Solana NFT Market Report - December 2023

Solana NFT Market Report - December 2023

Note: Below is the text-accessible version of this post for visually impaired readers.

Syndica Solana NFT Market Report - December 2023

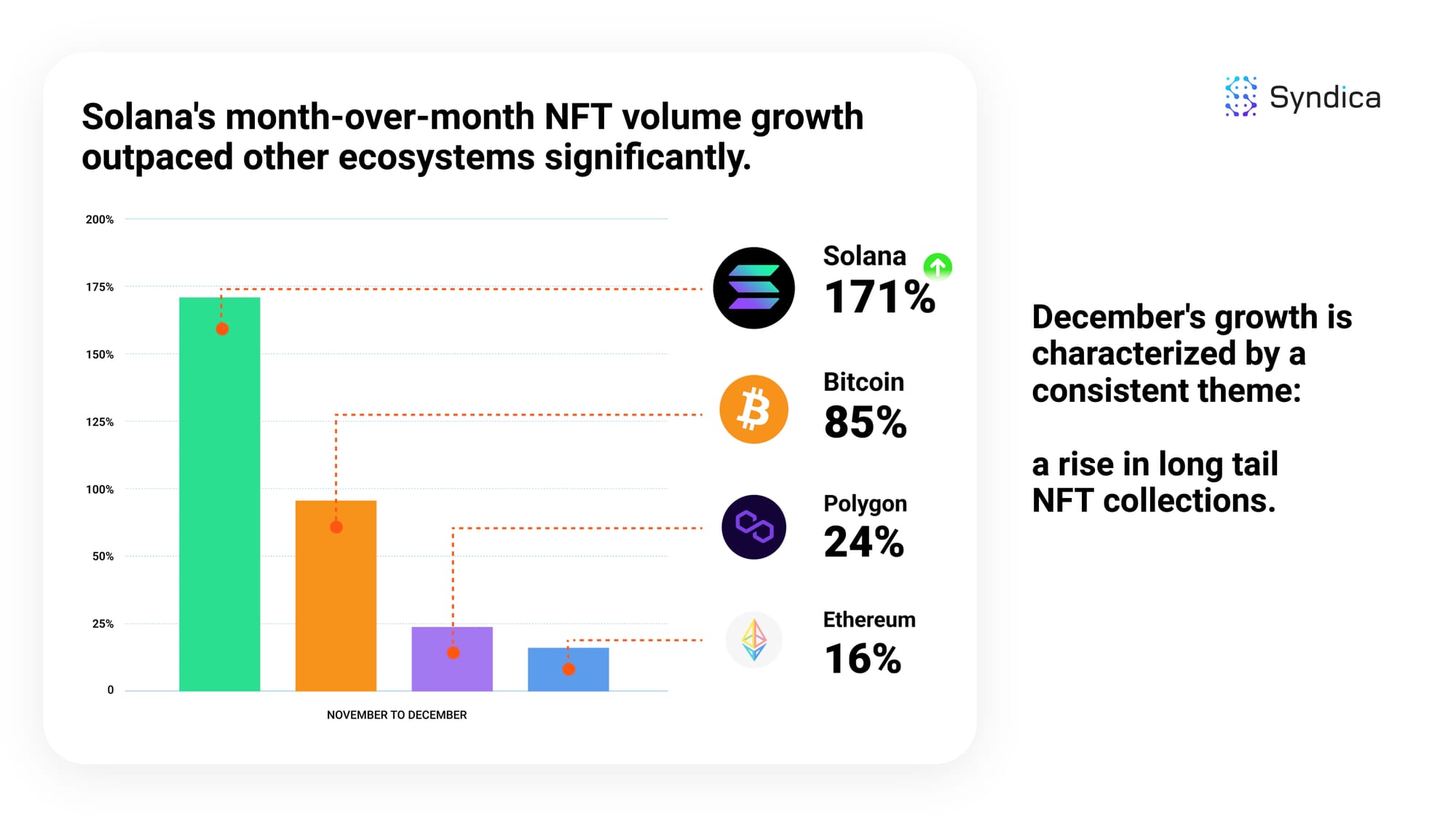

Solana's month-over-month NFT volume growth outpaced other ecosystems significantly.

December's growth is characterized by a consistent theme: a rise in long-tail NFT collections.

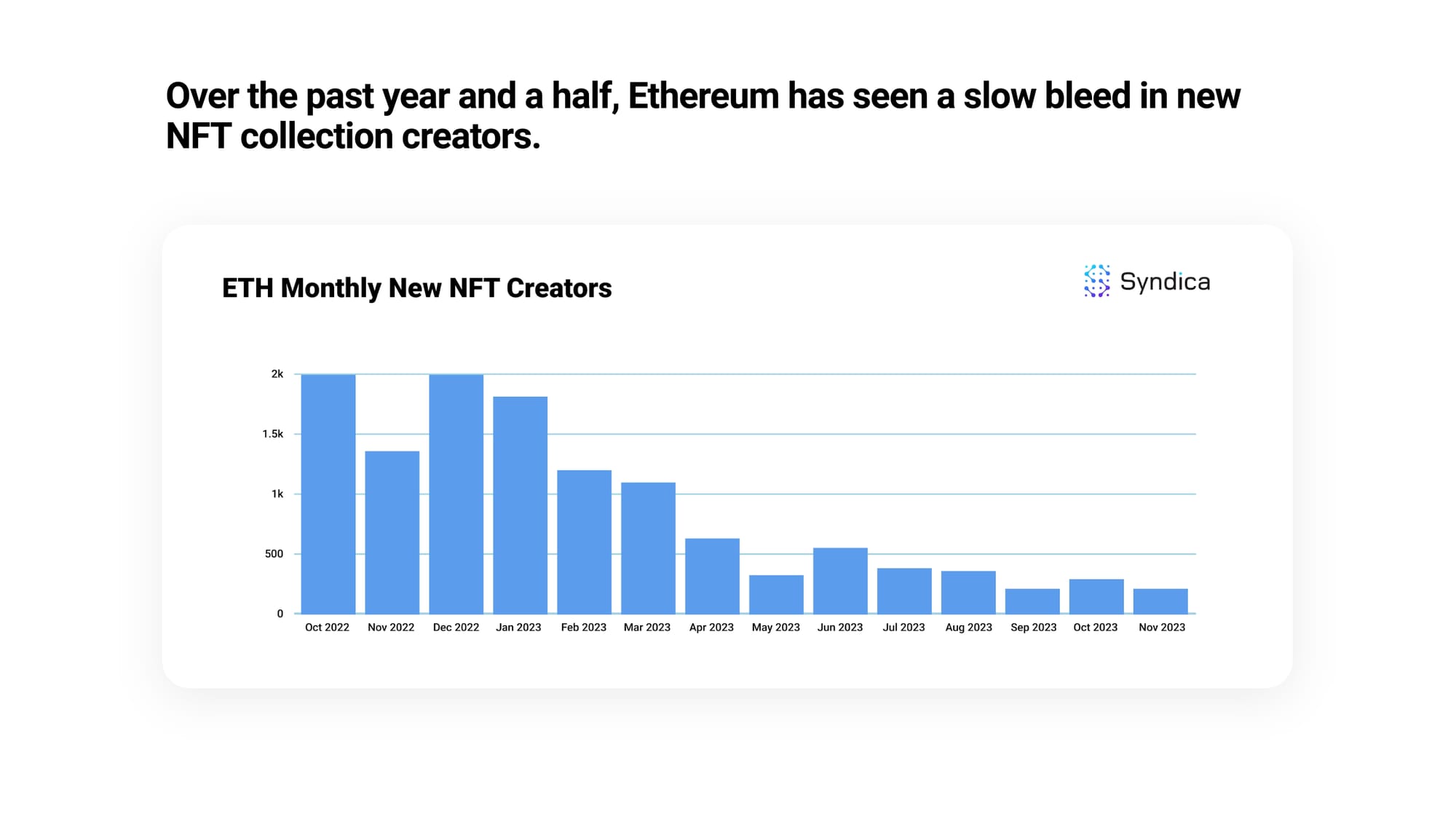

Over the past year and a half, Ethereum has seen a slow bleed in new NFT collection creators.

