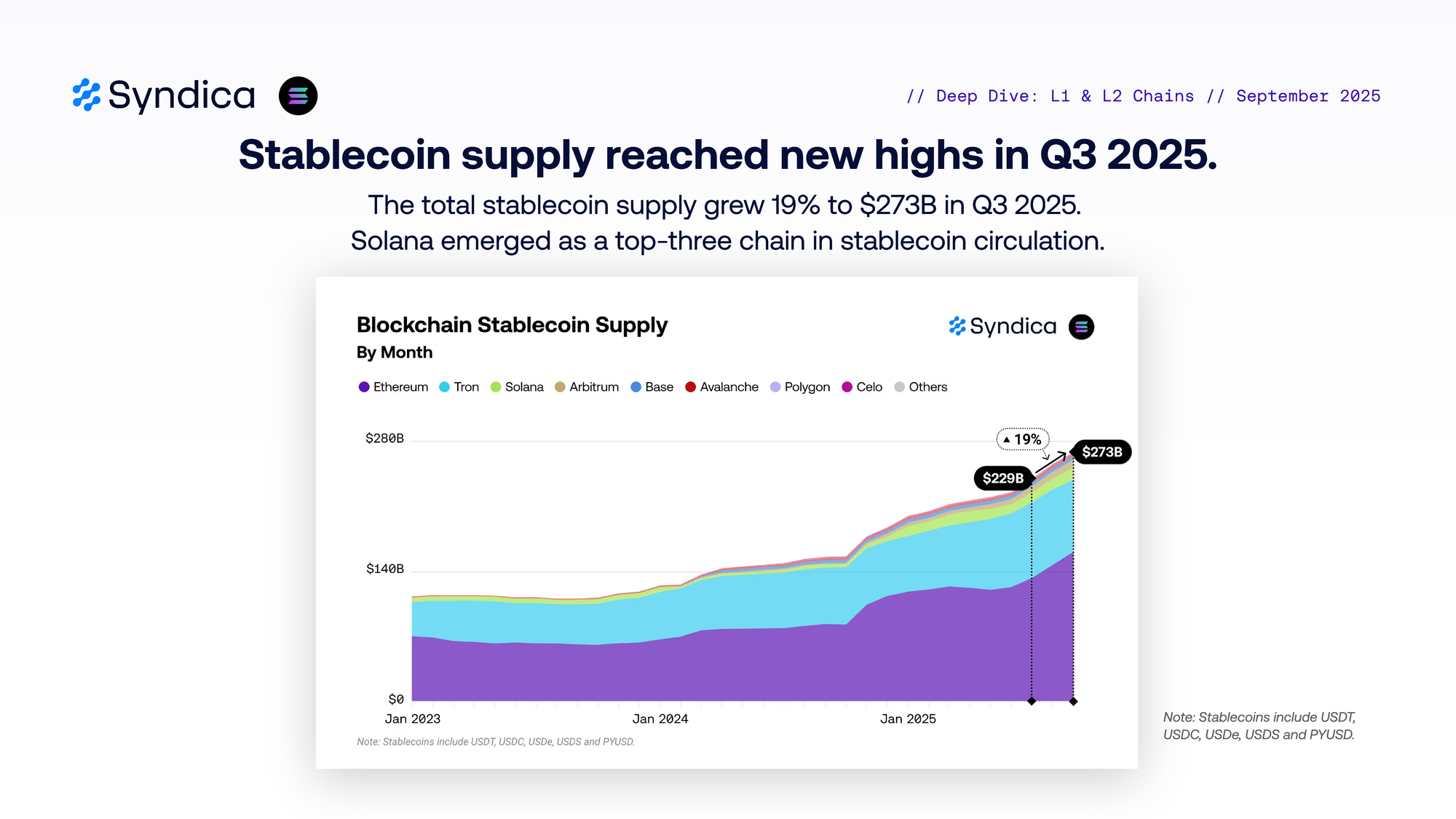

Stablecoin supply reached new highs in Q3 2025. The total stablecoin supply grew 19% to $273B in Q3 2025. Solana emerged as a top-three chain in stablecoin circulation.

