The Successful Implementation of Solana's Token-2022 Standard

The Token-2022 standard has garnered attention over the last couple of months as a vital new tool in the Solana program developer’s toolkit. The data shows that Token-2022’s new functionality can successfully incentivize holding. So far, we’ve had a few examples of popular tokens built on the Token-2022 standard. One of those was the widely distributed $BERN airdrop, which dropped BERN to over 50,000 wallets during the fourth week of May. BERN is one of the first case studies of how well an implementation of the Token-2022 standard performed at driving user behavior.

BERN’s creators implemented transfer fees, a new functionality introduced by the Token-2022 standard. These transfer fees meant that anyone buying or selling BERN tokens would pay a 6.9% fee, part of which would be redistributed to all BERN holders. Effectively, BERN penalized non-holders with a fee, and rewarded holders with a portion of those fees. This should've increased how many wallets held the airdrop (versus exited with quick profits).

Was that what happened?

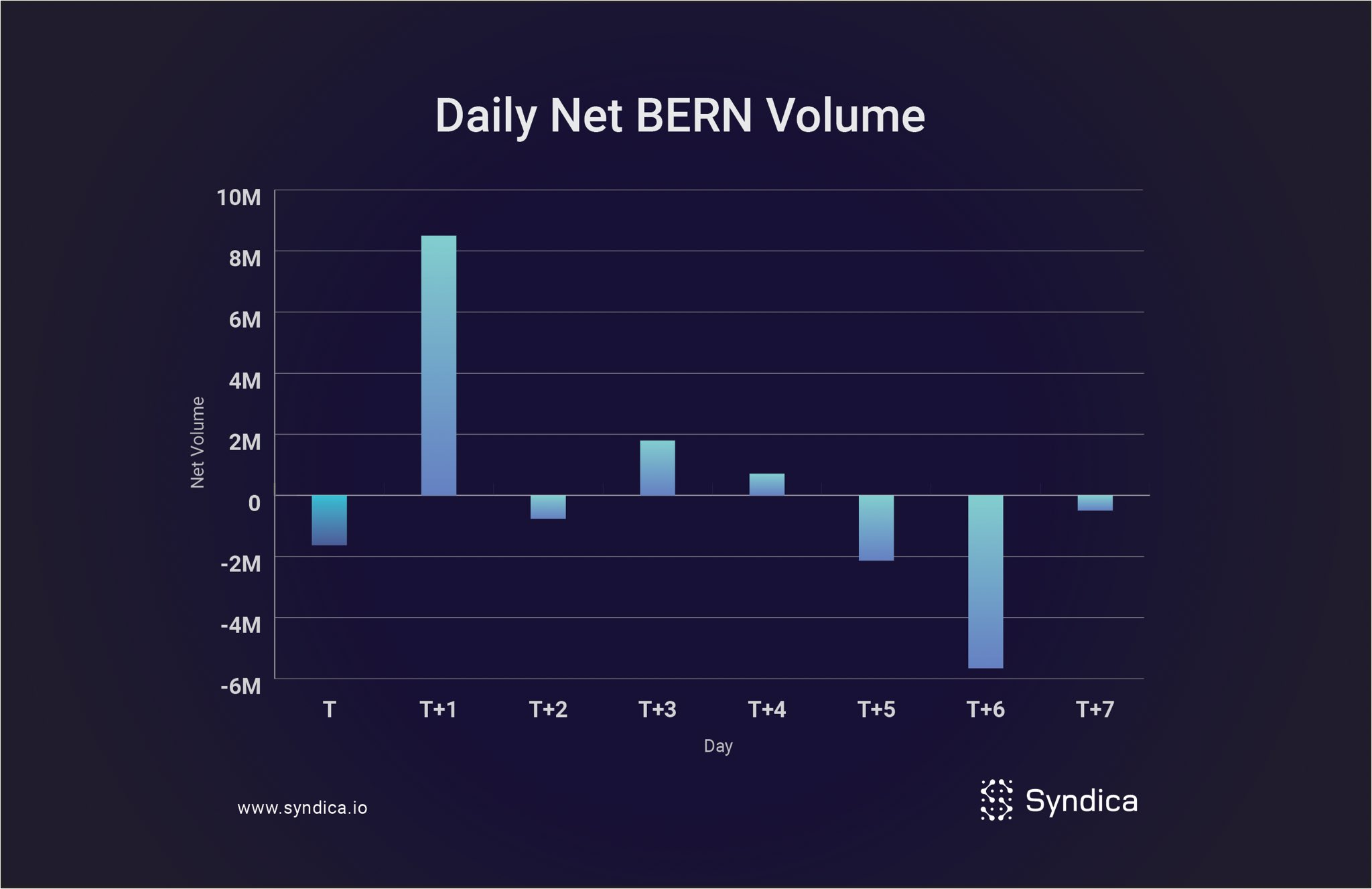

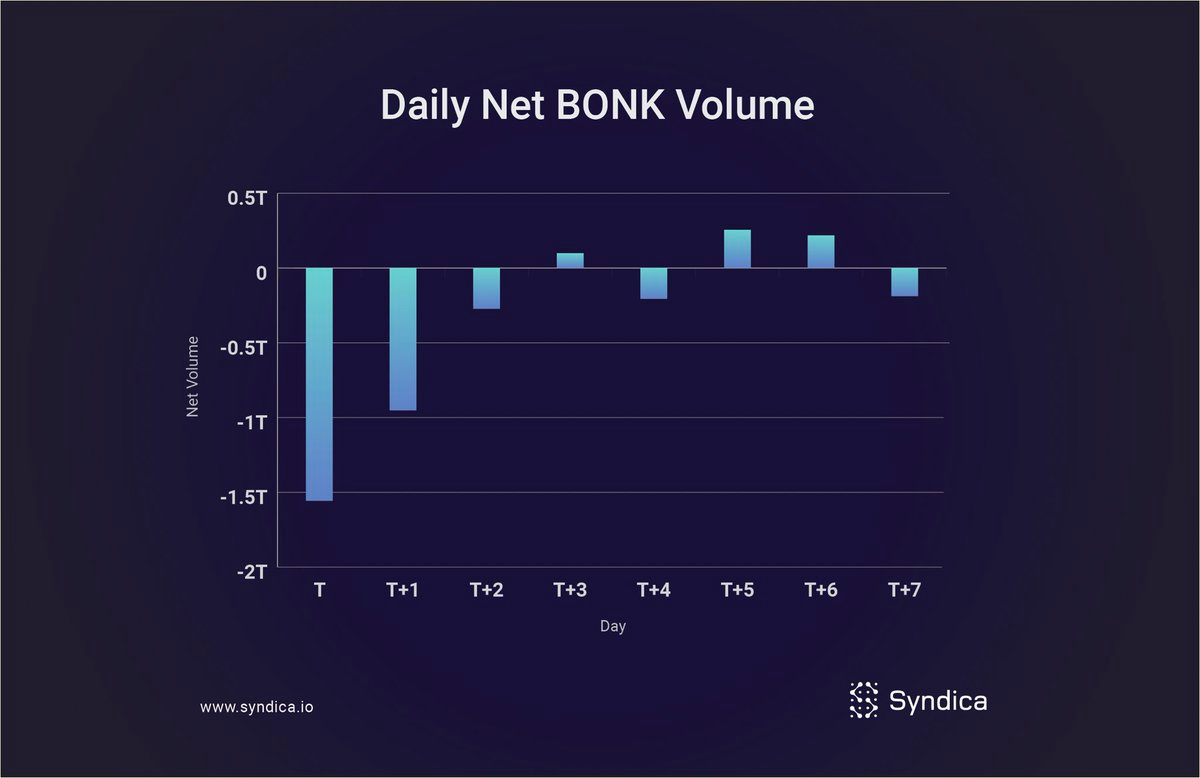

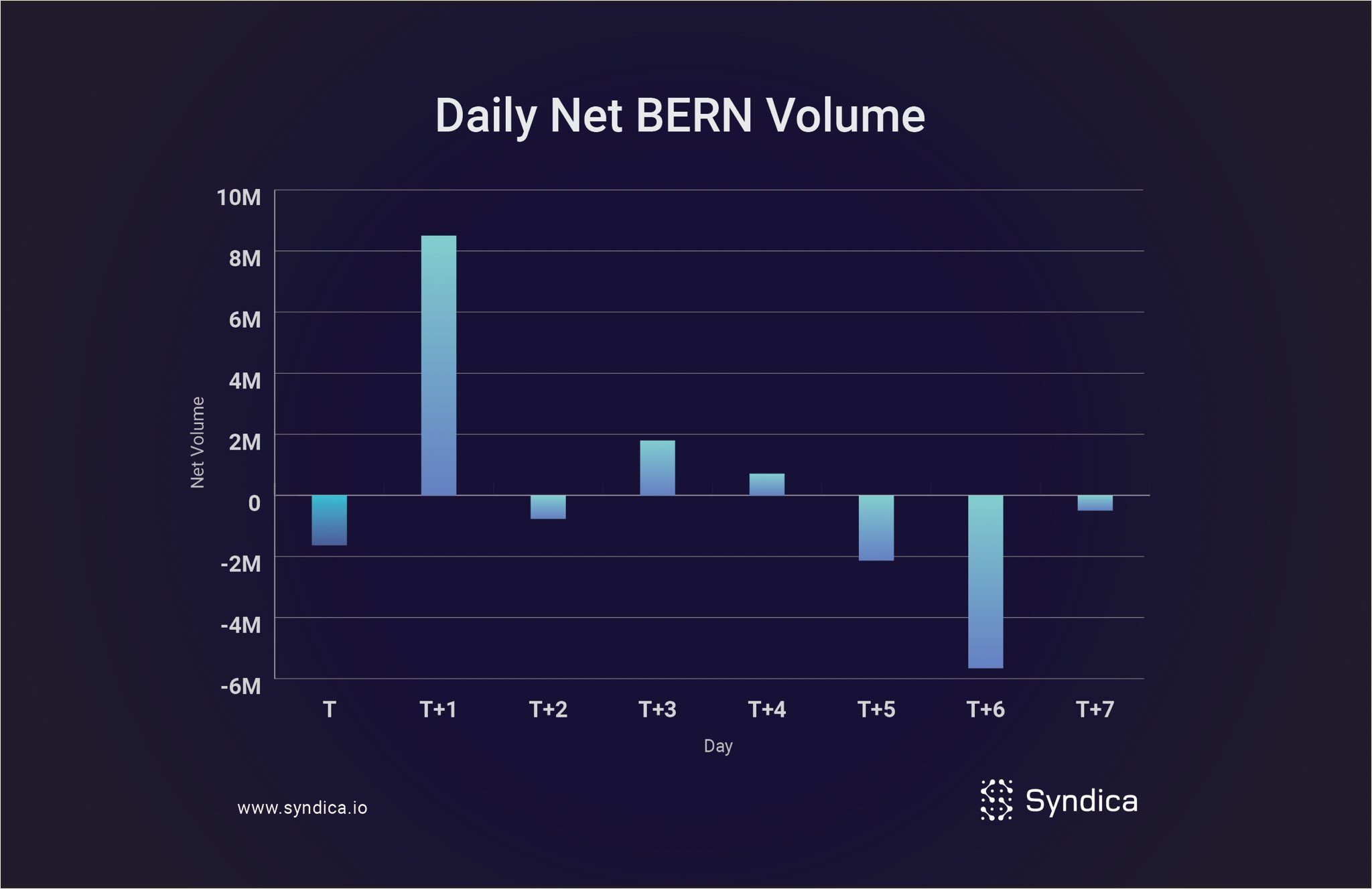

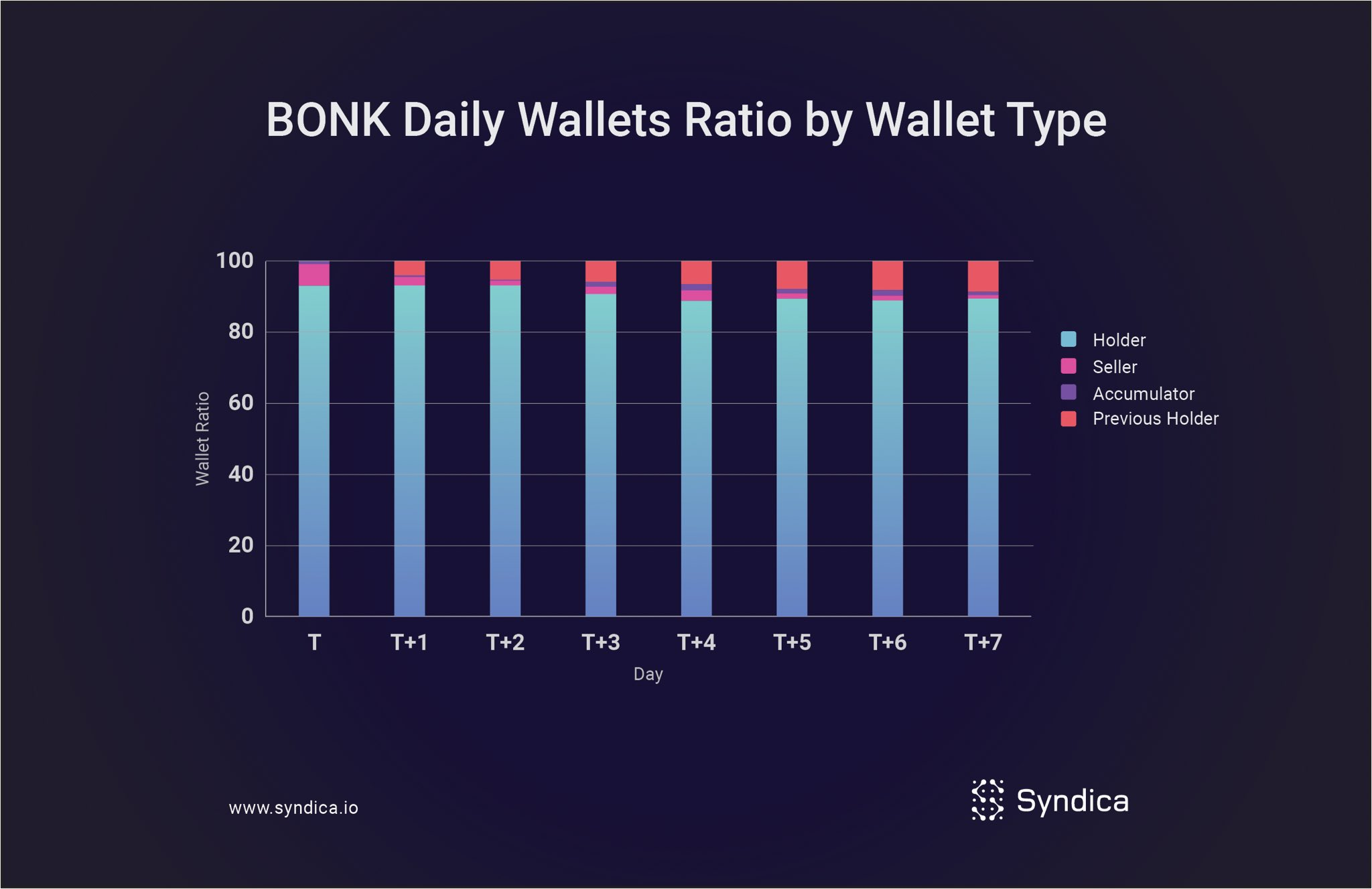

To answer this question, we benchmarked the BERN airdrop against other popular airdrops that did *not* implement the Token-2022 standard: BONK and MPLX. Analyzing the trading activity in the first few days of a respective airdrop: BERN airdrop recipients showed more signs of accumulating than BONK airdrop recipients. The first 2 days show a net accumulation of BERN tokens while an offloading of BONK tokens by airdrop recipients.