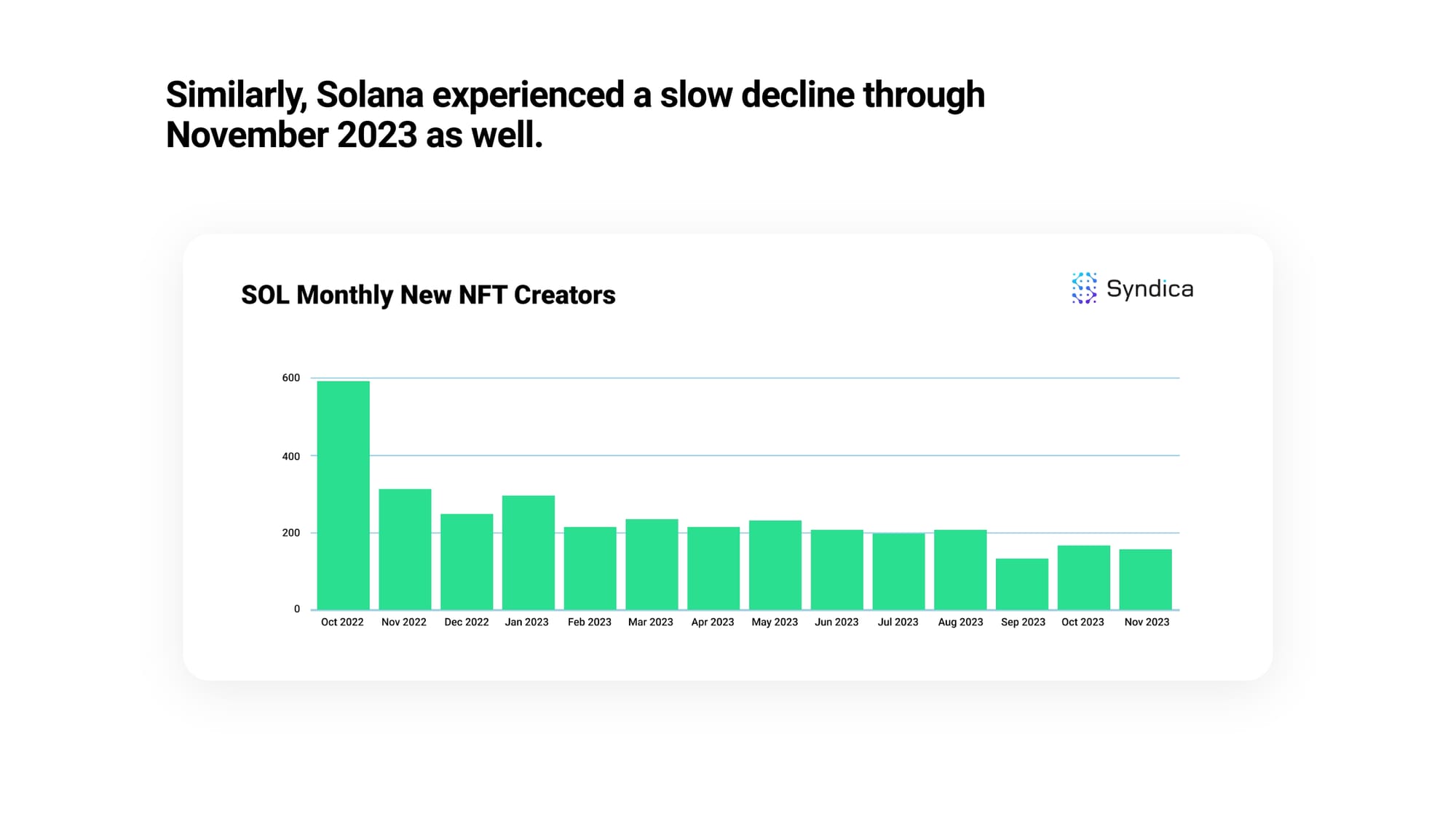

Similarly, Solana experienced a slow decline through November 2023 as well.

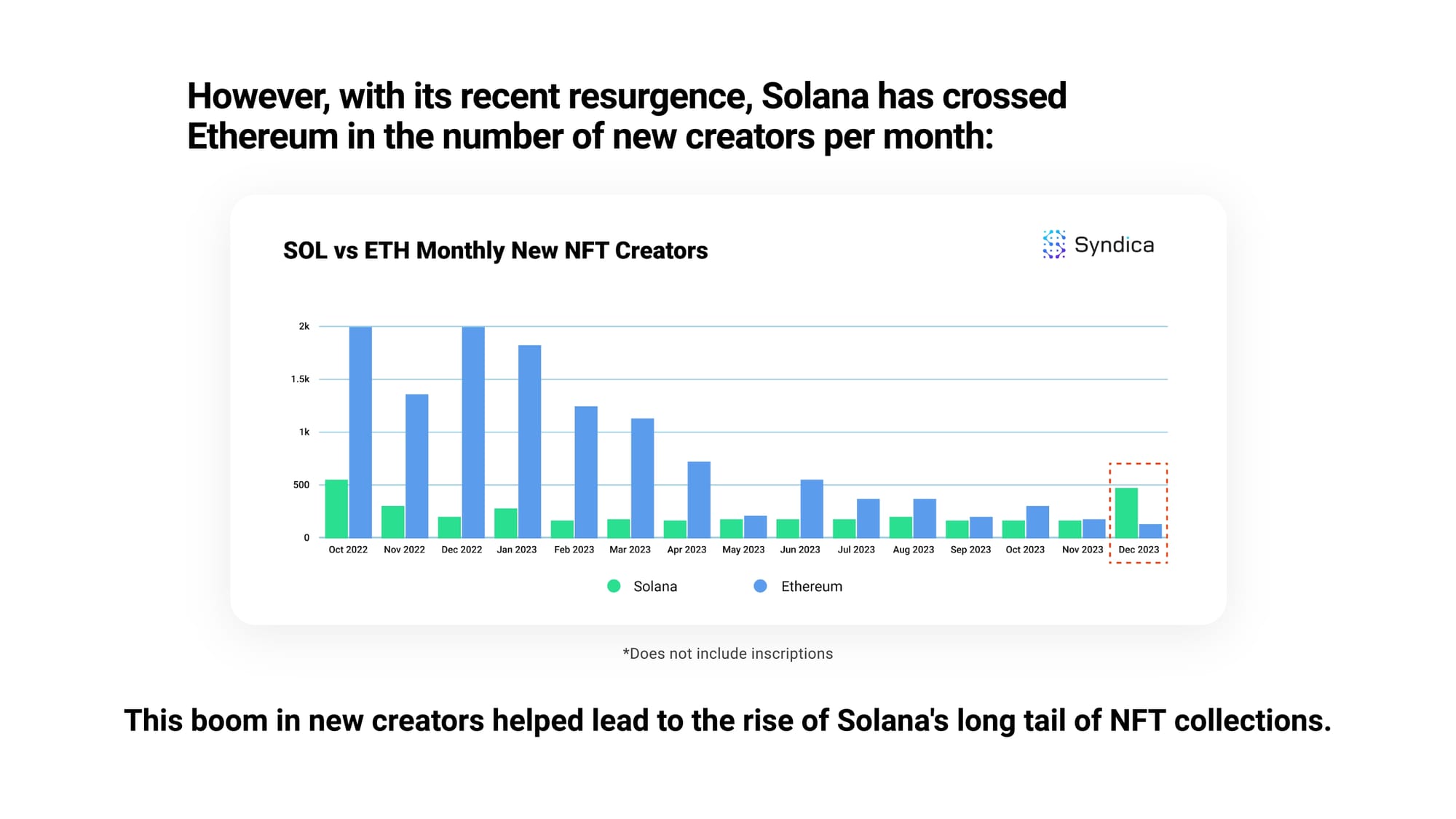

However, with its recent resurgence, Solana has crossed Ethereum in the number of new creators per month.

This boom in new creators helped lead to the rise of Solana's long tail of NFT collections.