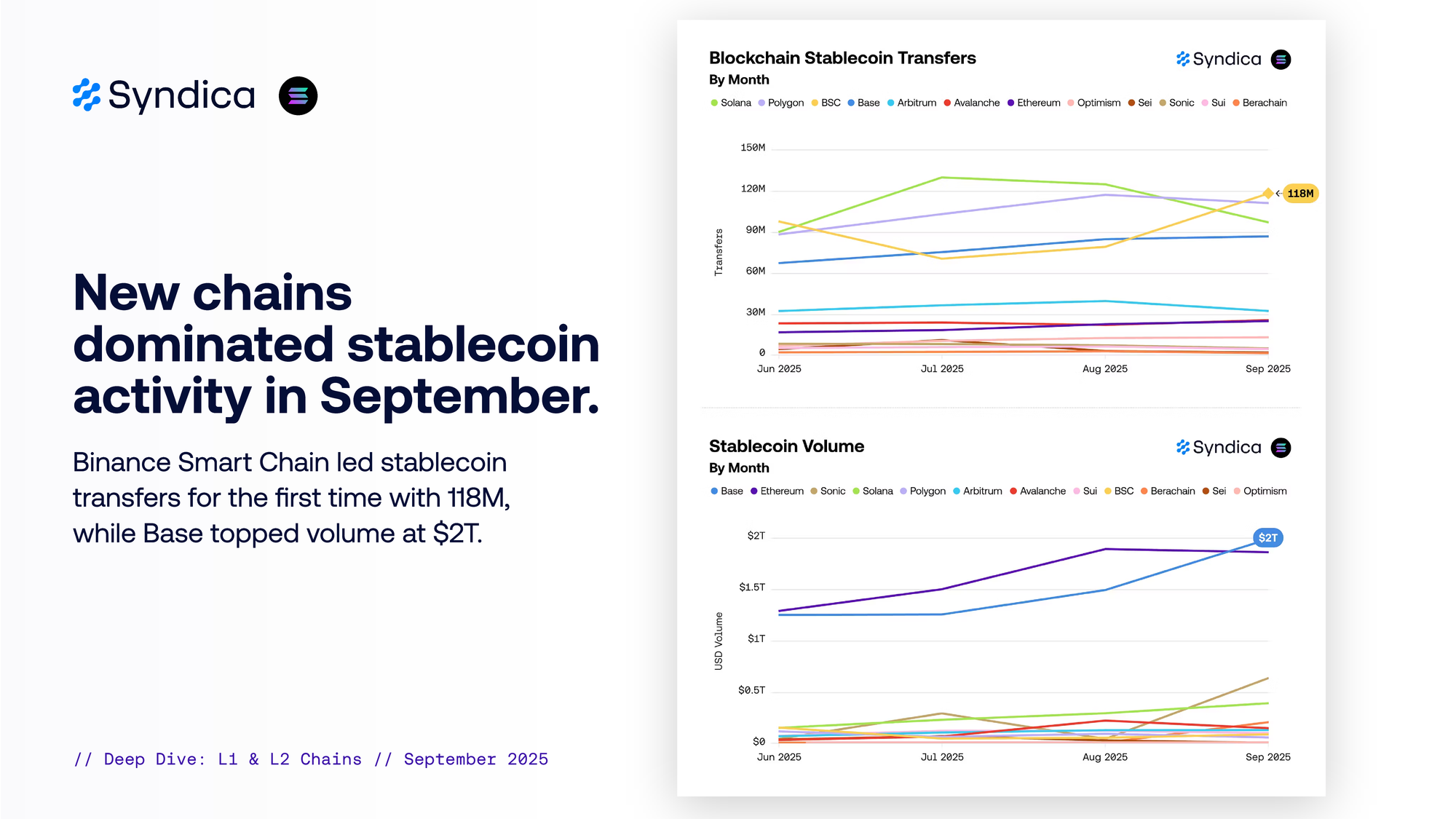

Different chains dominated stablecoin activity in September. Binance Smart Chain led stablecoin transfers for the first time with 118M, while Base topped volume at $2T.