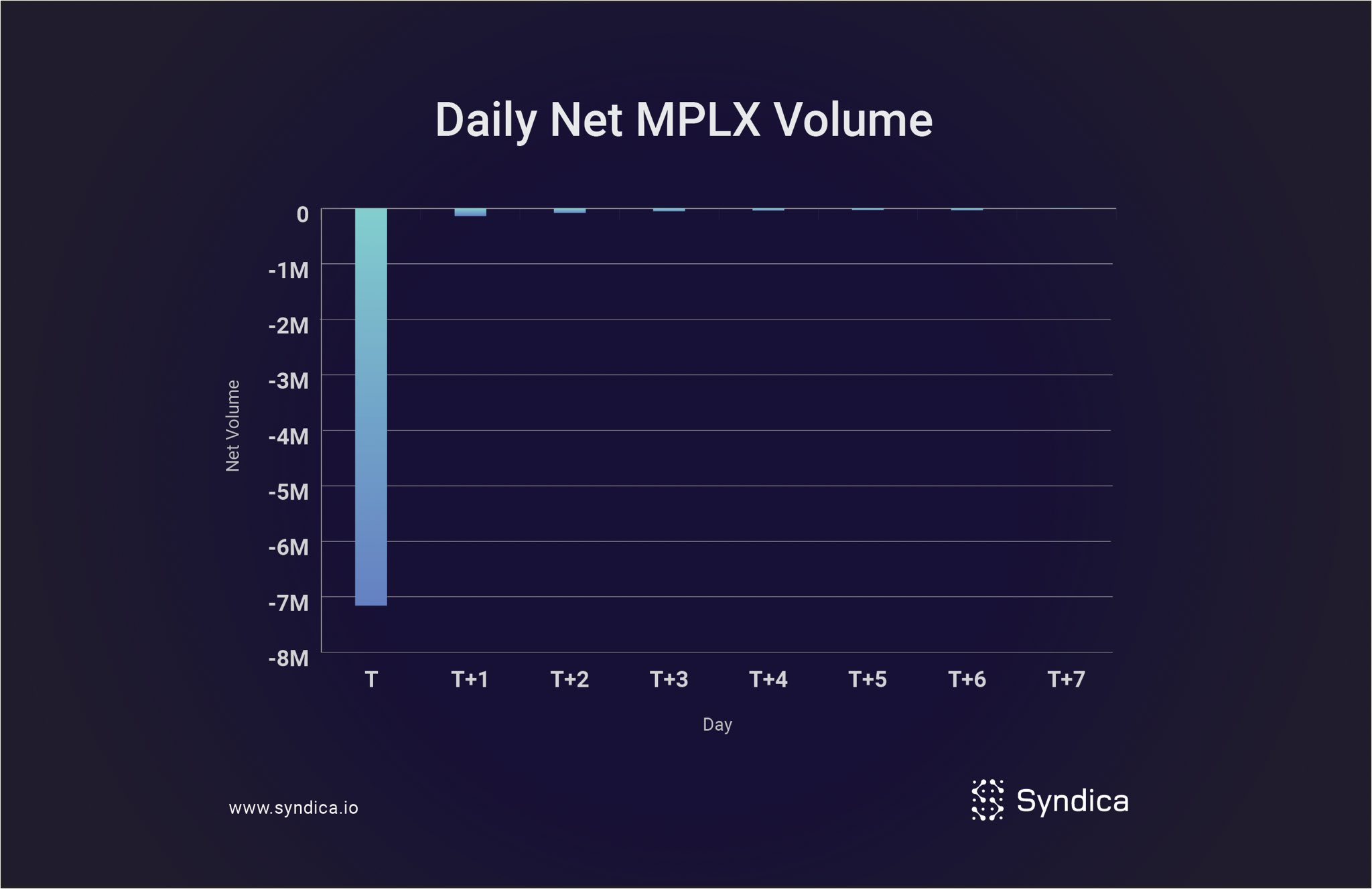

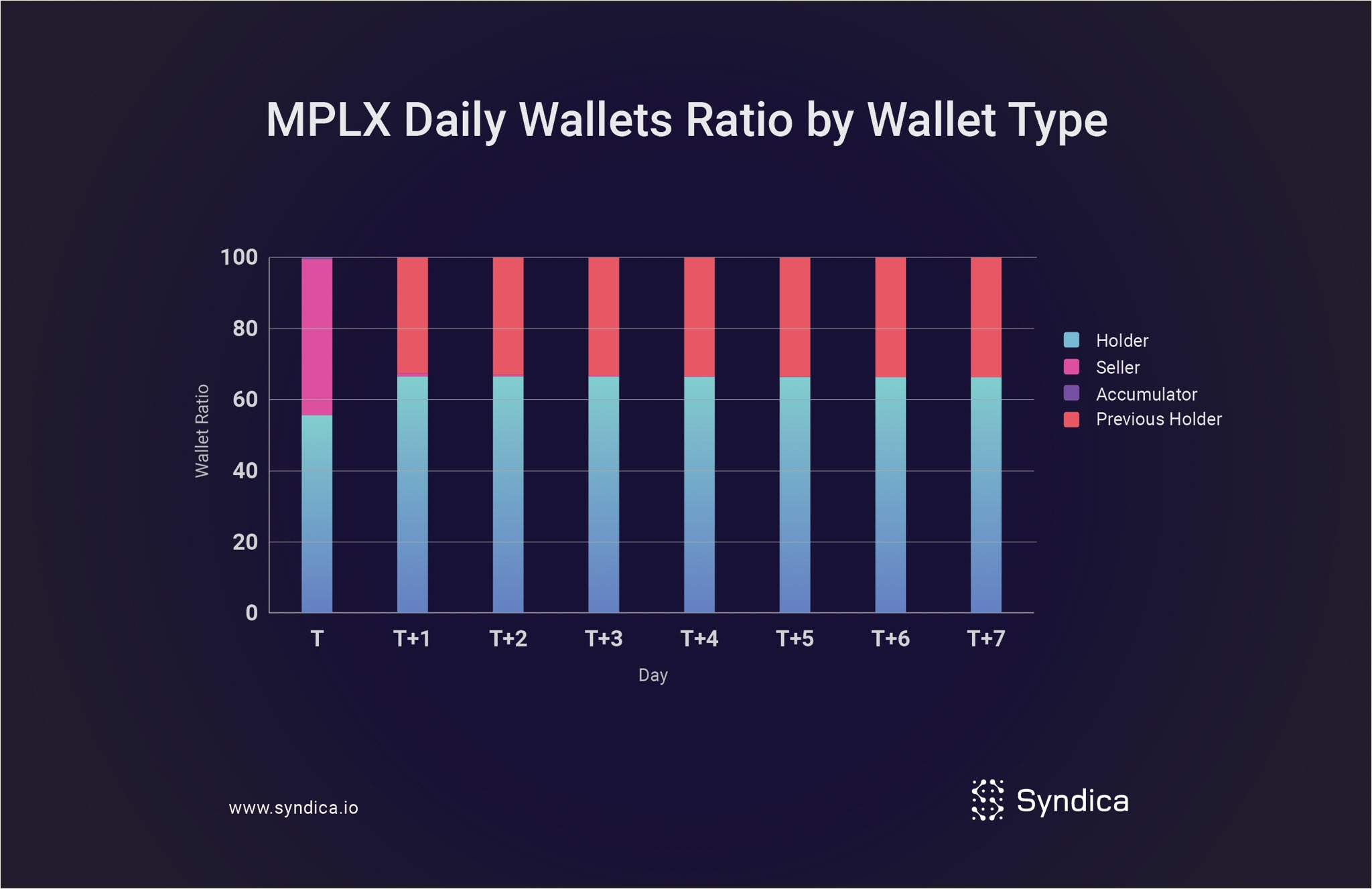

Comparing BERN to MPLX further shows how BERN recipients accumulated on the first few days with MPLX showing a massive selloff of more than 7 million(!) tokens on the day of receiving the airdrop.