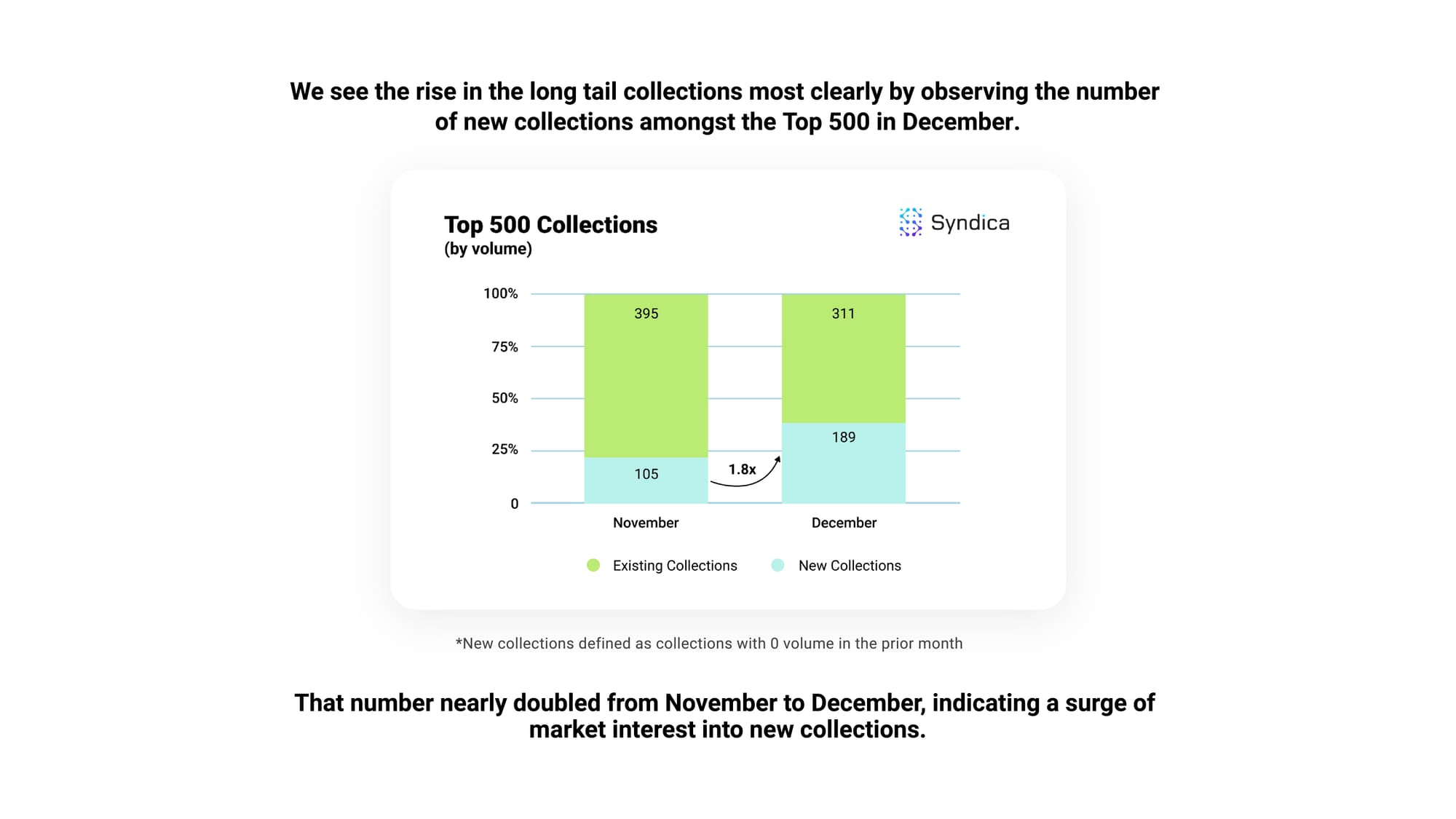

We see the rise in the long tail collections most clearly by observing the number of new collections amongst the Top 500 in December.

That number nearly doubled from November to December, indicating a surge of market interest into new collections.

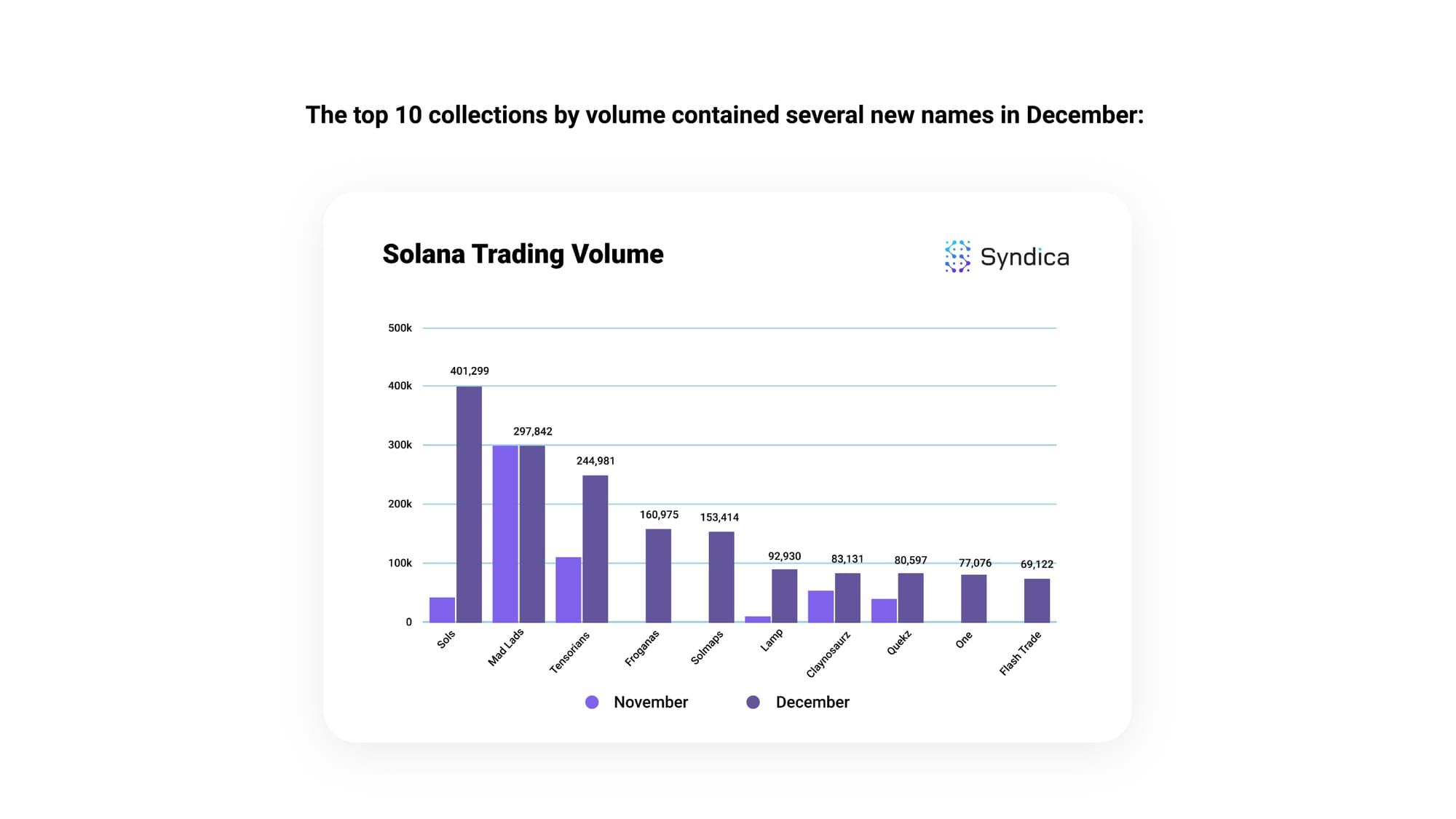

The top 10 collections by volume contained several new names in December.

Impressively, five of these top 10 collections by volume were newly launched collections: Froganas, Solmaps, Lamp, One, and Flash Trade.

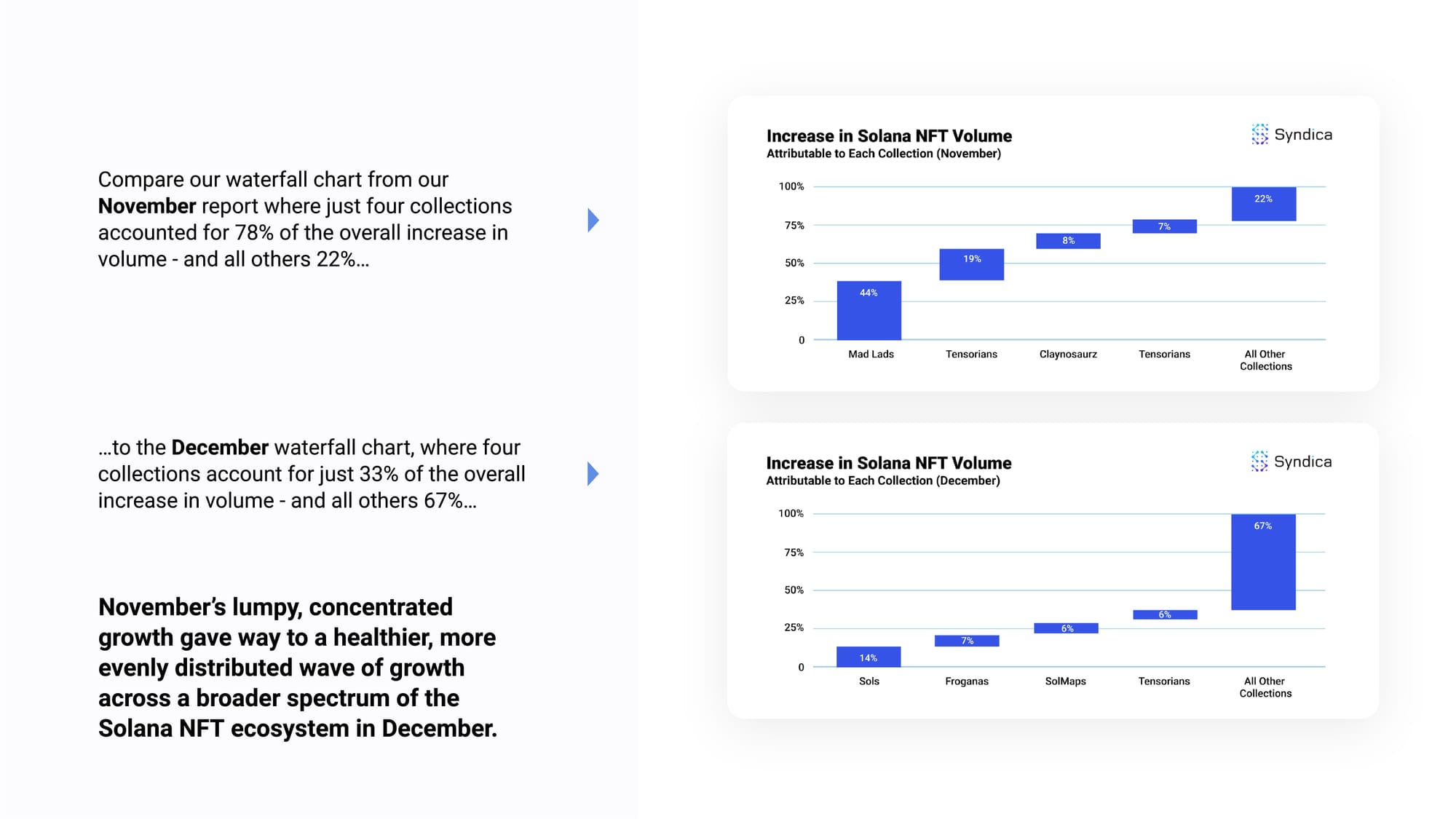

Compare our waterfall chart from our November report where just four collections accounted for 78% of the overall increase in volume - and all others 22%…… to the December waterfall chart, where four collections account for just 33% of the overall increase in volume - and all others 67%…

November’s lumpy, concentrated growth gave way to a healthier, more evenly distributed wave of growth across a broader spectrum of the Solana NFT ecosystem in December.