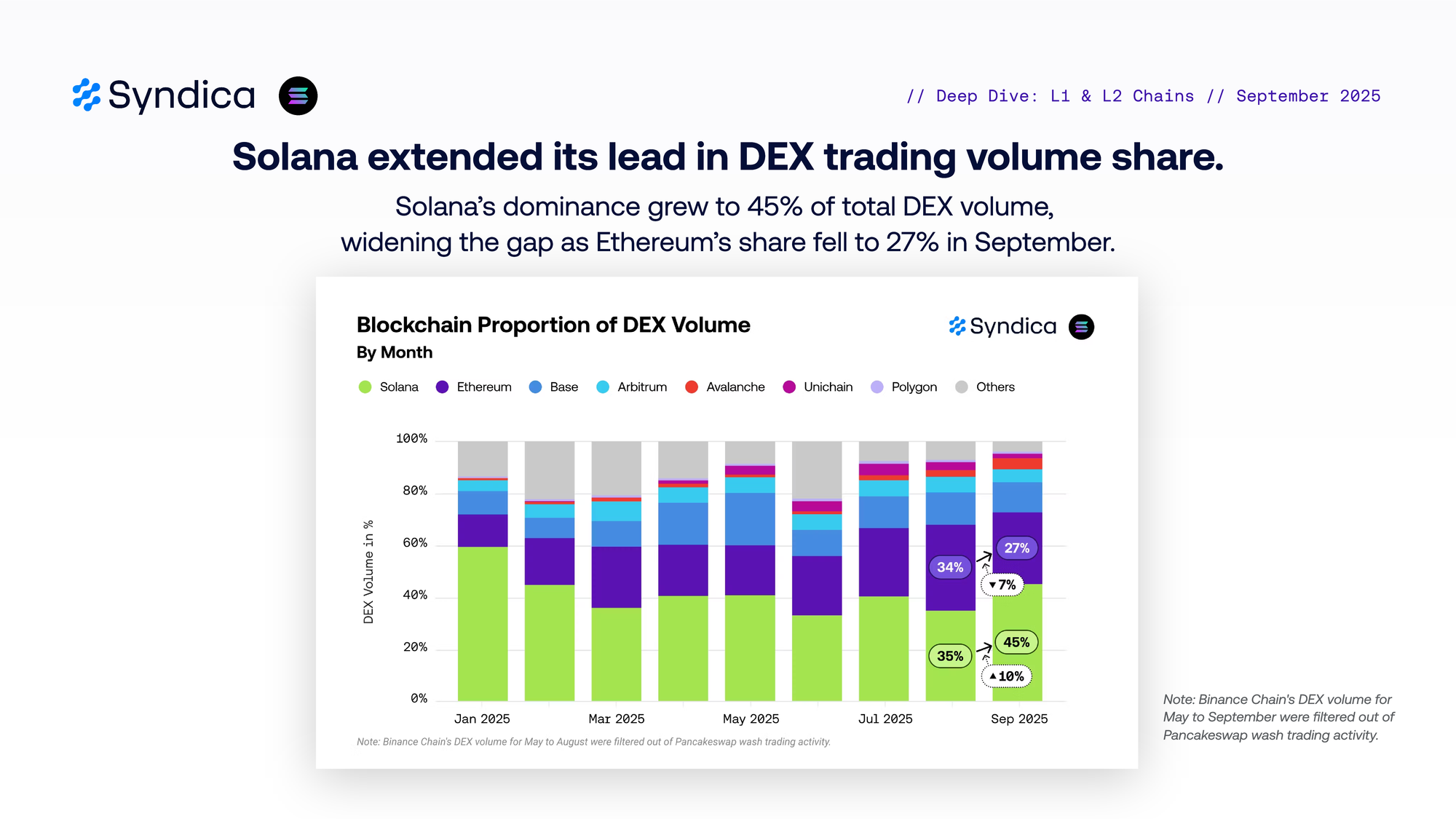

Solana extended its lead in DEX trading volume share. Solana’s dominance grew to 45% of total DEX volume, widening the gap as Ethereum’s share fell to 27% in September.

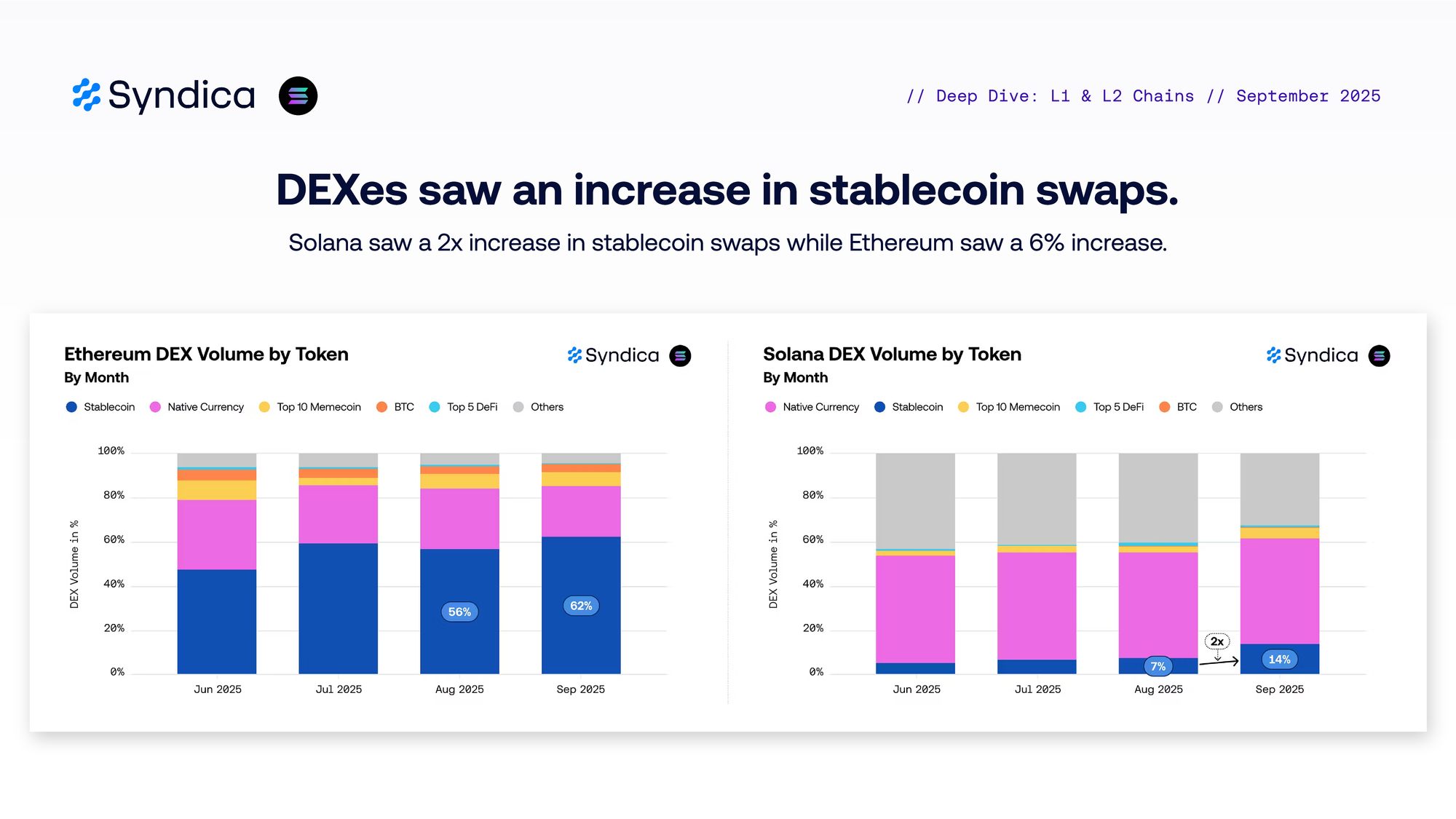

DEXes saw an increase in stablecoin swaps. Solana saw a 2x increase in stablecoin swaps while Ethereum saw a 6% increase.