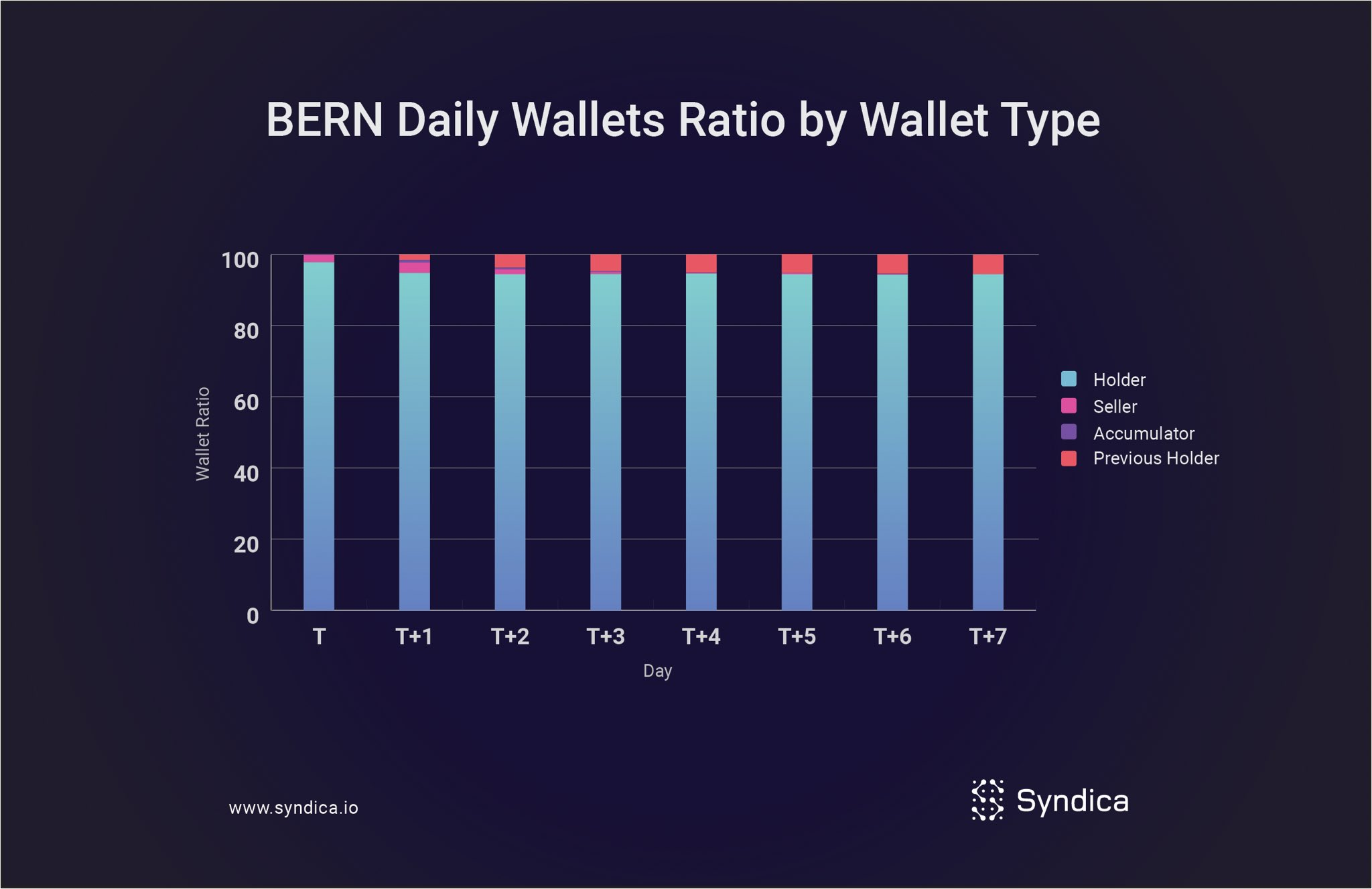

We can break down airdropped wallets into four categories:

1. Accumulator: net positive change in tokens,

2. Seller: net negative change,

3. Holder: holds at least 1 token, no change,

4. And Previous Holder: holds at least 1 token prior to that day AND token amount is 0 on that day.

We can then compare what proportion of wallets involved in each airdrop fall into each of the above categories. Really what we’re looking for is a *high Holder rate for a given airdrop*. Comparing the three, we see that BERN had the highest Holder rate at 94.38% of wallets holding 7 days after they were airdropped tokens. By comparison, 89.43% of wallets were still holding BONK 7 days in, and only 66.31% were still holding MPLX after the same period.