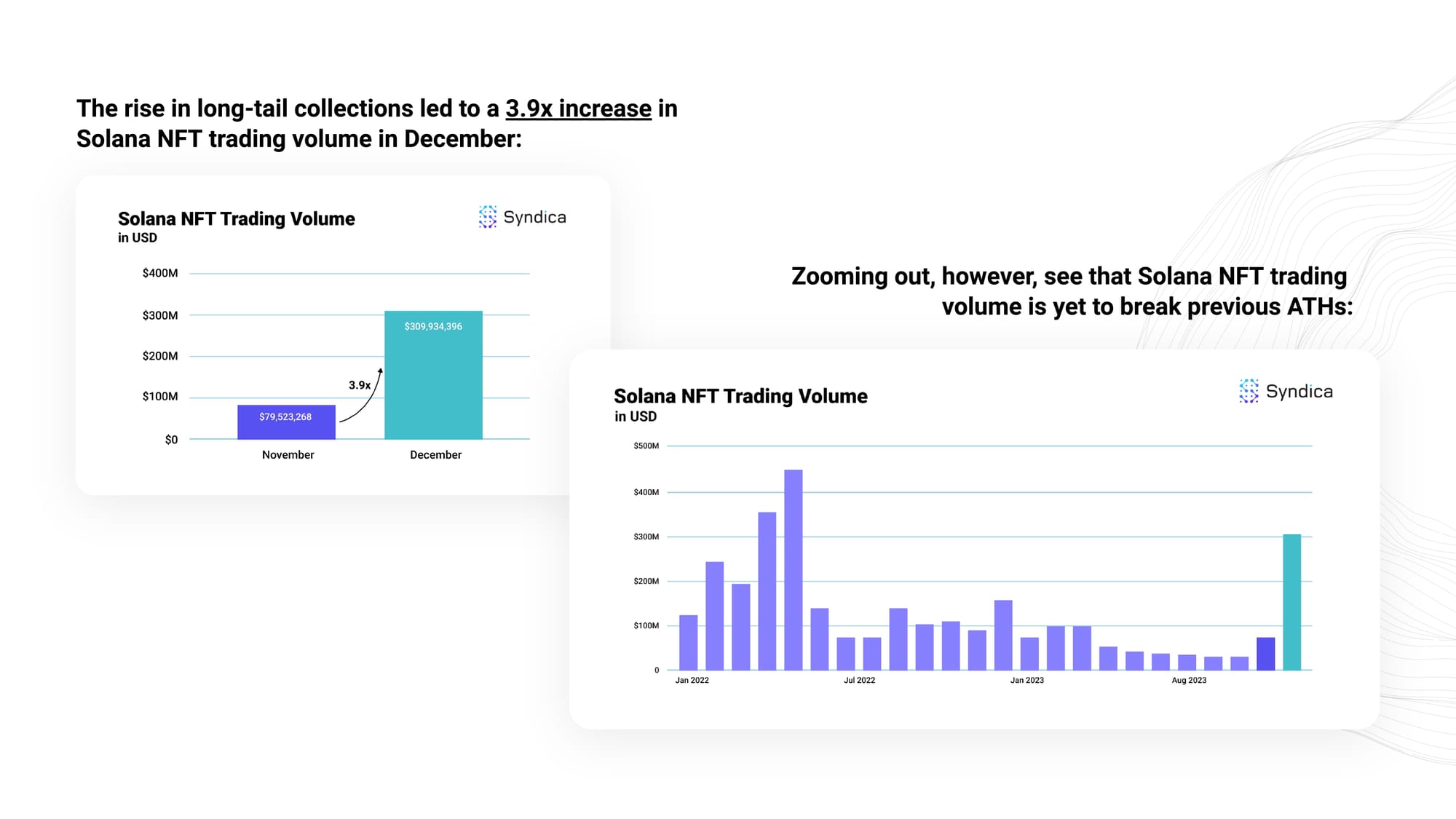

The rise in long-tail collections led to a 3.9x increase in Solana NFT trading volume in December.

Zooming out, however, I see that Solana NFT trading volume has yet to break previous ATHs.

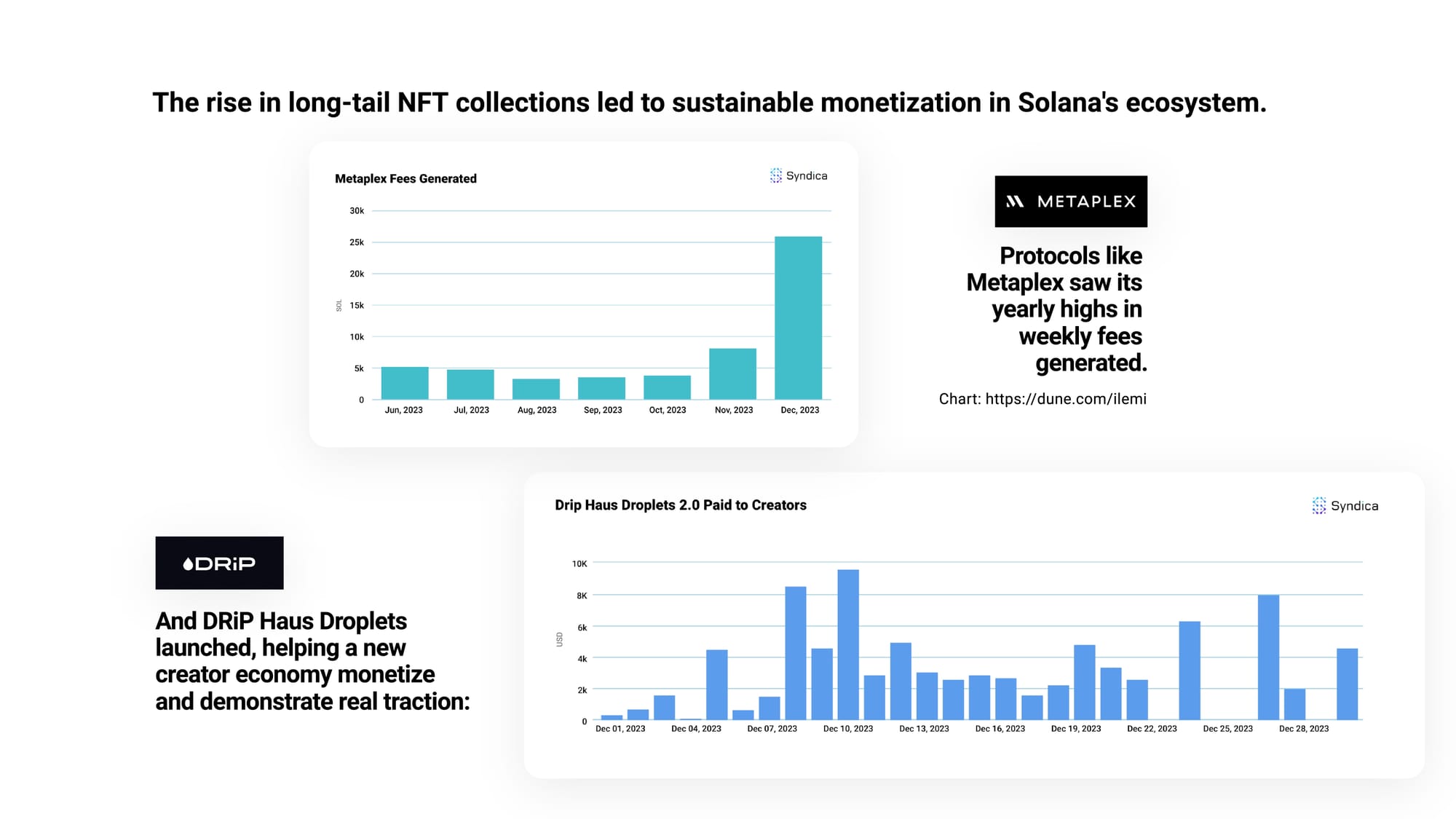

The rise in long-tail NFT collections led to sustainable monetization in Solana's ecosystem.

Protocols like Metaplex saw its yearly highs in weekly fees generated.