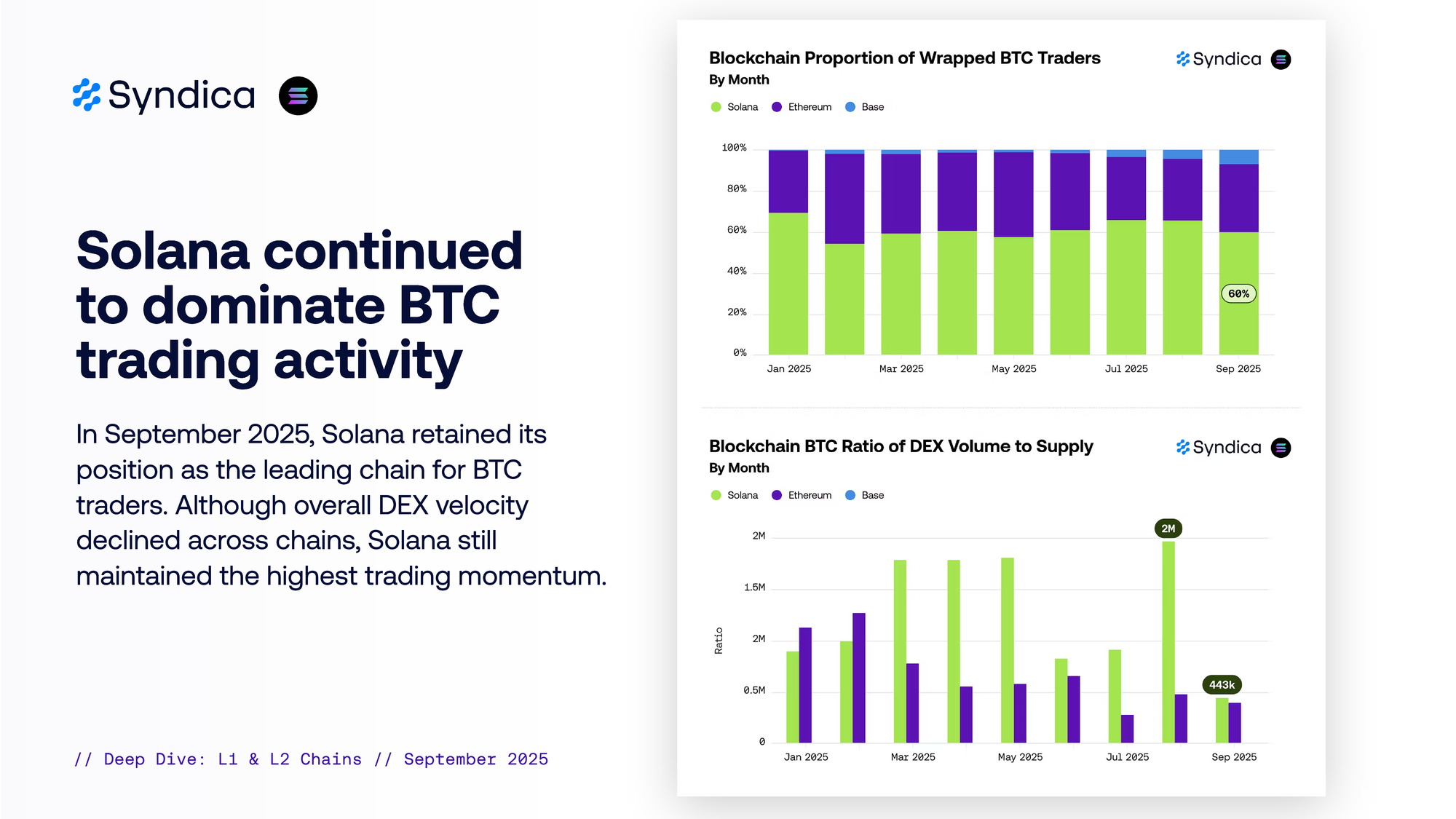

Solana continued to dominate BTC trading activity. In September 2025, Solana retained its position as the leading chain for BTC traders. Although overall DEX velocity declined across chains, Solana still maintained the highest trading momentum.