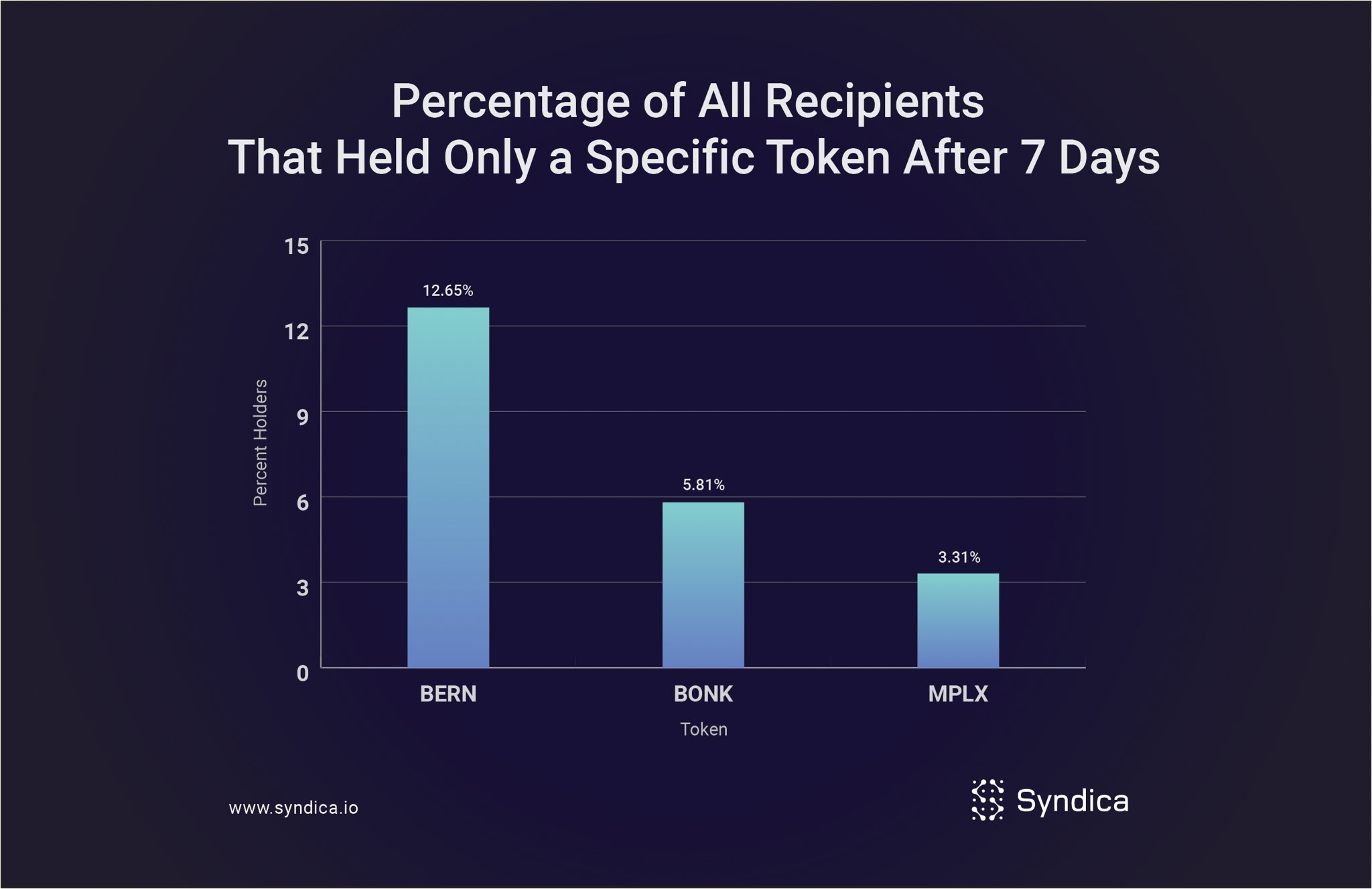

Last, we can ask what proportion of wallets that received all three airdrops sold the other two tokens but held onto BERN. That would show us if wallets that *typically* sell airdrops for ‘quick profits’ were sufficiently incentivized by BERN’s tokenomics to hold instead. 1,961 wallets received all three airdrops.

Affirming our other findings, the number is highest for BERN. 12.65% of wallets that received all three airdrops held onto their BERN but sold the other two, whereas 5.81% kept only BONK and even fewer, 3.31%, kept only MPLX.

The data we've gathered here indicates that the Token-2022 standard was successfully implemented by the BERN team to incentivize a very important user behavior: holding. We’re excited to see how developers make use of the new Token-2022 standard moving forward.