And DRiP Haus Droplets launched, helping a new creator economy monetize and demonstrate real traction.

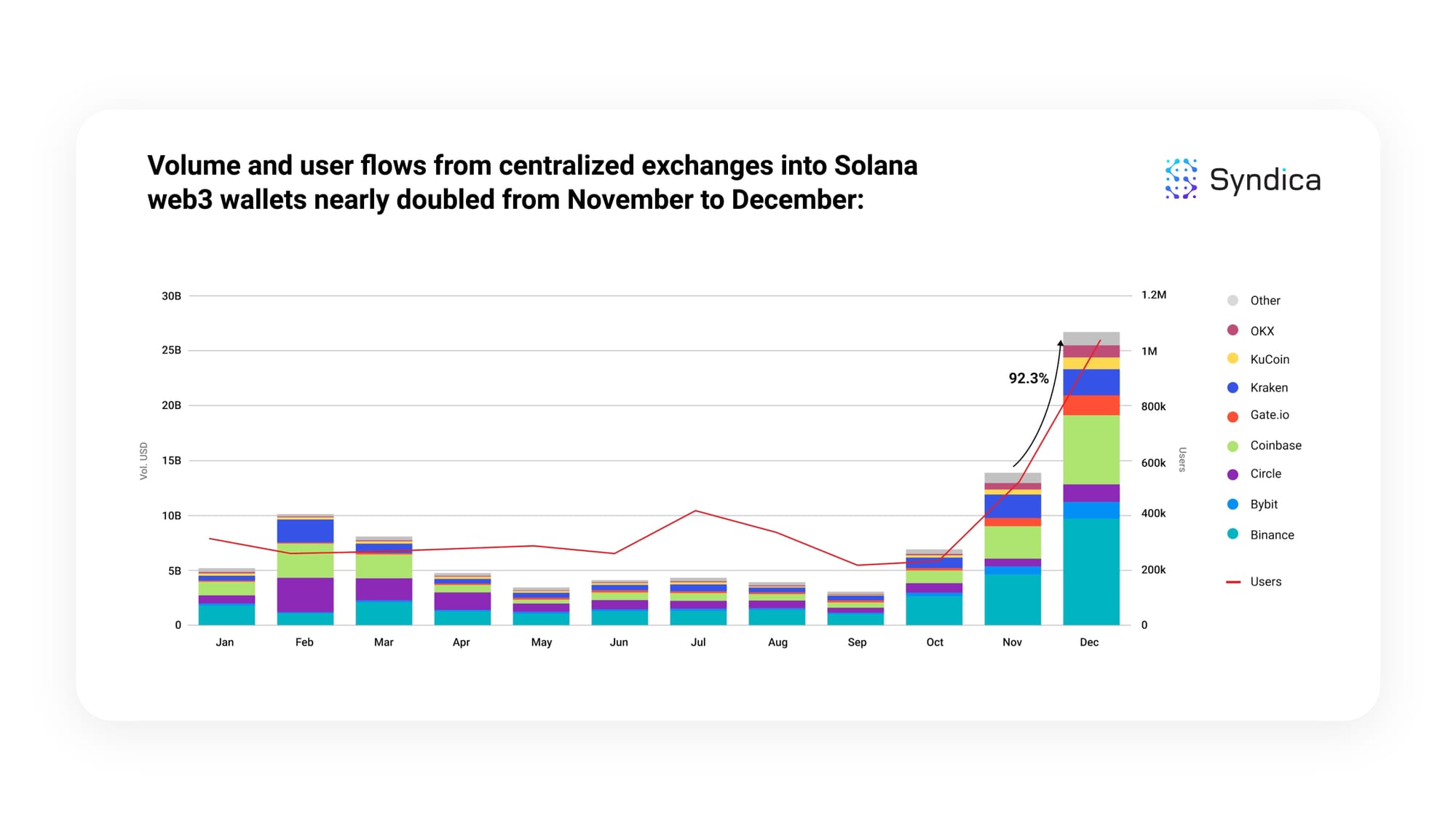

Volume and user flows from centralized exchanges into Solana web3 wallets nearly doubled from November to December.

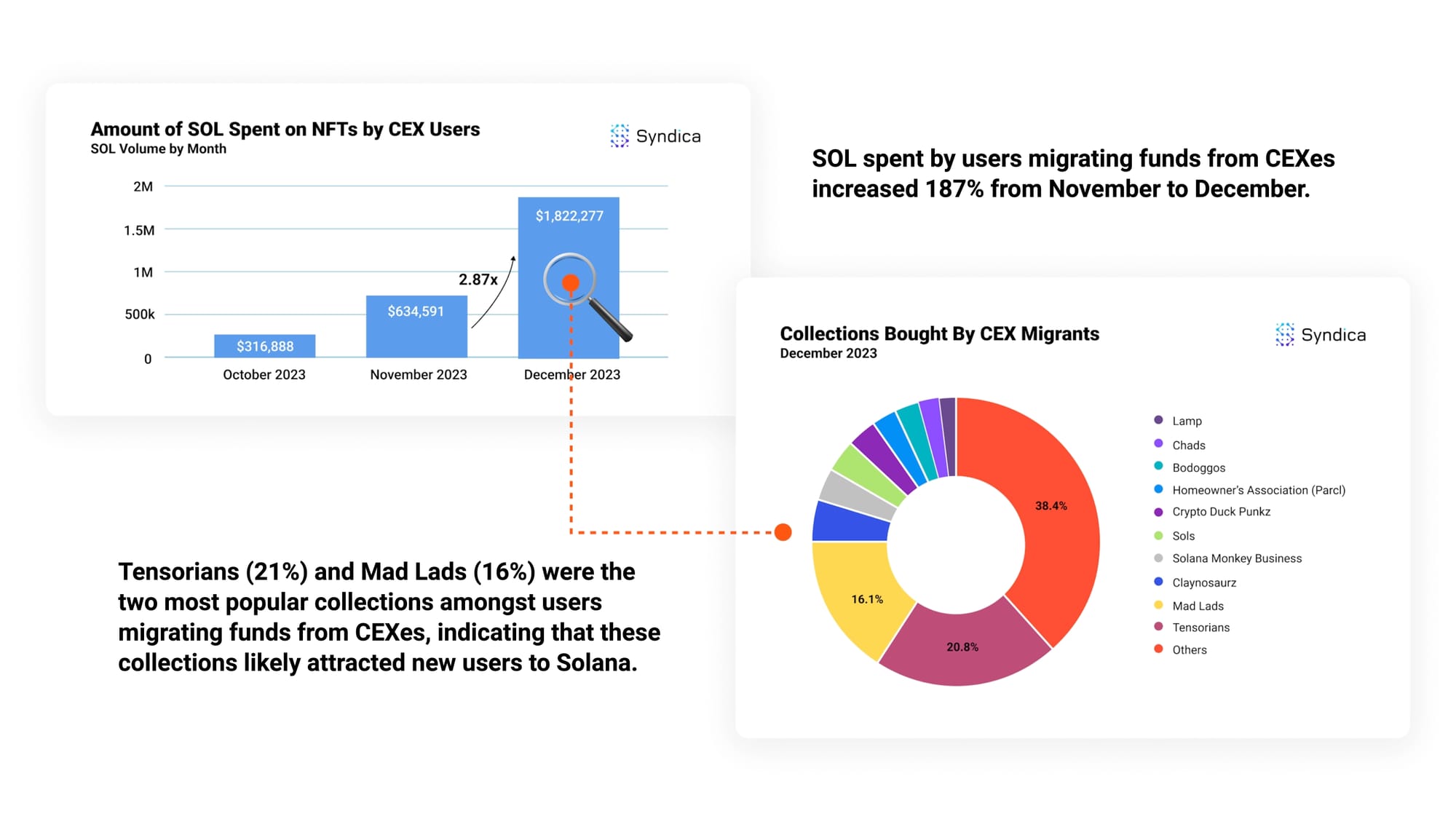

SOL spent by users migrating funds from CEXes increased 187% from November to December.

Tensorians (21%) and Mad Lads (16%) were the two most popular collections amongst users migrating funds from CEXes, indicating that these collections likely attracted new users to Solana.