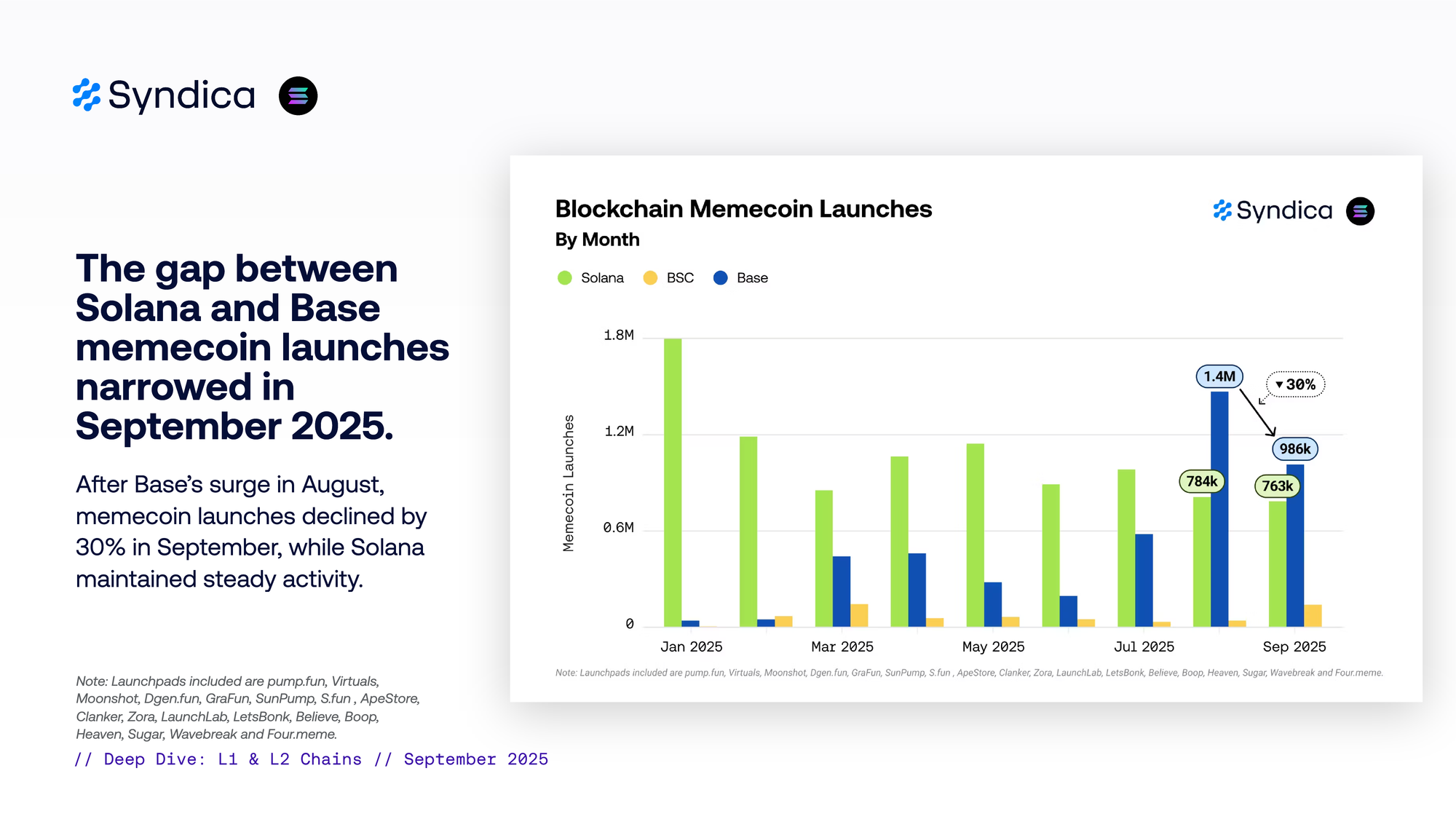

The gap between Solana and Base memecoin launches narrowed in September 2025. After Base’s surge in August, memecoin launches declined by 30% in September, while Solana maintained steady activity.

Solana reinforced its dominance as the leading hub for memecoin liquidity. Solana hosted over 998x more memecoins with at least $10k in trading volume than Base, and 420x more than BSC in September 2025.

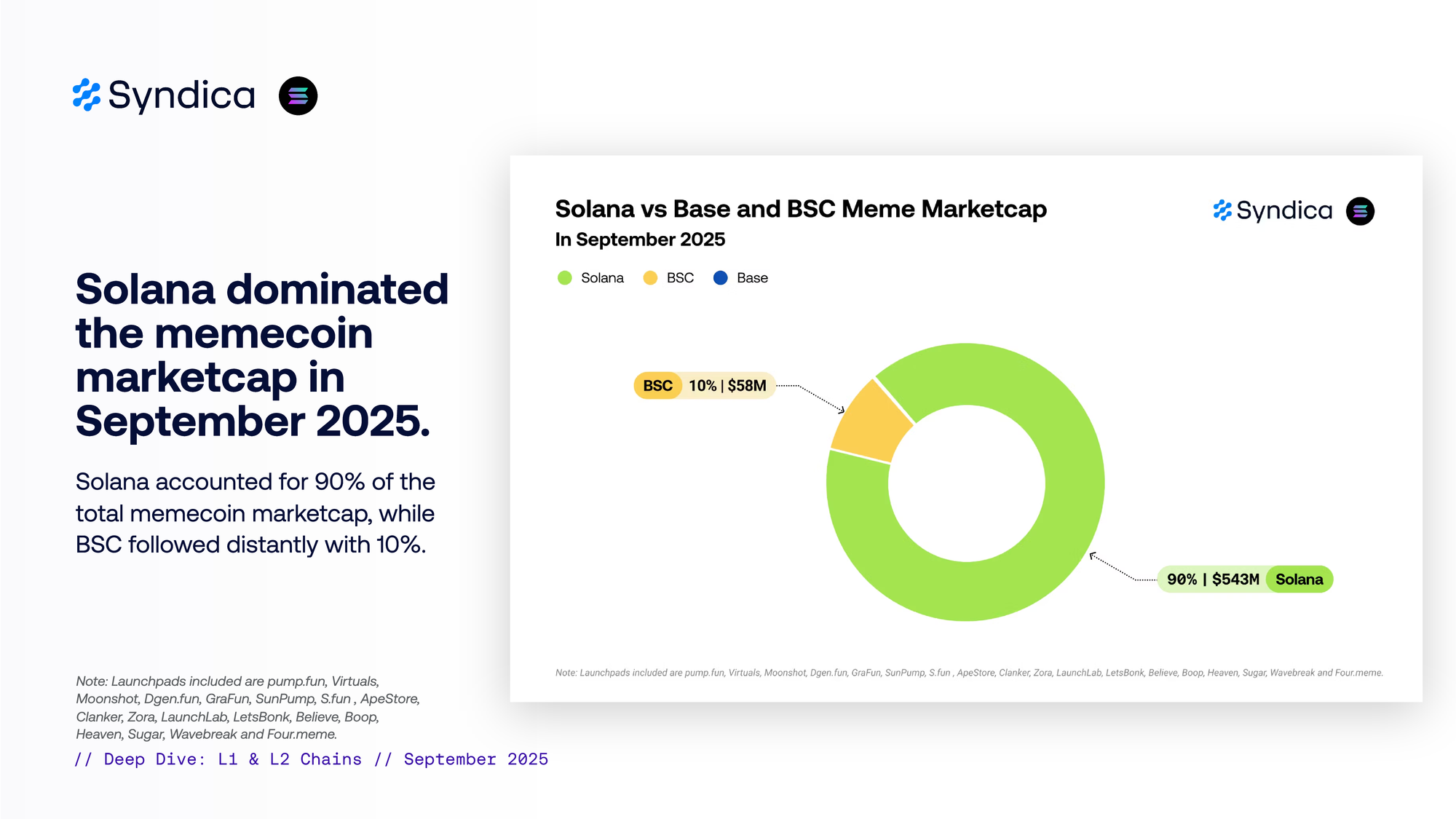

Solana dominated the memecoin marketcap in September 2025. Solana accounted for 90% of the total memecoin marketcap, while BSC followed distantly with 10%.