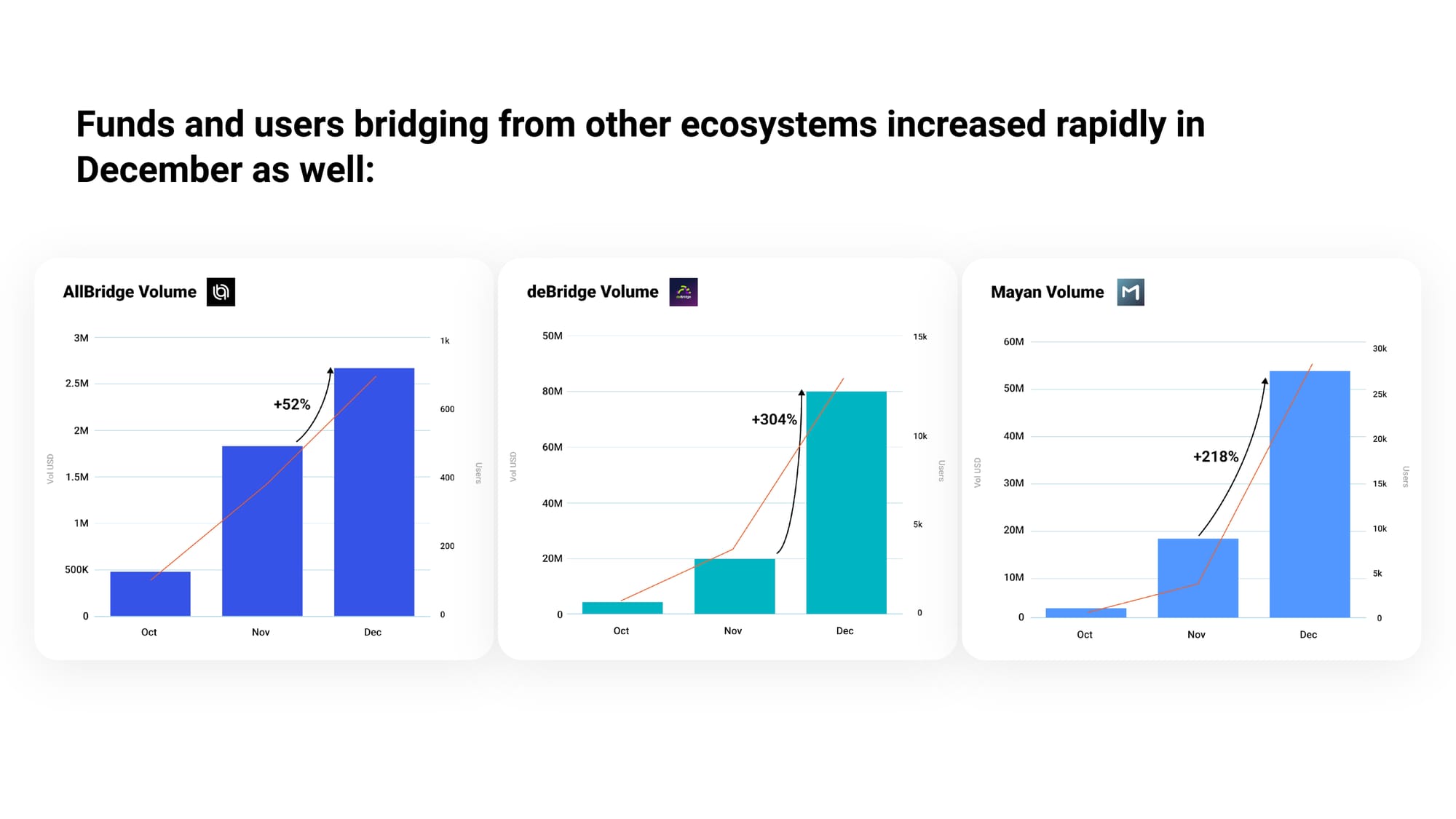

Funds and users bridging from other ecosystems increased rapidly in December as well.

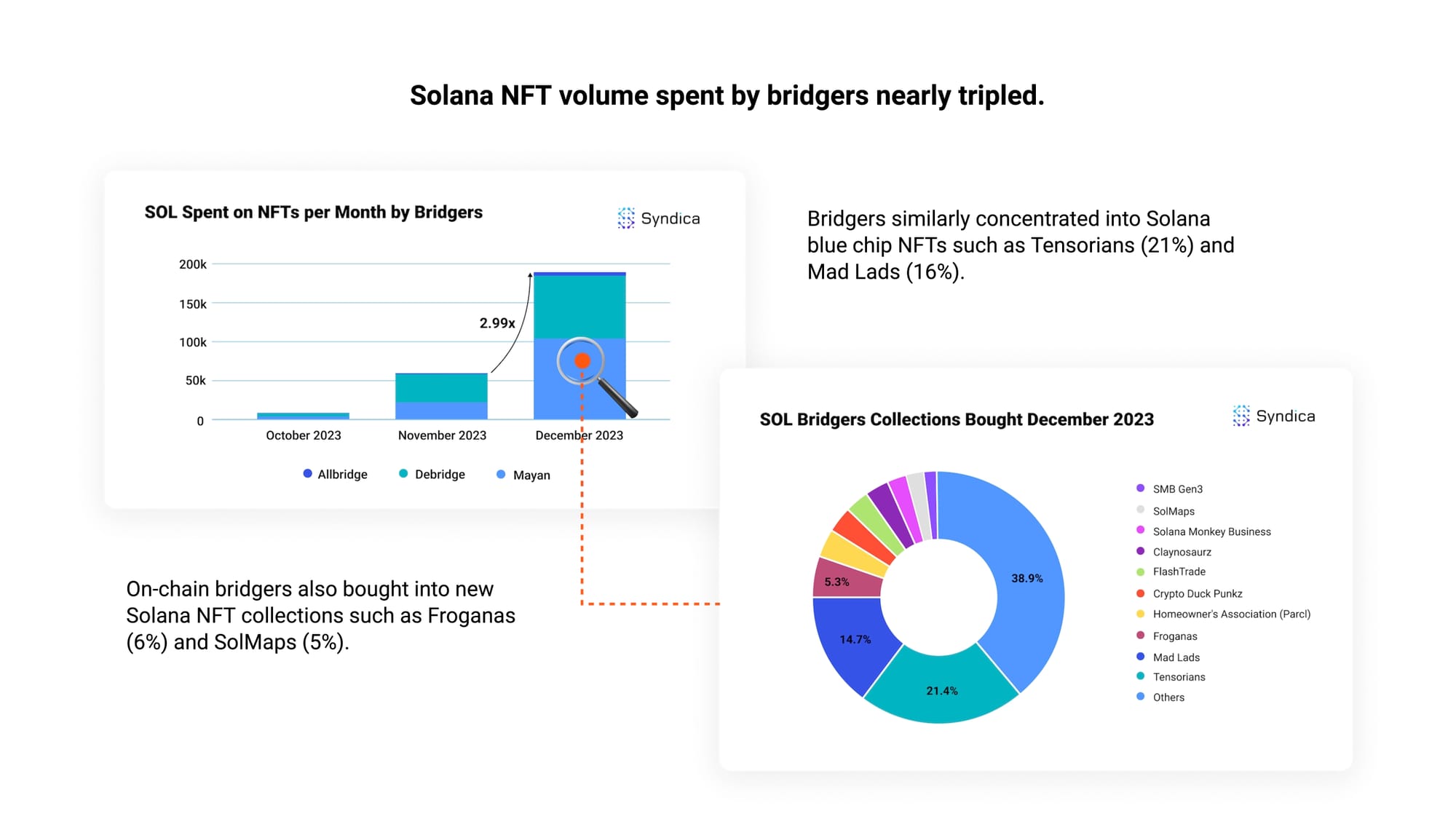

Solana NFT volume spent by bridgers nearly tripled.

Bridgers similarly concentrated into Solana blue chip NFTs such as Tensorians (21%) and Mad Lads (16%).

On-chain bridgers also bought into new Solana NFT collections such as Froganas (6%) and SolMaps (5%).