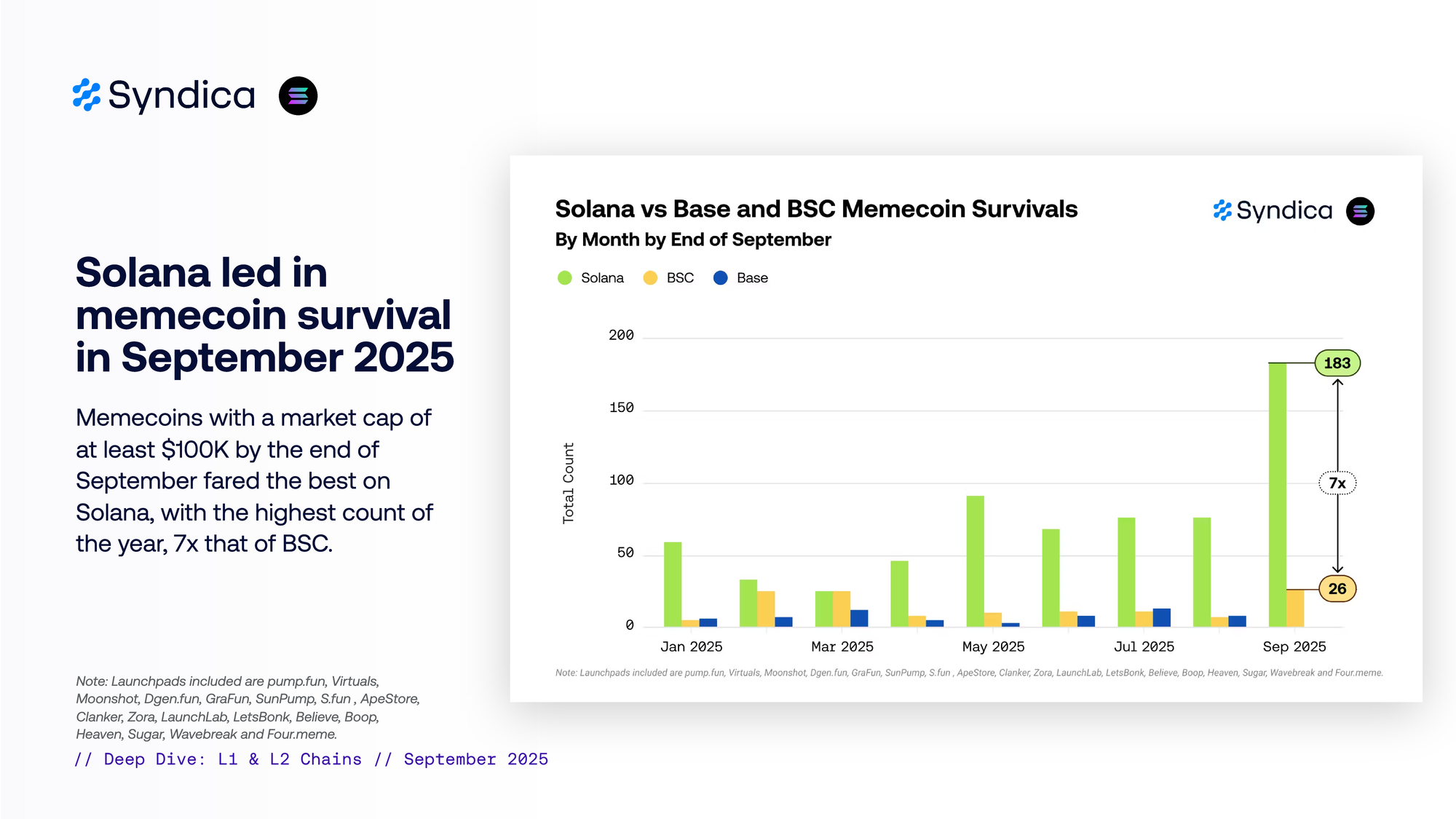

Solana led in memecoin survival in September 2025. Memecoins with a market cap of at least $100K by the end of September fared the best on Solana, with the highest count of the year, 7x that of BSC.