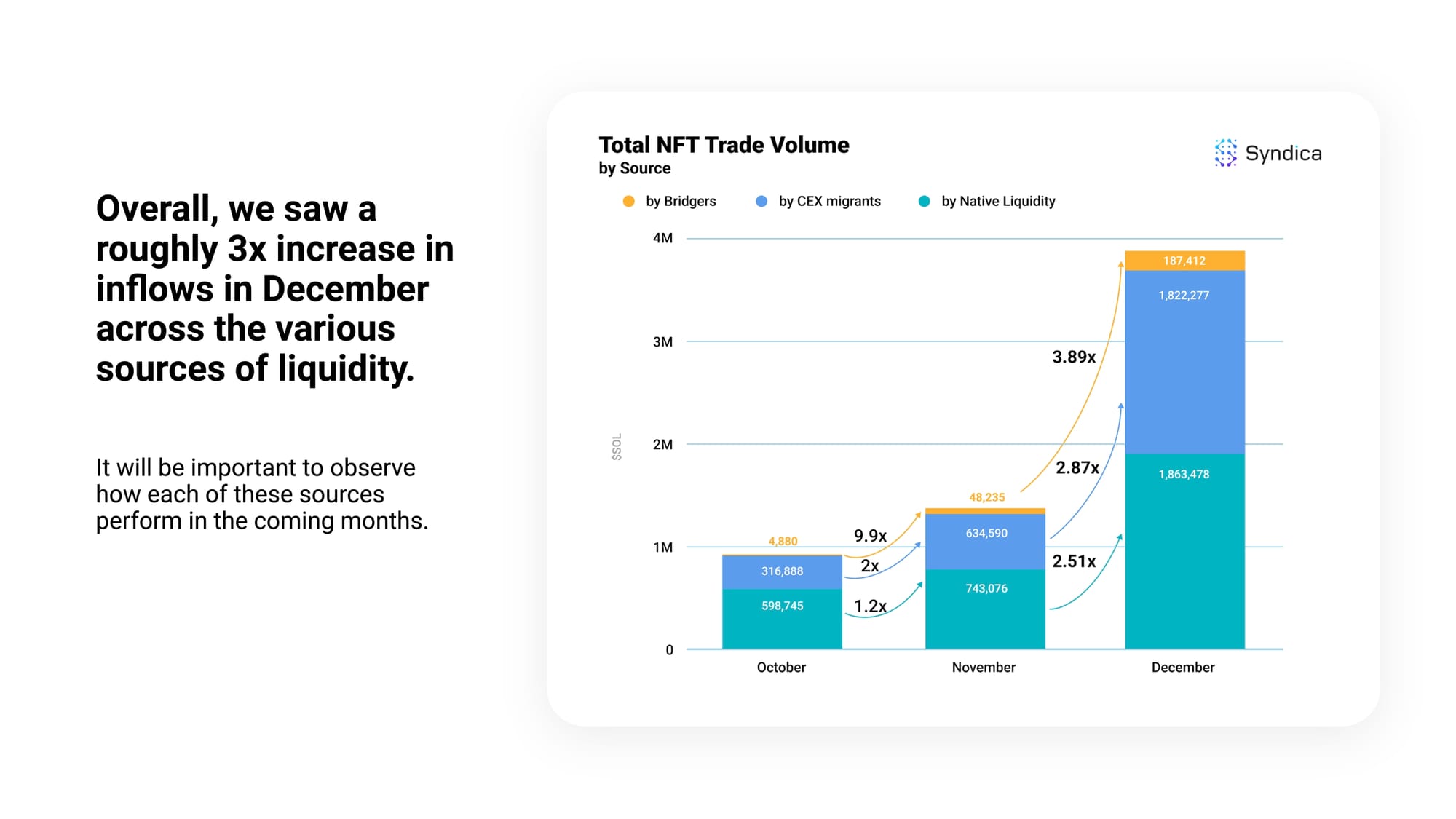

Overall, we saw a roughly 3x increase in inflows in December across the various sources of liquidity.

It will be important to observe how each of these sources perform in the coming months.

Our 3 Trends To Watch:

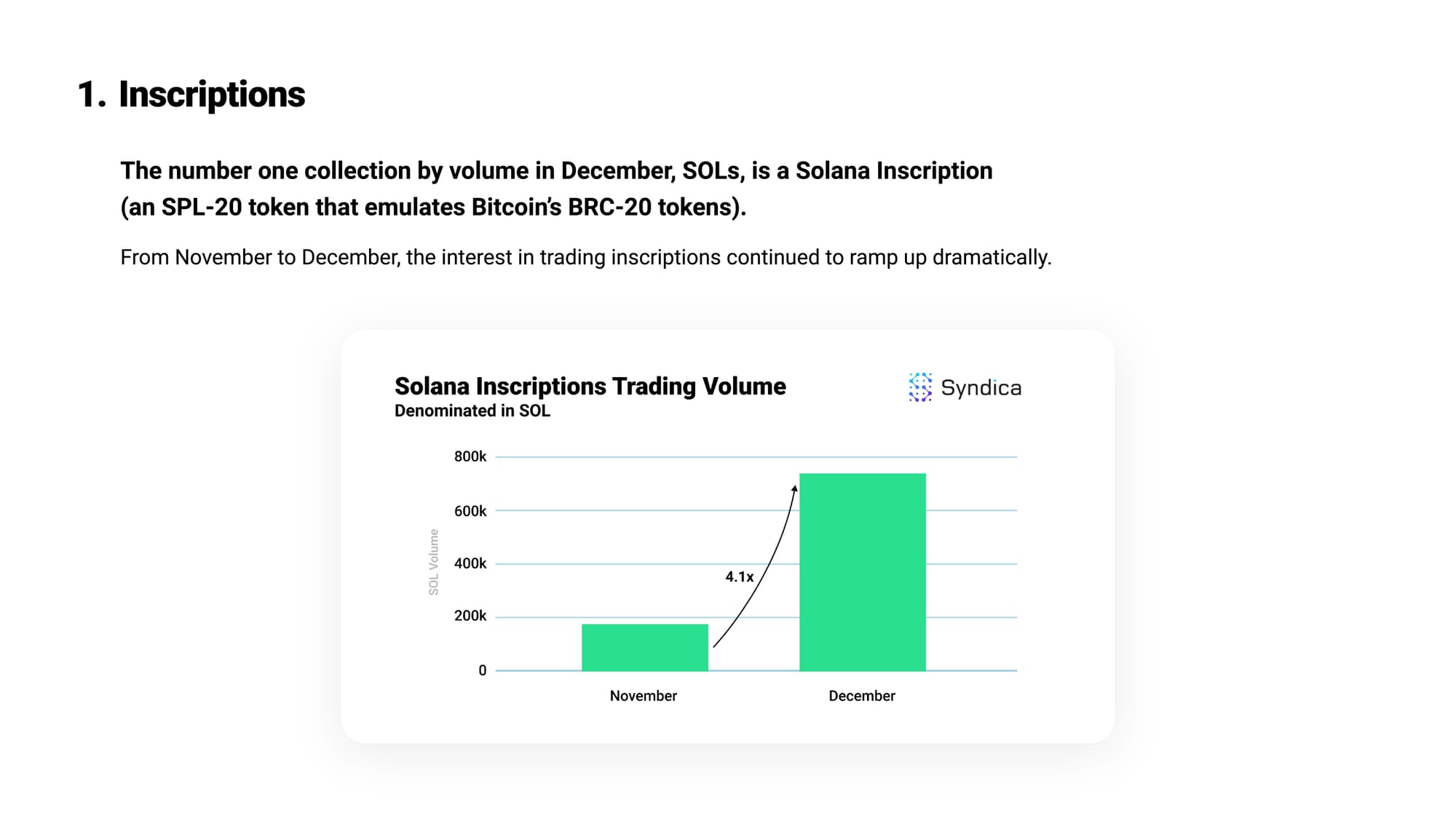

- Inscriptions

The number one collection by volume in December, SOLs, is a Solana Inscription (an SPL-20 token that emulates Bitcoin’s BRC-20 tokens). From November to December, the interest in trading inscriptions continued to ramp up dramatically.

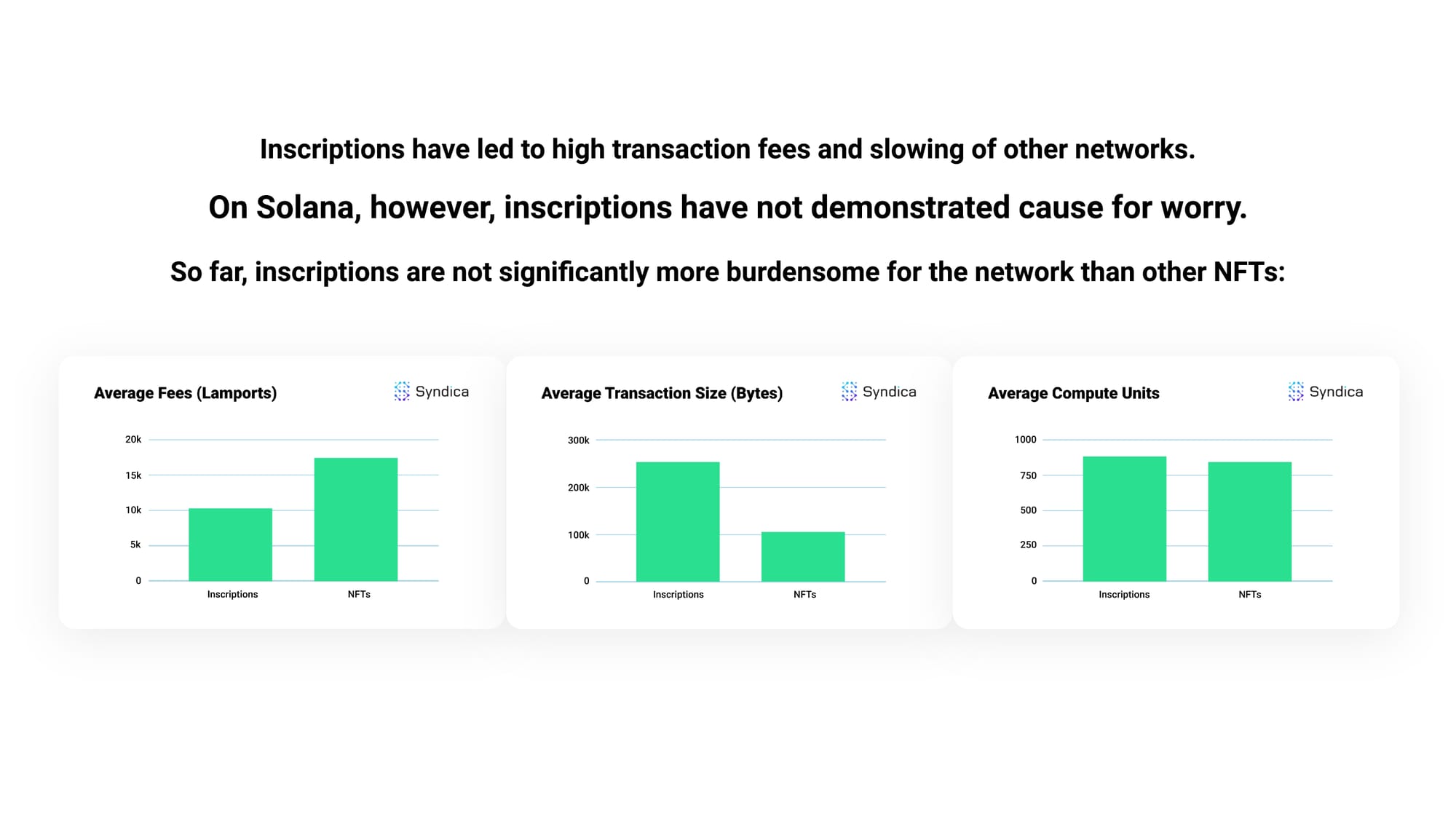

Inscriptions have led to high transaction fees and slowing of other networks. On Solana, however, inscriptions have not demonstrated cause for worry. So far, inscriptions are not significantly more burdensome for the network than other NFTs.