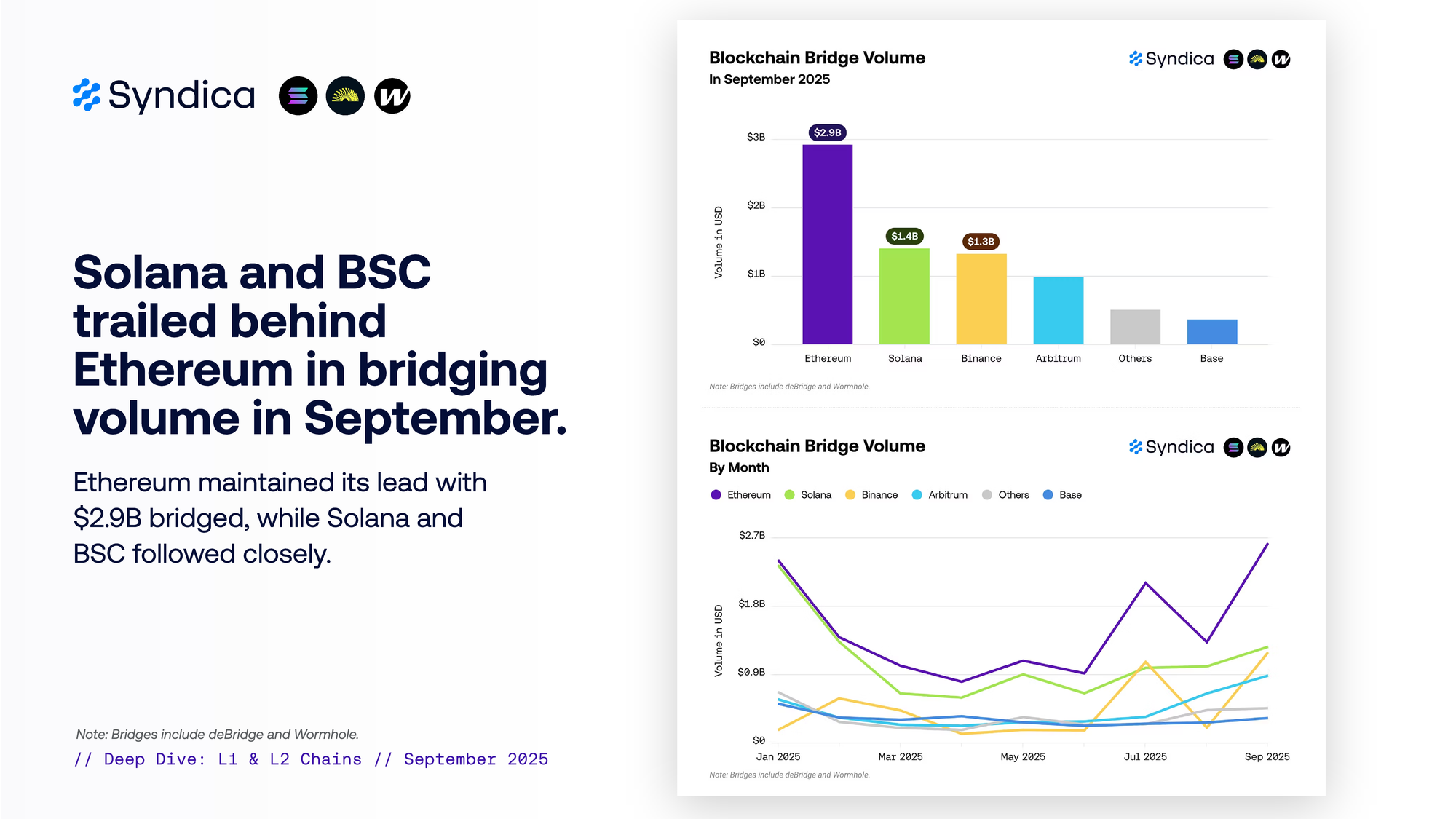

Solana and BSC trailed behind Ethereum in bridging volume in September. Ethereum maintained its lead with $2.9B bridged, while Solana and BSC followed closely.