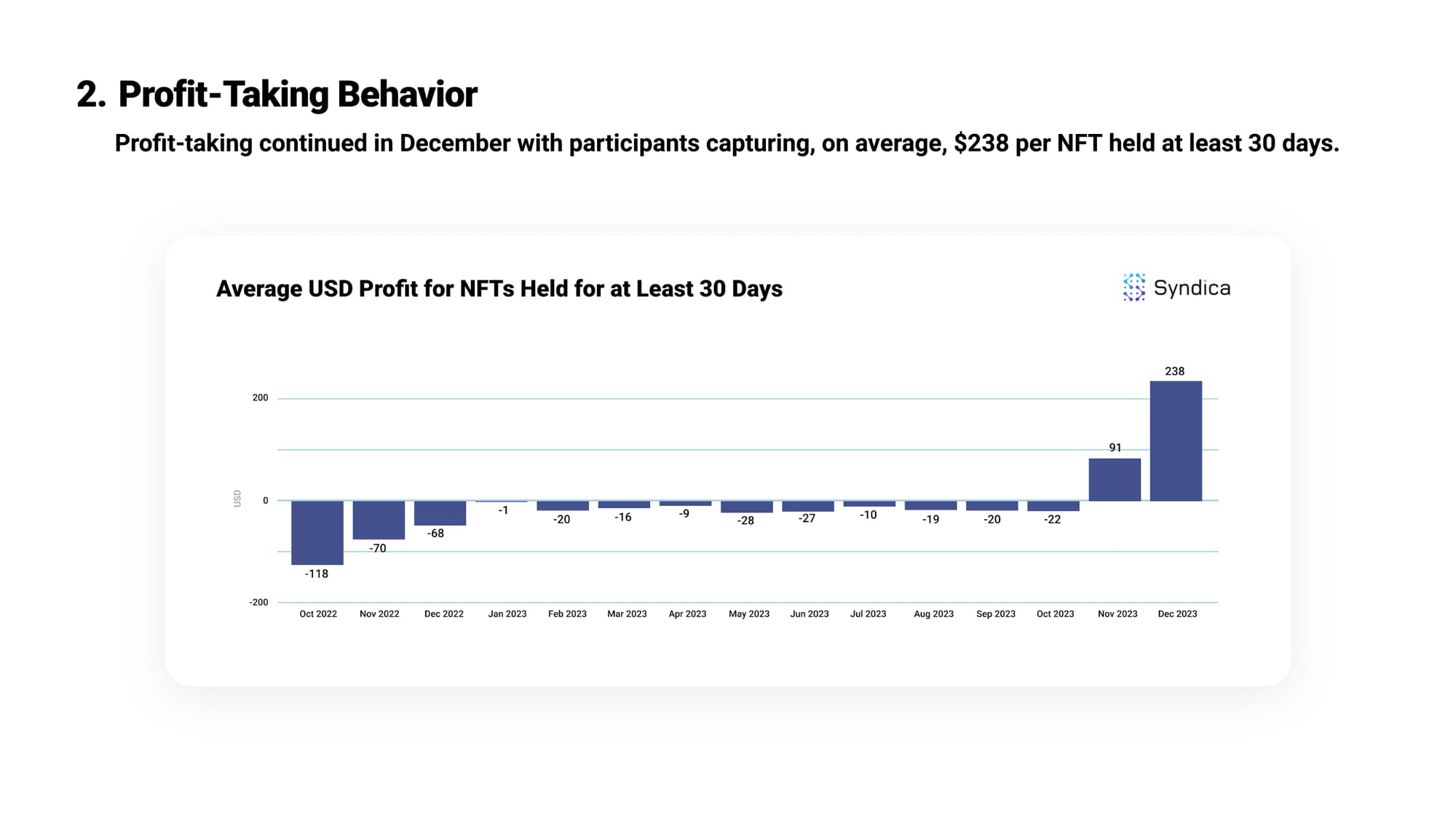

- Profit-Taking Behavior

Profit-taking continued in December with participants capturing, on average, $238 per NFT held at least 30 days.

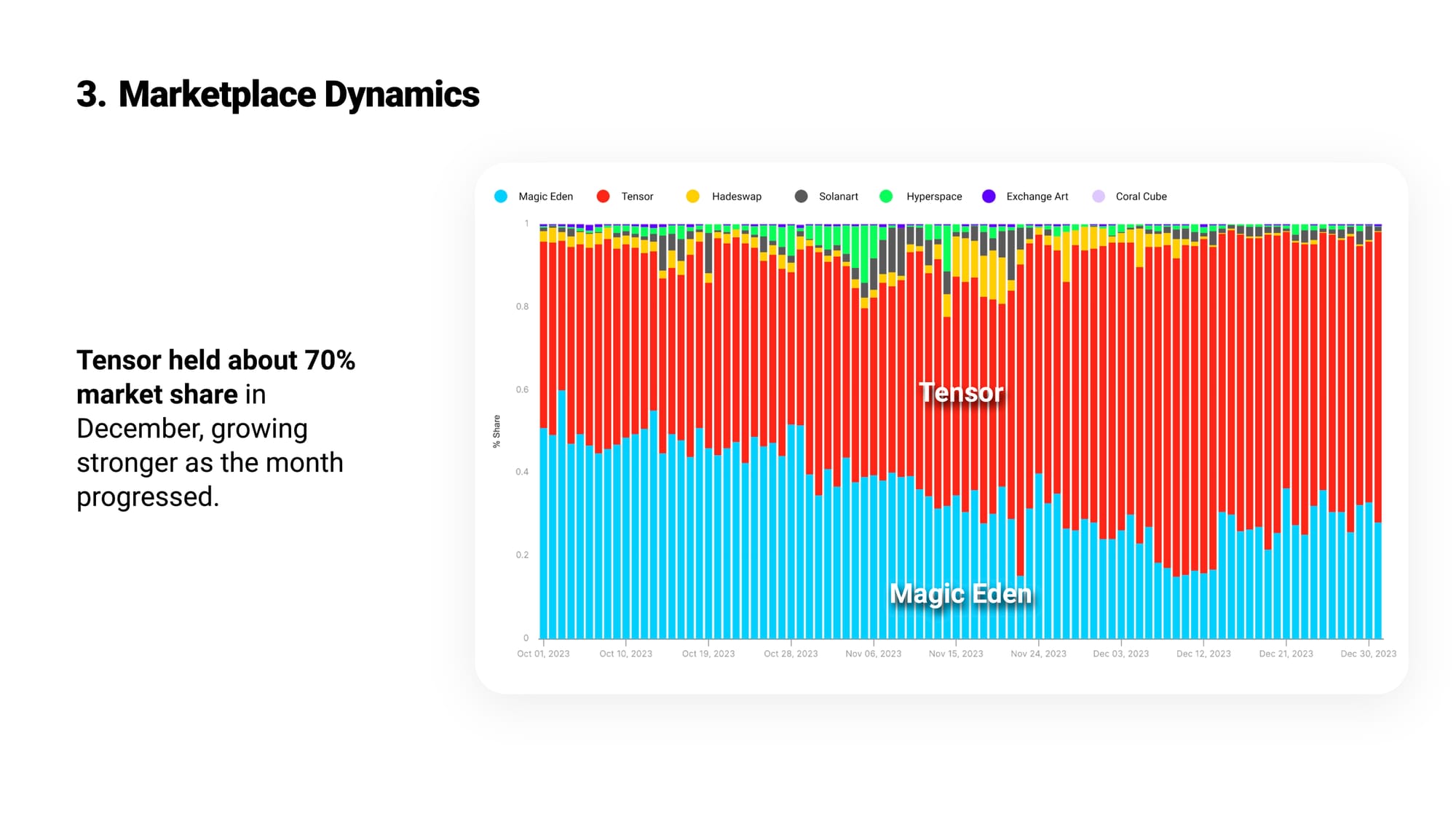

- Marketplace Dynamics

Tensor held about 70% market share in December, growing stronger as the month progressed. More market share in an increasingly large market led to a monster month for Tensor - its highest ever.