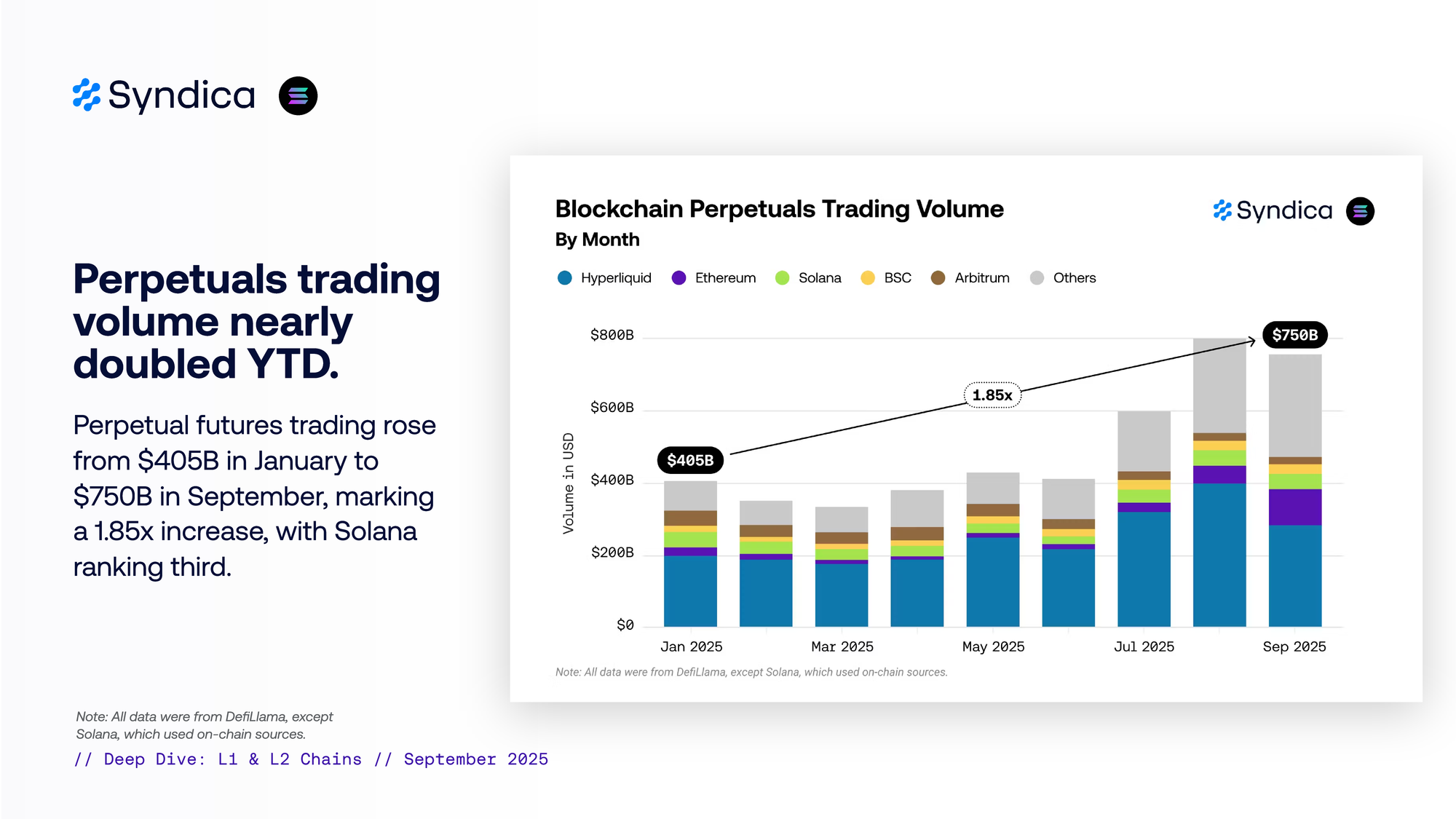

Perpetuals trading volume nearly doubled YTD. Perpetual futures trading rose from $405B in January to $750B in September, marking a 1.85x increase, with Solana ranking third.

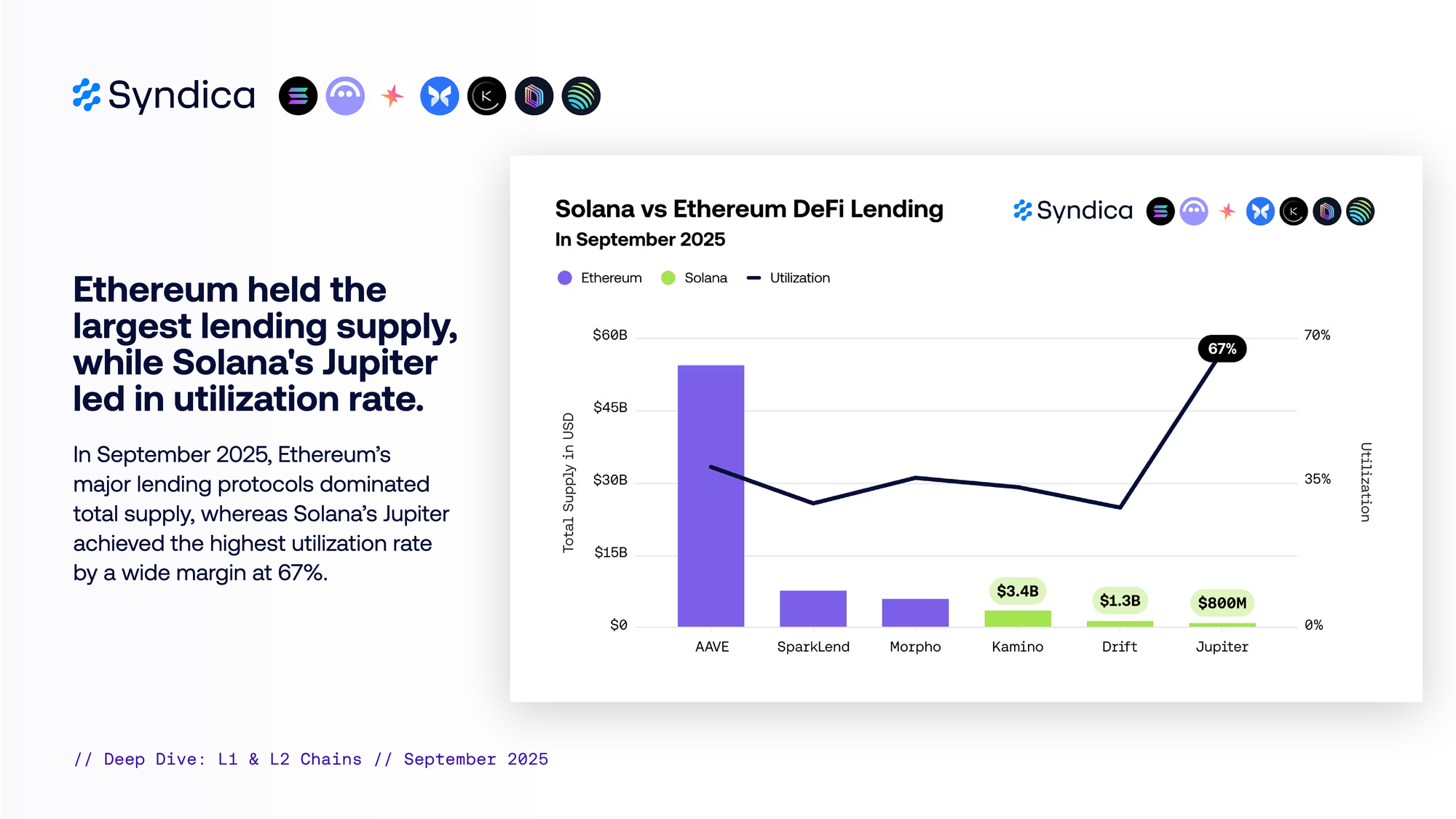

Ethereum held the largest lending supply, while Solana's Jupiter led in utilization rate. In September 2025, Ethereum’s major lending protocols dominated total supply, whereas Solana’s Jupiter achieved the highest utilization rate by a wide margin at 67%.